- What is Accuindex?

- Accuindex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Accuindex Compared to Other Brokers

- Full Review of Broker Accuindex

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Accuindex?

Accuindex is a brokerage firm that provides access to various financial assets such as Forex, commodities, indices, metals, CFDs, and stocks.

The company is regulated and authorized by the reputable financial authority Cyprus Securities and Exchange Commission (CySEC) in Cyprus and the Financial Services Commission (FSC) in Mauritius.

However, it is important to note that Accuindex EU Limited does not provide investment or supplementary services in specific regions, and the broker’s offerings may be different based on the entity.

Accuindex Pros and Cons

Accuindex is a regulated broker that provides a safe trading environment with competitive fees, low commissions, and fast execution through a user-friendly MT5 platform accessible on desktop and mobile. Additionally, traders can access a variety of educational resources through Accu Academy, market news, and an economic calendar.

Account options, including Islamic accounts, are available to cater to different traders. Additionally, professional customer service is available 24/7.

For the cons, the trading conditions may differ based on the entity, and the spreads might be higher compared to the industry average. Additionally, there is a limited number of trading instruments available for traders to access.

| Advantages | Disadvantages |

|---|

| CySEC license and overseeing | Conditions might vary based on the entity |

| Regulated broker with competitive trading conditions | Comparatively high spreads |

| Available for European and international traders | Limited number of trading instruments |

| 24/7 customer support | |

| MT4/MT5 trading platforms | |

| Trading academy | |

Accuindex Features

Accuindex is a regulated broker with a safe trading environment and well-tailored trading conditions. The broker offers advanced tools and features, an innovative platform, and average trading costs. We have reviewed different aspects of the Accuindex proposal and have created a visual for traders.

Accuindex Features in 10 Points

| 🗺️ Regulation | CySEC, FSC |

| 🗺️ Account Types | Standard, Pro, Raw, Copy trading |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, commodities, indices, metals, CFDs, stocks |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD |

| 📚 Trading Education | Accu Academy |

| ☎ Customer Support | 24/7 |

Who is Accuindex For?

Accuindex is a broker of measured diversity and provides traders with great features and trading opportunities. The broker is suitable for a range of trading purposes, including the following:

- Traders from Europe

- International traders

- Traders who prefer the MT5 trading platform

- CFD and currency trading

- Beginners

- Advanced traders

- Muslim traders

- Hedging strategy

- NDD/STP execution

- Competitive fees

- Supportive customer support

- Trading academy

- Good trading tools

- EA/Auto trading

Accuindex Summary

Accuindex is a reputable broker that offers a range of trading services to traders of all levels. The broker is authorized and regulated by CySEC, ensuring compliance with regulatory requirements and added security for clients’ funds. Accuindex offers competitive spreads for CFDs, and its MT5 trading platform provides traders with advanced features and effective trading tools.

Additionally, the broker offers a variety of funding methods and 24/7 customer support. Accuindex also provides an Accu Academy, an educational section where traders can engage in webinars, find deep market analysis, and access the educational blog. Generally, Accuindex has positive feedback from traders and is considered a favorable trading choice. However, we recommend clients do their research before opening an Accuindex account to ensure it is the right fit for them.

55Brokers Professional Insights

Accuindex is a well-established broker with good trading and performance records, good for setting up profitable trades and stable trading conditions over time. The broker is well regulated, which become one of the leading broker in the MENA region, expanding its reach, making them good for traders from that region too.

The broker provides diverse access to multiple financial markets through the popular MT5 platform, which is choice of the majority of traders and is a plus. There are several trading accounts with various conditions so you may choose the best trading fee condition suitable for your trading strategy. Yet, we have noticed trading fees are also dependent on the trading account and the entity conditions alike, there are considerable differences in the broker’s offerings between the entities in fact so good to check those.

Consider Trading with Accuindex If:

| Accuindex is an excellent Broker for: | - European traders

- International traders

- Beginner or intermediate traders

- MT5 enthusiasts

- Forex and CFD traders

- Muslim clients

- Those who prefer Web trader

- Clients looking for good education and webinars

- Mobile traders

- Clients looking for 24/7 support |

Avoid Trading with Accuindex If:

| Accuindex is not the best for: | - Long-term investments

- Traders looking for platforms other than MT5

- Clients looking for very low trading fees

- Traders looking for a variety of non-CFD products

- Those from the USA or other restricted region |

Regulation and Security Measures

Score – 4.4/5

Accuindex Regulatory Overview

Accuindex is a reputable brokerage company regulated by the Cyprus Securities and Exchange Commission (CySEC), a well-respected European regulatory body that imposes strict rules and guidelines on its operations.

Accuindex also holds an operational license from the FSC in Mauritius. This means that the broker follows regulatory requirements and operates under close supervision, which enhances traders’ safety and confidence.

How Safe is Trading with Accuindex?

We discovered that Accuindex ensures the safety of clients’ funds by keeping them separate from the broker’s accounts and not using them for business purposes. Moreover, Accuindex offers negative balance protection to clients, which ensures that traders’ accounts cannot go into negative balance, even during market volatility or unforeseen events.

Consistency and Clarity

Accuinex was founded in 2016 and has been in the market since then as a reliable broker with clear offerings and a transparent track record of operations. The broker aspires for constant growth, and proof of this is its industry awards as the fastest growing broker, best MT5 broker, best forex execution, and others.

When we reviewed the customer feedback on the broker, we found that Accuidex has mixed reviews, from positive experiences to negative ones, indicating different aspects of improvement. The positive ones mainly point out the advanced MT5 platform, competitive conditions, great educational resources, and dedicated support. On the other hand, the negative experiences are about withdrawal issues and concerns about the international entity the broker is running.

All in all, positive feedback is prevalent, showing that the broker excels in many aspects and continues to grow.

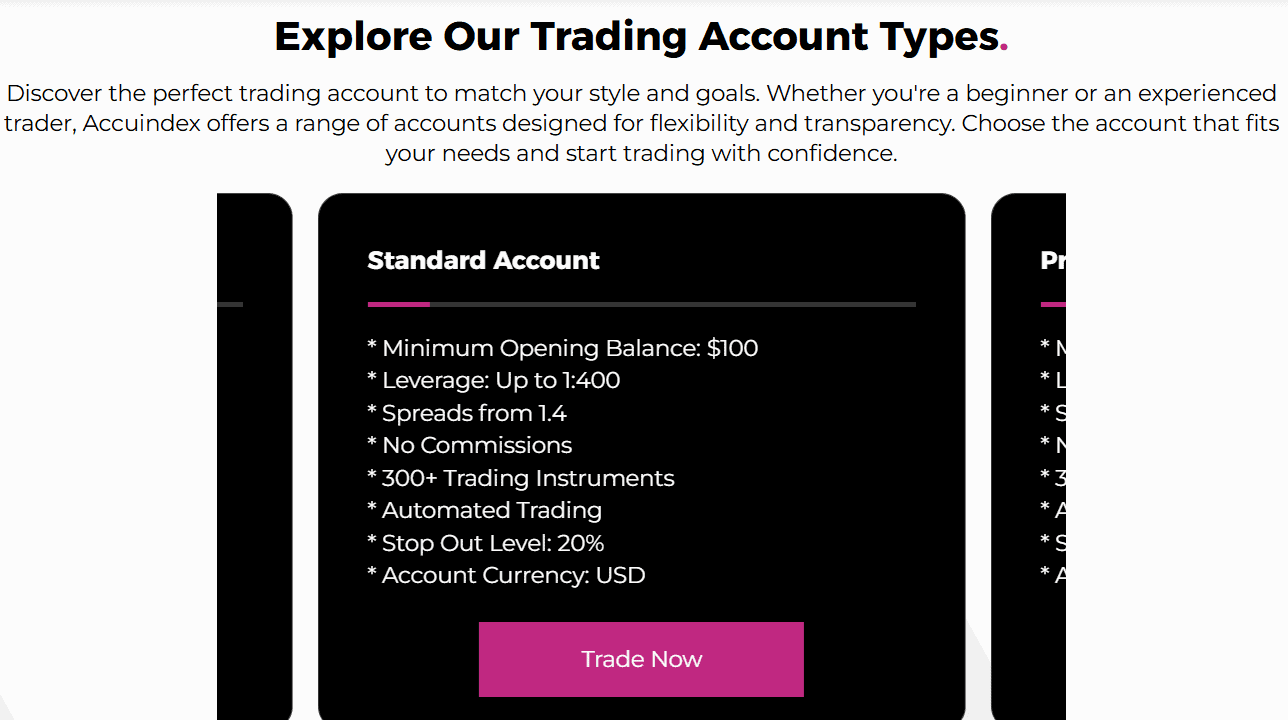

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Accuindex?

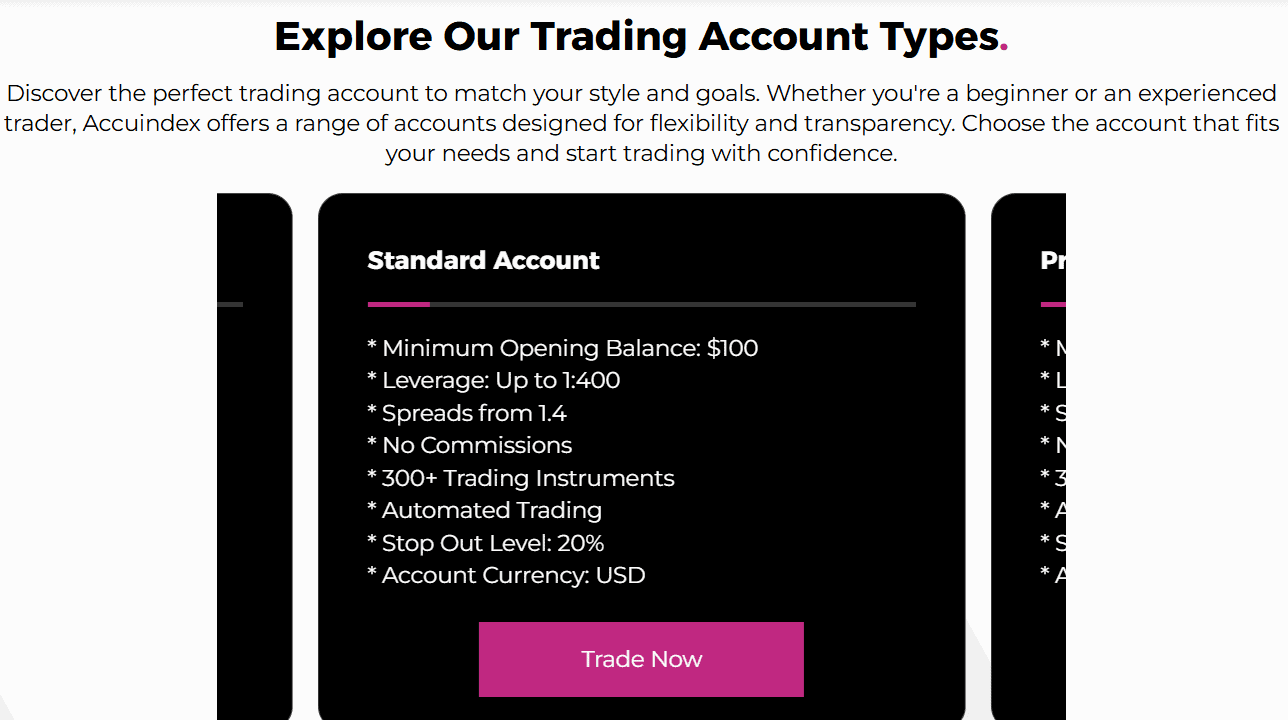

Accuindex trading conditions differ from entity to entity, including the trading account offering. Here, we will introduce the account types available under the international entity. The broker offers Standard, Pro, Raw, and Copy trading accounts tailored to specific needs and expectations. Accuindex also offers an Islamic account for its Muslim clients. The main difference between the accounts is the trading size and fee structure. From beginners to professional traders, each can find a suitable option. All the accounts enable access to over 300 tradable products across Forex, indices, stocks, and commodities. The available leverage is up to 1:400 for all the account types except for the Raw account, which offers leverage up to 1:100.

- The Standard and Copy trading accounts require a $100 initial deposit. This is a spread-based account with no commissions and spreads from 1.4 pips.

- The minimum deposit to open a Pro account is $5000. This account type is designed for more professional traders with larger trading sizes. The account is spread-based with lower spreads from 0.8 pips. No transaction fees are applied.

- The Raw account has a $25,000 minimum deposit requirement. Spreads start from 0.0 pips, with commissions applied based on the traded instrument.

Regions Where Accuindex is Restricted

Accuindex is an international broker that offers its services globally and accepts residents from a large list of countries. Yet, based on regulatory restrictions, it does not accept clients from the following countries:

- The United States of America

- Canada

- Israel

- Japan

- North Korea

- Belgium

- UN/EU Sanctioned countries

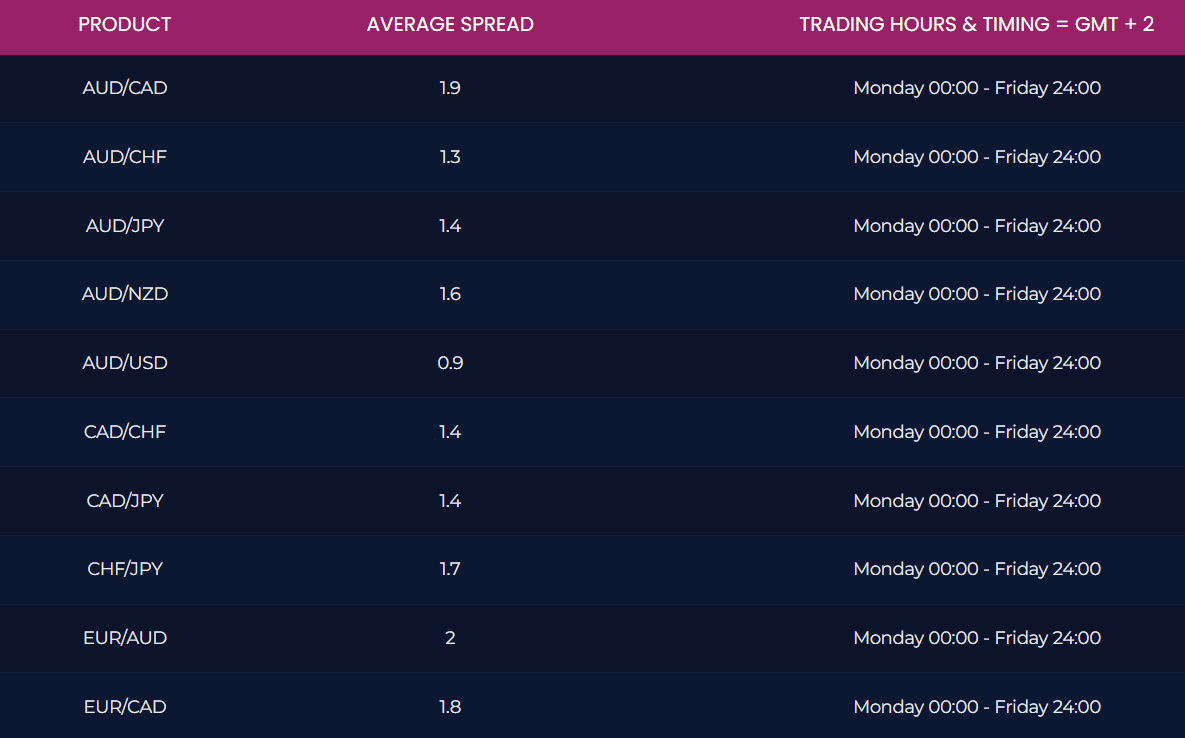

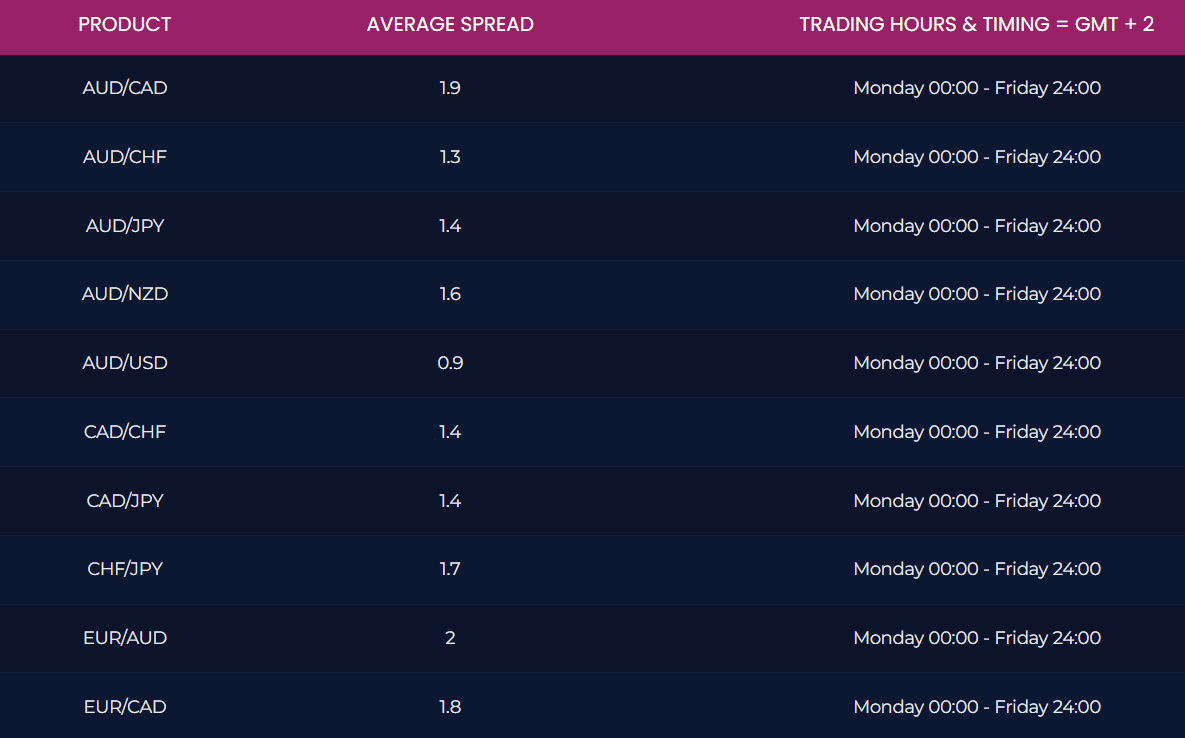

Cost Structure and Fees

Score – 4.4/5

Accuindex Brokerage Fees

Accuindex provides its clients with competitive pricing structures based on spreads and commissions. The broker’s fee structure is clear and well-defined, with transparent costs and no hidden fees. The broker offers three spread-based accounts and a commission-based account for traders who prefer very low spreads and a fixed fee for each trade.

Accuindex spreads depend on the account type chosen. The Standard account offers average spreads with no commissions. The spreads applied for the popular EUR/USD pair are 1.5 pips. The Copy trading account applies 1.4 pips on average, whereas the Pro accounts has lower spreads starting at 0.8 pips. Note that spreads depend on the instrument traded. Besides, the overall trading costs can vary from entity to entity.

Accuindex has only one commission-based account – the Raw account. It applies very low spreads from 0.0 pips, combined with fixed commissions. Commissions are $2.5 per side per lot. However, Accuindex does not publicly disclose its commissions, and it can depend on the traded instrument and other trading-related circumstances.

How Competitive Are Accuindex Fees?

Based on our research, Accuindex offers competitive fees in line with the market average. The broker publicly discloses the applied spreads for each account type and instrument. The commissions are $2.5 per lot per side. However, they may depend on the instrument and other specifications. For the commission-based account, spreads start from 0.0 pips.

As to the spread-based account, the average spread for the EUR/USD pair is 1.5 pips. The gold and silver spread is 15 cents.

All in all, the broker does not have hidden fees, and the offering is clear and transparent. However, clients should consider non-trading fees that are common in Forex trading and are added to the overall trading costs. At last, based on the differences in trading conditions between the entities, there might be slight inconsistencies in the applied fees.

| Asset/ Pair | Accuindex Spread | ThinkMarkets Spread | Moneta Markets Spread |

|---|

| EUR USD Spread | 1.5 pips | 1.1 pips | 1.2 pips |

| Crude Oil WTI Spread | 0.2 | 0.03 | 1.60 pips |

| Gold Spread | 15 cents | 19 cents | 2.20 pips |

| BTC USD Spread | - | 12 USD | 20.30 pips |

Accuindex Additional Fees

In addition to spreads and commissions, Accuindex applies non-trading fees that are included in the overall costs. While there are no deposit fees charged, clients who withdraw funds via bank wire transfers will be subject to a withdrawal fee of $25 per transaction. The broker also imposes an inactivity fee after the account is dormant for a certain period. The inactive accounts are also deprived of all the bonuses and other opportunities the broker credits otherwise. At last, there is an overnight fee for positions held for more than a day.

Score – 4.4/5

With Accuindex, clients can conduct their trades via the popular MT5 platform and WebTrader, the broker’s mobile platform AccuGo. Although the broker does not offer other advanced platforms, trading through the MT5 platform ensures quick executions, seamless transactions, and access to innovative trading tools

| Platforms | Accuindex Platforms | Moneta Markets Platforms | Fusion Markets Platforms |

|---|

| MT4 | No | es | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Accuindex Web Platform

WebTrader is an efficient solution for all traders, whether beginners or professionals. The flexibility and the ease of access to the market it provides enable traders to manage their accounts without installation or downloads. The web trader is available through any device with an internet connection, ensuring quick access from anywhere. The platform includes all the essential features for a successful experience, including real-time price tracking, various charts and analytical tools, and fast order execution. Besides, traders can access the same range of tradable products available through the desktop platform.

Accuindex Desktop MetaTrader 4 Platform

Based on our research, at present, Accuindex does not provide access to the popular MT4 platform. In the past, through the broker’s international entity, traders had access to the platform. Right now, only the MT5 platform, web, and mobile trading are available.

Accuindex Desktop MetaTrader 5 Platform

Accuindex offers the MT5 advanced platform. The platform offers innovative features, cross-platform access, and high-speed execution. According to our research, traders using the MT5 trading platform have access to advanced charting packages, custom indicators, news portals, and technical analysis tools. Moreover, they can automate their trades with the help of EAs, which can help to identify market movements and improve market-entry and stop-loss strategies. The platform can be downloaded from Microsoft, the App Store, or Google Play. The MT5 platform is available via the platform, web platform, and mobile app.

Accuindex MobileTrader App

Accuindex offers access through the mobile app. This is a flexible way to manage accounts and conduct trades from anywhere. The broker’s app, AccuGo, keeps traders connected to the market, providing access to advanced trading features, charts, analytical tools, and more. Traders can access various instruments across a good range of financial markets. The mobile app includes push notifications, trading indicators, and different order types. AccoGo enables easy funding, efficient execution of trades, and an overall positive trading experience.

Main Insights from Testing

Based on our findings, Accuindex offers the MT5 platform, WebTrader, and the broker’s mobile app. The available platforms enable quick and seamless trades, providing a positive trading experience. Users can benefit from various charting tools, in-depth analytics, and fast execution. Although the MT4 platform is not available, clients can still enjoy the innovative features that the advanced MT5 platform provides.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Accuindex Platform?

Accuindex offers its clients an extensive selection of over 300 trading instruments, including Forex, commodities, indices, metals, CFDs, and stocks. Traders can access over 300 tradable products, including a broad range of major, minor, and exotic currency pairs; global indices; stocks on CFDs; metals, such as silver and gold; and commodities like UK and US crude oil. The available instruments come with competitive spreads and favorable market conditions to ensure profitable trades.

Main Insights from Exploring Accuindex Tradable Assets

Accuindex offers all the essential and popular tradable products, enabling traders’ exposure to the financial market. With over 300 products available, clients can expand their portfolios in a measured way. Clients can access a good range of forex pairs and global indices, with access to the S&P 500 and NASDAQ, Dow Jones, FTSE 100, and exotic indices such as Nikkei 225. Besides, Accuindex offers precious metals, such as gold and silver. Furthermore, clients can access global stocks of leaders such as Netflix, Apple, Amazon, etc.

However, we have found that all the available products are based on CFDs. Traders can speculate on the movements of the underlying asset without owning shares. This way, traders can trade short or long positions and make profits. However, clients cannot engage in long-term investments, which can be a limitation for traditional traders.

Leverage Options at Accuindex

Leverage can increase potential profits in trading, but it can also result in substantial losses if not utilized correctly. Hence, it is crucial to understand leverage usage before trading with it.

Accuindex leverage is offered according to the CySEC and FSC regulations:

- European traders can use a maximum of 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:400.

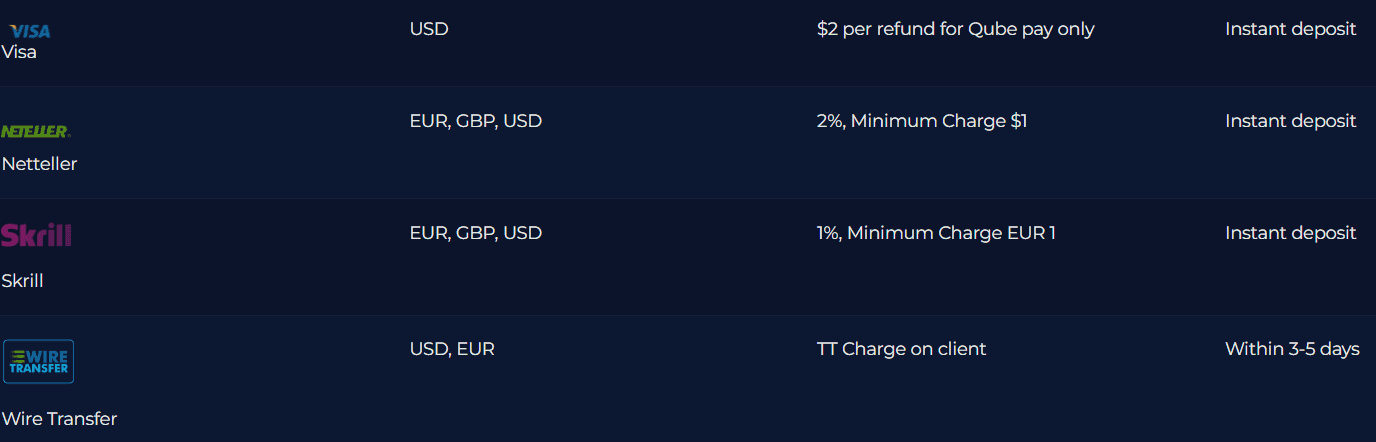

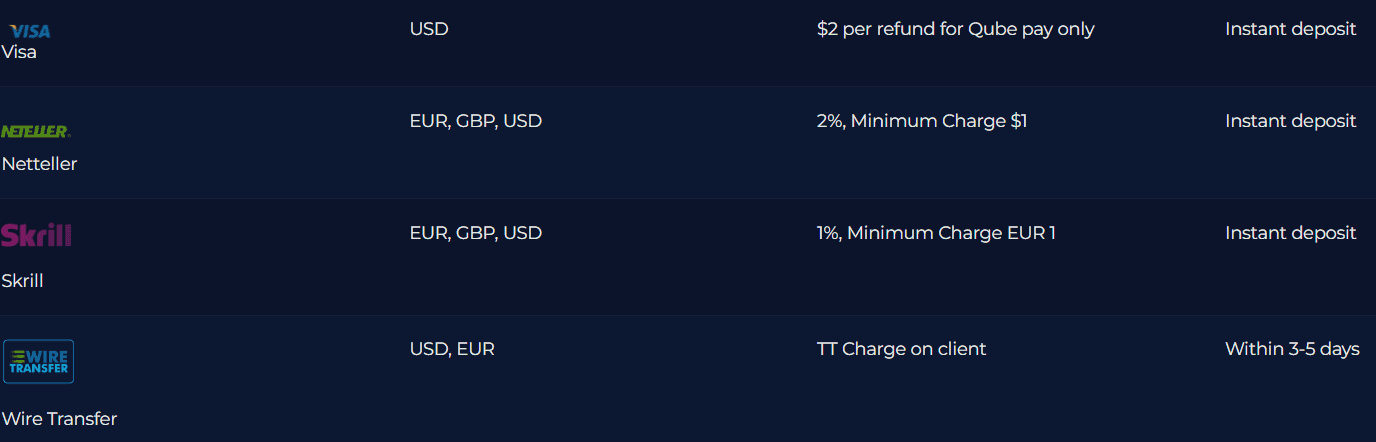

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Accuindex

Accuindex provides several funding methods for clients to deposit funds into their trading accounts, such as bank wire, credit/debit cards, Skrill, and Neteller. However, certain funding methods may have unique requirements or limitations depending on the bank or other financial institutions. Besides, based on the entity, some funding options might be unavailable.

Here is the full list of Accuindex deposit methods:

- Wire transfer

- Mastercard

- American Express

- Skrill

- Neteller

- My Fatoorah

Minimum Deposit

For the Standard account, the minimum deposit amount is $100. For the Pro account, the minimum funding amount is $5,000, and for the Raw account, the minimum requirement is higher—$25,000.

Withdrawal Options at Accuindex

Withdrawals at Accuindex are easy and fast for clients. The processing time of withdrawals may differ based on the withdrawal method. Generally, deposits are processed instantly, yet withdrawals may take up to three business days to reach the account.

- For the withdrawals, there is a $2 fee for each transaction.

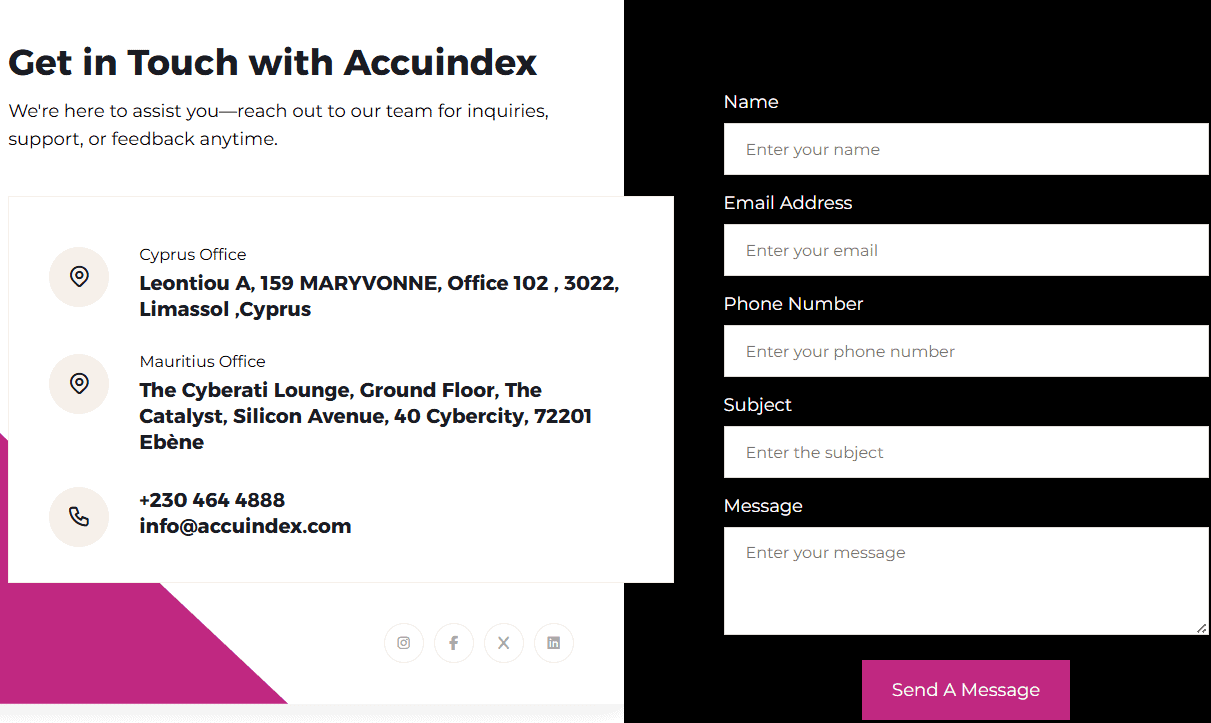

Customer Support and Responsiveness

Score – 4.5/5

Testing Accuindex Customer Support

Accuindex offers 24/7 customer support through Live Chat, Phone lines, WhatsApp chat, and Email. The broker’s support team is comprised of trading professionals who can assist traders with a range of concerns, such as technical support, analysis recommendations, general queries, and operational issues.

- The broker also has an FAQ section where traders can find answers to all the essential questions.

Contacts Accuindex

Our testing of Accuindex’s customer support has shown a client-oriented attitude, with an emphasis on helping and assisting with knowledge and guidance. The broker offers several communication options, and traders can choose the most comfortable one out of the following:

- The live chat is the best way to get quick and detailed answers to any question. Clients can ask trading-related questions, inquire about specific conditions, or ask for guidance via the live chat. The answers are almost instant.

- Traders can also direct their issues through the WhatsApp chat, which is another effective way to get answers and assistance.

- The international phone line is a good option for those traders who want to talk directly to the support team and solve their issues on the spot. Clients can use the provided phone number: +230 464 4888

- Also, the broker accepts emails with inquiries, questions, and complaints to enhance the service quality. All the emails should be sent to the following address: info@accuindex.com.

- At last, traders can get in touch with the support team by sending an email directly from the broker’s website, by providing their name, email address, and the main message.

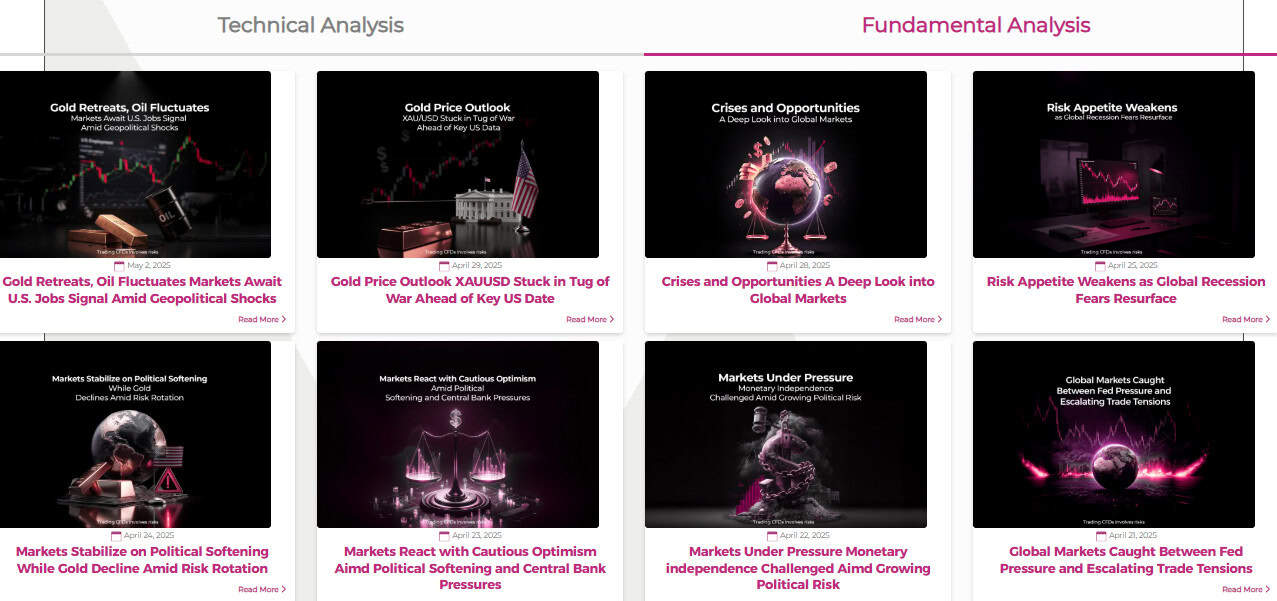

Research and Education

Score – 4.2/5

Research Tools Accuindex

We have reviewed the Accuindex research section to see what it offers in addition to the main research and analytical tools integrated into the broker’s platform. However, the offering is limited and includes only the following:

- Market analysis by experts helps traders stay ahead of the market and make informed decisions. The broker provides technical and fundamental analysis and helps traders with its comprehensive approach.

- Through its AccuNews section, Accuindex provides detailed and updated news on each market, including Forex, indices, commodities, metals, stocks, and energies.

Education

Although Accuindex’s education section does not include a wide range of comprehensive materials, it still includes a few essential resources helpful for traders of any level.

- The broker offers interactive webinars organized by industry experts, providing traders with substantial knowledge on different aspects of trading. The webinars cover various topics and guide traders towards success.

- The broker’s educational blog includes detailed articles on different topics, from how to navigate the market to more complex subjects.

Is Accuindex a Good Broker for Beginners?

Accuindex is a favorable broker, providing a safe environment for trades and good conditions to navigate the market with flexibility and ease. The broker is a good fit for any trader, including beginners. It offers different accounts tailored to meet the needs of novice to professional traders. The platforms are easy to use, and research and analytical tools are very helpful. Besides, the demo account is a good opportunity for beginners to practice and gain skills. At last, the education section includes essential resources to guide inexperienced traders. With the minimum $100 deposit requirement, Accuindex can become a favorable broker to explore the market.

Portfolio and Investment Opportunities

Score – 4.1/5

Investment Options Accuindex

Accuindex enables traders to explore the market by accessing over 300 trading instruments across multiple assets. The offerings include all the popular products that clients are mostly looking to invest in. With a good range of currency pairs and CFD products, traders can engage in both short- and long-term positions. Through the international entity, clients can also access global stocks and speculate on the price movements of the underlying assets. However, this offering does not enable clients to own shares and excludes traditional investment opportunities.

- The good news for traders who want to diversify their trading is the availability of copy trading. Through the copy trading account, traders can access favorable trading conditions and profit by mirroring the trades of professionals.

Account Opening

Score – 4.6/5

How to Open an Accuindex Demo Account?

A demo account gives traders a great opportunity to explore the market without any risks. Clients can have access to real-time market data, leverage up to 1:400, spreads of 1.4 pips, and access to 300+ trading instruments. Opening a demo account is quick and easy and requires the following simple steps:

- Visit the broker’s webpage and choose the demo account option.

- Fill out the registration form (name, email address, phone number, and password).

- Submit the form and receive a confirmation letter with login credentials.

- Download the MT5 platform, use the credentials to register, and start trading.

How to Open an Accuindex Live Account?

Opening an account with Accuindex is easy. Traders can choose one of the available trading account types that meets their trading expectations the most and follow the guidelines to proceed with the opening process:

- Click on the “Register” button.

- Enter the required personal data (name, email, phone number, etc.).

- Verify the personal data by submitting a government-approved ID and proof of address.

- Complete the electronic quiz confirming the trading experience.

- Once the account is activated and proven, follow with the money deposit.

Score – 4.2/5

Accuindex constantly develops its offerings and features to enhance its clients’ trading experience. We have found a few interesting tools and offerings that can make the trading process easier and more comfortable:

- The broker offers the AccuPay service, a payment system that simplifies the deposit and withdrawal processes, ensuring security, instant transactions, and flexible options. AccuPay is integrated with trading accounts and provides a seamless and user-friendly experience.

- AccuConnect is a perfect getaway for copy trading, ensuring that traders copy trades from professionals with ease and achieve profits. The platform is available for all levels of traders. Beginners can copy trades without engaging in exhaustive trading, and professional traders can diversify their trades through copy trading.

Accuindex Compared to Other Brokers

We have also compared Accuindex to other brokers in the market and reviewed different aspects of trading for each of them. Based on our findings, Accuindex is a well-regulated broker with a CySEC license and a license for international trades. On the other hand, Saxo Bank holds a few top-tier licenses, including the FCA license, ensuring an additional layer of protection for the broker.

When we compared the platform availability, Accuindex, with its MT5 platform and WebTrader fell behind brokers such as Fusion Markets, which offers not only the market-popular MT4/5 platforms but also cTrader, TradingView, DupliTrade, and its proprietary Fusion+ platform.

When it comes to the available instruments, Accuindex includes all the essential products, with a total of 300+. Yet, comparing the offering to brokers such as Saxo Bank with 71,000 available products, the difference is evident.

The education and research sections that Accuindex offers are good with webinars, educational articles, market news, and analysis.

Accuindex offers several account types with different fee structures. With an average spread of 1.5 pips for the EUR/USD, the broker is considered cost-effective. However, there are brokers with lower trading costs, such as CMC Markets with an average spread of 0.5 pips, and City Index with 0.8 pips.

| Parameter |

Accuindex |

Fusion Markets |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.5 pips |

Average 0.92 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $2.5 per side |

0.0 pips + $2.25 per side |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5, WebTrader |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

300+ instruments |

250+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, VFSC, FSA |

ASIC, VFSC, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/7 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$0 |

$0 |

$100 |

$0 |

$0 |

Full Review of Broker Accuindex

We have reviewed all the aspects of trading with Accuindex to see what the broker offers and who it can be attractive to. Based on our research, we have concluded that Accuindex is a reliable broker with a license from the respected CySEC. The broker offers favorable conditions that can be appealing for traders of different levels and various trading expectations. With its advanced MT5 platform, WebTrader, and mobile app AccuGo, traders can conduct efficient trades with fast execution and access to over 300 trading instruments. The trading costs depend on the account type and align with the market average. Spread for the popular EUR/USD pair is 1.5 pips. For the commission-based account, transaction fees are $2.5 per side per lot.

The broker offers a good variety of funding methods. Besides, traders can transfer money through the broker’s AccuPay payment system, making the funding process seamless and instant. Traders can also engage in copy trading through the broker’s AccuConnect copy trading platform. Accuindex clients also have access to the AccuAcademy, which includes webinars, articles, market analysis tools, market news, etc.

All in all, Accuindex is a favorable broker with diverse services that can meet anyone’s trading needs. Still, it is very important to consider under which entity you open an account, as the conditions can differ from entity to entity, and the safety measures are more lax for the international offering.

Share this article [addtoany url="https://55brokers.com/accuindex-review/" title="Accuindex"]