- What is FXCC?

- 55brokers Professional Insights

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

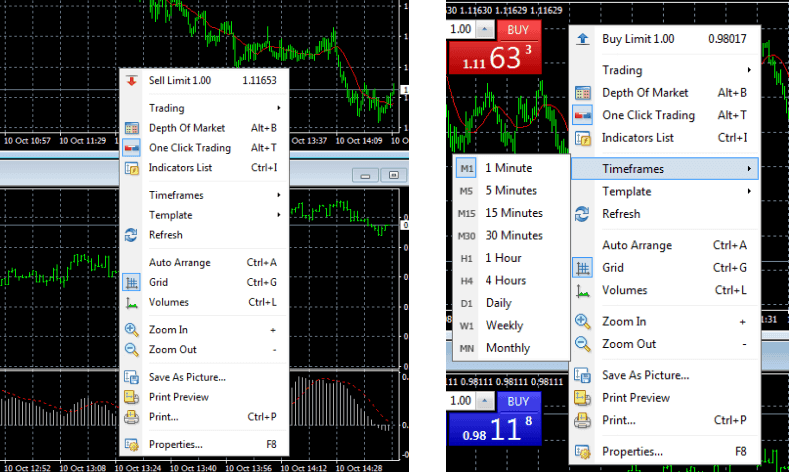

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

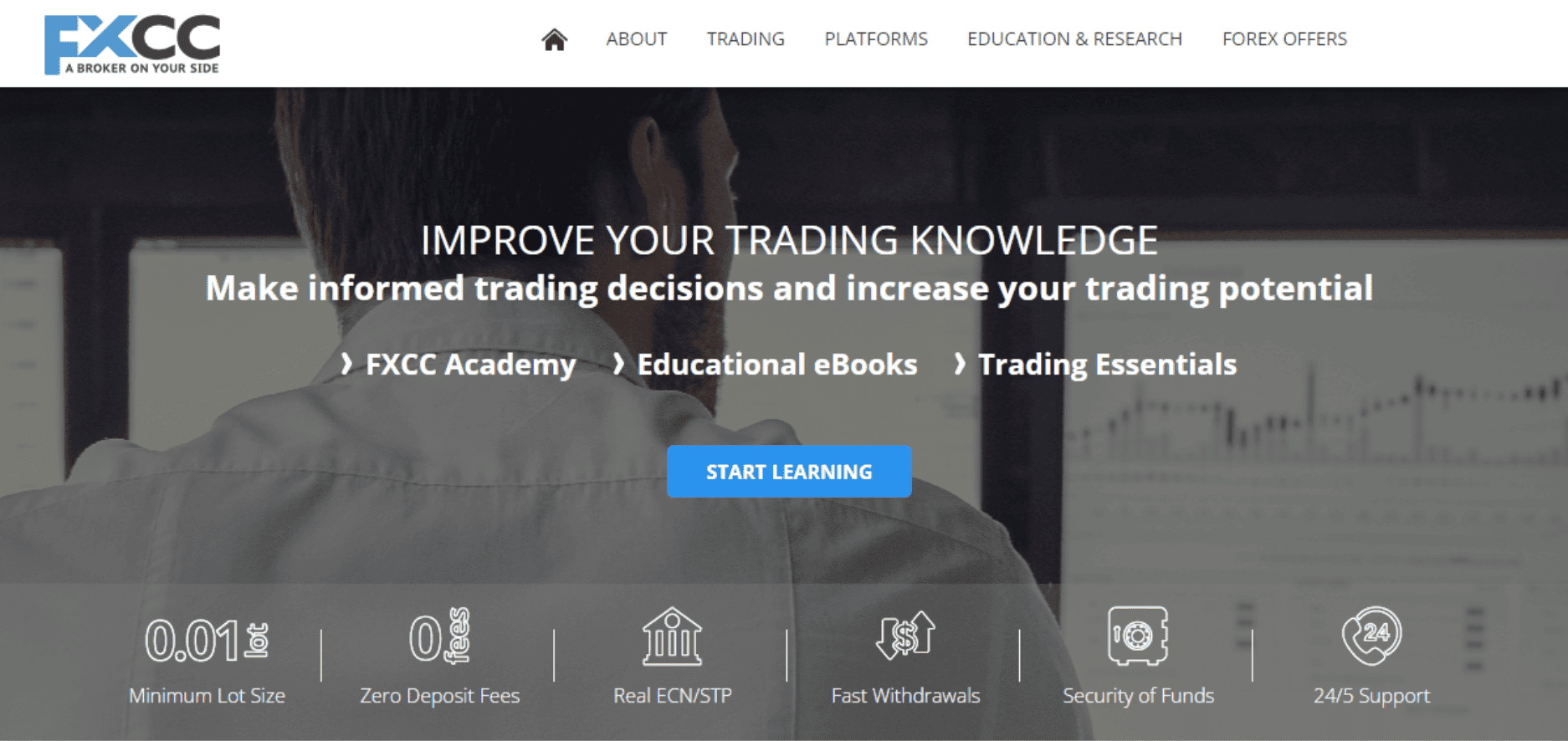

- Research and Education

- Portfolio and Investment Opportunities

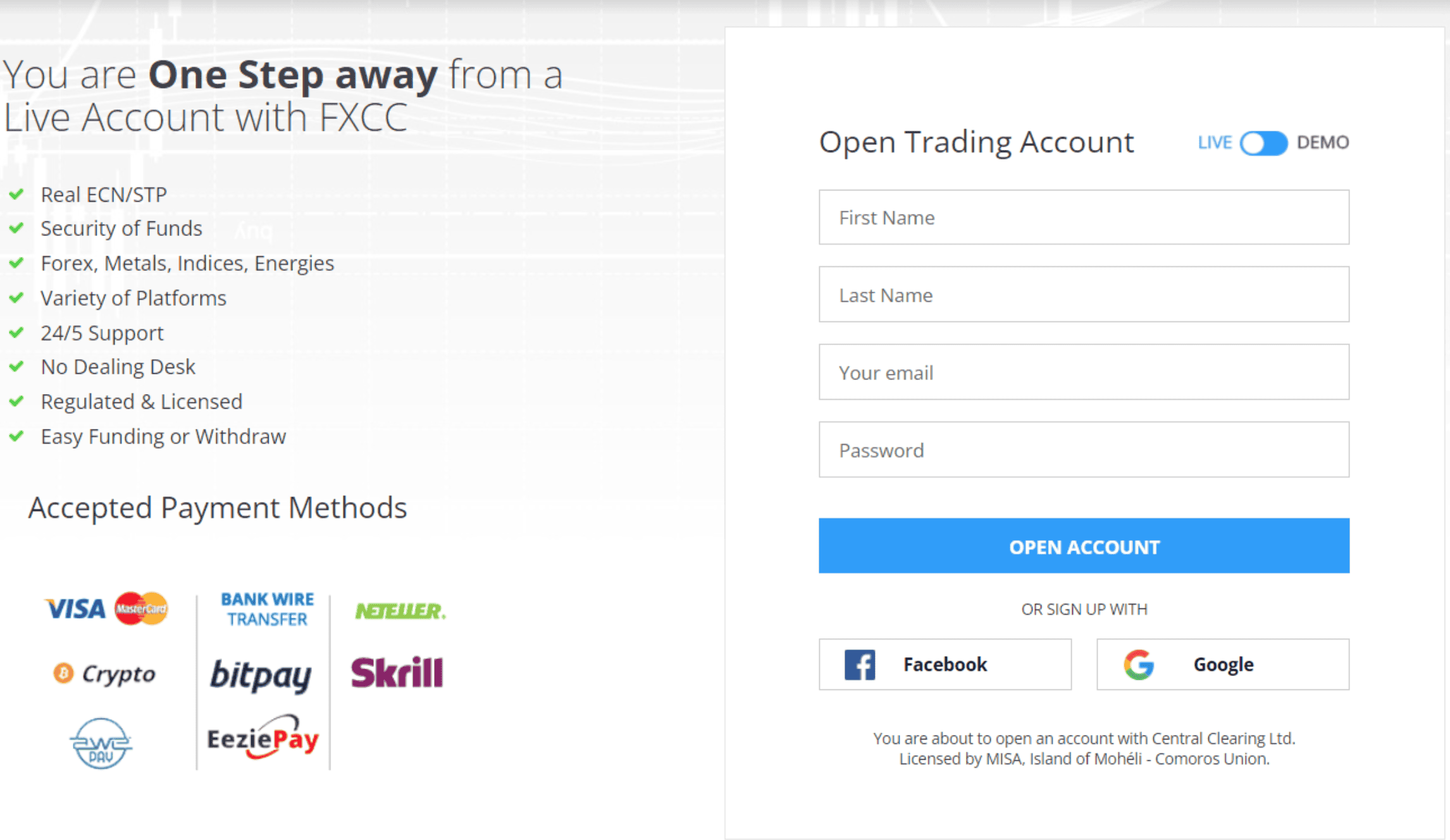

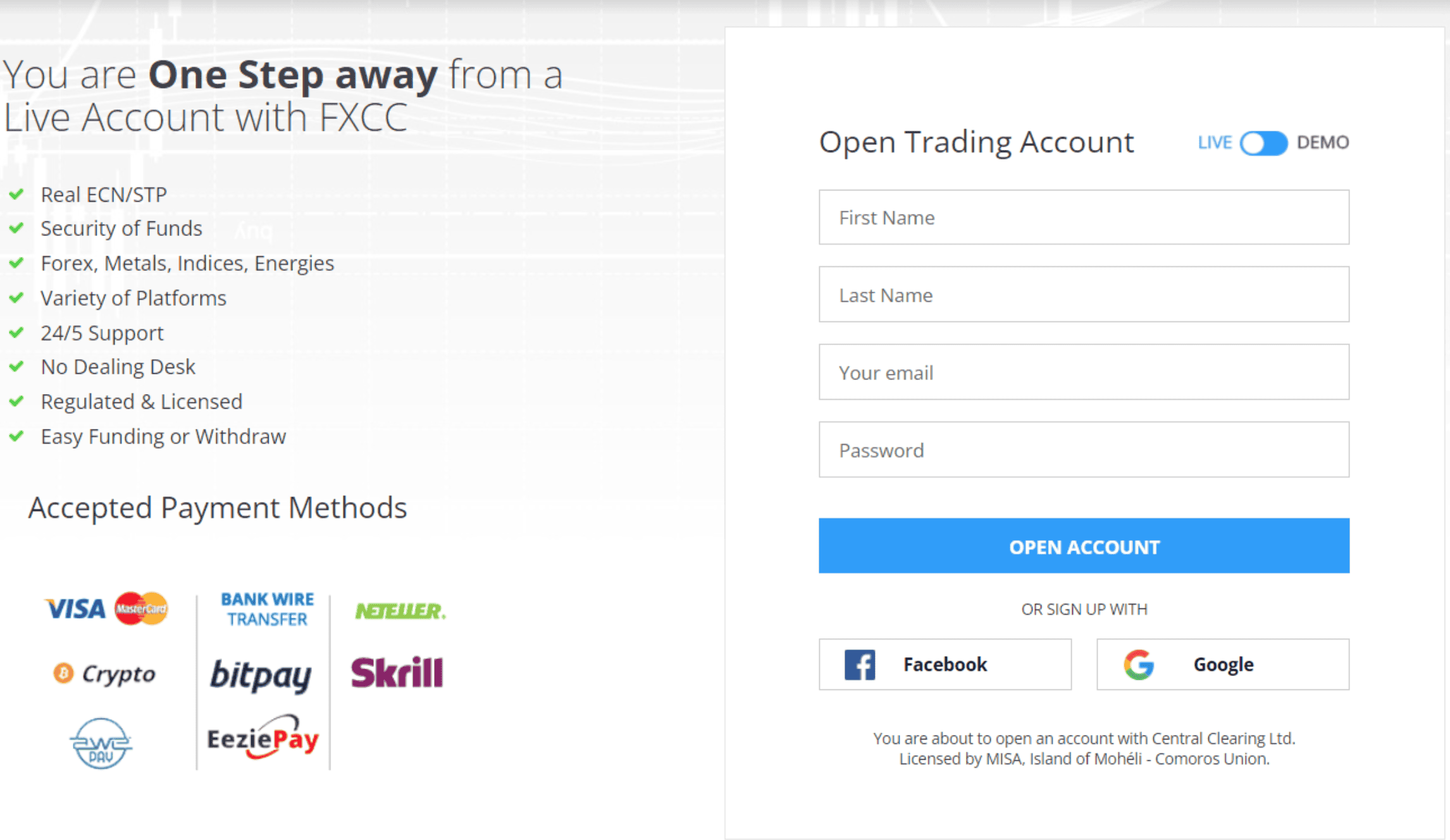

- Account Opening

- Additional Tools and Features

- FXCC Compared to Other Brokers

- Full Review Of FXCC

Overall Rating 4.3/5

| Regulation and Security Measures | 4.3 / 5 |

| Account Types and Benefits | 4.2 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is FXCC?

FXCC or FX Central Clearing is a Cyprus-established Forex broker founded in 2010 that provides forex exchange market professionals and retail traders access to trade currencies, cryptocurrencies, indices, energies, HK, EU, US equities, and metals through advanced technology. The company is known for its customer-centric approach by delivering competitive pricing with the most favorable trading conditions.

Being an NDD broker, FXCC provides quality execution and is a Trading provider that doesn’t take the other side of the trade meaning the broker is firmly on the traders’ side where all the orders, stops, limits, and trades are executed with counter-parties. What is also great, FXCC used technology to provide efficient and transparent pricing with the most possible low spreads. In addition, there is a range of ECN trading accounts that are designed to suit their own needs and requirements.

Is FXCC an ECN broker?

FXCC Broker is based on the ECN/ STP trading solution while all orders are routed and matched in the electronically configured network through the liquidity pools of institutional providers and market quotes.

FXCC Pros and Cons

Based on our expert opinion, FXCC Forex broker has been recognized by numerous traders around the world as well by the significant number of awards they receive. FXCC broker delivers dedicated support by a professional team and a good NDD trading environment based on quality technology, also with a good range of trading instruments and low fees and spreads.

On the flip side, the range of instruments is strictly limited to forex and CFD, the education section is relatively poor, and the support is only 24/5. Also, conditions for online trading might vary depending on the jurisdiction.

| Advantages | Disadvantages |

|---|

| Cyprus-based broker with CySEC regulation | Runs an offshore entity |

| Good Reputation and a decade of operation | Conditions and protection standards vary based on the entity |

| Global expansion | Only FX and CFD products |

| Low Spreads and Fees | Poor educational section |

| Competitive trading conditions | No 24/7 support

|

| Free VPS tools | |

| No minimum deposit requirements | |

| Client account protection | |

FXCC Features

Features of FXCC including various inluded into proposal benefits like various instruments, accounts and platforms selection. Below are the main features of FXCC, highlighting their benefits for users:

FXCC Review Summary in 10 Points

| 🏢 Regulation | CySEC and SVG FSA |

| 🗺️ Account Types | ECN XL Account and ECN Promo |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Cryptocurrencies, Indices, Energies, Equities, and Metals |

| 💳 Minimum Deposit | 0$ |

| 💰 Average EUR/USD Spread | 0.8 pips on ECN Account |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Trading Education and Research Tools |

| ☎ Customer Support | 24/5 |

Who is FXCC For?

Based on Our findings and Financial Expert Opinion FXCC is an option for traders of different preference including traders with or without experience, and mainly suitable for traders who prefere MT4 platform. Overall FXCC Good for:

- Professional Traders

- Regular size traders

- Algorithmic or API Traders

- EAs running

- Copy Trading

- Traders who prefer MT4 platform

- Currency Trading and CFD Trading

- CFD Shares Trading

- Suitable for a Variety of Trading Strategies

- Low Spreads Trading

FXCC Summary

For a final thought, we see FXCC as a company that gives an opportunity to engage in trading with the STP/ ECN model and quotes provided directly by the liquidity providers. The broker designed various accounts with comprehensive features and different minimum deposit requirements that allows traders of different levels to start trading in FXCC conveniently.

Also, it is essential to mention that the FXCC-regulated environment of operation ensures a safe and sufficient trading environment, along with providing customer support, yet we would advise signing with European entity for better transparency.

55brokers Professional Insights

Particularly attractive to cost-conscious traders, FXCC is a broker with a good reputation and large trading community with quite high scores on performance. Providing a competitive trading environment with ECN connectivity and quality execution, FXCC is ideal for traders who prefer to trade via the MT4 or MT5 platforms and access only popular Currency Pairs and some top CFD products provided with a low spread basis and no commission charges.

For the rest of demands like diverse range of paltforms, instruments, wide education resources or research, even accounts with commission basis FXCC might not be good fit since there is no good diversification provided, might you then opt to other Broker.

Consider Trading with FXCC If:

| FXCC is a Good Broker for: | - Looking for Reputable Firm

- Require No minimum deposit

- You trade Forex and popular CFDs

- Prefer High Leverage access

- Trading platform based on MT4

- Good Range of Tools and Insights

- Need Broker with Fees based on Spreads and Low quotes

- Prefere ECN execution with sprad basis

- Fast Execution

- MAM Account |

Avoid Trading with FXCC If:

| FXCC is not fit for: | – Investment Options

– PAMM accounts and Copy Trading are absent

– No wide selection of Products with thousands of instruments

– Prefer other than MetaTrader4/5 Platforms

– Traders from certain regions

– Trading on Commission Basis

– Requirement of 24/7 support |

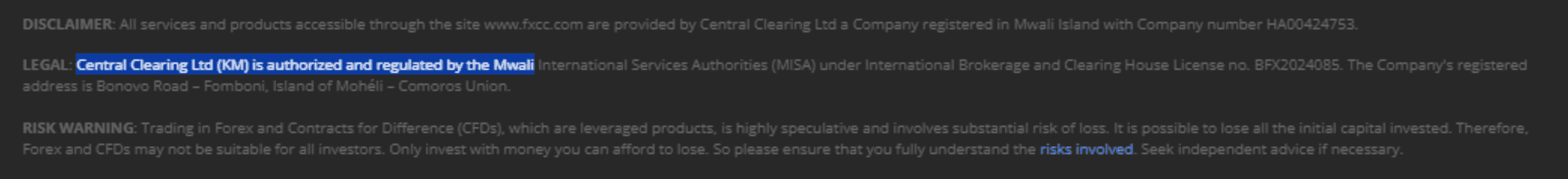

Regulation and Security Measures

Score 4.3/5

FXCC Regulatory Overview

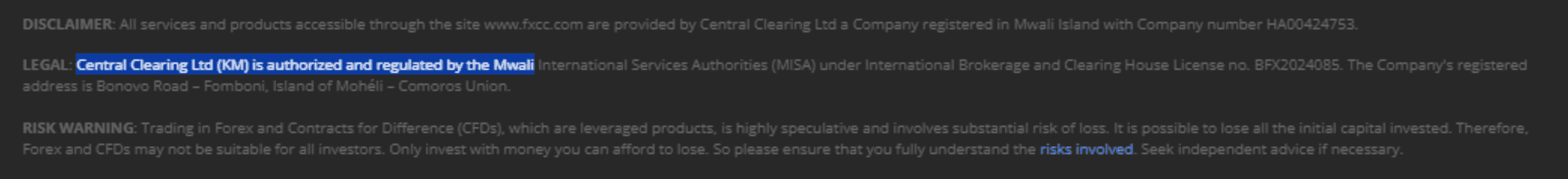

FXCC is regulated by Cyprus Securities and Exchange Commission (CySEC) , a low risk trading broker. Due to the fact that the company is authorized by an EU Member State, the broker also automatically operates under EU Markets in Financial Instrument Directive (MiFID) along with cross-border registrations in its states, which allows the provision of services within the EEA.

Also, an additional International entity FXCC serves is located in St. Vincent & the Grenadines and newly established Nevis and Mwali branch in Comoros. . Being an offshore zones, they do not define strict obligations to its financial registered firms, which may be a risky investment in case the firm is only based there. However, since FXCC is additionally authorized by the European regulator it is considered to be safe to trade with them.

How Safe is Trading with FXCC?

The protection of the client’s investments is provided in multiple ways according to the regulatory requirements and setter rules, yet always depends on the particular jurisdiction. Alike European regulation is way more strict and applies various rules, which apart from the segregation of the clients’ funds at all times, management and control of each type of risk complies to a number of rules.

Also, FXCC is a member of the Investor Compensation Fund, which secures the claims of covered clients against a company in case of its insolvency. Negative balance protection provided by FXCC guards traders from losing more than their account balance. Client money is also kept in separate accounts at Tier 1 banks, adding still another level of protection. For traders looking for a safe trading environment, FXCC is positioned as a consistent option by this mix of control, defensive actions, and financial transparency.

Consistency and Clarity

Established in 2010, FXCC has become known as a dependable broker in the forex trading space, regulated by the EU authority in Cyprus it provides reliable trading conditions overall. While International offering is provided by offshore zones it is still considered a reliable choice, but traders should be aware of various protective measures applied since they are strong at Cyprus entity not Internationally.

As for the consistency the Broker performs quite good operation along all the years and we didnt find serious breach of rules or fines imposed. In addition, real traders comments (which you may check underneath our review too) are mostly positive and there are many satisfied and happy traders at FXCC which is another plus to its clarity.

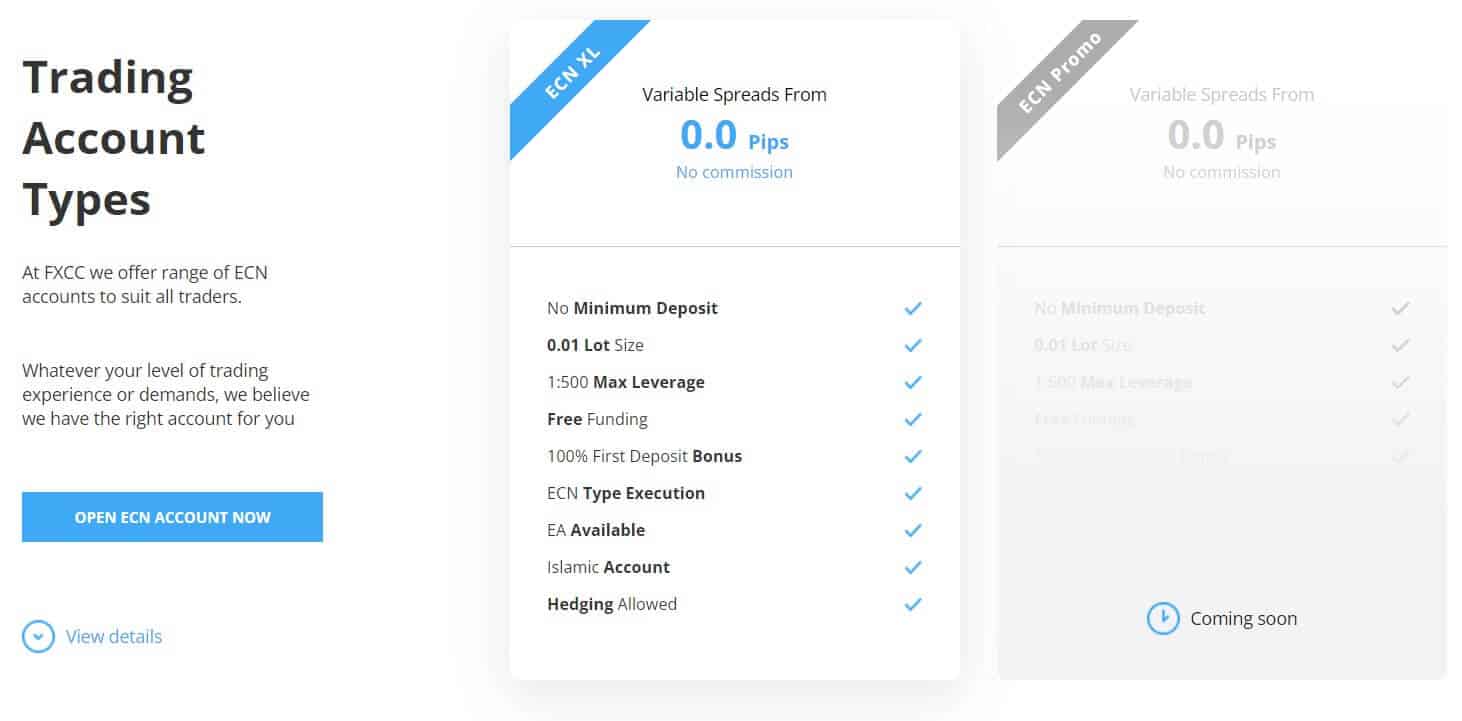

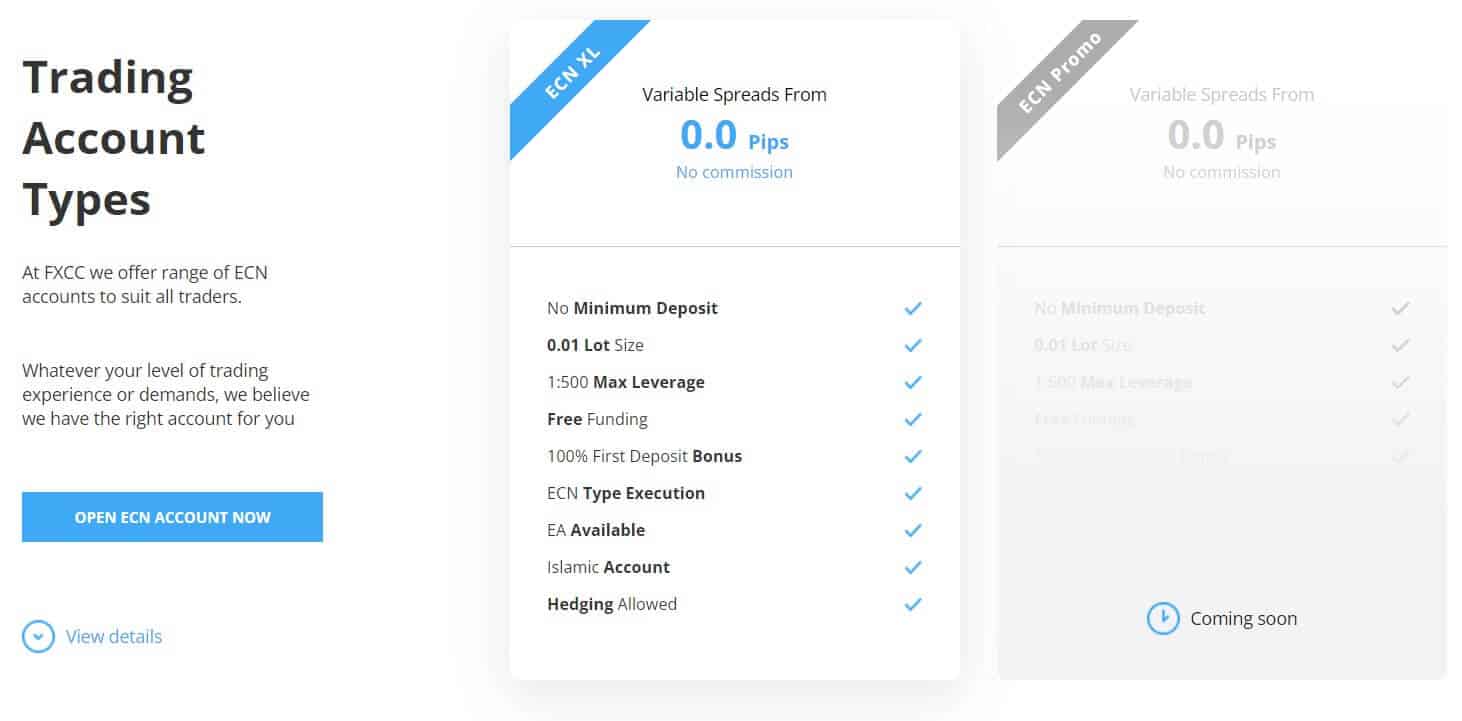

Account Types and Benefits

Score 4.2/5

Which Account Types Are Available with FXCC?

As we find at FXCC Account offerings there are two ECN accounts offered which differ by the level of trading size, experience, and particular demands. The most popular and widely used FXCC ECN XL Account features extra benefits of zero swaps, commissions, or mark-ups, or might be fully tailored solution for active traders or those who operate bigger sizes. Yet, as we notice ECN Promo account is currently unavailable for signing so mainly FXCC Login to ECN XL is available.

So trading with FXCC ECN account you will automatically access multiple currencies EUR, USD, GBP featured with tight spreads from 0.01 pips and availability to trade 30 currencies with a range of free tools alike VPS, SMS Notifications, EAs, Technical Analysis and Trading Tools.

Regions Where FXCC is Restricted

FXCC does not provide services to residents of several regions, specifically:

- European Economic Area (EEA) countries

- United States

- Some other unspecified countries

Cost Structure and Fees

Score 4.3/5

FXCC Brokerage Fees

Trading with FXCC ECN account you will access multiple currencies EUR, USD, GBP featured with tight spreads from 0.01 pips as mentioned on Broker site, yet to see the full fee structure be sure to check all the conditions including applicable commissions, funding fees and inactivity fees apart from the direct trading fees mainly built into Spreads. Here’s a detailed overview of the various fees associated with trading on the platform:

FXCC uses a spread-only methodology; hence, its ECN XL account shows no extra trading commissions. Spreads on important currency pairings start as low as 0.1 pips, which appeals to budget-conscious traders. For EUR/USD the average spread is about 0.8 pips, which is reasonable given many other brokers. Still, spreads depend on liquidity and market conditions.

Under its ECN XL account, FXCC charges no trading commissions; it depends on competitive spreads to make money. For high-frequency traders trying to cut expenses, this structure appeals especially. Further improving the broker’s cost-effectiveness without deposit or account maintenance fees.

- FXCC Rollover (Swap Fees)

Also, always consider FXCC rollover or overnight fee as a cost, which is charged on the positions held longer than a day defined by each instrument separately. However, trading with ECN XL Account broker promises no swap charges, which is very attractive since not so many Brokers as per our experience provide this kind of offering, so making you an easy calculation of trading position and great benefit too.

FXCC charges swap fees for overnight held positions. The asset being traded will affect these fees, which apply to both long and short positions. Swaps can be either positive or negative based on the interest rate differential between the two currencies in a currency pair. FXCC does not charge particular fees for overnight holding of positions outside the average swap rates.

How Competitive Are FXCC Fees?

FXCC Fees are low based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, but overall are among low levels compared to industry. Also, as for now FXCC has only single account type available fees are built on spread basis only, so commission account is not available important to note for traders who prefer this fee structure. For detailed info see our finds of fees and pricing of average spreads we find in the table below:

| Asset | FXCC Spread | FXTM Spread | XM Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.5 pips | 1.6 pips |

| Crude Oil WTI Spread | 3.2 pips | 6 pips | 3 pips |

| Gold Spread | 3 | 9 pips | 0.27 |

FXCC Additional Fees

Following three months of account dormancy, the broker levies a $5 inactivity fee per month. Although this cost is meager compared to some other brokers, casual traders should keep this in mind. FXCC charges no deposit fees. Still, the payment method followed affects the withdrawal fees. While other online payment systems like Neteller and Skrill have a set 2.7%, but bank wire transfers cost between $30 and $ 45. Pulling credit or debit cards is free of cost.

Notably, the payment service providers (PSPs) of FXCC apply their withdrawal fees rather than directly by the broker. When making their withdrawals, traders should consider these fees to help them to prevent unanticipated expenses.

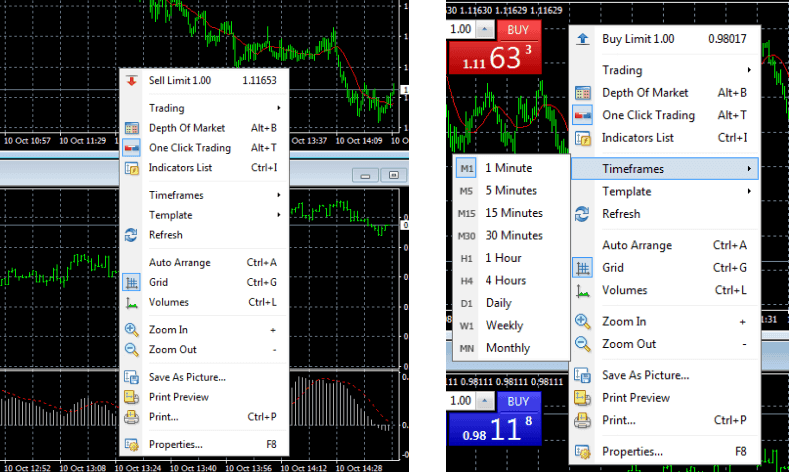

Score 4.3/5

FXCC Forex trading platforms, are based on highly regarded MetaTrader4 and MetaTrader5 in fact like many ECN brokers. FXCC platform software was developed to suit a downloadable version to be installed on a PC, a mobile application to follow trades on the go, a Multi-Terminal for simultaneous management of multiple accounts and is a MAM Broker.

The platform is available for all operating systems and fully compatible with EAs, hedging and equipped with advanced technical indicators, analytical objects, and charting tools.

However, the lack of alternative platforms is a major drawback, also some traders find MT4 slightly outdated.

Trading Platform Comparison to Other Brokers:

| Platforms | FXCC Platforms | Pepperstone Platforms | XM platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

FXCC Web Platform

FXCC runs on the most commonly used MetaTrader 4 (MT4) platform, which is well-known for dependability and sophisticated trading tools.

However, FXCC does not have a specific web-based trading platform; all trading is done using desktop or mobile applications based on MT4 software. This restriction could be a disadvantage for traders who want web access for convenience.

FXCC Desktop MetaTrader 4 Platform

The FXCC MetaTrader 4 (MT4) desktop platform offers quality trading experience characterized by its reliability and advanced features. The platform showed seamless trade execution across several asset classes, including FX, CFDs, and cryptocurrencies, during testing. The user-friendly interface let for speedy trade placements and effective market data navigation.

Technical indicators and broad charting tools of MT4 give traders complete analytical capacity. By means of Expert Advisors (EAs), the platform offers automated trading, empowering algorithmic traders to apply their ideas efficiently. For both new and seasoned traders looking for a strong but straightforward trading environment, FXCC’s MT4 platform is an overall fit.

Main Insights from Testing

Key results from testing the FXCC PC platform expose flawless execution of transactions, real-time market data, and many analytical tools necessary for efficient trading methods. Widely known for its simple interface and strong trading capabilities, the MetaTrader 4 (MT4) platform is the only supported choice by FXCC. Even though design of MT4 might be slightly outdated, also some capabilities should be added on as extra, like VPS, overall platform showed good performance, also execution based on ECN connectivity is very good.

FXCC Desktop MetaTrader 5 Platform

FXCC has recently introduced the newer version of the MT4 platform, MetaTrader 5, with more advanced conditions and opportunities. The platform is available through the broker’s ECN XL account, with no commissions and spreads starting from 0 pips. MT5 includes excellent analytical tools, deep insights into each instrument through 21 available timeframes, and access to a wide range of technical indicators, charts, and graphs. In addition, the FXCC’s MT5 platform includes trading alerts, an in-built economic calendar, and the MQL5 programming language to build custom tools and trading robots. The platform is available for PC, macOS, Android, and iOS, enabling better accessibility for traders.

FXCC MobileTrader App

Based on the MetaTrader 4 and 5 platforms, the FXCC MobileTrader app offers customers a strong trading experience on demand. After testing the app, it turned out that it provides real-time market access, sophisticated charting tools, and a range of technical indicators, among other basic capabilities. Benefiting from the same competitive spreads and execution speeds on the desktop platform, users may efficiently execute trades with only a few taps. Especially the MT5 mobile app stands out for its sophisticated tools and efficient solutions.

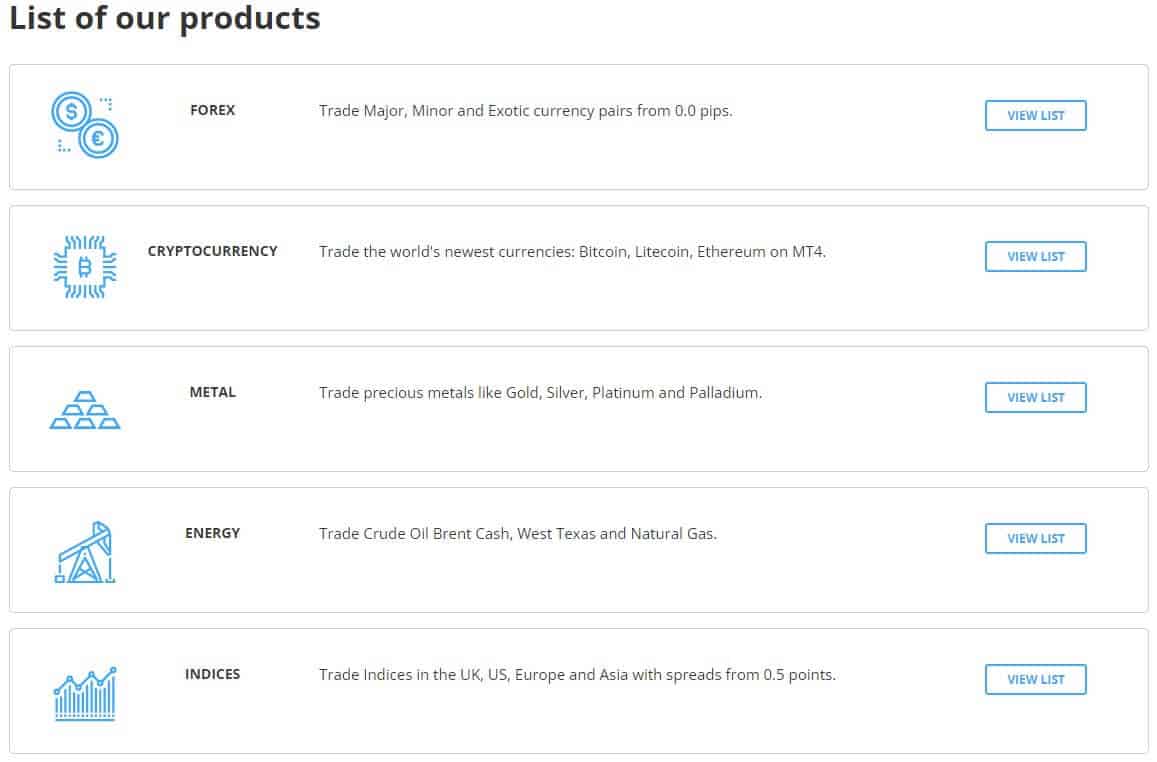

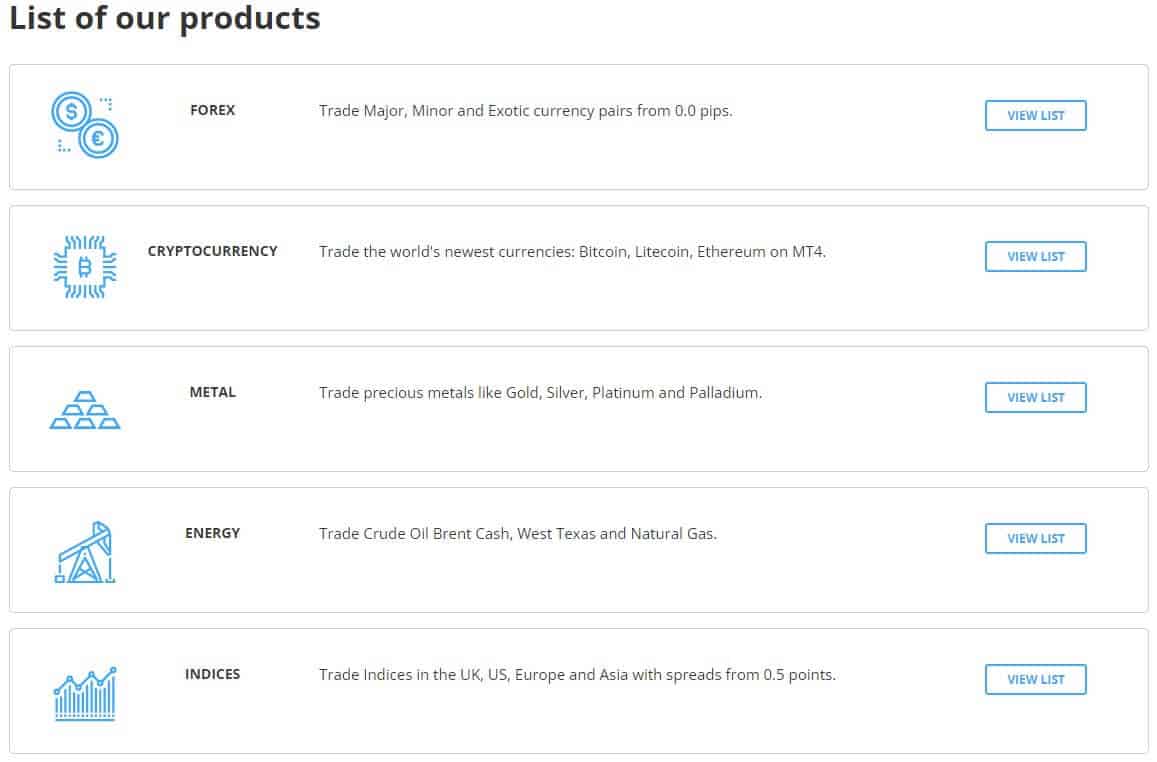

Trading Instruments

Score 4.2/5

What Can You Trade on FXCC’s Platform?

Based on our findings, the broker offers a good range of trading instruments with over 200 Trading products all based on FX and CFDs trading. It allows trading major, minor, and exotic currency pairs, and cryptocurrencies with access to Bitcoin, Litecoin, and Ethereum, major indices from the EU, US, UK, and Asia. It also allows the trading of precious metals and energies.

In addition, the broker has recently added over 1.000 HK, EU, and US equities for those clients who trade under the CySEC and MISA jurisdictions.

- FXCC Markets Range Score is 4.2 out of 5 for trading instrument selection, yet the only disadvantage is that they are limited to FX and CFDs while offered mainly popular instruments on each asset group, not diverse and wide selection. Also, trading conditions and the availability of the assets depend on the jurisdiction

Does FXCC trade Cryptocurrencies?

Yes, FXCC gives traders access to major cryptocurrencies like Bitcoin, Litecoin, and Ethereum available on a CFD basis. Yet note that instruments may vary depending on the jurisdiction. Under the CySEC and MISA entities, traders have access to over 32 cryptocurrencies.

Main Insights from Exploring FXCC’s Tradable Assets

Mostly concentrating on forex and CFDs, FXCC provides a range of tradable assets that might suit many traders who prefer trading of Forex. For those engaged in the forex market, traders can access over 70 currency pairs, including major, minor, and exotic choices. FXCC also offers 12 indices so customers may gamble on market movements without having any underlying assets, along with popular five commodities—including precious metals like gold and silver, also over 30 cryptocurrencies to satisfy the rising demand for digital assets.

However, FXCC does not provide ETFs or stock trading, thus reducing options for people looking for longer-term investments. Overall, FXCC offers a fine selection of products for forex and CFD traders; however, the range may discourage those investors seeking a more all-around opportunities and larger portfolios. This restriction emphasizes knowing one’s trading tastes before deciding on FXCC as a broker.

Leverage Options at FXCC

As the majority of Forex brokers, FXCC also offers to use leverage, a powerful tool to increase the potential of gains through its possibility to multiple initial accounts balance. However, leverage should be used smartly as it increases the power of losses as well.

- European retail clients and those who trade with the Cyprus FXCC entity are eligible to use the leverage of 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities due to ESMA restrictions.

- Yet, trading with the global FXCC branch you may access higher leverage ratios that go to a maximum of 1:500.

Leverage levels depend on the instrument you trade and are defined by the regulatory restrictions together with your personal level of proficiency.

Deposit and Withdrawal Options

Score 4.4/5

Deposit Options at FXCC

FXCC offers a range of handy deposit options to suit traders’ requirements. Instant funding for users’ accounts comes from bank wire transfers, Visa, Mastercard, Skrill, Neteller, and cryptocurrencies, also Neosurf, SOfort, Rapid, paysafecard, Neosurf, Yandex, Boleta, UnionPay and much more. FXCC notably charges no deposit fees, thereby enabling traders to begin free from further expenses.

While bank transfers could take longer, e-wallet transactions usually take one hour, and deposits are handled rapidly. FXCC enables accounts to use USD, EUR, and GBP, among several currencies. This adaptability serves a wide range of traders, improving the user interface. All things considered, FXCC’s deposit options enable effective fund management, making it available to new and seasoned traders.

Minimum Deposit

FXCC does not impose any minimum deposit requirement for opening a live trading account, making it accessible for traders to start with any amount they are comfortable with. However, according to the payment method the minimum amount ma vary from 50 to 100$ per transaction so be sure to check those conditions, which we find slightly different in each FXCC entity too.

Also, a recommended minimum deposit of $500 is suggested for those looking to maximize their trading experience and access additional features.

Withdrawal Options at FXCC

In addition to the selection of major withdrawal options making payment quite well-orhanized, we also notice the broker covers processing fees for both deposits or withdrawals. Yet, we advise always check with a particular payment provider in case of any other additional fees relevance or its possibility.

How long does it take to withdraw money from FXCC?

The withdrawal may take up to seven business days depending on the payment method but usually withdrawals are processed much faster.

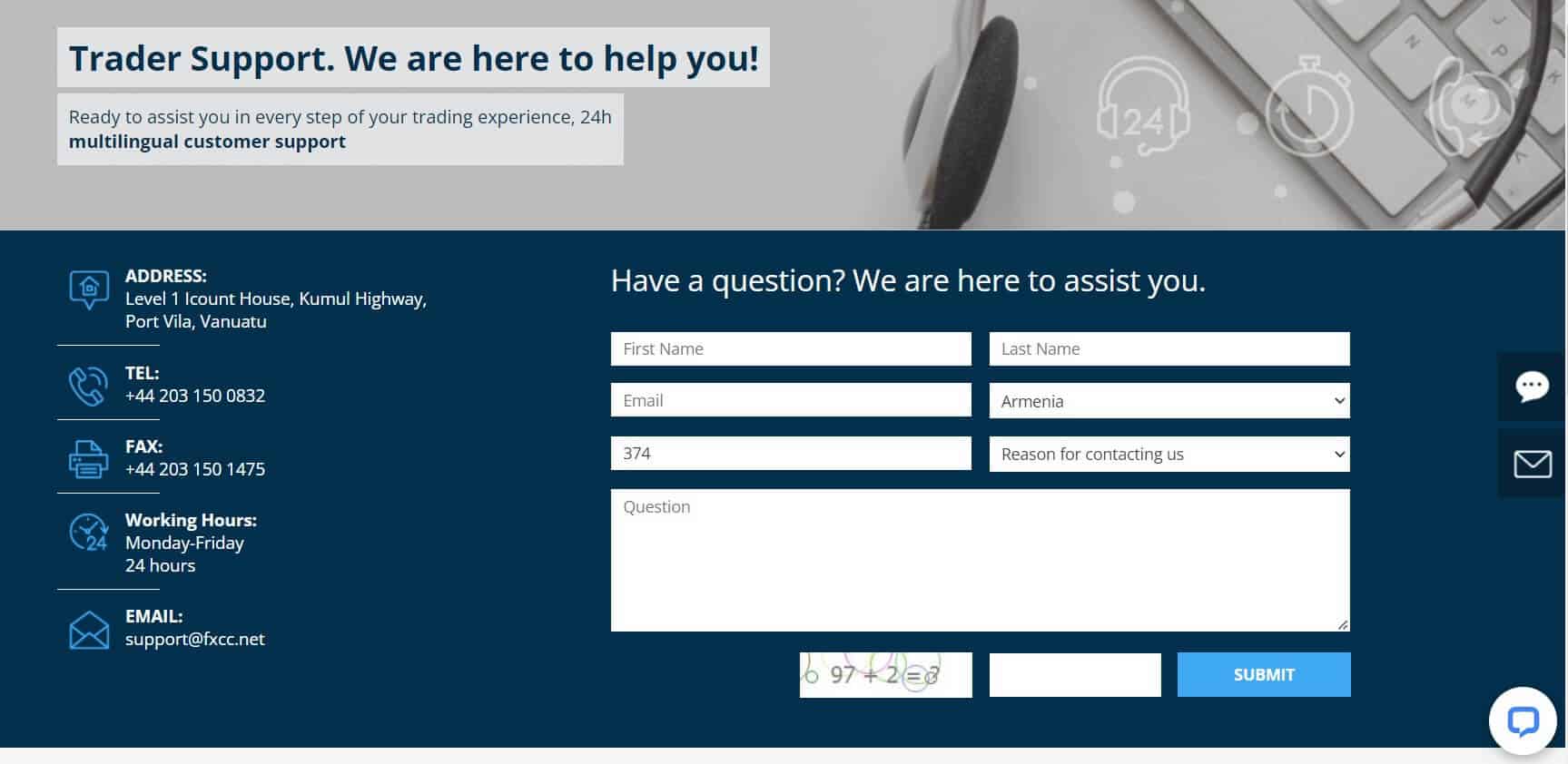

Customer Support and Responsiveness

Score 4.7/5

Testing FXCC’s Customer Support

Based on our findings, the broker provides excellent customer support available 24/5 through email, Live Chat, and international phone calls available in multiple languages allowing clients from across the globe receive quality customer support

- Customer Support in FXCC is ranked Excellent based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, the main point is the lack of 24/7 availability

Contacts FXCC

FXCC offers multiple communication channels to assist traders with inquiries and support. The broker provides 24/5 customer support, ensuring assistance is available during market hours. Traders can reach FXCC through the following methods:

- Email: For general inquiries, you can contact FXCC at info@fxcc.com. This allows for detailed communication regarding account issues or trading queries.

- Phone: FXCC can be reached at +44 203 150 0832, providing direct access to customer support representatives.

- Live Chat: The FXCC website features a live chat option, enabling quick responses to urgent questions.

FXCC’s commitment to multilingual support enhances accessibility for clients from various regions, although it’s important to note that support is unavailable on weekends.

Research and education

Score 4.3/5

Research Tools FXCC

FXCC provides quality research tools meant to improve traders’ market analysis and decision-making capacity. Although FXCC’s research products are helpful for traders, they might not be as thorough as those of other top brokers; hence, users should always augment their research with other sources as needed.

Some of Research tools included into the proposal that can be find either directly on the provided MT4 platform or on Broker Official Website include:

- Forex calculators among these instruments let traders compute margins, pips, and risk levels, thereby enabling improved trade management. Traders wishing to maximize their holdings and properly control their exposure depend on these calculators.

- FXCC live quotations, which provide real-time market data, enabling traders to be current on price changes on several instruments. Making wise trading decisions in a market driven by fast changes depends on this ability.

- Additionally, the broker provides an economic calendar that lists forthcoming releases and events. This instrument enables traders to prepare their strategy in line with possible market volatility.

- FXCC market analysis focused on key currency pairs, thereby revealing possible trading prospects depending on present market conditions. New traders could spend more analyzing the market and get experience for your self. Regular updates reflecting the most recent market trends allow the broker to offer trading signals for particular pairs of currencies and metals.

Education

Serving both beginner and experienced traders, FXCC has a variety of instructional materials meant to improve traders’ knowledge and skills. Basic e-books, educational articles, and a dictionary of key trading terms—which act as fundamental tools for understanding market dynamics—are available through the broker. Although the training materials are valuable, they are minimal compared to more all-encompassing offers from top brokers.

FXCC also includes demo accounts so users may hone their trading techniques free from financial risk. This helpful method enables traders to put their expertise into use in actual market environments. Nevertheless, the instructional resources’ absence of interesting components like interactive quizzes or films could compromise the learning process. Although FXCC offers necessary teaching tools, traders looking for comprehensive training materials could find the offerings inadequate to acquire advanced trading skills.

Is FXCC a good broker for beginners?

For several reasons, FXCC is a good broker for beginners. It’s no minimum deposit requirement that lets new traders start with any sum they want. Minimizing trading expenses, the broker provides a commission-free trading environment with competitive spreads.

Supported by the MetaTrader 4 (MT4) platform, which is well-known for its simple interface and strong trading capabilities, FXCC helps beginners to run transactions and access learning materials. Furthermore, controlled by the Cyprus Securities and Exchange Commission (CySEC), FXCC offers a degree of security very vital for new traders joining the market.

Portfolio and Investment Opportunities

Portfolio and Investment Opportunities

Score 3.8/5

Investment Options FXCC

Focusing primarily on trading opportunities in forex and CFDs, FXCC does not offer classic investment opportunities like purchase and hold of Shares.

Although FXCC is ideal for active forex traders searching for cheap spreads and leverage up to 1:500, the lack of stocks and ETFs could discourage those wanting a varied investment portfolio. With no specific copy trading or long-term investment scheme, the broker stresses trading over passive income approaches.

FXCC lacks standardized investment plans or portfolios but provides individualized assistance for investments over $10,000 for more significant individuals. FXCC serves currency traders well but falls short for individuals looking for longer-term development prospects or more general investing options.

Account opening

Score 4.4/5

Account opening at FXCC is quite easy to perform, you may simply navigate to Main Page and follow tih FXCC Login, while there are some differences between Demo and Live account opening, mainly for condirmation of your indentity before you may deposit funds to your Live account. As Demo trading is provided for testing purposes on virtual funds. Here are steps how to open trading account:

How to open FXCC Demo Account?

- Visit the FXCC Website: Go to the official FXCC website.

- Click “Open Account”: Locate and click on the “Open account now” or “Register” button at the top right corner of the homepage.

- Fill Out Registration Form: Complete the registration form with your personal details, including your first name, last name, email address, and a chosen password.

- Select Account Type: After submitting the form, you will be directed to choose the type of account you want to open. Select the demo account option.

- Receive Verification Email: Check your email for a verification link sent by FXCC and click on it to verify your account.

- Access Your Demo Account: Once verified, your demo account will be activated, and you will receive login details to start trading with virtual funds.

- Download Trading Platform: Optionally, download the MetaTrader 4 platform to begin practicing your trading strategies.

How to open FXCC Live account?

- Visit the FXCC Website: Go to the official FXCC website.

- Click “Open Account”: Locate and click on the “Open account now” or “Register” button at the top right corner of the homepage.

- Fill Out Registration Form: Complete the registration form with your personal information, including your first name, last name, email address, and a chosen password.

- Choose Account Type: On the next page, select the type of account you wish to open (e.g., ECN XL).

- Submit Verification Documents: After filling out the form, you may need to upload proof of identity (POI) and proof of residence (POR) documents for account verification.

- Verify Email Address: Check your email for a verification link sent by FXCC and click on it to confirm your account.

- Fund Your Account: Once verified, log in to your account and make an initial deposit using one of the available payment methods.

- Start Trading: After funding your account, you can begin trading on the FXCC platform.

Score 4.3/5

Several special tools and capabilities provided by FXCC improve the trading experience for its customers. For high-frequency traders especially, the ECN XL account is one of the best options since it has spreads beginning at 0 pips and no commission.

- Every FXCC client can apply for free trading tools through the Traders Hub environment that also offers a variety of complementary features to choose from and is a great advantage for all.

- Extensive range of tools offering various instruments that are helping on a daily trading process, range of free tools alike VPS, SMS Notifications, EAs, Technical Analysis and Trading Tools. Also, including interest rates presenting a comprehensive list of the key base rates relating to all global central banks.

- FXCC offers the ability to trade with free VPS (Virtual private Server) which brings stability under any conditions, speed and performance. Own dedicated server can be accessed with multiple platforms and accounts, which runs automated programs or applications and ensures smooth trading continuously.

FXCC Compared to Other Brokers

FXCC provides quality trading conditions for traders who focus on MT4 trading and mainly Currency Pairs provided with low costs. Compared to other Brokers, FXCC platform range, instruments selection, also account types availability is slightly losing since the Broker focuses more on particular trading conditions with ECN connectivity and offers less diversification on all above, like other Brokers IC Markets and Pepperstone has more flexibility of fee models, platforms and instruments selection.

| Parameter |

FXCC |

AvaTrade |

Capital.com |

IC Markets |

Pepperstone |

| Spread Based Account |

Average 0.8 pips |

Average 0.9 pips |

From 0.6 pips |

From 1 pip |

From 1 pip |

| Commission Account |

Not Available |

For Professional Account only |

Not Available |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

| Fee Ranking |

Low |

Low |

Low |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

Proprietary platform, MT4, Trading View |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

| Asset Variety |

1200+ Products |

250+ Instruemtns |

3,000+ Instruments |

Over 1,000 Instruments |

Over 1,200 instruments |

| Regulation |

CySEC, FSA |

Central Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

FCA, CySEC, ASIC , FSA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

| Customer Support |

24/5 |

24/5 |

24/7 |

24/7 |

24/7 |

| Educational Resources |

Good education and research |

Excellent |

Excellent Trading Education |

Good educational resources |

Excellent education and research |

| Minimum Deposit |

0$ |

$100 |

20$ |

200$ |

0$ |

Full Review of FXCC

Established in 2010, FXCC is a regulated broker providing forex, CFDs, commodities, and cryptocurrencies, among other trading instruments. Under tight rules from CySEC and MiFID, it ensures a safe trading environment with customer money kept in Tier 1 banks. Also, FXCC has 4.3 rating at Trustpilot.

Using spreads beginning from 0 pip and no commissions on its ECN XL account, FXCC offers competitive trading conditions overall. Accessible for beginners, the broker provides significant leverage of up to 1:500 and no minimum deposit requirement. The broker offers MT4 and MT5 trading platforms, renowned for reliability and sophisticated tools.

FXCC lacks stock and ETF trading options even if it provides tools and educational materials such as economic calendars and trading alerts. Also, although it has a rather small asset range and may not fit all investors, FXCC is a good option for traders looking for low-cost forex and CFD trading in a safe atmosphere.

Share this article [addtoany url="https://55brokers.com/fxcc-review/" title="FXCC"]

My FXCC review after a year of usage.

The beginning was tought, but not beacuse of the broker it was just hard to get used to gold and fx majors being volatile, as I used to trade on;y stocks before.

But going with a decent broker helps and I can say that spreads are really tight, and withdrawals arrive on time as promised.

it is a good , solid broker with attractive, above indsutry standard, conditions …

I ve been a trader here for around 2 years already, and all goes well, whether it is trade execution mode, low spreads or fast support service, all is top tier i d say…yeah, sometimes spreads arent low, but it is market nature.

recently they added new stocks, I see US names, the question is: Will they add more?

Now they have even lower spreads on gold, it’s actually nice cuz gold is active at last

I read other traders FXCC review here and this made me open account. I like the ecn xl acc and the trading terms, and the reviews show trader are satisfied with the service… let’s see

This fxcc review helped me decide to open account here. The confirmed fxcc traders reviews that are published here, with trading account number and everything gave me the final boost that i needed to trust this brand and open acc. So far, I have the account for three days, all looks fine, havn’t encountered any issue

Very strong regulatory status… they have many licences and this itself is a proof for those who still question their reliability..

This is not very deep FXCC review… if i was tasked with such a task i would write a better one.

Highlight their ecn execution model

Highlight the absence of the standard commissions for ecn accounts, which makes the costs shrink

Mention the market range

And there are so many other things that are worth mentioned like the awards for their ecn xl account

The ECN trading account is really something else, only one acc available, but conditions are superb.

I don’t trade on weekends so idk why would anyone need 24/7 support tbh

They already were legit but one reason they are on the top is becasue they improve their service each time. This time they added MT5 and then crypto trading all week. I wonder what would be the next addition here?

I wouldn’t be surprised if they create their own proprietary mobile app after seeing so many changes in the last 6 months. They proved everyone wrong, they’re still competitive in this field.

In what world is running an offshore entity a disadvantage? We have more flexible trading conditions and more levearge, they have more freedom for making improvements etc. Other than that, great review 👍

They finally add crypto. It was a long overdue, but it’s better later than never. Just wanted to update you with this information if anyone considers fxcc. I know there were many complaints about this fact, and they finly fixed it.

Do you think 1:20 provided by this broker is enough for trading crypto profitably?

Oh I believe it’s more than enough cause you have to remember that crypto currency is a very volatile asset so having this high leverage can have both positive and negative impact.

I have seen 1:5, and what I wanna say is that 1:20 is a nice opportunity overall. It’s not as large as forex becaus of the nature of crypto, you can’t predict is as effectively short term, this is why lower leverage is actually save you from taking too much risk. 1:20 is more than enough, plus weekend trading is here, double advantage.

Is the withdrawal time the same for crypto and bank wire, or does one of these methods get processed faster?

I tried crypto first and it was faster than bank wire for me. Don’t know if that’s always the case but I got mine quicker with crypto.

Definitely not the same and it depends on your region truth be told. Some regions require you to wait days for your wire transfer to be completed while others are instantly and with crypto it usually within a day so it all depends on your location and easy accessibility.

The 0 min deposit isn’t only to lure you in, it has really low cost anf favourable for beginners. The assets are a bit limiting tho, wish there were shares to trade

With no deposit requirements from this broker, how much do you think a beginner trader should start with?

Hmm, if we are talking about a beginner in trading, why would he even need to open a live account? Don’t you think that he is not experienced enough to trade with real money? Because of the lack of experience in the markets, he might easily blow all of the money he deposits in the account, no matter what the sum is, $5, $10 or even $1000.

So, i would suggest a beginner to open a demo account, which fxcc has. This way, you will not risk any of your money, however, you would be able to trade as if you deposited real money. The difference between demo and live account is that you have imaginary money to trade with, and that’s it. The charts are the same, the environment is the same, the tools are the same…

FXCC ecn account has the best trading conditions, I truly didn’t expect to see such narrow spreads and zero commissions there. There is even an opportunity to trade with hedge mode which is a big benefit for me because I always use hedging strategies that allows me to stay afloat in financial markets for a long period of time.

Which account type is more favourable for scalping trading style?

Dude, just open their official website… They do not offer multiple trading accounts unlike other brokerage firms. Traders can trade only on a single ECN XL account, however, the trading conditions are much better compared to those places where I’ve traded before and I know what I’m talking about. There are tight spreads, free funding and swap commissions that makes the trading process more enjoyable and cost-effective. You better try it out on your own to understand what I mean.

Does FXCC allow crypto for funding accounts?

Yes, it does… FXCC has quite an advanced payment system, and of course, crypto deposits/withdrawals are allowed. Furthermore, the cryptocurrencies accepted for deposits are many, not just usdt as it it the case with most of the brokers out there… here you can deposits using the follwoinf cryptos: BTC, ETH, USDT ERC-20, USDT TRC-20, USDT BEP-20. Keep in mind that fxcc doesn’t charge anything on their side as a transfer fee, but expect to pay a mining fee when using cryptocurrencies.

Yep, if you register to the broker and get to the phase when you have to deposit, you will easily find the crypto method for performing it. Besides crypto, you can find e wallets, banks and many other options both for deposit and withdrawal…

this platform has great features and some of the disadvantages can be a setback like the educational content, limited assets which can be perfect for someone who has created a niche and trades with specific assets but not ideal for a beginner or someone trying to build a portfolio or expertise.

Ah-ha looks like from your judgement if it’s not suitable for beginners and traders with expertise who it’s suitable for? I don’t think they have big limitations in assets. All popular one are there, including crypto and shares, not much of a problem. Anyway, it’s never been something they bragged about. Trading conditions yeah I think everyone would like this broker’s feature. Cheap+reliable, what else might be needed from the trading service?

I agree with you bro! This broker is on another level! Recently they finally added the MT5 after numerous requests from customers, this fact already shows how they’re focused on the client-orientation business model. Furthermore, from now on they allow us to trade crypto currencies 24/7, previously limited 24/5 which is a real game changer for crypto traders. It’s quite unusual when a forex broker offers such conditions. So I think it’s strange to question their services and quality.

What trading strategy will work with Fxcc trading accounts and conditions?

I’d say FXCC should have a good trading strategy be it scalping or intraday trading because it would be able to offer tight spreads and fast execution. It also helps in pairing with solid risk management and economic calendar awareness could work well under their conditions

What payment method do you prefer to use to make deposits and withdrawals there?

I prefer crypto, the usual USDT wallet. I know it might seem costly and not-friendly for someone who is far from this subject, but after some time I guarantee you’d love its speed and confidentiality. Card are good, nobody argues, no fees at FXCC. Anyway, they can’t provide the same deposit and withdrawal speed, as crypto alternatives. Too big time gaps…

Crypto and debit card are my personal go-to methods. Crypto is faster but the visa card opion doesn’t have any fees, so you can pick your own poison…

What’s important to keep in mind is that, first, fxcc doesn’t charge any fees on deposits. And second, any profits exceeding the initially deposited amount have to be withdrawn through bank wire anyway, so we don’t really have a choice here

Everything is similar to other ones, in terms of regulations, certain licenses for certain locations. I don’t think it’s their disadvantage. FXCC is more about super affordable trading conditions and great execution. This what makes them unique- model that whoever they have as liquidity partners, provides one of tightest spreads in the industry. At the same time, they don’t offer super x3000 leverages, so can be considered safe and not trying to blow your deposit. Ofc, it’s just a personal view. Number of people reflect the quantity of opinions.

Their regulatory status seems okay… multiple licences from various authorities. I always check this aspect first when I am interested in a broker. And FXCC offers pretty good platform for traders like me who prefer tight spreads and low trading costs. There are no trading commission on the ECN XL acc which is rare for and ECN account type

My trading style is scalping. So, usually i open about 5-10 positions a day. Does this broker charge for opening and closing positions?

That is a good question, and an important one to ask yourself before opening an account.

Fxcc doesn’t have any commissions for executing trades, so you only have to pay the spread. FYI, the spreads are pretty tight there considering that all the liquidity is being sourced from large providers.

Still, if you plan to open around 10 positions a day, I recommend trading during the peak operating hours (which you probably already know).

If you go for the ecn xl account, then NO. You will not be charged for opening and closing positions, as they do not charge any commission fees. Furthermore, the account suits scalping perfectly. The combination of tight spreads, absent commission and instant executions maximizes your profits.

Tight spreads are good for beginners as well, but straight through processing is a real game changer for large volume traders, especially considering the lack of commissions at fxcc

Does anyone know if this broker is suitable for scalping forex majors?

That’s a good question, actually. What makes a broker suitable for your scalping strategy may vary, but generally, you should look for one that offers spreads as close to zero as possible, specifically on pairs you want to trade (major currencies like USD/JPY in your case). The alternative is to open a fixed spread account based on commission.

And don’t forget about execution speed, everything below 11 milliseconds is considered good for scalping.

From my experience using FXCC, the average spread for EUR/USD is around 0.6-0.8 pips. If we account that there is no commission charged per trade, then the odds are definitely in your favor here compared to some other brokers.

Yes, Yes, and Yes. 😀

I will tell you why… for scalping, you need a few things: tight spreads, fast executions, and as low as possible trading costs. Let’s examine how FXCC is doing for each of the listed factors.

For tight spreads, you need an ECN execution broker, and FXCC is an entirely ECN broker. This means the execution is super fast, and the spreads are raw – which means they are not adjusted by the platform, your trades are executed at the market price without any interference.

For this service, most brokers charge an additional trading commission, which is quite common in the market. It ranges around $3 per lot per side. It’s not a small fee, especially if you trade frequently, this fee can add up. What is great, at FXCC this common trading commission is eliminated.

These are the reasons why FXCC is considered as one of the best brokers for scalpers

Can I fund account here with a cryptocurrency with inexpensive transactional cost?

Well you can definitely fund your account with crpyto, but the part where you say inexpensive transaction cost is tricky…

If you plan on funding with BTC or ETH, gas fee is not gonna be as affordable, and therefore I would advice you to avoid these if you can. USDT is the good option, but not ERC20 as it still uses ethereum network and gas fee is still high there, so TRC and bep20 are the best , the latest is the cheapest from my experience.

You can do it, it`s much faster than ordinary payment methods, but in terms of costs, it depends on the mining cost of a particular cryptocurrency. Here, you`ll face the dilemma, since FXCC offers to cover the associated deposit fee, even from the side of the payment processor, but it`s true for usual money fees, but crypto is another thing. So, keep it in mind, if you want to deposit by either bitcoin, usdt or eth, mining fees can be applied, what exact amount, it depends more on particular network capacity.

I trust this broker 100% but not gonna lie when i was about joining them, i had a lot of doubts about their reliability. However, it turned out the company has been operating since 2010 and i thought this is quite impressive that they are still able to offer the trading services for physical traders around the world. I mean I know how hard it is for brokers to survive in this cruel industry and it says a lot about their reputation if they didn’t go bankrupt for all that time.

Which of the account should I start with as a beginner?

Actually, the variety of trading accounts is not big here. If you didn’t know, FXCC has only one trading account ECN XL and it has been quite popular among traders.Yeah, perhaps, you may be surprised by that but the trading conditions which they offer on this account are better than in many other brokerage firms.

For instance, there are very tight spreads on the forex market and no commissions per trade. You can also open an islamic account to trade with free swap fees but you have to prove some islamic documents. Anyway, it seems you’re a total beginner, then you better start out by trading on a demo account with virtual money and only after that you can switch to real trading using a real account.

Is it possible to trade normally on a single account with those trading conditions?

I`m kind of not getting the whole point of your question. But, anyway, for now, as I know fxcc provides one type of trading account-Ecn XL, beside the demo. The benefits of trading on this account, is the affordability and accessibility of trading conditions. Golden middle leverage of x500, tight spread from zero and no commissions, make your trading more beneficial. So, in order to trade normally and take full advantage of these conditions, you can just register and start trading normally, it depends for sure, what you mean by the word normally…

Very transparent, without hidden commissions. I like that I can fund an fxcc account with USDT via a good set of networks, not only limited to erc-20. The company takes care of regulations and strives to accommodate traders from various countries with a relevant protection mechanism. Such trading feels much more secure.

What do traders – both new and experienced – stand to gain, if they decided to trade with FXCC? In addition, what negative implications can be expected from trading with the mentioned broker?

At last, a coherent and sound question, thank you for this.

I can choose in which sequence I can answer the questions, and I choose the second one first.

The only negative implication that you might face at FXCC is the one you make up for yourself, because as a broker, there aren’t any if we are being objective. For instance, if you start trading here but if you don’t like the design, this would be your negative implication which is subjective.

In contrast, what we stand to gain is a lot, and at least, it would be great support from the team, they are always ready to assist and help. Besides, you will get solid trading conditions as good leverage and tight spreads. The good part is that if you have your strategy, FXCC will not be limiting it in any way, you can trade whatever style you’d like.

very well maintained mt 4 without lags or hiccups. tidy and functional both for desktop and ios…

Hey Mike, I would gladly answer your questions.

1. As an experienced trader you gain a lot from FXCC. The broker offers NO commissions, one of the tightest spreads, secure payouts, great platform with all the instruments and indicators needed for professional trading. Furthermore, FXCC allows any trading style. Even hedging and scalping styles are welcome here;)

The same goes for novice traders, but they can also greatly benefit from the customer service and education that they offer on their website. Support is quick and helps with setting up accs, explaining how to open positions and etc.

2. Personally, i didnt notice any negative aspects with this broker. Trading is smooth here, executions are fast and costs are extremely low. Not every broker can offer this kind of trading conditions…

I`d say that from the perspective of this review and from my personal experience with FXCC broker, the service can be called favourable for traders. Like, many of traders, I pay attention to how much broker charges for its services and how reliable it is, of course, the cheap doesn`t mean, I`d subscribe for the service, if it doesn`t provide a stability and reliability, but it`s not a case for this broker.

They have a very good ECN order execution system from the direct liquidity providers, making opening any positions accurate and fast. At the same time, no commissions on trades and payments, tight spreads, all my expectations were matched completely.

In my opinion, FXCC is a solid brokerage company with reliable and high-quality services. And as I can see, this review confirms my opinion.

By all measures, FXCC has almost the highest scores. This means that broker is really as good as I think it is.

I can recommend this company to those who are looking for favorable trading conditions. And you know, I won’t worry because I’m sure that this broker is on top.

Can I have instant withdrawal in this system, I wonder?

You can have “instant” withdrawals, but not with the methods that are somehow associated with banks. So transfers and VISA is not gonna be instant, this is for sure.

When to comes to other methods, yep they will be in real time, pretty much quickly… And the same with crypto, withing 15 minutes, I think we can regard to this as instant, compared to 5-10 days of VISA…

The payment system at FXCC is pretty much the same as any other broker out there. This is a matter of regulation and following the AML policies imposed by regulators. I am going to explain this a bit thoroughly.

When you deposit a certain amount, let’s say $1000, regardless of the payment method you choose, everything you withdraw up to $1000 is processed swiftly and it can be labelled as instant withdrawal. You know, legally speaking, it’s not really considered a withdrawal – it’s more like a refund. See this like you buy something from an online store which offers money-back guarantee, adn you return the product and get your money back. Sounds crazy, but from a legal point of view, that’s how it works.

Everything above your deposited amount, in this case everything above $1000, is considered as withdrawal. And in this case, whatever broker you choose, you have only one option as a payment method for withdrawing – it is a bank transfer or wire transfer, which is not instant at all. It takes about 3-5 days.

It was nice of FXCC to provide me with a deposit bonus of 100%. Not gonna lie, they know how to bribe customers. It allowed me to open trading positions with larger trading volumes and I’m doing fine so far. Mainly I’m trading on the forex and am satisfied with the trading conditions. Swaps are really cheap here, i can hold positions for several weeks in a row without worrying about trading costs.

as a fledgling trader, i love their ecn xl account and dunno why some people complain about the lack of diversity of trading accounts. I dunno why u need other accs if everything you need is available on the ECN XL. There is a high leverage up to 1:500, narrow spreads, I even got a deposit bonus of 100% and it was a pleasant surprise for me. It allowed me to start trading with a large deposit and with less risks, I didn’t even use leverage higher than 1:10. What I wanna say is so far so good with the FXCC broker!

Well, poor education is a real thing unfortunately here. Could be much better considering the caliber of the company.

But, to make it fair, education is a responsibility of a trader, and brokers main job is to provide comfortable trading conditions, which FXCC is doing pretty good. Anything extra is a bonus of course, but still not a must.

FXCC has all needed conditions that every trader basically needs. Many people pay attention to secondary things, such as support, educational materials, bonuses and whatever having features of not vital things. Cost of the broker, withdrawal process, commission and regulations will always be the factors that true market sharks will admire. So, these conditions are widely presented by these broker, starting from very tight spreads on forex pairs, to all regulations of respected authorities, like cysec.

Well it may sound like a joke, but I like the only account here. I feel like this approach is better than having like multiple accounts, which willl have their own capital requirement.

At one place I have even seen 250K capital requirement, and this just sounds a bit crazy. IT should be about freedom of choice, and whatever sum you invest in your account, you should have the same trading conditions and spreads, this way it will be fair. This is why I like FXCC, they do offer fair services to all clients, without any discrimination. ✌

According to many parameters this broker is satisfying. I can’t say that fxcc is best of the best, real GOAT. But it’s definitely better than many other brokers, cause there are many CFDs, thin spreads and robust trading platform. Metatrader is something that will never let you experience bugs and lags… as for requotes and slippages then it’s the liability of the broker, ie its liquidity providers. But I haven’t encountered any.

If you were FXCC developers, would you increase leverage a bit or it’s enough for profitable trading?

I would, but not significantly, because here it comes a disaster right after 1:500 leverage.

So… 1:500 would be enough, as it perfectly caters to the needs of both professional traders and newbies who don’t even understand what leverage stands for. Of course, even such a ratio is dangerous for them, but if you utilise stop losses, then everything is ok.

All in all, it’s just my desire, I know those who would even lower the leverage here:))

Nah, dude! If I were a FXCC developer, I would not increase leverage at all! Being honest, I don’t think anything cool about using a high leverage in trading because it always leads to high risks and loss of deposit from my perspective.

On the contrary, I would decrease the size of leverage to 1:100 and it’s pretty enough for profitable trading. Personally, I never used leverage higher than 1:30. Usually, I use 1:10 and 1:5 in most deals and it helps me stay afloat on financial markets for many years.

The highlight of this review is that FXCC offers a true ECN trading experience. I agree!

It’s awesome that this broker has different leverage depending on the regulation. I mean… it’s obvious, but at the same time, if it’s about trading with a global entity, then as far as I know leverage is up to 1:500, not 1:300. It’s a considerable size, at the same time, it’s not about impressive x1000 or even x2000. 1:500 is a golden mean for many traders.

If it’s bigger then it’s super dangerous and those rookies entering trading with such a big leverage leave the market right away as a rule =D

Which of the ways to deposit FXCC account is the most balanced? Which one is both fast and favorable?

I would say the e-wallet method. Not only is it fast for the fees are zero to none. What i mean is that it is so little you might not notice.

It’s not a simple question where two words would be not enough to give a clear answer. Everything depends on your preferences, if you want to make deposits and withdrawals without charges, then probably a bank card is the best option for you since FXCC doesn’t charge any commissions for using bank cards.

If you are a person who places the speed of transactions on the 1st place, then using crypto currencies is an ideal choice for you, it doesn’t take a lot of time, everything happens pretty quickly and money is already in your trading account.

FXCC is a well-regulated global broker with a trust score of 8.5/10 ranked by this reviewer. It also insures the funds of its clients via the investor compensation fund. However, some weak points of this platform is that it runs an offshore entity and conditions and protection vary based on the entity.

What assets you can advise to trade on the fxcc platform from the point of trading conditions’ favorability?

If you ask my opinion, then without a doubt it would be the crypto market. There are no commissions and tight spreads with small leverage that make your trading safer and enjoyable. Especially, if you are not able to control yourself during high volatile markets that can deal rash actions and lose your deposit. I mean, you will not encounter slippage often since their system of order execution is based on ECN. So you got my advice and the rest of the decision is up to you, buddy!

Sharing my experience with FXCC here! I appreciate the broker for offering an STP model. The fact that the FXCC ECN acc requires no min deposit for such an account with floating spreads is rather inviting.

What features do you find most valuable in a trading platform?

I think the answer for everybody will be the same: the safety, and fees. One doesn’t work without the other. There are a ton of broekrs that have 0.1 spread and $1,5 round-trip fee lol, but then they don’t let you withdraw money so then whats the point. On the other hand, some brokers are ultra-safe, but to trade with them you have to buy Bloomberg Terminal for $2k to even just start… If you have like $10k to trade, then there’s most of your profit for the year gone. Fxcc is best of both worlds for me – very safe, but still fees kind of low for ECN.

Are there any pitfalls with using bank cards for withdrawing from FXCC?

No, bank cards are the most used payment methods that we have in the world rn. It is convenient and easy, and on FXCC, there are no fees associated with using them. So again, NO! There are no pitfalls.

hm I guess if I was to be super-nitpicky, the technical pitfall is the tax man. Also, if you’re trading with millions, yeah, it will be rough. NO bank will ever accept it randomly, you will need to come up with statements and all sorts of stuff. Also, some banks (like bunq in EU) don’t like any suspicious activity, and consider forextrading to be such. So if you’re with some more respected and well-to-do banks, you might become a target for them.

In all this, crypto is better tbh. Less trouble often, and moving even millions in/out is relatively easy (although they’re making it slowly harder in EU too, but not in many other parts of the world yet).

What is the minimum deposit like on FXCC broker accounts that allow trades above 50,0000$?

Quite an interesting question 😀 one needs first to decipher it, then think about the answer. I assume you meant $50,000 because there is one extra zero… anyway, the minimum deposit and the trades are not directly related.

First, there is no minimum deposit requirement for opening an account with FXCC.

Second, you need to understand the concept of margin and leverage. This is related to the second part of your question, what it takes to execute a position worth $50,000. Let’s calculate this.

The available leverage at FXCC is 500x, which means that for every dollar you keep in your trading account, you can “borrow” $500 from your broker. The simple maths says that you need to deposit $100 to be able to execute a position worth $50,000. But here comes the margin. This is somehow a guarantee that if you lose your trade, your account won’t go in minus and end up owing money to your broker. The margin required depends on the instrument you trade.

Let’s take the EURUSD pair, for instance. For a position of $50,000, the margin requirement is $109,3.

So, you need at least $210 account size to execute such a position size, but keep in mind that you don’t want to risk everything in one trade.

Nice review, but for me, the best thing with the broker was the variety in assets. I think that can be highlighted more because you just said about spread, but it’s not the main things about them. In 1 spot, its forex, commodities, crypto…

The STP/ECN execution too, its straight-through, no DD, which is mandatory, but in many reviews, people don’t even mention it. But it’s straight-up better. 1 pip of spread is not as important as non-DD execution within a broker.

Do I have to pay anything for opening of the Fxcc demo account?

This broker is genuine and this is what gets me everytime, I like how all their regulations and licensing are not hidden from the public and how we can verify every information out there! For the Demo account, no deposits are requested, after registering for the demo account, you get virtual funds with real-time trading conditions.

The platform looks advantageous and it deservedly got its 4 stars.

24/7 customer support is redundant in my opinion, because while trading it’s important to relax! when trader relax usually? exactly, during weekends.

some of them prefer trading OTC assets, but the majority anyway trade during the week, because there are way more opportunities.

all in all, I should say that Fxcc is a fascinating platform with its own pros and cons.

Definitely a good side ➡️ the payment system, different options and crypto, this is golden.

A bit arguable side ➡️ the limited ammount of accounts, some people want more choice, some don’t. I mean, if the conditions are nice and there’s only one, I don’t see that as a problem.

I completely agree with you.

I also think that their ways of depositing funds are a great set. Each trader can choose method of depositing and withdrawing money from account that he likes best.

I think that crypto transfers will be popular due to their reliability, anonymity and simplicity.

And as for trading account, I also think that they can add one or more. For example, it would be nice to see Cent account. Given trading conditions, this would be a great account

Do you feel any limitations when trading on this broker’s platform?

Limitations? Don’t know what you have in mind, but I definitely don’t feel any limitations. FXCC has no limits regarding the trading strategies traders employ. Scalping, EAs, Hedging… everything is allowed to be used by traders.

The only aspect that might be a bit limiting is the trading engine. You know FXCC is focused on the MT4 app, but I think that this is a good design by them since this is one of the best and definitely the most popular trading software.

All regulated brokers operate by jurisdiction, and every regulator has their peculiarities. Anyway, Fxcc has some of the tightest spreads I have used before. I respect the broker for making clients have a trading environment with great conditions.

How exactly is running an offshore entity a disadvantage??? I really don’t get that. the broker has a european regulator and license, but having non EU regulation in addition is only an advantage to its clients… period.

Yeah, I also believe that if the broker has many licenses and even the ones from such strict entities like CySEC, offshore regualtion in this case isn’t a disadvantage.

Offshore regulation ensures a broader access to trading services for traders, they aren’t limited in terms of trading conditions, they can have nice leverage size, and also they have the same protection as those who trade from EU countries.

So, it’s definitely not a drawback, I would even say an advantage.

Pretty good broker but I agree the educational section is quite poor. Analytic is okay kinda but also leaves much to be desired for the broker like FXCC.

It seems like FXCC is aimed at more experienced public rather than complete beginners.

It means you will have tight spreads during trading currency pairs and usually a lot of traders prefer to trade pairs with tight spreads and FXCC is able to provide such conditions. Thus it won’t bite your piece of profits.

I like their ECN XL trading accounts and I’m sure the conditions of this account will be suitable for every trader. There is a high leverage up to 1:500 but I prefer to use only up to 1:100 and not higher. The platform is easy to use and the execution of speed of orders works so fast that I can’t even manage to blink an eye. xD

What does spreads from 0 pips really mean?

It means you will have tight spreads during trading currency pairs and usually a lot of traders prefer to trade pairs with tight spreads and FXCC is able to provide such conditions. Thus it won’t bite your piece of profits.

Well, there are no spreads that literally start from 0,0 pips. It is rather tight spreads on major currency pairs, for instance, on EUR/USD it can start from 0,2 pips and you may not notice that.

The presence of the offshore license can’t be considered as a drawback in my opinion. Actually, this broker possesses many of them, I mean regulations, and there are such ones from very stringent entities like CySEC.

Offshore license just helps the company to expand the number of locations where it can provide services and this is it. It tells about broker’s desire to encompass more regions and make trading more accessible…

Despite the fact that they offer a single trading account ECN XL so far, I am satisfied with the trading conditions. There are such tight spreads, high leverage up to 1:500, free funding, hedging mode allowed and 100% first deposit bonus. I mean they provide you with everything you need so that we can trade confidently.

I can’t get along with those disadvantages specificied by the author of this review.

Yeah, FXCC broker is supervised by many regulators including reputable ones and not so recognized. But it’s not a drawback, the strength of the financial entity is conditioned by the rigidness of the government. If offshore entities are operated under more democratic government, then it doesn’t make them worse or weaker… So I believe that it’s even for better, since conditions are ultimate in the offshore zone.

For those looking for an ECT/STP trading solution, this is probably the best option for a broker out there. Maybe I am wrong, but it was the first time to saw that there can be an ECN account type without charging a trading commission for opening and closing positions. And the spreads were as I expected for an ECN account type.

Since I switched trading with FXCC, my profits have increased and my overall trading experience has improved.

Which do you think is more profitable using this broker; scalping or swing trading?

I guess scalping is smth that can be chosen here, even though for swing traders conditions are also appropriate.

I opt for scalping only because of tight spreads and the absence of hidden fees which is of utmost importance for scalpers who make 15-20 trades per day. They obviously have to pay the spreads and this significantly impact ROI.

But, I tried to scalp some major forex pairs and got out with profits several days in a row…

Well, everyone has their own specific standards for suitable trading conditions which allow you to trade effectively with your trading strategy.

From my point of view, I think scalping is more profitable to trade through FXCC broker than swing positions because they offer tight spreads with zero commissions. It means it doesn’t matter how many trading positions you open, you won’t pay any fees. As we know scalping traders usually open at least 50 orders daily and these conditions are beneficial for them.

First of all, the question you ask regarding the profitability of a trading strategy does not depend much on the broker. Yes, certain trading terms can affect profitability, but in this case – I mean, in the case of FXCC – it doesn’t.

What is the main difference between them? For scalping, you need very tight spreads, but for swing trading, you need low commissions, or to be precise, low swap fees. Regarding the swap fees, those are pretty much standard with every broker, and they depend on the instruments you trade. Regarding the spreads, FXCC has a unique offer – an ECN account with raw spreads without a trading fee. Hence, this account is more attractive for scalpers if you compare them with other brokers. However, regarding the swing trading, it is no less attractive compared to the others.

It depends on your personal preferences. If you like to be in the market all the time while trading, then go for scalping. If you don’t have enough time to spend hours in front of the monitor analysing charts, then go with swing trading. I think the time you want to spend trading is at the core of the decision. Regarding profitability, scalping can be more lucrative but also a more risky style of trading.

And a few words about FXCC. The trademark of this broker is their ECN account which doesn’t charge trading fees. So, trading with raw spreads without commission particularly appeals to scalpers, but at the same time, this broker can be a great fit for swing traders too.

Been founded in 2010, obtaining licenses from such reputable financial entities as Cysec and others, FXCC broker seems to be a good option. I scrutinized the article, approached to all the pros and cons objectively and should say that shortcomings look miniscule. No other assets besides FX and CFDs? It’s not a biggie, as the main focus of the FXCC is to provide access to exactly these markets. Real stocks investing isn’t about the platform.

Poor educational section also doesn’t seem to be a major deal, at least for me, as I rarely use something from learning materials available at platforms.

Wow, it looks like it’s really solid broker. I’ve heard about it before, but I didn’t know that this broker has so many licenses.

Most likely, this means that broker has all necessary legal documents.

But I also noticed that description of trading conditions has two sizes of leverage. It says 1:30 and 1:500 here.

Does this mean minimum and maximum size? Or did I get something wrong?

Hm, I suppose it depends on the preferred asset, because various assets imply different level of risk.

There are such assets which are risky, but at the same time price fluctuations aren’t so dangerous, so that is the reason why for such assets leverage can reach 1:500.

For others, like crypto, where volatility is high, leverage is lower to protect clients’ deposits from being drained.

That’s right! on this site we see a description of broker for several jurisdictions at once.

Some jurisdictions limit the amount of leverage, so there are two sizes

What can you say about their VPS service, does it make sense to obtain it?

VPS has some advantages, and their offer of a free VPS service if you fulfill ascertain conditions is really great.

I personally don’t need a VPS service. I am pretty satisfied with the speed of execution on its standard platform.

The main advantages of using a VPS are better execution speed and advanced security and accessibility. However, the main purpose of using a VPS server is if you employ trading robots. In that case, you need super-fast execution because the robot trades frequently and the spreads matter more than manual trading.

So, if you don’t use a trading robot, I think you don’t need a VPS server.

it makes sense to obtain the virtual private server only if you need it. apparent advantages include increased speed of execution, opportunity to run expert advisors and amplify trading results with their help + it’s a fully secure thing. T’s & C’s applied, so you can read about them.

FXCC provides vps for free only in case of meeting particular requirements such as making a new deposit and maintaining equity of $2.5k on the acc and having minimum monthly trading volume that equates to 30 standard lots round trip.

you are welcome =)

Oh, I like there is table where all pros and cons are listed.

Surely, the fact that the broker doesn’t require any minimum deposit should take advantage for newbies.

They adore trading with brokers that doesn’t have minimum deposit simply because they can test the services depositing a small sum.

You are absolutely right, dude! Many traders who love different brokers can test various services that brokers offer. I am also included and it helps expand the worldview and you are starting to better understand all nuances of services in trading.

I don’t know much about how my trading will be structured on this platform. I can say that I am relatively new here, I like the fact, that this is quite a budget friendly broker because of the costs associated to trading operations. I have heard some good word about this broker, so I am just hoping that everyhing will be allright for me as well.

For me the single account and trading platform is not a downside. On the contrary, it’s an advantage.

Basically the broker put all the goodies into one account and gave it to us, clients.

As for MT4 as a main platform, then I personally trade with it for many years, so I don’t need no better.

Fantastic. I tell you, this broker is mind-blowing. The trading conditions are amazing and also, there is a free VPS. Magnificent.

Many FXCC reviews are containing a positive opinion about company’s services and that is a deserved feedback. Company has several advantages and trading here is full of benefits. For example, trading platform has a nice intuitive navigation and smooth interface. It is quite comfortable to interact with.

Or if we are talking about assets to trade – there are many of them here, so every client can find something that suits.

Moreover, if you will have some questions you can always contact the friendly support team and they will solve it.

Do difficulties arise from the fact that there is only one trading account?