- What is FinecoBank?

- FinecoBank Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

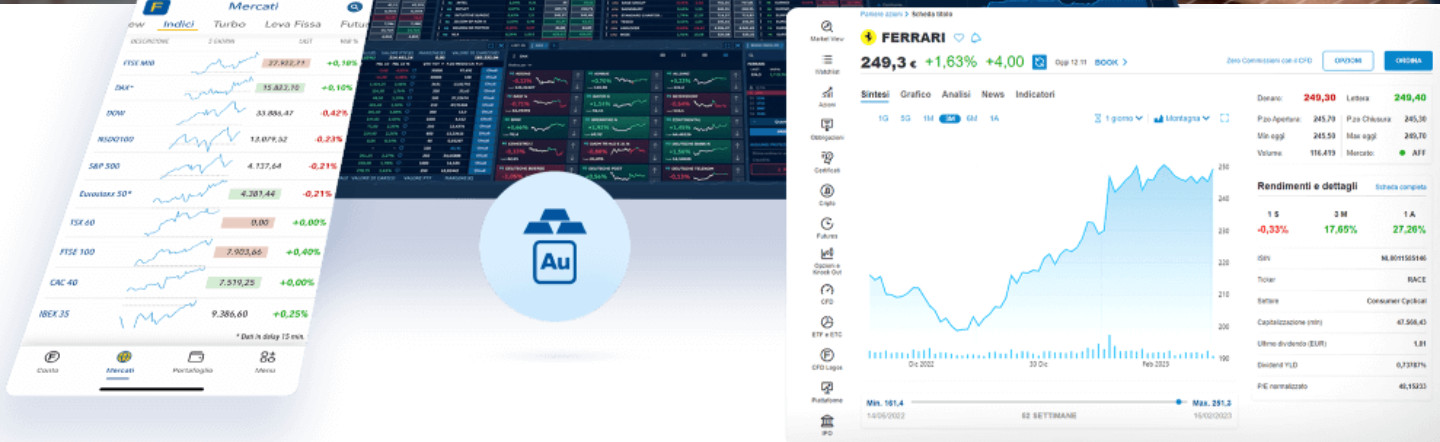

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

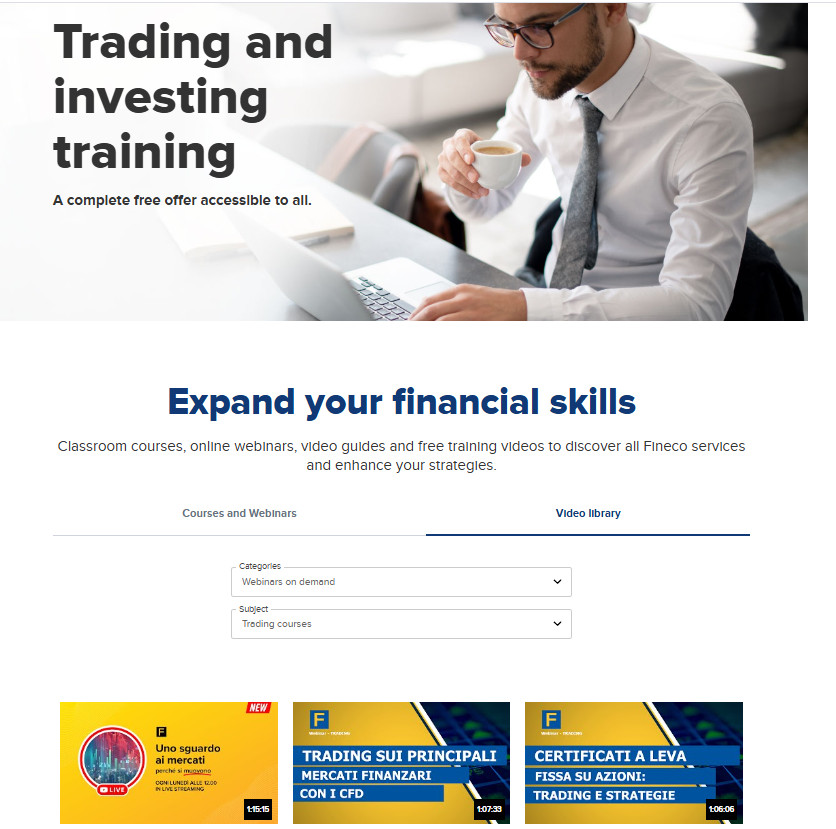

- Research and Education

- Portfolio and Investment Opportunities

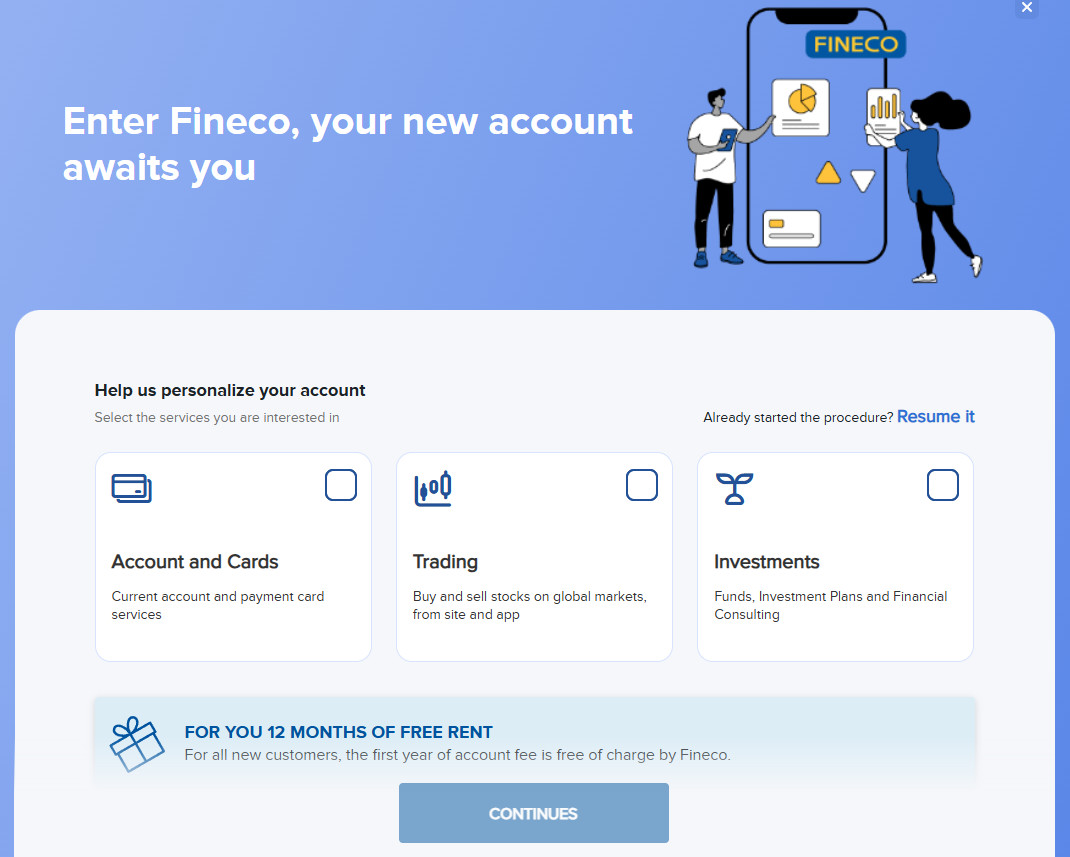

- Account Opening

- Additional Tools And Features

- FinecoBank Compared to Other Brokers

- Full Review of Broker FinecoBank

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is FinecoBank?

FinecoBank is a leading real stock trading company with good solutions and a technology base. FinecoBank is one of the leading FinTech banks in Europe. Listed on the FTSE MIB, the company offers a unique business model in Europe, which combines the best platforms with a large network of financial advisors.

It offers banking, credit, trading, and investment services from a single account through transactional and advisory platforms developed with proprietary technologies.

- The brokerage company has brought access to online trading since 2004 and is an Italian market leader with over 1,47 million customers.

Is FinecoBank Stock Broker?

Yes, FinecoBank is a Stock Broker that offers a range of brokerage services, including investment opportunities in Forex, CFDs, stocks, bonds, options, and other financial instruments, to its customers. The broker is known for its online platforms and is a reputable option for individuals looking to invest in the financial markets.

FinecoBank Pros and Cons

FinecoBank is a highly reliable company since it operates with a European Banking license with high trust and reliability. Trading conditions and proposals are good, and there is an extensive range of instruments, including Stocks, Indices, ETFs, and thousands of other financial instruments. The platform is also well-developed and has good research.

For the Cons, there is no proper market research, and a popular MT4 platform is not offered.

| Advantages | Disadvantages |

|---|

| European-regulated broker with a strong establishment | No 24/7 customer support |

| Globally recognized and awarded | No proper research materials |

| Competitive trading costs and spreads | |

| Stocks and Options trading, investing | |

| Wide range of instruments available including Stock Shares, Forex and CFDs | |

| Quality customer support | |

FinecoBank Features

FinecoBank is a leading Italian financial institution known for combining banking, trading, and investment services in a single digital platform. With its user-friendly interface and transparent pricing, Fineco caters to all types of clients looking for a streamlined way to manage their finances.

FinecoBank Features in 10 Points

| 🗺️ Regulation | Bank of Italy, CONSOB, ECB |

| 🗺️ Account Types | Single-holder current account |

| 🖥 Trading Platforms | PowerDesk, FinecoX |

| 📉 Trading Instruments | Forex, CFDs, Indices, Stock Shares, Futures, Options, Bonds, Cryptocurrencies, ETFs, ETCs, ETNs |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | $3.95 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | EUR, GBP, USD, AUD, CAD |

| 📚 Trading Education | Courses, Webinars, Video Library |

| ☎ Customer Support | 24/5 |

Who is FinecoBank For?

Fineco is ideal for individuals seeking a comprehensive and convenient financial solution, whether they are active traders or long-term investors. Its all-in-one platform is tailored for those who value seamless access to banking, trading, and investment tools. Based on our findings, FinecoBank is Good for:

- Advanced traders

- Investing

- Italian and European traders

- Professional Trading

- Currency and CFD trading

- ETF and Stock Trading

- Commission-based trading

- Competitive fees

- Tight spreads

- Good education

- Supportive customer support

FinecoBank Summary

The final thought upon FinecoBank is that it is the top-ranked Italian bank, holding a strong establishment and good reputation, offering safe and very favorable conditions.

The company provides a range of online trading services and user-friendly platforms with automatically updated markets and news. In addition, Fineco offers trustworthy proposals and banking services that are worth considering.

55Brokers Professional Insights

FinecoBank stands out in the financial services industry for seamlessly integrating banking, trading, and investment services within one intuitive platform. What sets it apart is its commitment to transparency, offering clear and competitive pricing with no hidden fees, as well as its robust tools like PowerDesk, which caters to professional traders with advanced charting, real-time data, and fast execution.

Additionally, Fineco is backed by a strong reputation for security and regulatory compliance, being supervised by the Bank of Italy and CONSOB. Its comprehensive offering, combined with a user-friendly experience and supportive customer service, makes it a preferred choice for both retail and professional clients.

Consider Trading with FinecoBank If:

| FinecoBank is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Access to robust proprietary platforms.

- Competitive fees and commissions.

- Stock Trading and Investment.

- Secure investment environment.

- Offering popular products.

- Who prefer leverage up to 1:100.

- European traders.

|

Avoid Trading with FinecoBank If:

| FinecoBank might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with industry-known MT4/MT5, or cTrader.

- Providing Copy Trading.

- Looking for VPS hosting.

|

Regulation and Security Measures

Score – 4.6/5

FinecoBank Regulatory Overview

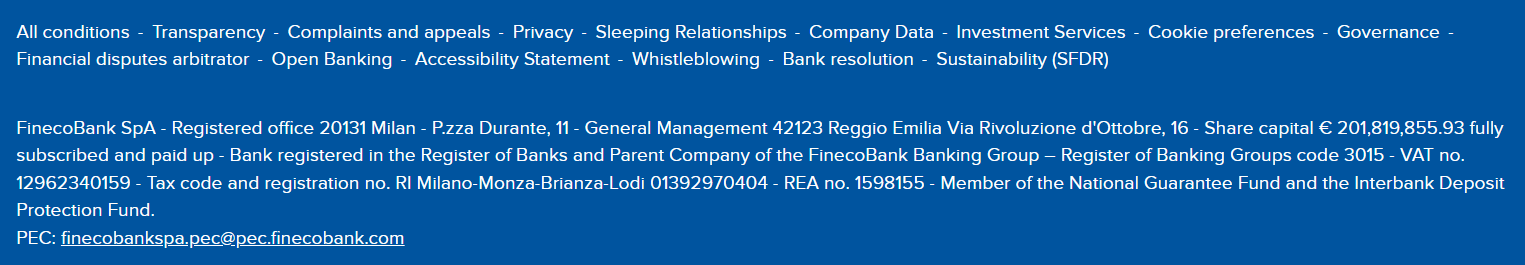

FinecoBank S.p.A. is a part of the UniCredit Banking Group enrolled in the Register of Banking Groups, with headquarters in Milan, Italy.

UniCredit Bank is one of the largest groups worldwide, which is also a Member of the National Compensation Fund and the National Interbank Deposit Guarantee Fund. Therefore, FinecoBank is regulated not only as a brokerage or trading firm but as a banking institution, which follows much more sharp authorization for its service delivery by the European Central Bank, Bank of Italy, and cross-regulation within Europe.

How Safe is Trading with FinecoBank?

FinecoBank follows and operates under safety measures, which means you can trade with trust, knowing the bank is constantly overseen and is not a scam.

To protect its clients, the company uses multiple levels of security, starting from data encryption and ending with numerous security rules regarding personal data, fund transactions, and storage, as well as execution policies.

All clients’ funds, of course, are kept in segregated accounts, which are supervised internally and externally, which ensures maximum protection of account holders.

Consistency and Clarity

Fineco has built a strong reputation through its consistent performance, transparency, and client-focused approach. While many users praise its all-in-one offering and advanced tools, some have noted that the platform may feel more tailored to experienced traders, especially when using features like PowerDesk.

Established in 1999 and operating under the UniCredit Group until its 2019 listing on the Italian Stock Exchange, FinecoBank now stands as one of Europe’s most well-regarded digital banks. It has received numerous awards for excellence in digital trading and customer service, further cementing its reputation.

Additionally, Fineco maintains an active presence in the community through different initiatives and sponsorships, contributing positively to its image as a forward-thinking and socially responsible broker.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with FinecoBank?

Fineco offers a streamlined approach to account management by providing a Single Multi-Currency Current Account that gives clients access to banking, investing, and trading services all in one place.

This account allows users to manage their daily finances, invest in a wide range of instruments from stocks and ETFs to bonds and funds, and actively trade on global markets through a single login.

Single Current Account

FinecoBank’s Single Current Account offers a comprehensive solution for managing banking, trading, and investment activities within a single platform.

Notably, there is no minimum deposit requirement, allowing clients to start with any amount that suits their financial goals. The account setup is free, and there are no maintenance fees, making it accessible to a wide range of users.

Clients can access Fineco’s proprietary PowerDesk platform, which is free for those who execute at least five trades per month or maintain an account balance of €250,000; otherwise, a monthly fee of €19.95 applies. This account structure is designed to provide flexibility and ease of use for both novice and experienced traders.

Regions Where FinecoBank is Restricted

Fineco imposes restrictions on account openings and certain services in specific countries, primarily due to international sanctions, regulatory compliance, and internal risk assessments. According to available information, FinecoBank does not accept clients from the following countries:

- USA

- Canada

- UAE

- China

- Japan

- Singapore, etc.

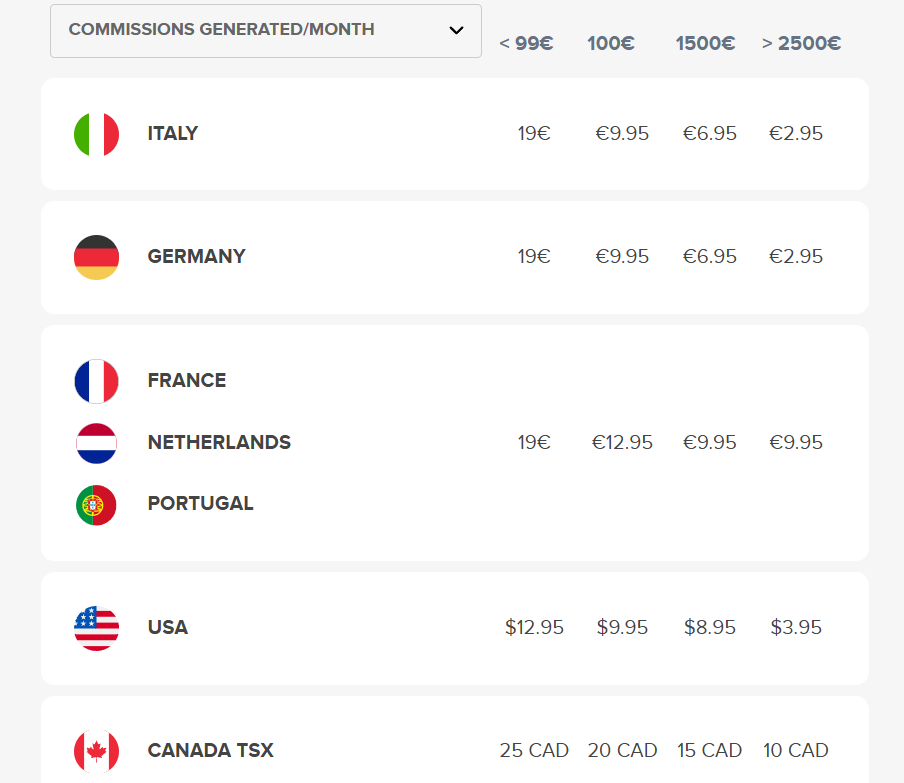

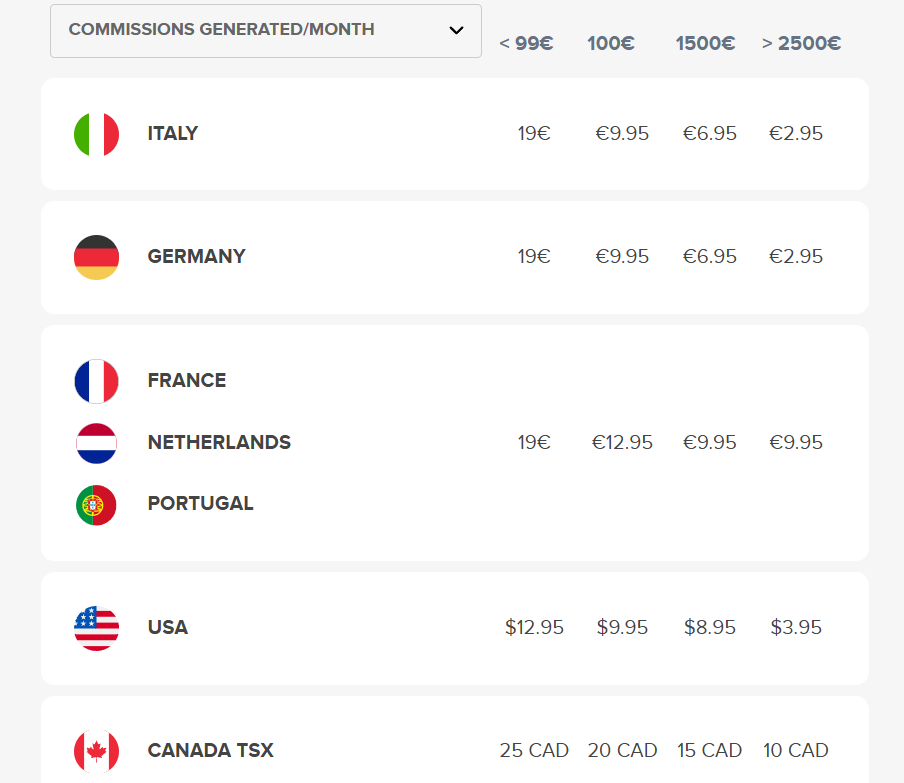

Cost Structure and Fees

Score – 4.5/5

FinecoBank Brokerage Fees

FinecoBank offers straightforward and competitive fees across all asset classes, mainly built into commission charges. We found that traders will pay less than €10 per order or even just €2.95 while making 1o order per month. Therefore, there is a great opportunity for both beginning and advanced traders, while all tools are developed for professional trading in addition to long and short intraday and multiday margin settings.

Options and futures are offered at €1.95 per batch, and CFDs, FX CFDs, and Super CFDs with zero commissions but only with a spread.

FinecoBank offers competitive and transparent spreads across a wide range of asset classes. For major Currency pairs such as EUR/USD, spreads typically start from 0.8 pips, which is considered reasonable for non-commission accounts. On index CFDs, minimum spreads can go as low as 0.4 points, making them attractive for day traders and scalpers.

For equity CFDs, Fineco provides access to real market prices without adding any spread markup, which means traders benefit directly from the underlying market’s bid/ask pricing.

Fineco offers a competitive and transparent commission structure across various asset classes, catering to both casual and active traders. For stock and ETF trades, commissions are fixed and vary by market: £2.95 for UK shares, $3.95 for U.S. shares, and €3.95 for major European markets like Germany, France, and Italy.

Canadian stocks incur a commission of C$10 per trade. In Spain and Switzerland, a 0.19% fee applies, with minimum charges of €14.95 and CHF 24, respectively. For share CFDs, FinecoBank offers commission-free trading on FTSE100, U.S., and EU share CFDs, with no additional spreads applied. However, for FTSE250 CFDs, a 0.06% markup per side is charged.

Futures trading commissions are competitive, starting as low as $0.70 per contract on CME Micro Futures and €0.75 on Mini DAX. Options’ fees begin at $1.95 per lot for indices and U.S. stock options.

- FinecoBank Rollover / Swaps

FinecoBank applies rollover fees, also known as swaps, to positions held overnight in leveraged products such as Forex and CFDs. These fees are calculated based on the reference interbank rate plus or minus a markup, depending on whether the position is long or short.

The exact swap rate varies by instrument and market conditions and can be found directly within the platform. While these fees are standard in the industry, traders should be aware of them when holding positions long-term, as they can impact overall profitability.

How Competitive Are FinecoBank Fees?

FinecoBank’s fee structure is considered competitive, especially for traders and investors seeking a transparent and cost-effective platform. The bank integrates banking and trading services, allowing clients to manage their finances and investments from a single account with no maintenance or inactivity fees.

While some services may incur costs based on trading volume or market access, Fineco avoids complex or hidden charges, making it easier for users to understand and predict their overall expenses.

| Asset/ Pair | FinecoBank Commission | Interactive Brokers Commission | PhillipCapital Commission |

|---|

| Stocks Fees | $3.95 | $0.0005 | $3.88 |

| Fractional Shares | No | $0.01 | No |

| Options Fees | $3.95 | $0.15 | $3.88 |

| ETFs Fees | $3.95 | $0.0005 | $3.88 |

| Free Stocks | No | Yes | No |

FinecoBank Additional Fees

FinecoBank maintains a transparent fee structure, but clients should be aware of certain additional charges that may apply depending on their activities and account usage.

For instance, after the first 12 months, a monthly fee of €3.95 is charged for the Fineco account; however, this fee can be waived if specific conditions are met, such as being under 30, receiving a salary or pension through Fineco, or executing at least four trades per month.

ATM withdrawals within EEA are free, but withdrawals outside the EEA incur a £2.50 fee per transaction. Additionally, bank transfers using the SWIFT network cost £19.95, and intermediary banks may apply extra charges.

For French securities, a financial transaction tax of 0.3% is applied to net positions held overnight, excluding intraday trades. While FinecoBank does not charge inactivity or custodial fees, clients should consider these potential additional costs when planning their trading and banking activities

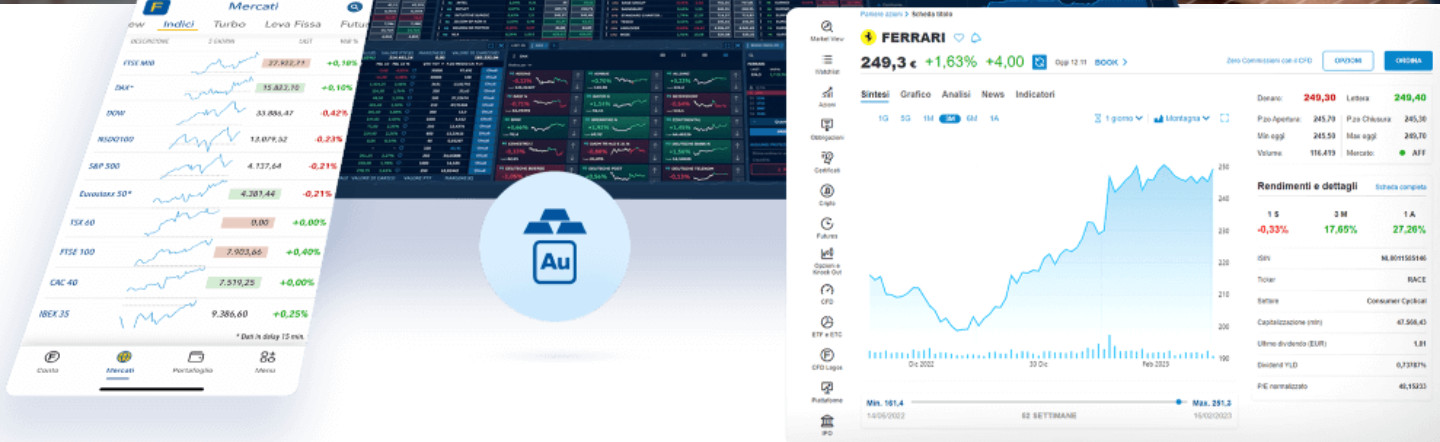

Trading Platforms and Tools

Score – 4.4/5

FinecoBank offers proprietary platforms PowerDesk and FinecoX designed to meet the diverse needs of traders and investors. PowerDesk is Fineco’s proprietary professional-grade platform tailored for serious traders. The platform provides real-time pricing, advanced charting with over 90 technical indicators, and customizable workspaces.

Traders can execute orders directly from charts, use advanced order types such as OCO and basket orders, and monitor multiple markets simultaneously.

Trading Platform Comparison to Other Brokers:

| Platforms | FinecoBank Platforms | ADS Securities Platforms | Cornertrader Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

FinecoBank Web Platform

FinecoX is a fully customizable platform designed for comprehensive market analysis and trading. The platform offers real-time push data, enabling traders to monitor watchlists, charts, news, portfolios, and order books concurrently.

Also, it supports trading across a broad spectrum of instruments, including equities, ETFs, certificates, options, CFDs, Forex, futures, bonds, and covered warrants. Its intuitive layout allows users to tailor their environment, ensuring that all critical information and tools are readily accessible.

Main Insights from Testing

Testing FinecoX reveals a platform that strikes a strong balance between functionality and user experience. The interface is intuitive, making it accessible even to less experienced traders while still offering the depth and tools that more advanced users expect.

Real-time push data keeps information up-to-date without the need for constant manual refreshes. Instrument search and order execution are smooth and responsive with minimal lag. Overall, FinecoX delivers a reliable and well-rounded web trading experience suitable for day-to-day investment activities.

FinecoBank Desktop MetaTrader 4 Platform

FinecoBank does not offer the MetaTrader 4 platform. Traders looking to use MT4’s interface or automated features like Expert Advisors will need to consider alternative brokers that support it.

FinecoBank Desktop MetaTrader 5 Platform

Similarly, FinecoBank does not support MetaTrader 5. The broker focuses on its proprietary platforms, such as PowerDesk and FinecoX, instead of offering third-party platforms like MT5.

FinecoBank MobileTrader App

Both of Fineco’s proprietary platforms, PowerDesk and FinecoX, are available in mobile versions, ensuring that traders can access real-time data, advanced charting tools, and fast execution from their mobile devices.

The apps feature an intuitive interface optimized for both iOS and Android, offering seamless navigation, customizable watchlists, and secure access to all core functionalities, making it an efficient companion for active traders and investors alike.

Trading Instruments

Score – 4.8/5

What Can You Trade on FinecoBank’s Platform?

FinecoBank provides access to an extensive range of over 20,000 financial instruments across 26 global markets, catering to both investors and active traders. Clients can trade more than 50 currency pairs in the Forex market, as well as CFDs on indices, stocks, cryptocurrencies, and commodities.

The platform also offers direct trading in equities, including over 7,850 stocks, and a vast selection of bonds, with more than 6,000 sovereign, corporate, and structured securities available. For those interested in derivatives, Fineco facilitates trading in futures and options across major exchanges.

Additionally, investors can diversify their portfolios with over 800 ETFs, Exchange-Traded Commodities (ETCs), and Exchange-Traded Notes (ETNs).

Main Insights from Exploring FinecoBank’s Tradable Assets

Exploring Fineco’s tradable assets reveals a strong commitment to market diversity and investor flexibility. The platform is designed to cater to a wide range of preferences, from long-term portfolio building to short-term speculative strategies.

Whether users are focused on traditional equities or more complex financial instruments, FinecoBank offers streamlined access within a single, unified account. The availability of multiple asset classes under one roof enhances portfolio diversification and allows for more dynamic investment strategies.

Leverage Options at FinecoBank

Being a European Bank and broker, FinecoBank falls under the ESMA regulatory requirements and regulations. Therefore, Fineco’s leverage is the following:

- Retail traders may use a maximum leverage of 1:30 for Forex instruments.

- 1:20 for minor currencies and even 1:100 for commodities.

However, professional trader may apply for higher multiplier levels once they confirm their status.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at FinecoBank

In terms of funding methods, FinecoBank offers the following payment methods:

- Apple/Google Pay

- Fitbit Pay

- Garmin Pay

FinecoBank Minimum Deposit

There is no minimum deposit requirement for Fineco thus, you can transfer any amount suitable for your needs. Just check the desired instrument conditions to be able to cover all necessary margins.

Withdrawal Options at FinecoBank

Though deposits and withdrawals are free of charge in Italy, and European Banks transfer along with Fineco Visa Debit Cards is also free of charge, other regions may apply international transfer fees, which you should check with customer service.

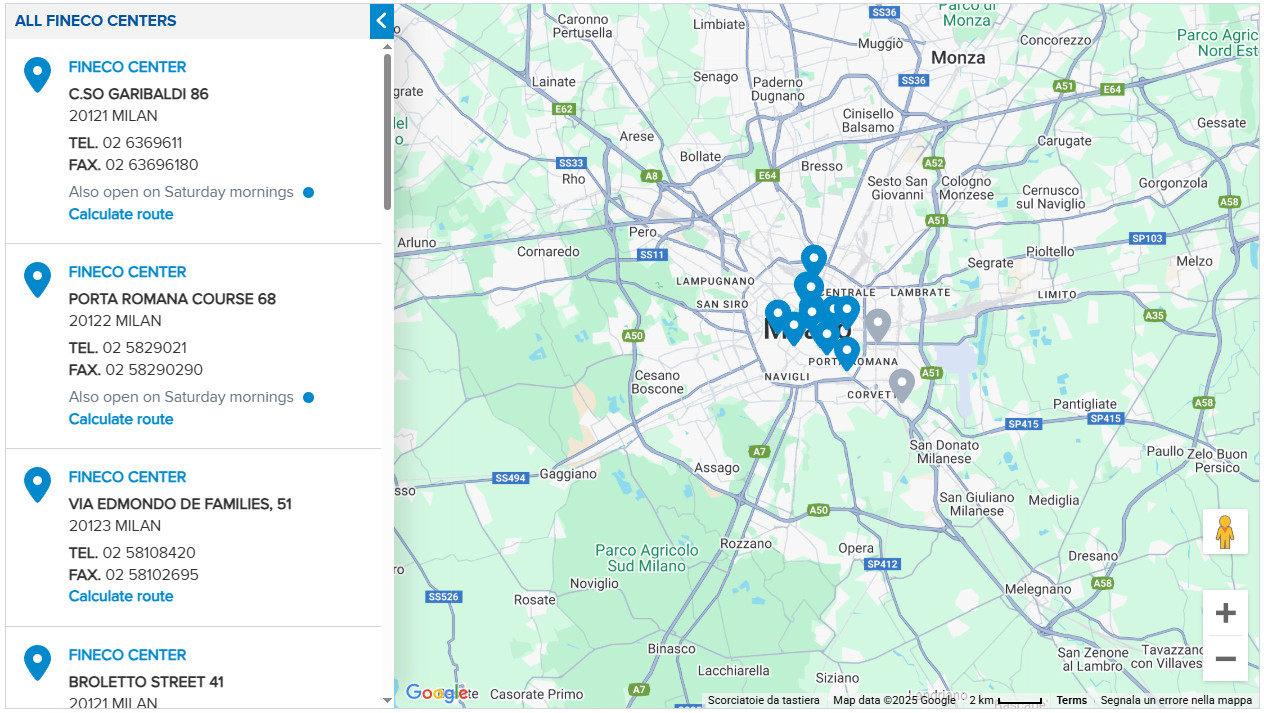

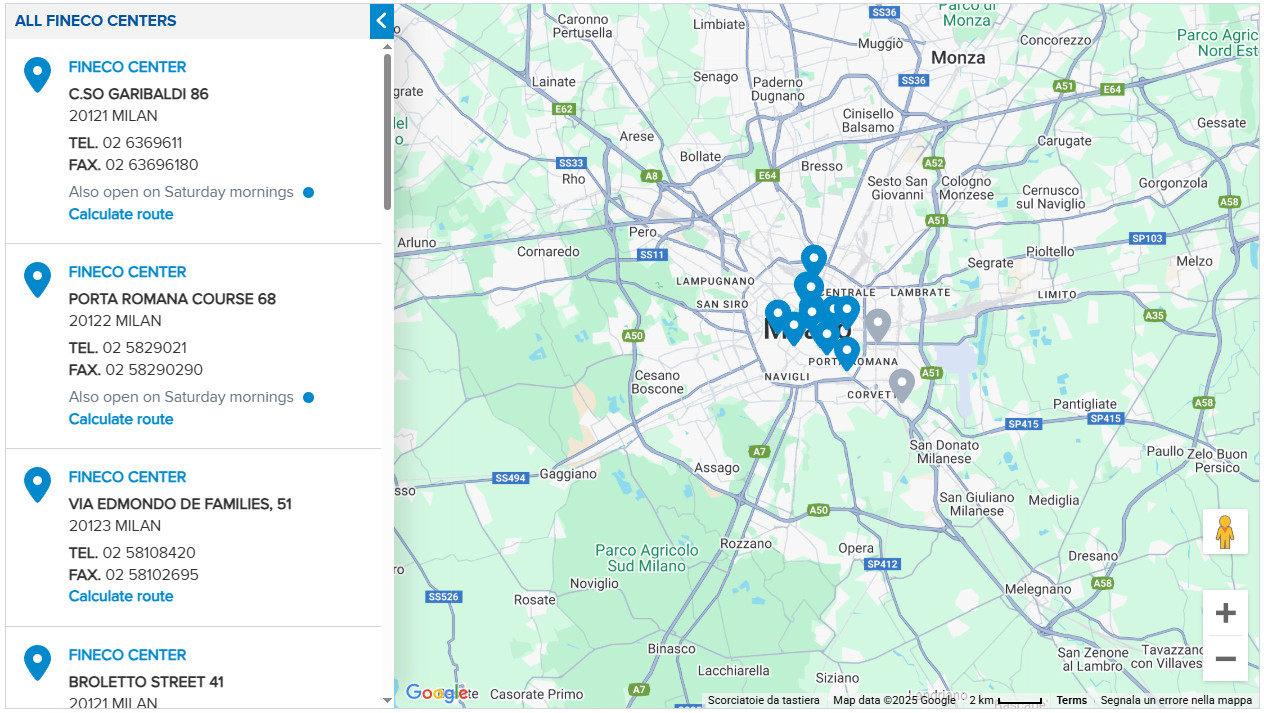

Customer Support and Responsiveness

Score – 4.6/5

Testing FinecoBank’s Customer Support

FinecoBank customer service brings 24/5 highly qualified support with a portfolio of over 96% satisfied customers and more than 200 operators at the disposal of the additional 2,600 personal financial advisors who can analyze and fulfill investment expectations. The bank also supports Live chat, Phone lines, and Email.

Contacts FinecoBank

Fineco offers dedicated customer service through various channels for any inquiries or support. Clients can reach the bank directly by calling 02 6369611 from Italy for assistance with banking, trading, or technical issues.

The support team is known for being responsive and helpful, guiding account setup, platform navigation, and investment services. Additional contact options, including email and secure messaging, are available through the official FinecoBank website for local and international clients.

Research and Education

Score – 4.5/5

Research Tools FinecoBank

Fineco provides a comprehensive suite of research tools accessible through its website and platforms, designed to support informed investment decisions.

- The platforms offer over 90 technical analysis indicators and customizable charts, enabling detailed market analysis.

- Users can operate directly from these charts, placing trades and exporting historical data for further examination.

- The platforms also feature multi-chart capabilities, allowing the simultaneous study of up to six different charts within a single window.

- Additionally, FinecoBank offers an economic calendar highlighting significant global events, real-time financial news updates from reputable sources, and a screener tool with intuitive searches and pre-set filters to help users identify trading opportunities across various markets.

These tools collectively enhance the experience by providing timely and relevant market insights.

Education

FinecoBank offers live seminars, online webinars, classroom courses, video library about accounts, markets, trading, and investments clearly explained by professionals. The bank also provides market and economic news and analysis.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options FinecoBank

FinecoBank offers a diverse range of investment options suitable for various investor profiles. Clients can invest directly in stocks, bonds, ETFs, and mutual funds across global markets, all from a single multi-currency account.

The platform also supports investments in more advanced instruments like futures, options, and certificates. Fineco’s fund marketplace includes thousands of professionally managed funds from top global asset managers, allowing for strategic portfolio diversification.

Additionally, Fineco provides access to managed investment services and financial advisory tools, helping clients build long-term wealth with personalized support.

Account Opening

Score – 4.5/5

How to Open FinecoBank Demo Account?

FinecoBank does not offer a demo account for clients or prospective traders. This means users are unable to practice trading with virtual funds or explore the platform’s features through a risk-free simulated environment. The absence of a demo account can be a drawback, especially for beginners who typically rely on this tool to familiarize themselves with market dynamics and trading interfaces before committing real funds. Traders looking for hands-on experience before live trading may need to consider alternative brokers that provide full demo account functionality.

How to Open FinecoBank Live Account?

Opening an account with FinecoBank is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core research functionalities, FinecoBank offers several extra tools and features that enhance the overall trading and investing experience.

- One standout is the multi-currency account, which allows clients to hold and manage funds in different currencies, ideal for those trading international markets.

- The Stop Loss and Take Profit automation tools help users manage risk and lock in profits more efficiently.

- Fineco also provides real-time price alerts, custom watchlists, and order-book depth visibility for a better overview of market activity.

FinecoBank Compared to Other Brokers

Compared to its competitors, FinecoBank positions itself primarily as a stock-focused broker rather than a traditional Forex-centric platform.

While most of the other brokers cater heavily to Forex and CFD traders with platforms like MT4 or TradingView and commission structures tailored to frequent FX trading, FinecoBank stands out with a more investor-oriented approach, offering a vast selection of equities, ETFs, and bonds. Its proprietary platforms, PowerDesk and FinecoX, are geared toward long-term investors and active stock traders rather than short-term Forex speculators.

In terms of fees, FinecoBank maintains competitive pricing, though it may lack some of the ultra-low spreads or leverage tools. Research and tools are more limited compared to others like Saxo Bank or CMC Markets, but for clients focused on portfolio building and diversified global investing, FinecoBank offers a solid, bank-backed alternative with a more traditional financial structure and regulatory foundation.

| Parameter |

FinecoBank |

Trade Nation |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

The average EUR/USD spread for Forex is 0.8 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

Average Stock Commission for U.S. shares is $3.95 |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

PowerDesk, FinecoX |

MT4, TN Trader, TradingView, TradeCopier |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

20,000+ instruments |

1000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

Bank of Italy, CONSOB, ECB |

FCA, ASIC, FSCA, SCB, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker FinecoBank

FinecoBank is a well-established Italian bank and brokerage that offers a wide range of investment services, including stocks, ETFs, bonds, and access to more than 20,000 financial instruments.

It operates under strong regulatory oversight from the Bank of Italy and CONSOB, contributing to its reputation for reliability and trust. The broker provides two proprietary platforms, PowerDesk and FinecoX, tailored for both active traders and long-term investors, with mobile versions also available.

While FinecoBank does not support MetaTrader platforms or offer a demo account, it maintains a competitive fee structure and access to global markets. Educational resources include free webinars, live events, and an online video library, providing valuable learning opportunities for clients.

With its transparent pricing, multi-asset access, and secure banking foundation, Fineco stands out as a strong option for serious investors seeking a bank-backed trading solution.

Share this article [addtoany url="https://55brokers.com/fineco-bank-review/" title="FinecoBank"]

And prrofessionalism When customers have problems,

the team must answer questions orr proide

assistance quickly and help solve problems.

Hi All,

There is a slight issue that is getting overlooked in most Fineco reviews. When I as a British citizen buy shares on the London Stock Exchange through Fineco, the dividends I get will be subjected to 20% withholding tax. Something I will never recover unless I exceed the dividend tax threshold. With British investment platforms no withholding tax gets deducted. This is a difference of up to GBP400 a year…

And Customer Service gives you a rather military style answer to the above remark:

“we inform you that nationally sourced dividends will be taxed

regardless of the tax residence of the recipient.

Thank you for your collaboration.”

Who could wish for more care and understanding?

I gave up jumping through their innumerable obstacles to setting up an account. Much too complex

fineco bank is a scam!

Read http://www.fineco-bank.com

Of course search engines have banned that website… everybody bows to bankers’ power!

After looking at the devastating reviews left by other users I wonder if there is any point, Fineco is a unprofessional, incompetent outfit, they do not care about their customer, in my experience the so called advisor, are badly trained and ignorant, both professionally and in interpersonal skill. So goodbye fineco.

Hi do you allow South African residence to open an account with the bank?