- What is Intertrader?

- Intertrader Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

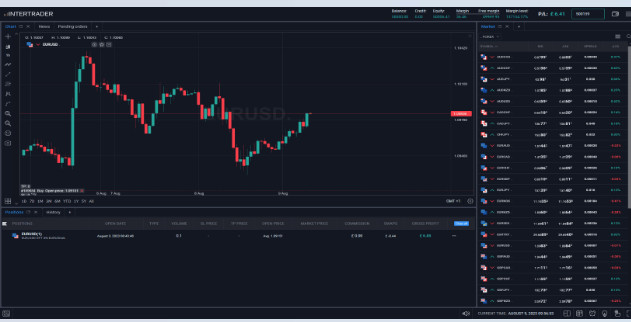

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Intertrader Compared to Other Brokers

- Full Review of Broker Intertrader

Overall Rating 4.2

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Intertrader?

Intertrader is a brokerage company offering spread betting and CFDs on thousands of shares, stock indices, Forex, commodities, and more.

The company was founded in 2009 to provide flexible and market-neutral trading. Trading execution is done by mirroring into the underlying market every position that the client opens, while the company covers its risks; hence, you execute in a transparent way.

The broker offers the popular MT4 and MT5 platforms, as well as a proprietary Intertrader+ web platform. The broker has earned many awards for providing exceptional services.

Intertrader Pros and Cons

Intertrader is a reliable broker with easy account opening and flexible trading conditions. The broker provides good technology solutions with low spreads and also the availability of social trading. Traders can conduct trades through the MT4/MT5 platforms and the broker’s web platform.

For the cons, there is no 24/7 customer support and good education, and also trading instruments are limited to CFDs.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| FCA license and overseeing | No 24/7 customer support |

| Competitive trading costs and spreads | |

| MT5 trading platform | |

| Quality customer support | |

Intertrader Features

Intertrader is a reliable broker licensed in several jurisdictions and holding an FCA license. The broker offers spread betting and CFD trading, with reliable execution on a good range of markets. Intertrader also offers fractional trade sizes to engage in lower-risk trading. We have reviewed the main aspects of trading with the broker, the differences in conditions based on the entity, and other essential points that would help traders decide if Intertrader is the broker for them.

Intertrader Features in 10 Points

| 🗺️ Regulation | FCA, GFSC, FSC |

| 🖥 Trading Platforms | MT4, MT5, Intertrader+ |

| 📉 Trading Instruments | CFDs on shares, stock indices, Forex, commodities, and more |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | Several currencies available |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is Intertrader For?

Our findings have revealed that Intertrader is favorable for clients of different levels and for a wide range of strategies. Based on our financial expert opinions and research, Intertrader is good for the following:

- Beginners

- Advanced traders

- Professional trading

- Investing

- Traders from the UK

- International traders

- Spread betting and CFD trading

- STP/NDD execution

- Competitive trading fees and spreads

- Tight dealing spreads

- Supportive customer team

Intertrader Summary

InterTrader provides trusted online trading services with unwavering reliability since the broker operates under the strict regulatory requirements of the FCA.

Functioning on a non-dealing desk business model, traders at Intertrader are getting the best possible spreads on their trades. The technological solutions are on a good level too, offering ultra fast execution, various trading tools and market analysis.

55Brokers Professional Insights

Based on the research of our experts, Intertrader is a good broker with a serious license from the UK FCA. The broker provides a reliable trading environment following strict regulatory rules and guidelines. Intertrader holds two other additional licenses from the Gibraltar Financial Services Commission and the Mauritius Financial Services Commission. There might be differences in trading conditions based on the entity.

As we have found, Intertrader offers trading on the MT4 and MT5 platforms and its Intertrader+ web platform. The account types are either CFD or spread betting, based on the trading styles. Intertader also offers fractional trading, which makes trading less risky. The trading charges are low, making the broker favorable even for beginner and cost-conscious traders. However, Intertarder does not include educational materials, and might not be suitable for traders who need good guidance and assistance. The broker’s customer support team is dedicated to solving the issues of its clients and answering their questions 24/5 via multiple channels.

Consider Trading with Intertrader If:

| Intertrader is an excellent Broker for: | - Spread betting and CFD trading

- Beginner traders

- Cost-conscious clients

- UK residents

- Global traders

-Professional traders

- MT4/MT5 platform enthusiasts |

Avoid Trading with Intertrader If:

| Intertrader is not the best for: | - Limited Deposit and Withdrawal options

- Lack of social trading

- Traditional investments

- Stock trading |

Regulation and Security Measures

Score – 4.6/5

Intertrader Regulatory Overview

Intertrader is a legitimate and regulated broker in various jurisdictions. It is authorized and licensed by a top-tier FCA (UK) with low-risk trading. The FCA regulation ensures the safety and security of trades, protecting clients from various trading risks.

- Intertrader is a trading name of Alvar Financial Services Limited. Alvar Financial Services Limited is authorized and regulated by the Gibraltar Financial Services Commission under the FSC1108MIF lice number.

- Also, Intertrader is regulated by the Mauritius Financial Services Commission (FSC) under the license number GB22201294/L10C23AB01. Although this is considered an offshore entity, the FCA license ensures that trading with the broker is secure and risk-free.

How Safe is Trading with Intertrader?

Security of funds is essential in forex trading. Research showed that the company handles all transactions with great responsibility.

- Client funds transferred to Intertrader are securely held in segregated accounts, by the regulator’s money rules.

- Also, every customer is protected by the Gibraltar Investor Compensation Scheme (GICS), up to €20,000 per client. Client funds are also insured by Lloyd’s of London for up to £1 million.

Consistency and Clarity

Intertrader has operated since 2009, providing high-quality services with great transparency and consistency. The broker holds multiple licenses and is available globally, continuously expanding its geography and worldwide exposure.

Our research has revealed that in its 15 years of operation, Intertrader has earned many industry awards, which speaks to the broker’s quality and dedicated services. It has been recognized as the Best Spread Betting Provider 2019, Best CFD Provider 2016, Best Value For Money Award for different years, etc.

We have also considered customer feedback for the broker to see what traders share about their real experiences. We have found a spectrum of varying opinions, from many positive ones on the low trading charges, great proprietary platform, and dedicated customer support to negative ones about withdrawal issues, insufficient education, etc. We recommend considering different experiences yet researching the broker to see how it meets your trading expectations. Also, as the broker operates through several entities, remember that trading conditions might be different.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Intertrader?

We have reviewed the account types based on the FCA-regulated entity. Because through this entity the broker offers spread betting and CFD trading, the account types are based on these two criteria. The broker also has a demo account to practice and gain skills before engaging in real trading.

We have reviewed the spread betting and CFD trading opportunities separately, and this is what we have found:

Spread betting offers a flexible way of trading, enabling traders to go long or short while trading shares, indices, forex, commodities, and other assets from a single account. For this account, there are no commissions, and the spreads are very low starting from 0.6 pips. The trades can be conducted through different platforms from a desktop, a web platform, or a mobile app. Also, traders can access in-depth analysis tools and features for advanced experiences.

The CFD account enables access to a good range of CFD-based instruments across shares, indices, FX, and commodities. CFD trading enables traders to speculate on the price changes of the tradable product. Intertrader ensures a reliable environment and fast execution of trades, providing low trading costs, a small minimum deposit, leverage ratio options up to 1:200 for professionals, and access to the popular MT4/MT5 platforms, as well as its own Intertrader+ web platform, equipped with great analytical tools and advanced features.

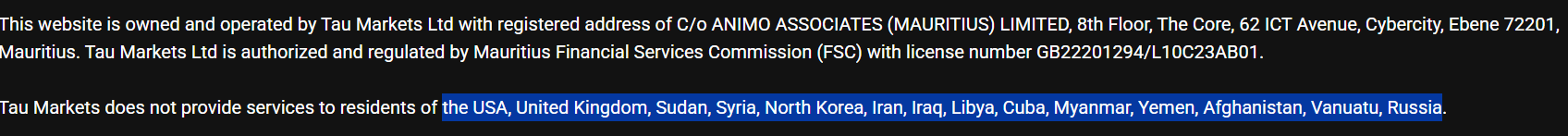

Regions Where Intertrader is Restricted

InterTrader is available in many countries, giving traders around the world access to the market. The availability of certain countries might depend on the entity. Generally, the broker’s services are available in all those countries where such financial services are permitted based on the regulations. Through its FSC entity, the broker mentions the following countries it does not accept clients from:

- USA

- United Kingdom

- Sudan

- Syria

- North Korea

- Iran

- Iraq

- Libya

- Cuba

- Myanmar

- Yemen

- Afghanistan

- Vanuatu

- Russia

Cost Structure and Fees

Score – 4.5/5

Intertrader Brokerage Fees

Intertrader trading costs are competitive and mostly low. As we have found, the broker is transparent about its fees and does not have any hidden costs traders are not aware of. In addition to spreads and commissions, Intertrader also charges swap fees and a few other trading and non-trading fees.

Intertrader charges a spread for both its spread betting and CFDs accounts. The spreads are low, and for most instruments, all trading costs are integrated into spreads. As we have found, for the EUR/USD pair, the average spread is 0.6 pips. The gold spread is 40, expressed in cents. For the WTI crude oil, the average spread is 3 (in cents).

Based on our research, for spread betting, the broker does not charge any commissions, and all the costs are included in spreads. As for the CFD account, commissions are applied to underlying spreads +$3 per side per trade.

- Intertrader Rollover / Swap Fees

Intertrader charges swap fees for positions held longer than normal trading hours. The swaps for each instrument are different and subject to change. Swap fees depend on market fluctuations, so it is essential to check them regularly. For Forex, swaps are calculated as the central bank interest rate plus 1% for long positions or minus 1% for short positions. For indices, the rate is calculated as +/– 2.5%.

How Competitive Are Intertrader Fees?

We have reviewed Intertrader fees carefully and come to the conclusion that the broker charges competitive and transparent fees that are low for most instruments. Generally, for spread betting, all the charges are included on the spreads, and commissions are charged only for CFD trading.

Besides, as Intertrader offers spread betting and CFDs, the charges also differ between these two offerings. The spreads for spread betting and CFD accounts are different for the same instruments. Based on our findings, with spread betting, clients have access to slightly higher spreads with no commissions, while the CFD products have lower speeds plus commissions.

| Asset/ Pair | InterTrader Spread | Spread Co Spread | Fortrade Spread |

|---|

| EUR USD Spread | 0.6 pips | 0.8 pips | 2 pips |

| Crude Oil WTI Spread | 3 pips | 0.04 pips | 0.04$ |

| Gold Spread | 40 | 0.4 pips | 0.45$ |

Intertrader Additional Fees

Intertrader trading costs are transparent and are mostly expressed in spreads, commissions, and swaps. The broker does not charge any fees for deposits and withdrawals. The inactivity fees are applied for accounts that have been inactive for an extended period. Other than that, there are no other non-trading fees that we have noticed.

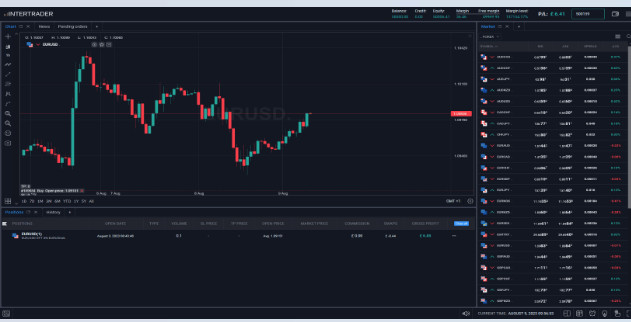

Score – 4.5/5

Intertrader has a good trading platform selection. The broker offers its clients the two most popular retail platforms – MT4 and MT5. Als, traders can access their accounts directly through the broker’s proprietary web platform – Intertrader+. At last, clients can conduct trades through the advanced mobile platform, equipped with innovative features and good analytical tools.

| Platforms | InterTrader Platforms | Spread Co Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Intertrader Web Platform

With the Intertrader web platform, traders access their accounts directly from the browser without downloads. This gives the clients perfect flexibility and the ability to trade from anywhere. Intertrader+ includes great charting and analysis tools, indicators, drawing objects, stop-loss or take-profit orders, and other features that enable traders to take advantage of market opportunities and experience profitable trading.

Intertrader Desktop MetaTrader 4 Platform

Intertrader allows access to one of the most demanded MT4 platforms in the market. Through the MT4 platform, clients gain access to a good range of currency pairs, commodities, and indices. The platform is available on desktop, tablet, or mobile, giving traders more flexibility. It includes essential analytical tools, charts, indicators, and effective risk management tools. Clients can trade manually or automate their trades through EAs, algorithmic trading, and trading signals. Also, the platform enables the use of copy trading, allowing traders more diversity and investment opportunities.

Intertrader Desktop MetaTrader 5 Platform

The MT5 platform is one of the most powerful platforms, allowing downloads for Windows and MacOS operating systems through desktop, tablet, and mobile, giving traders a chance for diversity and versatility. The platform has ultra-fast execution and access to a wide range of tradable products, including forex pairs, equities, commodities, indices, etc. The terminal is dynamic and simple to use, also, equipped with deep analytical tools. Through the MT5 platform, traders can engage in both spread betting and CFD trading. The platform allows the automation of trades through EAs and algorithmic trading. As we have found, over 80 technical indicators and analytical objects are available for in-depth analysis, and risk management tools such as stop-loss and take-profit instructions are available for more advanced experiences.

Main Insights from Testing

We have tested the broker’s available platforms to see how each meets traders’ different needs and expectations. The broker’s proprietary web platform is flexible, includes great tools and features, and is simple to use. The MT4 and MT5 platforms are available via desktop platforms and mobile apps. Both include advanced analytical tools, EAs, algorithmic trading, and a good range of technical indicators. Each platform is good in its own way, and it is up to traders to choose the one they are more comfortable trading with.

Intertrader MobileTrader App

Intertrader enables trading through a mobile app, which gives traders flexibility and a chance for mobility. They can enter their accounts and manage trades from the palm of their hands through the MT4/MT5 mobile apps, gaining access to essential analytical tools and features for profitable trading. The apps are available for iOS and Android devices, allowing them to enter their trades effectively with real-time access to financial instruments from the convenience of their phones.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Intertrader Platform?

We have reviewed Intertrader’s instrument offering to see what financial markets clients can access through the broke. Traders can get involved in spread betting or CFD trading, gaining access to Forex, commodities, shares, and indices. The instrument availability is also determined by the platform traders choose. With MT4 the range of instruments is slightly limited compared to the MT5 and Intertader+ web platforms. As we have found, spread betting is ideal for many styles and strategies, giving a chance for low-risk trading. On the other hand, CFDs enable the trader to speculate on the price differences of financial instruments, taking short or long positions based on their trading expectations.

However, the available instruments are based on CFDs, which means that traders can speculate on the prices, but not own the underlying asset, limiting their opportunities in regard to traditional and long-term investment.

Main Insights from Exploring Intertrader Tradable Assets

The main insights from our research on the broker’s tradable products are overall positive. The broker offers thousands of trading products across a good range of financial markets. Traders can choose access to spread betting or CFD trading, depending on their trading preferences and expectations. The broker allows access to a good range of Forex pairs, from major to the most exotic ones. Also, traders can access a good range of commodities, including gold, silver, and crude oil, with low spreads and good conditions.

The only drawback that can limit some traders is the fact that the products are available mainly on CFDs, restricting the chances of expanding portfolios. Also, the offering and conditions across entities might be different.

Leverage Options at Intertrader

Since InterTrader delivers its service through sharp, respective regulatory guidelines of FCA, the allowed leverage levels depend on the specific statement the regulation provides.

- UK traders are eligible to use low leverage up to 1:30 for Forex instruments, 1:20 for non-major currency pairs, 1:5 for stocks, etc.

- Professional traders have access to 1:200 leverage.

- The broker also has an offshore entity that gives access to higher leverage ratios.

Make sure to learn how to use leverage smartly and apply it in the best manner to your trading strategy.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Intertrader

Clients of InterTrader are able to deposit and withdraw funds through limited options. Traders can make withdrawal requests via the web platform, and download their full trade and transaction histories. Following money laundering regulations, traders cannot make deposits from third-party accounts.

In terms of funding methods, Intertrader’s offering is limited to the following payment methods:

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

Minimum Deposit

The Intertrader minimum deposit is $100. A new position on account requires a deposit depending on the instrument you would trade, known as margin. In the past, the broker required a $500 minimum deposit. Anyway, our advice is to confirm the information before opening an account with the broker. Note that the minimum deposit requirements can also vary from entity to entity.

Withdrawal Options at Intertrader

Intertrader withdrawals are made through credit cards and bank wire with $0 fees for any payments. Therefore, you may deposit and withdraw any amount that is suitable for you, while the broker will not charge any additional fees for your payments. However, check with your payment provider, as some fees may be charged by your payment provider.

Customer Support and Responsiveness

Score – 4.6/5

Testing Intertrader Customer Support

InterTrader provides 24/5 customer support to its clients. Phone lines, live chat, and email are available to contact the customer team. We tested the customer support and got fast and knowledgeable responses during working days. The live chat is not available on weekends.

- The broker also connected with its clients through its social pages, including FB, X, LinkedIn, and YouTube.

Contacts Intertrader

As we have found, Intertrader offers dedicated customer support through several options:

- Traders can leave their requests or questions via the provided form on the broker’s website.

- The live chat is also very helpful, especially when clients are looking for quick answers and assistance.

- Besides, traders can send their inquiries and questions to the provided email address: support@intertrader.com.

Research and Education

Score – 4.1/5

Research Tools Intertrader

Based on our findings, Intertrader includes all its research tools in its platforms. The MT4, MT5, and Intertrader + web platforms include enhanced and advanced analytical and research tools to help traders take their trading experience to another level. On the broker’s website, we have encountered only a few tools, and most are activated after opening a live account with Intertrader.

- The economic calendar allows traders to learn about essential events and make informed decisions.

- Market Buzz helps traders understand the market sentiment about a specific instrument to identify potential opportunities.

- The Market Insight section provides traders with expert analysis of key economic events to keep traders informed about market developments.

Education

We found that Intertrader does not provide proper educational resources, which can be limiting, especially for those beginner traders who need special guidance and assistance. The absence of learning materials such as webinars, tutorials, and courses may hinder the learning process for traders who want to improve their trading skills. Although the broker offers market news and analysis, it cannot replace structured and comprehensive materials tailored for different levels of experience.

Is Intertrader a Good Broker for Beginners?

After carefully considering all aspects of trading with Intertrader, we have concluded that the broker may be favorable for beginner and cost-conscious traders, as its charges are low, the minimum deposit is not very high, and the platforms are simple for navigation. The broker also offers a demo account, enabling traders to practice and enhance their trading skills before engaging in real trading with real funds. However, there are still drawbacks that can affect beginner traders, such as the lack of educational resources. Thus, Intertraer can be a suitable choice only if novice traders find alternative educational sources.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Intertrader

Intertrader offers a good range of financial assets with thousands of instruments. However, the offering revolves around either spread betting or CFDs. This means Intertrader does not focus on real stock trading and ownership of the underlying assets: traders cannot engage in long-term investments.

- On the other hand, traders have access to copy trading through the MT4 and MT5 platforms as an alternative option for trading diversification.

- Traders also have access to MAM accounts, which is a good way to diversify trading and explore the market further.

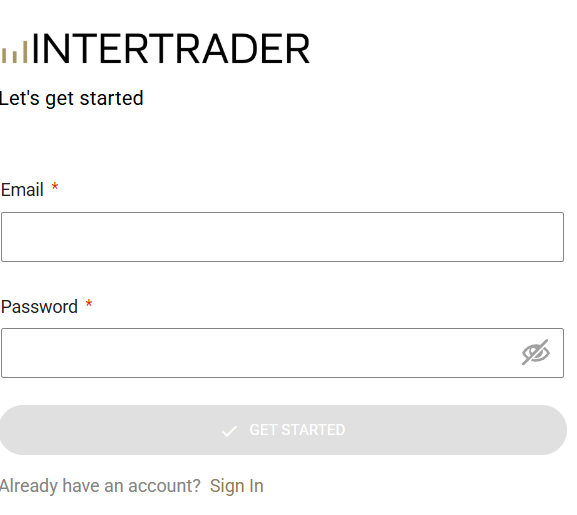

Account Opening

Score – 4.6/5

How to Open an Intertrader Demo Account?

The availability of a demo account is a great opportunity to gain market skills and knowledge before switching to live trading with real risks and challenges. Opening an Intertrader demo account is easy, with only a few simple steps:

- Visit the broker’s website and choose the demo account option.

- Fill out the registration form by providing personal information.

- Choose the preferred trading platform and account type (spread betting or CFD).

- Receive your account credentials via email and log in to your demo account.

- Start trading with the provided virtual funds.

How to Open an Intertrader Live Account?

Opening an account with InterTrader is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Create a Live Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Score – 4/5

We have also tried to find additional tools and features that can enhance trading with Intertrader even further. Although the broker already offers great analytical tools through its platforms, there are still some extra features traders need to be aware of.

- Intertrader offers an API, which allows traders to integrate their own trading platform with Intertrader’s server, which ensures seamless connectivity.

Intertrader Compared to Other Brokers

After reviewing all aspects of trading with Intertrader, we have compared Intertrader offerings to other brokers with similar services. The broker is regulated by the well-regarded FCA, which provides safety and security for trades. We compared Intertrader to Pepperstone, which also holds an FCA license with multiple other licenses from top-tier authorities, providing an extra layer of reliability.

Intertrader concentrates on spread betting and CFD trading. Spread Co is very similar to Intertrader in this respect; both brokers have a similar range of financial assets. The trading costs are also close. Intertrader applies spreads at 0.6 pips, whereas Spread Co spreads are only slightly higher at 0.8 pips.

We found the Intertrader trading platform selection favorable with MT4 and MT5 platforms and a proprietary Intertrader+ web platform. RoboForex also offers the MT4 and MT5 platforms and its proprietary R StocksTrader.

At last, we reviewed Intertrader’s educational section to find that the broker does not allow access to educational materials. On the contrary, Pepperstone has comprehensive educational materials suitable for different traders.

| Parameter |

Intertrader |

Spread Co |

RoboForex |

Pepperstone |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread Based Account |

Average 0.6 pip |

Average 0.8 pips |

Average 1.3 pip |

Average 0.7 |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission Based Account |

0.0 pips + $3 on CFDs |

0.05% on equity trades |

0.0 pips + $4 |

0.0 pips + $3.50 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Low/Average |

Average |

Average |

Average |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5, Intertrader+, Mobile App |

Proprietary platform, mobile app |

MT4, MT5, R StocksTrader |

MT4, MT5,cTrader, TradingView |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

1000+ instruments |

1000+ instruments |

12,000+ instruments |

1,200+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

FCA, GFSC, FSC |

FCA |

FSC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

No Education |

Good |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

£200 |

$10 |

$0 |

$0 |

$100 |

$5 |

Full Review of Broker Intertrader

As we have revealed from our full review of Intertrader, the broker offers a reliable and trustworthy trading environment, equipped with good features and tools that will meet the needs of a large scope of traders. The broker holds an FCA license and additional GFSC and FSC licenses, which ensure the broker’s adherence to strict rules and guidelines.

Intertrader focuses on spread betting and CFD trading, allowing access to multiple financial assets. The trading costs are transparent and reasonable, with no hidden fees. The trading platforms are also diverse, with great analytical tools and features. The broker’s proprietary Intertrader+ web platform offers great flexibility and an innovative approach to trading. The availability of copy trading and MAM accounts allows alternative options for investment.

The only drawback we noticed is the lack of satisfying educational materials. Beginner traders should consider this before making a final decision to engage with the broker. All in all, we find Intertrader a good broker with great opportunities.

Share this article [addtoany url="https://55brokers.com/intertrader-review/" title="Intertrader"]

Do you have a demo a/c??