- What is M4Markets?

- M4Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- M4Markets Compared to Other Brokers

- Full Review of Broker M4Markets

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is M4Markets?

M4Markets is an online CFD trading broker that offers a range of popular trading instruments, including Forex, Commodities, Indices, Shares, and Cryptocurrencies via the popular MT4, MT5, and cTrader platforms.

Founded in 2019, the firm is a multi‑jurisdictional entity regulated by Cyprus’s CySEC, the FSA in Seychelles, and Dubai’s DFSA. The broker is known for offering raw spreads starting from 0.0 pips, ultra-fast order execution, and high leverage up to 1:5000.

M4Markets also offers features such as social trading, segregated client funds, and negative-balance protection. However, trading conditions and available features may vary depending on the regulatory entity.

M4Markets Pros and Cons

M4Markets stands out for its low minimum deposits, tight spreads, fast execution, and access to popular CFD trading instruments. The broker supports both MetaTrader 4 and MetaTrader 5, while the cTrader platform is available exclusively under its European license.

For the cons, its educational resources are relatively limited, which may be a drawback for beginners. Additionally, trading conditions, available platforms, products, and account types vary depending on the regulatory entity.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversee | Conditions vary based on the entity |

| Competitive trading conditions | Limited educational materials |

| CFDs trading | |

| Industry-known trading platforms | |

| Client protection | |

| Low spreads and fees | |

| International trading | |

| Suitable for beginners and professionals | |

M4Markets Features

M4Markets provides a competitive trading environment with industry‑leading platforms and tools. The key features are summarized in 10 points, covering aspects like Trading Platforms, Account Types, available Trading Instruments, and more.

M4Markets Features in 10 Points

| 🏢 Regulation | CySEC, DFSA, FSA |

| 🗺️ Account Types | Standard, Raw Spread, Premium, Dynamic Leverage, Cent Accounts |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | CFDs on Forex, Commodities, Indices, Shares, Cryptos |

| 💳 Minimum Deposit | $5 |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, ZAR, JPY |

| 📚 Trading Education | Trading eBooks, Glossary, Video Courses |

| ☎ Customer Support | 24/5 |

Who is M4Markets For?

M4Markets is suitable for traders looking for a low minimum deposit amount, advanced tools, and tight spreads. Its variety of account types, high leverage options, and support for MetaTrader platforms and cTrader make the broker appealing to all levels of traders. According to our findings, M4Markets is Good for:

- Beginners

- Professional traders

- European traders

- Traders from the MENA region

- International trading

- Traders who prefer the MT4, MT5, or cTrader platform

- Copy trading

- Currency trading

- Algorithmic/EA trading

- MAM/PAMM trading

- Low fees and competitive spreads

- Good trading strategies

M4Markets Summary

In summary, M4Markets is a multi-regulated CFD trading broker that offers a good trading environment across various asset classes, including Forex, commodities, indices, shares, and cryptocurrencies. Additionally, the firm provides access to popular MT4, MT5, and cTrader, suitable for both beginner and professional traders.

With competitive fees, tight spreads, high leverage options, and fast execution speeds, M4Markets appeals to a wide audience. The broker also ensures client fund safety through segregation and negative balance protection.

However, trading conditions and available features vary depending on the regulatory entity, and the broker’s educational resources are relatively limited.

55Brokers Professional Insights

M4Markets is a competitive brokerage firm that meets the needs of CFD traders. One of its standout features is its range of trading platforms, providing traders with the flexibility to use algorithmic trading and advanced trading strategies.

The broker also focuses on speed and reliability, with an average execution speed of around 30 milliseconds. Additionally, M4Markets offers raw spread accounts starting at 0.0 pips, leverage of up to 1:5000 depending on the jurisdiction, and access to popular trading instruments.

Professional traders will also benefit from MAM/PAMM account options and trading signals to enhance algorithmic trading performance. The broker also ensures client protection through segregated accounts, negative balance protection, and regulation by authorities, including European CySEC.

Consider Trading with M4Markets If:

| M4Markets is an excellent Broker for: | - Need a well-regulated broker.

- Get access to MT4, MT5, and cTrader platforms.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:5000.

- Offering popular trading instruments.

- Providing Social Trading.

- Prefer MAM/PAMM trading.

- Currency trading.

- Secure trading environment.

- Offering a variety of account types.

- Looking for broker with low minimum deposit requirement.

- Providing competitive trading conditions.

- European and International trading.

|

Avoid Trading with M4Markets If:

| M4Markets might not be the best for: | - Need a broker with a Top-Tier license.

- Looking for broker with 24/7 customer support.

- Need broker with access to VPS Hosting.

- Need comprehensive educational materials.

|

Regulation and Security Measures

Score – 4.5/5

M4Markets Regulatory Overview

M4Markets operates under a multi-jurisdictional regulatory framework, offering traders added confidence and security. The broker is regulated by the Cyprus Securities and Exchange Commission, which ensures compliance with EU financial directives and provides investor protection measures.

The broker is also licensed by the DFSA in Dubai, a respected regulator in the Middle East known for its strict oversight and transparency standards. Additionally, M4Markets is authorized by the FSA of Seychelles, which offers more flexible trading conditions under a less restrictive regulatory environment.

How Safe is Trading with M4Markets?

Trading with M4Markets is generally considered safe due to its regulatory structure and commitment to client protection. The firm ensures the security of client funds through segregation from company assets, provides negative balance protection, and implements risk management strategies across its operations.

However, traders under offshore regulation may face fewer protections compared to those under stricter jurisdictions like CySEC or DFSA.

Consistency and Clarity

M4Markets has built a good reputation in the trading community through consistent service quality, regulatory compliance, and a growing presence in global markets. The broker receives generally positive ratings on review platforms, with traders highlighting its fast execution, tight spreads, and diverse platform options as major benefits.

However, some reviews point out drawbacks such as limited educational content and variations in trading conditions depending on the regulatory entity. The firm has also rapidly expanded its operations and gained recognition for its professional approach, including multiple industry awards that reflect its credibility and service standards.

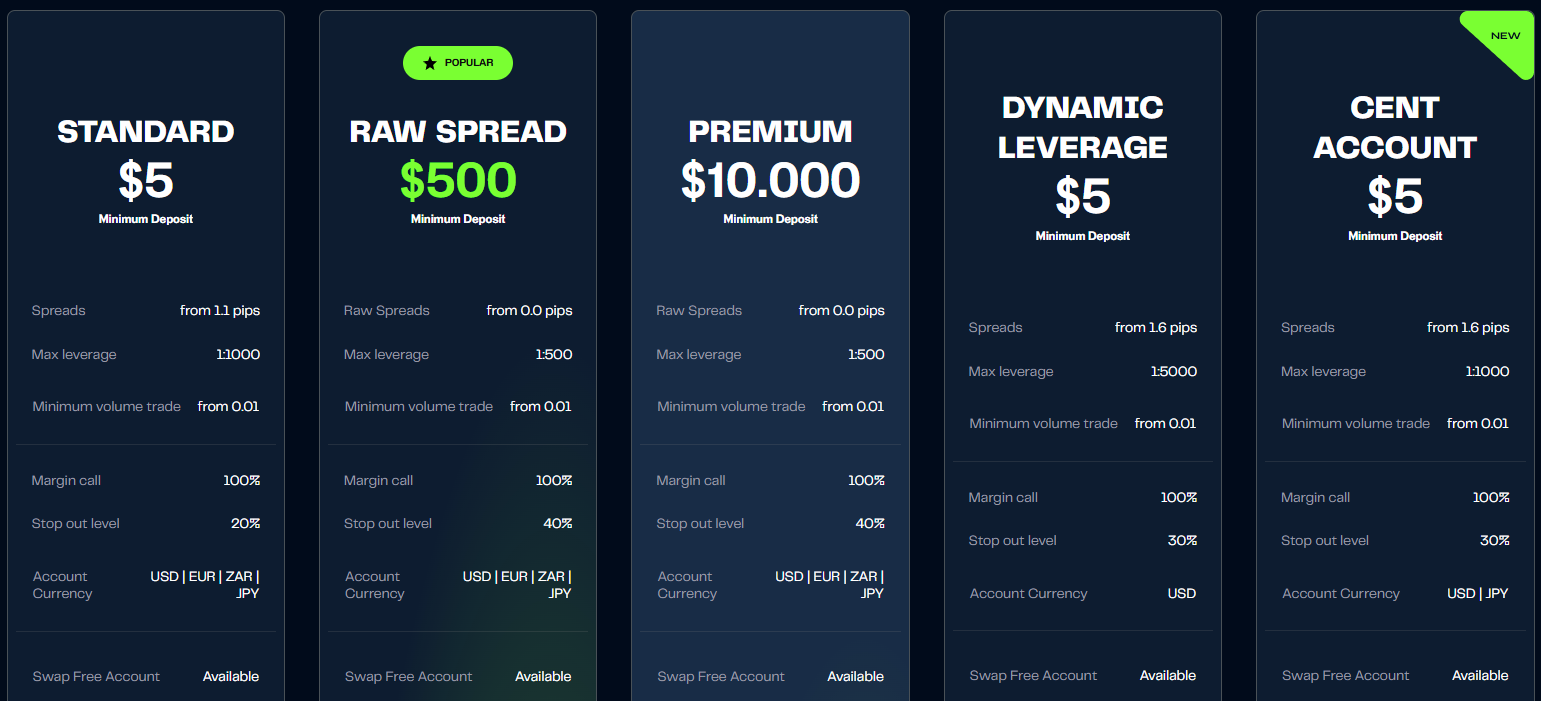

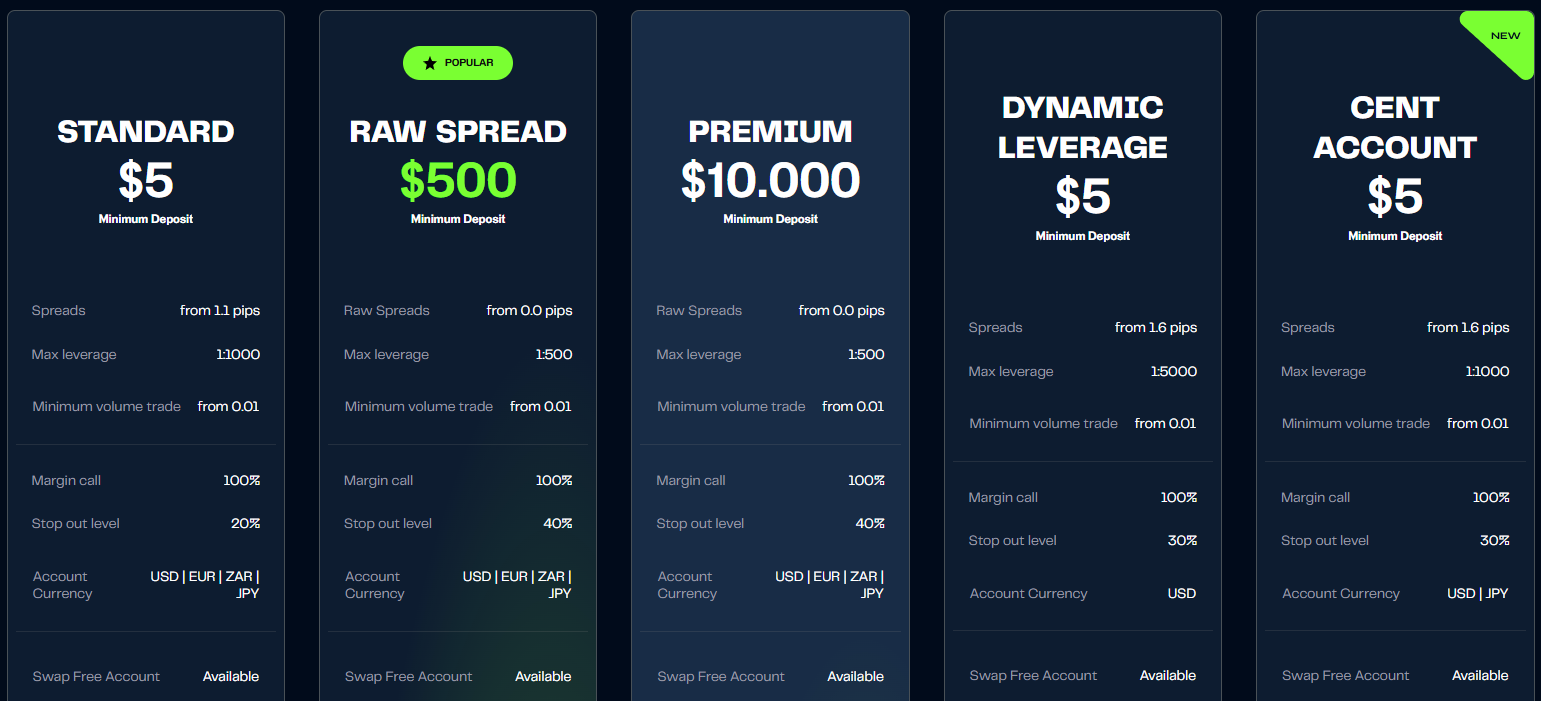

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with M4Markets?

M4Markets offers a variety of account types to suit different trading needs and experience levels. Under its international license, traders can choose from Standard, Raw Spread, Premium, and Dynamic Leverage accounts, as well as Cent Accounts, ideal for beginners or low-risk strategies.

Additionally, the broker provides a demo account for practice and strategy testing, along with an Islamic account for traders who follow Sharia principles.

However, for clients registered under the CySEC or DFSA licenses, the available account types are more limited, offering Standard, Premium, and VIP accounts with tighter regulatory oversight and more investor protection features. This structure allows traders to select accounts based on their preferred trading conditions.

Standard Account

The Standard Account at M4Markets offers accessible trading conditions for a wide range of traders. Under the international license, the required minimum deposit is just $5, ideal for beginners or those looking to start with a small investment. Traders also benefit from high leverage options of up to 1:1000 and access to a popular range of trading instruments.

However, for clients registered under the CySEC or DFSA licenses, the minimum deposit is higher at €100, and the maximum leverage is limited to 1:30 in line with stricter regulatory requirements. Traders under these entities typically benefit from lower spreads of 0.1 pips.

Regions Where M4Markets is Restricted

The broker’s services are limited in certain countries due to regulatory and compliance restrictions. The broker does not offer trading services in countries such as:

- USA

- Cuba

- North Korea, etc.

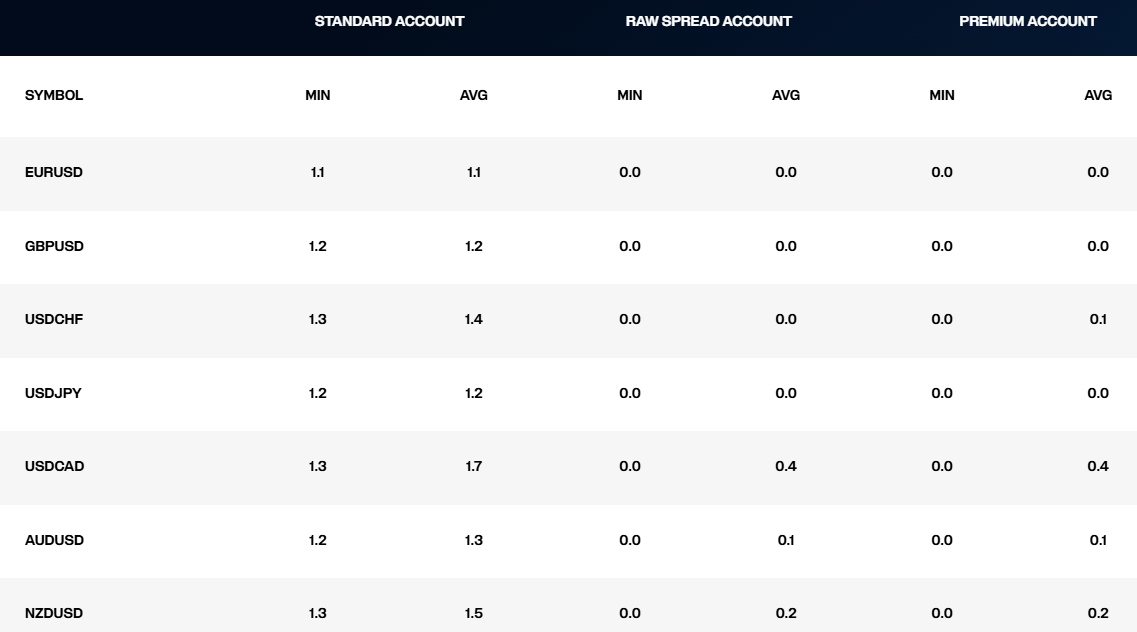

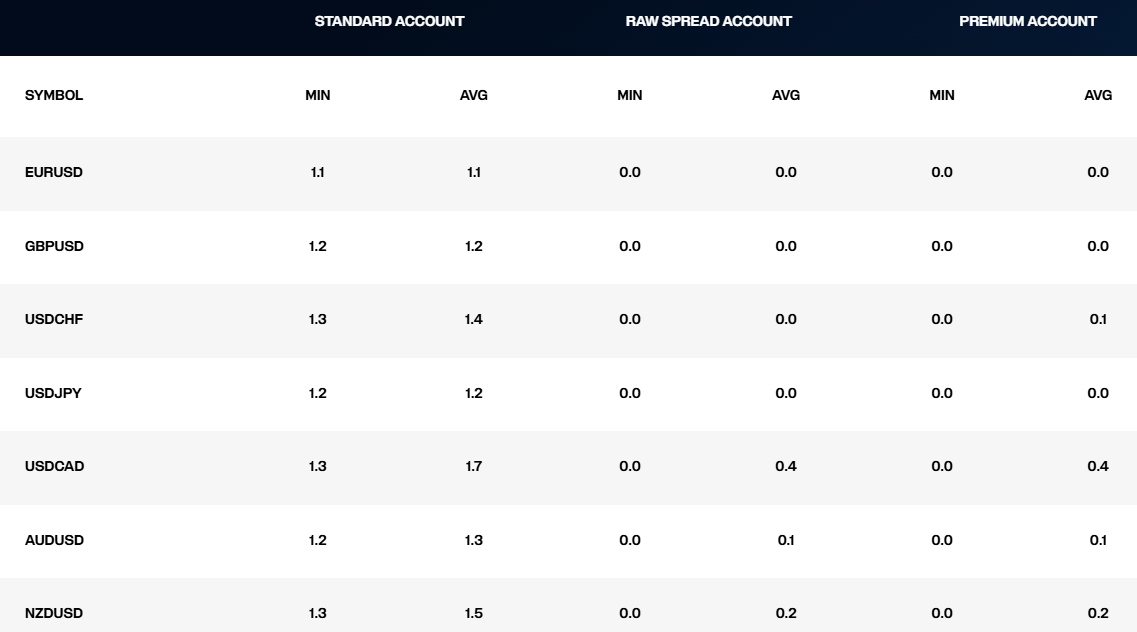

Cost Structure and Fees

Score – 4.5/5

M4Markets Brokerage Fees

M4Markets provides a competitive pricing structure tailored to different account types. Standard accounts apply floating spreads starting from around 1.1 pips with no commission, an accessible choice for retail traders.

Both Raw Spread and Premium accounts feature tight raw spreads from 0.0 pips; however, they include commission fees, $3.5 per side for Raw and $2.5 per side for Premium. There are no hidden charges; also, M4Markets does not impose deposit or withdrawal fees.

M4Markets offers competitive spreads across its various account types, with pricing that depends on both the account selected and the regulatory entity.

Under the international entity, the average spread for EUR/USD is around 1.1 pips on the Standard account, which is commission-free. For traders looking for lower spreads, the Raw Spread and Premium accounts offer spreads starting from 0.0 pips, though they include a commission per trade.

M4Markets’s commission structure varies based on the specified account type and instrument traded. For Standard accounts, there are no commissions, as costs are based on the spreads. In contrast, the Raw Spread account charges a commission of $3.5 per side, while the Premium account applies $2.5 per side for Forex and Metals trades.

- M4Markets Rollover / Swaps

M4Markets applies standard industry rollover rates for positions held overnight, with the actual fees depending on the specific instrument and account type. These swap charges are automatically calculated and reflected in your account when trades are carried into the next trading day.

Islamic accounts are available for traders who require positions without overnight interest, allowing you to avoid these rollover charges entirely.

- M4Markets Additional Fees

Typically, there are no deposit or withdrawal fees, allowing traders to fund or access their accounts without added charges. However, minor currency conversion fees may apply if your base currency differs from the account currency, depending on the payment method.

Additionally, an inactivity fee may be charged under the European license if an account remains dormant for 30 consecutive days. Swap-free accounts may also include administrative fees related to rollover exemptions.

How Competitive Are M4Markets Fees?

M4Markets offers a competitive fee structure that appeals to both beginner and experienced traders. The broker’s transparent pricing and clear disclosure of any additional charges contribute to a cost-effective trading environment.

While fees vary depending on the regulatory entity and account type, the broker generally provides attractive conditions for traders.

| Asset/ Pair | M4Markets Spread | Taurex Spread | FXTrading Spread |

|---|

| EUR USD Spread | 1.1 pips | 1.7 pips | 1 pip |

| Crude Oil WTI Spread | 4.8 | 0.054 | 22 |

| Gold Spread | 2.8 | 0.34 | 8 |

| BTC USD Spread | 14.1 | 41.92 | 323 |

Trading Platforms and Tools

Score – 4.7/5

M4Markets offers a selection of advanced trading platforms to meet the needs of various traders. Under its international license, the broker supports both MetaTrader 4 and MetaTrader 5, providing users with advanced charting, automated trading capabilities, and a wide range of technical indicators, with an average execution speed of 30 milliseconds.

Clients trading under the European and Dubai licenses have access exclusively to the cTrader platform, known for its intuitive interface, fast execution, and advanced order management features.

Trading Platform Comparison to Other Brokers:

| Platforms | M4Markets Platforms | Taurex Platforms | FXTrading Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

M4Markets Web Platform

M4Markets provides access to MT4 and MT5 Webtraders, allowing users to trade directly from any web browser without the need to download software.

The platforms offer the same functionalities as the desktop versions, featuring advanced charting, technical indicators, order management, and real-time market data.

M4Markets Desktop MetaTrader 4 Platform

The desktop MT4 platform offers a user-friendly interface, advanced charting tools with 30 built-in indicators, and flexible 9 timeframes.

Additionally, the platform supports algorithmic trading through Expert Advisors using the MQL4 scripting language, enabling strategy automation and custom tool development. Available across Windows, Mac, Android, and web, it ensures wide accessibility.

Overall, MT4 offers a flexible trading environment for those who need reliability and automation in their trading experience.

M4Markets Desktop MetaTrader 5 Platform

M4Markets offers the advanced MetaTrader 5 platform, delivering enhanced trading capabilities compared to MT4. MT5 supports a powerful range of analytical tools, including 38 built-in indicators and 44 analytical objects, along with up to 21 timeframes, allowing for deeper market analysis.

MT5 also provides an economic calendar, real-time market data, and strategy testing, enabling faster backtesting and advanced algorithm optimization. The platform supports social trading and integrates with the MQL5 community, giving traders access to automated strategies and signal services.

Main Insights from Testing

Testing the MT5 platform revealed a smooth and responsive trading experience, with fast order execution and minimal slippage. The platform interface is clean and modern, allowing for easy navigation and efficient trade management.

Order types and customization options are extensive, and real-time data updates are reliable even during high-volatility periods. Overall, MT5 performs well for both manual and automated trading, offering a stable environment that supports a diverse range of strategies.

M4Markets MobileTrader App

M4Markets offers mobile trading through the MT4 and MT5 apps, available for iOS and Android devices. The mobile apps provide users full access to their accounts on the go, featuring real-time quotes, interactive charts, technical indicators, and the ability to open and manage trades seamlessly.

AI Trading

M4Markets supports AI-powered trading through its MetaTrader 5 and cTrader, providing diverse algorithmic and automated trading strategies.

Traders can use EAs or run AI-based systems that analyze market data, identify patterns, and execute trades without manual intervention. These tools are especially useful for high-frequency trading, backtesting strategies, and reducing emotional decision-making.

While the broker does not offer proprietary AI tools, it provides the infrastructure and platform support to run AI-driven solutions efficiently.

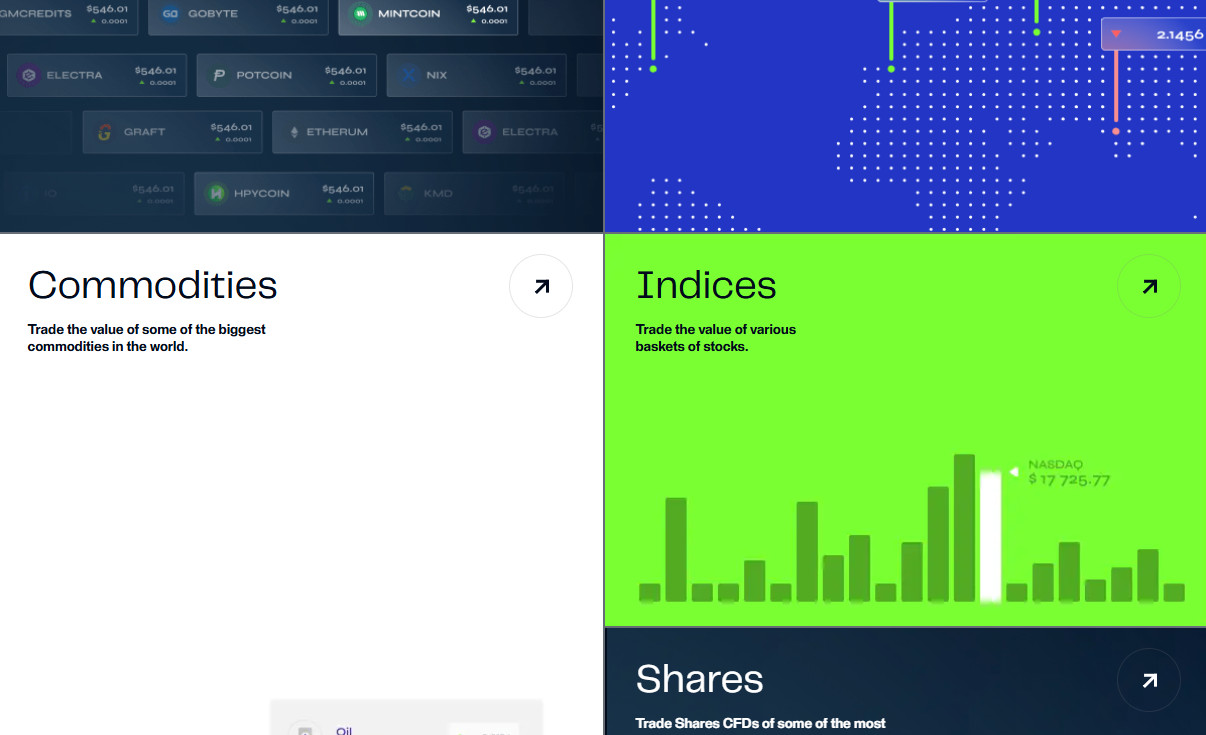

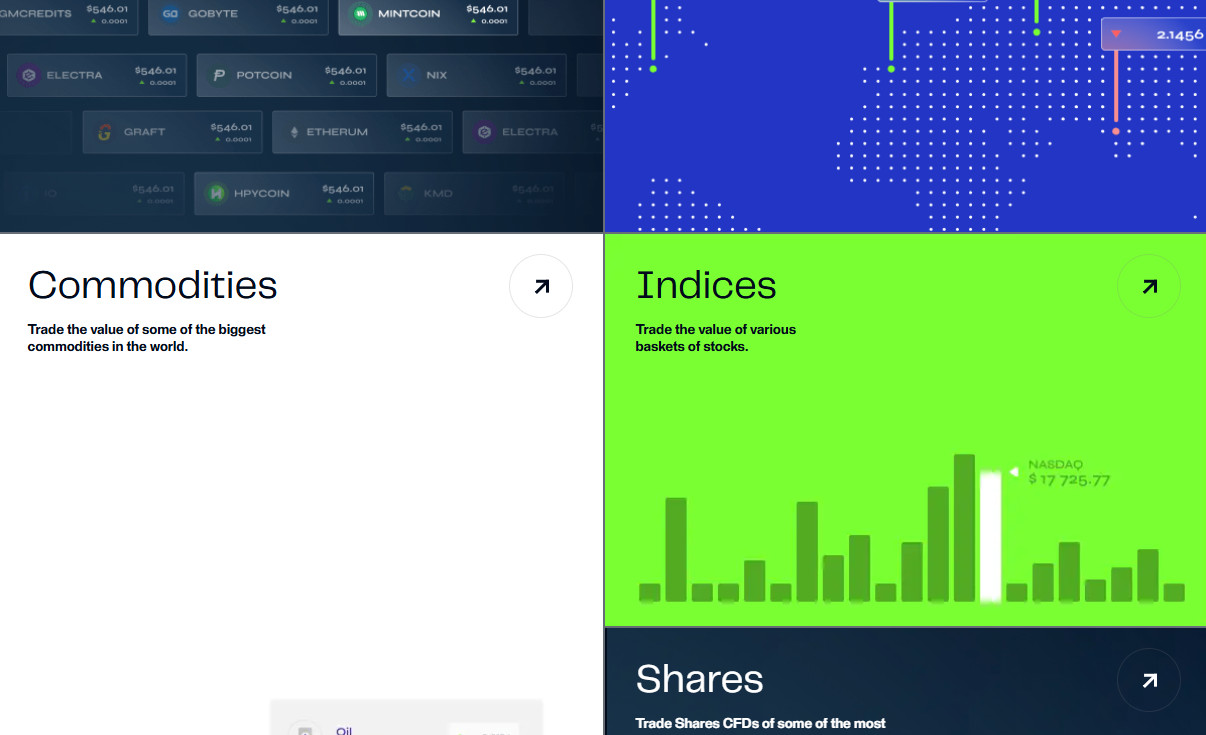

Trading Instruments

Score – 4.4/5

What Can You Trade on M4Markets’s Platform?

M4Markets offers access to over 120 trading instruments, including CFDs on Forex, Commodities, Indices, Shares, and Cryptocurrencies. The broker supports major, minor, and exotic currency pairs, as well as popular commodities such as gold and oil, global stock indices, and top digital assets.

However, the availability of specific instruments varies depending on the regulatory entity under which the client is registered.

Main Insights from Exploring M4Markets’s Tradable Assets

Exploring M4Markets’s tradable assets reveals a well-structured and diverse offering suited to a range of trading styles. The asset categories are organized on the platform, making it easy to filter and access specific markets.

Overall, the asset selection supports both diversification and specialization, providing traders with the necessary tools to pursue various strategies efficiently.

Leverage Options at M4Markets

Leverage levels offered by M4Markets depend on the entity you open an account with. It is a useful tool that enables traders to enter the market with limited capital, yet its use can lead to both substantial profits and losses.

Therefore, you should have a comprehensive understanding of how the multiplier works and its possible consequences before engaging in any trading activities that involve leverage.

- Clients under the European and DFSA licenses can use a maximum leverage of 1:30.

- For international traders, the maximum leverage is 1:5000.

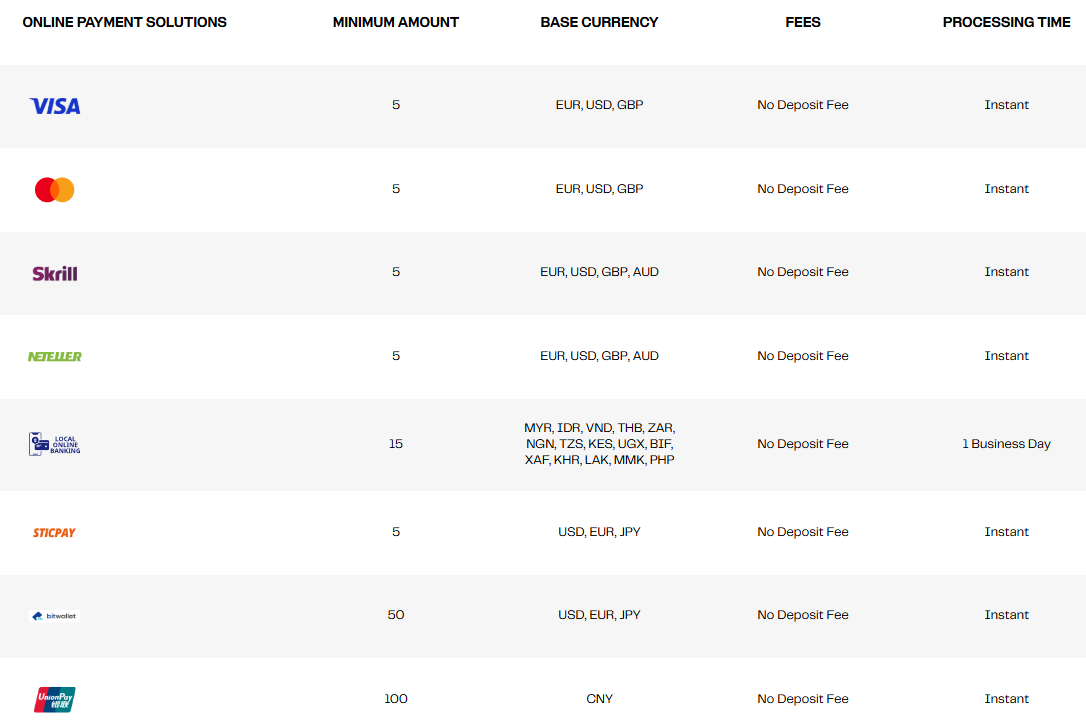

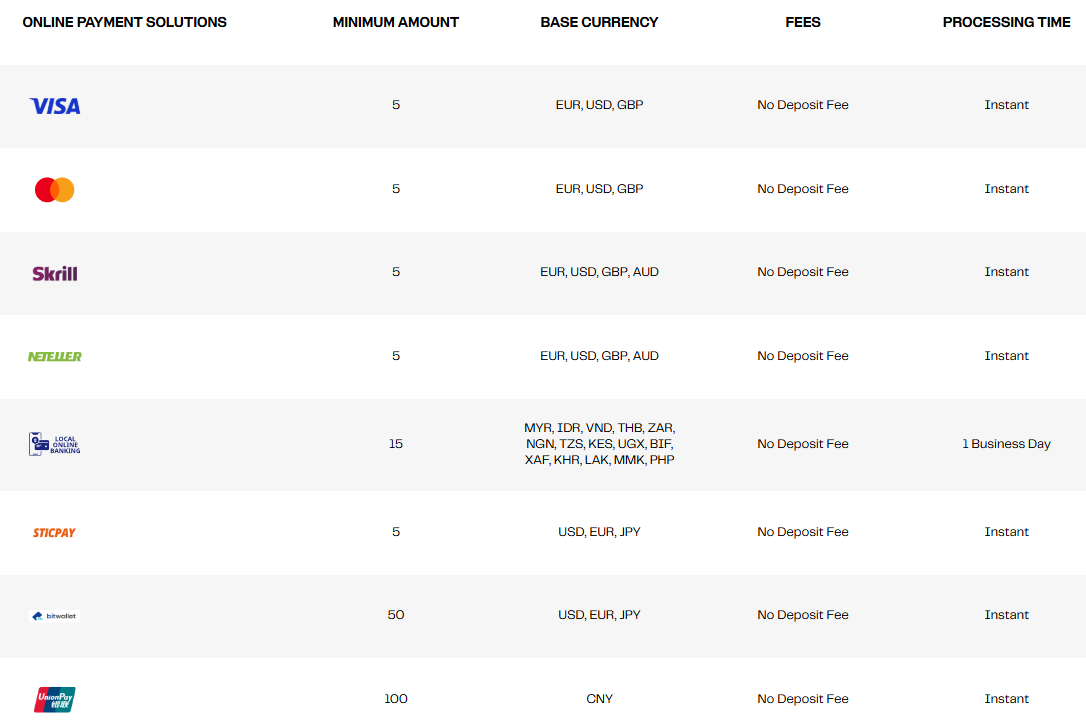

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at M4Markets

In terms of funding methods, M4Markets offers numerous payment methods, which is a very good plus. However, we advise checking funding methods as they might vary based on the client’s country of residence.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- UnionPay

- Sticpay and more

M4Markets Minimum Deposit

Under the broker’s international license, the Standard account requires a minimum deposit of just $5. For clients trading under the CySEC or DFSA licenses, the minimum deposit for the Standard account is €100.

Withdrawal Options at M4Markets

M4Markets provides clients with a range of withdrawal methods. Withdrawals are made via bank wire transfers and various e-wallets, including Skrill, Neteller, and local online payment solutions, often without any fees charged by the broker.

Withdrawal requests are typically processed within one business day, with fund arrival times depending on the method.

Customer Support and Responsiveness

Score – 4.5/5

Testing M4Markets’s Customer Support

M4Markets provides 24/5 responsive, multilingual support through live chat, email, and phone support, ensuring assistance during active market hours.

Additionally, a Support Center and FAQ are accessible on the website, covering topics like account setup, funding, platform usage, and regulatory details.

Contacts M4Markets

M4Markets offers several ways to contact the support team. You can reach them via phone at +248 463 2013 or by email at support@m4markets.com and support@m4markets.eu, ensuring you connect with the appropriate regional support desk.

Research and Education

Score – 4.4/5

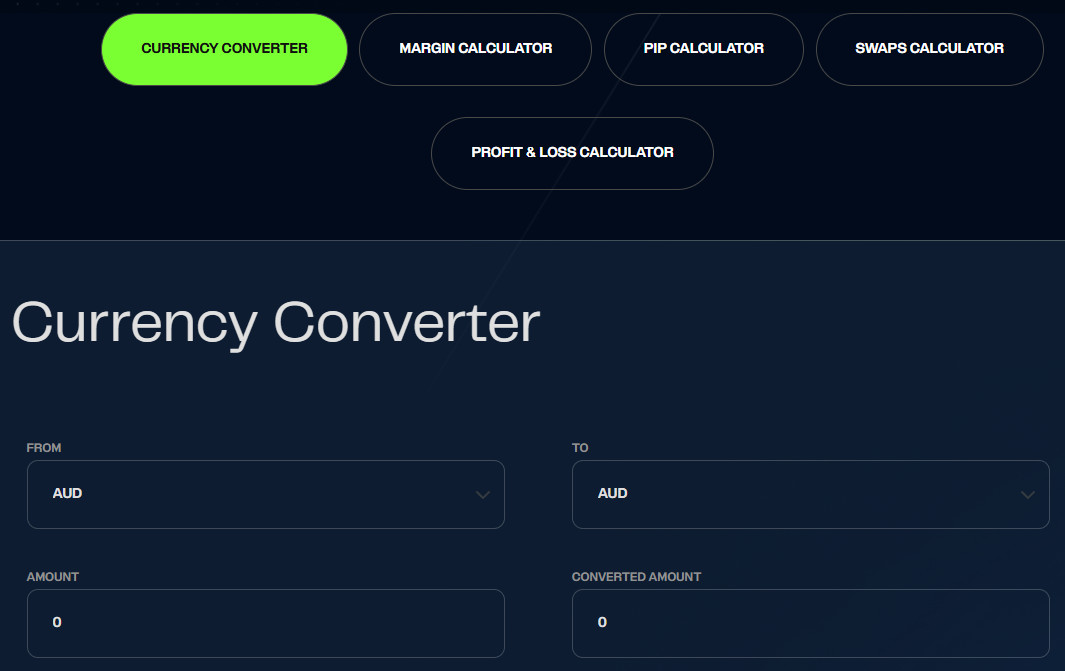

Research Tools M4Markets

M4Markets provides a range of research tools to support informed trading decisions.

- On the website, traders can access real-time market news, an economic calendar, and Forex calculators to assist with planning and risk management.

- Within the trading platforms, users benefit from built-in research features such as technical indicators, advanced charting, market depth, and price analysis tools. These tools help traders monitor price movements and analyze market trends efficiently across asset classes.

Education

The broker supports trader development through a suite of educational resources, including trading eBooks covering topics from Forex fundamentals to trading strategies, a Glossary that defines essential trading terms, and video courses to help users understand key concepts and market mechanics.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options M4Markets

While M4Markets primarily operates as a CFD trading broker, it also offers investment solutions, including MAM/PAMM accounts, enabling professional money managers to oversee multiple sub-accounts.

Additionally, the broker offers social trading, enabling beginners to follow and replicate the trades of experienced traders. These investment options offer both passive income opportunities and fund management tools for professionals.

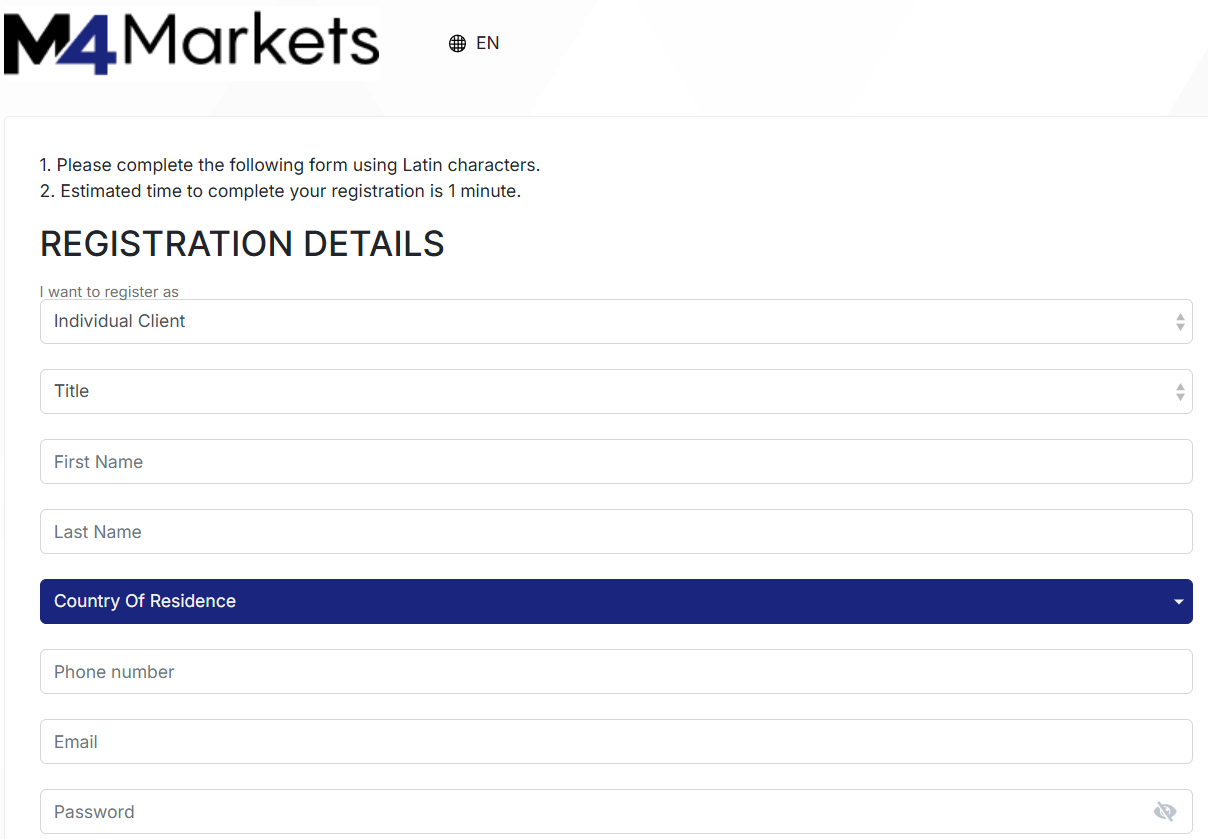

Account Opening

Score – 4.4/5

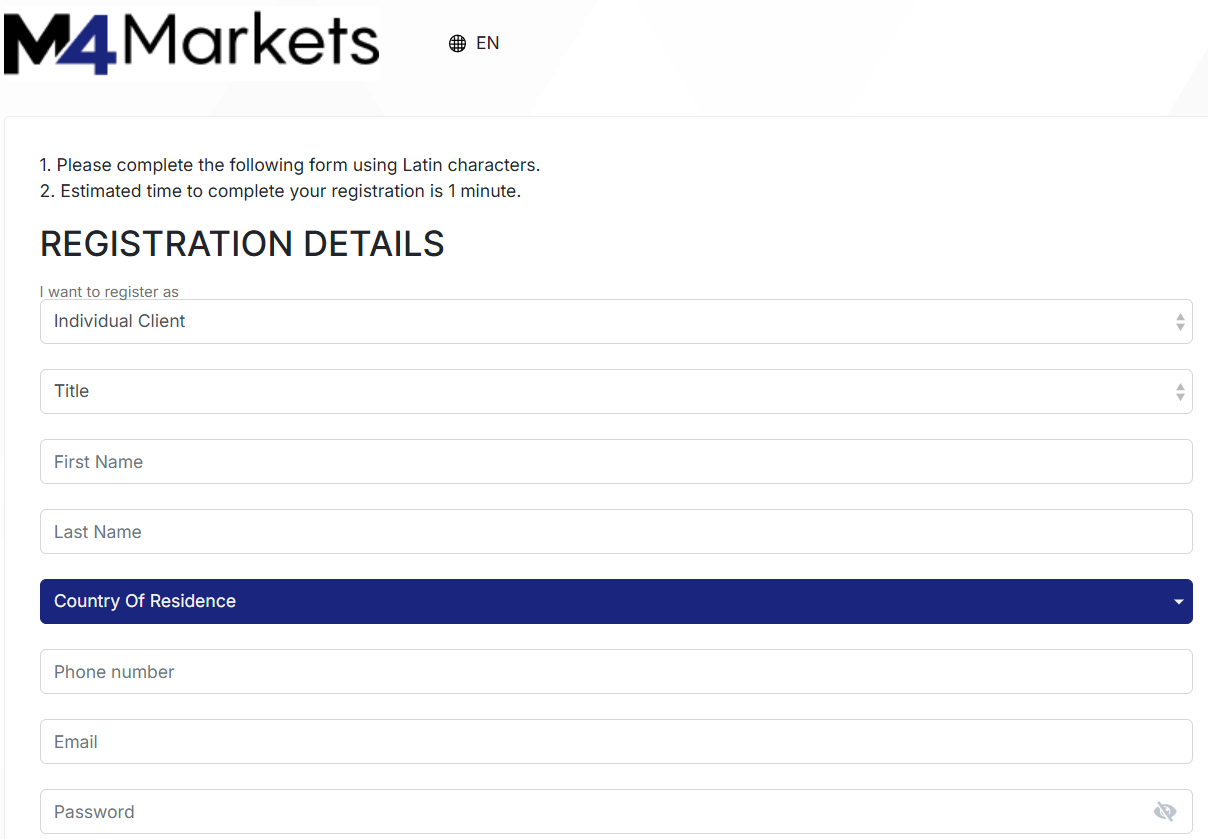

How to Open M4Markets Demo Account?

Opening a demo account with M4Markets is a quick process for traders who want to practice without risking real funds. To get started, visit the official M4Markets website and click on the “Open a Demo Account” button.

You will be asked to fill out a short registration form with basic personal details such as your name, email, phone number, etc. Once registered, you will receive login credentials and access to a simulated trading environment with virtual funds.

This allows you to explore the platform, test strategies, and become familiar with market movements in a risk-free environment.

How to Open M4Markets Live Account?

Opening an account with M4Markets is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Visit the official M4Markets website.

- Click on the “Open Account” link on the homepage.

- Fill out the registration form with your details (name, email, phone number, etc.).

- Verify your identity by submitting the required documents (passport, ID, proof of address).

- Choose your account type.

- Make your initial deposit.

- Download and set up your preferred trading platform.

- Log in to your trading account and start trading.

Additional Tools and Features

Score – 4.5/5

In addition to its main trading tools, M4Markets offers several additional features for enhancing the overall trading experience.

- One of the key additions is Social Trading, which allows users to follow and copy the trades of experienced traders directly through the platform, ideal for beginners or those looking for a more passive approach.

- The broker also provides access to Trading Signals, helping clients identify potential market opportunities in real time.

- For those managing multiple accounts or trading on behalf of others, MAM/PAMM solutions are available.

M4Markets Compared to Other Brokers

M4Markets stands as a solid choice among its competitors, offering a balanced trading environment with competitive prices, flexible platform options, and solid regulatory coverage.

While some brokers in the market provide a wider range of instruments or more advanced educational resources, the firm focuses on delivering efficient execution, user-friendly access to MT4, MT5, and cTrader, and diverse account types to match different trading needs.

The broker also requires a relatively low minimum deposit amount, accessible for beginners, while still offering features like social trading, MAM/PAMM, and multiple platform support that appeal to more advanced users. Overall, M4Markets combines essential tools with a strong focus on execution speed, suitable for all levels of traders.

| Parameter |

M4Markets |

FXTrading |

Tickmill |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.1 pips |

Average 1 pip |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3.5 per side |

0.0 pips + $2 per side |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, cTrader |

MT4, MT5 |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

120+ instruments |

1,000+ instruments |

180+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC, DFSA, FSA |

ASIC, VFSC |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$5 |

$50 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker M4Markets

M4Markets is a multi-regulated CFD broker offering a user-friendly trading environment with access to popular platforms like MetaTrader 4, MetaTrader 5, and cTrader.

The broker provides a range of account types to suit different trading styles, along with competitive trading conditions such as tight spreads, high leverage, and fast execution speeds.

Traders can access over 120 instruments across Forex, commodities, indices, shares, and cryptocurrencies. The broker also supports secure funding, negative balance protection, and 24/5 multilingual customer support, a reliable option for both individual and professional traders.

Share this article [addtoany url="https://55brokers.com/m4markets-review/" title="M4Markets"]