- What is Firstrade?

- Firstrade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Firstrade Compared to Other Brokers

- Full Review of Broker Firstrade

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

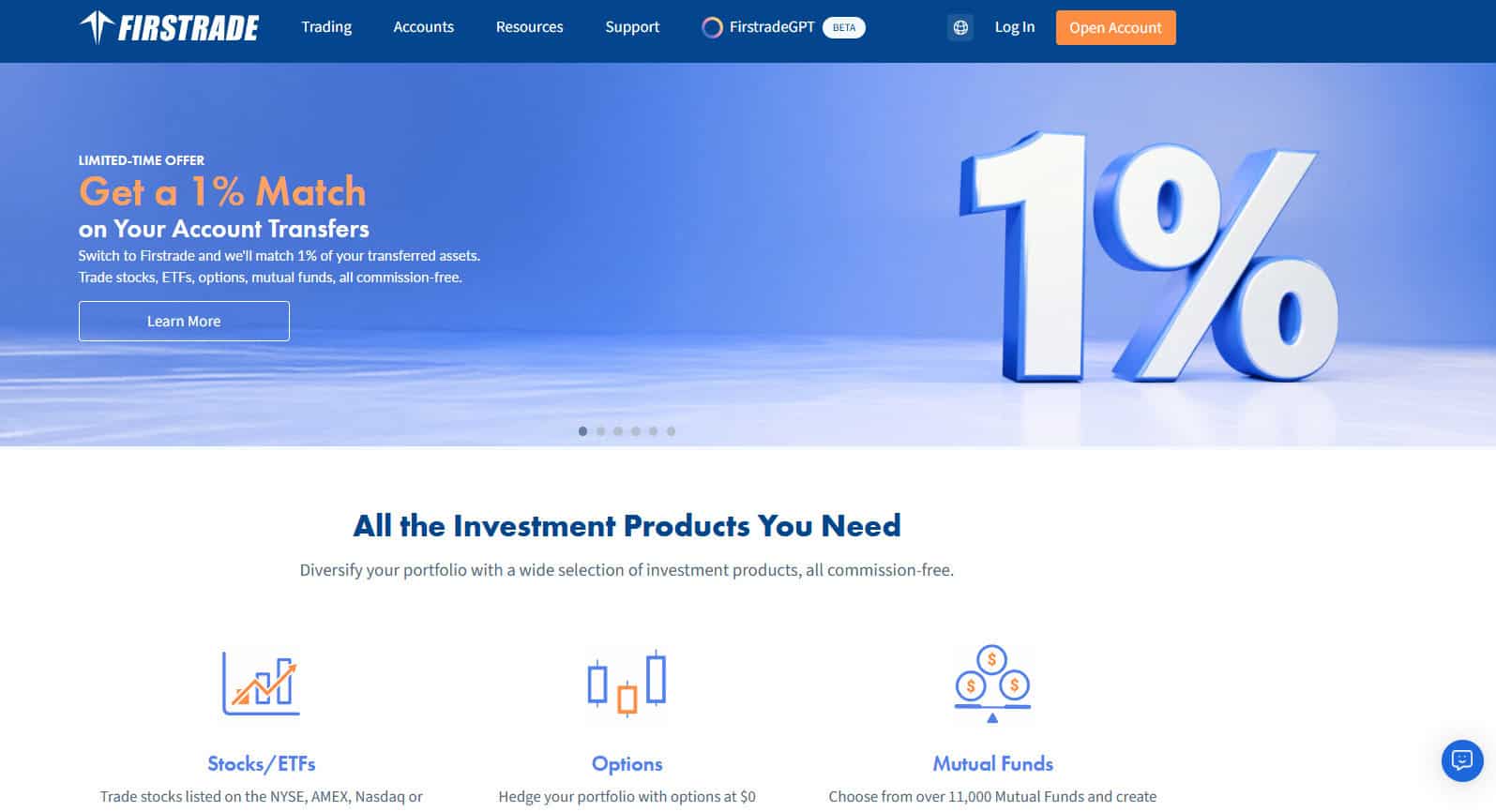

What is Firstrade Securities?

Firstrade is a Stock trading and Investment firm based in the United States. It provides a platform for individual investors to trade Stocks, ETFs, Options, Mutual Funds, Fixed Income, and Bonds.

The broker adheres to strict regulatory oversight by the US SEC. Also, it is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Overall, the firm offers competitive conditions and an intuitive interface for traders to manage their investment portfolios, access market research, and execute trades.

Is Firstrade Stock Broker?

Yes, Firstrade is a Stock brokerage firm. It operates as an online platform, providing individuals with the ability to trade various financial instruments, including stocks, options, ETFs, and mutual funds. Users can access Firstrade’s services through its online platform and mobile app, allowing for convenient and user-friendly trading experiences.

Firstrade Pros and Cons

The firm, like any brokerage platform, has its pros and cons. One of the advantages is its commission-free trading model, particularly for stocks, options, and ETFs, making it an appealing choice for cost-conscious investors. Additionally, Firstrade offers a range of research tools and educational resources, catering to both novice and experienced traders. Also, the platform does not impose account minimums, making it accessible to a broad range of investors, including those who may not have significant capital to start.

For the cons, the platform is not as feature-rich or technologically advanced as some competitors. Moreover, the availability of certain services and features may vary, and investors should verify the current offerings on Firstrade’s official website.

| Advantages | Disadvantages |

|---|

| SEC regulation and oversee | No 24/7 customer support |

| $0 minimum deposit | No paper trading or demo account |

| Good education and research | |

| US traders and investors | |

| Secure investing environment | |

| Commission-free trading | |

| Trading products | |

| User-friendly interface | |

Firstrade Features

Firstrade stands out with its competitive trading options and accessible educational resources, making it a suitable choice for cost-conscious investors, especially those seeking a straightforward platform with no account minimums. A summary of its key features is as follows:

Firstrade Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC |

| 🗺️ Account Types | Brokerage, Retirement, International, Education Planning, Business Planning Accounts |

| 🖥 Trading Platforms | Firstrade Proprietary Trading Platform, Options Wizard, Mobile Apps |

| 📉 Trading Instruments | Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Education Center, Investment Education Videos, Webinars, Blog |

| ☎ Customer Support | 24/7 |

Who is Firstrade For?

Firstrade is best suited for investors who want commission-free trading across stocks, ETFs, options, and mutual funds. With an easy-to-use platform, strong educational resources, and no account minimums, it appeals to those who are just starting their investing journey. Based on our findings and Financial Expert Opinions, Firstrade is Good for:

- US traders

- Investing

- Stocks and Options trading

- Advanced traders

- Professional trading

- Low fees

- Competitive investment environment

- Good educational materials and research

- Supportive customer service

Firstrade Summary

In conclusion, Firstrade is a reliable online brokerage that stands out for its commission-free trading model, making it an attractive option for cost-conscious investors. The platform offers a user-friendly interface, educational resources, and various tools to cater to a diverse range of investors.

While it may have some limitations in terms of advanced features, Firstrade’s commitment to accessible trading and investor education positions it as a viable choice for those looking for a straightforward and low-cost experience.

55Brokers Professional Insights

Firstrade stands out in the brokerage industry by combining a commission-free trading structure with an extensive range of investment products, including stocks, ETFs, options, and over 11,000 mutual funds.

What truly sets it apart is its strong focus on accessibility: there are no account minimums, making it appealing for both new investors and seasoned traders looking to keep costs low. Firstrade also provides robust research and educational tools, giving clients access to market news, analyst reports, and powerful screeners to support informed decision-making.

Additionally, the broker caters well to international investors by offering multilingual customer support and a user-friendly interface in multiple languages. This combination of affordability, product diversity, and investor-focused resources makes Firstrade a competitive option in today’s brokerage landscape.

Consider Trading with Firstrade If:

| Firstrade is an excellent Broker for: | - Need a well-regulated broker.

- Secure trading environment.

- US investors.

- Offering popular financial products.

- Competitive trading conditions.

- Commission-free trading.

- Stock Trading and Investment.

- Long-term investing.

- Looking for broker with a long history of operation and strong establishment.

- Need broker with Top-Tier licenses.

- Investors who prefer robust learning resources.

- Providing diverse account types.

- Professional trading.

|

Avoid Trading with Firstrade If:

| Firstrade might not be the best for: | - Futures and Cryptocurrency traders.

- Need a broker with trading services worldwide.

- Investors who need a Demo Account.

|

Regulation and Security Measures

Score – 4.7/5

Firstrade Regulatory Overview

Firstrade is a trustworthy Stock broker that follows the strict rules and guidelines established by the SEC, FINRA, CFTC, and SIPC, which safeguard client assets and provide low-risk trading.

How Safe is Trading with Firstrade?

Firstrade is a legitimate and regulated investing firm. It is authorized by respected US financial authorities and has a good reputation in the financial market.

The firm emphasizes customer protection through various measures, including the segregation of customer funds from the firm’s operational funds and adhering to regulatory standards.

Firstrade’s membership in regulatory bodies such as FINRA provides an additional layer of oversight, protecting traders’ accounts for up to $500,000. The platform employs encryption and other security protocols to safeguard customer data, ensuring the confidentiality and integrity of personal and financial information.

However, investors should verify the most recent policies and regulatory compliance directly from Firstrade’s official website or customer support, as features and practices may evolve.

Consistency and Clarity

Firstrade has built a solid reputation since its establishment in 1985, positioning itself as one of the longest-standing online brokers in the U.S. Its consistency in offering low-cost trading and investor-friendly policies has earned it positive recognition from both industry reviewers and everyday traders.

Independent ratings often highlight Firstrade’s reliability, regulatory compliance under FINRA and SIPC protection, and commitment to commission-free investing, while user reviews typically praise its transparency and ease of use, though some note limitations in advanced tools compared to higher-end platforms.

Over the years, the firm has also received awards from outlets like Kiplinger’s and StockBrokers.com, showcasing its credibility within the financial community. Beyond its services, Firstrade demonstrates social engagement through educational initiatives and active participation in investor awareness, further reinforcing its image as a trustworthy and community-conscious broker.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Firstrade?

Firstrade offers a wide range of account types tailored to different investor needs. These include Brokerage Accounts for everyday trading, Retirement Accounts such as Traditional, Roth, SEP, and SIMPLE IRAs, and International Accounts that allow non-U.S. investors to access U.S. markets.

For future planning, Firstrade provides Education Planning Accounts to help families invest for a child’s education, as well as Business Accounts for companies, partnerships, and entities looking to manage investments efficiently.

Brokerage Accounts

Firstrade’s Brokerage Accounts are flexible, accessible, and designed for investors of all levels. With no minimum deposit requirement, they allow beginners to start investing right away, while still offering the depth and features that experienced traders need.

These accounts provide access to a broad range of investment products, including stocks, ETFs, mutual funds, and options, all available with zero commissions.

Regions Where Firstrade is Restricted

Firstrade generally does not allow residents of the following countries to open accounts:

- Canada

- Ecuador

- Greece

- Netherlands

- Romania

- UAE

Cost Structure and Fees

Score – 4.7/5

Firstrade Brokerage Fees

The firm is known for its competitive fee structure, particularly for its commission-free trading on stocks, options, and ETFs. This approach has been appealing to investors looking to minimize transaction costs.

However, while fees are low or nonexistent, other fees may still apply. These can include margin interest rates for those engaging in margin trading, mutual fund transaction fees, and fees associated with certain account activities.

Firstrade is widely recognized for offering no-commission trading on various financial instruments. This fee structure has contributed to the platform’s appeal among investors, particularly for those who engage in frequent trading or are cost-conscious.

However, commissions and fees can change over time and may vary based on the specific investments and market conditions. Therefore, investors should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

Firstrade does not charge commissions on stocks, ETFs, options, or mutual funds, but like all brokers, clients are still responsible for exchange and regulatory fees imposed by the exchanges or governing authorities.

These fees are typically small and standardized, such as the SEC fee for sales of U.S. securities or FINRA trading activity fees, which help cover regulatory oversight and market infrastructure.

While Firstrade passes these fees through to clients, they are transparent about them and generally amount to only a few cents per transaction.

- Firstrade Rollover / Swaps

Firstrade does not offer leveraged products, so it does not charge rollover or swap fees. All standard trades, including stocks, ETFs, options, and mutual funds, can be held overnight without any additional financing costs.

- Firstrade Additional Fees

In addition to standard regulatory and exchange fees, Firstrade charges a few additional fees for specific account services or transactions. These include fees for paper statements, wire transfers, account transfers, returned checks, or inactivity in certain account types, though many basic services remain free.

Firstrade is generally transparent about these charges, and most investors using standard brokerage accounts for trading stocks, ETFs, options, or mutual funds will encounter minimal extra costs.

How Competitive Are Firstrade Fees?

Firstrade’s fees are highly competitive, particularly for retail investors seeking a low-cost trading environment. With commission-free trading on stocks, ETFs, options, and mutual funds, it positions itself as an attractive choice for both beginners and experienced traders who want to minimize costs.

The broker also offers no account minimums, helping new investors get started without financial barriers.

| Asset/ Pair | Firstrade Commission | M1 Finance Commission | AJ Bell Commission |

|---|

| Stocks Fees | From $0 | From $0 | From £3,50 |

| Fractional Shares | Yes | Yes | No |

| Options Fees | From $0 | - | - |

| ETFs Fees | From $0 | From $0 | From £5 |

| Free Stocks | Yes | Yes | No |

Trading Platforms and Tools

Score – 4.6/5

Firstrade offers a proprietary platform with a user-friendly interface for executing trades and managing investments. The platform is available in mobile apps for both iOS and Android devices, allowing investors to trade and monitor their portfolios on the go.

Additionally, Firstrade’s Options Wizard is a tool designed to assist users in making options trading decisions by providing educational insights and helping users build and execute option strategies.

Trading Platform Comparison to Other Brokers:

| Platforms | Firstrade Platforms | M1 Finance Platforms | AJ Bell Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Firstrade Web Platform

Firstrade’s Options Wizard is a web-based, specialized tool designed to assist investors, particularly those engaging in options trading. The platform provides educational insights, guiding users through the complexities of options trading strategies. It helps users build and execute option strategies based on their investment goals and risk tolerance.

This tool is valuable for both novice and experienced options traders, offering a structured approach to understanding and implementing various options strategies. Investors using Firstrade can leverage the Options Wizard to enhance their knowledge and make more informed decisions when navigating the options market.

Main Insights from Testing

Testing Firstrade’s Options Wizard is a user-friendly and insightful tool for options traders of all experience levels. The platform makes it easy to visualize potential profit and loss, compare multiple strategies, and assess risk-reward scenarios before executing trades.

Its intuitive interface allows users to adjust variables like strike prices, expiration dates, and market conditions, providing a clearer picture of possible outcomes. Overall, Options Wizard helps traders make more informed decisions by combining simplicity with practical analytical features.

Firstrade Desktop MetaTrader 4 Platform

Firstrade does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, which is typically associated with MT4.

Firstrade Desktop MetaTrader 5 Platform

The broker does not support MetaTrader 5 either. Firstrade does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platforms.

Firstrade MobileTrader App

Firstrade’s Mobile App is a comprehensive mobile platform that allows investors to trade stocks, ETFs, options, and mutual funds on the go. The app features an intuitive interface with real-time quotes, customizable watchlists, advanced charting tools, and access to market news and research.

Users can manage their accounts, monitor positions, and execute trades securely from their smartphones or tablets.

AI Trading

Firstrade offers AI-powered features to assist investors in their research and decision-making processes. One of the primary tools is FirstradeGPT, an AI-driven research assistant that centralizes financial data and analytics onto a single platform.

This tool provides users with access to institutional-quality company financials, segments, key performance indicators (KPIs), and more, all curated by human equity analysts.

Additionally, it simplifies and summarizes market insights, highlighting key points to help investors stay up-to-date on financial news.

Trading Instruments

Score – 4.7/5

What Can You Trade on Firstrade’s Platform?

The broker offers a range of products to suit investors’ preferences, including Stocks, ETFs, Options, Mutual Funds, Fixed Income, and Bonds. While Firstrade’s primary focus is on stocks and options, its product offerings cater to a variety of investment preferences and strategies.

Main Insights from Exploring Firstrade’s Tradable Assets

Exploring Firstrade’s tradable assets reveals a platform designed for investors seeking a straightforward, commission-free trading experience.

While it does not offer advanced instruments like futures or cryptocurrencies, the firm provides a solid range of traditional investment products. This focus on core asset classes, combined with its intuitive platforms and zero-commission structure, makes Firstrade an appealing choice for long-term investors and those new to the markets.

Margin Trading at Firstrade

The platform offers margin trading services, allowing eligible investors to borrow funds to amplify their trading positions. Margin trading can potentially increase both gains and losses, as investors are trading with borrowed money.

Firstrade sets specific margin requirements and interest rates for borrowing, and users should carefully review and understand these terms before engaging in margin trading.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Firstrade

The broker offers various funding methods to deposit money into trading accounts, including ACH electronic funds transfer from linked bank accounts, wire transfers, and checks.

The processing times for different funding methods may vary, so investors should consider their preferences and urgency when selecting a funding option.

Firstrade Minimum Deposit

The broker does not have a minimum deposit requirement for opening a brokerage account. This absence of a minimum deposit makes Firstrade accessible to a wide range of investors, including those who may be starting with smaller amounts of capital.

Withdrawal Options at Firstrade

The firm provides various options for withdrawals to accommodate the preferences of its users. Traders can initiate withdrawal requests through the online platform or mobile app.

However, investors should be aware of potential fees associated with certain withdrawal methods, such as wire transfers, and take note of processing times, which can vary.

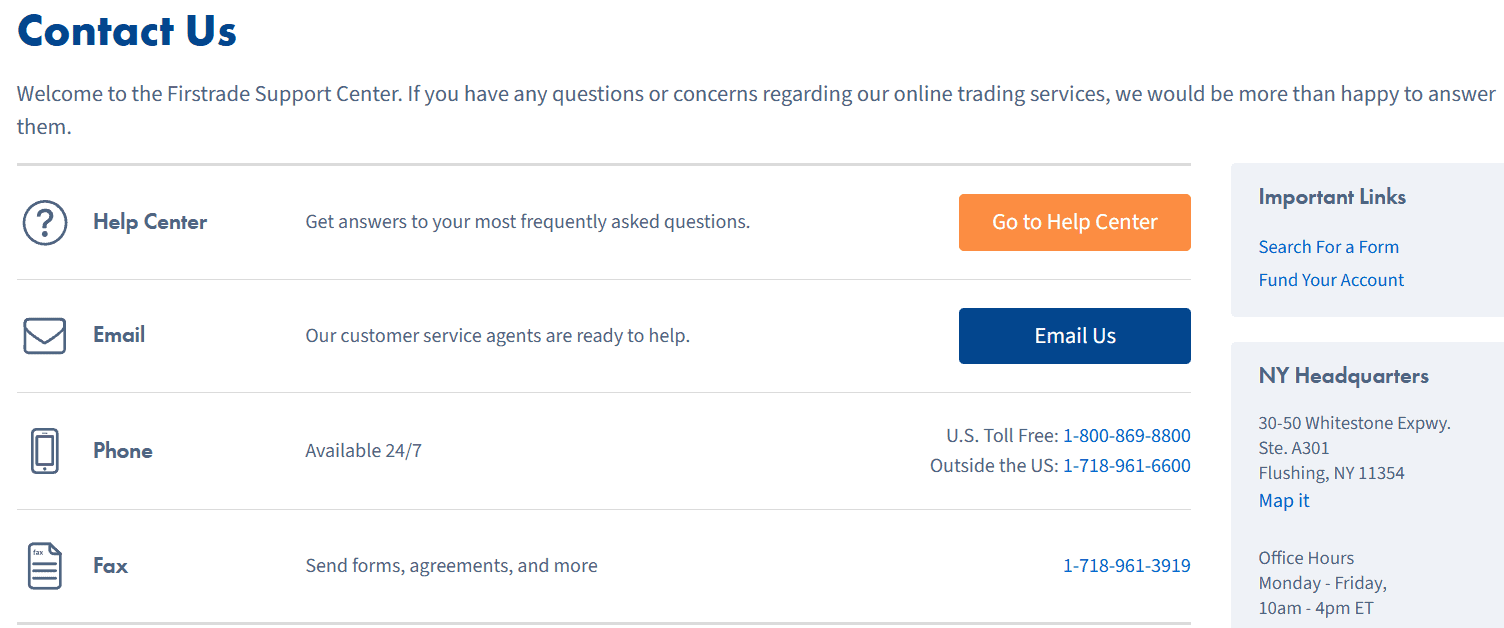

Customer Support and Responsiveness

Score – 4.6/5

Testing Firstrade’s Customer Support

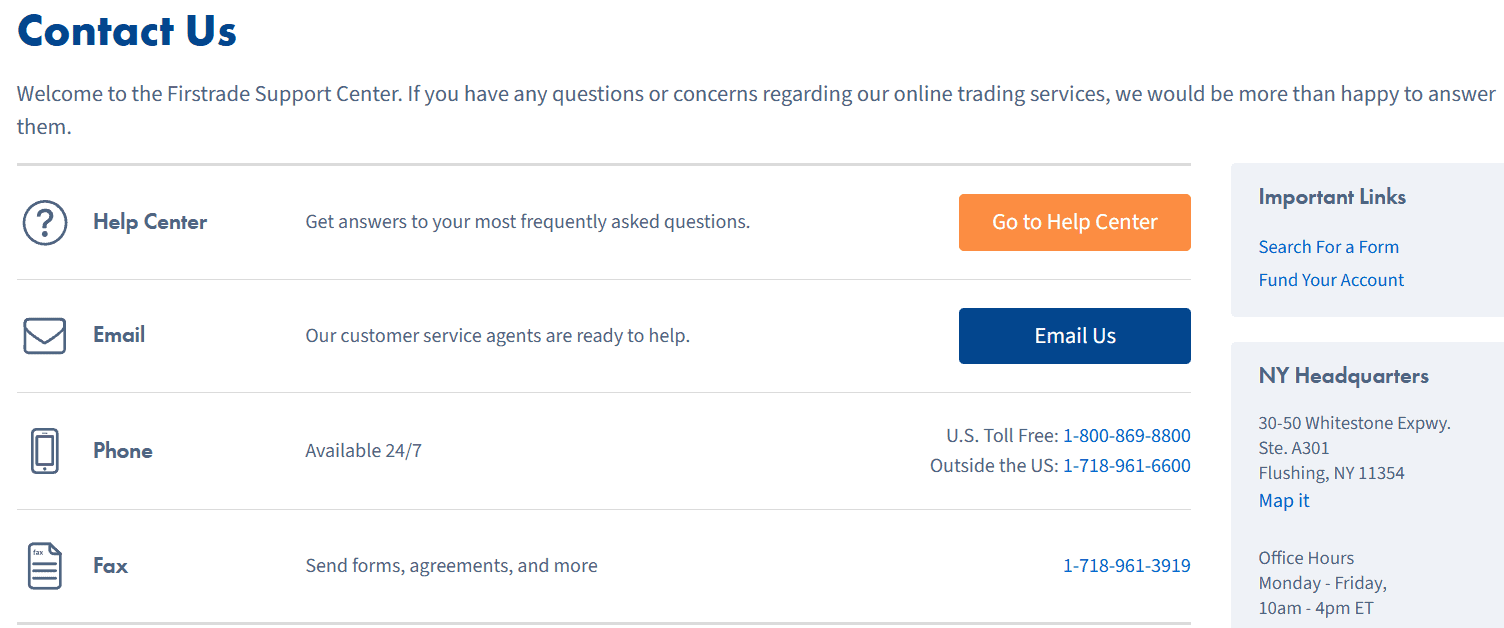

The broker offers 24/7 customer support through phone, live chat, email, and Help Center. The broker is known for providing responsive and accessible customer support to assist users with their inquiries and concerns.

Contacts Firstrade

You can contact Firstrade’s customer support via multiple channels. For users within the U.S., the toll-free number is 1-800-869-8800, while those outside the U.S. can reach Firstrade at 1-718-961-6600.

Firstrade also provides an email contact form on its website for inquiries, allowing clients to submit questions or requests securely online.

Research and Education

Score – 4.7/5

Research Tools Firstrade

Firstrade provides a robust set of research and trading tools accessible both on its website and across its trading platforms.

- On the website, investors can access detailed market data, stock screeners, analyst reports, and AI-powered insights via FirstradeGPT, helping them evaluate investment opportunities and monitor market trends.

- On its platforms, including the web-based and mobile apps, users benefit from real-time quotes, advanced charting, over 65 technical indicators, and strategy analysis tools, allowing them to execute trades while staying informed.

This integration of research and trading functionality ensures investors have the resources they need, whether analyzing markets from a browser or actively managing positions on the go.

Education

The broker places a strong emphasis on investor education, offering a variety of resources to help users enhance their financial knowledge. The platform offers educational materials, including articles, tutorials, and webinars, that cover a wide range of investment topics. These resources cater to both beginners and experienced investors, empowering users to make informed decisions about their portfolios.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Firstrade

Firstrade offers a wide range of investment solutions designed to meet the needs of both beginner and experienced investors. Clients can access stocks, ETFs, options, mutual funds, and fixed-income securities, allowing for diversified portfolio construction.

These investment options are available through both standard brokerage accounts and specialized accounts such as retirement, education, and business accounts, providing flexibility for different financial goals.

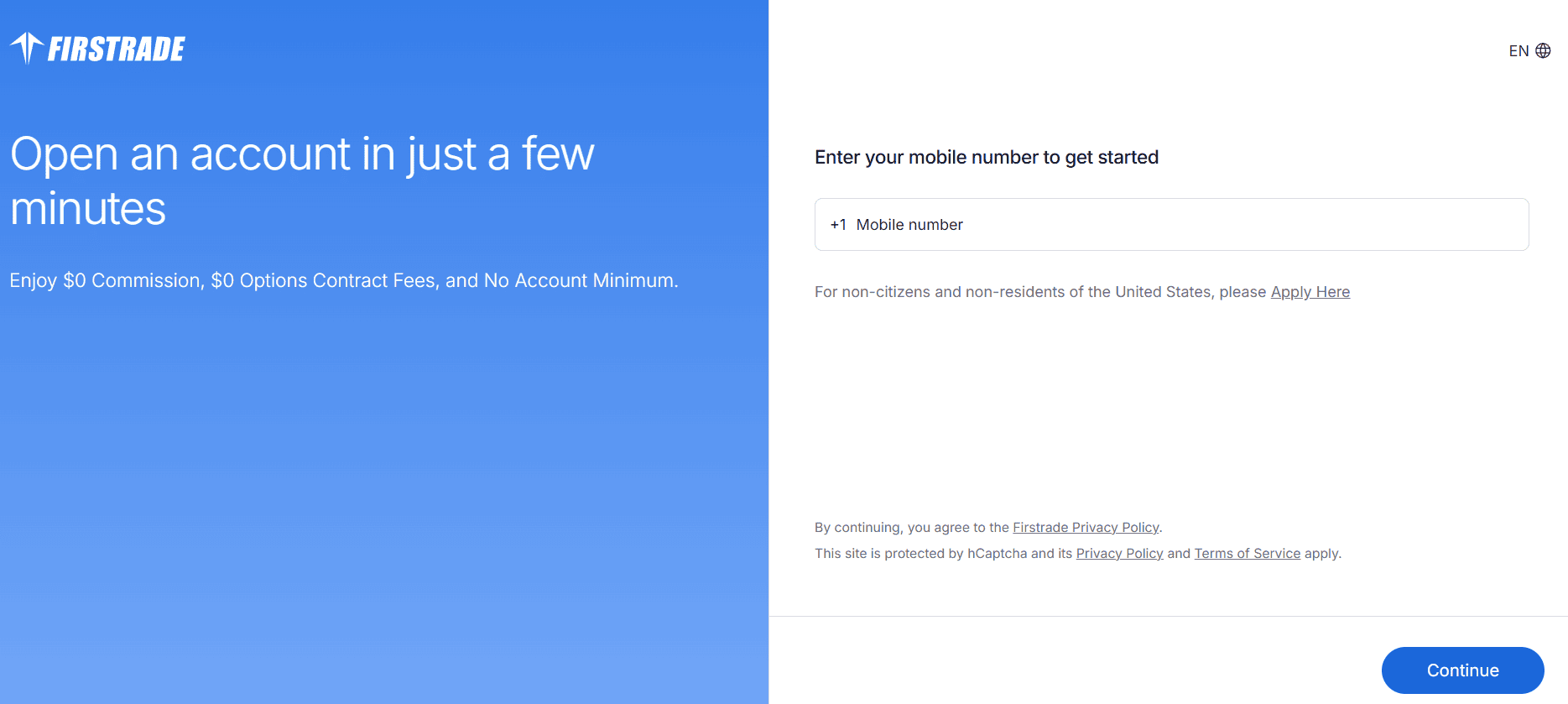

Account Opening

Score – 4.5/5

How to Open Firstrade Demo Account?

Firstrade does not offer a demo account, so users need to open a live account with real funds to start investing on the platform.

How to Open Firstrade Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Firstrade login page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

In addition to its research tools, Firstrade offers several additional tools and features to enhance the trading experience.

- These include customizable watchlists and alerts to monitor portfolio performance and market movements.

- Firstrade also provides account management features, such as automatic dividend reinvestment and tax reporting tools, helping investors efficiently manage their investments while staying informed.

Firstrade Compared to Other Brokers

Firstrade stands out among its competitors as a low-cost, investor-friendly broker with a strong emphasis on accessibility and versatility.

Compared to other brokers, it offers a wide variety of investment options and multiple platforms, including proprietary tools and mobile apps, making it suitable for both beginners and experienced investors.

Its regulatory compliance and customer support are on par with global standards, ensuring reliability and trustworthiness. While some competitors may offer niche products like futures, CFDs, or crypto, Firstrade focuses on providing a comprehensive range of traditional assets with intuitive tools, educational resources, and easy account setup, positioning itself as a solid choice for cost-conscious investors seeking a well-rounded trading experience.

| Parameter |

Firstrade |

Trade Republic |

AJ Bell |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from €1 |

Futures contracts not available / Stock Commission from £3,50 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low/Average |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

Firstrade Proprietary Trading Platform, Options Wizard, Mobile Apps |

Trade Republic Mobile App |

AJ Bell Trading Platform |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC |

BaFin, Bundesbank |

FCA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$0 |

€0 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker Firstrade

Firstrade is a reliable and user-friendly Stock trading firm that caters to a wide range of investors, from beginners to experienced traders. The broker offers commission-free trading on stocks, ETFs, options, and mutual funds, along with a variety of account types, including retirement, education, and business accounts.

Clients benefit from intuitive platforms, mobile apps, and AI-enhanced research tools like FirstradeGPT, as well as robust educational resources and portfolio management features.

With transparent fees, strong regulatory oversight, and responsive customer support, Firstrade provides a comprehensive, low-cost solution for building and managing diversified investment portfolios efficiently.

Share this article [addtoany url="https://55brokers.com/firstrade-review/" title="Firstrade"]