- What is Vanguard?

- Vanguard Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Vanguard Compared to Other Brokers

- Full Review of Broker Vanguard

Overall Rating 4.7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Vanguard?

Vanguard is a Real Stock trading company and investment management firm known for its role in providing low-cost investment options to individuals and institutions. The company’s range of investment products includes a diverse selection of funds spanning various asset classes, such as Stocks, Options, CFDs, ETFs, Bonds, and Mutual Funds, making it a popular choice for those seeking cost-effective and diversified investment solutions.

Established in 1975 in the USA, Vanguard has risen in the financial industry, providing passively managed index funds and exchange-traded funds (ETFs). As a financial institution operating in the United States, the broker is subject to strict regulatory oversight by several U.S. authorities, which ensures that Vanguard complies with securities laws and provides transparent and accurate information to investors.

Based on our research, the broker has a presence in various regions around the world, including Asia Pacific, Europe, and the Americas. These entities comply with local regulations and provide support to clients in their respective regions, offering a range of Vanguard funds and services tailored to the specific needs of investors.

Overall, the broker is widely recognized for its commitment to investor interests, emphasizing low fees and a long-term, buy-and-hold investment philosophy.

Is Vanguard Stock Broker?

Yes, Vanguard offers Stock and Options Investment services in addition to its primary focus on mutual funds and exchange-traded funds (ETFs). As a Real Stock trading broker, Vanguard allows investors to buy and sell individual stocks on various stock exchanges.

The broker provides a sophisticated platform for investors to access a wide range of investment options, making it a versatile choice for those looking to manage a diversified portfolio or engage in stock trading alongside their long-term investment strategies.

Vanguard Pros and Cons

Per our findings, the broker has earned a strong reputation in the investment industry for several reasons. One of the main advantages is a strong base and offering overall for Investments and Stock trading in particular, established with low-cost investing, offering some of the industry’s lowest expense ratios on its funds, which makes Vanguard an attractive choice for cost-conscious investors. Additionally, the company’s extensive range of passively managed index funds and ETFs makes it a solid choice for those seeking diversified, long-term portfolios.

For the cons, trading conditions may vary based on the entity, so good to verify conditions applicable to you. Also, the broker’s product selection might not be as extensive as other Stock brokerages, potentially limiting access to specialized markets or investment choices.

Additionally, the absence of 24/7 customer support and the limited availability of educational resources and research materials on the website could be drawbacks for traders seeking comprehensive learning tools.

| Advantages | Disadvantages |

|---|

| Strict regulation by SEC, FINRA, SIPC, FCA, ASIC | Limited trading products |

| FCA regulation and oversee | No 24/7 customer support |

| Good for Investors and Professionals | Limited educational and research materials |

| $0 minimum deposit | |

| Advanced trading platform | |

| Low trading fees and commissions | |

| Traders from Americas, the UK, Asia Pacific, and Europe | |

| Various account types | |

Vanguard Features

Vanguard ranks highly in the financial industry due to its focus on low-cost investing and a wide range of Stocks, index funds, and ETFs. It is a good choice for long-term investors who prioritize cost savings. Below is a comprehensive list of its key features:

Vanguard Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

| 🗺️ Account Types | Individual & Joint Brokerage, Retirement, 529 Savings, Small Business, etc. |

| 🖥 Trading Platforms | Proprietary trading platform, Mobile App |

| 📉 Trading Instruments | Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | News, Articles, Insights |

| ☎ Customer Support | 24/5 |

Who is Vanguard For?

Vanguard is designed for long-term investors who prioritize low costs, simplicity, and disciplined investing. The broker is ideal for investors who want to build wealth gradually through diversified portfolios of index funds, ETFs, and mutual funds, without frequent trading. Based on our findings, Vanguard is Good for:

- Real Stock Trading

- Investing

- Traders from the USA, UK, and Asia Pacific

- European investors

- Free Stocks

- Australian traders

- Advanced traders

- Professional trading

- Access to Stocks and ETF trading

- Commission-based trading

- Good trading tools

Vanguard Summary

In summary, Vanguard is a reputable and well-established Real Stock Trading brokerage firm known for its low-cost investing and long-term strategies. The broker’s focus on cost-effective investing makes its trading products particularly appealing to those looking to build diversified portfolios while minimizing fees and expenses.

Vanguard is heavily regulated and authorized by various Top-Tier financial authorities around the world, adding an element of trust and security for investors from the USA, the UK, Europe, and Asia Pacific. The broker provides a user-friendly proprietary trading platform and mobile apps with advanced charting tools and real-time market data, so it is suitable for various strategies investors.

Yet, there are some limitations too, like limited trading products, educational resources, and research materials, as well as the lack of 24/7 customer support.

Overall, we found that Vanguard provides a good trading environment for investment, however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Vanguard stands out for its commitment to low-cost and long-term investing. As a pioneer of index fund investing, the broker eliminated high fees and made passive investing accessible to everyday investors.

Its unique ownership structure, where the company is owned by its funds, which are in turn owned by the investors, ensures that clients’ interests come first, not shareholders’. This model allows Vanguard to consistently offer some of the lowest expense ratios in the industry.

With a strong reputation for transparency, a wide range of ETFs and mutual funds, and a conservative approach that avoids high-risk products like futures, Vanguard appeals to investors who value stability, simplicity, and long-term growth over speculative strategies.

Consider Trading with Vanguard If:

| Vanguard is an excellent Broker for: | - Suitable for professional traders and investors.

- Need a well-regulated broker.

- Access to robust proprietary trading platform.

- Long-term investing.

- Looking for broker with a long history of operation and strong establishment.

- Excellent trading technology.

- Providing services worldwide.

- Offering popular financial products.

- Stock Trading and Investment.

- Looking for broker with Top-Tier licenses.

- Secure trading environment.

- Low fees and commissions. |

Avoid Trading with Vanguard If:

| Vanguard might not be the best for: | - Who prefer to trade with industry-known MT4/MT5, or cTrader.

- Looking for broker with 24/7 customer support.

- Need high leverage.

- Investors who prefer robust educational resources.

- Beginner traders looking for commission-free trading. |

Regulation and Security Measures

Score – 4.8/5

Vanguard Regulatory Overview

Vanguard is a reputable and well-established Stock trading broker with a long history of Vanguard investments. The broker follows the strict rules and guidelines established by the SEC, FINRA, and SIPC in the USA, the FCA in the UK, and, along with other licenses, the broker operates through. These are Top-Tier regulations, safeguarding client assets and maintaining high ethical standards.

How Safe is Trading with Vanguard?

Vanguard is a legitimate and reputable company for individuals and institutions looking to invest and manage their assets.

The broker provides a high level of customer trading protection through various means. As a registered broker-dealer, it adheres to regulatory standards and industry best practices to ensure the security and protection of its clients’ assets. This includes safeguards to prevent fraud and unauthorized access to accounts, robust coding for online transactions, and strict identity verification procedures.

In addition, Vanguard is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for client assets held at the firm in case of brokerage failure, adding an extra layer of protection for investors. However, traders should remain cautious about their account security, regularly monitor their investments, and follow safe online practices to further enhance their trading protection.

Consistency and Clarity

Vanguard has built a good reputation over nearly five decades of operation, earning the trust of millions of investors worldwide. Established in 1975, the firm is credited with introducing the first index mutual fund for individual investors. The broker often receives high marks from independent evaluators like Morningstar and J.D. Power for investor satisfaction, fund performance, and low fees.

Trader often highlights key advantages such as the broker’s low-cost structure, reliable customer service, and a straightforward platform. However, some users note drawbacks, especially for active traders, such as limited charting tools and no real-time futures or Forex trading.

Vanguard is also active in social impact, supporting financial literacy initiatives, academic research, and community development programs.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Vanguard?

Vanguard offers a range of account types to cater to various investment needs and goals. Some of the most common account types include Individual Accounts, Joint Accounts, Traditional and Roth IRAs for retirement savings, SEP and SIMPLE IRAs for self-employed individuals and small businesses, and 529 College Savings Plans for education funding.

Vanguard’s diverse account options allow investors to tailor their holdings to their specific financial objectives, whether it is long-term retirement planning, education savings, or general investment purposes. Additionally, the broker supports both cash and margin accounts.

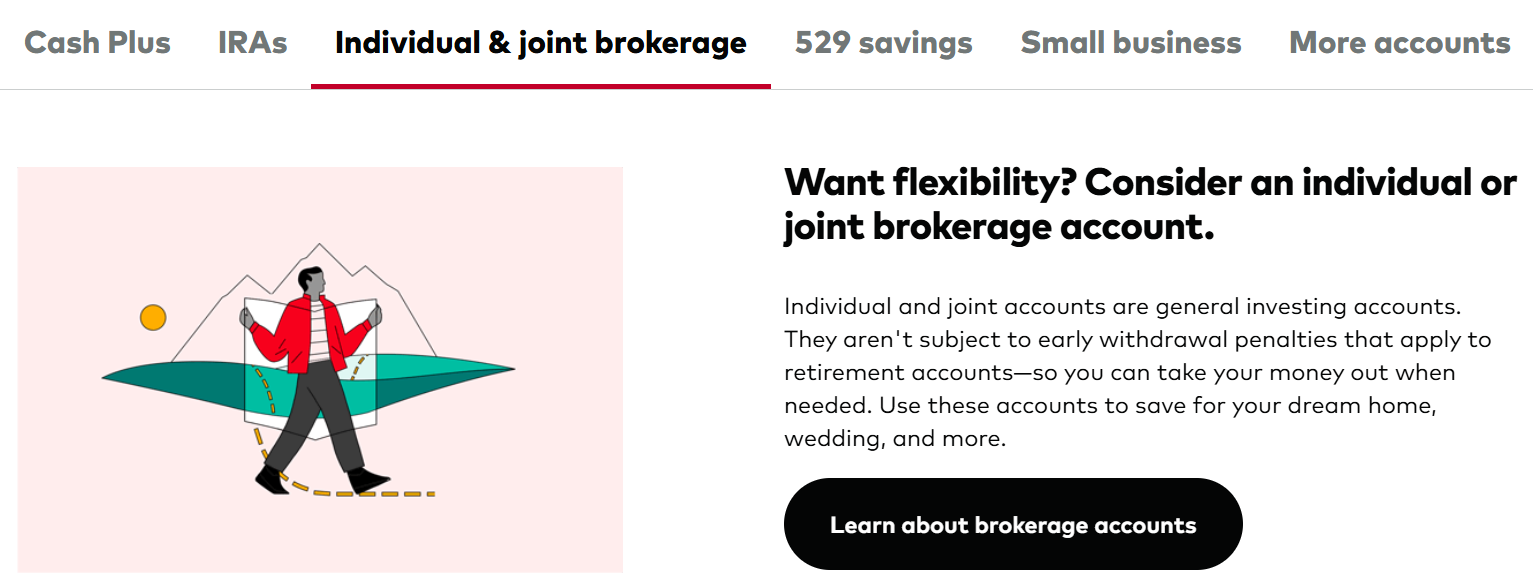

Individual & Joint Brokerage Accounts

Vanguard’s Individual and Joint brokerage accounts provide flexible, low-cost solutions for investors looking to manage taxable investments either independently or with a partner.

These accounts have no minimum deposit requirement to open, making them accessible to a wide range of investors. Users can trade a range of investment products, including ETFs, mutual funds, US stocks, bonds, and options, all through Vanguard’s proprietary trading platform and mobile app.

Regions Where Vanguard is Restricted

Vanguard restricts account openings in several regions and countries due to regulatory and compliance considerations, including:

- Some EU countries

- Iran

- South Korea

- Syria

- Some African countries

- Latin America

- Middle East, etc.

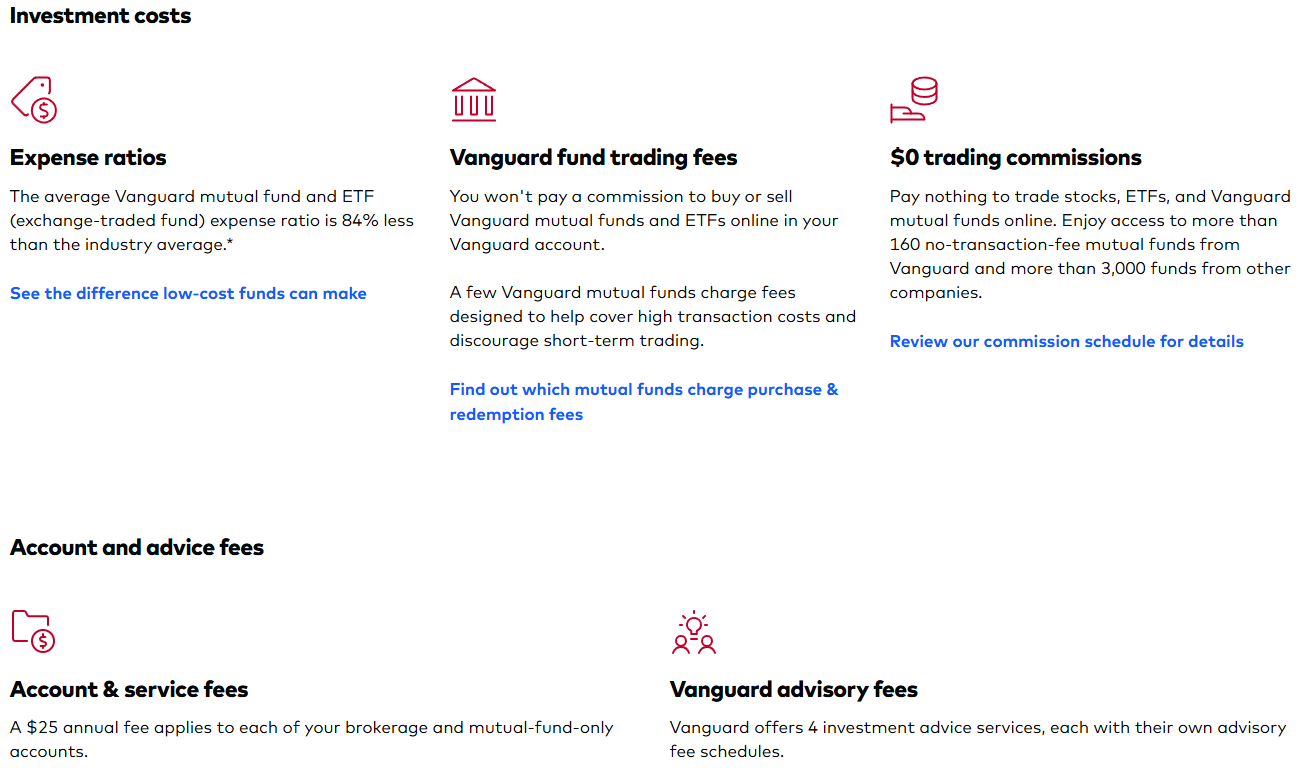

Cost Structure and Fees

Score – 4.7/5

Vanguard Brokerage Fees

The broker offers some of the lowest expense ratios in the investment industry. While Vanguard does not charge for withdrawals, and expense ratios are typically low, investors should be aware of any specific fees associated with their account type or trading activity, such as transaction fees for non-Vanguard products or account maintenance charges.

Understanding the fee structure is essential to making informed investment decisions and maximizing returns. Additionally, certain charges may vary depending on the chosen funding method, as well as the country you registered with.

Vanguard Commissions

As a commission broker, Vanguard does not charge spreads on trades. The broker offers commission-free trading for Stocks, ETFs, and mutual funds.

However, the fees and commissions can change over time and may vary based on the type of account, the specific investments, and market conditions. For example, while trading ETFs from different companies with assets less than $1 million over the phone, the commission is calculated as the online rate plus an additional $25 broker-assisted fee.

Vanguard Exchange Fee

Vanguard charges minimal exchange fees, aligning with its commitment to low-cost investing and transparency. However, frequent trading or short-term exchanges may trigger a short-term trading fee of 0.25% to 1.00%, depending on the specific fund.

Overall, the broker keeps exchange-related costs low to support long-term investing.

Vanguard Rollover / Swaps

Vanguard does not charge traditional rollover or swap fees, as it does not offer Forex trading or CFDs. This fee structure reflects the broker’s focus on investing through stocks, ETFs, and mutual funds rather than short-term or leveraged trading instruments.

How Competitive Are Vanguard Fees?

Vanguard is recognized for its competitive fee structure; therefore is a preferred choice for many investors. The broker offers some of the lowest fees in the industry, especially on its index funds and ETFs, helping investors keep more of their returns over time.

Trading commissions are also minimal, with $0 fees on online stock and ETF trades, making it affordable for casual and frequent investors. Additionally, Vanguard avoids hidden fees and maintains transparent pricing, which builds trust and clarity for users.

| Asset/ Pair | Vanguard Commission | TastyTrade Commission | FinecoBank Commission |

|---|

| Stocks Fees | From $0 | $0.0008 + $0.000166 | $3.95 |

| Fractional Shares | $1 | $0 | No |

| Options Fees | From $0 | $1 | $3.95 |

| ETFs Fees | $0 | $0 | $3.95 |

| Free Stocks | Yes | Yes | No |

Vanguard Additional Fees

While Vanguard is known for its low-cost investing approach, investors should be aware of a few additional fees that may apply in certain situations. These include fees for broker-assisted trades, typically around $25 per trade, and charges for trading some non-Vanguard mutual funds.

There might also be fees related to account services such as wire transfers, paper statements, or returned checks. Although Vanguard minimizes fees wherever possible, understanding these potential additional costs helps investors avoid surprises and better plan their investment expenses.

Trading Platforms and Tools

Score – 4.4/5

Vanguard offers its trading services through its proprietary Vanguard trading platform. This platform is designed to cater to long-term investors and provides access to a wide range of investment products, including Vanguard’s mutual funds and ETFs, as well as individual stocks, bonds, and other securities.

Additionally, the broker offers mobile apps for on-the-go trading and account management, available for both iOS and Android devices.

Trading Platform Comparison to Other Brokers:

| Platforms | Vanguard Platforms | Robinhood Platforms | PhillipCapital Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Vanguard Web Platform

Vanguard’s web platform is designed with simplicity, making it ideal for investors focused on retirement planning, mutual funds, and ETFs.

The interface is clean and user-friendly, offering essential features such as portfolio tracking, account management, and basic order placements like market and limit orders.

Investors can easily research Vanguard funds and manage automatic investment plans. However, the platform lacks advanced charting tools and real-time trading features, which may not appeal to active traders.

Vanguard Desktop MetaTrader 4 Platform

Vanguard does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

Vanguard Desktop MetaTrader 5 Platform

Vanguard does not support MetaTrader 5 either. The broker does not provide access to advanced trading platforms like MT5, maintaining its focus on its proprietary trading platform.

Vanguard MobileTrader App

Vanguard offers a user-friendly mobile app that allows investors to manage their accounts and investments conveniently from their smartphones and tablets.

The app provides access to a range of features, including the ability to view account balances, monitor portfolio performance, buy and sell investments, set up automatic contributions, and access important account documents. It also offers secure login options, such as biometric authentication, to ensure the safety of users’ financial information.

Main Insights from Testing

During testing, the Vanguard app reveals solid performance with a clean, intuitive interface that makes managing investments simple and convenient.

Navigating accounts, placing trades for ETFs and mutual funds, and tracking portfolio performance were all smooth and responsive. However, the app’s functionality is basic, lacking advanced charting, real-time alerts, and customizable trading tools, which may disappoint more active traders.

Trading Instruments

Score – 4.6/5

What Can You Trade on Vanguard’s Platform?

Vanguard offers a range of popular trading products to suit various investment strategies. The product lineup includes a diverse selection of mutual funds and ETFs, with a strong focus on low-cost index funds that cover various asset classes.

Investors can also trade individual stocks, bonds, options, and non-Vanguard ETFs through its platform. However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting good research to determine the range of options available, and also, if conditions vary based on your residence.

Main Insights from Exploring Vanguard’s Tradable Assets

Exploring Vanguard’s tradable assets highlights the broker’s commitment to providing cost-effective investment options. The focus is on broad-market exposure through well-managed funds that promote diversification and steady portfolio growth.

While the broker may not offer the variety of complex or leveraged products favored by active traders, its asset selection aligns well with investors who need disciplined, low-cost strategies to build wealth over time.

Margin Trading at Vanguard

Vanguard Margin trading allows investors to borrow funds from the Broker to leverage their investments, which is known as Margin Trading and is fully automatic based on the offered levels. The specific multiplier amount provided by the firm can vary depending on factors such as the trader’s account equity and the individual stock being traded.

Vanguard Margin Levels are offered according to the regulations:

- US traders may use a maximum of up to 1:50 for major currency pairs.

- UK traders are eligible to use low leverage up to 1:30.

- The Australian clients who hold ASIC-regulated accounts are entitled to up to 1:30.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Vanguard

The broker offers various funding methods to facilitate deposits into brokerage accounts. These typically include:

Vanguard Minimum Deposit

The broker offers great options with no minimum deposit requirement for opening an account. However, for mutual funds, the minimum requirement starts at $1,000.

Withdrawal Options at Vanguard

The broker offers flexible, no-cost withdrawal options to accommodate the needs of its investors. You can initiate withdrawals from your Vanguard account through electronic bank transfers (ACH), checks, or wire transfers. The availability of these withdrawal methods may depend on your account type and location.

Customer Support and Responsiveness

Score – 4.4/5

Testing Vanguard’s Customer Support

The broker’s customer support is available 24/5 through email, phone, and social media channels, offering multiple options to suit different preferences and urgency levels. The help center is staffed by trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Vanguard

Vanguard offers several ways to get in touch, depending on your needs. Personal investors can call 877‑662‑7447, while retirement plan participants can reach support at 800‑523‑1188.

Financial advisors can contact 800‑997‑2798 or email advisor_services@vanguard.com.

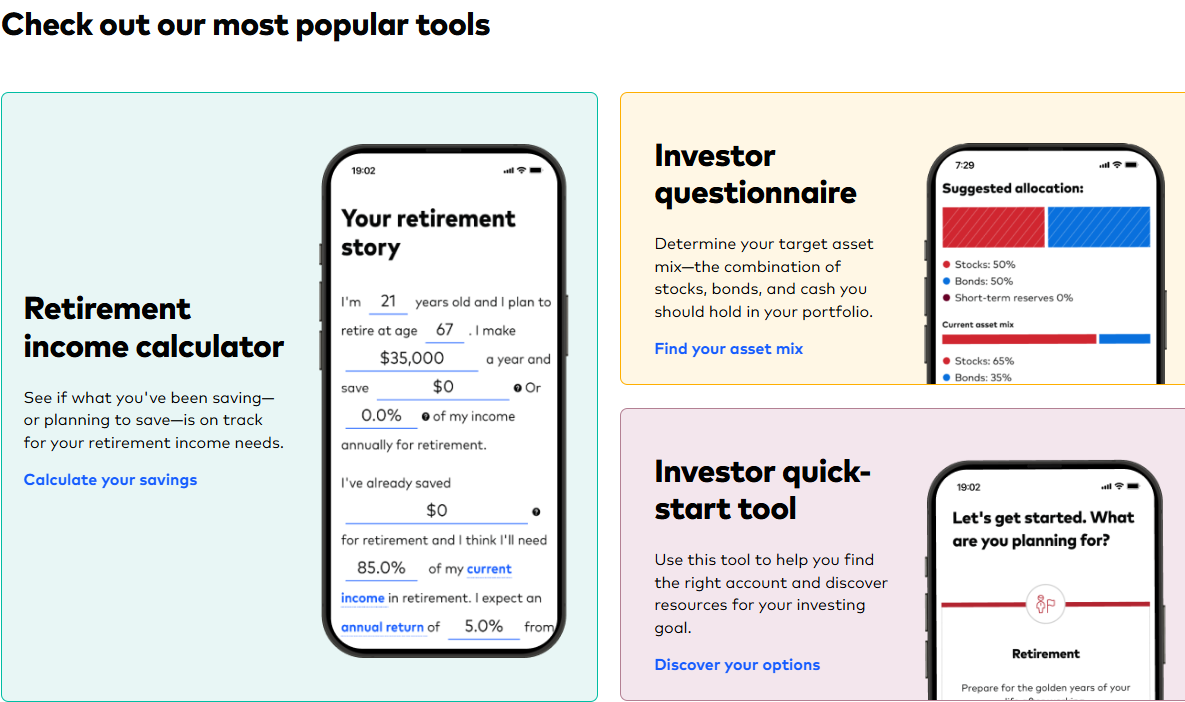

Research and Education

Score – 4.3/5

Research Tools Vanguard

Vanguard offers a range of research tools on both its website and trading platform to support informed trading and investment decisions.

- Investors have access to comprehensive fund screeners, performance comparison tools, and portfolio analysis features.

- The platform includes detailed data on mutual funds and ETFs, including historical performance, risk metrics, and expense ratios.

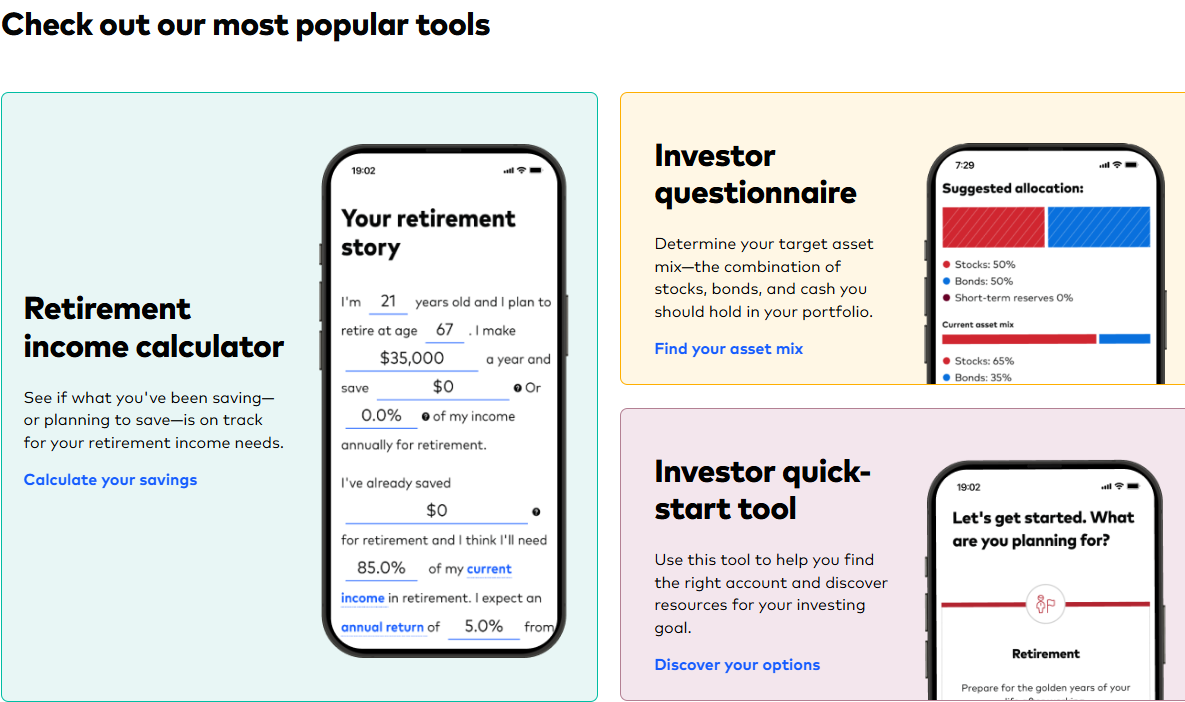

- Vanguard’s Retirement Income Calculator, Investor Questionnaire, Investor Quik-Start tool, and asset allocation guidance tools help users align their investments with personal goals.

While these tools are effective for planning and evaluation, they are directed more toward strategic investing rather than active trading or technical analysis.

Education

Vanguard does not offer extensive educational materials, webinars, or seminars, only providing news, articles, and insights. As the broker primarily targets investors and professional traders, we do not see this as a major drawback, considering that the firm provides a good range of advanced trading products.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options Vanguard

Vanguard offers a wide range of investment options for long-term growth and diversification. Investors can choose from mutual funds, ETFs, stocks, bonds, and retirement accounts, all with a strong emphasis on low-cost, index-based investing.

The firm supports goal-oriented strategies, making it ideal for investors planning for retirement or wealth building. Vanguard’s reputation and investor-focused values make it a strong choice for individuals looking to build and manage their portfolios over time.

Account Opening

Score – 4.4/5

How to Open Vanguard Demo Account?

Vanguard does not offer a traditional demo or paper trading account. Investors need to open a live account to explore the available tools and features.

How to Open Vanguard Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register with Vanguard within minutes. Just follow the opening account or Vanguard sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Submit identification and link a bank account for funding.

- E-sign and complete the application online.

- Fund your account.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.2/5

In addition to the main investment tools, Vanguard offers several helpful features that enhance the overall trading and investment experience.

- These include automatic investment and dividend reinvestment programs, which promote disciplined, hands-off investing.

- Investors can also access budgeting and savings planners, beneficiary management tools, and account aggregation to view external holdings in one place.

Vanguard Compared to Other Brokers

Vanguard stands out for its emphasis on low-cost and long-term investing, providing a user-friendly experience with its proprietary web and mobile platforms.

Unlike many competitors that offer a broad range of tradable assets and multiple advanced trading platforms, the broker concentrates on the main investment products such as stocks, ETFs, mutual funds, and bonds, catering to investors who prioritize simplicity and steady portfolio growth.

Vanguard’s fee structure is also straightforward and competitive, with no hidden charges, which appeals to cost-conscious investors.

Although the broker does not provide advanced trading features or educational materials, Vanguard’s reputation for transparency, consistency, and client-focused service makes it a strong choice for long-term investing.

| Parameter |

Vanguard |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

$0.49 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

Proprietary trading platform, Mobile App |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs , Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Excellent |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$0 |

$100 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker Vanguard

Vanguard is a well-established and highly regarded investment broker known for its strong emphasis on low-cost investing. The broker offers a diverse range of investment products, including stocks, ETFs, mutual funds, and bonds, with no minimum deposit required to get started.

Its proprietary Vanguard platform is accessible via both web and mobile, providing a user-friendly interface suitable for all experience levels. Additionally, the broker is regulated by top-tier authorities, offers transparent pricing with no hidden fees.

Overall, Vanguard is a strong choice for investors who need a reliable and transparent broker that prioritizes long-term wealth building through diversified, low-cost investment options and easy-to-use tools.

Share this article [addtoany url="https://55brokers.com/vanguard-review/" title="Vanguard"]

I’m waiting for my profit