- What is VPFX?

- VPFX Pros and Cons

- Regulation and Security Measures

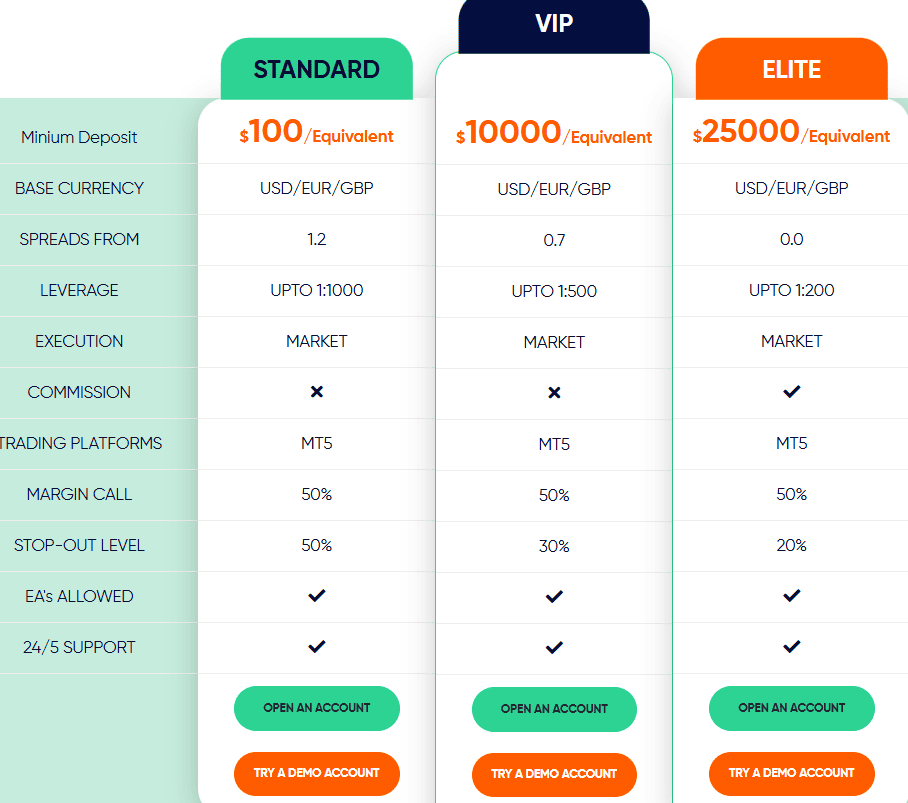

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- VPFX Compared to Other Brokers

- Full Review of Broker VPFX

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 3.9 / 5 |

What is VPFX?

VPFX is a multi-regulated Forex trading broker that offers a diverse range of trading instruments and access to global markets. The broker provides competitive spreads and allows traders to trade Forex, Shares, Indices, Energies, and CFDs on Commodities.

Based on our research, the company was established in 2020 and holds licenses from multiple authorities, including ASIC in Australia and Labuan FSA in Malaysia.

Overall, as we found, VPFX is known for its reputable services, an extensive selection of popular assets, and user-friendly trading execution on the widely used MetaTrader platforms.

VPFX Pros and Cons

When considering VPFX as your broker, there are both advantages and disadvantages. For the pros, the broker offers the widely recognized MT5 trading platform, suitable for various strategies and different trade sizes. The broker also facilitates quick deposits and withdrawals, and provides competitive spreads starting from 0.0 pips for its professional account.

For the cons, the trading conditions may vary depending on the entity, and there is no 24/7 customer support, which can be inconvenient for traders looking for immediate assistance. Another drawback is the absence of learning materials and seminars on its website, limiting access to educational resources for clients.

| Advantages | Disadvantages |

|---|

| ASIC regulation and oversee | Trading conditions might vary based on the entity |

| Access to the MT5 trading platform | No 24/7 customer support |

| Account segregation | Limited educational materials |

| MAM/PAMM multi-account managers | |

| Raw spreads | |

| White label | |

| Available for Australian and international traders | |

VPFX Features

As a well-regulated broker, we found that the company provides favorable trading conditions suitable for different traders. The availability of a variety of assets and various services makes it an appealing choice. Find the breakdown of all VPFX’s proposals below:

VPFX Features in 10 Points

| 🗺️ Regulation | ASIC, Labuan FSA, SCA, SVGFSA |

| 🗺️ Account Types | Standard, VIP, Elite |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, Precious Metals, Energies, Indices, Shares |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is VPFX For?

Based on our findings and Financial Expert Opinions, VPFX is for different traders and for various trading expectations. However, due to its certain features and regional availability, the broker is especially favorable for the following:

- Traders from Australia

- International traders

- CFD and currency trading

- Traders who prefer the MT5 platform

- Beginners

- Advanced traders

- Professional trading

- Market-making execution

- Competitive fees and low spreads

- White Label solution

- EA/Auto trading

- Good trading tools

VPFX Summary

To summarize, VPFX is an established Forex trading broker that offers a range of appealing features and services. Traders can benefit from its innovative MetaTrader 5 platform, which provides advanced charting tools and automated trading options. The broker also boasts competitive spreads, starting from 0 pips for its Elite account. The average spread for the Standard account is 1.2 pips.

Yet, it is essential to note that VPFX lacks a dedicated education section on its website and does not offer 24/7 customer support. However, considering the overall picture, the company ensures a reliable and competitive trading environment suitable for traders at different skill levels.

55Brokers Professional Insights

Based on our analysis and findings, the broker stands out for a good proposal and provides a secure and competitive trading environment, along with favorable fees and spreads across a wide range of trading instruments. As a result, we can conclude that VPFX is a suitable trading broker for individuals at different skill levels, whether they are beginners or experienced traders.

The broker offers three account types – Standard, VIP, and Elite, each tailored to meet specific trading expectations and needs. Trades are conducted through the widely recognized, innovative MT5, ensuring access to multiple markets and opportunities. Clients can also benefit from the MAM and PAMM accounts, expanding their investment options.

From the regulatory standpoint, clients are protected by the laws of ASIC, the Labuan FSA, and the SCA in the UAE.

We have also considered the broker’s fee structure to find competitive spreads and commissions, based on the account type and the instrument traded.

All in all, our experience with the broker is positive, and as a negative point, we can point out the lack of comprehensive education.

Consider Trading with VPFX If:

| VPFX is an excellent Broker for: | - International clients

- Traders prioritizing top-tier regulations

- The MT5 platform enthusiasts

- Clients looking for low spreads

- CFD and Forex traders

- Clients looking for MAM and PAMM accounts

- Professional clients

- Beginner traders |

Avoid Trading with VPFX If:

| VPFX is not the best for: | - Beginner traders looking for educational resources

- Traders looking for diversity of platforms

- Clients who prefer 24/7 support

- Long-term investments |

Regulation and Security Measures

Score – 4.5/5

VPFX Regulatory Overview

VPFX is a reliable brokerage firm that operates under the regulation of the reputable Australian ASIC authority and also holds additional licenses. This regulatory body enforces strict rules and guidelines to ensure that the broker operates in a trustworthy manner.

- Compliance with the regulatory requirements set by ASIC, which is one of the top-tier regulators, enhances the safety and confidence of traders who choose to trade with VPFX.

- The broker is also regulated in Malaysia by the Labuan Financial Services Authority and is an authorized and registered under the law of the Securities Commodities Authority (SCA) in the aaUnited Arab Emirates.

How Safe is Trading with VPFX?

We researched the broker to see how VPFX protects its clients.

We found that there are various rules applied to safeguard clients’ funds, including segregation from the firm’s accounts and refraining from using them for operational purposes, which are set by the strict regulatory requirements.

- Additionally, the broker has introduced Professional indemnity insurance, offering coverage of up to USD 1 million.

Consistency and Clarity

We have also reviewed the broker from the standpoint of its consistency. It is essential to estimate how consistent the broker has been throughout its operation, and what aspects have been improved.

All in all, VPFX is transparent about its proposal, including fees and conditions. We noticed that at the beginning, it also included the popular MT4 platform. However, at present, its client can rely only on the MT5 platform.

The regulatory oversight of the broker ensures fair and reliable practices. As we found, VPFX has received multiple international accolades and recognition from investors for its dependable trading services and financial technology offerings in recent years.

The feedback from clients is also mostly positive, with an emphasis on the quick and reliable deposits and withdrawals, innovative trading platform, and a supportive team. We have also noticed complaints and negative reviews against the broker, but the majority of what clients shared is positive.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with VPFX?

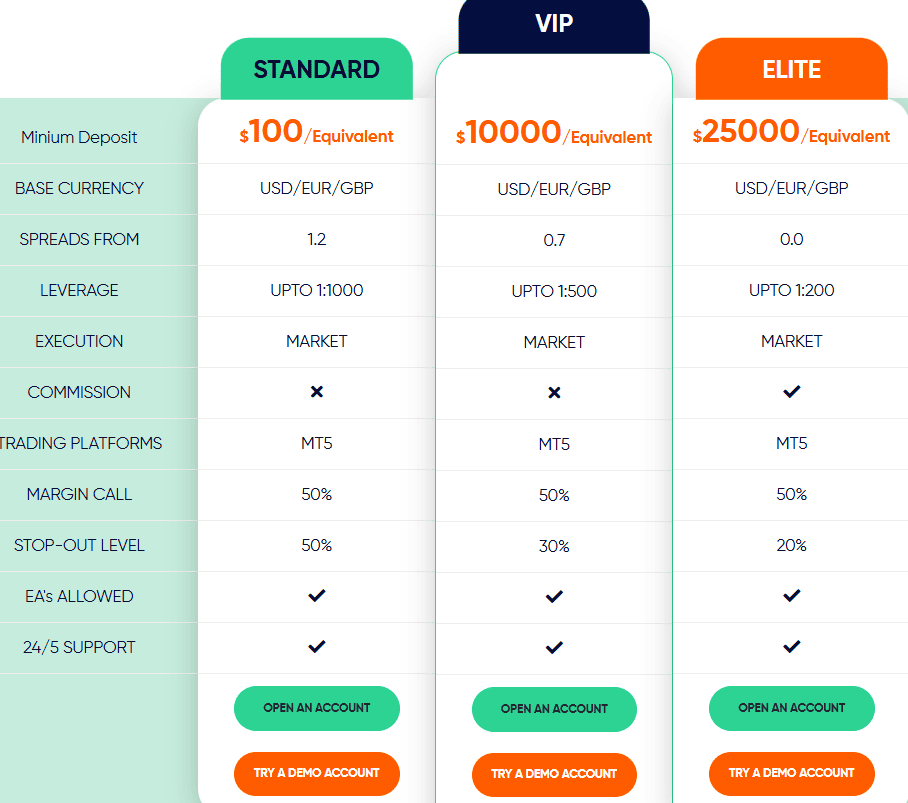

Reviewing VPFX broker account types, we found that traders can select three different account types: Standard, Vip, and Elite. However, the availability of account types may vary depending on the specific entity.

Traders can also open a Demo account to practice trading and make trial trades to test the strategies.

- The Standard account requires a $100 initial deposit, making it a favorable option for cost-conscious clients. With this account type, clients can access high leverage of up to 1:1000. The account is spread-based, with an average spread of 1.2 pips.

- The VIP account is for more professional clients who are willing to start trading with a $10,000 initial deposit. The account allows up to 1:500 leverage, based on the instrument traded. The VIP account also offers a spread-based structure, with spreads as low as 0.7 pips.

- The Elite account is another option for high-volume professional clients who prefer commission-based trading, with spreads from 0 pips. The initial deposit for this account type is $25,000. Also, traders can use up to 1:200 leverage.

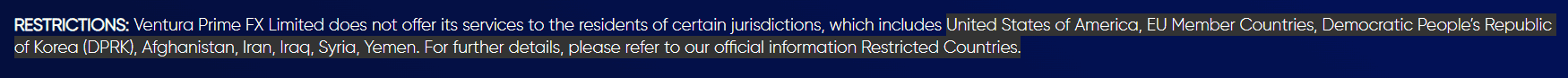

Regions Where VPFX is Restricted

VPFX offers its services globally, enabling international traders to access its services. However, due to regulatory restrictions, there are countries and regions where the broker is unavailable.

Here is the list of limited countries for VPFX:

- The United States of America

- EU Member Countries

- Afghanistan

- Angola

- Democratic Republic of Congo

- Iran

- Lebanon

- Myanmar

- Algeria

- Bahamas

- Bulgaria

- Democratic People’s Republic of Korea (DPRK)

- Haiti

- Iraq

- Mali

- Mozambique

- Namibia

- Pakistan

- Philippines

- South Sudan

- Syria

- Venezuela

- Uganda

- Zimbabwe

- Nigeria

- Panama

- Somalia

- South Africa

- Tanzania

- Vietnam

- Yemen

Cost Structure and Fees

Score – 4.4/5

VPFX Brokerage Fees

We found that the broker offers competitive pricing and stands out for its transparent fee structure. VPFX does not impose any hidden fees; however, certain charges may apply to deposits and withdrawals, which can vary based on the selected funding method and the country of registration. Additionally, the broker may incur additional charges such as swap or rollover fees.

Based on our test trade, VPFX provides tight and floating spreads, with an average spread of 1.2 pips for the popular EUR/USD currency pair in the Forex market. It is an attractive option for traders, as it aligns with the industry average. The broker also provides competitive spreads for other major currency pairs and popular trading instruments. However, it is important to note that trading conditions may vary depending on the entity. Besides, for the broker’s VIP account, spreads are lower and start at 0.7 pips. The Elite account offers spreads from 0 pips, combined with commissions.

VPFX offers a single commission-based account, the Elite account. The account is tailored for professional clients who prioritize a commission-based structure, so that they face very low spreads and fixed commissions of $4 per lot.

How Competitive Are VPFX Fees?

VPFX offers competitive fees with various structures. Based on our tests, spreads and commissions depend on the account type. Spreads are also determined by the instrument traded.

The broker offers a spread-based structure for its Standard and VIP accounts. The average spread for the Standard account is 1.2 pips, which is considered an average offering. The VIP account has even lower spreads. The commissions available for the Elite account are reasonable.

In addition to the commissions and spreads, VPFX applies swap fees for the positions held overnight.

| Asset/ Pair | VPFX Spread | TD365 Spreads | EC Markets Spread |

|---|

| EUR USD Spread | 1.2 pips | 0.5 pips | 1.1 pips |

| Crude Oil WTI Spread | 3 | 3 points | 0.45 |

| Gold Spread | 1 | 0.4 points | 2.8 |

VPFX Additional Fees

There are a few additional fees VPFX imposes, such as swap fees charged for the positions held overnight.

- The broker does not apply commissions for deposits. However, there are up to $40 transaction fees for withdrawals.

- Based on our findings, VPFX does not apply an inactivity fee for dormant accounts.

Score – 4.3/5

VPFX provides traders with access to the highly recognized and popular MetaTrader 5 platform. The platform is renowned for its user-friendly interface, wide range of features, and the ability to engage in automated trading.

Moreover, MT5 is accessible on both desktop and mobile devices, enabling traders to stay connected to the markets and trade conveniently at any time.

| Platforms | VPFX Platforms | TD365 Platforms | EC Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

VPFX Web Platform

The MT5 platform offers the web version, allowing traders uncomplicated access to the market. The advantage of the web platform is the easy access with no need for installations or downloads. The platforms offer functionality and flexibility, access to the main features and tools, good charting, different timeframes, and more.

All in all, VPFX’s web platform is a suitable choice for those who prefer quick market access and efficiency of trades.

VPFX Desktop MetaTrader 4 Platform

Our testing of the broker’s platforms revealed that VPFX used to offer the popular MT4 platform for easy and efficient trading. Although the platform is the first choice, especially for many beginner traders, VPFX has excluded it from its platform proposal. At present, the broker’s clients can conduct trades through the MT5 platform only.

VPFX Desktop MetaTrader 5 Platform

Based on our analysis, VPFX offers a range of trading tools that include advanced charting features with multiple chart types, various timeframes, trading signals, and an economic calendar. Moreover, the MT5 platform facilitates automated trading using Expert Advisors (EAs) and algorithmic trading.

With the MT5 platform, clients can access a set of technical analysis tools and alerts on breaking financial news, use trade signals, 30 technical indicators, and 24 analytical objects. The platform also supports various strategies, including hedging.

Main Insights from Testing

Our insights about the broker’s available platforms are positive. It offers the popular and innovative MT5 platform, available through web, desktop, and mobile versions. With great analysis tools and efficient capabilities, the MT5 platform is one of the first choices for traders. However, beginners might find it a little complicated. The absence of the popular and simpler MT4 platform can be a drawback for many.

VPFX MobileTrader App

The broker’s clients can download the MT5 mobile app on their Android or iOS devices. The apps ensure access to all the essential tools for profitable trading on the go. With integrated charting, one-click trading, real-time prices, a wide range of trading indicators, multiple timeframes, a built-in chat, netting/hedging functionality, and up-to-date financial news and push notifications, the mobile app will make trading a profitable and flexible experience.

AI Trading

We have found that VPFX supports automated trading, allowing access to EAs. However, these features are tailored to support advanced clients, but are not AI-driven functionalities.

Trading Instruments

Score – 4.3/5

What Can You Trade on the VPFX Platform?

VPFX offers a diverse selection of popular markets, including more than 30 pairs in the Forex market, Indices, Energy, Shares, and CFDs on Commodities. Among these markets, Forex is the most widely recognized and offers exceptional liquidity. It provides the advantage of starting spreads as low as 0 pips. However, the availability of trading instruments may vary depending on the entity, so we recommend thoroughly researching the range of available options.

- Yet, all the products offered by the broker are based on CFDs. Clients can speculate on the price movements and gain profits, but they cannot own the assets in the traditional sense.

Main Insights from Exploring VPFX Tradable Assets

Based on our findings, VPFX is a favorable choice for CFD and Forex traders. The broker offers over 30 major, minor, and exotic pairs with competitive conditions. Clients can also trade precious metals, including gold and silver, and access the share market on popular shares like Amazon, Apple, and Facebook.

In addition, VPFX allows access to popular indices, including the Dow Jones Industrial Average, the NASDAQ 100, the DAX30, the Nikkei 225, the FTSE 100, and more.

Access to instruments is determined by the entity; thus, it is essential to check all the conditions before opening an account with the broker.

Leverage Options at VPFX

Leverage is a helpful tool that enables Forex traders to enter the financial market with limited capital and gain larger exposure. Yet, it works in both directions, leading to significant profits or losses alike. Therefore, we advise traders to possess a thorough understanding before engaging in any trading activities that involve leverage.

VPFX leverage is offered according to the ASIC, Labuan FSA, and SCA regulations:

- Australian clients who hold ASIC-regulated VPFX accounts are entitled to up to 1:30.

- International traders can use high leverage of up to 1:1000.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at VPFX

For funding methods, the broker offers various options for traders to deposit funds into their trading accounts, including bank wire transfers, credit/debit cards, and online payment systems like Skrill, Neteller, and FasaPay. However, specific requirements and limitations for each funding method may vary depending on the financial institution and your country of residence.

- As we found, VPFX does not apply additional deposit fees.

Minimum Deposit

To open a live trading account with the broker, traders need to deposit $100 as an initial deposit amount for a Standard account, which is considered a good offering overall. For the VIP and Elite accounts, the deposit requirement is much higher and more suitable for high-volume clients.

Withdrawal Options at VPFX

According to our research, the withdrawal process is smooth and quick with VPFX, enabling traders to access their funds efficiently. The withdrawal requests are typically processed within 24 hours across all available methods.

- The broker mentions a $40 commission for bank wire withdrawals. For credit/debit cards, the transaction fee is 2.50%. For methods like Skrill and Neteller, no fees are incurred.

Customer Support and Responsiveness

Score – 4.5/5

Testing VPFX’s Customer Support

VPFX’s customer support is available 24/5 through various channels, including Live chat, Email, and Phone. The team of experienced trading experts is readily available to assist clients with a wide range of matters, including technical problems, market analysis advice, general inquiries, and operational concerns.

- In addition, the broker offers an FAQ section, where it provides answers to the most common trading-related questions.

Contacts VPFX

VPFX provides 24/5 reliable customer support through multiple channels. Traders can choose one of the following options for communicating with the broker’s team:

- The live chat ensures quick solutions and prompt answers, suitable for those who prioritize efficiency and speed.

- Besides, the VPFX clients can also use the provided email address to find answers to their inquiries and concerns: customerservice@vpfx.net.

- In addition, the broker is present on social platforms, such as Facebook and X, allowing its clients to access updated information not only on its operations but on the market as a whole.

Research and Education

Score – 3.8 /5

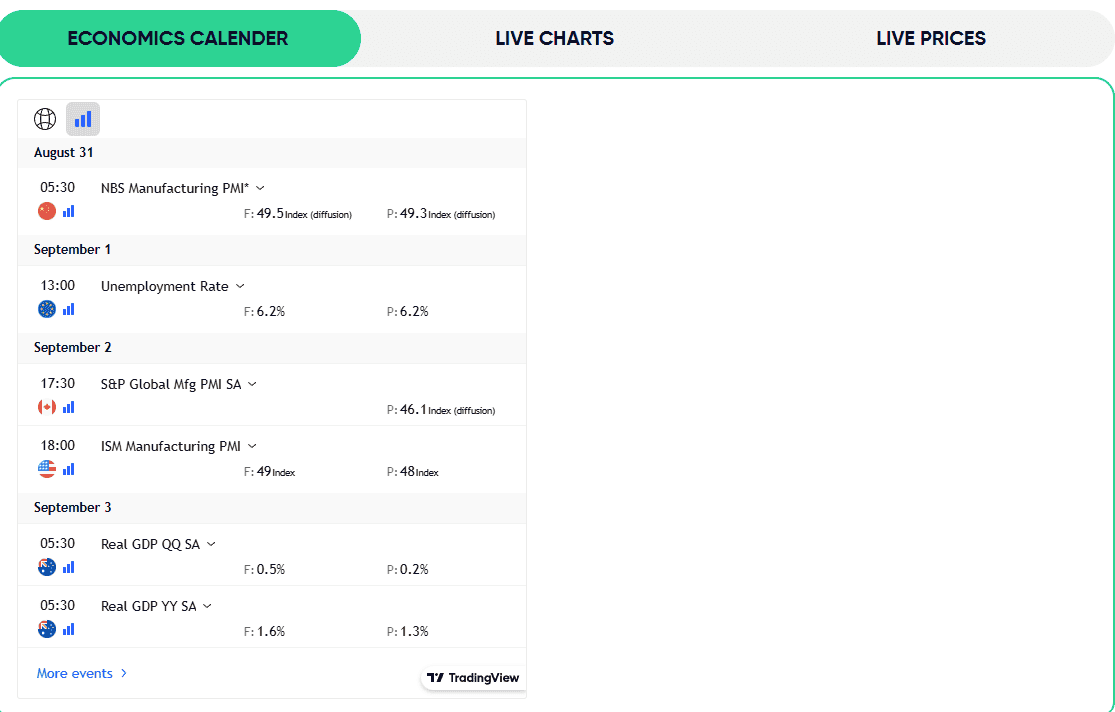

Research Tools VPFX

We didn’t find many additional research tools and features on the broker’s website. However, the MT5 platform is already equipped with all the essential and innovative capabilities to ensure efficient and profitable trades.

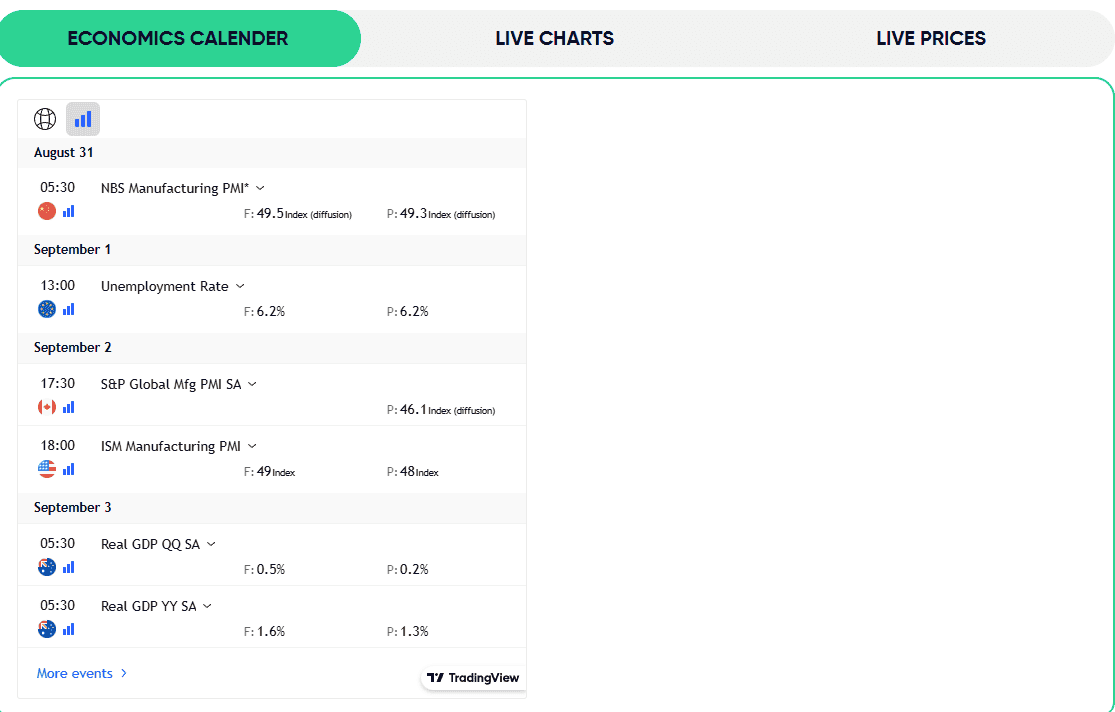

- Clients can still benefit from the Economic Calendar, live charts, and live prices. The mentioned features provide crucial insights into the market and support informed decision-making.

Education

We noticed that the broker does not have a dedicated education section on its website. This lack of educational support can be seen as a drawback since comprehensive resources are crucial for the development and enhancement of traders’ skills. While VPFX provides an Economic calendar and market news, and trading tools, these resources may not be sufficient for individuals seeking a more extensive educational experience.

Is VPFX a Good Broker for Beginners?

VPFX provides competitive trading conditions and a safe environment to explore the financial market. The broker offers three account types, suitable for beginners to professionals. It also provides a minimum deposit requirement of $100, average spreads, and commissions for the Elite account.

The broker also offers a demo account, enabling beginner traders to practice before trading live. However, it does not support educational and research tools and materials, which can limit the opportunities for beginner traders.

VPFX can be a favorable choice for many. Still, clients need to consider its advantages and drawbacks and estimate how they can benefit from the broker’s services.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options VPFX

As we found, traders can access over 500 tradable products straight from the broker’s MT5 platform. The provided number of instruments is above average and will support clients in expanding their portfolios. Yet, all the products are based on CFDs, resulting in the limitation of traditional investments.

However, VPFX ensures alternative investment opportunities:

- VPFX integrates a Multi Account Manager (MAM) system, enabling money managers to execute bulk orders across an unlimited number of accounts. Additionally, Percentage Allocation Money Management (PAMM) is available, providing further flexibility in managing funds across multiple accounts.

Account Opening

Score – 4.5/5

How to Open a VPFX Demo Account?

VPFX offers a demo account option, which allows traders to practice their trading strategies without risking real money. This option serves as an educational tool, particularly for beginners who can gain practical trading experience in a risk-free environment.

Here are the main steps to follow to set up a demo account:

- Go to the broker’s website and choose the ‘Try Demo Account’ option.

- Fill out the registration form with your name, email, country of residence, password, etc.

- Receive the demo credentials via email and complete the registration process.

- Use the credentials to enter the platform and start practicing with virtual funds.

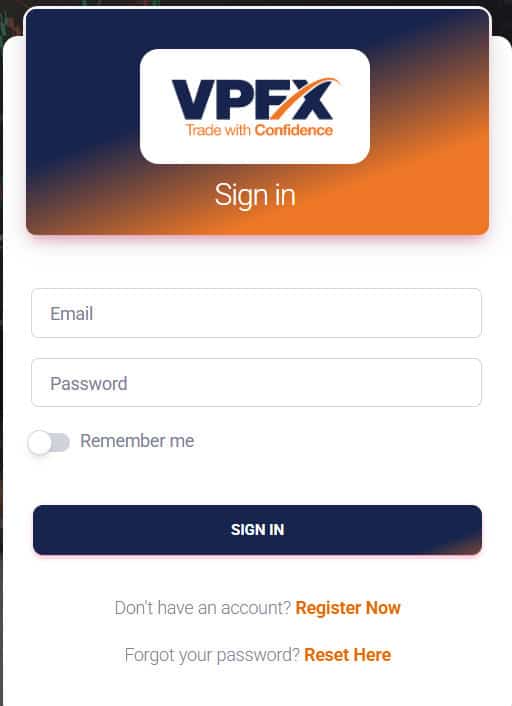

How to Open a VPFX Live Account?

Opening a live account with the broker is easy. We can open it within minutes, just by following the opening account or sign-in page and proceeding with the guided steps:

- Select and click on the “Open a Trading Account” button.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz to confirm your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Score – 3.9/5

The broker offers its tools and features through the MT5 platform, equipped with innovative capabilities to ensure an efficient trading outcome. The broker also offers an Economic calendar and live charts, which we mentioned in the research section of the review.

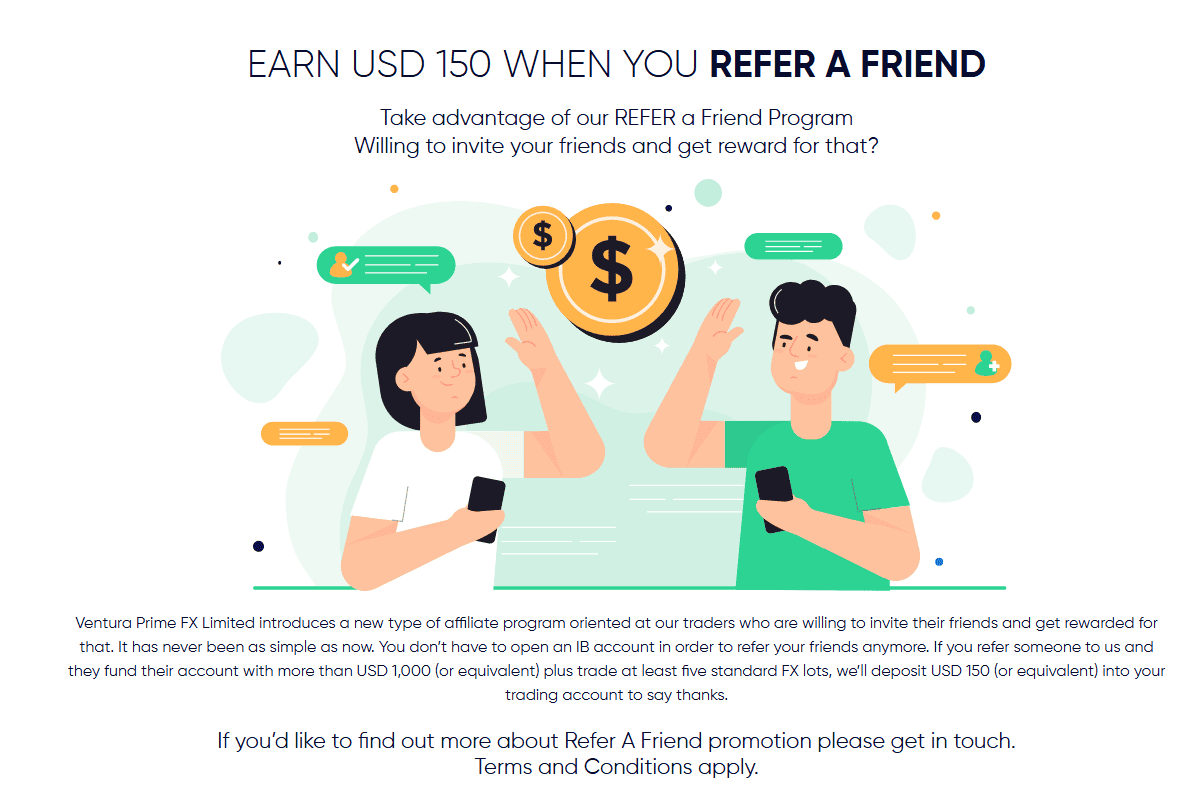

- Clients can benefit from the ‘Refer a Friend” program and earn a $150 bonus if the referred friend funds the account with $1000 or more.

VPFX Compared to Other Brokers

Comparing VPFX to other brokers is one of the essential parts of our review. In our comparison of VPFX, we have considered various aspects of trading with the broker and compared them to others with similar offerings.

To start with, VPFX stands out for its regulation, adhering to the rules and guidelines of ASIC, Labuan FSA, SCA, and SVGFSA. However, we see even more stringent regulatory oversight for such good-standing brokers, as Forex.com, EC Markets, and FXCM.

Further, we compared VPFX’s fees to FXCM and FXTM. The applied costs are almost similar, with spreads from 1 to 1.4 pips. The commissions VPFX offers are also in line with the market standards.

VPFX’s clients can access over 500 products through the single MT5 platform, with safe and favorable conditions. Although the platform is innovative and supports efficient trading, brokers such as FP Markets and Forex.com additionally offer cTrader, TradingView, IRESS, and proprietary platforms.

At last, the broker does not provide educational materials, falling behind Forex.com and FxPro, which stand out for extensive resources, including webinars, trading courses, glossary, eBooks, and more.

| Parameter |

VPFX |

FXTM |

Forex.com |

FP Markets |

EC Markets |

FXCM |

FxPro |

| Spread-Based Account |

Average 1.2 pips |

Average 1.5 pips |

Average 1.3 pips |

From 1 pip |

Average 1.1 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips +$4 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips +$2.5 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5 |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

500+ instruments |

1000+ instruments |

6000+ instruments |

10,000+ instruments |

150+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

ASIC, Labuan FSA, SCA, SVGFSA |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, CMA |

FCA, ASIC, FSCA, FSA, FSC, FMA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$100 |

$200 |

$100 |

$100 |

$10 |

$50 |

$100 |

Full Review of Broker VPFX

Based on our extensive research, we can conclude that VPFX is a favorable broker for those looking for an advanced platform, a good variety of financial products, competitive fees, and a reliable trading environment.

The broker holds licenses from the top-tier ASIC, Labuan FSA, SCA, and an additional international license to ensure its availability worldwide. VPFX offers three account types with spread and commission-based structures to meet different trading preferences. Both spreads and commissions applied by VPFX are average, with no hidden fees. The broker also applies withdrawal fees, based on the funding method used. Trades are conducted via the MT5 platform on web, desktop, and app.

Another positive point about the broker is the availability of a demo account. Although VPFX does not provide comprehensive educational resources, its demo account is a good means to practice before switching to live trading.

The minimum deposit requirement is another advantage, with a minimum of $100, suitable for cost-conscious clients. The customer support is available 24/5 through live chat, email, and WhatsApp.

Share this article [addtoany url="https://55brokers.com/vpfx-review/" title="VPFX"]