- What is VIBHS?

- VIBHS Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- VIBHS Compared to Other Brokers

- Full Review of Broker VIBHS

Overall Rating 4.1

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.1 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.5 / 5 |

| Portfolio and Investment Opportunities | 3.9 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.7 / 5 |

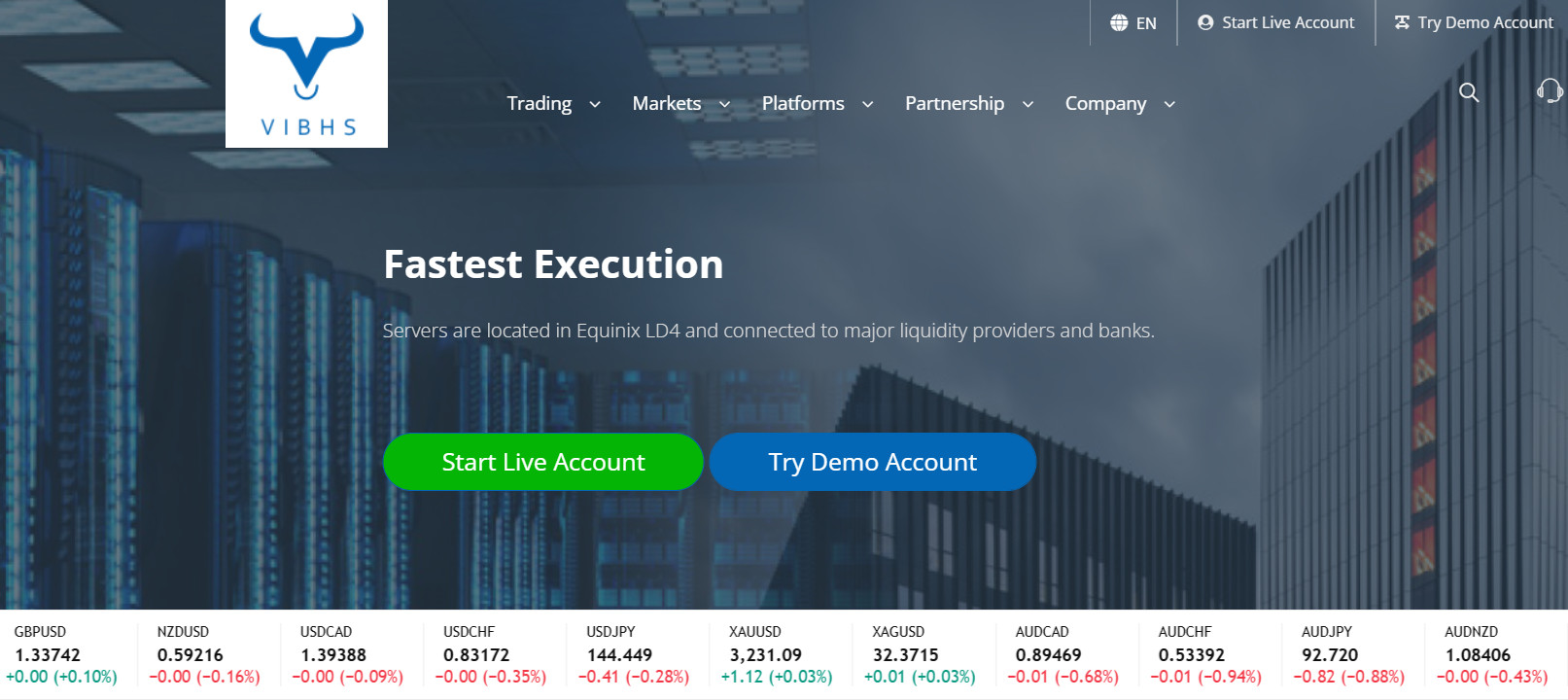

What is VIBHS?

VIBHS is an online Forex and CFD trading broker that offers a wide range of trading instruments, including CFDs on Stocks, Forex, Indices, and Commodities, to both retail and professional traders.

The company is based in London and is authorized and regulated by the top-tier Financial Conduct Authority (FCA), ensuring its operations are secure and reliable.

VIBHS provides a smooth trading experience with fast execution and a powerful trading platform. Overall, it is a trustworthy and efficient trading broker that traders can rely on for their trading needs.

VIBHS Pros and Cons

After conducting research, we found that VIBHS has pros and cons to consider when assessing the company. For the pros, the broker provides the well-known and reliable MT4 trading platform, along with the Multi Account Manager (MAM) and Fixed API Plugin features. It also offers a range of popular financial products at competitive fees and with raw spreads starting from 0.0 pips. Also, VIBHS provides 24/7 customer support throughout the year, a significant advantage for traders.

For the cons, traders may find that the broker has a limited selection of trading instruments and markets. Additionally, the firm is regulated by only one regulatory body, which could be a drawback for some traders due to the inability to open an account. However, being a UK-regulated firm makes the broker a reliable choice.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversight | One regulatory body |

| Available for UK traders | limited number of market instruments |

| Competitive spreads | No comprehensive education |

| 24/7 customer support | |

| MT4 trading platform | |

| Account segregation | |

| Compensation scheme | |

| Negative balance protection | |

| White label | |

VIBHS Features

VIBHS offers a secure and competitive trading environment, along with low fees and spreads for its range of trading instruments. Therefore, it is fair to say that VIBHS is a good trading broker for traders of various levels, whether newbies or experienced traders. To give more insight into the broker’s proposal, we have made a list of the main aspects of trading with VIBHS.

VIBHS Features in 10 Points

| 🗺️ Regulation | FCA |

| 🗺️ Account Types | Standard, Pro Accounts |

| 🖥 Trading Platforms | MT4 |

| 📉 Trading Instruments | Forex, Indices, Commodities, and Bullion, CFDs |

| 💳 Minimum deposit | $200 |

| 💰 Average EUR/USD Spread | 1.6 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | GBP, EUR, USD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/7 |

Who is VIBHS For?

Based on Our findings and Financial Expert Opinions, VIBHS stands out for favorable trading conditions and diverse features that will attract clients of various needs. We have found that VIBHS is Good for:

- Traders from the UK

- CFD and currency trading

- Traders who prefer the MT4 platform

- Advanced traders

- White Label solution

- Scalping/Hedging strategies

- STP/NDD execution

- Copy Trading

- Competitive spreads

- EA/Auto trading

- Good trading tools

- 24/7 customer support

VIBHS Summary

VIBHS provides a safe and competitive trading environment with average spreads and prices for its trading instruments. Traders can access one of the most popular trading platforms, MetaTrader 4, available on desktop, web, or mobile devices. The platform offers advanced charting features, automated trading capabilities, and a social trading feature. However, as we found, the broker does not provide comprehensive educational materials and research, which is unsuitable for beginner traders.

Overall, per our findings, VIBHS is a reliable broker and a suitable option for traders of all levels. However, we advise potential traders to conduct extensive research to determine whether the broker meets their individual trading needs.

55Brokers Professional Insights

With its top-tier license from the FCA, VIBHS is a highly reliable broker that provides a safe environment and quality trading conditions. We mark good functionality and flexibility of proposal, including two account types with different fee structures and opportunities mainly suitbale for traders of larger size and high volume trading. The trades are conducted through the MT4 platform, so if you prefer more modern version of trading software, we would advise to check other Brokers. On a positive note, it also includes a FIX API plugin, MAM accounts, and copy trading capabilities, which provide flexible solutions and facilitate white label partners, adding to the overall good execution and trading performance.

However, the broker does not offer an education section. VIBHS also has a limited range of trading instruments, offering only about 75 tradable products across Forex, indices, commodities, and ETF CFDs. Despite the limited range of instruments and limited chances of extending portfolios, the broker includes all the major and popular products. Besides, the availability of 24/7 customer support is a great advantage. All in all, VIBHS is a good broker, ensuring a seamless and profitable trading experience.

Consider Trading with VIBHS If:

| VIBHS is an excellent Broker for: | - Institutional traders

- Traders from UK

- White label partners

- MT4 platform enthusiasts

- Traders looking for different strategies

- FIX API connectivity

- Copy traders

- Traders looking for MAM accounts

- Clients looking for competitive spreads |

Avoid Trading with VIBHS If:

| VIBHS is not the best for: | - Beginner traders

- Ling-term investment

- Stock trading

- Clients who prefer platforms other than MT4

- Traders looking for crypto trading

- Traders looking for comprehensive education section |

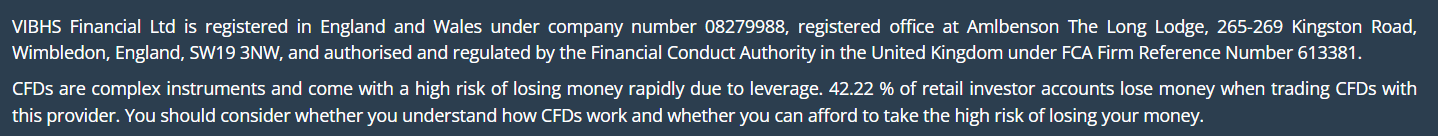

Regulation and Security Measures

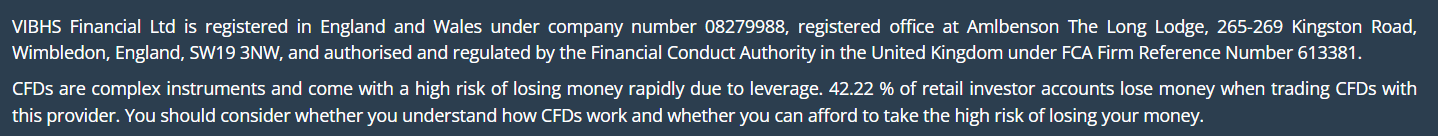

Score – 4.4/5

VIBHS Regulatory Overview

VIBHS is a trustworthy brokerage firm regulated by the reputable FCA (UK), which enforces strict rules and guidelines to ensure that the broker operates according to high standards. Adhering to regulatory requirements helps to boost the security and trust of traders interested in trading with VIBHS.

FCA regulation in Forex trading is considered a reassurance that the broker will follow stringent rules and laws and be under strict oversight. This means traders are provided with a trustworthy environment and are guaranteed the protection of their investments.

How Safe is Trading with VIBHS?

According to our research, VIBHS safeguards its clients’ funds by segregating them from the firm’s accounts and refraining from using them for operational purposes. Additionally, our investigation has revealed that the broker provides negative balance protection and funds protection up to £85,000 per person under the Financial Services Compensation Scheme (FSCS) to offer additional security for traders’ accounts.

Consistency and Clarity

VIBHS has been in the market since 2013, providing trustworthy services to traders. In the decade of its operation, the broker has shown consistency in the development and enhancement of its services. From the transparency point, VIBHS offers clarity in its offerings and openly mentions its applicable fees and trading charges.

Besides, the VIBHS customer feedback is mostly positive, as traders generally share their positive experiences with the broker. One of the best things about the broker, clients point out, is the exceptional customer service. Users also mention the advanced and easy-to-use MT4 trading platform, which ensures seamless trades. Based on customer feedback, deposits and withdrawals are processed promptly. The areas for improvement based on traders’ experience are the broker’s educational section and more clarity for each account’s details and capabilities.

All in all, VIBHS is a transparent solution for trading, ensuring clarity and consistency in its offerings.

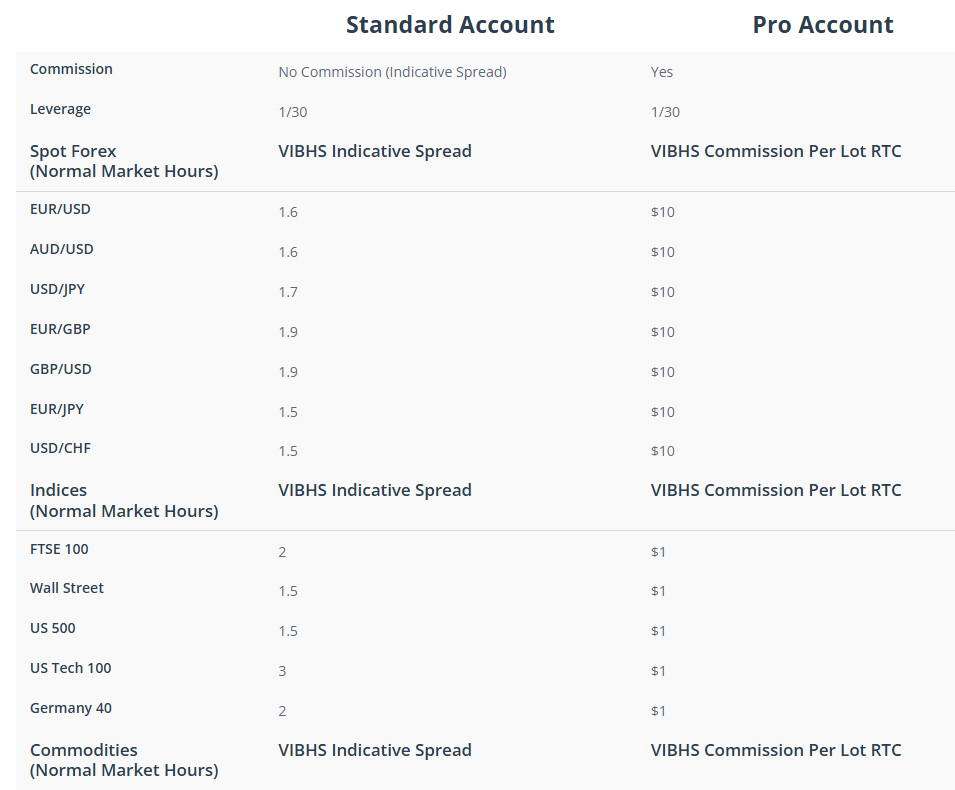

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with VIBHS?

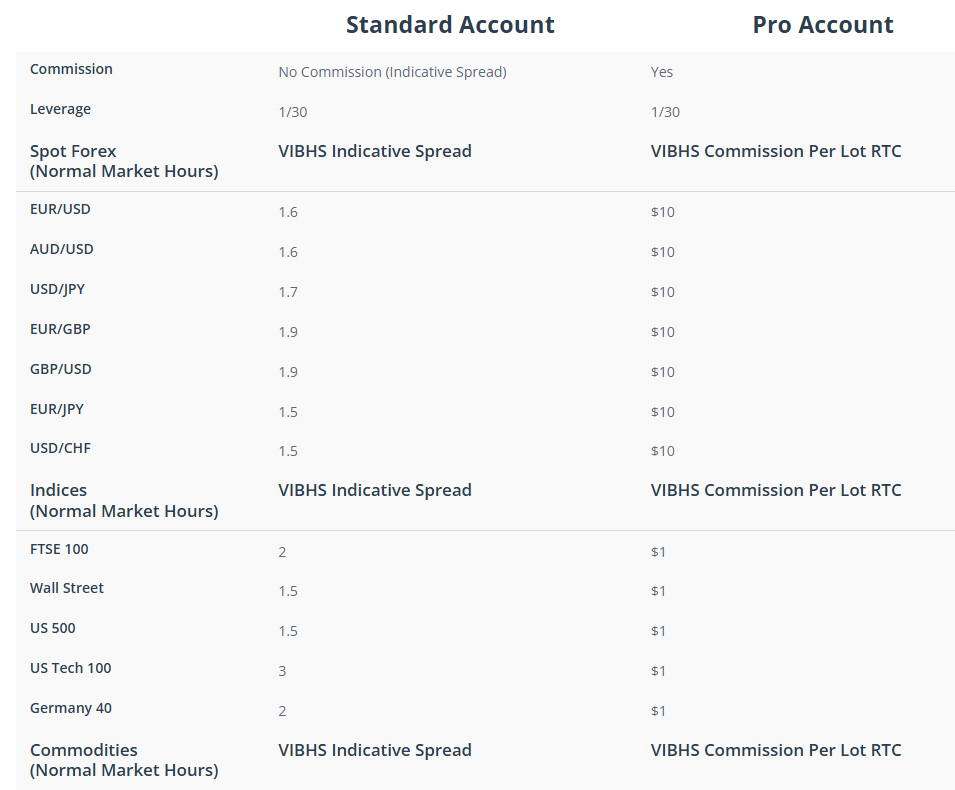

VIBHS offers its clients two main account types: Standard and Pro accounts. Each account has a unique set of features, with different fee structures, costs, and other trading conditions. The leverage available for the account types is up to 1:30. Clients can conduct trades through the MT4 platform and gain access to 75+ tradable products.

The broker also offers a demo account for free, allowing its clients to practice trading and make trial trades to test their strategies.

- The Standard account is spread-based, offering clients average spreads for the most popular instruments. For the popular EUR/USD pair, the available spread is 1.6 pips. For gold, VIBHS offers spreads of 0.5 pips.

- The Pro account is based on commissions, combined with raw spreads. The broker’s commissions depend on the instrument traded and vary from $1 to $10 per round turn.

Regions Where VIBHS is Restricted

Based on our research, on its website, VIBHS mentions that its services are not directed to the residents of the USA. However, brokers regulated by the FCA, due to regulatory restrictions, do not provide their services to the following countries as well:

- North Korea

- Iran

- Cuba

- Syria

- Russia

- Belarus

- Sudan

- Myanmar

Cost Structure and Fees

Score – 4.3/5

VIBHS Brokerage Fees

For the fees, the firm provides competitive pricing on trading instruments with raw spreads starting from 0.0 pips. However, fees may vary depending on the type of account and the financial market clients choose. Moreover, there might be additional charges such as swap or rollover and inactivity fees.

VIBHS spreads depend on the account type and the traded instrument. The broker’s Standard account is spread-based, and all the trading charges are included in spreads. Based on our findings, the spread for the EUR/USD pair is 1.6 pips, the spread for Gold is 0.5 pips, and for Crude oil, 2 pips. Spreads for the commission-based account are raw and combined with transaction fees.

VIBHS offers the Pro account, a commission-based account that offers spreads from 0 pips and fixed commissions based on the instrument. As we have found, the commissions applied for Forex pairs are $10 per round per trade. For indices and commodities, the broker applies $1 commissions. An exception to commodities is Gold, which has a fixed $10 transaction fee.

The broker also applies overnight fees for positions held overnight. The swap fees might be positive and negative, depending on a number of factors. More detailed information on swaps can be found on the client’s terminal.

How Competitive Are VIBHS Fees?

We found VIBHS fees competitive and transparent, with average spreads and commissions based on the instrument. The broker discloses most of the applicable charges for spreads, commissions, and other trading-related costs. The swap fees are changeable and can be found on the client’s terminal.

The average spread calculated is 1.6 pips. Commissions, on the other hand, vary from $1 to $10 based on the instrument. The broker also applies overnight, inactivity, and deposit/withdrawal fees. There are also no hidden fees, so the overall proposal is clear and transparent.

| Asset/ Pair | VIBHS Spread | XGLOBAL Markets Spread | EXT Spread |

|---|

| EUR USD Spread | 1.6 pip | 1 pips | 0.3 pips |

| Crude Oil WTI Spread | 2 pips | 0.035 | 3 |

| Gold Spread | 0.5 pips | 0.20 | 0.005% |

VIBHS Additional Fees

There are also a few additional fees included in the general trading charges.

- VIBHS charges an inactivity fee for accounts inactive for over 12 months.

- There are also deposit and withdrawal charges. The bank transfer fees vary from £15 to £40. For the EU transaction, the cost is 1.50%. For non-EU transactions, the broker charges 1.80%.

Score – 4.2/5

VIBHS allows clients to trade on the popular and widely used MetaTrader 4 trading platform, which is accessible through desktop, web, or mobile devices, enabling traders to stay connected to the markets and trade anytime and anywhere.

Moreover, MT4 is well-known for its user-friendly interface, comprehensive range of functionalities, and automated trading capabilities, allowing traders to trade with confidence and at their preferred pace.

| Platforms | VIBHS Platforms | XGLOBAL Markets Platforms | EXT Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

VIBHS Web Platform

VIBHS’s MT4 web platform is a great opportunity for traders to enter the market with ease and flexibility, with no need for downloads or installations. The platform enables clients to access the market anywhere with an Internet connection. Users can access all the available instruments, benefit from great charting capabilities, one-click trading, multiple account management, and other advanced tools and features.

VIBHS Desktop MetaTrader 4 Platform

We found the VIBHS MT4 platform equipped with advanced charting features, including multiple chart types, timeframes, an economic calendar, and technical indicators that can assist with market analysis.

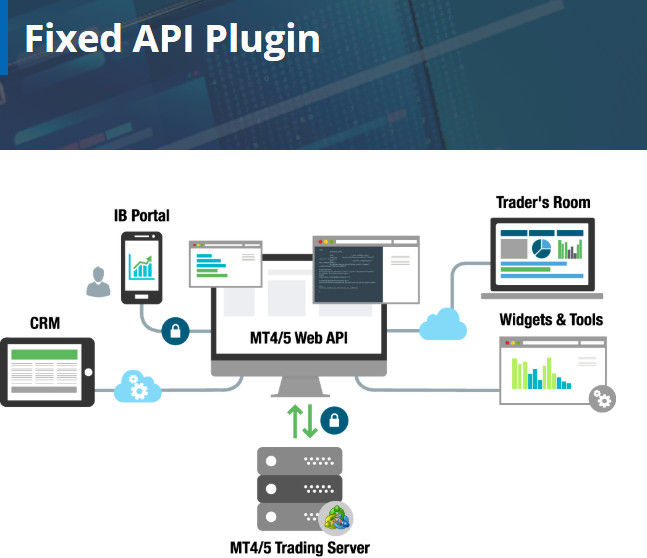

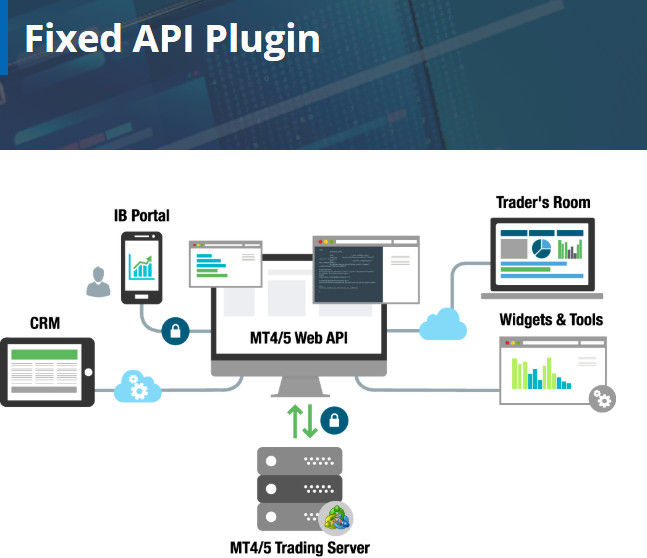

In addition, the broker provides a Multi Account Manager (MAM) feature integrated into the MT4 platform, enabling money managers to place orders across an unlimited number of accounts. Moreover, the FIX API is also available, a software tool that enables two applications to communicate with each other, allowing traders to access the broker’s feed and data, integrate them with other solutions, and customize them for a range of unique tasks. The MT4 platform also supports automated trading with the use of Expert Advisors (EAs) and algorithmic trading, making it a suitable option for those who prefer a more hands-off trading approach.

VIBHS Desktop MetaTrader 5 Platform

Our research has shown that VIBHS provides only the MT4 platform. The platform is available through the web, desktop platform, and a mobile app. However, those traders who are looking for a better variety of platforms and more advanced trading tools will find the broker’s proposal limiting. The newer MT5 version, which can meet the needs of even the most professional expectations, is unavailable.

VIBHS MobileTrader App

Traders can also access the market via the MT4 mobile version. The mobile app ensures access to clients’ accounts and portfolios at all times, enabling them to monitor their positions, receive constant updates and quotes on various financial instruments, and use advanced charting capabilities whenever they wish. The mobile trading combines flexibility, convenience, and great conditions in one place.

Main Insights from Testing

We have tested the broker’s platforms to see how they meet different trading expectations. Overall, the VIBHS MT4 platform ensures a great trading experience and seamless access through the web and desktop platforms, and the mobile app. Although the broker does not offer other platforms, such as MT5, cTrader, or TradingView, users seem to be pleased with the available option. Besides, they can also benefit from features like FIX API, copy trading, and MAM accounts.

Trading Instruments

Score – 4.1/5

What Can You Trade on the VIBHS Platform?

VIBHS offers its clients a selection of popular markets, such as Forex, Indices, Commodities, and Stock CFDs. Overall, Forex is the most widely known and offers a high degree of volatility and liquidity with spreads starting as low as 0.0 pips.

- We have found that the overall selection of instruments is limited. Many popular asset classes, such as cryptocurrency (banned in the UK), futures, and bonds, are not available to trade with VIBHS.

Main Insights from Exploring VIBHS Tradable Assets

All in all, our research revealed that VIBHS offers a limited range of trading instruments. Clients can trade only the most popular trading instruments, 75+ in total.

With VIBHS, clients can access 50+ currency pairs, including EUR/USD, AUD/USD, EUR/GBP, GBP/USD, EUR/JPY, etc. From the global indices, traders can trade the FTSE 100, US 500, US Tech 100, Germany 40, and more. Traders can also access popular commodities, including oil, gold, silver, and natural gas.

- However, the broker’s tradable products are not only limited, but they are also based on CFDs, eliminating the opportunity of long-term trading and real investments.

Leverage Options at VIBHS

Although leverage is a useful tool that enables traders to enter the market with limited capital, its use can lead to substantial profits or losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

VIBHS leverage is offered according to the FCA regulation:

- 1:30 for major currency pairs

- 1:20 for non-major currency pairs

- 1:10 for commodities

- 1:5 for individual equities

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at VIBHS

VIBHS provides multiple options for funding your trading account, including bank wire transfers, credit/debit cards, and online payment systems. However, the specific requirements and limitations for each funding method may differ based on the financial institution and the country of residence.

Overall, the following methods are available:

Minimum Deposit

To open a live trading account with the broker, traders need to deposit $200 as an initial deposit amount, which is a good offering overall. The amount is applied to both the Standard and Pro accounts. The deposits are typically processed within 24 hours.

Withdrawal Options at VIBHS

The VIBHS clients can expect a smooth and quick withdrawal process, as the broker typically processes withdrawal requests within 24 hours, ensuring that clients can access their funds immediately.

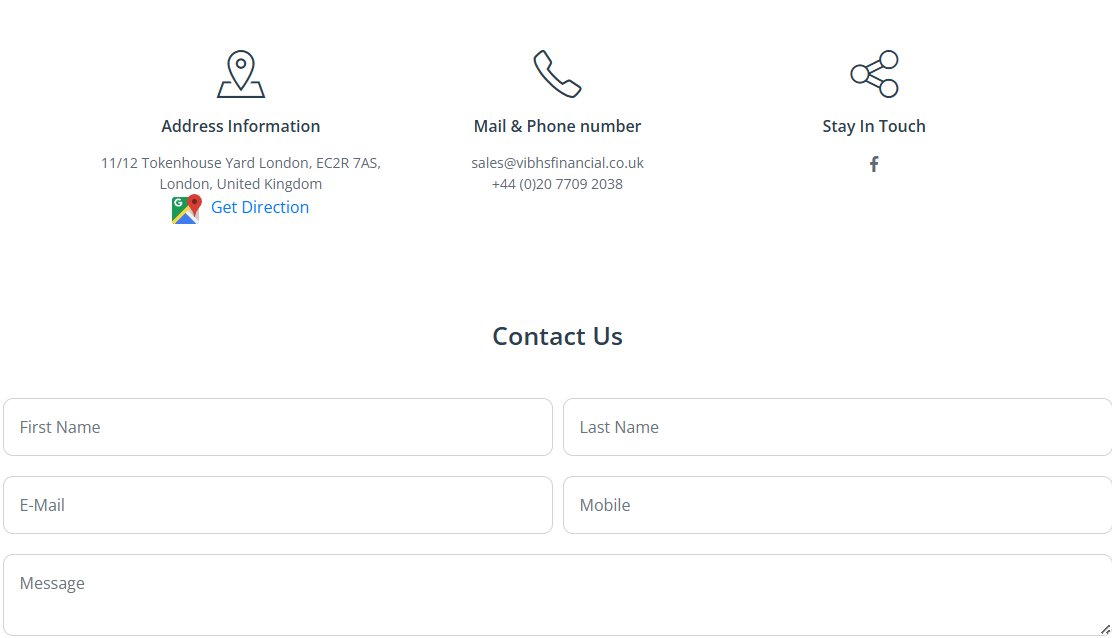

Customer Support and Responsiveness

Score – 4.6/5

Testing VIBHS Customer Support

The broker provides 24/7 multilingual customer support through live support, email, and phone. We found that the broker has a team of trading experts capable of assisting clients on a range of issues, including technical problems, market analysis advice, general inquiries, and operational concerns.

- VIBHS also has an FAQ section, where traders can find details on account opening, regulation, safety measures, etc.

Contacts VIBHS

VIBHS stands out for its 24/7 customer support that many traders find dedicated and prompt. The support is provided via multiple channels, enabling traders a chance to choose the most convenient option.

- Clients can connect with the broker directly by using the provided phone number: +44 (0)20 7709 2038.

- The broker also provides an email address for clients to send their inquiries, questions, and suggestions: sales@vibhsfinancial.co.uk.

- Besides, VIBHS clients can use the provided inquiry form on the Contact Us section by filling out the form and submitting their questions.

- At last, the broker has a live chat, the quickest way to receive detailed and helpful answers.

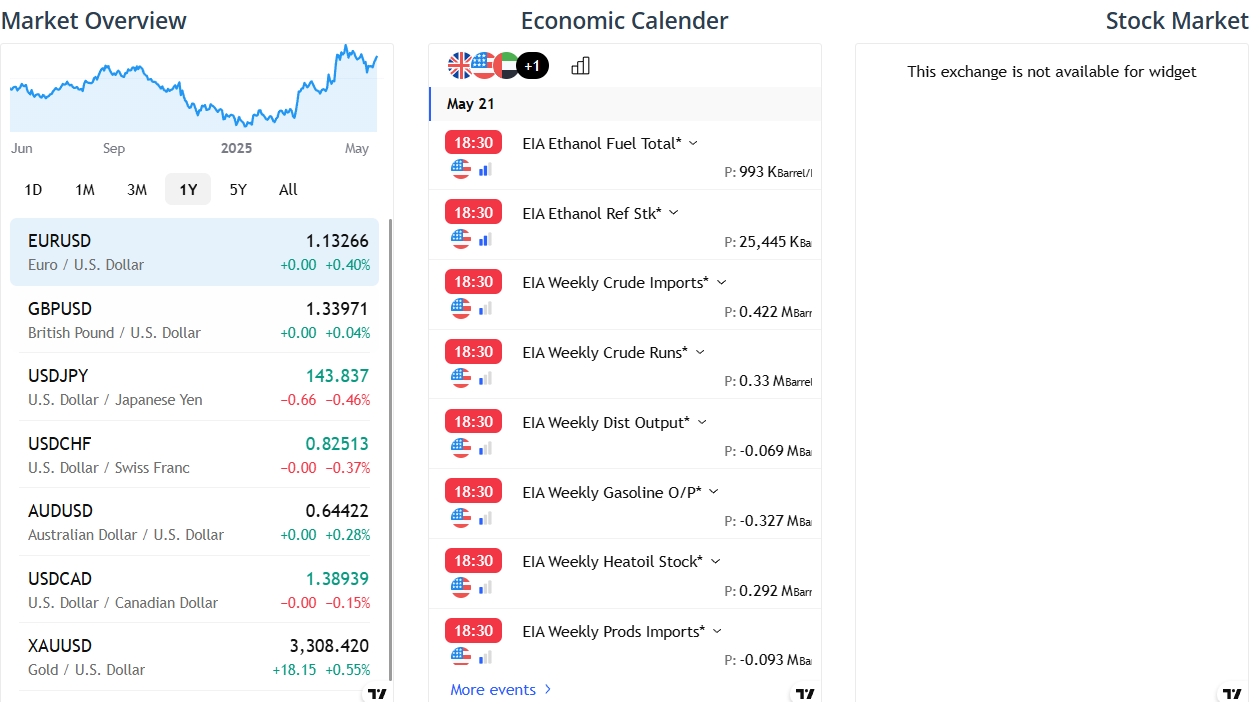

Research and Education

Score – 3.5/5

Research Tools VIBHS

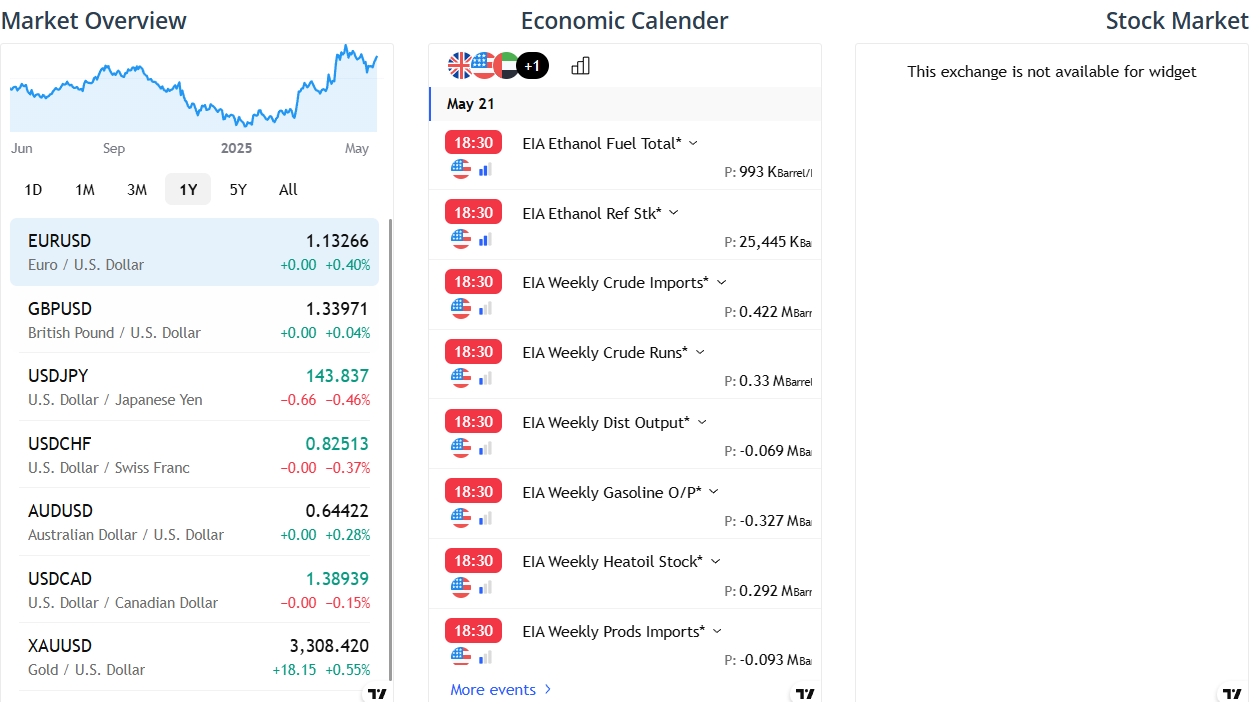

Overall, the broker’s trading tools and features are already included in the available MT4 platform. In addition, VIBHS’s market analysis section provides traders with a range of fundamental and technical analysis resources, including daily market reviews, trading signals, and economic calendars, that can help improve their trading skills and knowledge.

- The economic calendar provided by VIBHS is a helpful tool, ensuring that traders get insight into the market and learn about the coming market changes and events. This way, they can make informed decisions and benefit.

Education

Our research revealed that the broker does not have a dedicated section on its website for educational materials, such as articles, trading courses, educational videos, a Forex glossary, seminars, and webinars. Therefore, for beginners, we recommend seeking educational resources from established and reputable brokers.

Is VIBHS a Good Broker for Beginners?

Our review of the broker’s offerings has revealed positive trading services. The broker includes the advanced MT4 platform, a selection of account types, different fee structures, competitive trading costs, and access to popular trading products. Clients can also open a demo account and practice. Besides, the minimum deposit amount is also on the lower side, $200.

Another advantage that beginner traders can benefit from is the dedicated 24/7 multilingual support. However, those novice traders who rely on the broker to gain knowledge and skills will not be satisfied. This is, perhaps, one of the major disadvantages of the broker. If traders are willing to find educational materials elsewhere, then the broker can be a good choice for beginner clients as well.

Portfolio and Investment Opportunities

Score – 3.9 /5

Investment Options VIBHS

Although VIBHS provides favorable trading conditions and a safe environment, the broker has a very limited number of tradable products. It offers trading across only a few financial assets, including Forex, commodities, indices, and ETFs, and the total number of instruments is 75. The products are primarily CFD-based, which limits the opportunities for traditional investments. Yet, with VIBHS, there are other alternative ways to expand the portfolio, including.

- Copy trading enables traders to copy the successful trades of professionals, enhancing their opportunities to gain profits without too much engagement.

- The availability of MAM accounts is another alternative for gaining profits by trusting the account management to a professional account manager. MAM accounts are equally profitable for traders and account managers, as each gets a percentage of the profits.

Account Opening

Score – 4.6/5

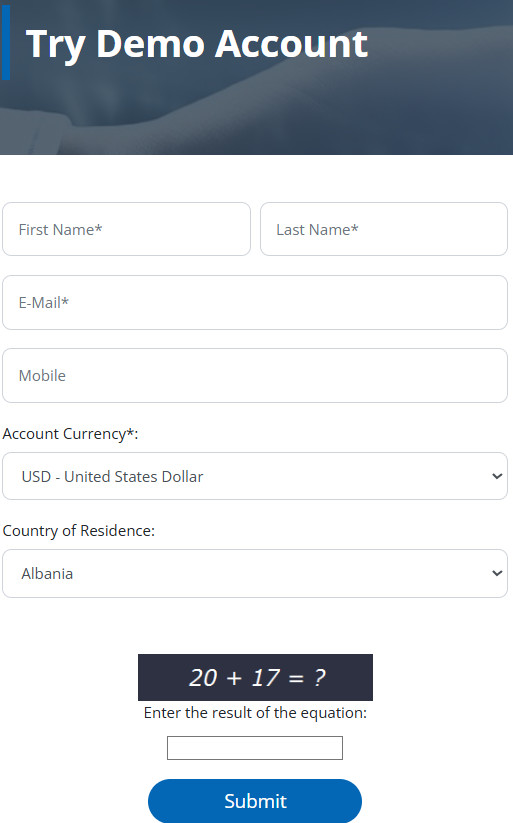

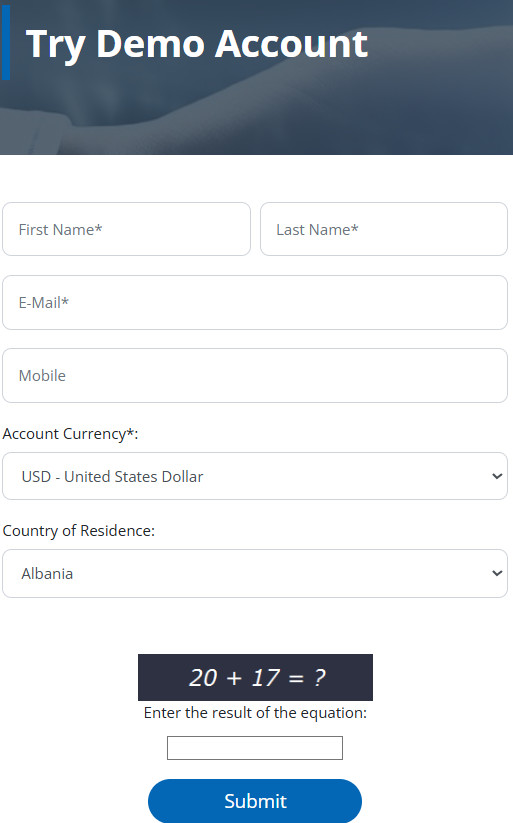

How to Open a VIBHS Demo Account?

Starting trading with a demo account is a wise choice. It will help gain knowledge and skills before switching to live trading. To open a demo account with VIBHS, clients can follow the simple steps below:

- Go to the broker’s website.

- Choose the ‘Try demo account’ option.

- Fill out the registration form with your name, email address, mobile number, and residency.

- Choose also the account currency.

- Receive the login credentials to the provided email.

- Log in to the MT4 platform in your preferred form (web, desktop, or mobile).

- Start practicing.

How to Open a VIBHS Live Account?

Opening an account with VIBHS is easy and can be opened within minutes. Clients should go to the opening account page and proceed with the guided steps:

- Select and click on the “Start Live Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.7/5

Apart from its trading platform, which includes a lot of trading tools and features, the broker does not offer a good range of additional tools. Among what we have already found and discussed are the economic calendar and FIX API. Overall, VIBHS has a good and favorable offering that can meet different needs and promote efficient and profitable trading.

VIBHS Compared to Other Brokers

As a final step, we have compared VIBHS to other brokers with similar proposals. The broker is regulated by the top-tier FCA, ensuring reliability and adherence to stringent laws. From the brokers we have reviewed and compared to VIBHS, Fortrade is another broker with the FCA regulation. Yet, Fortrade holds licenses from other respected authorities, including ASIC, CySEC, IIROC, and NBRB, providing an extra layer of security.

Comparing the broker’s trading platforms, we found that TriumphFX is another broker that offers only the MT4 platform. On the other hand, brokers like Eightcap offer more diversity, enabling traders access to MT4, MT5, and TradingView platforms.

The range of the VIBHS’s instruments is limited, with only 75+ available tradable products. Although this is indeed a small amount, TriumphFX offers even fewer products, 64 in total. In contrast, TMGM’s instrument offering is huge, with 12,000+ tradable products. Another limitation with VIBHS is the lack of educational materials. FXTB and TMGM have excellent educational materials.

| Parameter |

VIBHS |

Eightcap |

FXTB |

TriumphFX |

TMGM |

Forex.com |

Fortrade |

| Spread-Based Account |

Average 1.6 pips |

Average 1 pip |

Average 3 pip |

Average 0.6 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission-Based Account |

0.0 pips + $0.5 – $5 |

0.0 pips + $3.5 |

No commission |

Not available |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4 |

MT4, MT5, TradingView |

MT4, Web Trader |

MT4 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

75+ instruments |

800+ instruments |

300+ instruments |

64+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

FCA |

ASIC, SCB, CySEC, FCA |

CySEC |

CySEC, FSC, FSA |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/7 support |

24/4 |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Not provided |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$200 |

$100 |

€250 |

$100 |

$100 |

$100 |

$100 |

Full Review of Broker VIBHS

VIBHS is a reputable broker with strict oversight from the top-tier FCA. It offers tight security measures, ensuring that traders’ investments are protected.

VIBHS enables clients to conduct trades on the popular MT4 platform, including the web, desktop, and mobile versions. The platform includes great tools and capabilities, with the FIX API solution. Besides, clients can access copy trading and MAM accounts.

Traders can access over 75 trading instruments across Forex, Commodities, Indices, and ETF CFDs. The limited range of instruments does not provide enough diversity for traders to expand their portfolios. All the instruments are available with competitive pricing, with spreads starting from 1.6 pips for the popular EUR/USD pair.

Another limitation we have revealed about the broker is its lack of educational materials. Although the broker offers favorable trading conditions for beginner traders, the absence of educational materials might make the offering unsuitable for them. Yet, VIBHS has a demo account, so that beginner traders can practice their skills before engaging in real trading. All in all, VIBHS is a trustworthy option to engage in efficient trading.

Share this article [addtoany url="https://55brokers.com/vibhs-review/" title="VIBHS"]