- What is TradeStation?

- TradeStation Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- TradeStation Compared to Other Brokers

- Full Review of Broker TradeStation

Overall Rating 4․7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is TradeStation?

TradeStation is a Stock trading company that provides online brokerage services and platforms for individuals, institutional traders, and investors. The firm offers a range of financial products across different asset classes, including Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, and Mutual Funds.

The broker is subject to strict regulatory oversight by the US SEC, FINRA, and CFTC, and is also a member of the National Futures Association (NFA) and the Securities Investor Protection Corporation (SIPC).

Additionally, TradeStation UK’s entity, named TradeStation International Ltd, is authorized and regulated by the FCA (UK). It functions as an introducing broker, connecting clients with both affiliates and non-affiliates of TradeStation Group through Interactive Brokers (U.K.) Limited. For further details, you can explore the information on the TradeStation global website.

Overall, the company is renowned for its advanced trading technology and platforms, catering to a diverse range of traders with powerful tools for analysis and execution across multiple asset classes.

Is TradeStation Stock Broker?

Yes, TradeStation is a Stock and Real Futures Trading Broker, offering a user-friendly platform for traders to buy and sell different products on various exchanges. The platform is known for its advanced tools and technology and is a reliable choice for those seeking to execute stock and futures trades with efficiency.

TradeStation Pros and Cons

The broker has a good reputation and advantages in the investment industry, including a customizable platform equipped with advanced tools and analytics. The platform facilitates fast and efficient order execution, making it ideal for active traders and algorithmic strategies.

Additionally, TradeStation provides access to a wide range of products, catering to the diverse needs of investors, and is also very popular as a Real Futures Trading broker in the USA.

For the cons, the broker might not be the best fit for beginners, as its platform can be a bit complicated to learn. Some users also can find that its costs are relatively higher compared to other brokers, which could be a drawback for those looking for more budget-friendly options.

| Advantages | Disadvantages |

|---|

| SEC, FINRA, CFTC, and FCA regulation and oversee | Not suitable for beginner traders |

| $0 minimum deposit | No 24/7 customer support |

| Competitive trading conditions | |

| Stocks, Options, and Real Futures Trading | |

| Direct Market Access | |

| Secure investing environment | |

| Good learning materials | |

| Advanced trading platforms | |

TradeStation Features

TradeStation is known for its reliable investment services, advanced technology, and comprehensive trading tools. A summary of its standout features is as follows:

TradeStation Features in 10 Points

| 🏢 Regulation | SEC, FINRA, CFTC, NFA, SIPC, FCA |

| 🗺️ Account Types | Individual & Joint, Retirement, Entity Accounts |

| 🖥 Trading Platforms | TradeStation Desktop, Web Trading, Mobile Apps, FuturesPlus |

| 📉 Trading Instruments | Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, Mutual Funds |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $1.50 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, CAD |

| 📚 Trading Education | Webinars, Tutorials, Articles, Events, etc. |

| ☎ Customer Support | 24/5 |

Who is TradeStation For?

TradeStation is designed for active traders, seasoned investors, and professionals who demand powerful tools, advanced charting, and a wide range of asset classes. Based on our findings and Financial Expert Opinions, TradeStation is Good for:

- Traders from the US and UK

- Stocks and Options trading

- Investing

- Real Futures trading

- Direct market access

- Advanced traders

- Professional trading

- Paper trading

- Commission-based trading

- Competitive conditions

- Good educational materials

TradeStation Summary

In conclusion, TradeStation stands out as a comprehensive platform, renowned for its advanced technology, diverse product offerings, and commitment to trader education. With powerful tools for analysis and customization, a variety of tradable assets, and a user-friendly interface, it caters to a broad range of traders, from beginners to professionals.

Additionally, the availability of specialized platforms for futures makes the broker a compelling choice for those seeking a sophisticated and flexible trading experience.

Overall, we found that TradeStation provides a trustworthy environment for investment; however, we advise conducting your research and evaluating whether the firm’s offerings suit your specific requirements.

55Brokers Professional Insights

TradeStation stands out for its powerful trading technology, professional tools, and extensive market access and is one of the most regarded by active traders and Futures traders Brokers. Its award-winning platform offers advanced charting capabilities, provides great, very comprehensive capabilities with over 100 indicators, customizable workspaces, and automated strategy development, features that cater to the needs of serious traders and institutions alike. It will take some time to get in use to the platform, mainly due to its complexity of offered features, but overall it is great for navigation and managing trades or analysis alike.

The broker’s direct market access provides fast and reliable trade execution across a wide range of asset classes, including stocks, ETFs, options, futures, and cryptocurrencies. Additionally, TradeStation’s robust back-testing environment allows traders to refine strategies with historical data before going live, which is a great benefit provided to free if you’re client of TradeStation. Some other broker, including Trade Station platform in their offering too but you will need to pay subsriptionn for the platform and the data of the Exchange you trade too.

The broker also supports seamless integration with third-party applications and APIs, enabling algorithmic and quantitative traders to implement complex models with ease. Backed by comprehensive research, educational resources, and competitive pricing, TradeStation provides a professional trading experience that sets it apart from many retail-focused competitors great for active traders, trade of large size, Futures trading, especially and trading in US too.

Consider Trading with TradeStation If:

| TradeStation is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Professional trading.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Looking for broker with Top-Tier licenses.

- Providing diverse trading strategies.

- Looking for broker with a long history of operation and strong establishment.

- Competitive trading conditions.

- Futures and options traders.

- US and UK investors.

- Investors who prefer robust educational resources. |

Avoid Trading with TradeStation If:

| TradeStation might not be the best for: | - Looking for broker with 24/7 customer support.

- Need a broker with trading services worldwide.

- Beginner investors.

|

Regulation and Security Measures

Score – 4.8/5

TradeStation Regulatory Overview

TradeStation is a legitimate and reliable company for traders looking to invest and manage their assets. It is regulated by respected US financial authorities, as well as the FCA (UK), and has a good reputation and integrity in the financial industry.

How Safe is Trading with TradeStation?

TradeStation is a trustworthy Stock broker that follows the strict rules and guidelines established by the SEC, FINRA, CFTC, and FCA, which safeguard client assets and provide low-risk trading.

The company prioritizes the security and protection of its clients’ investments by adhering to regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud, unauthorized account access, and stringent identity verification processes.

Moreover, as a member of SIPC, the firm protects its customers up to $500,000, including $250,000 for cash, providing an additional layer of security. However, traders should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their trading protection further.

Consistency and Clarity

TradeStation has built a solid reputation over decades as a reliable and transparent brokerage, earning high scores from industry reviewers and maintaining a loyal client base of active traders.

Founded in 1982, the firm has demonstrated consistent performance, adapting its technology and services to meet evolving market demands. Trader reviews often praise its robust platform, advanced tools, and fast execution speeds, while noting that its complexity can be a challenge for beginners.

The broker has received numerous industry awards for innovation, technology, and customer service, further solidifying its status as a market leader. Beyond trading, TradeStation engages in community and industry activities, including sponsorships and educational initiatives, which enhance its visibility and trustworthiness in the financial world.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with TradeStation?

TradeStation provides various account types to cater to the diverse needs of traders. From Individual and Joint accounts to Retirement accounts such as IRAs, traders can choose the account type that aligns with their financial goals and preferences.

Additionally, the firm offers specialized accounts for Entities like corporations, ensuring a comprehensive range of options to accommodate different styles and entities.

TradeStation also offers a free demo account/paper trading. Traders can use it to test strategies, explore the platform’s features, and practice trading without risking real money.

Individual & Joint Account

TradeStation offers both Individual and Joint accounts, catering to single traders or multiple account holders sharing ownership. These accounts provide access to the broker’s full range of products, including stocks, options, futures, and cryptocurrencies.

The minimum deposit requirement for opening an account is $0, although futures and certain products may have higher funding needs. This flexibility allows traders of varying experience levels to start trading on a platform designed for both active and long-term investing.

Regions Where TradeStation is Restricted

TradeStation is not available to residents of certain countries due to regulatory and licensing restrictions, including:

- European Economic Area

- Hong Kong

- Japan, etc.

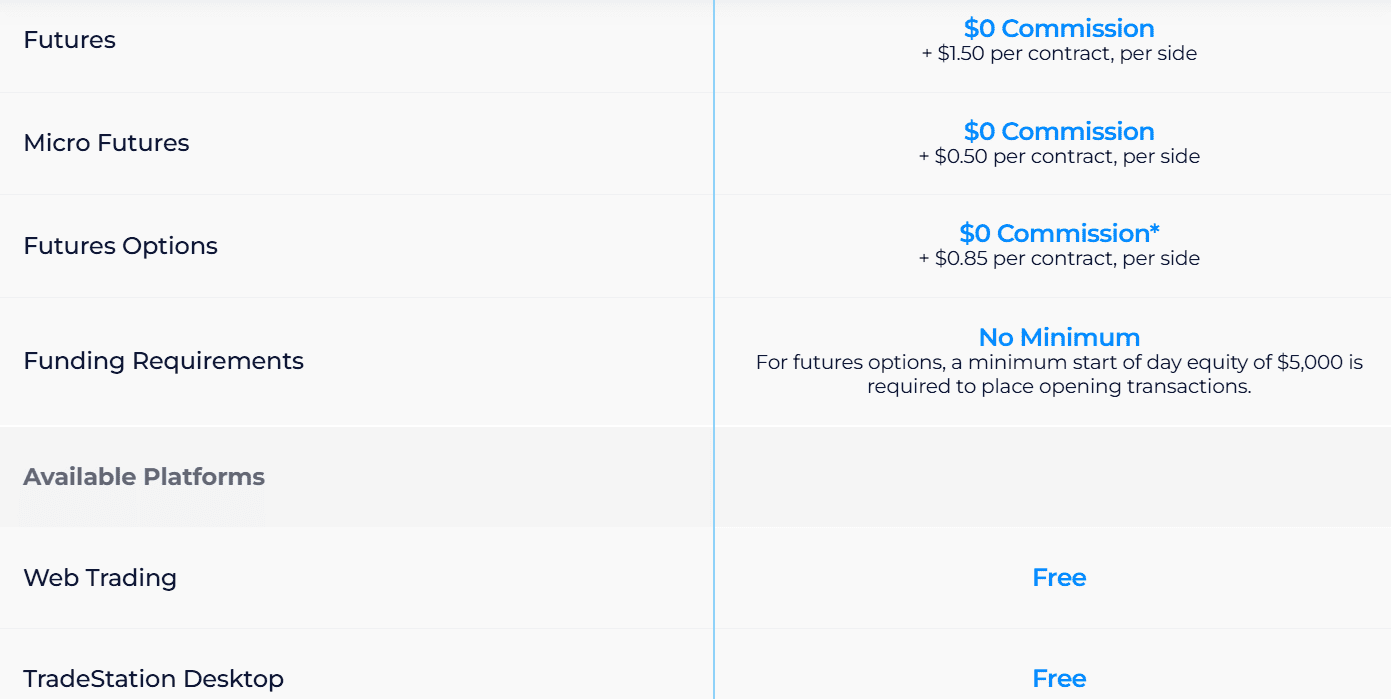

Cost Structure and Fees

Score – 4.5/5

TradeStation Brokerage Fees

The firm’s fee structure varies depending on the type of asset being traded. For equities, the standard commission rates apply, while options and futures trading involve additional contract fees.

For specific details on fees, traders should carefully review the fee schedule provided by TradeStation to understand the cost implications based on their preferred instruments and strategies.

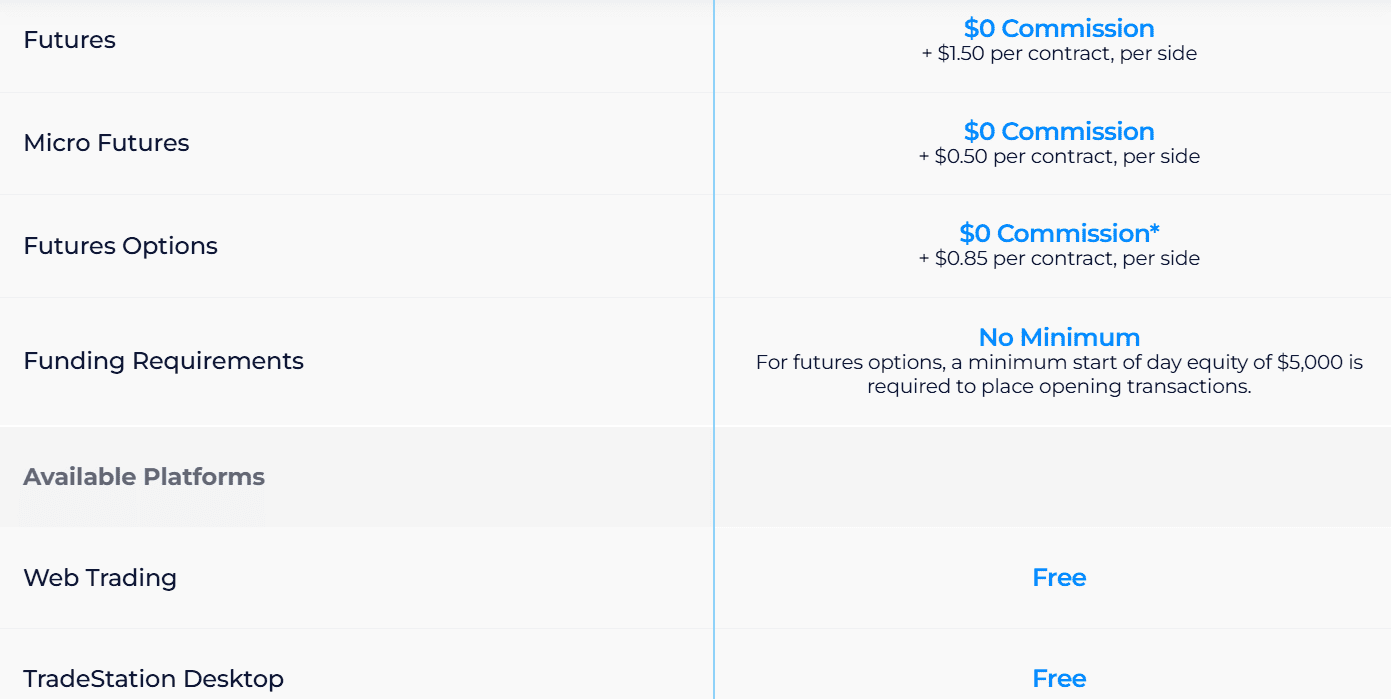

TradeStation charges competitive fees for futures trading, including E‑mini and Micro E‑mini contracts. For standard E‑mini contracts, the commission is typically $1.50 per contract, per side, plus applicable exchange and regulatory fees.

Micro E‑mini contracts have a lower commission, usually around $0.50 per contract, per side, making them a cost-effective option for smaller traders.

- TradeStation Exchange Fee

In addition to TradeStation’s commissions, traders are responsible for paying exchange and regulatory fees on futures contracts. These fees vary depending on the specific contract and exchange.

Such fees cover the costs imposed by market operators and regulatory bodies to maintain fair and transparent trading environments. Traders need to factor these fees into their overall costs when planning strategies.

- TradeStation Rollover / Swaps

TradeStation applies rollover fees for futures contracts when positions are held beyond their expiration and rolled over into the next contract.

These fees represent the cost of maintaining open futures positions over time and can impact the overall expenses for traders holding contracts long term.

- TradeStation Additional Fees

Besides commissions and exchange fees, TradeStation charges a $10 monthly inactivity fee if there is no trading activity during the month.

Additional fees may also apply for services like wire transfers, paper statements, and margin interest. Traders should review TradeStation’s full fee schedule to understand all potential costs and manage their accounts accordingly.

How Competitive Are TradeStation Fees?

TradeStation offers a generally competitive fee structure within the industry. Its transparent pricing, combined with advanced tools and direct market access, provides strong value for the cost.

While some fees may be higher than low-cost brokers targeting casual investors, the firm’s comprehensive platform and professional-grade features justify its pricing for advanced traders seeking performance and reliability.

| Fees | TradeStation Fees | Degiro Fees | MEXEM Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $1.50 | $0.75 | $0.85 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | Yes | No | No |

| Fee ranking | Low/Average | Low | Low/Average |

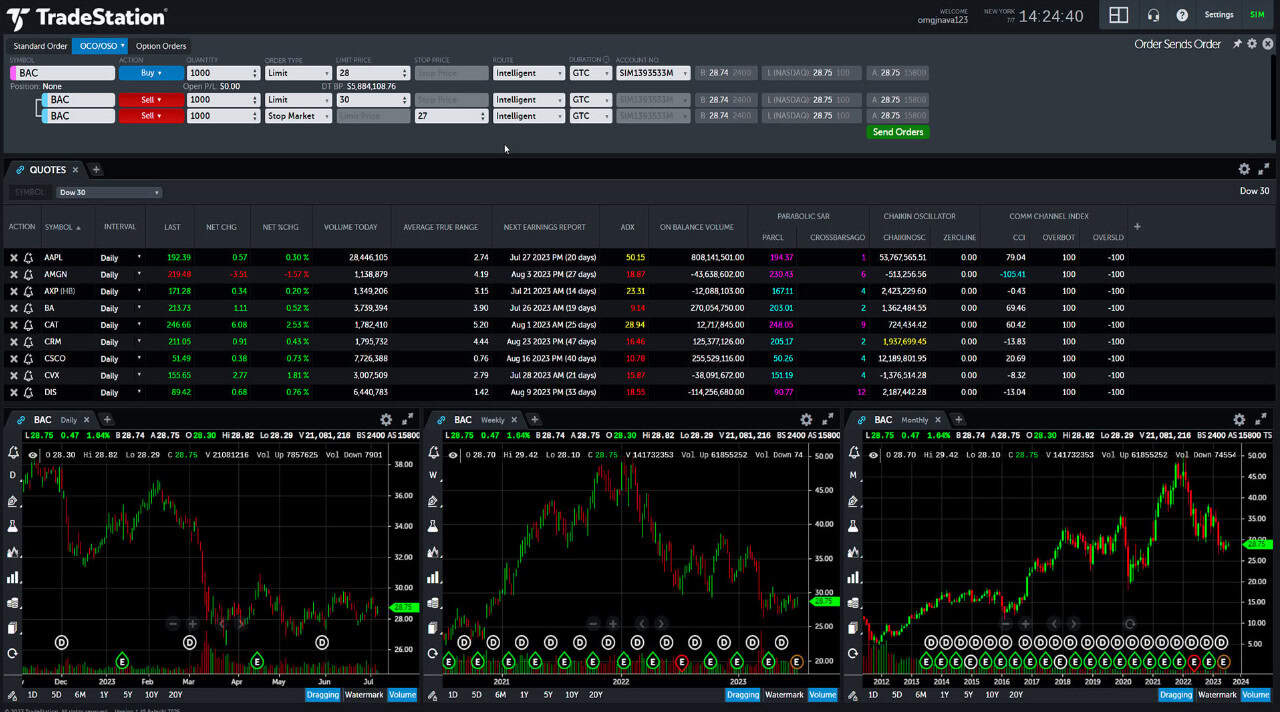

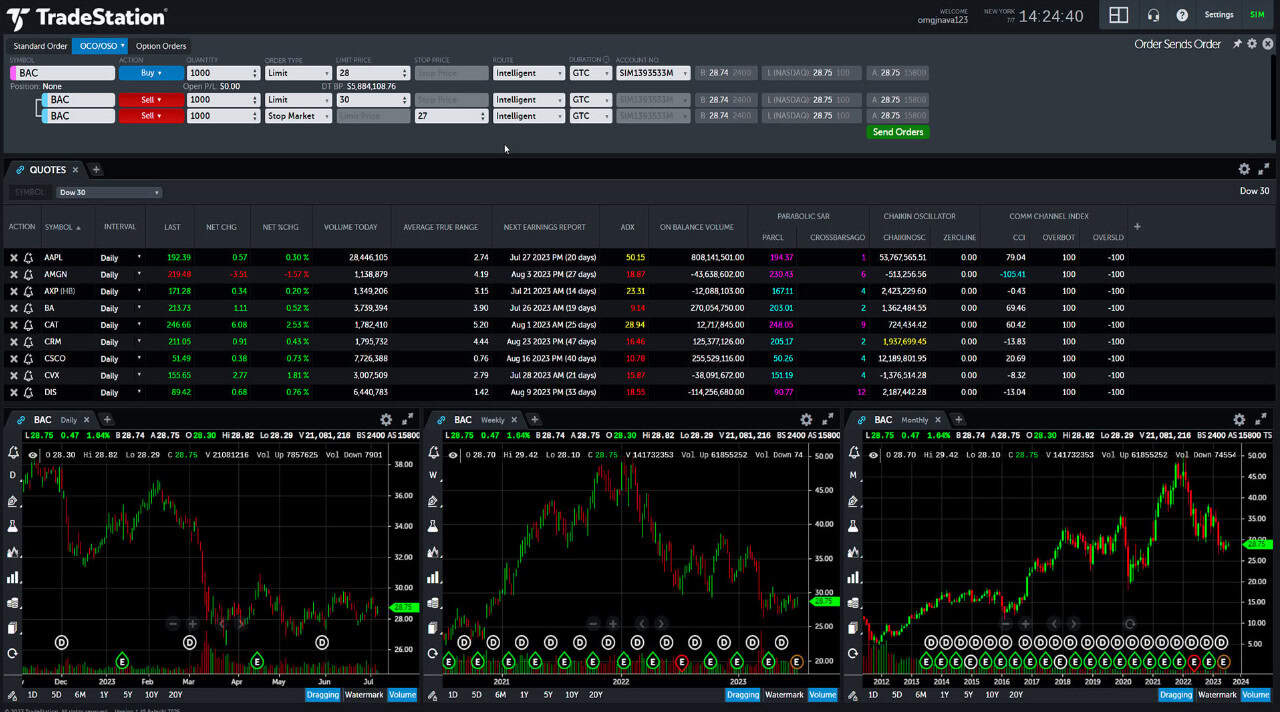

Trading Platforms and Tools

Score – 4.6/5

TradeStation offers a suite of powerful platforms designed to meet the diverse needs of traders. TradeStation Desktop provides advanced charting tools, comprehensive analysis capabilities, and customizable options for executing trades across multiple asset classes. The Web offers a browser-based alternative with accessibility from any device, while TradeStation Mobile caters to on-the-go trading with a mobile app featuring essential functionalities.

In addition to its core platforms, the broker provides specialized tools to enhance the trading experience. FuturesPlus is tailored for futures traders, offering advanced features for analyzing and executing futures contracts. However, pay attention that there is data to be paid for Futures trading.

Trading Platform Comparison to Other Brokers:

| Platforms | TradeStation Platforms | Merrill Edge Platforms | Trade Republic Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

TradeStation Web Platform

TradeStation’s web platform offers a powerful, user-friendly trading experience accessible directly through any modern browser without the need for downloads.

It provides advanced charting tools, real-time data, customizable layouts, and seamless order execution across stocks, options, futures, and cryptocurrencies.

Main Insights from Testing

Testing TradeStation’s web platform reveals a fast, responsive interface with intuitive navigation and a rich set of features. Users benefit from smooth order placement, detailed charting options, and real-time market data.

While some advanced tools may require a learning curve, overall, the platform delivers a reliable and efficient trading experience suitable for both intermediate and experienced traders.

TradeStation Desktop MetaTrader 4 Platform

TradeStation does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

TradeStation Desktop MetaTrader 5 Platform

TradeStation does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its platform.

TradeStation MobileTrader App

The TradeStation MobileTrader app provides traders with powerful, on-the-go access to markets via smartphones and tablets. It features advanced charting tools, real-time quotes, customizable watchlists, and seamless order execution across multiple asset classes.

Designed to deliver a desktop-quality trading experience in a mobile format, the app supports traders who need flexibility and control wherever they are.

AI Trading

TradeStation offers advanced technology that supports algorithmic and automated trading strategies, though it does not offer dedicated AI-driven tools.

Its platform allows traders to create, back-test, and deploy custom algorithms using powerful scripting languages. While AI-driven features like machine learning are not explicitly highlighted, TradeStation’s automation capabilities provide a strong foundation for traders looking to implement data-driven and systematic approaches.

Trading Instruments

Score – 4.7/5

What Can You Trade on TradeStation’s Platform?

The broker offers a diverse range of trading products across multiple asset classes, including Stocks, ETFs, Options, TradeStation Futures, Futures Options, TradeStation Crypto, Bonds, and Mutual Funds.

This variety of products empowers investors to create well-rounded portfolios that align with their financial objectives and risk preferences.

Main Insights from Exploring TradeStation’s Tradable Assets

Margin Trading at TradeStation

The broker offers margin trading, allowing traders to potentially amplify their profits or losses by borrowing funds to trade more than their account balance.

For TradeStation futures margin, users should be aware of the specific margin requirements, as they determine the amount of capital needed to open and maintain positions in futures contracts.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at TradeStation

The broker offers multiple funding methods to facilitate deposits into trading accounts. Clients can fund their accounts through bank wire transfers, ACH transfers, checks, and electronic funds transfers (EFT).

These diverse funding options provide flexibility for traders to choose the method that best suits their preferences and facilitate a seamless process for adding funds to their TradeStation accounts.

TradeStation Minimum Deposit

The broker does not have a specific minimum deposit requirement for its standard brokerage accounts, offering flexibility for traders to start with the amount they are comfortable with.

Withdrawal Options at TradeStation

The firm allows users to withdraw funds from their accounts through various methods, including bank wire transfers, ACH transfers, checks, and EFTs.

Traders can initiate withdrawals conveniently through the TradeStation platform, and the processing time and fees associated with withdrawals may vary based on the chosen withdrawal method.

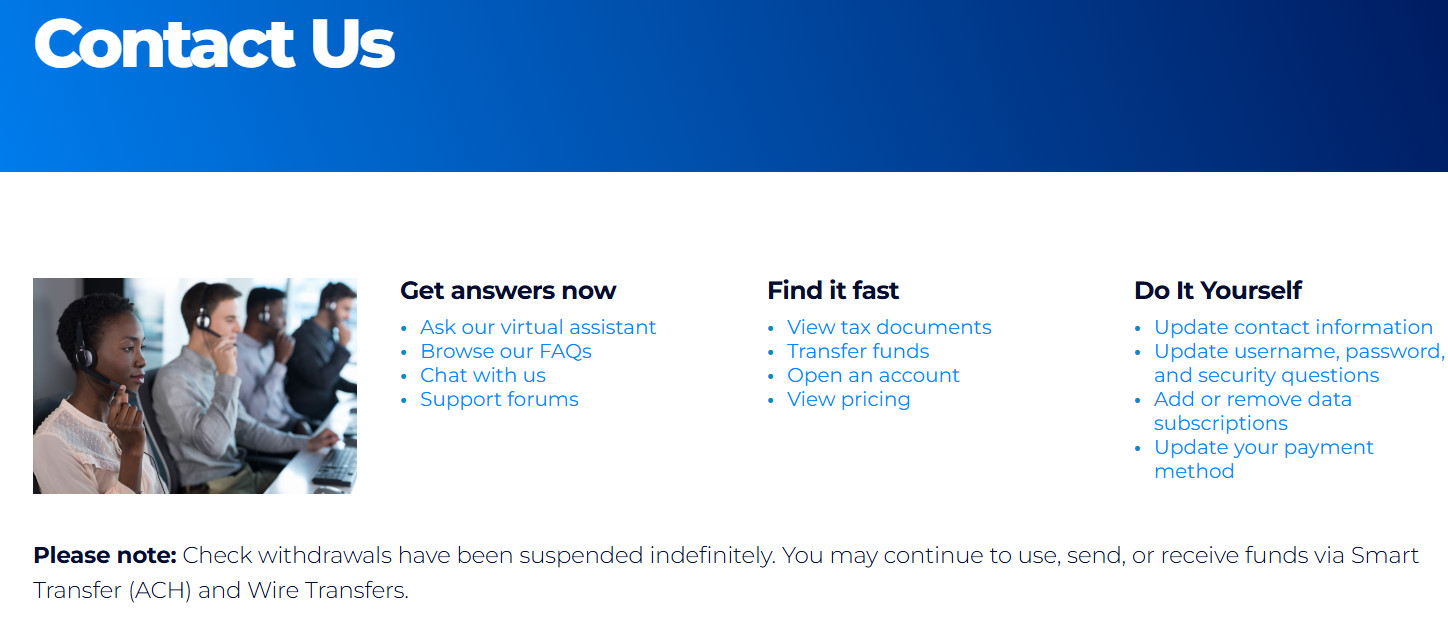

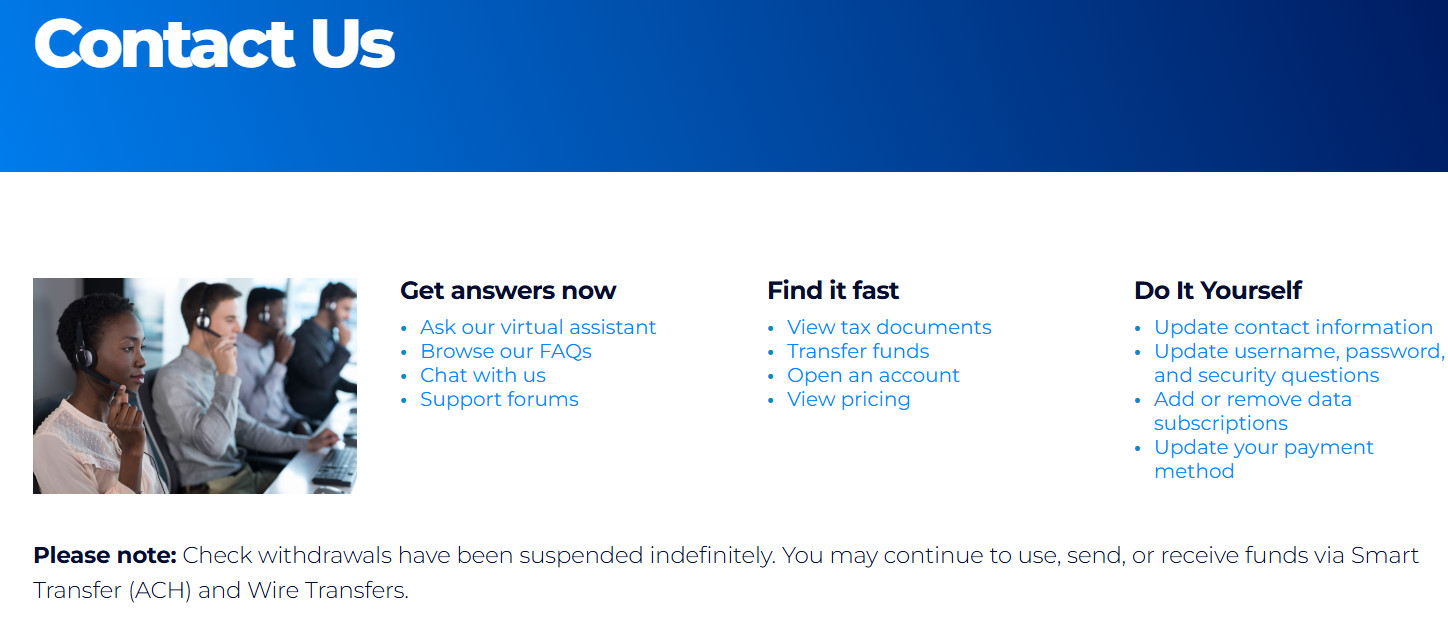

Customer Support and Responsiveness

Score – 4.5/5

Testing TradeStation’s Customer Support

The broker provides 24/5 customer support through various channels, including phone, email, and live chat, offering traders multiple options for assistance. Known for its responsive and knowledgeable support team, TradeStation aims to address user queries promptly, ensuring that traders have the necessary support and guidance for a smooth trading experience.

Additionally, the broker’s Client Center serves as a centralized hub for account management and essential administrative tasks. Through the client center, users can review and manage account information, access statements, trade confirmations, and make account-related adjustments.

Contacts TradeStation

For assistance, TradeStation provides multiple ways to get in touch. You can reach their Sales team via email at Sales@TradeStation.com. For Client Experience and Technical Support, help is available Monday to Friday, 8:00 a.m. to 5:00 p.m. ET, through phone or live chat.

U.S. customers can call toll-free at 800.822.0512 or directly at 954.652.7900. European clients have a toll-free number at 008.007.777.6543, while international callers can use +1.954.652.7900 for direct support.

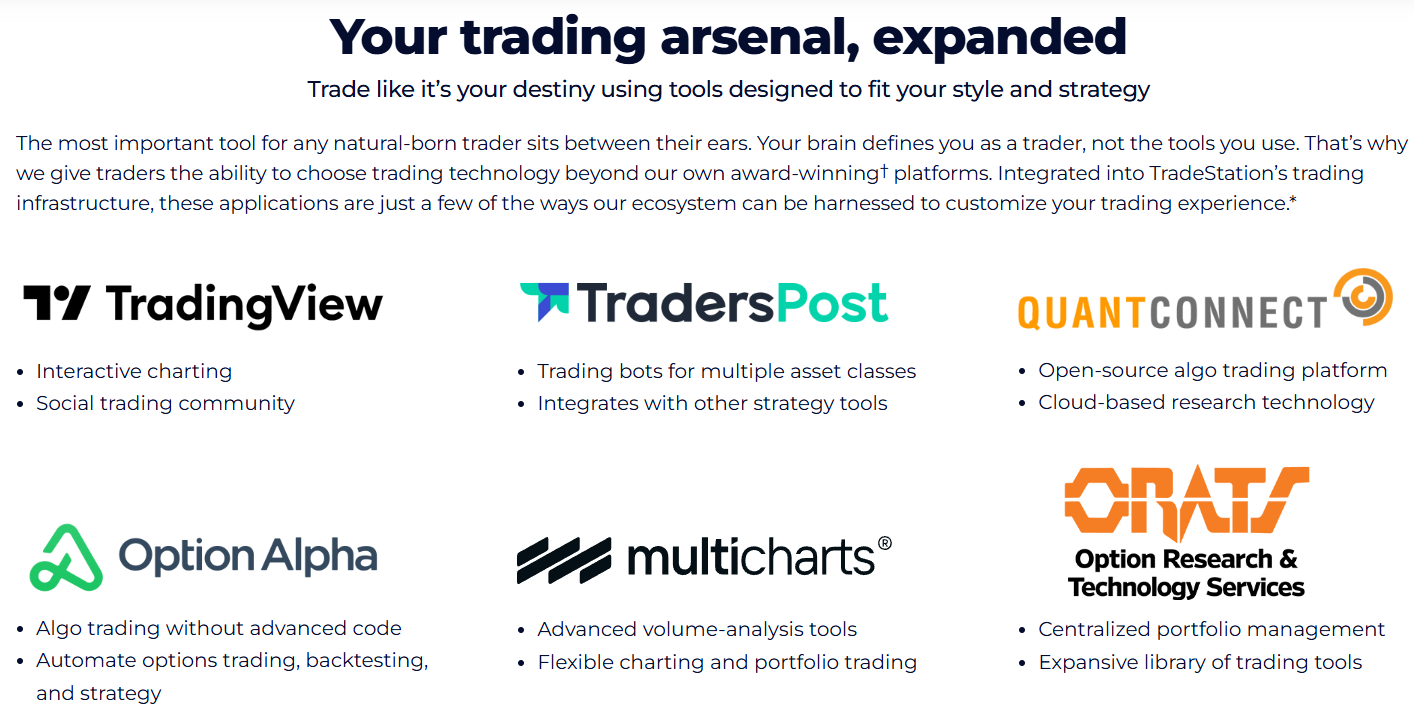

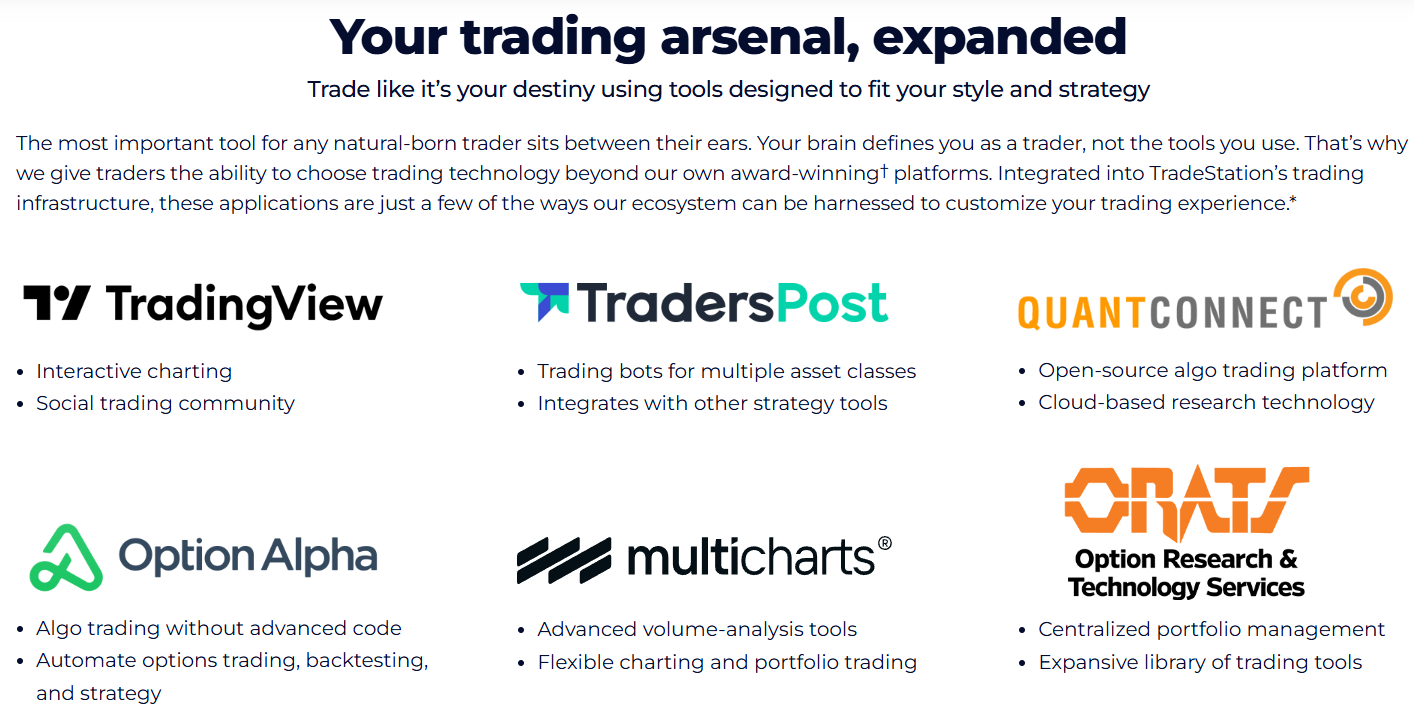

Research and Education

Score – 4.8/5

Research Tools TradeStation

TradeStation offers a robust suite of research tools accessible both through its website and platforms.

- Traders can utilize advanced charting, customizable technical indicators, and real-time market data to support informed decision-making.

- The platform also supports integration with popular third-party tools such as TradingView, MultiCharts, TradersPost, and more, expanding analytical capabilities.

- For more advanced users, TradeStation provides an API that allows developers to integrate third-party applications, algorithms, and tools with the TradeStation platform. By leveraging the TradeStation API, users can access market data, execute trades, and implement their unique trading strategies programmatically.

Education

TradeStation is committed to enhancing traders’ knowledge and skills through its comprehensive educational resources. The platform offers webinars, tutorials, and articles covering a range of topics, from platform functionalities to advanced trading strategies.

This commitment to education empowers users, whether beginners or experienced traders, to make informed decisions and maximize the capabilities of the TradeStation platform.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options TradeStation

TradeStation provides a wide range of investment solutions designed to meet diverse trader and investor needs. These include access to equities, options, futures, ETFs, and cryptocurrencies, allowing clients to build diversified portfolios across multiple asset classes.

With flexible account types and comprehensive market access, the firm supports both active trading and long-term investing strategies within a single platform.

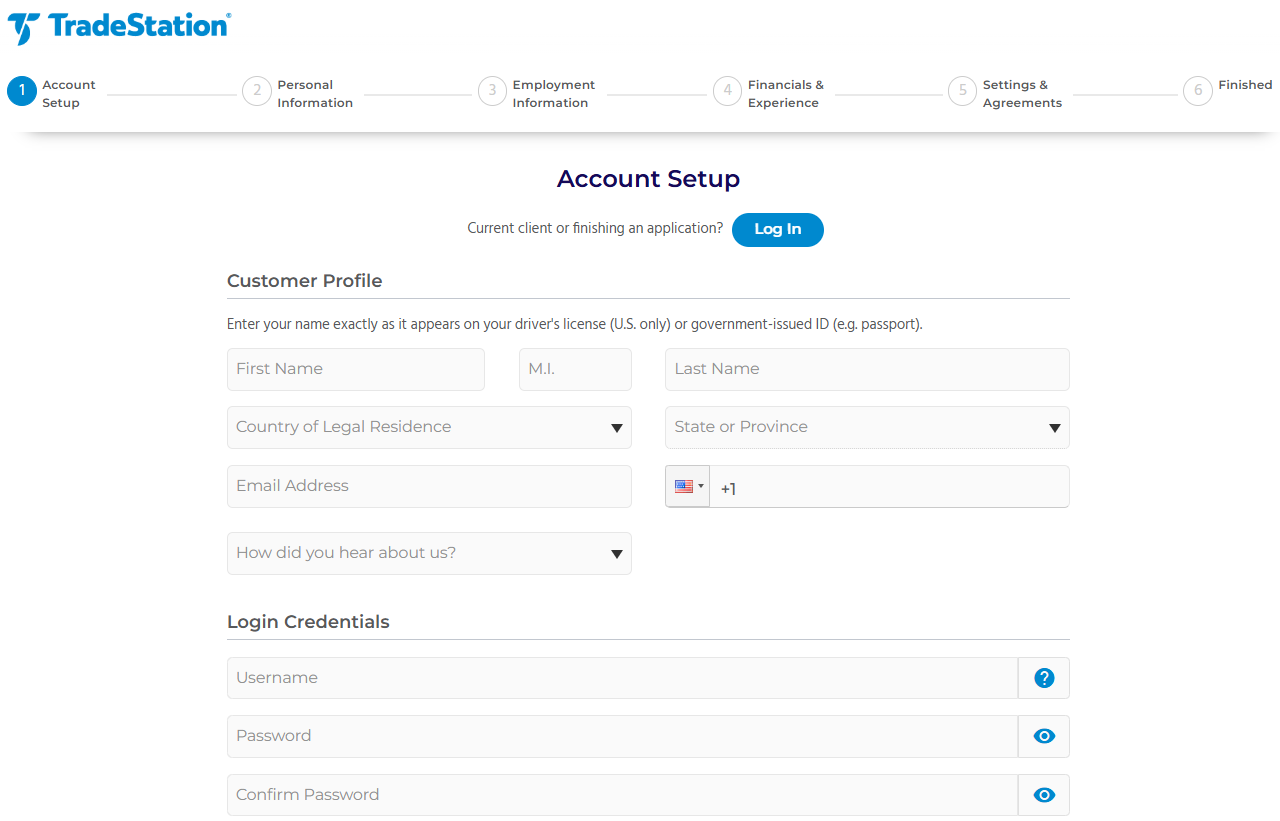

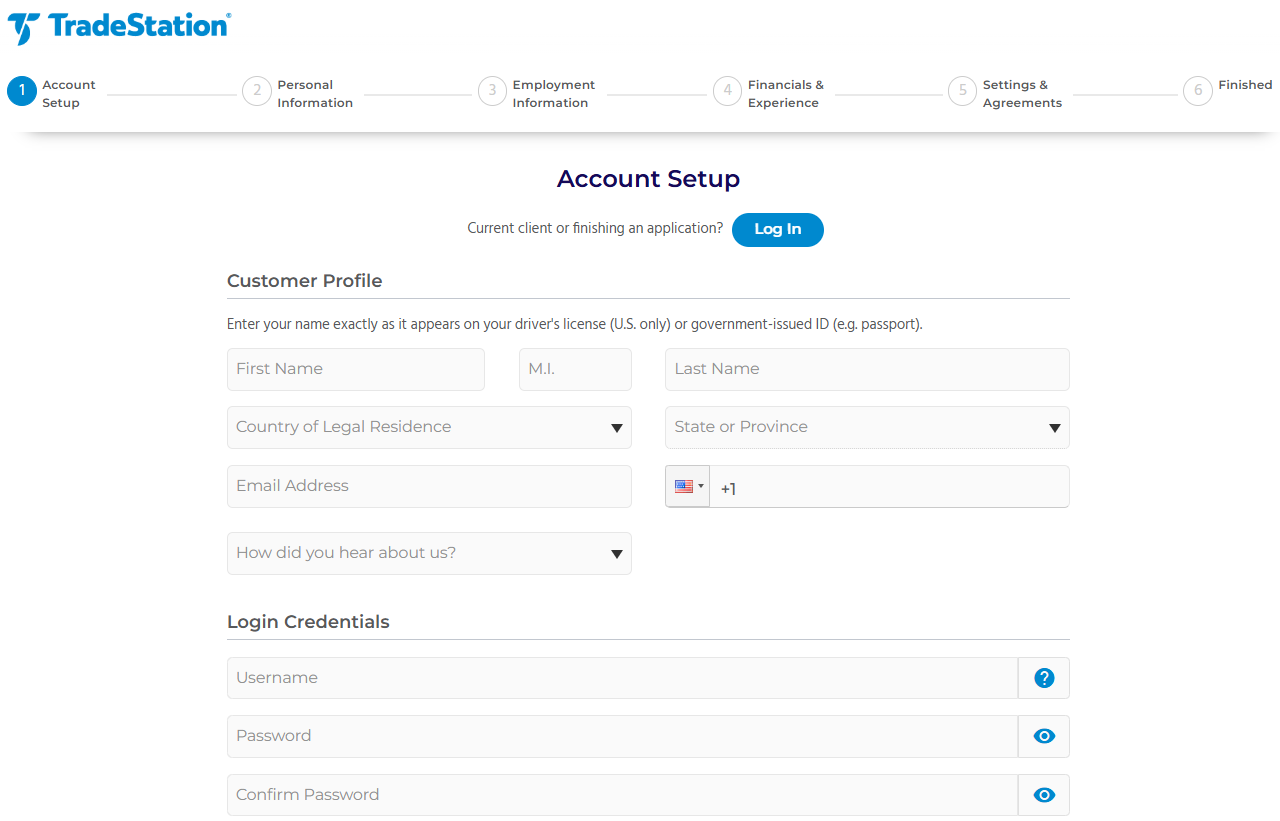

Account Opening

Score – 4.5/5

How to Open TradeStation Demo Account?

Opening a TradeStation demo account is a straightforward process to help traders practice and familiarize themselves with the platform without risking real money.

Simply visit TradeStation’s website and navigate to the demo or paper trading section, where you can sign up by providing basic personal information and creating login credentials.

Once registered, you will gain access to a fully functional simulated trading environment that mirrors live market conditions, allowing you to test strategies, explore features, and build confidence before trading with a funded account.

How to Open TradeStation Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or TradeStation login page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

Beyond its research capabilities, TradeStation offers a variety of additional tools and features to enhance the trading experience.

- These include customizable alerts, advanced order types, and portfolio analysis tools that help traders manage risk and optimize performance.

- The platform also provides market news and a vibrant trading community for collaboration and support.

- Moreover, TradeStation’s cloud-based solutions ensure traders can stay connected and execute trades seamlessly from anywhere.

TradeStation Compared to Other Brokers

TradeStation holds a strong position among its competitors by offering a comprehensive range of trading platforms, including desktop, web, and mobile apps, which cater well to both active futures traders and multi-asset investors.

Compared to some brokers, TradeStation provides a wide variety of tradable assets, including futures and cryptocurrencies, which some competitors do not offer.

While some brokers excel in providing 24/7 customer support, TradeStation balances solid customer service with robust educational resources and regulatory compliance.

Although certain competitors may offer slightly lower fees or specialize in particular markets, TradeStation’s offering of advanced tools, platform versatility, and broad market access makes it a compelling choice for traders seeking both professional features and a well-established brokerage.

| Parameter |

TradeStation |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.50 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

TradeStation Desktop, Web Trading, Mobile Apps, FuturesPlus |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, Mutual Funds |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, CFTC, NFA, SIPC, FCA |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker TradeStation

TradeStation is a well-established investment firm known for its powerful platforms and advanced tools tailored for active traders and professionals.

It offers extensive market access across stocks, options, futures, and cryptocurrencies, supported by robust charting, customizable workspaces, and automated strategy capabilities.

The broker’s transparent fee structure, combined with reliable execution and comprehensive educational resources, makes it appealing to those seeking a serious trading environment.

While its complexity might be challenging for beginners, TradeStation’s strong reputation, regulatory compliance, and ongoing technological innovation position it as a top choice for traders focused on performance and flexibility.

Share this article [addtoany url="https://55brokers.com/tradestation-review/" title="TradeStation"]