- What is Traders with Edge?

- Traders with Edge Pros Cons

- Is Traders with Edge Legit?

- Traders with Edge Challenge

- Funded Account

- Account Conditions

- Payout

- Traders with Edge Alternative

What is Traders with Edge Prop Firm?

Traders with Edge is a proprietary trading firm that provides funding and educational resources to traders. They offer different types of accounts for traders at various levels of expertise, including beginners and experienced traders. The firm is known for its challenge-based approach where traders have to pass certain criteria to get a funded account.

Traders with Edge, as a proprietary trading firm, provides a unique opportunity for traders to access company funds after passing a qualifying test or challenge. However, it’s important to assess potential risks before proceeding. Read more about Prop Trading here

| Traders with Edge Advantages | Traders with Edge Disadvantages |

|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Free Trial | Only MetaTrader Platform |

| MT5 and MT4 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Good range of Challenges | |

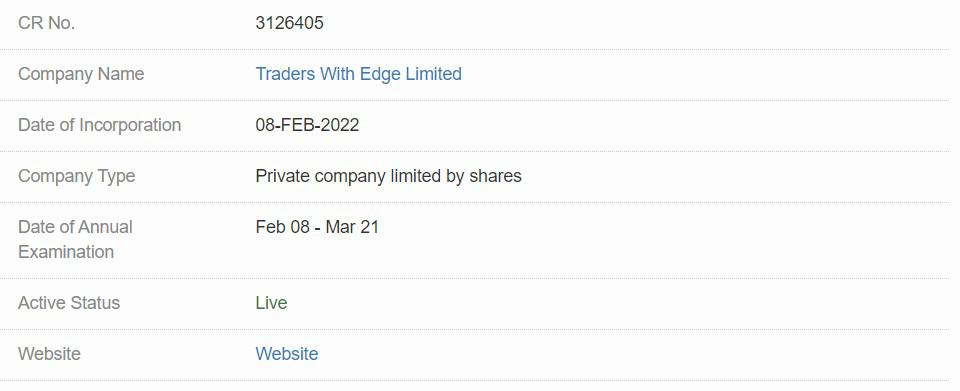

Is Traders with Edge Legit?

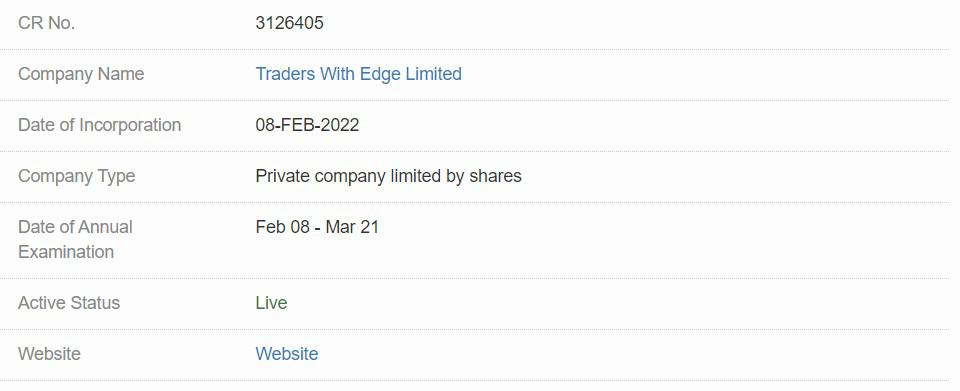

Traders with Edge has garnered positive reviews from various sources, highlighting its credibility in the proprietary trading firm industry. Additionally, it is based in Hong Kong, which is notable for its stringent financial regulations. Hong Kong’s regulatory environment is known for maintaining high standards in financial practices, which adds a layer of trust and credibility to firms operating within its jurisdiction.

- Generally, prop trading firms, unlike Forex brokers, typically do not operate under a Forex Broker license. Consequently, they face lower levels of regulation and oversight from industry regulators. This means they may not offer the same level of safety as Forex brokers. In prop trading, the company funds and oversees the entire trading operation, making it crucial for individuals to fully comprehend the associated risks.

Is Traders with Edge Scam?

We conducted a thorough check on the legitimacy of Traders with Edge through their official website and did not find any evidence to suggest that it is a scam. However, it’s important to note that Prop Trading Firms are subject to minimal regulation by financial authorities, making it challenging to definitively determine their true nature.

Our professional advice is to invest time in thoroughly understanding Prop Trading, its associated risks, and selecting a reputable company with a lengthy track record for greater stability. It’s worth noting that since you’re not investing a significant amount of capital for trading but rather paying subscription fees, potential losses are generally lower compared to engaging in real trading using your own funds.

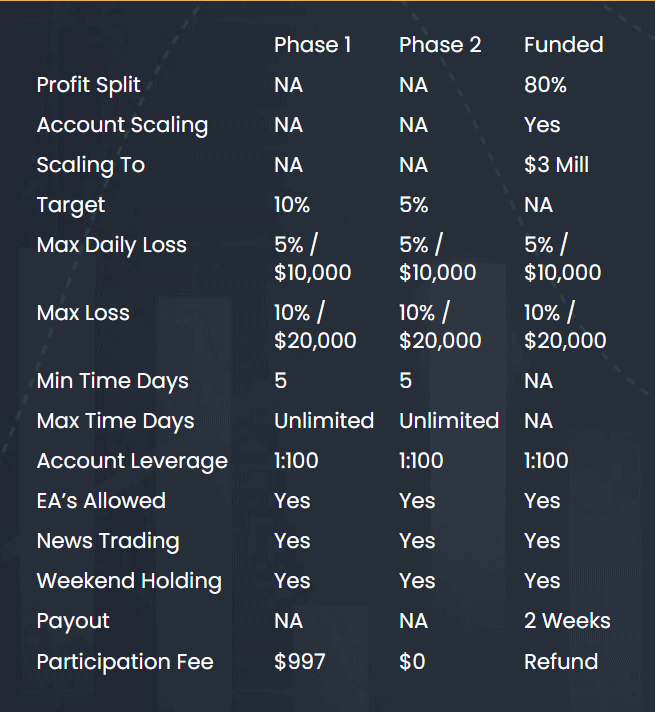

Traders with Edge Challenge Evaluation Rules

The pivotal aspect of our Traders with Edge Review centers on understanding how the evaluation challenge is structured and the requirements for participating in the trading challenge. This encompasses the specific test or criteria that must be met to acquire a Funded Trading Account and assume the role of a Proprietary Trader. Additionally, we’ll delve into the typical costs associated with becoming a trader, primarily based on registration fees.

- The primary objective of the Challenge or Test is to demonstrate your trading prowess. At Traders with Edge, the evaluation process is divided into two phases, each with profit targets that depend on the Account Size you opt for. Generally, Phase 1 has stricter rules, whereas Phase 2 offers slightly more lenient conditions, particularly concerning Drawdown. This setup is designed to assess not only your trading ability but also the sustainability of your trading activities over time.

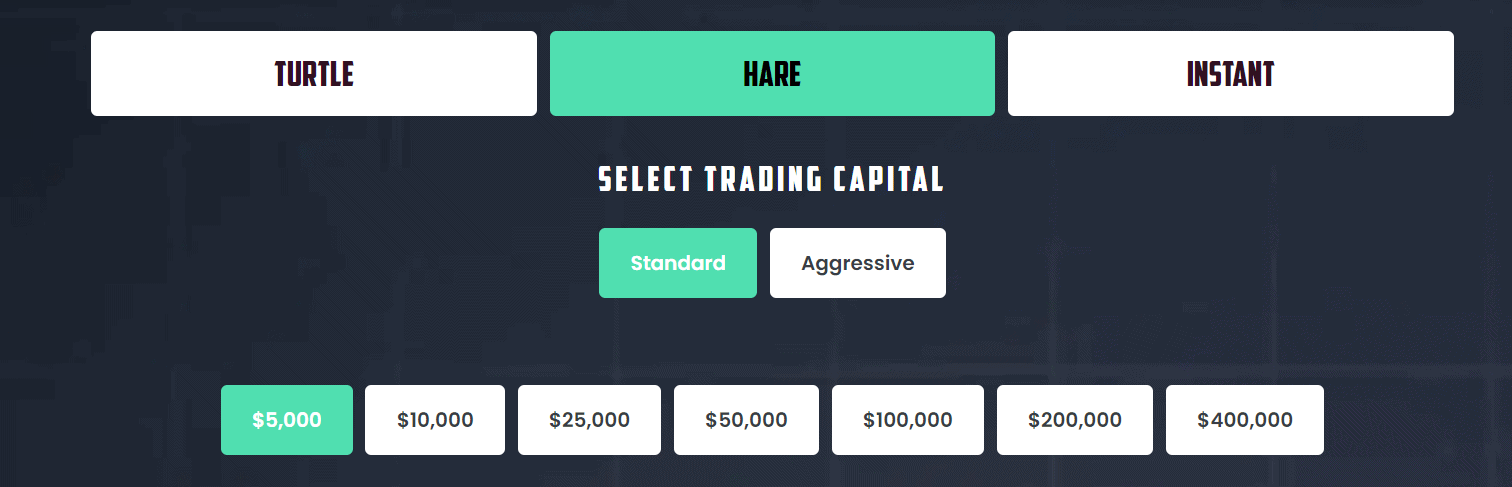

Account Balance and Registration Fee

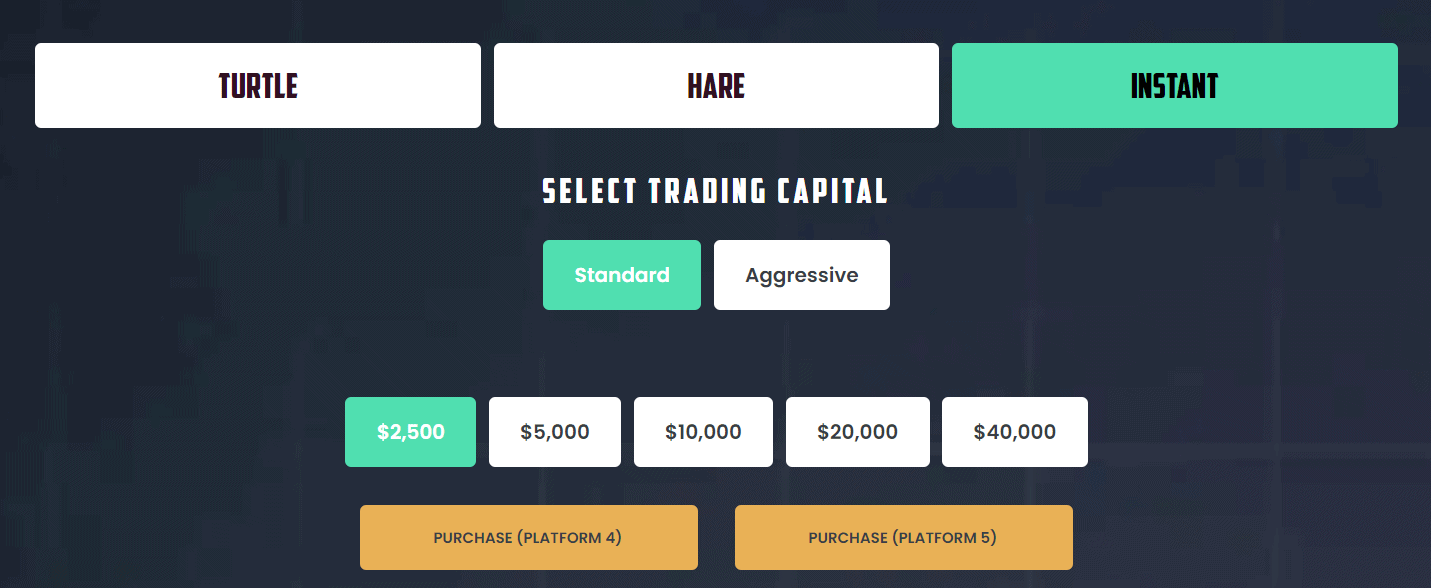

Prior to initiating your Traders with Edge login, you must first choose the Program and Account Balance that aligns with your qualification goals. Depending on the size you select, the challenge conditions may vary slightly. This choice also influences the registration fee you’ll be required to pay to participate in the challenge. It’s worth noting that the company offers a refund of the fee once you achieve the status of a Funded Trader. Please refer to our Registration Fee comparison table below for details:

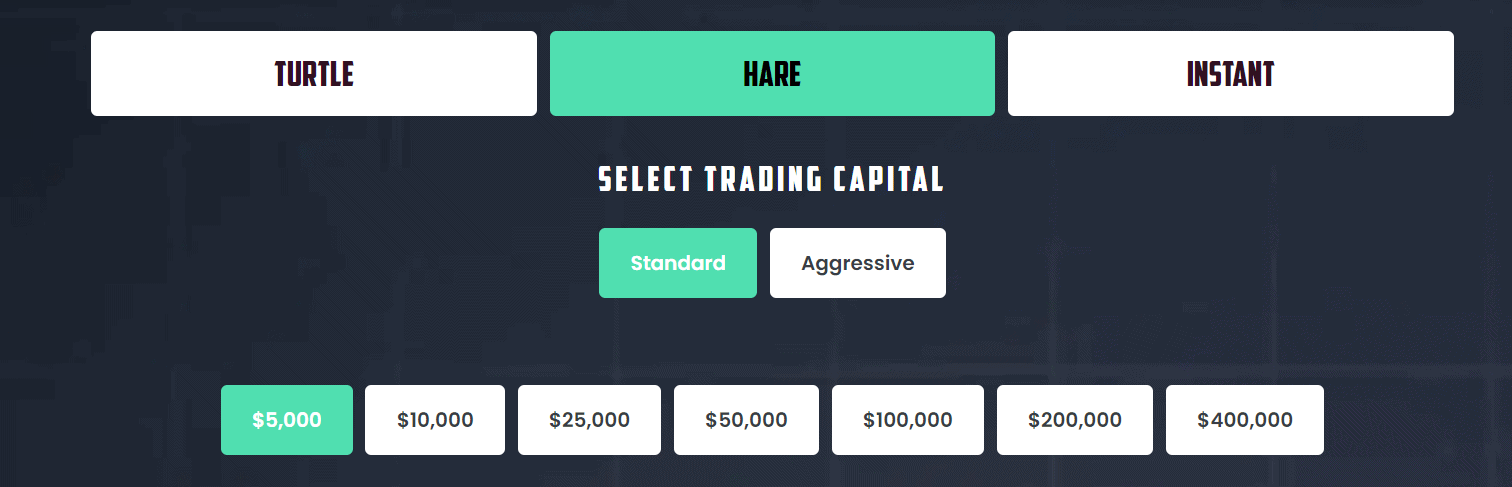

- Traders with Edge offer challenges, such as the Hare and Turtle challenges, where traders must meet specific targets without breaching rules to qualify for funding. The Hare challenge, for instance, involves a two-phase evaluation process targeting fast-paced traders, with varying maximum daily loss and profit targets depending on the trading format (standard or aggressive). The Turtle challenge is more suitable for consistent traders.

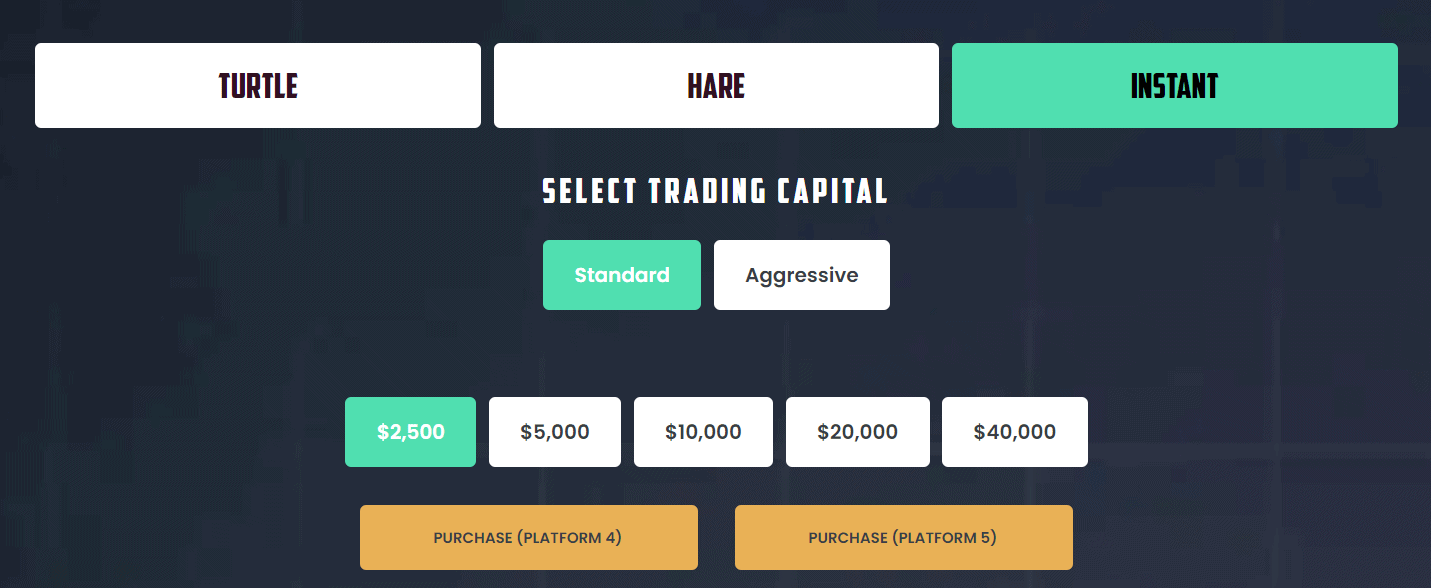

- For experienced traders, Traders with Edge offers instant funding, which bypasses the lengthy evaluation process, allowing quick access to trading capital.

- Traders with Edge provides various account sizes for traders, including the Hare Account with funding from $5,000 to $100,000, and instant funding accounts ranging from $2,500 to $20,000. Additionally, they offer scaling options that can increase account balances up to $1.28 million and high-end funded accounts up to $1,000,000

| Fees | Traders with Edge | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $5,000 | $10,000 | $50,000 |

| Fee | $95 | €155 | $289 |

| Maximum Account Size | $1,000,000 | $200,000 | $400,000 |

| Fee | $5,997 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

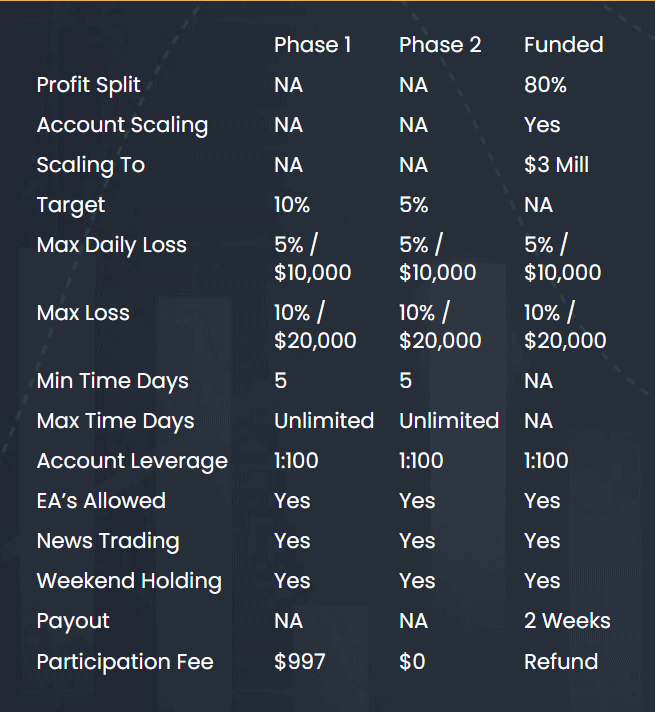

At Traders with Edge, the profit targets for traders vary based on the account type. For the Hare Standard Accounts, the target is 10% in phase 1 and 5% in phase 2. In contrast, the Hare Aggressive Accounts have higher targets, with 20% in phase 1 and 10% in phase 2. These targets are part of the firm’s evaluation process, designed to assess a trader’s ability to generate profits under specific conditions before they are eligible for funding

Maximum Loss

In the Traders with Edge program, both daily and overall loss limits are defined based on the account type. For Hare Standard Accounts, the maximum daily loss is set at 5%, with an overall maximum loss limit of 10% per phase. In contrast, Hare Aggressive Accounts have higher thresholds, allowing a maximum daily loss of 10% and an overall maximum loss of 20% per phase

- To clarify well All set rules have to be in line at the stage of challenge, otherwise your test will be canceled and you will either have to reset it, meaning pay another reset fee to participate to challenge from the beginning.

Minimum Trading Period

For Traders with Edge, the minimum trading period varies by program. The Turtle Challenge has no set minimum period, while the Hare Challenge and Instant Funding accounts require trading on at least 5 different days to meet scaling criteria

See the detailed table with Traders with Edge challenge conditions based on Account Size:

Traders with Edge Hare Challenge

Free Trial

Traders with Edge offers a 14-day trial of their trading challenges for a small fee of $15 per account. This fee covers technology costs. The trial includes different challenge formats like the Turtle and Hare challenges, each with set targets and rules.

Traders with Edge Funded Account

Once a trader successfully passes the test or challenge, their Funded Account will be established, typically within a few business days of verification. It’s crucial to understand that the account conditions and balance will match the qualifications obtained during the test. If a trader wishes to upgrade to a higher-grade Account, they will need to start from scratch by passing the test for the specific Account Balance they prefer to trade with.

Profit Split

At Traders with Edge, the profit split for traders varies by account type. Standard challenge accounts typically offer an 80% profit share to the trader. For Instant Funding accounts, the profit split starts at 50%, but traders have the option to increase this by 10% through customizations. The terms for Aggressive accounts are not explicitly detailed but may offer different splits due to their higher risk nature. These profit shares reflect the trader’s portion of the profits earned on their trades

Traders with Edge Instant Funding

Payout and Withdrawals

At Traders with Edge, traders can request payouts and withdrawals from their accounts once every 14 days. Eligibility for withdrawal requires reaching phase 2 in a funded account and having traded for a minimum of ten days.

Withdrawal Method

Various methods are available for withdrawing profits, including BTC, Wise, USDT, and bank transfers. When a withdrawal is made, Traders with Edge simultaneously deducts its share of the profits.

Account Conditions

We carefully assess the broker’s account options, platforms, instruments, trading costs, leverage levels, and trading conditions. Some brokers may restrict certain strategies in Funded accounts, potentially resulting in account loss and the need to retake the test. See the detailed breakdown below:

Trading Instruments

Traders with Edge offers a broad range of trading instruments, including Forex for currency trading, various digital currencies, commodities like metals and energy, major global indices, and a selection of individual company stocks. This diverse portfolio enables traders to apply various strategies across different markets and asset types, catering to a wide range of trading preferences and styles

Traders with Edge Commission

For more detailed information on the commission structure, participation fees, and other specific terms and conditions, it’s advisable to visit the Traders With Edge website or contact them directly.

Leverage

The leverage offered by Traders with Edge varies depending on the account type. For the Turtle and Hare accounts, the leverage is typically set at 1:100. In the case of Instant Funding accounts, the standard option also offers a leverage of 1:100. However, traders have the option to customize their accounts, which can include doubling the leverage.

Traders with Edge App Platform

Traders with Edge offers access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely used in the forex trading community and are known for their robust features, including advanced charting tools, a wide range of technical indicators, and automated trading capabilities through Expert Advisors (EAs).

Trading Conditions

Traders with Edge has thoughtfully crafted its trading conditions to establish an equitable and structured trading environment. These conditions provide traders with opportunities for profit and advancement in their trading pursuits.

- Traders with Edge allows a variety of trading strategies without imposing strict limits. This includes discretionary trading, hedging, and algorithmic trading. However, they have rules against certain practices like tick scalping (rapidly opening and closing trades), arbitrage, hedging between accounts, and unrealistic fills

- Traders with Edge, like many trading platforms, may experience slippage, which is a common occurrence in trading, especially around times of high market volatility or news announcements. Slippage happens when there is a difference between the expected price of a trade and the price at which the trade is actually executed.

Traders with Edge Promotions

Traders with Edge Alternative Brokers

Taking into account all the information we’ve gathered about Traders with Edge, we can conclude that the firm presents an appealing opportunity for Funded Traders. The company offers competitive costs compared to industry competitors and provides a range of programs with varying costs, expanding the possibilities for traders with budget constraints. It’s important to note that they offer a free trial, providing traders with an opportunity to test their services and assess the platform before making a financial commitment.

While considering Traders with Edge, it’s wise to compare their proposal with other Prop Trading Firms. Some well-known alternatives may offer similar conditions or better suit specific trader preferences, such as instrument variety or alternative trading platforms. However, Traders with Edge also boasts notable advantages. See our selection of alternatives and the comparison table below for more insights.

Share this article [addtoany url="https://55brokers.com/traders-with-edge-review/" title="Traders with Edge"]