- Is TMGM safe or a scam?

- Leverage

- Accounts

- Spread

- Deposits and Withdrawals

- Minimum deposit

- Trading Platform

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in the Forex market have checked trading offerings including fees, spreads, instruments, platforms, as well as verified licenses; then we contacted customer support and placed trades to evaluate trading conditions and give expert opinion about TMGM

What is TMGM?

TMGM, or Trademax Global Markets, is a Global broker offering traders access to CFDs in Forex, Metals, Energies, Indices, Shares, and Cryptocurrencies. At the beginning of the development, TMGM group started its operation in Australia back in 2013 when received its license from ASIC to provide OTC derivative and forex trading. Further on, for years of progress and continuous strives, the company brought a consistent and reliable DMA (Direct Market Access) trading environment without any human intervention.

Currently, the broker has spread its services across 150+ countries. While the main headquarter seats in Sydney, it holds several additional offices in Melbourne, Adelaide, Brisbane, Limassol, and Canberra, as well as regional offices in New Zealand and Taiwan.

TMGM Pros and Cons

TMGM is a reliable broker with good regulation and great conditions authorized by top-tier ASIC and FMA regulatory bodies. The broker provides an NDD trading environment with easy digital account opening. There’s a good range of trading education suitable for traders of all expertise levels, as well as Trading Central for enhanced research capacity.

As for the cons, the range of the market is rather limited trading only FX and CFD instruments, besides conditions and availability of the assets depend on the jurisdiction. Also consider, that it may charge fees for account inactivity. Another disadvantage is that international trading is done through an offshore entity.

| Advantage | Disadvantage |

|---|

| Established broker with multiple regulations | Only FX and CFD trading |

| Good reputation and a decade of operation | Conditions vary based on the entity |

| Low Spreads | Runs an offshore entity |

| 24/7 support | |

| Competitive trading conditions | |

| Low forex fees | |

TMGM Review Summary in 10 Points

| 🏢 Headquarters | Australia |

| 🗺️ Regulation and License | ASIC, FMA, VFSC |

| 🖥 Platforms | MT4, MT5, IRESS |

| 📉 Instruments | 100+ currencies, Commodities, Indices, Futures, Cash DMA Stocks, Options, Bonds and ETFs |

| 💰 EUR/USD Spread | 0.1 pips |

| 💳 Minimum deposit | US$100 |

| 💰 Base currencies | Multiple currencies |

| 🎮 Demo Account | Provided |

| 📚 Education | Vast range of online and offline educational support |

| ☎ Customer Support | 24/7 |

Overall TMGM Ranking

Overall, TMGM is a reliable broker with a good reputation and optimum conditions suitable for beginner and experienced traders alike. The broker spreads its offerings across the globe making international trading accessible for all. Another advantage is the broker’s relatively low fees and the minimum deposit is in line with industry standards.

- TMGM Overall Ranking is 8.6 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | TMGM | Dukascopy | OctaFX |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantage | Trading Conditions | Market Range | Deep Liquidity |

TMGM Alternative Broker

However, we found some disadvantages too, broker’s market offering is limited to FX and CFDs only meaning that there’s no real trading of assets only speculations on the asset’s price movements. Also, the conditions vary depending on the entity, and international trading is conducted through offshore regulation. So we’d also recommend you look through alternative brokers as well:

Is TMGM safe or scam?

No, TMGM is not a scam. The broker is well-established and regulated by several top-tier regulations ensuring traders’ safety and transparent conditions and transactions.

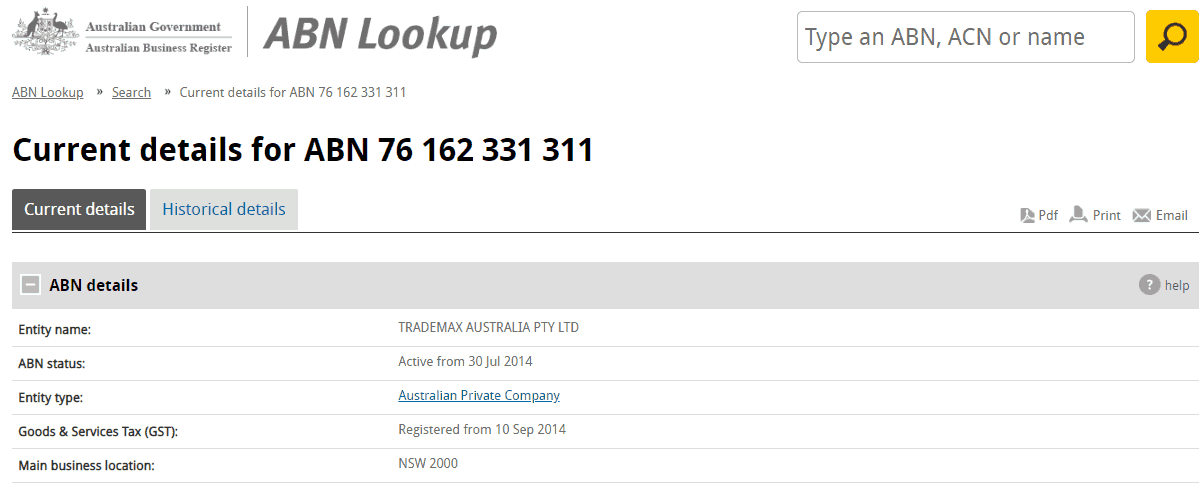

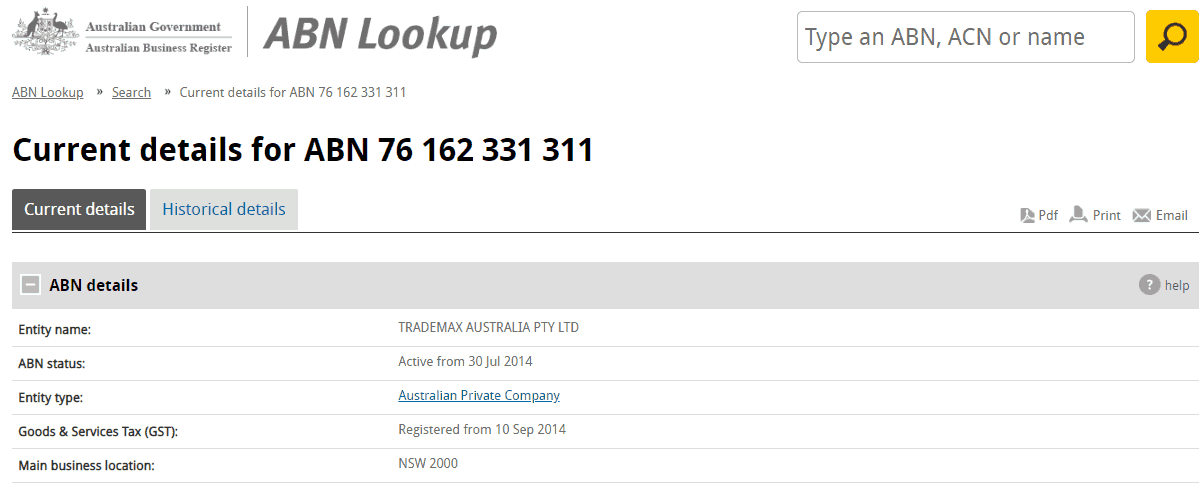

Is TMGM regulated?

TMGM, or Trademax Australia Limited, is a financial services company regulated by the Australian Securities and Investments Commission (ASIC) which adheres to strict standards. The ASIC regulation is among the strictest authorities worldwide, which ensures stability and trustable maintenance guidelines for the protection of the client.

Also, there is a TradeMax Global Limited entity that falls under the laws of Vanuatu, an offshore zone. While generally, we do not recommend trading with offshore brokers due to lack of requirements, since TradeMax holds an additional reputable license it is considered safe to trade.

See our conclusion on TMGM Reliability:

- Our Ranked TMGM Trust Score is 8.8 out 0f 10 for good reputation and operation over the years, being regulated by top-tier licenses ensures fair conditions and transparency. The only point is International trading available via the offshore entity.

| TMGM Strong Points | TMGM Weak Points |

|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity |

| ASIC and FMA regulated | Runs an offshore entity |

| Client protection | |

| Negative balance protection | |

| Compensation Scheme | |

How are you protected?

Along with that, there are numerous rules before a brokerage establishes among them are capital requirements that should meet the robust risk management and internal procedures, with sufficient cash equivalence that provides the broker’s reliability. All clients’ funds are held in a segregated trust account with National Australia Bank (NAB), as well the investors fall under the Professional Indemnity Insurance that places the compensation in case of the broker’s insolvency.

TMGM Leverage

While trading Forex you are able to use leverage, which allows you to profit from the fluctuations in rates through multiplied trading size, compared to your initial balance.

TMGM available leverage will depend if you are trading from Australia/New Zealand or outside these countries.

- In Australia where TMGM is regulated by ASIC, the maximum permitted leverage for Major forex pairs is 1:30 while Minor pairs are 1:20. This is in line with European and UK regulators. However, if you’re a pro trader on the TMGM platform, those numbers jump to 1:400 for both Major and Minor forex pairs.

- In New Zealand where TMGM is regulated by FMA, the maximum permitted leverage is 1:400 for forex

- If you are trading with TMGM and you reside outside these two countries and trading via International entities then the maximum leverage when trading forex is 1:500.

Leverage is a loan provided to a trader by the broker with the possibility to multiply potential gains, however, we recommend you learn how to use the tool smartly and not involve yourself in the highest risk.

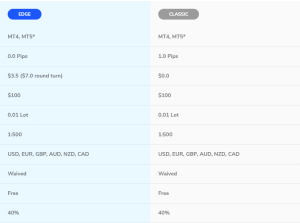

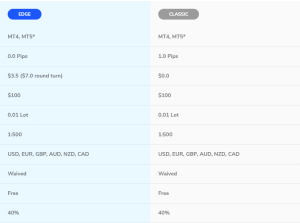

What are TMGM account types?

Based on our research, TMGM offers multiple trading accounts that provide you with the features and functionalities you need no matter what your trading experience level is. Whether you’re a long-term investor or a day trader, TMGM has a trading account designed for your needs. Users have the choice between a TMGM Classic account and a TMGM Edge account.

| Pros | Cons |

|---|

| Easy and quick account opening | Account types and proposals may vary according to jurisdiction |

| Demo Account available | Commissions charges for Edge Account |

| The proposal between Accounts based on spread only or based on commission | |

Swap-free account

If you can’t pay or receive interest due to your religious beliefs, TMGM also offers a Swap Free account. Swap-Free accounts are only available for Edge account types which means they have a $100 minimum deposit and a 0.01 lot minimum lot size.

Demo Account

TMGM offers a Demo account using the MetaTrader 4 trading platform. You can choose between three funding amounts for your demo account: $5,000, $10,000, and $50,000. However, your access will be removed if there is no activity for six months.

Trading Instruments

Overall, TMGM market offer comprises over 12,000 trading products available across 7 asset classes including forex, indices, shares, cryptocurrencies, precious metals, and energies with deep liquidity and tight spreads across all the assets.

- TMGM Markets Range Score is 8 out 0f 10 for a good selection of trading instruments, yet the only gap is that the range is m=limited to FX and CFD trading, and the proposal and conditions may differ based on the entity

TMGM Fees

Based on our research, TMGM pricings are either built into spreads or commission-based depending on which account type you choose. The prices are provided by multiple liquidity providers, spreads are low for almost all asset classes. The broker also doesn’t charge any deposit/withdrawal fees. there’s only an inactivity fee in case you don’t trade for more than six months.

- TMGM Fees are ranked low with an overall rating of 8.8 out of 10 based on our testing and compared to over 500 other brokers. Pricing might be different depending on the entity and account type, but overall are low and favorable. See our findings pf TMGM fees below:

| Fees | TMGM Fees | XM Fees | AvaTrade Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low/average | Average | High |

Spreads

TMGM’s Classic account type offers spreads from 1 pip. However, no commission fees are included, since they’re already part of the spread. The Classic account type is ideal for anyone who prefers to use mid or long-term strategies that aren’t spread-dependent.

By comparison, the TMGM Edge account offers the site’s lowest spreads, which start at 0 pips. Users will pay a $7 commission round turn ($3.50 one way) for each standard lot. The Edge account is the account that most closely resembles ECN trading since there is no dealing desk.

- TMGM Spreads are ranked low with an overall rating of 8 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average of 1 pip for EURUSD, and spreads for other instruments are very attractive too

| Asset/ Pair | TMGM Spreads | Pepperstone Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1 | 0.77 pips | 1.3 pips |

| Crude Oil WTI Spread | 1 pip | 2.3 pips | 3 pips |

| Gold Spread | 0.7 | 0.13 | 40 |

| BTC USD Spread | 3.2 | 31.39 | 0.75% |

Deposit and Withdrawal Methods

Based on what we found, account funding on TMGM can be performed by multiple secure methods with zero transaction fees and includes BankWire transfers, Cards payments, PayPal, UnionPay, POLi, and fasapay. The account base currency is a choice of the trader, so it means all your transactions to and from the trading account will be performed with the chosen currency making it an easier process.

- TMGM Funding Methods we ranked Excellent with an overall rating of 8.6 out of 10. The minimum deposit is in line with industry standards, the fees are either none or very small, however, conditions may vary based on the entity

Here are some good and negative points for TMGM funding methods found:

| TMGM Advantages | TMGM Disadvantages |

|---|

| Fast digital deposits, including Neteller, and Credit Cards | Methods and fees vary in each entity |

| $100 minimum deposit | |

| $0 deposits and withdrawals fees | |

| Multiple Account Base Currencies | |

Deposit Options

As for deposit options, TMGM offers a good range of funding methods including Debit/Credit Cards, Bank Transfers, and multiple e-payment wallets. A bank transfer can take several business days, while payment with a credit/debit card is instant. However, you should check the availability of the methods according to the entity and country of residence.

What is TMGM minimum deposit?

Minimum deposits when opening an account start is $100 however higher amounts may be needed to execute a trade. This is because you will still need to meet margin requirements. The Classic account does not charge a commission, however, you’ll experience higher spreads. Comparatively, Edge accounts require a $7 commission fee with tighter spreads. Regardless of the account type you select, you’ll have ECN execution with a 0.01 minimum lot size.

TMGM Minimum deposit vs other brokers

|

TMGM |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

TMGM Withdrawals

TMGM uses the same funding options for withdrawals as for deposits. TMGM charges no fees for withdrawal. However, you should take into account the bank processing fee based on your bank’s terms and conditions.

How do you withdraw from TMGM?

To withdraw money from TMGM, you need to go through the following steps:

- Log in to your account

- Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu

- Select the withdrawal method and/or the account to withdraw to

- Enter the amount of money to be withdrawn and verify and process

Trading Platforms

TMGM trading technology and software provide great performance with additional tools including, enhancing its technical capabilities. The broker offers three trading platforms: MetaTrader 4, MetaTrader 5, and IRESS, and it doesn’t provide any proprietary platform based on our findings.

- TMGM Platforms are ranked Excellent with an overall rating of 8 out of 10 compared to over 500 other brokers. We marked an excellent choice of best-performing platforms including MT4, MT5, and IRESS, all equipped with sophisticated features and technologies

Trading Platform Comparison to Other Brokers:

| Platforms | TMGM Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Desktop Platform

Along with that, the inbuilt platform IRESS. IRESS is a better choice over MetaTrader 4 if you plan to trade shares since IRESS allows you to trade on exchanges in the following countries – the United States, Australia, The United Kingdom, Hong Kong, China, and Singapore.

Direct market Trading

- The other benefit of IRESS is that it offers exchange pricing and market depth. This is because IRESS uses Direct Market Access (DMA) trading. DMA means you Level 2 Market Depth Order Book pricing, that is you can view live orders from institutional liquidity providers connected to the exchange. MetaTrader 4 does not offer DMA.

- The main thing to be aware of is the high minimum deposit fee of $5,000 USD. So IRESS is for serious traders only. To use IRESS you will need an IRESS account. Minimum deposits for IRESS are high as DMA trading is mostly for professional traders. The cost will differ between stock exchanges. The below shows costs for US stock exchanges.

TMGM Customer Support

TMGM Customer Support

Another good point from TMGM is its quality customer support provided via Live, Email, and international phone calls. The support is multilingual and available 24/7. The support is knowledgeable and provides quick relevant answers to your queries.

- Customer Support in TMGM is ranked Excellent with an overall rating of 9 out of 10 based on our testing. We got fast and relevant responses as compared to other brokers, also quite easy to reach during the weekends

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick and relevant responses | None |

| Live Chat available | |

| Multilingual Support | |

| 24/7 availability | |

Education

In addition to customer support, we found that TMGM offers a unique feature called TMGM Academy. Through the TMGM Academy, you can learn about the ins and outs of forex trading. There are three stages available, Beginner Stage, Intermediate Stage, and Advanced Stage. It consists of three stages:

- The beginner stage prepares you for your journey into forex trading. The Beginner Stage develops a strong foundation based on understanding margin trading, how to read various types of charts, plus an introduction to trading instruments, oscillators, indicators, and support plus resistance.

- TMGM Academy’s Intermediate Stage starts focusing on more technical aspects of forex trading. This includes considering indicators like MACD, RSI, ATRs, Moving Averages, and more. Additionally, TMGM introduces Fibonacci and Fundamental analysis, plus effective ways to employ them in trading.

- The Advanced Stage in the TMGM Academy is where traders get deep into various trading strategies and how to apply them. This stage includes learning about advanced forms of Fibonacci extensions and retracements, RSI, correlation, and trade management.

Our conclusion on TMGM Education:

- TMGM Education ranked with an overall rating of 9.8 out of 10 based on our research. The broker provides quality education suitable for all traders. The resources are free of charge and available in different forms including articles, guides, video tutorials, glossaries, etc.

TMGM Review Conclusion

Overall, our experience with the broker was quite positive. Throughout several years of operation, TMGM has proven itself as a good broker with a reputation, holding top-tier licenses from AISC and FMA. It provides transparent trading conditions with a state-of-the-art education section. The broker has a very competitive pricing model with low fees and spreads providing high leverage trading through industry-standard platforms. Overall, TMGM provides a really competitive offering as compared to other brokers.

Based on Our findings and Financial Expert Opinion TMGM is Good for:

- Beginning Traders

- Professional Traders

- EAs running

- Copy Trading

- Scalping / Hedging Startegies

- Traders who prefer MT4 or MT5 platform

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- High Leverage Trading

- Free VPS Tools

Share this article [addtoany url="https://55brokers.com/tmgm-review/" title="TMGM"]

TMGM Customer Support

TMGM Customer Support

dont use the tmgm becuse high rate for slippage

I made the deposit by sticapay but I can’t withdraw by sticpay, they said they accept deposit by sticpay but they don’t accept withdrawal

now the withdrawal has been processed and I have not received it in my bank account or in sticpay

I made the deposit by sticapay but I can’t withdraw by sticpay, they said they accept deposit by sticpay but they don’t accept withdrawal

said they accept deposit by sticpay but do not accept withdrawal

Our deposit and withdrawal options are shown on our website and Sticpay is not shown under the withdrawal section

Bank(银行名称): National Australia Bank

Account Name(收款人姓名): TRADEMAX GLOBAL USD CLIENT TRUST ACCT

Account Number (收款人账号): TRMAXUSD01

SWIFT Code: NATAAU3303M

Bank State Branch (BSB) number: 082-039(Optional)

Bank Branch Address(银行地址): Level 2, 28 George St, Parramatta NSW 2150

Beneficiary Address(收款人地址): Level 40 One International Towers, 100 Barangaroo Avenue, Sydney New South Wales 2000

Phone Number(收款人电话): +61 2 8036 8388

** 根据国际反洗钱法的规定, TradeMax 不接受任何第三方入金,入金必须使用您本人的银行账户。 如果被确认为第三方入金, TradeMax 会为您退款,退款可能会产生银行费用,同时耗时较长。 所有的时间/资金损耗需要由客户自行承担。 (第三方:除客户本人外的人或者机构。)

** 建议您电汇资金的币种与电汇的信托账户币种保持一致,以免多次换汇造成2002_NathalieHuang汇率损失

** 电汇可能会产生银行费用,请联系您的银行来详细咨询中间行费用。

** 大于1万美元的电汇需要在此上传电汇单。

Pls confirm back if the above account details us your company’s account address? I will remit payment to your company now through the your Asia agent no.2002_NathalieHuang, does your have this agent? I am afraid to be cheated.

Hi

Im chasing a broker that I can trade Forex and ASX stocks on the MT5 preferably but MT4 would be ok platform. Is this possible with you guys and do you allow both with a demo account?