- What is TD Markets?

- TD Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

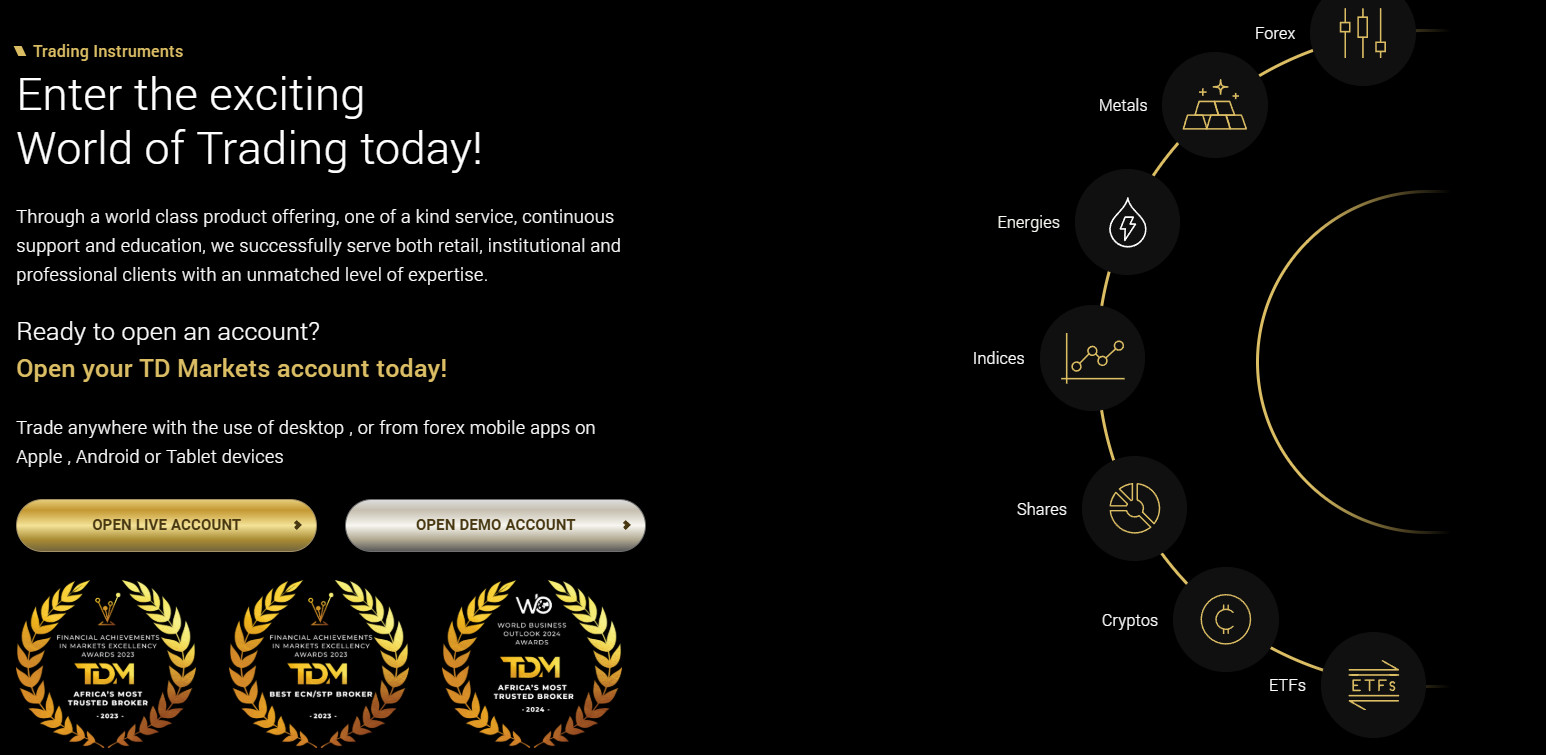

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- TD Markets Compared to Other Brokers

- Full Review of Broker TD Markets

Overall Rating 4.3

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4. 5 / 5 |

| Additional Tools and Features | 4 / 5 |

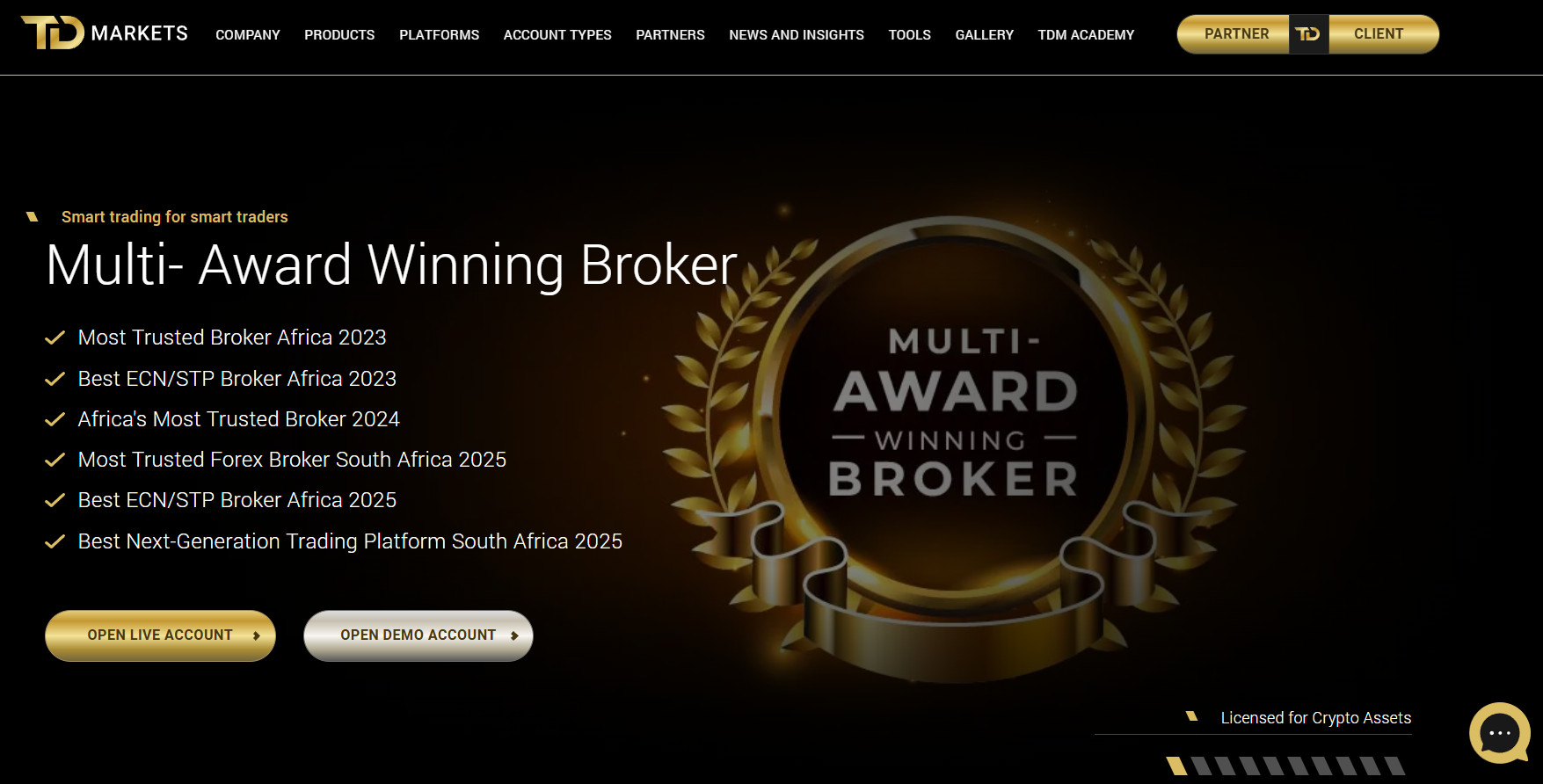

What is TD Markets?

TD Markets is an FX and CFDs company of TDM Holdings Inc., which is registered with the Financial Services Authority of St. Vincent and the Grenadines under number 23129 IBC. The broker operated under an offshore license for a long time and was considered an unregulated and untrustworthy choice. However, TD Markets itself is now registered in South Africa and is tightly regulated by the Financial Sector Conduct Authority.

The broker ensures a favorable and regulated trading environment, with access to numerous financial assets, including Forex, metals, energies, shares, ETFs, and cryptocurrencies. Trades are conducted through the popular MT4 and MT5 platforms, equipped with advanced tools and features. TD Markets also offers social trading and Cooma trading.

As we found, the education section of the broker stands out for different helpful resources, including tutorials, articles, webinars, and one-on-one mentorship sessions. The broker’s customer support is available 24/5 via live chat, email, and phone lines.

TD Markets Pros and Cons

TD Markets is a regulated broker in South Africa with a serious license from the FSCA.

TD Markets offers a diverse selection of 200 tradable products through the retail MT4/MT5 platforms. Besides, one of the advantages of the proposal is the availability of various trading accounts, with different conditions and opportunities. The education section, TD Academy, is another key strength of TD Markets, offering a variety of educational resources.

However, the broker has a few disadvantages, one of the biggest being its previous unregulated status. Additionally, customer support is not available 24/7, which many traders might see as a disadvantage.

| Pros | Cons |

|---|

| The FSCA regulation and oversight

| No 24/7 customer support |

| Availability in the South African region | Previous regulatory concerns |

| Availability of the MT4 and MT5 platforms | |

| TD Academy | |

| Social Trading | |

| Low minimum deposit | |

| High leverage opportunity | |

TD Markets Features

TD Markets holds a license from the well-respected FSCA, making the broker’s services safe and reliable. The broker’s trading conditions are competitive and favorable, ensuring successful trades. To see how the broker can meet specific trading needs, we have compiled a list of the broker’s main aspects:

TD Markets Features in 10 Points

| 🗺️ Regulation | FSCA, SVG |

| 🗺️ Account Types | Cent, Gold, Pro, Mini, Crypto, Max and Islamic accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, metals, energies, shares, ETFs, and cryptocurrencies |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Different currencies |

| 📚 Trading Education | TD Academy |

| ☎ Customer Support | 24/5 |

Who is TD Markets For?

We have carefully considered the broker’s proposal to see what it offers and who the broker’s services can be most beneficial for. Based on our research and expert opinion, here is what TD Markets is good for:

- Beginner traders

- South African traders

- Currency Trading and CFD Trading

- Social trading

- Trading through MT4 and MT5 platforms

- Advanced traders

- Cryptocurrency trading

- Suitable for various trading strategies

- Traders who are looking for different fee structure opportunities

- Clients looking for sufficient education

TD Markets Summary

TD Markets offers competitive trading conditions, a safe trading environment, and a range of services to meet any trading expectations. The good point about the broker is the variety of financial assets available and trading through the market’s popular MT4 and MT5 platforms.

Besides, TD Markets offers a selection of trading accounts, enabling traders to choose the most efficient option. Beginner traders can access a demo account and practice trading without risk. Additionally, they can benefit from the available educational resources and boost their trading knowledge. All in all, TD Markets can be a favorable choice for many clients who prioritize the safety of trades and advanced features.

55Brokers Professional Insights

With its easy-to-use yet advanced and quite innovative solutions, TD Markets is a favorable trading choice, especially for traders from South Africa, since the broker now holds a license from the FSCA in South Africa, even though been previously red-flagged by us due to absence of the license, now it is considered safe and favorable for trading in the region.

Provided software is on good quality mainstaying on the popular MT4 and MT5 platforms, also one of the broker’s advantages is the availability of various account types, suitable for different experience levels. The trading costs are reasonable, with average spreads of 1.8 pips, also you may choose commission-based accounts, which we find very competitive, as commissions are only $1 per trade.

Also, TD Markets has expanded its educational section, offering a TD Academy with trading courses, videos, articles, one-on-one mentorship, so are good for beginning traders alike. With our final thought, TD Markets is a quality choice for now, also for the years the broker operates, along with the obtaining of the licenses, gives a reasonable advantage to trust the trading process provided.

Consider Trading with TD Markets If:

| TD Markets is an excellent Broker for: | - Traders from South Africa

- Beginner traders

- Advanced clients

- Different trading strategies

- For those who prefer the MT4/MT5 platforms

- Social traders

- Islamic traders

- Cryptocurrency traders

- Beginner traders looking for good educational materials |

Avoid Trading with TD Markets If:

| TD Markets is not the best for: | - Long-term investors

- Real stock traders

- Clients looking for platforms other than the MT4 and MT5 platforms

- Traders prioritizing top-tier regulation and oversight |

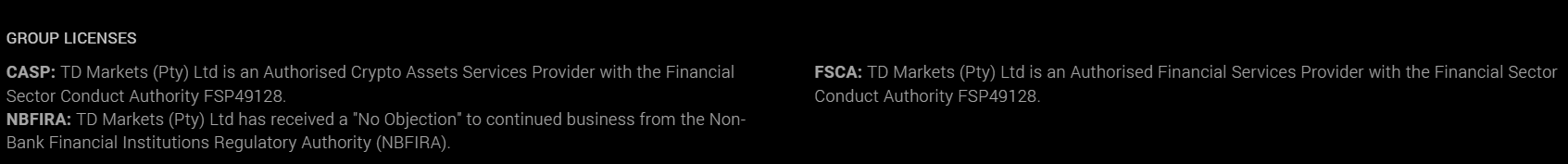

Regulation and Security Measures

Score – 4.2/5

TD Markets Regulatory Overview

Based on our research, TD Markets is a regulated broker with tight rules and good oversight. The broker is primarily regulated in South Africa by the FSCA, a respected authority in the region. The license assures the reliability and transparency of trades.

- TD Markets (Pty) Ltd is also an Authorised Crypto Assets Services Provider with the Financial Sector Conduct Authority, FSP49128.

- We have also found that TD Markets is a part of TDM Holdings Inc., which is registered and regulated by the St. Vincent and the Grenadines Financial Services Authority (FSA).

For many years, the broker operated with an offshore license, but the current FSCA regulation makes the broker a secure choice for trading.

How Safe is Trading with TD Markets?

Safety measures with TD Markets are enforced by the South African FSCA regulations. Although the broker does not have a top-tier license, which ensures stricter safety measures, the broker offers segregation of clients’ accounts. This means that TD Markets cannot use its clients’ funds for company operations.

- Although the FSCA license provides a certain level of protection, it does not compensate its clients in the event of insolvency.

Consistency and Clarity

Although TD Markets has been in the market for many years, the broker has operated with an offshore license for a considerable time. At present, TD Markets is regulated by the FSCA, ensuring compliance with strict rules.

We have reviewed the broker from the viewpoint of consistency and clarity. Firstly, as the broker has acquired a serious license, it shows a shift in the positive direction. The broker has also been awarded multiple times, which confirms once again the quality of the service.

We have also reviewed feedback from TD Markets’ customers to see what they share about the broker. Many traders share their positive experiences, pointing out the dedicated customer support, low spreads, and fast execution. However, some clients share their concerns about the broker’s security and the insufficient withdrawal process.

To conclude, TD Markets now operates under the FSCA and is considered a favorable broker, especially for South African clients. However, potential clients should weigh both the advantages and the negative points before opening an account with the broker.

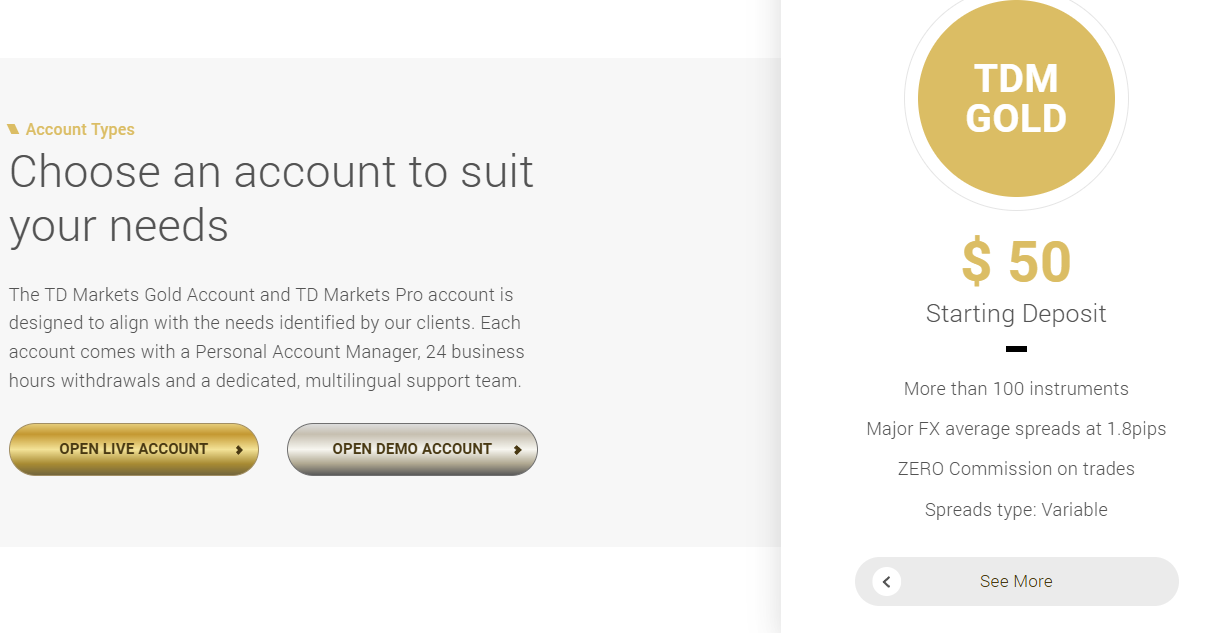

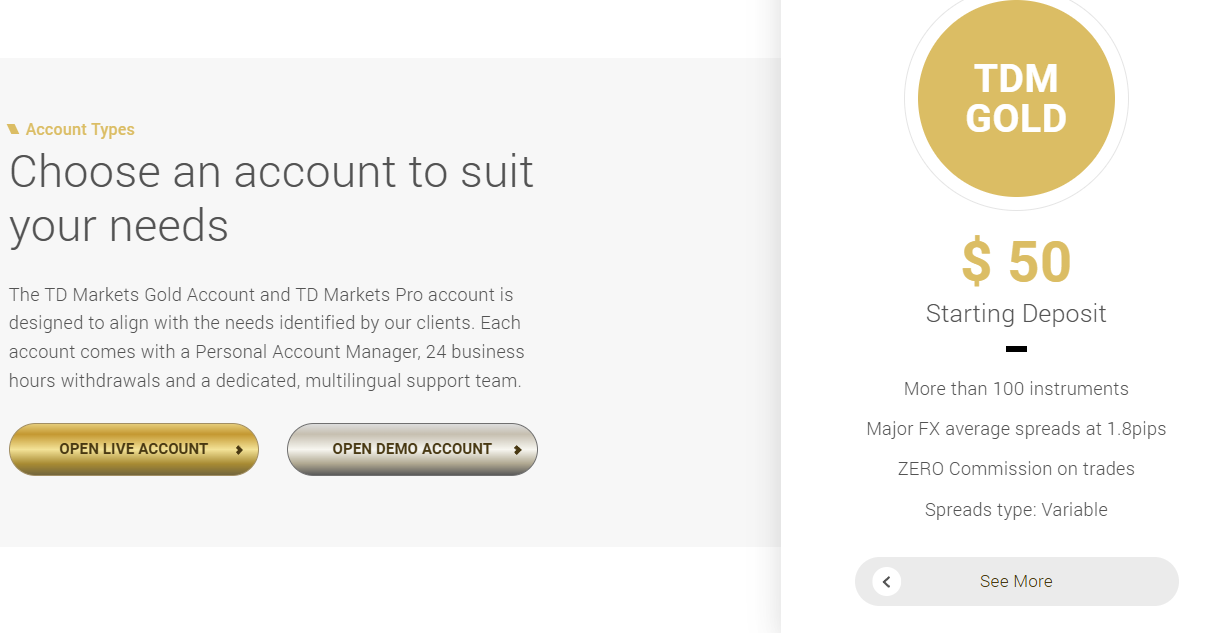

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with TD Markets?

One of the good points of TD Markets is that the broker offers a wide selection of account types: TDM Cent, TDM Mini, TDM Gold, TDM Max, TDM Crypto, TDM Islamic, TDM Max, and TDM Pro. Each account type comes with its own conditions and advantages.

- To open a TDM Cent account, there is a $10 requirement. The account type is based on raw spreads, starting from 0.2 pips. With the Cent account, traders can access over 100 tradable products across FX, commodities, stocks, and indices. The maximum account leverage is 1:500. This account type is tailored for beginner traders to start small, with minimal risks and investment.

- TDM Mini has a $50 minimum deposit requirement. The account is based on raw spreads, starting from 1.8 pips, and commissions of $1 for a mini lot. This account type is suitable for mid-level traders who seek stability, flexibility, and cost efficiency. The available instruments are over 100, including FX, CFDs, metals, and cryptos. The account denomination currency is USD.

- The TDM Gold account is suitable for traders looking for simple, commission-free trading, with low variable spreads from 1.8 pips for Forex pairs. The initial deposit is $50. The account base currencies are USD and ZAR. The Gold account will be a good choice for beginners to intermediate traders looking for access to FX, Crypto, metals, and CFDs.

- TDM Max account is an entry-level account for traders who are looking for minimal investments and simplicity, combined with access to advanced features and opportunities. However, the spreads for this account type are higher, starting at 1.8 pips. There are no commissions for trades, and all the costs are integrated into variable spreads. The leverage ratios for the TDM Max account vary from 1:500 up to 1:2000. The available instruments are FX, Metals (Gold, Silver, and Palladium), and selected Indices (GER 30, SPX500, US30 & NAS100).

- The TDM Pro account is tailored for advanced and high-volume traders to start with a $1,000 initial deposit. The account offers very low variable, raw market spreads starting from 0.1 pips. However, traders will pay an $8 commission fee for each trade. This commission-based solution enables traders to predetermine all the applicable trading costs, which gives them more precision and predictability. The account’s base currencies are USD and ZAR.

- The broker also offers an Islamic account for Muslim traders. The account offers an opportunity to hold overnight interest-free positions. The account does not apply any commissions, and all the trading costs are integrated into average variable spreads. The spreads for Forex pairs start from 1.8 pips. The available leverage is up to 1:500 based on the instrument.

- The Crypto account enables access to over 11 cryptos, as well as to traditional instruments, including FX, commodities, indices, and stocks. The starting amount is BTC 0.03. The account offers raw spreads from 0.2 pips.

Regions Where TD Markets is Restricted

TD Markets accepts clients from all over the world. The broker is especially favorable for traders from the South African region. However, due to regulatory restrictions, residents from certain countries cannot trade with TD Markets. Here is the list of the restricted countries:

Cost Structure and Fees

Score – 4.4/5

TD Markets Brokerage Fees

Our research on TD Markets’ trading costs revealed competitive, transparent, and average fees across different trading instruments. The trading fees depend on the account type and the instrument traded.

TD Markets offers mostly variable or raw spreads that align with the market average. The broker’s spreads depend on the chosen account type. TD Markets includes both spread-based and commission-based accounts, tailored for different trading purposes. The average spread for the EUR/USD pair is 1.8 pips for most of its spread-based accounts. For the Cent account, spreads are low and start from 0.2 pips, enabling cost-conscious traders to access the market with minimal charges.

TD Markets’ commissions depend on the account type. The broker offers three commission-based accounts: the TDM Pro account ($8), the TDM Cent account ($0.1), and the TDM Mini account ($1).

How Competitive Are TD Markets’ Fees?

Overall, our research revealed a competitive and clear pricing structure. The broker’s fees are applied either through spreads or commissions. With an average of 1.8 pips for Forex pairs, the broker’s offering aligns with the market standards; for some instruments, it can be slightly higher.

However, both spreads and commissions depend on the chosen account type. For some accounts, the applied spreads and commissions are very low, enabling cost-efficient solutions. For instance, the Cent account’s charges are very low, enabling traders to start with minimum charges. The Pro account, on the contrary, has an $8 commission fee, which is slightly higher than the average; however, the account is tailored for advanced trading with a clear cost structure.

All in all, the broker enables any trader to find a suitable option for a beneficial trading outcome.

| Asset/ Pair | TD Markets Spreads | Capital.com Spread | Eurotrader Spread |

|---|

| EUR USD Spread | 1.8 pips | 0.6 pips | 1 pips |

| Crude Oil WTI Spread | 2 | 0.4 | 0.030 |

| Gold Spread | 8 | 0.03 | 0.35 |

TD Markets Additional Fees

Based on our findings, the broker does not charge many additional fees. There are also no hidden fees, so clients can have a clear insight into fees before starting trading. There are no deposit or withdrawal fees, although some trading methods might apply transaction fees. Besides, the broker does not charge an inactivity fee, which is another advantage to consider.

Score – 4.3/5

With TD Markets, traders can conduct their trades through the market-popular MT4 and MT5 platforms. The platforms are equipped with the best tools and features, enabling traders to conduct in-depth analysis and research. Both platforms offer webtrader, desktop, and mobile versions. They are also easily downloaded for Windows, Linux OS, Android, and iOS systems, ensuring easy access.

| Platforms | TD Markets Platforms | Eurotrader Platforms | Capital.com Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platform | No | No | Yes |

| Mobile Platform | Yes | Yes | Yes |

TD Markets Web Platform

As we have found, TD Markets enables its clients to conduct trades through the web platform. They can access the platform from the broker’s website by clicking on the WebTrader option. It immediately transfers traders to the web platform without the need for installations and downloads. In addition to the simplicity of access, the web platform includes the most essential tools the desktop platform offers, without restricting them. TD Markets’ clients can easily analyze the market, place orders, and use different tools, such as technical indicators, real-time charts, trading history, and more.

The web platform interface is simple and easy to use, suitable for novice traders to navigate the platform successfully. All in all, the web platform is a great choice of platform that includes advanced features, easy navigation, and access right from the browser.

TD Markets Desktop MetaTrader 4 Platform

The MT4 platform is one of the most demanded platforms in the market, combining an easy interface with advanced features. The desktop platform ensures fast execution of trades. With the MT4 platform, clients can access a good range of instruments, including Forex, commodities, indices, stocks, and cryptocurrencies. The platform enables automated trading, allowing users access to Expert Advisors.

The MT4 desktop platform offers one-click trading, advanced charting, customizable features, access to the trading history, and backtesting. All in all, the platform is a perfect choice for beginners and experienced clients, offering every trader an opportunity for efficient trading.

TD Markets Desktop MetaTrader 5 Platform

The MT5 is a powerful platform that allows traders more opportunities and efficient trades. Clients can enter the platform through the web, desktop, and mobile versions, ensuring the same level of experience for all the platform options. The MT5 platform offers an impressive range of analytical tools, about 40 technical indicators, multiple timeframes, various charts, and analytical objects.

Compared to the MT4 platform, the execution time is even faster, ensuring that clients grasp market opportunities. The platform also provides market depth and includes essential analysis tools, such as the Economic Calendar. The platform also ensures enhanced security and reliability of trades.

TD Markets MobileTrader App

One of the advantages of mobile trading is the flexibility and access from anywhere. TD Markets enables its clients to access the mobile versions of the MT4 or MT5 platforms from the palm of their hands. The apps allow not only flexibility but also access to the most essential tools traders need for a positive trading experience. The app is available for both iOS and Android devices. Besides one-click trading, real-time charts and trading indicators can be used for deep market analysis.

Main Insights from Testing

Our testing of the TD Markets’ MT4 and MT5 platforms showed advanced, well-equipped platforms, ensuring reliable and efficient trades. Both MT4 and MT5 are available for web, desktop, and mobile options. The MT5 platform is the enhanced version of the MT4 platform. However, both platforms combine simplicity and enhanced features, leading to successful trades.

AI Trading

Based on our research, TD Markets offers AI-assisted tools for the automation of trades. However, the broker does not yet offer fully AI-powered tools. Traders who look for fully AI-driven solutions can consider alternative broker options, as many have already integrated AI trading into their proposals.

Trading Instruments

Score – 4.2/5

What Can You Trade on the TD Markets Platform?

We have also reviewed TD Markets’ tradable products to see the diversity of assets the broker offers. Traders can access FX, metals, energies, indices, shares, cryptocurrencies, and ETFs.

As we have found, currency traders can benefit from trading with TD Markets, as the broker offers 63 major, minor, and exotic FX pairs, providing great diversity and enabling traders to explore the market further.

However, the broker’s trading instruments are CFD-based; thus, traders cannot own real assets while trading with TD Markets.

Main Insights from Exploring TD Markets Tradable Assets

Based on our research, the broker offers over 200 tradable products to support its clients in the diversification of their trades. The amount of products provided will surely allow traders to explore new opportunities in the market; however, the overall number of available products is limited when compared to alternative brokers in the market. Besides, all the instruments are based on CFDs, eliminating the chances of long-term investments.

Yet, TD Markets offers a separate crypto account and a good range of cryptocurrencies, attracting crypto traders. The broker offers 3 energies (natural gas, Brent Crude Oil, and WTI Crude Oil). With TD Markets, traders also have access to 12 global indices, 114 shares, and over 19 ETFs.

To conclude, TD Markets offers various financial assets, enabling clients to trade with competitive trading conditions and in a reliable environment.

Leverage Options at TD Markets

Leverage is a crucial tool that enables traders to enter the market with smaller investments. The tool can lead to substantial profits; however, traders should have a clear understanding of how leverage works, so that it does not go against them.

Based on our research, TD Markets offers leverage by FSCA regulations. Unlike other authorities, such as ASIC or FCA, FSCA does not set very strict rules for leverage.

- TD Markets offers leverage of up to 1:500. The leverage ratio depends on the instrument traded and the account type.

- Professional traders can access higher leverage of up to 1:2000 for the TDM Max account type.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at TD Markets

TD Markets offers various flexible funding methods for quick and efficient deposits. The broker does not impose any deposit fees. For Bank transfers, there are no transaction fees for deposits above $200.

Here are the main deposit methods with TD Markets:

- Bank transfers

- Credit/debit cards

- Skrill

- Neteller

- Crypto deposits

Minimum Deposit

The minimum deposit with TD Markets depends on the account type. The TDM Max account has only a $5 funding requirement. For the Cent account, the deposit is $10. The highest funding requirement is $1,000 for the broker’s TDM Pro account.

Withdrawal Options at TD Markets

With TD Markets, traders can make withdrawals using the same method they used for deposits. All withdrawals are processed within a business day. The funds will reach the trader’s account within 1 to 5 working days, depending on the funding method. Clients are notified about the withdrawal status by email.

For withdrawals above $200, there are no transaction fees. For smaller withdrawals, there are additional costs.

Customer Support and Responsiveness

Score – 4.6/5

Testing TD Markets Customer Support

TD Markets has a dedicated customer support team, ensuring prompt and helpful assistance via different channels. Clients can contact the broker through Live chat, email, phone lines, and social media platforms. Also, the broker’s clients can send their questions through the online form from the ‘Contact Us’ section of the broker’s website.

Based on our findings, the overall client satisfaction with customer support is above average, with traders sharing their positive experiences with the broker.

Contacts TD Markets

TD Markets offers different communication options for traders to direct their questions, concerns, suggestions, and complaints. Here are the main channels for contact:

- The Live chat is a quick and helpful solution in any situation. Those who prioritize quick and efficient help will appreciate the broker’s live chat.

- Clients can also use the provided email to receive detailed answers to their questions and trading issues they are facing: care@tdmarkets.com.

- Many clients prefer to speak to the customer team members to receive direct and prompt solutions and directions. For this, the phone number provided is 010 300 0011.

- An online inquiry form is another efficient way to send a question to the broker’s team.

- TD Markets is also active on social media platforms, ensuring updated information on its operations and market development. Clients can reach TD Markets via Facebook, Instagram, X, and LinkedIn.

Research and Education

Score – 4.3/5

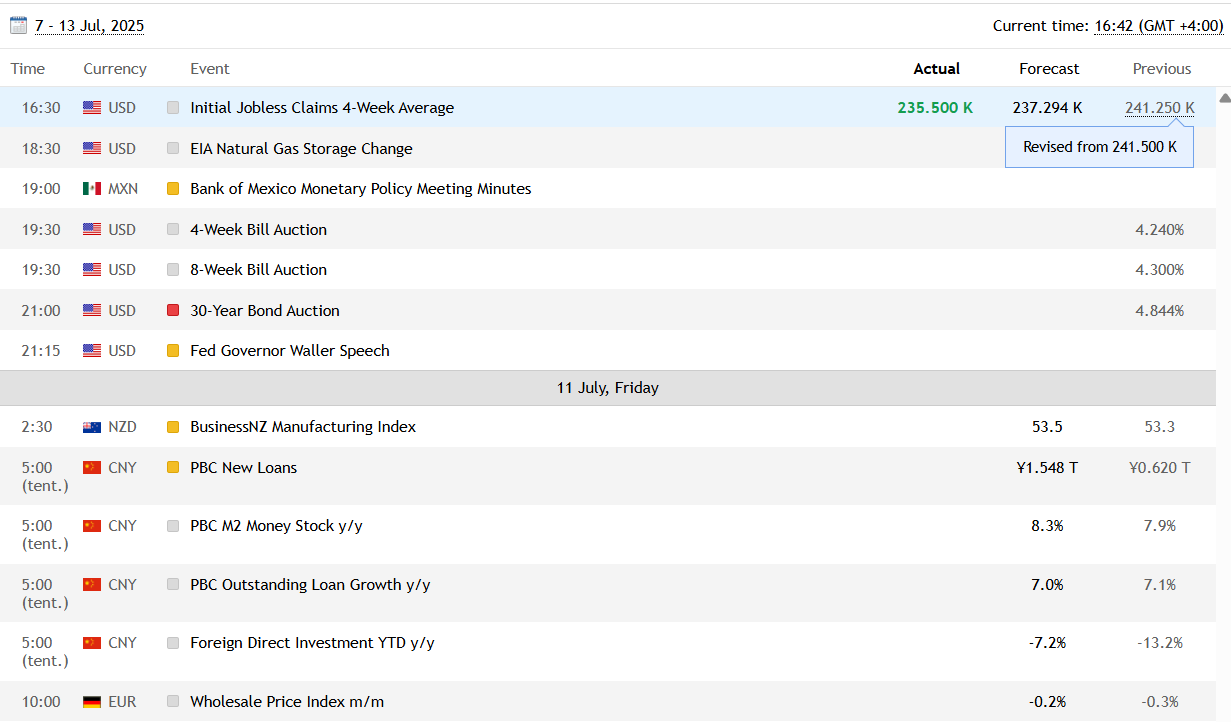

Research Tools TD Markets

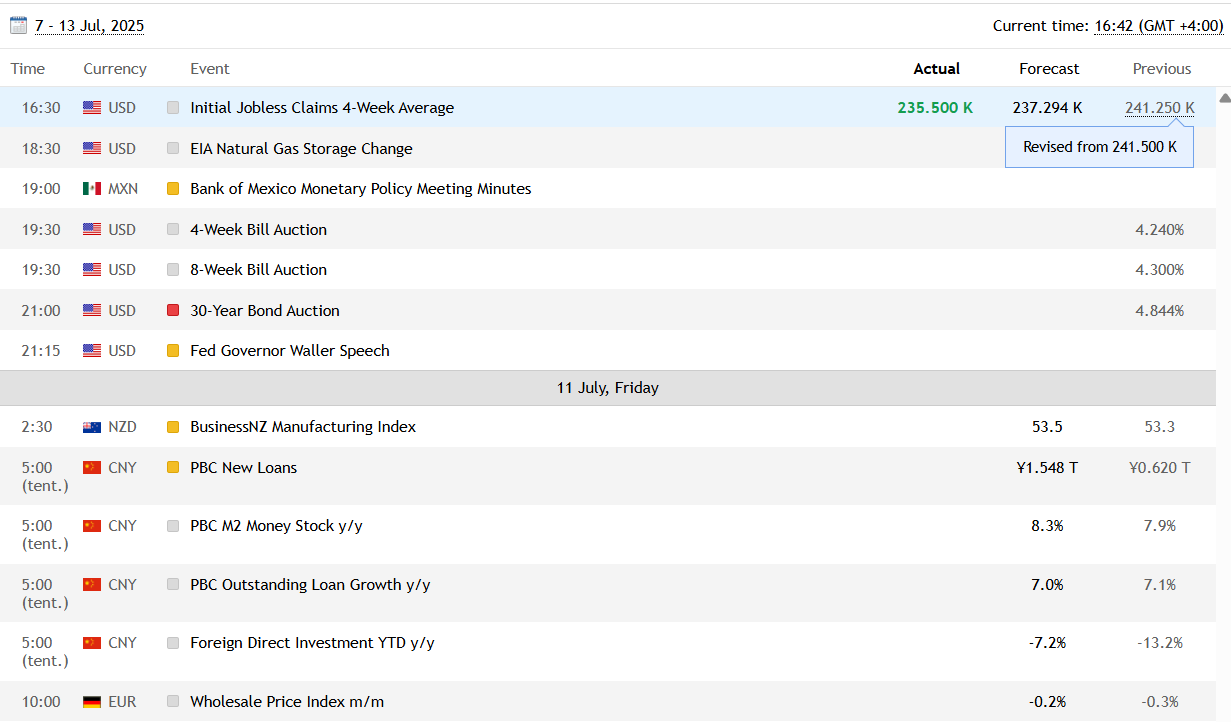

TD Markets offers comprehensive research and education sections. There are extensive research tools and features that the MT4 and MT5 platforms provide clients. In addition to the already helpful suite of tools, traders can use the following features for more in-depth research and analysis of the market:

- The Economic Calendar informs traders about the upcoming events of the market, potent enough to affect the financial world. Being aware of the market movements in advance will allow traders to make informed decisions and profit from those changes.

- TD Markets’ Market Commentary section supplies clients with updated market releases to recognize and grasp upcoming opportunities.

- The broker also offers a Live trading room, enabling its clients to access real-time analysis and trading opportunities.

Education

TD Markets offers a trading academy, including tutorials, one-on-one mentorship, podcasts, and courses for beginners, intermediate traders, and professionals.

- In the TDM Academy section, traders can access one-on-one mentorship where the broker’s experts sit in a session with the client and assist traders in different trading challenges they are facing.

- The broker also offers trading tutorials on a wide range of trading-related topics to give traders the essential knowledge they can use in their trading journey.

Is TD Markets a Good Broker for Beginners?

TD Markets is a good broker with a secure environment, offering traders an impressive selection of great tools and features. The broker offers different trading account types for traders to choose the most suitable option. Beginner traders can choose from cost-efficient account options, with low deposits and spreads. What is more, the MT4 platform’s simple interface offers easy navigation.

TD Markets offers comprehensive educational materials for beginners, intermediate traders, and professionals. The availability of educational resources is an excellent knowledge base for clients to build a successful trading journey.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options TD Markets

The broker offers over 200 tradable products, allowing moderate access to tradable products. As we have found, the range of currency pairs is impressive, 63 in total, ensuring good diversity. Besides, clients can trade cryptocurrencies by opening a crypto account and accessing more than 110 ETFs, global indices, shares, etc.

Despite the advantages mentioned, TD Markets’ proposal is based on CFDs, which means that clients cannot engage in traditional investments.

- From the alternative investment options, clients can access the broker’s social trading feature, choose top-performing professionals, and copy their successful trades.

- Digging deeper, there is no indication that TD Markets offers MAM or PAMM accounts.

Account Opening

Score – 4.5/5

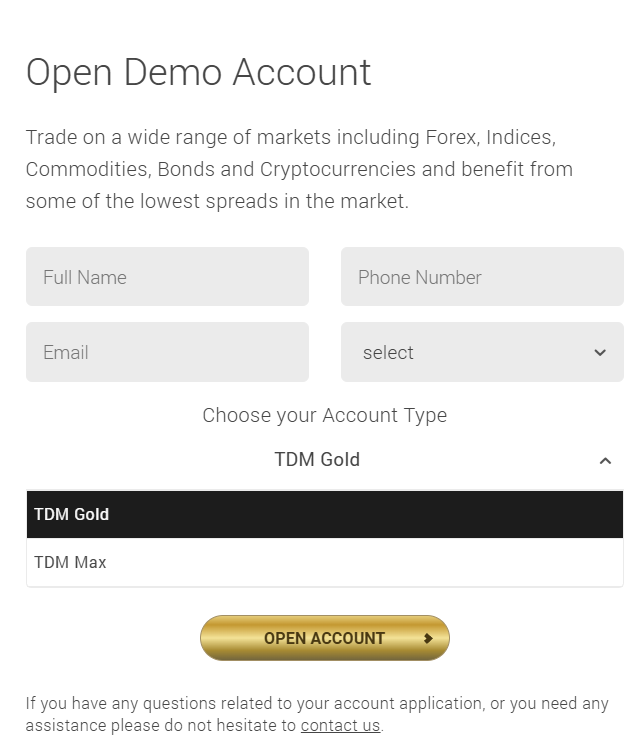

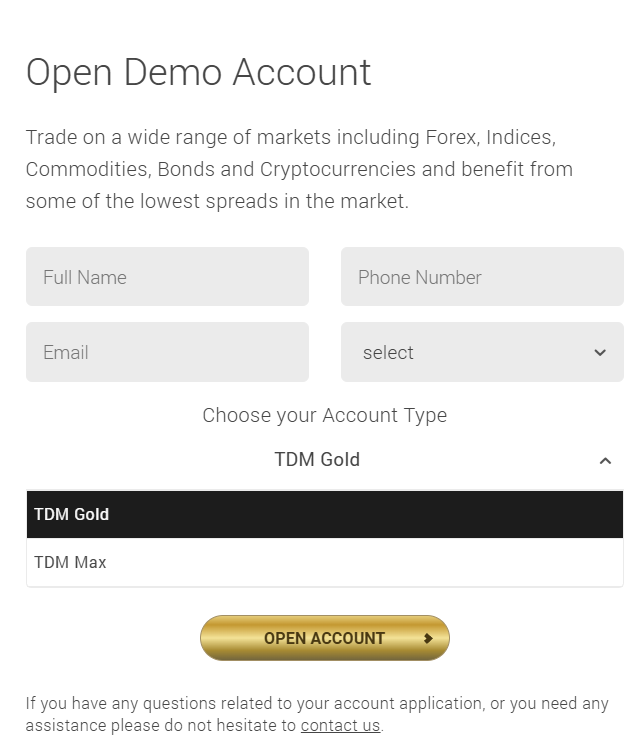

How to Open a TD Markets Demo Account?

The availability of a demo account allows traders to practice without any risks and losses. Traders can choose their preferred platform, account type, leverage range, and the amount of virtual funds.

Here are the steps to open a TD Markets demo account in a matter of minutes:

- Go to the broker’s website and choose the ‘Open demo account option.

- Fill out the form with your name, phone number, and email.

- Select the country of residency, leverage ratio, and the amount of funds.

- For some regions, there might be an additional requirement for email verification.

- Submit the form and get instant access to the demo account.

- Use the login details and access the platform via WebTrader, or download the desktop or mobile versions of MT4 or MT5.

How to Open a TD Markets Live Account?

Opening a live account with TD Markets is a quick and straightforward process. As the broker offers a wide selection of account types, it is essential to consider the conditions carefully and choose the most favorable option to meet the specific trading expectations.

To open a live account with TD Markets, clients should follow the following steps:

- Go to the broker’s official website and click on the ‘Open live account’ button.

- Specify the account category, type, and account preference.

- Fill out the registration form with the relevant information (name, email address, phone number, country, gender, date of birth, residency, and postal code).

- Also, create a safe and reliable password.

- Submit the form and wait for a verification email.

- Verify your identity by uploading a valid ID, proof of address, or other documentation.

- Download the MT4/MT5 platform and access it using the provided account credentials.

- Proceed with funding and start trading.

Score – 4/5

In the previous sections, we have already discussed the various features, tools, and capabilities TD Markets provides for a favorable trading outcome. Among them are the economic calendar, one-on-one sessions with clients, good research and analysis tools, news and blog sections, and tutorials.

- The Broker’s Trading Academy includes all the necessary resources to gain knowledge and upgrade trading skills.

- TD Markets also offers a social trading feature to mirror successful trades and gain profits.

- Other than the mentioned features, TD Markets does not offer additional tools. However, the broker expands its trading conditions and services constantly and might introduce new opportunities in the future.

TD Markets Compared to Other Brokers

Another important step in our review is TD Markets’ comparison to other brokers. This helps to see where the broker stands and how its offerings align with the market average.

First, we compared the broker’s safety and reliability to other similar brokers. Even though the broker operated under an offshore license for many years, TD Markets now holds an FSCA license and follows strict regulatory measures. Many brokers hold licenses from the South African FSCA, including Admirals, XS, Xtrade, and Eurotrader. However, some of the mentioned brokers (Eurotrader, Admirals, and XS) hold top-tier licenses from ASIC and FCA, adding an essential layer of safety to their offerings.

Trades with TD Markets are conducted on the popular MT4 and MT5 platforms. We found that most brokers enable access to one of the retail platforms. From the compared brokers, only XS does not offer MT4/MT5 platforms and allows access to its proprietary platform.

The range of the broker’s instruments is limited to 200, which is a moderate amount compared to Admirals’ 8,000+ and Forex.com’s 6,000+ tradable products. The average spread for TD Markets is slightly higher than OneRoyal’s 1 pip or Admiral’s 0.6 pips.

TD Markets has a low deposit requirement of $10. Xtrade requires a $250 deposit to open an account, which is a little higher compared to the brokers we reviewed.

| Parameter |

TD Markets |

Admirals |

Forex.com |

XS |

OneRoyal |

Xtrade |

Eurotrader |

| Spread-Based Account |

Average 1.8 pip |

From 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 1 pips |

| Commission-Based Account |

1.8 pips + $0.5 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, Admiral Markets app |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5 |

| Asset Variety |

200+ instruments |

8000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

2,000+ instruments |

| Regulation |

FSCA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

CySEC, FCA, FSCA, FSC, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$10 |

$1 |

$100 |

$0 |

$50 |

$250 |

$50 |

Full Review of Broker TD Markets

After reviewing all the aspects of trading with TD Markets, we can give a full conclusion of the broker. TD Markets is a part of TDM Holdings LLC. For many years, the broker operated under the Financial Services Authority of St. Vincent and the Grenadines, raising questions about the broker’s credibility because of its offshore nature. However, at present, TD Markets operates under the South African FSCA license and complies with strict rules.

All in all, TD Markets offers favorable conditions for different traders. It offers seven account types, each tailored for different trading purposes. The spreads and commissions applied are average and align with the market standard. For some of its account types, the broker offers very low spreads and commissions. The Broker also does not apply deposit and withdrawal fees.

The minimum deposit requirement is $10, making TD Markets an attractive option for beginners or cost-conscious traders. The availability of a demo account is another pro that beginner traders will appreciate.

The popular and advanced MT4 and MT5 platforms are available on web, desktop, and mobile versions and are compatible with different operating systems. TD Markets also offers Social trading as an alternative option for investments. t last, the broker’s education section includes comprehensive resources suitable for beginner, intermediate, and professional traders.

Share this article [addtoany url="https://55brokers.com/td-markets-review/" title="TDMarkets"]