What is Best Forex trading strategies?

There are thousands if not millions of trading strategies or techniques, where each strategy is eventually a specific approach towards market analysis either technical or fundamental, considering news trading or defining pattern trading, etc.

- Trading strategy is a definition of execution parameters so once they are met it is a signal for order placement or execution

Indeed, there are as many trading strategies as traders are, however, there are some ‘standard’ strategies or known practices that are commonly used and in most cases combine easy to use parameters yet showing great results. By the end of the day, you, as a trader is the ones who will define the strategy to use or might combine some known strategies into your own trading style, or even might become more sophisticated to apply unique practices.

All in all, trading prosperity is all about good education, discipline and constant development of knowledge, so always be sure to place your strategy at the test before you go live and adjust techniques according to your trading size.

- Indicate that none of the strategies are perfect or 100% success performance.

So the ‘right’ recipe to your trading success is in your hands where all trading risks are considered and trading is approached in healthy and a good way. Besides, be sure to choose only among well-regulated brokers as a ‘wrong’ choice of your trading venue will definitely spoil everything, indeed scammers never sleep.

So here let us get to the point of 12 Best Forex Trading Strategies that are very popular and are highly used by both amateurs, beginners or trading professionals.

Forex Technique #1 – Day Trading

Day trading simply means that trading orders are held within a short time or within same day, intraday only, where trader targeting smaller swings of currency pairs or instruments through the use either indicators or specified execution signals, which are used within minutes or hours only and are closed before markets or exchanges closing its daily operation as well.

This method is widely traded by the professional traders and those that operate large size, also by traders that use swap-free accounts where overnight trading is prohibited while traders may use various indicators and analysis for trading itself.

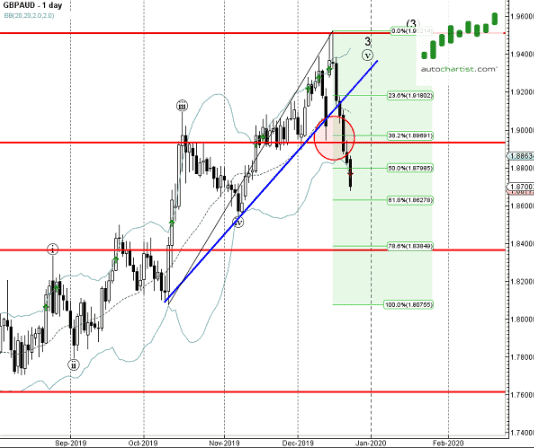

Forex Technique #2 – Pattern Trader or Trend Trading

Pattern trader using a simple ability to read charts and does not specifically require the use of indicators. The books say that every instrument has its Pattern or a graph which swings and fluctuates in a harmonized way and showing ‘defined’ behavior which is possible to read. So Patter Trader usually uses ‘necked charts’ and analyses price movement that identifies behavior mainly in the long term. Using this style, positions may stay open for months or even years and mainly good for bigger size traders with good experience.

Forex Technique #3 – Swing Trading

Swing trading is another strategy that using mainly trend analysis and is a longer term trading since positions are held longer than a day that’s why it called swing. So in this strategy trader defines a significant movement of currency pair or other assets to the direction or another and places the order in its defined timeframe, which may take days, weeks or even months to achieve the goal.

Nevertheless, since you will keep positions overnight be sure you learn about the broker’s conditions and fee structure, as there is a specified swap or overnight fee defined by each instrument separately.

Forex Technique #4 – Range Trading

Eventually, range trading means that trader analysis and defines trading range where the price is swinging back and forth, so upper and lower levels are acting as support and resistance levels. The strategy works well as primary counts on technical analysis while uses Stochastics or Strength Index or Channel Index indicators that say the price would rebound from the lower level and falling from the high one.

Forex Technique #5 – Price Action

Price Action is a great trading strategy as it does not involve any indicators or complicated ideas, simply you need to learn how to read a price chart and define its behavior that works in respect to mathematic rules of distribution and swings. As a result, strategy facilitate dynamic support and resistance levels where you would spot chart pattern so again you would buy lows and sell picks.

Forex Strategy #6 – Breakout

It is a quite simple technical analysis bases strategy, as it solely based on indicators like Bollinger band or moving average. The strategy might be helpful for those that prefer indicators use where the breakout of the lines either upper or down one will suggest that price is going to move into its ‘breaking’ direction.

Forex Strategy #6 – Liquidity trading

This method is also rather trend trading where the best execution will be defined by the level of liquidity. It requires a trader to identify and draw chart levels and liquidity swings with a purpose to catch the next rise of the liquidity that appears either with bearish or bullish directions. Also, this strategy usually using 2:1 ratios to take profit and stop loss which is suitable for many trading sizes and accounts as well.

Forex Technique #7 – Scalping

Scalping is a quite known technique and a term used by the traders that benefit by taking small and even very small profits but frequently, while mainly using short timeframes usually minutes. This strategy can be performed manually or through automatic trading via algorithms, yet it might be restricted in some regions and regulators so be sure to verify those as well.

Forex Technique #8 – Hedging

A great strategy that is usually used to protect positions where a trader holds both buying and selling positions simultaneously. Potentially it allows a trader to go long or go short and benefit from the successful trade, meaning you would close ‘wrong’ positing and can even re-enter at a better price. However, this strategy is also restricted at some regions so you would need maybe two different accounts in order to perform hedging.

Forex Technique #9 – Carry Trade

This is an interesting strategy as trader investing in one currency with a lower rate and following by trade of another currency pair or asset with a higher price. The result of the trade will be a positive profit between two trades where the length of the positions opened may take hours or even days or weeks. As entry or exit parameter trader may use confirmation from indicators or analysis that confirms the trend, as traders’ profit is eventually an interest rate between two orders.

Forex Technique #10 – Pivot Trade

This is great techniques as you would need only to see daily pivot levels on defined timeframes, yet strategy followers say daily chart works the best here. So the technique is rather simple as pivots show you the direction of the market either to bullish sentiment if price trading above the pivot point, and indicates bearish direction if the price goes below pivot daily point.

Forex Technique #11 – Trading Psychological levels

Psychological levels are actually round numbers that are very often key levels in Forex or other asset Charts. This technique is accurate to replicate how traders or human psychology works since there is a better reaction on rounded numbers. So trading round numbers or Psychological levels that are defined like support and resistance levels used for entry or exit of the positions.

Forex Technique #12 – Overbought and oversold

This strategy is based on mathematical price distribution where strategy mainly uses RSI (Relative Strength Index) that indicates if the market is overbought or oversold if it crosses defined ‘normal’ levels. Actually meaning that traders will use it as a signal that price is going to fall back or rebound.