- What is T4TCapital?

- T4TCapital Pros Cons

- Is T4TCapital Legit?

- T4TCapital Challenge

- Funded Account

- Account Conditions

- Payout

- T4TCapital Alternative

What is T2TCapital Prop Firm?

T4TCapital offers a prop trading opportunity that allows traders to manage funds with a structured profit-sharing and account scaling system. The company offers features such as 2 types of evaluation with no time limit, the possibility to scale account balance upon reaching specific profit targets, and trading with a wide range of instruments. Profits can be withdrawn, subject to conditions ensuring a portion of the profits remains in the account to support ongoing trading activities.

- T4TCapital is connected with Traders4Traders as entities under the same umbrella organization. Traders4Traders serves as the educational arm, providing comprehensive Forex trading education, while T4TCapital operates as the proprietary trading arm, offering funded trading challenges and managing funded trading accounts.

| T4TCapital Advantages | T4TCapital Disadvantages |

|---|

| Comprehensive Educational Materials | No Proper Overseeing |

| Low Profit Traget | It is hard to become Funded Trader |

| Good ranging of account Baance with Opportunity to Scale Up | Limited Instrument Range |

| Availability of MetaTrade Platforms | No Guaranteed Income |

| One-Time Refundable Fee | No Free Trial |

| UK Based Prop Trading Firm | Low Leverage |

| Low Commissions | |

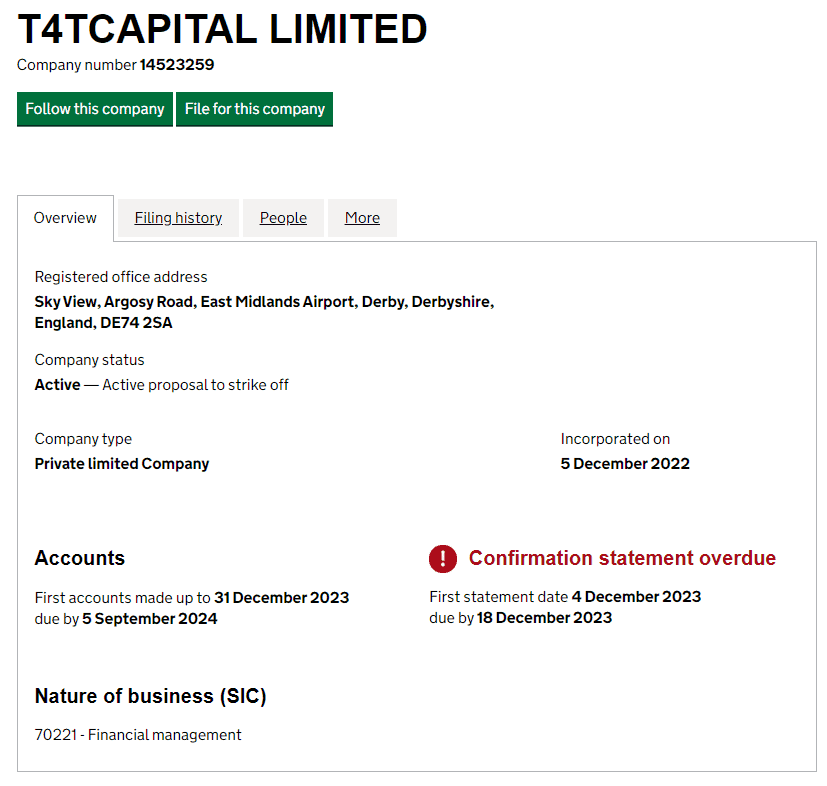

Is T4TCapital Legit?

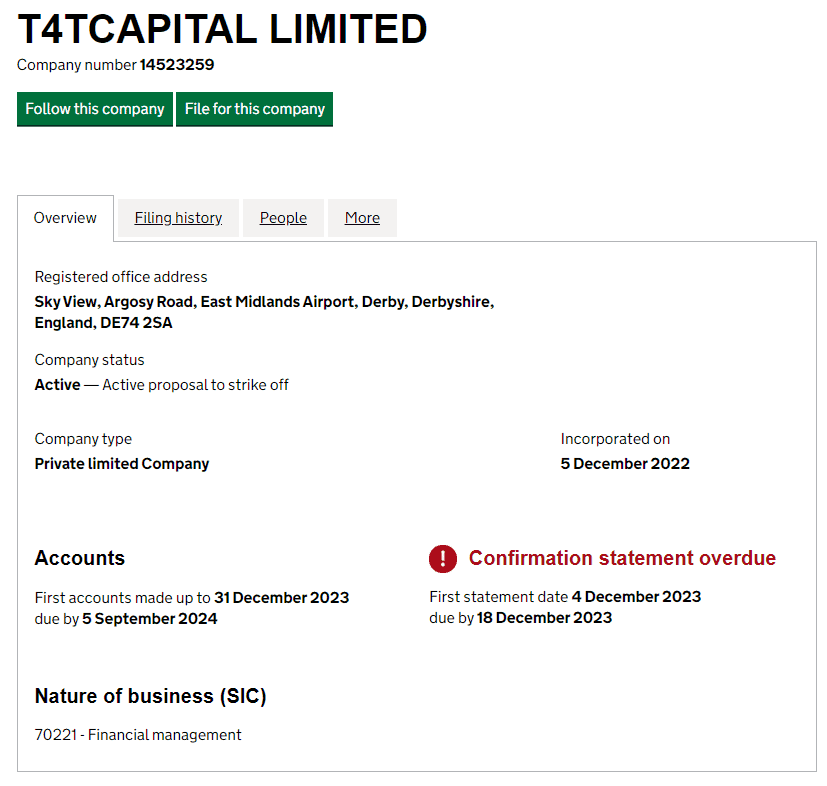

T4TCapital, operating within the UK‘s rigorous financial landscape, is indeed considered a legitimate proprietary trading firm. The UK’s strict regulatory environment ensures that firms like T4TCapital adhere to high standards of operation and transparency, further affirming its credibility and the trust traders can place in its services.

-

Proprietary Trading firms generally don’t hold a Forex Broker license, leading to less regulatory oversight, including from bodies like the FCA. This setup means they don’t provide the same protective measures since they internally manage operations and fund trading activities. It’s important for individuals to fully understand the risks involved.

Is T4TCapital Scam?

There isn’t definitive evidence to outright classify T4TCapital as fraudulent. While varied experiences from users, both positive and negative, exist, it’s essential to conduct personal, current research for informed decision-making. However, it’s crucial to remember that Proprietary Trading Firms generally experience less regulation by financial authorities, which complicates the process of categorically assessing their legitimacy.

- For those interested in prop trading, it’s advisable to thoroughly grasp the model and its risks. Choosing a reputable company with years of operation can indicate stability. It’s wise not to invest heavily in personal funds, as potential losses can be more manageable than trading with your own capital directly.

T4TCapital Challenge Rules

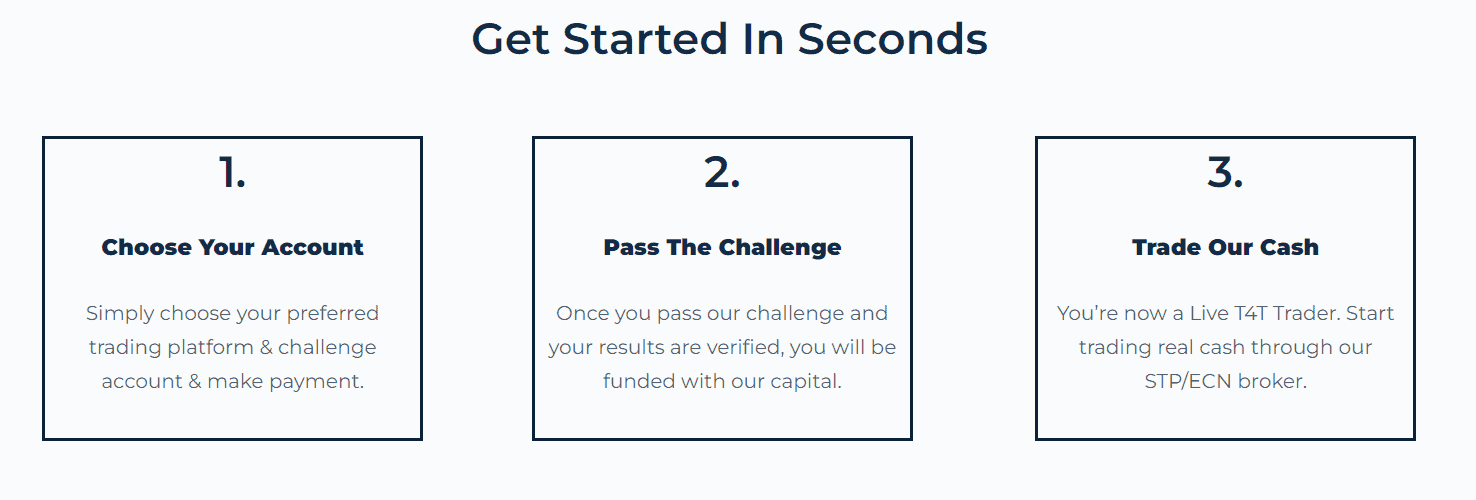

Prior to assigning a funded account to traders, T4TCapital endeavors to assess their proficiency in risk management. This initiative drives the formulation of trading objectives for both stages of the T4TCapital evaluation process. These objectives function as metrics for measuring a trader’s discipline, commitment, and accountability in their trading endeavors. The evaluation process comprises two pivotal stages: the t4tcapital Challenge and the Verification phase.

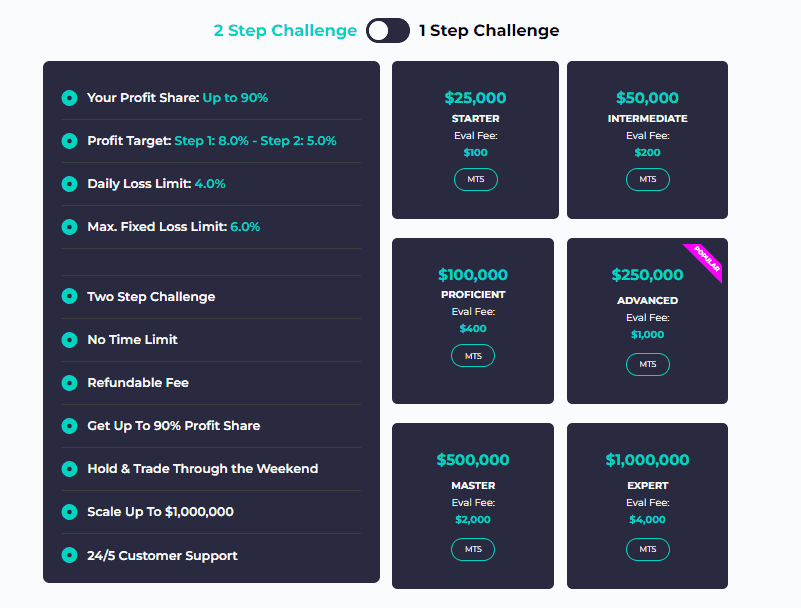

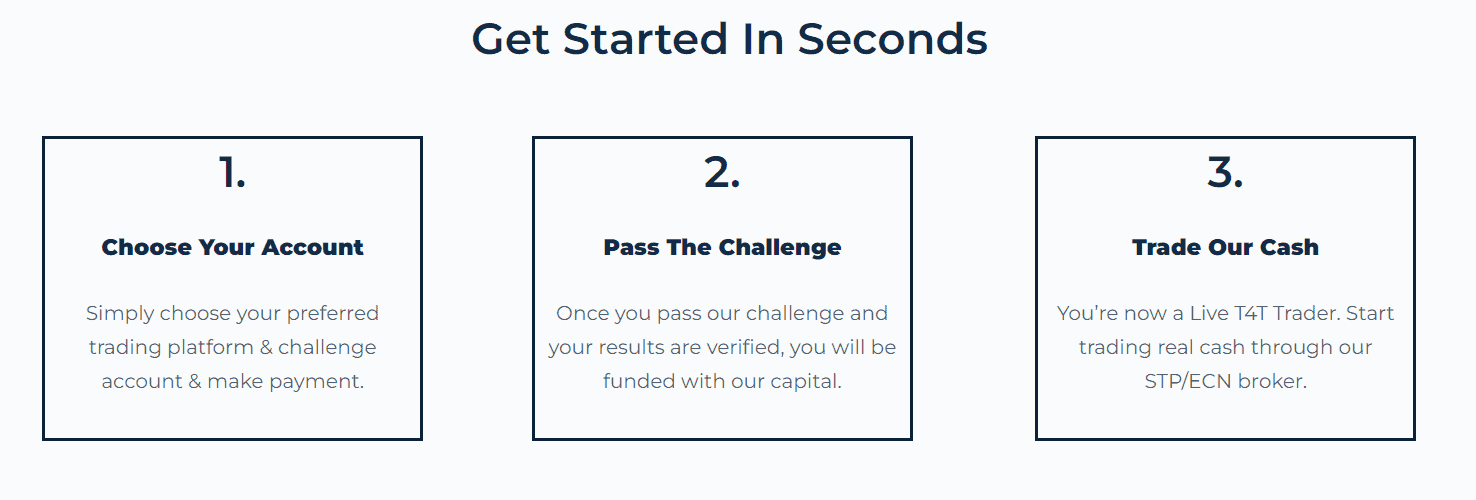

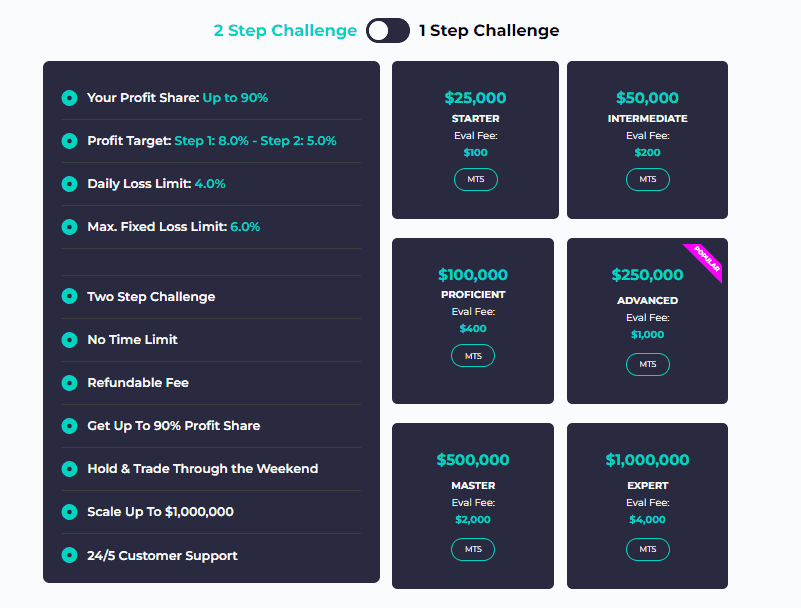

- T4TCapital offers both a 1-step and a 2-step challenge for traders seeking funded accounts. The 1-step challenge involves reaching a profit target within a flexible timeframe without exceeding maximum drawdown limits, suitable for those confident in their trading strategy. The 2-step challenge adds an extra layer, requiring traders to first demonstrate consistent trading over a specified period before advancing to the profit target phase, catering to those who prefer to showcase steady risk management and profitability.

Account Balance and Registration Fee

Before getting started, traders must undergo an evaluation process where they select their desired starting Account Balance. The conditions slightly vary based on the size of the chosen Account Balance. The evaluation process consists of two straightforward steps—Challenge and Verification. Traders who successfully complete this evaluation become eligible to join T4TCapital as traders. Additionally, T4TCapital imposes a registration fee for the challenge, which varies depending on the chosen account balance.

- T4TCapital offers challenges designed to evaluate a trader’s skill in managing a funded account. These challenges, including both 1-step and 2-step options, test a trader’s ability to achieve specific profit targets while adhering to risk management rules.

- T4TCapital offers funded account balances starting from $25,000 up to $1,000,000. Traders can choose their starting level based on the challenge they select, with the opportunity to scale their account to higher levels based on their trading performance.

- T4TCapital is recognized for offering competitive and relatively low fees and commissions, aligning with its goal to facilitate accessible trading opportunities for its clients.

| Fees | T4TCapital | FundedNext | The Funded Trader |

|---|

| Minimum Account Size | 25,000 | $6,000 | $50,000 |

| Fee | $100 | $59 | $289 |

| Maximum Account Size | $1,000,000 | $200,000 | $400,000 |

| Fee | $4,000 | $999 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

For T4TCapital’s challenges, the profit targets vary. The Two Step Challenge has an initial 8% profit target in the first step, followed by a 5% target in the second step. The One Step Challenge sets a singular profit target of 8% or 10%, depending on the specific challenge version selected by the trader.

Maximum Loss

The maximum loss limits for T4TCapital’s challenges are structured around daily and overall loss thresholds. Specifically, the daily loss limit is set at 4%, while the maximum fixed loss limit cannot exceed 6% of the account balance.

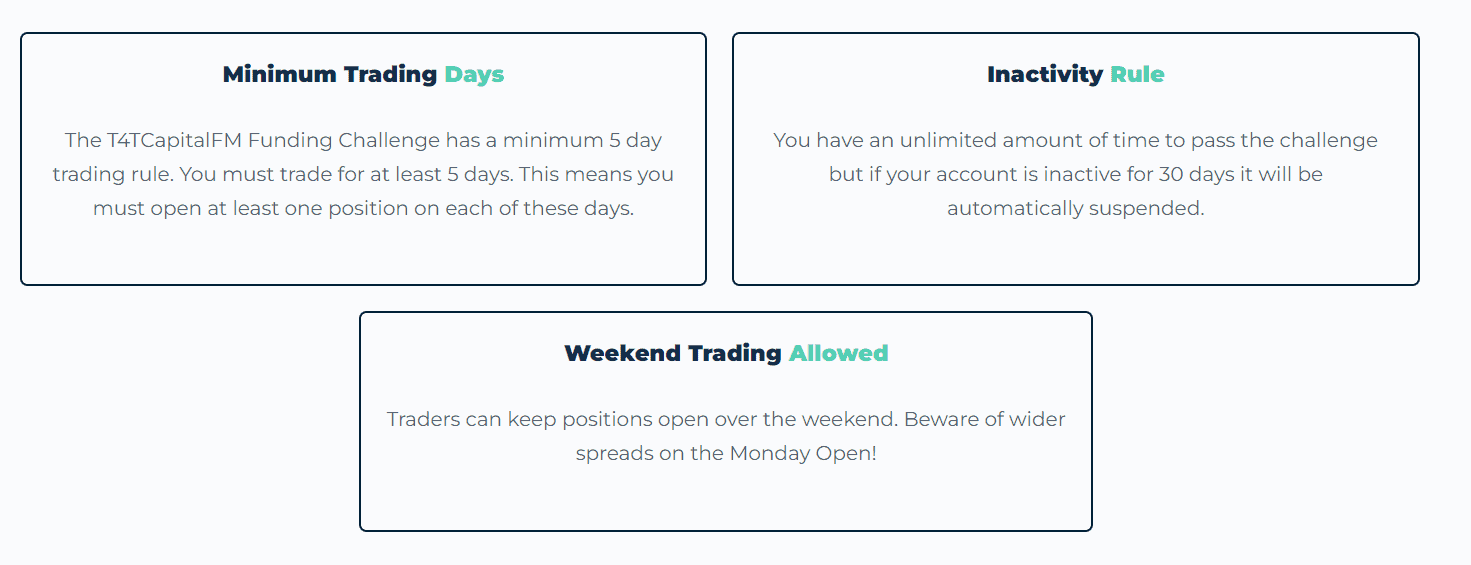

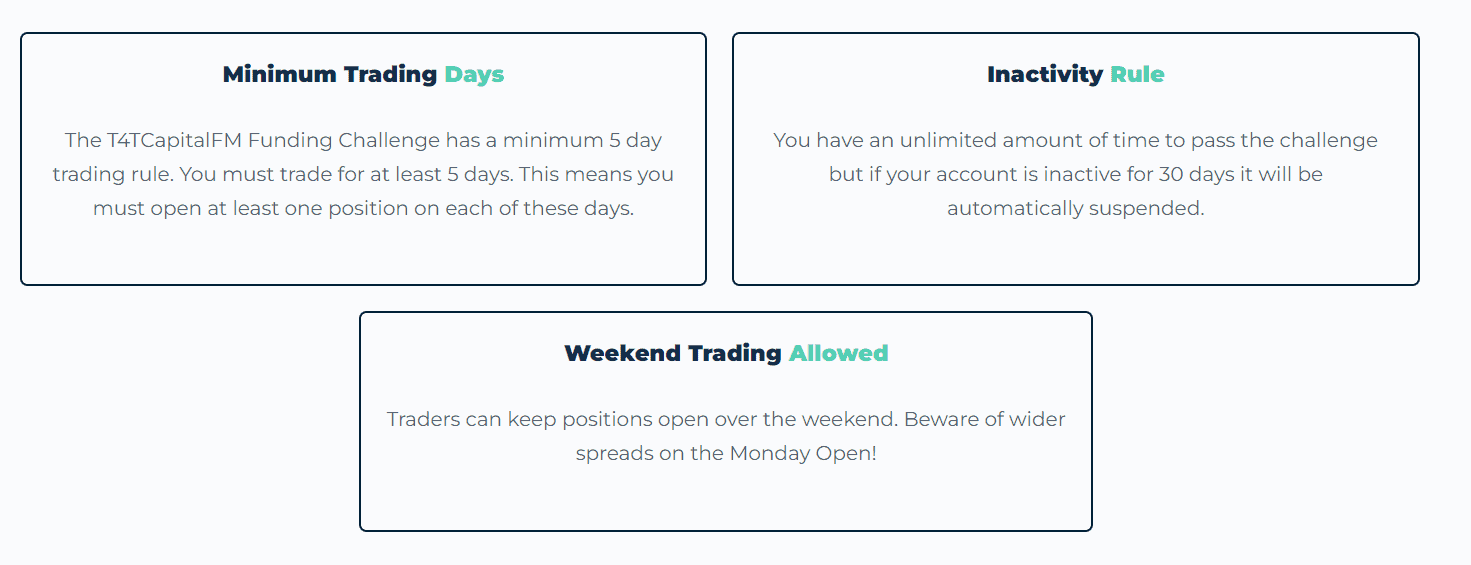

Minimum Trading Period

For T4TCapital’s trading challenges, a minimum trading period of 5 days is required. This means participants must actively trade on at least five different days during the challenge to meet the criteria for evaluation.

See the detailed table with T4TCapital Trading Objectives:

Free Trial

T4TCapital does not offer a free trial for its trading challenges. Participants are required to pay an evaluation fee to enter the challenge for a chance to manage a funded account.

T4TCapital Funded Account

Upon completion of the challenge, traders will be assigned their Funded Account, typically activated within a few business days. This account will replicate the conditions and balance corresponding to the level achieved in the challenge. If a trader desires to upgrade to a higher account level, they must undertake and pass the challenge again for the desired balance.

Profit Split

The standard profit split at T4TCapital starts at 75% for the trader, with the potential to increase up to 90% based on performance. This allows traders to earn a significant portion of the profits as they successfully trade with the firm’s capital.

Payout and Withdrawals

T4TCapital allows traders to request their first payout within 7 days after their first trade. Subsequent payouts are scheduled for the first of each month. Upon a withdrawal request, T4TCapital also withdraws its share of profits, and the total withdrawal amount is deducted from the trader’s account.

Withdrawal Method

T4TCapital offers withdrawal options that include Bank Wire transfers and Cryptocurrency, providing flexibility for traders to access their earnings.

Account Conditions

When examining Account Conditions, it is essential to thoroughly evaluate the range of account preferences offered by the proprietary firm, along with the Platforms, Instruments, and Trading Costs involved. It is also crucial to analyze the Leverage levels and Trading conditions provided, as certain proprietary firms may impose limitations on particular strategies and prohibit specific practices in funded accounts, which could result in potential account losses. In such cases, re-taking the test may be necessary to regain access to the account. Below is a comprehensive breakdown:

Trading Instruments

T4TCapital provides traders with access to a broad spectrum of financial markets, including Forex, equities, indices, shares, cryptocurrencies, commodities, and futures. This wide array of tradable instruments enables traders to diversify their portfolio, take advantage of various market conditions, and implement a range of trading strategies across different asset classes.

T4TCapital Commission

T4TCapital partners with the regulated broker Eightcap to offer traders good trading conditions, including tight spreads, low commission fees, and reliable trade execution speeds at the best available prices.

Leverage

T4TCapital sets the leverage for Forex trading at 1:10. This controlled leverage aims to manage risk effectively while allowing traders to amplify their potential returns within a defined risk management framework.

T4TCapital Platforms

Trading Conditions

T4TCapital permits a variety of trading styles without imposing restrictions, as long as the trading aligns with sound risk management principles, adheres to genuine market conditions, and avoids prohibited strategies.

- T4TCapital permits a variety of trading strategies as long as they adhere to the firm’s rules. However, the Martingale Trading Strategy and its variations are strictly prohibited, as they’re considered too risky.

- T4TCapital offers education that covers from basic to advanced trading concepts, focusing on institutional bank trading strategies. The goal is to equip traders with the knowledge and skills necessary to trade effectively and manage risk wisely.

- T4TCapital offers a scaling plan that enables successful traders to progressively manage larger account sizes up to $1,000,000, based on their performance. This scaling opportunity is contingent upon the trader achieving predetermined profit targets while adhering to T4TCapital’s trading rules.

T4TCapital Promotions

T4TCapital occasionally provides discounts or special offers on evaluation fees for their trading challenges, presenting traders with opportunities to enter these challenges at reduced costs. These promotions aim to make their funding opportunities more accessible to aspiring traders and may serve as incentives to encourage participation in their programs.

T4TCapital Alternative Brokers

In conclusion, T4TCapital stands out as a reputable platform offering funded trading challenges, enabling traders to showcase their abilities and potentially manage funded trading accounts. With a focus on comprehensive Forex education and institutional bank trading strategies, T4TCapital equips traders with the necessary knowledge and skills to navigate the financial markets effectively. Moreover, their scaling plan provides a progressive opportunity for traders to manage larger account sizes, up to $1,000,000, based on their performance.

- TopStep — Good Educational Material CHoice

- FTMO — Offering Favorable Conditions with no Profit Targets

- E8 Funding — Prop Trading Firm Higher Leverage

Share this article [addtoany url="https://55brokers.com/t4tcapital-review/" title="T4TCapital"]