- What is Sucden Financial?

- Sucden Financial Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

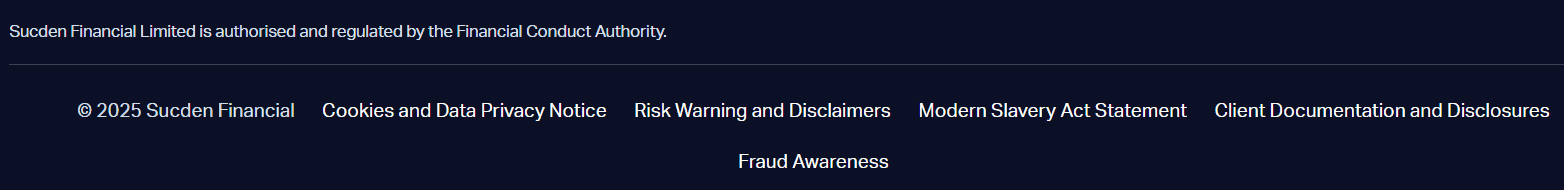

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Sucden Financial Compared to Other Brokers

- Full Review of Broker Sucden Financial

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is Sucden Financial?

Sucden Financial is an institutional non-bank Forex provider and a firm that has operated for over 50 years in the finance industry while being based in London. The broker’s services cater to financial institutions, corporates, and brokers, providing access to a wide range of options such as Forex, Metals, Energies, Softs, Agricultures, Futures, Options, and more.

However, due to the nature of the investment, the broker does not offer personal accounts and maintains its e-trading solutions through a variety of electronic and clearing execution tailored to individual requirements. These include non-bank FX Prime Brokerage, Institutional eFX Liquidity, FX Options, and Deliverable FX.

Sucden Financial Pros and Cons

Based on our research, Sucden Financial is a reliable ECN broker, providing integrity and reliability through its access to numerous instruments and truly comprehensive proposals.

For the cons, the proposal targets experienced traders, institutions, and professionals, indicating that it may not be suitable for beginners. Additionally, there is no educational section available on Sucden Financial’s website, and no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | No 24/7 customer support |

| ECN execution | Limited educational materials |

| No minimum deposit amount | |

| Institutional trading | |

| Popular trading products | |

Sucden Financial Features

Sucden Financial is a leading global multi-asset execution, clearing, and liquidity provider, renowned for its institutional-grade solutions across Forex, commodities, and derivatives markets. The key features are summarized in 10 points, covering aspects like Education, Account Types, available Platforms, and more.

Sucden Financial Features in 10 Points

| 🏢 Regulation | FCA |

| 🗺️ Account Types | Single Account |

| 🖥 Trading Platforms | STAR, CQG |

| 📉 Trading Instruments | Forex, Precious Metals, Equities, Bullion and Futures, Commodities |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Sucden Financial For?

Sucden Financial is tailored for institutional clients, professional traders, hedge funds, and brokers seeking deep liquidity, advanced technology, and direct market access across global financial markets. Based on our findings and financial expert opinions, Sucden Financial is good for:

- Traders from the UK

- Professional traders

- Institutional trading

- Currency trading

- ECN/DMA execution

- Access to futures trading

- Competitive pricing

- Good trading tools

Sucden Financial Summary

In conclusion, Sucden Financial offers a comprehensive range of services to cater to the needs of institutional and corporate traders. With direct electronic access to global markets, tight spreads, and strong financial standing, the broker provides competitive conditions.

Being an ECN broker, the company stands for reliability through its access to numerous instruments and truly comprehensive proposals within trading and investment technology.

While the broker offers secure and competitive conditions, we recommend conducting your research to ensure it suits your specific trading needs. Traders need to evaluate the broker’s regulations, fees, spreads, and customer reviews before making a decision.

55Brokers Professional Insights

Sucden Financial stands out in the industry with its robust infrastructure and solutions tailored to institutional needs. With over 50 years of experience, the broker has built a solid reputation for reliability, transparency, and innovation, making it aa good choice for traders looking for solid company and long-term trading relationship.

Its competitive edge lies in providing direct market access, ultra-low latency execution, and customized liquidity, which is great for high-frequency traders and long holding alike. As a trusted member of the London Metal Exchange and a leading provider of electronic technology, Sucden Financial combines world-class market intelligence with personalized service, making it a preferred choice for sophisticated traders and institutions worldwide.

Consider Trading with Sucden Financial If:

| Sucden Financial is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Competitive fees.

- Secure environment.

- Offering popular products.

- Looking for broker with no minimum deposit requirement.

- Institutional clients and financial companies. |

Avoid Trading with Sucden Financial If:

| Sucden Financial might not be the best for: | - Who prefer 24/7 customer service.

- Beginner traders.

- Looking for popular platforms.

- Need a broker with good education and research tools. |

Regulation and Security Measures

Score – 4.5/5

Sucden Financial Regulatory Overview

Sucden Financial is a regulated broker which is not only been established back in 1973 and has proven its reliability over many years of operation but is also a fully authorized firm by the UK’s FCA.

FCA is a well-respected regulatory body with strong control over its licensed firms that brings integrity to offering and protecting clients at all times.

How Safe is Trading with Sucden Financial?

Being a UK-regulated broker, Sucden Financial sets its operation concerning the clients, thus following strict rules of money operation, segregation, and withholding measures towards a healthy and reliable environment.

In case Sucden Financial or any other firm regulated by FCA violates one of the laws, FCA immediately takes measures resulting in even withdrawal of license and ban of its operation, which never happens with offshore or unregulated firms, whenever alluring its trading opportunity is.

Consistency and Clarity

Sucden Financial has built a strong reputation over decades of operation, earning trust through consistent performance, transparency, and a client-focused approach.

Regulated by the UK’s FCA, the broker maintains high standards of compliance and operational integrity. Trader reviews highlight the firm’s strengths in providing institutional-grade liquidity, fast execution, and robust customer support, although some note the lack of demo accounts and retail-focused tools as potential drawbacks.

Industry experts consistently rank Sucden Financial highly for its professional services, and the company has received recognition for its excellence in electronic trading and clearing solutions. Beyond its core services, Sucden Financial is actively engaged in the trading community through sponsorships, industry events, and thought leadership contributions, further solidifying its presence as a respected and reliable broker in the global financial market.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Sucden Financial?

Sucden Financial offers a streamlined account structure tailored for institutional and corporate clients. The primary offering is a Single Account that provides direct electronic access to global markets, encompassing a wide range of asset classes such as FX, commodities, and derivatives.

This unified account simplifies the trading experience by consolidating various services, including execution, clearing, and liquidity provision, into one comprehensive solution.

Single Account

Sucden Financial’s Single Account is tailored for institutional and professional traders, offering seamless access to global markets without imposing a minimum deposit requirement. This flexible entry point makes it accessible for clients of varying scales while maintaining a professional-grade environment.

The account caters to the specific needs of banks, hedge funds, asset managers, and brokers, allowing for customized configurations to match diverse strategies and operational requirements.

Regions Where Sucden Financial is Restricted

Sucden Financial has some restrictions based on local regulations. According to available information, Sucden Financial does not accept clients from the following countries:

- Canada

- Japan

- North Korea, etc.

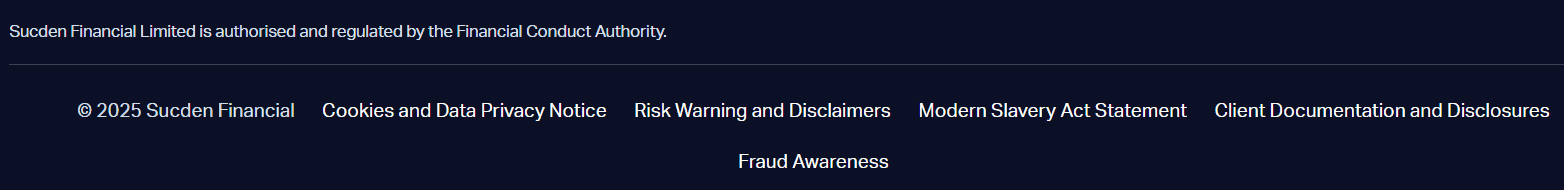

Cost Structure and Fees

Score – 4.4/5

Sucden Financial Brokerage Fees

The broker offers flexible fees, based on commission or spread, depending on the tailored solution you require. Due to its financial strength and its direct banking relationships, Sucden Financial ensures superior FX liquidity aggregation from multiple market participants and therefore makes 100% tailored solutions for its clients.

The broker provides competitive pricing with tight and floating spreads, which are based on interbank offerings. The average spread for the widely traded EUR/USD currency pair in the currency market is approximately 1 pip.

However, conditions, including spreads, may differ depending on the specific entity. Therefore, gain a clear understanding of the spread conditions offered by the brokerage firm and their relevance to individual strategies.

- Sucden Financial Commissions

Sucden Financial employs a flexible commission structure tailored to its institutional and professional clientele. Commissions are customized based on factors such as trading volume, asset class, and execution method.

The broker charges commissions on certain financial instruments, including CFDs, with commissions typically starting from $3 per lot per side.

- Sucden Financial Rollover / Swaps

Sucden Financial applies rollover fees or swap rates to positions held overnight. These fees are calculated based on the difference in interest rates between the two currencies in a currency pair or the underlying instrument.

Swap rates can either be positive or negative depending on market conditions, the asset being traded, and the direction of the position. The broker’s swap rates are updated daily and can vary across different instruments.

- Sucden Financial Additional Fees

Sucden Financial applies several additional fees depending on the circumstances. While there are no standard deposit fees, third-party payment providers may charge for currency conversions.

Withdrawals also come with a minimum fee of $30.00, and withdrawals in non-USD currencies may incur additional costs due to conversion rates.

Accounts that have been inactive for a year or more may face monthly inactivity fees, and positions held over the weekend are subject to a fee three times the standard overnight fee. For cryptocurrency transactions, transferring funds from the platform to a personal wallet incurs a flat transfer fee, regardless of the digital currency.

How Competitive Are Sucden Financial Fees?

Sucden Financial offers competitive fees, particularly for institutional and professional traders, with flexible pricing structures tailored to the specific needs of each client.

The overall fee structure is designed to remain competitive within the industry. Additionally, the broker provides personalized fee arrangements based on volume and asset classes, which can help clients achieve cost-effective execution based on their unique strategies.

| Asset/ Pair | Sucden Financial Spread | CPT Markets UK Spread | ALB Spread |

|---|

| EUR USD Spread | 1 pip | 1.8 pips | 1.5 pips |

| Crude Oil WTI Spread | 3 | 7.8 | 3 |

| Gold Spread | 1 | 2.8 | 1.4 pips |

| BTC USD Spread | - | 6 | 14 pips |

Trading Platforms and Tools

Score – 4.5/5

Sucden Financial offers a range of advanced platforms and tools tailored to meet the needs of institutional and professional clients. Among its key offerings is STAR, Sucden’s proprietary electronic platform, which provides direct access to global Forex and precious metals markets with ultra-low latency and customizable liquidity solutions.

The broker also supports CQG, a powerful third-party platform renowned for its sophisticated charting tools, fast execution, and extensive market data coverage, ideal for trading futures and commodities. These platforms are backed by Sucden Financial’s robust infrastructure, offering clients reliable connectivity, real-time analytics, and seamless integration with risk management systems.

Trading Platform Comparison to Other Brokers:

| Platforms | Sucden Financial Platforms | CPT Markets UK Platforms | ALB Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Sucden Financial Desktop Platform

Sucden Financial’s proprietary STAR desktop platform is specifically designed to meet the high-performance demands of institutional and professional traders. Built in-house, STAR offers direct market access to global FX and precious metals markets, combining ultra-low latency execution with a customizable and user-friendly interface.

The platform integrates advanced order management tools, real-time risk monitoring, and detailed post-trade analytics, making it a comprehensive solution for efficient trade execution and reporting. STAR’s robust infrastructure ensures reliable connectivity and seamless integration with clients’ back-office systems, giving users full control over their environment from a secure desktop interface.

Main Insights from Testing

Testing the STAR platform reveals its focus on providing high-speed execution and seamless order management. Users benefit from its intuitive interface, which simplifies complex trading processes while offering a range of advanced features such as custom liquidity solutions and detailed market analytics.

The platform’s stability under heavy trading volumes stands out, with minimal latency and reliable connectivity, which is crucial for institutional traders. Overall, STAR’s adaptability to different strategies and its comprehensive risk management tools make it a solid choice for professionals seeking precision and efficiency in their trades.

Sucden Financial Desktop MetaTrader 4 Platform

Sucden Financial does not offer the MT4 platform. Instead, the broker focuses on its proprietary STAR platform, which is specifically built for professional and institutional traders. It offers advanced features for efficient trade execution and comprehensive risk management.

Sucden Financial Desktop MetaTrader 5 Platform

Similarly, the broker does not provide the MetaTrader 5 platform. Rather than MT5, Sucden Financial supports other platforms like CQG and its in-house STAR platform, which provide the necessary tools for sophisticated strategies and real-time market analytics for institutional clients.

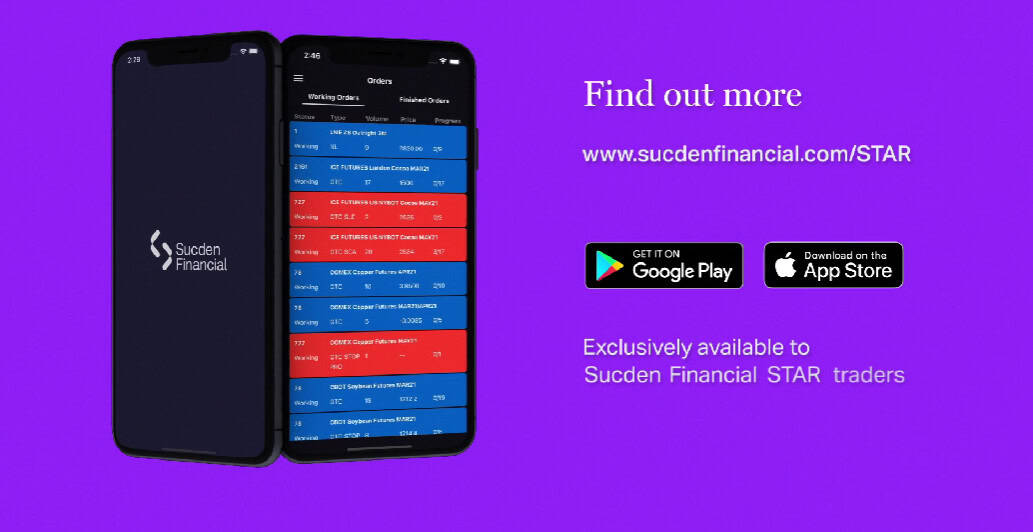

Sucden Financial MobileTrader App

STAR Mobile is Sucden Financial’s proprietary mobile application, designed to extend the capabilities of its STAR desktop platform to Android and iOS devices.

Tailored exclusively for institutional clients, STAR Mobile enables real-time trade and position monitoring, order management, and execution, allowing traders to respond swiftly to market movements while on the go.

The app integrates seamlessly with STAR’s desktop system, providing a unified trading experience across devices. It connects to major global exchanges, including CME, ICE, and the London Metal Exchange, supporting futures and options trading with a unique prompt-date structure.

Trading Instruments

Score – 4.3/5

What Can You Trade on Sucden Financial’s Platform?

Sucden Financial offers over 100 instruments across various asset classes, catering to professional and institutional clients. You can trade Forex, including a variety of major, minor, and exotic currency pairs.

The broker also provides access to Precious Metals like gold, silver, platinum, and palladium. Additionally, Equities from global stock markets are available, as well as Bullion and Futures contracts for precious metals and other commodities.

Commodities like energy products, agricultural goods, and soft commodities are also part of the offerings.

Main Insights from Exploring Sucden Financial’s Tradable Assets

Exploring Sucden Financial’s tradable assets reveals a diverse selection designed to meet the needs of institutional traders. With a focus on global markets, the broker enables traders to capitalize on opportunities across various exchanges, enhancing their ability to diversify portfolios and manage risk.

The variety and depth of available assets make it a valuable option for professional traders seeking flexibility and extensive market access.

Leverage Options at Sucden Financial

Leverage is a useful tool for traders with limited capital, enabling them to participate in the market. However, you should be aware that the multiplier carries the risk of significant gains or losses. Therefore, it is crucial to have a thorough comprehension of its functioning and the potential consequences before engaging in any leveraged activities.

Sucden Financial leverage is offered according to FCA regulation:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs and 1:10 for Commodities.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Sucden Financial

Sucden Financial mainly uses Bank Wire Transfers due to its efficiency and the best control over transfers. However, certain funding methods may have specific requirements or restrictions based on the client’s bank or other financial institutions involved.

Sucden Financial Minimum Deposit

The broker offers attractive options by not imposing a minimum deposit requirement for opening an account. This feature allows traders to start trading on Sucden Financial with any amount of funds they choose.

Withdrawal Options at Sucden Financial

The broker typically does not charge deposit or withdrawal fees, however, it is always better to verify information with the payment provider.

Customer Support and Responsiveness

Score – 4.5/5

Testing Sucden Financial’s Customer Support

Broker’s customer support is available 24/5 through Email, Phone, and Social Media. Also, the support team includes specialists who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Sucden Financial

For inquiries or support, you can contact Sucden Financial at +44 (0)20 3207 5000 or via email at info@sucfin.com. The team is available to assist with any trading or account-related questions.

Research and Education

Score – 4.4/5

Research Tools Sucden Financial

Sucden Financial offers a range of research tools designed to enhance the experience for its clients.

- On the website, traders can access a variety of resources, including market insights, news updates, and economic calendars.

- The platforms, such as STAR and CQG, provide advanced charting capabilities, multiple order types, and real-time data feeds.

- Traders also benefit from an integrated option calculator, a dynamic synthetic strategy creator for spread trading, and customizable interfaces that allow for a tailored environment.

These tools help users perform detailed market analysis, manage risk efficiently, and execute sophisticated strategies with ease.

Education

We found that the broker does not have a dedicated education section on its website, except for Market Insights and News. However, considering that the broker primarily caters to institutional trading, the absence of a learning section may not be considered a disadvantage.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Sucden Financial

Sucden Financial primarily focuses on providing institutional clients with access to currency and CFD trading. However, the broker also offers opportunities in futures and stocks, catering to a diverse range of financial instruments.

With a strong emphasis on serving institutions such as banks, hedge funds, pension funds, and asset managers, the broker delivers tailored solutions for execution, clearing, liquidity sourcing, and prime brokerage services.

Account Opening

Score – 4.4/5

How to Open Sucden Financial Demo Account?

Sucden Financial does not offer a demo account for clients. The broker primarily caters to institutional and professional traders, providing direct electronic access to global markets through its proprietary STAR platform and other institutional-grade solutions.

How to Open Sucden Financial UK Live Account?

To open a live account with Sucden Financial in the UK, prospective clients are required to complete a formal application process tailored for institutional traders. This process involves submitting necessary documentation, including proof of identity and tax information, to comply with regulatory obligations.

Due to the broker’s focus on serving professional clients such as banks, hedge funds, and asset managers, the application process is designed to assess the suitability of clients for institutional-grade services.

Additional Tools and Features

Score – 4.5/5

In addition to the core tools available on Sucden Financial’s platforms, the broker offers several other valuable features to enhance the experience.

- These include access to market analytics, enabling traders to make informed decisions based on technical indicators and fundamental analysis.

- For clients seeking customized solutions, Sucden Financial offers API integration, allowing for seamless connectivity with external trading systems.

- Moreover, institutional clients can benefit from prime brokerage services, providing access to enhanced liquidity and execution capabilities across various asset classes. These additional features are designed to cater to the needs of professional traders, ensuring a comprehensive and robust environment.

Sucden Financial Compared to Other Brokers

Sucden Financial stands out as a broker focused primarily on providing institutional-grade services, catering to professional traders and financial institutions. Unlike some of its competitors, which offer a wide range of educational resources and user-friendly platforms for retail traders, Sucden Financial targets more advanced clientele and provides advanced platforms like STAR and CQG.

While its asset variety might be smaller compared to brokers offering thousands of instruments, Sucden excels in specialized services and tailored solutions for institutions. In terms of costs, the broker offers competitive commission rates, particularly for CFD trading, but some competitors may offer lower spreads or commission-based structures that appeal to retail traders.

The broker is regulated by the FCA, providing a solid level of trust and transparency. Overall, Sucden Financial is a strong choice for professional and institutional clients seeking sophisticated tools, while retail traders might find other brokers with more accessible resources and lower fees.

| Parameter |

Sucden Financial |

ADS Securities |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1 pip |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

$3 per lot per side for CFD trading |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

STAR, CQG |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

100+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker Sucden Financial

Sucden Financial is a well-established UK-based brokerage firm that specializes in delivering institutional-grade trading services. Regulated by the FCA, the broker is known for its reliability, transparency, and strong reputation in the financial industry.

It offers access to a range of asset classes, including Forex, CFDs, commodities, futures, and equities, through advanced platforms like STAR and CQG. Designed primarily for professional and institutional clients, the broker provides tailored solutions, risk management tools, and deep liquidity.

While it does not offer retail-friendly features like demo accounts or MT4/MT5 platforms, its strengths lie in customized services, robust infrastructure, and high operational standards suited for sophisticated market participants.

Share this article [addtoany url="https://55brokers.com/sucden-financial-review/" title="Sucden Financial"]

Guide me on the opening of trading account

How do I register, am from Nigeria, if I register with $20 how much will I get on return