- What is SmartFX?

- SmartFX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

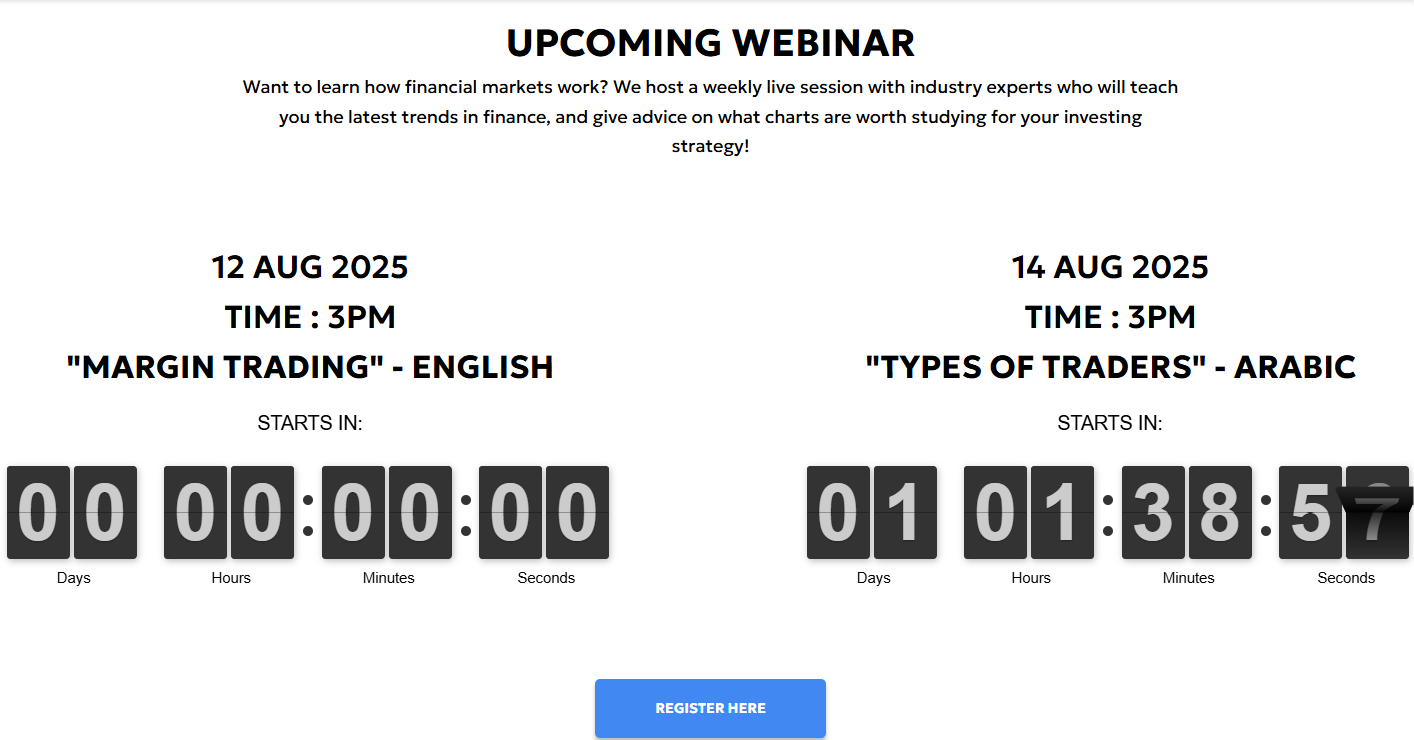

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- SmartFX Compared to Other Brokers

- Full Review of Broker SmartFX

Overall Rating 4.2

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.2 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is SmartFX?

SmartFX is a global online Forex and CFDs trading firm delivering access to a range of instruments across forex currency pairs, commodities, futures, indices, and stocks. Trades are conducted through the world-popular MetaTrader 5 platform, which ensures high liquidity, competitive pricing, in-depth technical analysis, and trading on the go.

To ensure a secure environment, the broker holds a highly respected license from the CySEC, catering to professional clients under the jurisdiction. SmartFX is also licensed by the Vanuatu Financial Services Commission (VFSC). As we have revealed, SmartFX started as a completely offshore company, which we flagged as insecure in our previous review of the broker. The broker currently operates in compliance with fair practices and strict rules.

The broker is beneficial for beginner traders who want to develop their market knowledge and skills essential for efficient trading. With the Daily Market analysis, webinars, blog, and other features, SmartFX becomes a favorable choice for many.

SmartFX Pros and Cons

SmartFX offers competitive services to its clients. The laws of the respected CySEC authority protect professional clients. The broker stands out for its extensive features, access to over 5000 tradable products, and in-depth analysis tools.

The availability of the popular MT5 platform allows clients to trade in an advanced environment. Another key advantage is the copy

trading opportunity to diversify investment opportunities. The broker also offers an adequate education section, with access to articles and webinars.

For the cons, retail clients cannot trade under CySEC protection and are eligible to open accounts under a Vanuatu entity only. Also, the customer support is available only 24/5.

| Advantages | Disadvantages |

|---|

| Holds a CySEC license | No 24/7 customer support |

| Competitive trading conditions | Retail clients are not eligible to open accounts under CySEC |

| Over 5000 trading instrument | |

| Competitive trading costs and spreads | |

| Advanced MT5 platform | |

| Mobile trading | |

| Long-term investment | |

SmartFX Features

SmartFX is known for its comprehensive tools, a good range of tradable products across various financial assets, and advanced technology. Below, see the details on the main aspects of trading with SmartFX.

SmartFX Features in 10 Points

| 🗺️ Regulation | CySEC, VFSC |

| 🗺️ Account Types | A single account |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, commodities, futures, indices, and stocks |

| 💳 Minimum deposit | $500 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Various currencies available |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is SmartFX For?

SmartFX is a good choice for active traders, professionals, and corporate clients. It offers powerful tools, an advanced platform, and a wide range of financial assets. Based on our findings, SmartFX is Good for:

- European professional traders

- Global traders

- Beginner clients

- MT5 platform enthusiasts

- CFD and Currency traders

- Traders looking for diversity

- Competitive spreads

- A single account type

- Good tools and conditions

- Webinars and educational articles

SmartFX Summary

SmartFX is a global Forex and CFD broker that operates under two entities. Under its CySEC entity, the broker accepts only professional clients. Retail clients can open an account only under the VFSC jurisdiction.

With a single account, the broker offers comfortable conditions, suitable for different traders. With access to over 5000 instruments across various financial assets, clients can conduct trades through the advanced MT5 platform.

Overall, the broker provides a competitive environment for clients of diverse skill levels. Although the broker’s educational resources are limited, clients can benefit from webinars, articles, and good research tools. As to the customer support, clients receive helpful assistance through multiple channels 24/5.

55Brokers Professional Insights

We conducted our research on SmartFX, considering various aspects of trading with the broker. As we found, SmartFX provides competitive costs and overall attractive conditions.

However, an important point to consider is that only professional clients can open an account under the CySEC entity, a jurisdiction that provides stringent regulatory standards. Retail clients, on the other hand, can engage in trading through the broker’s global entity. The latter does not offer the same strict safety measures and compliance with rules.

Moving forward, clients of SmartFX can enter the market through a single account, tailored to meet different needs. The initial deposit requirement is $500, which is considered higher than the market average and may not align with the expectations of cost-conscious traders.

SmartFX will be an appealing choice for MT5 platform enthusiasts, with extensive technical indicators, charts, and trading alerts. However, the broker does not offer any other platform options, which can be limiting, especially for beginners looking for a simpler MT4 platform.

Overall, SmartFX can become a favorable option for many; however, it is essential to consider he broker’s regulatory nuances and only then make a final decision.

Consider Trading with SmartFX If:

| SmartFX is an excellent Broker for: | - MT5 enthusiasts

- Forex and CFD traders

- Professional trading

- Offering popular financial products

- Secure trading environment

- Clients preferring a single account

- Good educational resources

- Long-term investors |

Avoid Trading with SmartFX If:

| SmartFX is not the best for: | - Clients looking for top-tier regulation

- Traders looking for 24/7 customer support

- Those looking for various platform options

- Beginner traders favoring extensive educational resources |

Regulation and Security Measures

Score – 4.2/5

SmartFX Regulatory Overview

Based on our research on the broker’s regulatory oversight, SmartFX holds licenses from the well-regarded CySEC and the VFSC in Mauritius.

- The broker holds a license from the CySEC, Cyprus, ensuring safe and reliable services for professional clients. It is essential to pay attention to this point, as under its CySEC license, the broker serves only professional clients, which leaves the retail clients to open an account under the VFSC jurisdiction only.

- The offshore license from the Financial Services Commission of Mauritius (FSC) does not provide strict oversight and is known for more relaxed practices. Thus, we strongly recommend retail clients recognize the risks of trading under the international entity.

How Safe is Trading with SmartFX?

As we have found, SmartFX offers a few security measures to protect its clients. It is crucial to know that the tightest protection practices are in place under its CySEC entity, which accepts only professional clients.

Anyway, this is how SmartFX protects its clients:

- Complying with stringent rules, the broker keeps its clients’ accounts segregated from the company’s accounts.

- Although CySEC-regulated companies generally provide negative balance protection, we did not find any evidence of that on the broker’s website.

Consistency and Clarity

We have also assessed SmartFX from the perspective of consistency and transparency. SmartFX has been in the market since 2018. It started as an offshore broker, with no compliance with serious laws and guidelines.

Based on this, the broker has been listed as an unregulated company and flagged as an untrustworthy trading choice. Yet, the present compliance with the CySEC laws makes the broker partly reliable; under the European entity, only professional clients are eligible to open an account. Retail clients continue to trade under the offshore oversight.

As to customer satisfaction, SmartFX has quite high ratings, with positive reviews on the broker’s fast execution, trustworthy practices, competitive pricing, etc. However, according to some sources, the positive reviews are suspected to be non-authentic, as some of them were traced back to the broker’s IP addresses.

Thus, we recommend that potential clients consider the mentioned points before opening an account with SmartFX.

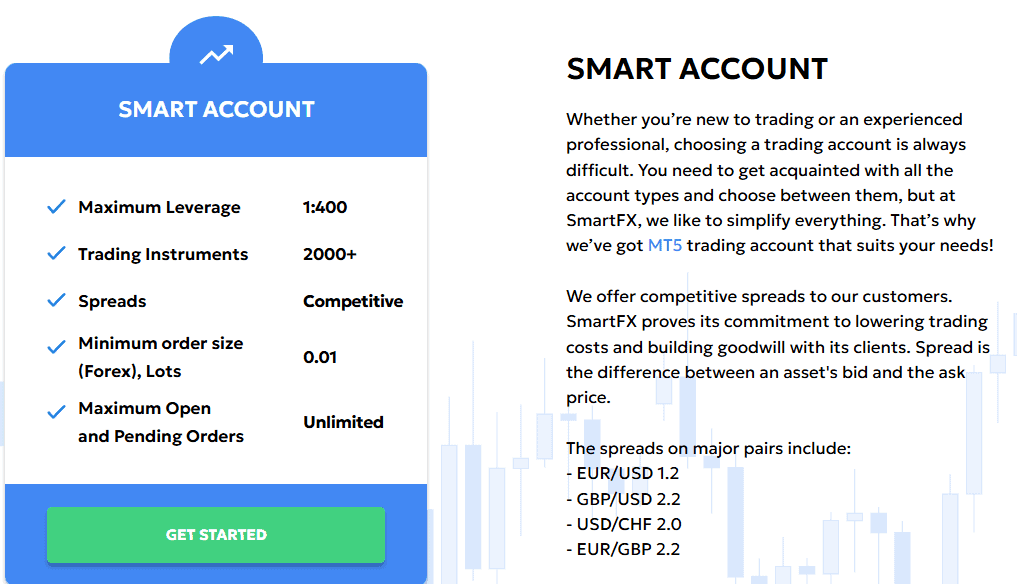

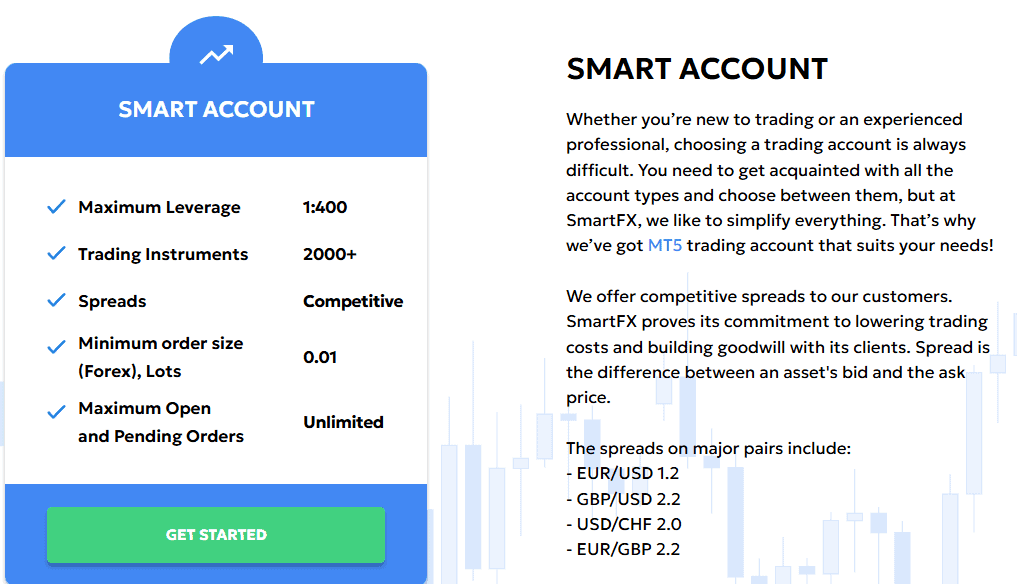

Account Types and Benefits

Score – 4.2/5

Which Account Types Are Available with SmartFX?

We found that SmartFX allows trading with a single MT5 account. The account has two distinct classifications – Individual and Corporate. There might be variations in conditions in these two options regarding the services and functions available. Also, SmartFX supports a practice account, so that its clients gain skills and experience before switching to the live account.

- The Single MT5 account meets various expectations. It offers up to 1:400 leverage, access to a good range of instruments, and competitive spreads for the popular instruments.

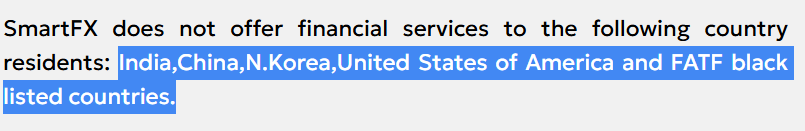

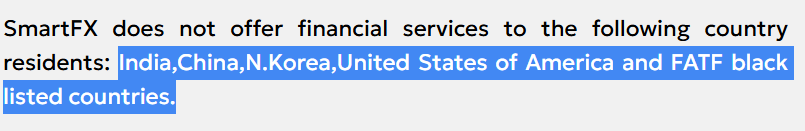

Regions Where SmartFX is Restricted

SmartFX services are not available in certain regions due to regulatory reasons. The broker does not accept clients from the following countries:

- India

- China

- North Korea

- United States of America

- FATF black listed countries

Cost Structure and Fees

Score – 4.3/5

SmartFX Brokerage Fees

SmartFX does not allow much flexibility in its fee structure, as the broker offers fees based on spreads. As we found, the spreads are competitive with no hidden fees and zero commissions. However, as we found, the broker does not disclose spreads for all its instruments. Clients should contact the broker’s support team for more information.

SmartFX offers a single account with a spread-based structure. Spreads depend on the instrument traded. The broker offers tight floating spreads. For the popular EUR/USD pair, the average spread is 1.2 pips.

One of the benefits of trading with SmartFX is the absence of commissions, as all the costs are expressed in spreads. This commission-free structure ensures transparent charges and frees traders from the traditional fixed fees for each trade.

How Competitive Are SmartFX Fees?

Relying on our research of the broker’s fees, SmartFX offers competitive pricing. Traders can benefit from favorable conditions and a friendly environment, with access to average spreads of 1,2 pips. The no-commission fee structure can also appeal to many clients who do not favor additional transaction fees.

However, the broker does not disclose spreads for each instrument separately, which might make it difficult for clients to calculate the trading prices in advance.

| Asset/ Pair | SmartFX Spreads | Evest Spreads | JustMarkets Spread |

|---|

| EUR USD Spread | 1.2 pips | 2 pips | 0.6 pips |

| Crude Oil WTI Spread | 0.03 | 1.1 | 4 cents |

| Gold Spread | 0.28 | 3.7 | 0.16 |

SmartFX Additional Fees

We have also considered the additional fees the broker charges, as these are a common occurrence in Forex trading and are added to the overall trading charges.

- As we found, SmartFX does not charge transaction fees for deposits and withdrawals. However, it mentions extra payments for certain international banking institutions.

- The broker also does not charge an inactivity fee for accounts that have been dormant for a while.

Score – 4.2/5

SmartFX does not offer a variety of platforms, like the popular MT4, cTrader, or TradingView. However, clients of the broker can conduct their trades on the advanced MT5 platform, available on desktop, web platform, and through a mobile app. The platform is a good fit for both beginners and professionals, ensuring access to advanced features, fast executions, and the safety of trades.

| Platforms | SmartFX Platforms | Evest Platforms | JustMarkets Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platform | No | Yes | No |

| Mobile Platform | Yes | Yes | Yes |

SmartFX Web Platform

SmartFX offers web trading through its MT5 web terminal, allowing traders to access the market straight from a web browser, with no need for installation or downloads. It is especially beneficial for traders who face difficulties in installing software on their devices. The platform ensures flexibility and good functionality, providing all the essential features and capabilities of a desktop platform.

SmartFX Desktop MetaTrader 4 Platform

Our testing of the broker’s platforms revealed that SmartFX does not offer the popular MT4 platform. Many MT4 enthusiasts may see this as a disadvantage. Beginner traders prefer to conduct their trades through the MT4 platform, which is simpler in its structure, has an easy-to-use interface, and great tools and charting.

SmartFX Desktop MetaTrader 5 Platform

SmartFX MetaTrader 5 platform offers improved functionality and advanced features. Traders gain access to more than 80 built-in technical indicators, 21 time frames, unlimited charts with one-minute quote history, financial news, and an economic calendar. MT5 is great for algorithmic trading and EA strategies. The platform also includes an integrated VPS for a better trading experience. The broker’s MT5 platform also supports two position accounting systems: netting and hedging.

Main Insights from Testing

All in all, the broker’s MT5 allows more features and capabilities than MetaTrader4, such as market depth, order type variety, larger availability of built-in indicators (38), and 21 timeframes. Although many indicate that the MT4 is more suitable for beginner traders, the MT5 platform is also designed to meet the needs of novice users.

In addition, due to the availability of desktop, web, and mobile options, traders have more flexibility to choose the most convenient option.

SmartFX MobileTrader App

The broker’s mobile app is an ideal tool for on-the-go trading. It allows traders to easily place orders, access a good range of instruments, and conduct in-depth analysis. Traders can use a calendar of economic events, conduct detailed fundamental analysis, and manage their accounts easily.

All in all, the mobile app delivers a desktop-quality experience and supports traders who prioritize flexibility and control wherever they are.

AI Trading

SmartFX supports algorithmic and automated trading strategies, allowing traders to create and test custom algorithms using scripting languages.

However, the broker does not support a built-in AI system and full automation of trades.

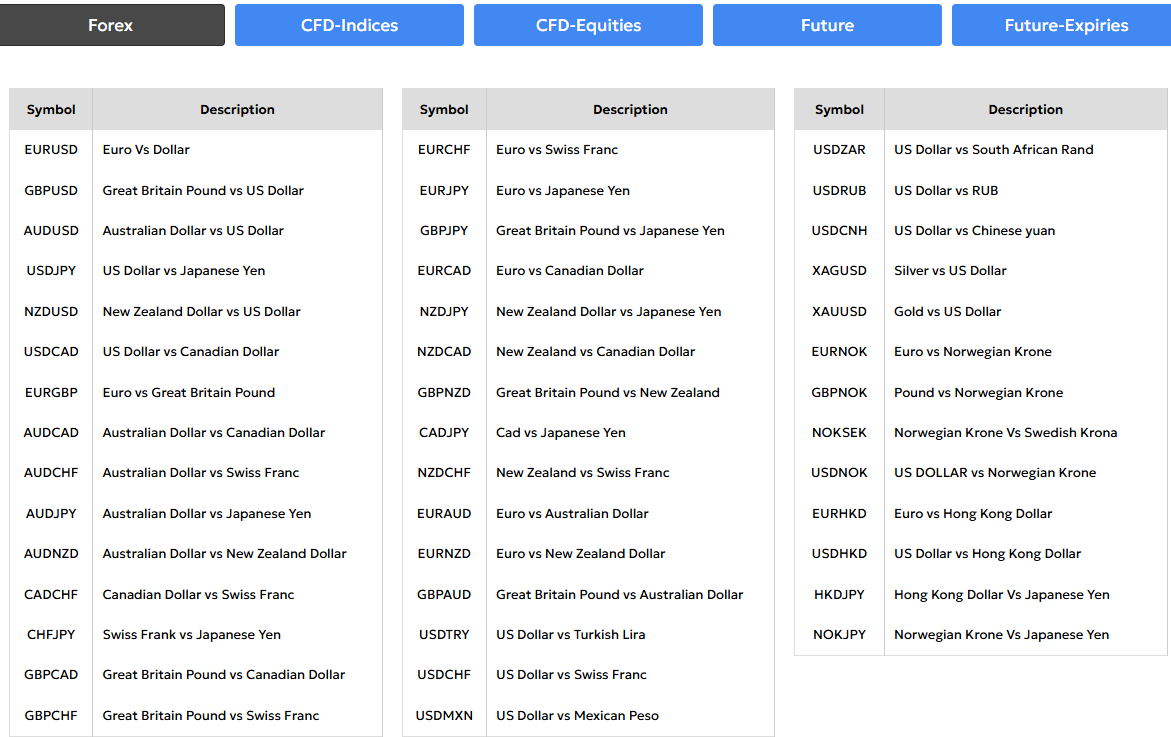

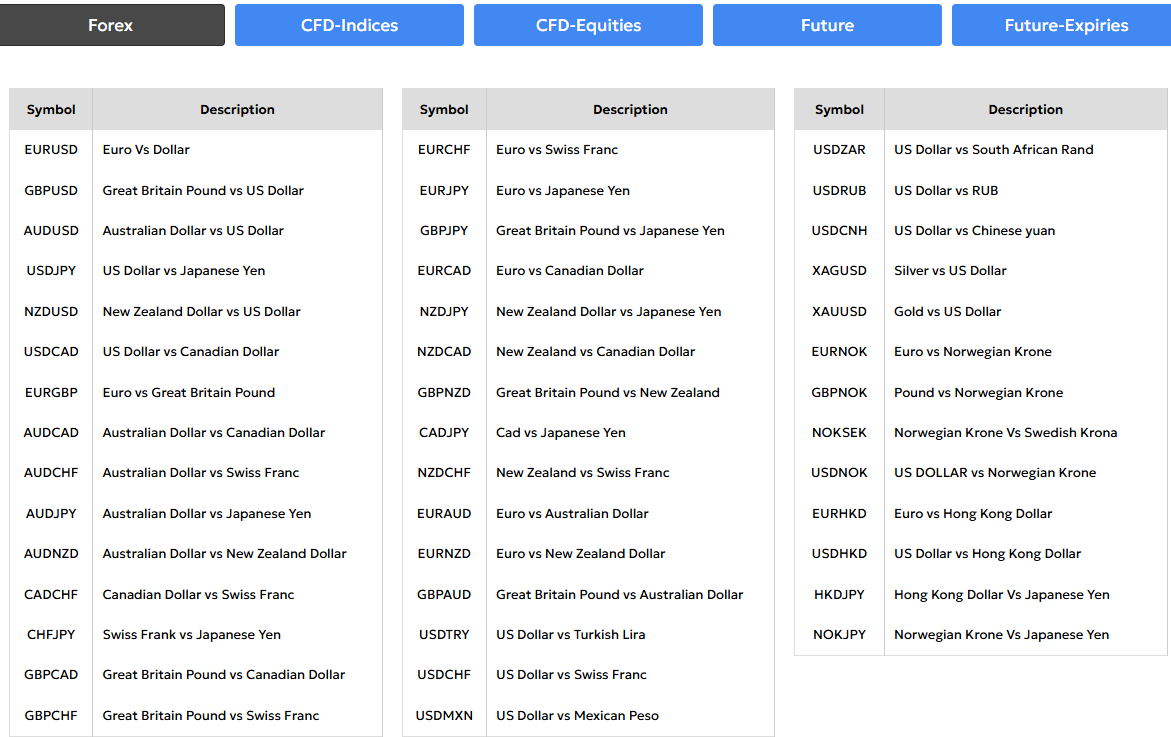

Trading Instruments

Score – 4.4/5

What Can You Trade on the SmartFX Platform?

We found that SmartFX offers all the popular market assets, allowing access to over 5,000 instruments, from the most popular products to more unique instruments. Among the offered markets, Forex is the most traded, offering exceptional liquidity and the advantage of very low spreads. However, the conditions offered might vary depending on the entity. SmartFX primarily offers CFD-based products and includes the following:

- Forex

- Commodities

- Stocks

- Indices

- Equities

- Futures

Main Insights from Exploring SmartFX Tradable Assets

Overall, we found that SmartFX provides its clients access to a wide range of trading assets, enabling trading for all kinds of traders based on their preferences. The availability of 5,000 instruments allows traders to diversify their portfolios and explore new markets.

The broker enables its clients access not only to a good range of currency pairs with competitive pricing, but also to trade futures, equities, and even engage in longer-term trading by investing in stocks.

Leverage Options at SmartFX

SmartFX allows marginal trading, enabling traders to join the market with smaller investments. Traders can profit from leverage by increasing their potential gains; yet, leverage can also work against them. Thus, it is essential to understand how leverage works and what risks it contains.

As SmartFX is a global broker, operating under different laws, there are also differences in the leverage ratios, based on the entity:

- Professional clients under the CySEC regulation are not allowed to use a high level of leverage, and can access up to 1:30 for Forex instruments. Based on the instrument, traders can use up to 1:100 leverage.

- International traders are allowed to use a higher leverage of up to 1:400.

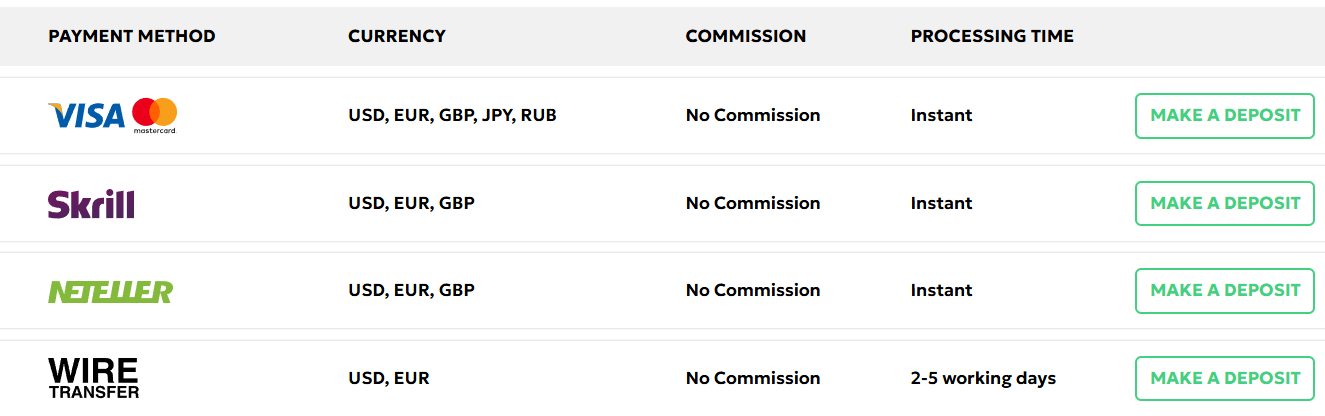

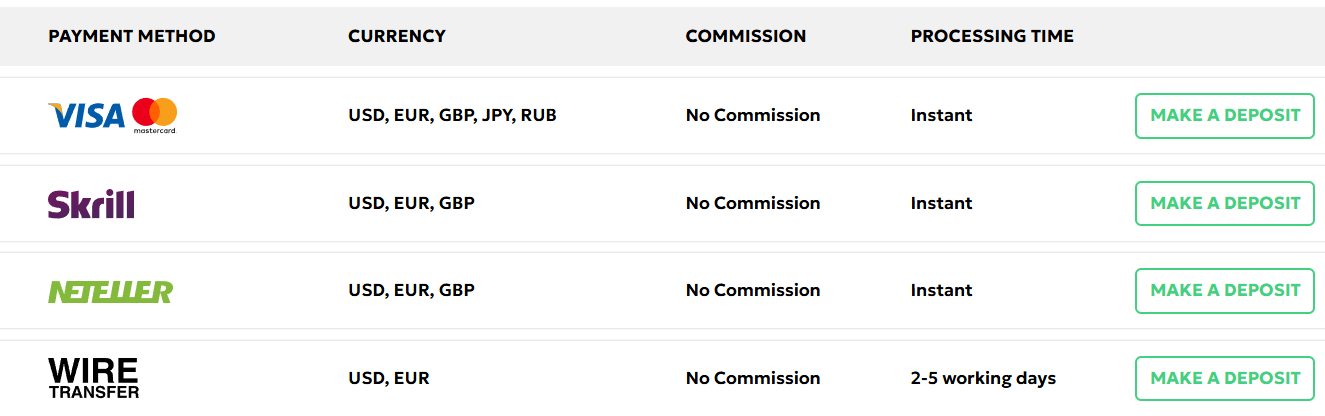

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at SmartFX

SmartFX offers a good variety of deposit methods. The broker does not impose any additional transaction fees for deposits. However, there might be charges applied by the payment provider. SmartFX accepts no responsibility for any such deposit fees.

The main funding methods with SmartFx include:

- Electronic Payment Methods (Skrill, Neteller)

- Bank Wire Transfers

- Credit/ Debit cards

Minimum Deposit

The minimum deposit requirement with SmartFX is higher than the market average, starting from $500. Especially for beginner and cost-conscious traders, the offering might not be favorable.

Withdrawal Options at SmartFX

With SmartFX, traders can withdraw their funds anytime. They must log in to the Client Portal and place a withdrawal request. It is only possible to send the withdrawal back to the source of the deposit. Usually, all withdrawal requests are processed within 24 hours on business days.

- The minimum withdrawal is 100 USD for Electronic Payment Methods, Credit/Debit cards, and Bank Wires.

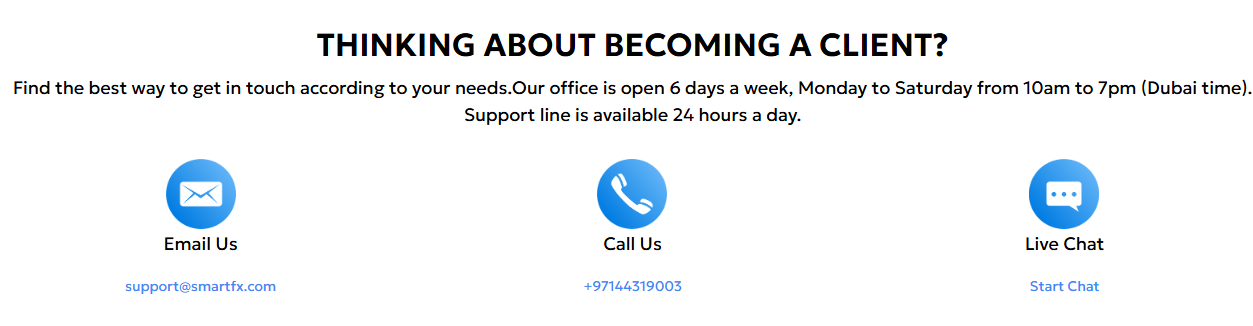

Customer Support and Responsiveness

Score – 4.3/5

Testing SmartFX Customer Support

SmartFX provides 24/5 customer service through various channels, including phone line, Live chat, WhatsApp call, or email.

- Additionally, SmartFX offers a helpful FAQ section with essential trading-related information on various common questions.

Contacts SmartFX

SmartFX provides devoted customer support. Clients can contact the support team by using one of the provided options:

- By using the provided phone number, clients can reach out to the support team for prompt answers and quick solutions: +97144319003.

- SmartFX clients can also send their inquiries, questions, and concerns to the support team via the email address: support@smartfx.com.

- The WhatsApp chat is the quickest way to contact the broker and receive fast and detailed answers.

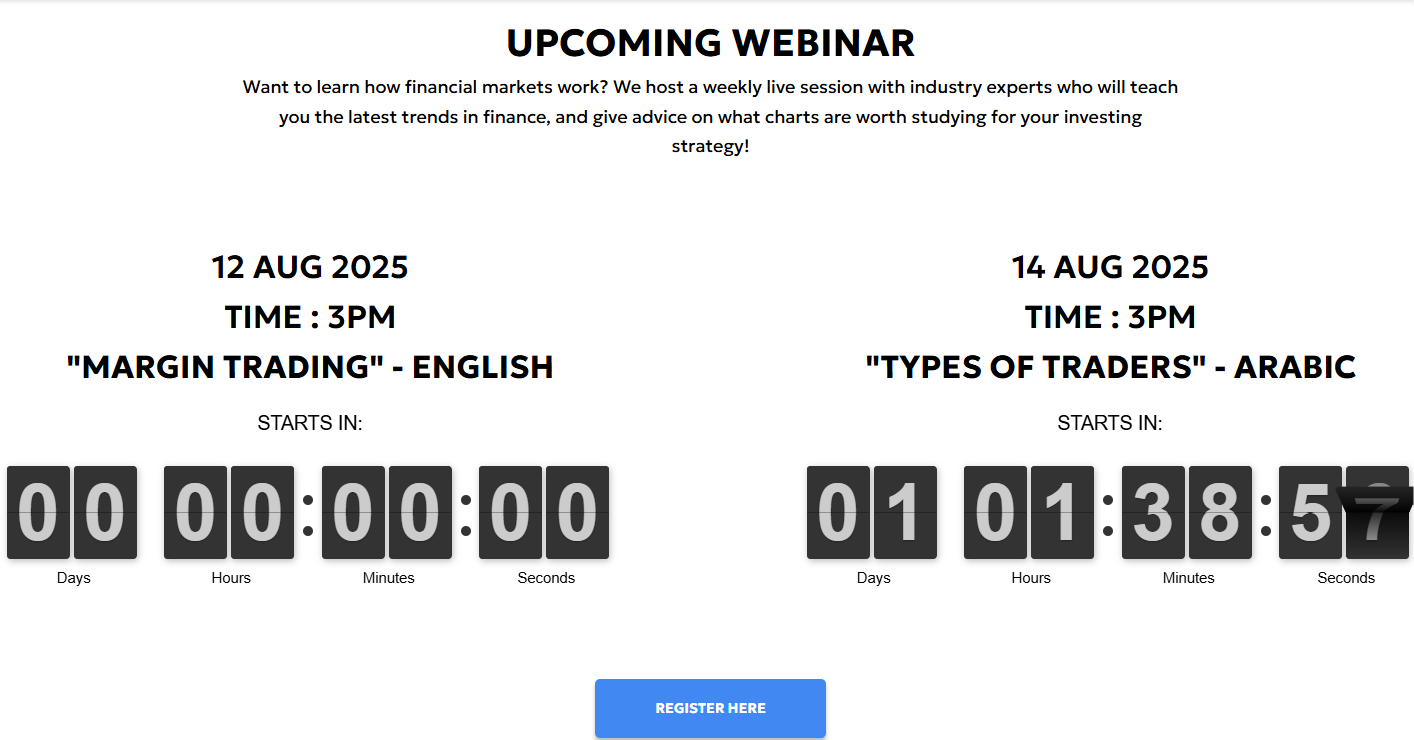

Research and Education

Score – 4.2/5

Research Tools SmartFX

SmartFX provides deep research through analysis tools included in its MT5 platform. The broker also offers a research section on its website, where traders can find the following features:

- Daily market analysis helps traders recognize potential possibilities for buying or selling assets, manage risks, and stay updated on market sentiment.

- The broker also includes an Economic Calendar, listing all the significant economic events that may impact the market and result in changes. Under the CySEC entity, traders have access to only the Economic Calendar. No other extra features are available.

Education

We checked if SmartFX offers comprehensive educational materials on its website and found a few resources, such as webinars and a Blog. Of course, this is far from a Trading Academy, and clients do not have access to video courses, a glossary, or e-Books, yet the provided materials are also helpful and can guide novice traders at the beginning of their journey.

- We also found that under the CySEC entity, which accepts only professional clients, there are no educational resources.

Is SmartFX a Good Broker for Beginners?

SmartFX is a favorable choice for beginner traders with competitive conditions, a single account, a spread-based fee structure, and an attractive range of instruments. SmartFX also offers a practice account for beginner traders to acquire skills before engaging in live trading.

However, the broker offers the MT5 platform, which, while providing advanced features, is often recognized as less straightforward than the MT4 platform. Besides, the initial deposit requirement is $500, which is higher than the market average.

- Also, retail traders are eligible to trade under the Vanuatu entity, which does not provide stringent oversight.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options SmartFX

SmartFX offers most of its products based on CFDs. The available products are over 5,000 in number, allowing clients a good diversity. However, based on our research, SmartFX offers longer-term investment opportunities for stock trading, diversifying its clients’ portfolios.

- Besides, SmartFX offers copy trading, allowing traders to copy the successful trades of professionals without active participation in the trading process.

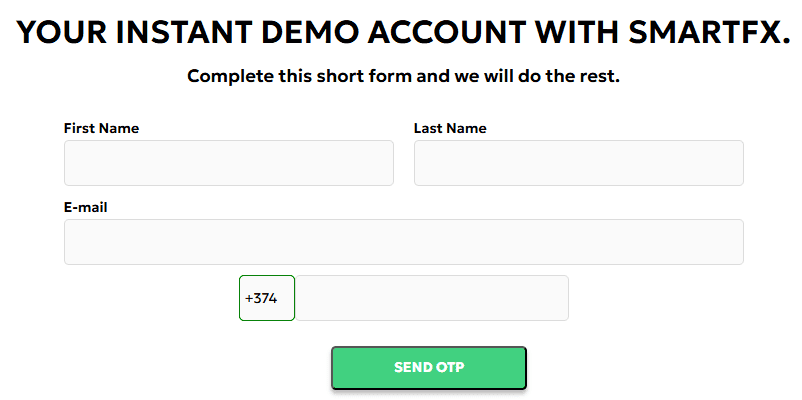

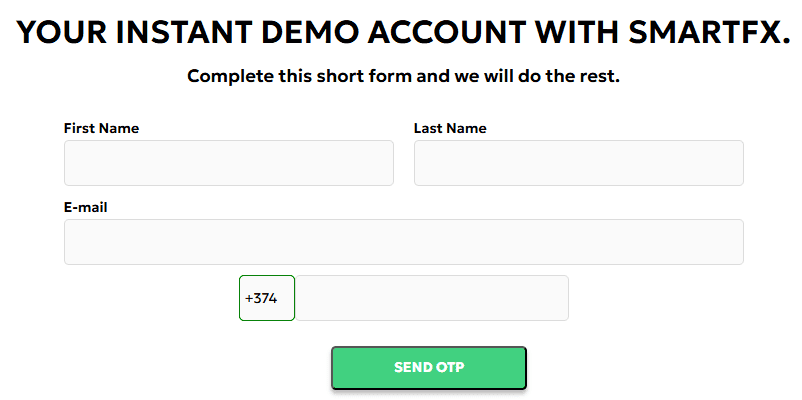

Account Opening

Score – 4.5/5

How to Open a SmartFX Demo Account?

Opening a SmartFX practice account is easy and requires a few simple steps.

Here are a few consecutive steps to follow for a smooth account opening:

- Go to the broker’s website and click on the “Practice” button

- Fill out the registration form with name, email address, etc.

- Select the account specifications.

- Submit the registration form.

- Receive the account credentials via the provided email address.

- Download the platform.

- Use the provided account information to access the platform.

- Start practicing.

How to Open a SmartFX Live Account?

The account opening process is quick and easy with SmartFX, allowing clients to open an account within minutes, without complications.

Here are the steps to follow:

- Go to the SmartFX official website and click on the “Start Trading” button.

- Fill out the registration form with personal information.

- Submit the form and receive the live account credentials at the provided email address.

- Afterwards, fill out the additional KYC form and upload verification documents (ID and proof of address).

- Choose trading specifications, such as leverage, account currency, etc.

- Download the platform, and use the account credentials to access the account.

- Make a deposit (from $500).

- Start trading.

Score – 4/5

Based on our further research, the broker provides great analysis tools, integrated into its advanced MT5 platform. Other than that, we were not able to find any additional tools. As mentioned earlier in the review, SmartFX offers an Economic Calendar, daily market analysis, and a few educational materials for beginner traders.

SmartFX Compared to Other Brokers

Comparing SmartFX to other brokers, we found that the broker has quite a good standing, offering favorable conditions. One of the first factors we consider is the trustworthiness and regulatory status of the broker. While SmartFX now holds a CySEC license, there are still brokers with multiple licenses from top-tier or other well-regarded authorities, such as Eightcap and FBS.

The next aspect we considered is the broker’s fee structure. When we compared SmartFX to over 500 other brokers, we discovered that its spreads are average, 1.2 pips for the EUR/USD pair, in line with spreads offered by FXGT.com and RoboForex.

Another point we found about SmartFX is the attractive range of instruments (5,000+). This offering is impressive, especially when compared to JustMarkets (260 instruments). However, BlackBullMarkets offers 26,000+ products, which is a far more extensive proposal.

At last, SmartFX offers the MetaTrader 5 platform with no other options, while most brokers we reviewed offer both the MT4 and MT5 platforms, proprietary platforms, or the advanced cTrader and TradingView.

The educational section of SmartFX is average, with webinars and a blog, combined with a few research tools. Among its competitors, FBS stands out for its excellent education section, which is attractive for beginner traders.

| Parameter |

SmartFX |

JustMarkets |

RoboForex |

FBS |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread-Based Account |

From 1.2 pip |

From 0.3 pip |

Average 1.3 pip |

Average 0.7 pip |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission-Based Account |

No commission |

0.0 pips + $3 |

0.0 pips + $4 |

0.0 pips+$3 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Average |

Low |

Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT5 |

MT4, MT5, JustMarkets App |

MT4, MT5, R StocksTrader |

MT4, MT5, FBS App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

5000+ instruments |

260+ instruments |

12,000+ instruments |

550+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

CySEC, VFSC |

FSCA, CySEC, FSA, FSC |

FSC |

ASIC, CySEC, FSC |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Good |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$500 |

$10 |

$10 |

$5 |

$0 |

$100 |

$5 |

Full Review of Broker SmartFX

Based on our review, SmartFX jas many positive aspects for trading that can attract traders of different levels of experience.

As we have found, the broker offers retail services under its Vanautau entity, accepting international clients. Under stricter supervision, CySEC, only professional clients are eligible to trade.

Moving forward, SmartFX offers a single platform-based account that caters to various needs and supports multiple strategies. Trades are conducted on the advanced MT5 platform, equipped with innovative features and in-depth analysis tools. The platform enables access to over 5000 instruments across multiple financial assets. Clients can also engage in copy trading and long-term investment in stocks.

The fees are competitive, with a spread-based structure. Spreads are floating with an average of 1.2 pips for the EUR/USD pair. SmartFX offers a range of research and educational resources through its global entity to support its beginner traders. However, the initial deposit requirement is $500, which is higher than the market average.

All in all, SmartFX has competitive conditions; however, retail traders should seriously consider the lack of stringent regulations and oversight.

Share this article [addtoany url="https://55brokers.com/smartfx-review/" title="SmartFX"]

I invested $200 generated profit of $6318.00 i was asked to pay $947 as commission fee. I did not have instead Taylor Jayden who is the manager on telegram group of Binary Option for smartfxtrade.net. i deposited into my account $200 as my first investment.

Taylor asked how much i have so he can help me by top up of the difference. I said i have $168.00. He said put it in your wallet and tell me. I did he gave me bitcoin address to deposit. After deposit he change and said its too little pay $200 more. I refused, and he wants me to bring more people to this platform. I will show screen shots of our converstion.smartfxtrade is a group of scammers

Hi andrew, did you get any return or refund in smartfxtrade.net . thanks

This is a scam, please guys do not trade with them for you will end up loosing all the money you have and find your self in Big debts. I borrowed money from people thinking il get my profit as they promised but unfortunately they kept on requesting more money from me. This people are heartless

Scammers. Erik Finman promised me that I would get my funds immediately but then constantly required me to pay miscellaneous fees to actually withdraw my money. Do not invest your money in this whatsoever. You will never see your “profits” nor be able to withdraw your money because there will be an endless fee of money to pay out. I thought I could trust Erik due to his reputation online but I was wrong.

I recently invested 1500usd and paid a withdrawal fee off 1733usd to receive profits of 22894usd, now they want another 860usd to pay IRS fees. Big scammers and now I have nothing to show

I’m surprised at some of the comments regarding withdrawal. You can even get the funds instantly except for bank transfer which usually takes 48 hours or less. I have tried it a few times.

Tradingsmart.com are real scammers when time to make an withdraw they kept on asking for management fees and they will kept on asking make a plan. Please everyone should be careful of this company they rip me off. I started trading with the from the first of April 2021 and I can’t withdraw my profit as we speak.

I’m not really sure if this legit, Last January I invest first from 24/7 Cryptotradingonline, but never got my profits because the fees never ending asking from me. Then somehow someone messaging me that my trading or my investment they transfer on this platform i can see i have profits but still cannot withdraw because i need to pay the Authorization fees again.. But im really disappointed… I invest little but i lose so much, Help me God, to all this people don’t have a heart…

Me to same happed some one chit me

i think they where scam for this trade..they say im going to widraw my profit but its gone also my momey i invested…also theyre gone in my messenger already

Smartfx is a scam. One member of the group uses the name Michelle Roldan on Facebook.

Big Time Scammer, Got my money showed in the system and then it’s gone I can even access.

Don’t even try to engage them, they are great in deception and manipulation.

I am a beginner and Smart FX is my first broker. I’ve been trading with them for almost 10 months now and so far, everything is going well. I was also able to withdraw my funds a few times now and did not experience any delays.

a big time scammer , do avoid them

R u still investing with them. R they sti paying u

Nice broker..got very nice advice during investment..timely withdrawl..

Dear Lynn,

Have you anytime invested at least a dollar with SmartFX. because i dont see you in the list of customers SmartFX. So when you have not invested with SmartFX how can you say it is a CON MERCHANTS.. So first invest then you will see the results. People like you are the cause legitimate brokers get the bad name. so it is never too late to learn from your mistakes..

I am totally confused now smartfxlive.com are not legit or what exactly I would like to know because I am new I don’t want to feel I gave a made the biggest mistake of my entire life. Everyone struggles in life and each one of us has there own difficulties . So U would like a true and honest opinion has anyone tried smartfxlive.com and are they honest do you actually get your profit after you pay a tax fee and upgrade

actually I invested at smrter fx trade and sad to say that more than 5000 pesos is gone from me….now that bid profit they promise me they would send in my bank account if I sent 3500 pesos is a lie because the insist $500 I must pay I dont have that big amount so now they stopped chatting me.. and mind you they input other bank name which is not my bank God must curse those who fooled me..and lied to me😡😡😡Lynn is right…I agree

samehere i invested 2000 it says it grows to 10k but suddenly it goes upper and need to updgrade to VIP and amounting 500$ for me to withdraw my investment there are scammers

That has happened to me now

they are best Broker in Dubai.!

Bloody con merchants – avoid like the plague! 😤