- What is Skilling?

- Skilling Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

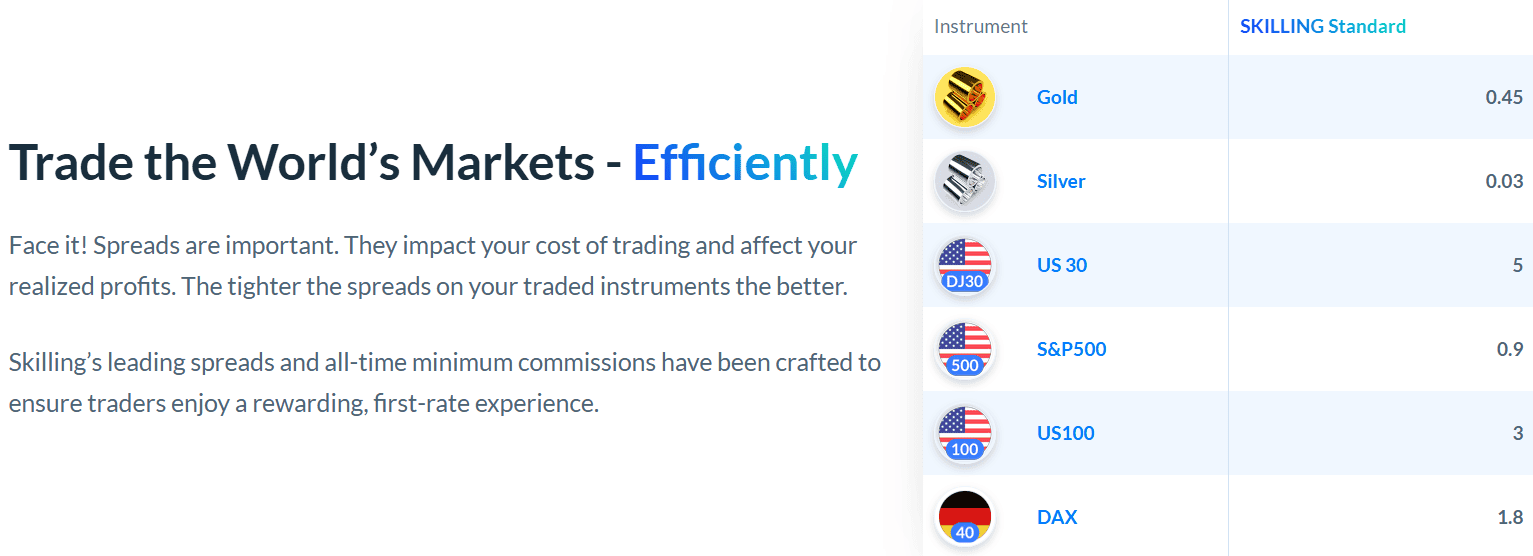

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Skilling Compared to Other Brokers

- Full Review of Broker Skilling

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Skilling?

Skilling is a brokerage company based on STP performance and was started as an accessible, simple-to-trade and navigate platform, allowing both beginners and professionals to engage alike. Founded by a Scandinavian tech team, it was first incorporated in Malta and now has its headquarters in Cyprus.

The broker maintained a balanced trading proposition with over 1200 CFD instruments and access to popular, powerful software, including MT4 and cTrader. Besides, Skilling developed its own software, Skilling Trader, so the technical solutions are on a good level, with transparent conditions that allow traders to focus on performance.

Skilling Pros and Cons

Skilling provides a good range of instruments and technical solutions, overall allowing low-risk trading. We admit a great range of platforms and advanced research tools with easy account opening, fees are at a good level, and overall, we find the trading proposal quite balanced.

For the cons, some funding fees may apply, and there are no proper educational materials.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversee | No 24/7 customer support |

| Range of instrument including Forex and CFDs | No proper education provided |

| Suitable for both beginners and Professionals | |

| MetaTrader, cTrader and proprietary platforms offered | |

| Good technical solution | |

| Advanced range of research tools and analysis | |

| Competitive trading conditions | |

| Client protection | |

Skilling Features

Skilling is a good and reliable broker that meets modern safety standards and offers a great service for trading Forex and CFDs. The broker is known for its innovative technology and low spreads as compared to many brokers in the industry. Here are the main features that the broker offers:

Skilling Features in 10 Points

| 🏢 Regulation | CySEC |

| 🗺️ Account Types | Standard, Premium, MT4, MT4 Premium |

| 🖥 Trading Platforms | MT4, cTrader, Skilling Trader, TradingView |

| 📉 Trading Instruments | Currency pairs and CFDs on Stocks, Indices, Energies, Metals, Cryptocurrencies |

| 💳 Minimum Deposit | €100 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, NOK, SEK |

| 📚 Trading Education | Help Centre, Trading Articles, Learning Videos |

| ☎ Customer Support | 24/5 |

Who is Skilling For?

Skilling is an online broker for traders of all experience levels, from beginners taking their first steps in the financial markets to seasoned professionals seeking advanced tools. Based on our testing, Skilling is good for:

- Professional traders

- MetaTrader4 Traders

- cTrader Traders

- Good spread Trading

- Cyprus Traders

- Scalping / Hedging Strategies

- Various strategies supported

- High Leverage Trading

- Copy Trading

- Currency and CFDs Trading

Skilling Summary

Overall, Skilling has obtained quite a good reputation and competitive conditions. One of the best points in its proposal is a great selection of software, including industry-leading platforms and a proprietary one.

Professionals will get an advanced proposal with tailored solutions as well, while the support center is quite responsive. However, the only con could be a lack of good educational sources and materials, so complete beginners would need to search for webinars and courses somewhere else.

55Brokers Professional Insights

Skilling stands out for its strong focus on simplicity, technology, performance, and flexible market access. The broker offers a seamless experience through multiple advanced platforms, including its own Skilling Trader, along with cTrader and MetaTrader 4, catering to all levels of users.

Clients benefit from fast execution speeds, competitive spreads, and popular financial instruments across Forex, indices, commodities, shares, and cryptocurrencies. Skilling’s intuitive design, transparent pricing, and commitment to innovation make trading more accessible and efficient, allowing users to focus on strategy rather than complexity.

Overall, its blend of modern tools, market variety, and user-oriented approach sets Skilling apart from many traditional brokers.

Consider Trading with Skilling If:

| Skilling is an excellent Broker for: | - Need a well-regulated broker․

- Secure environment.

- Providing competitive conditions.

- Offering a range of popular instruments.

- Offering Copy trading features.

- European trading.

- Various strategies allowed.

- Currency and CFDs trading.

- Who prefer higher leverage up to 1:200․

- Get access to MT4, cTrader, and TradingView platforms.

- Beginners and professional traders.

- Need good research tools.

- Offering a variety of account types.

- Need broker with fast execution. |

Avoid Trading with Skilling If:

| Skilling might not be the best for: | - Who prefer 24/7 customer service.

- Looking for broker with access to VPS Hosting.

- Who prefer MAM/PAMM trading.

|

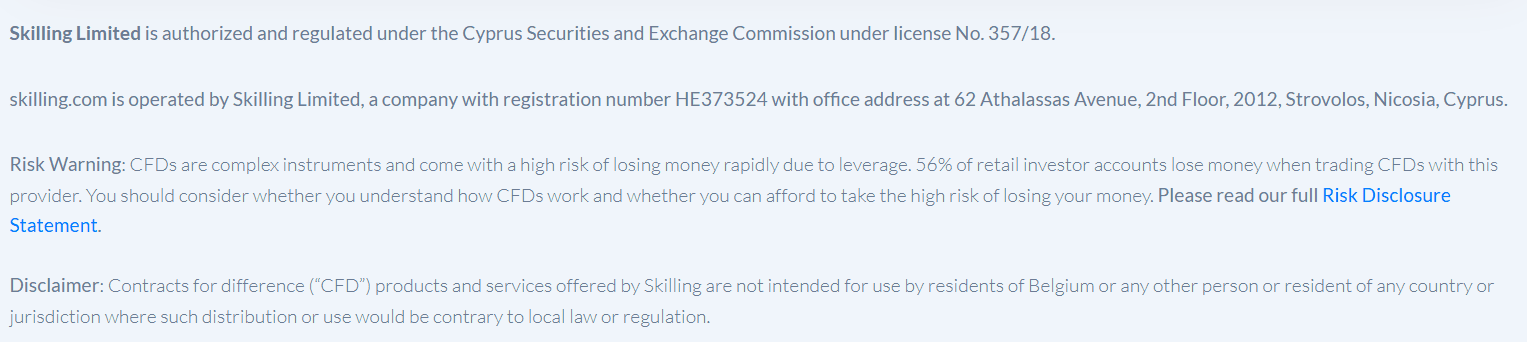

Regulation and Security Measures

Score – 4.5/5

Skilling Regulatory Overview

Skilling was first established in Malta and then moved its headquarters to Cyprus, before its operation received a Forex trading license from CySEC, which also complies with its standards and protective measures according to European ESMA.

How Safe is Trading with Skilling?

Skilling is a safe broker due to its license and legal matters, making sure that the company’s operations comply with the relevant trading requirements and internationally recognized financial standards that protect clients.

Consistency and Clarity

Skilling demonstrates consistency through its solid reputation and transparent operations within the trading community. Established in 2016, the broker has built credibility by maintaining high standards of service and providing traders with fair, reliable trading conditions.

Trader reviews often highlight Skilling’s intuitive platforms, fast execution, and responsive customer support as key advantages, while some note room for improvement in areas such as educational resources.

Over the years, Skilling has also gained industry recognition through various award nominations and partnerships, further reinforcing its reputation as a trustworthy trading brand in the global financial market.

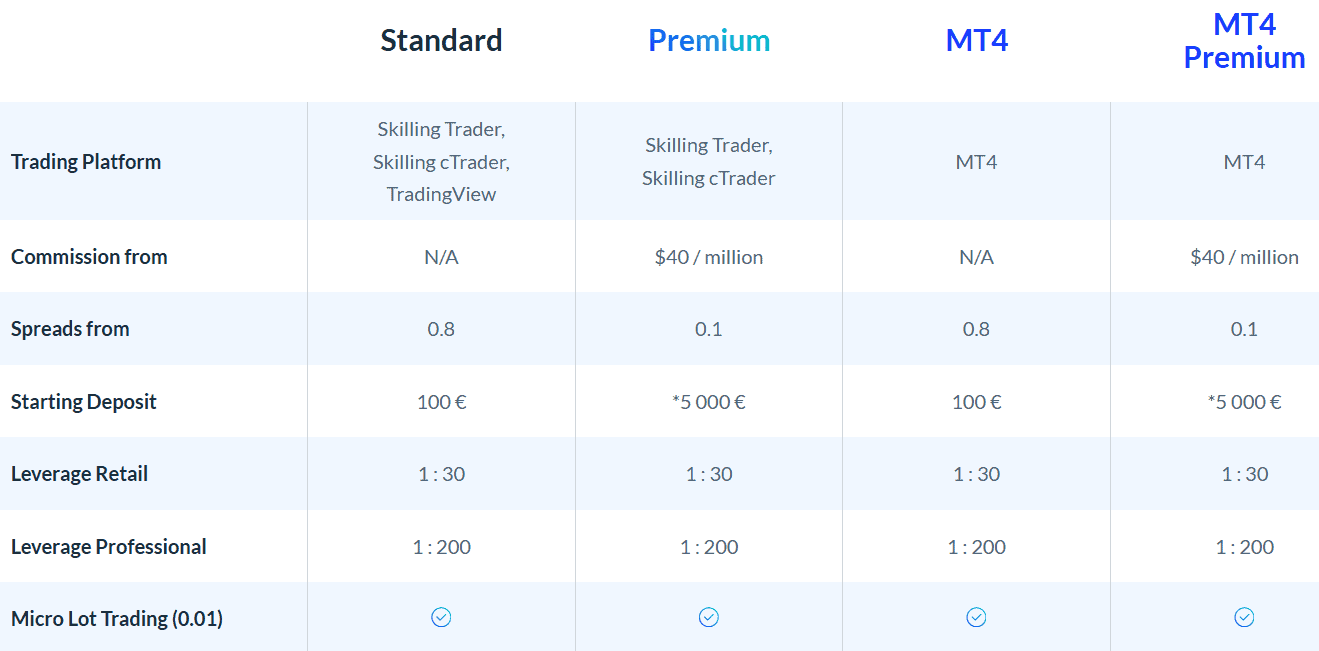

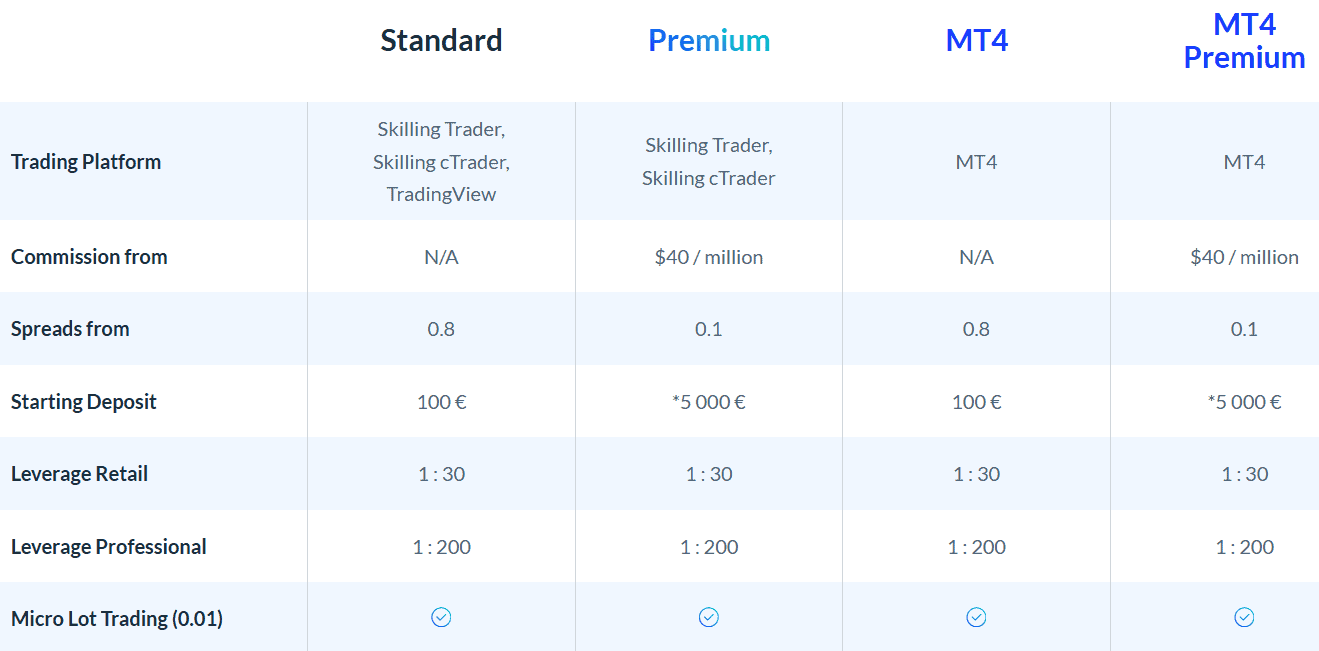

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Skilling?

Skilling offers several account types to accommodate different experience levels. The Standard Account is ideal for beginners and features competitive spreads with no commission when using the Skilling Trader, cTrader platform, or TradingView.

The Premium Account is tailored for more experienced or higher‑volume traders, offering tighter spreads but with higher entry requirements and volume‑based commissions.

For those who prefer the well‑known MetaTrader 4 platform, an MT4 Standard Account mirrors the Standard conditions, and an MT4 Premium Account reflects the tighter‑spread, higher‑volume Premium model.

In addition to the live accounts, Skilling provides a demo account for practice in a risk‑free environment, as well as swap‑free account options for users requiring conditions without overnight interest swaps.

Standard Account

The Standard Account is designed to provide a low‑entry, cost‑effective option for traders starting. The minimum deposit to open the account is €100.

Unlike premium tiers, this account type comes with no commission on trades, and spreads typically start from around 0.8 pips on major currency pairs. It also includes access to the broker’s primary platforms and offers the essential features suitable for retail traders.

Regions Where Skilling is Restricted

Skilling is restricted for residents of Belgium and generally for any person or resident of a country or jurisdiction where the distribution or use of its services would be contrary to local laws or regulations.

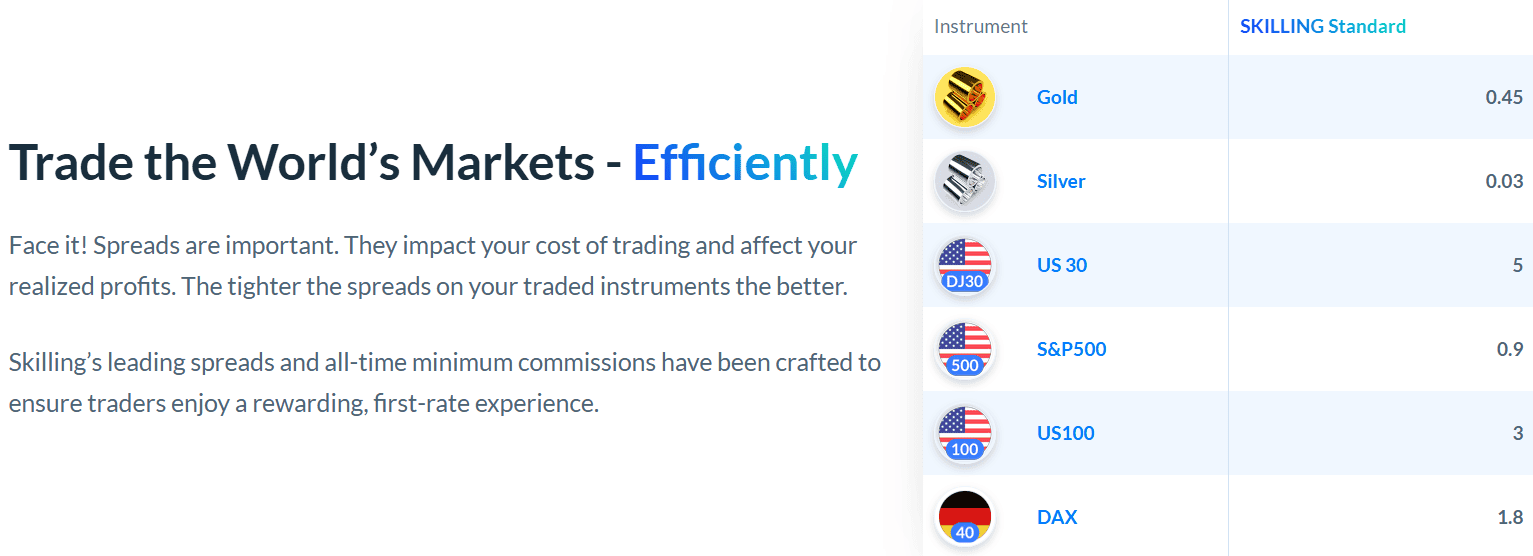

Cost Structure and Fees

Score – 4.5/5

Skilling Brokerage Fees

Skilling offers a clear and straightforward fee structure. Standard accounts have no trade commissions with spreads starting around 0.8 pips, while Premium accounts feature tighter spreads from 0.1 pips but include a commission.

Most deposits and withdrawals are free, though third-party fees may apply. Swap/rollover fees for overnight positions and an inactivity fee for dormant accounts also apply. Overall, Skilling’s pricing is transparent and competitive for all levels of users.

Standard account conditions are ideal for the majority of traders, as all costs are built into the spread, which averages 0.8 pips for the EUR/USD pair.

A Premium account offers interbank spreads from 0.1 pips, which is very competitive compared to the industry standard.

Skilling’s commissions vary by account type and instrument. Standard accounts have no trade commissions, while Premium accounts charge a volume-based commission of $40 per $1 million traded. This structure provides transparency and is especially suitable for higher-volume traders.

- Skilling Rollover / Swaps

Skilling applies a rollover fee when positions are held overnight. The amount depends on factors such as the interest-rate differential between the currencies, the size of the position, and whether the trade is long or short.

Rollover fees are calculated and applied once daily, typically after the end of the trading day, with a triple charge on Wednesdays to account for the weekend. Users should consider these fees when planning positions that extend beyond a single trading day, as they can impact overall profitability.

In addition to commissions and rollover fees, Skilling applies other charges depending on account activity and payment methods. These include inactivity fees if an account remains dormant for an extended period, as well as currency conversion fees when depositing, withdrawing, or trading in a currency other than the account’s base currency.

While most deposits and withdrawals are free, some third-party payment providers may charge a small fee. Overall, Skilling keeps additional costs transparent, ensuring clients are aware of any potential non-trading charges before opening or maintaining an account.

How Competitive Are Skilling Fees?

Skilling maintains a transparent, well-balanced fee structure to provide fair conditions for all types of traders. The broker’s pricing is structured to ensure clarity, with no hidden charges and straightforward cost calculations across different account types.

This approach allows users to manage their expenses effectively while benefiting from a consistent financial environment.

| Asset/ Pair | Skilling Spread | Purple Trading Spread | Ultima Markets Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.3 pips | 1 pip |

| Crude Oil WTI Spread | 0.9 | 0.03 | 1 |

| Gold Spread | 0.45 | 0.09 | 0.3 |

| BTC USD Spread | 230 | - | 11 |

Trading Platforms and Tools

Score – 4.7/5

Skilling offers a good range of platforms and tools to suit traders of all experience levels. Clients can choose between Skilling Trader, the broker’s intuitive proprietary platform with seamless web and mobile access; MetaTrader 4, known for its robust features, expert advisors, and automated trading; and cTrader, which provides advanced charting, fast execution, and transparency for professional traders.

Trading Platform Comparison to Other Brokers:

| Platforms | Skilling Platforms | Purple Trading Platforms | Ultima Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | Yes | Yes | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Skilling Web Platform

Skilling Trader is the broker’s proprietary web-based platform, developed to deliver a smooth, fast, and intuitive experience for all levels of users.

It features a clean and user-friendly interface that allows easy navigation between instruments, advanced charting tools, and multiple order types.

The platform is optimized for both web and mobile devices, ensuring seamless access and real-time synchronization across all devices. Skilling Trader also includes built-in analytics, risk management tools, and detailed performance tracking, helping clients make informed decisions efficiently.

Main Insights from Testing

Testing Skilling’s web platform revealed a smooth and efficient experience across devices, with stable performance and quick execution speeds.

The platform’s integration with cTrader enhances functionality, offering traders access to advanced charting, depth of market data, and algorithmic capabilities. The overall user experience feels consistent and responsive, making the platform a reliable choice for traders who value both technology and convenience.

Skilling Desktop MetaTrader 4 Platform

The MT4 desktop platform available with Skilling remains one of the most trusted and widely used platforms in the industry. It offers a comprehensive suite of tools for market analysis, automated trading, and risk management.

Users can access customizable charts, technical indicators, and Expert Advisors to automate strategies efficiently. MT4’s stability and fast execution make it suitable for all levels of traders who prefer a more traditional, feature-rich environment.

Skilling Desktop MetaTrader 5 Platform

Skilling currently does not offer access to the MetaTrader 5 platform. Instead, the broker focuses on providing trading through MetaTrader 4, cTrader, Skilling Trader, and TradingView.

Skilling MobileTrader App

The broker’s Mobile App offers users the flexibility to manage their accounts and trade on the go with ease. Designed for both iOS and Android devices, the app provides a clean, intuitive interface with full access to live market data, advanced charting tools, and multiple order types.

Users can monitor positions, execute trades, and analyze markets in real time, all from the convenience of their smartphones or tablets. The app also syncs seamlessly with the web platform, ensuring a consistent trading experience across devices.

AI Trading

Currently, Skilling does not offer dedicated AI trading solutions such as automated strategy builders or AI-driven trading assistants. However, traders can still benefit from advanced automation features through its supported platforms, such as cTrader and MetaTrader 4, which allow the use of algorithmic trading and Expert Advisors.

These tools enable users to create and run automated strategies based on predefined rules and market conditions. While not AI-based, these options provide a high level of customization and efficiency for traders seeking automation in their approach.

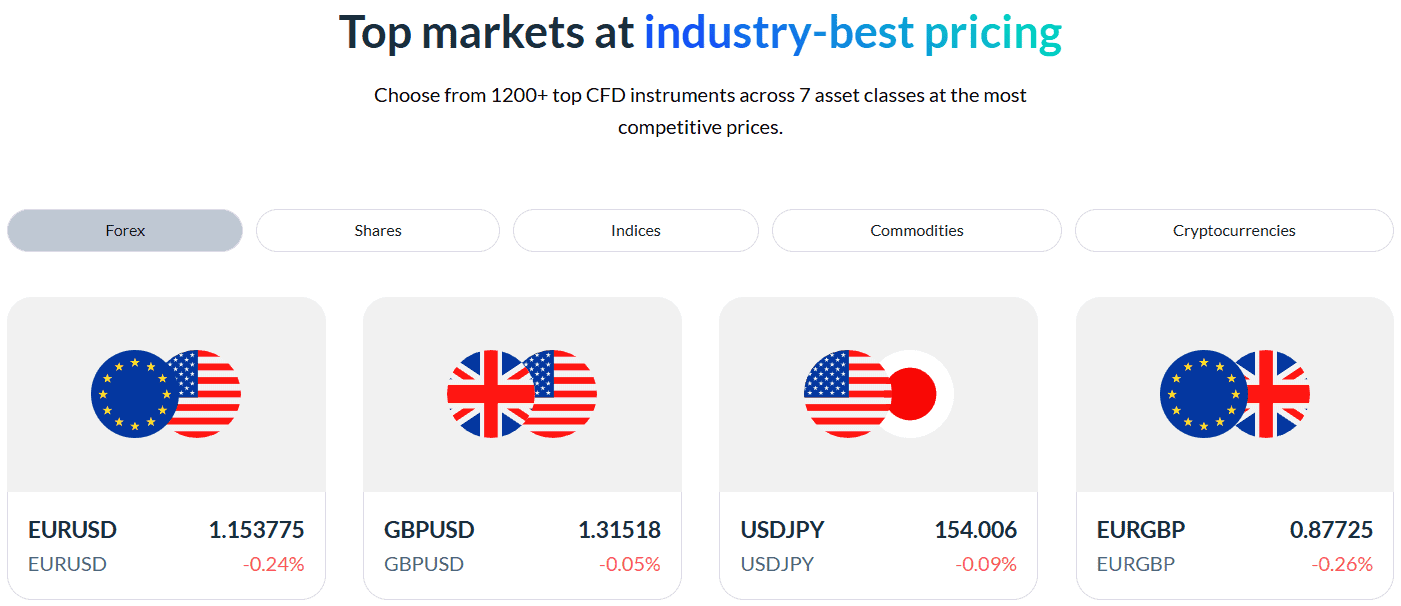

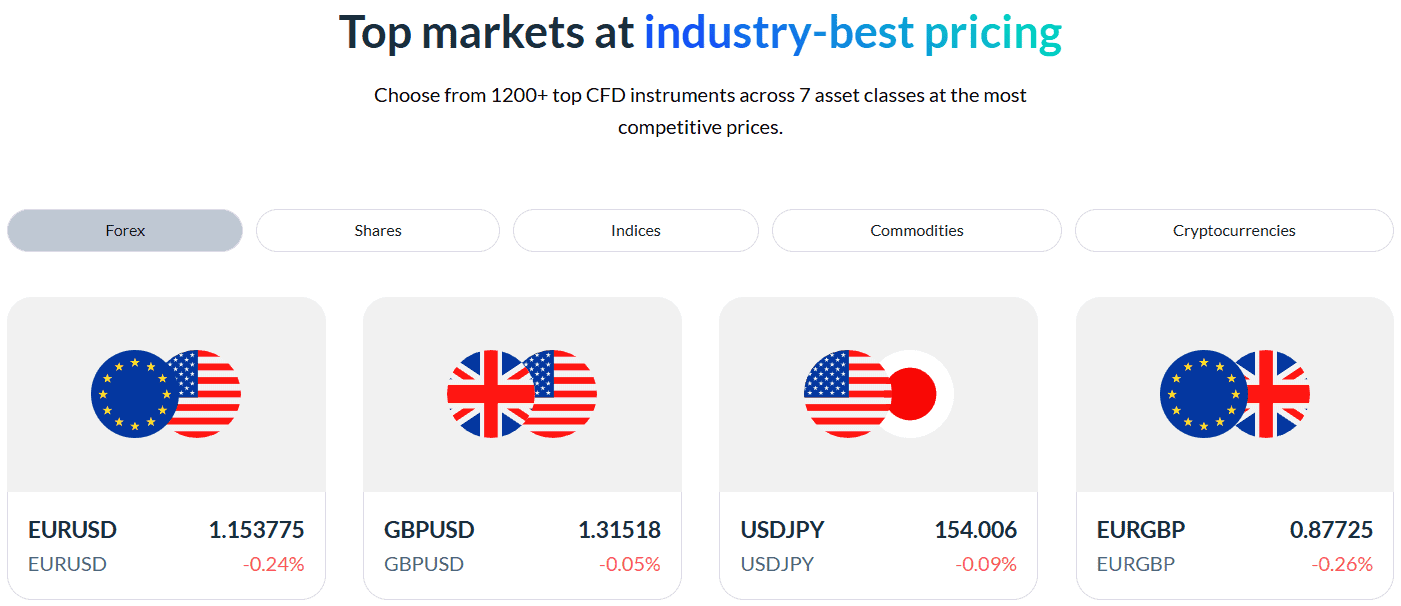

Trading Instruments

Score – 4.6/5

What Can You Trade on Skilling’s Platform?

On Skilling’s platform, users can access over 1200 instruments across a wide range of global markets. The broker offers currency pairs and CFDs on stocks, indices, energies, metals, and cryptocurrencies, giving traders plenty of opportunities to diversify their portfolios and explore different market sectors.

This market coverage allows traders to take advantage of various strategies and market movements all within one integrated platform.

Main Insights from Exploring Skilling’s Tradable Assets

Exploring Skilling’s tradable assets reveals a well-rounded offering that caters to a variety of trading styles and strategies. Users benefit from deep liquidity, tight execution, and a broad selection of instruments that support both short-term and long-term trading approaches.

The platform makes it easy to monitor price movements, track multiple markets simultaneously, and switch between asset classes efficiently.

Leverage Options at Skilling

Regulated Forex brokers are also known for the option to leverage positions with the potential to increase your gains and profits. Yet, the multiplier works in both ways, making profits and losses bigger likewise. For this reason, worldwide regulations restrict leverage to particular levels.

- European clients are eligible to use low leverage up to 1:30 for major currency pairs.

- However, for professional trading, the broker offers higher leverage levels up to 1:200.

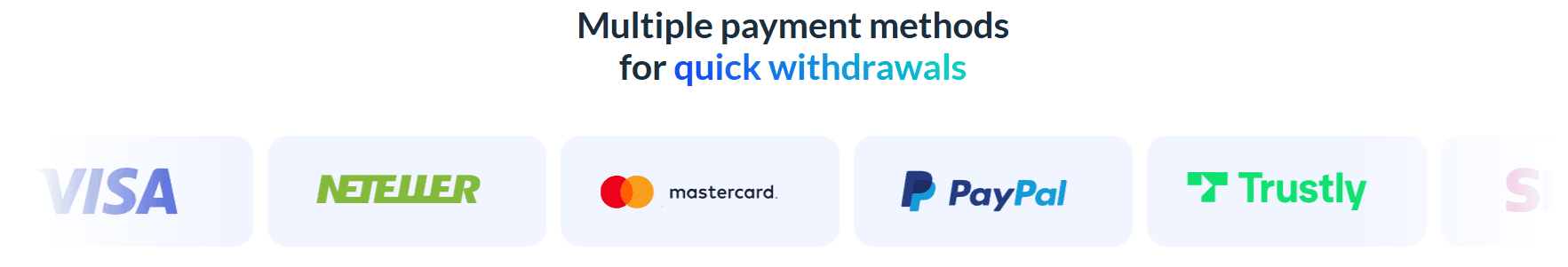

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Skilling

Skilling offers a variety of convenient deposit options, allowing traders to fund their accounts quickly and securely.

- Bank Wire Transfers

- Credit Cards, Debit Cards

- e-wallets, like Neteller and Skrill

Skilling Minimum Deposit

The minimum deposit to open a Skilling account is €100, making it accessible for most traders. This low entry requirement allows beginners to start trading without committing large amounts of capital.

Withdrawal Options at Skilling

Skilling withdrawal options include the most commonly used methods, such as bank transfers, credit/debit cards, and e-wallets.

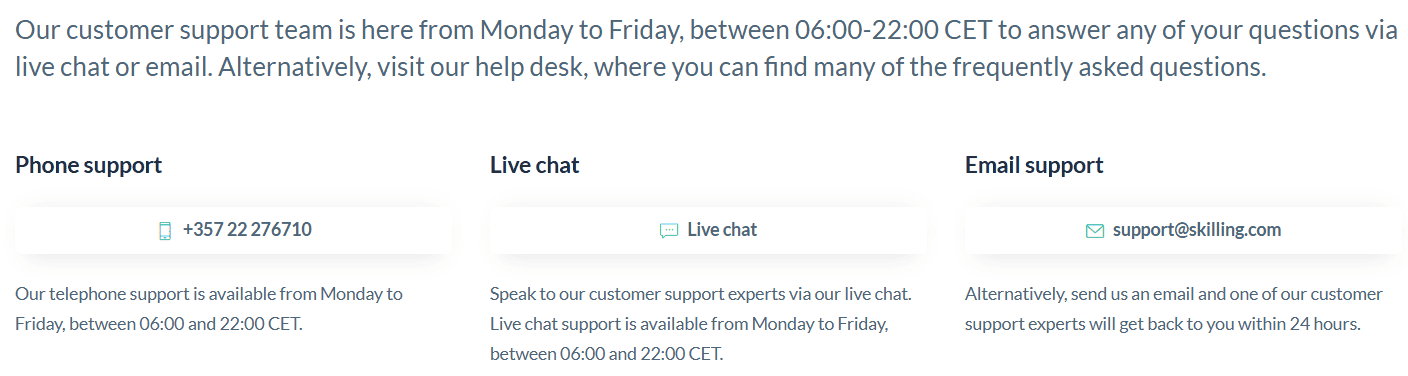

Customer Support and Responsiveness

Score – 4.6/5

Testing Skilling’s Customer Support

Skilling offers responsive 24/5 customer support to assist traders with account, platform, and trading-related inquiries. Support is available via live chat, email, and phone, ensuring users can get help quickly and efficiently whenever needed.

Contacts Skilling

You can contact the broker’s support team by phone at +357 22 276710 or via email at support@skilling.com. The team is available to assist with account, trading, and platform-related questions, providing prompt and professional guidance.

Research and Education

Score – 4.5/5

Research Tools Skilling

Skilling provides a range of research and analysis tools to help users make informed decisions.

- On its platforms, including Skilling Trader, cTrader, and MT4, users have access to advanced charting, technical indicators, and real-time market data.

- The broker’s website also offers market news, economic calendars, insights, and analysis reports, allowing traders to stay updated on global financial developments. Together, these tools support effective strategy planning, market monitoring, and risk management for both beginner and experienced traders.

Education

Skilling offers educational resources to help traders improve their knowledge and skills. The Help Centre provides guides on account setup, platform usage, and basics.

In addition, the broker publishes articles covering strategies, market insights, and analysis techniques, along with learning videos that demonstrate practical methods and platform features. These resources support all levels of users in developing a better understanding of the markets and refining their trading approach.

Portfolio and Investment Opportunities

Score – 3/5

Skilling is primarily a Currency and CFD broker, focusing on providing traders with access to a wide range of markets such as currency pairs, stocks, indices, commodities, and cryptocurrencies.

While the broker offers extensive opportunities and tools for active traders, it does not provide traditional investment solutions such as managed portfolios, mutual funds, or long-term wealth management services. Users using Skilling are responsible for managing their positions and strategies, making it best suited for those interested in active trading rather than passive investment products.

Account Opening

Score – 4.5/5

How to Open Skilling Demo Account?

Opening a Skilling demo account is quick and straightforward. Simply visit the broker’s website, select the demo account option, and complete a short registration form with your name, email, and preferred account settings.

Once registered, you will receive virtual funds to practice trading on platforms like Skilling Trader, MT4, or cTrader, allowing you to explore the markets, test strategies, and familiarize yourself with the platform’s tools without any financial risk.

The demo account is a valuable way for both beginners and experienced traders to gain confidence before trading with real money.

How to Open Skilling Live Account?

Opening a Skilling live account is a simple process that allows you to start trading real markets with actual funds. The registration is straightforward, and the broker provides multiple account types to suit different needs.

- Choose an account type; select accounts based on your preferences.

- Complete registration; fill in your personal details, including name, email, phone number, and country of residence.

- Verify your identity; upload identification documents and proof of address to comply with KYC regulations.

- Fund your account; deposit the minimum required amount using bank transfer, credit/debit card, or e-wallet options.

- Start trading; access Skilling Trader, MT4, cTrader, or TradingView to begin trading live markets.

Additional Tools and Features

Score – 4.4/5

In addition to its research tools, Skilling offers several additional features to enhance the trading experience.

- These include price alerts, watchlists, risk management tools such as stop-loss and take-profit orders, and portfolio tracking to monitor multiple positions in real time.

- The broker also provides customizable notifications and integration with external platforms like TradingView, helping traders stay informed and act quickly on market opportunities.

Skilling Compared to Other Brokers

Skilling positions itself as a competitive choice among online brokers, offering a balanced combination of conditions, platform options, and asset variety.

Compared to many competitors, it provides a good selection of instruments and multiple platform choices, catering to both beginner and experienced traders.

While some brokers may offer larger asset ranges or more extensive educational resources, Skilling stands out for its straightforward account structure, competitive costs, and user-friendly platforms.

Its customer support is reliable and accessible, and the relatively low minimum deposit makes it approachable for new traders, while still appealing to more active and professional clients. Overall, Skilling offers a solid all-around package that competes well with other brokers in terms of technology, accessibility, and trading flexibility.

| Parameter |

Skilling |

GBE Brokers |

Ultima Markets |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.8 pips |

Average 0.8 pips |

Average 1 pip |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.1 pips + $20 per side / million |

0.0 pips + $3.5 per side |

0.0 pips + $2.5 per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, cTrader, Skilling Trader, TradingView |

MT4, MT5, TradingView |

MT4, MT5, MT4 WebTrader, Mobile App |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

1200+ instruments |

1000+ instruments |

250+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC |

CySEC, BaFin, FSA |

FCA, CySEC, FSC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

€100 |

$1,000 |

$50 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker Skilling

Skilling is an online CFD broker that provides traders with access to a wide range of markets, including Forex, CFDs on stocks, indices, commodities, metals, and cryptocurrencies.

It offers multiple platforms, including Skilling Trader, MetaTrader 4, cTrader, and TradingView, catering to diverse traders with advanced charting, automated trading, and real-time market data.

The broker features transparent account types, competitive commissions, and various tools for risk management and market analysis. Funding and withdrawals are convenient, with support for bank transfers, cards, and e-wallets, while customer support is responsive and accessible.

Skilling also provides learning resources, including articles, videos, and a Help Centre, making it suitable for traders who want both flexibility and guidance in their trading journey.

Share this article [addtoany url="https://55brokers.com/skilling-review/" title="Skilling"]

I initiated a USD transactions and made sure I followed all due process and enough gap totaling 76322 pips, It reflected in my account and to my outmost amazement I couldn’t make my withdrawal, I had reached out severally and no response from anyone. these people shouldn’t be taken serious, you can reach w w w high forest capital ltd dot com, they reliable and will help retrieve any of your money that get stucked.