- What is Questrade?

- Questrade Pros and Cons

- Regulation and Security Measures

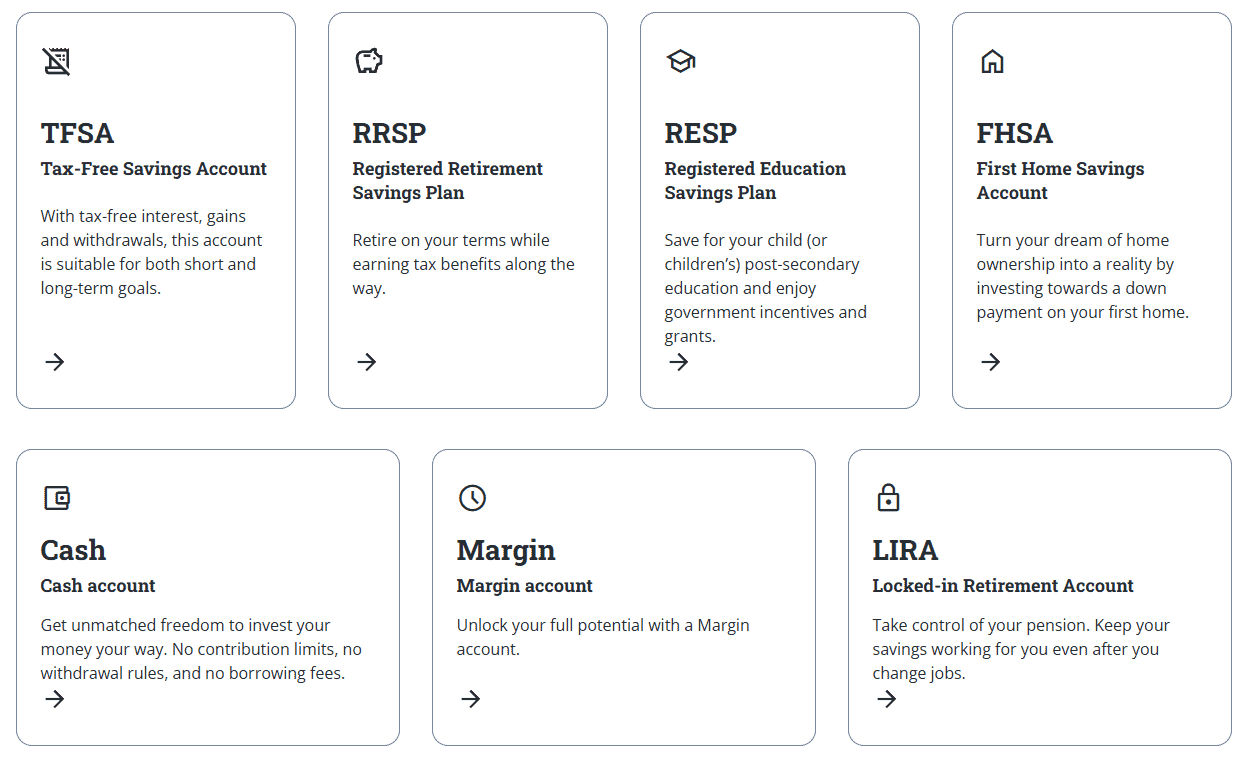

- Account Types and Benefits

- Cost Structure and Fees

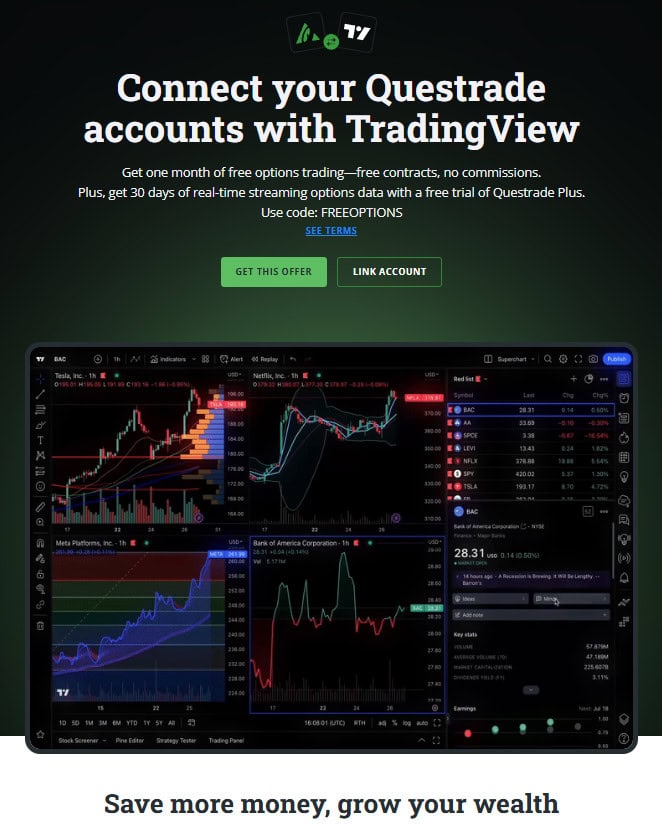

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Questrade Compared to Other Brokers

- Full Review of Broker Questrade

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Questrade?

Questrade is a Canadian Stock trading company that allows users to trade a variety of financial products, including stocks, options, bonds, ETFs, and more.

The firm is regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund (CIPF). Questrade USA Inc., an affiliated entity, operates in the US and is regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations ensure strict compliance with regulatory standards and help safeguard investors’ assets.

Overall, Questrade is recognized for its emphasis on cost-effective investment solutions, offering a self-directed investing approach, where clients have control over their investment decisions and can manage their portfolios independently.

Is Questrade Stock Broker?

Yes, Questrade is a Stock broker that provides online brokerage services, allowing users to trade a variety of instruments. The broker offers different platforms, including a web-based platform and a mobile app, to facilitate trading and portfolio management.

Questrade Pros and Cons

The broker has both advantages and disadvantages that are important to consider. On the positive side, Questrade is known for its low-cost investment approach, offering a range of products. Additionally, Questrade’s educational resources and research tools contribute to a supportive environment for investors looking to enhance their financial knowledge.

For the cons, some traders find Questrade’s platform interface to be complex, especially for beginners. Another disadvantage is the higher minimum deposit requirement for opening an account, which may not be suitable for investors looking for a more affordable starting point for their initial investment.

| Advantages | Disadvantages |

|---|

| CIRO, CIPF, SEC, FINRA regulation and oversee | No 24/7 customer support |

| Self-directed investing | High minimum deposit amount |

| Competitive trading conditions | |

| Investment products | |

| Secure investing environment | |

| Cost-effective | |

| Good education and research | |

| Trading platforms | |

Questrade Features

Questrade provides competitive investment solutions, a diverse range of instruments, and low-cost brokerage fees. A summary of its key features is as follows:

Questrade Features in 10 Points

| 🏢 Regulation | CIRO, CIPF, SEC, FINRA |

| 🗺️ Account Types | Cash, Margin, Tax-Free Savings, Registered Retirement Savings Plans Accounts, and more |

| 🖥 Trading Platforms | Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

| 📉 Trading Instruments | Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

| 💳 Minimum Deposit | $1,000 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | CAD, USD, |

| 📚 Trading Education | Questrade Basics, Tutorials, Investing Articles, Guides, Webinars |

| ☎ Customer Support | 24/5 |

Who is Questrade For?

Questrade is designed for investors who want low-cost access to the markets without sacrificing powerful tools and resources. It is well-suited for self-directed traders who prefer to manage their own portfolios, as well as long-term investors looking for affordable ways to build wealth. Based on our findings, Questrade is Good for:

- Canadian traders

- Stocks and Options trading

- Professional trading

- Advanced traders

- Self-Directed Investing

- Commission-free trading

- Competitive conditions

- Good learning materials

Questrade Summary

In conclusion, Questrade stands out as a comprehensive and reliable Stock firm, offering a range of features tailored to both novice and experienced investors. With a commitment to low-cost trading, a diverse selection of products, and a suite of educational resources, the broker provides a platform that aligns with various investment preferences.

While users may encounter some complexities in the platform interface, the overall package, including robust tools, contributes to Questrade’s reputation as a competitive option for those seeking a self-directed and cost-effective investment experience.

However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Questrade stands out by combining affordability with a feature-rich trading experience. Its competitive fee structure, including commission-free stock and ETF purchases and lower costs compared to many traditional banks, makes it particularly attractive for cost-conscious investors.

Beyond pricing, the firm offers advanced platforms with robust research tools, real-time market data, and customizable features that appeal to active traders. At the same time, its managed investing service, Questwealth Portfolios, provides a convenient solution for those who prefer professional management at a fraction of the cost of traditional advisors.

This balance of low fees, strong technology, and flexible investment options positions Questrade as a broker that meets the diverse needs of investors.

Consider Trading with Questrade If:

| Questrade is an excellent Broker for: | - Need a well-regulated broker.

- Secure trading environment.

- Offering popular financial products.

- Canadian and US investors.

- Competitive trading conditions.

- Professional trading.

- Stock Trading and Investment.

- Investors who prefer robust learning resources.

- Traders who need advanced trading tools.

- Long-term investing.

- Looking for broker with a long history of operation and strong establishment.

- Looking for broker with Top-Tier licenses. |

Avoid Trading with Questrade If:

| Questrade might not be the best for: | - Looking for broker with 24/7 customer support.

- International investors outside Canada and the US.

- Investors who need lower minimum deposit amount.

|

Regulation and Security Measures

Score – 4.7/5

Questrade Regulatory Overview

Questrade is a reliable Stock trading company that follows the strict rules and guidelines established by Canadian CIRO and the US SEC & FINRA. These Top-Tier regulations safeguard client assets and provide low-risk trading.

How Safe is Trading with Questrade?

Questrade is a legitimate and reputable company for traders looking to invest and manage their assets.

Questrade Canada prioritizes client protection through various measures to ensure the security and integrity of user accounts and transactions. The firm is a member of the Canadian Investor Protection Fund (CIPF), which offers protection in case the brokerage faces financial insolvency.

Additionally, the platform provides clients with access to real-time account monitoring and alerts, empowering users to stay informed about their account activities and take prompt action if any suspicious or unauthorized transactions are detected.

Consistency and Clarity

Questrade has built a strong reputation since its establishment in 1999, consistently recognized as one of Canada’s leading online brokers. Over the years, it has earned high scores in independent reviews for its low-cost structure, intuitive platforms, and investor-friendly policies.

Trader reviews often highlight the broker’s affordability and wide range of account options as major advantages, though some users note occasional platform slowdowns or longer wait times for customer support.

Beyond its core services, Questrade maintains visibility in the community through sponsorships and active social initiatives, reinforcing its image as a trusted and socially engaged financial institution.

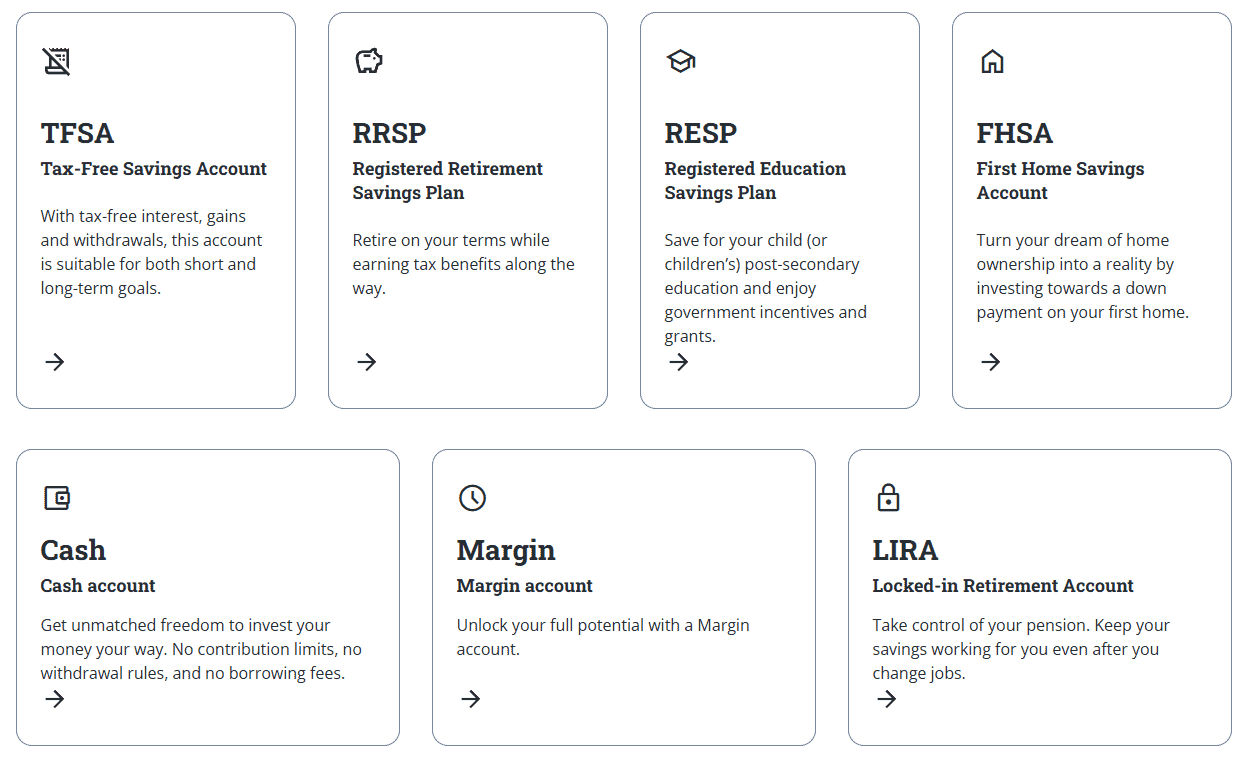

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Questrade?

The broker provides a variety of account options to cater to different investor needs. Clients can open Cash and Margin accounts, as well as various registered accounts such as Tax-Free Savings Accounts (TFSA), Registered Retirement Savings Plans (RRSP), and more.

The broker also offers practice accounts for its platforms, allowing users to trade with virtual money to test strategies before using real funds.

Cash Accounts

Questrade Cash Accounts are straightforward, non-margin accounts designed for investors who prefer to trade only with the cash they deposit, avoiding the risks of borrowing or leverage.

They are available for both individual and joint ownership, and can be used to buy and sell a wide range of securities, including stocks, ETFs, and options. Unlike margin accounts, cash accounts keep trading simple and lower-risk, making them a good fit for beginners or conservative investors.

To open a Cash Account, the minimum deposit requirement is $1,000, ensuring clients start with sufficient funding to actively participate in the markets.

Regions Where Questrade is Restricted

Questrade is a Canada-based online brokerage that primarily serves Canadian residents, and its services are generally not available to non-Canadians. The platform allows Canadian clients to trade in both global and U.S. markets.

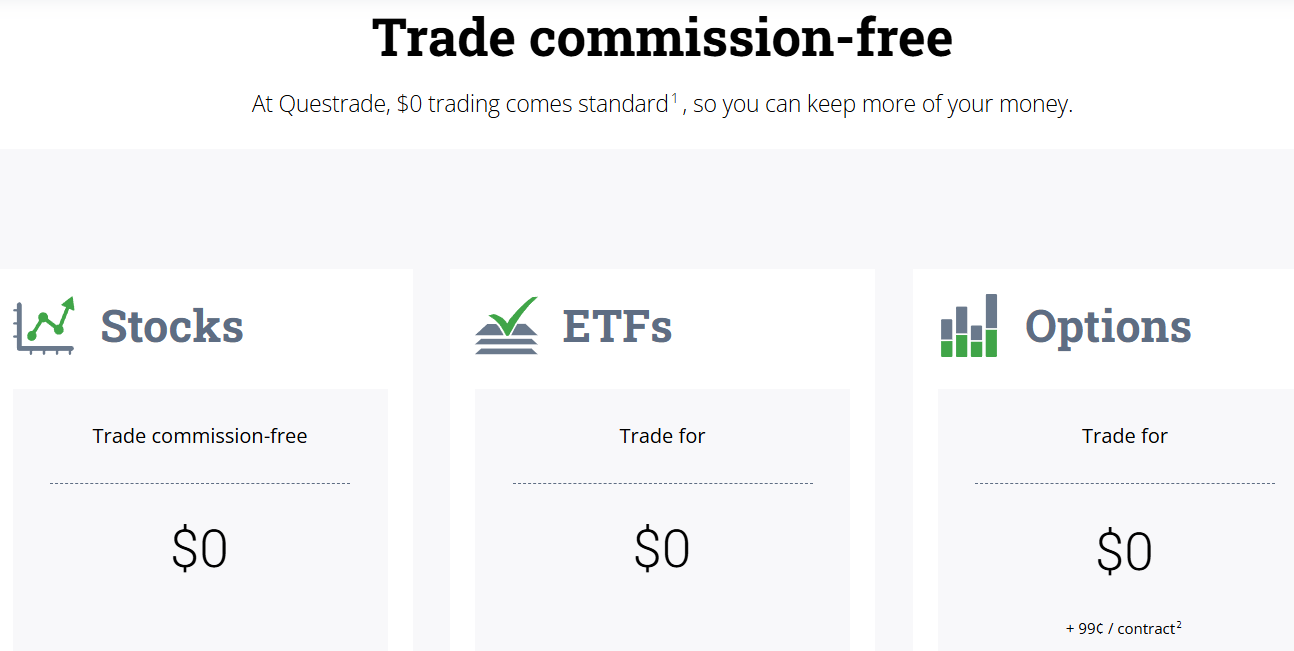

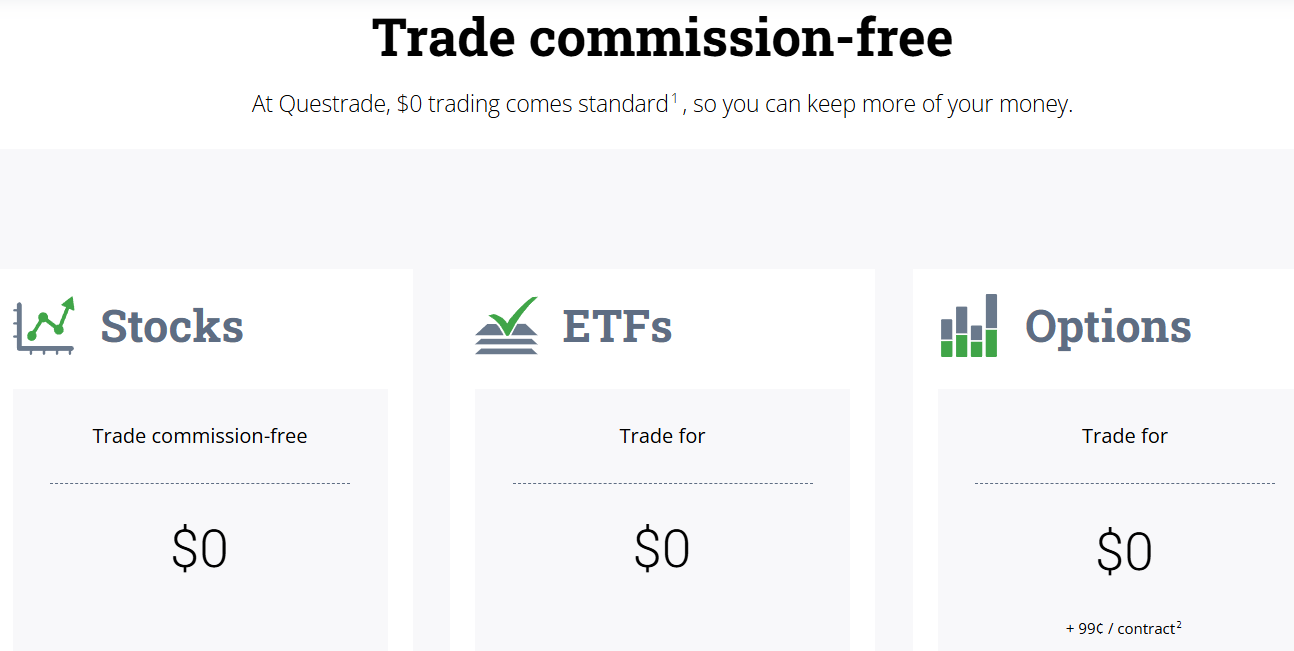

Cost Structure and Fees

Score – 4.5/5

Questrade Brokerage Fees

The firm is known for its transparent fee structure, offering competitive pricing for online trading services. The platform has a commission-based model for options trades, with varying rates depending on the trading volume.

While stock and ETF purchases are commission-free, there may be a charge for selling them. Questrade also has fees for certain account activities, such as currency conversion fees when trading in foreign currencies.

The broker implements a competitive and transparent commission structure. Options trading is subject to a per-contract fee. Notably, purchasing and selling stocks and ETFs are commission-free, making it an attractive option for investors looking to build diversified portfolios without incurring additional costs.

As fees and commissions can be subject to change, traders should check the broker’s official website or contact customer support for the latest and most accurate information regarding commissions.

When trading with Questrade, investors should be aware that, in addition to standard commissions, certain exchange and regulatory fees may apply.

These charges are set by stock exchanges and regulatory bodies, not by Questrade itself, and are passed directly to clients. Such fees typically include items like SEC or FINRA transaction fees for U.S. trades, or exchange levies when trading on Canadian markets.

While generally small on a per-trade basis, they can add up for high-frequency traders. Questrade clearly discloses these costs in trade confirmations, ensuring transparency so clients understand the full breakdown of their transaction expenses.

- Questrade Rollover / Swaps

Questrade does not provide a standard schedule of “swap fees,” but traders should be aware of related costs tied to financing and currency exchange.

A 1.5% conversion fee is embedded in the rate whenever funds are exchanged between CAD and USD. Additionally, Margin accounts are subject to interest charges that differ depending on the currency, functioning as the financing cost of using leverage.

How Competitive Are Questrade Fees?

Questrade is widely regarded as a cost-effective broker in the Canadian market, offering a fee structure that is generally lower than traditional banks and many full-service brokerages.

Its transparent pricing and lack of hidden charges make it appealing to both casual and active investors. The platform provides flexibility with commission-free ETF and stock purchases and competitive rates for stock and options trading, allowing traders to manage costs efficiently.

| Asset/ Pair | Questrade Commission | Moomoo Commission | Angel One Commission |

|---|

| Stocks Fees | From $0 | From $0 | From ₹0 |

| Fractional Shares | No | No | Yes |

| Options Fees | From $0.99 | From $0 | From ₹10 |

| ETFs Fees | From $0 | From $0 | From ₹20 |

| Free Stocks | Yes | Yes | Yes |

Questrade Additional Fees

In addition to standard costs, Questrade charges several additional fees depending on the type of account or service used.

These include account inactivity fees for clients who do not meet minimum trading or deposit requirements, fees for transferring accounts to another brokerage, wire transfer or electronic funds transfer charges, and paper statement fees for clients who opt out of electronic delivery.

While many of these fees are optional or avoidable, they are clearly outlined in Questrade’s fee schedule, allowing investors to plan accordingly and minimize extra costs where possible.

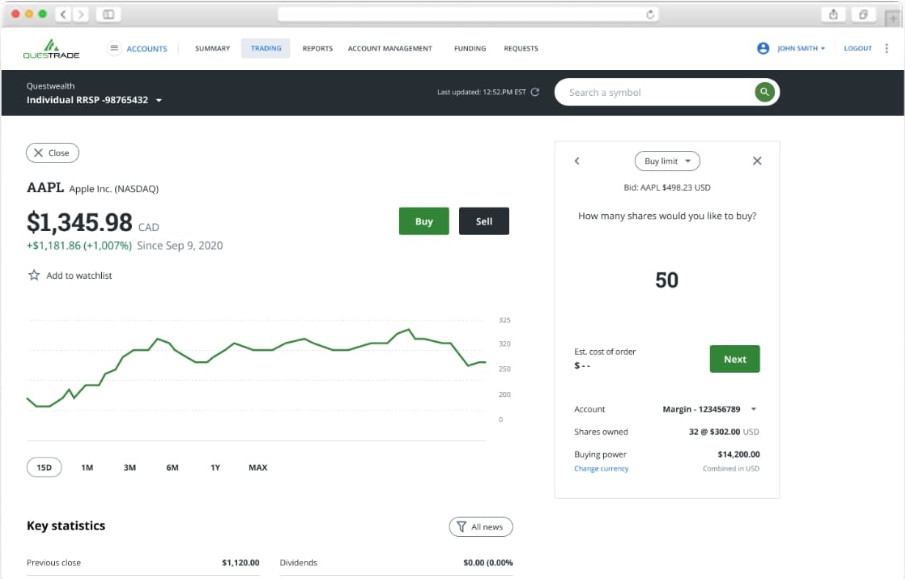

Trading Platforms and Tools

Score – 4.7/5

Questrade offers a suite of diverse and user-friendly proprietary platforms to cater to the varying needs of investors. Questrade Web is a browser-based platform that provides accessibility for trading from any device with internet access. QuestMobile is a mobile app that enables on-the-go trading and portfolio management.

Questrade Edge Mobile is tailored for active traders, offering advanced charting and analysis tools. Questrade Edge, the downloadable platform for Windows, provides a comprehensive experience with advanced features.

For international trading, Questrade Global offers access to global markets and foreign exchange. This range of platforms ensures that Questrade accommodates the preferences and requirements of a broad range of investors.

Trading Platform Comparison to Other Brokers:

| Platforms | Questrade Platforms | Moomoo Platforms | Angel One Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

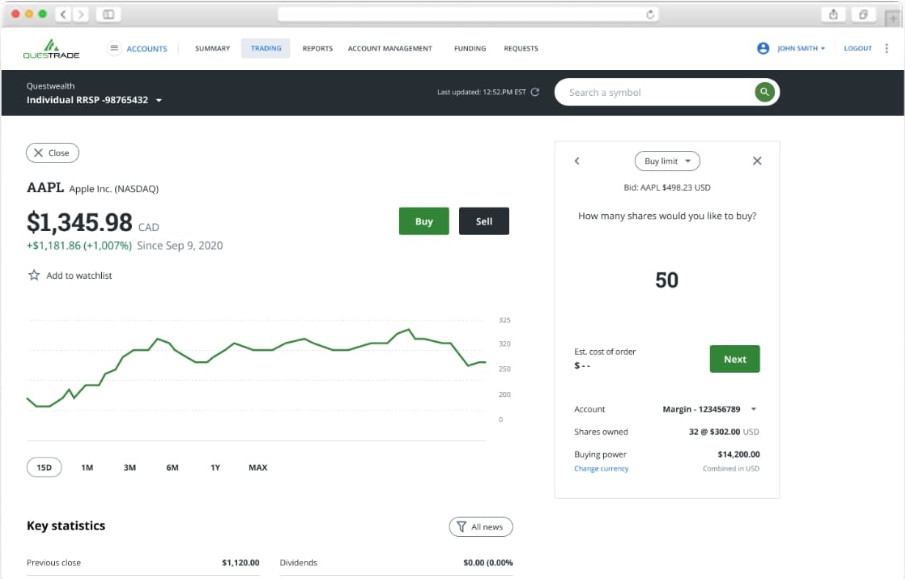

Questrade Web Platform

The Questrade Web Platform is a browser-based trading interface designed for ease of use while offering powerful tools for investors. It provides access to real-time market data, advanced charting, and customizable watchlists.

Users can execute trades across stocks, ETFs, options, and other instruments directly from the platform, while also accessing research reports and market news. With a clean layout and intuitive navigation, the web platform balances simplicity with functionality, allowing investors to monitor and manage their portfolios efficiently without the need to download additional software.

Main Insights from Testing

Testing the Questrade Web Platform reveals a responsive and reliable experience, with fast order execution and minimal lag. Its interface is intuitive, making it easy to navigate between account management, research tools, and trade execution.

Users benefit from clear data visualization, customizable charts, and integrated market news, which enhance decision-making. Overall, the platform performs consistently well, providing a solid balance between functionality and user-friendliness for both casual and active investors.

Questrade Desktop MetaTrader 4 Platform

Questrade does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, typically associated with MT4.

Questrade Desktop MetaTrader 5 Platform

Questrade does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platforms.

Questrade MobileTrader App

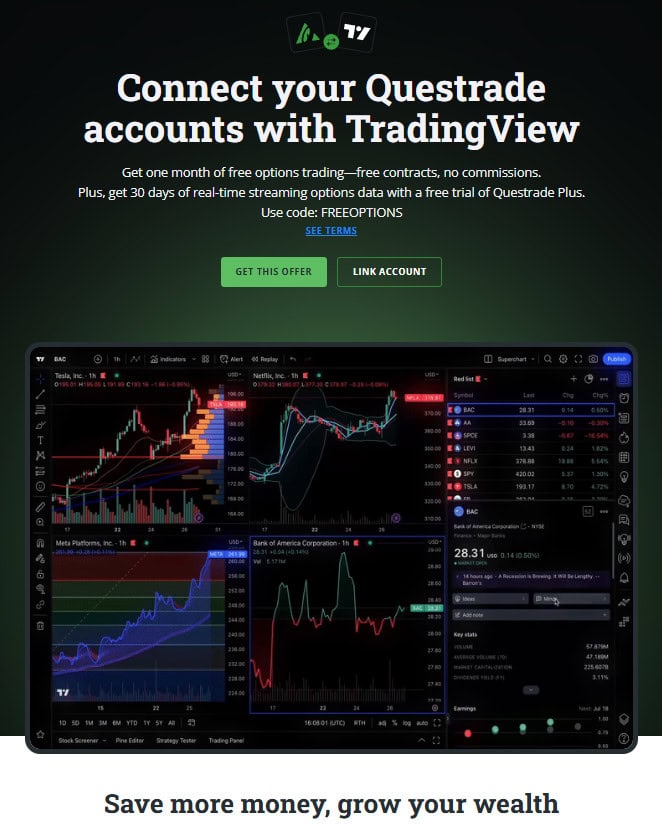

AI Trading

Questrade does not offer proprietary AI-driven tools. However, it provides access to third-party applications that incorporate AI and automation features.

TradingView, available through Questrade, offers advanced charting tools, automatic pattern recognition, and AI indicators to assist in technical analysis. For portfolio management, Passiv Elite, included with Questrade Plus, allows for one-click rebalancing and automated portfolio tracking.

These integrations enable Questrade clients to leverage AI and automation, enhancing their investment strategies.

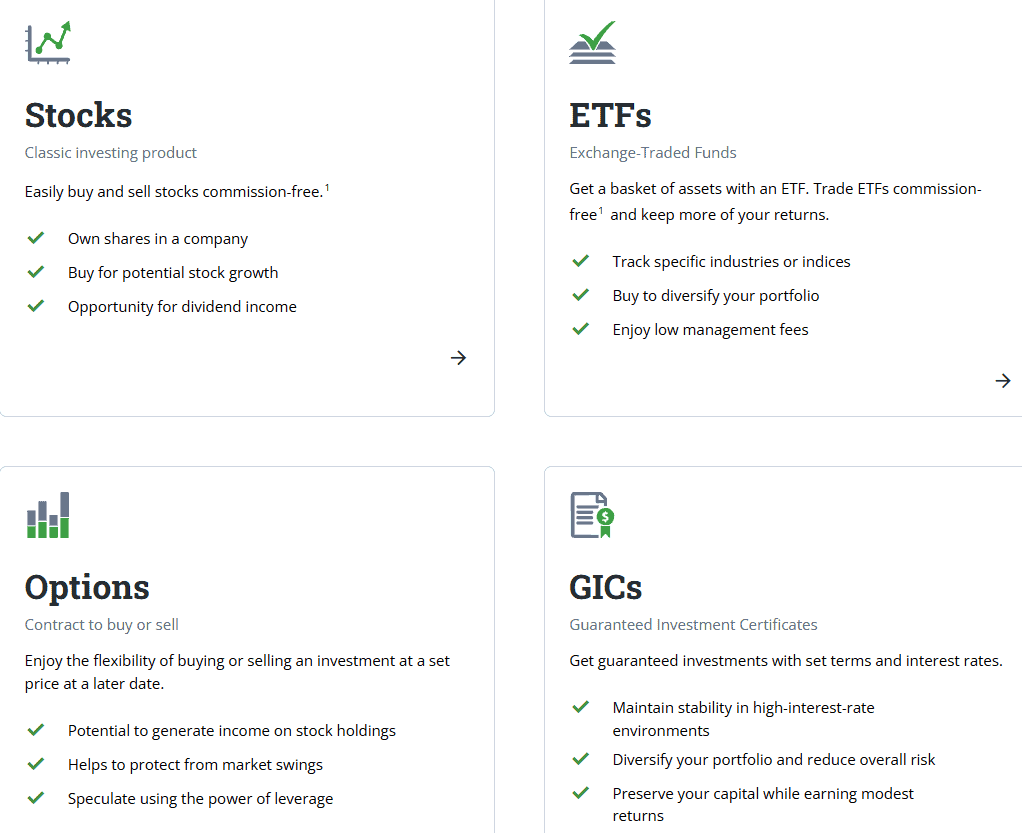

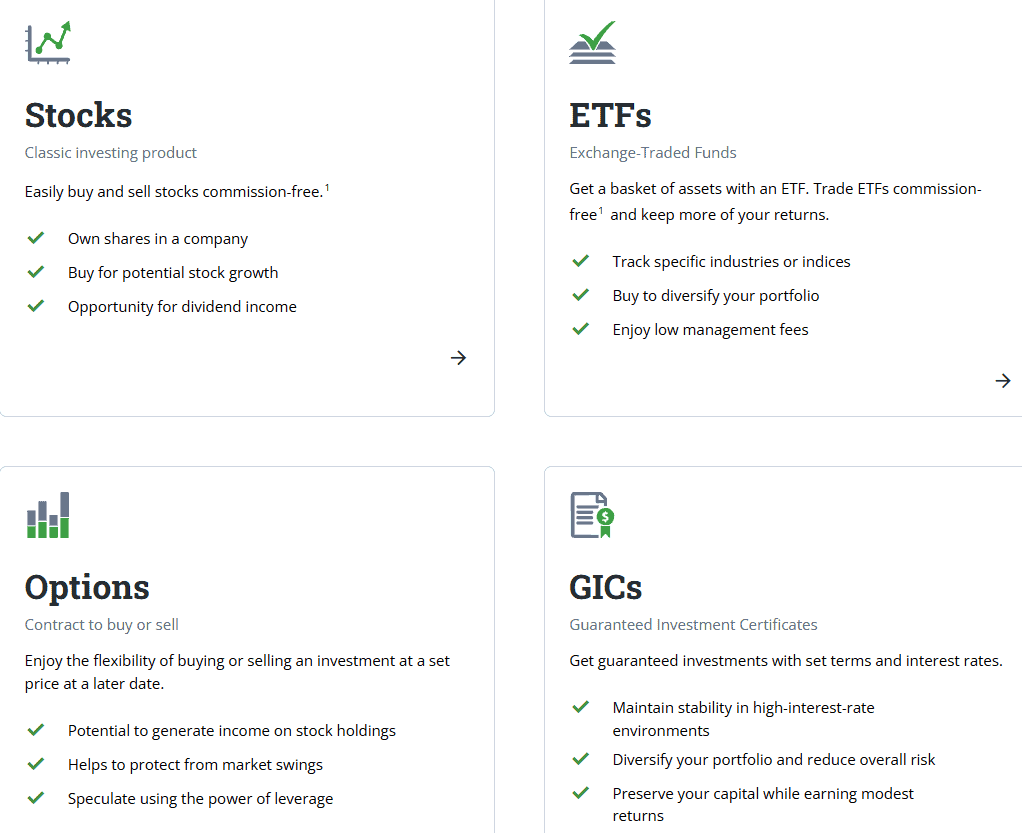

Trading Instruments

Score – 4.6/5

What Can You Trade on Questrade’s Platform?

Through the platform, traders can buy and sell a comprehensive range of financial products, including Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, and Precious Metals.

This extensive selection empowers users to create well-diversified investment strategies aligned with their financial goals.

Main Insights from Exploring Questrade’s Tradable Assets

Exploring Questrade’s tradable assets highlights the broker’s versatility and broad market access. The platform provides investors with the ability to diversify their portfolios across multiple markets and instruments, offering flexibility for both short-term and long-term investing strategies.

Overall, the broker’s range of assets caters to a wide spectrum of investor needs, from beginners seeking simplicity to experienced traders looking for advanced opportunities.

Margin Trading at Questrade

Questrade offers margin trading services, allowing clients to borrow funds against their existing securities to potentially amplify their positions.

However, margin trading involves additional risks, as losses can exceed the initial investment. Therefore, traders should thoroughly understand the associated risks and requirements before engaging in margin activities on the platform.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Questrade

The broker provides users with several funding methods to deposit funds into their accounts. Clients can fund their accounts through electronic funds transfer (EFT) from their bank accounts, instant deposits, wire transfers, and bill payments.

Additionally, Questrade accepts funds from other brokerage accounts through in-kind transfers. The platform does not charge fees for electronic funds transfers, making it a convenient and cost-effective way for clients to deposit funds.

Questrade Minimum Deposit

For self-directed customers aged 18 to 25 or those opening a self-directed First Home Savings Account, Questrade has a reduced minimum deposit requirement of $250. However, for all other self-directed customers, the minimum deposit stands at $1,000.

Withdrawal Options at Questrade

The broker facilitates withdrawals through various methods, allowing clients to access their funds conveniently. Users can request withdrawals through EFT to their linked bank accounts, and the platform typically processes these requests within a specified timeframe.

Additionally, Questrade offers the flexibility of initiating withdrawals through bank wire transfers for those who prefer this method, with associated fees varying depending on the chosen withdrawal option.

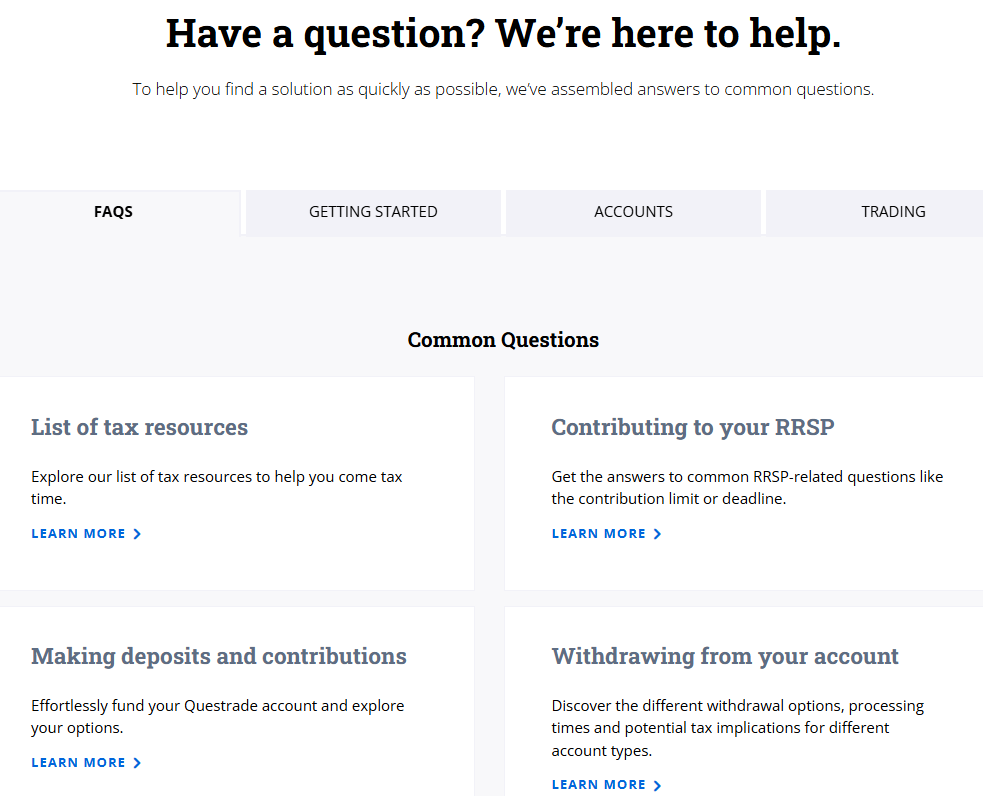

Customer Support and Responsiveness

Score – 4.6/5

Testing Questrade’s Customer Support

The broker offers 24/5 customer support through various channels to assist users with inquiries and concerns. Clients can reach out to Questrade’s customer support team via phone, email, or live chat.

Additionally, the platform provides FAQs to help users navigate and troubleshoot common issues independently.

Contacts Questrade

Questrade provides multiple ways to contact its support team. For general inquiries, you can email support@questrade.com or use the online chat. Phone support is available at 1-888-783-7866 (Canada toll-free).

Research and Education

Score – 4.7/5

Research Tools Questrade

Questrade offers a comprehensive suite of research tools across its trading platforms.

- On the web platform, users have access to advanced charting capabilities, customizable watchlists, and real-time market data.

- For more in-depth analysis, Questrade integrates tools like TipRanks for analyst ratings and Smart Score, as well as Seeking Alpha for market sentiment insights.

- Additionally, the platform provides access to TradingView for advanced charting and technical analysis.

- For active traders, the Questrade Edge platforms offer enhanced features such as OptionsPlay for options analysis, detailed news sentiment analysis, and an events calendar. These tools are designed to help investors make informed decisions and stay ahead in the market.

Education

The broker offers a range of resources to empower users with financial knowledge. The platform features educational webinars, tutorials, articles, and other informative content to help investors enhance their understanding of strategies, market dynamics, and investment principles.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Questrade

Questrade offers a range of investment solutions to cater to various investor needs.

For those who prefer a hands-on approach, their self-directed investing platform allows individuals to build and manage their own portfolios, selecting from a wide range of investment products.

Additionally, for investors seeking a more passive strategy, Questwealth Portfolios provides professionally managed, diversified portfolios tailored to different risk profiles. These portfolios are designed to help investors achieve their financial goals with minimal effort.

Questrade also offers tools like Passiv to automate portfolio rebalancing, ensuring that investments remain aligned with individual objectives.

Account Opening

Score – 4.5/5

How to Open Questrade Demo Account?

Questrade offers a practice account, also known as a demo or virtual account, which allows users to explore the platform and test strategies without risking real money.

This account provides access to real-time market data, simulated trading for stocks, ETFs, options, and other instruments, and many of the tools available in live accounts.

It is an ideal way for beginners to learn how to navigate the platform and for experienced traders to try out new strategies in a risk-free environment. Opening a practice account typically involves a simple registration process on Questrade’s website, after which users can start trading virtually and gain hands-on experience before committing real funds.

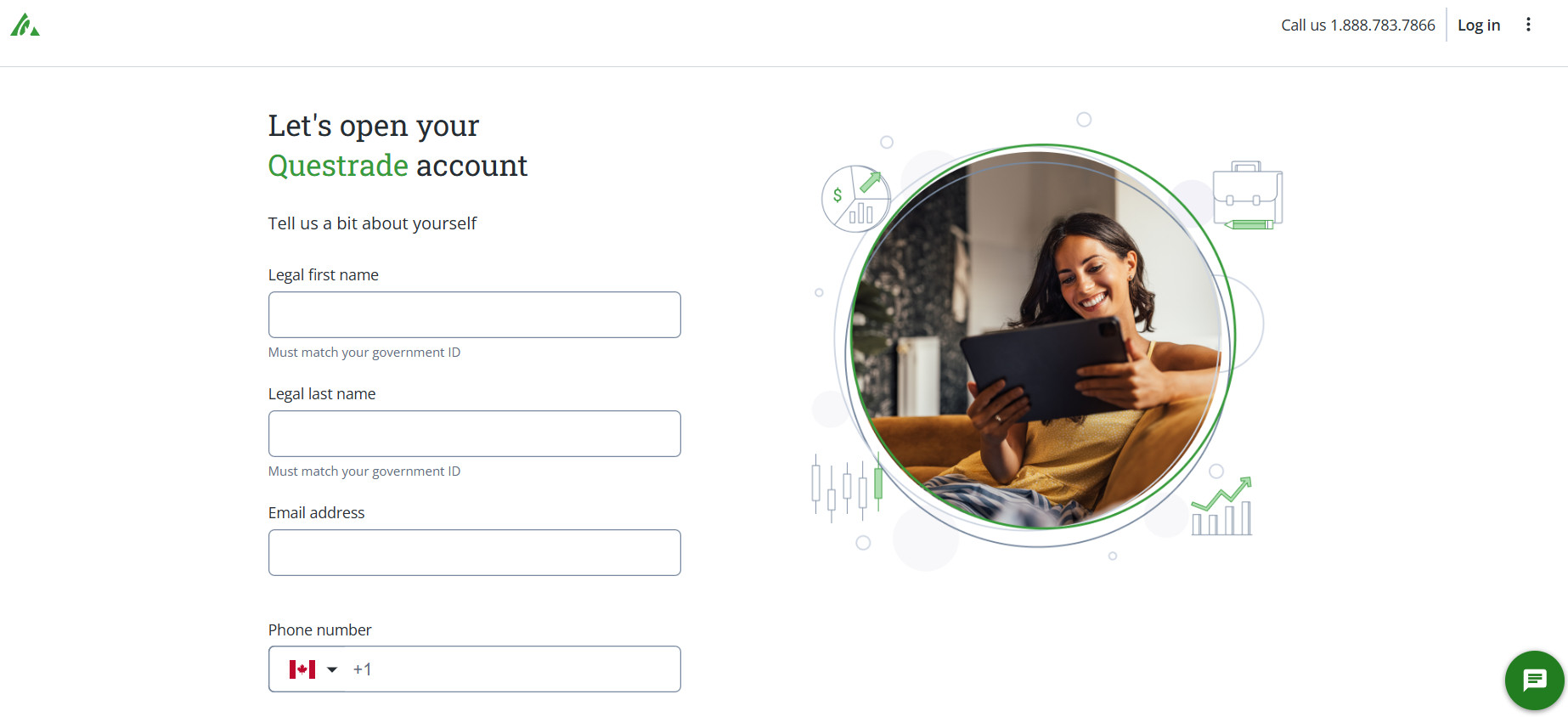

How to Open Questrade Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Questrade login page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.6/5

Questrade also provides a variety of additional tools and features to enhance account management and trading efficiency.

- These include automated dividend reinvestment, Questrade API, custom alerts for price changes or news events, and tax reporting tools to simplify year-end filing.

- Users can access integrated funding and withdrawal options directly through the platform, as well as secure mobile notifications for account activity. These additional features complement the research tools, helping investors stay organized, make timely decisions, and manage their portfolios with greater convenience.

Questrade Compared to Other Brokers

Questrade positions itself as a competitive option among online brokers, particularly for Canadian investors, by offering a well-rounded combination of low costs, versatile platforms, and a broad range of tradable assets.

Compared with other brokers, it provides strong regulatory protection and investor safeguards, which is especially important for clients seeking a reliable and transparent trading environment.

Its suite of web, mobile, and advanced desktop platforms caters to both beginners and active traders, while educational resources help users build their investing knowledge.

Although some competitors may offer lower minimum deposits or specific features for U.S. clients, Questrade’s focus on cost-effective trading, comprehensive account options, and robust customer support makes it a solid choice for investors looking for flexibility and security in a Canadian brokerage.

| Parameter |

Questrade |

TradeStation |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

TradeStation Desktop, Web Trading, Mobile Apps, FuturesPlus |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, SIPC, FCA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$1,000 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Questrade

Questrade is a Canadian Stock brokerage offering a comprehensive suite of investment services. With a focus on low-cost trading, the firm provides commission-free stock and ETF purchases and competitive pricing on options.

The platform supports a wide range of account types, including RRSPs, TFSAs, RESPs, and non-registered accounts. Questrade’s suite of platforms, such as Questrade Web, QuestMobile, and Questrade Edge, caters to various trading styles, from casual investors to active traders, offering features like real-time data, advanced charting tools, and customizable watchlists.

Additionally, the integration of Questwealth Portfolios provides a robo-advisory service for those seeking automated, diversified investment solutions. Overall, Questrade stands out as a competitive and cost-effective brokerage option within the Canadian market.

Share this article [addtoany url="https://55brokers.com/questrade-review/" title="Questrade"]