- What is Pu Prime?

- Pu Prime Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Pu Prime Compared to Other Brokers

- Full Review of Broker Pu Prime

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Pu Prime?

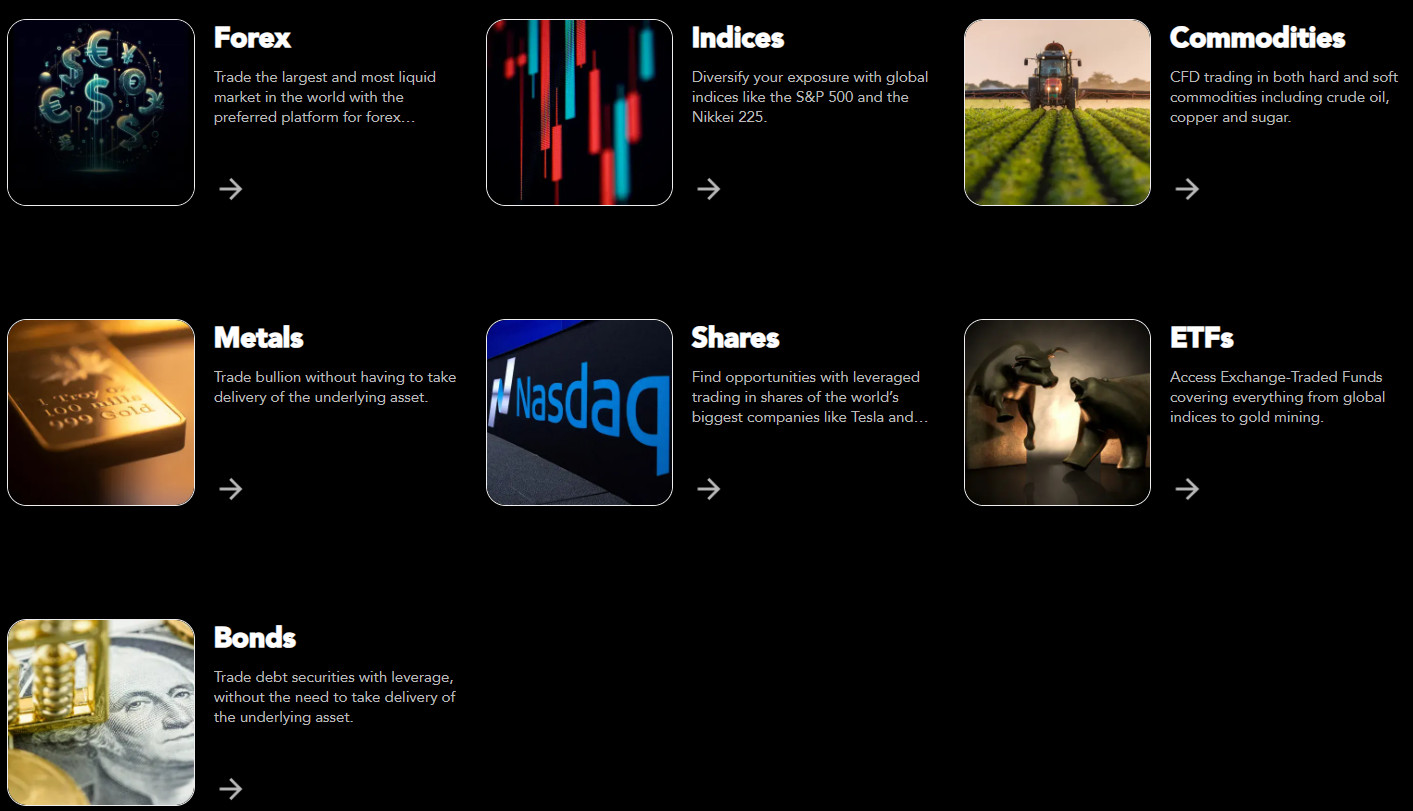

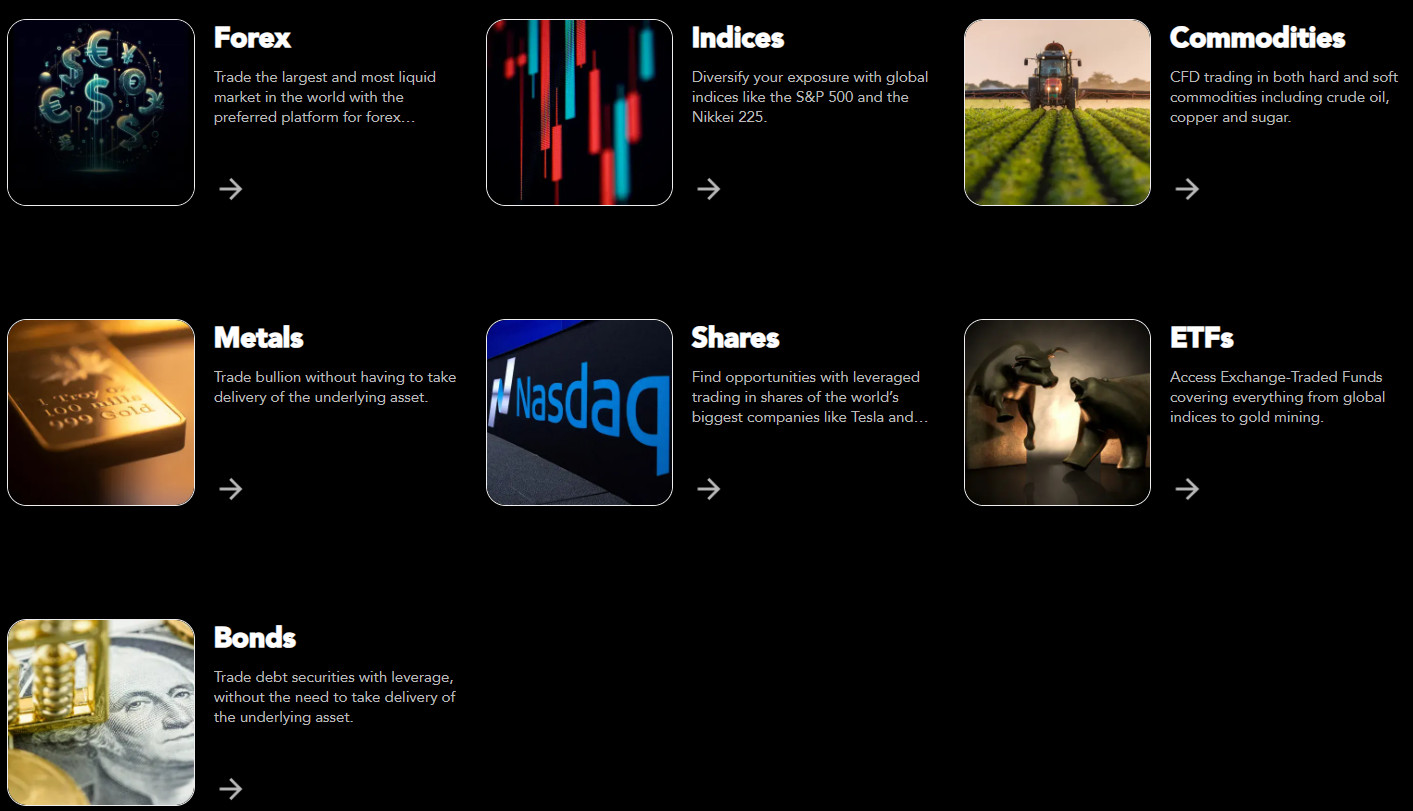

Based on the information we collected on PU Prime, the broker offers clients access to multiple markets, including Forex, Metals, Indices, Commodities, Shares, ETFs, and Bonds. The broker offers clients deep liquidity, resulting in low costs.

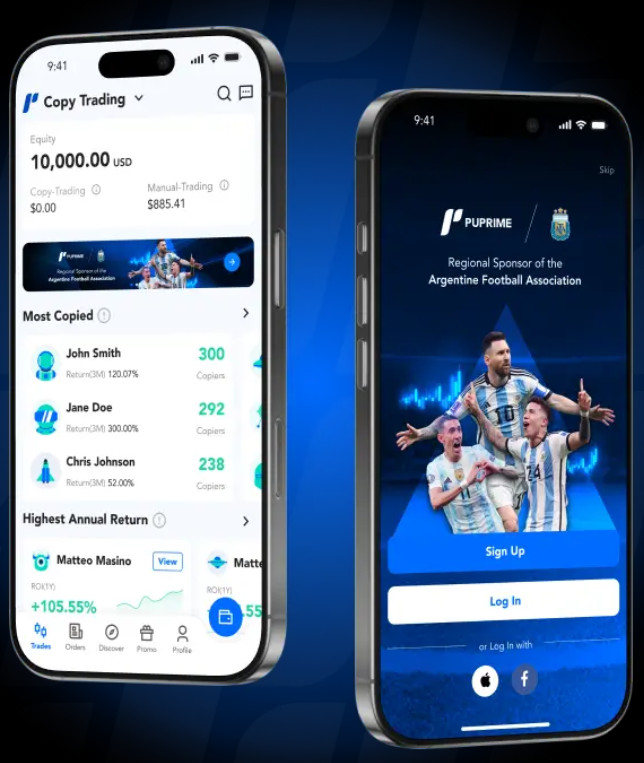

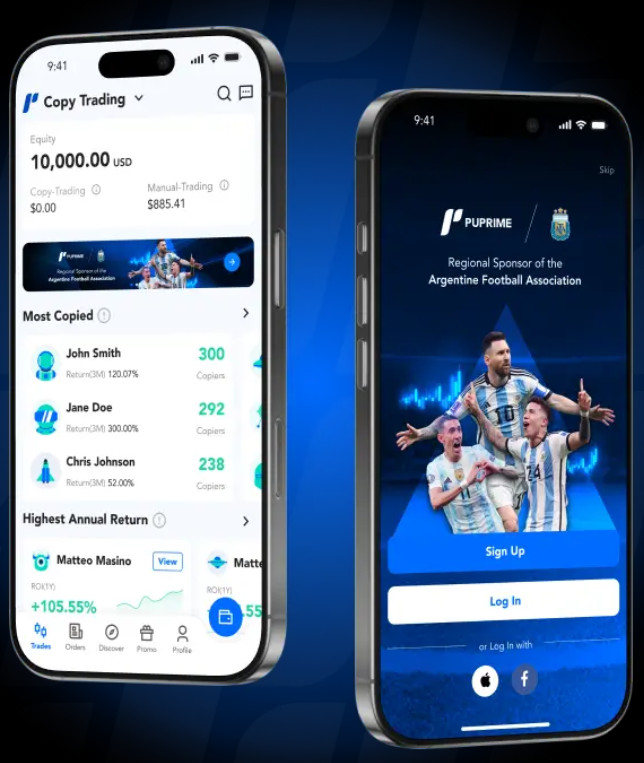

Pu Prime allows clients to conduct trades on the WebTrader, as well as through the market’s popular MT4 and MT5 platforms, and the WebTrader. Pu Prime also offers copy and social trading.

Regarding regulation, Pu Prime was regulated only by the Financial Services Authority of Seychelles in the past, which did not ensure stringent oversight. Currently, Pu Prime is closely regulated by the well-respected ASIC and FSCA. This means that despite the past inconsistency with strong regulations, at present, the broker stands out for its fair and safe practices.

Pu Prime Pros and Cons

Our research revealed that Pu Prime comes with advantages and a few disadvantages to consider before opening an account. We found that Pu Prime offers over 850 tradable products across Forex, metals, indices, commodities, shares, bonds, and ETFs. Traders can choose between MT4, MT5, and the WebTrader. Besides, clients can access copy/social trading, which enhances their opportunities. As to the regulatory oversight, the broker holds licenses from ASIC, FSCA, FSC, and FSA, ensuring compliance with stringent laws. The multilingual customer support is available 24/7 via multiple channels.

However, there are certain cons that Pu Prime clients need to consider. The broker’s primary regulation is via the FSA offshore authority. Besides, the conditions might differ from one entity to another.

| Advantages | Disadvantages |

|---|

| ASIC Regulation | Not available for traditional investments |

| Favorable for South African clients | |

| Good trading conditions | |

| Copy Trading | |

| Good education | |

| Professional trading | |

| 24/7 customer support | |

Pu Prime Features

Pu Prime is an STP/ECN broker with a secure environment and favorable conditions. The offering is attractive, with a wide range of instruments and reasonable costs. We have reviewed the main aspects of trading with Pu Prime and listed them for our readers:

Pu Prime Features in 10 Points

| 🗺️ Regulation | ASIC, FSCA, FSC, FSA |

| 🗺️ Account Types | Standard, Prime, ECN, Cent |

| 🖥 Trading Platforms | MT4, MT5, Web Trader, Pu Prime App |

| 📉 Trading Instruments | Forex, Metals, Indices, Commodities, Shares, ETFs, and Bonds |

| 💳 Minimum deposit | $20 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is Pu Prime For?

Our research shows that Pu Prime has many favorable features for an enhanced trading experience. However, the broker can’t be equally appealing to all clients. Below, see what Pu Prime is best for:

- Clients From South Africa

- Australian clients

- Currency and CFD Trading

- Beginner and Professional Traders

- Cost-conscious clients

- Education

- MT4/MT5 platforms enthusiasts

- Web traders

- Clients looking for Cent accounts

- Competitive spreads and fees

- Copy/Social trading

- EA/Auto trading

Pu Prime Summary

In conclusion, Pu Prime holds licenses from respected authorities that ensure transparent conditions and a safe environment. There are no hidden fees or commission policies; additionally, the negative balance protection offers a significant advantage. Overall, our experience with the broker was positive, with offerings suitable for a range of traders, including beginners. The availability of a cent account allows novice clients to trade under affordable conditions.

The platforms are the market’s popular MT4 and MT5 platforms, and a Web Trader for clients who prefer quick access through the browser. The range of instruments is also attractive, with over 850 instruments that allow traders good diversity.

55Brokers Professional Insights

Pu Prime is a good Broker with an attractive proposal for traders with experience who prefer advanced platforms and run various strategies, and look for a Broker that develop along the time also provides quality conditions. The broker is also suitable for cost-conscious traders to start small as account requirement allows it. The choice of accounts is advantage for clients looking for different options to meet specific expectations.

The available platforms are MT4 and MT5, which combine advanced features with ease of use and simplicity. The Web Platform’s availability with direct access to the market is another advantage for traders who want access to the market without any installations or downloads. Besides, clients can benefit from copy and social trading.

However, Pu Prime’s instruments are mainly limited to Forex and CFDs, with over 1,000 products across various financial assets. Long-term or traditional traders will need to look for another broker, as this offering will not satisfy them. Pu Prime also provides a comprehensive education and research section to assist and guide its clients. The customer support is available in multiple languages 24/7 through various channels.

We see that Pu Prime holds over 60 industry awards and has 25 offices globally, which speaks of the broker’s good standing at present. Despite the present positive status and good licenses, Pu Prime operated as an offshore broker and received negative feedback from clients in the past. We also marked the broker as an unsafe trading option due to multiple inconsistencies with stringent regulations. Yet for Now, Pu Prime is safe to trade with due to its serious licenses, but always check in advance and be sure to open an account under strict regulations rather than with international branch.

Consider Trading with Pu Prime If:

| Pu Prime is an excellent Broker for: | - International clients

- Beginner and professional traders

- Clients who prioritize ASIC regulation

- MT4 an MT5 platform enthusiasts

- Web traders

- Copy traders

- Traders who prefer multiple account types |

Avoid Trading with Pu Prime If:

| Pu Prime is not the best for: | - Long-term investors

- Real stock trading

- cTrader or Trading View traders |

Regulation and Security Measures

Score – 4.4/5

Pu Prime Regulatory Overview

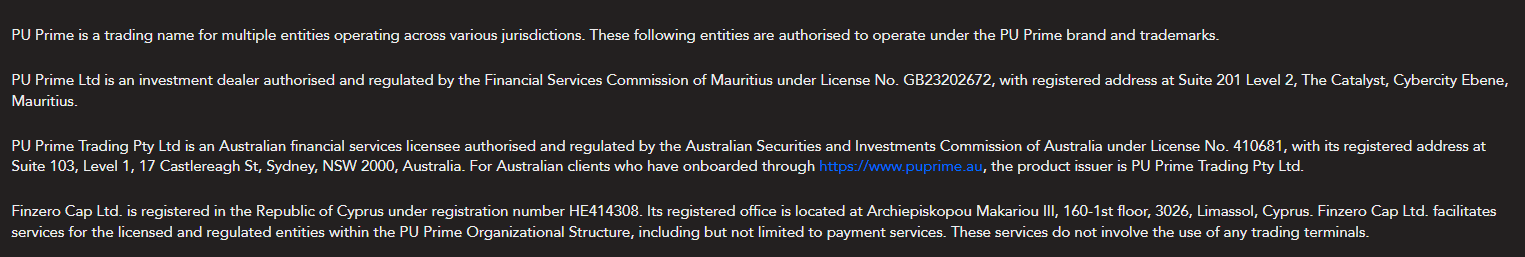

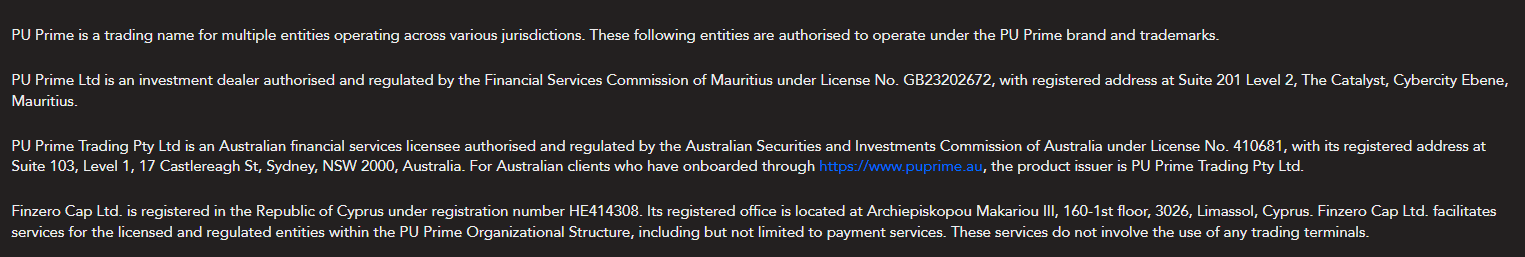

Our research of Pu Prime’s regulatory status revealed that the broker operates under the oversight of various regulatory authorities. At present, the broker holds a top-tier license from the Australian Securities and Investments Commission and a well-respected Financial Sector Conduct Authority in South Africa. The broker also operates under the Financial Services Commission of Mauritius and the Financial Services Authority in Seychelles. These licenses enable the broker’s operations internationally, ensuring access and availability of its proposal.

- However, this was not always the case with Pu Prime, as in the past, the broker held only offshore licenses and faced many regulatory issues and complaints. The good news is that as the broker now operates under ASIC and FSCA oversight, its practices are considered transparent and safe.

How Safe is Trading with Pu Prime?

Pu Prime safeguards its clients’ investments through a partnership with the Financial Commission, a neutral platform that resolves issues between the company and a client. This partnership also ensures a compensation fund to protect the broker’s clients in the event of insolvency.

- Pu Prime also keeps its clients’ funds in segregated accounts, apart from the broker’s capital, to eliminate the chances of investment misuse.

- Another measure of protection is the negative balance protection, so that clients don’t lose more than they have deposited.

Consistency and Clarity

Our research revealed that in the past, PU Prime could not be considered a secure broker due to its lack of a credible license from a prominent regulatory body. The firm conducted its operations through PU Prime Limited and held registration with the Financial Services Authority of Seychelles, which is frequently linked to questionable conduct in the industry. For a long time, we marked the broker as unregulated due to the lack of oversight and suspicious practices.

Besides, during our investigation of the broker, we carefully examined the feedback provided by fellow traders. There were many negative reviews in the past. The complaints indicated inadequate customer support, withdrawal challenges, and more.

At present, Pu Prime holds licenses from ASIC and FSCA and ensures transparent and consistent practices. The broker has also faced a rise in the client base. The reviews left by traders are also mostly positive, pointing out the broker’s advanced platforms, the variety of products, and fast funding.

And a last note: as the broker operates under different entities, conditions vary from one jurisdiction to another.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Pu Prime?

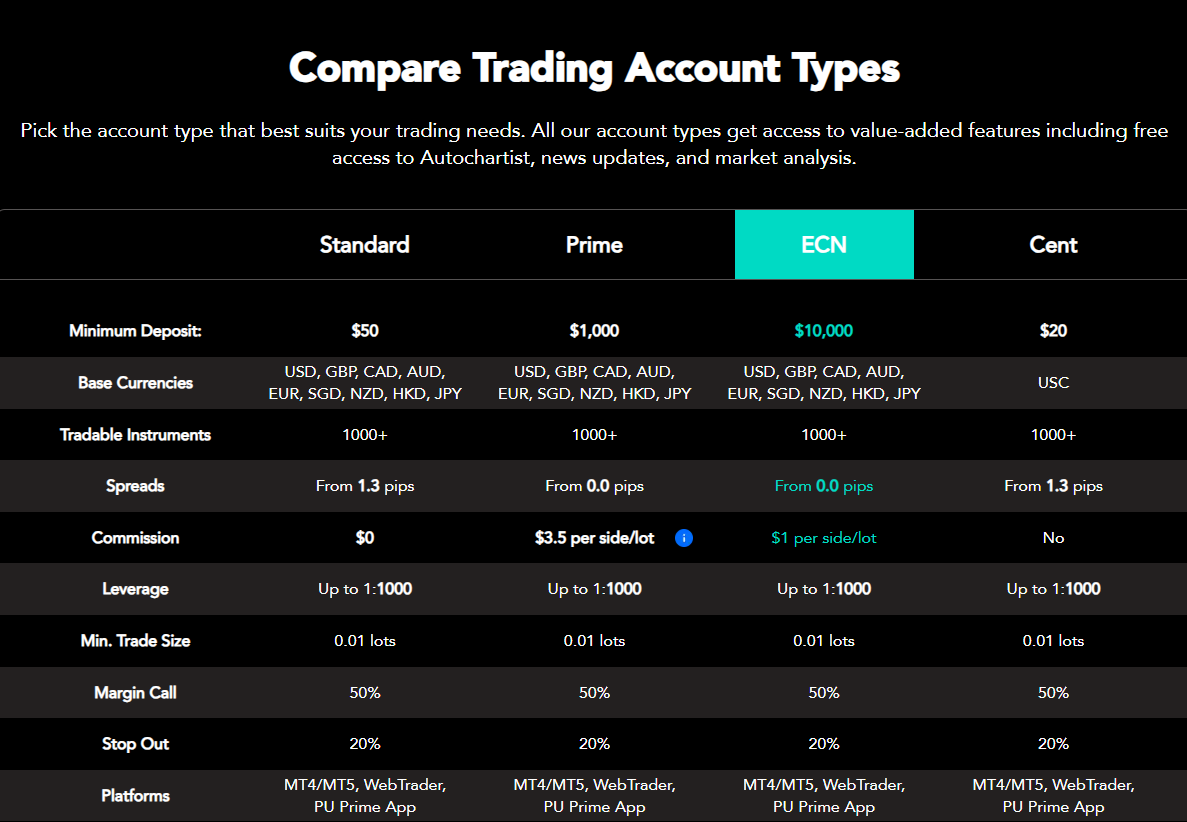

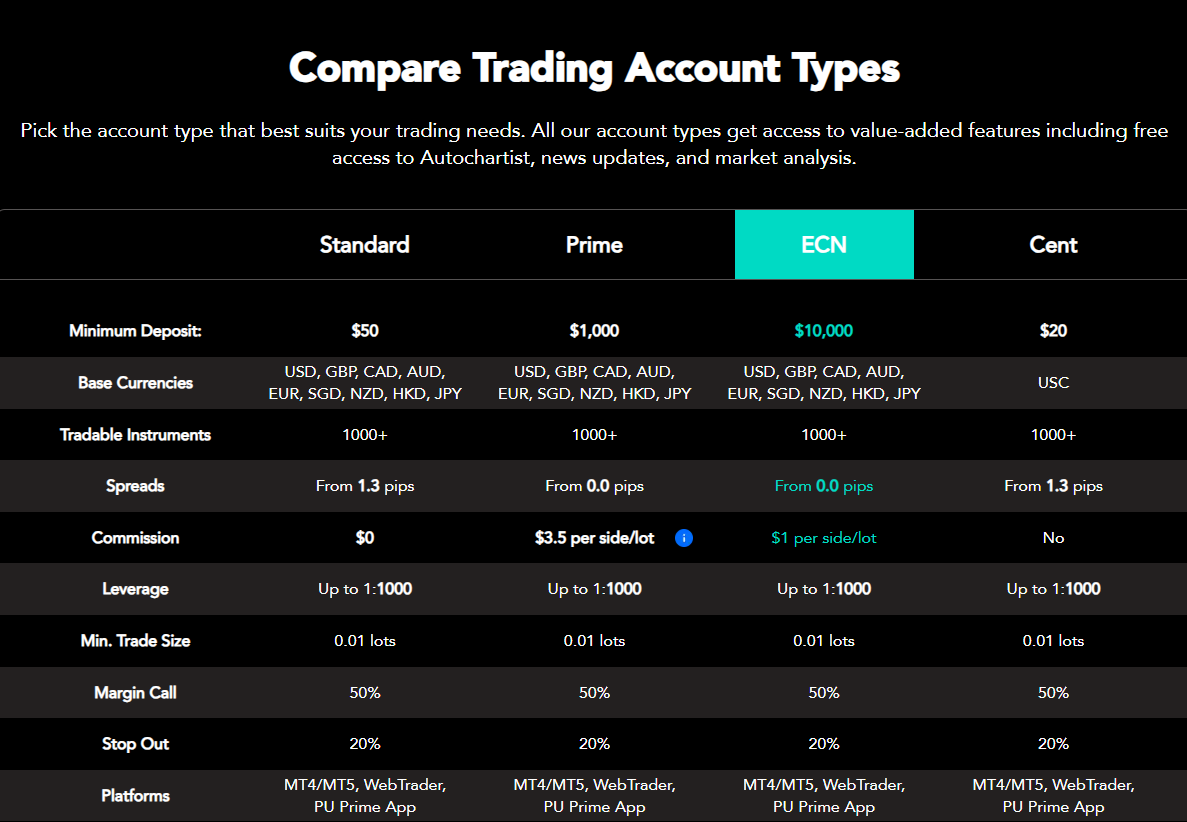

Account types offered by Pu Prime are several, tailored for different clients and trading expectations. The broker’s account type offering depends on the entity. Under its international jurisdiction, the broker offers Standard, Prime, ECN, and Cent accounts. Under the Australian entity, Pu Prime does not offer a Cent account.

All the accounts enable trading through the popular MT4/MT5 platforms, WebTrader, and Pu Prime app, with access to over 1,000 products. The leverage ratio is also very high, up to 1:1000, irrespective of the account type. Also, all the accounts offer an Islamic version for Muslim traders.

- The Cent account is considered a low-risk option tailored for beginner clients. The initial deposit requirement is very low, only $20. The Cent account offers a spread-based fee structure, with an average spread of 1.3 pips.

- The Standard account is another favorable option for beginner traders. The minimum deposit is also low and starts from $50. The costs for this account type are also integrated into spreads, with 1.3 pips, similar to the Cent account.

- The Prime account is suitable for intermediate to experienced traders, with a higher initial funding requirement ($1,000). This account is commission-based with spreads from 0 pips, combined with transaction fees of $3.5 per side per lot.

- The ECN account offers more professional conditions for high-frequency traders looking for access to liquidity providers. The initial deposit is very high, at $10,000. The spreads are tight, and the commission is fixed and lower than the market average. There is only a $1 commission per side per lot.

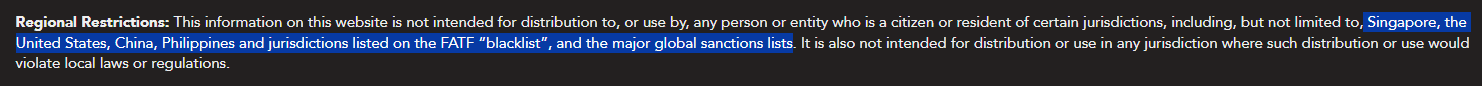

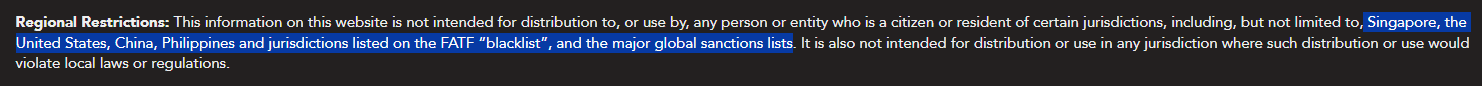

Regions Where Pu Prime is Restricted

Pu Prime ensures its international presence through regulations in multiple jurisdictions. However, due to regulatory limitations, there are countries where the broker’s services are unavailable. The broker is also unavailable for the residents of FATF blacklisted countries.

Pay attention to the list of restricted countries below:

- Singapore

- The United States

- China

- Philippines

Cost Structure and Fees

Score – 4.4/5

Pu Prime Brokerage Fees

Pu Prime offers transparent and reasonable prices for most of its account types. The charges depend on different factors: account types, instruments, and jurisdiction. The broker offers four account types: the Cent and Standard accounts are spread-based, while the Prime and ECN accounts offer tight spreads, combined with fixed commissions.

For its Cent and Standard accounts, Pu Prime offers an average of 1.3 pips. The commission-based accounts offer tighter spreads from 0 pips, combined with fixed commissions. Overall, the spreads for all instruments are mainly average, ensuring competitive prices. Besides, the broker openly indicates the spreads for each instrument, making the offering clear and transparent.

Commissions are applied based on the account type – Prime or ECN. Both accounts are tailored for more advanced clients, ensuring low spreads, combined with fixed commissions. For the Prime account, the fixed commission is $3.5, and for the ECN account, the commission is lower, a fixed $1 per side per lot.

How Competitive Are Pu Prime Fees?

Our research and testing of Pu Prime charges reveal competitive fees for most of the available instruments. Fees are based on various factors, including the account type, the instrument traded, and the entity.

Pu Prime has spread and commission-based fee structures. The average spread for the standard account is 1.3 pips, which is in line with the market average.

The applied commissions are based on the account type. The Prime account offers an average commission of $3.5 per side per lot, whereas the ECN account offers lower commissions of $1 per side per lot and is an ideal option for advanced clients who prioritize fixed prices.

As far as our testing showed, the broker has a transparent fee structure with no hidden fees. However, traders should check the fees with the support team based on the entity to avoid confusion.

| Asset/ Pair | Pu Prime Spread | TD Markets Spread | IQ Option Spread |

|---|

| EUR USD Spread | 1.3 pips | 1.8 pips | 0.8 pips |

| Crude Oil WTI Spread | 0.8 pips | 2 | 0.38% |

| Gold Spread | 1.2 pips | 8 | 0.01% |

Pu Prime Additional Fees

We also considered the broker’s additional fees, added to the overall trading charges. Pu Prime does not charge any inactivity or maintenance fees for the account. The broker also does not charge deposit fees. However, certain methods might incur transaction costs. Also, the first withdrawal each month is free, yet all subsequent withdrawals have a $20 fee.

Score – 4.4/5

Pu Prime offers several platform options, including MT4 and MT5 platforms, WebPlatform, and the Pu Prime app. The platforms are known for their advanced features, intuitive interface, extensive charting tools, and innovative capabilities.

The platforms are available through desktop, web, and mobile devices, allowing the users to trade through the most convenient option for their preferences and strategies.

| Platforms | Pu Prime Platforms | XTrend Platforms | IQ Option Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Pu Prime Web Platform

Pu Prime’s WebTrader is the browser-based version of the MetaTrader 4 and MetaTrader 5 platforms. The web platform enables clients to conduct trades without installation or download, straight from the web browser. Through WebTrader, traders can access Forex, CFD, metals, shares, indices, energies, and bonds.

The web platform preserves all the essential features of the desktop platform to ensure an advanced trading experience. Traders can enjoy fast execution and benefit from multiple charts and graphical objects. All in all, the web platform is a good mixture of innovative features, flexibility, and functionality.

Pu Prime Desktop MetaTrader 4 Platform

MetaTrader 4 is one of the most popular retail platforms that ensures a favorable experience with advanced tools and features. The platform is compatible with Windows, Linux, Mac OS, and Huawei.

With Pu Prime, traders can access helpful tools to facilitate an in-depth analysis. Clients have access to 4 pending order types, over 30 technical indicators, 31 graphical objects, and 9 timeframes. All these features make Pu Prime a good match for both beginners and more advanced traders seeking professional-grade analysis and market research.

Pu Prime Desktop MetaTrader 5 Platform

We have found that the Pu Prime MT5 platform is far more advanced compared to the broker’s MT4 platform. It ensures access to additional advanced tools and features. It offers enhanced EAs and improved analysis tools. Traders can access market depth, Economic calendar, exchange data, embedded MQL5, and a multilingual community chat. Clients can also customize their watch list and set alerts for upcoming essential events.

Graphs, graphical objects. Timeframes and symbols are more extensive for the broker’s MT5 platform, ensuring a top-notch trading experience and outcome.

Pu Prime MobileTrader App

We have tested the broker’s user-friendly mobile app that is available on Android and iOS. The platform supports advanced charting, real-time market data, and a range of technical indicators, customizable watchlists, price alerts, and more. The mobile app is a suitable option for traders on the go to enter the market with the best conditions and features. Besides, traders have access to the full range of instruments. Traders comment that the platform aligns with the desktop and web platforms, retaining all the essential features.

Main Insights from Testing

Pu Prime offers MT4 and MT5 advanced platforms and a browser-based web platform. Besides, the broker includes a Pu Prime app that fully aligns with market expectations.

All the platforms support access to over 1,000 instruments, advanced features, and fast execution, ensuring fast and profitable trades. The broker’s WebTrader is a versatile solution for those who prioritize flexibility and efficiency.

At last, with an intuitive interface, improved mobility, and innovative tools, the Pu Prime app supports real-time trading from anywhere.

AI Trading

As we found, Pu Prime does not support a built-in AI system. However, traders can take advantage of EAs via the MT4 and MT5 platforms.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Pu Prime Platform?

Pu Prime offers over 1,000 instruments across different assets. Currently, Pu Prime offers 41 major, minor, and exotic currencies with favorable pricing, CFDs on shares of major companies from markets, and access to global Indices. This wide range of offerings enables traders to diversify their trading and explore the market with advanced features and great market conditions.

However, all the products are based on CFDs, allowing clients to profit from the price movements rather than own the underlying assets.

Besides, clients should consider that the availability of certain instruments depends on the entity. Thus, this is something to learn before starting trading. All in all, below you can see the products Pu Prime offers:

- Forex pairs

- Indices CFDs

- Metals CFDs

- Shares CFDs

- Bonds CFDs

- Commodities CFDs

- ETFs

Main Insights from Exploring Pu Prime Tradable Assets

We have researched and tested Pu Prime’s available products to see how the offering supports beginner traders and professionals. As we found, the broker allows access to multiple financial assets, including currency pairs, access to global indices, and CFDs on bonds like US Treasury notes, Euribor, and German bunds. In addition, clients can access CFDs on shares of major international companies. Clients can also trade metals and commodities, including gold, silver, sugar, and coffee. The conditions, trading costs, and available leverage depend largely on the chosen account type and jurisdiction.

We found that Pu Prime does not include cryptocurrencies in its offering; thus, crypto traders will not find Pu Prime favorable.

The only note for traders is to scrutinize each account type and check conditions, as each account offers different opportunities, conditions, and fee structures. Also, consider the entity and regulatory specifications, as this can also impact the instrument’s accessibility.

Leverage Options at Pu Prime

Pu Prime offers marginal trading, enabling traders to enter the market with a smaller initial financial input and operate larger positions. Traders can benefit from leverage by increasing their potential gains; however, it is essential to use the multiplier smartly to avoid financial loss.

As Pu Prime is an international brokerage and operates under different jurisdictions and laws, there are also differences in the leverage ratios, based on the entity:

- Traders under the Australian regulation are not allowed to use a high level of leverage, and can access up to 1:30 for Forex instruments.

- International traders are allowed to use a higher leverage of up to 1:1000.

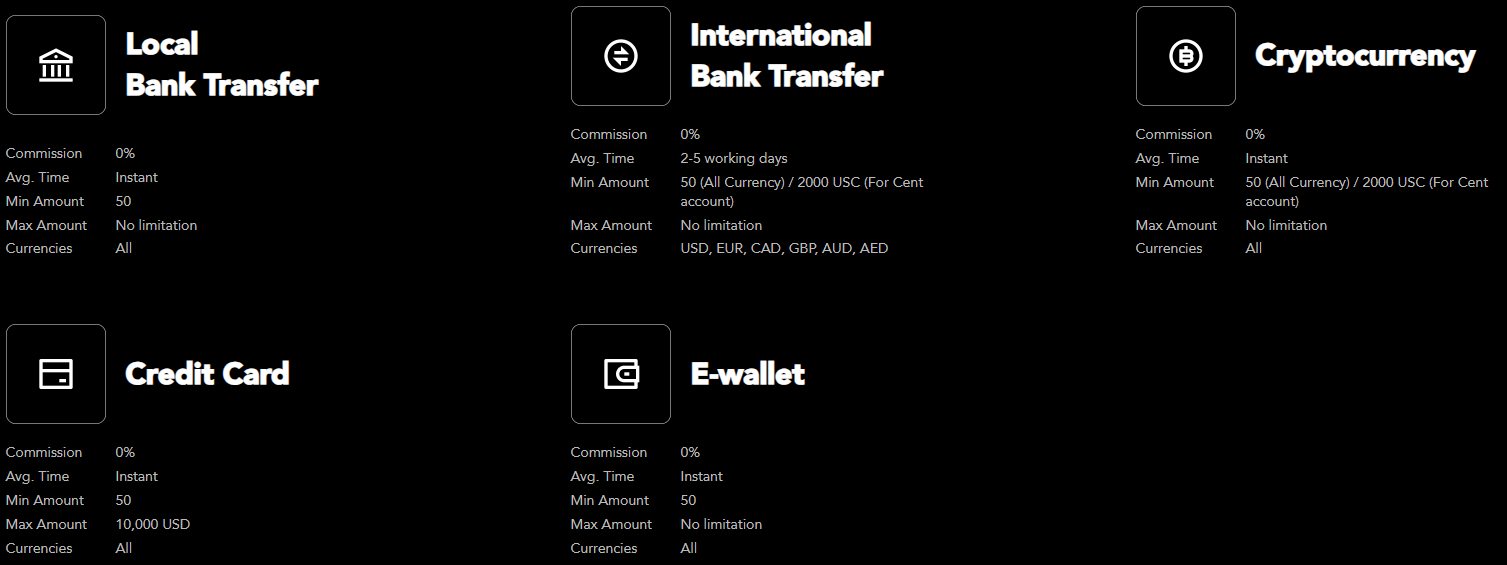

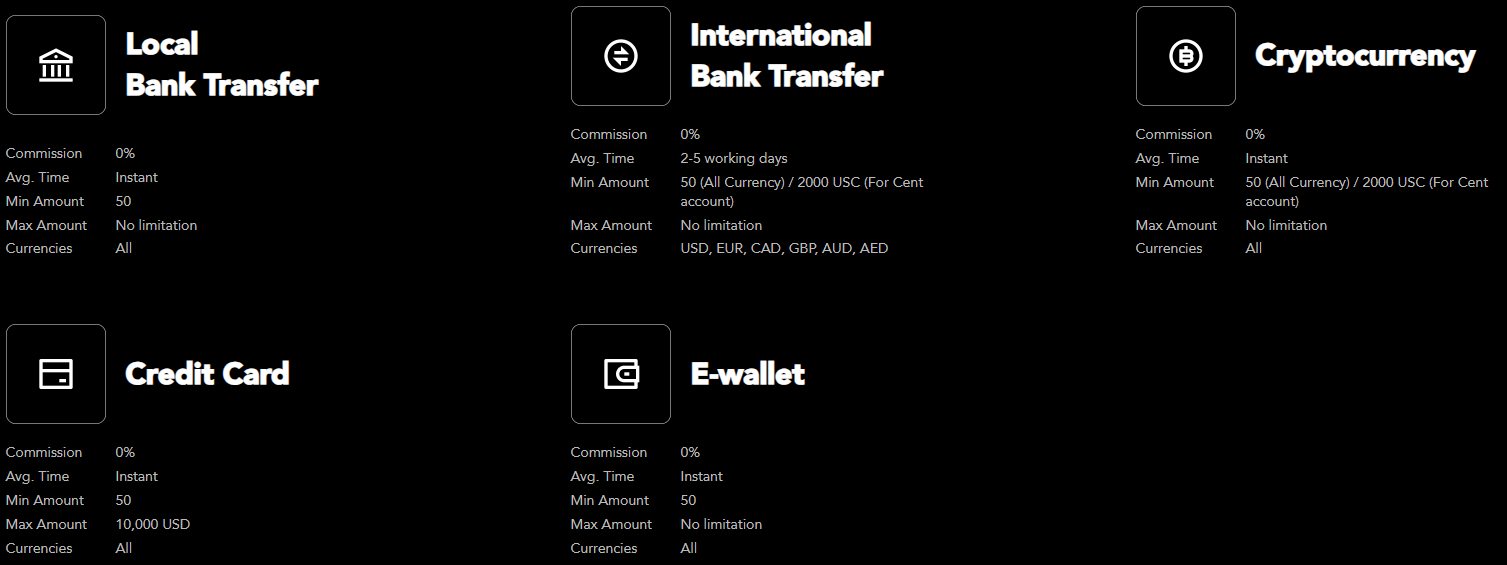

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Pu Prime

Pu Prime ensures a comfortable funding process by offering different deposit and withdrawal methods. The broker includes a good range of methods to meet the different needs of its international clients. Note that not all the methods are available in every region. Traders should check the availability of each method on their own. The broker supports multiple currencies. Besides, there are no additional deposit fees, which makes the offering suitable for cost-conscious traders.

The main deposit methods available with Pu Prime are:

- Local Bank Transfer

- International Bank transfer

- Credit cards

- eWallets

Minimum Deposit

The deposit requirement depends on the account type traders choose. The Cent account, which is an efficient variant for beginner traders, requires only a $20 initial deposit. The minimum deposit for the Standard account is $50. For more professional account types, the deposit is high and is affordable only for high-volume traders.

Withdrawal Options at Pu Prime

Generally, withdrawals are processed within 24 hours. However, it depends on the method used for when the funds will reach the account.

- The broker allows one free withdrawal every month. For the following withdrawals, the broker applies fixed commissions.

- The minimum withdrawal amount is $40.

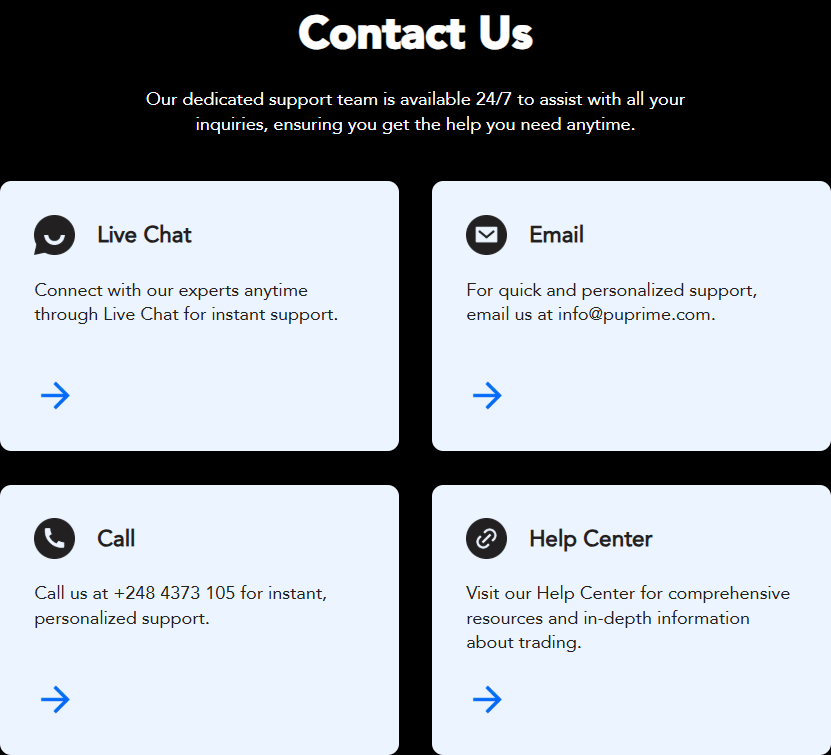

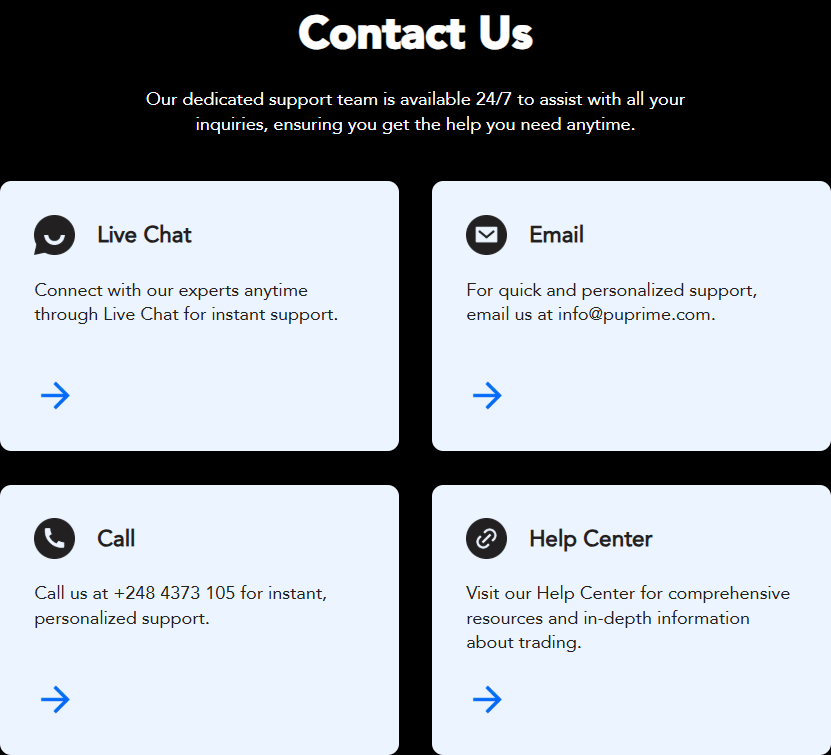

Customer Support and Responsiveness

Score – 4.5/5

Testing Pu Prime Customer Support

Pu Prime clients have 24/7 access to customer support through phone, live chat, or email. Our experience showed that the support team is professional and responsive, with almost instant and detailed answers.

- The broker also has a Help Center, where clients can find answers to the most frequently asked questions.

- In addition, Pu Prime keeps its clients informed through its social platforms on LinkedIn, YouTube, TikTok, Instagram, X, and Facebook.

Contacts Pu Prime

Pu Prime provides dedicated support through multiple channels. The broker enables its clients to choose the most convenient option for communication :

- Live chat support is an efficient solution to find the quickest answers for urgent trading-related issues.

- The broker also provides an email address for questions, suggestions, and complaints: info@puprime.com.

- Besides, for instant and personalized support, traders can contact the Pu Prime team through a phone call: +248 4373 105.

- The broker also provides an online inquiry form to fill out, and a representative from the broker’s team will get back to the client.

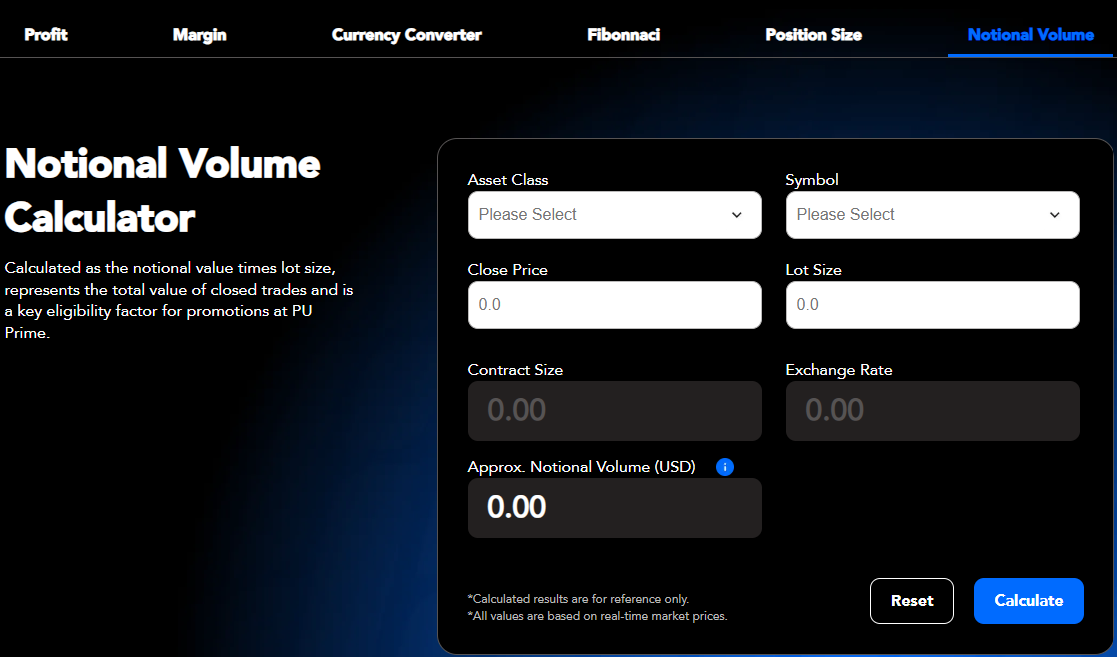

Research and Education

Score – 4.5/5

Research Tools Pu Prime

Pu Prime provides some of the most advanced and popular platforms, packed with excellent research and analysis tools. The broker also stands out for its additional research opportunities, which clients can access through the broker’s website.

- Traders can access the Market Insights and stay informed about the recent market changes, news, and predictions.

- The Market in Minutes provides traders with short videos on the latest market trends.

- The Daily Financial News section is another way to stay updated and in the know of the market’s latest changes and news.

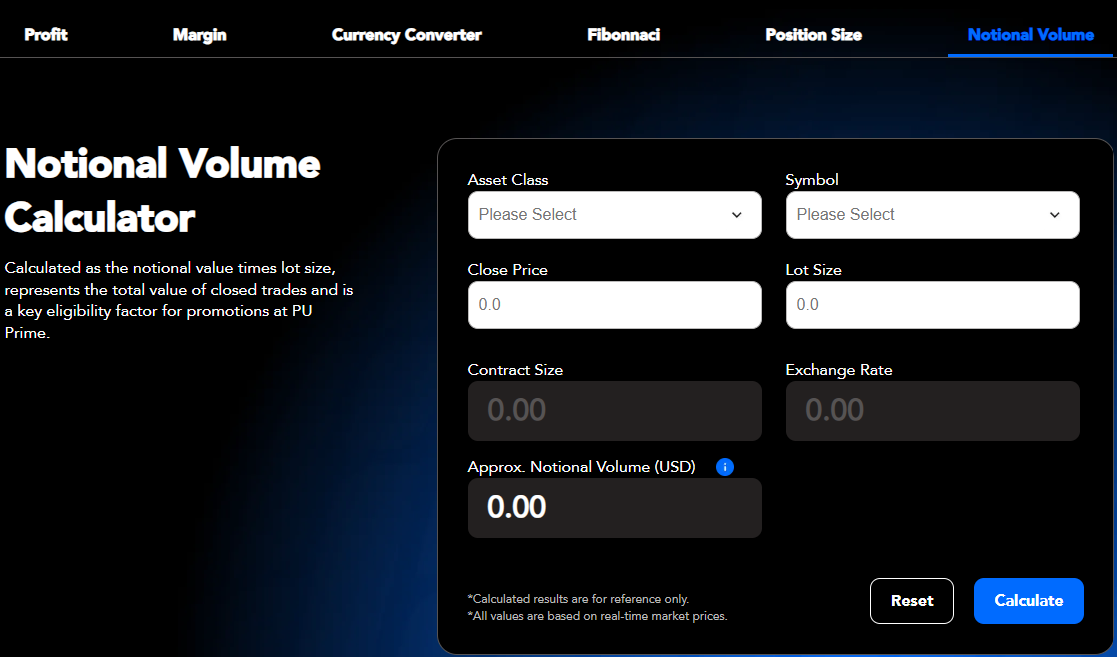

- Trading Calculators are helpful tools to calculate profits and margin, find Fibonacci retracements, calculate the position sizes, and more.

Education

Pu Prime offers its clients access to the Trading Academy to empower them with essential market knowledge. The broker provides diverse materials, suitable for different needs and levels of experience.

- Traders can access video tutorials on different trading-related topics and learn how to navigate the market correctly and with benefits.

- Webinars are an excellent way to enhance traders’ knowledge, get valuable market insights, and guidance from industry experts.

- The broker also offers eBooks to elevate its clients’ experience and gain in-depth insights into the market, strategies, and trends.

- Pu Prime offers a Quiz to test clients’ knowledge with interactive questions.

Is Pu a Good Broker for Beginners?

Our research confirmed that Pu Prime can be a favorable broker for beginners. The broker offers an extensive education and research section, with helpful articles, courses, webinars, market analysis, and an economic calendar. These materials ensure deep market insight and knowledge.

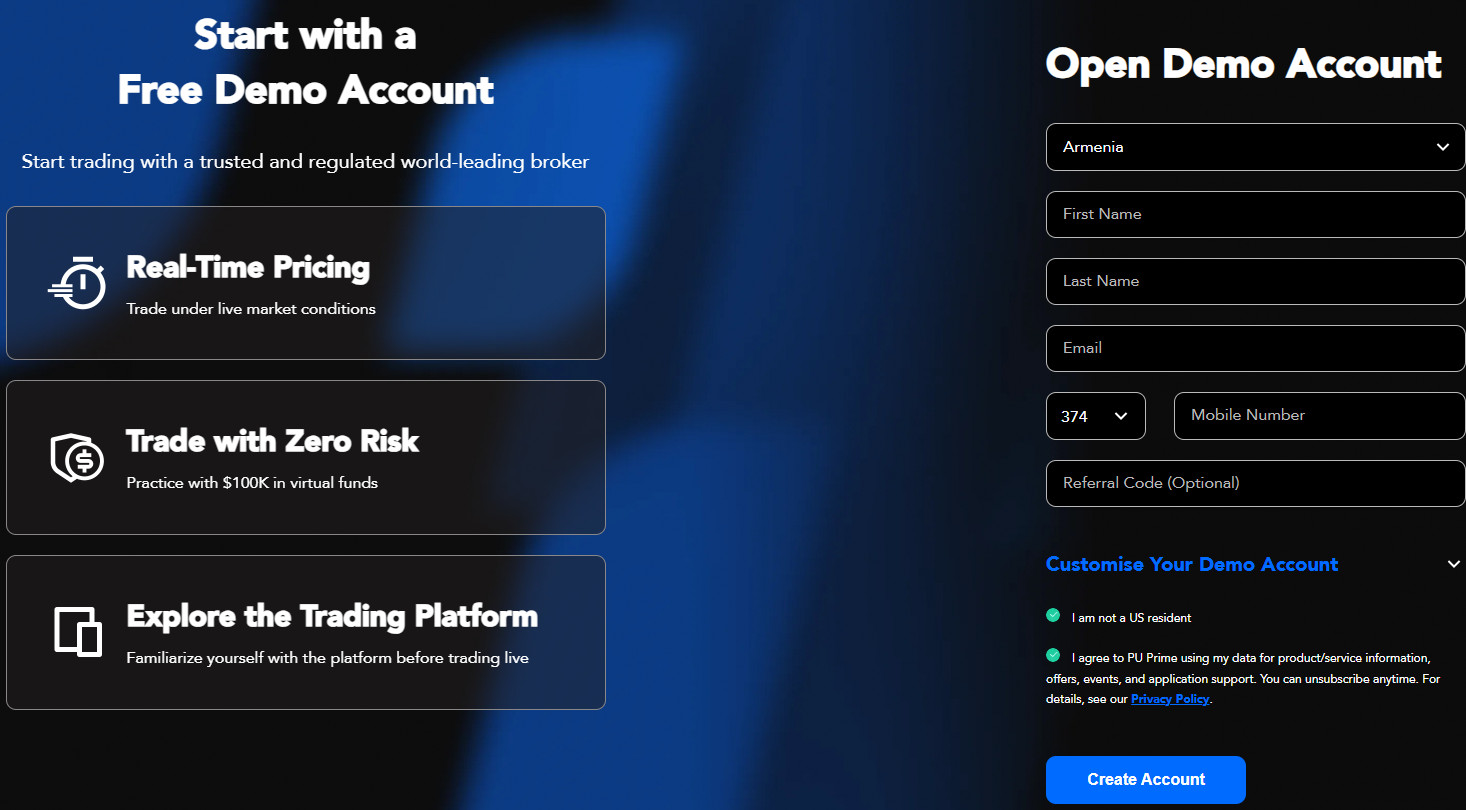

Besides, the broker’s advanced platform and various account types enable traders to immerse themselves in trading with a successful start. The broker offers a Cent account that ensures an efficient experience with low initial financial inputs and low fees. Also, traders can practice through a demo account prior to engaging in live trading.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Pu Prime

By allowing access to over 1,000 instruments, Pu Prime ensures good diversification. We found that all the products are based on CFDs, and clients can speculate on the price movements of underlying assets rather than owning them. This means the broker does not support traditional investments.

Despite this, Pu Prime allows alternative investments via copy trading.

- Through the Copy Trading feature, traders can copy the profitable trades of professionals and profit.

- Yet, the broker does not offer MAM or PAMM accounts.

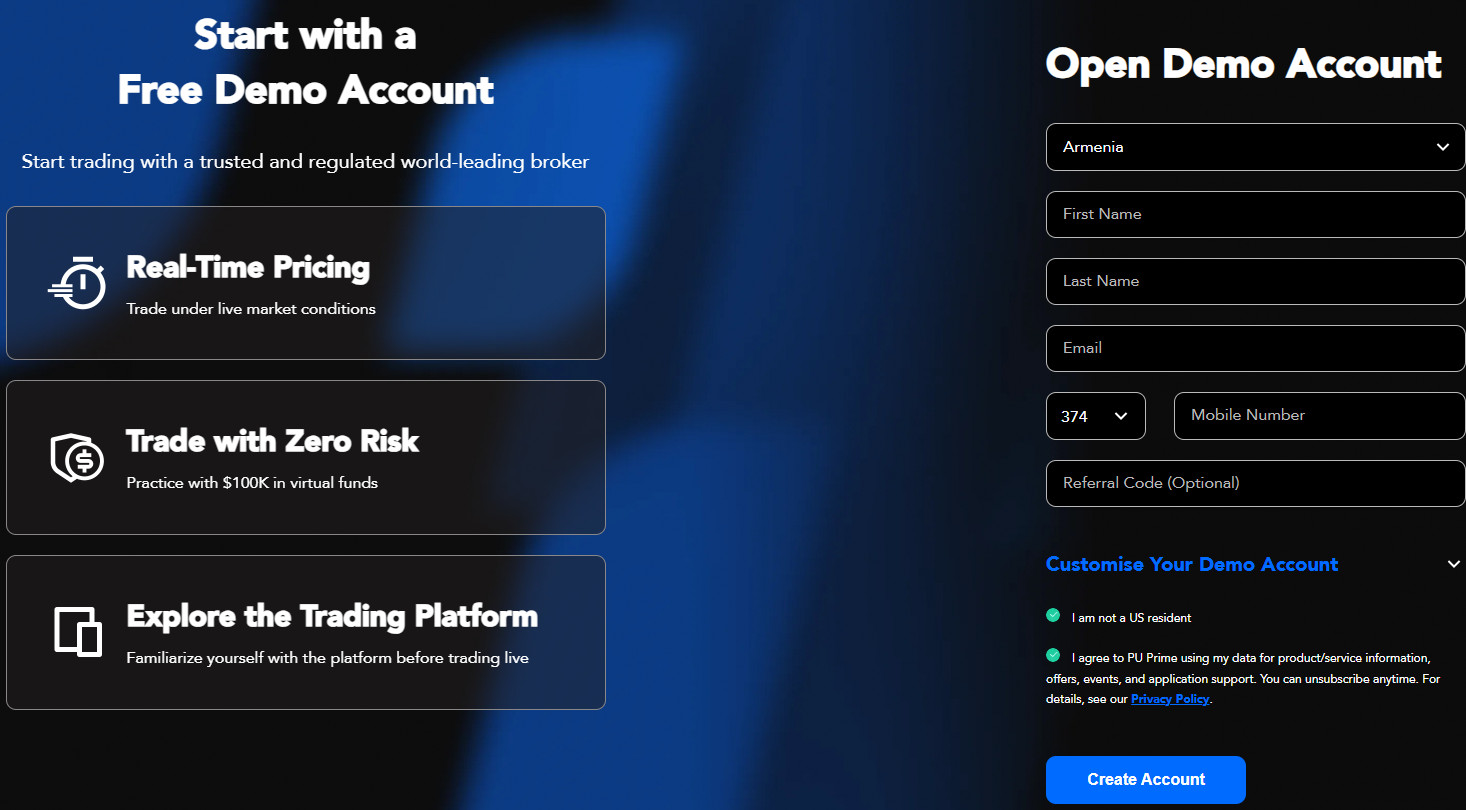

Account Opening

Score – 4.5/5

How to Open a Pu Prime Demo Account?

Opening a demo account with Pu Prime will enable novice clients to practice and gain market skills in a risk-free environment. Opening a demo account takes only a few minutes, with only a several easy steps to follow:

- Go to the broker’s official website and choose a demo account option.

- Fill out the registration form with your name, email address, phone number, etc.

- Submit the form to receive account details via email.

- Use the credentials to log into the MT4, MT5, or Web Trader and start practicing.

How to Open a Pu Prime Live Account?

Opening a Pu Prime live account is easy and quick. Traders should first choose the entity they want to trade under, then decide which account type is the best for them. After deciding on the account type, here are the steps to follow:

- Go to the Pu Prime official website and choose the live account option.

- Fill out the registration form (country, name, email address, and phone number).

- Then, traders are directed to the client portal to finish the application.

- Submit a valid ID and proof of address for identity verification.

- When the application is approved (within a business day), the broker sends a confirmation email with the account credentials.

- Clients can download the MT4/MT5 platforms or use the credentials to access their accounts through WebTrader.

Score – 4.3/5

On the Pu Prime website, traders can find various advanced tools and features, enhancing the trading experience for both beginners and experienced traders.

- Autochratist helps traders identify powerful opportunities. It is a helpful technical analysis tool, supporting traders with alerts about trading opportunities.

- Traders can get a 50% bonus for their deposit if they activate the promotion tab before making the deposit. The bonus is applied for a $1,000 deposit. All the subsequent deposits are subject to a $20 bonus, but the total amount should not surpass $10,000.

- Refer a Friend promotion is another opportunity to get a $150 for a successful referral.

- For the first deposit, traders can get a 20% cashback when they meet the requirements of the promotion.

- Besides, clients can get a free VPS if they make a $1,000 deposit and meet the trading volume.

Pu Prime Compared to Other Brokers

Another essential step we complete during our reviews is comparing the broker to other respected firms with similar services. To start, we review the broker’s regulatory status and adherence to laws. Despite the broker’s previous inconsistency with stringent regulations and operation under offshore licenses, the company now holds a license from the top-tier ASIC and the well-respected FSCA. EC Markets is another broker with oversight from ASIC and FSCA, providing the same level of safety.

Pu Prime supports the MT4/MT5 platforms, grants access through a web platform and a Pu Prime app, equipped with innovative features and tools. The broker also ensures access to over 1,000 products across popular financial assets. FxPro offers the same MetaTrader platforms and an FxPro WebTrader. However, it also supports an advanced cTrader, ensuring a better variety of platforms. Besides, FxPro includes a better range of instruments (2,100 in total). The smallest range of instruments among the brokers we researched for this review provides EC Markets (about 150 products).

One of the best aspects of Pu Prime is its extensive education and research sections. Forex.com, FXCM, and FxPro also offer attractive education sections, offering various courses, articles, webinars, eBooks, and more.

| Parameter |

Pu Prime |

FXTM |

Forex.com |

EC Markets |

Axi |

FXCM |

FxPro |

| Spread-Based Account |

Average 1.3 pips |

Average 1.5 pips |

Average 1.3 pips |

From 1.1 pip |

Average 1.2 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips +$3.5 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $2.5 |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, WebTrader, Pu Prime App |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

1000+ instruments |

1000+ instruments |

6000+ instruments |

150+ instruments |

220+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

ASIC, FSCA, FSC, FSA |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, FSCA, FSA, FSC, FMA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$20 |

$200 |

$100 |

$10 |

$0 |

$50 |

$100 |

Full Review of Broker Pu Prime

Based on the information we have gathered regarding Pu Prime, there were notable concerns about the broker’s trustworthiness and credibility in the past. The primary issue was around the absence of tight regulation, with a multitude of complaints and negative reviews from clients. However, at present, Pu Prime operates under serious licenses, with oversight from ASIC and FSCA, making the broker a reliable choice.

Pu Prime supports the market-popular MT4 and MT5 platforms, a WebTrader, and a Pu Prime app. The platforms have all the necessary features and tools for an efficient and profitable trading experience. Clients can also profit from copy trading.

As we have found, Pu Prime stands out for an extensive range of instruments across Forex, Metals, Indices, Commodities, Shares, ETFs, and Bonds. The costs are competitive, and clients can use high leverage through the international entity. However, the offering is suitable for short-term trades and profits on the price movements, as all the products are based on CFDs. Pu Prime does not support long-term investment and ownership of real stocks.

Another advantage of the broker is the variety of accounts, offering different fee structures and conditions. The Cent account is for beginner traders to start small with a $20 initial deposit. In addition, different promotions and bonuses enhance the trading experience and grant more opportunities to the broker’s clients.

At last, our testing of the education and research section revealed comprehensive materials and resources developed to guide and assist traders in their journey. The multilingual 24/7 customer support is another advantage traders will appreciate.

All in all, Pu Prime’s practices are backed up by stringent laws, and despite the past regulatory inconsistencies, the broker offers trustworthy services. We urge traders to conduct their research and also check differences based on the entity before opening a Pu Prime account.

Share this article [addtoany url="https://55brokers.com/pu-prime-review/" title="Pu Prime"]

I am with puprime for nearly 2 years now and still have not made any profit. In a longterm forex trade for the past yeay and a half but it still is not makeing any profit. Got cold call from there agent but lost money with there agents as the forex trades he put me into lost money and now in long term forex euro /dollar put he put me in at under 101 when the dollar against the euro was at that time but it may be a long time when it goes back to that rate. puprime will not get back to e mails there customer service is very poor. Can you please get back to me.Regards Gerald.