- What is SquaredFinancial?

- SquaredFinancial Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- SquaredFinancial Compared to Other Brokers

- Full Review of Broker SquaredFinancial

Overall Rating 4.5

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is SquaredFinancial?

SquaredFinancial, previously known as SquaredDirect and before that as ProbusFX, is a Forex and CFDs trading broker holding its headquarters in Cyprus. The broker gives access to trade CFDs on Forex, precious metals, energies, indices, futures, stocks, ETFs, and cryptos.

Based on our findings, the broker chooses its mainstay and approach on a technology-driven trading process with no dealing desk intervention. Therefore, institutional-grade liquidity delivers ultra-fast, tight-spread pricing with low latency and market execution.

SquaredFinancial Pros and Cons

The broker, like any financial services provider, has both advantages and disadvantages to consider. On the positive side, SquaredFinancial offers competitive trading conditions, different payment methods, and access to a range of financial instruments through the advanced MT4 and MT5 trading platforms. Also, we were impressed by the broker’s extensive educational and research materials that can be helpful for different levels of traders.

For the cons, there is no 24/7 support, which could be a concern for some traders seeking immediate assistance. Additionally, the broker changed its name several times, which may raise concerns for potential traders. Therefore, traders should carefully evaluate and conduct thorough research before deciding whether the broker aligns with their specific trading needs and preferences.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 support |

| MT4 and MT5 trading platforms | Conditions vary based on entity |

| Popular trading instruments | |

| Competitive trading conditions | |

| Education | |

| Low Spreads | |

| Negative Balance Protection | |

| Global coverage including Asia, Europe and Middle East | |

SquaredFinancial Features

SquaredFinancial is a reliable broker following strong regulatory oversight and providing favorable trading conditions. The broker supports popular trading platforms, access to a wide range of financial assets, a competitive fee structure, and dedicated customer support. We have compiled the most essential aspects of trading with the broker in one place for traders to have a quick look at:

SquaredFinancial Features in 10 Points

| 🗺️ Regulation | CySEC, FSA |

| 🗺️ Account Types | SquaredPro, SquaredElite |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | CFDs on Forex, Energies, Indices, Precious Metals, Futures, Stocks, ETFs, and Crypto |

| 💳 Minimum deposit | $0 |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | EUR, USD, GBP, CHF, ZAR |

| 📚 Trading Education | Trading Academy |

| ☎ Customer Support | 24/5 |

Who is SquaredFinancial For?

SquaredFinancial is a good broker that can meet different trading needs and expectations. Clients of different levels can find what they are looking for in trading, including the availability of various strategies, great educational resources, popular platforms, and more. Based on our expert opinion, you can see what SquaredFinancial is good for:

- Beginners

- Advanced traders

- Good trading tools

- European traders

- EA/Auto trading

- Copy trading

- Traders who prefer MT4 or MT5 platforms

- International traders

- Currency and CFD trading

- Competitive spreads and fees

- Good learning materials

- Suitable for a variety of trading strategies

SquaredFinancial Summary

SquaredFinancial is a regulated brokerage firm that acts as an intermediary between traders and liquidity providers. The company provides competitive trading conditions and access to popular trading instruments through the advanced MetaTrader platforms, which both beginners and professionals favor. Traders can benefit from low pricing and tight spreads across various trading activities. Additionally, users have access to an extensive range of educational materials that support them in expanding their knowledge and staying informed about the market.

Overall, we found that the broker provides a good trading environment; however, there are drawbacks as well, such as trading within an offshore zone and the absence of 24/7 customer support. Therefore, we advise traders to conduct their own research and evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

SquaredFinancial provides quite competitive trading conditions with access to a good range of instruments, more than 10,000 backed up with quality trading platforms and average spreads. The broker has global coverage by offering its services in many countries, so it is suitable mostly to all trading styles or trading account sizes and also to global traders.

What is also another advantage we want to mention is SquaredFinancial’s impressive educational and research sections, which will assist traders in their trading journey especially trading beginners, giving them knowledge and market insight throughout their collaboration with the broker.

Overall, we find SquaredFinancial a trustworthy broker with transparent and clear offerings, good standing in the market, and innovative tools and features. The only point we want traders to pay attention to is the availability of different entities, which will bring forth differences in trading conditions and safety levels.

Consider Trading with SquaredFinancial If:

| SquaredFinancial is an excellent Broker for: | - Beginner traders

- Clients who are looking for very low deposit requirements

- MT4/MT5 platform enthusiast

- Mobile traders

- High-frequency traders and scalpers

- Cost-conscious traders

- Clients looking for an extensive range of instruments

- Those beginner traders who look for a comprehensive education and research sections

- Global traders

- Currency and CFD traders

- Social traders |

Avoid Trading with SquaredFinancial If:

| SquaredFinancial is not the best for: | - Clients looking for tight regulatory oversight other that CySEC

- Very high leverage seekers

- Clients looking for 24/7 customer support

- Traders looking for platforms other than the Meta Trader

- Real stock traders

|

Regulation and Security Measures

Score – 4.4/5

SquaredFinancial Regulatory Overview

SquaredFinancial is a legitimate and regulated brokerage firm that holds the necessary licenses and follows regulations for offering Forex trading services. The broker is fully authorized by the European authority, CySEC. Due to its nature and being a part of the EU, the CySEC-registered companies deliver high-level investment services established in strict accordance with the set of rules and a cross-registration belonging to the EEA zone.

- However, the broker also holds an offshore license in Seychelles. Therefore, potential clients should conduct their research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

- The broker also holds additional licenses from the Spanish Comisión Nacional del Mercado de Valores and the French Autorité des Marchés Financiers.

How Safe is Trading with SquaredFinancial?

As the client regulation requirement focuses on client safety and fair treatment, SquaredFinancial delivers dedicated support along with unparalleled safety to every investor, with security procedures for money handling.

That covers money segregation, which means the company can’t touch the client’s funds at any time, along with participation in the schemes in case of insolvency. In addition, the broker supports Negative Balance Protection which keeps the trading accounts protected from losses that exceed the initial balance.

Consistency and Clarity

SquaredFinancial has been in the market since 2005, which is quite a long time to prove the broker’s consistency in offering its services to European and global clients. Since its establishment, the broker has undergone name changes twice, which can be a ground for suspicion and doubts, yet based on our findings, SquaredFinancial has always been transparent in its offerings, ensuring clarity and stability in its services. In addition, during the last several years, the broker has expanded even further, experiencing growth in its client base and loyalty. The broker has also been recognized as the best stock provider of 2022, the best client fund security of 2022, the best CFDs broker of 2022, and other awards from respectable financial platforms and establishments.

We have also reviewed clients’ feedback to see what they share about their experience with SquaredFinancial. The overall ratings are higher than average, with many clients indicating the broker’s advanced platform, straightforward deposit and withdrawal process, and tight spreads. Overall, SquaredFinancial stands out for its consistent growth and clarity in its offerings, positioning itself as a safe and trustworthy broker.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with SquaredFinancial?

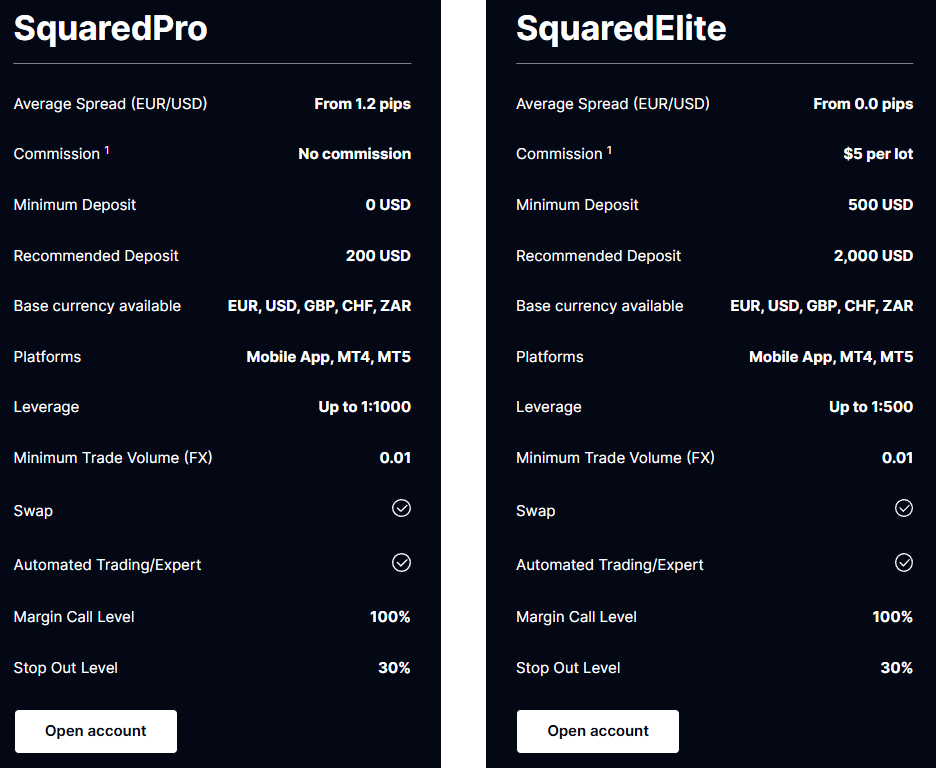

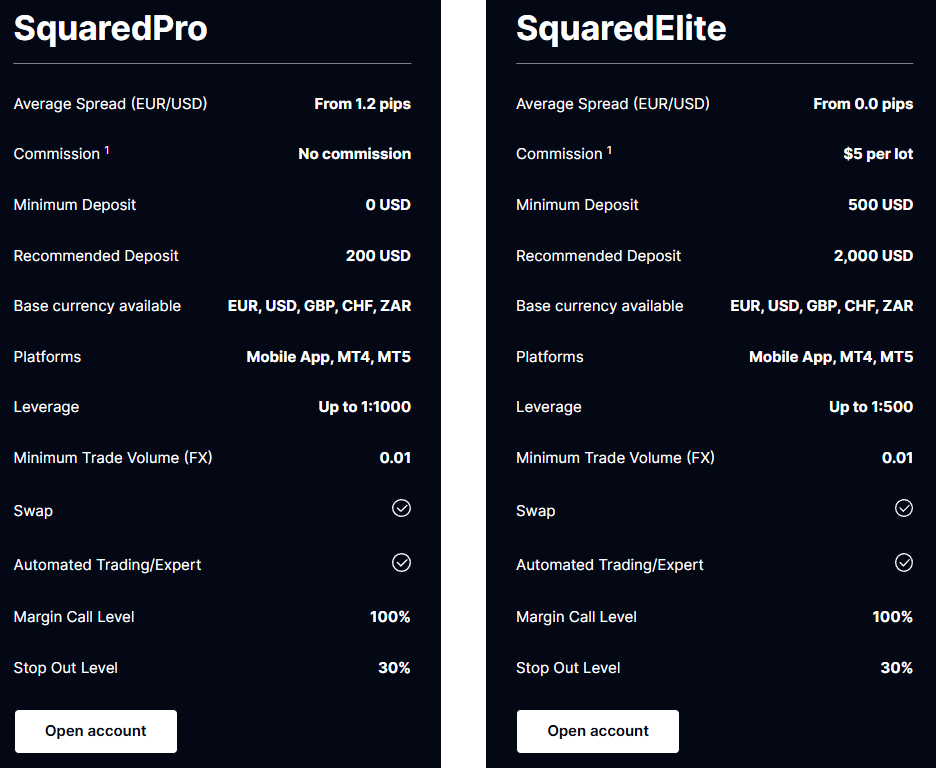

Per our findings, the broker offers 2 different account types, SquaredPro and SquaredElite, which are suited to the traders’ needs and experience requirements. The conditions between the account types are different. The broker also offers a demo account for inexperienced traders to practice before trading with a live account. In addition, SquaredFinancial offers an Islamic account for clients who, due to their religious beliefs, are not allowed to use swaps. The Islamic option is available for both account types—SquaredPro and SquaredElite.

SquaredPro Account

The SquaredPro account is a spread-based account with all the trading costs integrated into spreads starting from 1.2 pips. There are no transaction fees for this account type. Trades can be conducted on the popular MT4/MT5 platforms, and the mobile app. The minimum deposit starts from $0; however, the broker recommends starting with a $200 initial deposit. The available leverage is up to 1:1000.

SquaredElite Account

The SquaredElite account is commission-based, with spreads from 0.0 pips and a $5 commission per lot. The commission amount also depends on the instrument traded. The highest leverage available is 1:500. The minimum deposit for this account is $500, although the broker advises starting with a $2000 deposit. The SquaredElite account is suitable for high-frequency and professional traders who prefer very low spreads and fixed commissions.

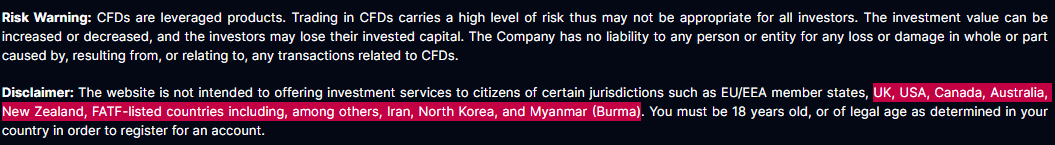

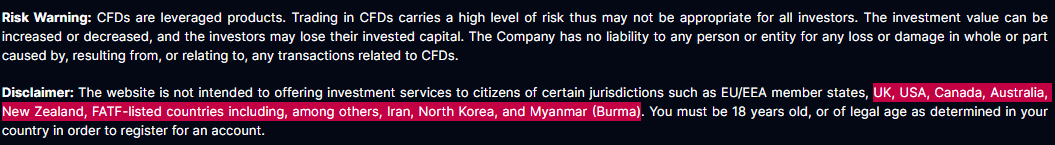

Regions Where SquaredFinancial is Restricted

SquaredFinancial is a global broker accepting clients from the EEA zone and all over the globe. However, due to certain regulatory restrictions, SquaredFinancial does not accept residents from a number of countries and regions.

Here is the list of the restricted countries:

- UK

- USA

- Canada

- Australia

- New Zealand

- Iran

- North Korea

- Myanmar

Cost Structure and Fees

Score – 4.5/5

SquaredFinancial Brokerage Fees

SquaredFinancial offers competitive fees that are in line with the market average. Depending on the account type, the broker offers two fee structures: spread-based and commission-based. The trading costs also depend on multiple factors, such as the entity under which the account is opened, the instrument traded, the account type, etc.

We have found that SquaredFinancial fees are mentioned on the broker’s website, enabling clients to be aware of all the possible charges they will face while trading.

SquaredFinancial spreads depend on the account type. Its SquaredPro account is fully spread-based, including all the trading fees in competitive spreads. The average spread for the EUR/USD pair is 1.2 pips. For the SquaredElite account type, spreads start from 0.0 pips, combined with commissions. As we have noticed, the EUR/USD pair spreads for the commission-based account start from 0.4 pips, combined with a fixed transaction fee.

We have also looked up spreads for gold for the SquaredPro account to find that the broker charges $0.10.

- SquaredFinancial Commissions

For its commission-based SquaredElite account, the broker applies very low spreads from 0.0 pips and commissions of $5 per lot. This commission-based offering appeals to advanced traders looking for fixed and predictable charges. However, as the broker mentions, the commission might change depending on the instrument traded.

- SquaredFinancial Rollover / Swap Fees

SquaredFinancial’s overnight fee, or overnight funding, is another cost that traders should consider. Generally, the overnight fee applies to long positions. For example, a long position will cost -12.5 for buying or 5.5 for selling on the EUR/USD pair.

How Competitive Are SquaredFinancial Fees?

Our research on SquaredFinancial trading costs revealed a positive picture, with average spreads and a reasonable commission fee. The good part is the transparency, as clients can find the applicable spreads for each instrument listed on the broker’s website. The fixed commission is $5 per lot; however, it may vary based on the instrument.

Another essential part about fees is that they depend on the entity traded and may vary between the entities, as many other trading conditions do. Besides, we recommend traders consider the non-trading fees, which are few, but still, they might affect trading.

| Asset/ Pair | SquaredFinancial Spread | Eightcap Spread | Scandinavian Capital Markets Spread |

|---|

| EUR USD Spread | 1.2 pips | 1pips | 0.1 pips |

| Crude Oil WTI Spread | 0.03 USD | 3 pips | 0.06 |

| Gold Spread | 0.10 USD | 1.2 pips | 0.45 |

SquaredFinancial Additional Fees

The broker does not charge deposit/withdrawal fees. As to the Inactivity fee, if the account has been inactive for 90 days or more, the broker charges a monthly inactivity fee of $50. If the account has been dormant for over a year, the company reserves the right to close the account.

Score – 4.4/5

SquaredFinancial offers the popular MetaTrader 4 and MetaTrader 5 platforms, as well as the broker’s proprietary SquaredFinancial mobile app. Through its CySEC-regulated entity, the broker offers only the MT5 platform and the mobile app. The platforms are compatible with all devices, mobile phones, and tablets. The platforms are well-known for their advanced trading capabilities, powerful level of analytical and technical tools, and additional features that enable vast trading possibilities.

| PLatforms | SquaredFinancial Platforms | XM Platforms | Scandinavian Capital Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | Yes |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

SquaredFinancial Web Platform

SquaredFinancial’s clients can conduct trades through the web version of the MT4 and MT5 platforms. This is a quick and uncomplicated way to enter their accounts and trade without the need for downloads or installations. Any device connected to the internet will give access to trading and the essential tools and features needed. Clients gain access to a wide range of instruments, advanced analytical tools, real-time data, and quick executions.

SquaredFinancial Desktop MetaTrader 4 Platform

The MT4 platform is one of the most favored trading platforms by traders worldwide. The platform has a simple interface and provides ease of use combined with advanced features, analytical tools, and customization ability. The platform is compatible with different devices. The mobile app is also available on both Android and iOS devices. The MT4 platform includes automated trading features, trading signals, advanced charts, historical data, and backtesting capabilities. Traders also have access to the MQL4 language and other innovative features for a trading experience of another level.

SquaredFinancial Desktop MetaTrader 5 Platform

The MT5 platform, the more enhanced version of the popular MT4, is available for use with SquaredFinancial. The available analytical tools are some of the best in the industry, ensuring market depth and innovative trading opportunities. The platform comes with four different order types, including market, pending, stop, and trailing stop. With expert analytical tools, the availability of built-in trading robots, mirror trading, and a Virtual Hosting Service, the SquaredFinancial MT5 trading platform ensures a high-standard trading experience and better opportunities.

SquaredFinancial MobileTrader App

SquaredFinancial offers its proprietary mobile app, and the broker also allows access to trading via the MT4/MT5 mobile apps. Through the proprietary app, traders access a wide range of CFD-based instruments with competitive conditions on the go. The SquaredFinancial app provides traders with a customizable, intuitive interface, one-click trading, an opportunity for direct deposits and withdrawals, and other opportunities. The flexibility of the mobile app enables traders to monitor and conduct trades from anywhere in the world.

Main Insights from Testing

We have tested the broker’s platforms to see how they accommodate the trading process. Both platforms are well-equipped with enhanced tools and features and are available for download for multiple devices. The MT4 and MT5 platforms are accessible through web and desktop platforms and the MetaTrader mobile apps. Besides, the broker has its proprietary mobile app that includes extensive analytical tools and essential features for successful trading. We also noticed that the MT4 platform is not available for traders who register under the CySEC-regulated entity.

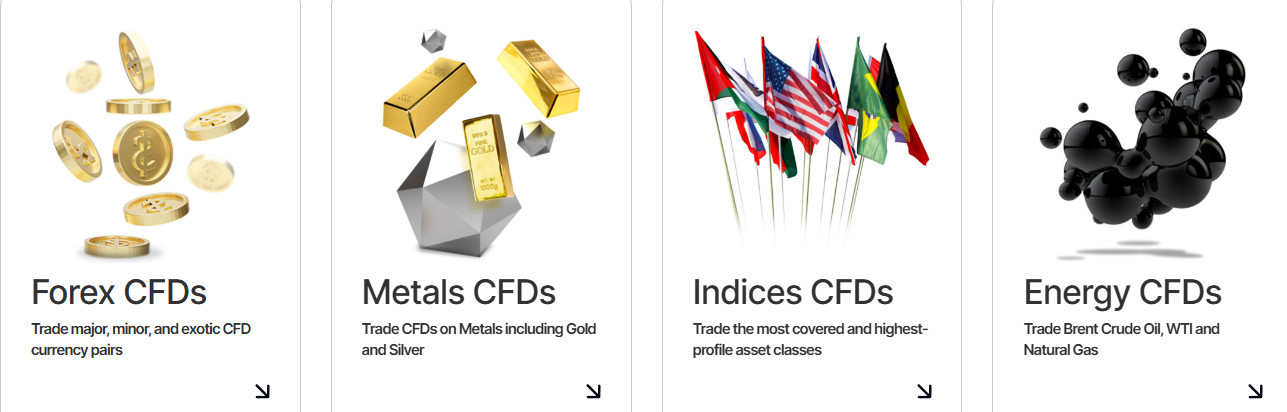

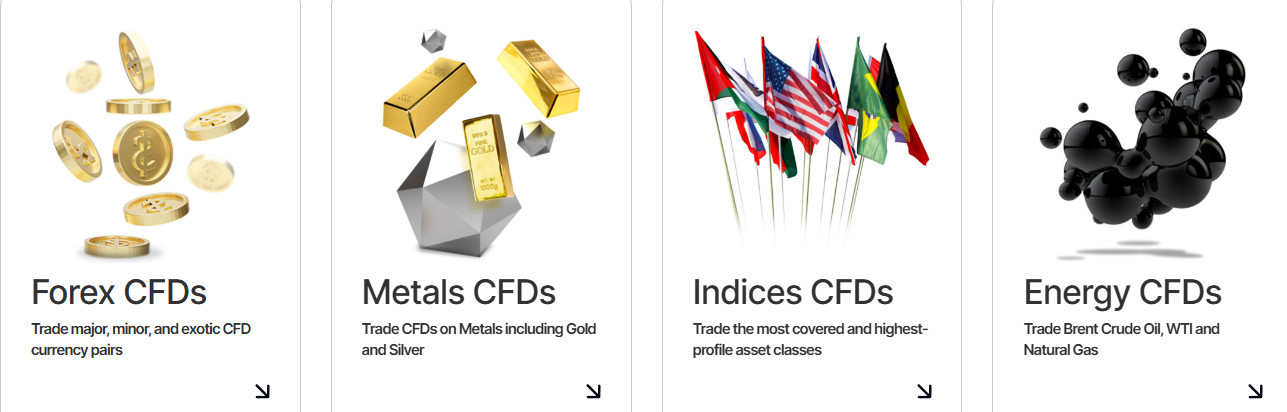

Trading Instruments

Score – 4.6/5

What Can You Trade on the SquaredFinancial Platform?

SquaredFinancial trading Instrument range is offered through FX and CFD models, offering over 10000+ tradable products, including cryptos, futures, metals, energies, indices, ETFs, and stocks.

The broker has over 44 forex pairs, including major, minor, and exotic pairs, and gives access to 7 of the most popular indices, including global indices such as the S&P 500, Nasdaq, and EURO STOXX 50. With SquaredFinancial, clients can trade precious metals like gold, silver, platinum, and palladium with competitive spreads and low margin requirements. Finally, SquaredFinancial enables traders to invest in the most popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, Polkadot, and others.

Main Insights from Exploring SquaredFinancial Tradable Assets

Based on our research and testing of the broker’s trading instruments, SquaredFinancial offers an extensive range of financial products, enabling traders to invest in major and popular instruments with competitive conditions, low spreads, good leverage ratios, and total transparency of trades.

The availability of a wide range of instruments across 7 financial assets enables traders to have more exposure to the market and, hence, more possibilities. However, all the products are CFD-based. The broker offers stocks and ETFs, yet traders cannot own the asset; they can only benefit from the market movements. Another important consideration is that the instrument availability and trading conditions may vary based on the entity, so we recommend traders check out the details of trading a certain instrument under the entity they open an account.

Leverage Options at SquaredFinancial

While leverage can provide benefits by allowing traders to enter the market with a smaller initial investment, clients should be aware of the potential risks it carries. Having a comprehensive understanding of leverage enables individuals to make well-informed decisions and effectively manage the associated risks when engaging in leveraged trading.

SquaredFinancial leverage is offered according to CySEC and FSA regulations:

- Therefore, the European CySEC allows a maximum of 1:30 leverage applied to Forex retail accounts and even lower levels towards other instruments, while professional traders may apply for the higher levels.

- Yet, by trading with the global offshore SquaredFinancial branch, traders may access higher leverage ratios that go to a maximum of 1:1000.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at SquaredFinancial

The SquaredFinancial clients can perform straightforward deposits or withdrawals with security and convenience through the client area. The range of depositing options includes the most common credit cards, bank wire, and e-payments, while another bonus is a 0% fee on deposits or withdrawals.

- The broker also offers its special product – the SquaredFinancial debit card that clients can get by making a $100 deposit.

Minimum Deposit

We have found that the broker’s initial deposit requirement for the SquaredPro account is $0. However, SquaredFinancial recommends starting with a $200 deposit to be able to experience the market opportunities. On the other hand, for the SquaredElite account, the minimum deposit is $500, while a $2000 deposit will ensure better access to the market and more chances for success.

Withdrawal Options at SquaredFinancial

We found that the broker does not impose any fees for deposits and withdrawals. The withdrawal options include the most used bank wire, cards, and e-wallets. The withdrawal process is quick and straightforward, and the withdrawals are generally processed within 24 hours.

Customer Support and Responsiveness

Score – 4.6/5

Testing SquaredFinancial Customer Support

The broker provides 24/5 customer support through email, phone, and live chat. Plus, their Secure Client Area gives users complete account management solutions and a real-time news feed accompanied by plentiful educational resources and market commentary for traders’ convenience.

- Traders can also find SquaredFinancial on different social platforms, such as IG, FB, YouTube, LinkedIn, X, and Telegram. There, the broker posts ongoing market updates, news, and insights into its activities.

Contacts SquaredFinancial

We have tested the broker’s customer support to see how it assists its clients. Support, especially for new traders, is crucial, so the quality of the service can impact the trading outcome dramatically.

Here are the main options for how the broker supports its clients:

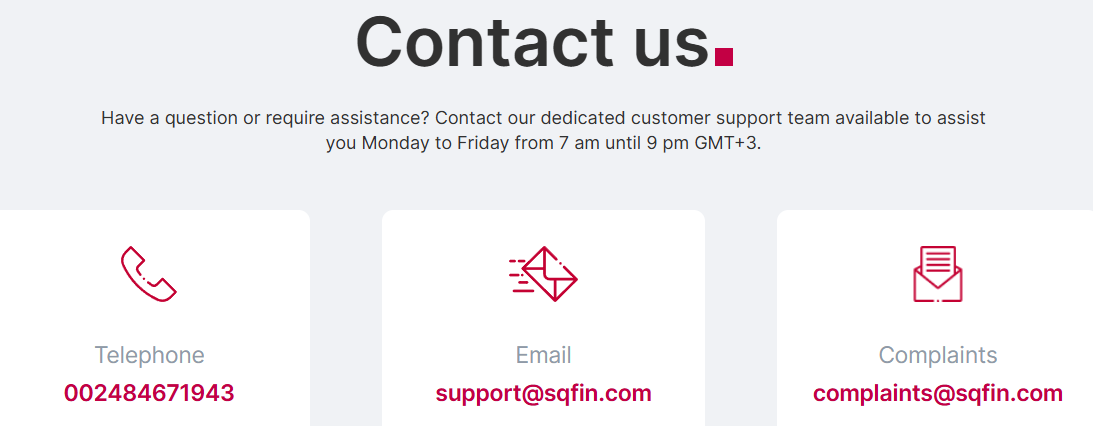

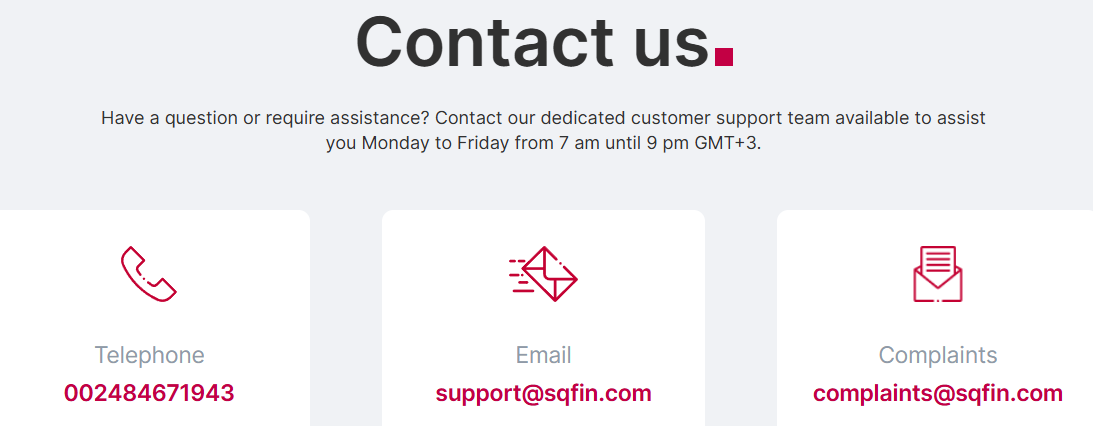

- To contact the broker by phone, the broker provides a phone number: 002484671943. Phone calls are an essential means of contact with the broker, as many traders prefer to get direct answers.

- Another option for contact is email. To send an inquiry to SquaredFinancial’s support team, clients can use the provided address: support@sqfin.com. Also, clients can send their complaints to complaints@sqfin.com.

- Based on our experience, the broker’s live chat is very helpful, with quick, detailed, and on-point answers.

- At last, traders can leave their questions right on the broker’s website, in the ‘Contact us’ section, by providing their name, email address, phone number, and the accompanying message.

Research and Education

Score – 4.7/5

Research Tools Fortrade SquaredFinancial

We found that the broker offers an extensive research section with market insights and analysis, live market news streaming directly to the platform, the economic calendar, a talk show, daily news, market watch, and other research tools to enhance the knowledge and skills of traders.

- The Market Insights section provides a helpful market analysis on global financial markets, offering traders an expert opinion on various market events and essential factors that may influence trading.

- The Daily News section informs traders about the latest events and market movements, assisting them in making informed decisions.

- The SquaredFinancial’s Market Watch provides details on every instrument on a daily, weekly, monthly, and yearly basis.

- The Newsfeed section includes all the market news, highlighting the latest and most impactful financial events.

- The Trading Talk Show includes discussions and analysis of the major global events by two renowned experts of the market.

Education

SquaredFinancial’s education section assists traders with various helpful resources to enhance their trading skills and knowledge.

- The broker provides traders with e-books covering different essential topics to elevate clients’ skills and give them important knowledge on how to trade CFDs, cryptocurrencies, and forex. The books also reflect on the trader’s psychology, fundamental and technical analysis, and other important topics every trader needs to be aware of.

- The trading glossary is another essential resource, especially for beginner traders who are still not acquainted with the main terms of forex trading and find themselves confused by complex language.

- Video tutorials are carefully designed to guide traders and help them trade and navigate the trading platforms with ease and without complications.

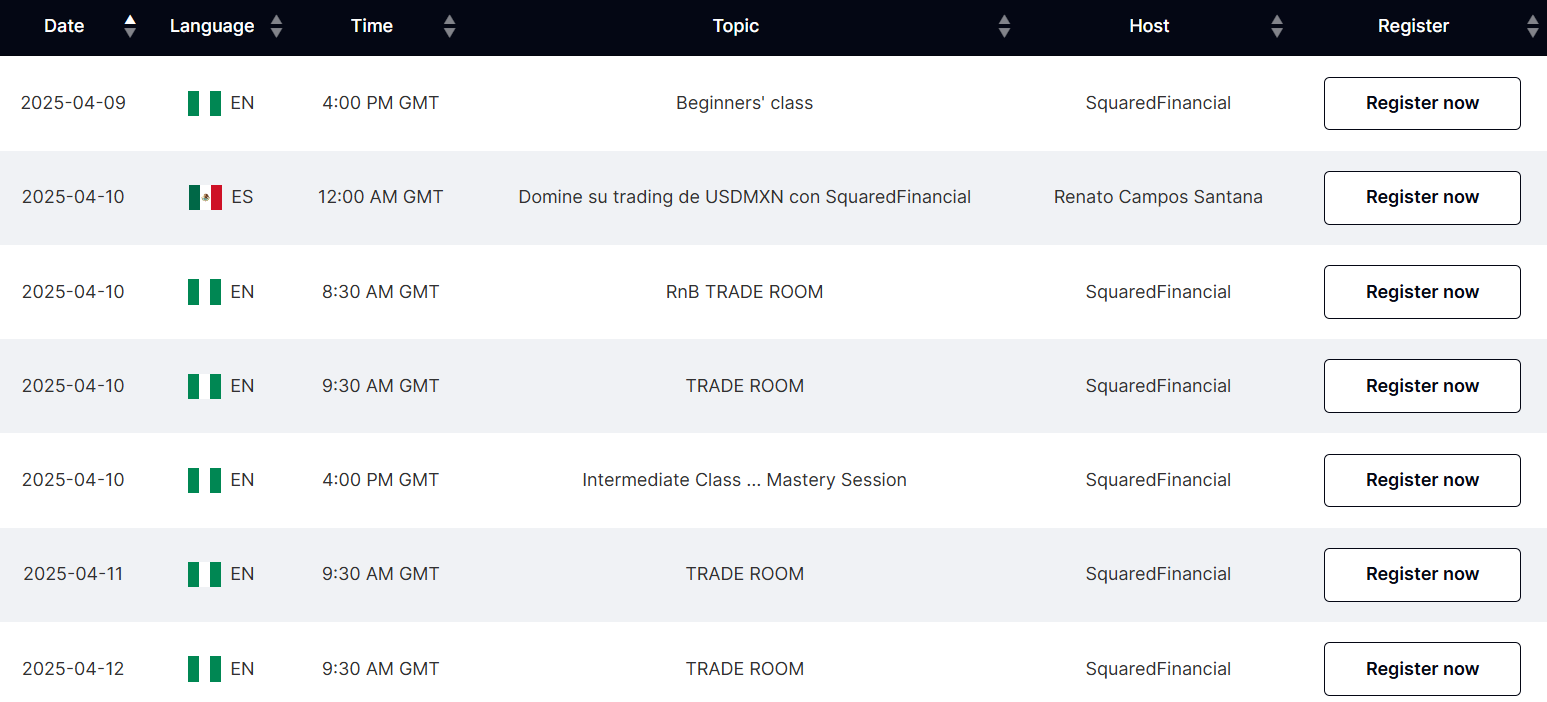

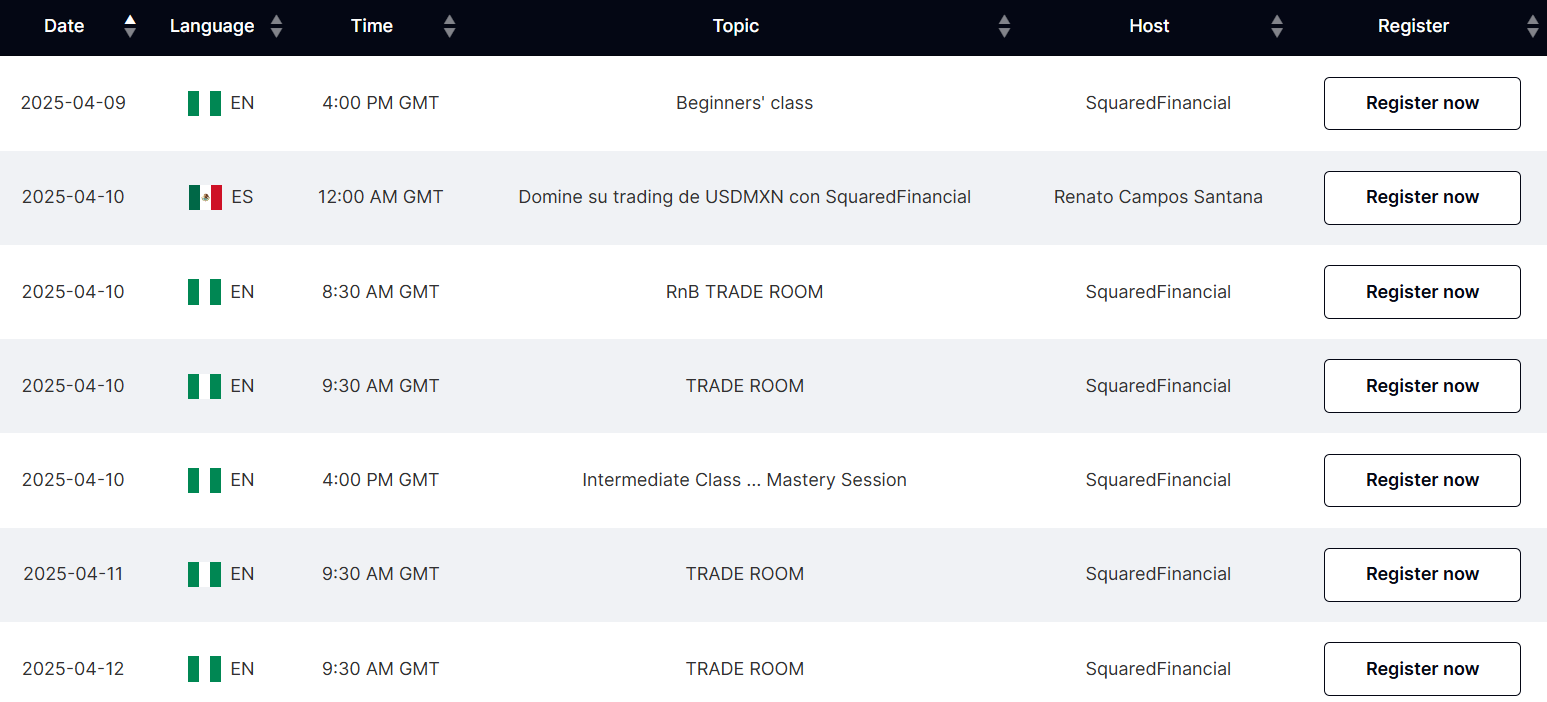

- In addition, SquaredFinancial provides systematic webinars and seminars hosted by experts and market professionals. Traders can register for webinars and seminars right on the broker’s website in the education section.

Is SquaredFinancial a Good Broker for Beginners?

Based on the knowledge and information we have accumulated on the broker, SquaredFinancial is a reliable broker with good offerings and favorable conditions. With SquaredFinancial, different traders will find what they are looking for. Beginner traders will be delighted by the Trading Academy the broker provides, packed with essential resources to guide and assist novice traders, and not only. Also, the available demo account is a good chance to practice trading in a risk-free environment before trading live and investing real money. Besides, the minimum deposit requirement starts from $0, which is a good opportunity for those traders who want to start small. The customer support is also responsive and friendly, providing immediate answers. So, due to so many advantages mentioned, SquaredFinancial is a great broker to start as a beginner.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options SquaredFinancial

SquaredFinancial has an extensive offering of trading instruments, ensuring that every trader finds their preferred tradable product for trading. The availability of over 10,000 instruments provides great diversification of portfolio and the opportunity to explore the market further. However, there are certain restrictions in terms of long-term investments. The broker offers mainly CFD-based products, which means that clients who are looking for real stock ownership or investments in ETFs will not be able to find any opportunities with SquaredFinancial.

Despite the unavailability of traditional investments, the broker offers alternatives to diversify trading:

- The broker’s social trading hub enables traders to copy the trades of professionals. Copying trades does not require constant monitoring or any intervention, enabling clients to trade with less effort. SquaredFinancial allows copying as many strategies and traders as clients want. Social trading is a great investment option for beginner traders who do not have profound knowledge of trading.

- SquaredFinancial also offers MAM accounts, allowing fund managers to trade on behalf of their clients and gain rewards and profit.

Account Opening

Score – 4.6/5

How to Open a SquaredFinancial Demo Account?

SquaredFinancial has a demo account for its beginner and inexperienced traders to open an account and practice with $50,000 virtual funds before switching to a live account and trading with real money. This is a great way for novice traders to get acquainted with the market in a safe and risk-free environment. To open a demo account with the broker, clients need to follow the steps below:

- Go to the broker’s website and choose ‘Try free demo.”

- Provide name, phone number, email address, and other information to fill out the registration form.

- Afterward, you will get a letter of confirmation.

- Confirm your demo account by using the account credentials sent through the email.

- Enter your account and download the trading platform.

- Receive the virtual $50,000 funds and start practicing.

How to Open a SquaredFinancial Live Account?

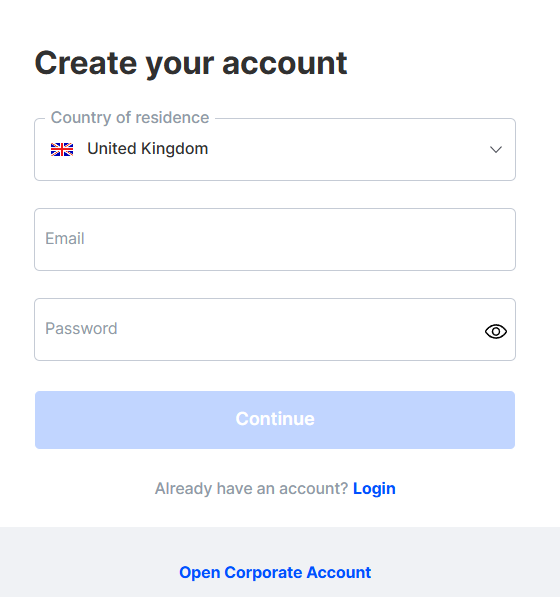

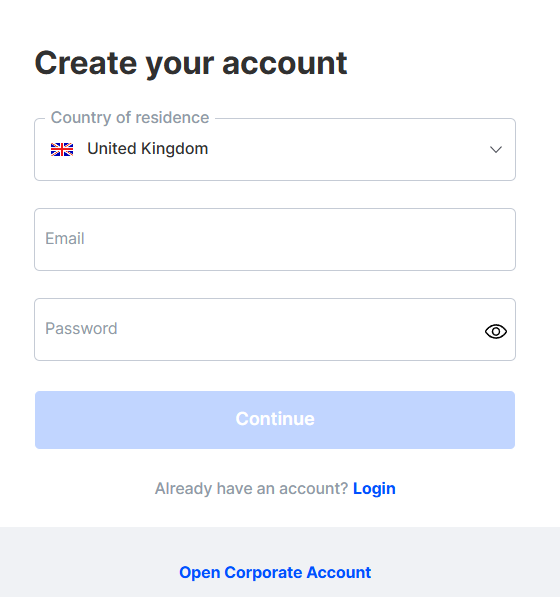

Opening an account with a broker is an easy process, as you can log in and register with SquaredFinancial within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Score – 4.3/5

SquaredFinancial has great tools and resources to accommodate clients during their trading journey. Additional features and tools are essential as they elevate the trading experience even further, opening more opportunities for a successful trading experience.

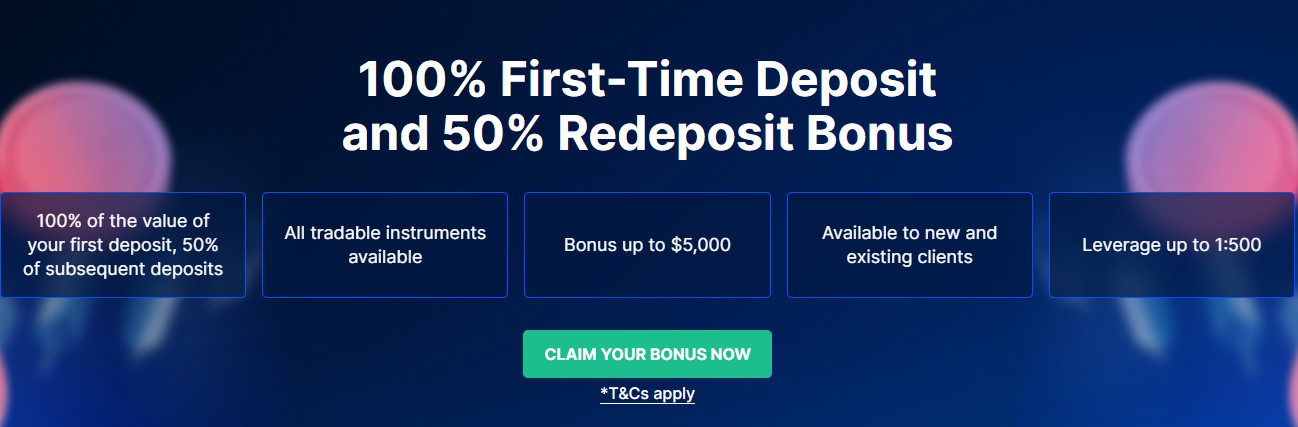

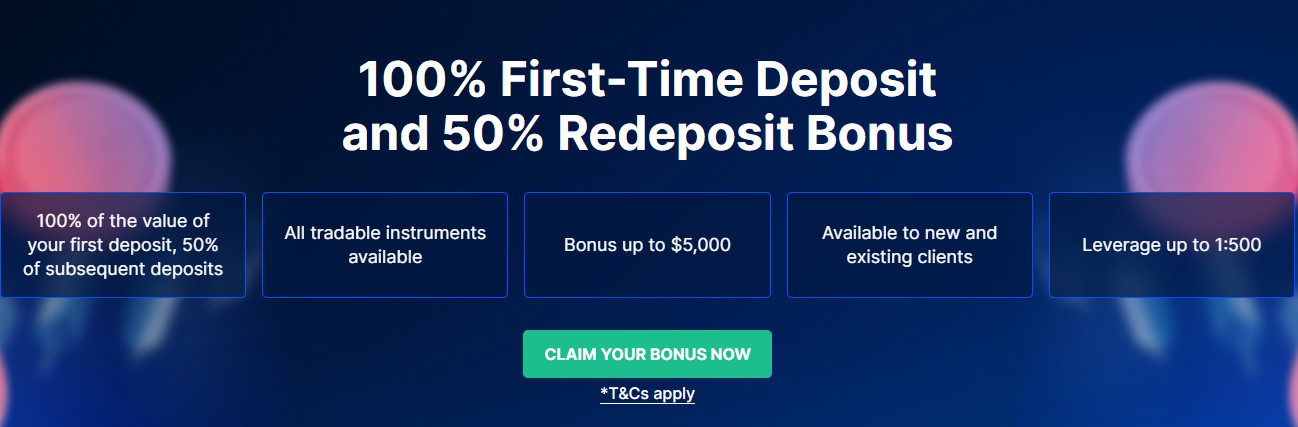

- With SquaredFinancial, clients receive 100% bonuses on their first deposits and a 50% bonus for subsequent deposits. This way, the broker encourages its clients.

- The Economic Calendar is a great tool that informs traders about the possible turns of the market and impending economic events strong enough to impact the market.

- SquaredFinancial VPS enables clients to conduct seamless trades via MT4/MT5 platforms from any device. The trades are executed in milliseconds due to the cutting-edge technology, providing traders with a flawless experience.

SquaredFinancial Compared to Other Brokers

We have also compared SquaredFinancial to other brokers to see how the broker stands out and what aspects it lacks. We first compared the broker in terms of its regulation. SquaredFinancial holds a license from the respected authority, CySEC, hence providing a reliable environment and adherence to rules and guidelines. It also holds an offshore FSA license. As we have found, OneRoyal also holds CySEC and FSA licenses; however, it is also licensed by ASIC, a respected Australian financial authority, adding an extra layer of security to its practices.

We have also reviewed SquaredFinancial’s fees and assessed them as average, with spreads from 1.2 pips and commissions of $5 per lot. The good part about the broker’s trading costs is the transparency and clarity; it does not have any hidden fees or extra costs. Forex.com has similar costs, with spreads from 1.3 pips and commissions of $5 per lot. The other brokers we reviewed have lower spreads, such as Tradeview with an average spread of 0.3 pips and Spreadex with spreads of 0.6 pips.

While we compared trading platforms, we noticed that most brokers include MT4 and MT5 platforms. SquaredFinancial also has its proprietary mobile app. However, Spreadex, for instance, offers its proprietary platform and TradingView and does not include MT4 and MT5 platforms. We also compared the range of instruments each trader offers, and SquaredFinancial is the one with the most extensive selection of instruments, including +10,000 tradable products across different assets. Spreadex also has more than 10,000 instruments, while Global Prime offers a more modest instrument selection of 150+.

At last, we were impressed by SquaredFinancial’s educational and research sections, equipped with webinars, seminars, trading courses, a glossary, e-books, and great analytical tools that will be of great help to traders of different levels. Forex.com‘s educational resources are also helpful and well-planned, while OneRoyal, Xtrade, and Tradeview include good materials, they still lack when compared to SquaredFinancial.

| Parameter |

SquaredFinancial |

Spreadex |

Forex.com |

Global Prime |

OneRoyal |

Xtrade |

Tradeview |

| Spread Based Account |

Average 1.2 pip |

Average 0.6 pips |

Average 1.3 pips |

Average 0.9 pip |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

0.0 pips + $2.5 |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $5 |

0.0 pips + $3.5 |

0.0 pips + $3.50 |

No commissions based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, Mobile app |

Spreadex Web Platform, TradingView |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

10.000+ instruments |

10,000+ instruments |

6000+ instruments |

150+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

CySEC, FSA |

FCA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, VFSC |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$100 |

No minimum deposit |

$50 |

$250 |

$1000 |

Full Review of Broker SquaredFinancial

Our overall impression of SquaredFinancial is positive, based on our thorough research and testing. SquaredFinancial is a tightly regulated broker, holding a license from CySEC and following strict rules and guidelines that protect traders’ safety. The trading conditions are also good, enabling clients access to a wide range of instruments across 7 assets, low/average trading costs, and transparency and clarity of practices.

SquaredFinancial offers 2 account types with different fee structures, meeting the needs of various traders. Trades are conducted on the popular MT4 or MT5 platforms or the broker’s proprietary SquaredFinancial mobile app, which stands out for its enhanced features and fast execution.

SquaredFinancial also impressed us with its additional tools and features, enabling traders more versatility, flexibility, and innovative opportunities. The education and research section is another level, packed with the essential resources to assist traders of different levels, from beginners to professionals, looking for more opportunities. We also tested the customer support and revealed a professional and dedicated team with quick and helpful answers. In short, SquaredFinancial is a reliable broker that provides traders with great conditions, diversity, innovative solutions, and profound analytics.

Share this article [addtoany url="https://55brokers.com/squared-financial-review/" title="SquaredDirect | SquaredFinancial"]

wow, these are some of the highest scores I’ve seen for a broker here… Need to check them out.

This is an objective review and article on SqFin. I have opened an account with them recently, and can confirm that the review is accurate 👍

The SquaredElite Account type I use, and as the review said the spreads are truly raw… it’s happening often to see 0 spread on EURUSD for example. The trading fee is $5 per lot round turn, which is another point on the pros side… you know the average fee for ecn accounts is around $7

Great and accurate review 👍

I have been trading with SqFin and all the pros mentioned in this article, like the spreads, the trading academy are truly pros. This is a great platform

good review, I’ve come to the same conclusions from my own research. Its an old, very solid broker, lacking some more modern features. If you don’t care about AI and think its hype, this might be a great broker for you.

One MISTAKE in the review, is that the min. acc size is $250. Its actually $0 (they have no requirement for basic Pro acc). Maybe fix or update?