- What is PhillipCapital?

- PhillipCapital Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

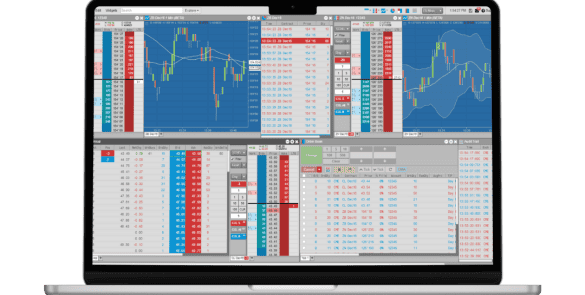

- Trading Platforms and Tools

- Trading Instruments

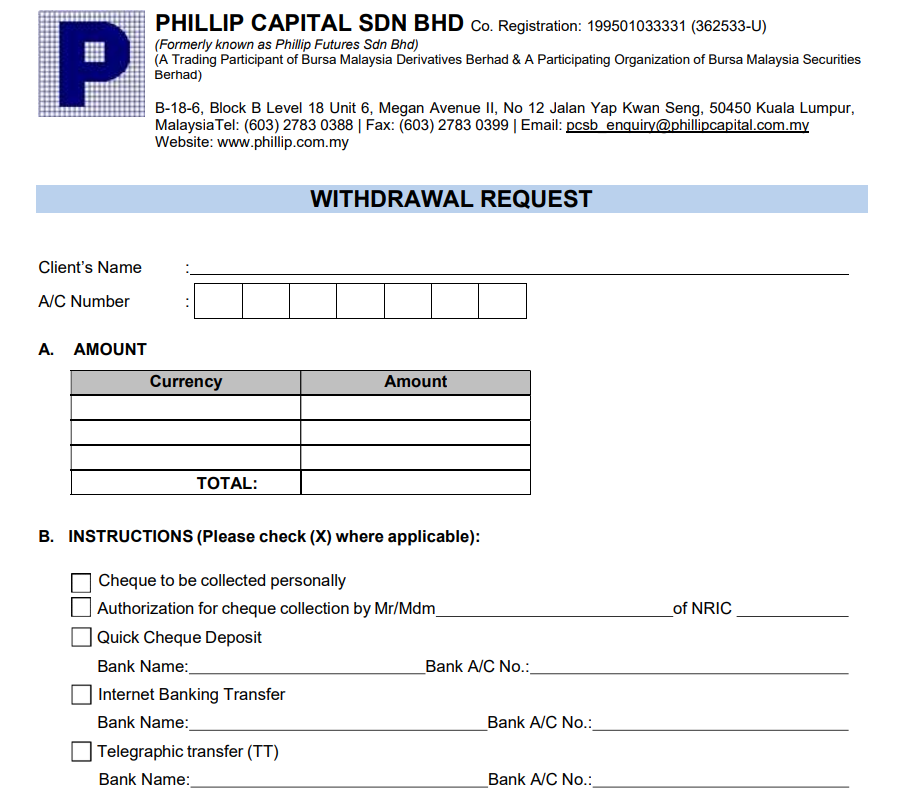

- Deposit and Withdrawal Options

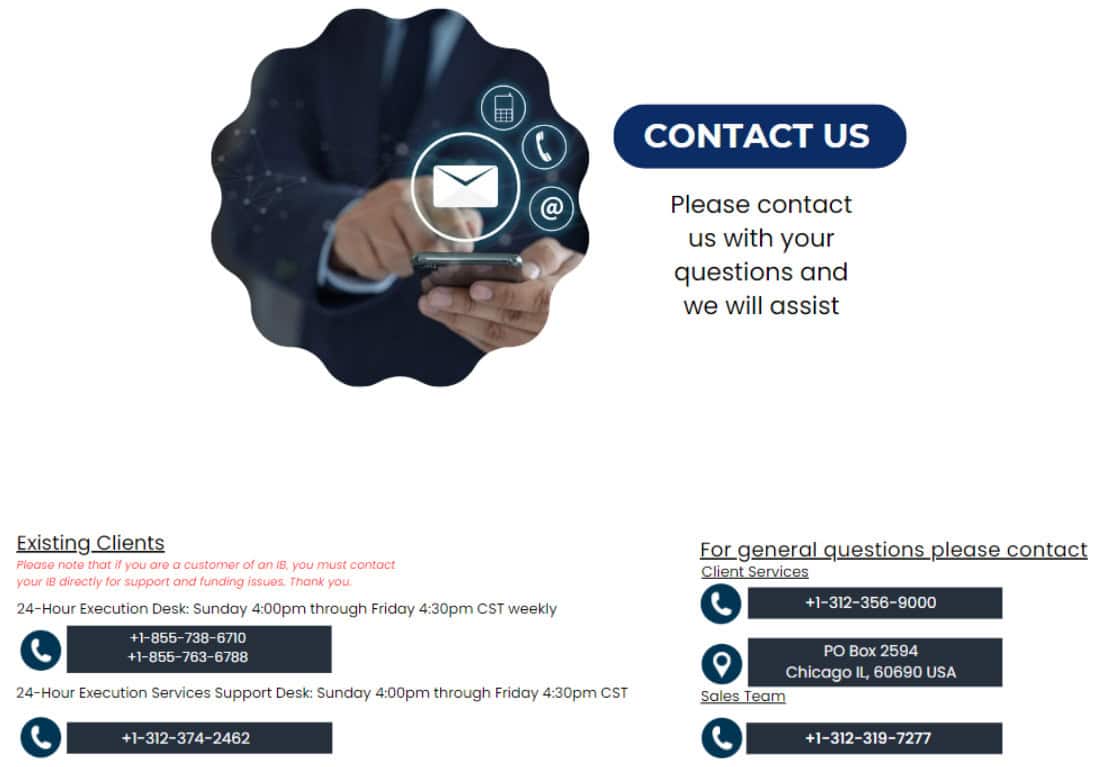

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

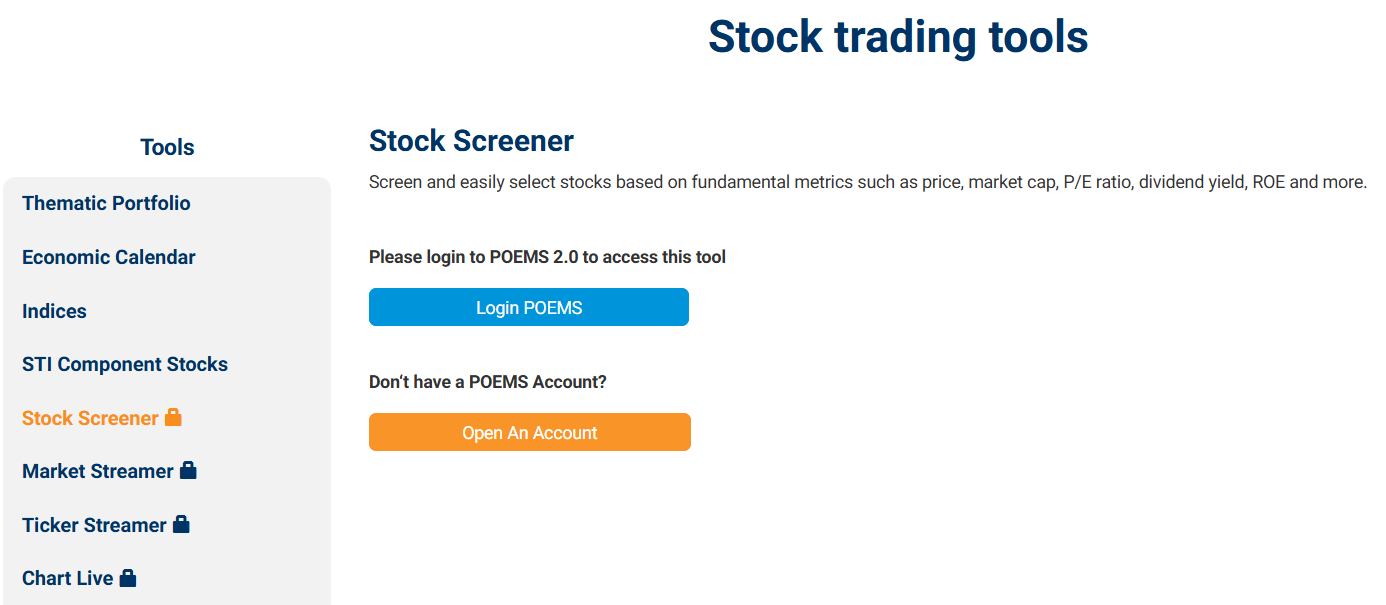

- Additional Tools And Features

- PhillipCapital Compared to Other Brokers

- Full Review of Broker PhillipCapital

Overall Rating 4.7

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is PhillipCapital?

PhillipCapital is a Futures Commission Merchant (FCM) and brokerage company offering access to trade Futures, Options, Forex pairs, CFDs, Indices, Stocks, Metals, etc.

As a part of the PhillipCapital Group, the company was founded in Singapore about 50 years ago with offices in 15 countries and over $1,5 billion in shareholder funds.

PhillipCapital operates as a multi-faceted broker with diverse execution models tailored to various client needs and regulatory environments.

Is PhillipCapital Stock Broker?

Yes, PhillipCapital is a prominent Stocks and Options broker with a global presence, known for offering a wide range of financial services to investors and traders. With operations in multiple countries, particularly in the Asia-Pacific region, the broker facilitates trading in various financial instruments, including equities, bonds, commodities, futures, options, and Forex.

PhillipCapital Pros and Cons

PhillipCapital is a reliable, regulated broker with low fees compared to industry peers, also is one of the Brokers with an excellent reputation and strong establishment over the years. It provides good investment conditions with a good range of instruments, PhillipCapital orders, and a selection of platforms and third-party APIs.

For the Cons, there is no 24/7 customer support, and conditions and offerings vary depending on the entity and regulations.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | No 24/7 customer support |

| Globally recognized | conditions vary depending on the entity |

| CFTC and FINRA licenses and overseeing | |

| Competitive fees and commissions | |

| Real Stock Trading and Investment | |

| Long history of operation and strong establishment | |

| Access to trade Real Futures | |

| Access to 26 exchanges worldwide | |

PhillipCapital Features

PhillipCapital is a well-established global financial provider offering a range of investment solutions. Below is a comprehensive list of the firm’s key features:

PhillipCapital Features in 10 Points

| 🏢 Regulation | CFTC, NFA, FINRA, SIPC, MAS, SC Malaysia |

| 🗺️ Account Types | Individual, Joint, Corporate, LLC, LLP, Trust, IRA, Pension Plan, Discretionary Trading Accounts |

| 🖥 Trading Platforms | MT5, CQG, TT, CTS, Rithimic, POEMS |

| 📉 Trading Instruments | Futures, Options, Stocks, Securities, Forex, CFDs, Indices, Metals, Bonds, Equities, ETFs, Commodities, Cryptocurrencies |

| 💳 Minimum Deposit | $5,000 |

| 💰 E-mini and Standard Contract | $0.25 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, JPY, AUD, CAD, CHF |

| 📚 Trading Education | Investment Seminars, Events, Market News, Video Tutorials |

| ☎ Customer Support | 24/5 |

Who is PhillipCapital For?

PhillipCapital is ideal for clients, from retail investors to large institutional traders. The broker offers accessible platforms, comprehensive research tools, and personalized wealth management solutions to support diverse investment goals. Based on our findings, PhillipCapital is Good for:

- Traders from the US

- Singapore traders

- International traders

- Professional trading

- Advanced traders

- Investors

- Real Stock trading

- CFD and currency trading

- Futures trading

- Direct Market Access trading

- Traders who prefer MT5

- Competitive commissions

- Powerful tools

- Good customer support

- Trading Education

PhillipCapital Summary

Overall, PhillipCapital is a reliable and safe broker with competitive prices in the industry. The broker supports a variety of platforms designed for the future trading market with comprehensive solutions, various instruments for analysis, and strategy improvements.

However, the firm offers quite a high deposit to start the trade, hence the broker may not be the best option for beginner traders, but a very considerable option for professional and active traders.

55Brokers Professional Insights

PhillipCapital stands out for its strong global presence, robust regulatory framework, and diversified product offering across multiple asset classes, espesially good for investing and Stock trading.

With about five decades of financial expertise and operations in more than 15 countries, the broker provides professional solutions supported by powerful platforms, which we find at a great level, tools are just great and very supportive in investment purpose. Also, the comprehensive investment offerings and competitive fee structure make it a fit for investors of different size, including institutional clients.

Since is a Real Stock Broker the Direct Market Access is stable, with low-latency order execution conneccted directly to global exchanges. Overall, conditions and executions is quite ideal for traders using strategies such as scalping, day trading, and spread trading for UK traders, where speed and minimal slippage are at place.

Additionally, we mark PhillipCapital’s commitment to investor education, personalized support, which is quite at a quality level for the concerns traders may have. Lastly, Broker constantly eveloves as we see along the history of its operation, and is definitely a plus for company traders as technological innovation comes up and enhances quality of everyday trading or investing, along with reputation as a trusted stock firm.

Consider Trading with PhillipCapital If:

| PhillipCapital is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Low fees and commissions.

- Need a well-regulated broker.

- Access to robust platforms.

- Stock Trading and Investment.

- Excellent technology.

- Providing services worldwide.

- Offering popular financial products.

- Investment educational materials.

- Trading of Real Futures. |

Avoid Trading with PhillipCapital If:

| PhillipCapital might not be the best for: | - Beginner traders looking for commission-free trading.

- Crypto-focused investors

- Traders looking for low initial deposit requirements.

- Looking for social or copy trading features.

- Need High Leverage or Margin levels.

|

Regulation and Security Measures

Score – 4.7/5

PhillipCapital Regulatory Overview

PhillipCapital operates under a strong and diverse regulatory framework across multiple jurisdictions. In the US, it is registered with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA), ensuring compliance with US trading standards.

The firm is a member of FINRA and the Securities Investor Protection Corporation, offering an added layer of investor protection. In Australia, PhillipCapital holds licenses from the Australian ASIC, while in Singapore, it is regulated by the Monetary Authority of Singapore (MAS). Additionally, the broker is authorized by the Securities Commission Malaysia, reflecting its regional strength in Asia.

This comprehensive regulatory coverage positions PhillipCapital as a globally trusted broker for retail traders and investors.

How Safe is Trading with PhillipCapital?

PhillipCapital is considered very safe to trade with, due to its strong global regulatory oversight and long-standing reputation in the financial industry. The broker is licensed by a few Top-Tier regulators, including the CFTC and NFA in the USA, and ASIC in Australia, ensuring strict adherence to financial compliance and client protection standards.

Client funds are typically held in segregated accounts, adding an extra layer of security. As the firm is a member of SIPC, client securities accounts are protected by SIPC for a maximum coverage of $500,000, with a cash sublimit of $250,000.

Consistency and Clarity

PhillipCapital has a solid reputation in the global trading community, backed by decades of financial experience under various regulated entities.

Its long-standing presence reflects a high level of consistency and clarity in the industry. Traders often point out advantages such as reliable execution, professional support, and diverse product offerings, while some drawbacks include platform complexity for beginners and limited promotional offerings.

While the firm has not received a large number of international awards, its active presence in financial education, in-depth market research, and industry sponsorships demonstrates its dedication to industry development and trader support.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with PhillipCapital?

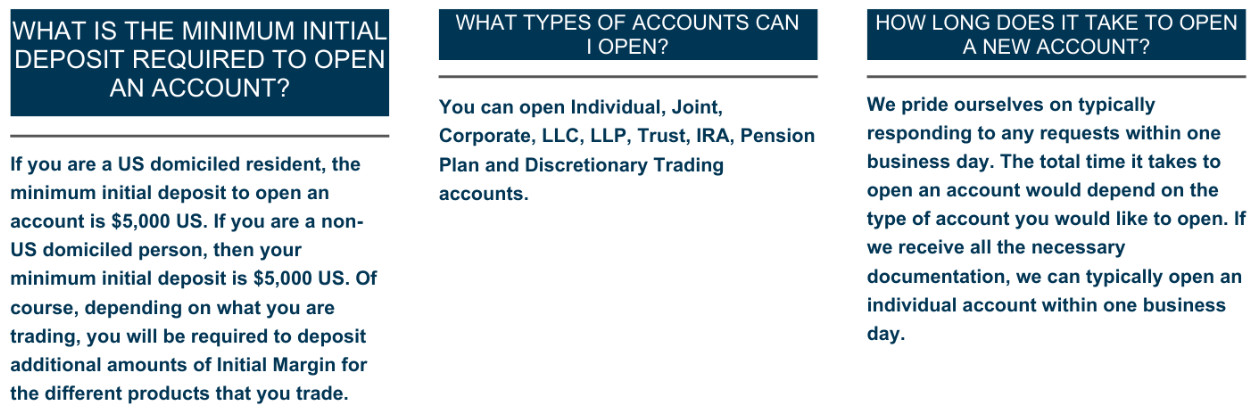

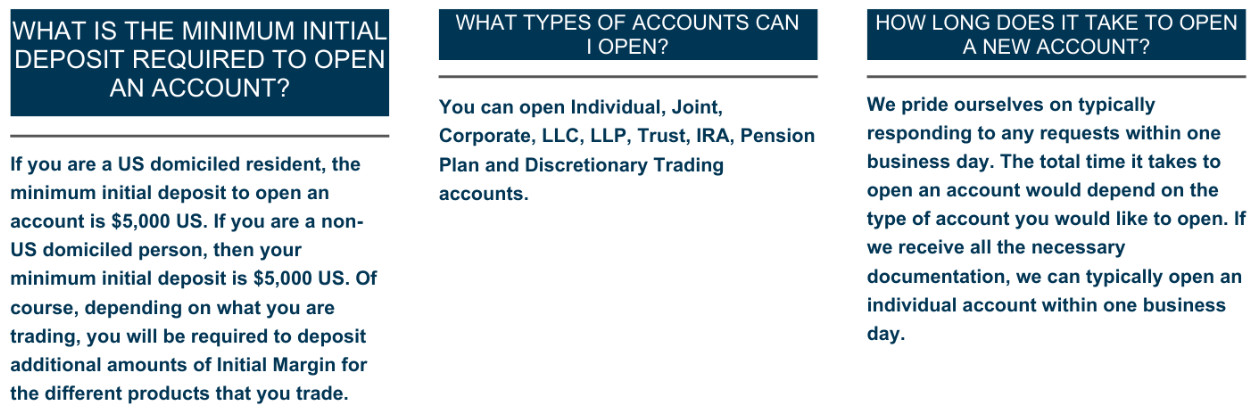

PhillipCapital offers a range of account types to meet the diverse needs of investors or institutional clients. These include Individual and Joint accounts for personal trading, Corporate, LLC, and LLP accounts designed for businesses and professional entities.

Investors with long-term financial goals can open Trust accounts, IRA (Individual Retirement Accounts), and Pension Plan accounts, offering structured, tax-efficient investment options.

For those looking for professional portfolio management, Discretionary accounts are also available, allowing authorized managers to make trading decisions on the client’s behalf.

Additionally, PhillipCapital provides a Demo account option, enabling new clients to explore the platform and practice trading in a risk-free environment before committing real funds. However, the selection of account types may vary depending on the jurisdiction, so traders should check the official websites or contact customer support for the most accurate information.

Individual Account

The Individual Account is designed for single traders who prefer to manage their portfolios. This account type offers full control over trading decisions and access to a wide range of financial instruments.

The minimum deposit requirement for an individual account is $5,000, though this may vary based on the instruments and platforms selected.

Joint Account

The Joint Account allows two individuals to co-manage a trading portfolio with shared access and responsibility. Like the individual account, the minimum deposit generally starts at $5,000, making it accessible to a wide range of investors who prefer collaborative account management.

Regions Where PhillipCapital is Restricted

Like many brokers, PhillipCapital is subject to regional regulations and therefore does not accept or open accounts for traders from certain countries. Also, the availability of specific financial instruments or services may be limited or restricted depending on the jurisdiction.

The following is a list of regions where PhillipCapital is restricted:

- North Korea

- Some EU countries

- UK

- Iran

- Russia

- Syria, etc.

Cost Structure and Fees

Score – 4.6/5

PhillipCapital Brokerage Fees

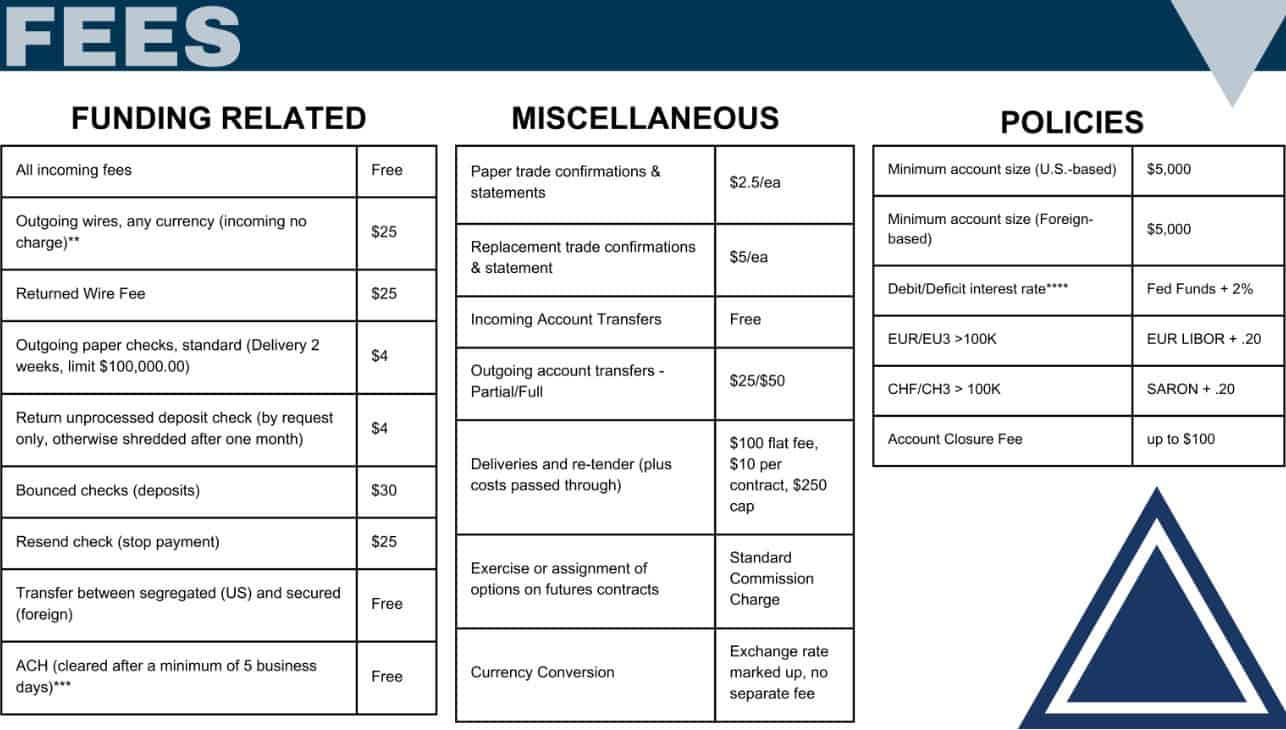

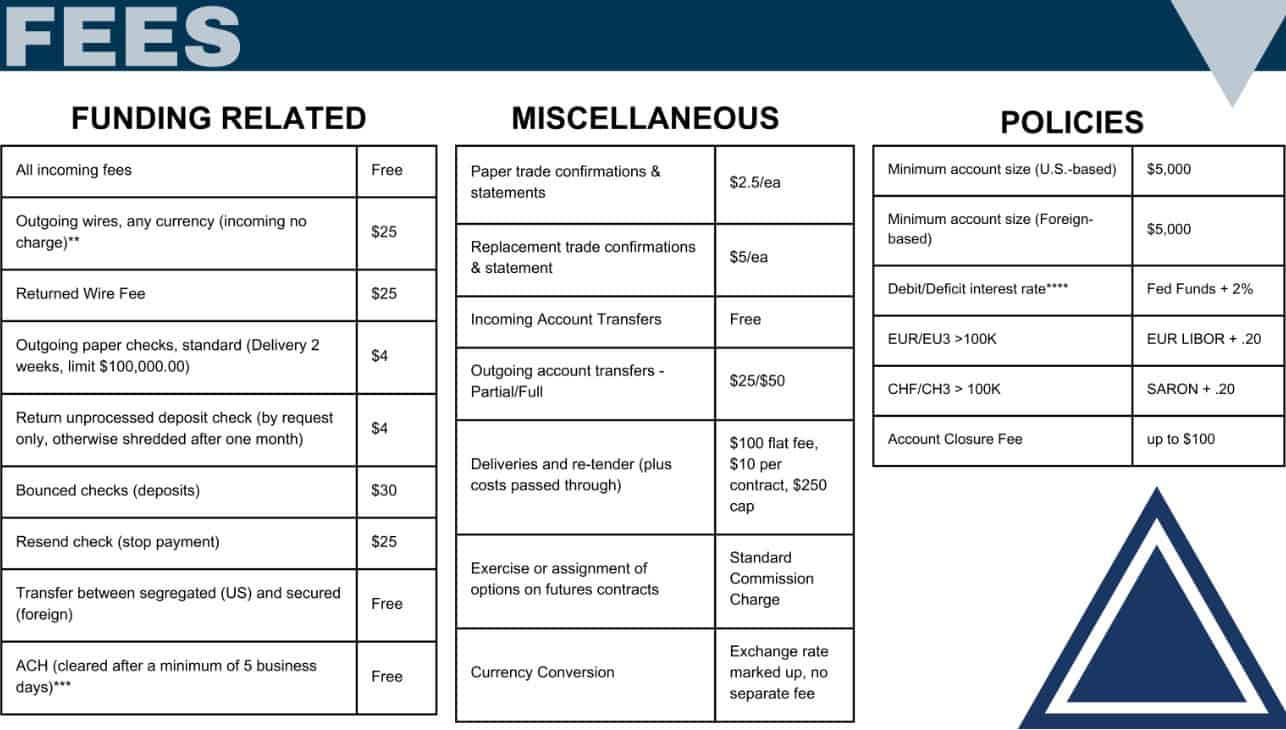

PhillipCapital’s fees vary depending on the product type, platform, and the specific entity or jurisdiction through which clients open their accounts.

The commission rates are generally transparent and aligned with industry standards. Futures contracts, such as E-mini and Micro contracts, typically incur a flat per-contract fee, while stock commissions may depend on trade volume or account type.

While PhillipCapital’s fees are reasonable for active and professional traders, traders should review the fee structure provided by the specific regional branch, as costs can differ based on regulatory and operational factors.

- PhillipCapital Broker Fee

PhillipCapital charges $0.50 per side for Micro Contracts, while for E-mini or Standard Contracts, the typical fee is around $0.25 per side. These rates can vary slightly depending on the platform, market, or the specific broker’s entity you are using.

Overall, PhillipCapital’s fee structure supports a wide range of strategies and account sizes, with transparent pricing that appeals to active traders seeking low-cost execution.

- PhillipCapital Exchange Fee

The second part of Fees is the Exchange Fee. PhillipCapital applies exchange fees that vary based on the specific futures contracts traded and the exchanges on which they are listed. For US exchanges, a $0.02 per lot each way fee applies under the NFA. Additionally, trades executed on CME, NYSE/LIFFE, and CFE (CBOE) are subject to an exchange fee of $0.03 per lot each way.

As the exchange fees may vary depending on the exchanges, traders should consult the latest fee structures or contact PhillipCapital directly.

- PhillipCapital Rollover / Swaps

PhillipCapital applies rollover or swap fees to positions held overnight, in Forex and CFD trading. These fees are influenced by the interest rate differential between the two currencies involved in a trade.

Swap rates are calculated daily and can vary based on market conditions, currency pair, and the direction of your trade.

How Competitive Are PhillipCapital Fees?

PhillipCapital offers a very competitive fee structure that caters to both retail and institutional traders. While the fees are not the lowest in the industry, the firm balances affordability with a strong emphasis on service quality, regulatory compliance, and platform reliability.

PhillipCapital’s pricing is especially suitable for traders who value institutional-grade infrastructure and robust market access over the lowest commissions alone.

| Fees | PhillipCapital Fees | TastyTrade Fees | AvaFutures Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $0.25 | $1.25 | $0.49 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | Yes | No | No |

| Data Fee | Yes | Yes | No |

| Fee ranking | Average/ Low | Low | Low |

PhillipCapital Additional Fees

In addition to the main fees, PhillipCapital imposes various additional fees that traders should be aware of to manage their costs effectively. For instance, broker-assisted trades incur an extra charge of $5 above the standard electronic commission. Wire transfer withdrawals are subject to a $25 fee per transaction, while check withdrawals carry a $4 fee.

Clients using Discretionary accounts may face an additional commission of $5 for broker-executed trades. Moreover, account closure is subject to a $100 fee.

Additionally, monthly platform subscription fees ranging from $40 to $100 may apply, depending on the platform used.

Trading Platforms and Tools

Score – 4.7/5

PhillipCapital offers a diverse range of platforms, including popular solutions such as MetaTrader 5 for Forex and CFDs, as well as advanced futures trading platforms like CQG, Trading Technologies (TT), CTS T4, Rithmic, and POEMS, which is PhillipCapital’s proprietary platform designed for multi-asset trading.

Each platform provides unique features tailored to different trading styles for algorithmic trading, high-frequency execution, or advanced charting and analytics.

However, the platform availability varies depending on the regulatory jurisdiction and specific PhillipCapital entity. Traders need to verify platform options with their local branch or on the official website to ensure access to the tools that best support their strategies.

Trading Platform Comparison to Other Brokers:

| Platforms | PhillipCapital Platforms | TastyTrade Platforms | AvaFutures Platforms |

|---|

| MT4 | No | No | No |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

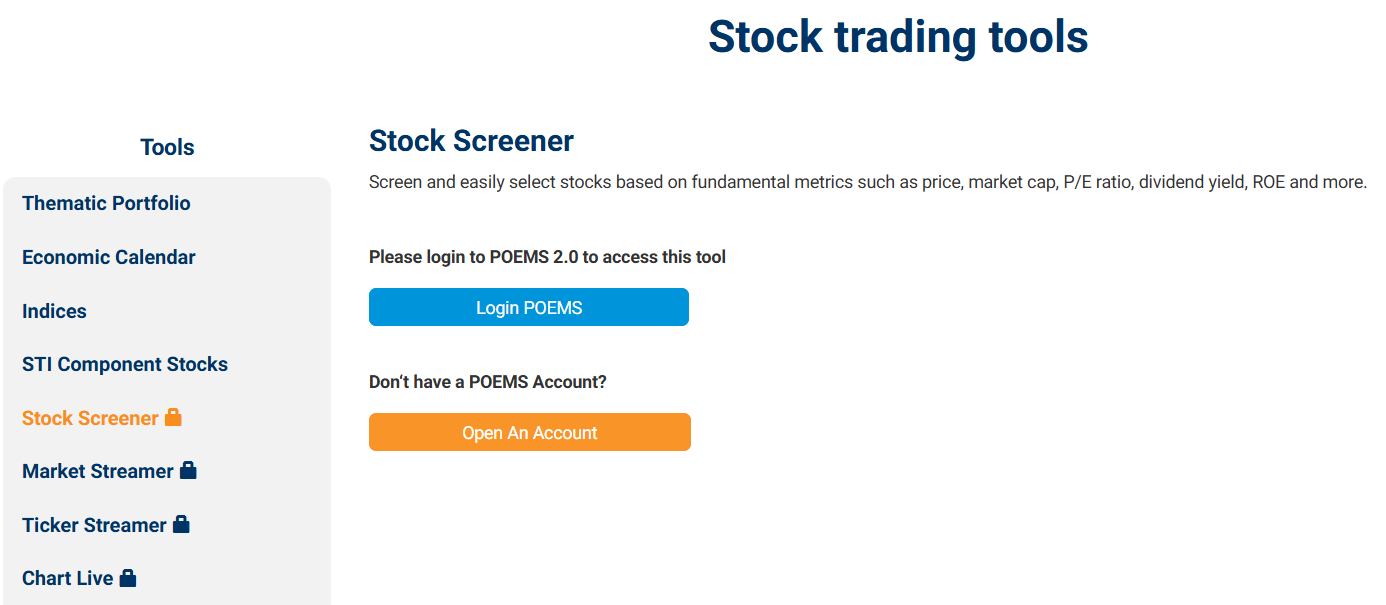

PhillipCapital Web Platform

PhillipCapital’s POEMS is a proprietary web-based platform, accessible directly through internet browsers. It provides seamless access to a wide range of financial instruments and more than 26 global exchanges.

The platform provides over 30 integrated tools and features such as advanced order types, real-time charting, stock screeners, and synchronized global watchlists, all aimed at enhancing the experience.

Additionally, POEMS offers live market data, timely research reports, and a user-friendly interface, without the complexity of traditional desktop platforms.

Main Insights from Testing

Testing the POEMS platform reveals a strong emphasis on user accessibility and functional design. Navigation is intuitive, and the platform responds quickly, providing a smooth experience.

While it is more suited to investors looking for broad market exposure and research integration, active day traders might find some advanced functionalities slightly limited compared to professional-grade platforms. Overall, POEMS is a reliable and well-structured platform ideal for multi-asset investors.

PhillipCapital Desktop MetaTrader 4 Platform

PhillipCapital does not currently offer the MT4 platform for trading. Instead, the broker provides access to MetaTrader 5, which supports a broader range of asset classes and advanced features. Yet if you still prefer MT4, it is better to opt for another Broker.

PhillipCapital Desktop MetaTrader 5 Platform

PhillipCapital offers the MetaTrader 5 platform for desktop users, providing a robust environment for novice and experienced investors.

The platform supports trading across various asset classes, including Forex, CFDs on indices, commodities, and cryptocurrencies. It features advanced charting tools, a range of technical indicators, and supports automated trading through Expert Advisors.

Additionally, the MT5 integrates with popular tools like Trading Central and Autochartist, offering real-time market analysis and signals.

PhillipCapital MobileTrader App

PhillipCapital offers a range of mobile platforms for different regions and user needs. Main apps include POEMS Mobile 3 with integrated TradingView charts.

Malaysian clients can use the PhillipTrade app. These mobile platforms provide real-time data, advanced charting tools, and user-friendly interfaces, allowing traders to manage portfolios and execute trades efficiently. The availability and features vary depending on the entity and region.

Trading Instruments

Score – 4.8/5

What Can You Trade on PhillipCapital’s Platform?

PhillipCapital provides access to a wide range of over 26,000 instruments, including Futures, Options, Stocks, Securities, Forex, CFDs, Indices, Metals, Bonds, Equities, ETFs, Commodities, and Cryptocurrencies.

However, the availability of the products varies depending on the specific PhillipCapital entity and jurisdiction. Each regional branch offers a different selection of products based on local regulations and market demand.

Main Insights from Exploring PhillipCapital’s Tradable Assets

With access to global exchanges and a wide selection of asset classes, PhillipCapital caters to both short-term traders and long-term investors. The range and structure of available instruments support various strategies and investment goals, reinforcing the broker’s position as a multi-asset platform suitable for different trader profiles.

Margin Trading at PhillipCapital

PhillipCapital offers margin rates that generally apply to all customers, while in various jurisdictions, local regulators require different or higher margin rates. The broker’s multiplier varies according to the instrument, region, and entity you trade with:

- US traders under CFTC and FINRA jurisdictions may use up to 1:50 leverage.

- Singapore traders are eligible to use a maximum of up to 1:20.

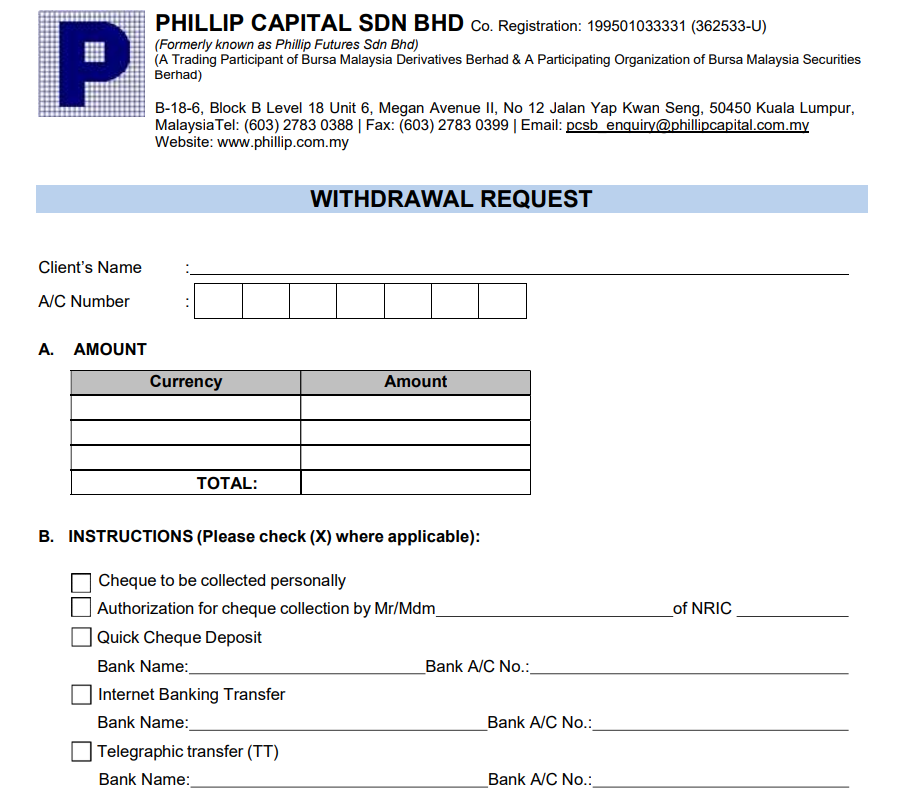

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at PhillipCapital

To fund the account and start trading with PhillipCapital, you will have a choice to select from:

- Bank Wire

- Credit/Debit Cards

- Check

- ACH Transfer

PhillipCapital Minimum Deposit

PhillipCapital’s minimum deposit amount is $5,000. This will allow you to subscribe to the first category of the offered PhillipCapital accounts.

Withdrawal Options at PhillipCapital

We found that withdrawal methods include bank transfers, cheque withdrawals, and internal transfers between accounts. Wire transfer withdrawals are subject to a $25 fee per transaction. The main account currencies for funding are GBP, EUR, and USD.

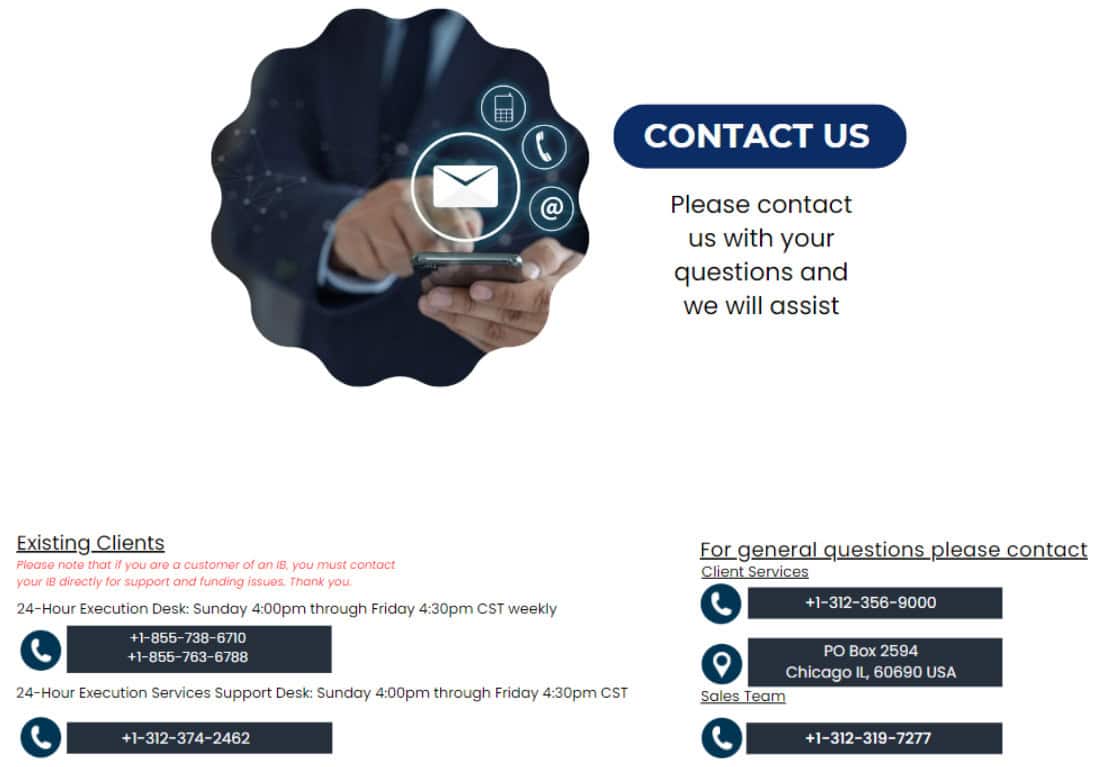

Customer Support and Responsiveness

Score – 4.6/5

Testing PhillipCapital’s Customer Support

PhillipCapital offers 24/5 responsive and multi-channel customer support via phone, email, and live chat.

The broker also provides an extensive FAQ section and support documentation across its regional websites to assist with common queries. Additionally, PhillipCapital entities like those in Singapore, Malaysia, and Australia have physical offices, offering clients the option of in-person support.

Contacts PhillipCapital

PhillipCapital provides multiple contact options across its global offices. For general inquiries in the US, clients can call +1 312-356-9000 or email info@phillipcapital.com.

In Singapore, the main customer service hotline is +65 6531 1555, and emails can be directed to talktophillip@phillip.com.sg. In Malaysia, clients can reach out via phone at +603 2783 0300 or email cse.my@phillipcapital.com.my.

Research and Education

Score – 4.7/5

Research Tools PhillipCapital

PhillipCapital offers a comprehensive range of research tools across its platforms and websites to support informed trading and investment decisions.

- On the POEMS platform, users have access to integrated TradingView charting, advanced order types, and Reuters fundamental data, facilitating in-depth market analysis.

- MT5 integrates with third-party tools like Trading Central and Autochartist, offering real-time market analysis and signals.

- On the website, clients can find daily market reports, economic calendars, and technical and fundamental analysis insights.

Education

PhillipCapital offers a diverse range of educational resources, including investment seminars, webinars, and events that cover various topics such as market analysis, strategies, and financial planning.

Additionally, clients have access to market news updates and video tutorials that provide insights into platform usage and market trends. However, the availability of the educational offerings varies depending on the specific PhillipCapital entity and regional regulations.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options PhillipCapital

PhillipCapital offers a good range of investment options for retail, institutional, and high-net-worth clients.

Based on the entity, investors can access futures, stocks, options, equities, bonds, mutual funds, ETFs, unit trusts, and discretionary portfolio management services. The firm also provides managed accounts, robo-advisory solutions, and access to both domestic and international markets.

PhillipCapital’s broad investment offerings support long-term wealth accumulation, portfolio diversification, and financial strategies, although availability and features may vary by the regulatory environment.

Account Opening

Score – 4.5/5

How to Open PhillipCapital Demo Account?

A demo account with PhillipCapital is a great way for new traders to explore the broker’s platforms, test strategies, and get familiar with market conditions, without risking real money. The account is typically valid for 30 days, offering access to real-time data and the full functionality of the selected platform.

To open Demo Trading, follow these steps:

- Visit the Official Website of the regional PhillipCapital entity.

- Locate the Demo Account Section under the “Platforms” or “Open Account” tab.

- Fill in the registration form, including details such as your name, email, phone number, and country of residence.

- Select the platform you want to try.

- Submit the form and wait for a confirmation email with your login credentials.

- Log in to the platform using the provided credentials and start paper trading.

How to Open PhillipCapital Live Account?

Opening a live account with PhillipCapital is a simple process, though specific steps and requirements may vary depending on your region and the entity you choose.

Generally, the process involves selecting your preferred account type, completing an online application form with personal details, and uploading necessary identification documents for verification.

Once your application is reviewed and approved, you will receive instructions to fund your account, after which you can start trading. However, the availability of certain account types and services may differ based on local regulations and the specific PhillipCapital entity.

Additional Tools and Features

Score – 4.4/5

In addition to its main research offerings, the firm provides several tools and features that enhance the overall investment experience.

- These include margin calculators, stock screeners, and performance tracking dashboards.

- Traders can also benefit from real-time price alerts, watchlists, and market summaries that help monitor key market movements efficiently.

- Also, some entities offer access to IPO subscriptions, fund evaluations, and retirement planning resources.

The availability of these tools may differ depending on the specific PhillipCapital entity and region, so users are encouraged to explore their local branch’s offerings for the most accurate information.

PhillipCapital Compared to Other Brokers

When compared to competitors, PhillipCapital stands out for offering a robust range of platforms, which may appeal to professional and institutional traders.

The firm provides a wide selection of asset classes, although the variety and access can differ based on regional entities. While its futures commissions and fees are relatively competitive, its minimum deposit requirement is higher, which may be a consideration for beginners.

Additionally, PhillipCapital provides solid educational resources and professional assistance, though it may not match the 24/7 availability of some US-based brokers.

Overall, the broker offers a strong platform for serious traders, especially those interested in futures and multi-asset trading, but may not be the first choice for low-budget or retail-focused users.

| Parameter |

PhillipCapital |

TastyTrade |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

$0.25 |

$1.25 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Average/ Low |

Low |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT5, CQG, TT, CTS, Rithimic, POEMS |

tastytrade, TradingView |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Futures, Options, Stocks, Securities, Forex, CFDs, Indices, Metals, Bonds, Equities, ETFs, Commodities, Cryptocurrencies |

Stocks, Options, Futures, Crypto, Futures Options, ETFs |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs , Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

CFTC, NFA, FINRA, SIPC, MAS, SC Malaysia |

CFTC, NFA, FINRA, SIPC |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$5,000 |

$0 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker PhillipCapital

PhillipCapital is a well-established Stock firm offering a comprehensive range of trading and investment services across global markets.

With a presence in multiple jurisdictions, the firm is regulated by several reputable entities, enhancing its credibility and safety. The broker supports diverse account types suitable for individuals, corporations, and institutional clients, as well as providing access to advanced platforms like MT5, CQG, TT, and its proprietary POEMS platform.

Traders can engage in a range of investment products, including futures, options, Forex, equities, and more. PhillipCapital also delivers solid educational content and research tools, along with reliable customer support.

However, account requirements and platform access may differ depending on the entity, so investors should evaluate offerings based on their specific location and trading needs.

Share this article [addtoany url="https://55brokers.com/phillipcapital-uk-review/" title="PhillipCapital"]