- What is One Financial Markets?

- One Financial Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- One Financial Markets Compared to Other Brokers

- Full Review of Broker One Financial Markets

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is One Financial Markets?

One Financial Markets is a global online broker providing retail 24/5 trading facilities and investment in forex and CFDs on indices, commodities, energies, bonds, and futures. One Financial Markets brokerage firm was established in London in 2007 and is the trading name of Axi Financial Services (UK) Ltd.

In addition, the broker expanded its global presence by establishing affiliate offices located in the Middle East, Europe, and Central and Southeast Asia, with offices in Dubai, Kuwait, and Hong Kong, which are also respectively regulated by local regulators.

All in all, One Financial Markets is a global, award-winning, online broker providing 24/5 trading facilities to private and institutional investors in forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies.

One Financial Markets Pros and Cons

One Financial Markets is a reliable broker with easy digital account opening and a good range of deposit methods. There are various account types and instruments, as well as the One Trading Academy, with a good education. The broker also offers a demo account to practice trades before opening a live account. Trades are conducted on the popular MT4 and MT5 platforms, with web, desktop, and mobile versions available.

On the negative side, there is no 24/7 support, and the instrument range is limited to Forex and CFDs.

| Advantages | Disadvantages |

|---|

| Good Education | No 24/7 support |

| Wide Range of Instruments | |

| Regulated by multiple top-tier authorities | |

| Competitive trading conditions | |

| MT4 Platform | |

One Financial Markets Features

Based on our Expert findings, One Financial Markets is a reliable broker providing good conditions that might be some of the best for Forex and CFDs trading, also available on a global scale for international trading. One Financial Markets is suitable for various traders, including European, African, and Asian traders. Below, we have compiled a list of the main aspects of trading with One Financial Markets for a quick review:

One Financial Markets Features in 10 Points

| 🗺️ Regulation | FCA, DIFC, FSCA |

| 🗺️ Account Types | Standard and Professional Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | FX and CFD products including trading of commodities, indices, Cryptocurrencies, Shares, Energies, Shares, Bullion |

| 💳 Minimum deposit | $250 |

| 💰 Average EUR/USD Spread | 1.1 pip |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | Range of currencies including USD, GBP, EUR, etc. |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is One Financial Markets For?

One Financial Markets is a strictly regulated broker with a reliable trading environment and favorable services suitable for different traders and different trading needs and strategies. Below, you can see who and what One Financial Markets is especially good for:

- Beginners

- Education

- Traders who prefer MT4/MT5

- Currency and CFD Trading

- Social Trading

- Islamic Account

- Clients from the African region

- Trading Central Access

- Shares trading

One Financial Markets Summary

During its years of operation, One Financial Markets has gained a favorable reputation for its excellence and has become a popular, well-established broker in the Middle East and Asia. The broker is a reliable company with professional and tailored trading services. Those seeking good opportunities to start and properly establish an educational system from A to Z, One Financial Markets would be a good partner too.

In the event of assistance, the company’s customer support team stands ready to help, along with its advanced and competitive trading conditions suitable for traders of different sizes. Clients can access the two most popular platforms in the market, MT4 and MT5, and conduct their trades with comprehensive tools and capabilities.

55Brokers Professional Insights

One Financial Markets has operated for quite a while, and made a good reputation among traders community, also provides quality conditions suitable for larger size or high volume traders. The broker offers a single account which is suitable for different types of traders, while software to use are popular MetaTrader with 4 and 5 versions offering good flexibility. The trading costs we find average, yet integrating costs into commission account traders would get very good fee, at times better than most competitors offer, so is definitley a plus for high volume traders.

Important to note, that all the products are based on CFDs, so if you look for investments or real futures trading check others by the link. The broker also offers an adequate education and research section, providing clients with live trading seminars, a comprehensive learning program, a glossary, investment strategies, a society specifically tailored for women, and free access to Trading Central, which is a big benefit for trading beginners.

All in all, One Financial Markets is a dedicated service provider with competitive conditions, good standing, and tight regulations. The only stipulation about the broker is that it operates under multiple entities, and trading conditions can vary accordingly, especially in the UK branch, so be sure to chheck relevant conditions.

Consider Trading with One Financial Markets If:

| One Financial Markets is an excellent Broker for: | - Beginner traders

- Advanced traders

- MT4/MT5 platform enthusiasts

- CFD traders

- Traders looking for competitive pricings

- Those who are looking to try new strategies

- Clients from the African region

- Clients looking for top-tier regulations |

Avoid Trading with One Financial Markets If:

| One Financial Markets is not the best for: | - Investors looking for real stock ownership

- Traders looking for platforms other than MT4/MT5

- Clients prioritizing 24/7 customer support

- Client looking for copy trading opportunities |

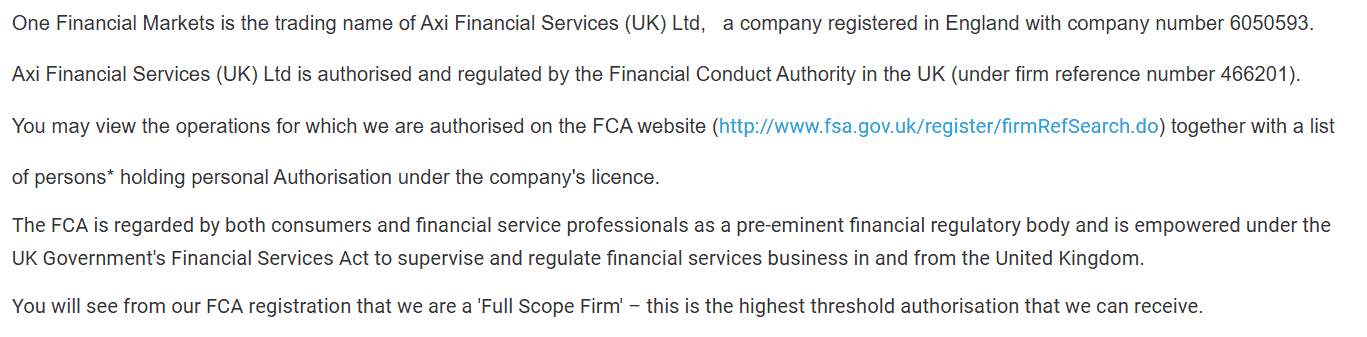

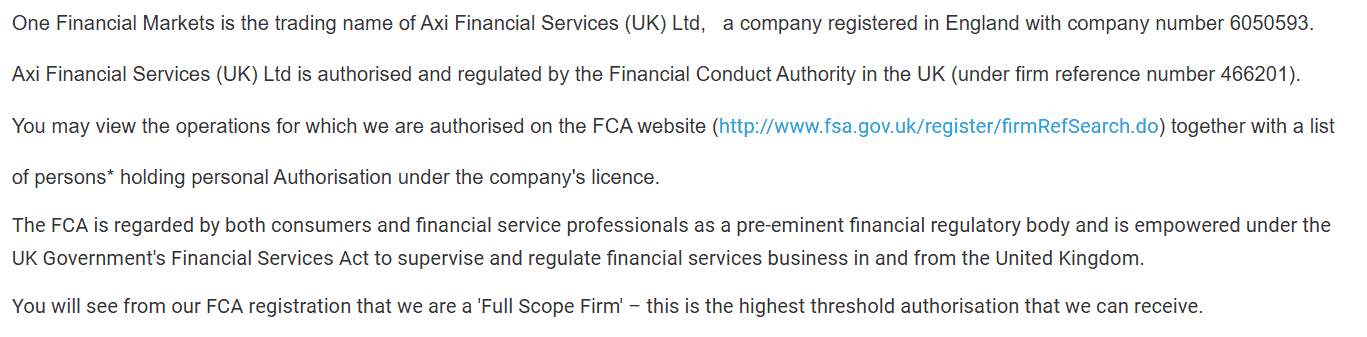

Regulation and Security Measures

Score – 4.5/5

One Financial Markets Regulatory Overview

One Financial Markets is regulated by top-tier authorities, including the FCA, FSCA, ASIC, and DFSA, with good customer protection. One Financial Markets is the trading name of Axi Financial Services (UK) Ltd, a company registered in the UK, established and operating with authorization and regulation by the FCA. This means that all operations of One Financial Markets are conducted according to the safety measures defined by the FCA.

- In addition, with its global presence, One Financial Markets (DIFC) Ltd is regulated by the Dubai Financial Services Authority. In Asia, the company has been approved as the introducing agent of One Financial Markets, authorized and regulated by the Hong Kong Securities and Futures Commission (with SFC CE No BFZ621).

How Safe is Trading with One Financial Markets?

Following strict regulatory oversight, the broker complies with multiple regulations and follows stringent client money rules, which provides confidence to their traders since all funds are kept in segregated accounts across a range of major banks.

- Besides, in the event the company becomes insolvent or ceases its operations, its clients will be entitled to compensation of up to £85,000.

- The broker’s compliance with the Money rules applied by the FCA is regularly monitored and controlled by the FCA, as well as audited annually by an independent statutory auditor.

Consistency and Clarity

Our research showed that One Financial Markets was founded in 2007 and since then, the broker has been offering consistent and transparent services, backed by strong regulatory rules and efficient conditions. Throughout its operation, One Financial Markets gained recognition and numerous awards for its efforts, along with great reviews from traders themselves.

Many users mention solid trading conditions, sufficient customer support, user-friendly platforms, and a safe trading environment. Among negative feedback or concerns, traders mention withdrawal complications and dissatisfaction with customer support. However, the majority of the broker’s clients express satisfaction with the broker.

Besides, the broker has enhanced its offerings over time, and the broker constantly introduces new instruments and better quality tools. At last, although regulatory oversight by multiple authorities ensures reliability, traders should remember that trading conditions can vary from one entity to the other.

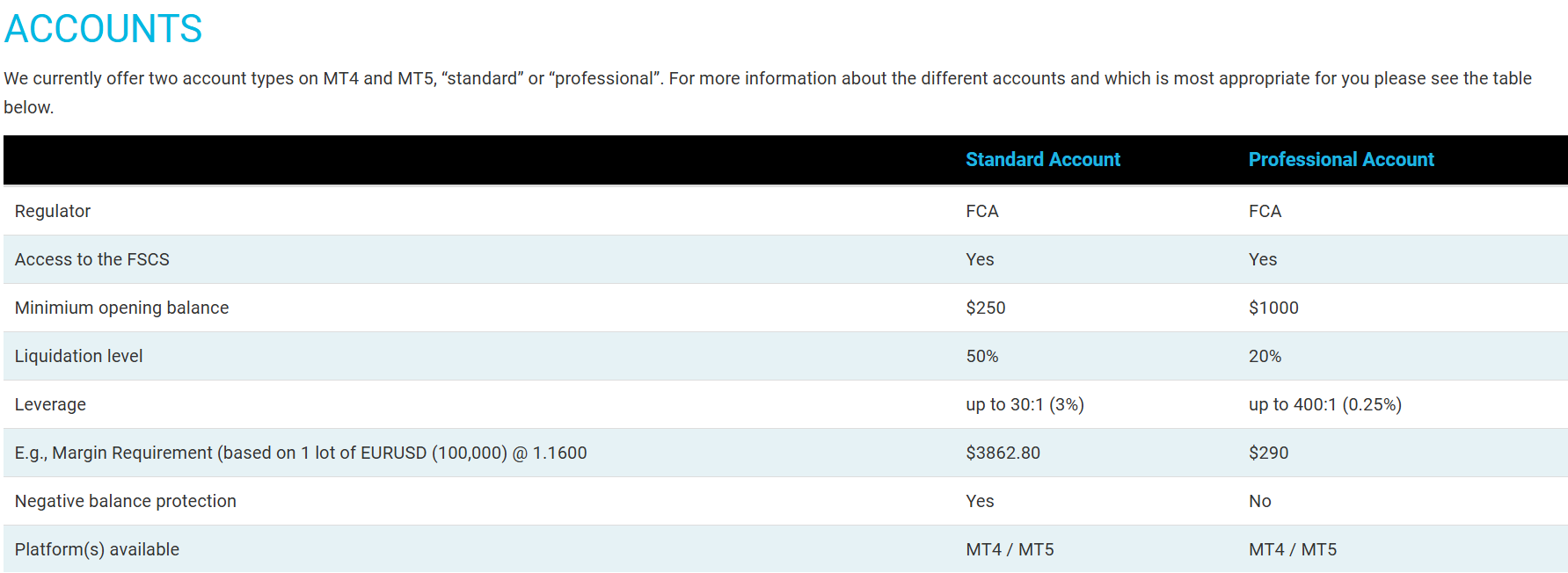

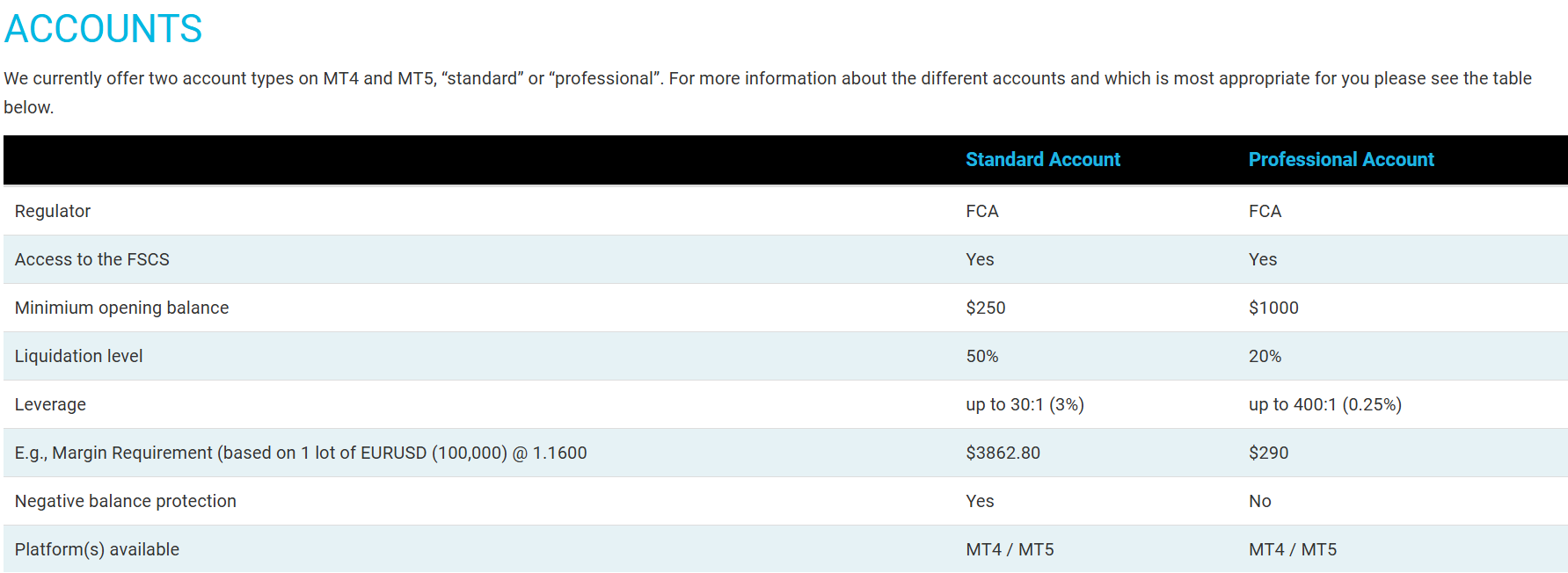

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with One Financial Markets?

The broker offers a Standard account with an initial deposit of just $250 while providing access to all ranges of FX and CFD products, including trading of commodities, indices, cryptocurrencies, shares, and more. More advanced clients can also open a professional account.

- For the Standard accounts, the leverage under the FCA entity is as high as 1:30. The account offers negative balance protection, access to the MT4/MT5 platforms, and a good range of instruments with competitive fees.

- The broker also offers Professional accounts, and the conditions can vary depending on the specific trading requirements of the client. By opening a professional account with One Financial Markets, traders will have access to leverage as high as 1:400. The initial deposit is higher for this account type, starting from $1,000.

Of course, since the broker operates in the Middle East region, traders may submit a swap-free account or an Islamic account compliant with Sharia rules.

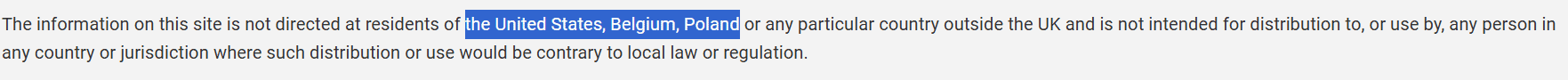

Regions Where One Financial Markets is Restricted

Although One Financial Markets is available in more than 100 countries, providing its services to different regions, there is still a list of restricted countries where the broker does not offer its services. Usually, the broker does not accept residents of countries based on jurisdiction and regulatory compliance.

One Financial Markets does not accept residents from the following countries:

- The USA

- Canada

- Japan

- North Korea

- Cuba

- Belgium

- Poland

- Iraq

Cost Structure and Fees

Score – 4.4/5

One Financial Markets Brokerage Fees

One Financial Markets offers competitive fees that are mostly in line with the market average. The broker’s pricing and fees are mainly built into spreads for its Standard account. The Professional account applies lower spreads combined with fixed commissions.

- One Financial Markets Spreads

Based on our research, the broker’s spreads depend on the account types. The Standard account offers average spreads that include all the costs; there are no additional fixed or non-fixed transaction fees for each trade. The average spreads for the popular EUR/USD currency pair are 1.1 pips. For the Gold, the broker offers an average of 70.003 pips spreads. All applicable spreads for each trading product can be found on the broker’s website, making the offering transparent and clear.

- One Financial Markets Commission

Commissions are applied only for the Professional accounts. The account offers lower spreads compared to the Standard account, paired with reasonable fixed commissions of $2 per side per lot. Professional traders are encouraged to contact the broker and check both spreads and commissions before starting trades.

How Competitive Are One Financial Markets’ Fees?

Our research revealed competitive and transparent prices for all the available tradable products. Spreads are average, and for the Standard account, spreads include all the charges. Commissions offered for the Professional account are small, $2 per side per trade, which is considered lower than most brokers offer.

What we find great about One Financial Markets’ fees is the transparency the broker offers. Clients can find the applicable spreads for each instrument on the website, which makes the proposal clear and predictable.

| Asset | One Financial Markets Spread | Axi Spread | ICM Capital Spread |

|---|

| EUR USD Spread | 1.1 pip | 1.2 pips | 1.3 pip |

| Crude Oil WTI Spread | 3.001 | 0.03 | 4 |

| Gold Spread | 70.003 | 0.16 | $0.35 |

One Financial Markets Additional Fees

As to additional charges associated with trading, One Financial Markets applies swaps for overnight positions. The swap amounts are reflected in the position closing balance. They can be either positive or negative.

- We have also found that the broker charges a $25 fee for dormant accounts that have been inactive for over 12 consecutive months.

- The broker does not mention deposit or withdrawal transaction costs, yet there might be third-party fees that shouldn’t be neglected.

Score – 4.4/5

Our experts found that the broker offers the well-known MT4 platform for desktop, web, and mobile versions. The platform ensures great functionality and availability of essential tools and features. The broker has recently included the MT5 platform in its offering, allowing clients access to more advanced trading capabilities.

| Platforms | One Financial Markets | FXTM Platforms | HFM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | No | No |

| Mobile App | Yes | Yes | Yes |

| cTrader | No | Yes | No |

One Financial Markets Web Platform

The broker offers the web version of its MT4 and MT5 platforms. This is a browser-based version, enabling traders easy access to their accounts without the need for downloads or installations. The web platform allows access from any device with an internet connection.

The platform includes all the essential tools and features of the desktop version, not limiting traders from advanced features. Clients can use a selection of technical analysis tools and charts and access the full account history. In short, the web platform combines flexibility and efficiency without restricting traders from using innovative and high-performance capabilities.

One Financial Markets Desktop MetaTrader 4 Platform

The MT4 platform is one of the most demanded platforms among traders. The One MT4 desktop platform allows extensive features and tools for a profitable and efficient trading experience. It offers most of the standard indicators, analytical objects, and trends. The MT4 platform includes about 30 technical indicators, 31 graphical objects, and 8 timeframes. The platform is especially suitable for traders concentrated on Forex pairs and CFD trading. It is also a favorable choice for beginner traders, as it has an easy-to-use interface and is easier to use than the more advanced MT5 platform. The MT4 platform is also a good start for those who will eventually switch to trading with the MT5 platform.

One Financial Markets Desktop MetaTrader 5 Platform

The MT5 platform of the broker enables users to trade all the available assets from one platform offered by One Financial. The MT5 platform is a more advanced option than the MT4, offering more advanced and innovative features and allowing the use of more comprehensive solutions.

It offers extra-fast execution, 38 built-in indicators, 44 graphical objects, 21 timeframes, an embedded Economic Calendar, and an MQL5 community chat. The MT5 platform is especially favorable for stock trading and exploring the market further. Its use might be slightly complicated at first, compared to the MT4 platform, yet it offers more functionality and better capabilities.

Main Insights from Testing

Based on our testing, One Financial Markets offers two of the most popular and demanded platforms, MT4 and MT5. The choice between the two platforms enables traders to choose between an easier MT4 option and a more complicated MT5 platform, which offers better functionality and more capabilities.

Yet, both platforms ensure seamless access to the market and the ability to conduct profitable trades. Besides, both offer desktop, web, and mobile versions, retaining all the essential features for all versions.

One Financial Markets MobileTrader App

The One Financial Markets knows how much traders appreciate functionality and flexibility, offering mobile versions of the MT4 and MT5 platforms. The mobile apps are easy to upload, offering quick and effortless access to the market from anywhere, right from the phone. The apps are available for Android and iOS devices, making them accessible to every trader. The mobile apps do not differ much from the desktop platform in terms of their functionality and capabilities. The apps offer one-click trading, trade monitoring, access to real-time charts, and full account management.

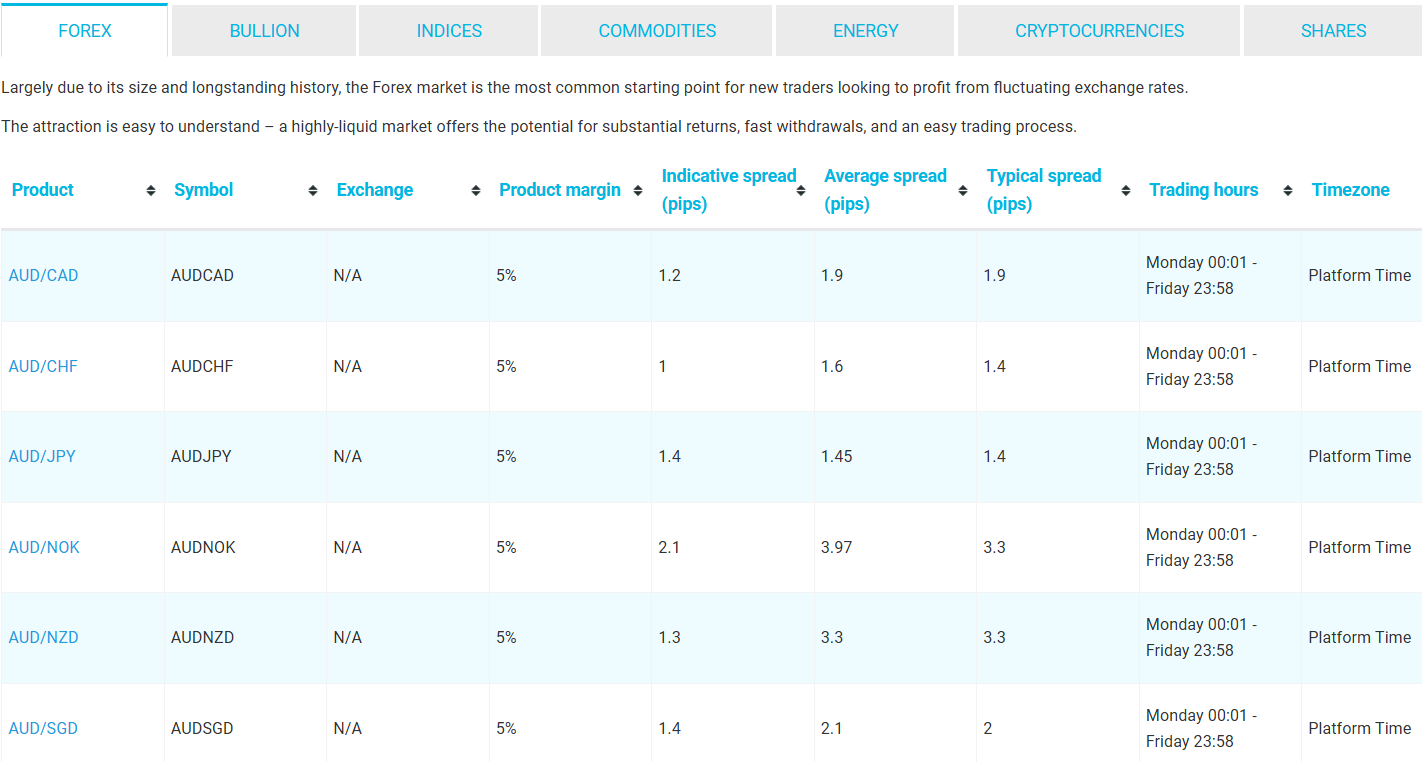

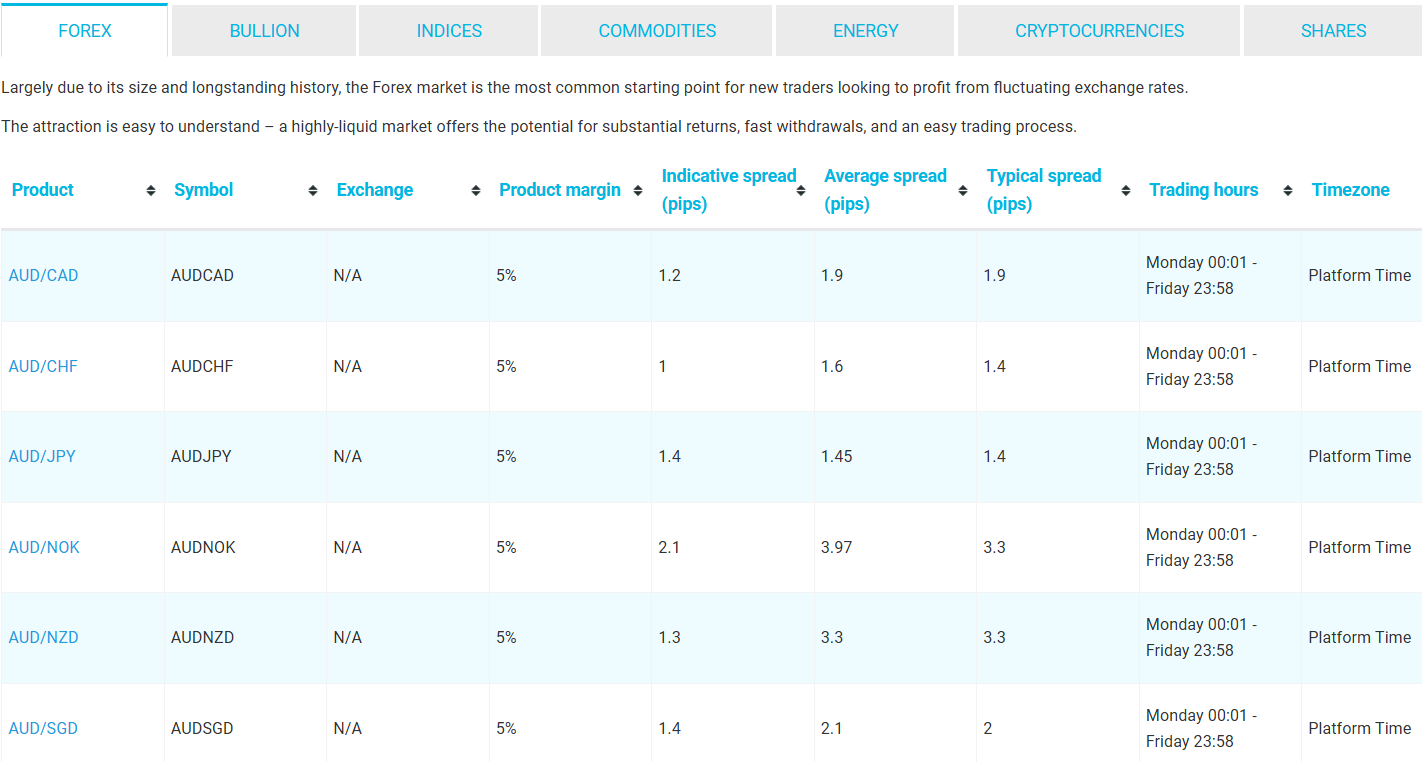

Trading Instruments

Score – 4.4/5

What Can You Trade on the One Financial Markets Platform?

One Financial Markets offers a wide range of instruments in Forex and CFDs. The range includes Forex, Bullion, Indices, Commodities, Energy, Cryptocurrencies, and Shares. The broker offers more than 60 major, minor, and exotic forex pairs. The broker also offers a good range of global indices and commodities such as gold, copper, coffee, cotton, cocoa, and more.

Traders can also access cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, Litecoin, Ripple, Solana, and more.

- The broker’s available products are based on CFDs, making the proposal suitable for shorter-term investments.

Main Insights from Exploring One Financial Markets Tradable Assets

One Financial Markets offers over 500 tradable products across a wide range of instruments. Traders can access an impressive range of currency pairs and US, UK, and EU shares from such well-known companies as Amazon, Alibaba, Apple, American Airlines, and more. Besides, the availability of a selection of cryptocurrencies allows traders better exposure to the market.

In addition, we found that all the available instruments have competitive fees and conditions, making trading accessible for cost-conscious traders. However, as the proposal is based on CFDs, clients cannot engage in long-term trading and own real stocks and shares.

- At last, One Financial Markets operates through several entities, and the availability of instruments can differ based on the jurisdiction.

Leverage Options at One Financial Markets

Leverage is an essential tool that enables traders to trade with limited capital and gain profits. However, its wrong use can lead to losses. This is why traders should understand how leverage works and use it with caution. Leverage ratios depend on the regulation, as some jurisdictions put limitations on the leverage usage to protect traders.

- European resident traders are allowed to use a maximum leverage of 1:30.

- While other entities offer a significant increase up to 1:200 or even up to 1:400 on Forex instruments.

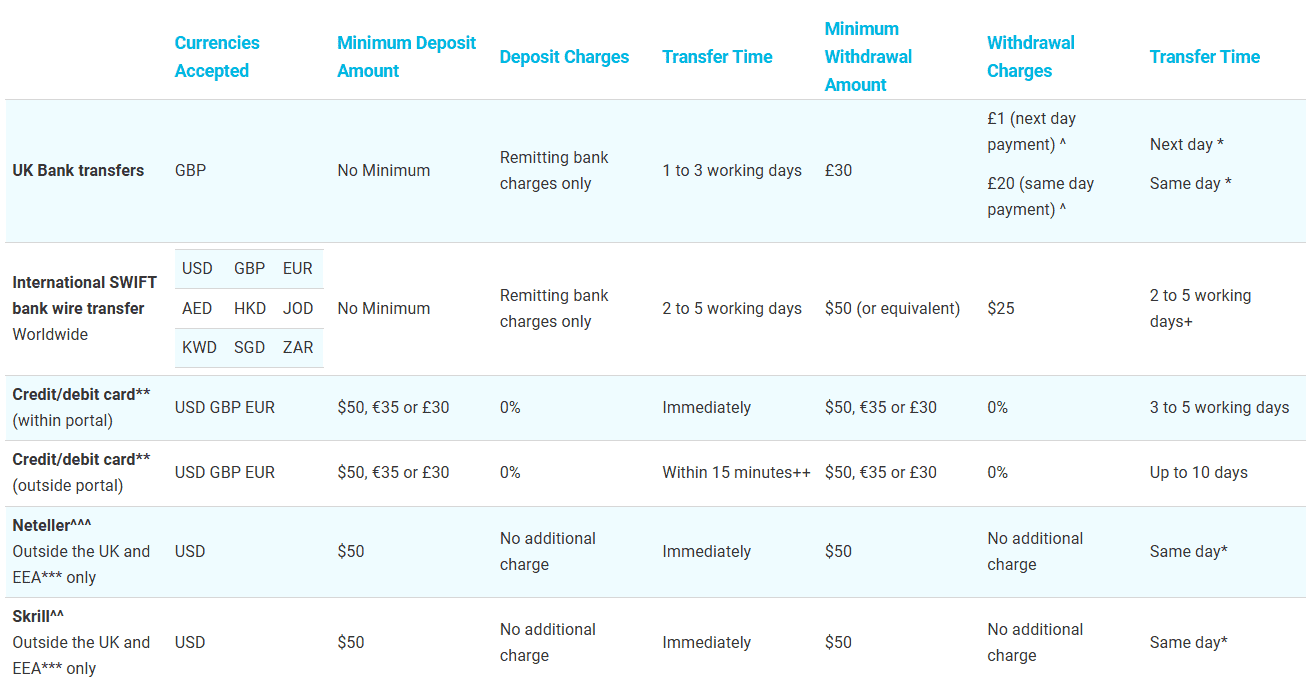

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at One Financial Markets

One Financial Markets offers a variety of payment methods. Once the account is open, traders can log in to their client portal and view all payment options to make a deposit. What is more, after making a deposit, funds are added to the landing account, from which traders can transfer funds to the particular account.

A landing account is a comfortable addition, allowing traders to use it as a wallet, independent from the account. This way, clients have more flexibility to control the funds when trading on multiple accounts.

The broker offers the following deposit methods:

- Credit/debit cards

- UK Bank transfers

- SWIFT bank wire transfer

- Wire transfers

- Neteller

- Skrill

Minimum Deposit

One Financial Markets’ minimum deposit amount is $250. However, the deposit amount depends on the funding method; bank wire transfers require no minimum deposit, and for credit card or e-wallet deposits, the minimum amount is $50.

Withdrawal Options at One Financial Markets

One Financial Markets offers popular transfer options and card payments for withdrawals. However, some payment methods are subject to transaction fees. For deposits or withdrawals via credit/debit card, there are no fees. However, international SWIFT applies a $25 processing fee.

- The broker requires that all withdrawals be paid to the source of deposits.

- Withdrawals are generally processed on the same day; however, it depends on the payment method when the amount will reach the client’s account.

Customer Support and Responsiveness

Score – 4.6/5

Testing One Financial Markets Customer Support

One Financial Markets offers dedicated customer support through multiple channels, enabling traders to choose the most efficient options for them. Traders can find assistance via Live Chat, WhatsApp messaging, email, and an online inquiry form right from the broker’s ‘Contact us’ section.

- The FAQ section that the broker offers is also helpful, including answers to the most common trading-related questions.

Contacts Online Financial Markets

Based on our research and testing, One Financial Markets offers quality customer support, offering the following options for contact:

- The live chat is one of the efficient options to find solutions and answers, enabling traders to solve the issues they face most quickly and effectively.

- The WhatsApp chat is another productive way to communicate with the broker’s team and direct their questions and concerns. The broker has the following WhatsApp contacts: +61448088246

- The broker also offers an email, as many clients find it the most convenient way of communicating their trading problems. Traders can use the following email address: info@ofmarkets.com.

- The online inquiry form is another helpful option to fill out the form right from the broker’s website and send questions, suggestions, or concerns.

- The broker also offers fax details for those who find this option convenient: +44 (0) 203 857 2001

- At last, the broker is active on social platforms, offering market updates, company news, and helpful advice via Facebook, X, and YouTube.

Research and Education

Score – 4.5/5

Research Tools One Financial Markets

One Financial Markets offers extensive research tools right from the available platforms, MT4 and MT5. Although the platforms already include intensive capabilities for in-depth research and analysis, traders can also access additional features offered on the broker’s website.

- The broker offers access to Trading Central, which is one of the most effective ways to have free access to one of the world’s leading research centers. Trading Central will help traders find new opportunities, learn to manage risks, and access essential economic data in multiple languages.

- The Market News section offers traders updated news on market developments, keeping traders informed about the changes and market movements.

Education

One Financial Markets ensures its clients gain confidence and knowledge of trading, offering them the One Trading Academy. The broker provides its clients with a glossary, investment strategies, and live seminars.

- Moreover, there is a unique Yasmeen Society, a forum exclusively established for women that supports female empowerment in the financial investment world and for women in the Arabic world. The forum offers structured training and education on commerce and allows women to share their experiences in the business.

Is One Financial Markets a Good Broker for Beginners?

One Financial Markets can be a favorable choice for traders seeking competitive conditions, easy-to-use platforms equipped with advanced tools, and a diverse range of financial products. Professional traders can try new strategies with the broker and explore new opportunities; however, it is equally beneficial for beginner traders. The initial deposit is $250, which is lower than most brokers offer and can attract even cost-conscious traders. Besides, traders can first open a demo account and practice before opening a live account and investing real money. In addition, One Financial Markets’ Trading Academy includes essential resources for beginner traders to acquire knowledge and skills at the beginning of their trading journey.

Portfolio and Investment Opportunities

Score – 4.1 /5

Investment Options One Financial Markets

One Financial Markets offers a selection of over 500 tradable products across a range of financial assets. This number of instruments will ensure the diversity of trades and enable clients to expand their portfolios. Still, the offering is mainly based on CFDs, which limits the opportunities for long-term investors.

- One Financial Markets does not offer alternative options of investment options, nor does it offer MaM or PAMM accounts.

- However, the broker introduces a separate platform for copy trading, offering a separate copy trading app where professional signal providers are connected with traders. Traders can choose the successful trades of professionals, copy them, and profit.

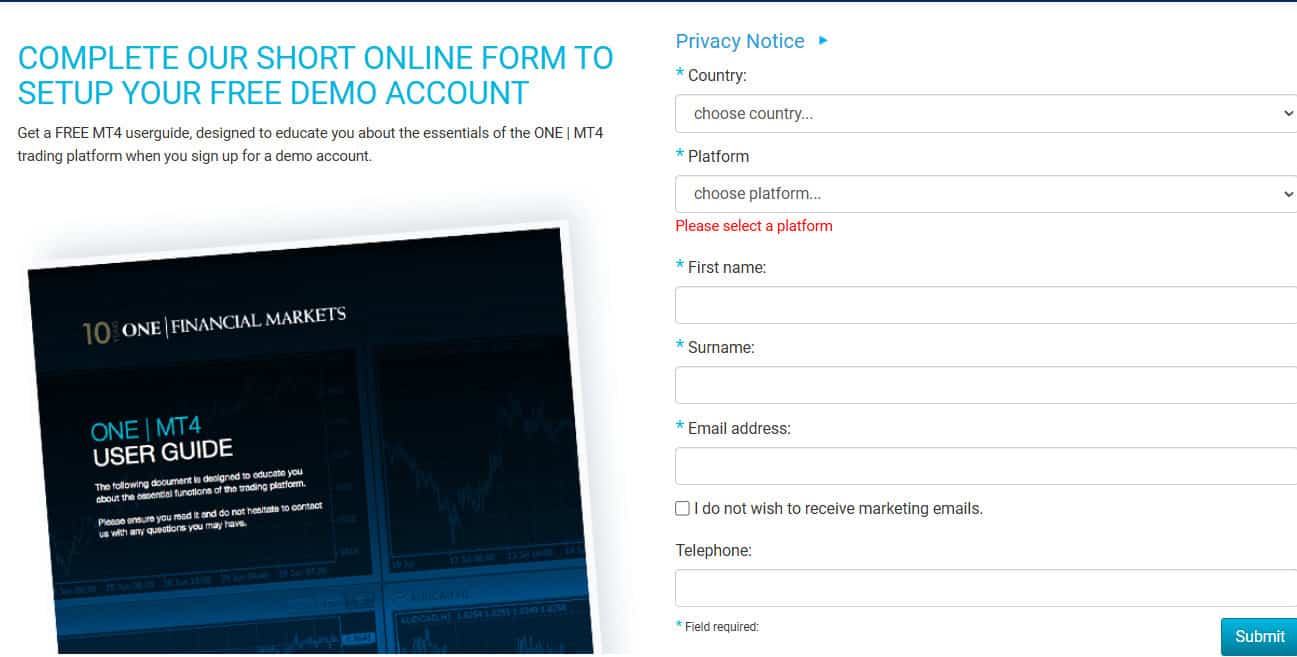

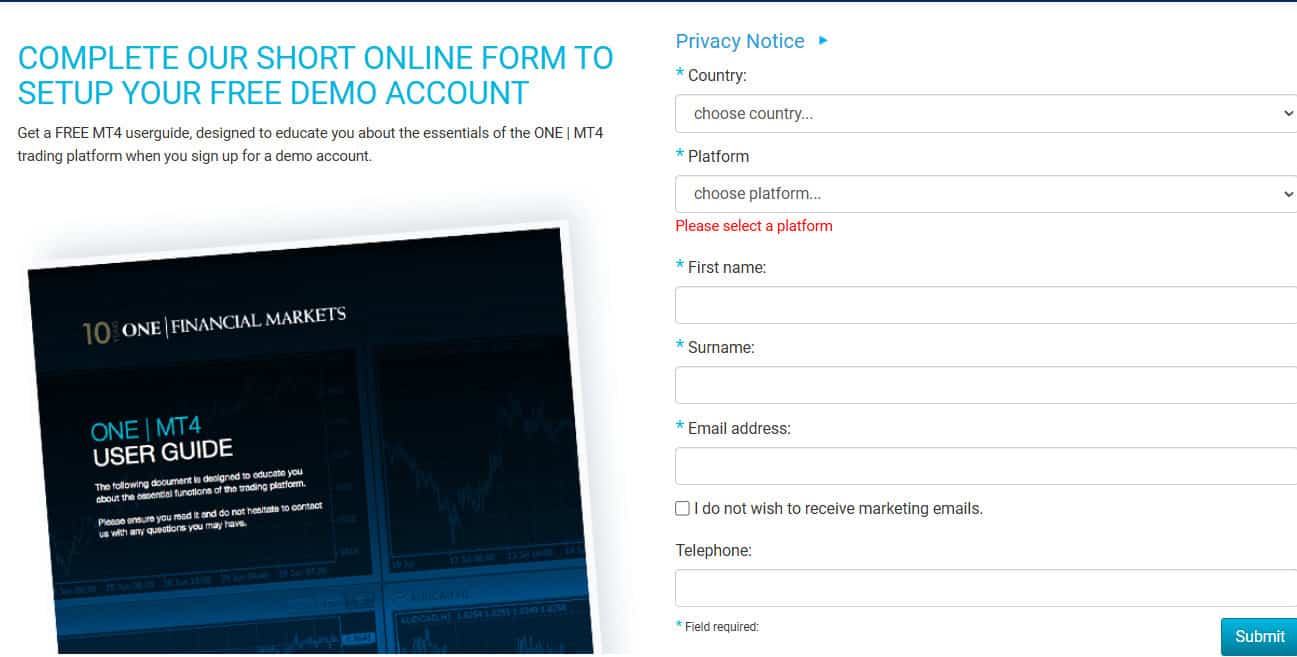

Account Opening

Score – 4.5/5

How to Open a One Financial Markets Demo Account?

The One Financial Markets’ Demo account gives traders a beneficial opportunity to trade with $10.000 in virtual funds, develop new strategies, and practice trading before switching to the live account.

To open a demo account, traders should follow the following simple steps:

- Go to the broker’s website.

- At the top of the page, choose the ‘Demo account’ option.

- Complete the short form by providing the country of residence, name, surname, email address, and phone number.

- Also, choose the platform you want to practice with.

- Submit the form and receive a confirmation email with the account credentials.

- Download the platform and log in using the account details provided in the email.

- Start practicing.

How to Open a One Financial Markets Live Account?

Opening a Live account with One Financial Markets is a quick and straightforward process. There are a few consecutive steps to follow to open an account and access the market in a reliable and favorable setting:

- Go to the broker’s live account opening page.

- Fill out the registration form by providing your name, surname, country of residence, and email address.

- Select the account type and platform.

- Submit the required documents, including a valid ID, bank statement, etc.

- Wait for the approval (the process is completed within a day).

- After the approval, receive the account credentials via email.

- Log in to your account by using the provided account details.

- Deposit funds and start trading.

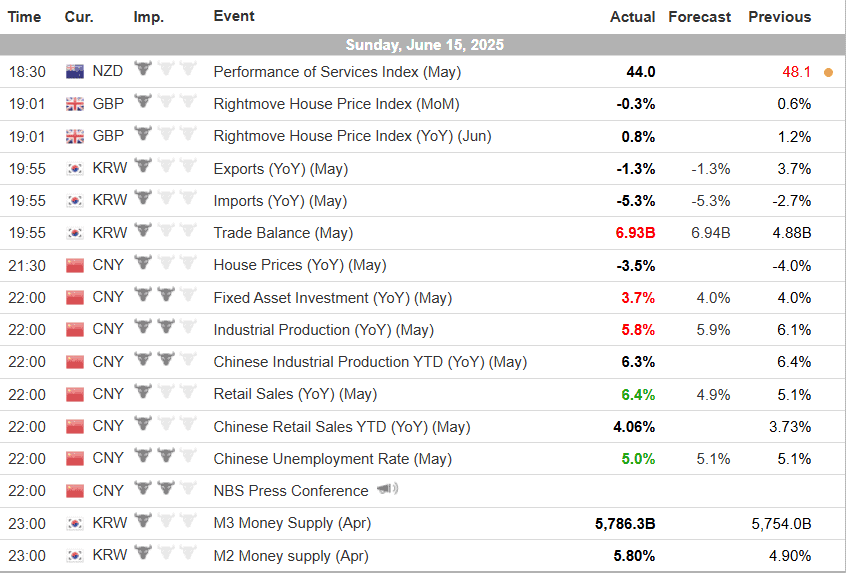

Score – 4.2/5

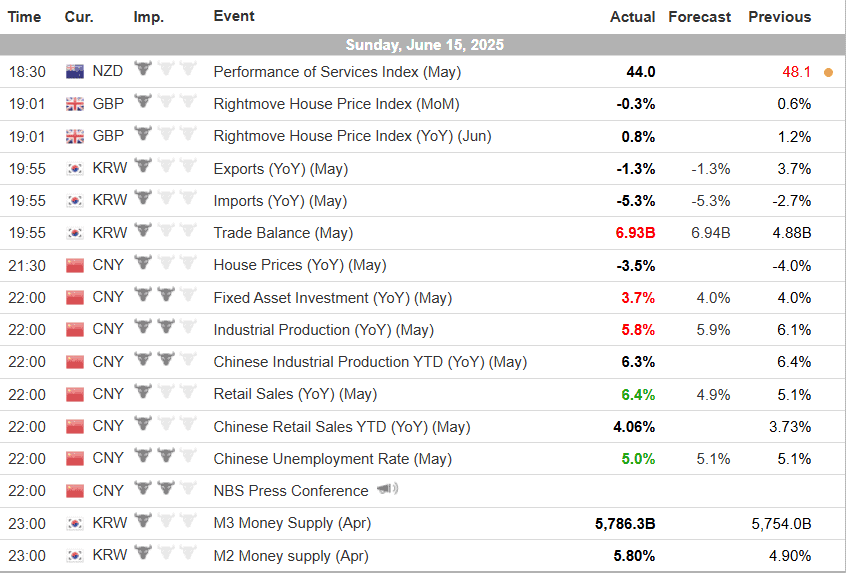

One Financial Markets’ platforms are equipped with extensive research tools, allowing traders to conduct trades based on in-depth analysis. The broker also offers tools and features on its website to further enhance clients’ trading experience. Clients have access to Trading Central, Trading Academy, market news, indicators, and many more, already discussed in this review’s research and education sections. As an additional tool, we will mention the Economic Calendar.

- The Economic Calendar provides traders with valuable information and insights about the upcoming market changes and major economic events, substantial enough to affect the market. By using the Economic Calendar, clients will always be one step further and planning their trades based on informed decisions.

One Financial Markets Compared to Other Brokers

At last, as a final step, we have compared One Financial Markets to other brokers with similar services.

From the regulatory point of view, One Financial Markets is a trustworthy option, protecting its clients by the strict rules of the FCA, DIFC, and FSCA. Compared to RoboForex with its FSC license, One Financial Markets has far more stringent rules and protection measures.

We have also compared the instrument availability to see how it can expand the portfolios of the One Financial Markets clients. With over 500 tradable products available, this is certainly a more extensive offering than the modest 64+ instruments traders can access with TriumphFX. However, in this respect, RoboForex stands out for its 12,000 tradable products, which allows for better diversity.

One Financial Markets ensures trading through the popular MT4 and the more advanced MT5 platforms. This offering is similar to the one Exness offers, with the availability of the two most popular retail platforms.

The One Financial Markets’ education section includes extensive resources, providing both beginner and advanced clients with helpful materials. The research section is also impressive. The same extensive educational offering traders can find with Blueberry Markets and ThinkMarkets. On the contrary, traders will not find comprehensive trading resources with Exness.

| Parameter |

One Financial Markets |

TriumphFX |

RoboForex |

Exness |

XM |

Blueberry Markets |

ThinkMarkets |

| Spread-Based Account |

From 1.1 pips |

Average 0.6 pip |

Average 1.3 pip |

From 0.2 pips |

Average 1.6 pips |

From 1 pip |

From 0.4 pips |

| Commission-Based Account |

0.0 pips + $2 |

Not available |

0.0 pips + $4 |

0.0 pips + $3.5 |

Only on the Shares Account |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low |

Average |

Low |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4 |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, XM WebTrader |

MT4, MT5, Web Trader |

MT4, MT5, ThinkTrader , TradingView |

| Asset Variety |

500+ instruments |

64+ instruments |

12,000+ instruments |

200+ instruments |

1,000+ Instruments |

300+ instruments |

4000+ instruments |

| Regulation |

FCA, DIFC, FSCA |

CySEC, FSC, FSA |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSC, DFSA |

ASIC, VFSC |

FCA, ASIC, FSCA, FSA, CySEC, JFSA, CIMA, FSC, DFSA, FMA |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Excellent |

Good |

Good |

Fair |

Excellent |

Excellent |

Excellent |

| Minimum Deposit |

$250 |

$100 |

$10 |

$10 |

$5 |

$100 |

$50 |

Full Review of Broker One Financial Market

To sum up our research, One Financial Markets is a well-regulated and reliable option for various clients. Since its operation in 2007, the broker has provided favorable and consistent services. With its Standard and Professional accounts, it caters to the needs of novice and professional traders. The minimum deposit requirement is not high, starting at $250, and for some funding methods, even lower, enabling even cost-conscious clients to invest easily.

Traders can access over 500 instruments across FX and CFD products, including commodities, indices, cryptocurrencies, shares, energies, shares, and bullion, ensuring diversity and opportunities for exposure to the market. However, the broker does not offer real stocks, limiting investment opportunities for traditional traders. Trades are conducted via the MT4/MT5 platforms, equipped with great tools and features for efficient trading. The broker also enables EAs and copy trading through a separate copy trading platform.

Traders can practice by opening a demo account or benefit from the broker’s Trading Academy. For in-depth analysis, traders can access Trading Central, one of the best portals for deep research. The broker’s 24/5 customer support offers assistance through live chat, WhatsApp, email, fax, and an online inquiry form.

All in all, One Financial Markets can become the right broker choice for traders globally and ensure easy access to the market.

Share this article [addtoany url="https://55brokers.com/one-financial-markets-review/" title="One Financial Markets"]

Experience with OFM was awful, they are pure scammers.

In April when Oil markets crashed, they stopped taking orders and put the USOIL in to close only and they started charging swap on the account while opening the account they promised a swap-free account. Even after one month, they are not allowing the clients to open a new position and today also their USOIL price is under $12 per Barrel when all over the world the Crude oil price is above $33 per Barrel.