- What is OCBC Securities?

- OCBC Securities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- OCBC Securities Compared to Other Brokers

- Full Review of Broker OCBC Securities

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is OCBC Securities?

OCBC Securities, a subsidiary of OCBC Bank, is a Singapore-based Forex and Stock broker. The firm provides services for individuals and institutional clients to buy and sell Securities, Bonds, ETFs, leveraged Futures, Forex, Precious Metals, Stocks, and more on various financial markets.

Based on our research, the firm is regulated and authorized by the Monetary Authority of Singapore (MAS). Additionally, the broker is a member of the Singapore Exchange Securities Trading Limited (SGX-ST) and the Singapore Exchange Derivatives Trading Limited (SGX-DT).

In general, the firm provides favorable conditions, a variety of products, and research tools to assist clients in managing their investment portfolios and trade execution.

Is OCBC Securities Stock Broker?

Yes, OCBC Securities provides Stock Trading for individual and institutional investors. The firm is dedicated to offering a competitive environment and provides a suite of tools to help clients effectively manage their Forex and Stock portfolios.

OCBC Securities Pros and Cons

The broker comes with its set of advantages and drawbacks that are important to consider. The firm offers competitive trading solutions, including favorable fees and access to various financial markets. Additionally, OCBC Securities provides comprehensive learning materials and research tools, enabling clients to make informed investment decisions. The association with OCBC Bank lends credibility and financial stability to the brokerage.

For the cons, there is no 24/7 customer support available. Additionally, the broker lacks a top-tier license and operates under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities. Also, certain services may come with specific fees or limitations, so investors should be mindful of these to avoid unexpected costs.

| Advantages | Disadvantages |

|---|

| MAS license and oversee | No 24/7 customer support |

| Competitive trading conditions | High minimum deposit requirement |

| Trading products | No top-tier license |

| Good education and research | |

| STP/DMA Execution | |

| Professional trading | |

| Singapore investors | |

OCBC Securities Features

OCBC Securities is known for its reliable investment services and extensive range of trading products. Key highlights of its features include:

OCBC Securities Features in 10 Points

| 🏢 Regulation | MAS |

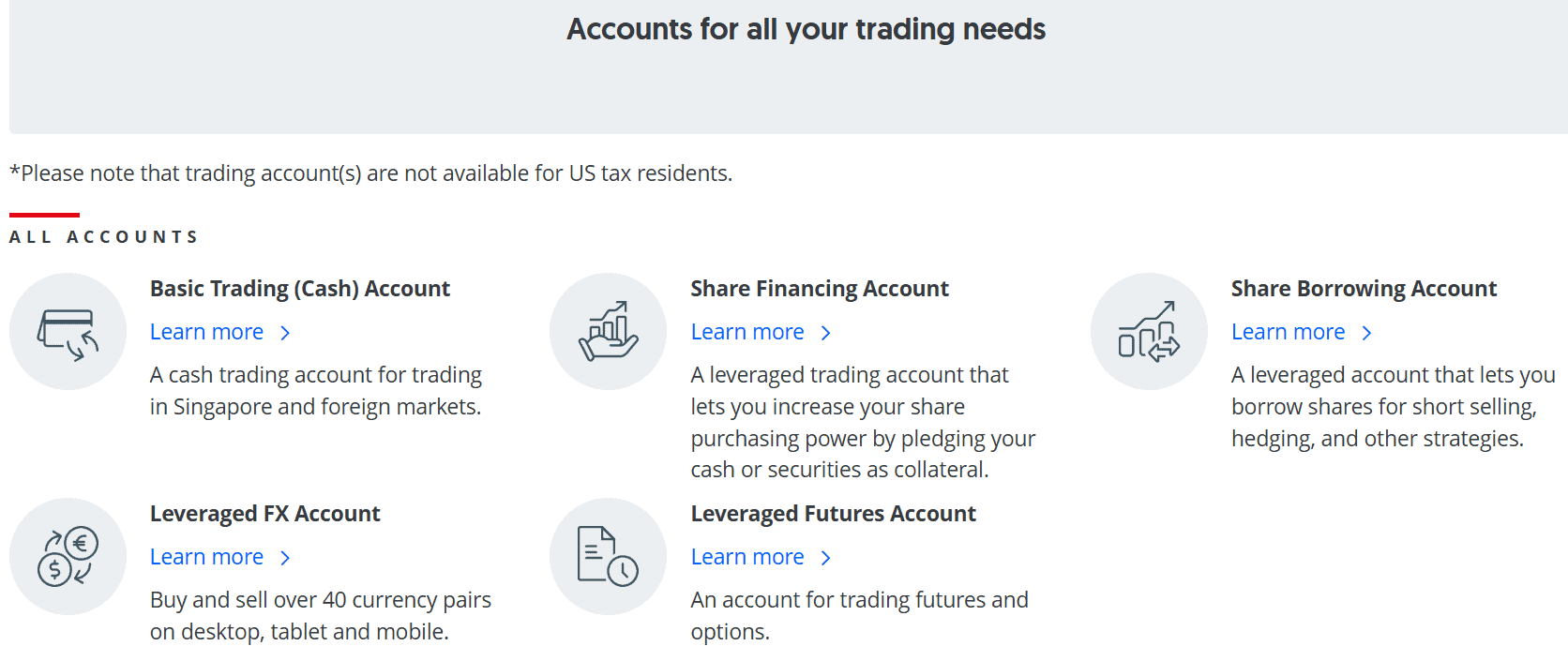

| 🗺️ Account Types | Basic Trading, Leveraged Forex, Share Borrowing, Leveraged Futures, Share Financing Accounts |

| 🖥 Trading Platforms | iOCBC Proprietary Trading Platforms |

| 📉 Trading Instruments | Securities, Bonds, ETFs, leveraged Futures, Forex, Precious Metals, Stocks, Indices, Commodities, Options, Shares |

| 💳 Minimum Deposit | S$1,000 |

| 💰 Average Stock Commission | From $15 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | SGD, HKD, USD, AUD |

| 📚 Trading Education | Seminars, Events, News Updates, Insights |

| ☎ Customer Support | 24/5 |

Who is OCBC Securities For?

OCBC Securities is made for investors seeking a reliable and versatile brokerage platform. It caters to both individual and institutional traders who want access to a wide range of global markets. Based on our findings, OCBC Securities is Good for:

- Traders from Singapore

- Stocks trading

- Currency trading

- Professional trading

- Investing

- Beginners

- Advanced traders

- STP/DMA execution

- Competitive spreads

- Good education and tools

OCBC Securities Summary

In conclusion, OCBC Securities is a reliable Singapore-based investment firm. With competitive conditions, robust educational resources, and a range of tools, it caters to the needs of both individual and institutional investors.

While the specifics of fees, minimum deposits, and other factors should be considered individually, the broker stands out as a comprehensive option for those seeking a well-rounded and informed trading experience.

55Brokers Professional Insights

OCBC Securities stands out as a robust and reputable brokerage good for Stoc traders, investros especially from Asia region and Singapore. Due to its comprehensive suite of trading services and global market access we highly regard company , along with its services provided. As part of the OCBC Group, one of Southeast Asia’s largest financial institutions, it combines the stability and credibility of a major bank with the flexibility and innovation of a modern platform. Traders benefit from multi-asset offerings, including equities, ETFs, futures, and leveraged forex, supported by advanced trading platforms.

The broker also provides competitive commissions, margin facilities, and share financing options, suitable for both retail and professional investors. Beyond execution, OCBC Securities emphasizes research, insights, and educational resources, helping traders make informed decisions.

Its standout features include global market access across 15 exchanges, seamless integration with banking services, and dedicated customer support, positioning it as a trusted choice for investors seeking reliability, versatility, and professional-grade tools.

Consider Trading with OCBC Securities If:

| OCBC Securities is an excellent Broker for: | - Looking for Reputable Firm.

- Investors seeking share financing or margin trading.

- Retail investors and active traders.

- Need a well-regulated broker.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Competitive trading conditions.

- Investors from Singapore and the Asia-Pacific region.

- Futures traders.

- Investors who prefer robust learning resources. |

Avoid Trading with OCBC Securities If:

| OCBC Securities might not be the best for: | - Investors outside Singapore.

- Looking for broker with 24/7 customer support.

- Beginners who want fully simplified platforms.

- Cryptocurrency traders. |

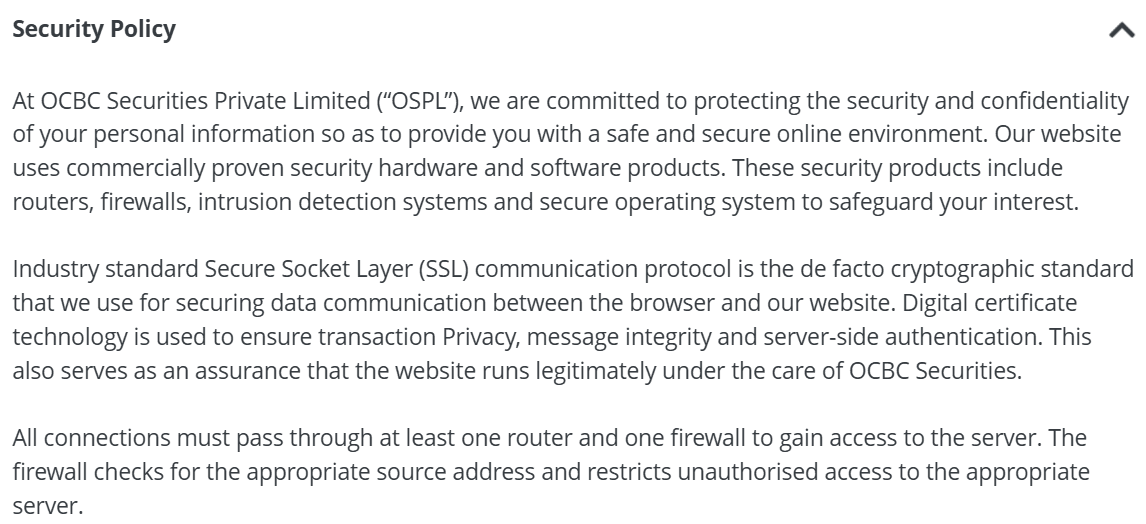

Regulation and Security Measures

Score – 4.5/5

OCBC Securities Regulatory Overview

OCBC Securities is a reliable Stock broker that follows the guidelines established by MAS. This regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry.

How Safe is Trading with OCBC Securities?

OCBC Securities is a legitimate firm for traders looking to invest and manage their assets. It is regulated by a respected Singapore authority and has a good reputation and integrity in the financial industry.

The firm implements diverse measures to safeguard its trading accounts. These typically include regulatory oversight and ensuring compliance with applicable rules and regulations. The company also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds.

However, we suggest conducting thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

Consistency and Clarity

OCBC Securities is a well-established brokerage with a strong reputation in Singapore and the Asia-Pacific region. It has earned accolades such as Euromoney’s Best Securities House for its innovation and service quality.

Traders highlight its reliable platforms, broad market access, and competitive fees, though some note that minimum commissions can make small trades relatively costly.

Beyond trading, OCBC Securities actively engages in community and ESG initiatives, including sponsorships and awards programs, reflecting its commitment to both professional excellence and social responsibility.

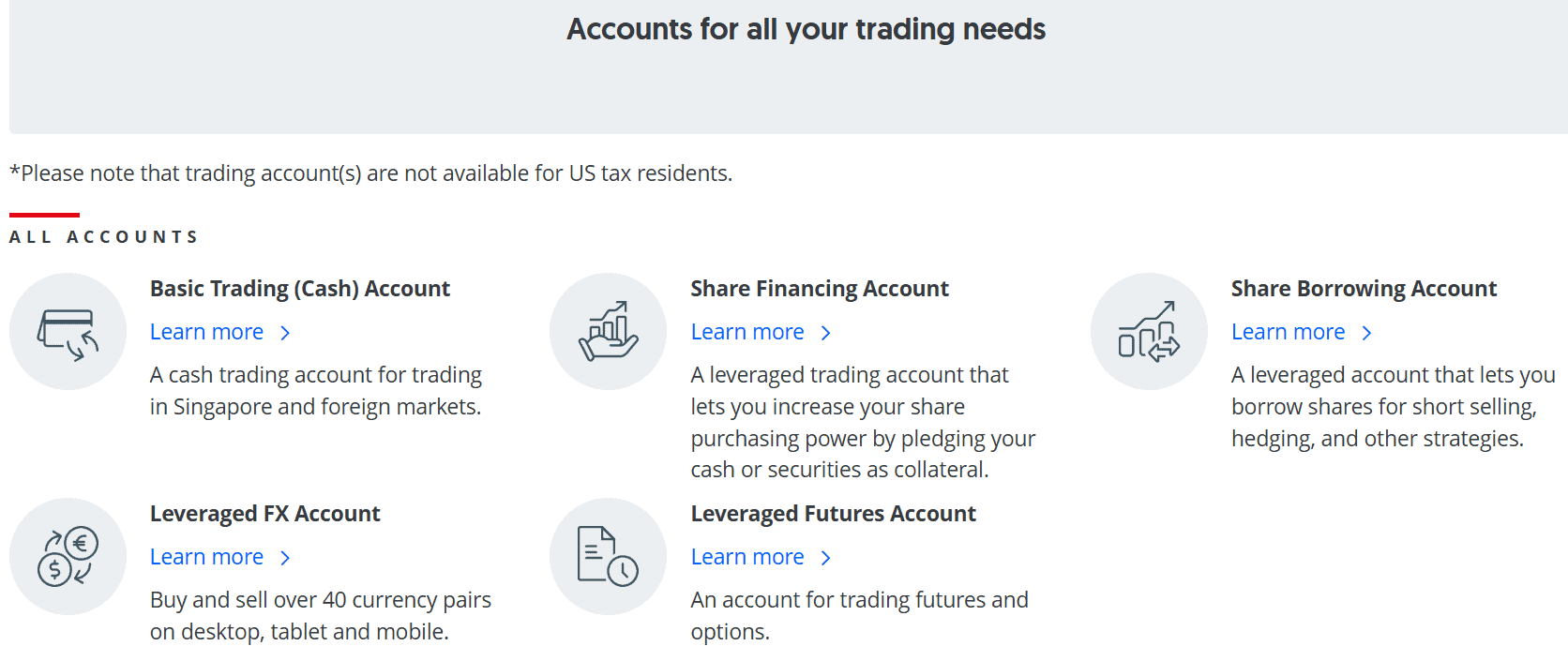

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with OCBC Securities?

OCBC Securities provides a range of accounts designed to meet the diverse needs of investors. These include Basic Trading, Leveraged Forex, Share Borrowing, Leveraged Futures, and Share Financing accounts.

In addition, a Demo account is available, allowing users to practice strategies risk-free and familiarize themselves with the platform.

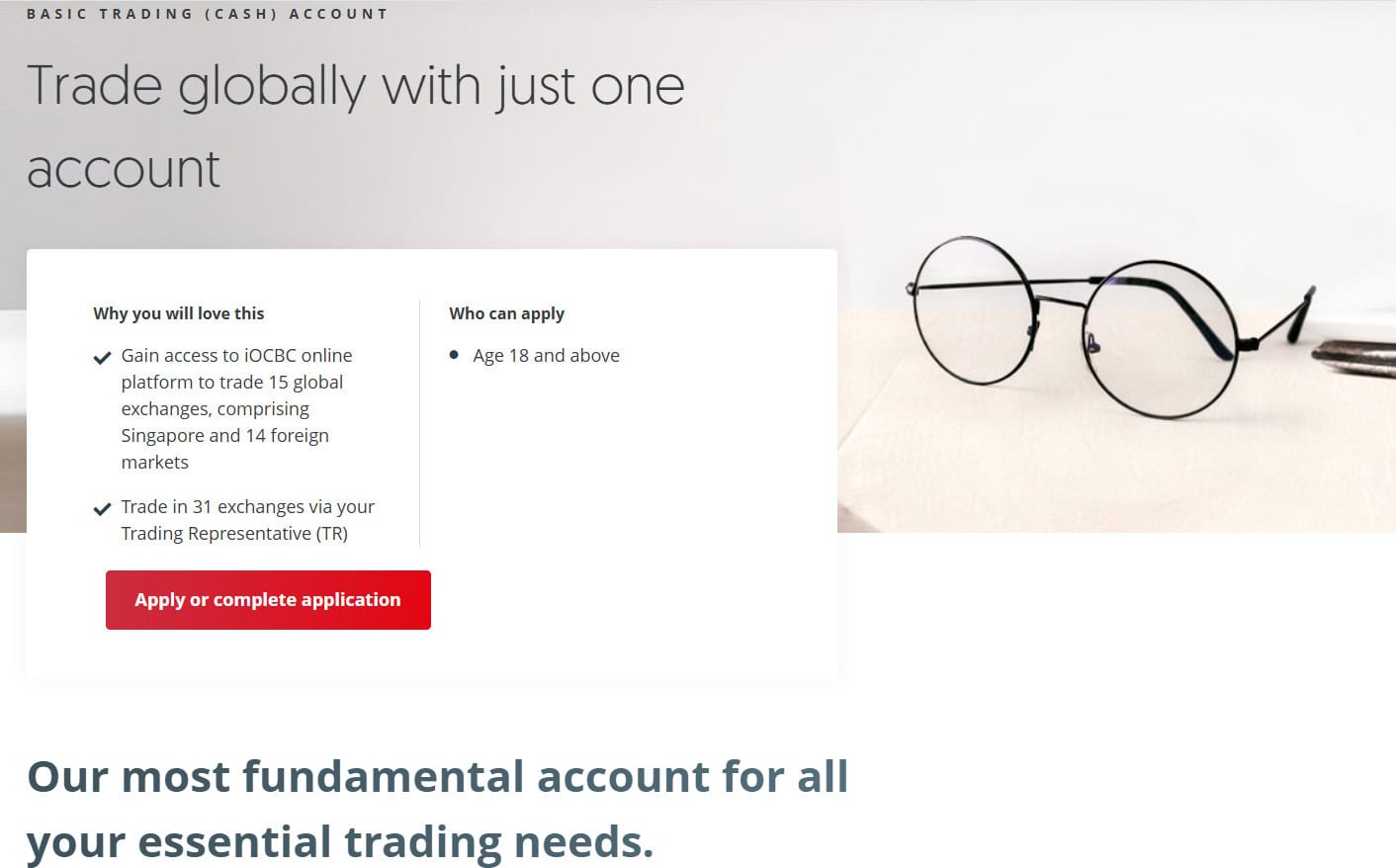

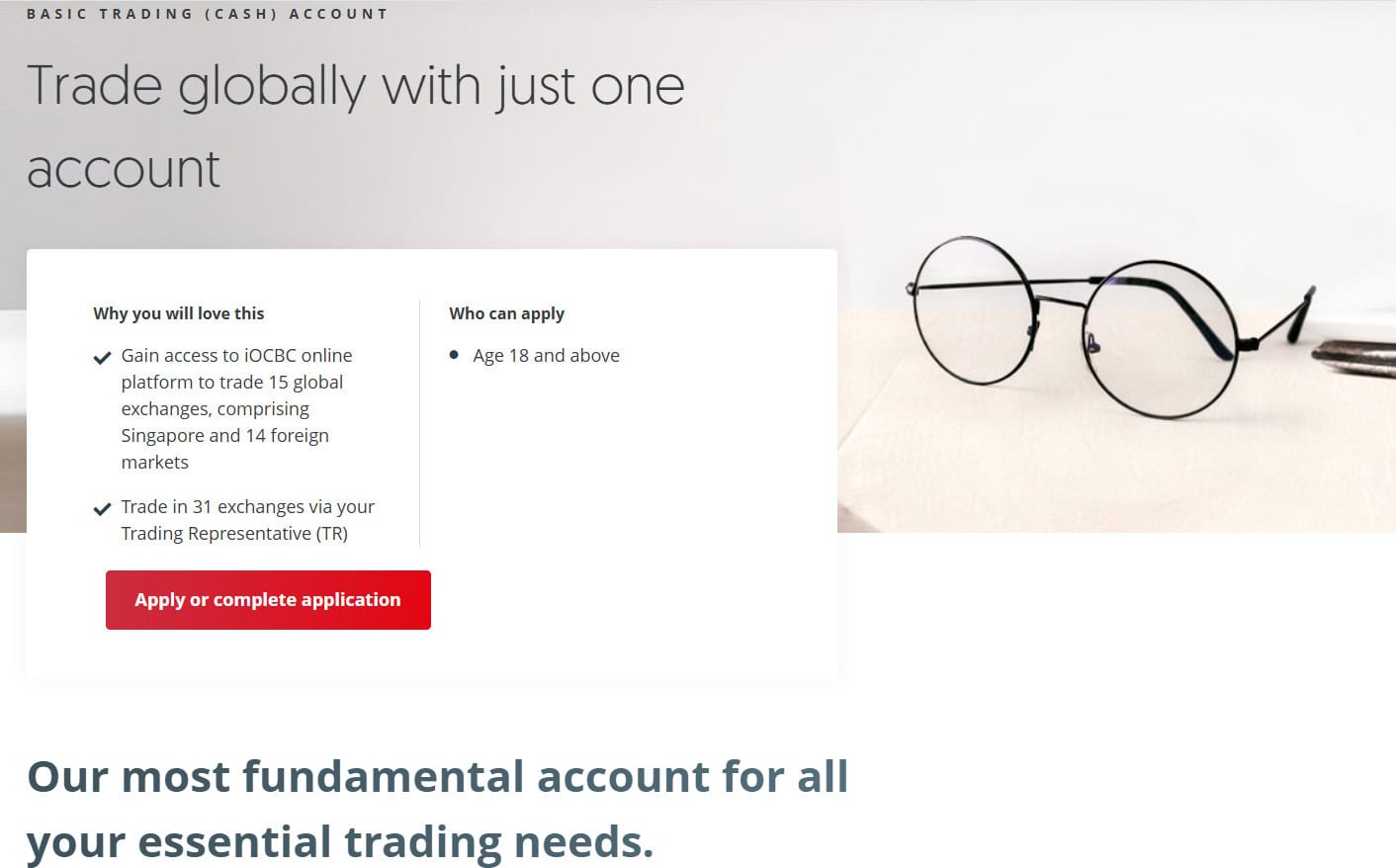

Basic Trading Account

The Basic Trading Account at OCBC Securities is ideal for investors who want straightforward access to global equities, ETFs, and bonds. It offers an intuitive online platform with real-time market data, research tools, and portfolio management features.

Typically, a minimum deposit of S$1,000 is required to open the account, allowing traders to start investing with a manageable initial capital.

The Basic Account also benefits from competitive commission rates, secure fund handling through OCBC Bank, and access to multiple international exchanges.

Regions Where OCBC Securities is Restricted

OCBC Securities primarily serves investors in Singapore and the Asia-Pacific region. While it offers access to global markets, certain jurisdictions may have restrictions that affect account opening and trading activities.

Cost Structure and Fees

Score – 4.5/5

OCBC Securities Brokerage Fees

The broker’s fees vary based on the type of account, trading services, and the financial instruments involved. Generally, brokerage fees may include commissions and other charges associated with trading activities.

Therefore, carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated charges and their potential impact on trading operations.

- OCBC Securities Commissions

OCBC Securities applies a transparent fee structure across its financial services, with commissions varying based on market and product type. For stock trading, the average commission starts from $15, making it straightforward for investors to calculate costs when buying or selling equities.

- OCBC Securities Exchange Fee

In addition to commissions, investors with OCBC Securities are subject to exchange and regulatory fees that are standard across global markets.

These charges are imposed by the respective stock exchanges and regulatory bodies to facilitate trade execution, market transparency, and compliance oversight.

- OCBC Securities Rollover / Swaps

For leveraged products such as Forex and futures, OCBC Securities applies rollover or swap fees when positions are held overnight. These charges reflect the cost of carrying a position beyond the trading day and are influenced by factors such as interest rate differentials and market conditions.

- OCBC Securities Additional Fees

In addition to standard commissions, OCBC Securities applies a range of additional fees that vary depending on the type of account or product traded.

These include custody fees for holding foreign securities, corporate action handling fees, settlement and transfer charges, and broker-assisted trade service fees.

Investors may also encounter administrative charges for account maintenance or for specific requests such as duplicate statements and contract notes.

How Competitive Are OCBC Securities Fees?

OCBC Securities maintains a fee structure that reflects its position as a leading Singapore-based broker, offering competitive rates within the regional market.

While its stock commissions may be higher than some discount brokers, the fees are balanced by the security of trading through a trusted, bank-backed institution and the convenience of access to multiple global markets.

| Asset/ Pair | OCBC Securities Commission | Merrill Edge Commission | Trade Republic Commission |

|---|

| Stocks Fees | From $15 | From $0 | From €1 |

| Fractional Shares | No | No | Yes |

| Options Fees | From S$15 | From $0,65 | - |

| ETFs Fees | From S$25 | From $0 | €1 |

| Free Stocks | No | Yes | Yes |

Trading Platforms and Tools

Score – 4.6/5

OCBC Securities provides a range of platforms to suit different investor needs. The iOCBC Trading Platform offers access to global equities, ETFs, and bonds with real-time data and advanced charting.

The iOCBCfx Platform caters to Forex traders with multiple order types and technical indicators, while the Futures Trading Platform supports trading in commodities, indices, and currencies with sophisticated analytics and order options.

Trading Platform Comparison to Other Brokers:

| Platforms | OCBC Securities Platforms | E-Trade Platforms | TradeStation Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

OCBC Securities Desktop Platform

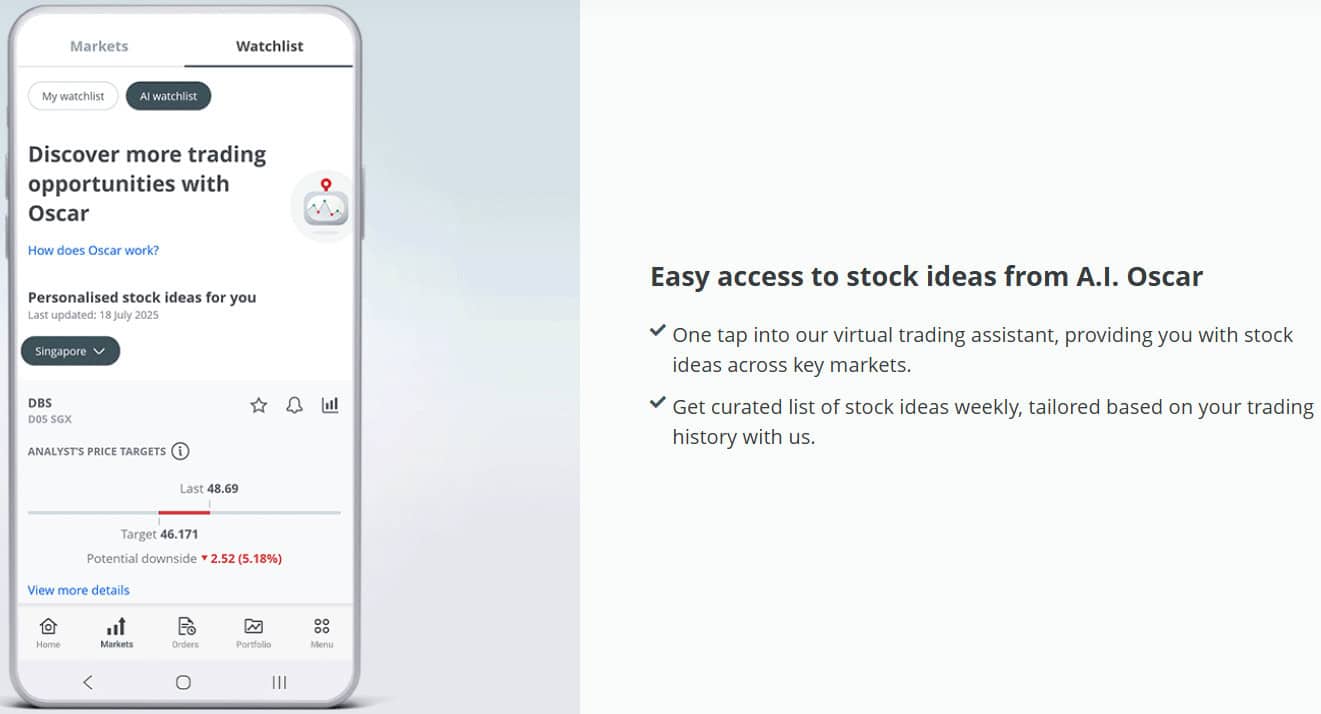

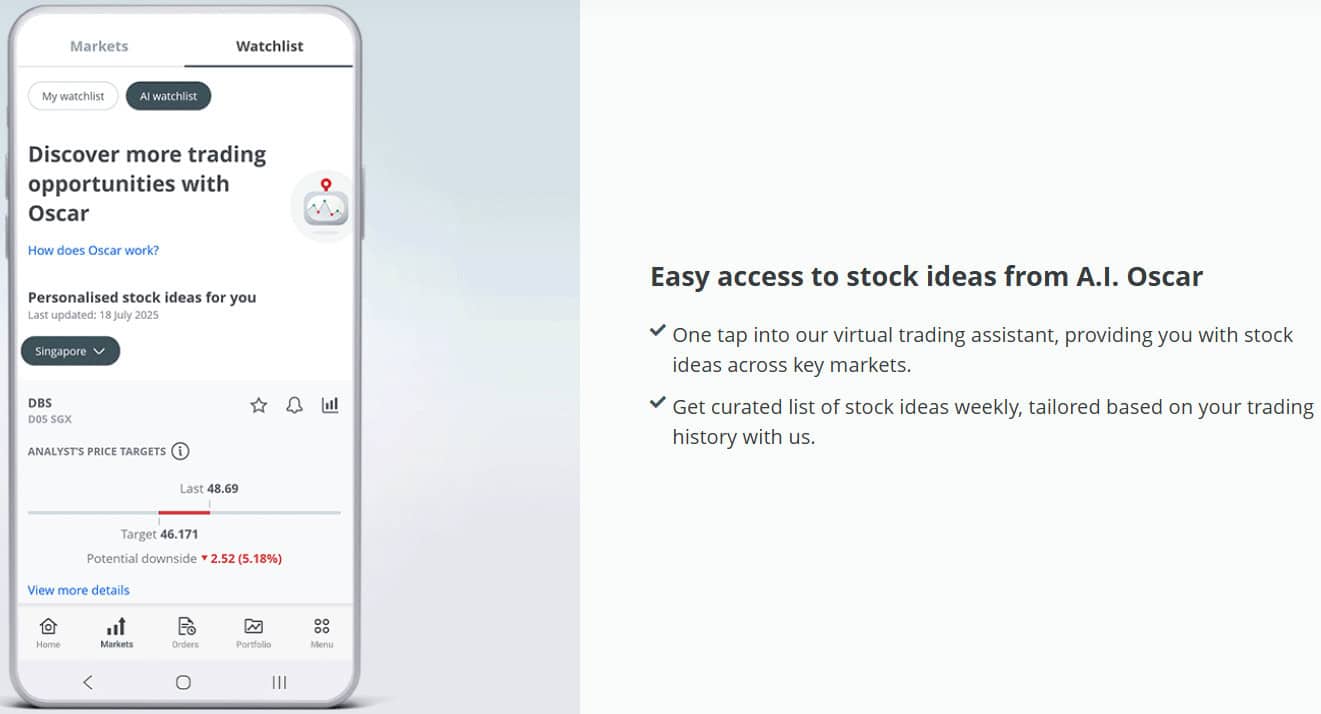

The iOCBC Trading Platform offers a user-friendly desktop experience with advanced tools for investors. A highlight is A.I. Oscar, OCBC’s AI-powered assistant that delivers personalized weekly stock ideas across Singapore, Hong Kong, and U.S. markets.

The platform also features real-time portfolio tracking, advanced charting, and seamless integration with OCBC Bank accounts, providing easy access to 15 global exchanges.

OCBC Securities Desktop MetaTrader 4 Platform

OCBC Securities does not offer the MetaTrader 4 platform for trading; instead, it provides its proprietary platforms for equities, Forex, and futures trading.

OCBC Securities Desktop MetaTrader 5 Platform

The broker does not offer the MT5 platform; investors use OCBC’s proprietary platforms, such as iOCBC Trading, iOCBCfx, and Futures Trading Platform.

OCBC Securities MobileTrader App

The broker’s mobile app provides investors with a convenient and secure way to trade on the go. Available for both iOS and Android devices, the app offers real-time market data, advanced charting tools, and access to multiple global exchanges.

Users can manage portfolios, place orders, and monitor positions seamlessly from their mobile devices. The app also supports secure fund transfers through OCBC Bank.

Main Insights from Testing

Testing the OCBC Securities MobileTrader App reveals a smooth and responsive user experience, with intuitive navigation and quick access to key trading functions.

The app provides reliable real-time quotes, easy order placement, and efficient portfolio management. Users particularly appreciate the customizable watchlists, alerts, and in-app notifications, which help them stay on top of market movements.

AI Trading

OCBC Securities leverages artificial intelligence to enhance the trading experience and support informed investment decisions. Its flagship solution, A.I. Oscar, analyzes market data and individual patterns to provide personalized stock ideas across multiple markets, including Singapore, Hong Kong, and the U.S.

The AI tool also offers insights, alerts, and predictive analytics to help investors identify opportunities and manage risks efficiently. These solutions are integrated across OCBC’s desktop and mobile platforms.

Trading Instruments

Score – 4.7/5

What Can You Trade on OCBC Securities’s Platform?

OCBC Securities provides access to a comprehensive selection of products, such as Securities, Bonds, ETFs, leveraged Futures, Forex, Precious Metals, Stocks, Indices, Commodities, Options, and Shares.

This variety of trading products empowers traders and investors to create well-rounded portfolios that align with their financial objectives and risk preferences.

Main Insights from Exploring OCBC Securities’s Tradable Assets

Exploring OCBC Securities’ tradable assets reveals a broad and well-structured offering. The firm provides access to global markets with reliable execution and transparent pricing.

Overall, the range and quality of assets, combined with strong platform functionality, make OCBC Securities suitable for all levels of investors.

Margin Trading at OCBC Securities

OCBC Securities offers margin trading to allow investors to increase their buying power by borrowing funds against their existing portfolio or cash deposits.

While the multiplier can enhance potential returns, it also involves increased risk, as losses can exceed the initial investment, and users should carefully consider their risk tolerance and financial situation before engaging in margin trading on the platform.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at OCBC Securities

The broker provides a variety of funding methods for traders to instantly deposit funds into their accounts, including:

- Electronic Payment for Shares (EPS)

- Telegraphic Transfer

- PayNow

- Internet Bill Payment

However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

OCBC Securities Minimum Deposit

The broker’s minimum deposit requirements can differ depending on the type of account and trading services. Specifically, for the Basic Trading account targeted at individuals between 18-20 years old, the initial deposit stands at S$1,000.

Withdrawal Options at OCBC Securities

The withdrawal process is both convenient and swift. The specific withdrawal process might vary depending on your local bank.

Customer Support and Responsiveness

Score – 4.6/5

Testing OCBC Securities’s Customer Support

The broker offers 24/5 customer support via email, phone lines, help & support center, and social media channels. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts OCBC Securities

Investors can reach OCBC Securities for support or inquiries via email at askocbcsec@ocbc.com or by phone at +65 6538 1111 (Overseas), or 1800 338 8688 (Local).

The customer service team is available during business hours to assist with account setup, trading questions, and platform support, ensuring prompt and professional guidance for clients.

Research and Education

Score – 4.7/5

Research Tools OCBC Securities

OCBC Securities provides a comprehensive range of research tools to support investors in making informed decisions.

- On its website, investors can access market news, analyst reports, and market commentary covering equities, ETFs, futures, and Forex.

- Within its platforms, iOCBC Trading, iOCBCfx, and the Futures Trading Platform, users benefit from advanced charting, technical indicators, customizable watchlists, alerts, and portfolio analytics.

- Combined with AI-driven insights from A.I. Oscar, these tools help investors identify opportunities, track market trends, and manage risk effectively across global markets.

Education

The broker prioritizes client education by offering a range of educational resources and materials, including articles, webinars, and tutorials, which provide valuable insights to help clients make informed decisions in their trading and investment activities.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options OCBC Securities

OCBC Securities offers a wide range of investment solutions. Clients can access equities, ETFs, bonds, and futures, along with structured products and margin solutions.

The broker also provides AI-assisted stock ideas, research reports, and portfolio management tools to help investors make informed decisions. With its integrated platforms and global market access, the firm caters to investors seeking diversified investment opportunities.

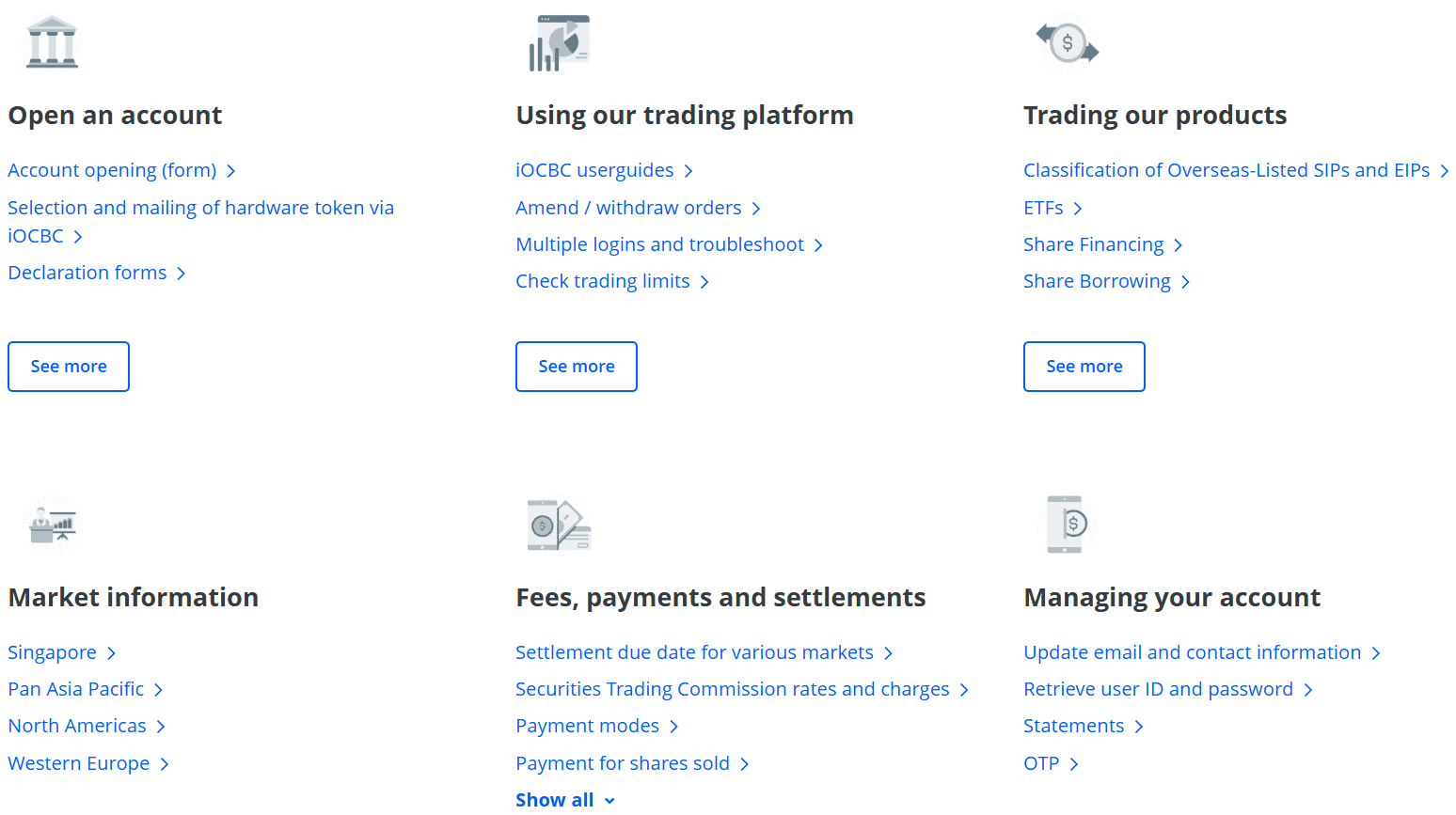

Account Opening

Score – 4.5/5

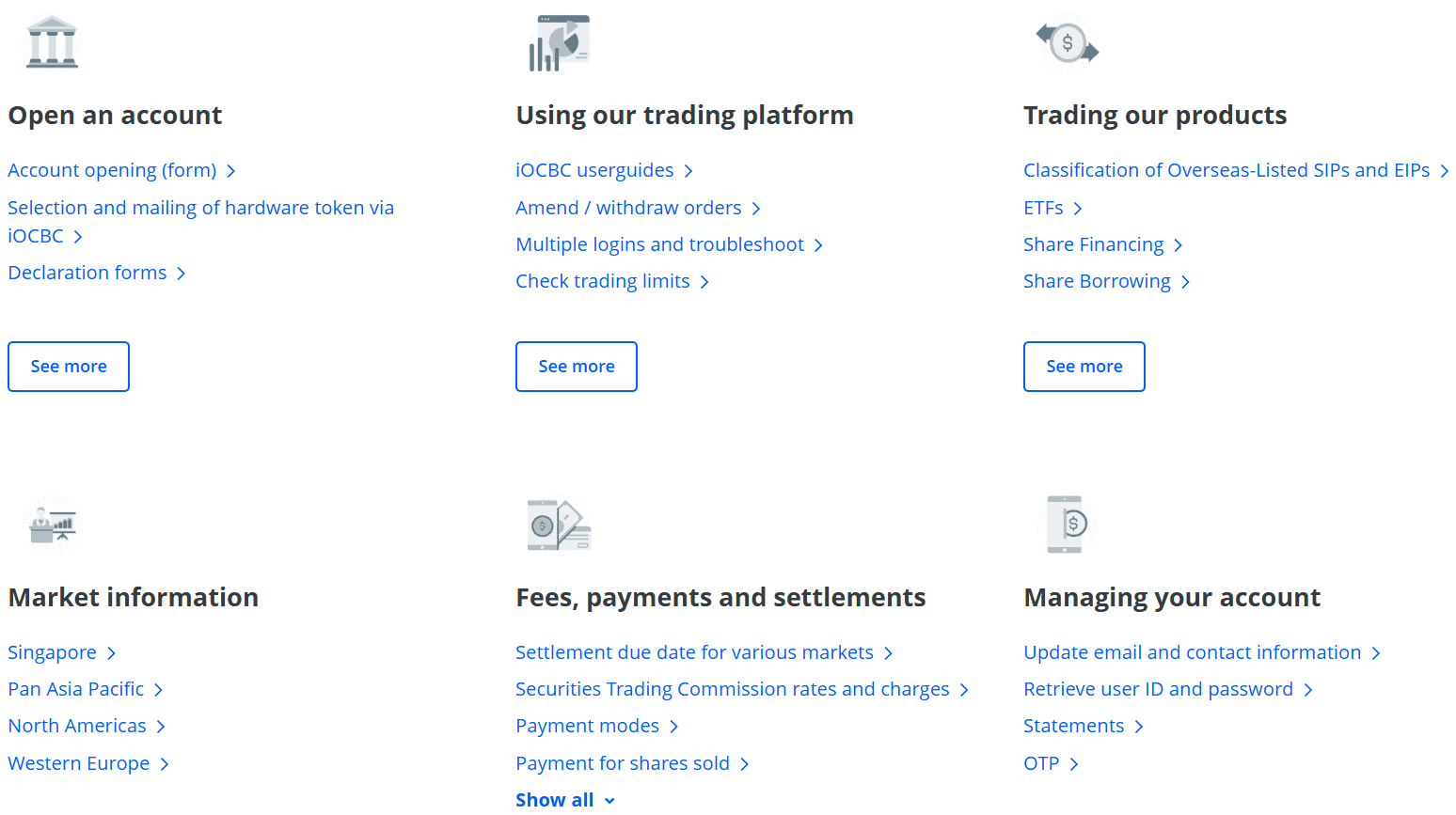

How to Open OCBC Securities Demo Account?

To open a demo account with OCBC Securities, you can request one by emailing the relevant department for the specific platform you are interested in:

- For Forex Trading, you can email via fxdealing@ocbc.com

- For Futures Trading, it is futuresdesk2@ocbc.com

Upon request, you will receive a free 1-month demo account with virtual funds to practice trading without financial risk. This allows you to explore the platform’s features, test strategies, and familiarize yourself with market conditions before trading with real capital.

How to Open OCBC Securities Live Account?

Opening an account with a broker is quite an easy process, as you can log in and register with OCBC Securities within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Create an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

OCBC Securities offers a range of additional tools and features to enhance the investment experience.

- These include StockReports+, which provides detailed company analysis, and ChartSense for advanced technical charting.

- The broker also provides portfolio analytics and integrated fund transfer capabilities with OCBC Bank accounts. These features collectively support informed decision-making, efficient trade execution, and convenient portfolio management for both beginner and experienced investors.

OCBC Securities Compared to Other Brokers

OCBC Securities stands out as a full-service broker within the Asia-Pacific region, offering a broad range of tradable assets and advanced proprietary platforms.

Compared with competitors, it provides strong regulatory oversight and robust customer support, making it appealing for both retail and professional investors.

While some newer or app-based brokers may offer lower fees, zero minimum deposits, or highly mobile-focused platforms, OCBC Securities emphasizes security, comprehensive research tools, and multi-asset access, including leveraged products and global market coverage.

Its combination of bank-backed reliability, AI-assisted insights, and educational resources positions it as a strong choice for investors seeking a secure and well-supported environment, even if certain competitors are more cost-focused.

| Parameter |

OCBC Securities |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Stock Commission from $15 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

iOCBC Proprietary Trading Platforms |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Securities, Bonds, ETFs, leveraged Futures, Forex, Precious Metals, Stocks, Indices, Commodities, Options, Shares |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

MAS |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

S$1,000 |

€0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker OCBC Securities

OCBC Securities is a reputable Singapore-based broker offering a wide range of investment products, including equities, ETFs, bonds, futures, Forex, and options.

Its proprietary platforms, such as iOCBC Trading and iOCBCfx, provide advanced charting, real-time market data, and seamless integration with OCBC Bank accounts.

The broker also leverages AI tools like A.I. Oscar to deliver personalized stock ideas and insights. With transparent fees, comprehensive research tools, and strong regulatory oversight, the firm combines security, flexibility, and technology-driven features for an efficient trading experience.

Share this article [addtoany url="https://55brokers.com/ocbc-securities-review/" title="OCBC Securities"]