- What is Next Step Funded ?

- Next Step Funded Pros Cons

- Is Next Step Funded Legit?

- Next Step Funded Challenge

- Funded Account

- Account Conditions

- Payout

- Next Step Funded Alternative

What is Next Step Funded Prop Firm?

Next Step Funded is a proprietary Forex trading firm that emerged in early 2023, quickly gaining popularity among traders seeking funding opportunities. It was founded by Jalel Abougouche, an entrepreneur with a strong background in trading and investment, with the aim of providing skilled retail Forex traders lacking sufficient capital with the means to trade more effectively.

- The firm offers a comprehensive platform for both new and experienced traders, featuring a wide range of trading instruments including major and minor forex pairs, metals, oil, indices, and stock CFDs. Their partnership with Eightcap allows traders access to over 1000 trading instruments and fast execution speeds, which is crucial for effective trading

Next Step Funded offers a unique opportunity for traders to engage in Real Trading with minimal initial capital. By becoming a Funded Trader, individuals can trade with Company Funds after passing a Test or Challenge. However, it’s crucial to consider the associated risks before getting involved. Explore more about Prop Trading for informed decision-making.

| Next Step Funded Advantages | Next Step Funded Disadvantages |

|---|

| Low Profit Target | Not Regulated |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Generous Profit Share | No Alternative Platforms |

| Competitive Fees | No refund |

| Good range of Challenge Accounts | |

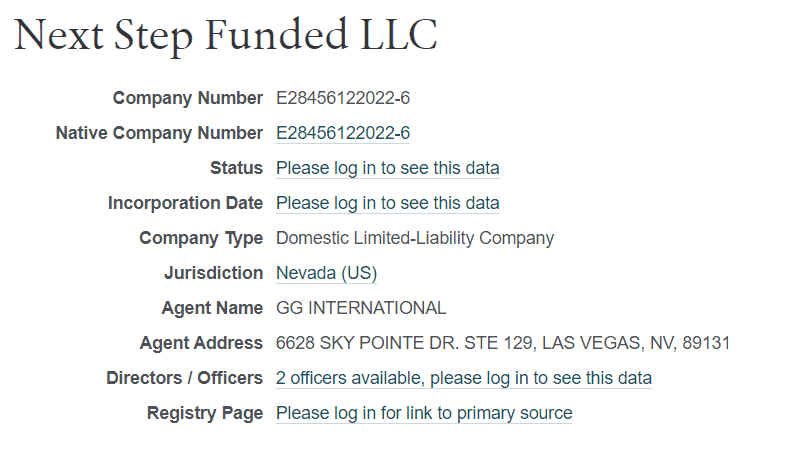

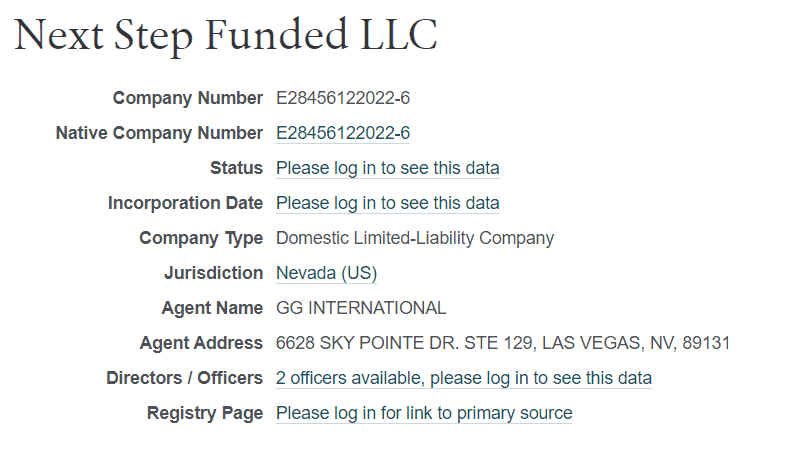

Is Next Step Funded Legit?

Next Step Funded appears to be a legitimate proprietary trading firm based on various sources and Next Step under TrustPilot reviews. Launched in early 2023 by Jalel Abougouche, a seasoned entrepreneur with a track record in the trading and investment sector, the firm has quickly gained attention in the Forex trading community.

Is Next Step Funded Scam?

After conducting a thorough check on the official website, we found no evidence suggesting that Next Step Funded is a scam. However, due to the limited regulation of Prop Trading Firms by financial authorities, it’s challenging to determine the true nature of such firms and differentiate between scams and legitimate operations.

Our professional advice is to thoroughly educate yourself about Prop Trading, grasp the associated risks, and opt for a company with a solid reputation and years of operation for increased stability. While the initial investment in trading is minimal, consisting mainly of subscription fees, potential losses remain relatively lower compared to traditional trading with personal funds.

Next Step Funded Rules

The key focus of our Next Step Funded Review lies in understanding the structure of the evaluation challenge and the prerequisites for participating in the trading challenge. This involves examining the specific test criteria required to acquire a Funded Trading Account and transition into a Proprietary Trader. Additionally, we’ll explore the typical costs associated with becoming a trader, primarily based on the Registration Fee.

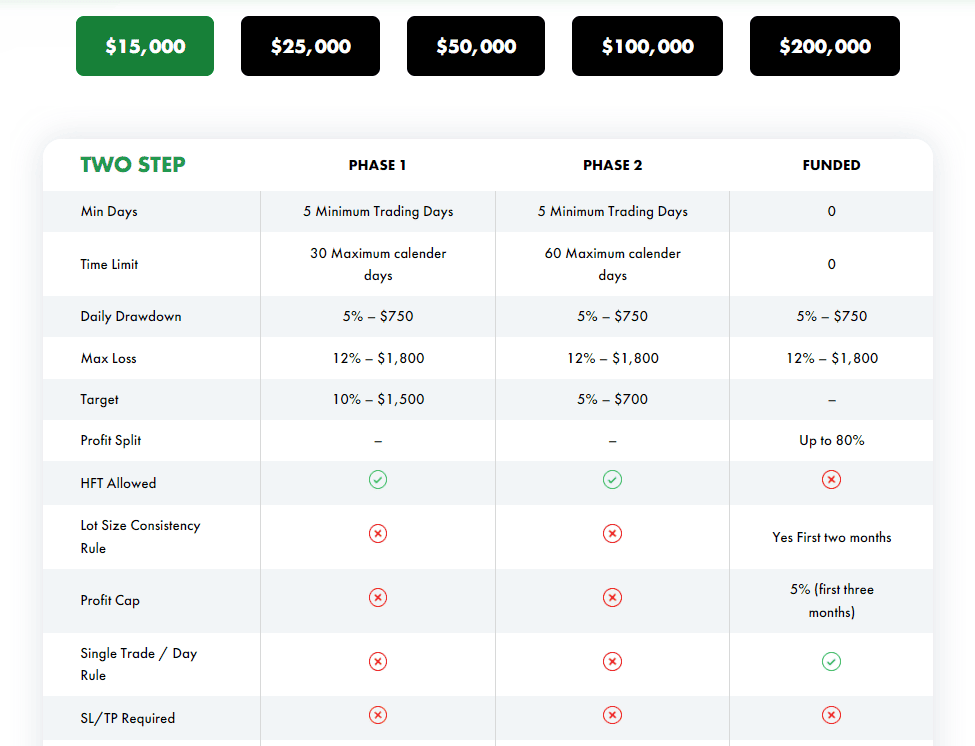

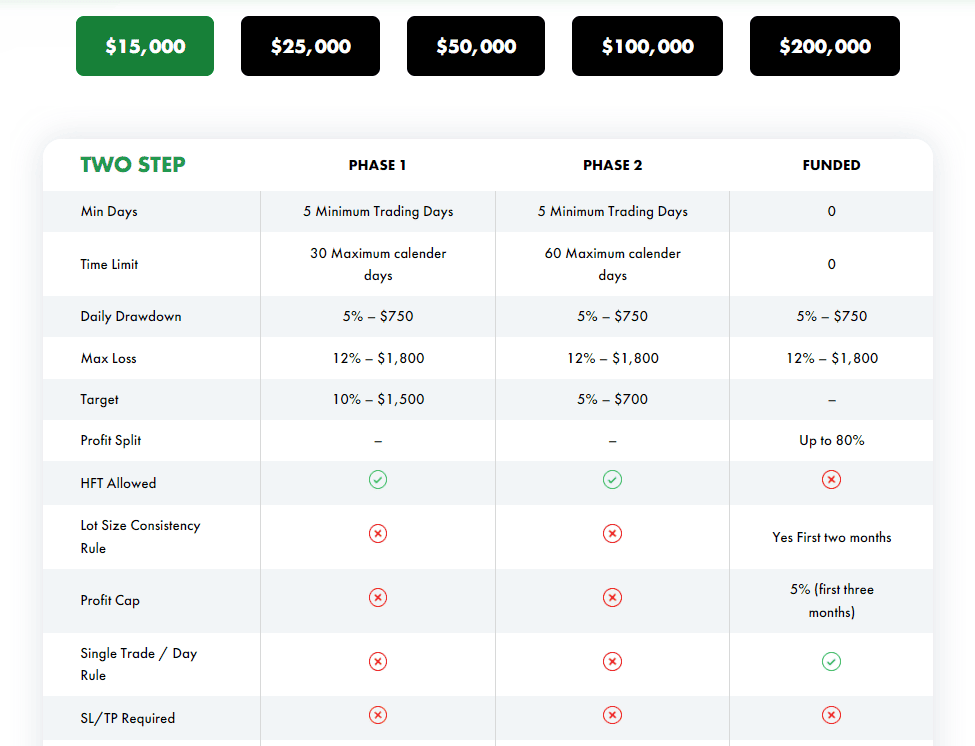

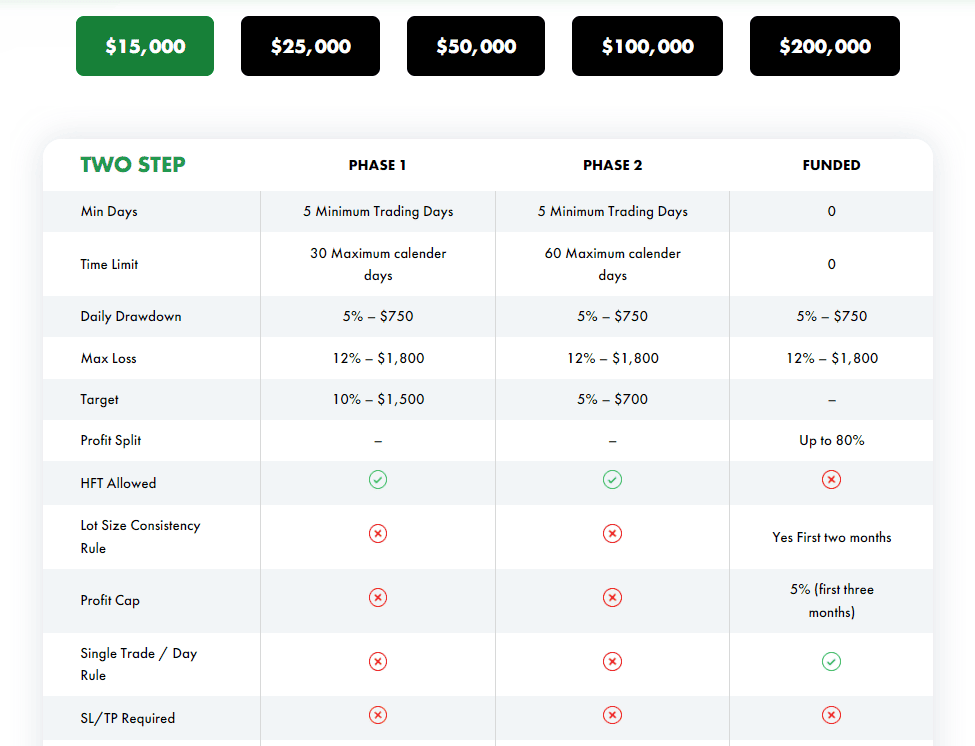

- Next Step Funded provides One Step and Two Step evaluations, plus an HFT Limited Edition for traders. These programs test a trader’s ability to meet profit targets and follow risk management rules. Successful completion grants access to a funded account, where traders can earn a share of the profits. Participants select a program, adhere to trading guidelines, and aim to demonstrate consistent trading discipline and profitability.

Account Balance and Registration Fee

Before you can log in to Next Step Funded, you must choose the Challenge type and Account Balance you wish to qualify for. The challenge conditions vary depending on the selected size, affecting the registration fee you must pay to participate in the challenge. However, Next Step Funded refunds this fee once you become a Funded Trader. For more details, refer to our Registration Fee comparison table below:

- There are several programs available, including the One Step Challenge, which is aimed at both intermediate and beginner traders, the Two Step Challenge that involves a two-phase evaluation process, and the HFT Limited Edition which is a special challenge with varying account sizes from $15,000 to $300,000.

- In all these programs, traders are required to meet specific profit targets while adhering to rules regarding maximum trading periods, minimum trading days, leverage, and limits on daily and overall losses. Successful completion of these evaluations can lead to a trading partnership, where traders manage a funded account and earn a significant portion of the profits generated from their trading activities.

- Next Step Funded offers various account sizes for its trading challenges, ranging from $15,000 to $200,000. Each size has specific conditions and a registration fee, which is refunded upon becoming a Funded Trader. These accounts cater to different levels of experience and risk tolerance, from beginners to highly skilled traders.

| Fees | Next Step Funded | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $15,000 | $10,000 | $50,000 |

| Fee | $98 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $999 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

Profit Target

Next Step Funded sets profit targets for its trading challenges, which vary depending on the account size and challenge type. Typically, for the One Step Challenge, the profit target might be set around 10% of the account balance. In the Two Step Challenge, the first phase usually has a profit target of 10%, and the second phase a target of 5%.

- These targets are designed to assess a trader’s ability to generate profits while managing risk effectively. Achieving these targets is a key requirement for successfully completing the challenge and qualifying for a funded account.

Maximum Loss

Next Step Funded imposes a maximum loss limit to manage risk during its trading challenges. This limit typically includes both a maximum daily loss and a maximum overall loss. The maximum daily loss is often set at around 5% of the initial account balance, while the maximum overall loss is usually capped at 12%.

- These limits are designed to ensure traders practice effective risk management, protecting both the trader and the firm from excessive losses. Adhering to these loss limits is crucial for traders aiming to complete the challenge successfully and qualify for a funded account.

Minimum Trading Period

The minimum trading period in Next Step Funded challenges varies depending on the specific program a trader is participating in. For the One Step Challenge, traders are typically required to trade for a minimum of three days, whereas the Two Step Challenge usually demands a minimum of five trading days for each phase of the evaluation.

See detailed table with Next Step Funded Challenge conditions based on Account Size:

Free Trial

Next Step Funded doesn’t explicitly offer a free trial for their trading challenges or evaluation programs. Proprietary trading firms like Next Step Funded usually require a registration fee for participants to enter their evaluation challenges, with this fee often refundable upon successfully becoming a funded trader.

Next Step Funded Funded Account

Upon successfully passing the test or challenge, the trader’s Funded Account will be established, a process that typically takes a few business days to activate. It’s crucial to understand that the account conditions and balance will mirror those achieved in the qualifying test. Should a trader wish to upgrade to a higher-grade account, they’ll need to retake the test from scratch to qualify for the desired account balance.

Profit Split

Next Step Funded offers a profit split to traders who successfully become funded traders after completing their evaluation challenges. The profit split is typically generous, with traders often receiving up to 80% of the profits they generate, while Next Step Funded retains the remaining 20%.

Payout and Withdrawals

Next Step Funded typically processes payouts to traders based on the profits earned from trading with a funded account. After successfully completing the evaluation phase and becoming a funded trader, individuals can start earning a share of the profits generated from their trades, in accordance with the agreed-upon profit split, often up to 80% in favor of the trader.

Payouts are usually subject to certain conditions, such as reaching a minimum profit threshold before a withdrawal can be requested. The frequency of payouts can vary, with some firms offering monthly withdrawals, while others might provide more flexible withdrawal options.

Withdrawal Method

Next Step Funded likely provides a variety of withdrawal methods for funded traders to access their earnings, including bank wire transfers, electronic wallets (e-Wallets) like PayPal, Skrill, or Neteller, cryptocurrency transactions, and possibly credit/debit card returns.

Account Conditions

When evaluating Account Conditions, we meticulously review the broker’s range of account options, available platforms, tradable instruments, and associated trading costs. Equally significant is examining the leverage levels and trading conditions provided, as certain brokers may impose restrictions on particular strategies or practices within funded accounts. Deviating from these guidelines could potentially lead to the loss of the account, necessitating the need to retake the test. Below, you’ll find a comprehensive breakdown of these aspects.

Trading Instruments

Next Step Funded offers a variety of trading instruments including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and Futures. These instruments cater to different trading strategies and market preferences, providing traders with diverse opportunities for investment.

Next Step Funded Commission

Next Step Funded’s commission rates are not explicitly detailed in the provided information. These rates can vary and may be structured as a percentage of trade value, a flat fee per trade, or a combination thereof, and can be influenced by factors such as trading volume and market conditions.

Leverage

Next Step Funded App Platform

Next Step Funded offers MetaTrader 4 (MT4) as one of their trading platforms. MT4 is a popular choice among traders for its advanced charting tools, comprehensive market analysis features, and the ability to use automated trading systems known as Expert Advisors (EAs).

Trading Conditions

Next Step Funded offers trading opportunities through various challenges and programs, each designed to assess and accommodate traders’ skills and risk management capabilities.

- Next Step Funded allows for a wide range of trading styles and strategies, including News Trading, Swing Trading, EA (Expert Advisor) Trading, and Weekend Holding, catering to the diverse approaches of traders. Additionally, traders have the benefit of employing Copy Trading from another Next Step Funded account, enhancing the flexibility for those with varying strategic preferences. However, it’s crucial to be aware that some trading practices are restricted.

- High-Frequency Trading, Latency Trading, and Arbitrage are not allowed, ensuring fair trading conditions and risk management across all participants.Next Step Funded, like any trading platform, may experience slippage, which is the difference between the expected price of a trade and the price at which the trade is actually executed. Traders should consider slippage, especially when trading around news events or using strategies that require precise entry and exit points.

Next Step Funded Promotions

We’ve observed that the company occasionally offers promotions, including Next Step Funded promo codes for discounts, as well as possible Next Step Funded discounts. However, these offers tend to be temporary, so it’s advisable to check the current availability and details when you sign up.

Next Step Funded Alternative Brokers

In conclusion, Next Step Funded presents an opportunity for traders to engage in real trading with minimal initial capital requirements. However, it’s essential for traders to carefully consider factors such as account conditions, trading instruments, and profit split arrangements before getting involved. Conducting thorough research and understanding the risks involved is crucial for making informed decisions.

It’s always beneficial to evaluate and compare proposals from different Prop Trading Firms. Many reputable firms may provide comparable terms or might be better suited for certain traders, offering a wider choice of instruments and alternatives to MetaTrader platforms. Nonetheless, Next Step Funded also presents clear advantages. For further insights, see our curated list of alternatives and the table below, which contrasts Next Step Funded with other companies:

Share this article [addtoany url="https://55brokers.com/next-step-funded-review/" title="Next Step Funded"]

They are no longer paying

Fu*** Scam