- What is NCM Investment?

- NCM Investment Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

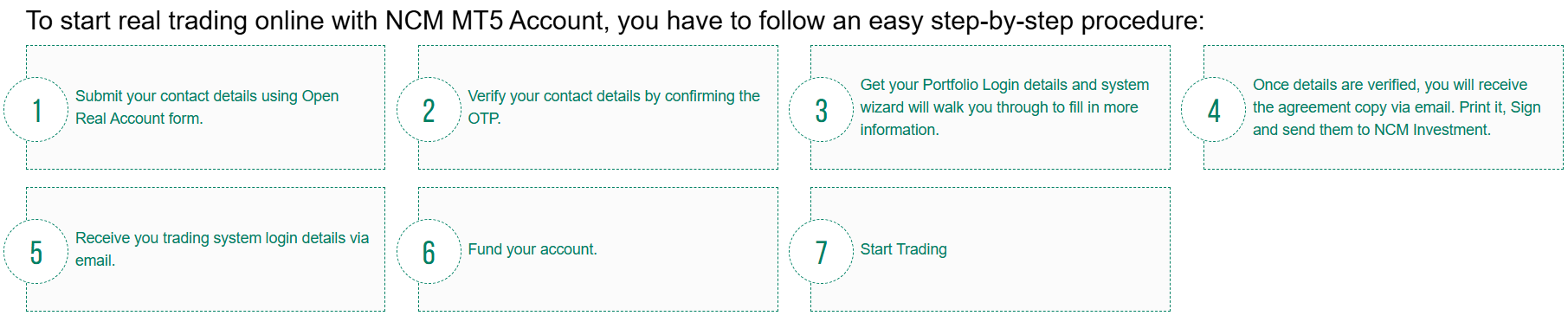

- Account Opening

- Additional Tools And Features

- NCM Investment Compared to Other Brokers

- Full Review of Broker NCM Investment

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is NCM Investment?

NCM Investment, formerly known as Noor Capital Markets or Noorcm, is an online Forex trading company providing a wide range of financial trading services to individual and institutional clients. The brokerage firm’s products include Forex, Gold and Silver, Oil and Gas, Agriculture, and CFDs on Shares, Indices, and Cryptocurrencies.

Originally established in 2009 in Kuwait, the broker has since acquired licenses and complied with regulations from several financial authorities, including the CMA in Kuwait, Labuan FSA in Malaysia, SCA in the UAE, CMB in Turkey, and JSC in Jordan.

Overall, NCM Investment is a reliable Forex and CFD broker in the Middle East that offers competitive and transparent trading solutions to investors at various experience levels. It offers a diverse selection of popular market assets and utilizes the widely recognized MetaTrader 5 platform.

NCM Investment Pros and Cons

Based on our research, selecting NCM Investment as your broker has both benefits and drawbacks. For the pros, the broker provides a well-regarded MT5 trading platform, known for its efficiency in executing trades. As an advantage, NCM Investment also offers Swap-Free accounts specifically designed for Muslim traders. Lastly, there is a comprehensive learning Academy so making the offering suitable for beginning trading,

For the cons, the trading conditions may vary depending on the entity. Another limitation is the lack of top-tier regulations, indicating that the company may not adhere to strict regulatory standards. Also, the minimum deposit amount is higher than the industry average, which might be a drawback for beginners who are looking for a more accessible entry point.

Moreover, NCM Investment may not be available to traders globally, so it is good to verify with the broker whether you can open an account or not.

| Advantages | Disadvantages |

|---|

| MT5 trading platform | Trading conditions might vary based on the entity |

| Account segregation | No top-tier regulation |

| Competitive trading conditions | High minimum deposit amount |

| Variety of trading instruments | |

| NoorCM Academy | |

| Available for traders in the Middle East | |

| Professional trading | |

NCM Investment Features

NCM Investment is a multi-asset brokerage firm offering a comprehensive trading experience with a strong presence in the Middle East. The main features are summarized in 10 points, covering aspects like Trading Instruments, Account Types, available Trading Platforms, and more.

NCM Investment Features in 10 Points

| 🏢 Regulation | CMA, SCA, Labuan FSA, CMB, JSC |

| 🗺️ Account Types | Variable Execution, Plus Leverage Accounts |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, Gold and Silver, Oil and Gas, Agriculture, and CFDs on Shares, Indices, and Cryptocurrencies |

| 💳 Minimum Deposit | $3000 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, KWD, TRY |

| 📚 Trading Education | NoorCM Academy |

| ☎ Customer Support | 24/6 |

Who is NCM Investment For?

NCM Investment is designed for traders who need a secure and user-friendly trading environment in the MENA region. Based on our findings and Financial Expert Opinions, NCM Investment is Good for:

- Traders from the MENA region

- CFD and currency trading

- Traders who prefer the MT5 platform

- Professional trading

- Advanced traders

- Institutional trading

- Muslim Trading

- Market Making execution

- Competitive fees and spreads

- White Label solution

- EA/Auto trading

- Good trading tools and learning materials

NCM Investment Summary

In summary, NCM Investment is a reputable online Forex broker with a strong presence in the Middle East. With its multiple licenses and regulations, the broker has established itself as a reliable and trustworthy broker mainly in the MENA region. Traders have access to competitive and transparent trading solutions, supported by the widely recognized MetaTrader platform.

However, there might be certain limitations, such as variations in trading conditions depending on the entity. Yet, the availability of Swap-Free accounts for Muslim traders and the comprehensive NoorCM Academy further add to its appeal, offering educational resources to enhance traders’ knowledge and decision-making capabilities.

Although NCM Investment is considered a trustworthy option for traders of all levels, we highly recommend conducting thorough research to assess whether the broker meets your trading needs, as there might be slight variations in conditions across different entities.

55Brokers Professional Insights

NCM Investment stands out by offering robust regulatory compliance, advanced trading technology, and a client-centric trading approach. Users have access to a range of trading instruments, all available through the advanced MetaTrader 5 platform.

The platform offers features such as fast and secure execution, support for Expert Advisors, and mobile compatibility, allowing traders to manage their accounts anywhere.

Additionally, the broker provides swap-free options on major currency pairs, catering to clients seeking Sharia-compliant trading solutions. With 24/6 customer support and a strong commitment to trader education, NCM Investment provides a comprehensive and reliable trading experience.

Consider Trading with NCM Investment If:

| NCM Investment is an excellent Broker for: | - Providing competitive trading conditions.

- Get access to MT5 trading platform.

- Need a broker with good education.

- Professional trading.

- Secure trading environment.

- Who prefer higher leverage up to 1:100.

- CFDs and Currency trading.

- MENA region traders.

- Broker with a variety of trading strategies.

- Need broker with fast execution.

|

Avoid Trading with NCM Investment If:

| NCM Investment might not be the best for: | - Who prefer to trade with MT4 or cTrader.

- Providing Copy Trading.

- Need broker with access to VPS Hosting.

- Looking for MAM and PAMM Trading.

- Need a broker with a Top-Tier license.

- Looking for broker with low minimum deposit requirement to open an account.

|

Regulation and Security Measures

Score – 4.3/5

NCM Investment Regulatory Overview

NCM Investment operates under the regulation of the Capital Markets Authority (CMA) in Kuwait and also carries additional licenses, including SCA in the UAE, Labuan FSA in Malaysia, CMB in Turkey, and JSC in Jordan.

These regulatory bodies enforce rules and guidelines to ensure that the broker operates securely.

How Safe is Trading with NCM Investment?

NCM Investment is considered a reliable Forex trading broker in the MENA region, even though it is not regulated by top-tier regulations, since the proposal is based in other regions.

The broker places a high priority on safeguarding the funds of its clients. It ensures the safety and security of client funds by segregating them from the company’s accounts, which means that traders’ funds are kept separate and not used for operational purposes.

Even though Broker does not comply with strict measures like those leading regulators require, there are some measures taken by the Broker, yet fund safety may vary depending on the regulations applicable in different jurisdictions where the brokerage company operates.

Consistency and Clarity

NCM Investment demonstrates strong consistency in its operations, backed by a solid regulatory foundation and over a decade of experience in the financial markets.

While the broker receives praise for its regulatory transparency, educational resources, and customer service, trader reviews also highlight drawbacks like the relatively high minimum deposit, limited advanced features, and no Top-Tier license.

NCM Investment is also active in social engagement, frequently participating in financial expos and supporting trader education through its NoorCM Academy. Overall, the broker maintains a positive reputation in the trading community, particularly within the MENA region, for its regulatory compliance and commitment to trader development.

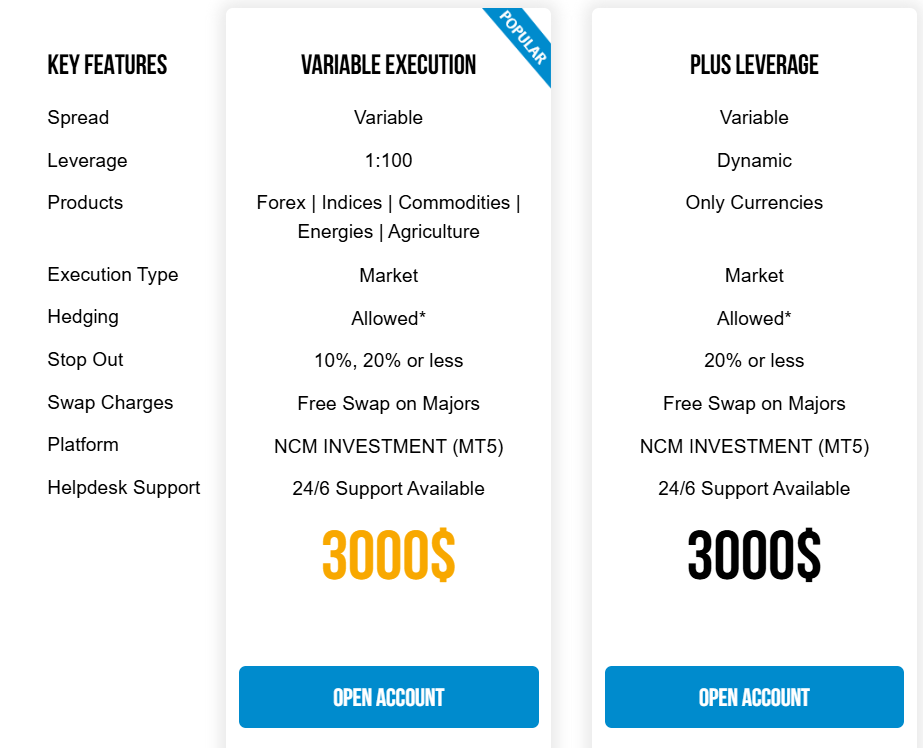

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with NCM Investment?

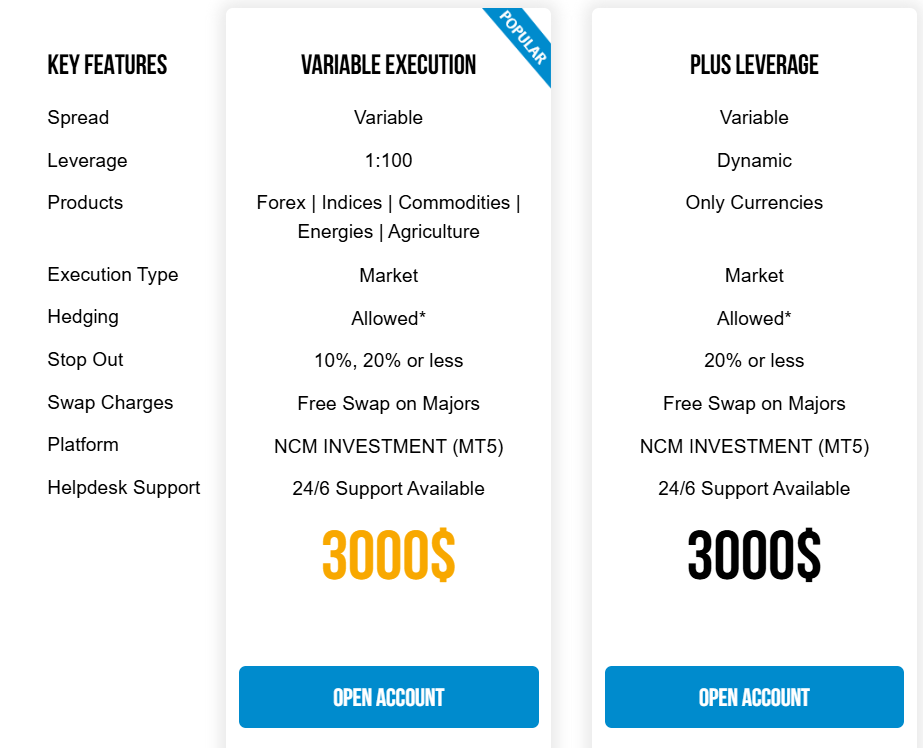

Traders can select between two account types on NCM Investment: Variable Execution and Plus Leverage.

Additionally, new traders can choose a Demo account for free, allowing them to practice trading and make trial trades to test their strategies. For Muslim clients, the broker offers Swap-Free and Islamic accounts.

Variable Execution Account

The Variable Execution Account is designed for traders who need flexible spreads and real-time market execution. It requires a minimum deposit of $3,000, making it more suitable for intermediate to advanced traders.

This account offers variable spreads with no fixed commissions, as trading costs are included in the spread. Clients can access the markets via the MT5 platform, ensuring a smooth trading experience with advanced tools and charting capabilities.

Plus Leverage Account

The Plus Leverage Account is suitable for traders looking to maximize their exposure with enhanced leverage. Spreads are variable with no additional commission fees charged. Trading is conducted on the MetaTrader 5 platform, offering speed and stability for high-leverage strategies.

Regions Where NCM Investment is Restricted

NCM Investment’s services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide trading services in countries including:

- USA

- Some European countries

- Iran

- North Korea

- Syria, etc.

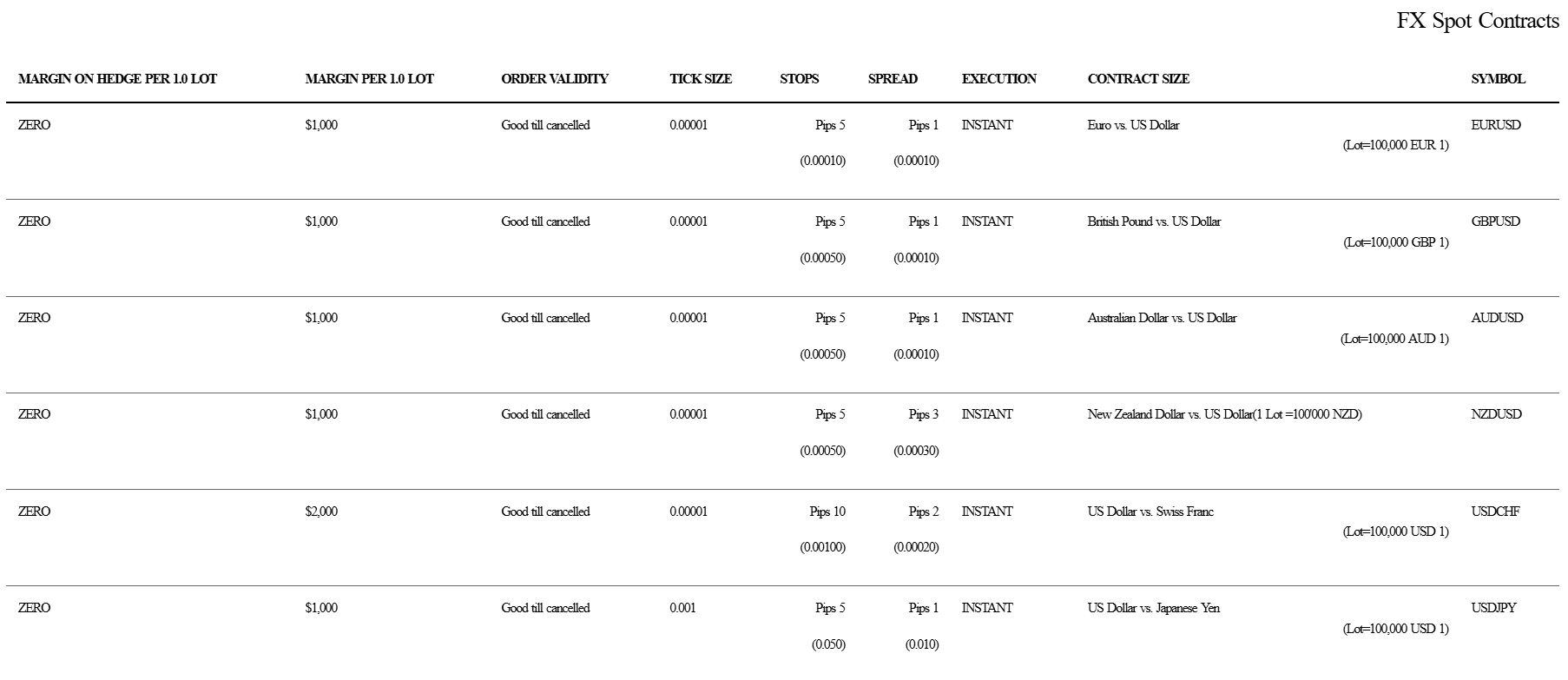

Cost Structure and Fees

Score – 4.3/5

NCM Investment Brokerage Fees

When it comes to fees, the broker offers competitive pricing for trading products, ensuring transparency by not imposing any hidden fees.

However, certain charges may apply to deposits and withdrawals, which can vary depending on the selected funding method and the country of registration.

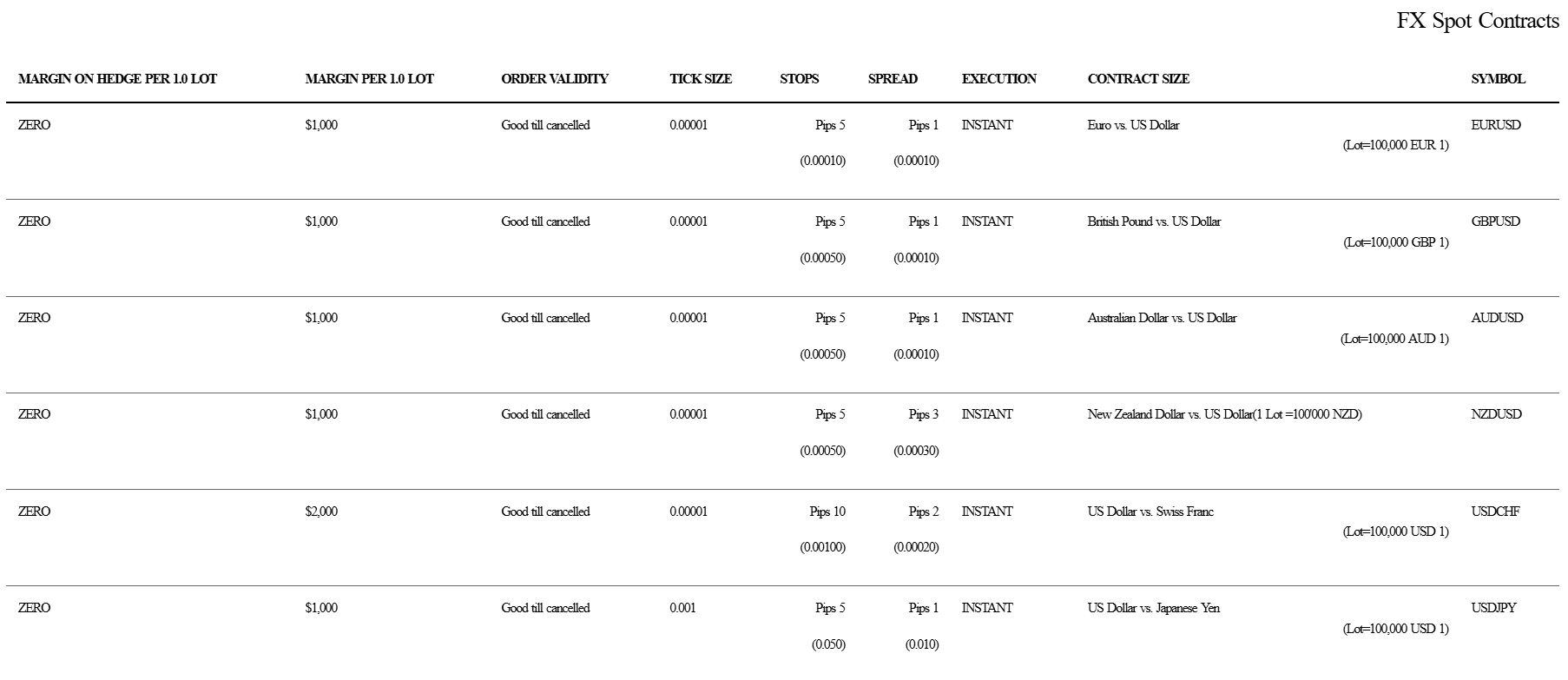

NCM Investment offers floating spreads with an average spread of 1 pip for the widely-traded EUR/USD currency pair in the Forex market.

The spread offerings for all major currency pairs and other popular trading instruments are competitive too. However, the trading conditions might differ depending on the entity, so do your research to understand the specific spread conditions that are in place.

- NCM Investment Commissions

NCM Investment does not charge commissions on Forex and CFD trades or account types, as all trading costs are based on spreads .

- NCM Investment Rollover / Swaps

NCM Investment applies overnight rollover rates that vary depending on the asset, position direction, and prevailing interest rate differentials.

Traders should check specific rollover rates directly on MT5 or via the broker’s platform to understand daily financing costs.

- NCM Investment Additional Fees

NCM Investment maintains a transparent fee structure. The broker does not charge deposit, withdrawal, or inactivity fees, however, traders may incur external charges from payment providers.

How Competitive Are NCM Investment Fees?

NCM Investment’s fees are relatively competitive, particularly for intermediate to professional traders focused on Forex and major CFDs. The broker offers variable spreads that align with industry standards, and its no-commission trading structure on most accounts appeals to cost-conscious traders.

While the minimum deposit on some accounts is higher than average, the absence of additional internal fees and access to the advanced MT5 platform help balance overall trading fees.

| Asset/ Pair | NCM Investment Spread | FXTrading Spread | Colmex Pro Spread |

|---|

| EUR USD Spread | 1 pip | 1 pip | 4 pips |

| Crude Oil WTI Spread | 3 | 22 | 0.10 |

| Gold Spread | 1 | 8 | 0.68 |

| BTC USD Spread | 45 | 323 | $195.45 |

Trading Platforms and Tools

Score – 4.4/5

Traders have the opportunity to trade using the highly popular MetaTrader 5 trading platform provided by NCM Investment. The platform has gained wide recognition and is accessible through desktop, web, and mobile devices, enabling traders to stay connected to the markets and execute trades conveniently from any location.

Known for its user-friendly interface, comprehensive features, and the capacity to automate trading strategies, the MetaTrader platform instills confidence in traders and empowers them to trade at their preferred pace.

Trading Platform Comparison to Other Brokers:

| Platforms | NCM Investment Platforms | FXTrading Platforms | Colmex Pro Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

NCM Investment Web Platform

The broker provides access to the MT5 Web Terminal, offering a powerful and user-friendly trading experience directly from any web browser without the need for downloads or installations.

The web platform supports real-time quotes, one-click trading, advanced charting tools, multiple order types, and technical indicators.

NCM Investment Desktop MetaTrader 4 Platform

NCM Investment has transitioned its focus from MT4 to MT5 as its primary desktop platform, reflecting a move toward more modern, multi-asset trading capabilities.

NCM Investment Desktop MetaTrader 5 Platform

The MetaTrader 5 platform provides a comprehensive trading experience for both beginner and professional traders. It features advanced charting tools, faster execution speeds, and support for multiple asset classes.

One of its key advantages is access to over 30 built-in technical indicators, including Moving Averages, RSI, MACD, and Bollinger Bands, allowing for in-depth market analysis. The platform also includes features like an integrated economic calendar, depth of market, and improved algorithmic trading capabilities.

Main Insights from Testing

Testing the MT5 platform revealed a smooth and intuitive trading experience, marked by stable performance and quick order execution. The interface is user-friendly, with customizable charts and easy access to trading tools. Overall, the platform provides a reliable and efficient environment for Forex trading.

NCM Investment MobileTrader App

The broker offers a robust MT5 mobile app, which brings full platform functionality to traders’ smartphones or tablets. Available on iOS and Android, the app supports secure login via Face ID or fingerprint, delivers real-time quotes across multiple asset classes, and includes interactive charts with technical indicators.

Trading Instruments

Score – 4.3/5

What Can You Trade on NCM Investment’s Platform?

NCM Investment provides its clients over 200 trading instruments, including Forex, Gold and Silver, Oil and Gas, Agriculture, and CFDs on Shares, Indices, and Cryptocurrencies.

Forex trading stands out among these markets due to its wide recognition, high liquidity, and competitive spreads. However, the availability of trading instruments may vary depending on the specific entity. Therefore, conducting research is recommended to ensure a comprehensive understanding of the range of options available.

Main Insights from Exploring NCM Investment’s Tradable Assets

Exploring the broker’s tradable assets reveals a well-balanced selection suitable for various trading strategies. The broker offers access to major and minor currency pairs, commodities, global indices, and CFDs, giving traders the flexibility to diversify across markets.

This range supports both short-term trading and longer-term investment approaches.

Leverage Options at NCM Investment

Leverage is one of the most popular trading tools that allows Forex traders to enter the market with limited capital and gain greater exposure.

However, traders should understand that it can result in substantial gains or losses. Therefore, they must have a comprehensive understanding of how the multiplier operates and its potential consequences before engaging in any trading activities involving leverage.

NCM Investment leverage is offered according to the CMA, Labuan FSA, SCA, CMB, and JSC regulations:

- Mena region’s traders are eligible to use a maximum of up to 1:100 for major currency pairs while trading with NCM Investment, which is considered high leverage since the majority of world popular regulations limit it to 1:30.

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at NCM Investment

Clients of NCM Investment can deposit funds into their trading accounts using the KNET credit/debit card funding option. However, traders should understand that the requirements and limitations associated with funding methods may differ based on the financial institution and the client’s country of residence.

NCM Investment Minimum Deposit

To open a live trading account with the broker, you need to deposit $3000 as an initial deposit amount, which is considered high compared to the industry average.

Withdrawal Options at NCM Investment

Traders can expect a smooth and quick withdrawal process with NCM Investment, enabling them to access their funds efficiently. However, conditions usually vary by the payment provider and might take several days to appear in your account.

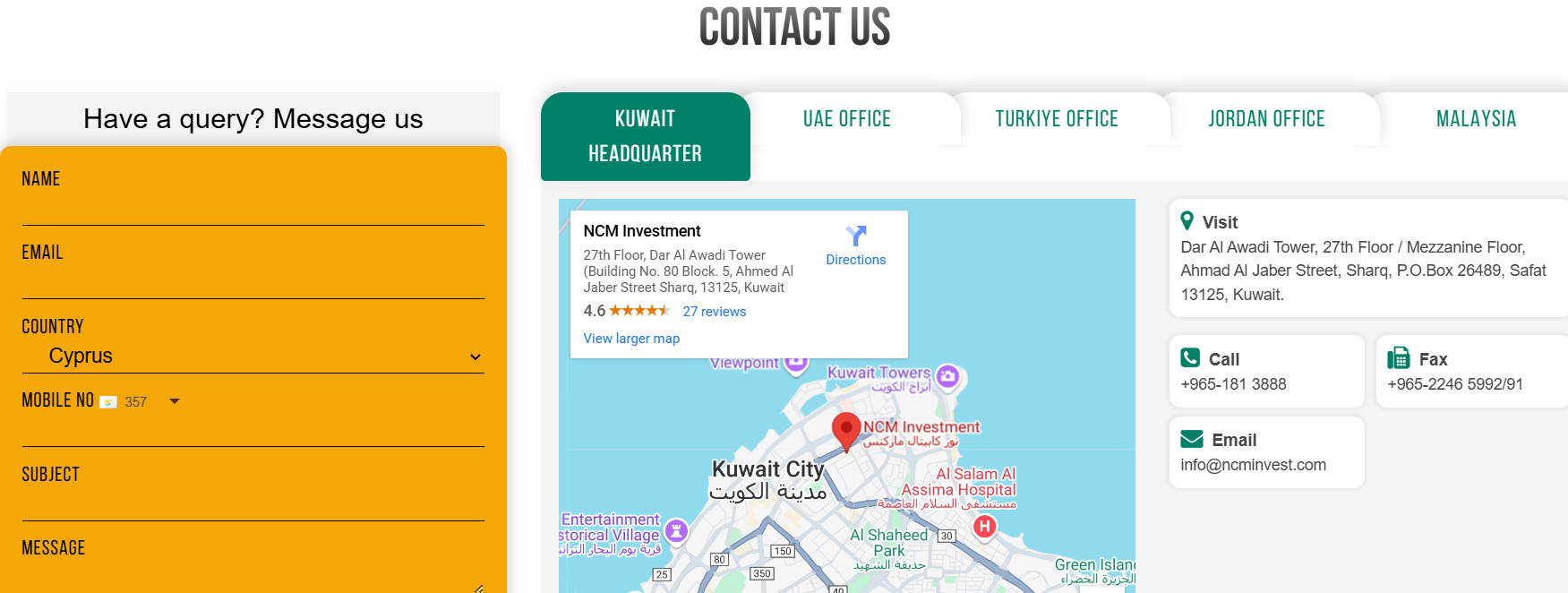

Customer Support and Responsiveness

Score – 4.5/5

Testing NCM Investment’s Customer Support

Traders can access 24/6 customer support through Live chat, Email, Phone, and Social Media channels. We found that the company has a team of experienced trading specialists who are available to help clients with various issues. These include technical problems, market analysis advice, general inquiries, operational concerns, and more.

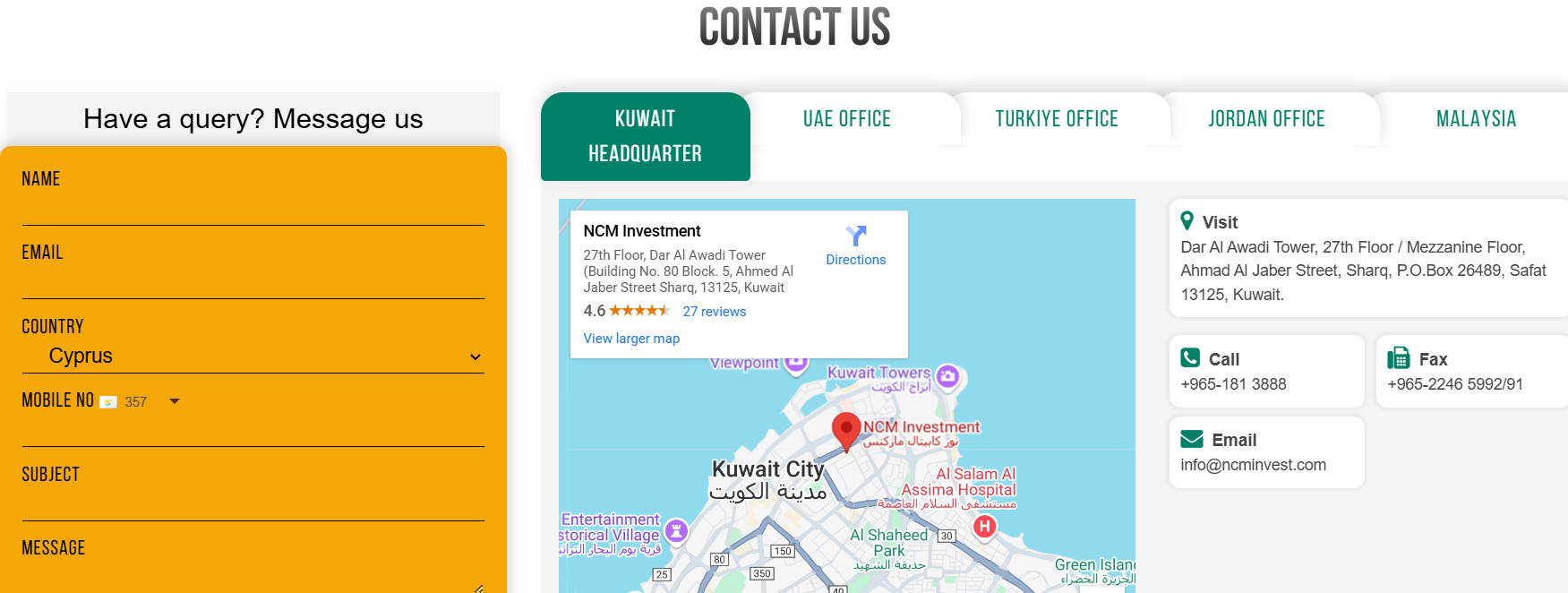

Contacts NCM Investment

NCM Investment offers several ways to get in touch. Clients can reach support via email at info@ncminvest.com or call regional offices, including +965 1813888 (Kuwait), +971 4 5952 888 (UAE), +962 6 5622404 (Jordan), +90 212 280 6666 (Turkey), and +60 8 758 2900 (Malaysia).

Research and Education

Score – 4.4/5

Research Tools NCM Investment

NCM Investment provides traders with a range of research tools accessible both via its website and the MT5 platform.

- On the website and MT5 desktop, clients benefit from live market news, expert analysis, and a fully integrated economic calendar, delivering timely data that supports informed trading decisions.

- The MT5 also offers a range of trading tools that include advanced charting features and technical indicators.

- Moreover, the platform facilitates automated trading using Expert Advisors (EAs) and algorithmic trading.

Education

The broker offers its NoorCM Academy, which serves as a valuable educational hub. Traders can access a wide range of educational resources, including webinars, workshops, research and analysis materials, an economic calendar, market news, E-Books, and more.

These resources are designed to help traders expand their knowledge of trading and equip them with the necessary information to make informed decisions in their trading activities.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options NCM Investment

Investment is not exactly the main objective of the broker. NCM Investment’s proposal is designed particularly for Forex and CFD trading, which is different from Investment Portfolio firms.

Account Opening

Score – 4.4/5

How to Open NCM Investment Demo Account?

To open a NCM Investment demo account, simply follow these steps:

- Visit the NCM Investment website.

- Select “Open Demo Account.”

- Fill in your details, submit the form, and you will instantly receive login credentials.

- Download and log into MT5 or use the Web Terminal to start trading in a risk-free demo environment.

You will have access to the full range of trading instruments, real-time quotes, charts, and tools, perfect for testing strategies before moving to a live account.

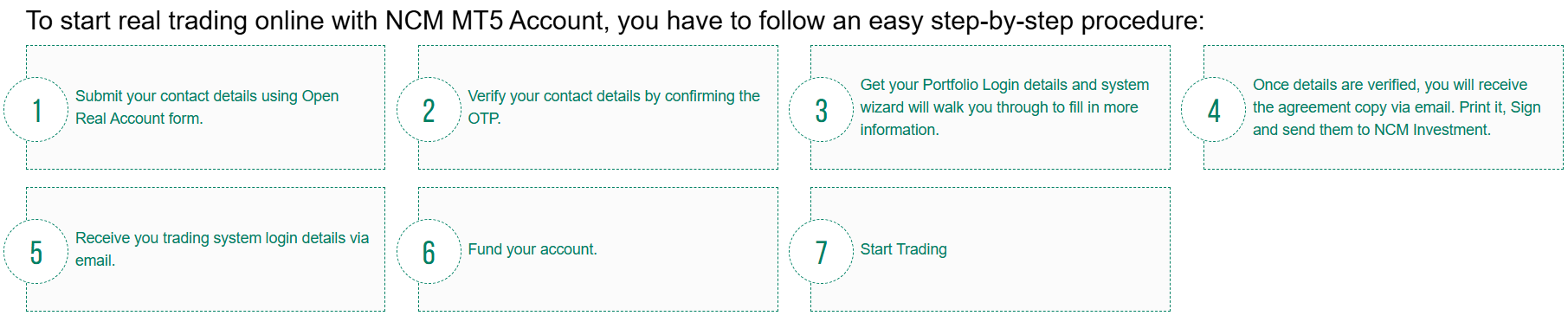

How to Open NCM Investment Live Account?

Opening an account with a broker is quite easy. You can open the account within minutes. Follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Real Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to standard research tools, NCM Investment provides several extra features to enhance the trading experience.

- These include real-time price alerts, one-click trading, order execution history, and advanced risk management tools integrated within the MT5 platform.

- The broker also offers multi-terminal access, allowing traders to manage multiple accounts simultaneously, a useful feature for advanced traders. These tools collectively contribute to a more efficient and informed trading environment.

NCM Investment Compared to Other Brokers

NCM Investment offers competitive trading conditions, although its minimum deposit requirement is notably higher than that of many competitors, which may be a drawback for beginner traders.

Compared to other brokers, the broker offers reliable spread-based accounts that align with industry standards, however, it does not provide commission-based account options like some competitors.

While its platform offering centers on MT5, which is very popular in the industry, some competitors provide additional platforms or integrations such as TradingView or proprietary solutions, offering more variety for different trader preferences.

The broker also delivers strong educational resources, which is a key advantage over certain competitors with more limited learning materials. Overall, NCM Investment caters to traders looking for a reliable trading environment; however, due to its high deposit amount, it may appeal more to experienced traders or those with higher initial capital.

| Parameter |

NCM Investment |

TastyFX |

Tickmill |

Colmex Pro |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1 pip |

Average 0.8 pips |

Average 0.1 pips |

Average 4 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

None |

None |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5 |

tastyfx, MT4, TradingView, ProRealTime |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

200+ instruments |

80+ currency pairs |

180+ instruments |

28,000+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CMA, SCA, Labuan FSA, CMB, JSC |

CFTC, NFA |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/6 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$3000 |

$100 |

$100 |

$500 |

$50 |

$0 |

$0 |

Full Review of Broker NCM Investment

NCM Investment is a multi-regulated Forex trading broker offering access to popular trading instruments across Forex, commodities, indices, and CFDs. It supports the advanced MetaTrader 5 platform for web, desktop, and mobile, providing traders with powerful tools such as technical indicators, risk management features, and real-time analytics.

The broker maintains a transparent fee structure with no deposit, withdrawal, or inactivity charges and provides flexible account options that are suitable for different trading styles.

Educational resources and research tools are also well-integrated, helping traders enhance their financial knowledge. NCM Investment also provides a demo account for practice and supports clients with responsive 24/6 customer service.

Share this article [addtoany url="https://55brokers.com/ncm-investment-review/" title="NCM Investment"]