- What is Moneta Markets?

- Moneta Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Moneta Markets Compared to Other Brokers

- Full Review of Broker Moneta Markets

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Moneta Markets?

Moneta Markets is a CFD and Forex trading company based in South Africa, with over 10 years of experience in the global financial market. We found that the broker offers access to more than 1000 trading products and has served over 70,000 clients worldwide, equaling over $1.5 million in trades per month. The broker offers multiple advanced platforms equipped with innovative tools and features.

Moneta Markets is authorized and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and holds additional licenses in Seychelles and Saint Vincent and the Grenadines.

Moneta Markets Pros and Cons

Moneta Markets is a well-established broker offering competitive trading fees and spreads starting from 0.0 pips. Our research shows that the broker offers its clients a diverse selection of trading instruments through the widely used MT4 and MT5 platforms. Also, the broker offers the PRO Trader platform and a newly introduced App Trader. Clients can choose between ECN and STP accounts for their trading needs and styles.

For the cons, the trading conditions might vary based on the entity, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Regulated broker with good trading conditions | Conditions might vary based on the entity |

| MT4 and MT5 trading platforms | No 24/7 customer support |

| Additional PRO Trader and APP Trader platforms | |

| STP execution model | |

| FSCA license and oversight | |

| Over 1000+tradable products | |

Moneta Markets Features

Moneta Markets is a well-regulated broker with multiple licenses and over a decade of presence in the market. It offers multiple platforms, well-defined and tailored account types, and a wide selection of instruments across 6 financial assets. Based on our thorough research, below you can see the breakdown of the main aspects of trading with Moneta Markets:

Moneta Markets Features in 10 Points

| 🗺️ Regulation and License | FSCA, Saint Lucia IBC Registry |

| 🗺️ Account Types | Direct STP, Prime ECN, Ultra ECN |

| 🖥 Trading Platforms | MT4, MT5, PRO Trader, APP Trader |

| 📉 Trading Instruments | Forex, Share CFDs, Indices, Commodities, ETFs, Bonds |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1.2 Pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, NZD, SGD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Moneta Markets For?

Based on our financial expert opinions, Moneta Markets offers beneficial trading opportunities backed up by strict regulatory oversight and over 10 years of experience in the market. Our findings show that the broker is good for the following:

- International traders

- Clients from South Africa

- Those who prefer MT4 and MT5 trading platforms

- Beginners

- Advanced traders

- CFD and currency trading

- Copy trading

- Scalping/Hedging strategies

- ECN/STP execution

- Muslim clients

- Competitive spreads and costs

- Supportive customer support

- EA/Auto trading

Moneta Markets Summary

Moneta Markets appears to be a reputable broker that provides access to a wide range of trading instruments, including CFDs and Forex, with low spreads and high leverage ratios. Additionally, the broker supports popular trading platforms, including MT4 and MT5, which provide clients with multiple tools and features for manual and automated trading. Clients also have access to PRO Trader and APP Trader.

Moneta Markets also provides multilingual customer support and good research and educational resources, including a comprehensive economic calendar and market news. However, we noted that Moneta Markets does not include webinars and seminars, which could be helpful for novice traders.

55Brokers Professional Insights

According to our test trade, Moneta Markets offers competitive and transparent trading conditions suitable for traders of all levels. Traders can benefit from a variety of trading services with low spreads and fees, which we found mainly innline with industry competitors too. As benefit, you may choose between trading fee options based on spread or commission. The trading instruments selection in also good, so those looking for portfolio diversification might find broker a fit.

THe software offering inlcudes MT4 and MT5 platforms, also PRO Trader or APP Trader developed by Moneta Markets, if you look for copy trading app for those who prefer mirroring successful trades and gaining profit without much engagement, welcome too. Lastly, we admit a low deposit requirement of $50 for its Direct STP and Prime ECN accounts, enabling cost-conscious traders access to the best market conditions with an initial low investment. Besides, clients can get a 50% cashback bonus for their deposits, if available at the time of your signing so is benefit too.

Overall, broker’s proposal is quite good with research and education sections at good level, with lots of essential tools and materials that can enhance the overall trading experience. The only point to consider is that the broker operates through offshore entities as well, with lower safety measures in place. Besides, trading conditions from entity to entity can be different.

Consider Trading with Moneta Markets If:

| Moneta Markets is an excellent Broker for: | - Beginner and intermediate traders

- Scalpers and automated traders

- Copy traders

- Cost-conscious traders

- MT4 and MT5 enthusiasts

- Forex and CFD traders

- Clients who prefer alternative platforms, such as PRO Trader

- Muslim traders

- Mobile traders

- |

Avoid Trading with Moneta Markets If:

| Moneta Markets is not the best for: | - Long-term investors

- Clients looking for Tier-1 regulation

- Clients looking for fixed spreads

- Beginner traders looking for webinars and seminars

- Stock traders |

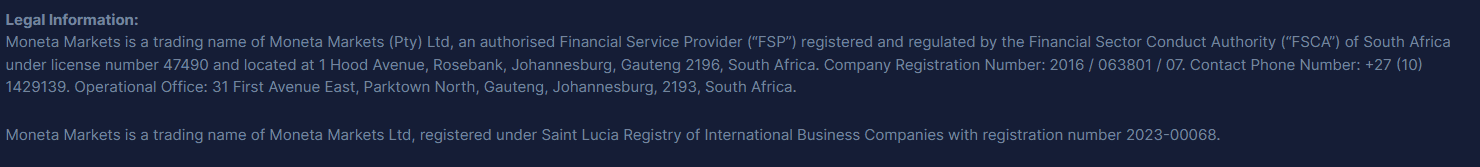

Regulation and Security Measures

Score – 4.4/5

Moneta Markets Regulatory Overview

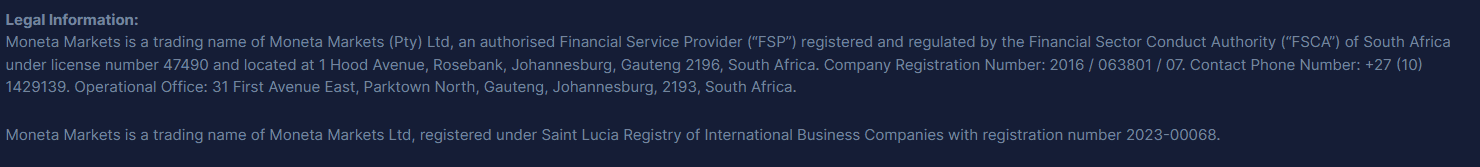

Moneta Markets is a regulated broker established in South Africa, authorized and regulated by the FSCA regulatory body. In addition, we discovered that Moneta Markets has obtained licenses in the offshore zone, which makes the broker accessible to global traders.

- Besides, Moneta Markets is a trading name of Moneta Markets Ltd. and is registered and authorized under the Saint Lucia Registry of International Business Companies with the 2023-00068 registration number.

How Safe is Trading with Moneta Markets?

We discovered that Moneta Markets keeps clients’ funds separate from its accounts and does not use them for business purposes. The broker also provides negative balance protection, which means that clients’ accounts cannot go into negative balance, even in cases of extreme market volatility or unforeseen events.

Consistency and Clarity

We have also reviewed Moneta Markets from the viewpoint of its consistency. The broker has been in the market for about a decade, and during the years of its operation, it has obtained over 70,000 active traders and the trust of global clients. The broker is also transparent in its offerings, providing clients with clear conditions and possible trading charges.

Besides, Moneta Markets has won a range of awards from reputable industry organizations, which serve to prove the broker’s credibility. We have also considered clients’ feedback, both positive and negative, to see what traders share about their real experiences with Moneta Markets. From the positive reviews, many clients point out the intuitive interface of the trading platforms, a good range of instruments across multiple financial assets, and responsive customer support. On the contrary, negative reviews point out limited payment methods. All in all, the feedback from clients is mostly positive, pointing out different positive aspects of trading with Moneta Markets.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Moneta Markets?

Our research has revealed that Moneta Markets offers three types of accounts: Direct STP, Prime ECN, and Ultra ECN accounts, with USD, AUD, EUR, GBP, SGD, and other currencies available for trading. Moneta Markets offers swap-free accounts as well, also known as Islamic accounts, for its Muslim clients. The broker also offers a demo account for practicing trading before switching to live accounts with real investments.

All the account types give access to over 1,000 trading instruments via the MT4, MT5, Pro Trader, and APP Trader platforms. Direct STP and Prime ECN accounts offer high leverage up to 1:1000.

- The Direct STP account is a spread-based account with spreads from 1.2 pips with no commissions. The account type is tailored for beginner clients, with an initial deposit of $50.

- The Prime ECN account is a commission-based account with spreads from 0.0 pips combined with commissions of $3 per lot per side. The account is especially suitable for scalpers and EAs.

- At last, the Ultra ECN account is a good choice for professional traders and money managers, with specific trading conditions and features. The minimum deposit is higher and starts from $20,000. The account is commission-based with variable spreads from 0.0 pips. The commission applied per lot per side is $1. The available leverage is 1:500.

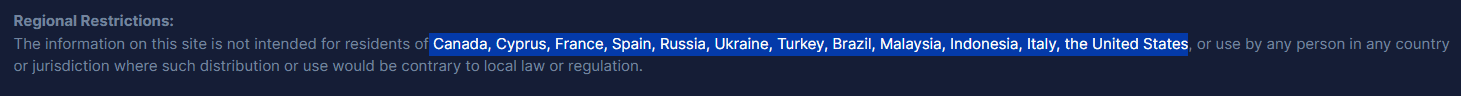

Regions Where Moneta Markets is Restricted

Although Moneta Markets is available globally and accepts clients from a wide range of countries, there are still restrictions, and the broker does not accept residents from certain countries or regions due to regulatory limitations.

- Canada

- Cyprus

- France

- Spain

- Russia

- Ukraine

- Turkey

- Brazil

- Malaysia

- Indonesia

- Italy

- The United States

Cost Structure and Fees

Score – 4.5/5

Moneta Markets Brokerage Fees

Moneta Markets has competitive fees based on the account type selected. According to our research, the broker offers transparent fees that are average or lower than the market average. The broker does not impose any deposit or withdrawal fees. However, any additional fees charged by banks and intermediaries involved will be at the trader’s expense. Typically, an international bank wire transfer incurs a cost of $25.

Moneta Markets offers low floating spreads starting from 0.0 pips on Prime ECN and Ultra ECN trading accounts. Our testing found that the average spread for EUR/USD in Forex trading for the spread-based Direct STP account is 1.2 pips.

- Moneta Markets Commissions

The broker offers 2 commission-based accounts with different costs. The Prime ECN account combines spreads from 0.0 pips with $3 commissions per lot per side. The Ultra ECN account offers floating spreads from 0.0 pips with lower commissions of $1 per lot per side.

How Competitive Are Moneta Markets’ Fees?

Based on our research, Moneta Markets offers competitive fees that are mostly lower than the market average. The broker offers floating spreads that start from 0.0 pips for the commission-based accounts. The commissions are different based on the account type. On the other hand, the spread-based accounts include all the trading costs and offer average fees. For the popular EUR/USD pair, the spread is 1.2 pips, while the gold spread is 2.20 pips.

Based on our research, professional clients who prefer fixed commissions on each trade, by opening the Ultra ECN account, gain access to spreads from 0.0 pips, combined with very low fixed commissions of $1. This is a beneficial offering, enabling advanced clients to access efficient trading costs and get the most out of trading.

| Asset/ Pair | Moneta Markets Spread | Mitrade Spread | ThinkMarkets Spread |

|---|

| EUR USD Spread | 1.2 pips | 0.6 pips | 1.1 pips |

| Crude Oil WTI Spread | 1.60 pips | 1.33 | 0.03 |

| Gold Spread | 2.20 pips | 0.31 | 19 cents |

| BTC USD Spread | 20.30 pips | 0.42 | 12 USD |

Moneta Markets Additional Fees

Moneta Markets offers a few non-trading fees that are common in the market. First, the broker charges overnight fees for positions held open for more than a day. The swap rates are available on the trading platforms.

- Besides, when it comes to additional charges, traders should be careful while making deposits and withdrawals. The broker does not charge any funding fees, yet the payment providers can still incur certain fees. As we have found for withdrawals, there is a $25 charge for wire transfers.

- The good news is that Moneta Markets does not charge an inactivity fee or a maintenance fee, which is a benefit that many brokers do not offer.

Score – 4.5/5

Based on our research, Moneta Markets offers its clients a selection of widely used trading platforms, including the industry-popular MetaTrader 4 and MetaTrader 5, as well as APP Trader and Pro Trader. The available platforms are available in web, mobile, and desktop versions, providing traders with flexibility in accessing their accounts and trading tools.

| Platforms | Moneta Markets Platforms | Mitrade Platforms | Fusion Markets Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Moneta Markets Web Platform

Moneta Markets gives easy access to the market via any browser, with no need for installations or downloads. The broker’s MetaQuotes WebTrader platform gives clients access to over 1,000 products, 30 trading indicators, analytical tools, and one-click trading. Users can access the platform through any operating system, ensuring flexibility and easy access. The web platform enables traders to benefit from the essential features the desktop platform offers and trade with ease and convenience.

Moneta Markets Desktop MetaTrader 4 Platform

The MT4 platform, one of the most popular retail platforms, enables clients to access global markets with powerful tools. Traders can access over 1,000 trading instruments and use 40+ built-in indicators, charts, and graphs. Besides, users can code their own indicators and automate trading systems with EAs. The platform ensures ultra-fast execution, 24/5 support, and access to the MT4 MultiTerminal to manage multiple accounts at the same time. The platform is also easily integrated with the broker’s PRO Trader, enabling traders to trade on either platform.

Moneta Markets Desktop MetaTrader 5 Platform

The MT5 platform is a great choice for those who are looking for more functionality and access to innovative tools. The platform enables traders to access the global market with enhanced features, including over 30 built-in indicators, advanced charts and graphs, and order management tools, including market, limit, and stop-loss orders. Users also have access to 21 timeframes, an integrated economic calendar, trading history, and the capability to build automated strategies through the MQL5 programming language. Like the MT4 platform, the MT5 is also smoothly integrated with the broker’s PRO Trader, enabling users to switch between the platforms of their choice.

Moneta Markets PRO Trader

Moneta Markets’ PRO Trader is a simple but powerful web-based solution to meet the needs of both beginner and professional traders. The platform offers over 100 built-in indicators, 12 chart types for in-depth analysis, risk-management tools, customizable charting modes, and access to over 1000 trading instruments, including forex, indices, commodities, share CFDs, and ETFs. The platform is also integrated with the MT4 and MT5 platforms, which is an advantage, enabling clients to access the platform of their choice whenever they like.

Moneta Markets APP Trader

Moneta Markets has introduced a new app that gives traders access to global markets and an opportunity to benefit from the advanced features from the palm of their hands, from anywhere. The app integrates all the important tools so users can access all the features available through the desktop or web platforms. The app is available on iOS and Android devices, making it easily accessible. The app platform is user-friendly, with a clear and easy-to-use interface, multiple charts and trading indicators, and good risk-management tools. This is a flexible choice for clients to manage their trades with freedom.

Main Insights from Testing

We have tested Moneta Markets’ platforms to see how they accommodate trading. Our verdict is positive based on the broker’s advanced platforms and powerful features that meet the trading expectations of different clients. Beginners will have no problem navigating the platforms due to their ease of use and simple interface, while more professional users can utilize innovative features to further explore the market. In addition to the popular retail platforms MT4/MT5, Moneta Markets offers PRO Trader and APP Trader, giving more choice and flexibility to trades. All the platforms enable access to more than 1,000 trading instruments without restrictions.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Moneta Markets Platform?

Moneta Markets provides access to more than 1000 trading instruments across Forex, Share CFDs, Indices, Commodities, ETFs, Bonds, and Crypto CFDs, with spreads starting from 0.0 pips. Traders can access the whole package of instruments via all the available platforms, without any restrictions.

Here is a more detailed breakdown of the broker’s available tradable products:

- 45 major, minor, or exotic Forex pairs

- About 15 of the most popular commodities, including oil, gold, gas, coffee, oranges, and juice

- Global indices, such as the SP500, FTSE, DAX, NIKKEI, and HANG SENG

- Over 635 UK, US, and European shares CFDs, including Apple, Deutsche Bank, Vodafone, Amazon, Google, and more

- 50+ of the world’s most popular ETFs

- 7 most popular bonds from the world’s leading economies

Main Insights from Exploring Moneta Markets’ Tradable Assets

Moneta Markets offers an extensive range of trading instruments across 6 asset classes, enabling traders’ exposure to the market and a chance to diversify trades and try new opportunities. The costs and overall trading conditions with Moneta Markets are also good, enabling them to trade in a safe environment via advanced platforms and with efficient charges.

Based on our findings, although the broker’s proposal is appealing, it offers products based on CFDs. This means traders can only speculate on the underlying asset rather than own the product. For short-term trades, this is a beneficial solution. Yet long-term investors who prefer traditional investments will not benefit from Moneta Markets’ offering.

Leverage Options at Moneta Markets

Using leverage in trading can enable traders to increase their trading size and potentially make more profits. However, it is important to note that leverage can also work in reverse and result in substantial losses. Therefore, we highly recommend traders take the time to understand how to use leverage properly.

Moneta Markets’ leverage is offered according to the FSCA and Saint Lucia regulations:

- The minimum leverage is 1:33 for share CFDs, 1:50 for soft commodities, and up to 1:1000 for Forex, indices, and metals.

- The leverage also depends on the chosen account type: up to 1:1000 for Direct STP and Prime ECN accounts and up to 1:500 for Ultra ECN.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Moneta Markets

While trading with Moneta Markets, you have the option to fund your account via your Client Portal through various funding methods, including bank wire, credit/debit cards, Skrill, Neteller, etc. It is important to note that certain funding methods may vary based on banks and other entities.

- Note that international wire transfers might include certain fees applied by the bank that the company does not cover and are solely the client’s responsibility.

- There is a restriction on the maximum deposit of not more than $1,000 by card.

- Besides, some funding methods might be unavailable depending on the account base currency or jurisdiction.

Minimum Deposit

Based on our research, the minimum deposit requirement for the broker’s Direct STP and Prime ECN accounts is $50. For the Ultra ECN account, the minimum funding requirement is $20,000.

Withdrawal Options at Moneta Markets

Clients of Moneta Markets can easily and quickly withdraw their funds by accessing their Client Portal. The processing time for the withdrawal may vary depending on the chosen method, but generally, it takes from 1 to 3 business days.

- Note that to submit a withdrawal request, clients should use the same method and account details used for deposits.

- The bank wire transfers apply a minimum $20 fee, which is usually deducted from the withdrawal amount.

Customer Support and Responsiveness

Score – 4.6/5

Testing Moneta Markets Customer Support

We got in our test that Moneta Markets offers 24/5 multilingual customer support through Live Chat, International Phone Lines, and Email. Based on our experience, the broker’s support service delivers dedicated and prompt responses, providing detailed answers to clients’ questions and answers.

- Moneta Markets also includes an FAQ section where traders can quickly find answers to the most common trading-related questions.

Contacts Moneta Markets

Moneta Markets provides 24/5 customer support, assisting clients with issues they encounter while trading with the broker.

- The broker provides a UK phone number, +44 (113) 3204819, and an international phone line, +61 2 8330 1233, making the service easily reachable. Those clients who prefer direct contact with the support team will prefer using the phone option.

- Traders can also send an email with their inquiries and questions to the provided address: support@monetamarkets.com. Usually, the answers are quick and prompt.

- The live chat is the quickest way to contact Moneta Markets’ support team and get almost instant answers.

- Besides, the broker is available through social platforms, including LinkedIn, Facebook, IG, X, and YouTube.

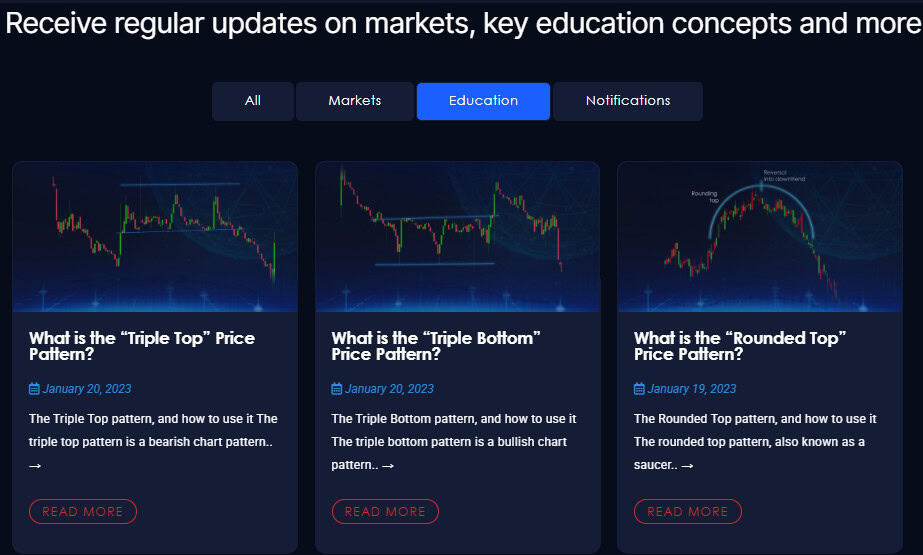

Research and Education

Score – 4.4/5

Research Tools Moneta Markets

Moneta Markets offers a really impressive research section with extensive tools and features for in-depth analysis and a better understanding of the market.

Based on our research, Moneta Markets offers the following research tools:

- Forex trading calculators assist traders in calculating values in real-time market-based prices. The calculations are made in an instant, helping clients to make smart trading decisions.

- The economic calendar is another essential tool that informs traders about the coming events and how these events will affect the market.

- The market updates section offers key event breakdowns, giving traders a professional insight into the market.

Education

Although Moneta Markets’ education section does not include an extensive selection of materials and features, such as webinars or seminars, educational articles, or courses, it still provides important resources that would come in handy for beginner and professional clients.

- Access to the Forex glossary is essential for traders, as the knowledge of the basic terms enables a better understanding and orientation in the market. Complex terms can be bewildering and confusing, especially for novice traders, becoming an obstacle to successful trades.

- The Trading Education section provides valuable concepts and updates, guiding clients and assisting in decision-making.

Is Moneta Markets a Good Broker for Beginners?

The research of the broker’s main aspects of trading has led us to believe that Moneta Markets is a trustworthy and attractive choice for traders of different experience levels. The broker offers well-defined account types, excellent trading platforms, a transparent fee structure, and a low deposit requirement. Traders can also benefit from the demo account, access to good research tools and educational resources, and additional tools that enhance the trading quality. Overall, this offering is suitable for beginner traders. It will not meet the needs of only those novice clients who are looking for an extensive educational section.

Portfolio and Investment Opportunities

Score – 4.1 /5

Investment Options Moneta Markets

Moneta Markets offers an impressive range of instruments (1,000+) across a wide range of financial assets that will certainly enable traders to explore the market and expand their portfolios. This is a great opportunity for traders who want to move forward from the most popular and basic product offerings and expand their investment scope. However, despite the range of the offering, Moneta Markets offers only currency trading and CFD-based products. While many traders enjoy short-term trading opportunities and make profits, traditional investors will be restricted.

- However, clients can still invest in alternative ways. The broker’s copy trading feature via its MT4 and PRO Trader platforms enables clients to copy trades of successful professionals and profit without effort.

- Moneta Markets offers MAM accounts for high-performance traders to trade on behalf of their clients and earn profits.

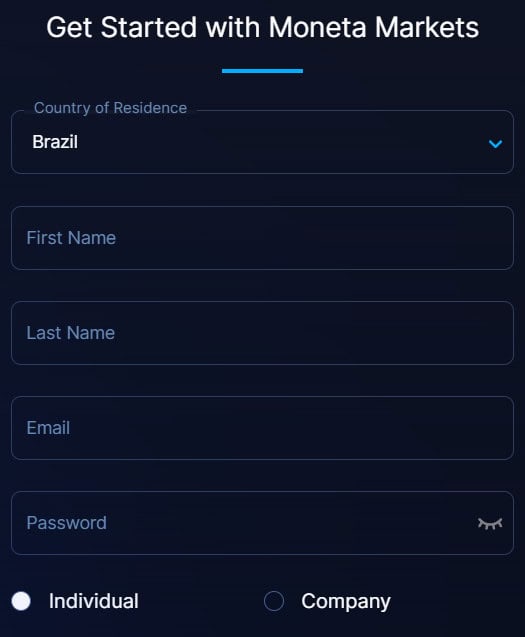

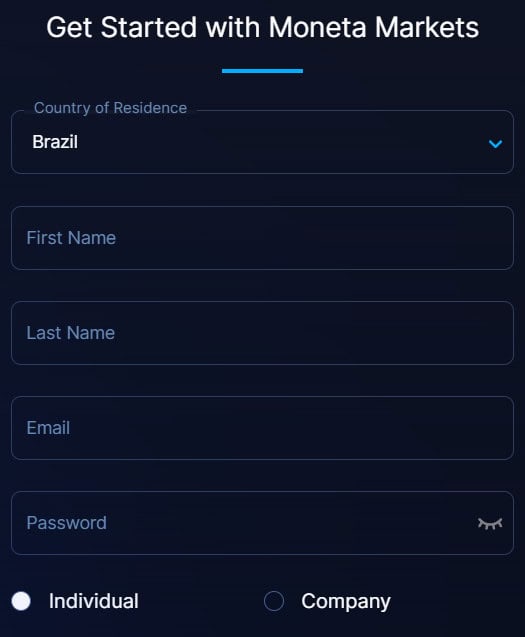

Account Opening

Score – 4.6/5

How to Open a Moneta Markets Demo Account?

Traders are encouraged to practice their skills through the demo account before starting live trading. The Moneta Markets’ demo account is available for 30 days after opening. The opening process is quick and easy and consists of the following steps:

- Go to the broker’s homepage and choose ‘Open Demo Account.’

- Complete the registration form by providing your name, phone number, email, etc.

- Create a secure password.

- Receive the login credentials after submitting the registration form. The information will be sent to the provided email address.

- Use the credentials to access your demo account.

How to Open a Moneta Markets Live Account?

Opening an account with Moneta Markets is a straightforward process. First, go to the sign-in page to select between the individual or company options, and then start the registration. You should follow the following steps:

- Select and click on the “Open Live Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 4/5

We have noticed that in addition to the extensive tools and features available on the brokers’ multiple platforms, Moneta Markets also includes a range of extra tools that will take trading experience to another level. Here are the additional features Moneta Markets offers:

- The Free Forex VPS will enable traders to keep their MT4 and MT5 platforms running 24/7. This helps traders not to miss important trading opportunities, improve execution speed, and avoid problems connected with technical issues.

- The 50% cashback bonus is a great opportunity for traders to get their funds back after the deposit. The more deposits traders make, the more cashback they get. This is a good way to encourage traders to be active and make constant deposits. To receive a cashback, traders need to deposit $500 or more.

Moneta Markets Compared to Other Brokers

We have compared Moneta Markets to other brokers to see where the broker and its offerings stand. The broker is regulated by the well-respected FSCA, giving traders peace of mind and security. FXCM is another broker with an FSCA license. However, the broker also receives regulation from top-tier FCA, ASIC, and CySEC, which enhances the credibility and safety of its offerings.

We have also reviewed Moneta Markets’ costs; with spreads from 1.2 pips for its spread-based account, the broker has an average offering, much like Eightcap, FXCM, and FxPro. Mitrade, on the other hand, has lower spreads with no commissions. The available trading platforms for Moneta Markets are the popular MT4 and MT5. The broker also offers PRO Trader and APP Trader. This is a favorable offering that competes with Forex.com and FxPro. FXTM, as we have found, offers the MT4 and MT5 platforms, while Mitrade has its own proprietary platform.

We have also reviewed the available instrument range. Moneta Markets offers more than 1,000 tradable products across 6 assets. This is an extensive offering, as most brokers have a more modest range of instruments, like Mitrade with its 400+ and FXCM with 200+ products. We have also compared educational resources. Although Moneta Markets’ research and education sections offer good tools and materials, Forex.com and FxPro still stand out for their better educational sections.

| Parameter |

Moneta Markets |

FXTM |

Forex.com |

Mitrade |

Eightcap |

FXCM |

FxPro |

| Spread-Based Account |

Average 1.2 pips |

Average 1.5 pips |

Average 1.3 pips |

From 0.6 pip |

Average 1 pip |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $5 |

Not available |

0.0 pips + $3.5 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Average |

Average |

Low/ Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, PRO Trader, APP Trader |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

Mitrade Trading Platform |

MT4, MT5, TradingView |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

1,000+ instruments |

1000+ instruments |

6000+ instruments |

400+ instruments |

800+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

FSCA, Saint Lucia IBC Registry |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, CIMA, FSC |

ASIC, SCB, CySEC, FCA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$50 |

$200 |

$100 |

No minimum deposit |

$100 |

$50 |

$100 |

Full Review of Broker Moneta Markets

Our research on Moneta Markets has shown the broker in a positive light, with favorable trading conditions and opportunities for traders of different experience levels. The broker offers a safe environment with adherence to strict laws and oversight from the FSCA. With access to 6 financial assets, the broker offers more than 1,000 trading instruments, including all the popular products, as well as rarer opportunities that enable traders to explore the market further. Trades are conducted on the popular MT4 and MT5 platforms, which are smoothly integrated with PRO Trader, another advanced platform with in-depth analysis capabilities and strong tools and features. Moneta Trader has also included an APP Trader in its offerings, taking mobile trading to another level.

Moneta Markets offers a very low initial deposit of $50, with a 50% cashback opportunity for each deposit, encouraging clients to invest and trade more actively. The education and research sections are rather impressive, enabling clients to use analysis tools and educational materials to enhance their market knowledge.

Besides, Moneta Markets offers copy trading and a MAM account, enhancing investment opportunities. Overall, the broker stands out for its consistent and transparent proposals, attracting traders globally.

Share this article [addtoany url="https://55brokers.com/moneta-markets-review/" title="Moneta Markets"]