- What is Merrill Edge?

- Merrill Edge Pros and Cons

- Regulation and Security Measures

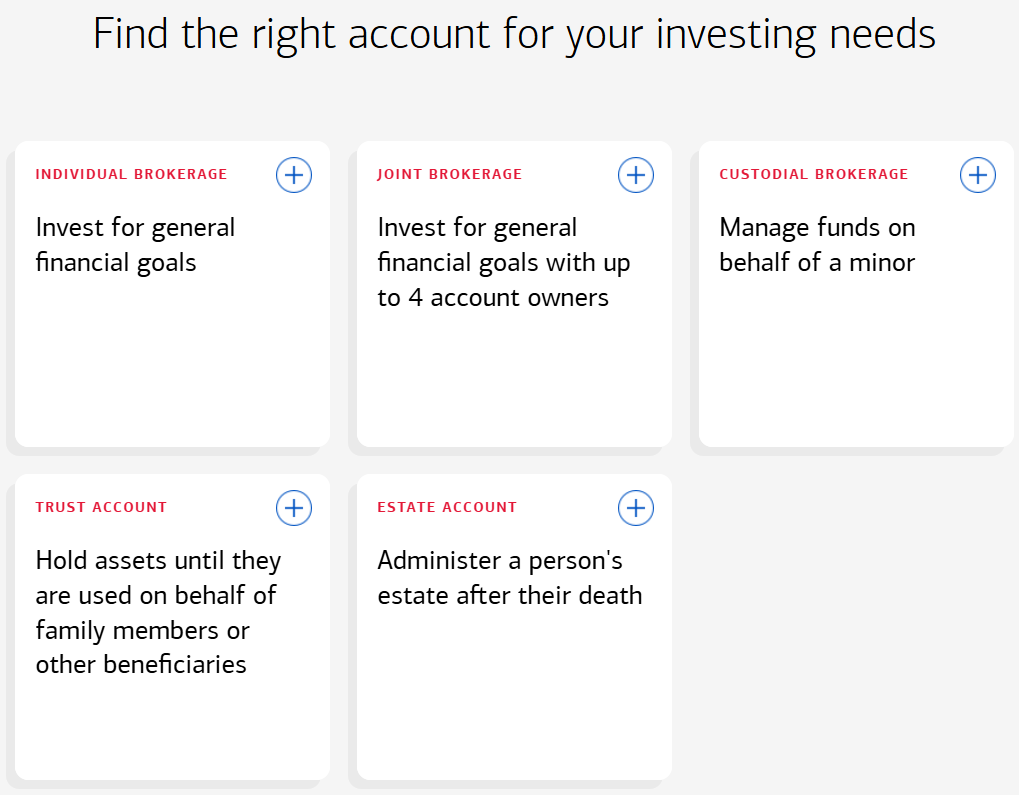

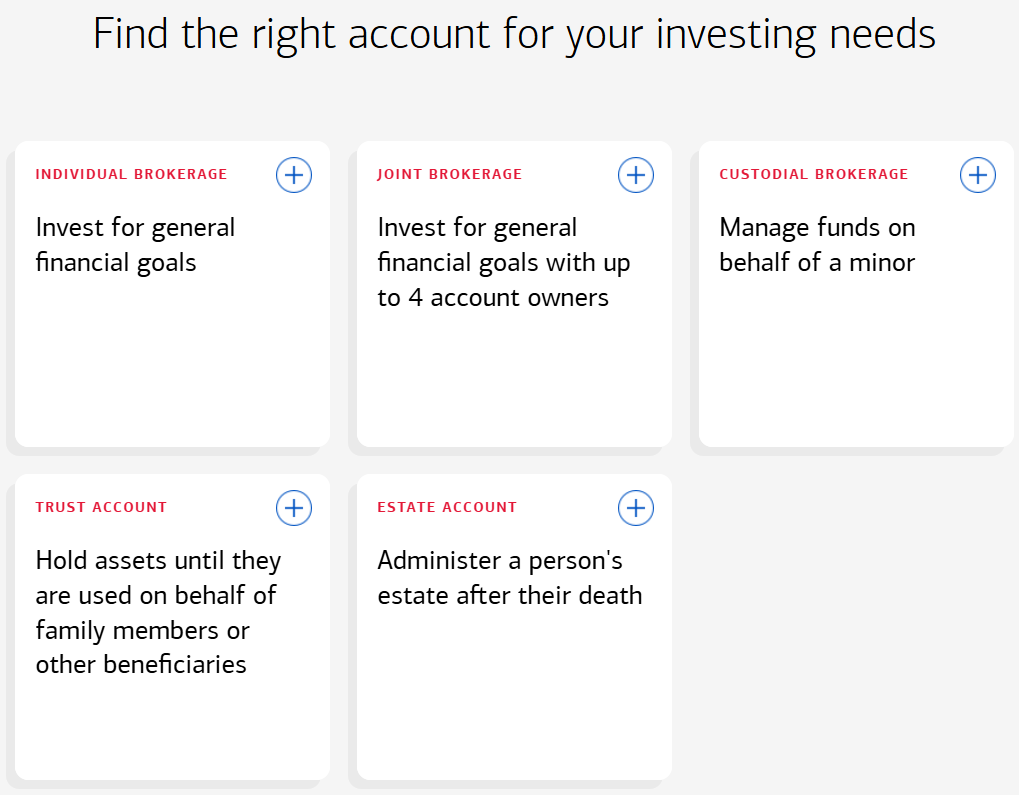

- Account Types and Benefits

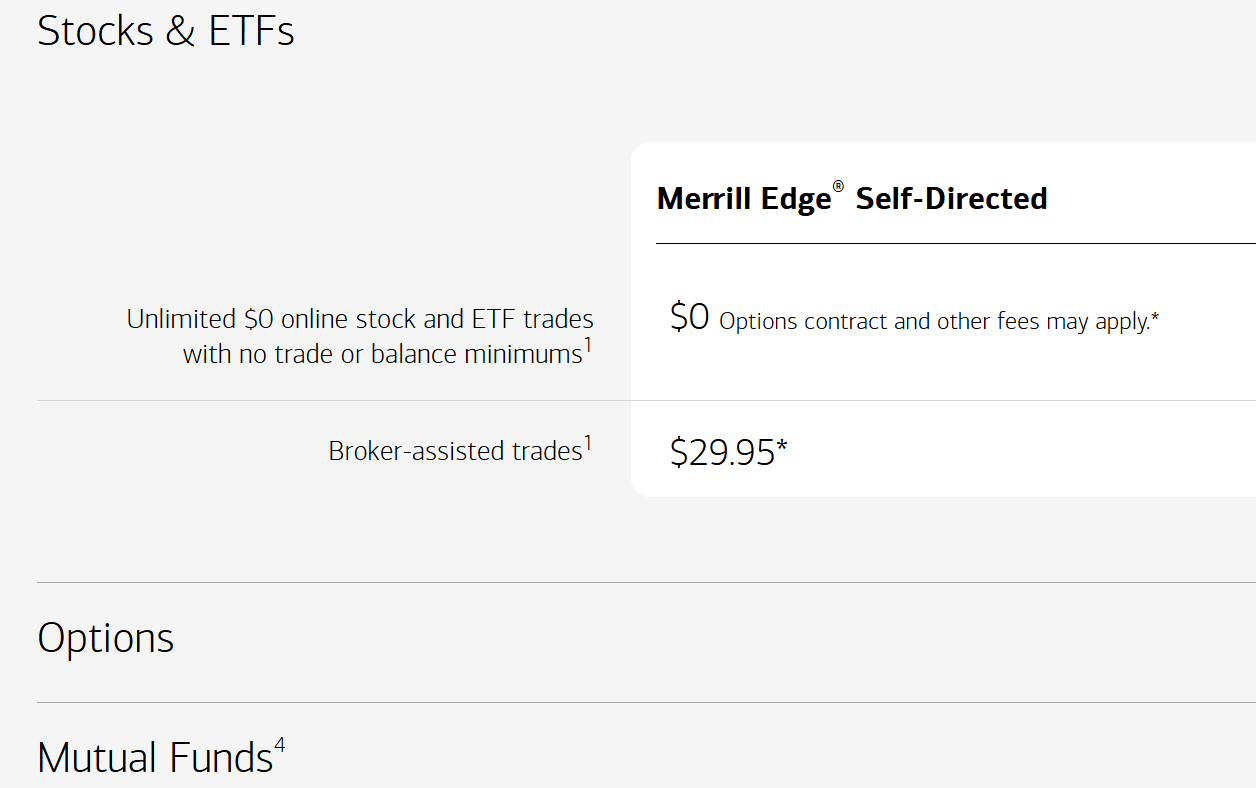

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

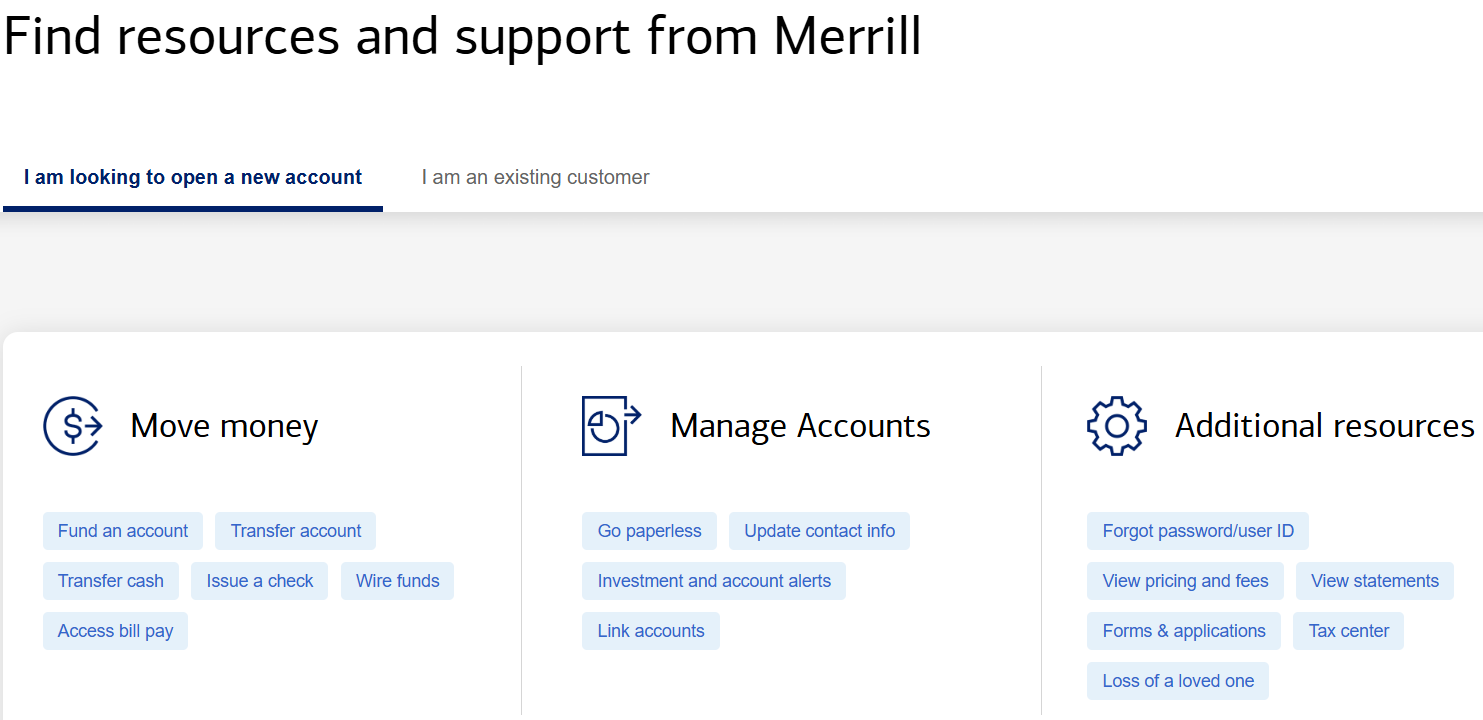

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Merrill Edge Compared to Other Brokers

- Full Review of Broker Merrill Edge

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Merrill Edge?

Merrill Edge is a Stock trading and Investing company provided by Bank of America. It allows users to manage their investment accounts, trade stocks, ETFs, options, mutual funds, fixed income, bonds, CDs, and annuities, as well as access research and educational resources.

The firm primarily serves investors in the US and adheres to strict regulatory oversight from the SEC, FINRA, and SIPC to ensure compliance with securities laws and provide transparent information.

Overall, Merrill Edge focuses on providing a convenient way for individuals to engage in self-directed investing, with tools and support to help them make informed financial decisions.

Is Merrill Edge Stock Broker?

Yes, Merrill Edge is a Stock Brokerage platform that allows users to engage in the buying and selling of stocks, bonds, and other financial securities. The firm provides traders with a range of tools and resources for market research and analysis. Additionally, the platform is known for its user-friendly interface, making it accessible for both novice and experienced investors.

Merrill Edge Pros and Cons

The firm comes with several advantages, such as a user-friendly platform, integrated research tools, and the backing of Bank of America’s resources. Moreover, the platform’s seamless integration with Bank of America accounts makes it convenient for users seeking an all-in-one financial solution.

For the cons, some traders may find the fees and commissions relatively higher compared to other online brokerages. Additionally, there is no paper trading or demo account available.

| Advantages | Disadvantages |

|---|

| SEC, FINRA, and SIPC regulation and oversee | No paper trading or demo account |

| Self-directed investing | |

| $0 minimum deposit | |

| Competitive trading conditions | |

| Good education and research | |

| US investors | |

| Secure investing environment | |

| 24/7 customer support | |

Merrill Edge Features

The firm is well-regarded for its user-friendly interface, integrated research tools, and the convenience of being linked with Bank of America accounts. Below is a comprehensive list of its key features:

Merrill Edge Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC |

| 🗺️ Account Types | General Brokerage, IRAs, Education Accounts |

| 🖥 Trading Platforms | Merrill Edge Online Trading Platform, Merrill Edge MarketPro |

| 📉 Trading Instruments | Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds, CDs, Annuities |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Investing Insights & Education, Product Education |

| ☎ Customer Support | 24/7 |

Who is Merrill Edge For?

Merrill Edge is best suited for self-directed investors and Bank of America customers who want a seamless way to manage both banking and investing. It also appeals to users seeking robo-advisory or guided investing options with relatively low minimums. Based on our findings and Financial Expert Opinions, Merrill Edge is Good for:

- Traders from the US

- Stocks and Options trading

- Investing

- Self-Directed Investing

- Advanced traders

- Professional trading

- Competitive conditions

- Good learning materials

- 24/7 customer support

Merrill Edge Summary

In conclusion, Merrill Edge offers comprehensive investment opportunities with its user-friendly trading platforms and integration with Bank of America. The firm caters to a diverse audience, providing accessible tools for new and experienced investors.

While fees are competitive, potential investors should be aware of the transaction costs associated with specific activities.

Overall, we found that Merrill Edge provides a reliable trading environment for investment; however, we advise conducting your research and evaluating whether the firm’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Merrill Edge stands out for its strong integration with Bank of America, offering a streamlined experience for clients who want to manage banking and investing in one place, great for investors or traders looking to manage of multiple tasks in one place and especially US invest or trade.

It combines robust research from Merrill Lynch, including detailed market analysis and investment insights, with user-friendly trading tools tailored to both beginners and experienced investors, so various levels of exepreince will find it easy to manage.

The platform offers commission-free trading on stocks and ETFs, with good access and diversification, as well as a wide range of investment options like mutual funds, bonds, and options. Merrill Edge also provides exceptional customer support, educational resources, and access to physical Bank of America branches for in-person assistance, making it a well-rounded choice for investors seeking reliability and convenience in one platform.

Consider Trading with Merrill Edge If:

| Merrill Edge is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Professional trading.

- Low fees and commissions.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Looking for broker with Top-Tier licenses.

- Beginner and intermediate investors.

- Looking for broker with a long history of operation and strong establishment.

- Looking for broker with 24/7 customer support.

- US investors.

- Long-term investing.

|

Avoid Trading with Merrill Edge If:

| Merrill Edge might not be the best for: | - International investors outside the US.

- Active day traders.

- Investors seeking fractional shares or cryptocurrency trading. |

Regulation and Security Measures

Score – 4.6/5

Merrill Edge Regulatory Overview

Merrill Edge is a reliable Stock trading broker that follows the strict rules and guidelines established by the SEC, FINRA, and SIPC. These Top-Tier regulations safeguard client assets and provide low-risk Stocks and Options trading.

How Safe is Trading with Merrill Edge?

Merrill Edge is a legitimate and regulated investing firm. It is authorized by respected US financial authorities and has a good reputation in the financial market.

The firm prioritizes the security and protection of its clients’ investments by adhering to regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud, unauthorized account access, and stringent identity verification processes.

Moreover, as a member of the Securities Investor Protection Corporation (SIPC), the company protects its customers up to $500,000 in equity with up to $250,000 in cash, providing an additional layer of security. However, investors should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their trading protection further.

Consistency and Clarity

Merrill Edge has built a strong reputation as a reliable and well-established broker, consistently earning high ratings from industry analysts and financial publications.

Backed by Bank of America and operating under the Merrill Lynch brand, it benefits from decades of financial expertise and trust. It regularly receives praise for customer satisfaction, ease of use, and integrated banking-investing services.

Trader reviews highlight advantages like solid research tools, responsive customer support, and educational resources, though some note drawbacks such as the lack of cryptocurrency or fractional share trading.

Merrill Edge has also received multiple awards, including Best Online Broker recognition from NerdWallet and Investopedia. Beyond performance, the broker is active in social responsibility through financial literacy programs, community outreach, and Bank of America’s broader sponsorships in education and environmental causes.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Merrill Edge?

Merrill Edge offers a variety of account types to support different financial goals, including general brokerage accounts for self-directed investing, a full range of IRAs for retirement planning, and education savings accounts like 529 plans and custodial UGMA/UTMA accounts.

This flexibility allows investors to manage everyday investments, plan for retirement, and save for education—all within a trusted, Bank of America-integrated platform.

Brokerage Account

Merrill Edge’s Self‑Directed brokerage account requires no minimum deposit to open and carries no ongoing account balance requirements, accessible to beginning investors and those with limited capital.

You can trade stocks, ETFs, bonds, mutual funds, and options with $0 online commissions for stocks and ETFs and receive access to high-quality BofA Global Research and tools like MarketPro at no extra cost.

Regions Where Merrill Edge is Restricted

Merrill Edge accounts are restricted to U.S. residents and U.S.-based businesses. Non-U.S. residents and non-U.S.-based entities are not eligible to open a Merrill Edge Self-Directed Investing account.

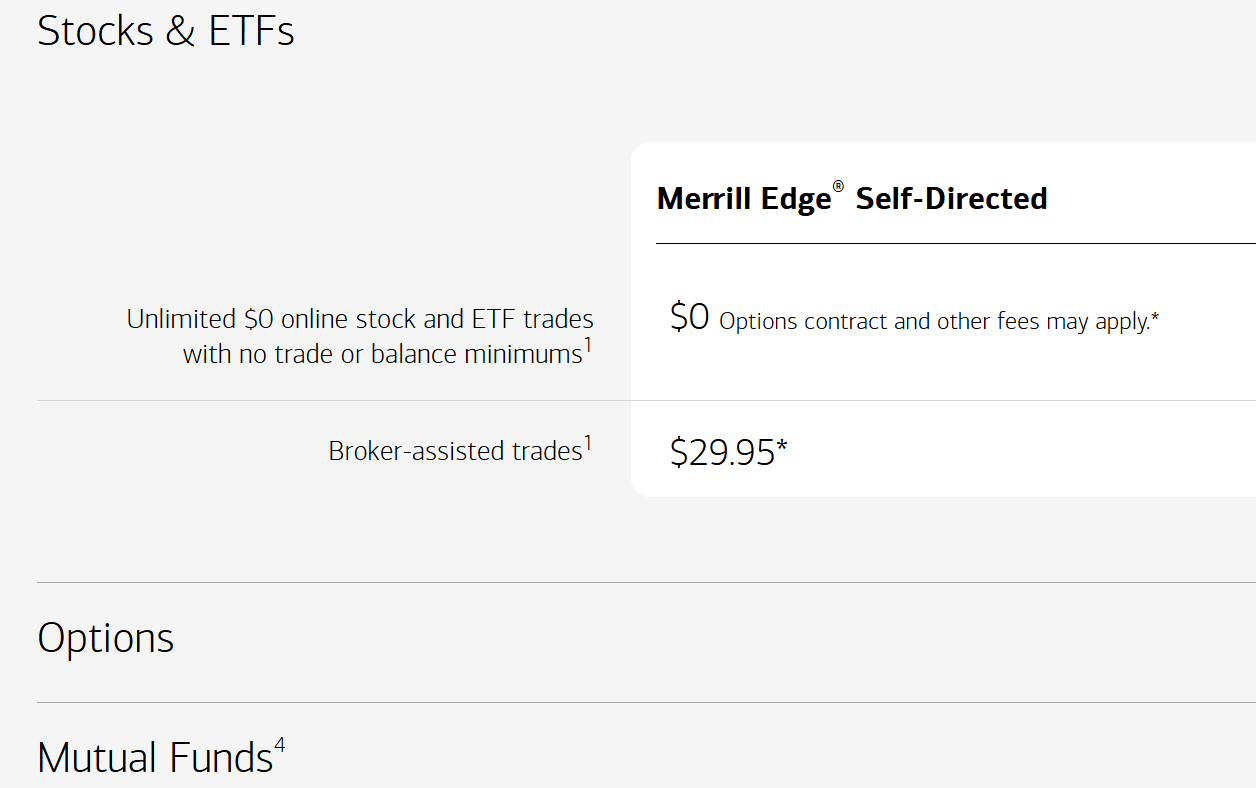

Cost Structure and Fees

Score – 4.7/5

Merrill Edge Brokerage Fees

The firm, like any brokerage platform, has a fee structure that users should be aware of. While the platform offers free trade for stocks or ETFs, other fees may apply. These may include fees for broker-assisted trades, specific mutual funds, and certain account services.

For specific details on fees, you should carefully review Merrill Edge’s fee schedule to understand the cost implications of its trading and investment activities on the platform.

Merrill Edge implements a commission structure that caters to various trading preferences. For stock and ETF trades, the platform offers commission-free transactions, aligning with the industry trend. However, you should be aware of potential charges for other services.

Understanding Merrill Edge’s trading commission details is crucial for investors to make informed decisions and manage costs effectively while navigating the financial markets.

- Merrill Edge Exchange Fee

Merrill Edge does not charge commissions on online stock and ETF trades, but like all U.S. brokers, it passes through exchange and regulatory fees mandated by agencies such as the SEC and FINRA.

These fees apply only to sell transactions and are minimal, typically around $0.01 to $0.03 per $1,000 of trade value. For options trades, in addition to a $0.65 per-contract fee, similar regulatory charges are applied on the sell side.

These costs, including the SEC Fee, FINRA Trading Activity Fee, and OCC Fee for options, are standard across the industry and not retained by Merrill Edge.

- Merrill Edge Rollover / Swaps

Merrill Edge offers a straightforward process for rolling over retirement accounts like 401(k)s into a Rollover IRA. While incoming rollovers are free, outgoing full account transfers carry a $49.95 fee.

More complex internal account swaps may require manual steps and can involve additional charges.

- Merrill Edge Additional Fees

The firm applies additional fees for certain services. These include $29.95 for broker-assisted trades, $19.95 for mutual fund transactions, and $49.95 for full outgoing account transfers.

Other charges may include wire fees, returned checks, and special service requests, so traders should review the full fee schedule if they plan to use more than basic trading features.

How Competitive Are Merrill Edge Fees?

Merrill Edge offers a competitive fee structure that aligns well with other major online brokers, especially for self-directed investors.

While the broker has the absolute lowest costs for options or mutual funds, the overall pricing remains transparent and reasonable for long-term investors, making Merrill Edge a solid choice for those seeking a balance between affordability, service, and research tools.

| Asset/ Pair | Merrill Edge Commission | Trade Republic Commission | Nutmeg Commission |

|---|

| Stocks Fees | From $0 | From €1 | Management fee of 0.75% per annum on the first £100,00 |

| Fractional Shares | No | Yes | Yes |

| Options Fees | From $0,65 | - | - |

| ETFs Fees | From $0 | €1 | 0.17% - 0.32% per year |

| Free Stocks | Yes | Yes | No |

Trading Platforms and Tools

Score – 4.5/5

Merrill Edge offers a user-friendly online trading platform that provides investors with tools and features to manage their portfolios. The platform includes real-time market data, research tools, and customizable dashboards, creating a user-friendly environment for investors.

Additionally, the firm caters to more active traders with its advanced platform, Merrill Edge MarketPro, which features sophisticated charting tools, streaming market data, and comprehensive research capabilities. For those on the go, the mobile app provides flexibility, enabling users to trade and monitor their accounts at any time, from anywhere.

Trading Platform Comparison to Other Brokers:

| Platforms | Merrill Edge Platforms | Trade Republic Platforms | Degiro Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Merrill Edge Web Platform

Merrill Edge offers a robust web-based platform to meet the needs of both beginner and experienced investors. The standard Merrill Edge website provides an intuitive interface for managing portfolios, placing trades, and accessing research, all with seamless integration to Bank of America accounts.

For more active traders, the platform also features Merrill Edge MarketPro, a powerful browser-based tool offering advanced charting, streaming real-time data, customizable dashboards, and professional-grade research tools, all at no extra cost.

Main Insights from Testing

Testing Merrill Edge’s web platform reveals a smooth and reliable user experience with fast trade execution and intuitive navigation. The platform is stable across browsers, with a responsive design and minimal downtime.

Features are easy to access, and tools load quickly, making portfolio management and research efficient.

Merrill Edge Desktop MetaTrader 4 Platform

Merrill Edge does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

Merrill Edge Desktop MetaTrader 5 Platform

The broker does not support MetaTrader 5 either. Merrill Edge does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platform.

Merrill Edge MobileTrader App

Merrill Edge Mobile app offers a user-friendly experience for trading stocks, ETFs, and options on the go. It features real-time quotes, watchlists, account management, and full integration with Bank of America.

While great for everyday investors, it lacks some of the advanced tools found on the MarketPro platform.

AI Trading

Merrill Edge does not offer dedicated AI-driven or automated trading tools such as backtesting engines, algorithmic execution systems, or third-party strategy integrations.

However, it offers Merrill Guided Investing, a hybrid robo-advisor service. While the underlying portfolio recommendations and rebalancing are algorithmically managed, they are overseen by professional portfolio managers from Merrill’s Chief Investment Office, blending automation with human insight.

Trading Instruments

Score – 4.6/5

What Can You Trade on Merrill Edge’s Platform?

Merrill Edge offers a range of trading products to suit investors’ preferences, including Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds, CDs, and Annuities.

This variety of trading products empowers investors to create comprehensive portfolios that align with their financial objectives and risk preferences.

Main Insights from Exploring Merrill Edge’s Tradable Assets

Merrill Edge offers a solid range of tradable assets, focusing primarily on U.S.-listed stocks, ETFs, mutual funds, and bonds.

While the platform caters well to long-term investors and those seeking diversified portfolios, it lacks access to Forex, futures, and international markets. This makes it more suitable for traditional investors rather than active or global traders.

Margin Trading at Merrill Edge

Merrill Edge offers margin trading, allowing users to leverage their investment positions by borrowing funds.

While the multiplier can enhance potential returns, it also involves increased risk, as losses can exceed the initial investment, and users should carefully consider their risk tolerance and financial situation before engaging in margin trading on the platform.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Merrill Edge

The platform provides users with several funding methods to facilitate account deposits. Common options include:

- Electronic funds transfer (EFT)

- Wire transfers

- Mobile check deposits

Additionally, traders can fund their accounts by transferring funds from other Bank of America accounts. These diverse funding methods offer flexibility to users, allowing them to choose the most convenient and efficient way to deposit funds into their Merrill Edge accounts.

Merrill Edge Minimum Deposit

The platform does not have a specific minimum deposit requirement to open a basic brokerage account. Investors can start with any amount to initiate their investment activities.

Withdrawal Options at Merrill Edge

The firm allows traders to make withdrawals from their accounts through various methods. Common options include electronic funds transfer to linked bank accounts, wire transfers, and checks. Users can initiate withdrawals online through the platform, providing flexibility in accessing their funds.

Customer Support and Responsiveness

Score – 4.6/5

Testing Merrill Edge’s Customer Support

The broker offers 24/7 customer support primarily through the Merrill Edge phone number, providing users with direct and immediate access to help.

Additionally, support is available through social media channels, and there is an extensive FAQ section designed to address commonly asked questions.

Contacts Merrill Edge

You can contact Merrill Edge customer support for self-directed investing at 1-877-653-4732 and for advisory services at 1-888-654-6837. General inquiries can be sent via email to contactme@ml.com. Support is available during extended business hours, with additional help through the Secure Message Center online.

Research and Education

Score – 4.5/5

Research Tools Merrill Edge

Merrill Edge provides a comprehensive suite of research tools accessible via its website and the MarketPro platform.

- On the website, investors can use the Idea Builder, which helps generate investment ideas based on themes like sustainability or technology.

- Additionally, Trading Central offers technical insights, and OptionsPlay assists in evaluating options strategies.

- For active traders, MarketPro delivers real-time streaming data, interactive charting, Level II quotes, and customizable layouts, enhancing the trading experience.

These tools are complemented by BofA Global Research reports and a variety of investment calculators to support informed decision-making.

Education

The firm offers a range of educational resources to empower investors with knowledge and insights. The platform provides articles and tutorials covering various investment topics, helping users make informed decisions.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Merrill Edge

Merrill Edge offers a range of investment options suitable for both beginners and experienced investors.

Clients can invest in stocks, ETFs, mutual funds, bonds, and options. The platform also provides access to professionally managed portfolios and guidance tools to help tailor investment strategies based on individual financial goals.

Account Opening

Score – 4.4/5

How to Open Merrill Edge Demo Account?

Merrill Edge does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Merrill Edge Live Account?

Opening a Merrill Edge live account is a straightforward process done entirely online. Users need to choose the type of account they want, complete a secure application form, and verify their identity with basic documents.

Once approved, funding the account can be done via bank transfer, check, or rollover from another brokerage.

Additional Tools and Features

Score – 4.3/5

In addition to its research tools, Merrill Edge provides several valuable features to support investors:

- The platform also includes a Portfolio Story tool that helps users visualize and understand their asset allocation, performance, and diversification.

- Clients benefit from integration with Bank of America accounts for seamless fund transfers and financial planning through the Merrill Guided Investing service.

Merrill Edge Compared to Other Brokers

Merrill Edge stands out as a solid choice for investors seeking a reliable and well-regulated brokerage with a user-friendly online platform and advanced tools like MarketPro.

Compared to competitors, Merrill Edge benefits from strong integration with Bank of America, enhancing convenience for existing customers.

Its fee structure is competitive, especially for commission-free stock and ETF trades, though some brokers offer lower costs for futures or more specialized assets. Customer support and educational resources at Merrill Edge are robust, supporting investors at all levels.

Overall, the broker appeals most to investors who value stability, comprehensive service, and seamless banking integration over access to a wider variety of asset types or low-cost trading in financial markets.

| Parameter |

Merrill Edge |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Merrill Edge Online Trading Platform, Merrill Edge MarketPro |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds, CDs, Annuities |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Limited |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Merrill Edge

Merrill Edge is a reputable Stock brokerage known for its strong integration with Bank of America, offering seamless banking and investing experiences.

It provides a user-friendly platform suitable for both beginners and experienced investors, with access to a wide range of investment products including stocks, ETFs, mutual funds, bonds, and options.

The broker offers commission-free trading on stocks and ETFs, backed by solid research tools and customer support. While it lacks futures trading and some advanced features for active traders, Merrill Edge delivers reliable service, competitive fees, and helpful educational resources, making it a strong choice for long-term investors seeking a balanced, well-rounded brokerage.

Share this article [addtoany url="https://55brokers.com/merrill-edge-review/" title="Merrill Edge"]