Ment Funding 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:100

Regulation: USA

Min. Deposit: $250

HQ: USA

Platforms: MT5, MT4

Found in: 2021

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:100

Regulation: USA

Min. Deposit: $250

HQ: USA

Platforms: MT5, MT4

Found in: 2021

Ment Funding is a proprietary trading firm that provides traders with the opportunity to trade with significant capital, up to $2,000,000 per account. Founded in 2021, it stands out in the prop trading industry by offering a unique, simplified one-step evaluation process for traders to qualify for a Funded Account. This approach distinguishes Ment Funding from other firms that may have more complicated evaluation or multiple-step processes.

Ment Funding, as a proprietary trading firm, provides a distinctive opportunity for individuals to participate in actual trading with minimal personal funds required. To become a funded trader, which means trading with the company’s funds, all a trader needs to do is successfully complete a test or challenge to gain access to a funded account. Once achieved, they can trade with a company account like a professional trader. Read more about Prop Trading here.

| Ment Funding Advantages | Ment Funding Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Good range of Accounts | Only MetaTrader Platform |

| MT5 and MT4 with EAs | |

| Refundable Fee once you become Funded Trader |

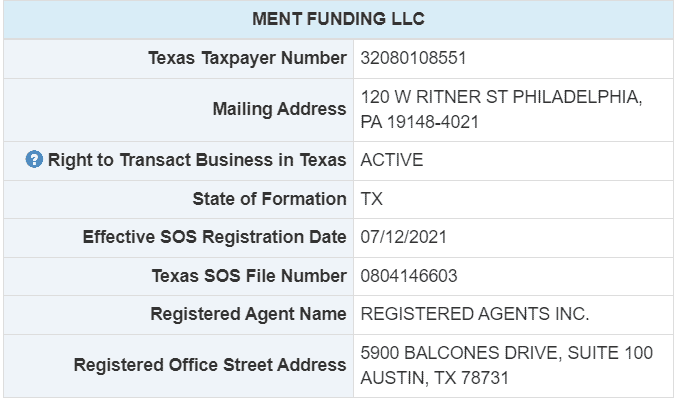

Ment Funding, operating in the United States, adheres to the regulatory standards and rules that govern financial and trading activities within the country. By partnering with Eightcap, an ASIC-regulated broker, Ment Funding ensures that its operations align with the necessary compliance frameworks to offer secure and regulated trading environments for its users.

We examined the official information concerning Ment Funding and found no evidence suggesting that the company operates as a scam. However, it’s important to note that proprietary trading firms generally do not fall under strict regulation by financial authorities, making it challenging to categorically determine the legitimacy or the true nature of such firms.

It is best to educate yourself well about Prop Trading, understand risks and choose Company with a good reputation also one operate for many years so the proposal is more stable. Yet, since you do not invest much money to trading but just pay subscription fees the potential losses still considered lower if compared to engaging into Real Trading with your own funds.

| Fees | Ment Funding | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $25,000 | $10,000 | $50,000 |

| Fee | $250 | €155 | $289 |

| Maximum Account Size | $2,000,000 | $200,000 | $400,000 |

| Fee | $15,000 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

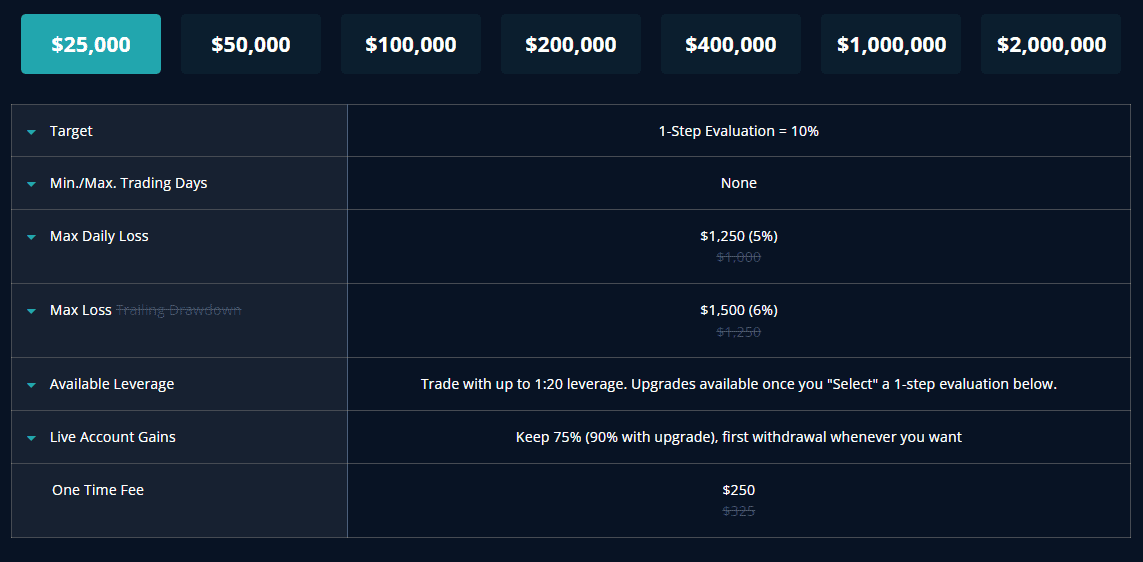

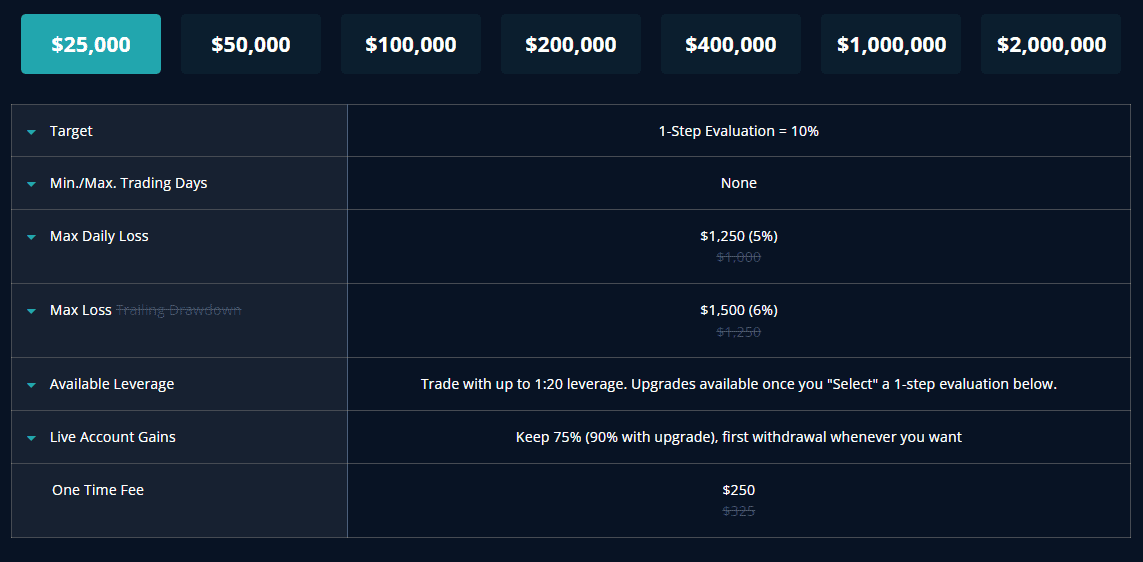

So the challenge itself includes numerous rules you have to follow to prove your sucessful strategy and performance, one the most important parameters is Profit Target, which is set based on the challenge you select. The firm’s one-step evaluation program aims at a 10% profit target, with rules in place to manage risk effectively

That is another challanging rule included in ever Prop Trading test, it is important to clarify there are two Loss levels important to follow, one is Maximum Daily Loss set to 5% for all Account and Maximum Overall Loss set to 6%.

Ment Funding’s one-step evaluation process for traders looking to manage funded accounts does not impose a minimum trading period requirement.

See detailed table with Ment Funding Challenge conditions based on Account Size:

Ment Funding does not offer a free trial for their evaluation program. This is consistent with some proprietary trading firms that provide free trials, but Ment Funding is not among them according to a recent comparison of prop firms and their offers regarding free trials.

Once the test or the challenge is successfully passed trader will get his Funed Account set, which may typically take few business days to activate. It is important to note, that the account conditions and balance will be exactly as the one you qualify for in your test, in case you would like to change Account to higher grade there will be a need to pass test from the very beginning for the Account Balance you prefer to trade with.

Upon successful completion of the evaluation, traders are eligible for a profit split starting from 75% up to 90%, depending on the chosen plan and performance.

Payouts after the first can be requested monthly, and the process for withdrawing profits involves submitting a request to the company, which then deposits the trader’s share of the profits into their account, allowing for various withdrawal methods

Ment Funding allows traders to trade a wide variety of instruments across different markets, including forex pairs, commodities, indices, stocks, and cryptocurrencies. This diversity ensures traders have ample opportunities to apply their trading strategies across different asset classes.

Based on our findings, the Ment Funding broker offers two account conditions eith Swap Accounts suitable for swing trading or swap free accounts available in all challenges available for trader who prefer to avoid overnight charges.

After examining all the findings regarding Ment Funding, we find that the firm presents an attractive opportunity for funded traders. The company offers competitive costs and provides a range of programs with lower fees, expanding opportunities for traders with reduced expenses.

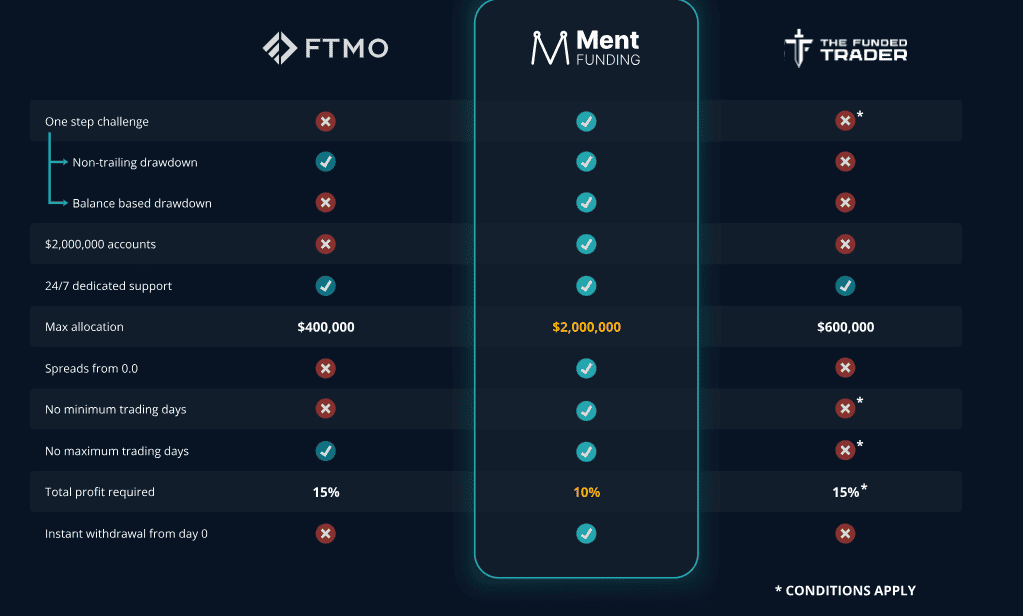

It’s always wise to evaluate and compare proposals with other proprietary trading firms. Some popular firms may offer similar conditions or may be better suited for specific traders, offering a wider selection of instruments and platforms beyond MetaTrader. Nevertheless, there are distinct advantages to Ment Funding as well. Below, we present our selection of alternatives, along with a table comparing Ment Funding to other companies:

No review found...

No news available.