- What is Liberty Market Investment?

- Liberty Market Investment Pros Cons

- Is Liberty Market Investment Legit?

- Liberty Market Investment Challenge

- Funded Account

- Account Conditions

- Payout

- Liberty Market Investment Alternative

What is Liberty Market Investment Prop Firm?

Liberty Market Investment (LMI) is a UK-based proprietary trading specializing in futures trading. They offer evaluation programs for traders to access funding for trading in CME and EUREX futures markets. LMI is known for its transparent and competitive approach, offering robust support and educational resources to traders of all experience levels.

| Liberty Market Investment Advantages | Liberty Market Investment Disadvantages |

|---|

| Transparent Evaluation Program | No Regulation |

| Low Profit Traget | Subscription Costs |

| Good ranging of account Baance with Opportunity to Scale Up | Limited Instrument Range |

| Free Trial Option | No Guaranteed Income |

| Low Commissions | |

| UK Based Prop Trading Firm | |

Is Liberty Market Investment Legit?

Is Liberty Market Investment Scam?

Definitive evidence classifying Liberty Market Investment as fraudulent is lacking. User experiences vary, highlighting the importance of conducting personal, updated research for informed decision-making. It’s important to note that Proprietary Trading Firms often face less regulation, adding complexity to assessing their legitimacy.

Liberty Market Investment Challenge Rules

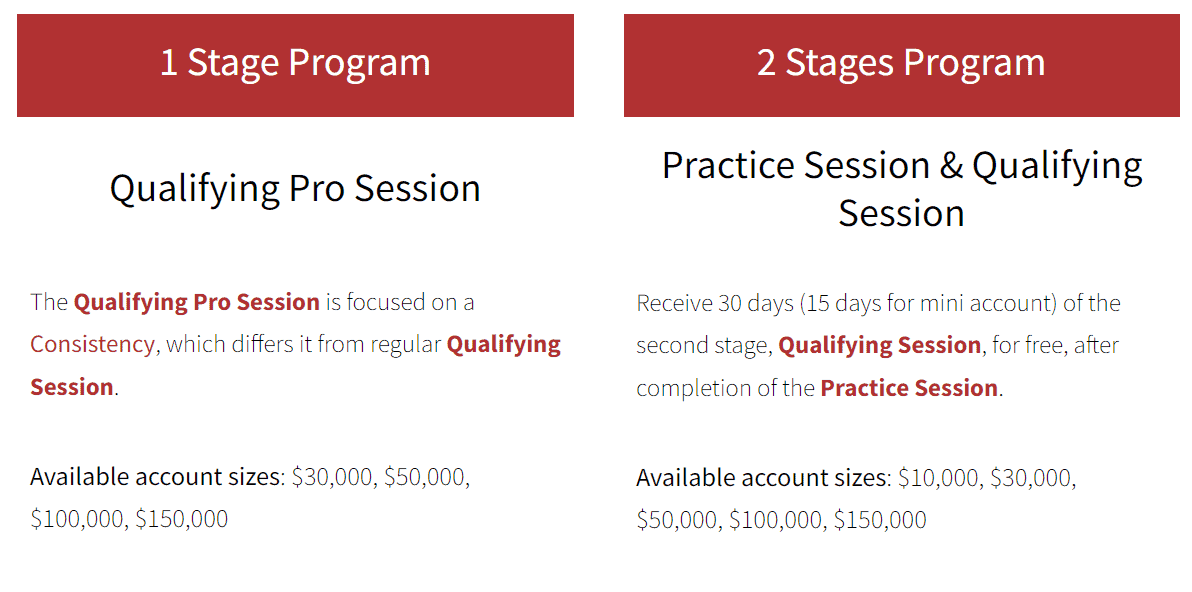

- The firm’s evaluation process is structured differently from other proprietary trading companies, with options like a 1-Stage Program or a 2-Stage Program leading to funded account status. The evaluation criteria include consistent profit growth and managing risk, with specific profit targets and account sizes.

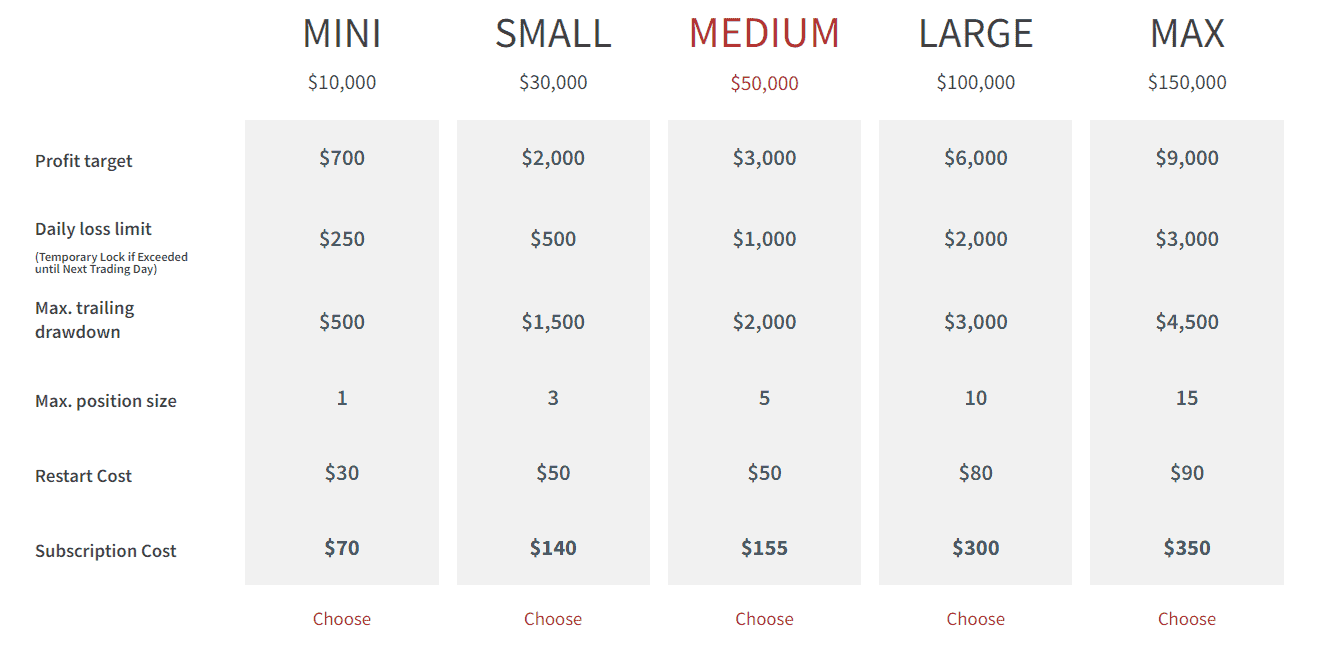

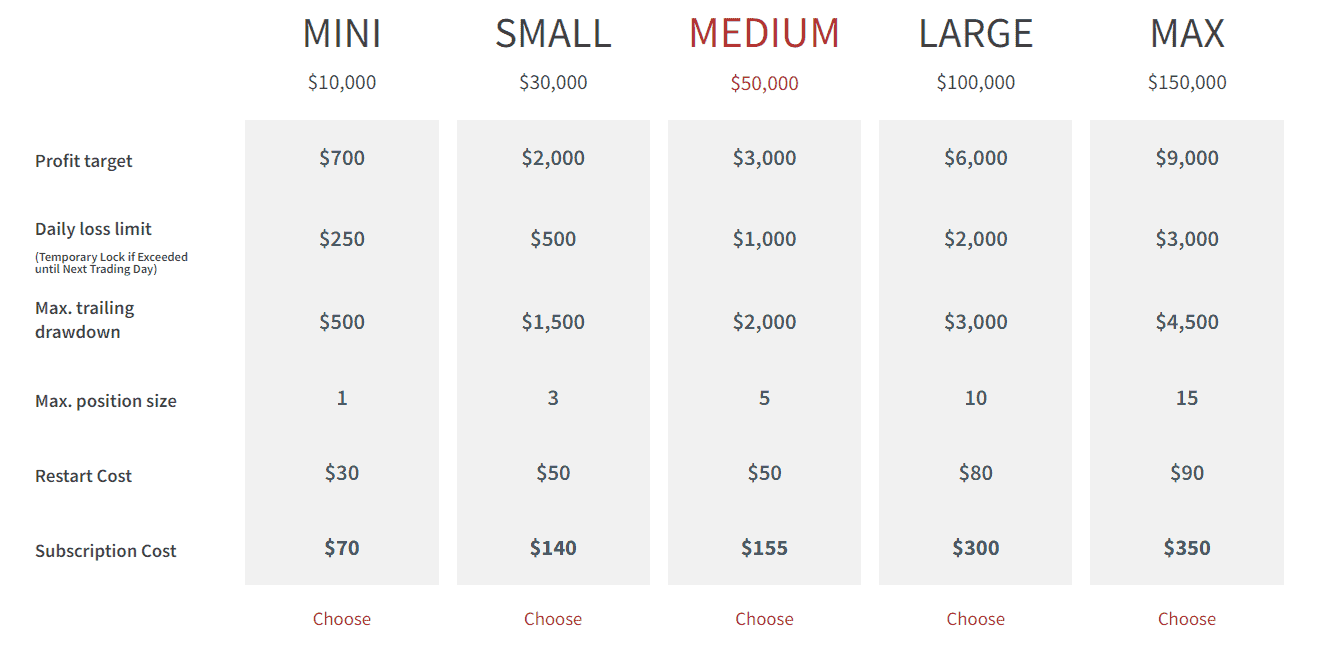

Account Balance and Registration Fee

Before starting, traders must go through an evaluation process where they choose a preferred initial Account Balance. The specific terms of this process can vary with the chosen Account Balance size. The evaluation comprises two phases: Challenge and Verification. Completing these steps successfully allows traders to become part of Liberty Market Investment. In contrast to a registration fee, traders are required to pay a subscription fee, the amount of which depends on the selected Account Balance.

- The initial phase allows traders to select from a range of account sizes ($10,000 to $150,000) and work towards achieving set profit targets while adhering to risk management protocols.

- After completing the Practice Session, traders advance to the Qualifying Session, where the conditions mimic those of the funded account. Success in this stage indicates readiness for real-world trading with LMI’s capital. The first 30 calendar days (or 15 for the mini account) of this stage are offered free, post-completion of the Practice Session.

- Successful completion of the preceding stages leads to the Funded Session, where traders are allocated real capital to trade in the markets.

| Fees | Liberty Market Investment | FundedNext | The Funded Trader |

|---|

| Minimum Account Size | 10,000 | $6,000 | $50,000 |

| Fee | $70 | $59 | $289 |

| Maximum Account Size | $150,000 | $200,000 | $400,000 |

| Fee | $350 | $999 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

Profit Target

Liberty Market Investment establishes its profit targets based on the account sizes, with these targets typically falling between 6% and 7% of the total account balance. This structured approach in setting profit goals ensures that traders have clear, attainable objectives during their evaluation period.

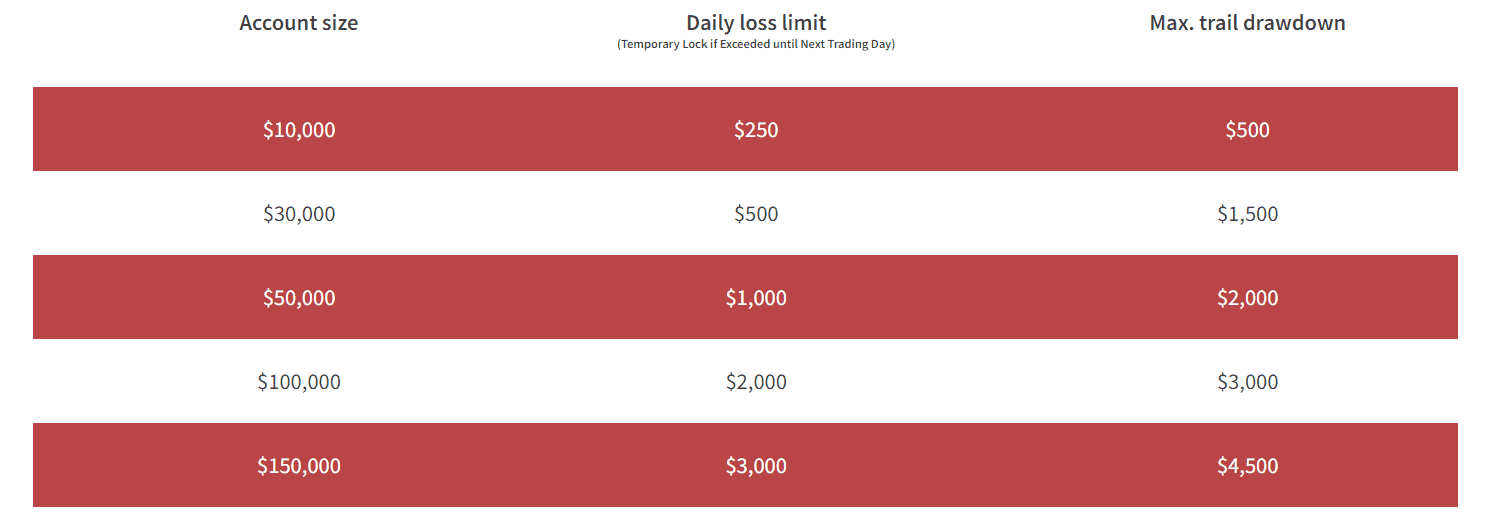

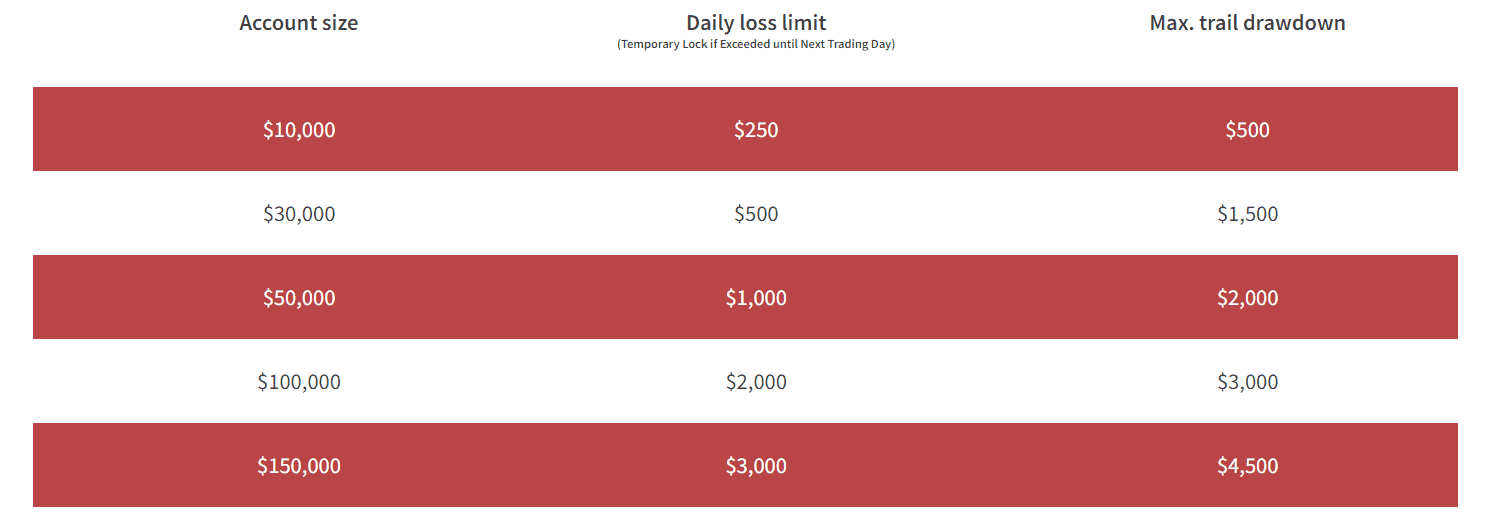

Maximum Loss

Liberty Market Investment specifies daily loss limits and maximum trailing drawdowns as a percentage of account balances, ranging between 1.67% and 5%. These parameters are established to mitigate financial risk and maintain disciplined trading within the firm’s evaluation program.

Minimum Trading Period

In the Liberty Market Investment evaluation program, the minimum number of trading days required for participants varies between the Practice and Qualifying Sessions. Traders must actively trade for at least 5 days during the Practice Session, while the Qualifying Session demands a minimum of 7 trading days, except for those in the Mini account category, where the requirement stays at 5 days

See the detailed table with Liberty Market Investment Trading Objectives:

Free Trial

Liberty Market Investment offers a free trial period for their evaluation program. Specifically, they provide a 14-day free trial for the Qualifying Pro session, allowing traders to try out their Trader Evaluation Program without initial financial commitment

Liberty Market Investment Funding

After completing the challenge, traders are granted access to their Funded Account, which is generally activated within a couple of business days. The conditions and capital in this account mirror the achievements accomplished during the challenge phase. Should traders wish to access a higher-level account, they need to re-engage in and successfully pass the challenge tailored to the higher balance they aim for.

Profit Split

Liberty Market Investment offers a profit split arrangement where traders receive 100% of the profits up to a total of $30,000. After reaching this threshold, the profit split adjusts to 90/10, with the trader retaining 90% of the profits

Payout and Withdrawals

Traders who participate in the Funded Session can withdraw their profits through various methods, such as bank transfers, PayPal, Payoneer, and other platforms, suggesting flexibility in accessing earnings. The profit split arrangement allows traders to retain 100% of the profits up to $30,000, and 90% thereafter. The process to start trading with a Funded Session account occurs a few days after completing the necessary evaluations and documentation

Account Conditions

Trading Instruments

Liberty Market Investment allows traders to engage in futures trading, offering a selection of markets to trade. The instruments available include futures on various asset classes such as equities, cryptocurrencies, forex, agricultural commodities, and interest rate futures.

Liberty Market Investment Commission

Liberty Market Investment’s commission structure, specifically related to their funded accounts, isn’t fully detailed in the available information. However, it is mentioned that traders are responsible for paying monthly exchange fees directly from their account balances. For instance, the Futures exchange fee is noted as $13/month, and the EUREX exchange fee is around €20/month

Leverage

Based on the information provided, Liberty Market Investment does not offer leverage for its trading accounts. This means traders would be operating without the ability to leverage their capital to increase their market exposure.

Liberty Market Investment Platforms

Trading Conditions

- Liberty Market Investment allows traders to employ various trading strategies within their evaluation and funded accounts, as long as they adhere to the company’s risk management rules and guidelines

- In Liberty Market Investment, traders are initially tasked with scaling their trading plans to navigate through initial drawdowns, ensuring a genuine opportunity for success in the Qualifying and Funded Sessions.

Liberty Market Investment Promotions

From time to time, Liberty Market Investment extends discounts or special deals on evaluation fees for their trading challenges, offering traders the chance to join at lower costs. Liberty Market Investment promo codes are designed to enhance accessibility to their funding opportunities for aspiring traders and act as incentives to foster engagement in their programs.

Liberty Market Investment Alternative Brokers

In conclusion, Liberty Market Investment presents a compelling platform for aspiring traders to cultivate their skills and pursue opportunities in the financial markets. Their evaluation program provides transparent criteria and structured challenges, enabling traders to demonstrate their abilities while emphasizing the importance of risk management principles. Notably, the provision of a free trial period offers traders a risk-free opportunity to experience the platform and evaluate its suitability for their trading goals.

- TopStep — Good Educational Material CHoice

- FTMO — Offering Favorable Conditions with no Profit Targets

- E8 Funding — Prop Trading Firm Higher Leverage

Share this article [addtoany url="https://55brokers.com/liberty-market-investment-review/" title="Liberty Market Investment"]