- What is KCM Trade?

- KCM Trade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

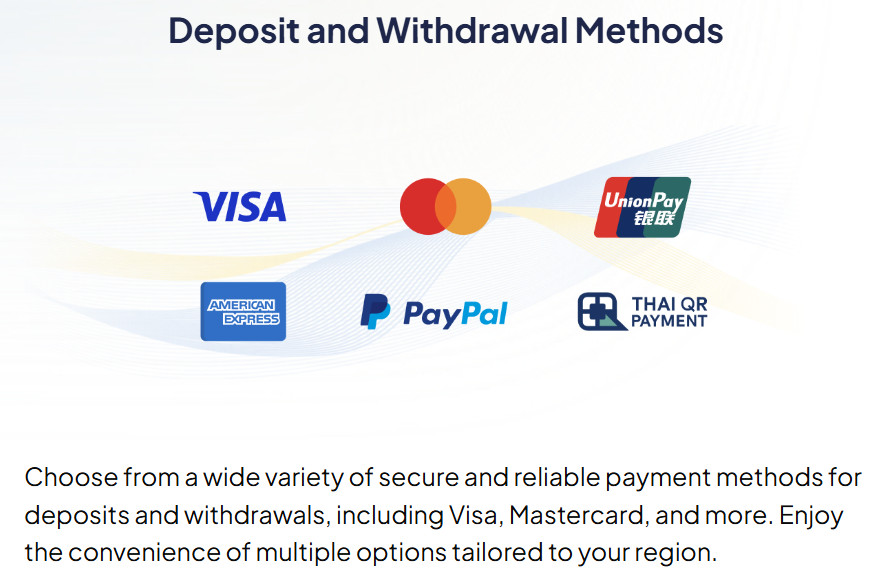

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

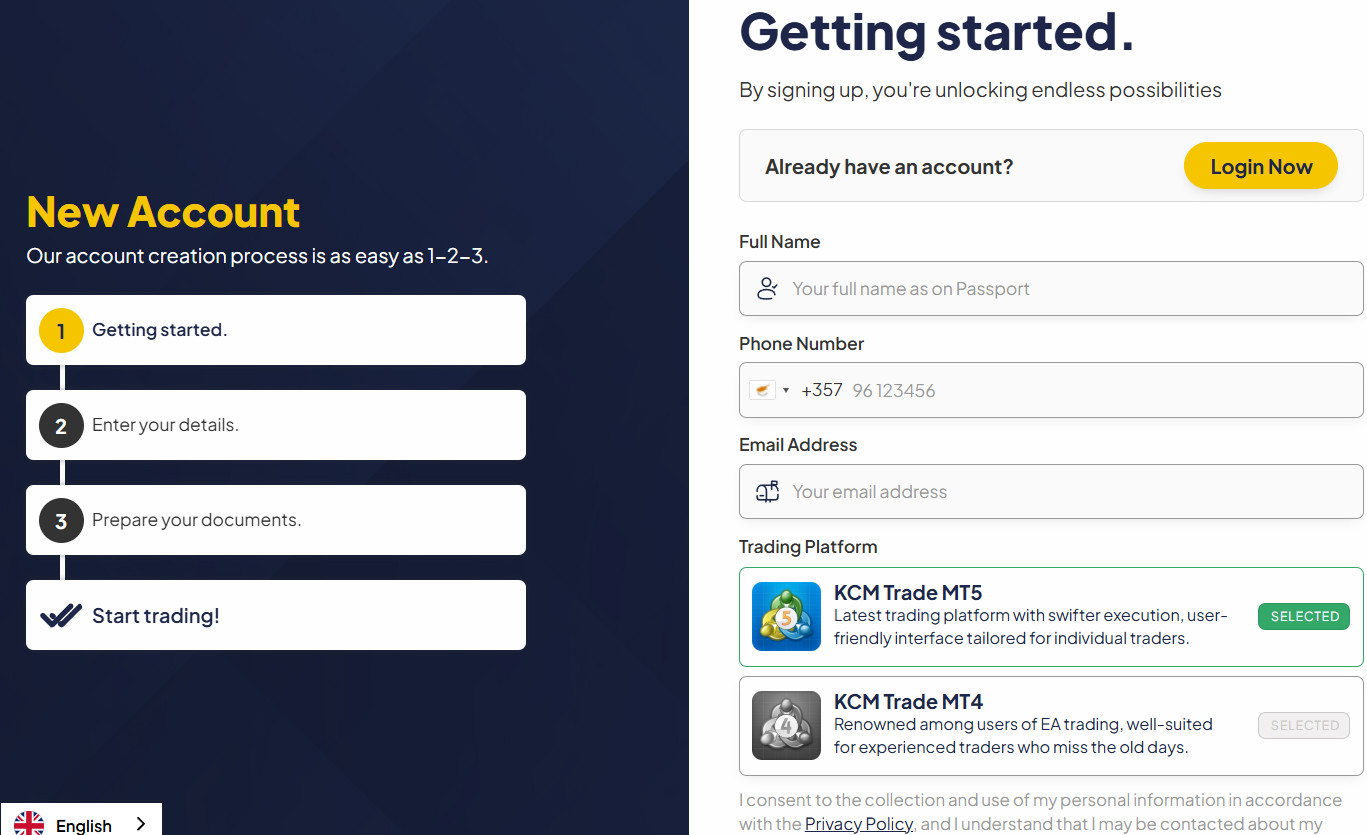

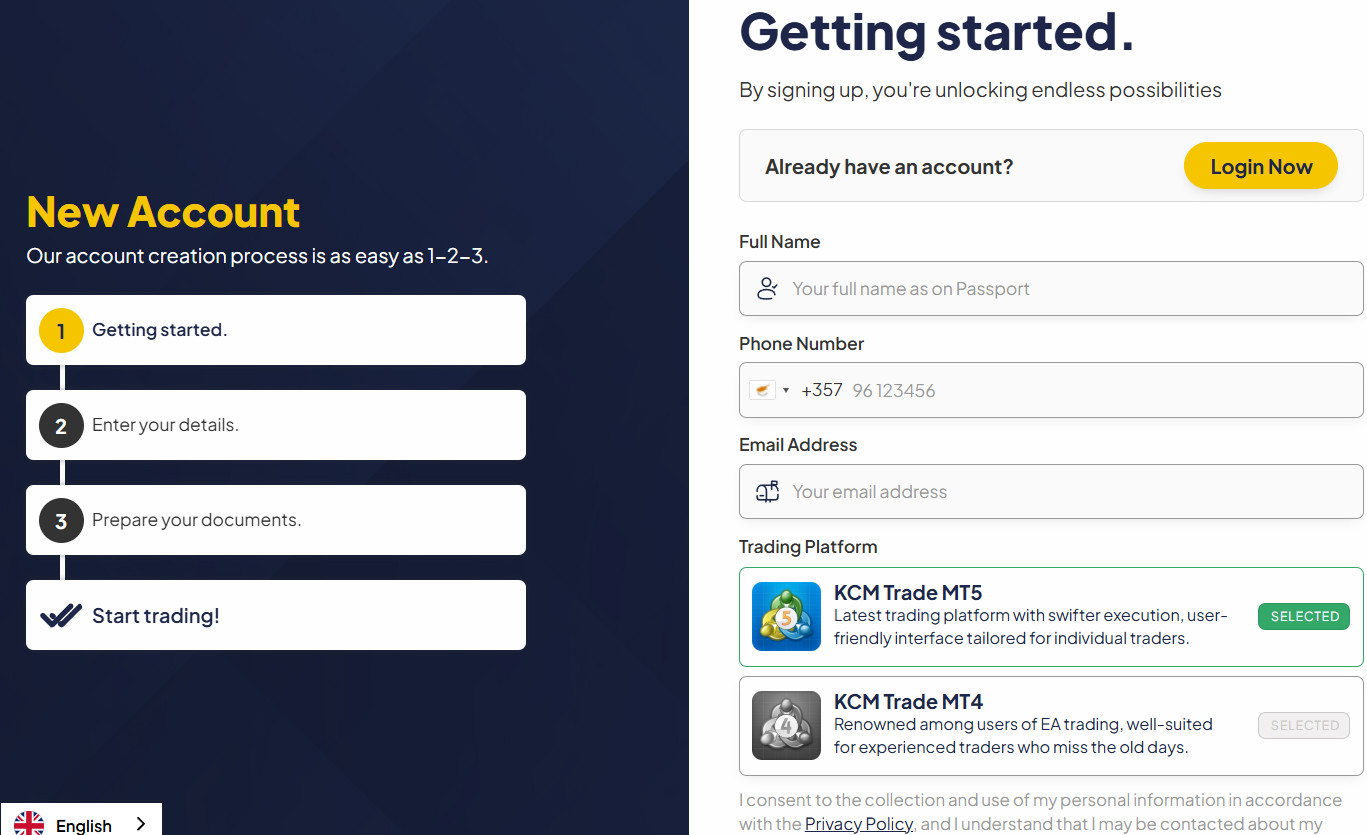

- Account Opening

- Additional Tools And Features

- KCM Trade Compared to Other Brokers

- Full Review of Broker KCM Trade

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.8 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is KCM Trade?

KCM Trade, a global award-winning CFD broker, is a subsidiary of Kohle Capital Markets Limited. Since its establishment in 2016, KCM Trade has been dedicated to providing traders worldwide with a wide range of CFD products, including Forex, Precious Metals, Energies, Commodities, Crypto ETFs, Equity Indices, and Stock CFDs.

The company offers high-quality liquidity quotes and technical support to over 80 financial institutions, serving as a crucial partner in their growth.

With maximum leverage reaching up to 1:1000 under Mauritius Financial Services Commission (FSC), tight spreads starting from 0.6 pips, and a commitment to swift execution, the broker provides quite a good overall trading experience. Additionally, KCM Trade facilitates fast deposits and withdrawals, and is available in various regions, including Australia (Melbourne), Mauritius, Thailand, Vietnam, Malaysia, Hong Kong, Taipei, and other markets, which is convenient for clients.

The broker is considered safe due to regulations by the Australian Securities and Investments Commission Act (ASIC). Additionally, there is an international Branch based under the Mauritius Financial Services Commission.

KCM Trade Pros and Cons

KCM Trade is renowned for its good reputation and adherence to regulatory standards. Spreads are quite competitive and kept considerably low, enhancing cost-effectiveness for clients. Additionally, the broker provides access to major platforms like MetaTrader 4 and MetaTrader 5, allowing users to trade with advanced charting tools, automated trading capabilities, and a user-friendly interface across multiple devices.

Besides, the broker offers high leverage exceeding the market average at 1:000 under the Mauritius Financial Services Commission (FSC), providing traders with enhanced opportunities for potential returns.

For the cons, KCM Trade requires a minimum deposit starting from $50, yet some brokers offer much lower deposits or no minimum deposit, which might be more convenient for smaller traders.

| Advantages | Disadvantages |

|---|

| Well-regulated broker with excellent reputation | Regulatory oversight vary based on entity |

| Competitive trading conditions | |

| Low spreads and fees | |

| Wide range of trading instruments | |

| MT4 and MT5 platforms | |

| Global expands | |

| Award-winning broker | |

| ECN technology | |

| Suitable for beginners and professionals | |

| Learning courses and seminars | |

| Ultra-Fast Execution: 0.25s average order speed | |

| Top-tier bank segregation & SSL encryption | |

| OneZero aggregation with 5-tier liquidity pool | |

KCM Trade Features

KCM Trade is a reliable broker with good trading conditions suitable for various traders and excellent service that makes the broker suitable for beginners, with quality educational guidelines and comprehensive tools. Below is a comprehensive list of its key features:

KCM Trade Features in 10 Points

| 🏢 Regulation | ASIC, FSC |

| 🗺️ Account Types | STP, ECN Accounts |

| 🖥 Trading Platforms | MT4, MT4, KCM Web Trader |

| 📉 Trading Instruments | Forex, Precious Metals, Energies, Commodities, Crypto ETFs, Equity Indices, Stock CFDs |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread (STP) | 1.6 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP, AUD, JPY |

| 📚 Trading Education | Education Center, Seminars, Webinars, Courses, Market Analysis |

| ☎ Customer Support | 24/7 |

Who is KCM Trade For?

KCM Trade is ideal for traders looking for a reliable and globally regulated broker that offers access to a wide range of financial instruments. Based on our research, KCM Trade stands out for the following features and offerings:

- STP/ECN Execution Type

- Currency and CFD Trading

- Beginners

Advanced traders

- MT4, MT5 platforms

- Hedging

- Low spreads

- High leverage up to 1:1000

- EAs

- Algorithmic or API traders

- International Trading

- Suitable for a variety of trading strategies

- Tight regulation

- Good customer support

KCM Trade Summary

Overall, KCM Trade stands as a well-established, customer-oriented broker, offering a secure and regulated trading environment suitable for nearly every trader. Their services and products are tailored to specific requirements, providing a wide range of choices, including accounts, platforms, tools, and instruments, so that most traders, regardless of size or experience, will find a suitable solution with KCM Trade.

It is worth noting that Chief Market Analyst Tim Waterer is a recognised industry expert and a member of the Forbes Advisor Australia advisory board. His insights have been featured in leading international media outlets, including the BBC, The Wall Street Journal, Bloomberg, and Reuters. With over 20 years of experience in the financial sector, he specialises in analysing currencies, stocks, indices, and commodities, making significant contributions to the industry.

KCM Trade stands out for offering one of the favorable propositions in terms of costs, trading conditions, and overall opportunities. While some features may vary by region, the broker’s global presence and commitment to transparency make it a solid choice for traders seeking a secure and user-friendly trading experience.

55Brokers Professional Insights

KCM Trade stands out for its quality blend of global regulation, advanced technology, and trader-focused services to meet the needs of all levels of traders. We would mark KCM Trade as suitable for beginners, international trade, and those who look for industry-popular software with a balanced proposal in all aspects.

Regulated in different jurisdictions, the broker ensures a good level of transparency, security, and compliance. The broker platforms provide access to the industry-leading MetaTrader 4 and MetaTrader 5 platforms, which are known for their reliability, advanced charting tools, and support for automated strategies. All the necessary features are included; you may choose multiple add-ons and use Auto trading or EAs for the strategies.

With competitive spreads starting from as low as 0.6 pips, fast execution speeds, and deep liquidity from top-tier providers, KCM Trade is considered a professional-grade trading environment. What is also a benefit – the broker provides good education and support, offering expert market analysis, learning courses, seminars, insights, and multilingual customer service.

Consider Trading with KCM Trade If:

| KCM Trade is an excellent Broker for: | - Need a well-regulated broker.

- Get access to MT4, and MT5 trading platforms.

- Looking for reputable firm.

- Providing competitive trading conditions.

- Need broker with fast execution.

- Who prefer higher leverage up to 1:1000.

- Secure trading environment.

- Various strategies allowed.

- East-Asian traders.

- International trading.

- Need broker with advanced trading tools.

- Looking for quality customer support.

- Providing services worldwide.

- Get good educational and research materials. |

Avoid Trading with KCM Trade If:

| KCM Trade might not be the best for: | - Looking for cTrader platform.

- Providing copy trading.

- Looking for broker with access to VPS Hosting.

|

Regulation and Security Measures

Score – 4.6/5

KCM Trade Regulatory Overview

KCM Trade is a regulated brokerage company that imposes strict rules and guidelines on the broker’s operations.

Kohle Capital Markets Limited operates under the authorization and regulation of the Australian Securities and Investments Commission (ASIC). Holding an Australian Financial Services License, KCM Trade ensures compliance with Australian laws and regulations governing its operations.

The broker is also regulated by the Mauritius Financial Services Commission, offering its services to clients around the world.

How Safe is Trading with KCM Trade?

KCM Trade is a legit and regulated broker due to being licensed by a top-tier authority. Another advantage is that client funds are securely deposited in segregated accounts held with major banks.

KCM Trade ensures top-tier fund protection by storing client funds in segregated bank accounts under the highest security standards, protected by SSL encryption technology.

The broker places utmost importance on safeguarding customer trades through a variety of measures, including operation of the trading account, money management, and use of safety protocols set by the Regulatory authority.

Consistency and Clarity

KCM Trade demonstrates consistency through its steadily growing reputation in the global trading community. Established with a strong operational framework, the broker has built a trustworthy presence, reflected in its generally favorable ratings across multiple broker review platforms like WikiFX and its recognition through several prestigious industry awards.

Trader reviews often highlight strengths such as tight spreads, fast execution, and responsive customer support, though some note areas for improvement, like limited promotions in certain regions.

KCM Trade also actively engages with the financial and broader community through industry sponsorships, educational events, and participation in expos and summits, enhancing its visibility and credibility.

The broker strengthened its position in international markets through a diverse range of sporting partnerships. The company signed rising Australian golf star Enshan Hooi and, for the second consecutive year, sponsored the Medway Corporate Golf Cup in Australia. Additionally, KCM Trade entered its third year as the official partner of Japan’s FDJ2 drift racing series, exemplifying the brand’s values of precision, efficiency, and professionalism.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with KCM Trade?

KCM Trade offers STP and ECN trading accounts. The STP accounts are designed for traders who prefer direct access to the market with competitive spreads and no dealing desk intervention, while the ECN accounts cater to more advanced traders seeking ultra-low spreads, faster execution, and deeper liquidity.

In addition to live accounts, KCM Trade also provides a Demo Account, allowing beginners to practice and experienced traders to test strategies in a risk-free environment using real-time market conditions.

STP Account

KCM Trade’s STP Account requires a minimum initial deposit of $1,000, positioning it as a suitable option for intermediate traders or beginners who are ready to invest a more substantial amount.

While the deposit amount may be higher than entry-level accounts at other brokers, it comes with benefits such as competitive spreads and no dealing desk intervention, ensuring transparent and efficient order execution.

The STP account supports a variety of trading styles, a practical choice for traders looking to explore real-market conditions with flexibility.

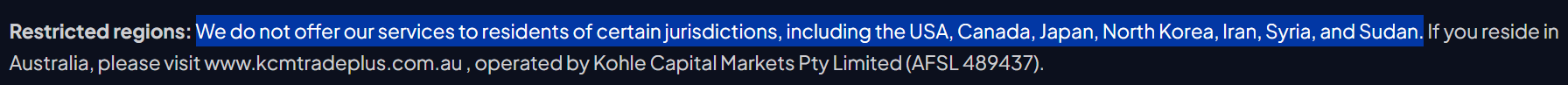

Regions Where KCM Trade is Restricted

KCM Trade does not offer its services in certain jurisdictions due to regulatory restrictions and international sanctions. Users from the following countries or regions are not supported:

- USA

- Canada

- Japan

- North Korea

- Iran

- Syria

- Sudan

Cost Structure and Fees

Score – 4.7/5

KCM Trade Brokerage Fees

KCM Trade maintains a competitive fee structure to accommodate a wide range of traders. The broker primarily charges through spreads and commissions, with the specific costs depending on the account type selected.

KCM Trade does not impose fees for deposits or withdrawals, making it an advantageous choice for traders. Also, the broker is transparent about its pricing, and there are no hidden charges, making it easier for traders to manage their costs and plan their strategies effectively.

KCM Trade offers competitive spreads that vary based on the chosen account type, providing flexibility for different trading strategies. On the STP account, the average EUR/USD spread is 1.6 pips, with no additional commission fees.

While the spreads may be slightly wider than those on ECN accounts, they remain reasonable for a regulated broker and offer good value for traders seeking transparent pricing.

KCM Trade applies a commission-based pricing model on its ECN account, which is designed for more advanced traders seeking tighter spreads and faster execution. On this account type, the broker charges a commission of $7 per round-turn lot.

This straightforward commission structure offers clarity in trading costs, making it easier for traders to manage their expenses and optimize their strategies accordingly.

- KCM Trade Rollover / Swaps

KCM Trade applies rollover or swap fees to positions held overnight, which reflect the cost of borrowing one currency to buy another in forex trading.

These fees can be either positive or negative, depending on the interest rate differentials between the currencies involved. Swap rates vary based on the instrument being traded and market conditions, and are displayed within the trading platform, allowing traders to monitor and manage overnight costs effectively.

- KCM Trade Additional Fees

In addition to spreads and commissions, KCM Trade may charge certain additional fees. While deposits are typically free, some withdrawal options might incur processing costs.

The broker does not charge inactivity fees, which benefits traders who take breaks from active trading. There are no hidden charges, and all applicable fees are transparently communicated to clients, helping traders plan their expenses and avoid unexpected costs.

How Competitive Are KCM Trade Fees?

KCM Trade’s fees are generally competitive within the industry, particularly when compared to other regulated brokers offering similar services.

The broker’s flexible account structure allows traders to choose between commission-free or commission-based models depending on their trading needs. For active traders, especially those using the ECN account, the fee structure is appealing due to its transparency and alignment with professional trading standards.

While not the lowest-cost provider on the market, KCM Trade offers solid value through reliable execution, regulated conditions, and a balance of affordability and service quality.

| Asset/ Pair | KCM Trade Spread | IFX Brokers Spread | Earn Spread |

|---|

| EUR USD Spread | 1.6 pips | 1.3 pips | 0.1 pips |

| Crude Oil WTI Spread | 5 | 0.03 | 0.027 |

| Gold Spread | 3.5 | 1 | 0.150 |

| BTC USD Spread | 300 | 2.7 | 13.13 |

Trading Platforms and Tools

Score – 4.8/5

KCM Trade mainstays on MT4 and MT5 platforms, an industry-standard software loved by most traders due to an efficient trading environment via the web, desktop, and mobile app.

The broker also offers its KCM PRO Trader, a browser-based platform that allows users to trade Forex and CFDs with ease. It delivers fast execution speeds, strong security features, and the convenience of cross-device access.

These platforms boast widespread recognition and offer an array of advantages, including access to numerous extensions and comprehensive educational resources for mastering trading tools available online.

Trading Platform Comparison to Other Brokers:

| Platforms | KCM Trade Platforms | IFX Brokers Platforms | Earn Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

KCM Trade Web Platform

KCM WebTerminal is a powerful, web platform designed for both convenience and performance. With no installation required, it allows traders to access global markets from any device while enjoying lightning-fast execution speeds as low as 0.25 seconds.

The platform features up to five levels of market depth, providing greater insight into liquidity and pricing. Professional traders can also benefit from FIX API integration, enabling advanced trading strategies and seamless connectivity with external systems.

Additionally, the platform supports flexible hedging, giving users more control over risk management.

Main Insights from Testing

Testing the KCM PRO Trader platform reveals a user-friendly interface combined with advanced functionality tailored to both new and experienced traders.

The platform offers smooth navigation, customizable charting tools, and real-time market data, allowing for efficient trade analysis and execution. It supports a wide range of order types and provides reliable stability during volatile market conditions.

KCM Trade Desktop MetaTrader 4 Platform

MetaTrader 4 is one of the most popular platforms used for currency trading, with access to a spectrum of various good features suitable for traders of different styles, which include real-time market data, sophisticated charting tools, and the capability to execute trades instantly.

Moreover, MT4 facilitates algorithmic trading through custom indicators and expert advisors. The platform is also very convenient and easily accessible through desktop, mobile devices, and web-based platforms.

KCM Trade Desktop MetaTrader 5 Platform

The MT5 platform provides good charting capabilities, multiple time frames, and diverse order types, alongside a robust algorithmic trading system, like expert advisors and custom indicators.

Traders benefit from real-time market data and news updates, as well as a comprehensive view of their positions and trading history directly within the platform.

KCM Trade MobileTrader App

KCM Trade allows users to trade on the go through the MT4 and MT5 mobile platforms. Available for both iOS and Android devices, these apps provide full access to trading accounts, real-time price quotes, interactive charts, technical indicators, and a wide range of order types.

Whether monitoring the markets, placing trades, or managing positions, traders can enjoy a smooth and secure experience directly from their smartphones or tablets.

AI Trading

KCM Trade integrates advanced AI-powered trading tools, including its proprietary AI Mentor, to support traders in making smarter and more informed decisions.

The AI Mentor acts as a personalized assistant, offering real-time insights, strategy suggestions, and performance analysis tailored to each trader’s behavior and goals.

Trading Instruments

Score – 4.5/5

What Can You Trade on KCM Trade’s Platform?

KCM Trade offers a diverse range of financial instruments, giving clients access to over 200 financial assets across multiple global markets. Traders can explore major, minor, and exotic Forex pairs, as well as Precious Metals like gold and silver, and Energies such as oil and natural gas.

The platform also supports trading in Commodities, Crypto ETFs, Equity Indices, and Stock CFDs, allowing for a well-rounded portfolio and opportunities in both traditional and emerging markets.

Main Insights from Exploring KCM Trade’s Tradable Assets

Exploring KCM Trade’s tradable assets reveals a well-structured and accessible offering to suit a wide range of trading styles. The platform provides intuitive asset categorization and detailed product specifications, making it easy for traders to understand contract sizes, leverage options, and trading hours.

Leverage Options at KCM Trade

The multiplier levels vary depending on the entity with which traders open an account. Since leverage is one of the most heavily regulated aspects, traders should understand the specific regulations that apply to each entity.

- Australian clients can use a maximum Leverage of 1:30.

- Traders seeking higher leverage opportunities have the option to trade under the jurisdiction of the Mauritius Financial Services Commission. This regulatory body permits trading with leverage levels as high as 1:1000, providing traders with increased flexibility and potential for amplified returns.

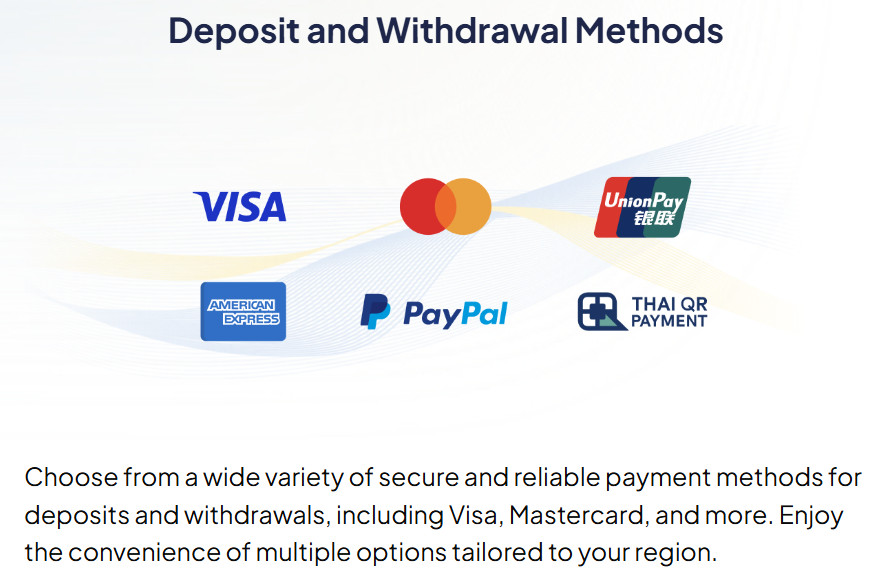

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at KCM Trade

KCM Trade offers a few payment methods to make funding the accounts quick and convenient, including:

- Credit/Debit cards

- UnionPay

- American Express

- PayPal

- Thai QR Payment

KCM Trade Minimum Deposit

KCM Trade has a minimum deposit requirement of $50, making it ideal for every trader looking for a professional and well-resourced trading environment.

Withdrawal Options at KCM Trade

Withdrawals at KCM Trade are simple and swift for traders. The processing time for withdrawals may vary depending on the chosen withdrawal method, but typically, withdrawals take one working day, which is ranked as a good proposal among industry competition.

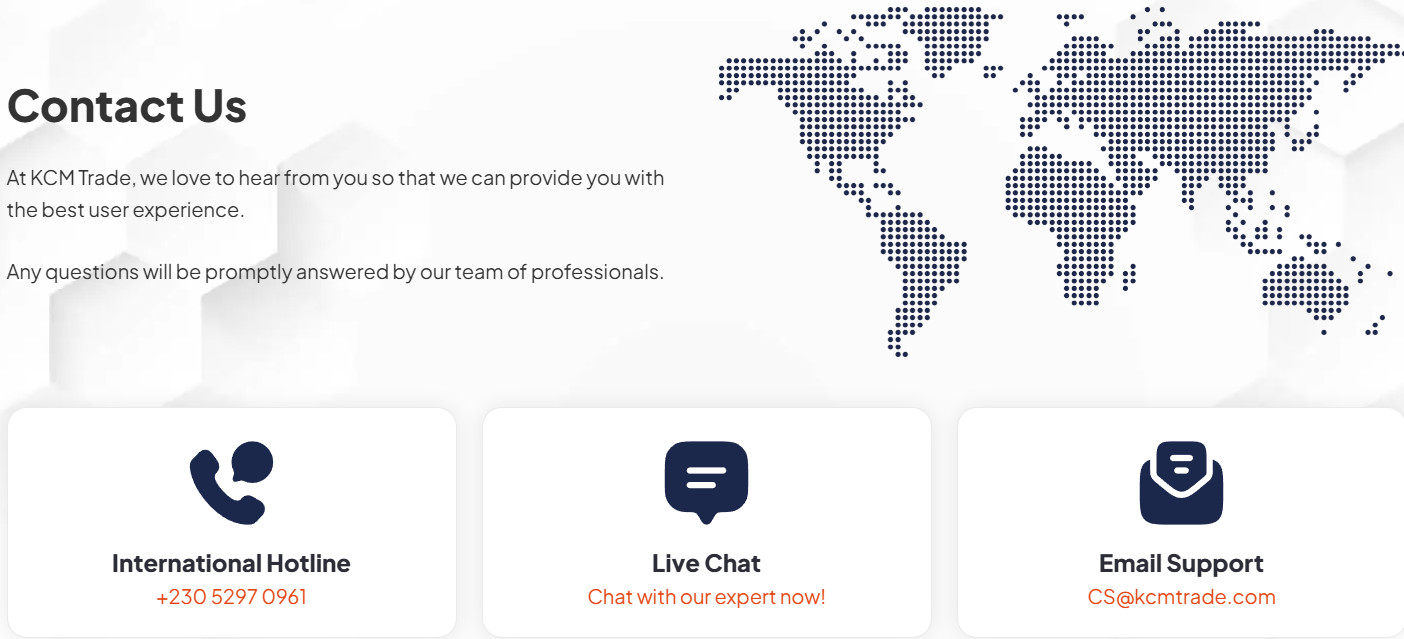

Customer Support and Responsiveness

Score – 4.5/5

Testing KCM Trade’s Customer Support

KCM Trade provides 24/7 global customer support, ensuring traders can receive assistance whenever they need it. The support team is available through multiple channels such as live chat, email, phone, and Line, offering multilingual service to accommodate clients worldwide.

Contacts KCM Trade

Users can reach KCM Trade’s customer support through several convenient contact options. For international inquiries, the hotline is available at +230 5297 0961, while local calls can be made to +230 4672 000.

Additionally, traders can contact the support team via email at CS@kcmtrade.com for assistance with account issues, technical support, or general questions.

Research and Education

Score – 4.7/5

Research Tools KCM Trade

KCM Trade provides a comprehensive range of research tools to support traders in making informed decisions.

- On its website, users can access the Signal Centre, which offers timely trade signals and market insights to help identify potential opportunities.

- The Economic Calendar keeps traders updated on important financial events and economic releases that may impact the markets.

- Additionally, the Trading Calculator helps traders accurately estimate potential profits, losses, and margin requirements, making risk management more precise and straightforward. Together, these tools provide a well-rounded resource base for traders at all levels.

- For those using MT4 and MT5, EA support enables automated strategies, allowing for more efficient and emotion-free trading.

Education

KCM Trade places a strong emphasis on trader education by offering a variety of resources to help clients enhance their knowledge and skills. Its Education Center provides access to comprehensive materials, including articles, tutorials, and video lessons covering fundamental and technical analysis.

The broker also regularly hosts seminars and webinars, where traders can learn directly from experts and stay updated on market trends and trading strategies.

Additionally, KCM Trade offers structured courses designed to guide traders from beginner to advanced levels. Complementing these educational offerings is the broker’s ongoing market analysis, which provides valuable insights and updates to help traders make informed decisions in real-time.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options KCM Trade

KCM Trade primarily focuses on Forex and CFD markets. Through its trading platforms, clients can access a wide range of currency pairs as well as CFDs on commodities, indices, stocks, and cryptocurrencies.

However, the broker does not offer traditional investment solutions such as managed portfolios or long-term wealth management products. Its services are mainly directed toward active trading rather than passive investing.

Account Opening

Score – 4.5/5

How to Open KCM Trade Demo Account?

Opening a demo account with KCM Trade is a simple way to practice trading and familiarize yourself with the platform without risking real money. Here is how you can get started:

- Visit the official KCM Trade website.

- Navigate to the Demo Account section, usually found on the homepage or under the account types menu.

- Fill out the registration form with your basic details, such as name, email address, phone number, and preferred account settings.

- Choose your desired platform for the demo account.

- Submit the form and verify your email if required.

- Once registered, download the selected trading platform or access the WebTerminal directly through your browser.

- Log in using the demo account credentials provided.

- Start exploring the platform and practicing trades with virtual funds.

This process allows you to experience live market conditions risk-free and build confidence before moving to a live account.

How to Open KCM Trade Live Account?

Opening a live account with KCM Trade is a straightforward process to get you trading quickly and securely. First, you need to visit the official KCM Trade website and complete the online registration form by providing your personal information and contact details.

After submitting your application, you will be required to verify your identity and address by uploading relevant documents, such as a passport or utility bill, to comply with regulatory requirements.

Once your account is verified, you can choose your preferred account type, set up your platform, and make the minimum deposit to activate your account.

Additional Tools and Features

Score – 4.4/5

In addition to its core analytical tools, KCM Trade offers other advanced features to enhance the trading experience.

- One such tool is FIX API integration, which allows for ultra-low latency trading and seamless connectivity, making it ideal for high-frequency traders and institutions seeking direct market access.

- KCM Trade also provides an AI Mentor, a smart educational assistant designed to guide traders with personalized tips, strategy suggestions, and risk management support.

KCM Trade Compared to Other Brokers

When compared to other brokers in the industry, KCM Trade positions itself as a well-rounded option, especially for traders seeking a blend of advanced tools, solid platform choices, and professional-grade services.

Unlike many competitors that offer very low entry points, KCM Trade’s higher minimum deposit reflects its focus on more serious traders looking for robust infrastructure and deeper market access.

While some brokers provide an extensive range of instruments or proprietary platforms, KCM Trade stands out with its strong combination of MT4, MT5, and its own KCM PRO Trader, along with advanced features like AI Mentor and FIX API integration.

Though its fees are competitive and on par with industry standards, KCM Trade maintains a balance between cost, technology, and trader support, making it particularly appealing to those who prioritize reliability and professional features in their trading environment.

| Parameter |

KCM Trade |

M4Markets |

Earn |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.6 pips |

Average 1.1 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3.5 per side |

0.0 pips + $3.5 per side |

0.0 pips + 0.007% per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, KCM PRO Trader |

MT4, MT5, cTrader |

MT4, MT5, Earn.Broker |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

200+ instruments |

120+ instruments |

950+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

ASIC, FSC |

CySEC, DFSA, FSA |

CySEC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$1,000 |

$5 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker KCM Trade

KCM Trade is a global Forex and CFD broker offering access to a wide range of markets, including currencies, commodities, indices, and cryptocurrencies.

The broker is well-regulated and provides competitive trading conditions, including tight spreads, leverage options, and a choice of account types suitable for different trader profiles.

KCM Trade supports popular platforms like MetaTrader 4 and MetaTrader 5 and offers both demo and live accounts. Traders can benefit from multilingual customer support, an in-house Education Center with seminars and webinars, daily market analysis, and tools like FIX API integration and an AI trading mentor.

Share this article [addtoany url="https://55brokers.com/kcm-trade-review/" title="KCM Trade"]