- JFD Brokers Pros and Cons

- Is JFD Brokers Safe or a Scam?

- Leverage

- Trading Fees

- Spread

- Deposits and Withdrawals

- Platforms

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about JFD Brokers.

What is JFD Brokers?

JFD Brokers is a Forex and CFD trading broker offering its clients access to trading Forex, Indices, Cryptos, Commodities, Metals, and more.

- JFD Brokers was founded in 2011 by professional traders that adhere to transparent trading and fairness as one of the core values. The company’s main office is located in Cyprus and additional offices served in Bulgaria, along with a subsidiary in Germany.

JFD Brokers has become a progressive and very respected company in the trading industry, as the broker uses a pure agency model with Direct Market Access, hence executing orders straight with client-centric trading without any misunderstanding.

JFD Brokers Pros and Cons

JFD Brokers is a good broker with regulation and Direct access to markets for a quality trading solution, a range of trading platforms, and easy account opening. There are many funding methods supported and traders can find education.

For the Cons, there is no 24/7 support and conditions vary according to the entity rules, so might be more competitive for some regions.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded | No 24/7 customer support |

| Competitive trading costs and spreads | |

| Wide range of trading instruments including Forex and CFDs | |

| MT4 and MT5 trading platforms | |

JFD Brokers Review Summary in 10 Points

| 🏢 Headquarters | Cyprus |

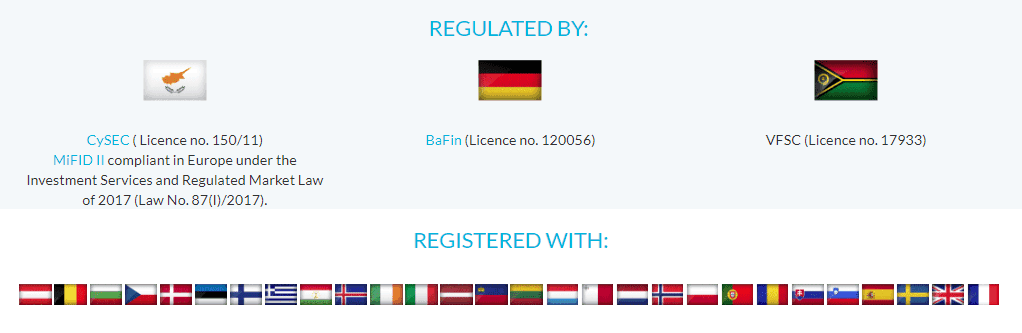

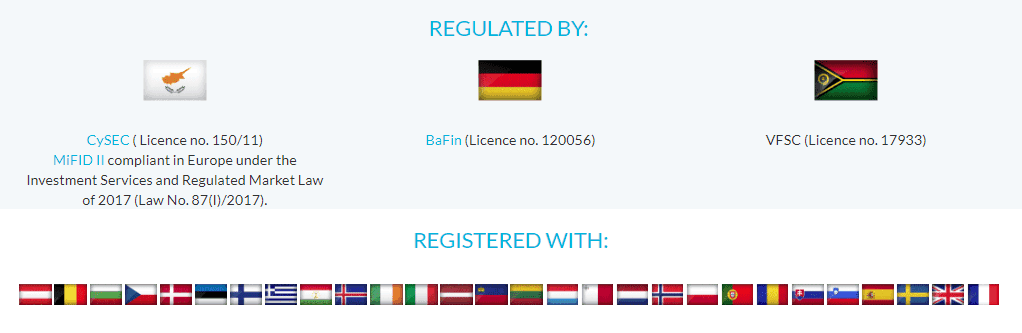

| 🗺️ Regulation | CySec, BaFIN, VFSC |

| 🖥 Platforms | MT4, MT5, stock3 |

| 📉 Instruments | Forex, CFDs on Index, Shares, Commodities, Bonds, ETF and ETN, Cryptocurrency, and more |

| 💰 EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | $500 |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Education tools and daily analysis |

| ☎ Customer Support | 24/5 |

Overall JFD Brokers Ranking

JFD Brokers is considered a good broker with safe and favorable trading conditions with transparency. The broker offers a range of trading services with competitive trading costs. As one of the good advantages, JFD Brokers is available in many countries, so traders can sign in also with the lowest spreads.

- JFD Brokers Overall Ranking is 8.5 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | JFD Brokers | Capital Index | Trading 212 |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Costs | Trading Conditions | Trading Instruments |

JFD Brokers Alternative Brokers

JFD Brokers offers good trading conditions, a range of trading instruments, also low trading spreads, and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to JFD Brokers:

Awards

JFD Brokers is an award-winning and fast-growing FX and CFD broker with competitive trading conditions. The broker has also garnered collective recognition from industry leaders many times.

Is JFD Brokers Safe or Scam?

No, JFD Brokers is not a scam. It is a registered and licensed broker and operates as a JFD group under strict European regulations, by CySEC and the MiFID along with numerous registrations in EEA zone like FCA, CONSOB, BaFIN, and ACPR.

Is JFD Brokers Legit?

Yes, JFD Brokers is a legit and regulated broker in various jurisdictions.

Together with its CySEC license, JFD is sharply authorized by German BaFIN known for its strict regulations and control over the brokerage. Even though, JFD also serves an offshore entity in Vanuatu its parallel regulations from ESMA do not leave questions about their reliability and transparency.

See our conclusion on JFD Brokers Reliability:

- Our Ranked JFD Brokers Trust Score is 8.9 out of 10 for good reputation and service over the years, also for reliable licenses. The only point is that regulatory standards and protection vary based on the entity.

| JFD Brokers Strong Points | JFD Brokers Weak Points |

|---|

| Regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity |

| CySEC and BaFin licenses and overseeing | |

| Negative balance protection | |

| Compensation scheme | |

How Are You Protected?

All clients’ funds are kept separately from the company funds while kept in licensed financial institutions and guaranteeing their security. Since JFD is a member of the Investor Compensation Fund (ICF), all clients run with its protection in case of insolvency. Furthermore, the broker implements negative balance protection.

Leverage

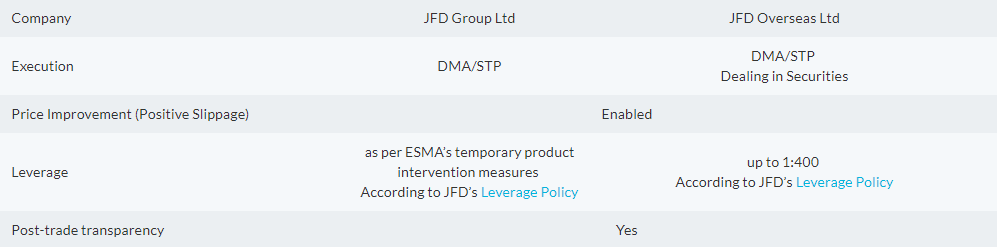

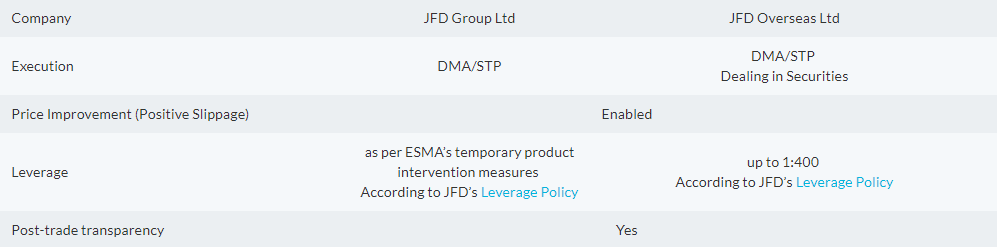

Under the regulatory restrictions, JFD falls within specific requirements in each jurisdiction it runs a business. Generally, JFD Brokers uses lower leverage to reduce the risk of money lost.

- European resident traders are allowed to use maximum leverage at 1:30,

- While other traders operating through JFD overseas may apply for leverage up to 1:400 on Forex instruments.

Account Types

JFD Brokers offers only one JFD Account which offers tight spreads and fast direct execution into the market.

Of course, in the beginning, any trader can open a risk-free demo account with JFD Brokers.

| Pros | Cons |

|---|

| Fast account opening | Account types and proposals may vary according to jurisdiction |

| Hedging and scalping allowed | |

| Demo account is available | |

| Account base currencies USD, GBP, EUR, CHF | |

How to Open JFD Brokers Live Account?

Opening an account with JFD Brokers is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

JFD Brokers offers over 1,500 trading instruments across 9 asset classes including Forex, Metals, CFDs on Index, Stocks, Commodities, ETFs and ETNs, and Cryptocurrencies, and also JFD is the first broker which launched Physical Stocks on the MT5 platform.

- JFD Brokers Markets Range Score is 9.2 out of 10 for wide trading instrument selection among Forex, Stocks, Indicies, and more.

JFD Brokers Fees

JFD Brokers fees are good, mainly built into a commission charge, but good to check funding fees, non-activity fees, and other conditions too. The broker offers Zero-Commission ETFs and Stocks trading conditions.

In addition, overnight financing costs are calculated for CFDs on Stocks and Cash Indices are 3.25% +/- Libor.

The Agency Model brings an absolutely 0 rejection rate and no requotes, with the addition of unconditional and anonymous access to the interbank market based on a “Fill or Fill” model with negative and positive slippage enabled.

- JFD Brokers Fees are ranked low with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | JFD Brokers Fees | Capital Index Fees | Tickmill Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | No |

| Fee ranking | Low | Low, Average | Low |

Spreads

JFD Brokers offers an average spread of 0.2 for EUR/USD pair, starting from 0 pip for all clients. Trading on DAX and DOW is offered through reduced commissions on CFDs (0.1 per lot per side), while risks are controlled with mini lots on CFD trading and the right money management.

- JFD Brokers Spreads are ranked low with an overall rating of 9 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower, and spreads for other instruments are very attractive too.

| Asset/ Pair | JFD Brokers Spread | Capital Index Spread | Tickmill Spread |

|---|

| EUR USD Spread | 0.2 pips | 1.1 pips | 0.3 pips |

| Crude Oil WTI Spread | 0.57 | 7 | 4 |

| Gold Spread | 0.01 | 0.5 | 20 |

| BTC USD Spread | 0.01 | - | 12 |

Deposits and Withdrawals

In order to start live trading, you may choose an applicable payment method to fund the account or transfer money. The options include bank transfers, bank transfer with Sofort, which will include a 1.8% deposit fee, and online payments like Skrill with a 2.9% fee, Safecharge with a 1.95% fee, and UnionPay with no charges. Therefore, you should carefully check which payment method to choose along to consult applicable fees to perform fund transfers.

- JFD Brokers Funding Methods we ranked good with an overall rating of 8.9 out of 10. Fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for JFD Brokers funding methods found:

| JFD Brokers Advantage | JFD Brokers Disadvantage |

|---|

| $500 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for withdrawals | |

| Fast digital deposits, including Credit/Debit Cards | |

| Multiple account base currencies | |

| Withdrawal requests confirmed within 1-3 business days | |

Deposit Options

In terms of funding methods, JFD Brokers offers many payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- Nuvei, and more

JFD Brokers Minimum Deposit

JFD Brokers minimum deposit amount is $500 regardless of the platform or trading account you choose to trade.

JFD Bank minimum deposit vs other brokers

|

JFD Bank |

Most Other Brokers |

| Minimum Deposit |

$500 |

$500 |

JFD Brokers Withdrawals

To withdraw the funds you can use the same methods, which are eligible for fees also. Thus, Skrill and Safecharge will require a 1% fee for the transaction process. Also, JFD Brokers does not charge any internal fees for withdrawals. However, deposit fees might be charged depending on the type of payment method you choose.

How Withdraw Money from JFD Brokers Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

For the trading platforms, JFD Brokers chose industry-proven platforms for their proven performance and capacities. The award-winning MT4 and MT5 platforms are available at the traders’ toolbar to access markets through flexible, yet comprehensive trading along with a powerful Guidance platform available with its JFD unique offering in German.

The broker also offers one of the most popular CFD and Forex trading platforms in Germany, named stock3. The platform is a highly interactive, social way to trade within an intuitive interface, which you can use to trade over 1500+ instruments in 9 asset classes through JFD’s pure Agency Model with 100% DMA/STP execution.

Moreover, traders stay connected under any conditions with VPS (Virtual Private Server) for advanced trading strategies and continuous EA monitoring.

- JFD Brokers Platform is ranked excellent with an overall rating of 9 out of 10 compared to over 500 other brokers. We mark it as excellent since it offers popular MT4 and MT5 professional trading platforms.

Trading Platform Comparison to Other Brokers:

| Platforms | JFD Brokers Platforms | Capital Index Platforms | Tickmill Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Desktop and Web Trading Platforms

Overall, all platforms bring the utmost level of trading capabilities with slightly different features that support various trading stiles, which are remaining as an option to choose from for a particular trader. Platforms available through desktop, web, and mobile application versions, as well as including options to automate, perform technical trading, or use social trading capabilities with the help of stock3 trading platform

Customer Support

JFD Brokers provides 24/5 customer support to its clients. Phone lines, Live chat, and Email are also available here.

- Customer Support in JFD Brokers is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of live chat, phone lines, and email | |

JFD Brokers Education

JFD Brokers provides daily market news and analysis along with learning materials and data, webinars, and live events.

- JFD Brokers Education ranked with an overall rating of 8.5 out of 10 based on our research. The broker provides good quality educational materials, and analysis and also cooperates with market-leading providers of data.

JFD Brokers Review Conclusion

The final thought upon JFD Brokers review is that the broker from many perspectives is a great offer in technology, reliability, customer service, and pricing. Broker’s technical optimization and servers are on top of technology, which all bring a truly powerful combination to trade for both beginning or even very advanced traders with various trading styles, which is a great option to consider.

Based on Our findings and Financial Expert Opinions JFD Brokers is Good for:

- Beginners

- Advanced traders

- Currency and CFD trading

- Social trading

- STP execution

- Traders who prefer MT4 and MT5 trading platforms

- Low spread trading

- Competitive fees

- EA trading

- Supportive customer support

- Good educational materials

Share this article [addtoany url="https://55brokers.com/jfd-brokers-review/" title="JFD Brokers"]

Maiores laborum ipsum esse occaecat dolore recusandae Molestiae libero aliquid sed perferendis ullamco officiis qui eiusmod ratione rerum est voluptatem