- What is JFD Brokers?

- JFD Brokers Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

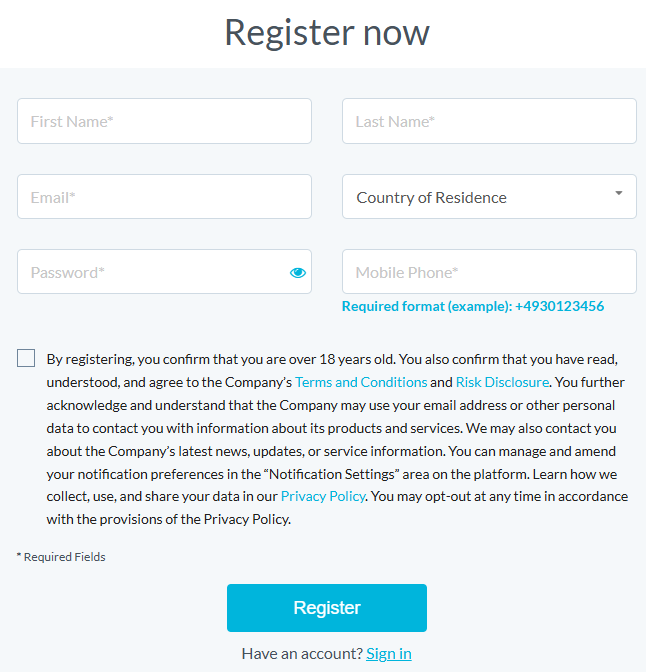

- Account Opening

- Additional Tools And Features

- JFD Brokers Compared to Other Brokers

- Full Review of Broker JFD Brokers

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is JFD Brokers?

JFD Brokers is a Forex and CFD trading broker offering its clients access to trading Forex, Indices, Cryptos, Stocks, Commodities, Precious Metals, ETFs/ETNs, and more.

- JFD Brokers was founded in 2011 by professional traders who adhere to transparent trading and fairness as core values. The company’s main office is located in Cyprus, and additional offices are in Bulgaria, along with a subsidiary in Spain.

JFD Brokers has become a progressive and very respected company in the trading industry. The broker uses a pure agency model with Direct Market Access, hence executing orders straight with client-centric trading without any misunderstanding.

JFD Brokers Pros and Cons

JFD Brokers is a good broker with regulation and direct access to markets for a quality trading solution, a range of trading platforms, and easy account opening. The broker offers an extensive range of instruments, including 9 financial assets. Also, many funding methods are supported, and traders can access quality education with webinars, a trading glossary, and a JFD Club with exclusive offerings.

For the cons, there is no 24/7 support, and conditions vary according to the entity rules.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded | No 24/7 customer support |

| Competitive trading costs and spreads | |

| Wide range of trading instruments including Forex and CFDs | |

| MT4 and MT5 trading platforms | |

JFD Brokers Features

JFD Brokers is a well-established broker with multiple licenses and a strong global presence. The broker offers favorable and transparent services, standing out for a good choice of platforms, an extensive range of instruments, and good educational materials. We have researched all the aspects of trading with JFD Brokers and have made a list of main features to consider:

JFD Brokers Features in 10 Points

| 🗺️ Regulation | CySEC, CNMV, VFSC |

| 🗺️ Account Types | A single account |

| 🖥 Trading Platforms | MT4, MT5, stock3 |

| 📉 Trading Instruments | Forex, CFDs on Index, Shares, Commodities, Stocks, ETF and ETN, Cryptocurrency, Physical Stocks |

| 💳 Minimum deposit | $500 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | Several currencies offered |

| 📚 Trading Education | Education tools and daily analysis |

| ☎ Customer Support | 24/5 |

Who is JFD Brokers For?

We have conducted thorough research to determine what trading needs JFD Brokers meets. Based on our findings and financial expert opinions JFD Brokers is Good for:

- Beginners

- Advanced traders

- Currency and CFD trading

- Social trading

- STP execution

- Traders who prefer MT4 and MT5 trading platforms

- Low spread trading

- Competitive fees

- EA trading

- Real Stock trading

- Supportive customer support

- Good educational materials

JFD Summary

JFD Brokers has a great offering in technology, customer service, and pricing. Broker’s technical optimization and servers are on top of technology, which all bring a powerful combination to trade for both beginner or even very advanced traders with various trading styles. Besides, JFD Brokers has an extensive offering of tradable products, a functional and advanced platform, great educational materials, and a safe and reliable setting for profitable trades.

55Brokers Professional Insights

JFD Brokers is a reliable broker with quality trading conditions and transparent practices, while one of its main advantages is true DMA access. The Broker is a great reputation also running JFB Bank, making it smooth for financial purposes. Making it one of the Broker suitable for technical traders, scalpers, news traders and those who operate large trading volumes. The costs applied are competitive and on the lower side, spreads are very competitive and commission accounts are with good costs based on our tests too.

JFD Brokers has transparent pricing and no hidden fees. It offers nine asset classes with an overall availability of over 1,500 instruments. Another advantage is that the broker provides more than 600 real stocks, allowing clients to diversify their portfolios and invest for long holding.

Additionally, JFD Brokers has great global exposure, operating in numerous regions. However, the broker also runs an offshore entity, and the conditions may differ across jurisdictions. As for the trading technology, it is based on MetaTrader software so if you prefer other platforms, it might be good to check other proposals too.

Consider Trading with JFD Brokers If:

| JFD Brokers is an excellent Broker for: | - Beginner traders

- Those looking for an extensive range of instruments

- Advanced traders

- Commission-based trades

- Advanced clients

- Cost-efficient trading

- MT4/MT5 platforms enthusiasts

- EA traders

- Those looking for comprehensive educational materials

- ETF trading

- Real stock traders |

Avoid Trading with JFD Brokers If:

| JFD Brokers is not the best for: | - Traders looking for 24/7 support

- Those looking for alternative platforms

- Those looking for spread-based fee structure

- Traders prioritizing low minimum deposit requirement |

Regulation and Security Measures

Score – 4.5/5

JFD Brokers Regulatory Overview

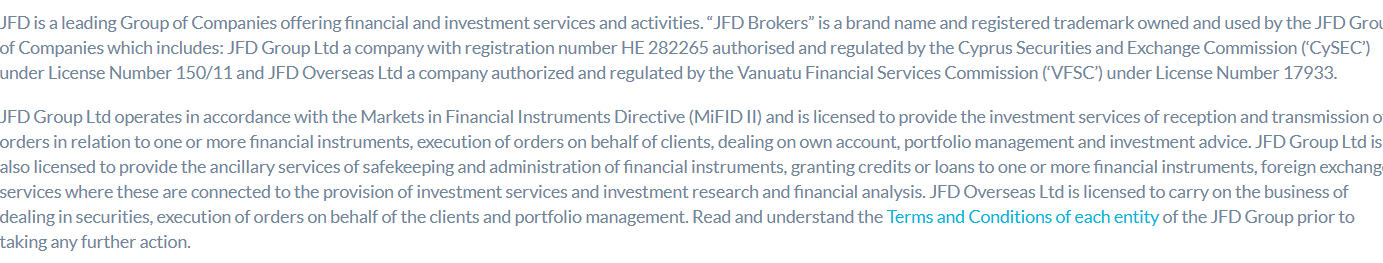

JFD Brokers is a registered and licensed broker and operates as a JFD group under strict European regulations, by CySEC and the MiFID.

Together with its CySEC license, JFD is sharply authorized by the Spanish CNMV, known for its strict regulations and control over the brokerage. Even though JFD also serves an offshore entity in Vanuatu, its parallel regulations from ESMA do not leave doubts about its reliability and transparency.

How Safe is Trading with JFD Brokers?

We have found that JFD Brokers takes various measures to protect its clients:

- All clients’ funds are separated from the company funds and are kept in licensed financial institutions, guaranteeing their security.

- JFD is a member of the Investor Compensation Fund (ICF), and all clients have its protection in case of insolvency.

- At last, the broker implements negative balance protection to protect clients’ account balances from turning negative. The negative balance protection is only for clients who are registered under the CySEC entity.

Consistency and Clarity

JFD Brokers is an award-winning and fast-growing FX and CFD broker with competitive trading conditions. The broker has garnered collective recognition from industry leaders many times and ranked high for top execution services in Germany and the best OTC broker in Western Europe.

The broker is available worldwide and has good global coverage. We have also reviewed real feedback from customers from different regions to evaluate their experience. Most traders point out the broker’s transparent fee structure and safe trading environment. Besides, the customer support is at a good level. There are also a few negative reviews that shouldn’t be neglected. We recommend considering both positive and negative feedback before opening an account with the broker. Make sure that the services of the broker align with your trading expectations.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with JFD Brokers?

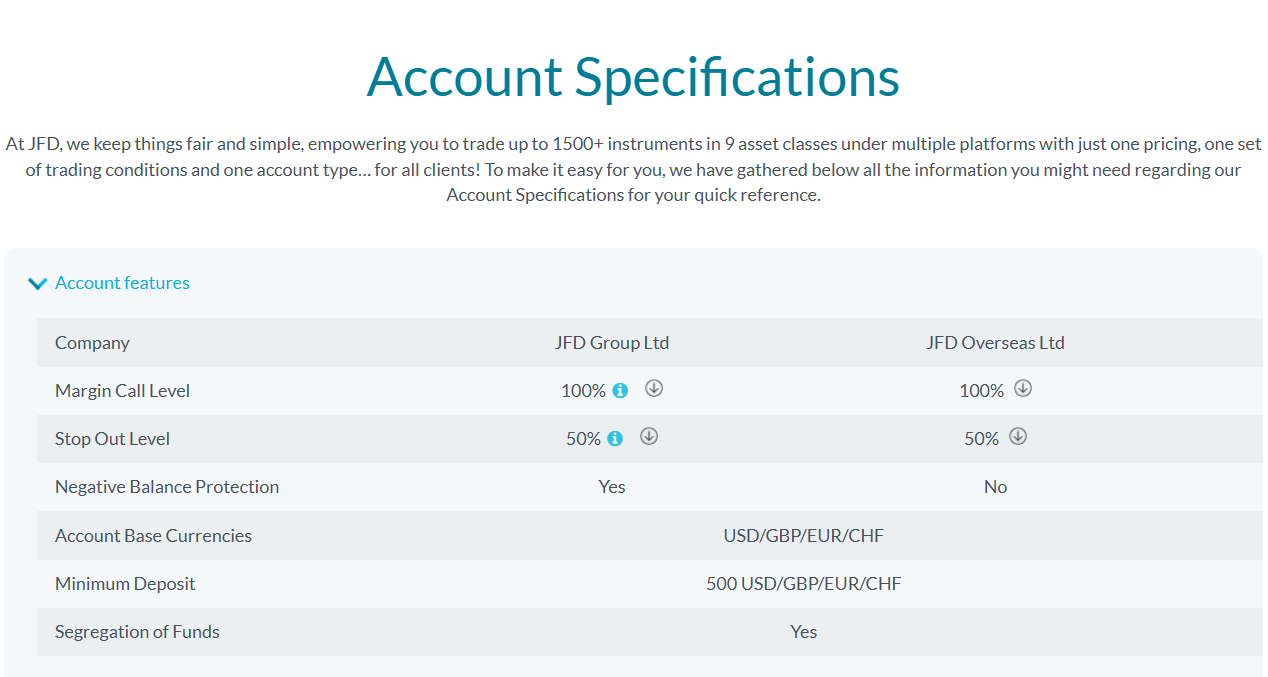

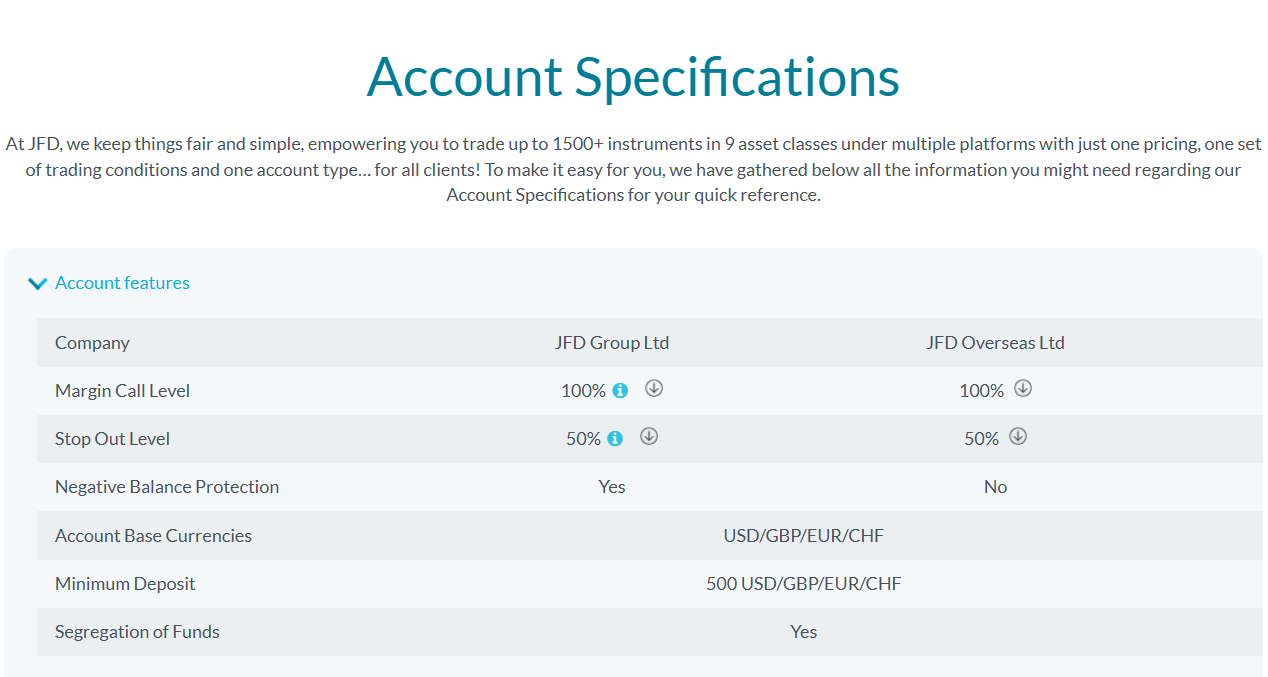

JFD Brokers offers a single account, which offers tight spreads and fast direct execution into the market. The account is commission-based, with very low spreads and commissions that are different based on the instrument. The account gives access to several platforms—MT4, MT5, and Stock3. To start trading, clients need to deposit at least $500. The available account base currencies are USD/GBP/EUR/CHF.

- Note that the negative balance protection is only available for accounts registered under the CySEC entity.

- The available leverage ratio also depends on the entity signed.

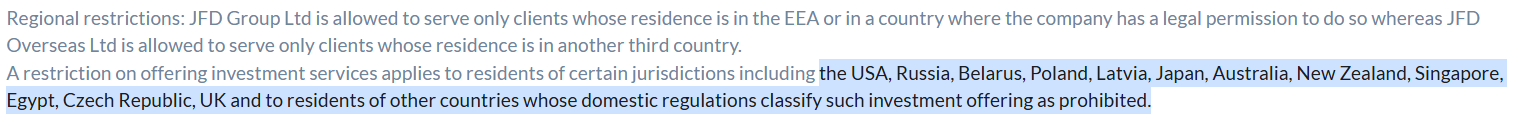

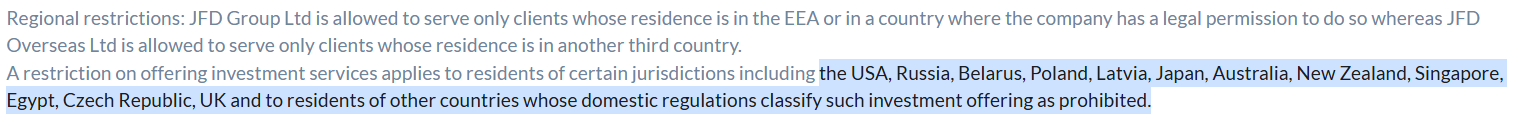

Regions Where JFD Brokers is Restricted

There are certain restrictions on the availability of the broker in different regions. First, the JFD Group Ltd is allowed to serve clients from the EEA zone only. The JFD Overseas Ltd. gives more global exposure and only restricts its services to the following countries:

- USA

- Russia

- Belarus

- Poland

- Latvia

- Japan

- Australia

- New Zealand

- Singapore

- Egypt

- Czech Republic

- UK

Cost Structure and Fees

Score – 4.5/5

JFD Brokerage Fees

JFD Brokers offers a single commission-based account. The broker’s spreads are very low, and for each trade, clients pay a fixed commission. The commission size depends on the instrument traded. Commissions for each instrument are described in detail on the broker’s website.

JFD Brokers applies additional trading and non-trading fees that should be considered. The broker charges inactivity fees, currency convertion fees, and swap fees.

JFD Brokers offers a single account with very low spreads. The broker offers an average spread of 0.2 for the EUR/USD pair, starting from 0 pip for all clients. For more information on spreads, clients can find them presented in real-time on the broker’s platform. As the JFD Broker’s account is commission-based, besides the small spreads, there are also commissions for each transaction.

JFD Brokers’ commissions depend on the instrument type and are charged for each transaction per side per trade. Here are the main commissions defined for each instrument:

Forex and Precious Metals—$2.7 per side per lot

ETFs—$0.05 per share / minimum ticket charge of $3

CFDs on EU Stocks—0.05% of order volume/minimum ticket charge 5 EUR

CFDs on Stocks (UK) – 0.05% of order volume/minimum ticket charge 5 GBP

CFDs on Indices, CFDs on Commodities—$0.09

CFDs on ETFs—2.5 cents per share/minimum ticket charge of $5

CFDs on Cryptocurrencies—There are no commissions for Cryptocurrencies.

- JFD Brokers Rollover / Swap Fees

JFD Brokers charges swap fees. They are determined whether the swaps are long or short. Swap fees are updated and changed daily due to volatility and other market changes. The long swap for EUR/USD is -10.03, and the short swap is 0.78.

How Competitive Are JFD Brokers Fees?

We found JFD Brokers’ fees competitive and transparent. The broker gives a detailed description of all the commissions based on the instruments traded. The spreads applied are 0.2 pips on average, which is considered a low offering. Detailed specifications of spreads can be found on the broker’s platform. All in all, we find the costs quite competitive. The commissions for some instruments are lower than the market average. Besides, there are no commissions for cryptocurrencies.

We have also found a few non-trading fees included in the overall charges when you trade with the broker. So, it is advisable to consider all the applicable costs.

| Asset/ Pair | JFD Brokers Spread | Capital,com Spread | Eightcap Spread |

|---|

| EUR USD Spread | 0.2 pips | 0.6 pips | 1 pips |

| Crude Oil WTI Spread | 0.57 | 0.4 | 3 pips |

| Gold Spread | 0.01 | 0.03 | 1.2 pips |

| BTC USD Spread | 0.01 | 106 | 170 |

JFD Brokers Additional Fees

JFD Brokers also charges a few additional fees. We have found that the broker applies charges for the inactive accounts. If there is no trading activity on the account, the broker will charge a $20 monthly fee. Also, when funding actions are performed in a currency other than the account’s base currency, the broker charges a 1% currency conversion fee. At last, JFD Brokers does not charge withdrawal fees, yet the third-party payment provider might apply charges traders need to be aware of.

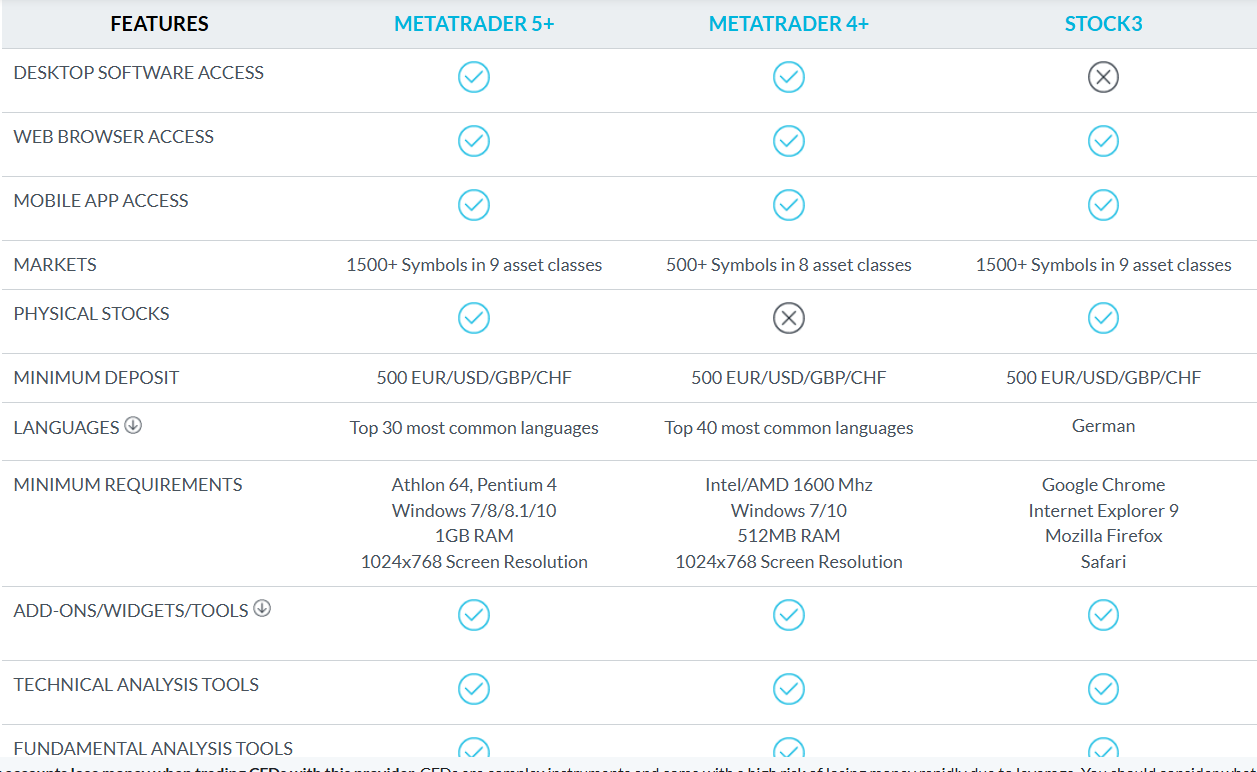

Score – 4.4/5

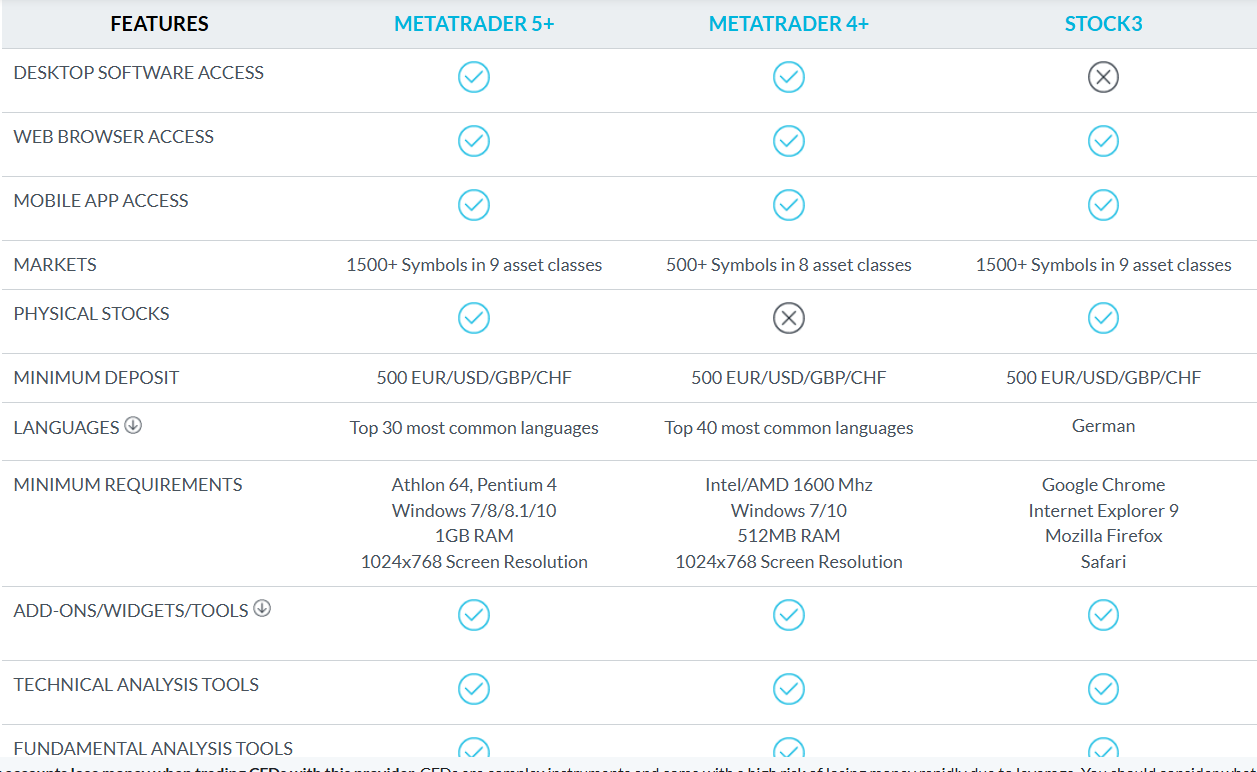

For the trading platforms, JFD Brokers chose industry-proven platforms for their quality performance and capacities. The award-winning MT4 and MT5 platforms are available on the traders’ toolbar to access markets through flexible and comprehensive trading.

The broker also offers a popular CFD and Forex trading platform named Stock3. The platform is a highly interactive, social way to trade within an intuitive interface, which you can use to trade over 1500+ instruments in 9 asset classes through JFD’s pure Agency Model with 100% DMA/STP execution.

Moreover, traders stay connected under any conditions with VPS (Virtual Private Server) for advanced trading strategies and continuous EA monitoring.

| Platforms | JFD Brokers Platforms | Capital.com Platforms | eToro Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

JFD Brokers Web Platform

The broker enables its clients to access MT4/MT5 web traders from its official website. The platforms give traders flexibility and ease of use. There is no need for installations or downloads, allowing direct access to the trader’s account. The web platforms are equipped with all the essential tools that assist users in profitable and efficient trading. The web platform gives traders access to the same trading conditions as the desktop platform.

JFD Brokers Desktop MetaTrader 4 Platform

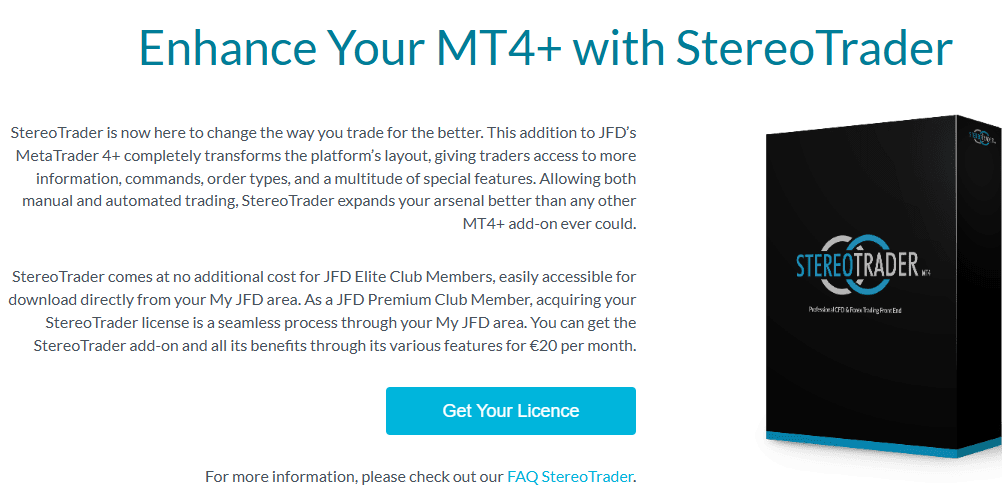

JFD Brokers offers an MT4+ platform, the enhanced variant of the popular retail platform, which the broker has enhanced even further. The JFD Brokers MT4+ account offers a wider range of instruments across eight popular financial assets. Through the pure agency-only model, traders will be connected to over 20 LPs. The platform includes an impressive selection of trading tools, a variety of indicators and EAs, backtesting opportunities, chart history, and updated company news. Among other innovative solutions, the MT4+ platform also allows access to Stereo Trader with no charge for the elite members and a $20 monthly charge for others.

JFD Brokers Desktop MetaTrader 5 Platform

As in the case of the MT4 platform, JFD Brokers has enhanced the MT5 platform as well, adding a range of innovations and better opportunities for its clients. With the MT5+ platform, clients gain access to over 1500 instruments across nine asset classes. The MT5+ platform offers different orders, including the buy stop, sell limit, buy limit, and more order options. Traders can also download add-ons right from the broker’s website. The platform also includes technical indicators, a market watch, an economic calendar, and the Stereo Trader.

Main Insights from Testing

Our research of the broker’s platforms has revealed that the MT4 and MT5 platforms offered by JFD Brokers are more enhanced and improved, with better conditions and offerings. The broker has added many new tools, instrument availability, and other innovative solutions. Overall, both platforms are great for advanced trading.

stock 3 Platform

JFD Brokers is one of the few brokers that offers Forex and CFD trading through the Stock 3 platform. It gives access to over 1500 tradable products. The platform is browser-based, giving traders more flexibility. It offers one-of-a-kind charting capabilities and advanced trading tools. The Stock 3 platform provides fundamental analysis, access to webinars, deep analysis, and customization opportunities.

JFD Brokers MobileTrader App

JFD Brokers allows access to your account through the Metaquotes mobile app, for Android and iOS devices. The app allows you to execute complex orders, manage your trades, and access the trading history from the palm of your hand. With the MT4 and MT5 apps, clients access all the instruments and features offered by the desktop platforms. Also, they can access six pending orders, two closing options, and real-time charts. Market depth is also available through the app and is fully functional. To sum it all up, JFD Brokers’ mobile application enables complete flexibility and versatility of trades, allowing clients to enjoy all the functions of the desktop platform anywhere and anytime.

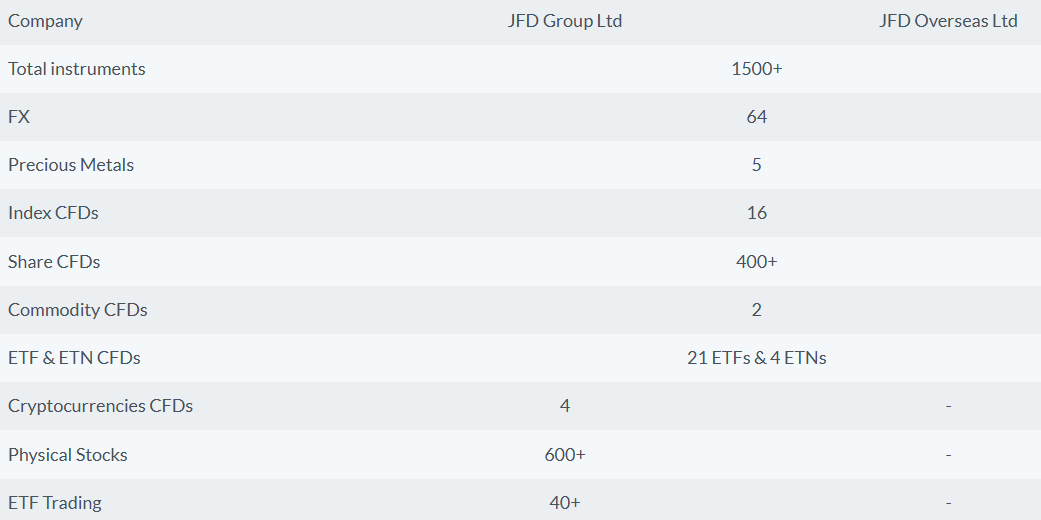

Trading Instruments

Score – 4.7/5

What Can You Trade on the JFD Brokers Platform?

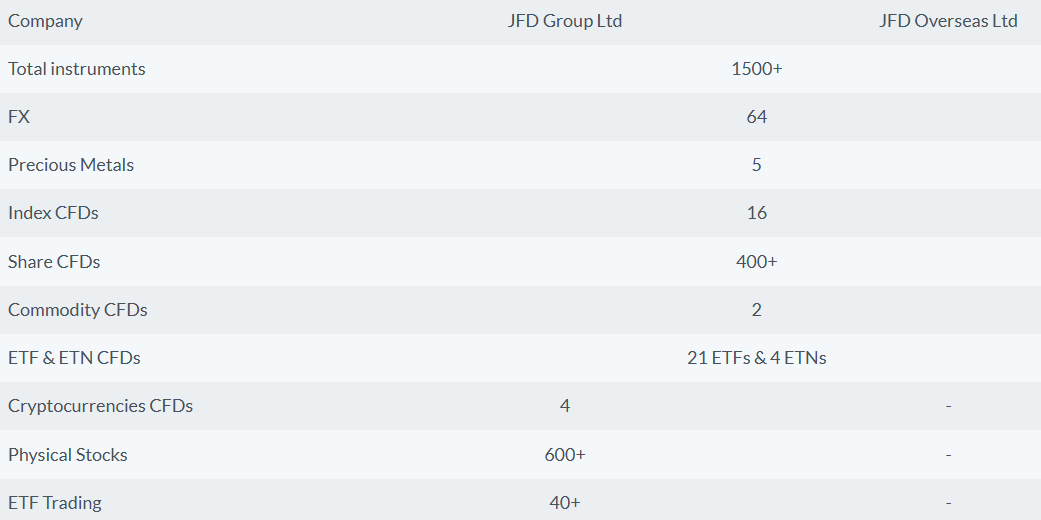

JFD Brokers offers over 1,500 trading instruments across 9 asset classes, including Forex, Metals, CFDs on Index, Stocks, Commodities, ETFs and ETNs, and Cryptocurrencies, and also JFD is the first broker to launch Physical Stocks on the MT5 platform.

The broker offers over 1500 tradable products, including 9 asset classes. Traders have access to 64 major, minor, and exotic currency pairs, 5 precious metals, 16 index CFDs, 400+share CFDs, 2 commodity CFDs, 21 ETFs & 4 ETNs on CFDs, 4 cryptocurrency CFDs, 600+ physical stocks, and 40+ ETF trading.

Main Insights from Exploring JFD Brokers’ Tradable Assets

Our research of the JFD Brokers’ trading instruments has revealed an impressive number of over 1500 tradable products across nine classes. The range of instruments allows traders to explore the market with good variety and expand their portfolios. Note that the MT4 platform allows access to 8 asset classes, while the MT5 and Stock3 enable access to 9 classes with accessibility to the full range of instruments.

JFD Brokers also offers over 600 physical stocks for long-term investors and those who prefer traditional investments. All in all, the broker’s instrument offering is quite extensive and gives great diversity and opportunities for growth and better exposure to the market.

Leverage Options at JFD Brokers

Under regulatory restrictions, JFD falls within specific requirements in each jurisdiction it runs. Generally, JFD Brokers uses lower leverage to reduce the risk of money loss.

- European resident traders are allowed to use maximum leverage at 1:30.

- Traders operating through JFD overseas may apply for higher leverage ratios of up to 1:400 on Forex instruments.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at JFD Brokers

In order to start live trading, you may choose an applicable payment method to fund the account or transfer money. The options include bank transfers, bank transfers with Sofort, which will include a 1.8% deposit fee, and online payments like Skrill and Neteller with a 2.9% fee, Safecharge with a 1.95% fee, and UnionPay with no charges. Therefore, you should carefully check which payment method to choose. The broker also allows the use of various account-based currencies. The only point to pay attention to is that the deposit options may vary for each entity.

Minimum Deposit

JFD Brokers’ minimum deposit amount is $500. This is a little higher compared to other brokers in the market, especially brokers with no minimum deposit requirement.

Withdrawal Options at JFD Brokers

To withdraw the funds, you can use the same methods used for deposits. Skrill and Safecharge will require $0.25 for withdrawals. For credit/debit cards, there is a $2 transaction fee charged. Also, pay attention to fees applied by the payment provider, which are not connected with the broker. All in all, the transaction fees are small and in line with the market standards.

Customer Support and Responsiveness

Score – 4.6/5

Testing JFD Brokers Customer Support

JFD Brokers provides 24/5 customer support to its clients. Phone lines, live chat, and email are also available here. Clients can also get in touch with the broker through multiple social platforms, including Twitter, FB, LinkedIn, Telegram, and YouTube. These platforms also provide the latest and updated information on the broker’s activities and market news.

- JFD Brokers also has an adequate FAQ section and offers detailed answers to common questions and issues.

Contacts JFD Brokers

We have tested the broker’s customer support and also researched feedback from traders to see if they find the service satisfactory. All in all, the support team is dedicated, with prompt and quick answers. Here are the main channels traders can use for different trading inquiries and questions:

- If traders prefer to use a phone line as the primary way to connect with the broker, the provided number is +49 40 87408688. We have also noticed that the broker has separate phone numbers for different countries and regions. Traders can find them on the ‘Contact Us’ section of the broker’s website.

- Another method to contact the support team is by email. The provided email address is support@jfdbrokers.com.

- At last, the quickest way to get detailed answers to urgent questions is by contacting the broker through a live chat. The live chat is available 24/5.

Research and Education

Score – 4.6/5

Research Tools JFD Brokers

JFD Brokers provides daily market news and analysis, learning materials and data, webinars, and live events. The research and education sections of the broker are quite comprehensive, allowing traders of any experience level to benefit. The main research tools available with JFD Brokers are listed below:

- Historical data export downloads historical data, including bid and ask prices and trading volumes for all the available instruments. To download the historical data, it is essential to have an account with the broker.

- JFD Brokers provides fundamental and technical analysis with a primary focus on FX, precious metals, indices, commodities, and stocks.

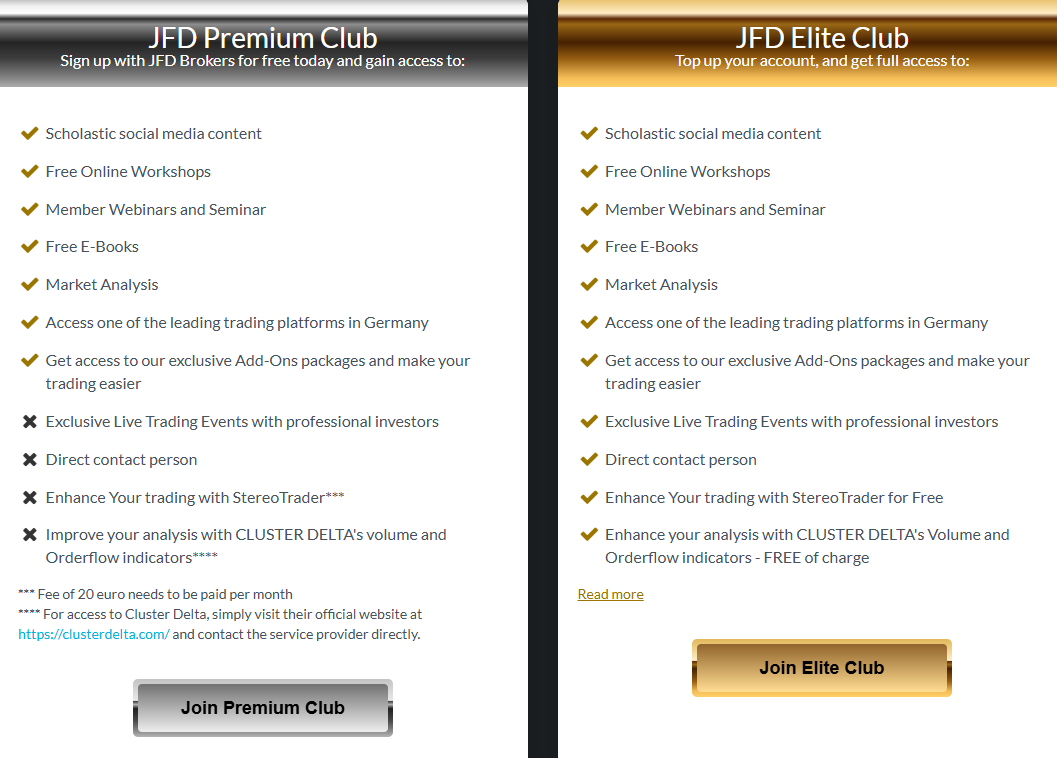

Education

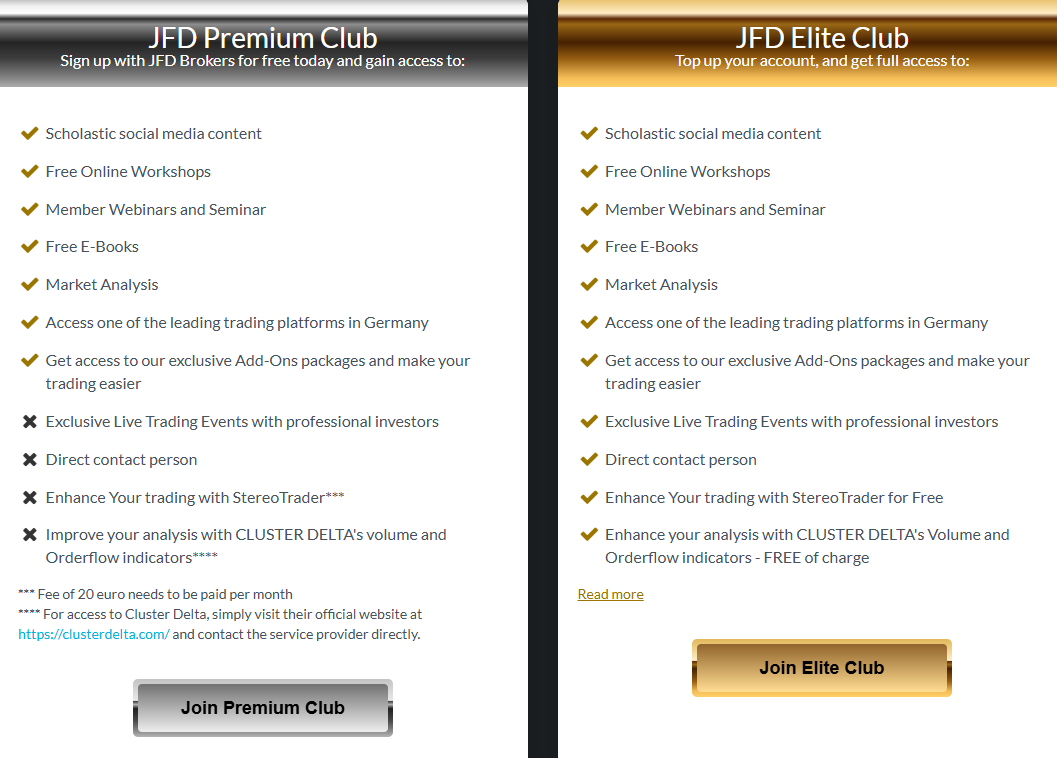

We found the broker’s education section very useful and comprehensive including live webinars and events, and a trading glossary. JFD’s trader club is a unique offering that enables access to useful educational materials and one-of-a-kind features.

- The JFD Premium club enables access to extensive features, including webinars, scholastic social media content, online workshops, webinars and seminars for members only, market analysis, add-ons, and other tools and features. The JFD Premium Club has a $20 monthly fee.

- The JFD Elite Club includes all the features that the Premium Club has, additionally granting access to exclusive live trading events with professionals, StereoTrader, etc. The minimum balance of the account should be $5000 to sign for the broker’s Elit Club.

Is JFD Brokers a Good Broker for Beginners?

Overall, JFD Brokers has great trading conditions that can fit any trader, from beginners to professionals. The broker gives access to an impressive range of instruments that enable advanced traders to explore the market further. Besides, beginner traders have access to a demo account and excellent education. The costs are low, with tight spreads and fixed commissions for each instrument. The trading platforms are also suitable for any trader, allowing ease of use, yet advanced tools for trying different strategies. At last, to the question of whether JFD Brokers is a good fit for beginners, the answer is positive. The only drawback is perhaps the broker’s minimum deposit requirement, which is slightly higher than the market average.

Portfolio and Investment Opportunities

Score – 4.4 /5

Investment Options JFD Brokers

One of the advantages of JFD Brokers is its wide range of instrument offerings. Most of the products are CFD-based, allowing traders to speculate on the price movements. However, the broker also offers over 600 physical stocks, available through its MT5 platform, which is an extensive opportunity for clients to expand their portfolios and engage in long-term investments.

- Another advantage JFD Brokers gives its clients is engaging in social trading. Social trading is available through the broker’s Stock3 innovative platform.

- There is another alternative for investments with JFD Brokers. Clients have access to MAM (Multi Account Manager), which is available within the MetaTrader environment and is compatible with manual trading, EA trading, FIX API, and mobile apps.

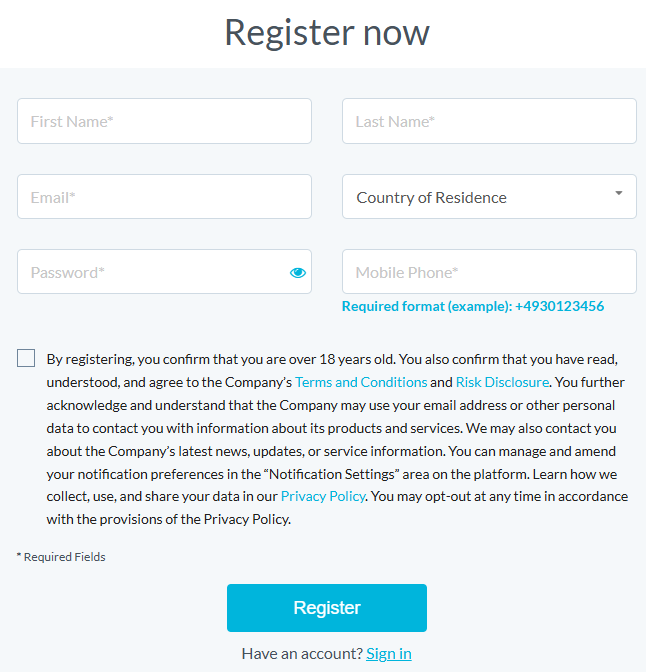

Account Opening

Score – 4.6/5

How to Open a JFD Brokers Demo Account?

A demo account is a great way to practice trading and enhance your trading skills before switching to a real account. JFD Brokers’ demo account registration is a quick and simple process. Here is a step-by-step guide:

- Go to the broker’s website and choose the ‘Start Now’ button.

- Register by providing the required information.

- Choose the account specifications (demo account option, platform, leverage, currency).

- Agree to the Terms and Conditions and apply.

- You will receive an email with your account credentials, which you will use to sign in to your account.

- Start practicing.

How to Open a JFD Brokers Live Account?

Opening an account with JFD Brokers is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Start Now” page.

- Enter the required personal data (name, email, phone number, residency, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz to confirm your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Score – 4.1/5

After a meticulous review of the broker and its overall conditions, we have concluded that JFD Brokers offers a favorable and versatile environment and conditions that can meet the needs of many traders and elevate their trading. While most of the great features and tools are already included in the broker’s advanced platforms, we would still like to mention a few unique offerings the broker has:

- StereoTrader is an innovative addition to the broker’s MT4 platform and enhances the overall trading experience. It allows more access to the market data, commands, and order types. The feature is free of charge for Elite club members, while the Prime club members need to make a $20 payment to access it.

JFD Brokers Compared to Other Brokers

We have compared JFD Brokers to other brokers with similar offerings. The purpose is to see where the broker and its services stand.

We first compared the broker from a safety perspective. JFD Brokers is regulated by the respected CySEC. The authority provides extensive oversight and rules to follow. Similar oversight is true for brokers, like Forex.com and Fortrade.

We have also viewed JFD Brokers spreads and commissions. All in all, the applicable costs are on the lower side. JFD spreads are much lower compared to JP Markets and TMGM. We were also impressed by JFD Brokers’ instrument range and multiple asset classes. Compared to JFD Brokers, JP Markets and TriumphFX have a much more modest offering, limiting diversification opportunities. JFD Brokers’ trading platforms also allow diversity with options like MT4/MT5 and Stock3, enabling clients to choose the platform of their preference in contrast to JP Markets and TriumphFX which offer only one platform.

Among other advantages, JFD Brokers has an excellent educational section that makes it a great broker for beginners. TMGM and FXTB also offer extensive education materials – a great bonus for beginner traders.

| Parameter |

JFD Brokers |

JP Markets |

FXTB |

TriumphFX |

TMGM |

Forex.com |

Fortrade |

| Spread Based Account |

Average 0.2 pips |

Average 2pip |

Average 3 pip |

Average 0.6 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission Based Account |

0.0 pips + $2.7 – $5 |

0.5 pips + $3 |

No commission |

Not available |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, Stock3 |

MT5 |

MT4, Web Trader |

MT4 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

1500+ instruments |

100+ instruments |

300+ instruments |

64+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

CySEC, CNMV, VFSC |

FSCA |

CySEC |

CySEC, FSC, FSA |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/5 |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Basic |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

R100 ($5.42) |

R100 ($5.42) |

€250 |

$100 |

$100 |

$100 |

$100 |

Full Review of Broker JFD Brokers

We have reviewed all the aspects of trading with JFD Brokers and can conclude that the broker is a great choice for traders of different levels and trading expectations. The most essential aspect, regulation, is covered by the well-regarded CySEC, which ensures the transparency of the broker’s practices. JFD Brokers also holds a license from the Spanish CNMV and Vanuatu. The conditions between the entities can vary. We recommend potential clients be careful and consider the conditions with caution.

One of the most impressive aspects of JFD Brokers is its extensive trading products of over 1500 and 600 physical stocks that enable traders to make long-term investments and enjoy great diversification. The broker offers the most popular MT4 and MT5 platforms that give great accessibility to advanced and innovative tools and features.

JFD Brokers also stands out for its comprehensive education and research sections. Traders have access to webinars and trading glossaries, and they can also become JFD Club members and gain access to exclusive educational resources and other features.

One of the drawbacks of trading with JFD Brokers is its higher deposit requirement of $500, which can be unsuitable for cost-conscious traders. To summarize, we find JFD offerings favorable and suitable for profitable trading and for a wide range of traders of any experience level.

Share this article [addtoany url="https://55brokers.com/jfd-brokers-review/" title="JFD Brokers"]

Maiores laborum ipsum esse occaecat dolore recusandae Molestiae libero aliquid sed perferendis ullamco officiis qui eiusmod ratione rerum est voluptatem