Interstellar FX 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:30 | 1:500

Regulation: CySEC, FSA

Min. Deposit: $50

HQ: Cyprus

Platforms: MT4

Found in: 2011

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:30 | 1:500

Regulation: CySEC, FSA

Min. Deposit: $50

HQ: Cyprus

Platforms: MT4

Found in: 2011

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

Interstellar FX is a European Forex and CFD broker that provides users access to global financial markets through a range of instruments, including currency pairs, commodities, indices, and cryptocurrencies.

The broker is regulated under two jurisdictions. Its European operations are run by The First Interstellar Capital Ltd, a Cyprus Investment Firm licensed by the Cyprus Securities and Exchange Commission. Additionally, its international entity operates under regulation from the Seychelles Financial Services Authority.

Interstellar FX focuses on offering user-friendly conditions, competitive spreads, and multiple account types to suit different levels of experience. The broker supports the industry-standard MetaTrader 4 platform, along with market analysis to help traders improve their strategies.

FISG, or First InterStellar Group, is the parent company operating the Interstellar FX brokerage brand. The group oversees multiple entities, including the CySEC-regulated European company and the Seychelles-licensed offshore entity, both functioning under the Interstellar name.

FISG serves as the corporate backbone of the broker, providing operational support, compliance oversight, and regional service structures. While Interstellar FX is the trading brand presented to clients, FISG represents the broader organization behind its regulatory framework, business operations, and global presence.

Interstellar FX comes with several advantages, including access to a popular range of Forex and CFD instruments, competitive spreads, and support for the well-known MetaTrader platform.

The broker is also regulated by the European CySEC, which adds an extra layer of credibility and client protection.

For the cons, fees for certain transactions may be higher than expected. Additionally, its global availability can vary depending on the client’s region, which may limit access for some users. The availability of specific instruments may also be restricted based on the client’s jurisdiction.

| Advantages | Disadvantages |

|---|---|

| CySEC regulation and oversee | Conditions vary based on the entity |

| Professional trading | No 24/7 customer support |

| Currency and CFD trading | Limited educational materials |

| Competitive trading conditions | |

| European clients | |

| International trading | |

| MT4 platform | |

| Client protection |

Interstellar FX offers a variety of features to cater to users of all experience levels, combining advanced technology, flexible account options, and regulatory oversight to create a transparent financial environment. Here are the key features that the broker offers:

| 🏢 Regulation | CySEC, FSA |

| 🗺️ Account Types | Standard, ECN, Cent Accounts |

| 🖥 Trading Platforms | MT4 |

| 📉 Trading Instruments | Forex, CFDs on Indices, Metals, Energies, Cryptocurrencies |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD |

| 📚 Trading Education | Glossary, Market News, Ebooks |

| ☎ Customer Support | 24/5 |

Interstellar FX is suitable for a wide range of clients, from beginners seeking a reliable and regulated platform to experienced traders looking for tight spreads and access to global financial markets. According to our findings, the broker is Good for:

Overall, Interstellar FX is a multi-regulated online broker specializing in Currencies and CFDs, offering traders access to a range of instruments via the MetaTrader 4 platform.

With competitive spreads, flexible leverage, and several account types, the broker meets the needs of both beginners and experienced traders.

While the broker’s transaction fees can be somewhat high for certain services, and product availability depends on jurisdiction, Interstellar FX remains a solid choice for traders seeking a diverse, regulated, and flexible environment.

Interstellar FX stands out as a versatile and regulated online broker, offering a broad range of CFD instruments suitable for all levels of traders. Its key strength is regulatory oversight from CySEC, which adds credibility and client protection, as well as support for the widely used MetaTrader 4 platform.

The broker provides multiple account types, flexible leverage, and risk management features like segregated accounts and negative-balance protection.

With competitive spreads, access to global markets, and a focus on combining technology with user-friendly conditions, the broker aims to deliver a reliable and adaptable environment that caters to diverse trading styles.

| Interstellar FX is an excellent Broker for: | - Need a well-regulated broker․ - Secure trading environment. - Offering a range of popular trading instruments. - Providing competitive trading conditions. - Offering Copy trading features. - European trading. - Currency and CFD trading. - International trading. - Various strategies allowed. - Who prefer higher leverage up to 1:500․ - Get access to MT4 platform. - Beginners and professional traders. - Need broker with fast execution. - Offering a variety of account types. |

| Interstellar FX might not be the best for: | - Who prefer proprietary trading platforms. - Need good learning materials. - Who prefer 24/7 customer service. |

Score – 4.5/5

Interstellar FX is regulated by the European CySEC, which enforces strict compliance with EU financial standards such as MiFID II. This regulation guarantees transparency, client fund segregation, and investor protection through the Investor Compensation Fund (ICF).

Moreover, the firm operates internationally and is licensed by the FSA in Seychelles as a Securities Dealer. This dual regulatory setup allows Interstellar FX to maintain high operational standards within the EU while offering more flexible conditions to clients registered under its offshore entity.

Trading with Interstellar FX is considered relatively safe due to its CySEC regulation, which ensures oversight and client protection. The broker keeps funds in segregated accounts and provides negative-balance protection, reducing the risk of losing more than your deposit.

While these measures enhance security, trading CFDs always carries inherent risks, including the potential for significant losses due to leverage.

Interstellar FX has built a relatively strong reputation in the financial community, with generally positive reviews highlighting its competitive spreads, reliable MetaTrader platform, and responsive customer support.

Traders often praise its regulatory compliance under CySEC and the transparency of segregated client accounts, which adds confidence in fund security. At the same time, some users note drawbacks, such as higher withdrawal fees and limited availability of certain instruments depending on jurisdiction.

In terms of operations and market presence, Interstellar FX has steadily expanded its global footprint, actively participating in financial events and sponsorships to strengthen its visibility in the trading community.

Score – 4.6/5

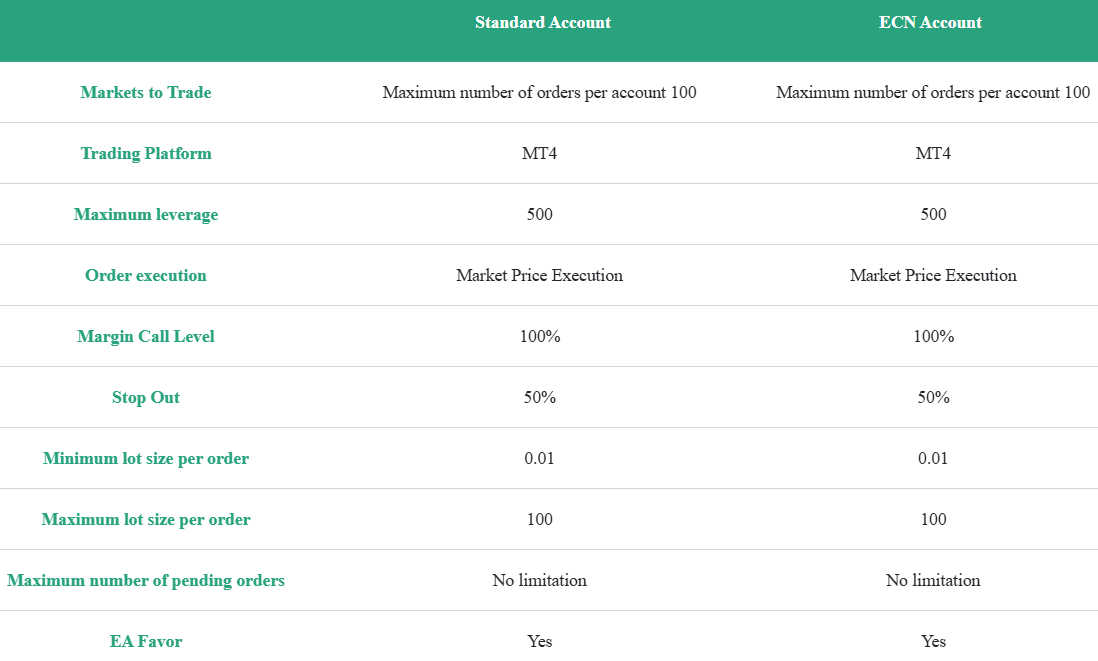

Interstellar FX offers a variety of account types to suit different kinds of users. There is a Standard account, which provides a balanced mix of cost and flexibility, and an ECN account for more advanced traders who demand tighter spreads and more direct access to market liquidity.

For beginners or very small-scale traders, there is a Cent account, which lets you trade with smaller lot sizes and lower financial exposure. The broker also provides a demo account, so users can practice in a risk-free environment using virtual funds. Finally, swap-free versions of the standard, ECN, and cent accounts are available, allowing traders to avoid overnight swap interest in compliance with Sharia‑law principles.

Standard Account

The Standard account is a flexible option with a minimum deposit of $50. It offers floating spreads and maximum leverage of up to 1:500, giving users the potential to control larger positions with a relatively small capital base.

This account type supports a wide variety of asset classes, including Forex, commodities, indices, and more, making it suitable for both beginners and more experienced traders

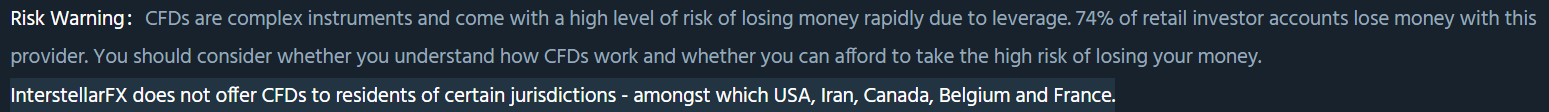

Interstellar FX does not provide services in certain jurisdictions due to regulatory restrictions and compliance requirements. Residents of the following countries are not eligible to open accounts:

Score – 4.5/5

Interstellar FX’s fee structure is relatively transparent and moderate. Spreads are floating, with currency spreads starting from around 0.1 pips. However, non‑trading costs can be more significant; in particular, the broker charges a withdrawal fee of approximately 3.25% plus €2.50 for card-based withdrawals.

Additionally, swap rates apply to positions held overnight, and these are based on prevailing market interest rates.

The broker offers competitive spreads across its instruments, with the average EUR/USD spread of 1 pip. Spreads vary depending on market conditions, liquidity, and the type of account used.

This level of spread makes Interstellar FX suitable for both short-term and long-term strategies, providing transparency and cost-effectiveness for traders.

Interstellar FX charges a commission of $3.50 per standard lot, per side, on its ECN account. This means that each trade incurs a cost both when opening and closing a position, providing a clear and transparent fee structure for traders using this account type.

The broker applies rollover fees for positions held overnight, reflecting the interest rate differential between the currencies or instruments traded.

These fees can be either positive or negative, depending on the direction of the trade and the underlying rates. Swap rates are clearly displayed in the platform, allowing traders to anticipate holding costs and manage positions effectively.

Interstellar FX’s fees are competitive within the financial market. The broker balances cost-efficiency with transparent pricing, ensuring that users can access global markets without excessive charges.

While not the lowest in the industry, the overall fee structure, including spreads, commissions, and additional costs, provides good value for both beginner and professional traders, supporting a fair environment.

| Asset/ Pair | Interstellar FX Spread | Purple Trading Spread | Ultima Markets Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.3 pips | 1 pip |

| Crude Oil WTI Spread | 6.8 | 0.03 | 1 |

| Gold Spread | 0.8 | 0.09 | 0.3 |

| BTC USD Spread | 50 | - | 11 |

Interstellar FX applies several additional fees that traders should be aware of. They charge a withdrawal fee of approximately 3.25% + €2.50 for card-based withdrawals.

There are also financing rates for positions held overnight, based on current market interest rates. In some cases, clients may be required to pay execution-venue fees or third‑party costs if trades are routed through external liquidity providers.

Score – 4.4/5

Interstellar FX offers trading exclusively through the MetaTrader 4 platform, a widely used and trusted platform in the Forex and CFD industry.

MT4 provides traders with access to advanced charting tools, technical indicators, automated trading via Expert Advisors, and real-time market analysis. While the broker does not offer other platforms, MT4’s versatility and reliability make it suitable for all levels of traders who want a robust environment for manual and automated trading.

| Platforms | Interstellar FX Platforms | Purple Trading Platforms | Ultima Markets Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

Interstellar FX provides access to the MT4 Web Platform, which allows users to trade directly from a web browser without downloading any software.

The web version offers the core features of MT4, including real-time charting, technical indicators, and trade execution, making it convenient for users who want to trade from different devices or locations while maintaining the flexibility and functionality of the MT4 environment.

Interstellar FX’s desktop MT4 platform offers a comprehensive trading environment for its clients. The platform supports multiple chart timeframes, allowing users to analyze price movements in detail and adapt their strategies.

It comes equipped with 9 schedules, 23 analysis objects, and 30 built-in technical indicators, enabling thorough technical analysis and strategy development. With features like real-time quotes, advanced order types, and customizable layouts, the MT4 desktop platform provides traders with the tools they need to make informed decisions and execute trades efficiently.

Testing the MT4 desktop platform shows that it is highly stable and responsive, handling multiple open charts and orders without noticeable lag. The platform’s customization options, such as templates and profiles, make it easy to organize workspaces according to personal preferences.

Additionally, the execution of trades is fast and reliable, and built-in tools for alerts and notifications help clients stay informed about market movements in real time.

Interstellar FX does not offer the MetaTrader 5 platform. Traders looking to use Interstellar FX can only access trading through MT4, which remains the broker’s sole supported platform for both desktop and web trading.

The broker offers a mobile solution through the MT4 platform, allowing users to manage their accounts and execute trades anytime, anywhere.

These mobile apps provide access to real-time market data, interactive charts, and essential tools directly from smartphones or tablets.

Interstellar FX does not offer any proprietary AI‑powered solutions. While its MetaTrader 4 platform supports Expert Advisors for algorithmic trading, the broker does not provide built‑in AI tools or automated strategy assistants.

According to its client agreement, using robots requires prior written consent.

Score – 4.3/5

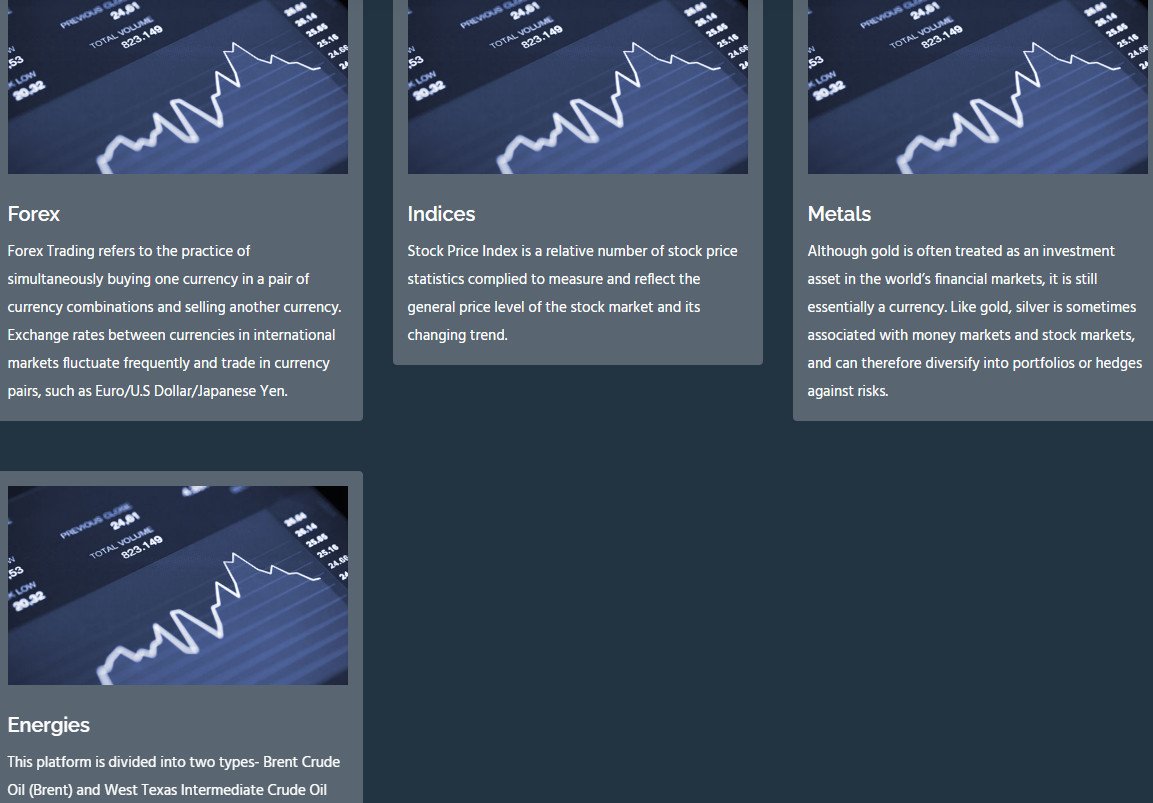

Interstellar FX offers clients access to over 100 instruments, including Currency pairs (majors, minors, and exotics), CFDs on global indices, precious metals such as gold and silver, energy commodities like crude oil, and cryptocurrencies.

This instrument offering means traders can build multi-asset strategies and take advantage of market movements across different markets.

Exploring Interstellar FX’s tradable assets shows that the broker provides a well-structured but somewhat limited selection of instruments compared to some larger brokers.

While the platform offers a range of markets suitable for different strategies, the overall choice is focused, emphasizing quality over quantity. This setup is ideal for traders who prefer a manageable set of assets, though those seeking an extremely broad or niche range of instruments may find the options somewhat restrictive.

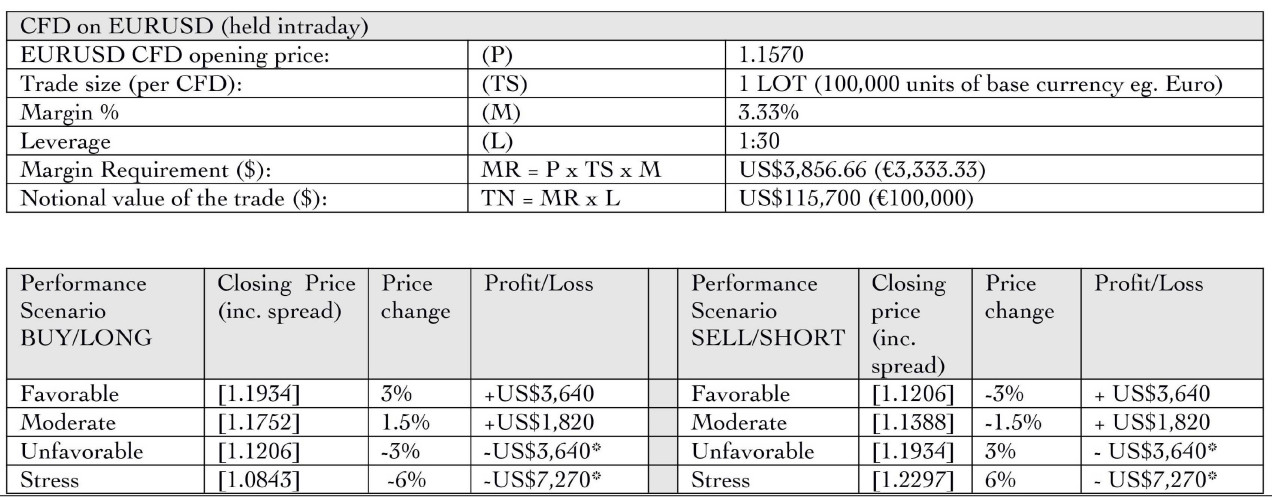

Interstellar FX offers flexible leverage options that vary depending on the trader’s account type, experience level, and regulatory jurisdiction. The broker provides the multiplier, allowing users to control larger positions with a smaller initial investment, thus enhancing potential returns while also increasing risk exposure.

Score – 4.4/5

Interstellar FX supports funding via bank cards (Visa/MasterCard) and bank wire transfers (Sepaga).

Interstellar FX requires a minimum deposit of $50 to open a standard account.

Interstellar FX supports withdrawals via bank wire and credit/debit cards (Visa/MasterCard). The company processes most withdrawal requests within 5 business days, provided the client’s account is fully verified.

Clients are responsible for any third‑party banking or payment system fees when funds are being transferred out.

Score – 4.5/5

The broker provides 24/5 customer support through email, phone lines, social media channels, and FAQs.

The support team is generally responsive and knowledgeable, helping users navigate the platform, understand conditions, and resolve issues efficiently.

You can reach Interstellar FX via phone at +357 25 211495 or by email at info@interstellarfx.eu for any inquiries regarding accounts, deposits, trading, or support.

The customer service team is available to assist clients with general questions, technical issues, and account-related matters.

Score – 4.4/5

Interstellar FX provides several research tools to help users make informed decisions.

Interstellar FX offers a range of educational resources for traders. These include a glossary of trading terms, regular market news updates, and a selection of eBooks covering basic financial concepts.

While the educational section provides some helpful guidance for beginners, it is relatively modest compared to brokers with more comprehensive training programs.

Score – 3.5/5

Interstellar FX primarily focuses on Currency and CFD trading and does not provide traditional investment solutions or portfolio management services.

Traders can speculate on price movements across various instruments, but the broker does not offer real asset investing, managed accounts, or long-term wealth-building programs. This makes it suitable for active trading rather than passive investment strategies.

Score – 4.5/5

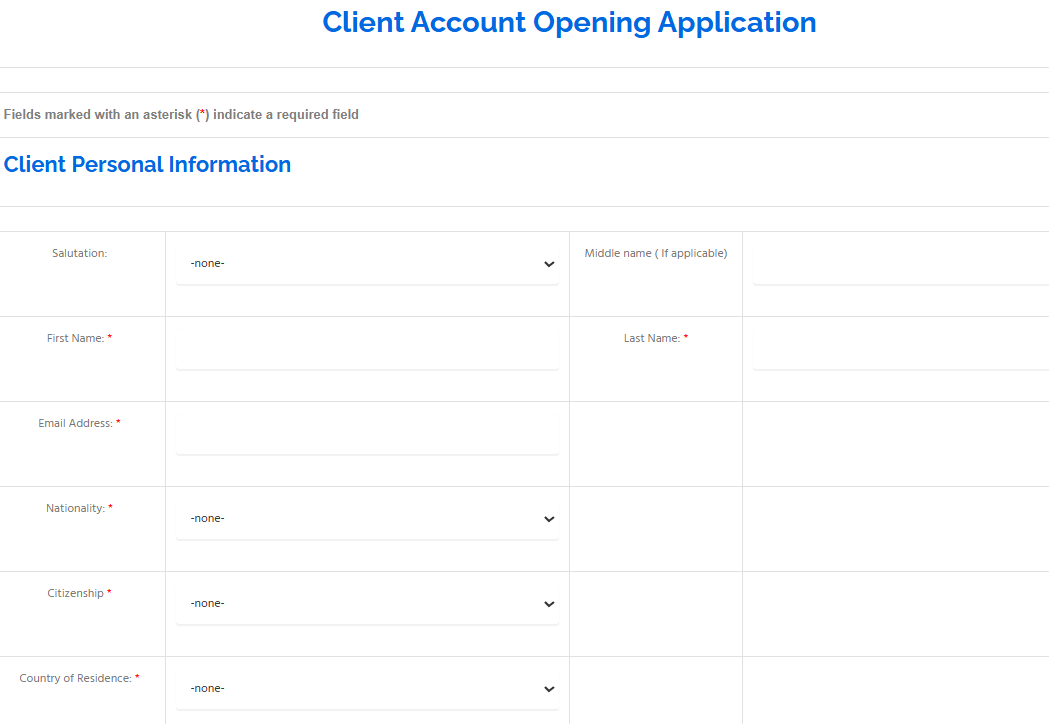

To open a demo account with Interstellar FX, simply visit their website and fill out the demo registration form with your basic details. Once submitted, you will receive login credentials for the MT4 platform, allowing you to trade virtual funds in a risk-free environment.

The demo account mirrors live market conditions, making it ideal for practicing strategies and familiarizing yourself with the broker’s trading tools.

Opening a live account with Interstellar FX is a straightforward process that allows you to start trading real funds across Forex and CFD instruments. Steps to open a live account:

Score – 4.3/5

In addition to research resources, Interstellar FX offers several trading tools and features to enhance the user experience.

Compared to its competitors, Interstellar FX is a regulated broker focused on providing a straightforward trading experience primarily through the MT4 platform.

Its offering is smaller in asset variety compared with some larger brokers, but it covers the key markets, including Forex, CFDs on indices, metals, energies, and cryptocurrencies. While its fee structure is generally moderate, it is less competitive than brokers offering ultra-low spreads or more extensive commission-based accounts.

Interstellar FX provides basic research materials and standard customer support, making it suitable for beginners and intermediate traders, but it lacks the broader platform options, extensive educational programs, and advanced features found at competitor brokers.

Overall, the broker appeals to traders who prioritize a regulated, reliable, and simple trading environment over highly diversified instruments or advanced platform tools.

| Parameter | Interstellar FX | Purple Trading | Ultima Markets | Colmex Pro | Taurex | CMC Markets | ActivTrades |

| Spread Based Account | Average 1 pip | Average 1.3 pips | Average 1 pip | Average 4 pips | Average 1.7 pips | Average 0.5 pips | Average 0.5 pips |

| Commission Based Account | 0.0 pips + $3.50 per side | 0.3 pips + $2.5 per side | 0.0 pips + $2.5 per side | For stock CFDs, $0.01 per share + a minimum of $1.5 per side | 0.0 pips + $2 per side | 0.0 pips + $2.50 | For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking | Average | Low/ Average | Low/ Average | Average | Low/ Average | Low/ Average | Low/ Average |

| Trading Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, MT4 WebTrader, Mobile App | Colmex Pro 2.0, MT4 | MT4, MT5, Taurex Trading App | CMC Markets Next Generation Web Platform, MT4 | ActivTrader, MT4, MT5, TradingView |

| Asset Variety | 100+ instruments | 200+ instruments | 250+ instruments | 28,000+ instruments | 1,500+ instruments | 12,000+ instruments | 1,000+ instruments |

| Regulation | CySEC, FSA | CySEC, FSA | FCA, CySEC, FSC | CySEC, FSCA | FCA, FSA, SCA | FCA, ASIC, BaFin, IIROC, FMA, MAS | FCA, CMVM, FSC, SCB |

| Customer Support | 24/5 | 24/5 | 24/7 | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Limited | Good | Good | Limited | Excellent | Good | Good |

| Minimum Deposit | $50 | $100 | $50 | $500 | $10 | $0 | $0 |

Interstellar FX is a regulated online broker offering access to CFD markets via the MetaTrader 4 platform. The broker provides multiple account types, catering to a range of trader experience levels.

With competitive spreads and transparent commissions, it delivers a clear fee structure, while deposit and withdrawal options are straightforward through bank cards and wire transfers.

Users can utilize research tools, technical indicators, and charting features to inform their strategies, though educational resources remain limited. Overall, Interstellar FX is suited for traders seeking a regulated, reliable, and focused trading environment without the complexity of additional platforms or extensive asset offerings.

No review found...

No news available.