- What is IGM FX?

- IGM FX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- IGM FX Compared to Other Brokers

- Full Review of Broker IGM FX

Overall Rating 4.1

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 3.7 / 5 |

| Account opening | 4.2 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is IGM FX?

IGM FX is a CFD and Forex trading broker established in 2016 in Cyprus. The brokerage firm offers a wide range of trading products, including over 160 CFDs on assets such as Forex, Stocks, Indices, Commodities, Metals, and Cryptocurrencies.

Based on our findings, IGM FX is regulated by the Cyprus Securities and Exchange Commission (CySEC) and offers trading opportunities to both beginner and experienced traders in various global markets.

Overall, the broker provides a secure and competitive trading environment for both retail and professional trading. It is made possible through its proprietary Webtrader and Desktop platforms, which offer a user-friendly interface for conducting trading activities, as well as a balanced proposal that might suit various trading expectations.

IGM FX Pros and Cons

Upon our analysis, we have identified certain benefits and drawbacks to consider when selecting IGM FX as your Forex trading broker. For the pros, the broker provides various trading accounts with access to a wide selection of CFDs on major, minor, and exotic currency pairs. Additionally, IGM FX offers competitive pricing with low spreads, as well as the opportunity to select leverage up to 1:400 for Professional trading.

For the cons, the company does not offer 24/7 customer support, which may be inconvenient for some traders. Also, the absence of an education and research section on the website limits access to educational resources. Another limitation is that the firm is regulated by only one regulatory body, which could be a drawback for some traders due to the inability to open an account.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversight | No 24/7 customer support |

| Available for European traders | No educational and research materials available |

| Low minimum deposit | One regulatory body |

| Commission-free trading | |

| Low spreads | |

| Investor Compensation Fund | |

| Suitable for retail and professional trading | |

IGM FX Features

IGM FX offers a secure and competitive trading environment, along with low fees for its range of trading instruments. Therefore, it is fair to say that IGM FX is a suitable choice for traders of various levels, whether new or experienced. To provide further insight into the broker’s proposal, we have compiled a list of the key aspects of trading with it.

IGM Fx Features in 10 Points

| 🗺️ Regulation | CySEC |

| 🗺️ Account Types | Classic, Silver, Gold, VIP |

| 🖥 Platforms | Webtrader |

| 📉 Trading Instruments | CFDs on Forex, Stock, Indices, Commodity, Metals, and Cryptocurrency |

| 💳 Minimum deposit | $250 |

| 💰 Average EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Not available |

| 💰 Account Base currencies | EUR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is IGM FX For?

According to our research, IGM FX is suitable for both retail clients and professionals. It will become a favorable choice for those seeking a variety of trading instruments, competitive fees, and a user-friendly experience. Based on our findings, IGM FX is Good for:

- Traders from Europe

- CFD and currency trading

- Web traders

- Beginners

- Advanced traders

- Professional trading

- STP/NDD execution

- No commission trading

- Competitive spreads

- EA/Auto trading

- Good trading tools

IGM FX Summary

In summary, IGM FX is a reliable Forex trading company that allows both retail and professional clients to access a diverse range of financial products. The broker’s presence in Cyprus and regulation by CySEC ensure a trustworthy trading environment.

IGM FX provides clients with useful trading tools and strategies. However, the broker lacks a dedicated section for educational materials, seminars, and webinars. Additionally, 24/7 customer support and live chat are not available.

Overall, the company offers secure trading platforms and competitive trading conditions. However, since every trader has unique requirements, you should carefully assess whether IGM FX suits your specific trading goals and preferences.

55Brokers Professional Insights

Our research revealed that IGM FX offers reliable and competitive trading services with competitive prices.

As we found, IGM FX delivers strictly regulated and reliable services, with oversight by CySEC and compliance with MiFID rules.

The broker offers account types tailored separately for retail traders and professionals. With four trading accounts, access to Webtrader, and the opportunity to explore a good range of financial markets, IGM FX can become a favorable choice for many.

However, due to a sole regulation from the CySEC, the broker might be restricted in certain regions. Besides, clients have access to up to 1:30 leverage, according to the CySEC laws. Another point for consideration is the lack of comprehensive education.

Consider Trading with IGM FX If:

| IGM Fx is an excellent Broker for: | - Traders looking for EU regulation

- Clients from Europe

- Various account types

- For professional and retail clients

- Web traders

- CFD and Forex traders

- Cost-conscious traders |

Avoid Trading with IGM FX If:

| IGM Fx is not the best for: | - International clients

- Long-term investors

- The MT4/MT5 platform enthusiasts

- Clients looking for comprehensive education

- Traders who prefer 24/7 customer support |

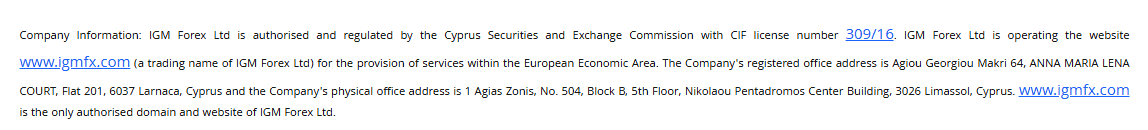

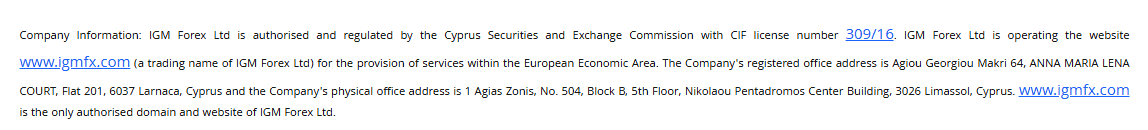

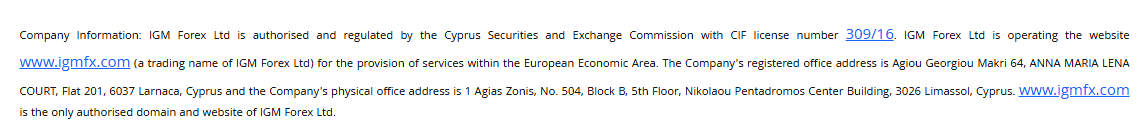

Regulation and Security Measures

Score – 4.2/5

IGM FX Regulatory Overview

IGM FX is a reliable and secure brokerage firm that follows the strict rules and guidelines established by CySEC, the European regulatory authority that oversees its operations. Compliance with the regulatory requirements set by CySEC enhances the safety and confidence of traders who choose to trade with IGM FX.

- The company also closely follows the laws and rules imposed by the European Directive MiFID II.

How Safe is Trading with IGM FX?

IGM FX prioritizes the safety and security of its clients’ funds by segregating them from the firm’s accounts and not using them for operational purposes.

- Also, the broker provides different protective measures, such as negative balance protection, which is great during times of market volatility to ensure the safety of traders’ accounts that do not go below zero.

- Moreover, the broker is a member of the Investor Compensation Fund, which protects retail clients in case the company fails to fulfill its financial obligations.

Consistency and Clarity

IGM FX is considered a safe broker to trade with, with a license from the well-regarded CySEC.

Over the years of its operation, IGM FX has been consistent and clear in its proposal. However, we noticed that IGM FX has limited some of its services: in the past, the broker offered the MT4 platform, yet at present, its clients can conduct trades only through the Web Trader.

As to the customer feedback, we found favorable reviews on easy and fast deposits, smooth trading, and helpful customer service. However, on the other hand, some traders share about the aggressive sales tactics.

All in all, the broker has both positive aspects and areas for improvement, which potential clients should consider.

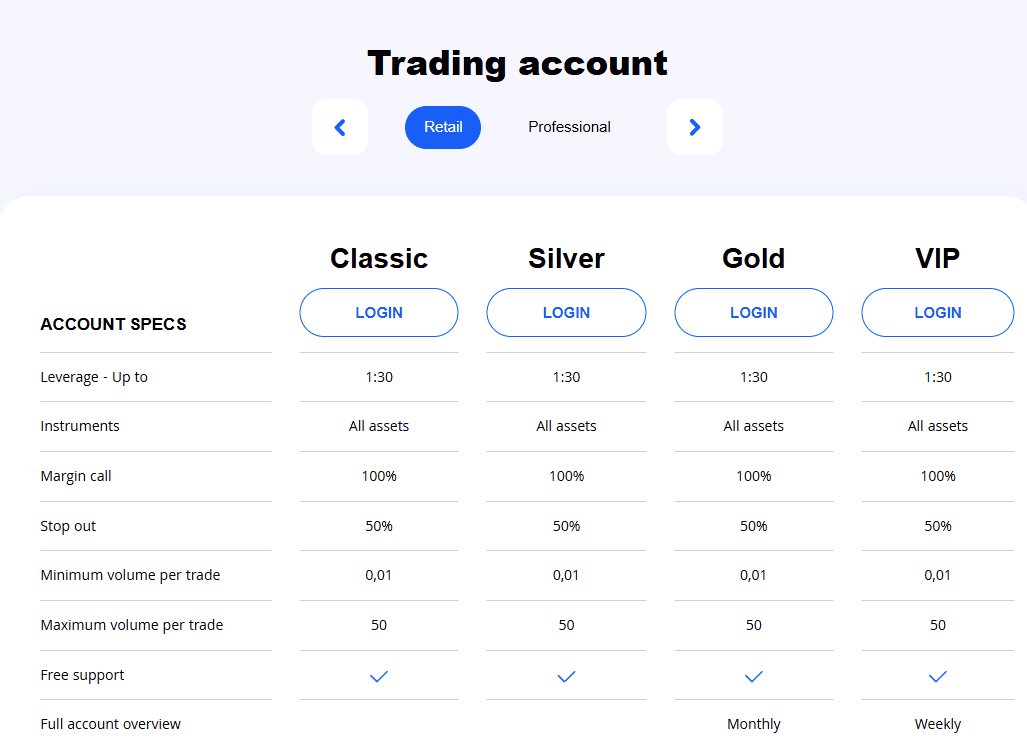

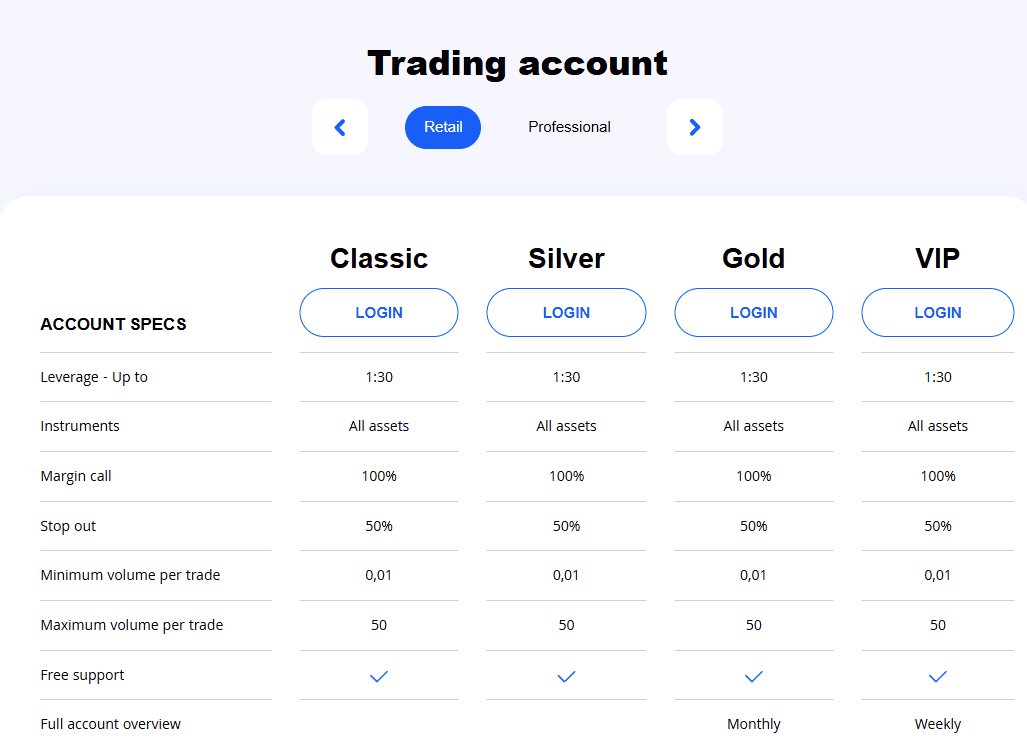

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with IGM FX?

Based on our findings on IGM FX broker, traders have the option to select between Retail and Professional account types: Classic, Silver, Gold, and Vip, which offer quite a good flexibility to choose conditions that might suit your trading needs better. For Professional accounts, traders have the opportunity to select leverage with a maximum limit of up to 1:400. Retail clients can use leverage up to 1:30.

- All trades are conducted through the Web Trader. Besides, all the account types enable access to the same number of financial assets (160 instruments in total).

Regions Where IGM FX is Restricted

IGM FX complies with strict regulatory requirements, and due to certain restrictions, it does not offer its services in many regions.

The broker mainly directs its services to European traders. On its website, as a restricted region, IGM FX mentions the United Kingdom.

Cost Structure and Fees

Score – 4.2/5

IGM FX Brokerage Fees

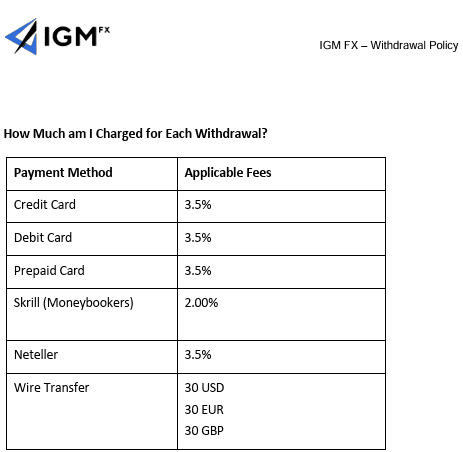

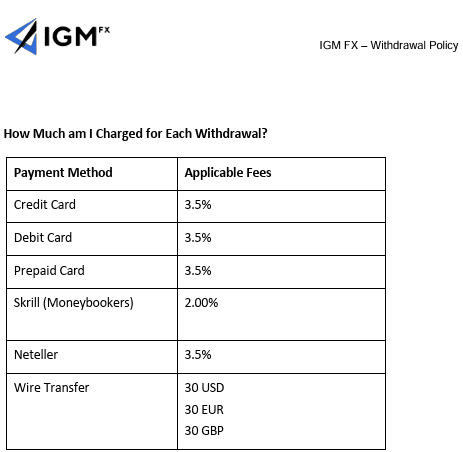

In terms of fees, we found that the broker offers competitive pricing for trading instruments. However, certain charges may apply to deposits and withdrawals, depending on the selected funding method. Also, traders should consider additional fees, including swap or rollover fees incurred during trading activities.

Based on our test trade, IGM FX provides low floating spreads with an average spread of 1 pip for the widely traded EUR/USD currency pair in the Forex market, which is an attractive option for traders considering the market average starts at 1.2 pips. Additionally, the broker provides competitive spreads for all major currency pairs and other popular trading instruments.

As we have found, the broker offers a spread-based structure, with all the fees integrated into spreads. It means there are no commissions, and clients do not pay fixed transaction fees for each trade. Whereas this fee model can be favorable for many clients, the commission-based structure is often appealing to professional clients who look for very low spreads and fixed commissions for more predictable charges.

How Competitive Are IGM FX Fees?

Based on our research and testing, IGM FX offers a competitive fee structure with floating spreads. All the account types offered by the broker are commission-free, with fees primarily integrated into the spreads.

However, as we found, the broker does not disclose all its fees and spreads for each instrument, which can be negative for those clients who are looking for more predictable charges.

| Asset/ Pair | IGM Fx Spread | TD365 Spreads | Opofinance Spreads |

|---|

| EUR USD Spread | 1 pips | 0.5 pips | 1.8 pips |

| Crude Oil WTI Spread | 0.03 | 3 points | 10 |

| Gold Spread | 2.5 | 0.4 points | 20 |

IGM FX Additional Fees

We have also tried to find what additional fees IGM FX charges.

- Based on our further research, the broker charges a $20 inactivity fee for dormant accounts.

- Although the broker does not charge a deposit fee, the payment provider can still charge costs.

- At last, the broker charges swap fees for the positions held open overnight. For each instrument, there are short and long swaps. For instance, the long swap for the EUR/USD pair is -47.28, while the short swap is -45.7.

Score – 4/5

As we found, the broker offers its proprietary web-based platform called IGM FX Webtrader. The platform offers a wide range of features, including technical indicators, trading analysis tools, intuitive interfaces, multiple execution options, and various order types.

| Platforms | IGM Fx Platforms | xChief Platforms | Opofinance Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

IGM FX Web Platform

IGM FX Web Trader includes numerous technical indicators for effective management of trading strategies. The platform has a user-friendly interface, allowing for seamless navigation and utilization. Additionally, traders can access all 160+ available instruments through the platform, accompanied by interactive charts and analysis tools.

The platform does not require any downloads, allowing easy access through a browser. Traders can also benefit from stop loss and take profit tools and various limit orders.

Traders can also access free educational materials right from the platform.

IGM FX Desktop MetaTrader 4/5 Platforms

We have researched the broker’s platform offering and found that IGM FX used to offer the popular MT4 platform. However, at present, it seems IGM FX offers only its proprietary web platform, limiting the platform choice for its clients. Moreover, the MT5 platform is also unavailable with the broker. Although the web platform is practical and includes powerful features and tools, many clients might still see the lack of the MT4/5 platforms as a huge drawback.

IGM FX MobileTrader App

We found that the broker’s proprietary WebTrader platform is mobile-compatible. The platform is accessible through any mobile’s web browser. All the features, tools, and capabilities are the same. However, IGM FX does not offer a separate mobile application.

AI Trading

IGM FX does not offer an AI bot or feature at present. Traders who prioritize the availability of AI-powered tools will need to find another broker with such capabilities.

Trading Instruments

Score – 4.2/5

What Can You Trade on the IGM FX Platform?

IGM Fx offers clients the opportunity to trade over 160 CFDs on more than 40 Forex pairs, Stocks, Indices, Commodities, Metals, and Cryptocurrencies. Forex trading is particularly popular among these markets due to its widespread recognition, high liquidity, and competitive spreads.

- IGM FX does not support long-term investments, as all its offerings are CFD-based and concentrated on short-term transactions.

Main Insights from Exploring IGM FX Tradable Assets

IGM FX offers over 160 trading instruments across various financial assets, ensuring the availability of the most popular products. Although the number does not allow great diversity, traders can still explore the market. Besides, Forex traders have a choice from 40 currency pairs, which is a rather impressive offering.

From commodities, IGM FX offers commodities, such as cotton, cocoa, coffee, Brent oil, and more. IGM FX clients can also trade access CFDs on the stocks of the most popular companies worldwide, such as Apple, Microsoft, Netflix, andTesla.

However, all the products are based on CFDs, which do not allow long-term investments and ownership of the assets.

Leverage Options at IGM FX

Leverage is a popular trading tool that allows Forex traders to enter the market with limited capital and gain greater exposure. However, it can not only result in substantial gains but also in losses. Therefore, you must comprehensively understand how leverage operates and its potential consequences before engaging in any trading activities involving leverage.

IGM FX leverage is offered according to the CySEC regulation:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- For Professional account holders, the maximum leverage is 1:400.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at IGM FX

The broker offers various funding methods to deposit funds into trading accounts. These methods include bank wire transfers, credit/debit cards, and online payment systems like Skrill and Neteller. However, as a European Broker, some payments might not be available for certain regions; thus, it is essential to check conditions in advance.

- We also found that IGM FX does not apply transaction fees for deposits. Still, clients should consider certain charges from the side of the payment provider.

Minimum Deposit

To open a live trading account with IGM FX, traders are required to deposit a minimum amount of $250, which is an average offering. For more professional accounts, clients will make higher initial deposits.

Withdrawal Options at IGM FX

As we found, traders can expect a smooth and quick withdrawal process with IGM Fx, enabling them to access their funds efficiently. However, conditions usually vary by the payment provider and might take several days to appear in your account.

- From clients’ feedback, we found that some clients share positive experiences about speedy withdrawals, whereas others warn about delays and various issues.

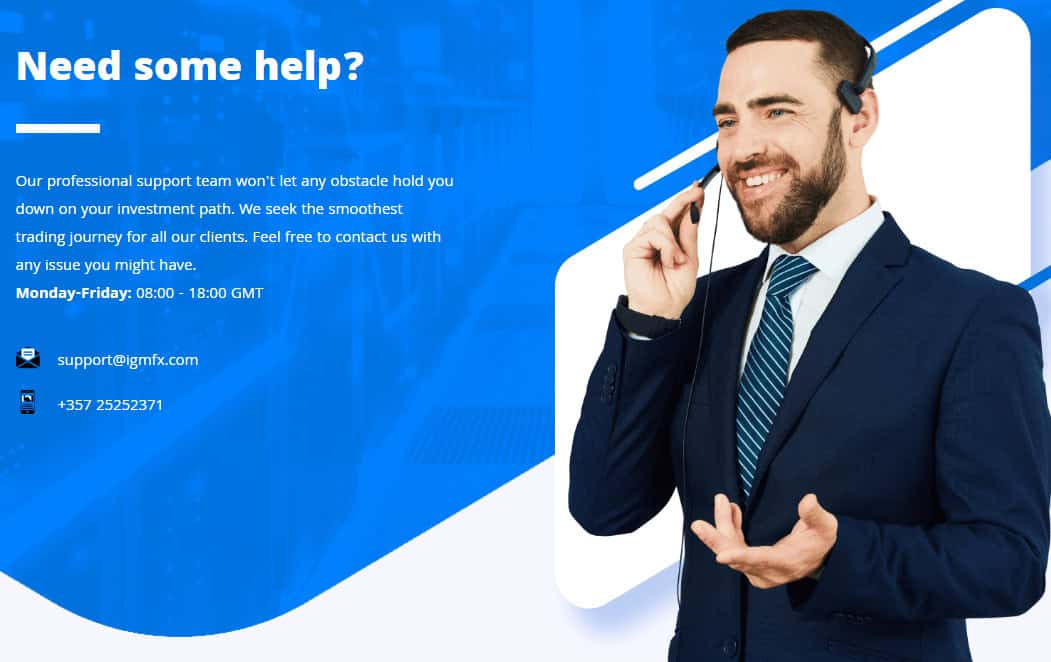

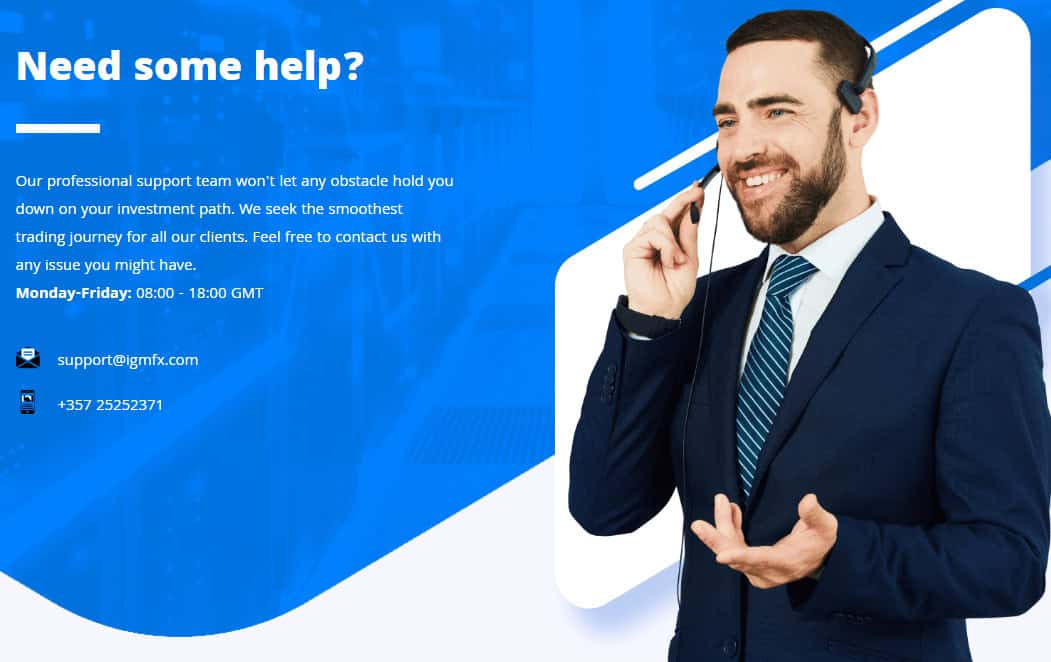

Customer Support and Responsiveness

Score – 4.3/5

Testing IGM FX Customer Support

We found IGM Fx customer support is available 24/5 through Email and Phone. The Broker has a team of experienced trading specialists who are available to help clients with various issues. These include technical problems, general inquiries, and operational concerns.

- However, as we found, IG FX does not support live chat, which can be a drawback for clients prioritizing quick responses and prompt solutions to trading-related issues.

Contacts IGM FX

As we found, IGM FX assists its clients through email and a phone line.

- Clients can submit their inquiries via the available email address: support@igmfx.com.

- The broker also provides a phone number suitable for direct communications: +357 25252371.

- Besides, clients can send their questions and suggestions through an online form, right from the official website.

Research and Education

Score – 3.8/5

Research Tools IGM FX

IGM FX provides an advanced Web Trader platform with extensive tools and features to conduct in-depth analysis. It includes charting capabilities and technical analysis to support the clients in decision-making. However, other than the advanced platform, there are no additional research tools on the broker’s website.

Education

We found that the broker lacks a dedicated section on its website for educational materials, seminars, and webinars. This absence is a drawback since educational resources play a crucial role in the development and improvement of traders’ skills. However, as we found, the Webtrader platform provides traders with access to some basic free educational materials and resources, mainly with general tools.

Is IGM FX a Good Broker for Beginners?

IGM FX can become an attractive broker choice for different clients. It offers an advanced web platform and various account types tailored for retail clients and professionals.

IGM FX also offers floating spreads, mostly in line with the market average or lower. The initial deposit is $250, which is an average offering in the market. The number of instruments is modest, yet clients can access the most popular products with competitive conditions.

The only significant disadvantage is the lack of extensive learning and research materials.

Portfolio and Investment Opportunities

Score – 3.7 /5

Investment Options IGM FX

We found that with IGM FX, the options to invest are limited to CFD-based products. Besides, the broker provides access to only 160 instruments. It is a modest offering, especially if compared to other brokers with thousands of products. Moreover, it does not provide traditional investment opportunities, limiting the chances to expand portfolios.

- Another drawback is the lack of alternative investment options, such as copy trading, as well as the availability of MAM or PAMM accounts.

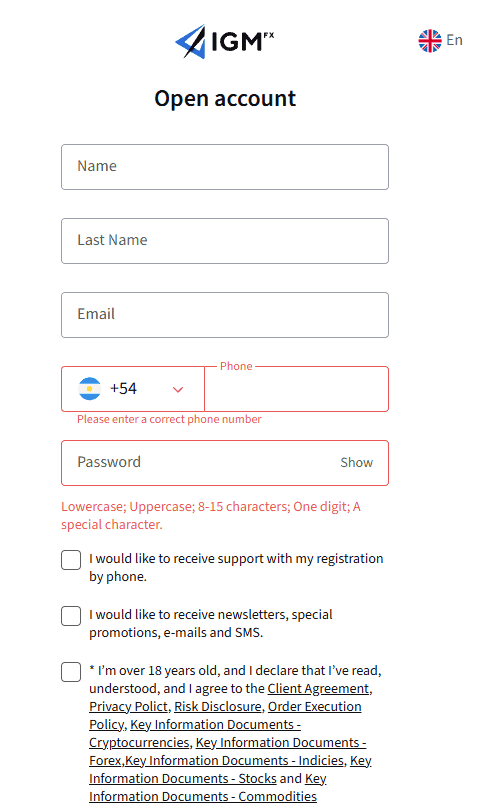

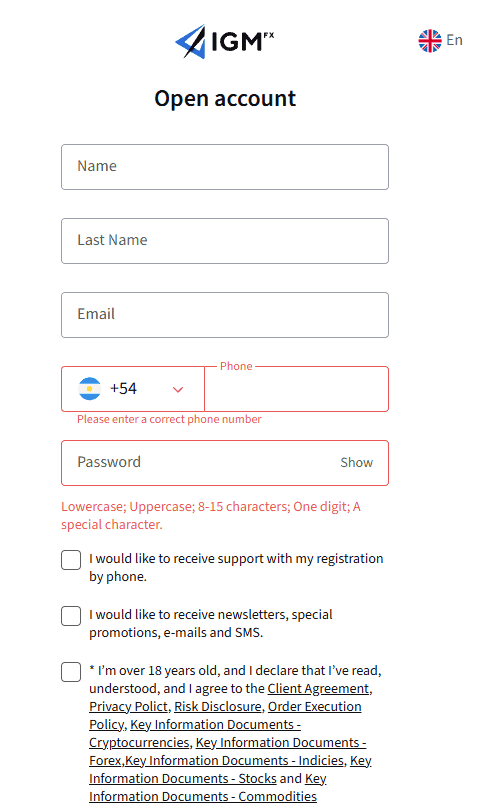

Account Opening

Score – 4.2/5

How to Open an IGM FX Demo Account?

New traders always look for ways to enhance their skills. One of the best opportunities to gain practice is the availability of a demo account. However, contrary to clients’ expectations, IGM FX does not include a demo account in its proposal.

How to Open an IGM FX Live Account?

Opening an account with IGM FX is a quick and straightforward process. You can open it within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Fill out the registration form with the required personal data (name, email, phone number, etc.).

- Upload documentation for verification (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once the account is activated and proven, follow with the money deposit.

Score – 3.5/5

We have considered IGM FX’s additional offerings and features to check if the broker supplies extra tools to enhance its clients’ experience. However, our research showed that all the main features can be found on the broker’s trading platforms. There are no extra offerings on the IGM FX website.

- Thus, those who prioritize additional opportunities, such as Fixed API, free VPS, bonuses, and promotions, will have to look elsewhere.

IGM FX Compared to Other Brokers

We compared IGM FX with reputable brokers in the market to find how competitive its proposal is. Based on this comparison, we uncovered important insights.

Foremost, we compared the broker’s regulation. IGM FX is regulated by the respected CySEC, yet compared to Pepperstone, its regulatory oversight is limited, as the latter holds additional licenses from top-tier authorities, ensuring an extra level of protection.

We further reviewed the broker’s fees to find that it offers floating spreads at an average rate of 1 pip with no commissions. On the contrary, HFM and IC Markets offer commission-based accounts with fixed transaction fees and very low spreads.

As for trading platforms, IGM FX only supports its proprietary WebTrader. With its advanced features, the web platform can satisfy different trading needs. However, there are many brokers with a better choice of advanced platforms, including Deriv and AvaTrade.

Besides, the lack of an education section makes the broker fall behind brokers AvaTrade and Pepperstone, which stand out for better learning resources.

| Parameter |

IGM FX |

AvaTrade |

HFM |

Deriv |

IC Markets |

Pepperstone |

eToro |

| Spread-Based Account |

Average 1 pip |

Average 0.9 pips |

Average 1 pip |

Average 0.5 pips |

From 1 pip |

Average 0.7 |

Average 1 pip |

| Commission-Based Account |

No commissions |

For Professional Account only |

0.0 pips + $3 |

0.0 pips + $0.05 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

| Fees Ranking |

Low/ Average |

Low |

Low |

Low/ Average |

Low/ Average |

Low |

Average |

| Trading Platforms |

IGM FX WebTrader |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, HFM App |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary |

| Asset Variety |

160+ instruments |

250+ instruments |

500+ instruments |

200+ instruments |

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

| Regulation |

CySEC |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

MFSA, Labuan FSA, BVI FSC, VFSC |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

| Customer Support |

24/5 |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Limited |

Excellent |

Good |

Good |

Good |

Excellent |

Good |

| Minimum Deposit |

$250 |

$100 |

$0 |

$5 |

$200 |

$0 |

$200 |

Full Review of Broker IGM FX

IGM FX is a well-established broker with a license from the respected authority, CySEC. The CySEC regulation makes the broker a favorable choice for European traders.

IGM FX can be a suitable trading option for both retail and seasoned clients with its wide choice of trading accounts and varying conditions. Traders can access over 160 popular instruments across a wide range of financial assets. However, the products are based on CFDs and do not support longer-term investments.

IGM FX clients can conduct their trades through the broker’s WebTrader, equipped with useful trading tools. However, we found that there are no alternative platforms, such as MT4/MT5, limiting clients’ choice of platforms. Besides, another drawback is the absence of a demo account. With a lack of a dedicated educational section, it can be a serious disadvantage for beginner traders.

Generally, IGM FX offers a secure trading environment and competitive trading conditions. However, traders should check whether it can become a favorable option for their specific needs.

Share this article [addtoany url="https://55brokers.com/igm-fx-review/" title="IGM Fx"]