- What is iFOREX?

- iFOREX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

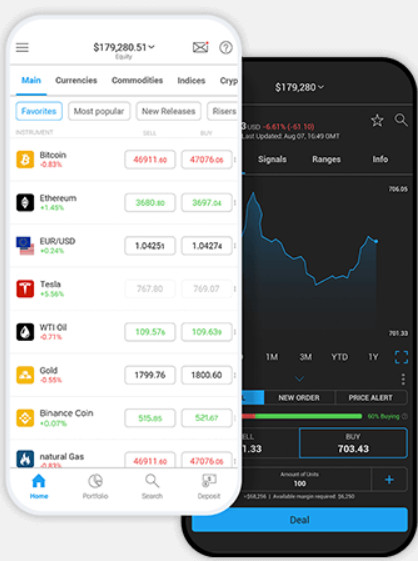

- Trading Platforms and Tools

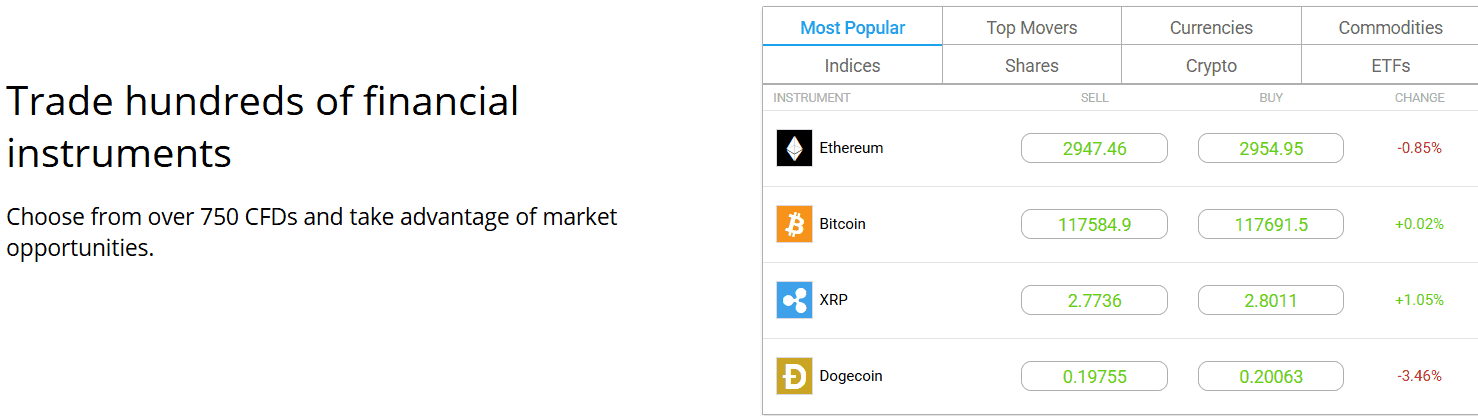

- Trading Instruments

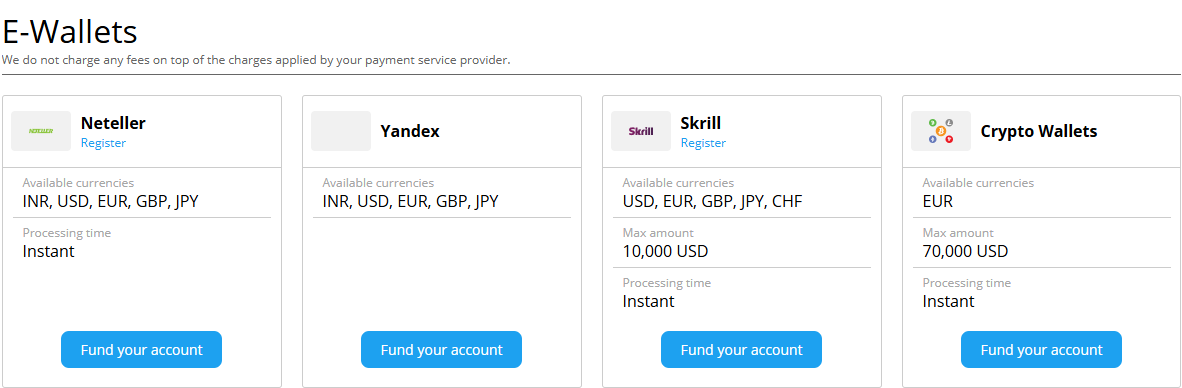

- Deposit and Withdrawal Options

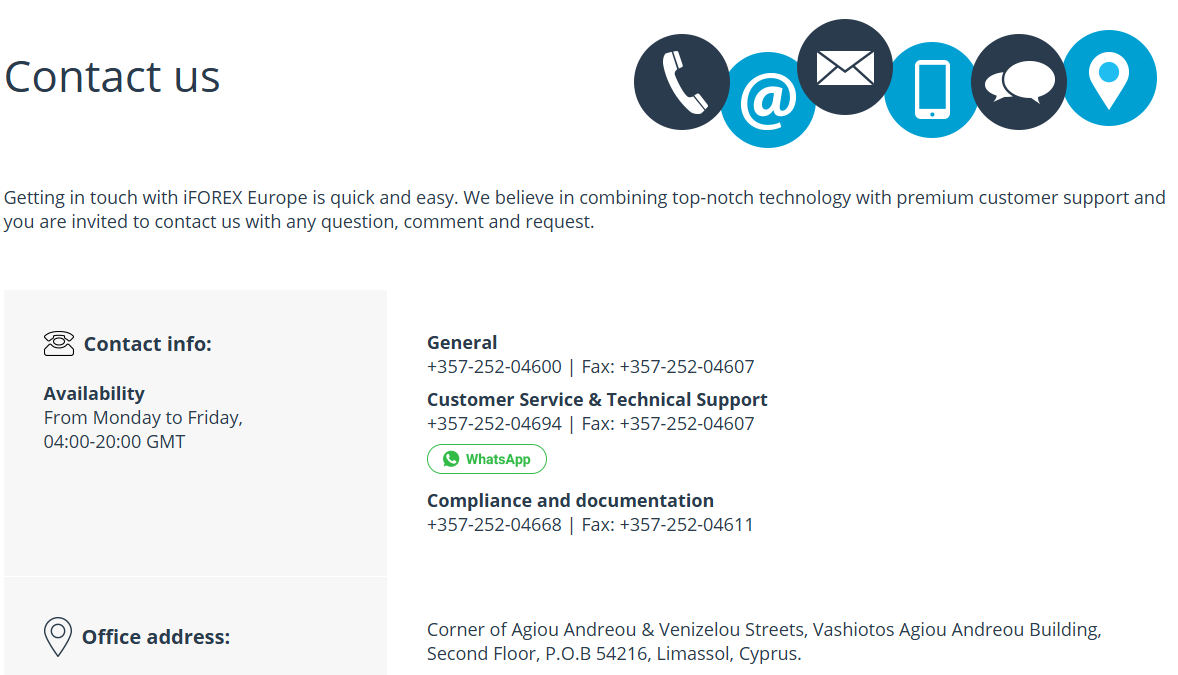

- Customer Support and Responsiveness

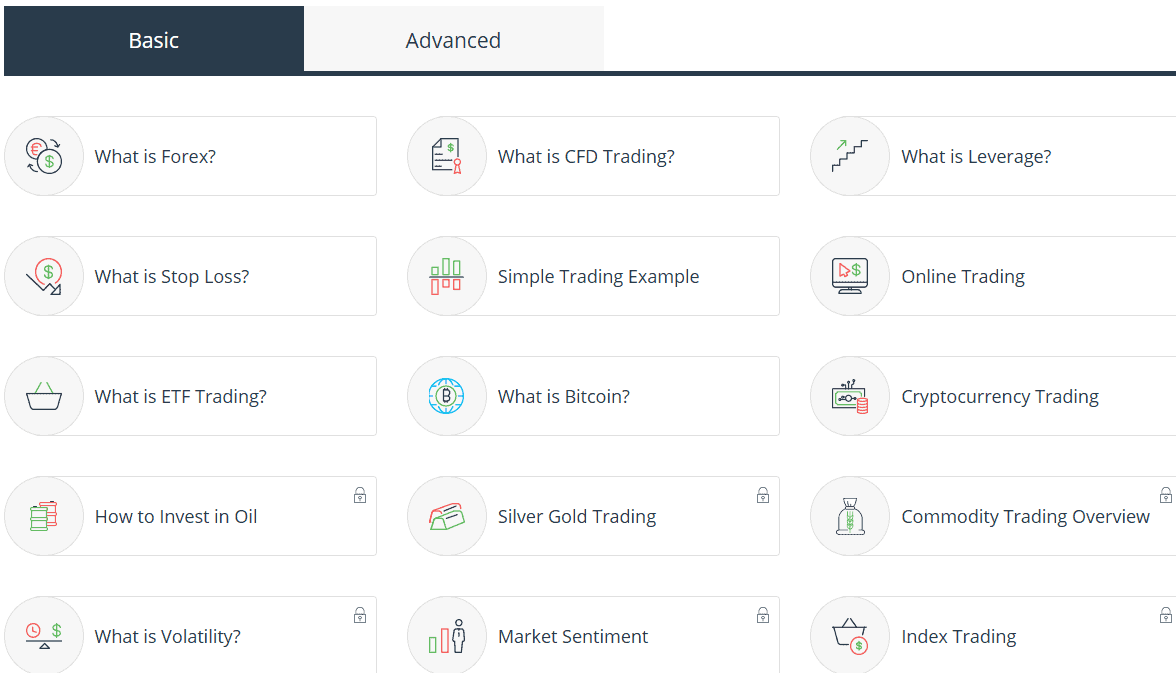

- Research and Education

- Portfolio and Investment Opportunities

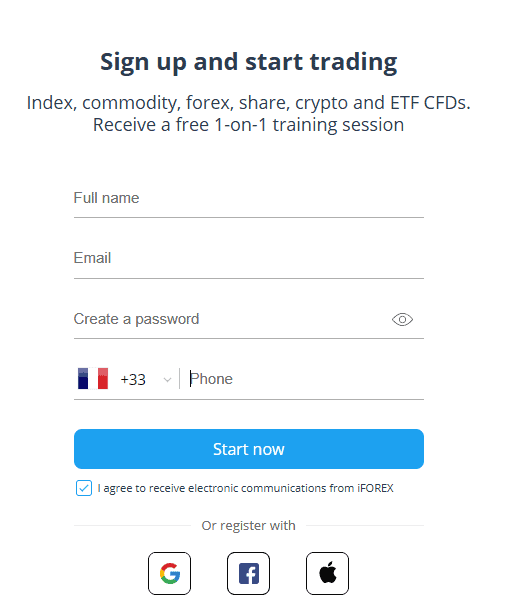

- Account Opening

- Additional Tools And Features

- iFOREX Compared to Other Brokers

- Full Review of Broker iFOREX

Overall Rating 4.2

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is iFOREX?

iFOREX is the brand name of the group of companies that offers a wide range of solutions to trade CFDs and Forex, as well as commodities, indices, shares, ETFs, and cryptocurrencies through its proprietary mobile app.

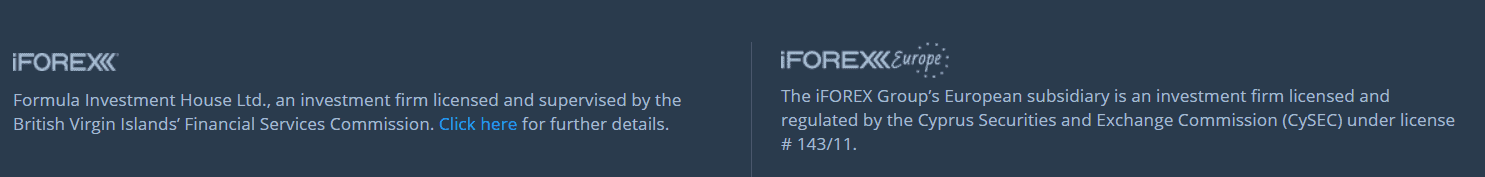

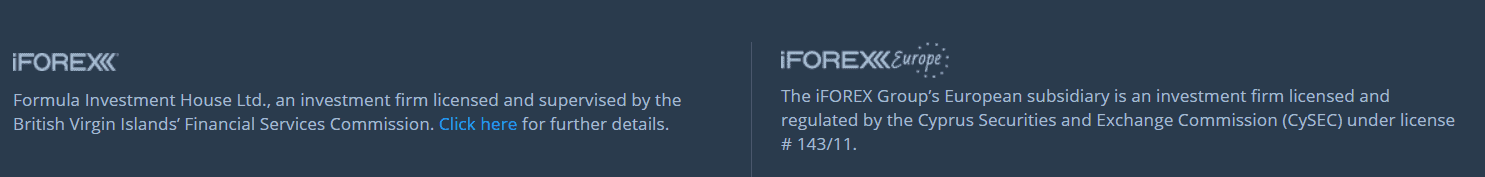

The broker was formerly licensed and supervised by the British Virgin Islands Financial Services Commission. The broker is now additionally licensed by the well-respected CySEC, ensuring the safety and reliability of trades.

iFOREX also features an educational section with resources for both beginner and advanced traders. The broker’s customer support is available through multiple channels.

iFOREX Pros and Cons

Our research revealed that iFOREX has both advantages and disadvantages to consider. On the positive side, iFOREX offers competitive conditions, a diverse range of trading instruments, and a wide array of funding methods. The broker also provides helpful educational resources for both beginners and professionals.

However, iFOREX offers only a proprietary mobile app and a web platform to conduct trades, which can be restricting for many traders who are used to advanced platforms and look for a desktop platform version. Customer support is prompt via several channels, yet it is not available 24/7.

| Pros | Cons |

|---|

| European license and oversight | No 24/7 customer support |

| CySEC regulation | No traditional investment opportunities |

| Good trading conditions | Only a proprietary app and web platform available |

| A good range of trading instruments | |

| Education | |

| Fast account opening and free Demo account | |

iFOREX Features

iFOREX comes with competitive trading conditions and features to meet different trading expectations. The broker can become a favorable choice for both beginners and advanced traders. We have prepared a list of the main aspects of trading with the broker to understand how it meets your specific trading goals.

iFOREX Features in 10 Points

| 🗺️ Regulation | CySEC, BVI FSC |

| 🗺️ Account Types | Standard, VIP, Premium, Islamic |

| 🖥 Trading Platforms | iFOREX app, Fxnet web platform |

| 📉 Trading Instruments | Forex, commodities, indices, shares, ETFs, and cryptocurrencies |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | Different currencies |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is iFOREX For?

Based on our research and findings, iFOREX offers competitive services that will be good for different traders, various strategies, and trading needs. Here is what iFOREX is good for:

- Experienced traders

- Beginners

- Mobile traders

- International traders

- Currency trading

- Competitive spreads and fees

- Good education and trading tools

- Short-term trading

iFOREX Summary

iFOREX offers a safe trading environment with diverse services, advanced features, and capabilities. The broker offers over 750 tradable products across a range of financial assets. Trades are conducted through the broker’s iFOREX proprietary platforms. Traders of iFOREX have no other platform options.

The broker offers average trading charges, an initial deposit of $100, a demo account, and good educational resources dedicated to novice and advanced traders. The multilingual customer support is available 24/5 through live chat, email, and phone lines. Although the broker is now tightly regulated by the CySEC, we advise traders to be careful and check the broker’s proposal before opening an account.

55Brokers Professional Insights

iFOREX for years been in our ssection of brokers to avoid, yet now the Broker obtain a CySEC license, so improved its proposal and now follow rules and guidelines that protect clients, making it suitable choice for European or international traders and their investments. The broker is available in over 100 countries, so is indeed with great coverage providing services to global clients.

As for the trading performance itself, traders gain access to products across Forex, commodities, indices, shares, ETFs, and cryptocurrencies, so is quite favorable diversity. Although iFOREX offers only an iFOREX mobile app, the platform is equipped with advanced tools and features so provide quite quality environment. However, on the negative side, the proprietary mobile app and web platform limit the opportunities for those traders who prefer trading via the popular MT4, MT5, or other advanced platforms.

Consider Trading with iFOREX If:

| iFOREX is an excellent Broker for: | - Beginner traders

- Advanced traders

- Islamic clients

- Mobile traders

- Clients prioritizing diversity of instruments

- Currency traders

- CFD traders

- Beginners looking for educational resources |

Avoid Trading with iFOREX If:

| iFOREX is not the best for: | - Clients who prioritize top-tier licenses

- Long-term investors

- Clients looking for 24/7 customer support

- MT4/MT5 platform enthusiasts |

Regulation and Security Measures

Score – 4.2/5

iFOREX Regulatory Overview

The Formula Investment House Ltd. is the parent company of iFOREX, established back in 1996, and has offices in the British Virgin Islands and operates under the regulation of the BVI FSC. The broker also operates under its European subsidiary and is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license # 143/11.

- However, the company was previously penalized due to several violations. The broker, operating through the company ICFD Ltd, received a 138,000€ fine from CySEC for providing unlicensed services and failing to protect its clients’ best interests. Thus, it is essential to consider the history behind the broker before making a final decision to open an account with it.

How Safe is Trading with iFOREX?

Operating under the oversight of a reputable authority, iFOREX ensures the security of its clients. Here are the iFOREX safety measures to protect its clients.

- The broker ensures segregation of accounts, keeping client funds in segregated accounts, separated from the broker’s capital.

- iFOREX also provides Negative balance protection, ensuring clients do not lose more funds than their initial investment.

- Besides, clients’ data is protected by encryption and SSL protocols.

Consistency and Clarity

From the consistency and clarity viewpoint, there are a few things to consider about iFOREX. The broker was established in 1996, under offshore oversight. The broker operated for many years under a BVI FSC license until it later obtained a license from CySEC for its European entity. As of now, the broker has over 8 million active accounts and is available in over 100 countries globally.

However, the broker’s regulatory track is not completely clean: its European entity was fined by CySEC for providing services beyond its licensed activity. Besides, we have found a lot of negative feedback regarding the broker’s operations.

Despite this, iFOREX is now tightly regulated and its services comply with the market standards.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with iFOREX?

Based on our research, iFOREX does not publicly provide information about its account types. To learn about its various account options and conditions, traders need to contact the customer support team.

iFOREX offers several account options: Standard, Premium, and VIP. It also offers a swap-free account for its Islamic clients. iFOREX offers leverage up to 1:400. The accounts are typically spread-based, with average spreads of 1.2 pips for the Standard account. The VIP account offers lower spreads, starting at 0.6 pips. The first deposit requirement for the Standard account is $100. The VIP and Premium accounts are tailored for more advanced traders and higher trading volume. The initial deposit for the VIP and Premium accounts is 10,000 and 1,000, respectively.

Regions Where iFOREX is Restricted

Although iFOREX accepts clients from over 100 countries and offers its services globally, there are still countries where iFOREX is unavailable. Of course, the broker’s availability also depends on the entity that traders open an account.

Thus, due to regulatory restrictions, iFOREX does not accept clients from the following countries:

- Afghanistan

- American Samoa

- Australia

- Belgium

- British Indian Ocean Territory

- British Virgin Islands

- Canada

- Christmas Island

- Cocos Islands

- Congo

- Crimea

- Cuba

- Guam

- Guinea

- Haiti

- Iran

- Israel

- Lebanon

- Libya

- Mali

- Myanmar

- New Zealand

- North Korea

- Northern Mariana Islands

- Puerto Rico

- Russian Federation

- Singapore

- Somalia

- South Sudan

- Sudan

- Syria

- Turkey

- United States of America

- US Minor Outlying Islands

- US Virgin Islands

Cost Structure and Fees

Score – 4.3/5

iFOREX Brokerage Fees

We have carefully considered iFOREX fees and found that the broker offers competitive fees for most of its tradable products. The trading charges depend on the entity, account types, and the instrument traded. Overall, the broker’s fees are in line with the market average, making it a cost-efficient option for different traders.

Based on our research, iFOREX does not offer commissions, and the trading costs are integrated into spreads for all the account types.

iFOREX offers competitive spreads with an average spread of 1 pip for the EUR/USD currency pair for the Standard account. The good thing about the broker’s spreads is that iFOREX introduces them in detail for each instrument, so traders are aware of the applicable trading charges. Besides, there are no commissions for any of its account types, and all the fees are expressed in spreads. For the VIP account, spreads are much lower, starting from 0.6 pips.

iFOREX does not mention any commission fees. Our testing showed that all the trading costs are applied through spreads. This fee structure might not be suitable for advanced traders looking for fixed transaction fees combined with very low spreads. However, the broker might offer client-personalized conditions for more professional clients.

How Competitive Are iFOREX’s Fees?

Overall, iFOREX offers competitive fees in line with the market standard. iFOREX expresses trading costs for each instrument in detail, which is a great advantage and makes the proposal transparent and clear for its clients.

By visiting the broker’s official website, clients can see and calculate all the applicable fees beforehand. There are no hidden fees, and all the charges are applied through spreads and overnight fees. Besides, there are very few additional fees that traders might face.

The only precaution is to be aware of the differences between the jurisdictions, as the trading conditions (including fees, account types, etc.) might vary.

| Asset/ Pair | iFOREX spreads | XTrend Spread | TD Markets Spreads |

|---|

| EUR USD Spread | 1.2 pips | 0.2 pips | 1.8 pips |

| Crude Oil WTI Spread | 3.2 | 0.024 | 2 |

| Gold Spread | 35 | 0.07 | 8 |

iFOREX Additional Fees

We have found that iFOREX does not impose any deposit or withdrawal fees. Even if the third parties apply transaction fees, iFOREX will cover them for its clients.

iFOREX has overnight or swap fees for the positions held during the night. The applicable swaps are short or long and vary based on the instrument and market conditions.

At last, after a year of inactivity, the broker will charge a monthly maintenance fee of $15.

Score – 4/5

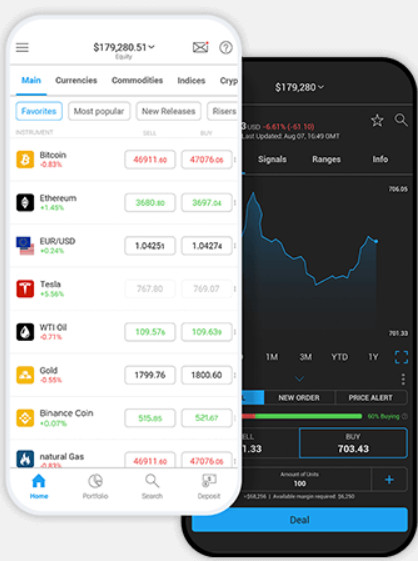

At iFOREX, clients can trade through the broker’s proprietary iFOREX app or, for the European entity, also access the broker’s FXnet is a tailor-made web platform. Both the broker’s mobile app and the web platform include advanced tools and features to support traders on their trading path.

| Platforms | iFOREX Platforms | XTrend Platforms | TD Markets Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | No |

| Mobile Platform | Yes | Yes | Yes |

iFOREX Web Platform

iFOREX offers its own specifically tailored Fxnet web platform for its European entity. Fxnet is customized according to the client’s needs, supporting a simple and friendly interface and access to more than 750 tradable products across a good selection of financial assets. Clients can use different charts, signals, various decision-making tools, and market sentiment.

The web platform ensures easy access to the platform through any browser, ensuring flexibility and convenience.

iFOREX Desktop MetaTrader 4/5 Platform

Based on our research, iFOREX does not offer the market-popular MT4 or MT5 platforms. Traders can conduct the trades through the broker’s proprietary mobile or web platforms. Those traders who prefer the MT4/MT5 platforms will likely look for other brokers that offer access to the mentioned platforms.

However, despite the platform limitations, iFOREX still ensures access to essential analysis tools for a positive trading experience.

iFOREX MobileTrader App

The iFOREX mobile app can be easily downloaded through the App Store or Google Play. The platform enables flexible trades on the go with just an internet connection. The platform is also equipped with advanced trading capabilities, ensuring secure and profitable trades. Traders can use the built-in economic calendar for information about upcoming market changes. Besides, they can access trading signals, live charts, and technical indicators.

In addition, the platform can be easily customized according to the client’s needs. All in all, the mobile app ensures easy access to the trades with efficient tools and features to conduct in-depth analysis and research.

Main Insights from Testing

We have drawn our final conclusion on the broker’s trading platforms. Although iFOREX offers a web and a mobile app that include innovative tools and features, a simple interface, and easy availability, some traders might find the offering unfavorable for their trading expectations. The MT4/MT5 platform enthusiasts, or those who look for access to cTrader or TradingView, will find the proposal limiting for their trading needs and expectations.

AI Trading

Although iFOREX includes a few AI-powered features, such as a trading assistant with artificial intelligence, the broker does not include fully AI-assisted systems.

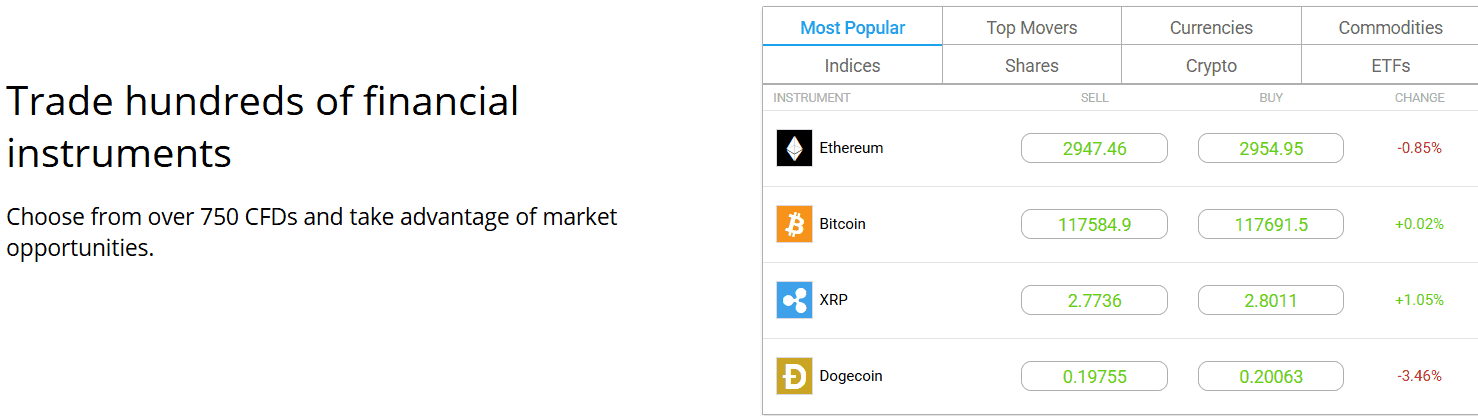

Trading Instruments

Score – 4.3/5

What Can You Trade on the iFOREX Platform?

Based on our research of the broker’s trading instruments, iFOREX offers an impressive selection of trading products across FX, commodities, indices, shares, ETFs, and cryptocurrencies. It ensures good diversity for those who are looking to expand their trading experience and explore new market opportunities.

iFOREX is a favorable choice for many traders, as it provides a large selection of Forex pairs for those who are interested in currency trading, a good selection of precious metals, energies, agricultural products, global indices, and more.

However, the products are based on CFDs, making the broker suitable for short-term trades and profits based on price movements. Traditional investors will likely not be interested in the proposal.

Main Insights from Exploring iFOREX Tradable Assets

After exploring the broker’s instrument offering, we conclude that traders can access over 750 products with competitive fees and good market conditions. The broker enables traders to explore new products outside of the major and popular currency pairs, precious metals, or commodities. In addition, cryptocurrency traders can access an impressive range of cryptos, including the most popular Bitcoin, Ethereum, Dogecoin, Solana, and many other altcoins with average spreads.

Traders can also access the most popular indices and shares of world-renowned companies. The offering ensures transparency, clarity, and variety. Besides, one of the most essential benefits is that the broker introduces all the applicable trading fees for each instrument on its website.

Lastly, we urge traders to consider the differences between the broker’s entities and ensure they are well-informed before opening an account with iFOREX.

Leverage Options at iFOREX

Leverage is a beneficial tool for traders who enter the market with a smaller initial investment. While leverage can boost potential gains, it can also increase the trading risks. Traders need to understand how leverage works and the associated risks with it.

We found that iFOREX leverage is offered by CySEC regulations:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- iFOREX offers up to 1:400 leverage for its international clients.

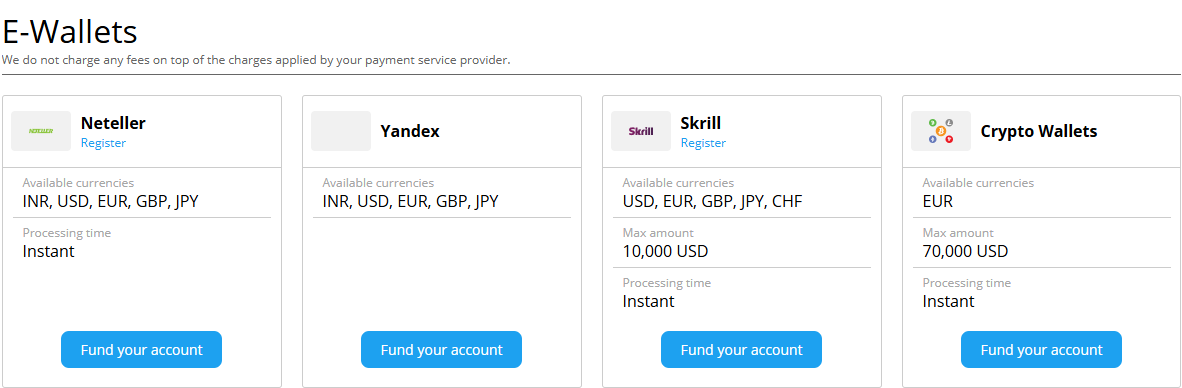

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at iFOREX

The broker offers various funding methods for the convenience of its clients. Of course, the availability of the deposit method depends on the jurisdiction. There are no transaction fees or commissions. Even when the third-party funding providers impose fees, iFOREX will cover those charges, so that traders do not pay any additional fees.

Here are the available deposit methods with iFOREX:

- Wire transfers

- Credit/debit cards

- Neteller

- Skrill

- Jeton

- AstroPay

- Crypto deposits

Minimum Deposit

The minimum deposit required by iFOREX is $100 for the Standard account. The requirement is in line with the market average and enables even cost-conscious traders to open an account with the broker. For its Premium and VIP accounts, the initial deposit is much higher. To open a VIP account, traders need to make a $10,000 deposit.

Withdrawal Options at iFOREX

iFOREX offers quick and easy withdrawals through multiple methods. Generally, clients are required to use the same method used for deposits.

For Credit/debit cards and wire transfers, there are no transaction charges. For the withdrawals processed to the trader’s bank account, there might be a $20 fee applied.

- The processing time varies across funding methods; however, for electronic payments like Skrill and Neteller, the withdrawals are instant.

Customer Support and Responsiveness

Score – 4.5/5

Testing iFOREX Customer Support

We estimate iFOREX’s customer support as adequate. The broker assists via Live chat, phone lines, email, and WhatsApp. Besides, the broker includes a support section where traders can find answers to the most common trading-related questions.

- In addition, iFOREX is available on multiple social media platforms, providing the most up-to-date information on the market and its activities. Traders can follow iFOREX on LinkedIn, X, YouTube, and Facebook.

Contacts iFOREX

We tested iFOREX’s customer support to see how dedicated the broker’s support team is and how quickly it solves the issues traders face. Our experience revealed that iFOREX provides prompt answers to all the questions. Through the live chat, the assistant also suggests proceeding with a phone call for more clarification in case it is needed.

- From our testing, the quickest way of communication with the broker is the live chat. The answers are almost instant, sometimes within 2-5 minutes.

- iFOREX provides different email addresses for various issues and specific requests. Clients can use the following email address for general inquiries: info@iforex.eu. For technical support, the broker provides another address: tech@iforex.eu.

- iFOREX encourages communication through phone calls and provides different numbers based on the client’s country. The general phone number provided is +357-252-04600; however, traders can find the phone number for their region or country on the broker’s website.

- European traders can also use WhatsApp.

Research and Education

Score – 4.1/5

Research Tools iFOREX

We found iFOREX trading tools and features helpful in analyzing the market further and trading efficiently. Combined with the capabilities included on the broker’s proprietary platforms, the additional features will take the trading experience to another level.

- The Economic Calendar is an essential tool to explore the market changes and learn about the upcoming changes that can impact the market.

- iFOREX provides Live rates for hundreds of tradable products to stay informed about the changes in prices across different markets and economies.

- The News section provides traders with the latest market updates and events to stay informed and make trading decisions based on valid and up-to-date information.

- The Trading Insights section is a great way to access essential market insights and make the right moves based on them.

Education

iFOREX offers an education section where both beginner and advanced clients can access a wide range of helpful resources. The articles and short videos provided in the section cover various trading-related topics, giving the broker’s clients insight into the market. The Blog section also includes helpful articles, elaborating further on the market.

- However, traders looking for webinars, seminars, a trading glossary, or extensive courses should look for another broker option with a relevant proposal.

Is iFOREX a Good Broker for Beginners?

iFOREX comes with competitive trading conditions to meet the different needs of its clients. The broker can be a favorable choice for both inexperienced and advanced clients. It offers different trading accounts, tailored for various needs, offering a $100 initial deposit. The fees are transparent and in line with the market average, with no hidden fees or any additional non-trading costs.

Another advantage is the good variety of tradable products that will satisfy both novice traders looking for the most essential and popular products and those who are looking for diversification. Besides, traders can learn with iFOREX by accessing its education section, equipped with articles and guidelines. In short, the answer to whether iFOREX is suitable for novice traders is positive.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options iFOREX

Although iFOREX offers a good selection of trading instruments across Forex, commodities, indices, shares, cryptos, and ETFs (750 in total), the offering is based on CFDs. It eliminates the chances of longer-term investments, and traders can profit only from short-term price changes.

We also researched whether the broker offers alternative options for investment, such as copy trading, MAM, or PAMM accounts. However, iFOREX does not provide any of the mentioned opportunities. Thus, iFOREX will be a good match for traders interested in short-term trading rather than traditional investments or alternative options.

Account Opening

Score – 4.5/5

How to Open an iFOREX Demo Account?

iFOREX offers a demo account to practice and gain skills in a risk-free environment. To open a demo account with iFOREX, clients need to open a live account first. Then, they are able to easily switch to a demo version whenever they like. The demo account provides unlimited virtual funds and enables traders to access the full suite of iFOREX’s tools and features.

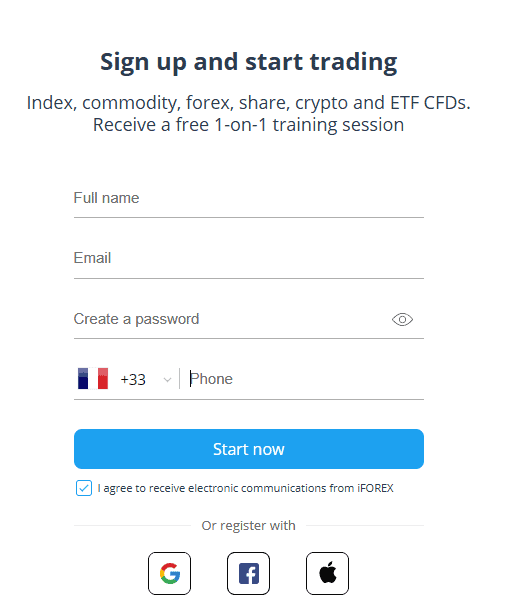

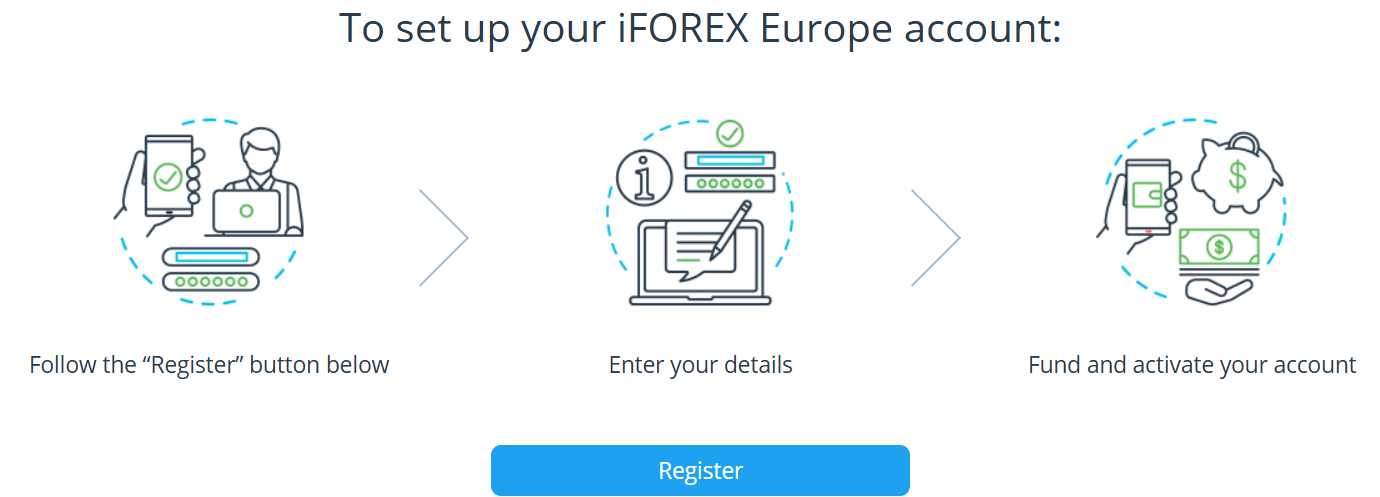

How to Open an iFOREX Live Account?

To open an iFOREX live account, traders need to go to the broker’s website and start the registration process. It generally takes a few minutes to open an iFOREX live account.

Here is a step-by-step guide on how to open an iFOREX live account:

- Go to the broker’s website and click on the ‘Registration’ button.

- Fill out the form with personal details (name, email, phone number).

- Create a password.

- After submitting the registration, traders will receive an email with account details.

- Use the credentials to access the live account instantly and start trading.

- No need for downloads as the platforms are either web-based or mobile-based.

- For the final verification of the account, upload the required documents (ID, proof of address, etc.).

- Make a deposit and start trading.

Score – 4/5

In the previous sections, we have already discussed the main tools and features iFOREX provides for deep analysis and market research. Here we will mention a few benefits iFOREX offers for a better client experience and enhanced opportunities:

- iFOREX offers a Welcome package that includes additional educational and research tools. The package includes one-on-one sessions, guides, trading courses, and detailed articles.

- iFOREX clients can refer a friend and earn from $35 to $80 for each referral. All iFOREX clients can apply for this bonus. They need to send the referral link to a friend and receive a bonus after the friend registers with iFOREX.

iFOREX Compared to Other Brokers

After reviewing iFOREX’s aspects of trading, we have compared the broker to other companies with similar standing and services. This approach helps us estimate the broker’s proposal more vividly.

To start, we compare iFOREX’s regulation to other brokers to see what safety measures different brokers ensure. iFOREX is regulated by CySEC, which puts the broker in a reliable and trustworthy sector. When we compare it to brokers, such as ATFX or IC Markets, we see that they also hold a license from the authority. However, both brokers hold top-tier licenses from ASIC and FCA, offering additional safety measures.

iForex provides over 750 tradable products, which is considered a good offering. To see how it complies with the market standards, we reviewed ATFX’s and FP Markets’ instrument offerings. As we found, ATFX offers about 300 products, while FP Markets has a more extensive offering of over 10,000 products. Thus, iFOREX’s offering is better than the ones available for many other brokers, yet there are still brokers with an extensive range of products that ensure wide diversity. The trading costs are average, with spreads of 1.2 pips: iFOREX falls into the category of brokers with average spreads that can attract many traders.

Finally, iFOREX offers various educational resources to boost its traders’ knowledge and understanding of the market. Yet, Pepperstone and FP Markets stand out for better proposals.

| Parameter |

iFOREX |

ATFX |

FP Markets |

IC Markets |

Pepperstone |

eToro |

Forex.com |

| Spread-Based Account |

From 1.2 pips |

From 1.8 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 1 pip |

From 0.8 Pips |

| Commission-Based Account |

No commissions |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

0.0 pips + $5 |

| Fees Ranking |

Average |

Average |

Low/ Average |

Low/ Average |

Low |

Average |

Average |

| Trading Platforms |

iFOREX mobile app, Fxnet web platform |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5,cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary Platform |

MT4, MT5, Forex.com Platform |

| Asset Variety |

|

300+ instruments |

|

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

500+ instruments |

| Regulation |

CySEC, BVI FSC |

FCA, CySEC, ASIC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$100 |

$100 |

$100 |

$200 |

$0 |

$200 |

$100 |

Full Review of Broker iFOREX

We have thoroughly researched and analyzed iFOREX’s different aspects and can now draw a conclusion based on our findings.

iFOREX is a CySEC-regulated broker that offers a reliable trading environment paired with competitive trading solutions. The broker has a long history of operation. In 1996, it started as an offshore broker and developed its proposal over the years. Today, iFOREX is recognized by traders worldwide and is favored by many.

iFOREX does not offer the popular MT4 or MT5 platforms. Instead, it has its own web and mobile proprietary platforms (Fxnet web platform and iFOREX mobile app) equipped with intense analysis and research features and tools. The platforms enable access to over 750 tradable products with competitive fees and conditions.

To open a live account with iFOREX, clients need to make at least a $100 initial deposit. The broker also offers a swap-free account for Muslim traders and a demo account for those who want to practice their skills.

The education section is also good. In addition to the available detailed and thorough articles, iFOREX offers a welcome education package with attractive educational resources.

To conclude, iFOREX can become a favorable choice for many clients who appreciate a transparent fee structure, average charges, and compliance with strict laws. However, it is essential to remember that the broker’s different jurisdictions provide different trading conditions and operate under different safety standards.

Share this article [addtoany url="https://55brokers.com/iforex-review/" title="iFOREX"]

This old looking platform doesn’t fit them, especially with the low spreads they have . they need better platform with high exeuction and they can compete with the rest better. my opinion as a client.

The review is pretty much accurate. I agree with the pros and cons here. I opened an account recently and it’s true that the min deposit required is $100. You can find brokers with even lower entry requirements, but hardly you can find a credible platform as iforex with the same deposit requirement. On top of that, if you are a new client like me, you get a welcome package. I choose the one with focus on education and learning resources and it was the right decision

iForex offers a great quality of their servvices. When I signed up and started trading, I didn’t noticed their fees immediately which is usually a good sign. They matched my expectations. Btw, the support team gets in touch with me frequently to make sure I don’t have any issues. That alone shows how much they care about customers. Even though I was skeptical, guys always replied in a polite way.

I looked at cons here and it says : no traditional invest,ing opportunities, like whatst hta supposed to mean😅 its a cfd broker firs of all and thats what you are gonna find it. Just investing is with real stocks where you get 1:1 leverage and you have to have,much higher capital.

with the rest I agree btw, it might now hurt to add some new payment options, accounts and platforms

FXNET is a great trading platform. It has everything needed for trading, tools 4 charting especially

Hmm, interesting takes on the broker I currently have an acc with. The major pro is about their expertise I guess. That’s why I trade here, not somewhere else, where you can easily trade directly on tradingview. Their edu materials are solid and credible, as a whole in these years (Idk it was smth 20 and more) they managed to build a solid environment. I think it will pay off in the long run…

with such rating an regulationss no way iforex is scam…legit and safe broker,also it has good edu

Once I saw that the broker was found back in 1996, I had no doubts that they are legit. They have almost 30 years of experience, it’s too much. Plus, the partnership with PSV, one of the biggest clubs in its championship just proved the point once again… When it comes to ratings, I would agree with you guys. The spreads are competitive, the average numbers were 1.1 pips for eur/usd pair. The customer service is also good. Yeah, they are not working 24/7 which is definitely a downside, but at least the people working there are knowledgeable and actually resolve issues.

iForex opened my eyes on how to trade more effectively, ya know I used to think that I have to trade as much as possible to earn money, but by passing their courses, I changed my trading mindset. Profit is easy, keeping it isn’t. That’s where maturity begins.

There were three topics that made me who I am today:

-bollinger bands

-RSI

-elliot waves

It turned out that I was using these indicators incorrectly, but now I understand what the secret is. Of course, I practiced a little bit on a demo account before diving into real trading. It was worth it, I made a lot of mistakes, but I learned!

Suprisingly not much payment method for Mexico, but they accept local cards, ngl it’s lighting fast.

IMpressed with their year of foundation – 1996. I prefer the services with a proven history. Trading here opened new markets for me like soft commodities and ETF. Good alternative for stagnating forex

I was recommended to use this broker, judging from the experience of my friend and how well he started in trading. Interesting broker, in terms of education. Much better insight and pro analysis, than the one I found on YT on my own. Here at least, I could be sure, materials are created by proven market experts, not random youtuber that claim themselves to be trading gurus.

about the platform. Design needs an improvement, though it was convenient to open trades and draw lines. Maybe there are better platforms over there, but for now, I don’t have anything to change it.

they got tight liecnsing and legal stuff, tradin’ on iforex been with no issues. My say: legit

I dont think giving 4/5 for the selection of assets is a fair deal🙄 they have like 750+ assets which is a lot, so the rating for it should have been higher in my opinion.

With overall 4.2 I agree, they are a solid broker but they are lacking some improvem,ent and features to easily compete with popular brokers now. I would apprecaite more AI based help in my trading here.

To be honest, I prefer to trade only with time-tested ones.

I’m not sure why this broker is not in top-3. I agree with your review almost everywhere, but why 4.2 for safety? They are nearly 30 years old, in this market its grandpa-level. Its better than any regulation can buy. I would give it solid 4.9 for safety at least, and then the score would be fully reflective.

they show extra care to beginners,this is why I liked this place. Turns out they are almost 30 years old, which means they have been here for 3 deacades and earned their credibility! and when I. singed up I enjoyed some stuff like todays opportunity where I can see like insights for the day, I ve been struggling to pick assets to trade.

Recap of my iforex trading experience.for over the last 2 years: very positive.

I can say I didnt.have any serious. problems and payments were not problem.

Iforex is an excellent platform for trading indices. While most popular insutments will always be forex, commodities, maybe shares with some brokers, the indices are always in the back and brokers tend to provide great spreads on forex and other instruments on the account on the indices. At least this is my opinion after many years in trading. What i wanted to say is that on this platform the spreads, the execution the overall trading costs even on indices are pretty good and i am glad that i have found a reliable platform for my trading style

Old gold broker if you want… The best thing about iforex is that they didn’t stop improving, relying on the legacy. AI, constant improvement in analytical resources. Interesting trading platform///

The welcome package is spot on for new clients… I took the one for a bit more experienced traders, and it was great for boosting my confidence a bit more and preparing me for a new trading chapter with iforex. I have good feeling that this time it’s gonna work it out, the platform is really flawless, it provides everything one needs for proper trading

My main assets for trading right now:

-EUR/USD (DXY is falling)

-GOLD (Bitcoin is growing, means gold too)

-Oil (New tariffs, but the price is not growing)

But spreads on oil asset aren’t the best.

iforex trading is ok, payments are quick ,though the selection is not that big.

The mobile app was something new to me because I always traded only on MT5 and MT4 software versions before. It’s much simpler and at the same time, it offers enough tolos for smooth trading.

Iforex trading conditions are fine, spreads start from 1,1-1,5 pips.

That’s enough for me.

I like my trading experience. From the beginning I could trust the broker. 20 years is something they can be proud about!! So, RELIABILITY TOPIC wasn’t doubted. Smooth trades, various assets. Their in-chart analytics was helpful to improve my decisions. RARE to see that those “analytics” help for real. Here it was real.

I tend to lean towards more traditional assets, but I’m not gonna lie, the IPO trading thing they’ve got going is very alluring…

There are various trading assets and tools here that make it very possible to be able to trade and diversify your assets without any restrictions… The execution speed also works at a rate which is Fast. US 2000 seems like a lucrative asset to delve into, I’ll see how much i can learn first.

Impressive how I could switch from demo to real acc… For real, I developed my trading here!!

iForex broker is a reputable broker and they knowing how to do their job. All the services are pretty good and I didn’t notice any suspicious activity. I’m staying here for a long time! 😎

iforex trading is weel regulated by CysSEC and has very good reviews, It’s pretty cool!

Can you share iForex reviews about withdrawal or deposit experience, how safe it is to make payments with this broker, article left some mixed feeling about their reliability?

Well, iForex has become qutie a prominent broker in the trading community and more and more traders cooperate with them. They offer mtuliple options for making deposits and withdrawals. Personally I use USDT for transactions and it always works finely and without serious issues.

They didn’t charge any commission for opening trades, so I was more than willing to trade at this platform. iForex broker is a nice one to try, I think, I haven’t faced any flaws for now, ngl.

The broker is nown for providing more than 750 assets and this is very very impressive. Protection with the FCA license is a good feature to have but all this margin trading must be pre–faced with a comprehensive education, this is my personal biazed view. Well, no complaints about trading on the iforex platform, fast and smart.

iforex stil remains lowesst in stock fees 🙂 Nobody can take the crown from a king.

They always choose the clubs which are the best, and PSV has come so far in champions league, they are making some nice moves!🤞

Much as the club, Iforex is powerful as well, they have their history and after all these years – still showing the results which are better tha nevery body elses. Love trading here, even tho I am not that pro, but still I am doing my best here and growing!

Man I respect iForex for makign a partnership with PSV, one of the biggest clubs in Erdivision… Actually it’s a bold move because you get the fans of one team and all the other teams will see you as a an enemy😂 Nah just jk tho, everybody respects iForex, they are one of the oldest in trading, more than 20 years in the market, no other broker can show you think kind of history. The sole fact that they are around for so many years just confirms that they are more than solid. I always liked some market analysis in there… learned a lot of their materials.

I joined the iForex broker a few months ago and was kinda skeptical about them at first. After trading on the forex market and making profits on eur/usd I changed my mind. They deserve my trust! 😃

Support is the face of the company, so while I first started trading with iforex, I contacted them about the details. Worked pretty well, so iforex reviews didn`t lie, quality is on a decent level.

I’m only with standard acc here (theres also vip) but in general the trading is ok. Most iForex reviews here focus on spreads and safety, I also think these are good. Swaps at 0,75% are meh though.

I am sure that those who have tradd on the demo were delighted with the speed of execution and realness of quotes. I also traded on the demo initially, but now I switched to a real acc.

Initially, I didn`t want to trade with this broker I don`t know why it seemed to be not trustworthy at all. But everything changes, when you personally try the service, it turns out it`s trustworthy👌

It appeared to be a broker with a long history and strong liquidity PROVIDER, though I wasn`t that sure about iForex propriary platform, diferent from MetaTrader. Actually, I haven`t faced any drawbacks in its woRk, even if the interface looks better. Trading CONDITIONS were also reasonable and suitable for me, there were a bunch of tradable assets and normal spreads, so I like my XP.

I am happy with iFOREX platform Every service works fine but trading platform is the best tool. For now I have nothing to complain about.

iForex broker has proven to be an excllent choice for me. I like its custom trding app, the spreads I get here, and its overall reliability in terms of support and withdrawals.

I approve 👍🙂

Wasn’t sure to fund my Iforex trading account, reading over 100 reviews I decided to try them out!

GBP/JPY is like riding a rollercoaster – fast, thrilling, and full of sharp twists, but when you time it right, the payoff is well worth it!

Btw, iforex trading terms on this instrument – fine 👍

I didn’t expect anything from iForex broker because I knew that they were launched in 1996 and I thought they can’t offer something unique like other modern brokerage firms.

How wrong I was, they provide such tight spreads on the forex market that I can hardly notice the difference between bid and ask prices. Ngl, I was surprised and I should admit this broker is better than other brokerage firms.

I kinda feel that there is no broker out there that caters for its traders like iforex. FOr new traders… and old traders as well, you can get one on one training sessions, and also other educational materials which are actually very good. There are many tools on the platform that help traders succeed. And that is why so many love the platform… it has a good name in trading circles.

For me, trading in financial markets is of great importance because it is the main source of my income.

Therefore, you understand how strict my requirements are not only for the reputation of broker, but also for some other characteristics.

iForex is an experienced player in this game.

This broker has excellent selection of assets and among them, of course, some those that interest me.

Lately I trade metals and in particular Gold. Therefore, I closely monitor quality of order execution.

It’s great here.

Moreover, I have well-balanced trading conditions here, which helps me earn more

When I faced this platform and noticed that they have been in the bizz since the end of the previous century:) I was sure that they also had a conventional fee system. I know that back in the day brokers rly ripped off traders, there were no user-centricity in this regard at all.

Fortunately I was mistaken ’bout them. Spreads here are tight and there are no hidden fees, so you can literally find information about all expenses that you bear on the website. They charge neither more nor less tha stated and it’s captivating. Trade only liquid currency pairs, spreads are the narrowest.

I had some minor troubles during the verification process of a trading account and I couldn’t make a replenishment. Fortunately, the technical support helped me to sort out this problem and I’m really grateful for that!

It was my first time when I was transferring money through a financial broker and fortunately, it was easier than I expected. iForex offers many ways for transferring money and everything depends on which country you are from. Anyway, it doesn’t matter for me because mainly I use crypto currencies for transactions. Everything works perfectly and without serious delays. I recommend this broker!

Yeah, I can agree with those traders who claim that the website looks a bit outdated, because it’s like that, nevertheless, for me, as for a true oldie trader, it’s even more habitual. Right after I entered the site, I understood how to register, verify account and so on.

I had certain difficulties with the verification process, there were some delays, and I had to ask client support team about this. As it turned out, they just had a big load of work and couldn’t process my documents faster. But I ain’t complain! I always can relate, especially since that trading experience is super positive.

The payment method of this broker has been easy and swift. It’s not stressful and that is something I really appreciate that. Building trust is not the easiest thing to do in this industry, as I have come to learn. But I am happy I got a reliable and safe broker early on.

The user interface on the official website is so beautiful that I’m ready to glance at it for a long time because I noticed that many financial brokers have outdated user interfaces on their websites and at this point iForex stands out among them.

I joined this company recently but thanks to the AI assistant I could understand how everything works and iForex AI was answering my requests quite fast. It seems easier to contact artificial intelligence than the support team. Yeah, the trading conditions are also great and there are so many financial instruments available for trading.

This is one of the most reliable brokers in the financial industry and as far as I know they have been in the BIZZ for over 25 years and it proves that the company is highly trustworthy.

I think they are capable of existing for another 25 years, thus I don’t need to worry about the safety of my money. I mean, it is an important factor for me to join this company.

iForex is a reliable broker that offers a big choice of financial assets with more than 750+ CFDs available for trading. I mainly trade on the Forex market and there are tight spreads, cheap swaps with leverage.

There are also many ways to make deposits and withdrawals. I like that I can make transactions through crypto wallets and it is really convenient. I recommend this broker.

An industry OG. This broker is just amazing. iForex has the king of stellar history that industry competitors only dream of. I do not know any other brokers that have been around for this long.

It seems that this company can offer unique conditions for its clients.

Maybe conservative traders will not like it, but for me it is just what I need. I want to have an advantage over other traders and here I can get such advantage.

And it’s also pretty reliable broker even though it doesn’t have the most famous name.

For brokers with such a long history in the business like iForex, the question about its reliability and trustworthiness is redundant. This greatly simplifies the process of choosing a broker, you only need to focus on the trading conditions.

But everything is easier here too.

If you appreciate other trader’s experience, let me share mine. Their custom trading app has exceeded my expectations. It is incredibly fast and stable. The execution is out of this world, and the app is packed with all you may need as indicators and tools.

IFOREX is safe or not for trading and investing

IFOREX is recommended fro trading because you can get your money back easily.

Which broker is fully legal on all parameters