- What is FXGiants?

- FXGiantsPros and Cons

- Regulation and Security Measures

- Account Types and Benefits

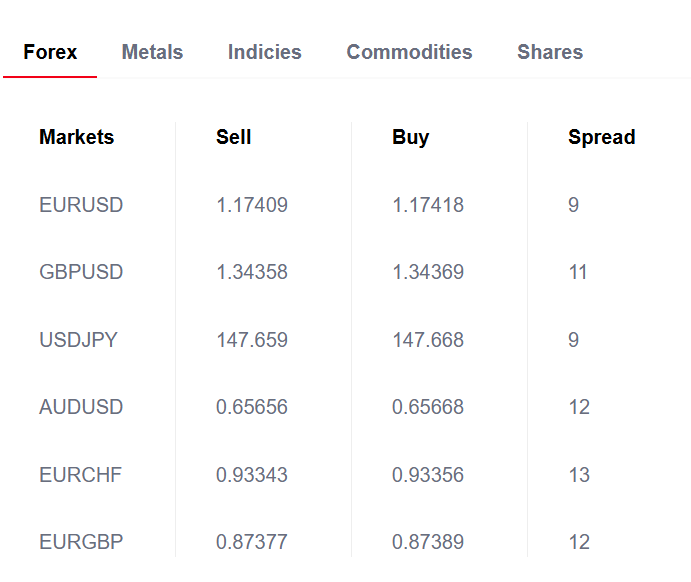

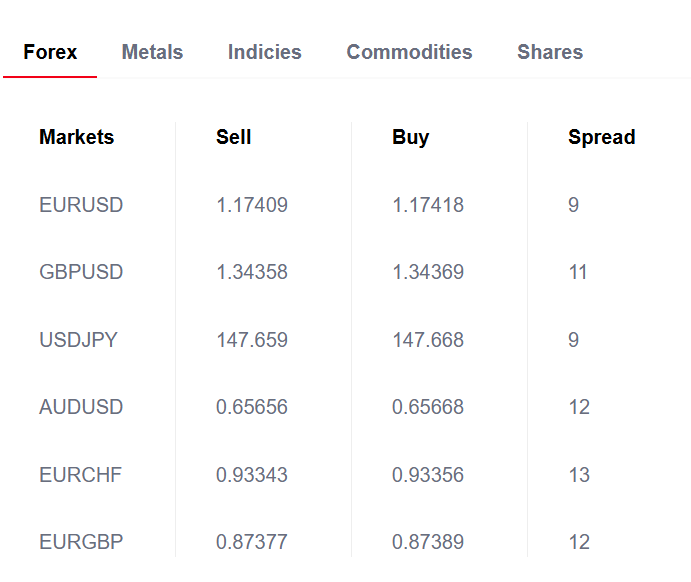

- Cost Structure and Fees

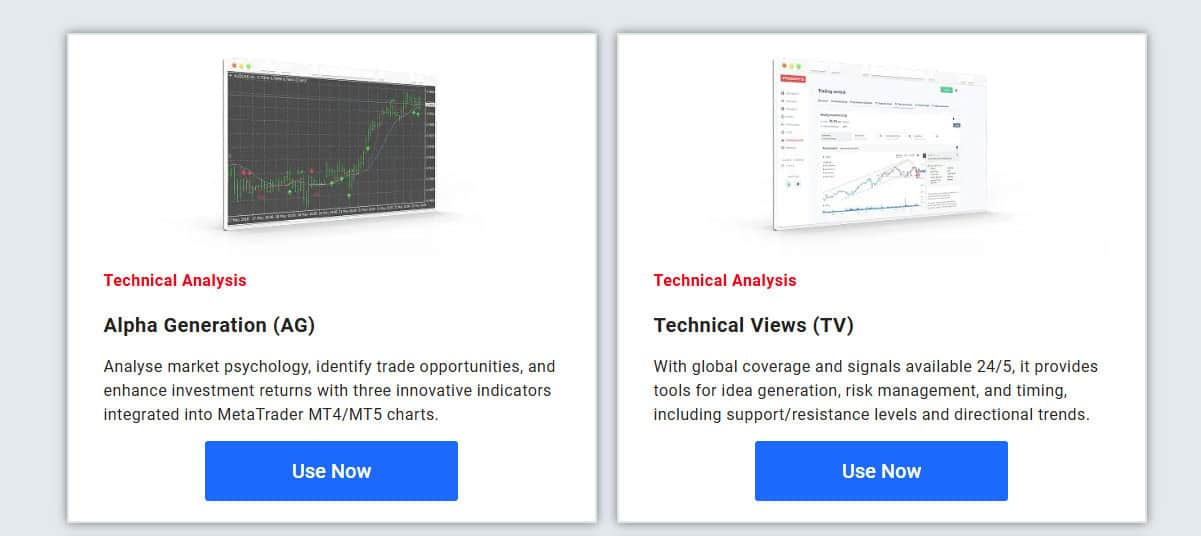

- Trading Platforms and Tools

- Trading Instruments

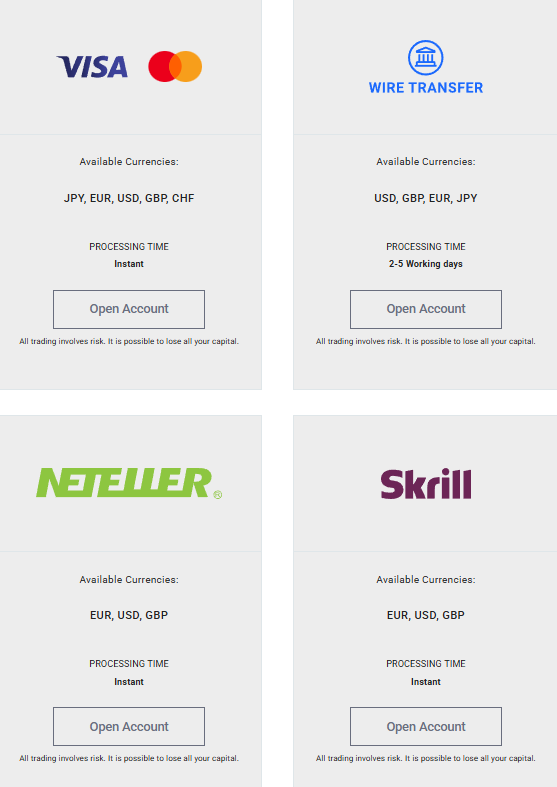

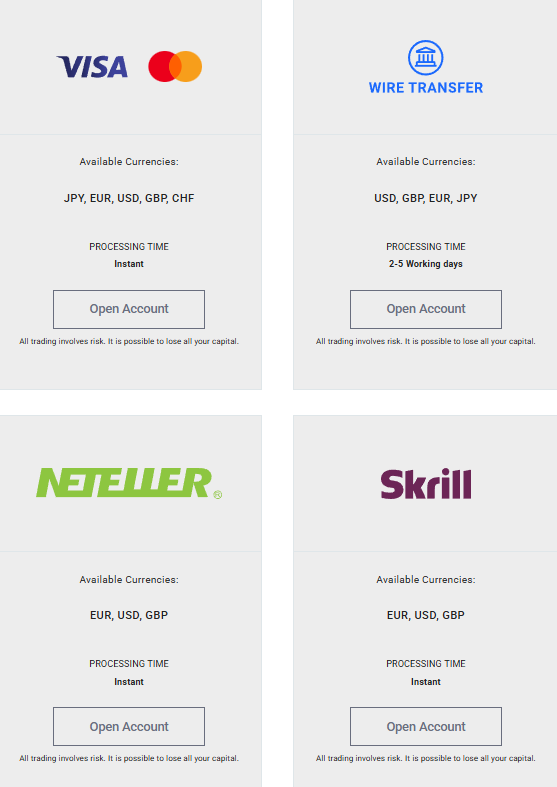

- Deposit and Withdrawal Options

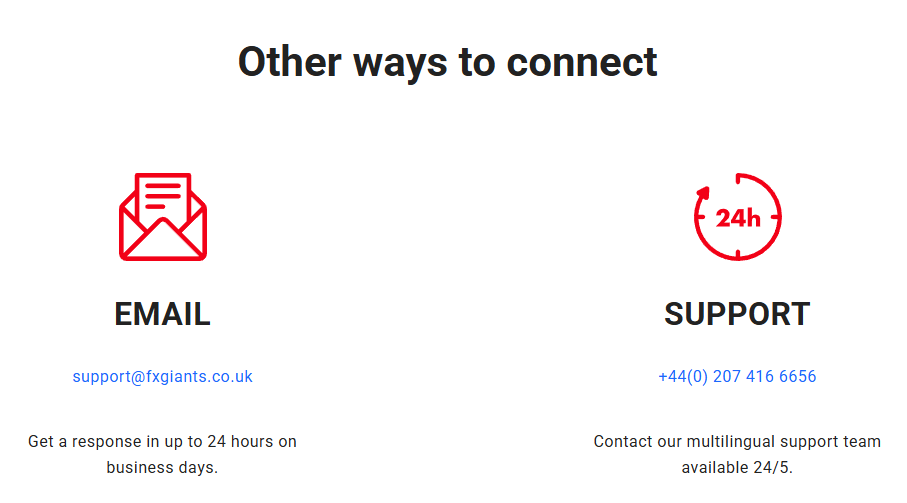

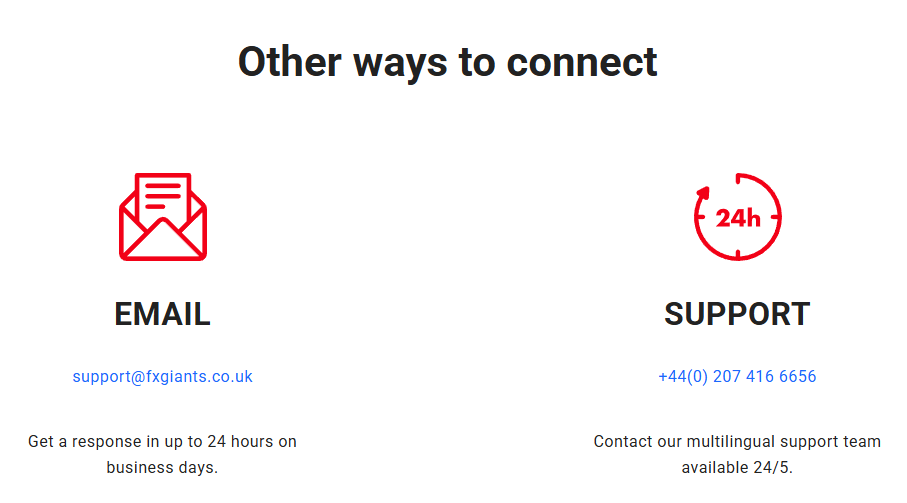

- Customer Support and Responsiveness

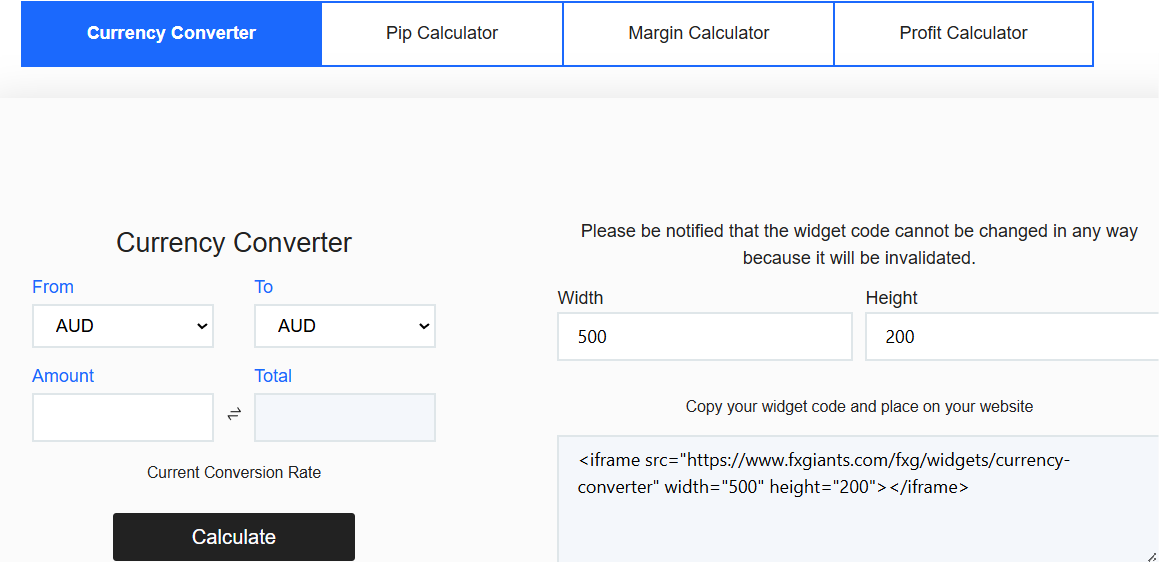

- Research and Education

- Portfolio and Investment Opportunities

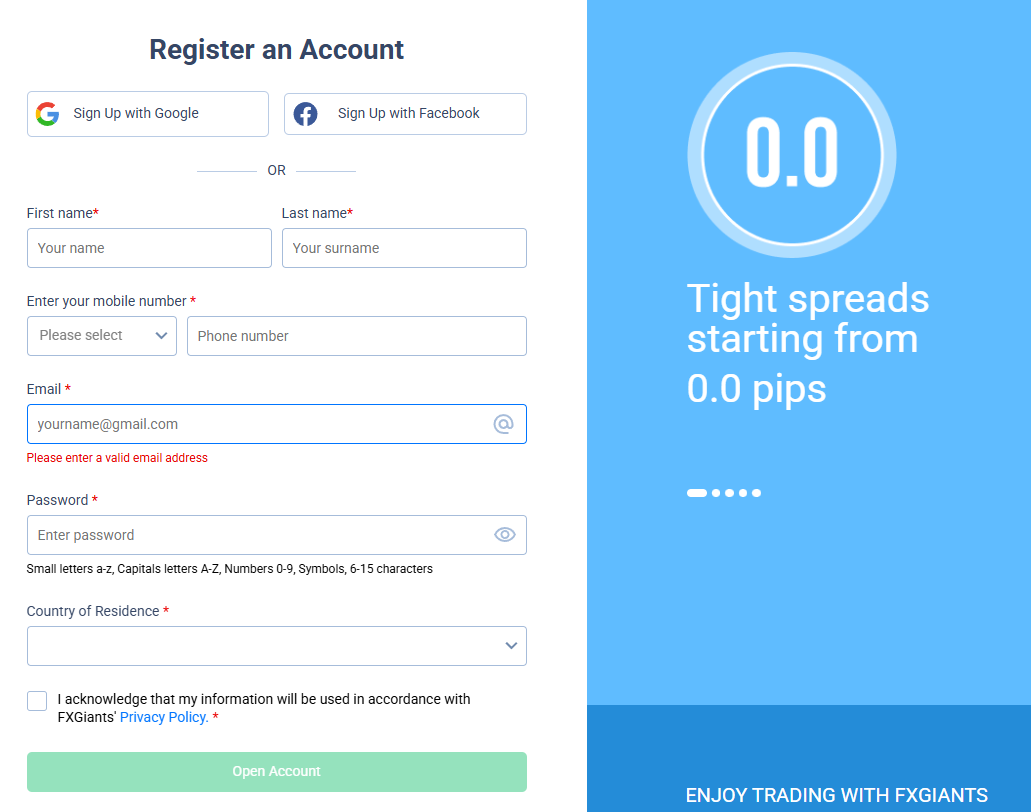

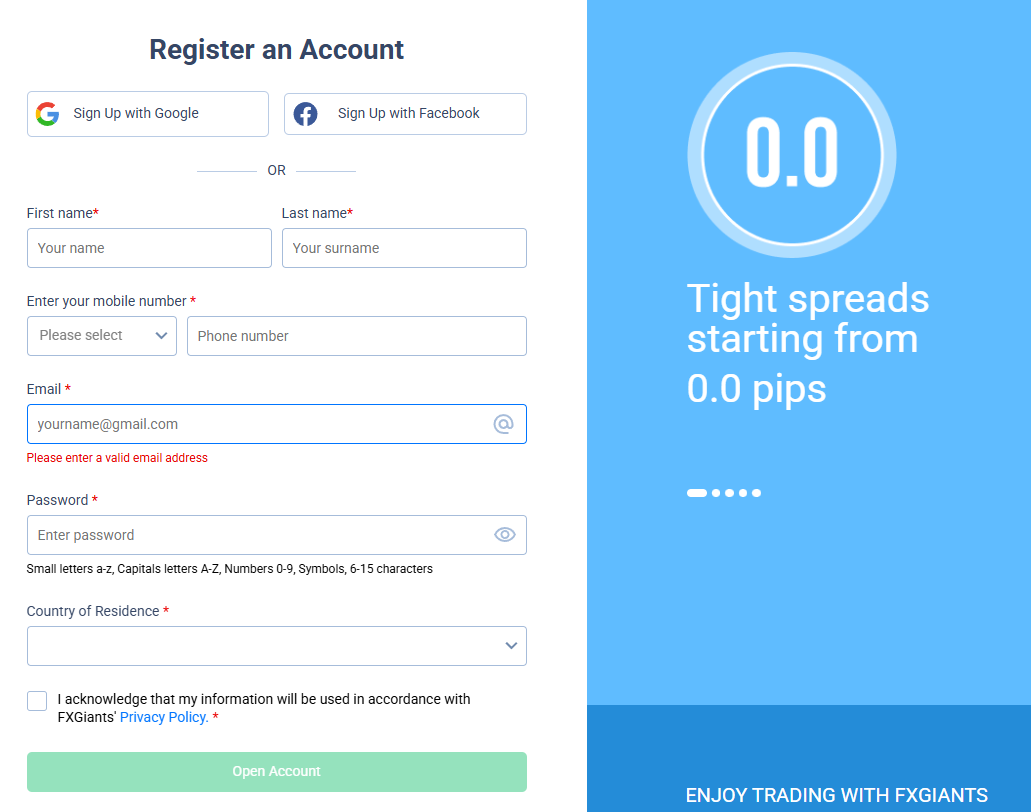

- Account Opening

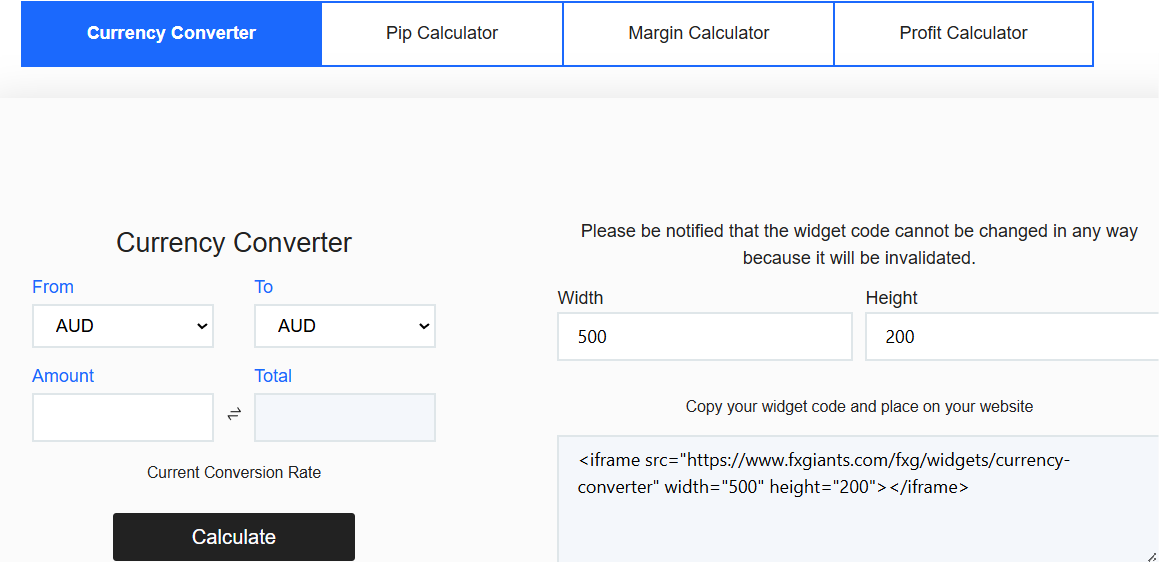

- Additional Tools And Features

- FXGiants Compared to Other Brokers

- Full Review of Broker FXGiants

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is FXGiants?

FXGiants is a Forex and CFD broker that provides access to over 300 products across Forex, metals, indices, commodities, futures, and shares. The broker offers secure trading under its FCA license, ensuring safe and reliable services. The broker attracts clients from more than 150 countries globally.

The broker serves its clients through the MT4 platform, ensuring access to innovative features and tools. The customer support is available 24/5 in multiple languages.

The broker now operates under Natesco Group and holds licenses from the top-tier FCA and serves its international clients through the entity registered in Anguilla. FXGiants is a part of the same group as IronFX, a broker holding multiple serious licenses at present. However, in the past, both brokers faced serious regulatory issues and received negative feedback from clients. For many years, both brokers were placed on our unregulated brokers list, and traders were warned against them.

FXGiants Pros and Cons

FXGiants is a respected firm that operates under the strict oversight of the FCA and has many benefits. We have also noticed a few aspects for improvement. The broker provides access to the advanced MT4 platform, with advanced research and charting capabilities. The number of available instruments is over 300 across six financial assets, ensuring a mid-level diversity. The fee structure is based on the chosen account, with fixed and floating spreads.

Another advantage is the selection of account types tailored to please different traders. The availability of a demo account ensures a reliable and risk-free environment to practice before starting live trading.

Among the disadvantages is the absence of 24/7 customer support. Besides, all the products are based on CFDs, limiting traders from making long-term investments. Another con is the absence of the more advanced MT5 platform that many traders prefer.

| Advantages | Disadvantages |

|---|

| FCA regulation | Previous regulatory concerns and complaints from clients |

| Global reach | No 24/7 support |

| MT4 platform | Lack of long-term investment |

| Various account types | Lack of advanced platforms, like MT5 or cTrader |

| Competitive and transparent fees | |

| Favorable for beginner traders | |

| Professional trading | |

| A good variety of financial products | |

FXGiants Features

FXGiants is a licensed broker with a global presence, ensuring access to favorable conditions. The broker offers competitive fees, low spreads, and an innovative platform. The broker meets different trading needs, from beginners to professionals. Below, we have compiled a list of the main aspects of trading with FXGiants.

FXGiants Features in 10 Points

| 🗺️ Regulation | FCA, Anguilla registration |

| 🗺️ Account Types | Live Floating Spread, Live Fixed Spread, Live Zero Fixed Spread, STP/ECN No Commissions, STP/ECN Zero Spread, STP/ECN Absolute Zero |

| 🖥 Trading Platforms | MT4 |

| 📉 Trading Instruments | Forex, metals, indices, commodities, futures, and shares |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Different currencies available |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is FXGiants For?

FXGiants stands out for its attractive conditions and fair practices, drawing clients of different experience levels. Based on our financial expert’s opinion, the broker is a good fit for the following:

- Beginner traders

- Professionals

- Institutional clients

- International traders

- Currency and CFD trading

- Traders who prefer the MT4 platform

- Competitive spreads and fees

- Web traders

- VPS hosting

FXGiants Summary

FXGiants is a reliable broker with a range of trading instruments and various account types to meet the needs of traders of all levels. A demo account is also available. The broker provides competitive pricing structures with fixed and floating spreads, fast order execution, and various funding methods, making it a convenient and efficient choice for traders from over 150 countries.

Customer support is also good, provided through various channels and in multiple languages. Traders also have access to alternative VPS hosting and the FXGiants PMAM platform.

55Brokers Professional Insights

We have considered FXGiants’ offering to find that it has competitive trading conditions suitable for traders at all levels. With its advanced features, the broker can attract traders looking for various strategies and opportunities. The range of account types ensures excellent diversification, as each account type comes with its specific conditions and possibilities.

FXGiants provides the popular MT4 platform via web, desktop, and mobile versions. The availability of VPS hosting and a PMAM platform ensures more opportunities and a unique experience for traders.

Besides, FXGiants is available worldwide in over 150 countries. Along with the positive aspects, the broker also has serious points to consider. Previously, FXGiants was blacklisted by serious authorities and received numerous negative reviews from its clients. Besides, it changed names several times, which also taints the broker’s reputation regarding consistency and transparency. However, for now, the broker holds a license from the top-tier FCA and is considered safe to trade.

Consider Trading with FXGiants If:

| FXGiants is an excellent Broker for: | - Clients looking for tight regulation

- Traders looking for diverse account types

- MT4 platform enthusiasts

- Trader looking for VPS hosting

- Clients looking for an access to a wide range of assets

- Traders looking for fixed and floating spreads |

Avoid Trading with FXGiants If:

| FXGiants is not the best for: | - Clients looking for more advanced platforms

- Real stock traders

- Clients looking for extensive education and research

- Traders prioritizing 24/7 customer support

- |

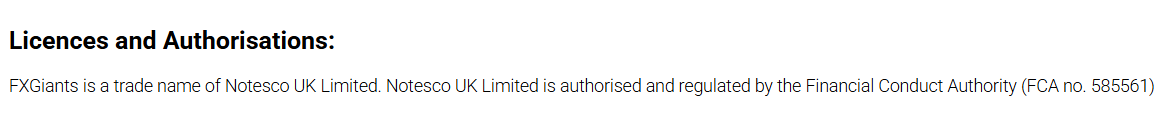

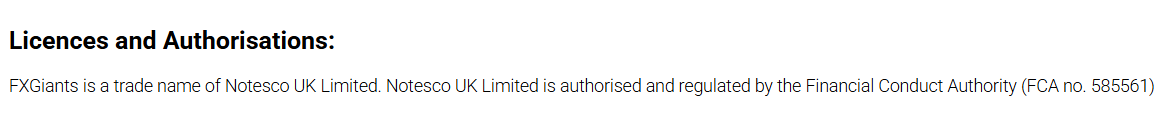

Regulation and Security Measures

Score – 4.4/5

FXGiants Regulatory Overview

FXGiants is a trade name of Notesco UK Limited, authorized and regulated by the Financial Conduct Authority. The Notesco group includes several trade names, including IronFX, another well-regulated broker.

FXGiants also operates under an offshore entity incorporated in Anguilla with registration number A000001800. Yet, this is an offshore zone with limited regulatory oversight. Even though we found that the international entity offers better trading features and tools and allows the use of higher leverage ratios, traders’ funds are not protected by serious laws and safety measures.

How Safe is Trading with FXGiants?

Under the FCA regulation, FXGiants’ clients are protected through multiple safety measures. Our research indicates that FXGiants’ clients are protected by the Investor Compensation Fund with a coverage of up to €20,000 in the event of insolvency.

- In addition, traders’ funds are kept in segregated accounts, apart from the company’s money.

- At last, the FCA regulation ensures Negative balance protection.

Consistency and Clarity

To estimate FXGiants’ consistency over the years, we conducted deep research. We have found that the broker operated under an offshore entity for a long time and faced serious regulatory issues. The broker was fined for its noncompliance with regulatory rules and received negative reviews, indicating insufficient withdrawals, a lack of compliance with stringent laws, and the delivery of unsupervised services. Still, years ago, we noticed these issues and listed the broker as unregulated.

Currently, FXGiants operates under stringent rules and oversight; however, it is essential to consider the broker’s previous issues and its journey. Also, we noticed differences between the entities in conditions and safety measures, as the international entity does not ensure the same level of protection.

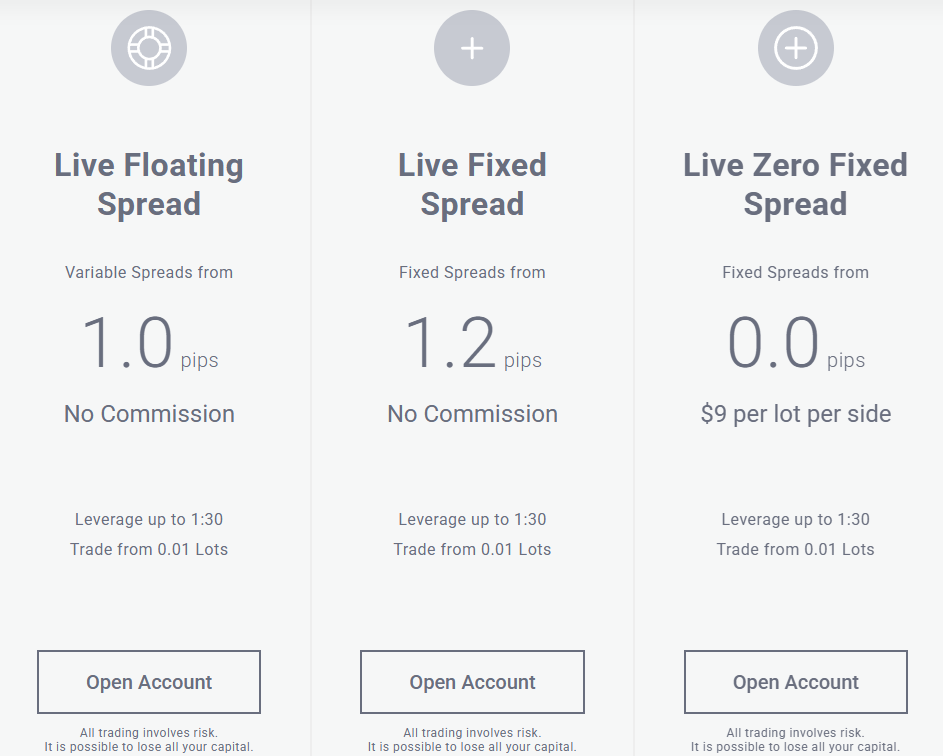

Account Types and Benefits

Score – 4.5/5

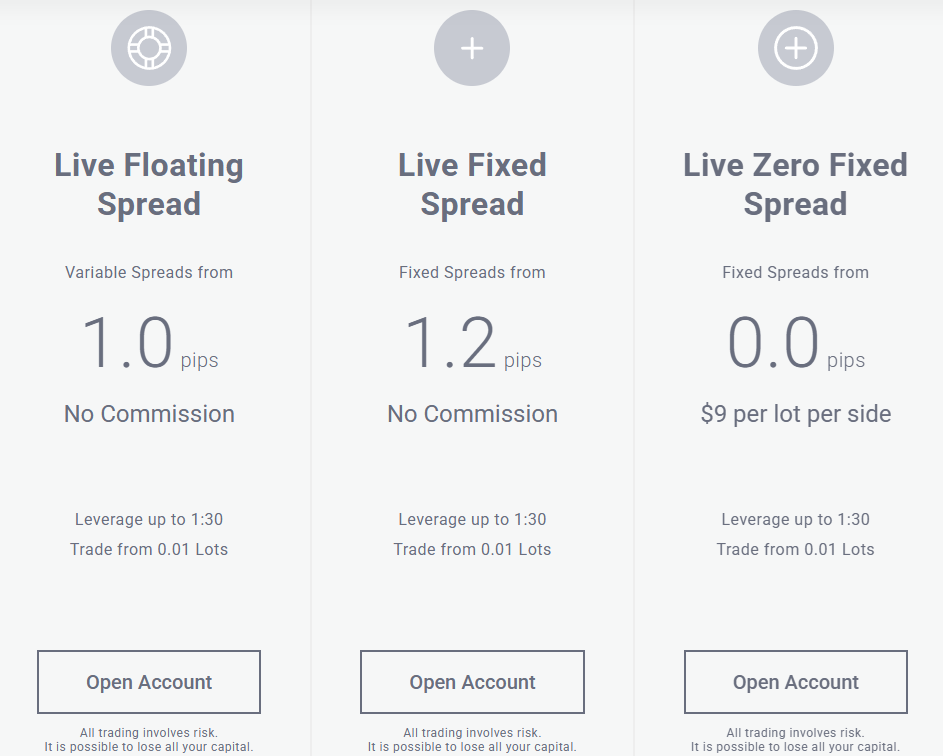

Which Account Types Are Available with FXGiants?

FXGiants accounts meet various trading needs and expectations. The account types and conditions are based on the jurisdiction; thus, it is essential to check carefully before opening an account under a certain entity. Here we have reviewed the account types available under both entities and found that they fall under two categories. Under the Live category, traders have access to Live Floating Spread, Live Fixed Spread, and Live Zero Fixed Spread accounts.

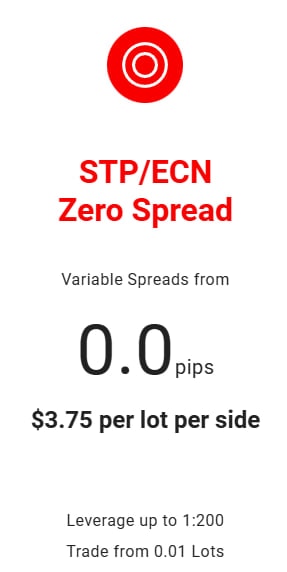

The STP/ECN accounts are No Commission, Zero Spread, and Absolute Zero accounts. Each account offers a different fee structure and conditions.

Each account supports the MT4 platform and enables access to a good number of instruments. The leverage under the international entity can reach up to 1:1000, based on the instrument traded. To sum up, each account meets certain needs and expectations with tight spreads and reasonable commissions for the commission-based accounts.

Regions Where FXGiants is Restricted

FXGiants provides its services worldwide and accepts clients from over 150 countries. Generally, the broker’s accessibility and international exposure are good. Still, due to regulatory restrictions, the broker does not provide its services to the residents of the following countries:

- The USA

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Cost Structure and Fees

Score – 4.5/5

FXGiants Brokerage Fees

The broker’s fees depend on the account type traders choose and the entity. We find FXGiants’ trading costs competitive and transparent. The spreads applied align with the market average. Commissions may be slightly higher than the market norm. The broker offers spread- and commission-based structures, with fixed or floating spreads based on the account type.

As we have found, FXGiants has two distinct fee structures: spread- and commission-based. Live Floating Spread, Live Fixed Spread, STP/ECN No commission, and STP/ECN Absolute Zero accounts are spread-based, with no commissions applied. The typical average spread for the popular EUR/USD pair is 1.2 pips. For the STP/ECN Absolute Zero account, spreads are very low and start at 0.3 pips.

Commissions are applied based on the account type. FXGiants offers two commission-based accounts, Live Zero Fixed Spread and STP/ECN Zero Spread. The fixed commission for the Live Zero Fixed Spread account is $9 per lot per side. The STP/ECN Zero Spread applies lower commissions of $3.75 per lot per side, combined with spreads starting from 0 pips. The commission-based accounts will likely be suitable for more professional clients looking for fixed fees and more enhanced conditions.

How Competitive Are FXGiants Fees?

FXGiants publicly discloses all the spreads and commissions, making the offering transparent and clear. Information on spreads for each instrument is detailed on the broker’s website. This enables traders to calculate costs and predict the applicable charges per trade.

As we found, the broker’s spreads are in line with the market average; however, FXGiants’ commission for the Live Zero Fixed Spread account is considerably high. In contrast, the STP/ECN Zero Spread applies lower commissions of $3.75 per lot per side and aligns with the market standards.

| Asset/ Pair | FXGiants Spread | ATFX Spread | IQ Option Spread |

|---|

| EUR USD Spread | 1.2 pips | 1.8 pips | 0.8 pips |

| Crude Oil WTI Spread | 5.26 | 3 pips | 0.38% |

| Gold Spread | 29 | 3.8 pips | 0.01% |

FXGiants Additional Fees

We found that FXGiants does not charge many additional fees. There are no deposit fees for any of its funding methods. Yet, depending on the deposit method, there might be a third-party transaction fee.

- Another advantage we noticed is that FXGiants does not charge an inactivity fee to cover the account maintenance charges.

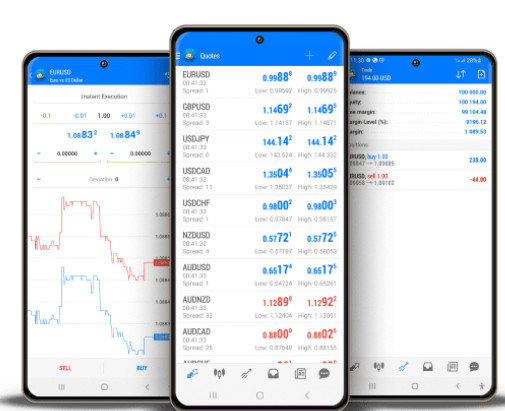

Score – 4.4/5

FXGiants offers an advanced and well-equipped MT4 platform available for access via web, desktop, and a mobile app. The platform includes a range of innovative tools and features that ensure successful trading outcomes.

| Platforms | FXGiants Platforms | ATFX Platforms | IQ Option Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

FXGiants Web Platform

The MT4 platform ensures access to the accounts through multiple options. Clients who prefer web trading can access the market through any browser; the only requirement is Internet availability.

The broker ensures that web traders have the same opportunities as desktop users, with access to the platform’s full capacity and functionality.

The platform enables one-click trading, real-time trading alerts and notifications, and customizable and adaptable tools.

FXGiants Desktop MetaTrader 4 Platform

FXGiants supports trading on one of the industry’s most powerful platforms, MT4. The platform combines simplicity and ease of use with professional and comprehensive tools. The platform includes robust charting, great analytical tools, and various technical indicators. The platform is accessible through any device. The platform also supports Expert Advisors, allowing clients to automate their trades based on predefined rules.

We also found that the MT4 platform supports a wide range of instruments across various financial assets, ensuring a safe and profitable outcome of trades. With in-depth market analysis features, the platform is ideal for those clients who prioritize strong analysis.

FXGT Desktop MetaTrader 5 Platform

One of the market’s most efficient platforms, MT5, is not supported by FXGiants. The broker offers only the older MT4 version, which is also known for its top-notch capabilities. However, it is common knowledge that the MT5 platform allows traders more opportunities. So, traders who strictly prioritize the MT5 platform availability will not find what they are looking for with FXGiants.

FXGiants MobileTrader App

The broker enables its clients’ mobile trading through the MT4 mobile application. The app is an excellent substitute for the desktop platform, including an extensive range of analytical and research tools, such as multiple order types, interactive charts, more than 30 technical indicators, 24 analytical items, and 3 types of charts, most commonly used bars, including bars, Japanese candlesticks, and broken line.

Main Insights from Testing

Our testing of the FXGiants platforms revealed powerful and flexible solutions suitable for various clients and trading needs. The availability of the MT4 platform in web, desktop, and mobile versions ensures more flexibility and choice to conduct trades. However, FXGiants does not provide an extensive platform choice. It does not include such advanced options as MT5 or cTrader.

AI Trading

Although FXGiants supports Expert Advisors for trading automation, it does not provide a full package of AI solutions. We did not find any built-in AI-powered features with the broker.

Trading Instruments

Score – 4.4/5

What Can You Trade on the FXGiants Platform?

Based on our analysis of the broker’s instruments, FXGiants includes Forex, CFDs, shares, metals, oils, futures, and indices in its proposal. The broker offers more than 300 tradable products across different financial assets, ensuring that clients have the chance to expand their portfolios. Below is the detailed breakdown of the available tradable products:

- Over 70 major, minor, and exotic currency pairs

- Over 300 global shares are available for trading, such as Amazon, Meta Platforms, Microsoft Corporation, and Walmart Inc., among others.

- Indices such as the S&P 500, the UK 100, and Wall Street

- Commodities and metals

- Futures

Main Insights from Exploring FXGiants Tradable Assets

After carefully considering FXGiants’ instrument offering, we found over 300 tradable products across various assets. FXGiants grants its clients a measured opportunity to explore the market and expand their portfolios. The offering is attractive for traders interested in popular products, such as currency pairs, commodities, and global CFD shares. However, clients seeking wider exposure to the market and traditional investments will find the proposal restricting. This means that long-term investors will not be able to invest with FXGiants, as it offers mainly CFD-based products.

An essential note for global traders is that FXGiants operates under two entities, and the conditions, including instrument availability, costs, and overall conditions, are different from entity to entity. Besides, the international entity does not provide the same level of safety.

Leverage Options at FXGiants

Leverage is a helpful tool that increases profits in trading, but it can also lead to substantial losses if not used carefully. Thus, understanding its usage is crucial.

FxGiants’ leverage is offered according to the FCA regulation:

- UK traders can use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is much higher and can reach up to 1:1000.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at FXGiants

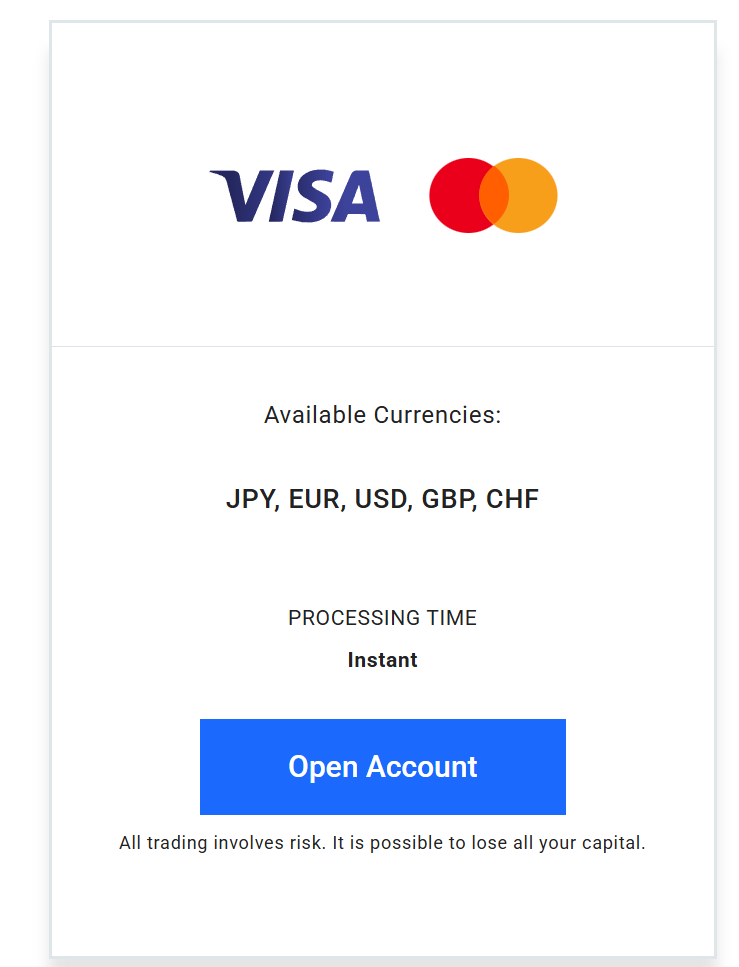

We researched the broker’s deposit options to see how FXGiants’ clients can deposit funds into their trading accounts. The offering includes Wire transfers, Credit/Debit cards, UnionPay, Neteller, Skrill, and Bitwallet. However, it is important to note that some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions. There may also be restrictions based on the entity.

- We also found that FXGiants does not impose deposit fees for any of the funding methods. All the additional transaction fees that might occur are due to the third-party providers.

Minimum Deposit

The minimum amount for deposits depends on the account type. For the FXGiants Live Fixed Spread Account, the minimum deposit requirement to open an account is $100. Other account types have higher deposit requirements.

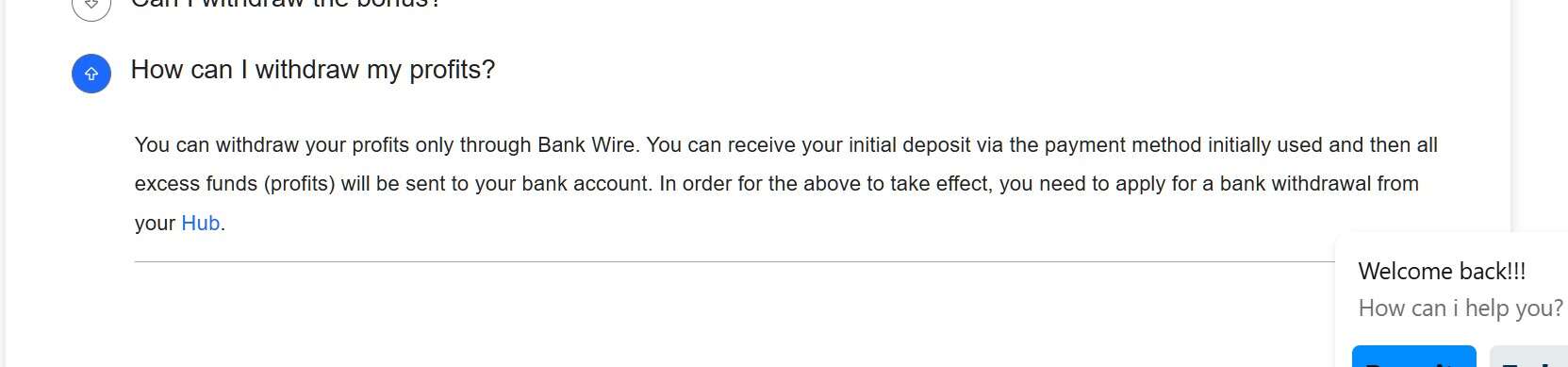

Withdrawal Options at FXGiants

FXGiants offers the same funding methods used for deposits to withdraw money. As we found, there are no withdrawal fees, and most methods ensure instant withdrawals. For the wire transfers, it might take from 2 to 5 working days for the funds to reach the account.

Customer Support and Responsiveness

Score – 4.6/5

Testing FXGiants Customer Support

We also tested FXGiants’ customer support to see how helpful the broker’s team is. The broker offers 24/5 multilingual customer support through Live Chat, Phone lines, Email, and an online request form. The broker also offers an FAQ section with answers to the most common trading-related questions.

- All in all, the broker’s team provides solid and dedicated assistance.

Contacts FXGiants

We conclude that FXGiants assists 24/5, providing its clients with quick responses through multiple channels. Clients are free to choose from several options depending on the urgency of their issue.

- We were provided with the quickest responses via the Live chat. The answers were instant and accurate.

- Traders looking for direct contact with the support agent are provided with a phone number: +44(0) 207 416 6656.

- Traders can send an email to support@fxgiants.co.uk and receive detailed solutions. The answers are provided within a day.

- At last, the FXGiants is active on social media, providing updated information on the market and its operations. FXGiants is active on Facebook, Instagram, X, LinkedIn, and YouTube.

Research and Education

Score – 4/5

Research Tools FXGiants

Based on our research and testing, FXGiants provides extensive research tools through its platform, equipping its clients with essential tools for in-depth research and insights. In addition to its already innovative platform, traders can also find helpful tools on the broker’s website:

- The widgets offered by FXGiants are effective tools for everyday trading. Among FXGiants’ widgets are a currency converter, as well as pip, margin, and profit calculators.

Education

We researched the broker to see how it accommodates its clients with educational resources. However, FXGiants does not provide any learning materials on its website. The only source provided is the Blog to keep clients informed about the market’s recent news. Traders can also get insights regarding Forex and other markets.

Is FXGiants a Good Broker for Beginners?

A careful analysis of the FXGiants proposal has revealed that the broker is a favorable choice for different clients, offering a secure trading experience with suitable conditions. The broker can become a good first choice for beginner traders for numerous reasons. One of the advantages is the demo account for novice traders. Besides, the easy-to-use platform, great features, and simple analysis ensure a positive trading experience. However, FxGiants does not include an impressive educational section to guide and lead beginners in their trading journey, which is a disadvantage for many novice traders.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options FXGiants

With over 300 instruments across multiple financial assets, clients have a moderate opportunity for trade diversification. The broker’s proposal concentrates on Forex pairs and CFDs. Whereas many traders prefer short-term trades, longer-term investors will find the offering limiting. Traditional investors and long-term traders cannot engage in stock investment or own the underlying assets.

That said, FXGiants offers an alternative to diversify trading opportunities.

- FXGiants’ PMAM accounts provide easy and simple investment opportunities for traders to expand their market exposure and benefit from trades without active participation and engagement in the processes.

Account Opening

Score – 4.6/5

How to Open an FXGiants Demo Account?

A demo account ensures that inexperienced traders practice their skills before switching to live trading. A demo account has the same feel and environment as a live account, enabling clients to have a full experience of live trading in a risk-free setting. Only the funds provided are virtual. To open a demo account with FXGiants, traders should follow the simple steps below:

- Visit the broker’s demo account page.

- Fill out the registration form, providing the name, phone, email, country of residence, and creating a password.

- Select the account specifications.

- Submit the form and receive the account credentials via email.

- Download the MT4 platform and access the platform by using the account credentials.

- Receive the virtual funds and start practicing.

How to Open an FXGiants Live Account?

Opening a live account with FXGiants is a simple process. Traders should click on the ‘Open Account‘ button and proceed with registration:

- Select and click on the “Open Account” page.

- Enter the required information, including name, email, phone number, country of residence, etc.

- Verify personal data by uploading residential proof or ID (verification will be completed within 24 hours).

- Once the account is activated and verified, traders can proceed with funding the account.

- Start trading.

Score – 4/5

FXGiants offers extensive trading tools and features, a blog on its website, and widgets. Yet, the additional tools and features are not diverse.

Traders can benefit from the broker’s bonuses if they are qualified.

- The Booster Bonus enables clients to deposit $10,000 and get a bonus of $4,000.

- The Bonus maximizer grants traders a unique opportunity to deposit $10,000 and get $10,000 on the deposited money.

- The Bonus Advantage allows clients to receive a 60% bonus on deposits of up to $1,000.

FXGiants Compared to Other Brokers

After researching FXGiants’ services, we compare the broker to other well-regarded firms in the market. Starting from regulation, FXGiants is tightly regulated by the respected FCA, with an additional registration in Anguilla. However, we see that EC Markets holds licenses from the FCA, ASIC, FSCA, FSA, FSC, and FMA, ensuring an extra level of safety.

The broker’s fee structure depends on the account type chosen and the entity. Overall, the trading costs align with the market standards and ensure transparency and clarity. The average spreads applied by FXGiants are 1.2 pips; the same is true for Axi’s spreads. However, FXGiants’ commissions are slightly higher.

As we found with FXGiants, trades are conducted on the MT4 platform, a common offering for most of the brokers we reviewed, including Pu Prime, FXCM, and EC Markets. Regarding the available instruments, FXGiants includes 300+ tradable products, which is considered a good range. However, Pu Prime’s instrument number exceeds 1,000, making the broker a better choice for diversification.

FXGiants does not include comprehensive educational materials, such as webinars, seminars, or well-planned courses. On the other hand, Pu Prime and FXPro’s educational sections are excellent, providing extensive materials for traders of different levels of experience.

| Parameter |

FXGiants |

Pu Prime |

Forex.com |

EC Markets |

Axi |

FXCM |

FxPro |

| Spread-Based Account |

Average 1.2 pips |

Average 1.3 pips |

Average 1.3 pips |

From 1.1 pip |

Average 1.2 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips +$3.75 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $2.5 |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4 |

MT4, MT5, WebTrader, Pu Prime App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

300+ instruments |

1000+ instruments |

6000+ instruments |

150+ instruments |

220+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

FCA, Anguilla registration |

ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, FSCA, FSA, FSC, FMA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Limited |

Excellent |

Excellent |

Good |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$100 |

$20 |

$100 |

$10 |

$0 |

$50 |

$100 |

Full Review of Broker FXGiants

We have considered FXGiants’ various aspects of trading and concluded that the broker is a well-regarded and safe option for trading with a license from the FCA regulatory authority. However, according to the information we collected during our research, FXGiants did not comply with regulatory standards in the past and received multiple negative feedback from clients. Yet, the Notesco group, under which FXGiants and several other brand names operate, has settled the brokerage operations at a decent level by acquiring serious licenses and following stringent rules.

Today, the broker is available in more than 150 countries, providing high-quality and safe services to clients worldwide. The broker offers the popular MT4 platform and access to the PMAM feature, allowing alternative opportunities. The costs are average and depend on the account types and the instruments traded. The broker offers two commission-based accounts with low spreads and fixed transaction fees. The STP/ECN Zero Spread account applies lower commissions of $3.75 per lot per side.

All in all, FXGiants is a good broker for different trading needs and expectations. Yet, beginner traders looking for extensive educational resources will not be satisfied, as the section is limited. The multilingual customer support is available 24/7 via various convenient channels.

Share this article [addtoany url="https://55brokers.com/fxgiants-review/" title="FXGiants"]

made my depositing through btc, swift and affordable

no commission on live floating spread+

Fxgiants doesn’t charge high swap fees on major currencies. Thanks to this, I didn’t worry about trading-costs. Recently I opened long positions on GBP/USD and EUR/USD one week before the CPI data because I was sure there would be a steady growth. As a result, CPI was around 2,7%, while expected data was 3,1% which is very good news, and my positions pumped strongly. It was easy peasy, just clear trading skills, not luck, hope I’ll keep doing profits here.

The support assisted me promptly when I got some minor troubles with withdrawal process. ThANKS!

bitwallet,skrill,neteller have worked fine for me so far, the broker didn’t let me down in withdrawals processing

$18/Lot on live zero spread account is fair, acceptable for regular fx trading

Only two days with tradingcentral, it’s like a 15 minute test drive on a bmw haha.

but on a serious note, no matter what account you nmight have, if you can afford it – then just go for it beacuse $500 aint that much. I know it’s not cheap either, but you are not paying for trading central ,you are making an investment to your own trading and getting technical help on it, so it’s still a win for you.

I think it’s a broker with a lot to show and much potential if you giive it a chance, and you can start by FAQ too they have much covered there.

I’m thinking more about compatibility with my strategy. And they had what I trade: nasdaq futures.

Have automated one simple strategy for trading the US30 on 1 hour timeframe and it showed promising results. Like that this platform is open for using algos and have no limits on stategies

People chase low spreads like bargain hunters. Bun in trading, the order execution plays a more important role because wtihout that you can incur huge losses and that’s what happened to me befoer. Fortunately, FxGiants is providing high order execution and it’s noticeable how they’re able to support high liquidity on most assets, even on minor and exotic pairs.

Well done, they didn’t freak me out when I used a bank card for transfers, it was fast and no frills

Withdrawal came through, was waiting for this to happen before I put out a review, and I can say I am satisfied for the most part. Analytics are for improvement tho.

Total freedom of choice with the accounts, this is decent indeed. I am saying that because a scalper can find his comfort here with absolute zero, and yes it has pricey commission of $9 for a lot, but that is pretty justified with volume you open on short term. I am with live floating spread, also a good account and I think spreads here are great.

Only 2 live accounts get bonuses for joining. The rest of all the accounts, dont, so be aware. I wasnt sure about it but talkked to the sup department, and they confirmed which one I should go with. That said, when I di a withdrawal, it still disappeared. All the bonuses I got from them. So any withdrw is a no-no when you’re still tradjng with the bonuses from it. kinda sad.

Oh my fav combination here of MT4 and trading central’s technical analysis. Give an edge to skip some part of my analysis and get sniper entries. Saved time and produced more pips.

I’m not sure it’s okayish to look at the account types and overthink for hours to choose which one is the best. After all, I chose live zero fixed spreads with some commissions.

Although the MT4 is outdated in terms of interface, it’s still multifunctional for trading.

You guys showed only live accounts on photo, but the STP ECN accounts are a real deal here! Absolute zero acc is the cherry on top, as i’m paying literally only spreads of 0.4pips with no commissions.

The support has been good always, they never respond aggressively or with templates. They try to do their best to solve a problem as soon as possible. I appreciate it!

mt4 paired with live floating spread account=my recipe here for trading 🙂

Too many accounts, perhaps, but can’t go wrong with floating spreads, I don’t like anything fixed, seems unnatural in a volatile market. Trading here is a pleasure actually, support is here to help

Easy to trade there. And of course payments. No worries, received withdrawal in a promised time.

All is good, but if they could provide market analytics and stuff, it would be great

Idk if i did the right choice, but live floating acc looks gorgeous with 0 com fees and 1pips spread

My first Deposit went through in under 30 minutes. Withdrawal usually lands in time as long as due process is followed, not instant but not too bad either. I trade mainly EUR/USD and Gold and haven’t run into any weird pricing. Platform feels stable enough. Nothing flashy, just does what it’s supposed to. Support replies, not super fast but they get back eventually. Not a perfect setup but good enough to stick around for now.

There is so much a broker can do to prove its legitimacy and also its reliability but with this platform the positive reviews and personal experiences are aligned.

Must share this… FXGiants is a fully reliable broker! I used a 100% deposit bonus and traded for a week… made solid profits, decided to see if they would pay me out. I withdrew all the profits made and the transfer was completed in less than 24h. Made those profits thanks to the bonus and they paid me out to the last cent !

The live floating spread account with zero commissions and tight spreads from 1,0 pips is an ideal choice for me. I’m using scalping strategies and it couldn’t be better to trade with such conditions.

I feel that my funds and personal information are safe with the fxgiants. Their security is top-notch. I completed the verification process without any issues. Also deposit and withdrawal transactions proceed with the extra security measures. Transparency in trading conditions is something I value here. They meet all my requirements!

Looking at they offer oveall – the services are decent, the accounts and the spreads they offer .Plus the payments to fit most of the needs, and crypto is there as well. A decent broker, perphaps has some flaws, but I don’t see any that are the obstacle in my trading here.

P.S> The blog is – questionable. Done only for the sake of a blog being a blog, it needs to be higher quality.

I tried out almost every account type with FXGiants and can give my opinion on them. For me i trade only several currencies during session overlaps, so they usually have high spreads. I had no problem with floating spread account, as the spreads that this broker provide are not bad but not the best. Nevertheless, i calculated and found out that zero fixed account, where i have to pay only for lot size, is more profitable for my trading strategy.

I’ve got something to tell about this broker. I used to trade with many of them, both successfully and not. For myself, I noted two qualities that a suitable trading service provider must have: being reliable and being convenient. Fxgiants somehow could fit this criteria.

Withdrawals were something very easy to perform at the platform, no thousands of clarifying questions, on-time delivery, basically no issues at any step of the process.

The platform is MT4, not the cutting edge, but my experience with it, hasn’t provided any doubts about its stability and reliability, the decent software.

Simple broker… solid offer of account types, the MT4 works as expected and the withdrawals are processed faster than I initially thought.

Def a broker I recommend

Somewhere, it was recommended to start with the MT4 platform, which is easier to learn. Despite this advice might seem weird I l deliberately looked for the broker that has it. My choice was made after I saw those bonuses that fxgiants broker offered to me. Since I haven’t gained enough to enjoy trading with my own money, I thought it a good idea to use a 40% bonus, even though I can’t withdraw it. For practice and getting used to the strict risk-management, it works pretty fine.

By the way, talKING about the MT4, the interface is really beginner-friendly, no problems for opening my trades.

These gentlemen really are PATHETIC, they ignore you, technical support doesn’t respond to you, they leave you waiting in the chat. Since last February I have been trying to verify my email and mobile phone number and it was impossible, I recorded videos of the problem, sent them to support and they never responded to me. Finally, I gave up depositing my money with them when I realized that when validating the phone number to obtain the no deposit bonus my password is sent unencrypted to their servers and thus goes throughout the entire internet. It’s true, your password is sent unencrypted! That is, anyone can intercept that information on the Internet and access my account, anyone from fxgiants can access your account! If you have money in fxgiants.com withdraw it now! I could attach a screenshot where I certify what I am stating but truspilot does not allow me to upload images. Be careful!

Don’t get fooled by this company and if you’ve fallen victim lodge a complaint to refundback.org to get a chargeback

Prices and fees are well below average and there are discounts for bulk transactions. Great customization (for graphs, workspaces). Users have access to a variety of great research tools

The main advantage of fxgiants is a wide range of intelligent trading tools, including technical, basic, sentiment analysis tools and advanced chart packages. It provides performance analysis of other traders and helps you find a trader to copy. It also provides risk management tools to help traders close their trades when their performance is poor.

FXgiants is a great trading site I’ve been there for so long and I deposit there a big sump of money and course, I have withdrawn my profit as well.

FX GIANTS hat mir 55.000,–Euro gestohlen. Ich habe 2018 bei einem Trade 55.000,– Euro gewonnen. Kurz darauf ist mir der Gewinn storniert worden. Der Ombudsman in England konnte auch nicht helfen, weil FXGIANTS auf Bermuda sind und dort keine Lizenz besitzen.

Vorsicht Betrüger

FXGiants is a proxy name of IronFX. A total scam!