- What is FXDD?

- FXDD Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

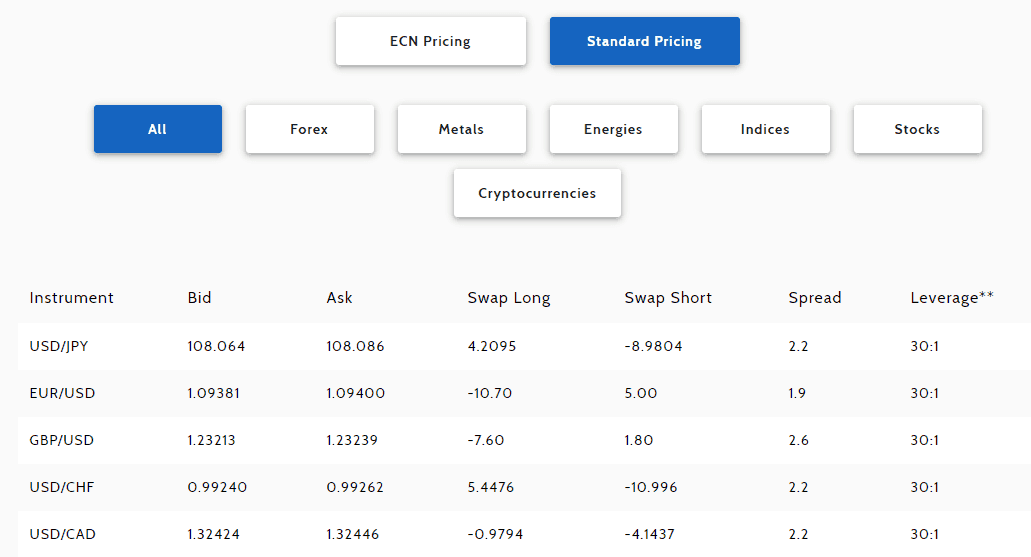

- Cost Structure and Fees

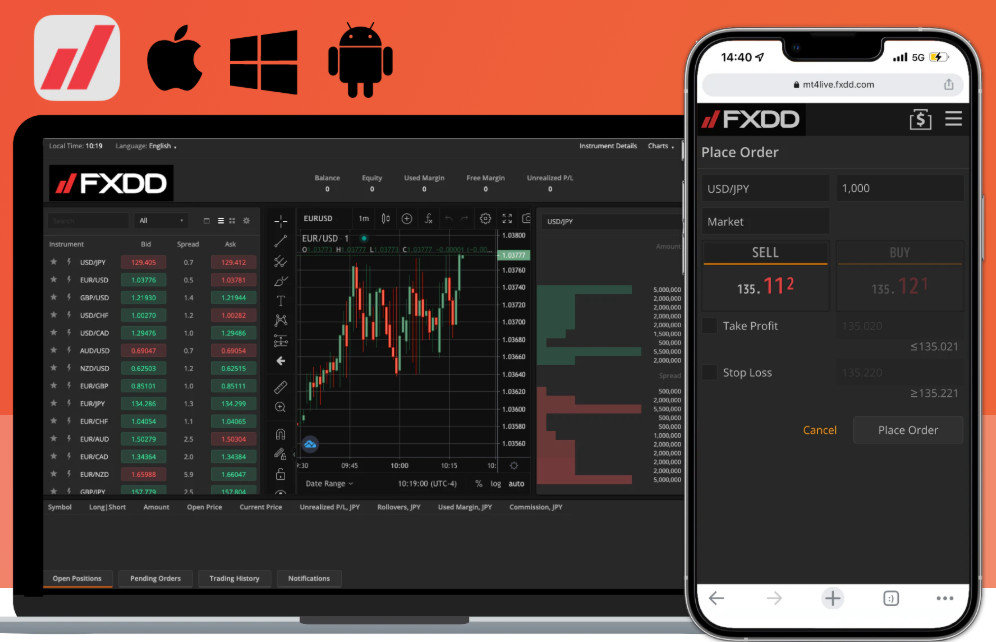

- Trading Platforms and Tools

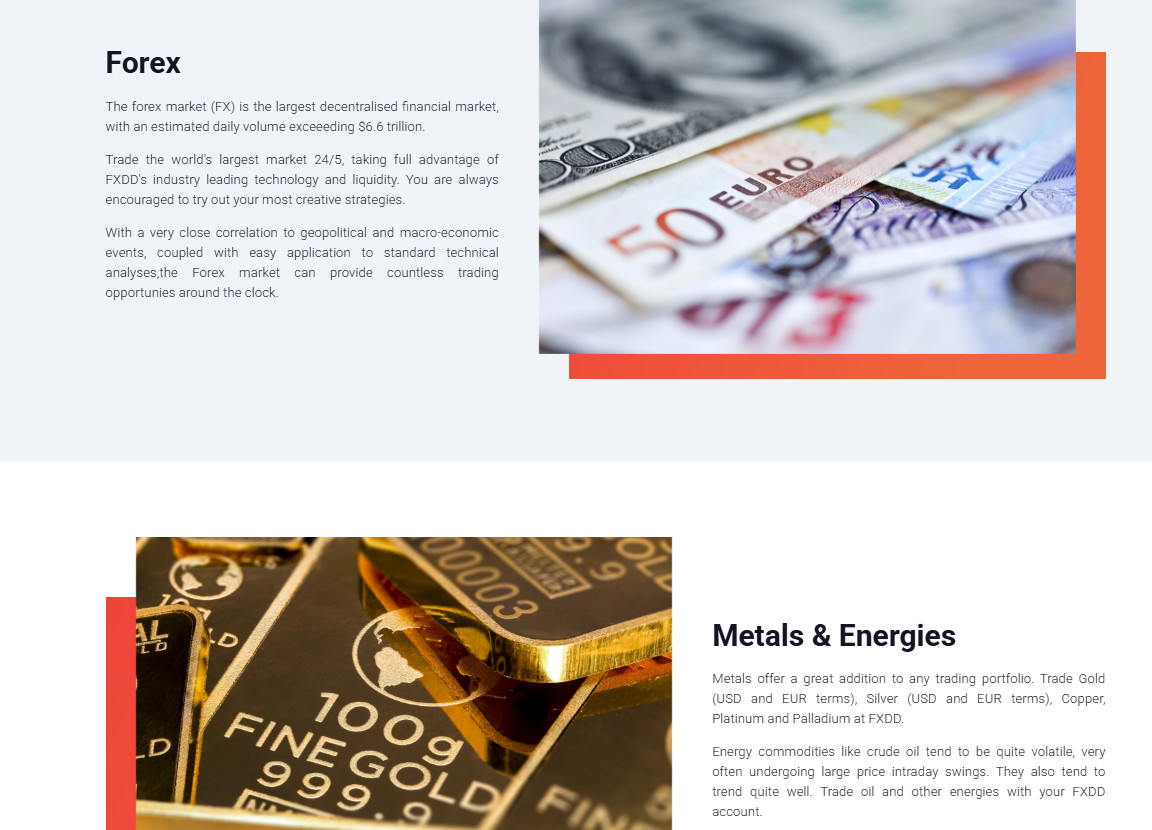

- Trading Instruments

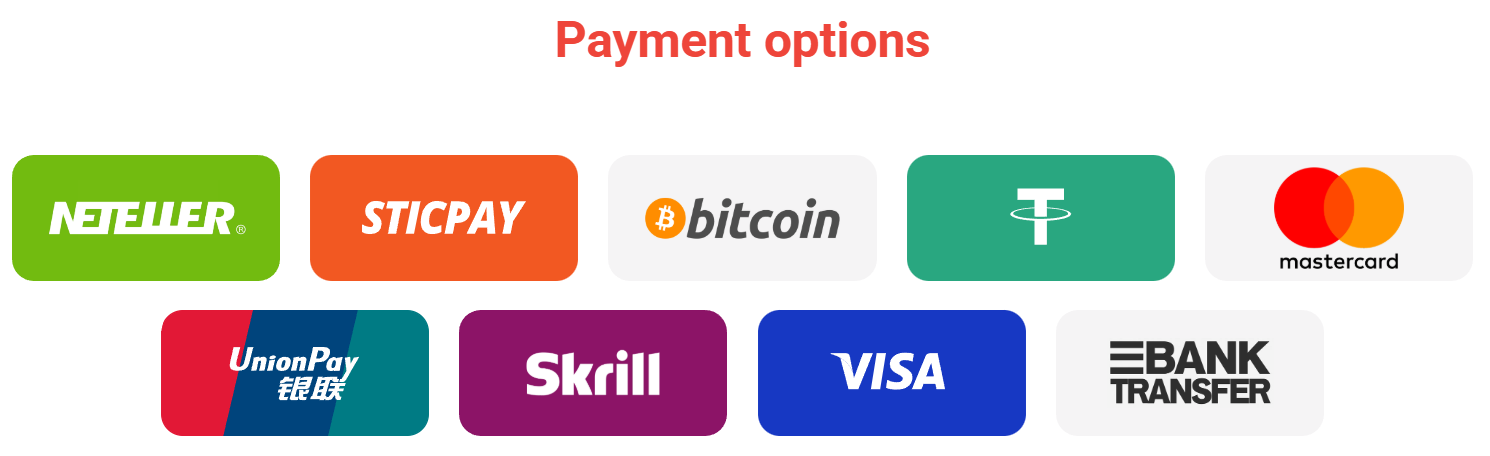

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXDD Compared to Other Brokers

- Full Review of Broker FXDD

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is FXDD?

FXDD is a Malta-established financial services company that delivers vast investment opportunities to retail, corporate, and institutional clients. The ECN-based technology provides clients with low spreads and no commissions, while the raw spreads and quotes are received directly from the liquidity providers with ultra-low latency.

The company has operated for over 20 years in the business while serving over 350 thousand accounts with a 7.3 trillion transacted volume. The available markets include the execution of orders over Stocks, Commodities, Indices, as well as Cryptocurrencies with Bitcoin, Ethereum, Litecoin, and Ripple.

FXDD Pros and Cons

FXDD is a regulated broker with low-risk trading, good platform selection with research, and an instrument range including cryptocurrencies. The pricing is either built on a spread or a commission basis.

For the negative side, education is rather basic. Also, the range of markets is limited to FX and CFDs.

| Advantages | Disadvantages |

|---|

| Competitive trading conditions | Limited educational materials

|

| Popular trading instruments | Conditions vary according to regulations

|

| Low commissions | No 24/7 support |

| Global expansion | |

| Suitable for beginners and professionals | |

| Good technical solutions and research | |

FXDD Features

FXDD is a global Currency and CFD broker known for its flexible conditions and user-friendly platforms like MetaTrader 4 and 5. Below, you can find the main points to consider while choosing FXDD as your broker.

FXDD Features in 10 Points

| 🏢 Regulation | MFSA, RUC |

| 🗺️ Account Types | Standard, Premium |

| 🖥 Trading Platforms | MT4, MT5, FXDD WebTrader |

| 📉 Trading Instruments | Forex, CFDs on Stocks, Indices, Commodities, Indices, Cryptocurrencies |

| 💳 Minimum Deposit | $200 |

| 💰 Average EUR/USD Spread | 1.9 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, JPY |

| 📚 Trading Education | Daily FX Analysis, Blog, Autochartist |

| ☎ Customer Support | 24/5 |

Who is FXDD For?

FXDD is ideal for a wide range of traders, from beginners looking for an accessible entry into currency trading to experienced professionals seeking advanced tools and tighter spreads. Based on our findings and Financial Expert Opinion, FXDD is Good for:

- Regular Traders

- Traders who prefer the MT4 and MT platforms

- Currency and CFD Trading

- Crypto CFD Treading

- EAs running

- European Trading

- Suitable for a Variety of Strategies

FXDD Summary

FXDD Review reveals good opportunities globally, with the support of different accounts, trading styles, tools, and features. The level of customer support, along with the highest operational standards, allows FXDD clients to invest smartly and head on to potential success.

The traders of any style can enjoy the best suitable platform along with the enlarged offering of conditions in a conflict-free environment with STP technology.

55Brokers Professional Insights

FXDD stands out for its good track record, institutional-grade liquidity, and customizable solutions suitable for vast trading styles, also traders from different regions globally. One of its key advantages is the dual account structure, offering both Standard and ECN options, allowing traders to choose between spread-based and commission-based pricing so good for either scalpers or trend traders.

The broker also provides access to deep liquidity and fast execution speeds, making it attractive for scalpers and high-frequency traders. Additionally, FXDD supports algorithmic trading, VPS hosting, and advanced charting tools.

With multilingual customer support and regulatory oversight in different jurisdictions, FXDD combines reliability with flexibility, setting it apart as a professional broker.

Consider Trading with FXDD If:

| FXDD is an excellent Broker for: | - Providing competitive fees and spreads.

- Offering popular instruments.

- Get access to MT4, and MT5 platforms.

- Broker with a variety of strategies.

- Beginners and professional traders.

- Prefer MAM/PAMM trading.

- Need broker with access to VPS Hosting.

- Providing diverse tools and research.

- Looking for broker with low minimum deposit requirement.

- Need broker with fast execution. |

Avoid Trading with FXDD If:

| FXDD might not be the best for: | - Need a broker with a Top-Tier license.

- Looking for broker with 24/7 customer support.

- Providing Copy Trading.

- Who prefer to trade with cTrader. |

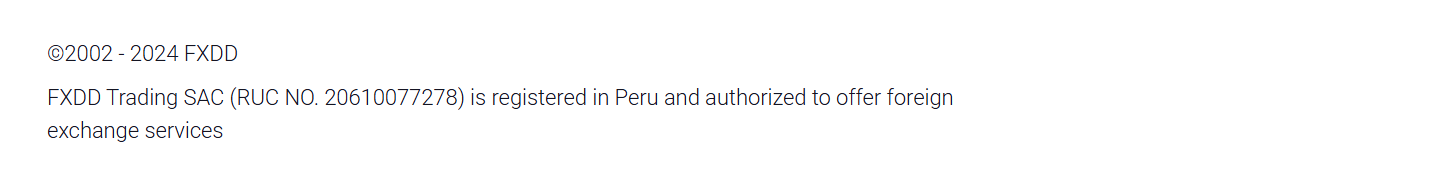

Regulation and Security Measures

Score – 4.3/5

FXDD Regulatory Overview

FXDD Malta Limited is a part of an EU company that respectively complies with the law requirements in terms of the financial service companies and holds an Investment Service Category 3 License. This license is received and regulated by the Malta Financial Services Authority.

- Being a European regulator, the company is therefore enabled to provide services within the EEA zone and is registered with the partner EU authorities, regulated by the MiFID.

- Also, there is an additional entity of FXDD, FXDD Trading SAC, which is registered in Peru, a jurisdiction with limited regulatory oversight in the financial sector.

Although the broker claims to follow European standards, its offshore license may provide weaker regulation and less protection if issues arise. Traders should carefully evaluate this aspect before choosing FXDD as their trading partner.

How Safe is Trading with FXDD?

Trading with FXDD is overall considered safe for many users, especially due to its long-standing presence in the market and support for trusted platforms like MetaTrader.

However, safety also depends on the specific entity you register with. While FXDD emphasizes its compliance with European standards, its offshore registration in Peru may offer less regulatory protection. As with any broker, traders should review the terms, licensing, and reputation before opening an account with the broker.

Consistency and Clarity

FXDD has built a steady reputation due to its long history since 2002 and its international customer base.

Many traders appreciate the broker for its fast trade execution, variety of platforms, and low ECN spreads. However, some users have raised concerns about its offshore registration and withdrawal delays.

Although FXDD has not won many major industry awards, the broker has maintained a stable presence in the market and engages in different sponsorships to boost its public image.

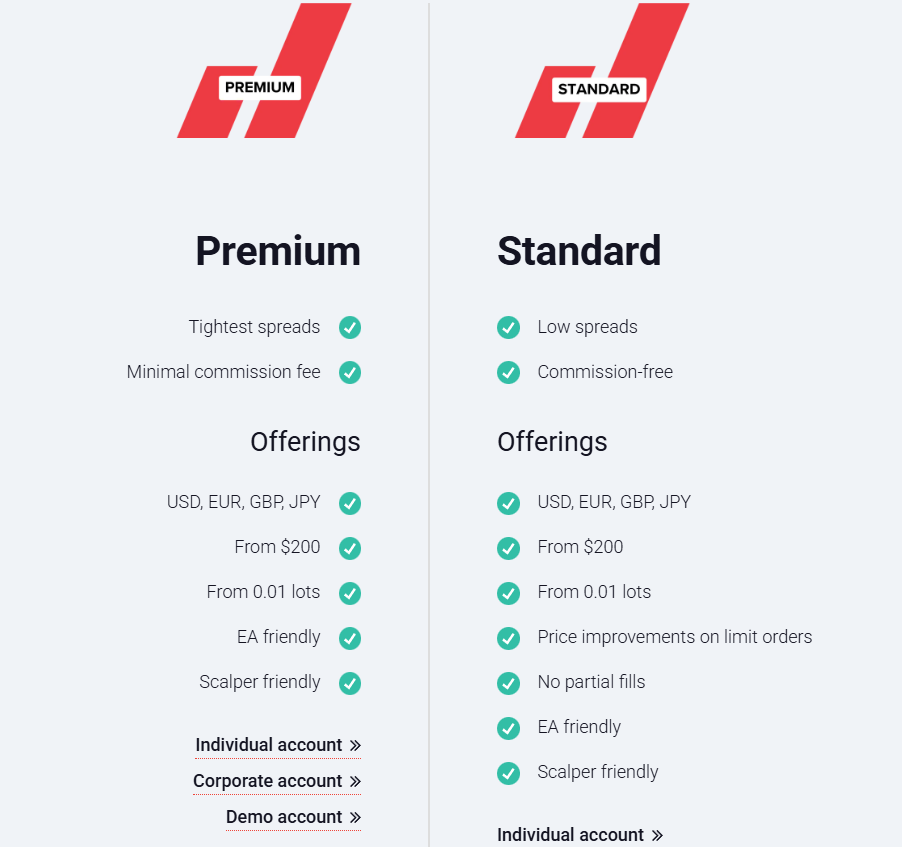

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with FXDD?

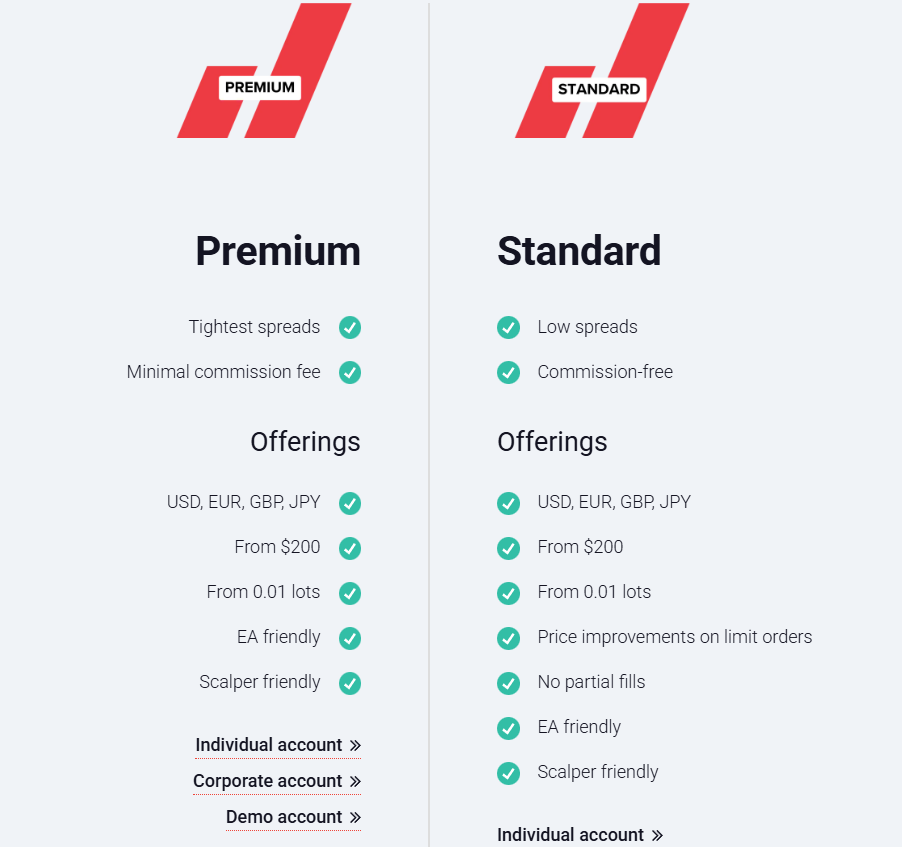

FXDD offers two different account types based on the pricing models, thus, the account types Standard and Premium are available through both platforms, MT4 and MT5.

Also, the Demo account of both types is available immediately to the new company clients. Then, once the client is sure about his expertise, the registration of the live account follows easily and quickly.

Standard Account

The Standard Account is designed for beginner to intermediate traders, offering a commission-free experience. It requires a $200 minimum deposit, making it accessible to all types of users.

Spreads are floating and typically are around 1.8 to 1.9 pips for major pairs like EUR/USD. This account type is ideal for those who prefer simplicity, though the costs are slightly higher due to the wider spreads.

Premium Account

FXDD Premium Account, also known as the ECN account, caters to more experienced traders seeking tighter spreads and faster execution.

It requires a minimum deposit of $200 and offers ultra-low spreads, often as low as 0.2 to 0.4 pips for major pairs. Typically, the account comes with a commission of $5.98 per round-turn lot.

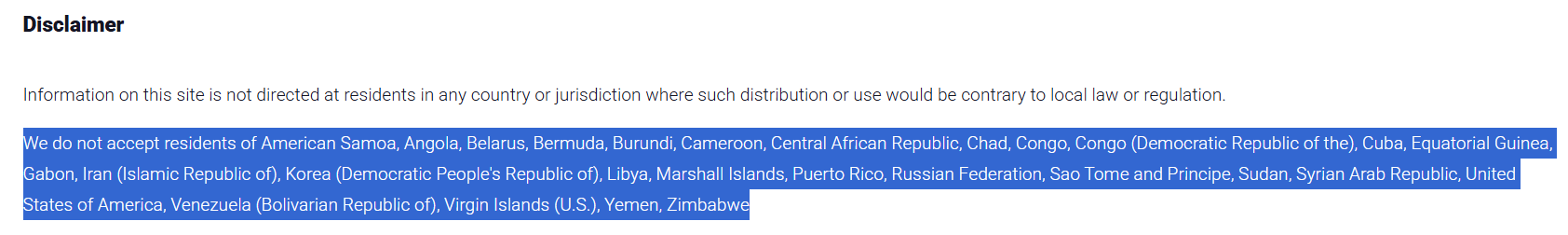

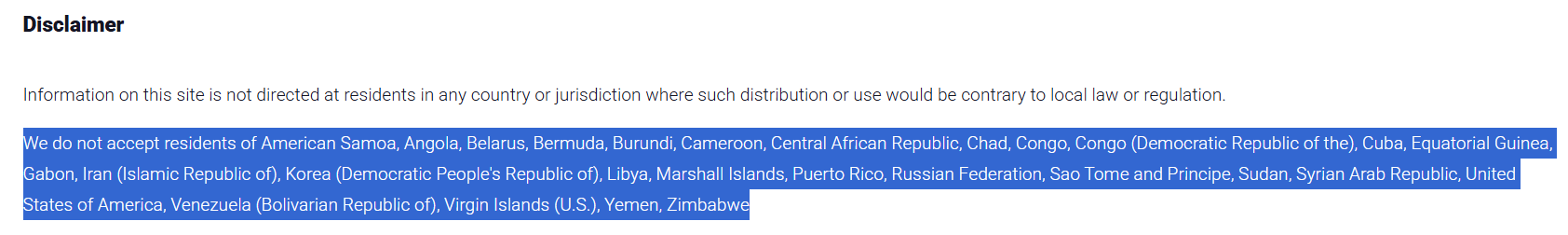

Regions Where FXDD is Restricted

FXDD’s services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide services in countries including:

- American Samoa

- Angola

- Belarus

- Bermuda

- Burundi

- Cameroon

- Central African Republic

- Chad

- Congo

- Cuba

- Equatorial Guinea

- Gabon

- Iran

- Korea

- Libya

- Marshall Islands

- Puerto Rico

- Russia

- Sao Tome and Principe

- Sudan

- Syria

- USA

- Venezuela

- Virgin Islands

- Yemen

- Zimbabwe

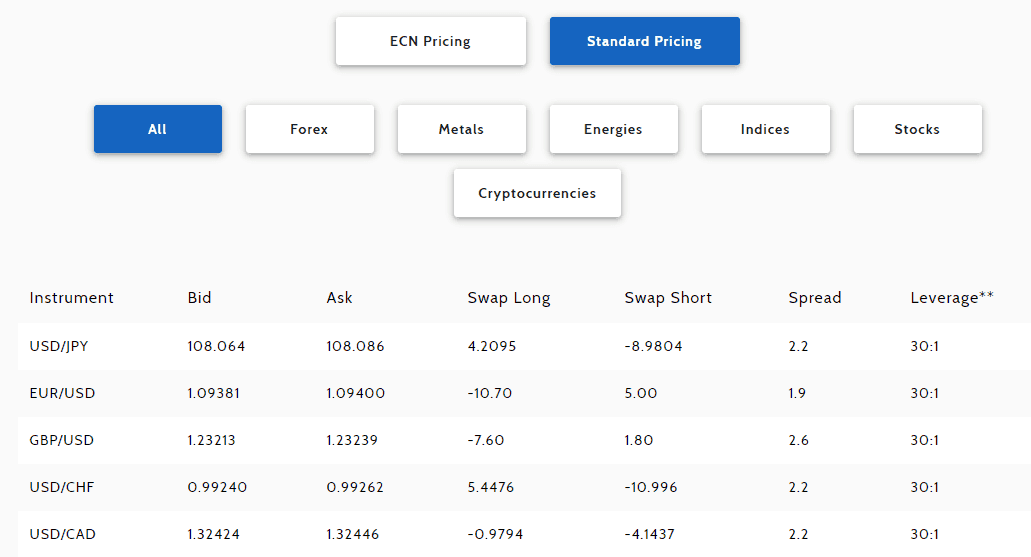

Cost Structure and Fees

Score – 4.4/5

FXDD Brokerage Fees

FXDD Standard account pricing delivers competitive spreads with no commissions, while there is no compromise on the high company standards of execution and service delivery. ECN Account fees are based on the commission and volumes traded.

But overall, the fees consist of funding fees, spreads, and commissions are quite favorable.

FXDD offers variable spreads that differ based on the type of account chosen. For Standard Accounts, the average spread for major currency pairs like EUR/USD is 1.9 pips, with no added commission.

In contrast, Premium Accounts feature much tighter spreads, often starting from as low as 0.2 to 0.4 pips.

FXDD’s commission charges depend on the account type. The Standard account has no commissions, while the Premium account charges a commission of $5.98 per round-turn lot.

Also, always consider rollover or overnight fees as a cost, which are charged on the positions held longer than a day and are defined by each instrument separately.

FXDD covers the cost of the first withdrawal each calendar month, but charges $40 for each additional withdrawal within the same month. Wire withdrawals must be at least $100; amounts under $100 incur an extra $25 fee. To avoid these charges, FXDD suggests using alternative payment methods.

For inactivity, accounts with no trades for 90 days or more face a monthly fee starting at $40 for less than one year of inactivity, increasing up to $70 for accounts that are inactive for over three years.

How Competitive Are FXDD Fees?

FXDD’s fees are generally competitive within the industry, especially for traders using the ECN accounts, which offer tight spreads combined with reasonable commission rates.

While some additional fees apply, overall, the broker provides a cost structure that can suit both beginner and experienced traders looking for flexible conditions.

| Asset/ Pair | FXDD Spread | TastyFX Spread | HYCM Spread |

|---|

| EUR USD Spread | 1.9 pips | 0.8 pips | 1 pip |

| Crude Oil WTI Spread | 5 | - | 2 |

| Gold Spread | 40 | - | 20 |

| BTC USD Spread | 50 | - | 90 |

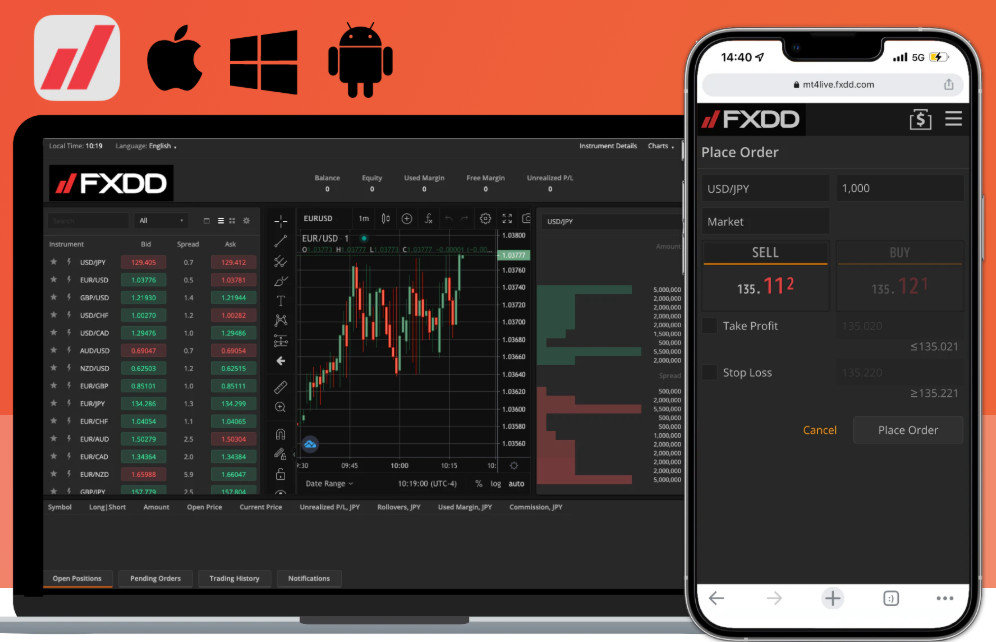

Trading Platforms and Tools

Score – 4.5/5

FXDD offers a range of platforms designed to meet the needs of all experienced levels of traders. The platform selection includes the popular MT4 and MT5, known for their advanced charting tools, automated capabilities, and user-friendly interfaces.

Additionally, the broker provides the FXDD WebTrader, a browser-based platform that allows traders to access the markets without needing to download software, offering convenience and flexibility for traders.

Trading Platform Comparison to Other Brokers:

| Platforms | FXDD Platforms | TastyFX Platforms | HYCM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mible Apps | Yes | Yes | Yes |

FXDD Web Platform

FXDD WebTrader is a proprietary software with a web-based interface for easy access at any time and from anywhere.

The platform is a specialized feature for experienced traders with a robust charting package and presents only the ECN pricing model.

FXDD Desktop MetaTrader 4 Platform

FXDD’s MetaTrader 4 desktop platform is a widely recognized tool among Forex and CFD traders, offering a robust suite of features for both novice and experienced traders. The platform provides access to advanced charting capabilities, real-time market data, and a comprehensive range of technical indicators.

Traders can also use automated trading through Expert Advisors, allowing for algorithmic strategies. The platform supports multiple order types and execution modes, catering to various strategies. Additionally, FXDD offers Virtual Private Server hosting for MT4, ensuring uninterrupted trading and enhanced execution speeds.

Main Insights from Testing

Testing FXDD’s MT4 platform reveals a reliable and user-friendly experience with smooth execution and responsive performance. The platform offers a solid range of customization options for charts and indicators, making it suitable for technical analysis and automated trading.

Overall, MT4 provides a stable environment that meets the essential needs of most Forex and CFD traders.

FXDD Desktop MetaTrader 5 Platform

The MetaTrader 5 desktop platform offers enhanced capabilities, introducing additional order types, more timeframes, and an improved strategy tester, making it suitable for a broader range of strategies.

With its advanced charting tools, real-time market depth analysis, and the ability to run multiple charts simultaneously, MT5 provides a comprehensive environment.

FXDD MobileTrader App

FXDD’s all platforms support a mobile trading experience, allowing traders to access their accounts and execute trades seamlessly across devices.

FXDD mobile app offers over 180 technical indicators, including candle pattern recognition, and features such as chart-based order management, cloud-based alerts, and multiple chart types. Additionally, it integrates Analyst Views from Trading Central and global news sources, ensuring traders stay informed on the go.

Available for both iOS and Android, the app ensures that traders have full control over their trading activities anytime, anywhere.

Trading Instruments

Score – 4.6/5

What Can You Trade on FXDD’s Platform?

FXDD offers traders access to over 3,000 instruments across multiple markets, including more than 90 currency pairs, CFDs on Stocks, Indices, Commodities, Indices, and popular Cryptocurrencies including Bitcoin and Ethereum.

This wide range of assets allows traders to diversify their portfolios and trade various markets conveniently from an FXDD account.

Main Insights from Exploring FXDD’s Tradable Assets

Exploring FXDD’s tradable assets reveals a diverse and flexible offering suited for a range of trading styles. With a focus on variety and accessibility, the broker’s asset selection supports portfolio diversification and strategic trading across multiple sectors.

Leverage Options at FXDD

Like the majority of Forex brokers, FXCC also offers to use leverage, a powerful tool to increase the potential of gains through its possibility of multiple initial account balances. However, the multiplier should be used smartly as it increases the power of losses as well.

FXDD Leverage levels depend on the instrument you trade and are defined by the regulatory restrictions, together with your level of proficiency.

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International clients can use the high leverage of up to 1:100.

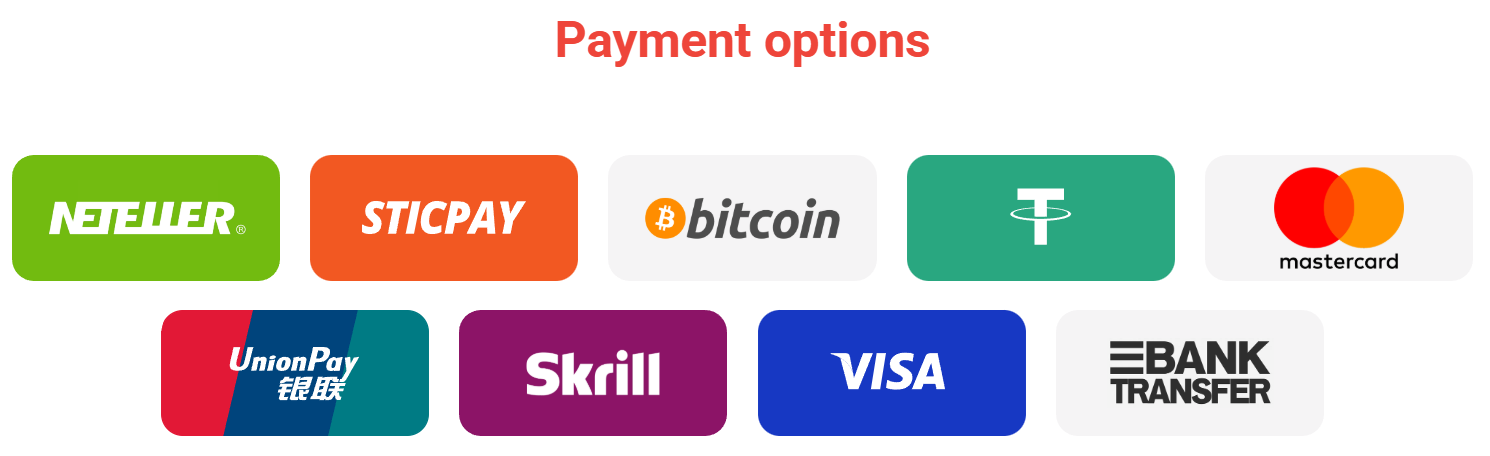

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at FXDD

The variety of methods to deposit or withdraw funds is delivered by the most convenient and safe payment methods. All transactions are requested by the customer portal, while the options include:

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller, and more

FXDD Minimum Deposit

The minimum amount for FXDD is $200 for both account types, which will allow you to transfer your Demo account to a live account. However, always make sure to check on the necessary margins for the particular instrument while trading.

Withdrawal Options at FXDD

FXDD does not charge any fees for making the deposit, as well as you may withdraw funds at any suitable time. While FXDD withdrawal options include Bank wire and Cards, the broker will also cover the costs of the first withdrawal each calendar month.

Any further redemptions may result in an additional $40 truncation fee, while the minimum amount is set to $100.

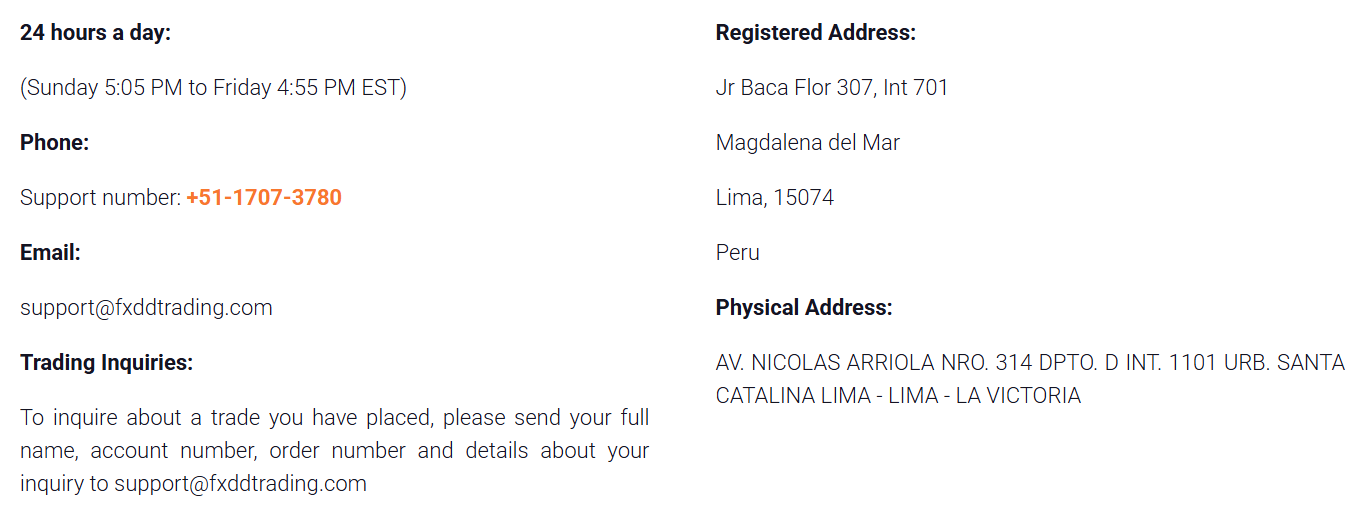

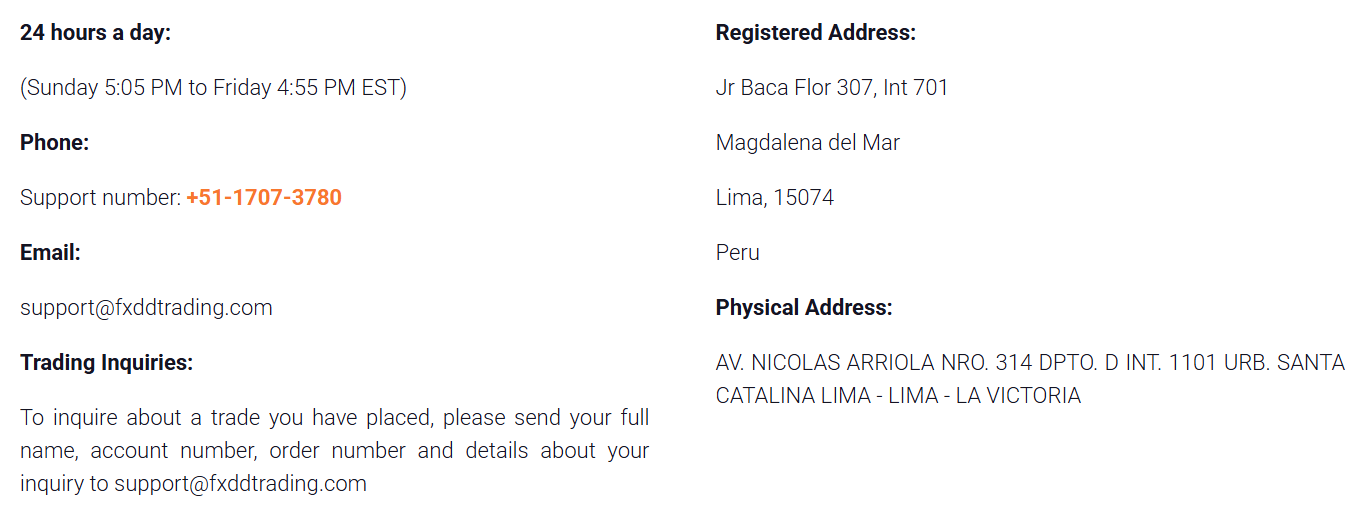

Customer Support and Responsiveness

Score – 4.4/5

Testing FXDD’s Customer Support

FXDD provides multilingual 24/5 customer support via phone, email, or live chat for assistance with account setup, trading inquiries, or technical issues.

The support team is experienced and aims to provide prompt and helpful responses.

Contacts FXDD

Clients can contact the support team via phone at +51-1707-3780 or email at support@fxddtrading.com. For inquiries, clients need to provide their full name, account number, order number, and details about their inquiry when reaching out.

Research and Education

Score – 4.5/5

Research Tools FXDD

FXDD provides traders with a comprehensive suite of research tools and enhancements across its website and platforms.

- Through a partnership with Trading Central, clients gain access to expert technical and fundamental analysis, including daily newsletters, market insights, and integrated indicators for MT4.

- Additionally, FXDD integrates Autochartist into both MT4 and MT5 platforms, offering automated chart pattern recognition and signals.

- The broker also offers Virtual Private Server hosting, ensuring uninterrupted trading and reduced latency for automated strategies.

Education

FXDD provides traders with a range of educational resources aimed at enhancing their knowledge and skills. The broker offers daily FX analysis and insights through its blog, featuring expert analyses on currency movements, market trends, and strategies.

While these resources are valuable, the broker’s educational offerings are relatively limited compared to other brokers that provide more comprehensive educational materials, such as extensive video tutorials, webinars, and interactive courses.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options FXDD

While FXDD primarily focuses on currency and CFD trading, it also provides access to MAM/PAMM trading, allowing clients to invest in professionally managed accounts, providing an alternative investment tool for those seeking to benefit from expert strategies without directly managing trades.

Account Opening

Score – 4.4/5

How to Open FXDD Demo Account?

Opening a FXDD Demo Account is a simple and quick process. To get started, visit the FXDD website and navigate to the account registration section. Select the option for an Open Demo Account, where you will be prompted to fill in basic details, including your name, email, and preferred platform.

Once you complete the registration, you will receive login credentials to access the demo account, which provides virtual funds for you to practice trading in real market conditions without financial risk. The demo account is a valuable tool for testing strategies, learning platform features, and gaining experience before trading with real capital.

How to Open FXDD Live Account?

Opening an account with FXDD is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Click on the “Open Live Account” icon on the FXDD homepage.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core tools, FXDD offers various additional features designed to enhance the experience:

- These include an economic calendar, margin calculator, and position size calculator, all accessible on the broker’s website. These tools help traders stay informed about key market events and manage risk more effectively, providing added convenience alongside FXDD’s platform offerings.

FXDD Compared to Other Brokers

Compared to its competitors, FXDD provides a solid yet relatively average offering in the online trading space. While it supports popular platforms like MT4 and MT5, and offers a good range of tradable instruments, it falls behind in terms of spreads and commissions compared to lower-cost brokers like Tickmill and CMC Markets.

Its educational resources are more limited than others, which may not appeal to beginner traders seeking in-depth learning.

Although FXDD is regulated and offers a competitive environment, some competitor brokers offer stronger global regulatory coverage, broader platform choices, and more competitive fee structures.

| Parameter |

FXDD |

Spreadex |

Tickmill |

OANDA |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.9 pips |

Average 0.6 pips |

Average 0.1 pips |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.2 pips + $2.99 per side |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $3 |

0.1 pips + $5 commission per 100,000 traded |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, FXDD WebTrader |

Spreadex Web Platform, TradingView |

MT4, MT5, Tickmill Trader |

OANDA Web Platform, MT4, MT5, TradingView, fxTrade |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

3,000+ currency pairs |

10,000+ instruments |

180+ instruments |

100+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

MFSA, RUC |

FCA |

FCA, CySEC, FSCA, FSA |

CFTC, NFA, FCA, ASIC, IIROC, MFSA, MAS, FFAJ, BVI FSC |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$200 |

$0 |

$100 |

$0 |

$50 |

$0 |

$0 |

Full Review of Broker FXDD

FXDD is a global Currency and CFD provider operating since 2002, offering access to global markets through popular MT4 and MT platforms, and its own WebTrader. It supports trading in a wide range of instruments, including Forex, indices, commodities, stocks, and cryptocurrencies.

FXDD offers both standard and commission-based accounts with competitive spreads and reliable execution. Additionally, the broker provides useful tools such as VPS hosting, Autochartist, economic calendars, calculators, and access to Trading Central for analysis.

Share this article [addtoany url="https://55brokers.com/fxdd-review/" title="FXDD"]

Merhaba ben fxdd trading 1 ay işlem yaptım para çekebilmem için vip1 üye olmam istendi vip1 üyelik yapmak istemiyorum. Ana paramı çekebilimiyim

Hello, I’m not able even to open a demo account, the web page keeps saying that website is down due maintenance

HI

can FXDD in my behalf trade in MT5

Best regards,

IVAN.