Advertising Disclosure

- Our Review

- FX2 Funding 2025 User Reviews

- FX2 Funding 2025 News

- What is FX2 Funding?

- FX2 Funding Pros Cons

- Is FX2 Funding Legit?

- FX2 Funding Challenge

- Funded Account

- Account Conditions

- Payout

- FX2 Funding Alternative

What is FX2 Funding Prop Firm?

FX2 Funding is a prop trading firm offering traders a chance to manage a simulated trading account under specific conditions. Traders undergo an evaluation, adhere to rules like drawdown limits, and if successful, can trade and earn from their performance without risking their capital. The firm prohibits certain trading strategies to ensure fair play and offers opportunities for account scaling based on profits. It operates globally, excluding residents of certain countries.

FX2 Funding, a proprietary trading firm, offers traders the chance to trade with the company’s funds after passing a qualifying test or challenge, essentially requiring no initial capital from the trader to start real trading. To become a funded trader and operate as a professional with the company’s account, one must first succeed in this evaluation phase. While this presents a significant opportunity for traders, it’s important to carefully consider the associated risks before participating. For detailed insights on prop trading and the specific risks related to prop trading read our article.

| FX2 Funding Advantages | FX2 Funding Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| High Profit Share | Doesn't offer MetaTrader Platforms |

| Refundable Fee once you become Funded Trader | No EA Trading |

| No Commissions |

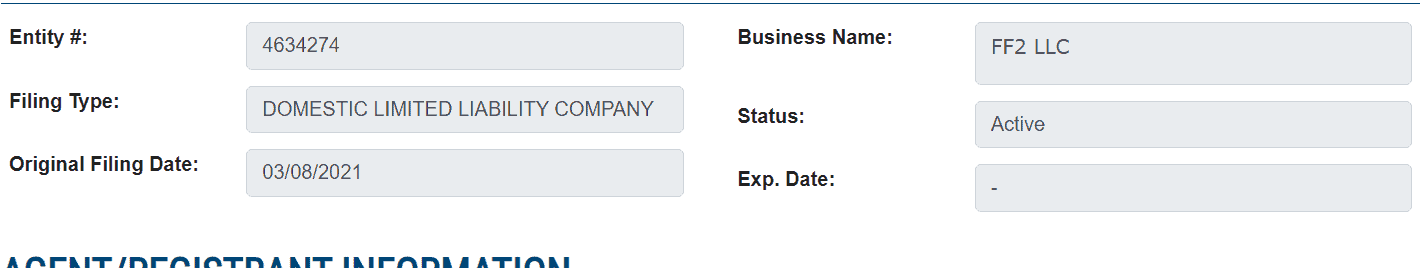

Is FX2 Funding Legit?

FX2 Funding is a legitimate proprietary trading firm, and its legitimacy is often highlighted by its operation within the regulatory framework of the USA. Being based in the United States, it’s presumed that FX2 Funding adheres to strict regulatory standards, which typically involve compliance with financial regulations and consumer protection laws.

- Prop Trading firms generally operate with less regulation than Forex Brokers, as they don’t require Forex Broker licenses and are not monitored by industry regulators. This means they have more freedom in how they manage operations and funds for trading, leading to different risk levels. It’s vital to understand these risks before getting involved, as the protective oversight found in more regulated financial environments may not be as robust.

Is FX2 Funding Scam?

Upon reviewing FX2 Funding’s official website, we found no clear indicators that the company is a scam. However, given that Prop Trading Firms often operate with minimal regulation by financial authorities, it’s challenging to definitively categorize the firm’s legitimacy.

For a cautious approach to Prop Trading, it’s wise to thoroughly research and understand the risks involved. Opting for a company with a solid reputation and a longer operational history can offer more stability. While the financial commitment may primarily be subscription fees, rather than direct investment, this can lower potential losses compared to trading with your own funds directly.

FX2 Funding Challenge Evaluation Rules

A key focus of our FX2 Funding review is the evaluation challenge’s structure and the conditions required for signing up. This aspect involves understanding the testing criteria necessary to secure a Funded Trading Account and to embark on a career as a Proprietary Trader. Additionally, it encompasses the costs incurred by the trader to attain this status, usually in the form of a Registration Fee.

- FX2 Funding distinguishes itself with a straightforward, one-step evaluation process for traders aiming to qualify for a funded trading account. This simplified approach is designed to efficiently assess a trader’s ability to manage risk and generate profits without the multi-tiered challenges often seen in other proprietary trading firms. The evaluation focuses on meeting specific trading objectives within set parameters, such as achieving a certain profit target while adhering to maximum drawdown limits.

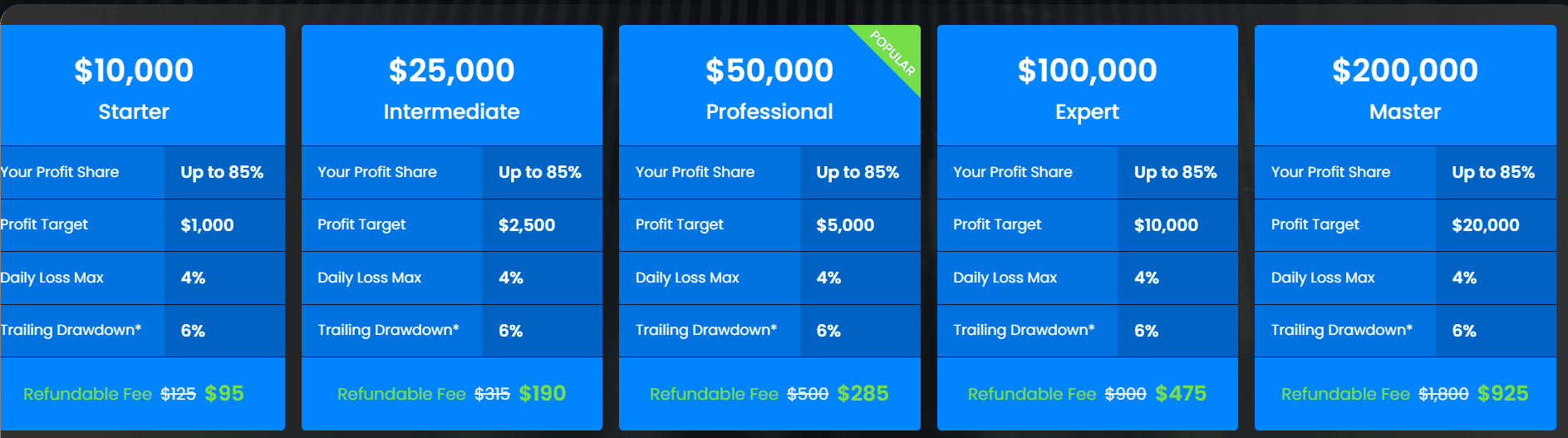

Account Balance and Registration Fee

To begin with FX2 Funding, your first step involves selecting a trading model and the account balance you aim to qualify for. The challenge’s conditions vary slightly depending on the chosen account size. This selection impacts the registration fee required to enter the challenge. However, FX2 Funding has a policy of refunding this fee once you successfully become a Funded Trader. For a detailed comparison of registration fees based on account size, refer to our Registration Fee comparison table provided below.

- To access funded accounts, traders undergo a one-stage evaluation that is focused on demonstrating trading acumen without the pressure of strict time limits.

- FX2 Funding offers trading accounts ranging from $10,000 to $200,000, allowing traders to choose the account that best suits their needs

| Fees | FX2 Funding | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $10,000 | $10,000 | $50,000 |

| Fee | $95 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $925 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

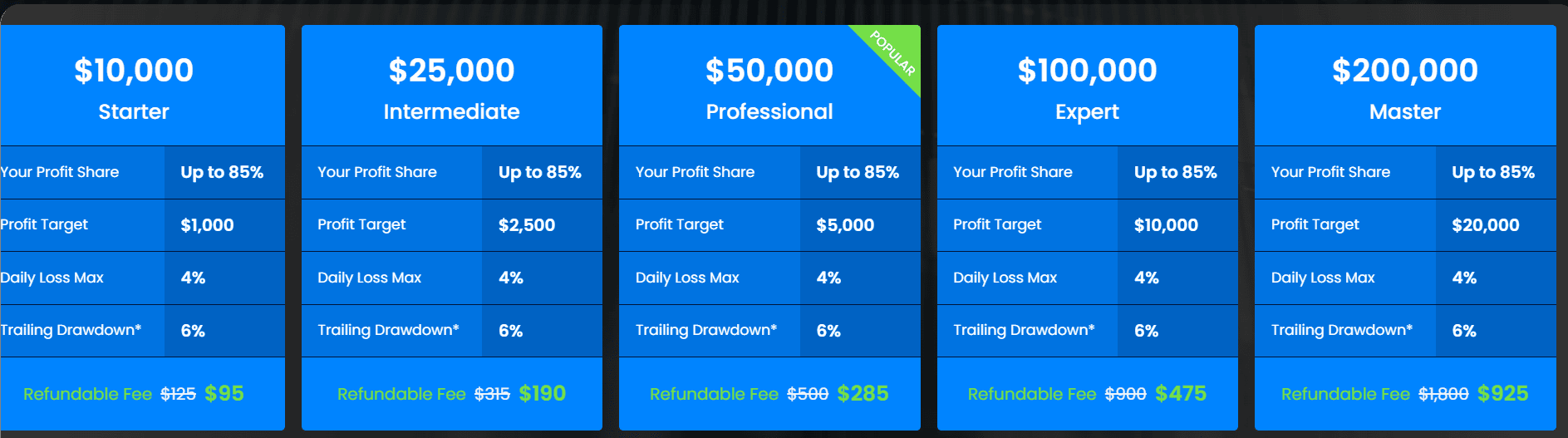

Profit Target

The challenge set by FX2 Funding involves adhering to specific rules to showcase a trader’s strategy and performance effectively. A crucial aspect of this is achieving the Profit Target, which depends on the chosen challenge and account size. Traders must attain a 10% gain on their account balance during the evaluation to qualify for a funded account, reflecting their ability to navigate and profit within the trading environment designed by FX2 Funding.

Maximum Loss

In FX2 Funding’s trading challenge, traders face a maximum loss limit to ensure disciplined risk management. The specific limits include a 4% maximum daily drawdown and a total 6% maximum drawdown from the starting balance. Successfully managing to stay within these limits is essential for passing the evaluation and qualifying for a funded account. This framework is designed to test traders’ ability to protect capital while pursuing profit targets.

Minimum Trading Period

FX2 Funding does not impose a minimum trading period for their evaluation challenge, allowing traders the flexibility to trade at their own pace. This approach is designed to accommodate various trading strategies and personal circumstances, providing traders with the opportunity to demonstrate their proficiency without the pressure of a strict timeline.

See the detailed table with FX2 Funding Evaluation conditions based on Account Size:

Free Trial

FX2 Funding does not offer a free trial for their trading challenges or evaluation process. Participants are required to pay a registration or evaluation fee to access the trading challenge, although this fee can be refunded once the trader qualifies for a funded account by meeting specific criteria set by FX2 Funding.

FX2 Funding Funded Account

Profit Split

FX2 Funding offers a generous profit split to its traders, allowing them to keep up to 85% of the profits they make. This high-profit share is part of what makes FX2 Funding attractive to traders, rewarding them significantly for their successful trading strategies and skills.

Payout and Withdrawals

FX2 Funding allows traders to request their first payout just 7 days after receiving their funded account. Subsequent payouts are available every 14 days. This quick payout structure is part of their commitment to providing traders with prompt access to their earnings, enhancing the flexibility and financial management capabilities of their participants.

Withdrawal Method

FX2 Funding withdrawal is typically processed through various methods to accommodate the preferences of their traders globally. While the specific options can vary, common withdrawal methods often include bank transfers, electronic wallets like PayPal, and other online payment platforms.

Account Conditions

When assessing FX2 Funding broker’s account options, it’s important to examine account types, platforms, instruments, costs, leverage, and trading conditions. Some strategies may be restricted, potentially leading to account loss. Re-passing the evaluation may be necessary to regain access. Analyzing these factors provides valuable insights into FX2 Funding’s offerings and limitations.

Trading Instruments

FX2 Funding allows traders to engage with a variety of financial instruments. These typically include major currency pairs, perhaps some commodities, indices, and possibly cryptocurrencies, depending on the trading platform’s offerings and policies.

FX2 Funding Commission

FX2 Funding typically operates on a profit-sharing model rather than charging commissions on trades. Traders keep up to 85% of the profits they generate, with the remainder going to FX2 Funding. This profit-sharing arrangement incentivizes traders to maximize their trading performance while aligning the interests of both the trader and the firm.

Leverage

FX2 Funding offers leverage up to 1:100 for forex and indices trading, while for cryptocurrency trading, the leverage is up to 1:20. Traders should always be aware of the risks associated with leverage and trade responsibly.

FX2 Funding App Platform

FX2 Funding utilizes the DXtrade platform, which is white-labeled under the name Gooey Trade. The DXtrade platform offers user-friendly charts, advanced annotation tools, and features designed to enhance decision-making and trading strategies. Additionally, there are plans to integrate TradingView charts into the platform. While currently available as a web-based platform, an app version called Gooey Trade is scheduled for release in March 2024.

Trading Conditions

FX2 Funding provides a meticulously tailored array of conditions aimed at meeting the diverse needs of traders who participate in their funded account programs.

- FX2 Funding typically allows a wide range of trading strategies, including scalping, swing trading, and news trading. However, certain high-risk strategies such as arbitrage and high-frequency trading may not be permitted. Additionally, traders should adhere to responsible trading practices and avoid engaging in manipulative or fraudulent activities.

- Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. In the context of FX2 Funding, slippage may occur during volatile market conditions or when executing large orders, resulting in a slight variation between the intended and actual execution prices. Traders should be aware of the potential for slippage and consider it as part of their overall trading strategy and risk management.

FX2 Funding Promotions

As observed, FX2 Funding occasionally offers promotions, including FX2 Funding discount codes, along with other discounts. However, these promotions typically come with temporary conditions, so it’s recommended to verify them when signing in.

FX2 Funding Alternative Brokers

In conclusion, FX2 Funding provides traders with the opportunity to access funded trading accounts through a straightforward evaluation process. The company offers transparent rules and high-profit shares, making it an attractive option for traders. However, the lack of a free trial, absence of MetaTrader platforms, and restrictions on EA trading may be considered drawbacks by some traders. These factors should be carefully considered before opting for FX2 Funding’s funded account programs.

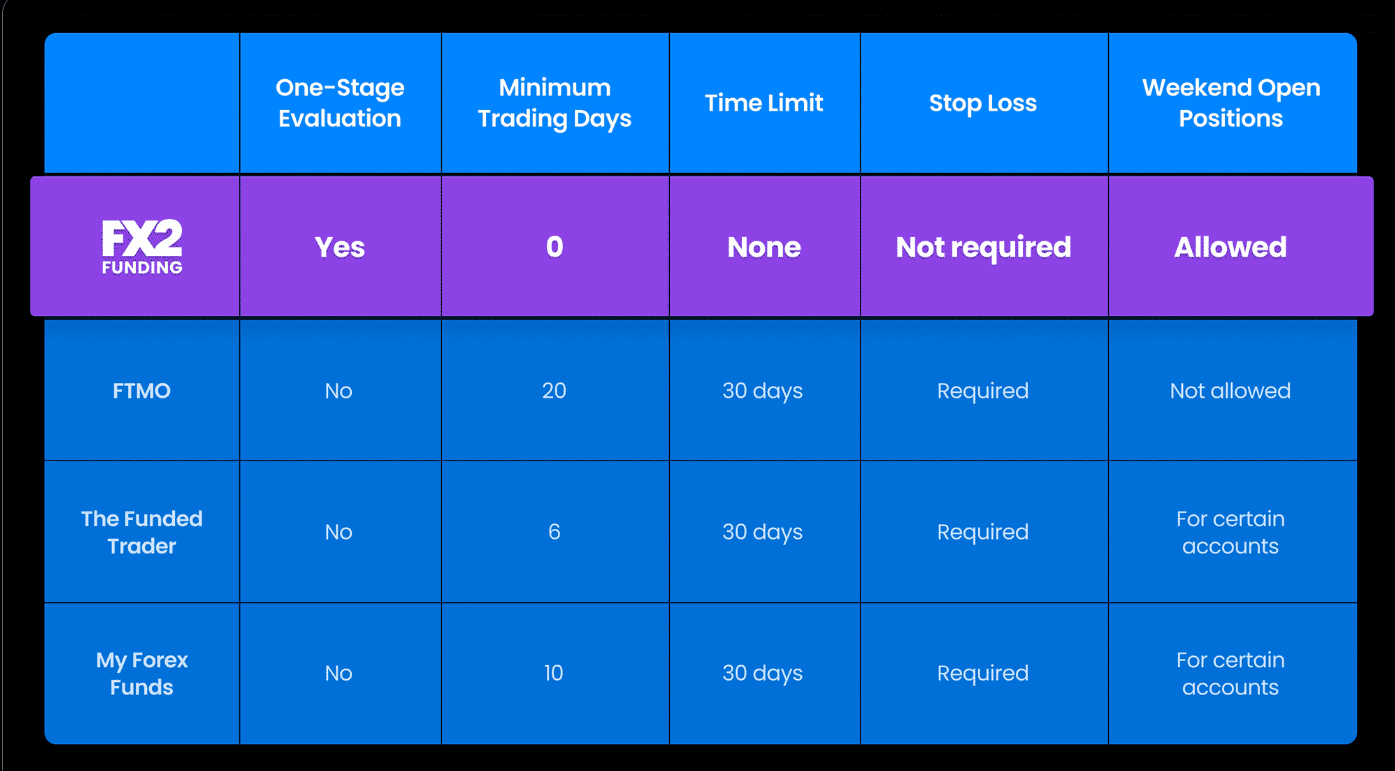

When evaluating options among Prop Trading Firms, it’s essential to compare and consider various proposals. Some popular firms may offer similar conditions or better suitability for certain traders, such as a wider choice of instruments or more versatile platforms. However, FX2 Funding also presents distinct advantages. For a comprehensive comparison, explore our selection of alternatives and refer to the table comparing FX2 Funding to other companies.

- FTMO — Great Free Trial Prop Firm

- TopTier — Great Prop Trading Firm offering MetaTrader platforms and EA trading

- The Funded Trader — Best for Higher Account Size

No review found...

No news available.