FTUK 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:100

Regulation: UK

Min. Deposit: $149

HQ: USA

Platforms: MT4, MT5

Found in: 2021

FTUK Licenses:

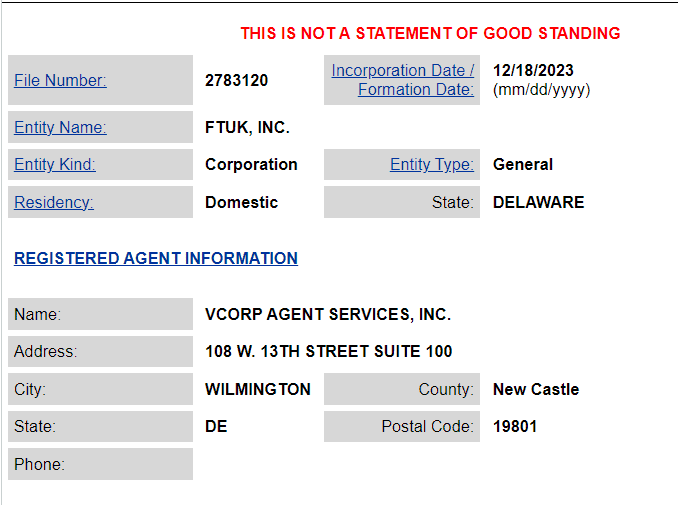

- FTUK - registered in USA company number 2783120

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:100

Regulation: UK

Min. Deposit: $149

HQ: USA

Platforms: MT4, MT5

Found in: 2021

FTUK Licenses:

FTUK, established in February 2021, represents a significant evolution in the proprietary trading firm landscape. This firm distinguishes itself by offering ambitious and skilled traders two main pathways to success: the Evaluation program and the Instant Funding program. It offers two main programs for traders: the Evaluation program and the Instant Funding program.

The firm aims to enhance the proprietary trading world by providing improved services to profitable traders globally. Traders who join FTUK can expect a streamlined joining process and the opportunity to earn while trading with the firm’s capital.

While FTUK prop firm presents a promising opportunity, potential traders should consider their trading style, risk management strategies, and compatibility with the firm’s programs. The proprietary trading world is competitive and demands discipline, strategic acumen, and the ability to adapt to market changes. Read more about Prop Trading here

| FTUK Advantages | FTUK Disadvantages |

|---|---|

| Low Fees | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Availability of Instant Funding | Limited Instrument Range |

| Good Profit Share | Mandatory Stop-loss |

| MT5 and MT4 with EAs | No Alternative Platofrms |

| Refundable Fee | Fee refundable only if trade is not placed |

| Good range of Accounts with suitable conditions |

FTUK is considered legitimate based on various positive reviews and its operation within the USA, where the trading environment is known to be strict and highly regulated. The positive feedback highlights the firm’s solid risk management strategies, which allow for news trading and overnight trades. Additionally, customers have praised FTUK for its excellent customer service and the intuitive design of its dashboard.

We investigated the legitimacy of the company through its official website and found no indications that FTUK is a scam. However, given that Proprietary Trading Firms are minimally regulated by financial authorities, determining the definitive nature of the firm as either a scam or a genuine entity can be challenging.

As our professional advise, it is best to learn well about Prop Trading, understand risks and choose Company with a good reputation also one operate for many years so the proposal is more stable. Yet, since you do not invest much money to trading but just pay subscription fees the potential losses still considered lower if compared to engaging into Real Trading with your own funds.

The focal point of our FTUK review revolves around examining the structure of the evaluation challenge, including the prerequisites for enrollment in the trading challenge. This encompasses the nature of the test required to secure a Funded Trading Account, enabling one to become a Proprietary Trader, as well as the financial obligations—primarily the Registration Fee—incumbent upon a trader to fulfill this role.

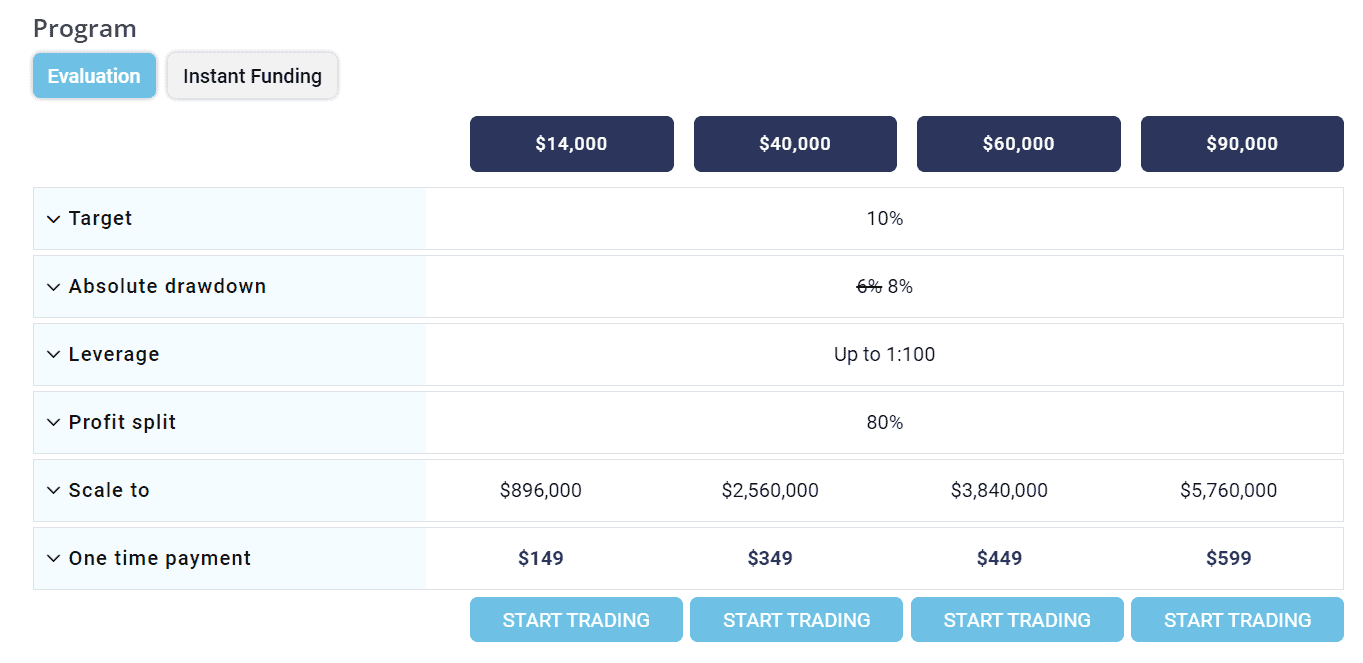

To start Ftuk Trading your first step is to decide on the Account Balance level you wish to aim for. The size of the account you select influences the specific conditions of the challenge, including variations in the challenge requirements. Moreover, the choice of account size directly impacts the registration fee you’re required to pay to engage in the challenge. For a detailed comparison of registration fees across different account sizes, refer to our Registration Fee comparison table provided below.

| Fees | FTUK | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $14,000 | $10,000 | $50,000 |

| Fee | $149 | €155 | $289 |

| Maximum Account Size | $90,000 | $200,000 | $400,000 |

| Fee | $599 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

FTUK sets a milestone target of 10% for its funding levels across all accounts. When a trader reaches this target, they are instructed to close all open trades and report their achievement to FTUK. Successfully hitting the first milestone allows a trader’s funding amount to be increased by 400%, and for every subsequent milestone achieved, the funding amount is doubled.

FTUK has set the absolute drawdown limit at 8% for its funded accounts. This means there is a fixed equity stop-out level for each funding level. Once the account equity drops below this fixed stop-out threshold, all running trades are closed, and trading access is disabled. This stop-out level is a fixed value for each funding level, which implies that any profits made by the trader increase the loss allowance, providing a cushion and potentially more room to manage trades before hitting the drawdown limit

There is no longer a minimum trading days requirement for their programs which is a big plus. As soon as a trader hits their milestone target, they become eligible for a payout and additional funding responsibility

See the detailed table with FTUK Challenge conditions based on Account Size:

FTUK does not currently offer a free trial for their trading programs. This policy means that potential traders interested in FTUK’s funding opportunities must proceed through the standard sign-up and evaluation process without the option to test the platform and trading conditions free of charge.

Upon successfully completing the test or challenge, the trader will receive their Funded Account setup, which can typically take a few business days to activate. It’s essential to understand that the account’s conditions and balance will mirror those qualified for in the test. If a trader wishes to upgrade to a higher-grade account, they must undertake and pass the test anew for the desired Account Balance they aim to trade with.

FTUK offers a profit split of 80% to the trader, which is among the more generous offerings in the proprietary trading firm industry. This means that traders keep 80% of the profits they generate, while FTUK retains 20%. The profit split applies once traders successfully complete their evaluation phase or when they start trading with an instant funding account.

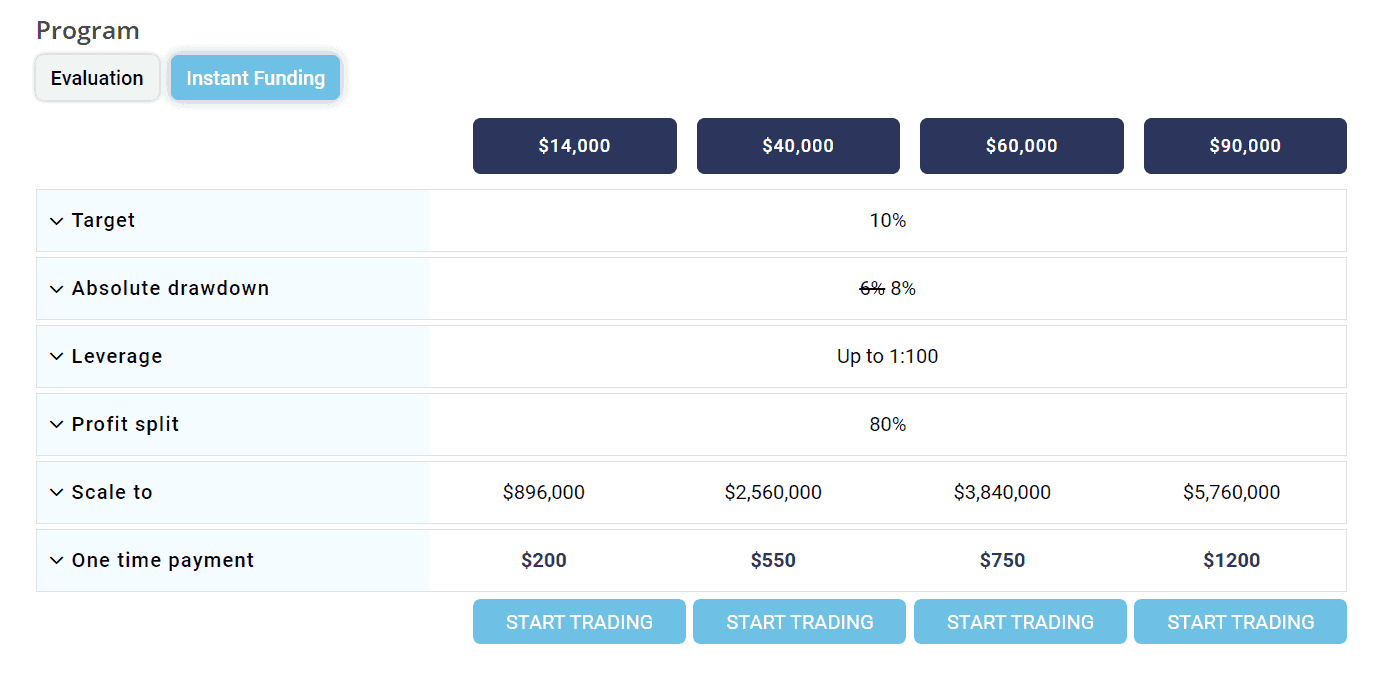

The Instant Funding Program caters to traders ready to bypass the evaluation stage and dive directly into live trading. This option offers immediate access to funding after a one time payment, enabling traders to earn from day one. Highlights of the program include starting on a live account, earning from the first day, no time limits, and rapid capital scaling. Like the Evaluation Program, traders can withdraw their profits from level 2 onwards, holding trades overnight and over weekends, thus offering significant flexibility

FTUK facilitates payouts once a trader has advanced to a level 2 funded account or higher. Traders become eligible for a payout after they have traded for a minimum of 10 trading days on their level 2 account. This structured approach ensures traders have demonstrated consistent trading ability before receiving their earnings.

To process payouts, FTUK utilizes Deel, a platform designed for managing global payments and contracts. Once a payout request is approved, the funds are credited to the trader’s Deel account. If Deel is not available in the trader’s country, FTUK can make direct payments via PayPal or cryptocurrency. From Deel, traders can then transfer their earnings through various means, including bank transfer, Deel Card, Coinbase, PayPal, Payoneer, Revolut, and Wise

We meticulously evaluate broker offerings, including account types, trading platforms, instruments, and costs. It’s also vital to review leverage options and trading terms, as restrictions on strategies or certain practices could lead to account loss. In such cases, requalification through testing is necessary. See below for more details:

FTUK provides a diverse range of trading instruments, catering to various trading preferences and strategies. Their offerings include Forex, Commodities, Indices, and Cryptocurrencies, featuring digital currencies like Bitcoin and Ethereum. This variety ensures traders have access to a wide spectrum of financial markets.

Based on our research, FTUK typically offers commission-free trading, meaning traders don’t incur additional charges for executing trades. Instead, the firm generates revenue through the spread, which is the difference between the buy and sell prices of a financial instrument. This model allows traders to execute trades without worrying about commissions eating into their profits.

FTUK provides leverage options tailored to different trading programs and risk levels. For low-risk programs, traders can access leverage of up to 1:50, while aggressive programs offer leverage of up to 1:100.

FTUK offers access to leading trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their user-friendly interfaces, advanced charting tools, customizable indicators, and automated trading capabilities through Expert Advisors (EAs).

Based on our findings, the FTUK broker offers two account conditions eith Swap Accounts suitable for swing trading or swap free accounts available in all challenges available for trader who prefer to avoid overnight charges.

Based on our research, the company occasionally offers promotions featuring FTUK Coupons for discounts and FTUK Promo Codes. However, these conditions are typically temporary, so it’s advisable to confirm availability upon signing in.

No review found...

No news available.