- What is Freetrade?

- Freetrade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

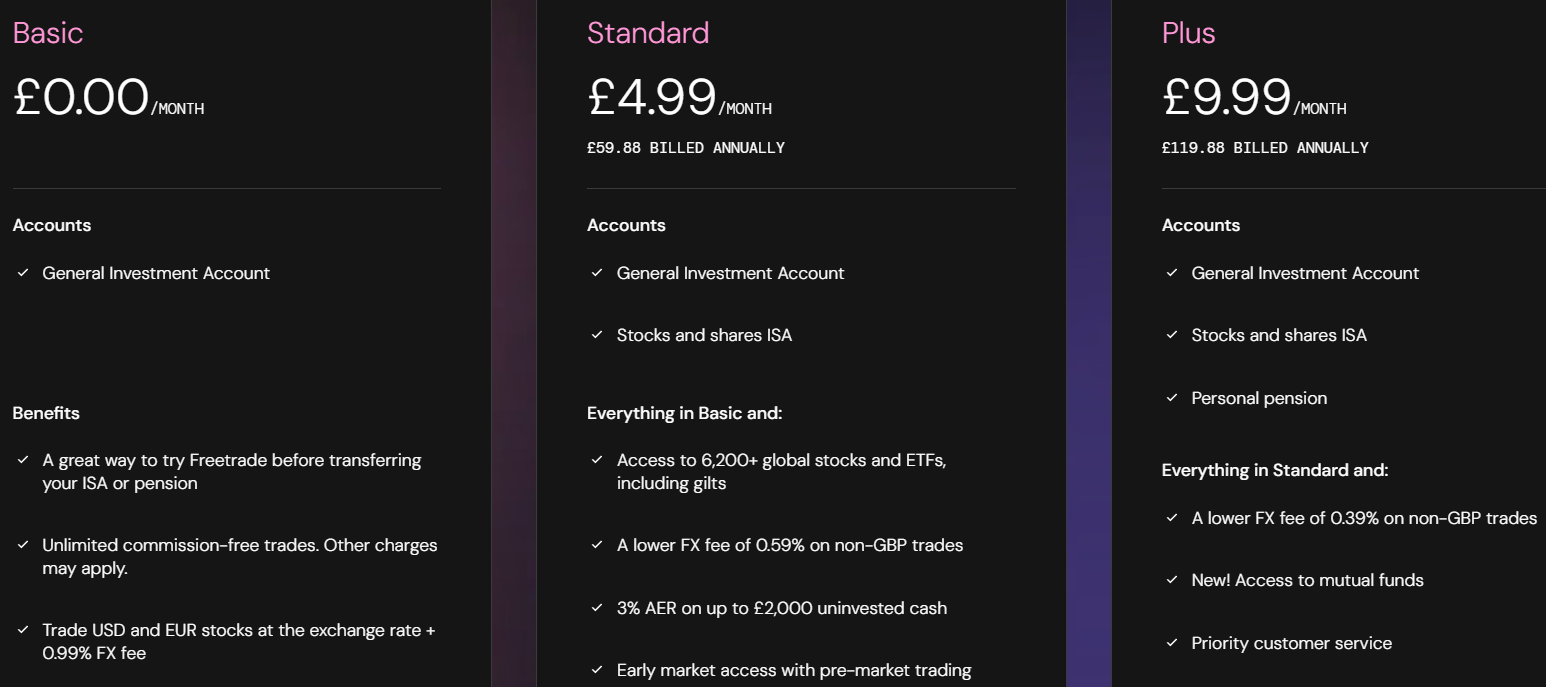

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Freetrade Compared to Other Brokers

- Full Review of Broker Freetrade

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Freetrade?

Freetrade is a UK-based investment firm that allows users to invest in global stocks, ETFs, fractional shares, bonds, and equities through its proprietary mobile and web-based platform.

The broker is regulated by the UK’s reputable Financial Conduct Authority (FCA) and offers commission-free trading, catering primarily to long-term investors.

Freetrade was acquired by IG Group in January 2025, with regulatory approvals expected by mid-2025.

Is Freetrade Stock Broker?

Yes, Freetrade is a Stock Trading Broker that offers access to thousands of UK, US, and European stocks and ETFs, unlimited commission-free fractional shares, and interest on uninvested cash.

The broker is known for its focus on long-term investing through a self-directed investment platform.

Freetrade Pros and Cons

Freetrade offers several advantages and drawbacks that investors need to consider. One of the advantages is commission-free trading on most stocks and ETFs, which helps reduce overall investment costs. The broker also supports fractional shares, making diversification more accessible.

Freetrade’s platform is intuitive and easy to navigate, which is ideal for those new to investing. Additionally, the firm is regulated by the Top-Tier FCA, ensuring a high level of safety and transparency.

For the Cons, the broker does not support margin trading, options, or futures, which may be a drawback for more advanced or short-term traders. Additionally, research tools and educational materials are limited, which may require users to rely on other resources for in-depth analysis.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | Limited investment products offered |

| Stock Trading and Investment | No diverse range of platforms available |

| UK traders | Limited research and educational materials |

| No minimum deposit | No margin multiplier |

| Suitable for long-term investing | |

| Commission-free trading | |

| Access to fractional shares | |

| Various account types | |

Freetrade Features

Freetrade is a UK investment platform that offers an intuitive mobile and web experience where users can buy and sell a variety of assets, including stocks and ETFs. Below is a comprehensive list of its key features:

Freetrade Features in 10 Points

| 🏢 Regulation | FCA |

| 🗺️ Account Types | General Investment, Stocks and shares ISA, Self-Invested Personal Pension, Treasury Bill Accounts |

| 🖥 Trading Platforms | Freetrade Platform |

| 📉 Trading Instruments | Stocks, ETFs, Fractional Shares, Bonds, Equities |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | GBP |

| 📚 Trading Education | Learning Guides and Articles |

| ☎ Customer Support | 24/5 |

Who is Freetrade For?

Freetrade is suitable for investors who prefer a simple, low-cost, and long-term investment approach. With commission-free trading and a simple, intuitive interface, it appeals to those who want to invest without high fees or complicated tools. In our opinion, Freetrade is Good for:

- Investing

- UK Traders

- Beginner and professional investors

- Direct market access

- Real Stock Trading

- Commission-free trading in stocks and ETFs

- Access to fractional shares

- Supportive customer service

- Competitive trading fees

- Long-term investors

Freetrade Summary

In summary, Freetrade is a well-established Real Stock Trading Broker that appeals to individuals looking for an affordable way to invest in the stock market.

With a focus on long-term investing, it offers a user-friendly experience, making it especially attractive to beginners and casual investors. The platform provides essential features like commission-free trading, fractional shares, and tax-efficient accounts, while maintaining a strong regulatory standing.

Overall, Freetrade positions itself as a reliable choice for those who value simplicity and transparency in their investment journey.

55Brokers Professional Insights

Freetrade stands out with its commission-free trading across UK, US, and European stocks and ETFs. It also supports fractional share investing, allowing users to own portions of high-priced stocks without needing to commit large amounts of capital upfront.

One of the main advantages of the broker is its focus on tax efficiency and portfolio diversification. UK-based users can open Stocks and Shares ISAs and Self-Invested Personal Pensions, helping them grow their investments in a tax-advantaged environment. While the platform does not provide advanced trading tools or margin accounts, this aligns with its primary focus to provide long-term, self-directed investing rather than high-frequency trading.

Freetrade is also authorised by the UK’s Financial Conduct Authority, which provides a high level of investor protection and trust.

Consider Trading with Freetrade If:

| Freetrade is an excellent Broker for: | - Need a well-regulated broker.

- Long-term investing.

- Stock Trading and Investment.

- Access to robust proprietary trading platform.

- Looking for broker with a Top-Tier license.

- Secure trading environment.

- Low trading fees.

- Need broker with no minimum deposit requirement.

- Commission-free trading.

- For UK traders.

- Beginner and experienced investors. |

Avoid Trading with Freetrade If:

| Freetrade might not be the best for: | - Who need good research and educational materials.

- Who prefer to trade with industry-known MT4/MT5, or cTrader platforms.

- Investors seeking margin multiplier or leverage.

- Looking for broker with 24/7 customer support.

- Investors outside the UK. |

Regulation and Security Measures

Score – 4.7/5

Freetrade Regulatory Overview

Freetrade operates under strong regulatory oversight of the UK’s FCA. This ensures that the broker adheres to strict standards of client fund protection, transparency, and operational integrity.

As an FCA-regulated firm, the firm is required to segregate client assets from company funds and is also covered by the Financial Services Compensation Scheme, which protects eligible clients’ accounts up to £85,000 in the case of firm insolvency.

How Safe is Trading with Freetrade?

Trading with Freetrade is considered safe, as the broker is regulated by one of the most reputable financial regulators globally. This means that the firm must adhere to strict rules regarding the protection of client assets, financial conduct, and operational transparency.

Consistency and Clarity

Freetrade has built a solid reputation in the UK’s financial market, known for its transparency, user-friendly platform, and commitment to commission-free investing.

The broker has received positive reviews from many investors, particularly for its simplicity, mobile-first experience, and access to fractional shares. However, some users have expressed concerns about the lack of advanced features and limited product offerings compared to traditional brokers.

While the company has not received many industry awards, it has gained recognition in financial media and among the UK’s investment community.

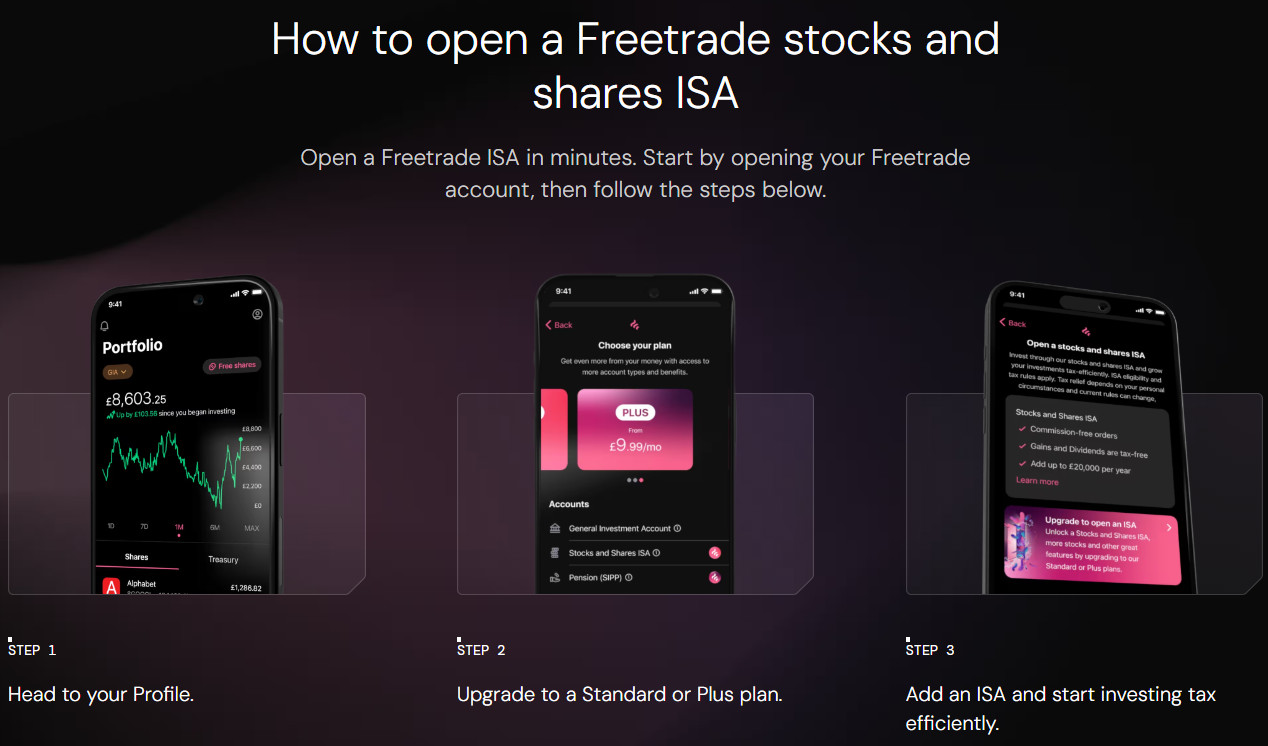

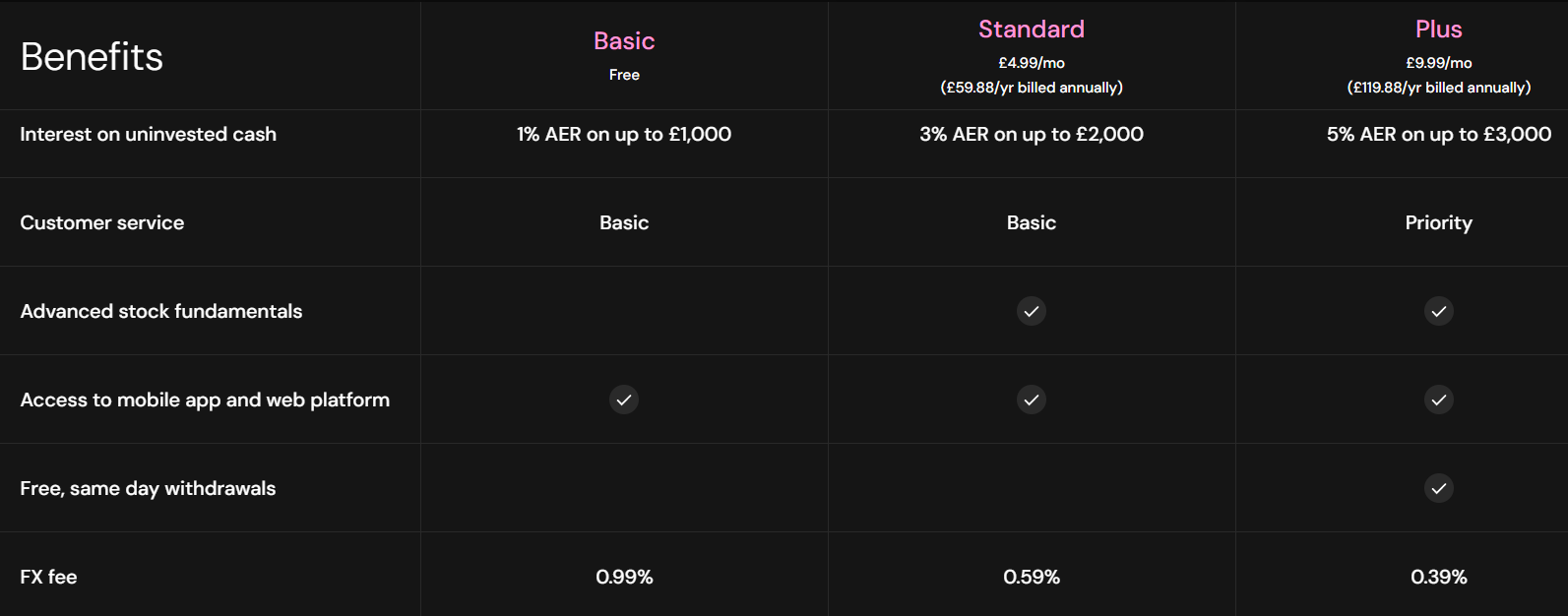

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Freetrade?

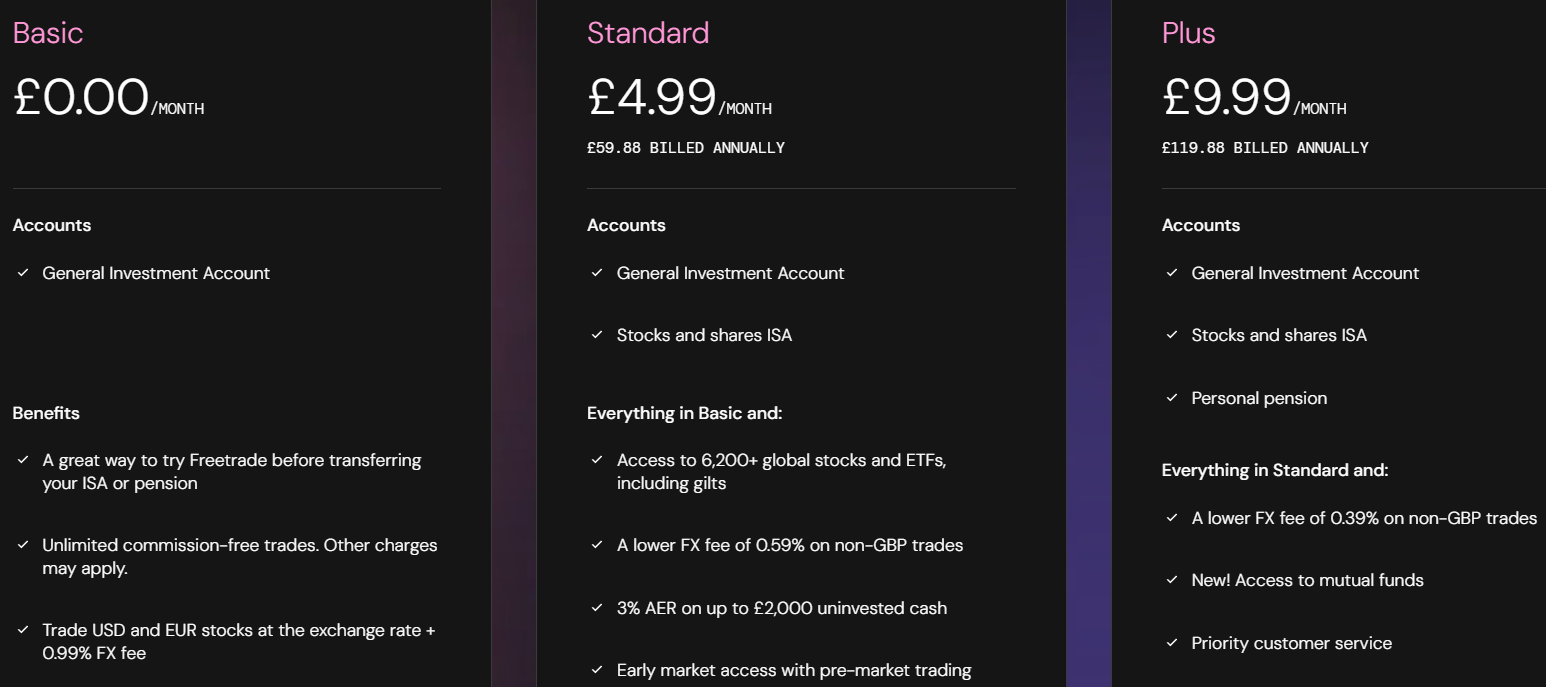

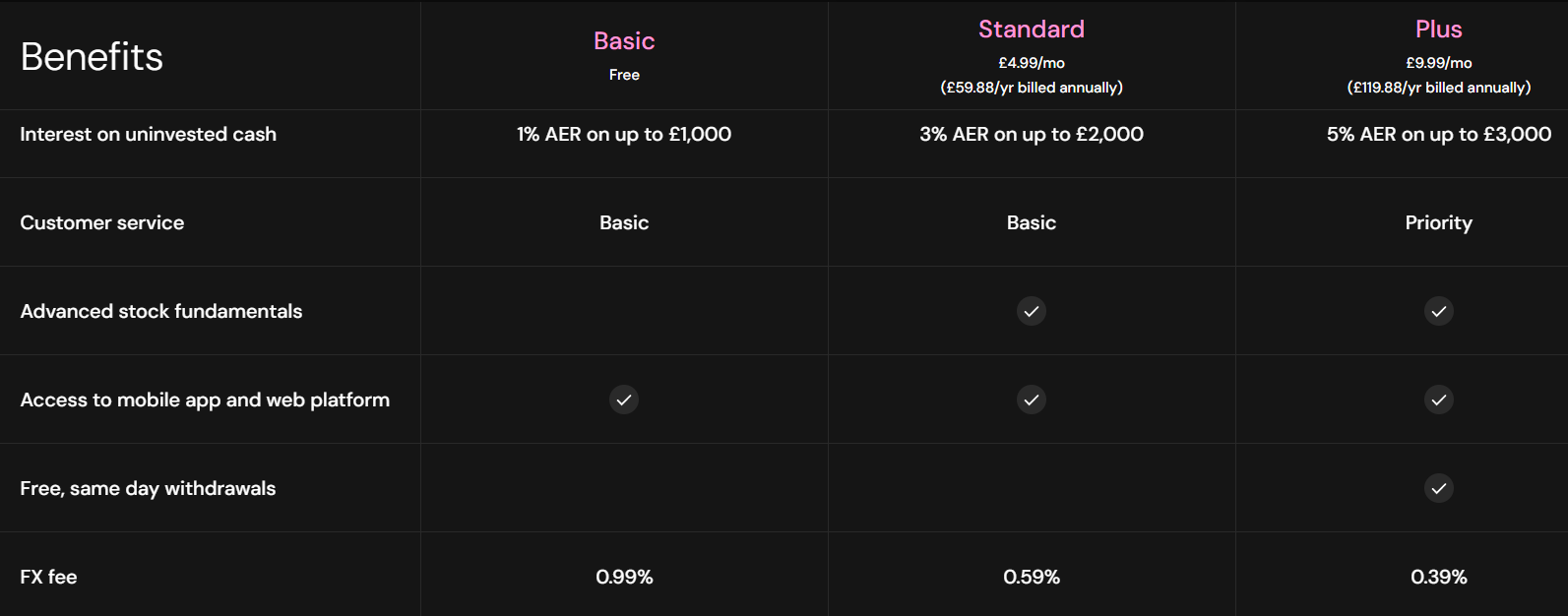

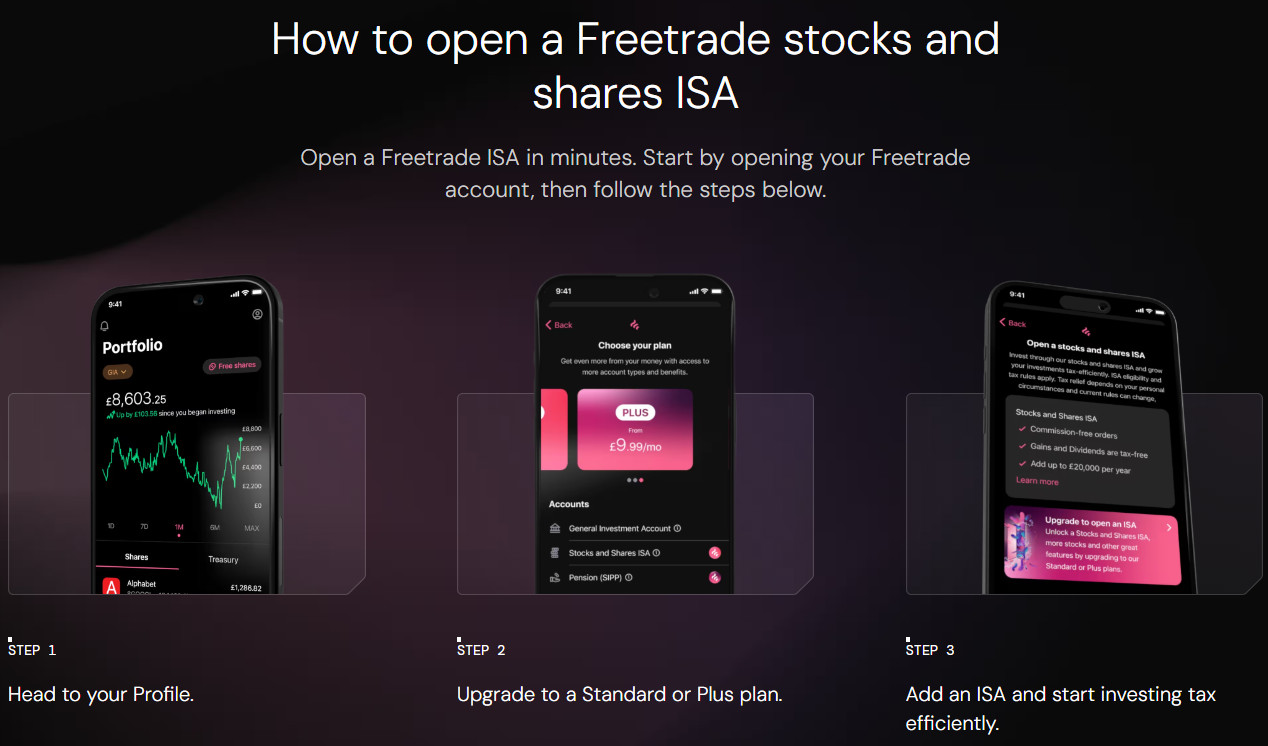

Freetrade offers four main account types across three subscription plans: Basic, Standard, and Plus. The General Investment Account is available to all users, including those on the free Basic plan, and allows flexible and taxable investing.

The Stocks and Shares ISA, which offers tax-free investing, is included in the Standard and Plus plans. For retirement-focused investors, the Self-Invested Personal Pension is available under the Plus plan, offering long-term tax benefits and portfolio control.

Additionally, all users can access the Treasury Bill account, which pays interest on uninvested cash. However, Freetrade does not offer a demo account, so traders must initially deposit real money.

General Investment Account

The General Investment account is a flexible, commission-free account available across all plans. It allows users to invest in UK, US, and European stocks, ETFs, and UK Treasury bills without any account-opening or monthly fees. There is no minimum deposit requirement, which is an advantage for beginners and casual investors.

While trades are commission-free, FX fees apply to non-GBP transactions, with rates varying by plan, from 0.99% to 0.39%.

The account does not offer any tax advantages; however, it provides full flexibility, allowing investors to withdraw their funds at any time without penalties, ideal for those who want simple and unrestricted investing.

Regions Where Freetrade is Restricted

Freetrade is currently only available to UK tax residents with a UK bank account, and it is restricted to all other regions, including most of Europe.

Cost Structure and Fees

Score – 4.7/5

Freetrade Brokerage Fees

Freetrade offers commission-free trading on UK, US, and European stocks and ETFs, with no account or inactivity fees on its Basic plan.

However, a foreign exchange fee applies for non-GBP trades, like 0.99% on Basic, 0.59% on Standard, and 0.39% on Plus. Paid plans also include additional features like ISAs, SIPPs, and higher interest on uninvested cash.

The broker does not charge commissions on most of the stocks and ETFs. However, it applies FX fees for non-GBP trades, ranging from 0.99% on the Basic plan to 0.39% on the Plus plan.

Additionally, standard charges like UK stamp duty and ETF management fees still apply.

Freetrade applies a FX fee on all non-GBP trades, charged in addition to the standard exchange rate. The fee structure varies by subscription plan: 0.99% for Basic, 0.59% for Standard, and 0.39% for Plus.

The fees affect the purchase and sale of international assets, such as US and European stocks.

- Freetrade Rollover / Swaps

Freetrade does not impose any rollover or swap fees, as it offers direct market access to stocks and ETFs, not leverage-based derivative products like CFDs or Forex, where such fees are common.

- Freetrade Additional Fees

While there are no inactivity, custody, or deposit fees, traders may encounter a £17 fee per US stock holding when transferring shares out to another broker.

Additionally, Freetrade charges £5 for same-day withdrawals, while standard withdrawals remain free.

How Competitive Are Freetrade Fees?

Generally, Freetrade’s fee structure is highly competitive, especially for long-term investors. The main advantage is zero-commission trading across a range of UK, US, and European stocks and ETFs. Additionally, the platform offers a much more accessible entry point.

Overall, Freetrade offers great value for investors who prefer low-frequency trading or primarily invest in GBP-based assets.

| Asset/ Pair | Freetrade Commission | Vanguard Commission | TastyTrade Commission |

|---|

| Stocks Fees | From $0 | From $0 | $0.0008 + $0.000166 |

| Fractional Shares | £2 | $1 | $0 |

| Options Fees | - | From $0 | $1 |

| ETFs Fees | From $0 | $0 | $0 |

| Free Stocks | Yes | Yes | Yes |

Trading Platforms and Tools

Score – 4.3/5

Freetrade offers its proprietary trading platform, designed with simplicity and suitable for beginner to intermediate investors.

The platform is available via mobile and web wth an intuitive and user-friendly interface. However, it does not provide advanced charting tools or technical analysis features; instead, it supports watchlists and basic performance tracking.

Trading Platform Comparison to Other Brokers:

| Platforms | Freetrade Platforms | Vanguard Platforms | TastyTrade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Freetrade Web Platform

The broker’s web platform offers a clean and intuitive interface that mirrors the simplicity of its mobile app. Designed for ease of use, it allows investors to manage their portfolios, place trades, and monitor market movements with a few clicks.

While it lacks advanced tools such as technical indicators, charting tools, or real-time market depth, it caters well to long-term investors who prioritize direct access to UK, US, and EU stocks and ETFs.

Freetrade Desktop MetaTrader 4 Platform

Freetrade does not offer the MT4 platform. Traders looking to use MT4’s interface or automated trading features should consider alternative brokers that support it.

Freetrade Desktop MetaTrader 5 Platform

Similarly, Freetrade does not support MetaTrader 5. The broker focuses on its proprietary trading platform, instead of offering third-party platforms.

Freetrade MobileTrader App

Freetrade’s MobileTrader is suitable for beginners and long-term investors. The interface is clean and simple, featuring essential functions, though some users report a lack of advanced analytical tools.

Overall, the app delivers a smooth and reliable mobile investing experience, making it easy for investors to manage their portfolios on the go without unnecessary complexity.

Main Insights from Testing

Testing the Freetrade mobile app reveals a seamless and beginner-friendly user experience, with smooth navigation and quick access to essential investing features.

While it lacks real-time market data and customization options, the app performs with minimal bugs, offering a stable platform for straightforward, long-term investing.

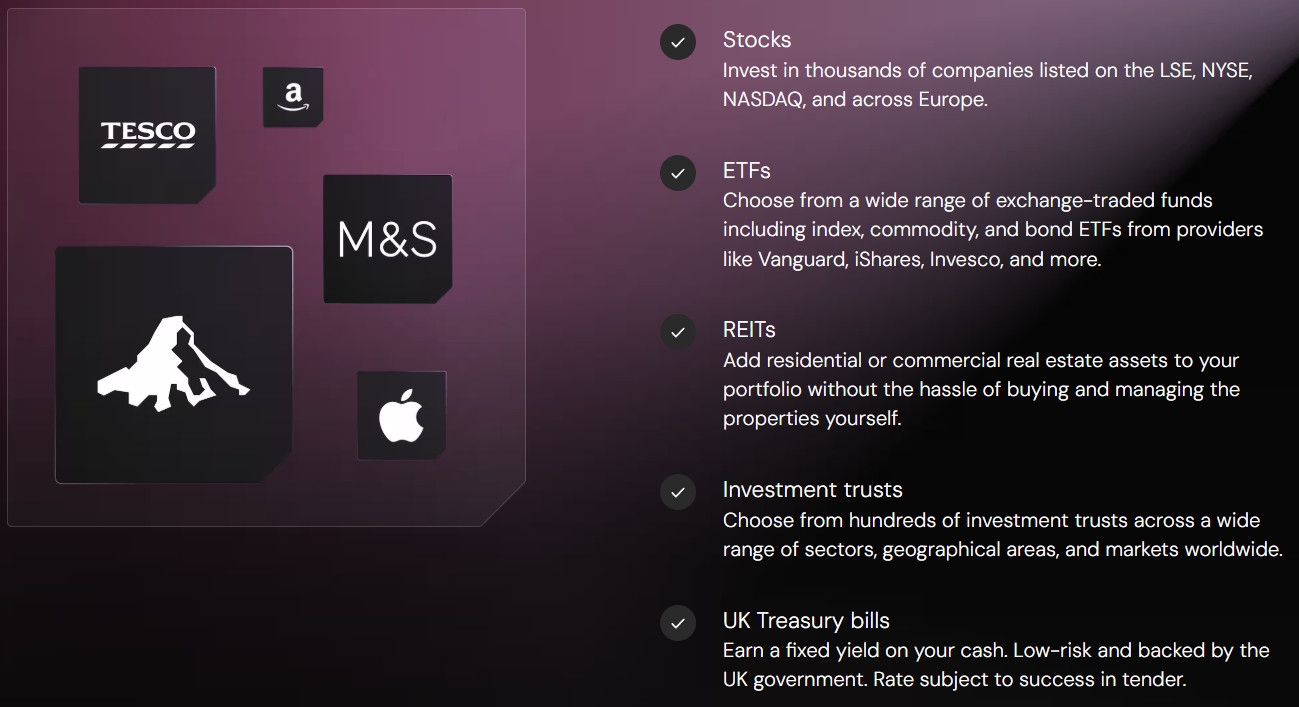

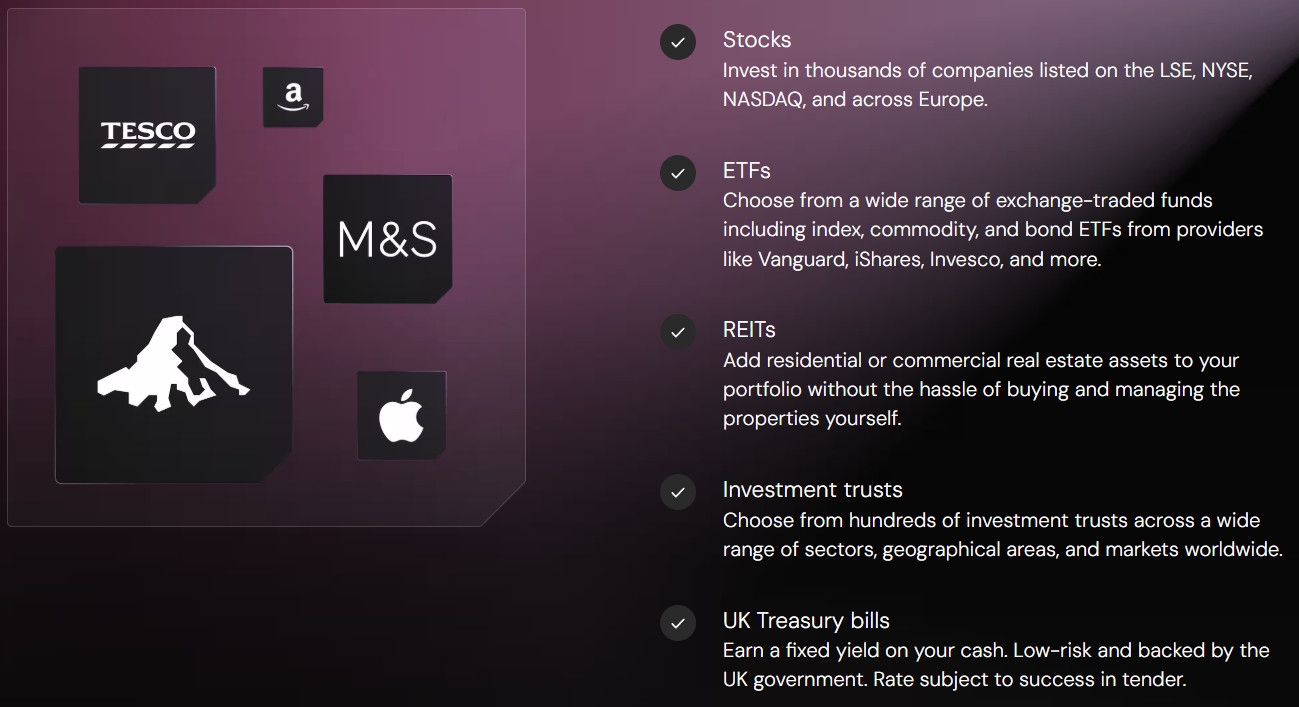

Trading Instruments

Score – 4.5/5

What Can You Trade on Freetrade’s Platform?

Freetrade offers access to over 6,000 trading products, including UK, US, and European stocks, more than 1,000 ETFs, as well as investment trusts, fractional shares, bonds, equities, and UK Treasury bills.

However, the platform does not support complex financial products such as options, futures, mutual funds, or cryptocurrencies.

Main Insights from Exploring Freetrade’s Tradable Assets

Exploring Freetrade’s tradable assets reveals a platform tailored for simplicity and long-term investment strategies. The asset selection focuses on core investment products, without overwhelming users with high-risk instruments.

While advanced traders might find the selection limited, the available assets are well-suited for building diversified portfolios with a focus on transparency and accessibility.

Leverage Options at Freetrade

Freetrade does not offer any multiplier or margin trading. The platform provides only cash-based investment accounts, meaning you can only trade with the funds you have deposited.

Freetrade views margin trading as a risky practice that conflicts with their focus on long-term investing

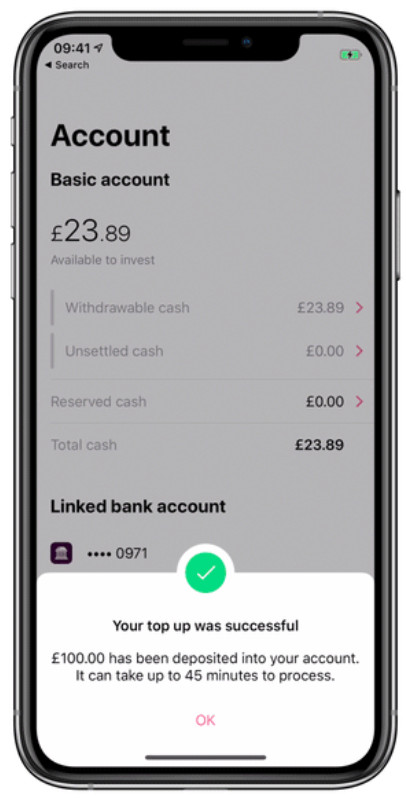

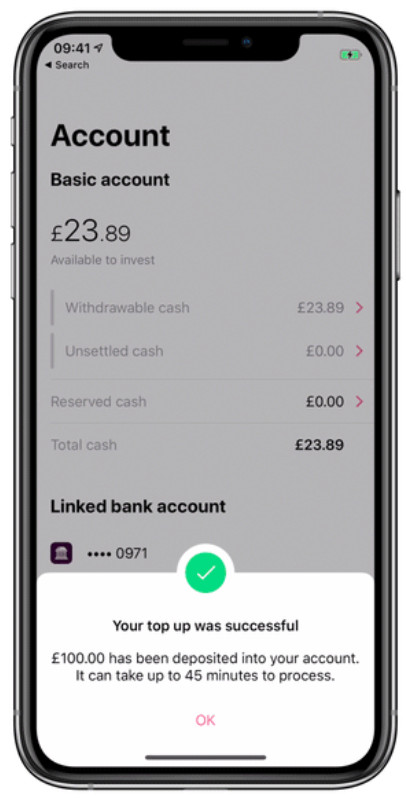

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Freetrade

In terms of funding methods, Freetrade offers the following payment methods:

- Credit/Debit cards

- Wire Transfer

- Apple Pay

- Google Pay

Freetrade Minimum Deposit

There is no minimum deposit requirement for Freetrade. This makes the platform highly accessible for new investors, allowing users to start small and scale their investment over time.

Withdrawal Options at Freetrade

Freetrade allows you to withdraw money anytime to your linked UK bank account, using the same account you used for deposits. Withdrawal requests are processed via BACs, typically taking 2-3 working days for Freetrade to initiate, followed by 3-5 additional days for the funds to reach your bank.

There are no standard withdrawal fees; however, Freetrade charges £5 for same-day withdrawal requests.

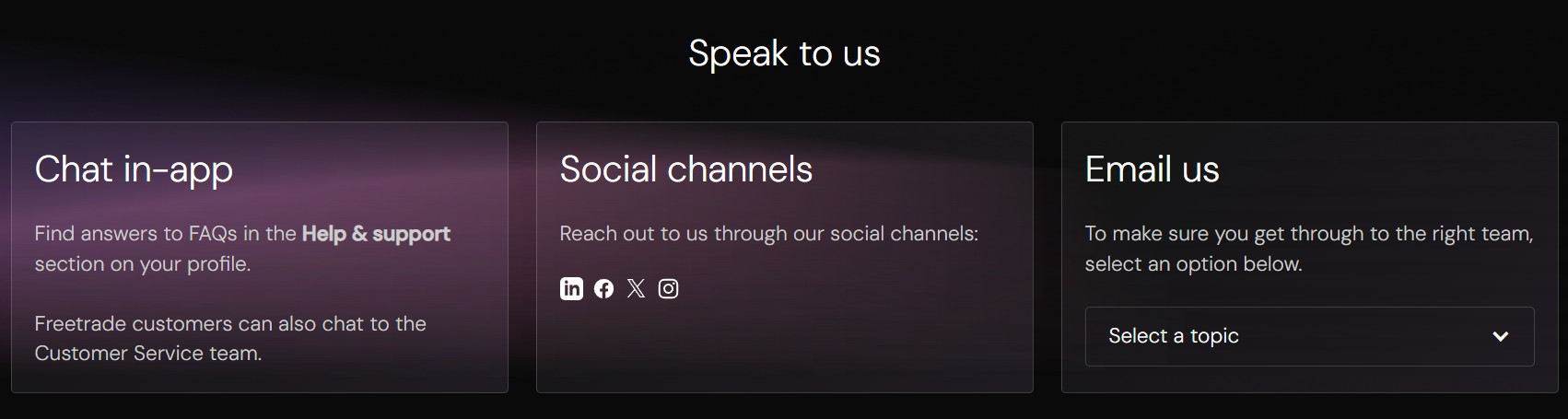

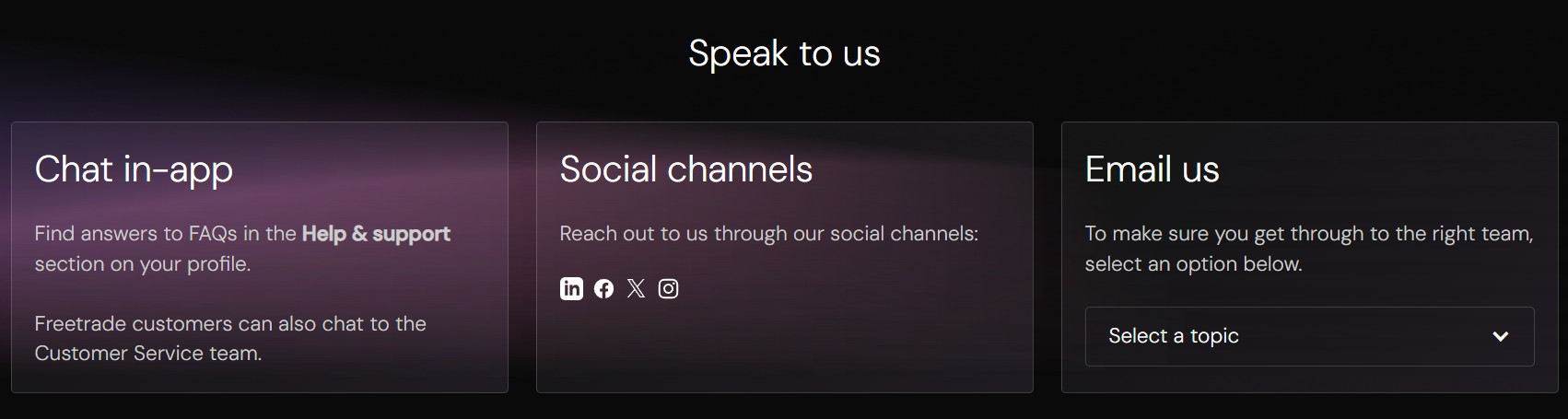

Customer Support and Responsiveness

Score – 4.3/5

Testing Freetrade’s Customer Support

Freetrade offers 24/5 customer support via chat in-app, email, live chat, social media channels, and Help Hub.

Freetrade’s customer support is generally responsive; however, the response times can vary, with some users reporting delays during busy periods.

Contacts Freetrade

Freetrade provides customer support mainly through in-app messaging and email. For general inquiries, you can contact them at contact@freetrade.io or call +44 203 488 2539.

Research and Education

Score – 4.4/5

Research Tools Freetrade

Freetrade offers a set of research tools to support informed trading decisions.

- The platform provides real-time market data, including quotes, news, and performance tracking, to help users stay informed about their investments.

- Additionally, users can access fundamental data such as earnings reports and key financial metrics for individual securities.

- Also, Freetrade offers portfolio analysis tools that allow users to assess their holdings’ performance and diversification.

Overall, the broker’s research capabilities are suitable for investors seeking a straightforward approach without the complexity of advanced analytical tools.

Education

Freetrade does not offer extensive educational materials, only providing Learning Guides that cover topics from the basics of stock investing to more advanced concepts like interest rates and portfolio diversification.

Additionally, Freetrade’s Articles delve into specific investment strategies and market dynamics, including discussions on penny stocks, cash management in portfolios, and the impact of interest rates on investments.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Freetrade

Freetrade offers a range of investment options for long-term investors. Users can invest in thousands of UK, US, and European stocks, as well as a wide selection of Exchange-Traded Funds (ETFs), providing ample opportunities for portfolio diversification.

The platform also supports fractional shares, allowing users to invest in high-priced stocks with smaller amounts, accessible for beginners and those looking to gradually build their portfolios.

Account Opening

Score – 4.5/5

How to Open Freetrade Demo Account?

Freetrade does not offer a traditional demo or paper trading account where users can simulate trades with virtual funds. All accounts are live and require real money to trade

How to Open Freetrade Live Account?

To open a live trading account with Freetrade, follow these steps to get started with investing on the broker’s platform:

- Sign up by creating an account using your email address and verifying it.

- Provide your details, including full name, date of birth, address, and National Insurance number (for UK residents).

- Verify your identity by uploading a valid form of identification.

- Choose the type of account you want to open.

- Link your UK bank account to enable deposits and withdrawals.

- Deposit funds into your account, starting from as little as £2.

- Start exploring the available investment options and begin building your portfolio.

Additional Tools and Features

Score – 4.2/5

In addition to the main research tools, Freetrade offers several other features to enhance the user experience.

- These include real-time price updates for Plus subscribers, customizable watchlists to monitor preferred assets, and a simple in-app dividend tracking system.

- Investors also benefit from push notifications for corporate actions and account activity.

Freetrade Compared to Other Brokers

Compared to its competitors, Freetrade stands out as a straightforward, low-cost investment platform tailored for long-term investors seeking simplicity and ease of use.

Unlike stock trading providers such as Interactive Brokers or TD Ameritrade, which cater to active traders with extensive tools, futures trading, and advanced assets, Freetrade focuses on commission-free stock and ETF investing, including fractional shares.

While it lacks advanced charting tools and broad asset classes like futures or options, it offers a user-friendly proprietary platform and tax-advantaged account options ideal for UK investors.

However, regarding educational resources and platform depth, Freetrade remains more limited than providers like Interactive Brokers or Webull, which appeal to more experienced traders.

| Parameter |

Freetrade |

Vanguard |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from $0 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

Freetrade Platform |

Proprietary trading platform, Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

FCA |

SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$0 |

$0 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker Freetrade

Freetrade is a UK-based, reliable Stock Trading platform primarily for long-term investors seeking a simple and cost-effective way to build their portfolios.

The broker offers commission-free trading on UK, US, and European stocks and ETFs, along with access to Fractional Shares. Users can choose from various account types, including a General Investment Account, Stocks and Shares ISA, SIPP, and a Treasury Bill account.

The proprietary Freetrade platform is intuitive and easy to use; however, it does not support complex trading products, margin accounts, or advanced research tools. Overall, Freetrade is best suited for beginner to intermediate investors focused on long-term, self-directed investment strategies.

Share this article [addtoany url="https://55brokers.com/freetrade-review/" title="Freetrade"]