- What is MarketsVox?

- MarketsVox Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- MarketsVox Compared to Other Brokers

- Full Review of Broker MarketsVox

Overall Rating 4.3

| Regulation and Security | 3.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is MarketsVox?

MarketsVox is a brokerage and trading firm based in Seychelles. It is quickly expanding, becoming the choice of many traders. The founders of the brokerage firm are traders who are very well acquainted with traders’ needs. This is why MarketsVox has considered the needs and expectations of traders while establishing the firm.

The broker is based in Seychelles, holding FSA regulation that allows the broker to give access to traders from across the globe. In our MarketsVox Review, we will introduce more of the details and conditions the broker proposes so that you will be able to decide whether this broker is good for you.

MarketsVox Pros and Cons

Our experts find MarketsVox a broker with good quality service. The broker offers user-friendly trading conditions, with a choice of the MT5 trading platform, fast and straightforward account opening process. The broker has created special chatting rooms, where traders can write their questions and concerns and get answers from specialists and other traders.

As for the cons, the broker seems to have a limited trading market range that is traded only on a CFD basis. Additionally, the broker does not currently hold any reputable or top-tier licenses, which may raise concerns among traders. Also, the education is limited, and the support is available only 24/5.

| Advantages | Disadvantages |

|---|

| MT5 trading platform | No reputable license |

| International trading | Only Forex and CFDs

|

| Great technical solution and tools | |

| Competitive trading conditions | |

| Suitable for beginners and professionals | |

MarketsVox Features

MarketsVox provides traders with access to popular trading instruments. The platform offers competitive spreads, fast trade execution, and leverage options to suit different trading styles. Here is the comprehensive list of its main features:

MarketsVox Features in 10 Points

| 🏢 Regulation | FSA |

| 🗺️ Account Types | Cent, Standard, ECN Accounts |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, Indices, Metals, Commodities |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, GBP, EUR |

| 📚 Trading Education | Glossary |

| ☎ Customer Support | 24/5 |

Who is MarketsVox For?

With flexible account options, access to a range of CFD instruments, and a user-friendly MetaTrader 5, MarketsVox caters to both casual traders and active investors. Based on our findings and Financial Expert Opinion, MarketsVox is Good for:

- Beginning Traders

- Professional Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer MT5

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

MarketsVox Summary

Although MarketsVox is a relatively new brokerage firm and does not hold a Top-Tier license, it has managed to win traders’ trust and build its client portfolio. We find the broker’s proposals good.

For MarketsVox clients, convenience is a priority hence, it offers quality support for traders available in two languages. Another advantage is that the broker spreads its proposals and services across the globe.

What we also liked, one of the advantages the broker stands out for, is the specifically created chatrooms, where traders can get their answers, discuss the market trends, and find useful advice and recommendations from experts.

55Brokers Professional Insights

MarketsVox stands out by offering a good selection of CFDs across Forex, commodities, indices, and metals, combined with competitive spreads, fast execution speeds, and access to the widely respected MetaTrader 5 platform.

The broker appeals to traders looking for flexible leverage options, a variety of account types, and a straightforward, easy-to-navigate trading experience. However, while MarketsVox provides solid trading conditions, it currently lacks regulation from any reliable financial authorities, which may raise concerns for more risk-conscious traders.

Additionally, the limited educational resources and absence of advanced research tools might not fully meet the needs of those seeking in-depth market analysis and professional-grade support.

Consider Trading with MarketsVox If:

| MarketsVox is an excellent Broker for: | - Looking for broker with low minimum deposit requirement.

- Providing competitive fees and spreads.

- Offering popular trading instruments.

- Get access to MT5 trading platform.

- Broker with a variety of trading strategies.

- Offering MAM/PAMM trading.

- Who prefer higher leverage up to 1:2000.

- Beginners and professional traders.

- Providing Copy Trading.

- Access to VPS Hosting.

|

Avoid Trading with MarketsVox If:

| MarketsVox might not be the best for: | - Need a broker with reliable license.

- Need a broker with good educational materials.

- Looking for broker with 24/7 customer support.

- Who prefer alternative trading platforms. |

Regulation and Security Measures

Score – 3.8/5

MarketsVox Regulatory Overview

MarketsVox operates under the trade name of MarketsVox (SC) Ltd, a company registered in the Republic of Seychelles. It is authorized and regulated by the Financial Services Authority (FSA) of Seychelles, holding a Securities Dealer License with the number SD142.

The FSA aims to maintain a robust and modern regulatory framework, ensuring compliance with international standards and protecting the interests of investors. However, it is largely considered an offshore authority on the global stage. Traders should keep this in mind when evaluating the regulatory environment of MarketsVox.

How Safe is Trading with MarketsVox?

While MarketsVox has gained a reputation for its competitive trading conditions, trading with the broker carries some risks. Although the broker is regulated by the Financial Services Authority (FSA) of Seychelles, this is considered a lower-tier offshore regulator, offering less investor protection compared to top-tier authorities.

Consistency and Clarity

MarketsVox has earned recognition for offering competitive trading conditions, but its reputation among traders is mixed. While some traders appreciate its user-friendly platform and diverse range of instruments, others have raised concerns about issues like withdrawal delays and account suspensions.

Broker reviews across various platforms reflect both advantages, such as competitive spreads and fast execution, and drawbacks, such as the lack of top-tier regulatory oversight. Additionally, MarketsVox’s establishment in Seychelles and its offshore regulation may raise concerns for some traders about investor protection.

In terms of social presence, the broker has been involved in sponsorships and other marketing activities, helping to increase its visibility within the trading community. However, despite its positive aspects, the broker’s overall reputation remains a subject of debate, and traders should carefully weigh both the advantages and risks before engaging.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with MarketsVox?

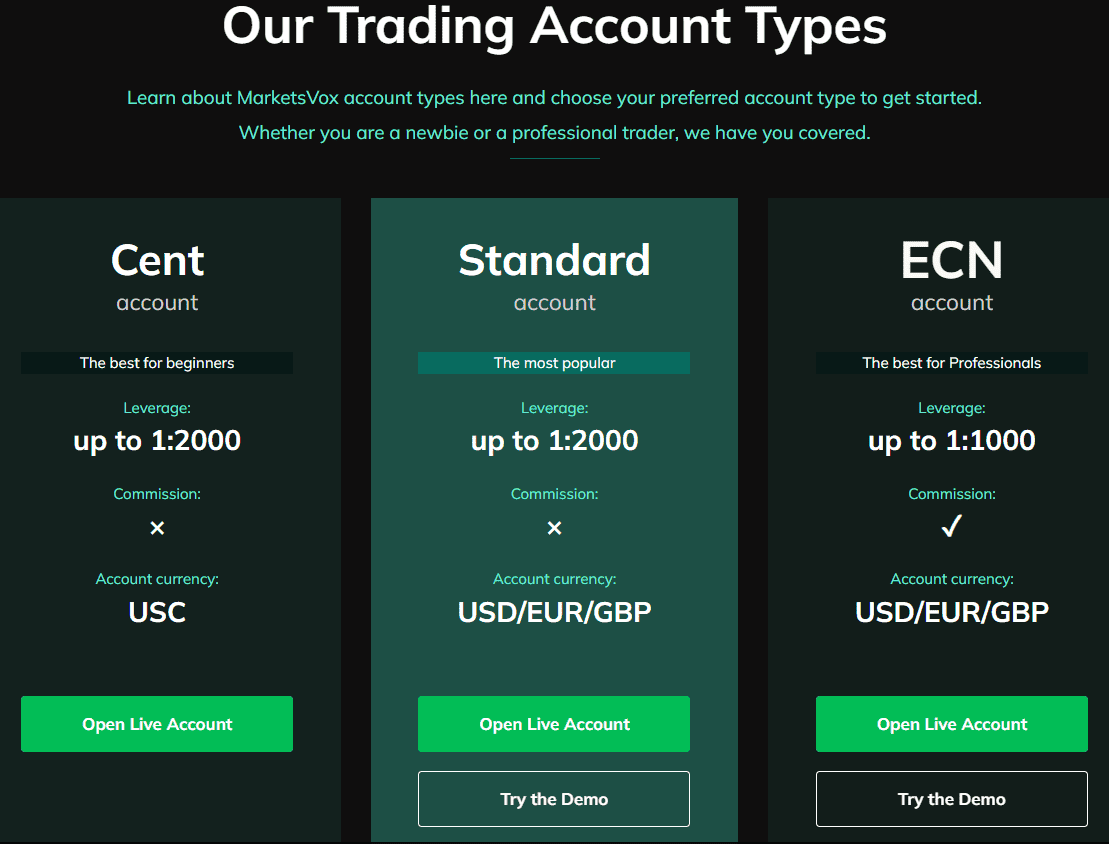

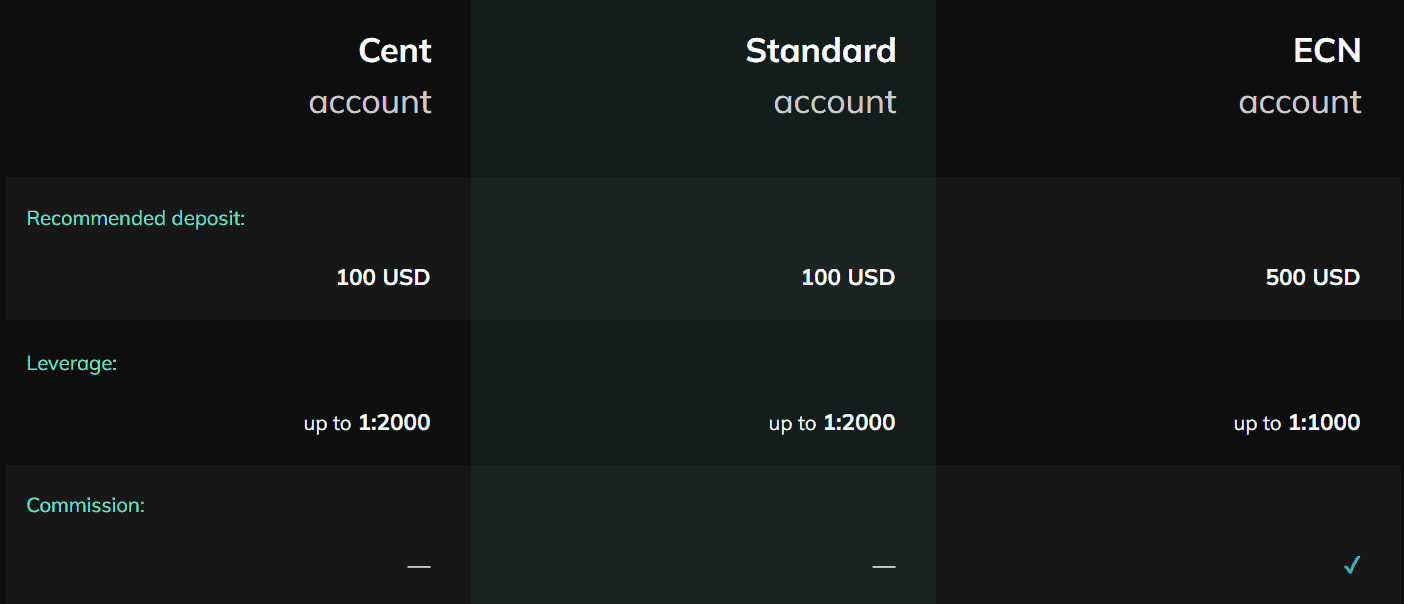

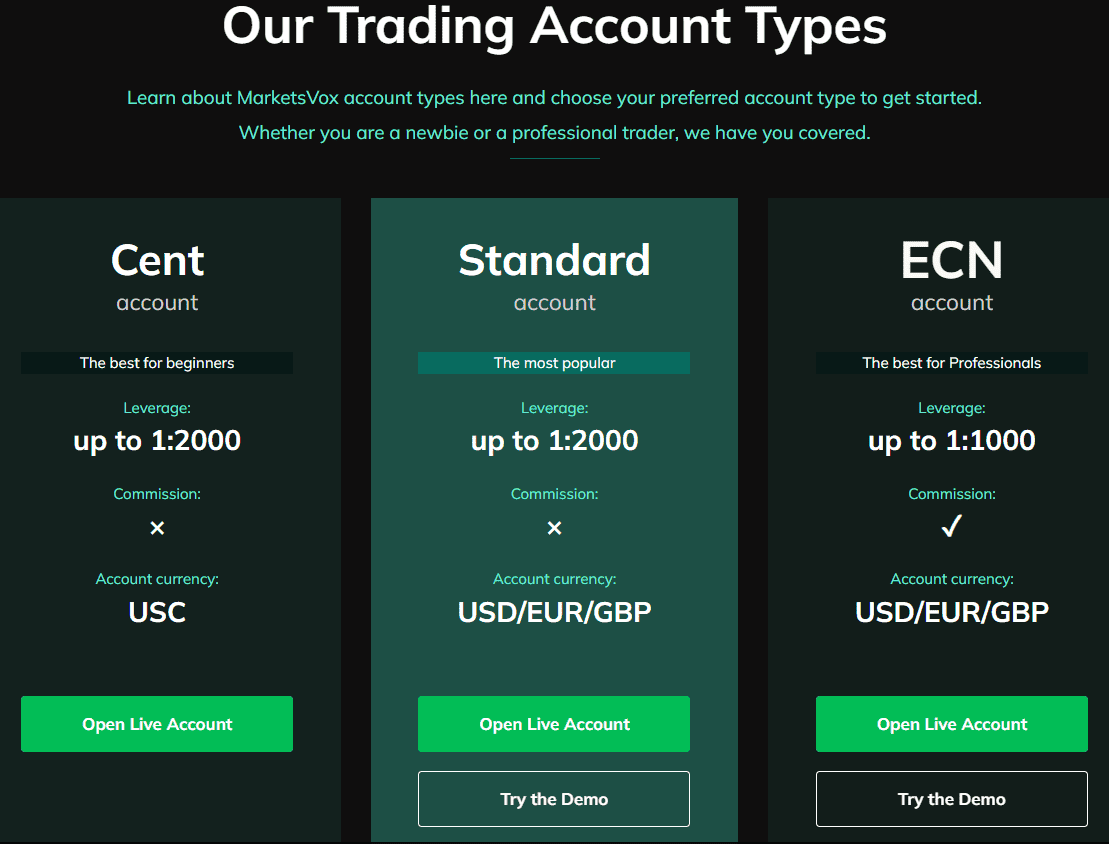

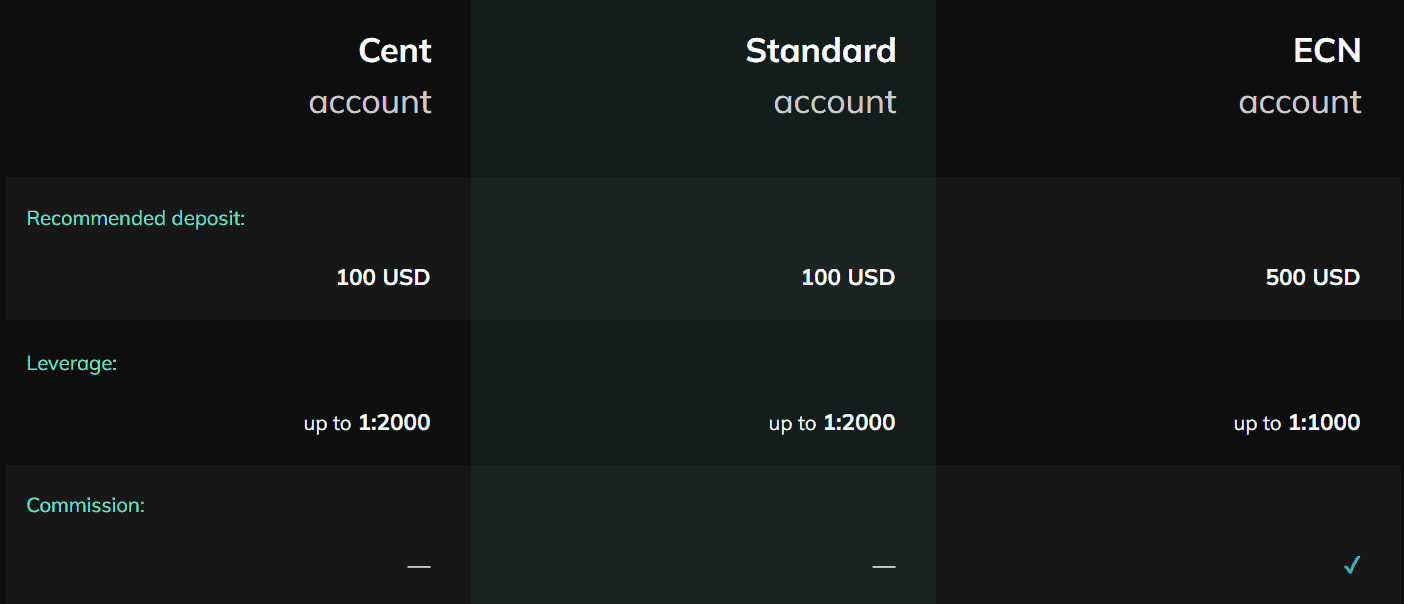

MarketsVox offers three main account types: Cent, Standard, and ECN Account. The Standard and Cent accounts are commission-free STP accounts. The spreads start from 1 point. Traders are recommended to make a $100 initial deposit.

On the other hand, the ECN account is an advanced account with a commission. It offers tighter spreads, starting from 0 pip. To start with, traders are advised to make a $500 deposit.

Additionally, MarketsVox provides a Demo Account, allowing traders to practice and familiarize themselves with the trading platforms and market conditions without risking real capital. For clients seeking interest-free trading, a Swap-Free Account is available, enabling trading without overnight fees.

Standard Account

The Standard Account is designed for traders seeking a balance between accessibility and trading flexibility. With a minimum deposit requirement of $100, it offers leverage up to 1:2000 and supports account currencies in USD, EUR, and GBP.

Traders benefit from commission-free trading, making it an attractive option for those who prefer straightforward pricing. The account provides access to over 90 trading instruments, including Forex, indices, commodities, and metals, all through the MetaTrader 5 platform.

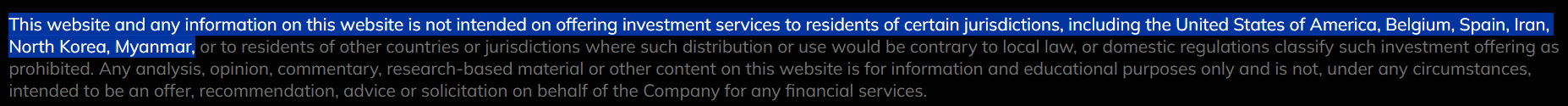

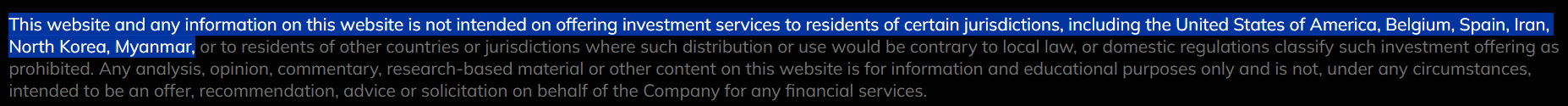

Regions Where MarketsVox is Restricted

MarketsVox’s services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide trading services in countries including:

- USA

- Belgium

- Spain

- Iran

- North Korea

- Myanmar, etc.

Cost Structure and Fees

Score – 4.4/5

MarketsVox Brokerage Fees

MarketsVox trading fees are mostly based on spreads. For Standard and Cent accounts, there is no commission fee. However, ECN accounts are commission-based. The broker does not have any hidden costs, and the overall fees offered are either none or small.

MarketsVox offers tight spreads that are considerably lower compared to the industry average. The average spread for the EUR/USD Forex currency pair is 0.1 pips. The broker’s flexible spread structure ensures cost-effective trading solutions, allowing traders to choose the option that best suits their needs.

MarketsVox offers a competitive commission structure through its ECN account, catering to different trading styles and preferences. Designed for professional traders, the ECN account charges a commission of $6 per lot traded.

- MarketsVox Rollover / Swaps

MarketsVox offers rollover (swap) rates that vary based on the interest rate differentials between the currencies in a pair and whether a trader holds a long or short position.

These rates are subject to daily fluctuations and can be either positive or negative, depending on the prevailing market conditions and the specific currency pair involved.

- MarketsVox Additional Fees

MarketsVox provides a transparent and cost-effective trading environment. While the broker does not charge fees for deposits or withdrawals, third-party providers may impose their fees.

To further enhance trading profitability, MarketsVox offers promotional cashback programs. For example, traders can earn $2 for every lot traded on Standard Accounts and $1 per lot on ECN Accounts, provided they meet specific conditions, such as a minimum deposit and trade duration requirements.

How Competitive Are MarketsVox Fees?

MarketsVox offers relatively competitive fees compared to many brokers in the industry. The broker does not charge commissions on its Standard Account, making it appealing to traders who prefer straightforward pricing.

For traders using the ECN Account, the fees are generally competitive, with a commission of $6 per lot, which is in line with industry standards for direct market access accounts. Additionally, the broker provides rebate programs that can help reduce trading costs for active traders.

While the fees are generally competitive, traders should be aware that the lack of top-tier regulation may influence overall fee transparency and stability.

| Asset/ Pair | MarketsVox Spread | GoldWell Spread | Sucden Financial Spread |

|---|

| EUR USD Spread | 0.1 pips | 1.8 pips | 1 pip |

| Crude Oil WTI Spread | 3.6 | 4 | 3 |

| Gold Spread | 23 | 50 cents | 1 |

Trading Platforms and Tools

Score – 4.5/5

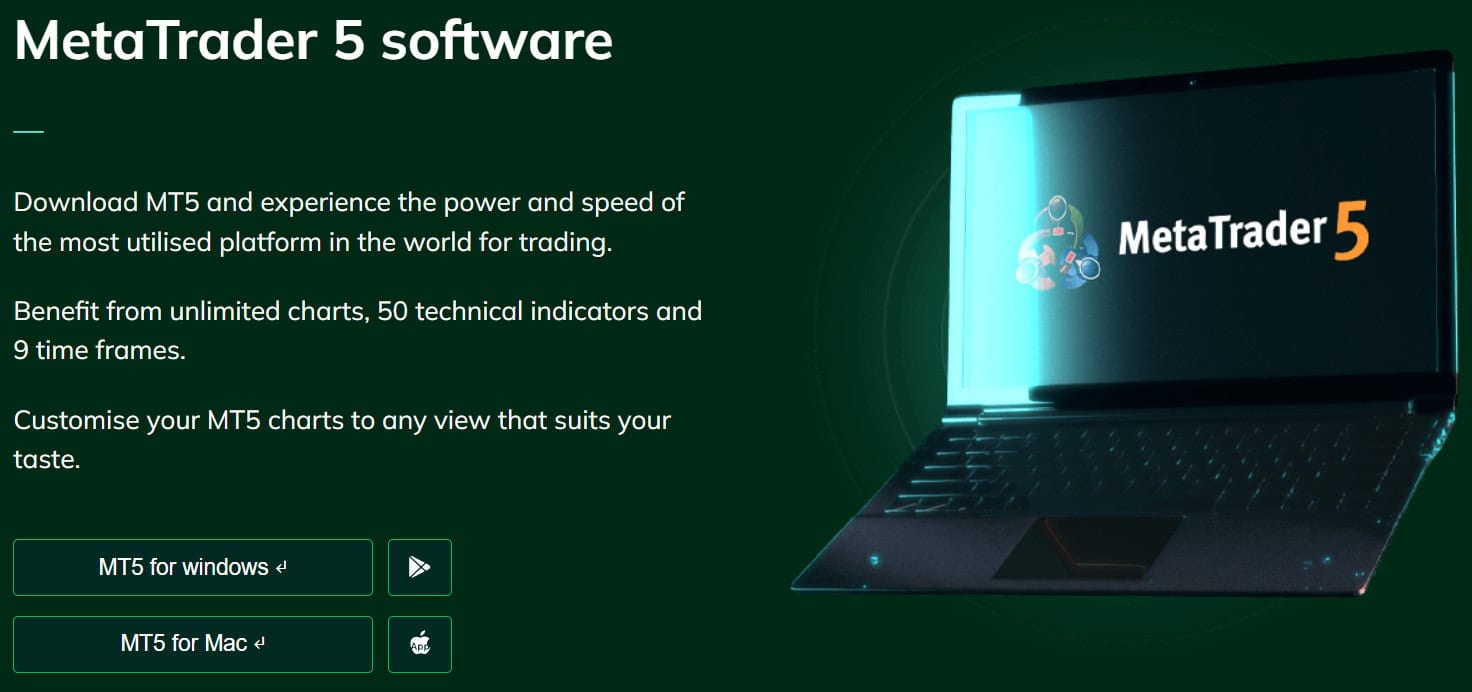

MarketsVox offers a comprehensive trading experience through the MetaTrader 5 platform, widely recognized for its advanced features and user-friendly interface.

The platform provides multiple chart types, over 50 technical indicators, and multiple timeframes, facilitating detailed market analysis. Additionally, MT5 is accessible across desktop, web, and mobile devices, ensuring traders can manage their accounts and execute trades conveniently from anywhere.

MarketsVox further enhances the trading experience with MVSocial, an exclusive MT5-integrated social trading platform. MVSocial allows traders to engage in copy trading, share strategies, and participate in a community-driven environment, promoting collaborative learning and trading.

Trading Platform Comparison to Other Brokers:

| Platforms | MarketsVox Platforms | GoldWell Platforms | Sucden Financial Platforms |

|---|

| MT4 | No | No | No |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

MarketsVox Web Platform

MarketsVox offers an MT5 WebTrader platform, providing traders with a seamless, browser-based trading experience. Accessible from any device with an internet connection, the MT5 WebTrader eliminates the need for software installation, allowing for immediate access to trading functionalities.

Key features of the MT5 web platform include real-time charting with multiple timeframes, over 50 technical indicators, and advanced order management capabilities.

MarketsVox Desktop MetaTrader 4 Platform

MarketsVox does not offer the MT4 platform. The broker exclusively provides the MT5 platform, which is widely recognized for its advanced features and user-friendly interface.

MarketsVox Desktop MetaTrader 5 Platform

MarketsVox offers the MetaTrader 5 desktop platform, providing traders with advanced tools for effective market analysis and trading. With the MT5 desktop version, traders can benefit from unlimited charts, 50 technical indicators, and 9 timeframes, allowing for in-depth analysis and precise decision-making.

The platform also supports automated trading through Expert Advisors (EAs) and is compatible with both Windows and macOS operating systems.

Main Insights from Testing

Testing the MetaTrader 5 platform highlights its efficiency and reliability as a trading tool. Users appreciate its smooth performance and quick order execution, which are critical for time-sensitive trades.

The platform’s advanced charting tools and analytical features provide a clear advantage for traders who require in-depth market insights.

MarketsVox MobileTrader App

The MarketsVox MT5 Mobile App offers traders the flexibility to manage their accounts and execute trades on the go. Available for both iOS and Android devices, this app provides access to a wide range of financial instruments, including Forex, commodities, indices, and metals.

This mobile solution ensures that traders can stay connected and responsive to market movements, regardless of their location.

Trading Instruments

Score – 4.3/5

What Can You Trade on MarketsVox’s Platform?

MarketsVox provides access to trading over 100 underlying assets, choosing from the leading instruments: Indices, Forex, Commodities, and Metals. Thus, the broker enables its clients to trade with the most popular markets. Clients, therefore, can choose the most suitable instrument, taking into account their trading needs.

Main Insights from Exploring MarketsVox’s Tradable Assets

Exploring MarketsVox’s tradable assets reveals a good range of financial instruments catering to various trading strategies. While the available selection of instruments is limited compared to industry-known brokers, the range of tradable assets is still appealing to many traders.

However, traders should consider the market conditions and volatility of these instruments before making decisions.

Leverage Options at MarketsVox

Leverage is a loan given by the broker to the trader. It enables the trader to conduct the trades in a multiplied volume, raising the potential gains. However, it may be risky, too, if the market goes against the trader.

- MarketsVox offers up to a 1:2000 leverage ratio for major Forex pairs and other products.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at MarketsVox

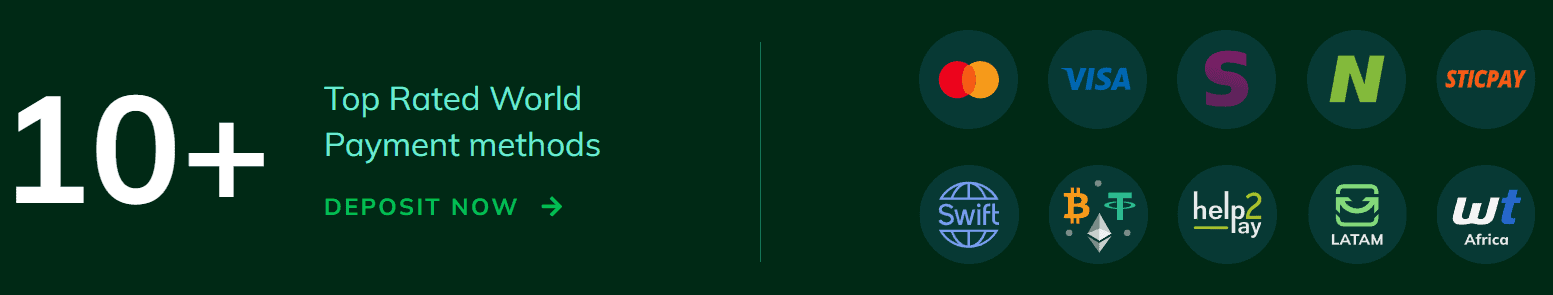

MarketsVox offers 10+ top-rated world payment methods. The wide range of choices gives traders from different countries the opportunity to have access to the payment methods available in their region.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller, and more

MarketsVox Minimum Deposit

MarketsVox offers flexible deposit options across its account types, including Cent, Standard, and ECN accounts. The Standard and Cent accounts have a recommended minimum deposit of $100, while the ECN account requires a recommended minimum deposit of $500.

Withdrawal Options at MarketsVox

MarketsVox charges a withdrawal fee for bank transfers. Every time you transfer funds back to your bank account, these withdrawal fees become relevant.

Clients can withdraw money from their MarketsVox account at any time, provided it is within their account balance.

The funds withdrawn will be transferred to the account used for the deposit. However, the broker also offers the option to choose an alternative withdrawal method.

Customer Support and Responsiveness

Score – 4.5/5

Testing MarketsVox’s Customer Support

As our testing showed, MarketsVox Customer Support is quite good. The service is available 24/5 through live chat, phone, and email. The support is bilingual and quite satisfying, solving the issues customers may face.

Contacts MarketsVox

You can contact MarketsVox via email at support@marketsvox.com or by phone at +248 437 3790. For further inquiries or support, you can also visit their office located at CT House, Office 9A, Providence, Mahe, Seychelles. Additionally, more information can be found on the official website at marketsvox.com.

Research and Education

Score – 4.4/5

Research Tools MarketsVox

One of MarketsVox’s main aims is to support clients with helpful and unique materials and make them better traders. Besides general tools such as economic calendars, charts, and quality market analysis, the broker also offers a range of unique offerings:

- Tech Traders provides a daily 5-minute morning market scan video, daily trade ideas, weekly market analysis videos, an exclusive channel for daily posts, and access to a dedicated trading mentor.

- Reflex Trading offers a unique color-coded strategy, daily pre-market video analysis, daily evening video review, proven track record, and daily charts with colored key levels provided pre-market.

- HF Systems provides access to short-term, systematic trading signals covering a wide range of currency pairs, open positions viewed in real time over the Metatrader platform, screenshots posted frequently to highlight system entry and exit levels, and long-term market analysis based on Elliott Wave theory.

Education

MarketsVox offers limited educational resources, primarily providing a glossary of trading terms. While the glossary can help beginners understand key trading terminology, the broker does not offer in-depth educational materials, tutorials, or courses to support traders in developing their skills.

Traders looking for comprehensive educational content may need to seek resources outside of the platform.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options MarketsVox

MarketsVox, primarily recognized as a Forex and CFD broker, extends its offerings to include investment tools such as MAM and PAMM accounts. These platforms enable investors to allocate funds to professional traders, allowing for hands-off management and potential profit-sharing based on performance.

Additionally, the broker provides copy trading services, where traders can replicate the strategies of successful investors in real-time. These investment options cater to individuals seeking to diversify their portfolios and leverage the expertise of experienced traders.

Account Opening

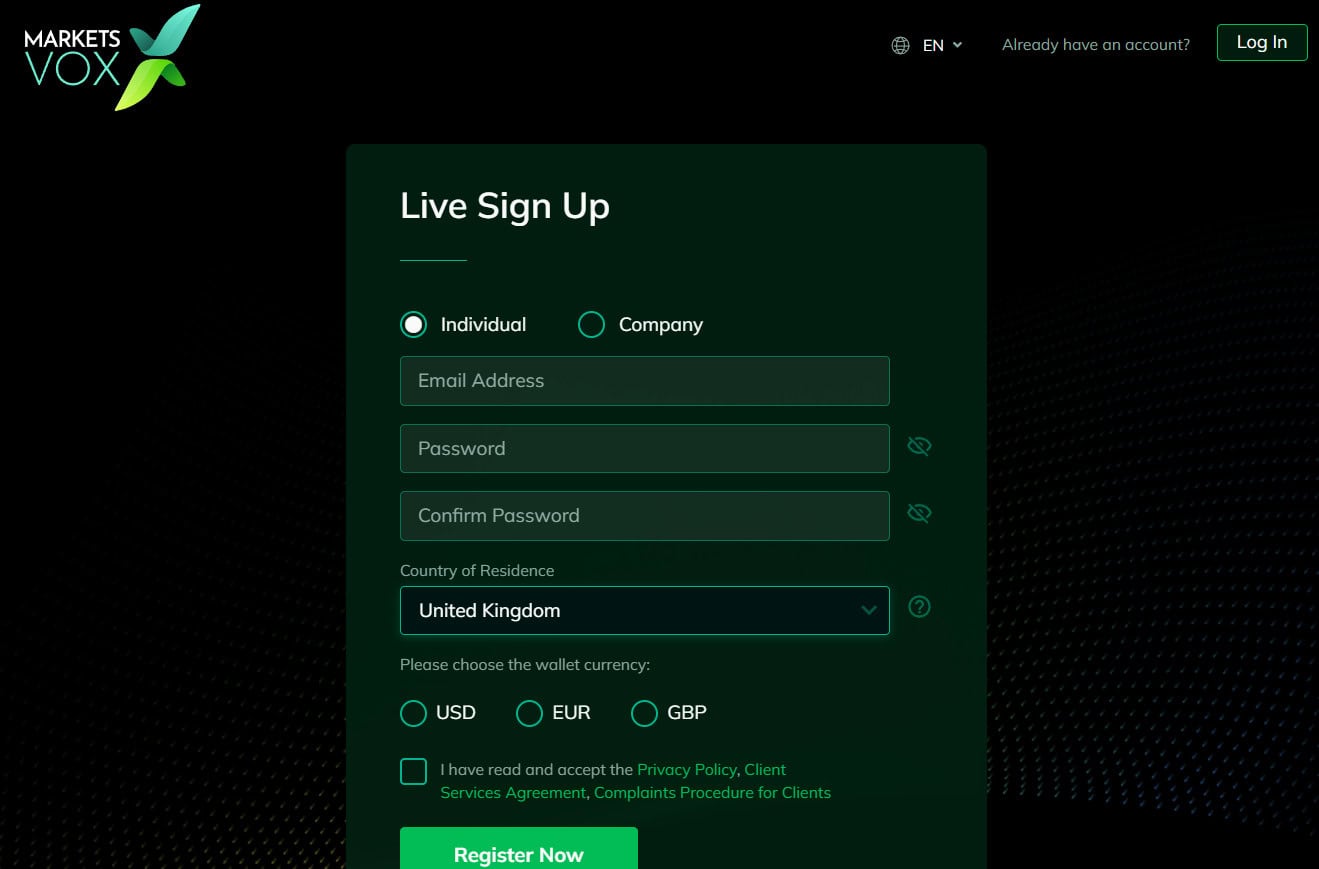

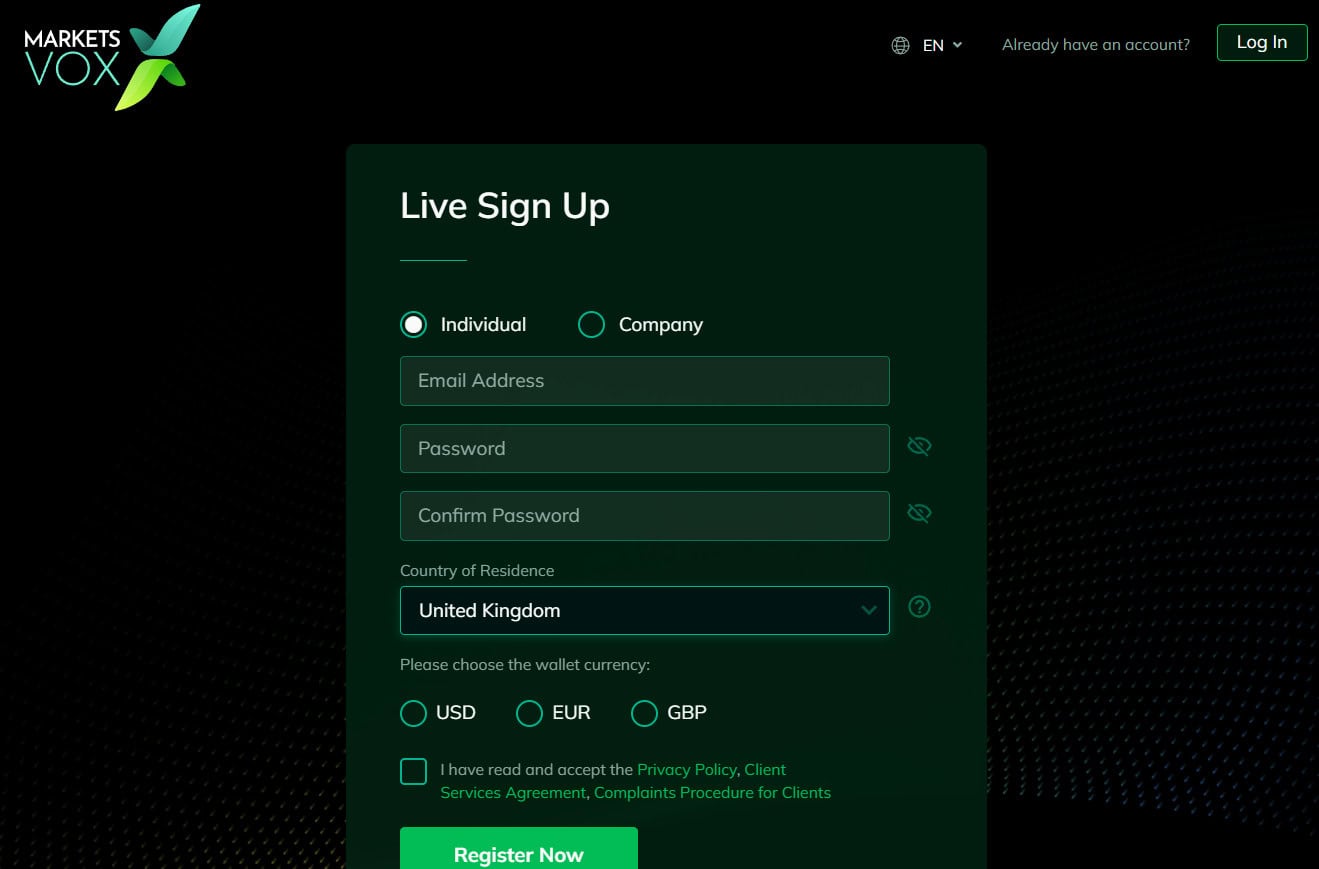

Score – 4.4/5

How to Open MarketsVox Demo Account?

To open a MarketsVox demo account, follow these steps:

- Navigate to MarketsVox’s website.

- Locate and click the “Try the Demo” button on the homepage.

- Provide your full name, email address, phone number, country of residence, and choose your preferred trading platform (MT5).

- After filling in the required details, submit the form to create your demo account.

- You will receive your demo account login details via email.

- If you have not already, download the MetaTrader 5 platform from the MarketsVox website.

- Open the MT5 platform and use the provided credentials to access your demo account.

How to Open MarketsVox Live Account?

To open a MarketsVox live account, start by visiting the official MarketsVox website and clicking on the “Open Live Account” button. You will need to complete the registration form by providing personal details such as your full name, email address, phone number, country of residence, and preferred account currency.

After submitting the form, you will receive a confirmation email; click on the verification link to activate your account. Then, log in and fill out additional information, including your date of birth, address, and financial details. To complete the Know Your Customer (KYC) process, upload the required documents such as proof of identity and proof of address.

Once your documents are verified, you will receive a notification confirming your account activation. Finally, fund your account through the available payment methods like bank transfers, credit/debit cards, or e-wallets. After these steps, you can start trading on the MetaTrader 5 platform with your live account.

Additional Tools and Features

Score – 4.3/5

In addition to the main trading tools, MarketsVox offers a variety of additional tools and features to enhance the trading experience.

- One notable feature is MV Social, a social trading platform that allows traders to connect, share strategies, and copy trades from experienced professionals. This tool is ideal for those looking to benefit from the expertise of others while building their trading skills.

- VPS hosting is also available, providing traders with a stable and uninterrupted connection to the trading platform, even during periods of high market volatility.

These tools provide traders with valuable resources for improving their strategies and ensuring smooth trading operations.

MarketsVox Compared to Other Brokers

When comparing MarketsVox to its competitors, it stands out for offering competitive trading conditions, with a focus on providing low spreads and flexible commission structures. The broker also provides essential tools like the MetaTrader 5 platform and a few additional features like MV Social and VPS, which are similar to what competitors such as Velocity Trade and ADS Securities offer.

In terms of regulation, MarketsVox is governed by the FSA, which, while a valid jurisdiction, is often considered less prestigious than the regulatory bodies that other brokers are under, such as the FCA, ASIC, or CySEC.

MarketsVox’s educational resources are more limited compared to brokers like Saxo Bank or City Index, which offer more comprehensive training materials. Overall, MarketsVox is a solid choice for traders looking for competitive spreads, flexible account types, and access to a reliable trading platform, though those seeking more in-depth education or a wider asset selection may prefer other brokers.

| Parameter |

MarketsVox |

ADS Securities |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.1 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $3 per side |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5 |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

100+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FSA |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$100 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker MarketsVox

MarketsVox is a Forex and CFD broker offering competitive trading conditions. It provides traders with access to the MetaTrader 5 platform, known for its advanced charting tools, multiple time frames, and technical indicators.

The broker offers a range of tradable assets, including major currency pairs, commodities, and indices, though its overall selection may be more limited compared to larger industry players.

MarketsVox operates under the regulation of the FSA of Seychelles, but as an offshore regulator, this may raise concerns for some traders. Customer support is available 24/5, and the broker provides additional tools like MV Social for social trading and VPS hosting for uninterrupted trading.

However, educational resources are fairly basic, offering only a glossary and minimal content for beginners. While the broker offers attractive trading conditions, potential users should consider the regulatory environment and educational resources when evaluating it.

Share this article [addtoany url="https://55brokers.com/forexvox-review/" title="MarketsVox"]