- What is xChief?

- xChief Pros and Cons

- Regulation and Security Measures

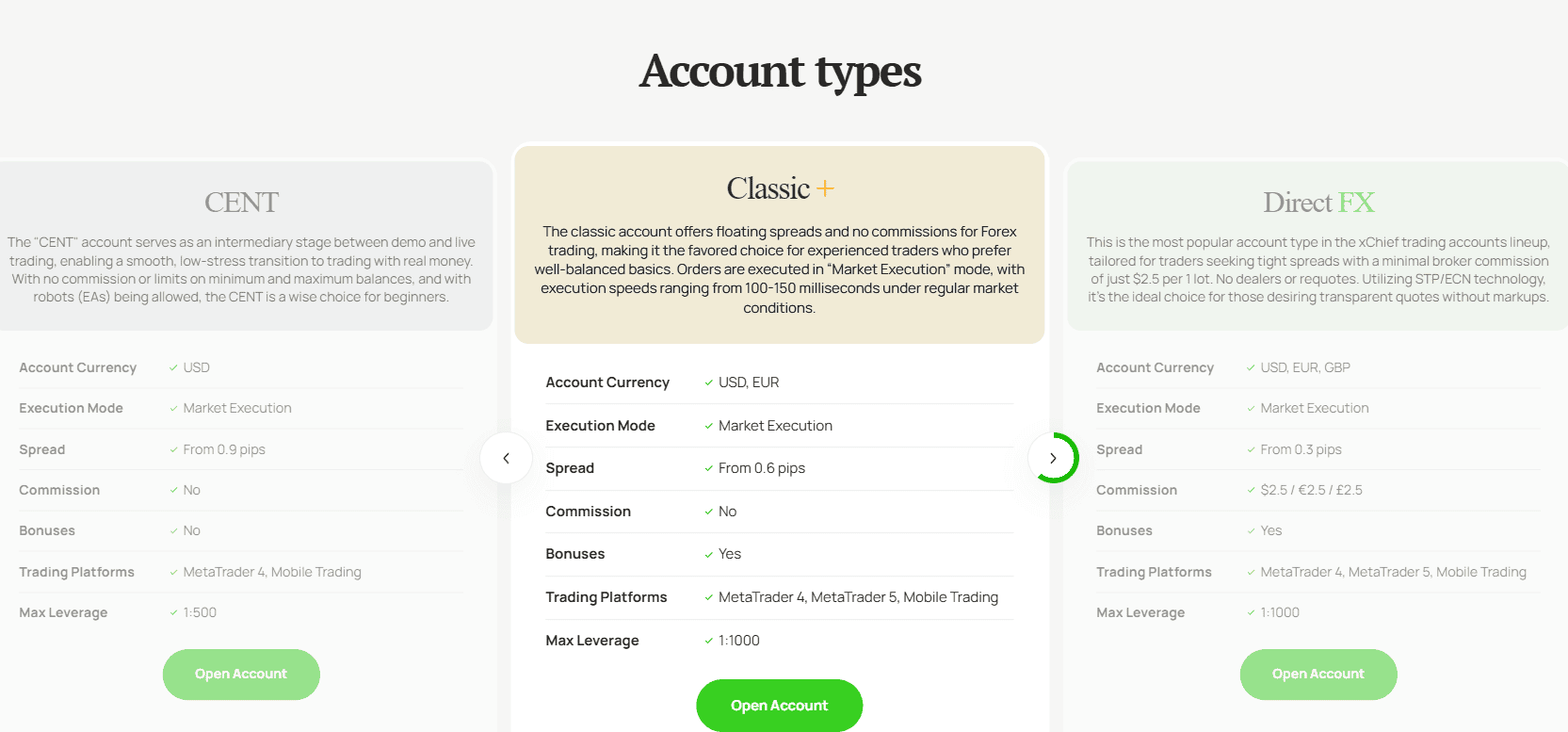

- Account Types and Benefits

- Cost Structure and Fees

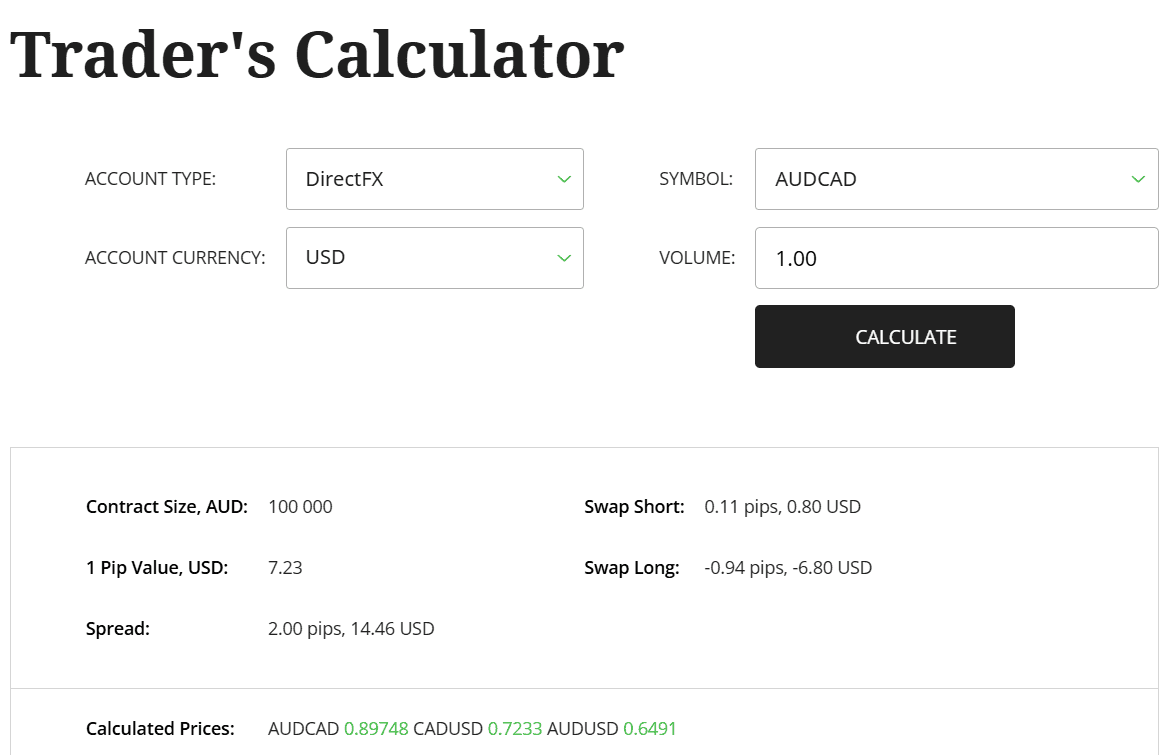

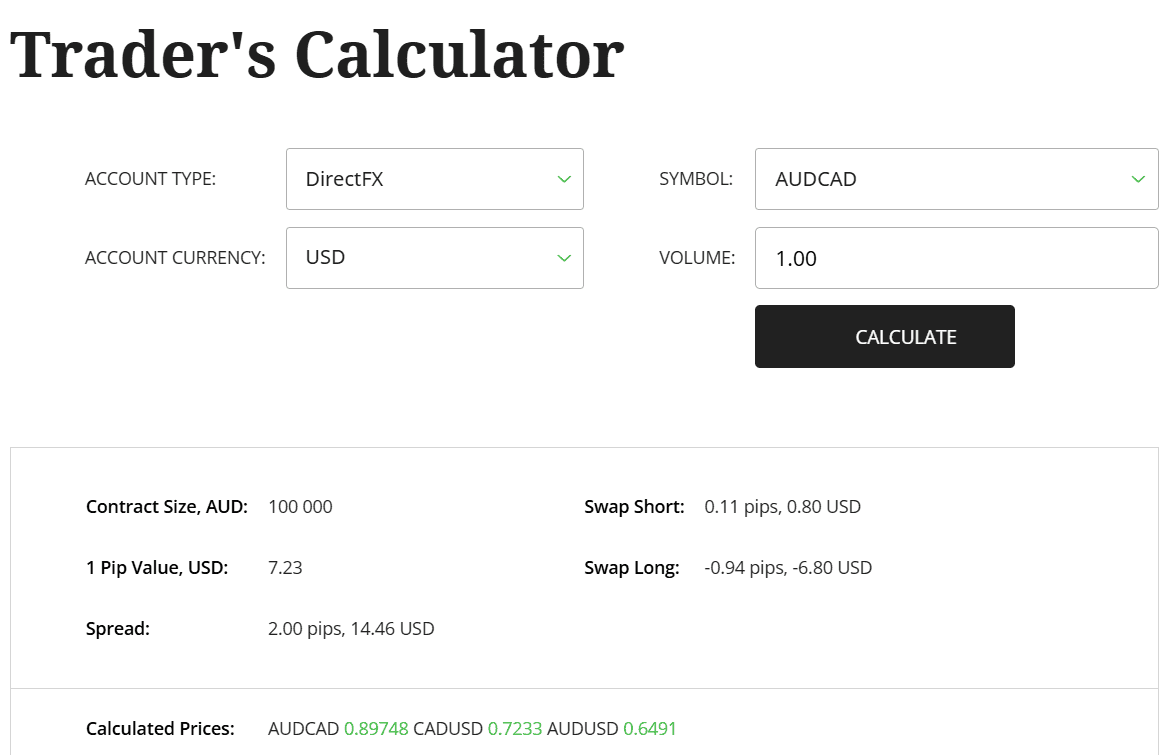

- Trading Platforms and Tools

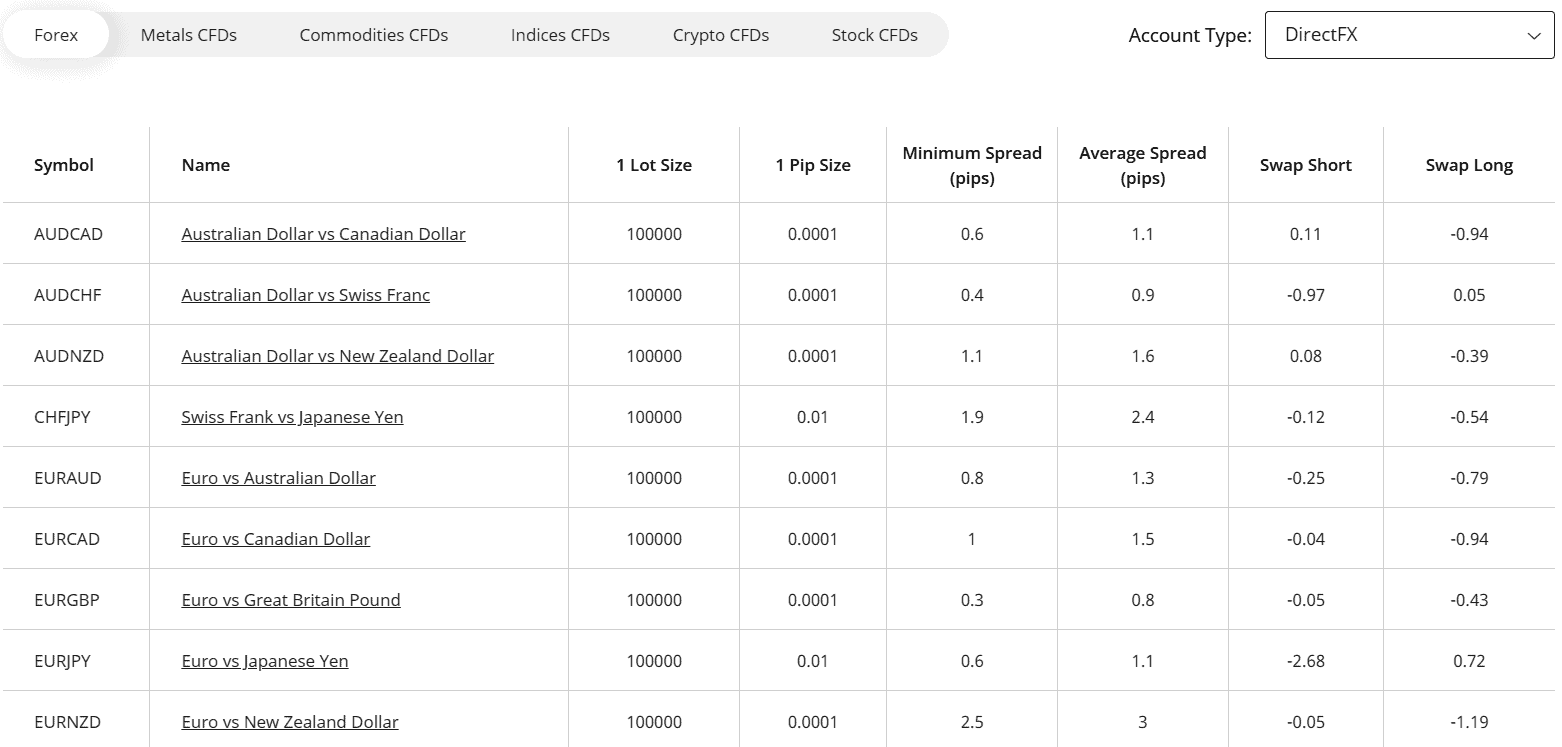

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- xChief Compared to Other Brokers

- Full Review of Broker xChief

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

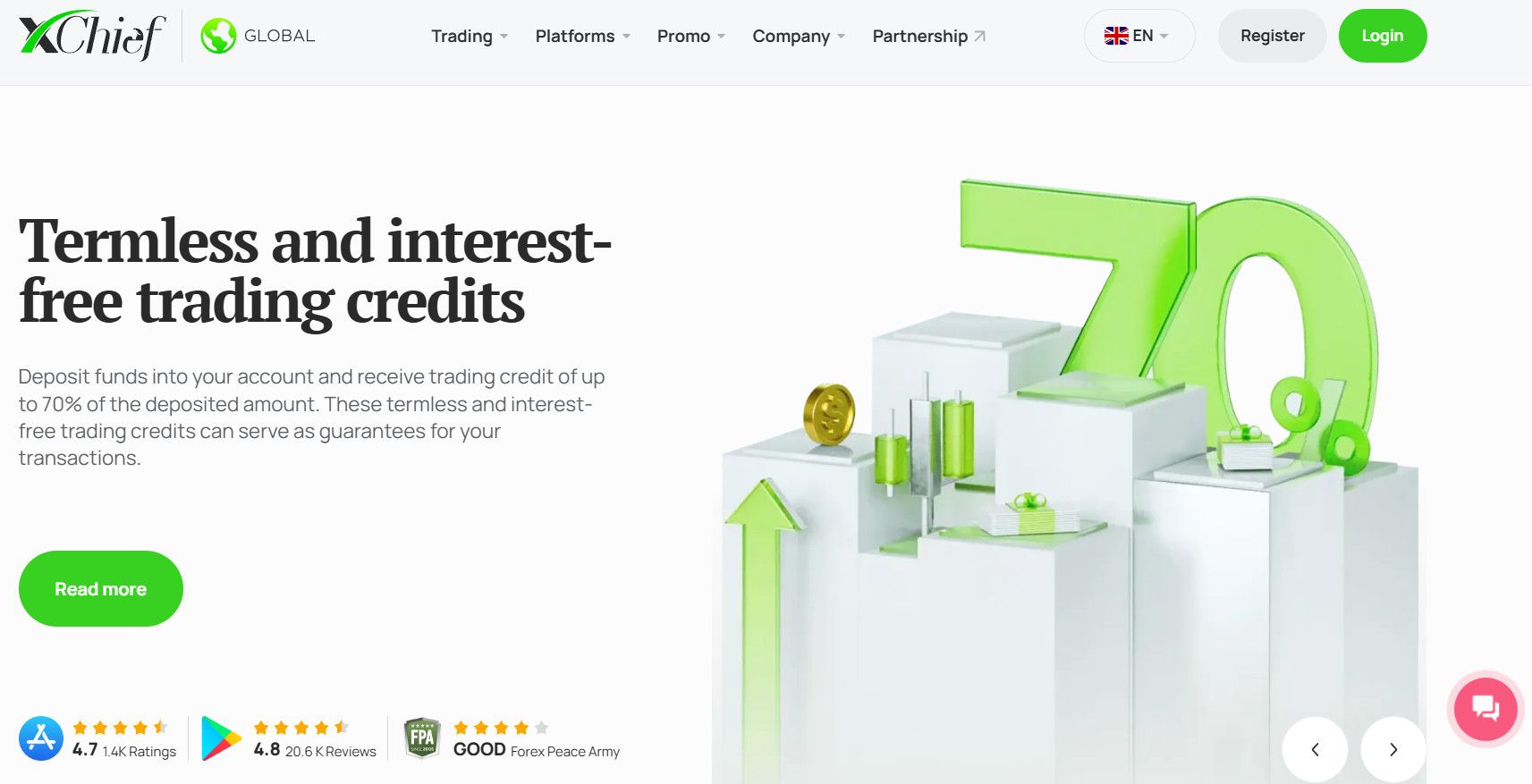

What is xChief?

xChief is a global online Forex and CFDs trading brokerage offering Forex, commodities, indices, cryptocurrency, and stocks trading on CFDs. Traders can access the market through the popular MT4 and MT5 platforms via desktop, web, and mobile options.

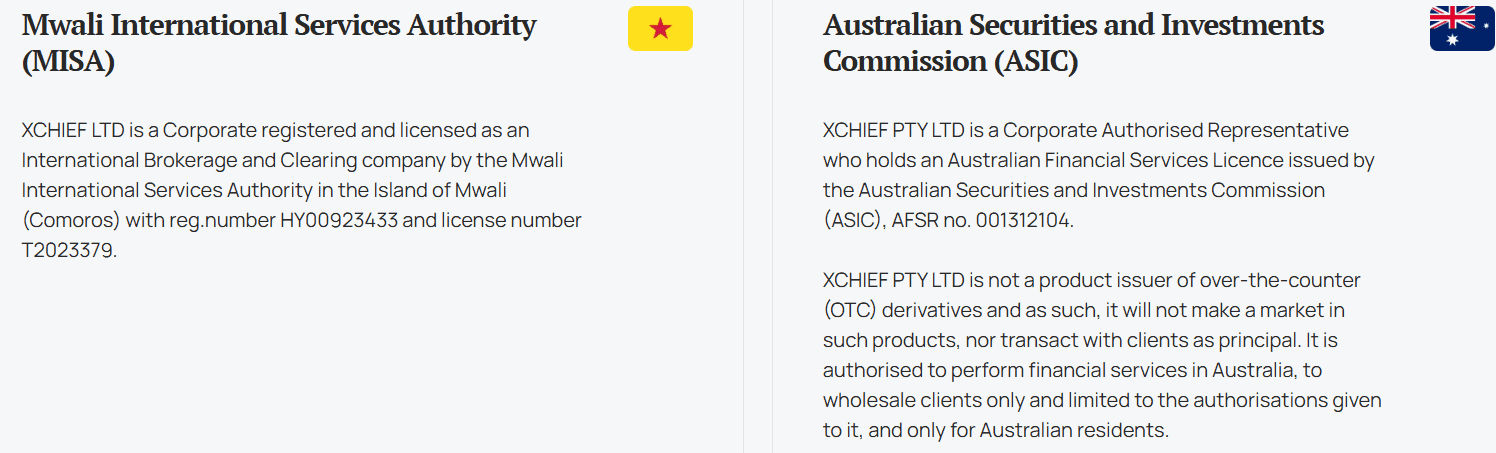

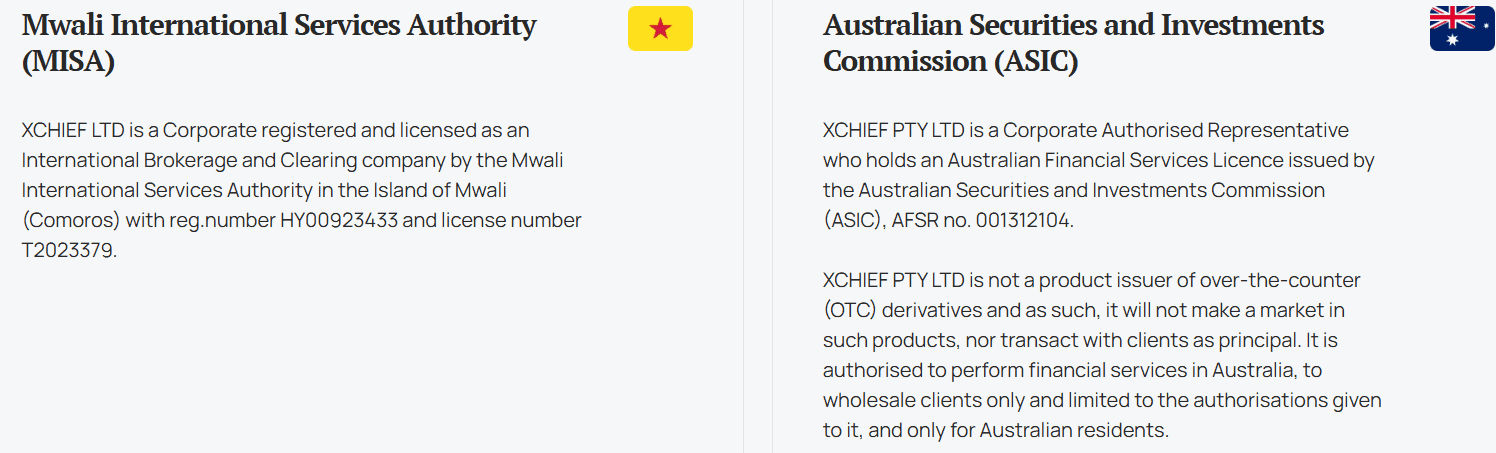

The broker primarily holds a license from the Mwali International Services Authority in the Island of Mwali (Comoros), which is an offshore entity. However, xChief is also authorised by the ASIC to perform financial services in Australia, to wholesale clients (only for Australian residents).

The broker’s offering is clear, with all the prices publicly disclosed for each instrument. Traders can also expand their opportunities by engaging in copy trading or benefiting from the PAMM features.

xChief Pros and Cons

With xChief, traders can benefit from the ECN/STP technology, taking advantage of high liquidity and tight spreads.

The broker protects its wholesale clients through the laws of the top-tier ASIC, ensuring the safety of funds. Trades are conducted through the MT4 and MT5 platforms, with access to over 150 instruments across a range of assets. The broker is favorable for CFD and Forex traders, allowing access to the most popular forex pairs and tradable products.

xChief also offers different bonuses, such as a deposit bonus, a welcome bonus, and other promotions. Copy traders or those looking for a PAMM account feature will appreciate the broker’s proposal. Besides, the broker provides 24/7 customer support through multiple channels.

On the other hand, retail traders are not protected by the tight rules imposed by the ASIC. Instead, they can only register under the MISA supervision. Another drawback is the lack of proper educational materials.

| Advantage | Disadvantage |

|---|

| ASIC supervision for wholesale traders | Lack of educational recourses |

| Various account types | Retail traders can only register under the offshore entity |

| Transparent and competitive pricing | Limited number of instruments |

| Advanced MT4/MT5 platforms | |

| Mobile trading | |

| International availability | |

| 24/7 customer support | |

xChief Features

xChief provides multi-asset services with a focus on transparency and safety. The firm has over 1 million active traders worldwide, attracting them with advanced platforms, competitive spreads, and various promotional programs.

xChief Features in 10 Points

| 🗺️ Regulation | ASIC (for wholesale clients), MISA |

| 🗺️ Account Types | Cent, Classic+, DirectFX, xPrime |

| 🖥 Trading Platforms | MT4/MT5, xChief mobile app |

| 📉 Trading Instruments | Forex, commodities, indices, cryptocurrency, and stocks |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/7 |

Who is xChief For?

xChief is a favorable option for traders, especially for wholesale clients, as they can register under rigorous oversight. It offers effective tools, advanced platforms, and different account types. As we found, xChief is Good for the following:

- Traders from Australia

- International trading

- CFD and currency trading

- Cryptocurrency trading

- The MT4 and MT5 platforms enthusiasts

- Beginners

- Wholesale traders

- STP/ECN execution

- Copy Trading

- Competitive spreads

xChief Summary

To sum up, xChief is a reliable choice that caters to the needs of both retail and wholesale traders. The ASIC authority’s laws protect Australian wholesale clients.

The broker offers the widely used MT4 and MT5 platforms, ensuring access to extensive analytical tools. The broker offers low spreads, various account types, and over 150 instruments across multiple markets. Traders have access to 24/7 customer support via multiple channels. However, as we found, xChief does not provide comprehensive educational resources.

Although the broker has appealing conditions, it is essential to remember that retail clients can only register under the offshore entity.

55Brokers Professional Insights

xChief is a Forex and CFD broker that allows access to trade global markets and operates for quite some time. The broker caters to both retail and wholesale clients, as it holds an ASIC license that protects primarily its wholesale clients in Australia and therefore considered safe choice. Yet, Retail clients can trade under the MISA regulation which is international branch and is an offshore zone where regulation is not strict, for this reason, we would strongly advise traders to check well all the conditions and risks involved to make an informed decision.

As we prrimarily test AU conditions for wholesale clinets, we mark what sets xChief apart in this proposal it is a wide range of account types, tailored to meet various needs, including Cent account. Wholesale clients can open the more advanced xPrime account with better features and unlimited order size. As for the trading fees, xChief offers different fee structures, with low spreads and reasonable commissions applied mostly to all instruments we tested. Clients can conduct their trades through the MT4 and MT5 platforms, ensuring access to extensive analytical tools that are provided on these platforms. Another good point about the broker is its 24/7 customer support through various channels.

However, the broker offers a limited range of instruments that can be restrictive for clients who are looking for diversification of their portfolios. Also, the international proposal is a very different feature from its AU proposal, the international on its own been placed by us to Broker to Avoid section for years, for a reason it is not transparent enough due to low regulation.

Consider Trading with xChief If:

| xChief is an excellent Broker for: | - Beginner traders

- Residents of Australia

- Wholesale traders

- MT4 and MT5 enthusiasts

- CFD traders

- Clients looking for flexible funding methods

- Copy traders

- Traders looking for the PAMM feature

- High leverage traders |

Avoid Trading with xChief If:

| xChief is not the best for: | - Long-term investors

- Retail clients looking for rigorous regulatory oversight

- Beginner traders who prioritize comprehensive education |

Regulation and Security Measures

Score – 4.3/5

xChief Regulatory Overview

After conducting thorough research on the broker’s regulatory status, we found the following details worth careful consideration.

- The broker holds licenses from the Mwali International Services Authority in the Island of Mwali (Comoros), an offshore zone that does not provide sufficient rules and guidelines. Therefore, there is not much trust in such companies.

- However, xChief also holds a license in Australia from the top-tier ASIC, ensuring stringent oversight and reliable practices. Yet, the ASIC regulation is partial and applies only to the wholesale clients who are residents of Australia. This means that retail clients can open accounts under the MISA entity only, which, to a certain extent, leaves them vulnerable and unprotected.

How Safe is Trading with xChief?

Our findings show that xChief follows stringent industry standards and requirements under its ASIC regulations. However, not all clients are under the same stringent protection with xChief, which is essential to remember.

- We found that xChief assures full compensation for any losses resulting from technical faults, regardless of the nature of the fault. This guarantee sets xChief apart, as not all brokers compensate their clients due to technical issues.

- Besides, xChief keeps its clients’ accounts segregated from the company’s accounts, protecting their investments from illegal use.

Consistency and Clarity

As we have found, xChief has maintained consistency and transparency over the years. However, from a regulatory standpoint, it has changed. The broker operated as a fully offshore entity for a long time, offering limited client protection.

At present, xChief holds an ASIC license, which applies only to wholesale clients residing in Australia. Retail clients are still not protected by the same stringent protections.

However, xChief clients seem to be mostly satisfied with the proposal, pointing out smooth withdrawals, advanced platforms, and low fees. In addition, the website offers clear information on fees, protection policies, and other information.

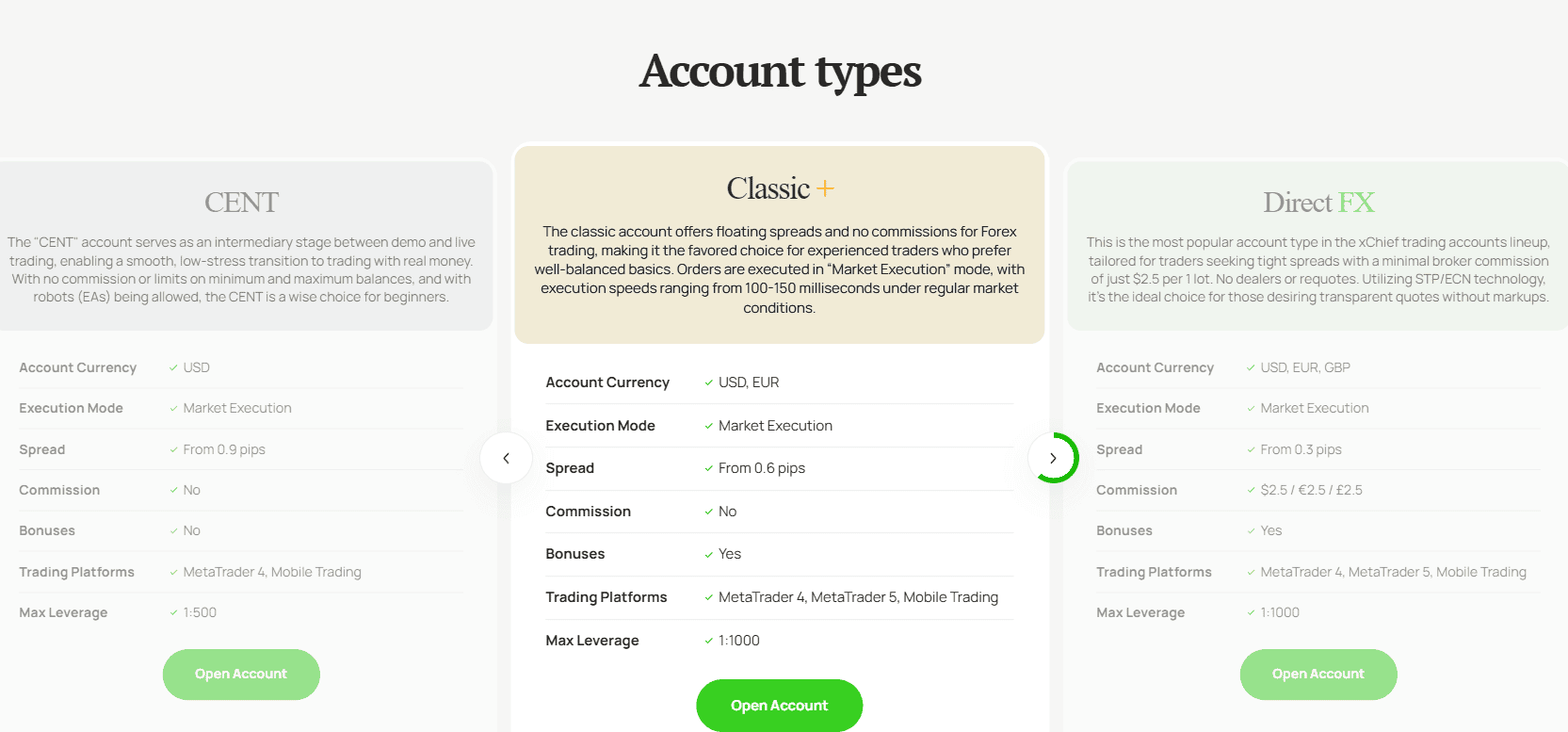

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with xChief?

xCief stands out for the wide range of account types, tailored for different needs. Traders can choose from Cent, Classic+, DirectFX, and xPrime accounts. Each account offers a different execution type, fee structure, initial deposit requirement, available leverage, and number of instruments.

The broker also offers an Islamic account for Muslim clients.

- The Cent account enables trading through the MT4 and mobile platforms. The account is a favorable option for beginners and cost-conscious traders as it does not have a minimum deposit requirement. The account base currency is USD. This is a spread-based account with an average spread of 0.9 pips. Traders have access to a limited range of instruments (25+ Forex pairs and metals).

- The Classic+ account allows traders to conduct trades through MetaTrader 4, MetaTrader 5, and the Mobile app. The minimum deposit requirement is $10. The account offers spreads from 0.6 pips, with no commissions. Through the Classic+ account, clients have access to 70+ products, including Forex, Metals, Commodities, Indices, and Crypto.

- The DirectFX account is a commission-based account with fixed transaction fees of $2.5, combined with low spreads starting from 0.3 pips. The account’s base currencies are USD, EUR, and GBP. To open the DirectFX account, clients are required to make an initial deposit of $50. The number of available instruments is 70+. The execution type of the account is STP/ECN.

- The xPrime account is tailored for more professional clients, offering advanced opportunities and capabilities. The initial deposit starts from $2000. With a commission-based fee structure, clients pay very low spreads from 0 pips and fixed transaction fees of $3. Trades are conducted through the MT5 platform, with access to over 150 tradable products. The leverage is as high as 1:1000. Besides, clients can hold an unlimited number of open orders.

Regions Where xChief is Restricted

The broker complies with strict regulatory requirements, and due to certain restrictions, it does not offer its services in the following countries and regions:

- The USA

- Angola

- Bangladesh

- Botswana

- Cameroon

- Congo

- Malaysia

- El Salvador

- Cuba

- Somalia

- Sri Lanka

- Morocco

- Zambia

- Kenya

- Honduras

- Ghana

- Uganda

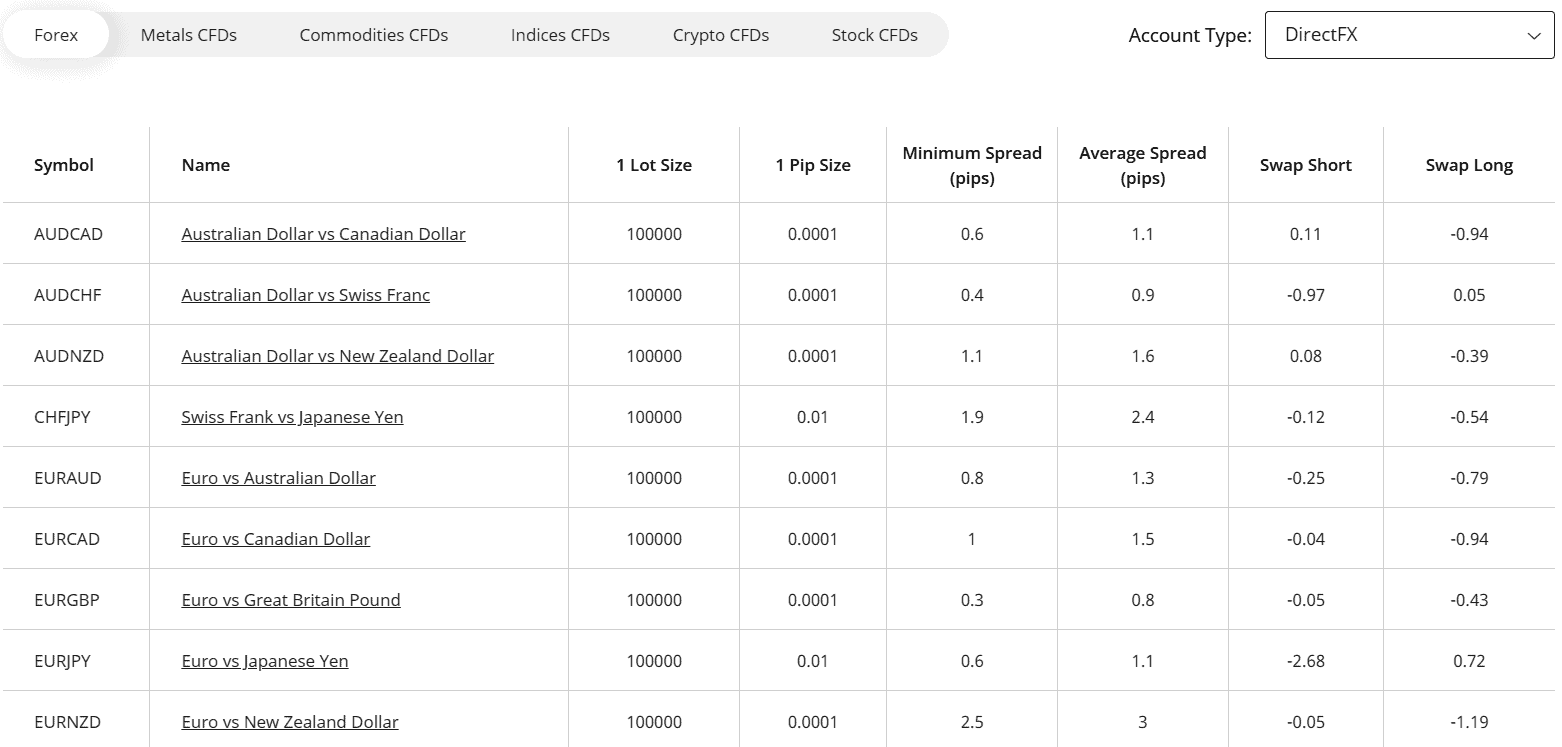

Cost Structure and Fees

Score – 4.5/5

xChief Brokerage Fees

xChief offers competitive fees, with spread and commission-based structures. The broker’s fees depend on the chosen account type and the instrument traded. Overall, the broker’s contract specification of fees is clear and transparent, ensuring that clients are aware of the applicable fees before placing an order.

xChief spread depends on the account type traders choose. The broker offers two spread-based and two commission-based accounts. The Cent and Classic+ accounts offer competitive spreads with no commissions. For the Cent account, the average spread is 0.9 pips, while the Classic+ account offers even lower spreads from 0.6 pips. For the EUR/USD pair, the average spread is 1.1 pips.

For the commission-based accounts, the broker combines very low spreads from 0 pips with fixed transaction fees.

xChief’s DirectFX and xPrime accounts offer a commission-based structure. The DirectFX account offers spreads from 0.3 pips with low commissions of $2.5 per side per trade. It is lower than the market average commissions. On the other hand, the xPrime account offers spreads from 0 pips, combined with $3 commissions per side per trade.

How Competitive Are xChief Fees?

xChief offers different fee structures to meet the needs of both retail clients and more professionals, who are looking for fixed charges for each trade. The spreads are low for all the account types if compared to the market average.

With commission-free trading for the Cent and Classic+ accounts, the broker provides cost-effective options for beginner and intermediate traders.

What we liked about xChief’s offering is the transparency and clarity it provides. xChief discloses fees for each instrument, which is very helpful for calculating all the charges before placing a trade. However, the conditions depend on the jurisdiction, so we recommend being careful and contacting the support team for more detailed information.

| Asset/ Pair | xChief Spreads | Opofinance Spreads | JustMarkets Spread |

|---|

| EUR USD Spread | 0.3 pips | 1.8 pips | 0.6 pips |

| Crude Oil WTI Spread | 4 | 10 | 4 cents |

| Gold Spread | 1.5 | 20 | 0.16 |

xChief Additional Fees

As we found, xChief does not charge inactivity fees, and clients can maintain their accounts without paying additional charges. This is especially favorable for cost-conscious traders.

Besides, deposits are also without additional transaction fees, enabling clients to choose the convenient funding method and deposit without extra charges. However, for certain methods, the broker charges withdrawal fees. The withdrawal fees may depend on the method used and the country of residency.

Score – 4.4/5

xChief provides traders with access to the widely recognized MT4 and MT5 platforms that stand out for their user-friendly interfaces, advanced tools, and robust trading capabilities. The platform availability depends on the account type. Each account allows access to either the MT4 or the MT5 platforms.

As we found, both platforms are available through desktop, web, and mobile options, ensuring efficiency and accessibility.

| Platforms | xChief Platforms | Opofinance Platforms | JustMarkets Spread |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

xChief Web Platform

The MetaTrader 4 and 5 web platforms stand out as powerful solutions. Clients can access the web platforms through any browser, including Google Chrome, Safari, Opera, and Mozilla Firefox. The web platform enables access to a demo option. Besides, traders can benefit from the hedging feature.

The web platforms also support trade orders, advanced market depth, and one-click trading. Besides, the platform includes technical indicators, graphical objects, and multiple timeframes.

All in all, the web-based platforms ensure functionality and flexibility that lead to an efficient trading experience.

xChief Desktop MetaTrader 4 Platform

MetaTrader 4 is one of the most favored platforms, known for its convenience and functionality. It allows fast execution and deep market analysis. Clients can even develop trading robots using the MQL4 programming language.

The MT4 desktop platform offers 40 technical indicators, 3 different chart types, and nine timeframes for in-depth market analysis. Besides, economic and financial news is available within the terminal.

The platform also includes a comprehensive suite of features, ensuring diverse trading strategies and order types.

xChief Desktop MetaTrader 5 Platform

The MT5 desktop platform has a modern and intuitive interface, with advanced analytical tools and customizable capabilities.

MT5 supports a broader selection of instruments: through the xPrime account, clients can access over 150 instruments. Traders gain access to full information about prices for each instrument. With the MT5 platform, clients can choose from the four execution types. It also supports over 21 timeframes, ranging from one minute to a month. Copy trading is available directly on the platform, enabling users to copy trades from successful professionals.

All in all, the standard MT5 package includes 38 technical indicators and 44 analytical tools.

Main Insights from Testing

Testing the MT4 and MT5 platforms offered by xChief, we noticed the reliability and efficiency of the platforms. The execution is fast, even in times of high volatility.

The platforms are easy to navigate. The MT4 platform will be an ideal choice for beginner traders. The MT5 will be a better match for wholesale clients looking for more advanced features and capabilities.

xChief MobileTrader App

The xChief Mobile App encompasses all the essential functions supporting easy access to accounts. The platform supports no deposit and welcome bonuses, leverage up to 1:1000, and extensive features. It is available through the Apple App Store, Google Play Store, and Huawei AppGallery. Besides, the platform enables access to a wide range of instruments, including Forex, Metals, Commodities, Indices, Stocks, and Crypto.

All in all, xChief ensures efficient and smooth trading on the go.

AI Trading

Based on our testing, xChief does not provide fully AI-powered trading. Yet, it supports automated trading and Expert Advisors.

Trading Instruments

Score – 4.3/5

What Can You Trade on the xChief Platform?

Based on our testing, xChief offers over 150 tradable products across diverse financial assets. The xPrime account for wholesale clients enables the best diversity, while other accounts have a limited range of instruments.

xChief supports Forex trading, with access to over 60 major, minor, and exotic currency pairs with low and transparent fees. Besides, xChief supports metal trading, including gold and silver, commodities, such as WTI Crude Oil, and natural gas.

All the products are based on CFDs, allowing speculations on the price movements. Yet, the offering is not favorable for long-term investments.

Main Insights from Exploring xChief Tradable Assets

xChief offers up to 150 tradable products, the availability depending on the platform and the account type. However, this diversity does not allow for expanding the portfolios and experiencing new opportunities.

As we found, the broker is a favorable option for Forex traders, as the number of currency pairs is impressive. xChief also allows access to the most popular stablecoins and altcoins, including Bitcoin, Ethereum, Litecoin, Ripple, and more.

xChief also offers access to CFD stocks trading of such global companies as Netflix, NVIDIA Corporation, McDonald’s, Costco Wholesale, and more.

Leverage Options at xChief

xChief offers leverage to control larger positions with a smaller amount of capital. Leverage levels vary by asset class and are subject to regulatory restrictions. Although leverage can expand potential profits, it also increases risks. Thus, it is crucial to understand the impact of using leverage.

- Australian clients can use a maximum leverage of 1:30. However, professional clients may be subject to higher leverage.

- International clients can use up to 1:1000 leverage, depending on the account type.

- The Cent account enables access to 1:500 leverage.

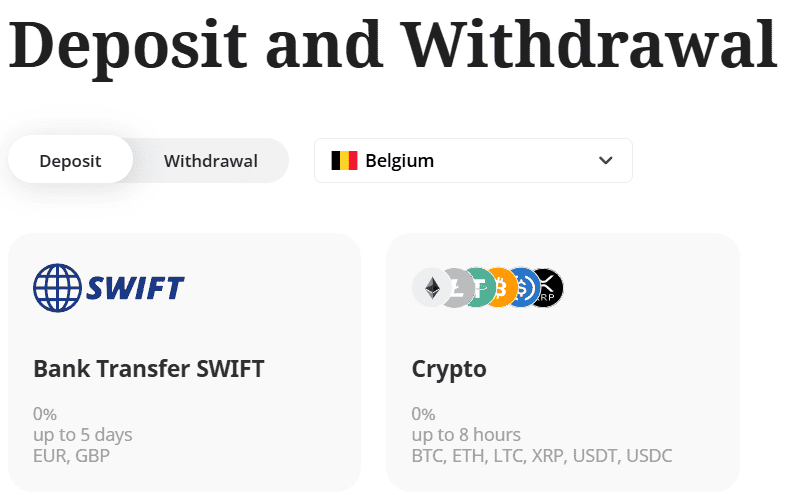

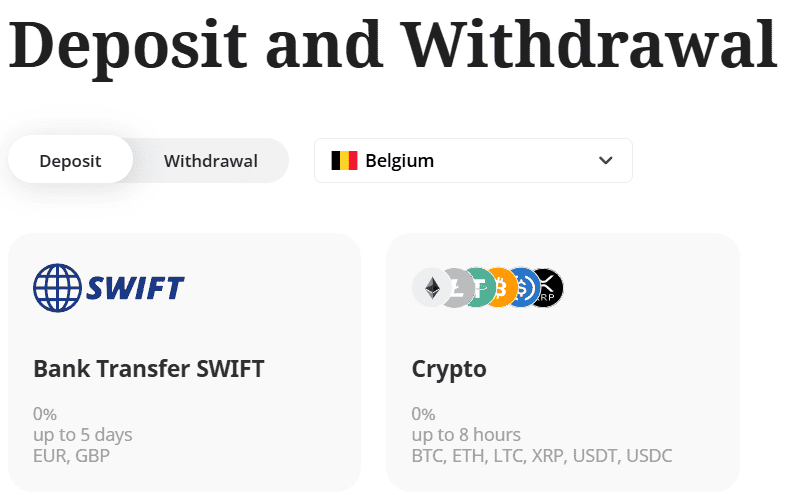

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at xChief

The broker offers various deposit options, including Bank Transfer, Credit/Debit Card, and e-wallets such as Skrill, Neteller, and Webmoney. Credit/Debit card deposits are almost instant. We recommend checking regulatory requirements to confirm whether a funding method is available in a particular region.

Minimum Deposit

As we found, there is no minimum deposit requirement for the xChief Cent account. To open the Classic+ account, clients are required to make at least a $10 deposit. More professional accounts require much higher initial funding, starting from $2000.

Withdrawal Options at xChief

Our research showed that with xChief, withdrawals take from 2 to 7 working days to be processed. For electronic payment methods, the withdrawal time is one working day.

- The Company mentions that it is not responsible for the Client’s financial losses if caused by a fault in a payment system.

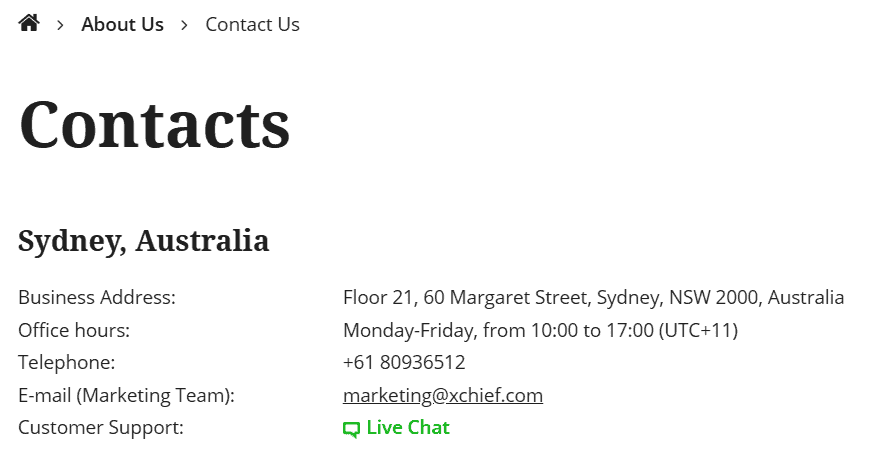

Customer Support and Responsiveness

Score – 4.6/5

Testing xChief Customer Support

The xChief customer support is available 24/7 through different channels. The broker assists via live chat, phone calls, and email.

- The xChief customer service team ensures high-quality support. In addition to the main methods, the broker is also active on social media, including IG, Facebook, LinkedIn, YouTube, and X.

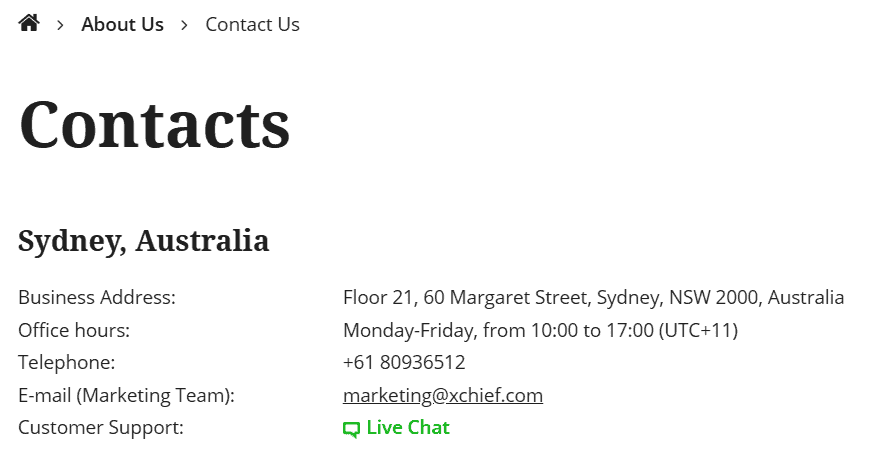

Contacts xChief

As we found, xChief supports its clients through different methods to ensure effective communication.

- The Live chat is the fastest way to get prompt and detailed answers and solve trading-related issues.

- Clients can also submit their inquiries via the provided email address. The broker offers several email addresses based on the location. The Australian clients can use the following address: marketing@xchief.com.

- The broker also provides a phone number for direct communication: +61 80936512. There are other phone numbers based on the region, so clients should check the information on the broker’s website.

Research and Education

Score – 3.8/5

Research Tools xChief

xChief offers comprehensive platforms that possess advanced capabilities. All the platforms include innovative features and abilities, ensuring in-depth research.

- On its website, the broker provides a few features to support market analysis and research. Traders can access calculators, interest rates, analytical reviews, economic articles, and CFD charts.

Education

We didn’t find any extensive educational materials on the xChief website. This lack of learning resources is a disadvantage for many novice traders looking for guidance. There are no webinars, video courses, or eBooks included in the broker’s proposal.

- Instead, it offers articles about trading and information on CFD trading strategies.

Is xChief a Good Broker for Beginners?

xChief is a favorable option that includes competitive conditions, innovative platforms with enhanced features, and low trading fees. It is a suitable broker for cost-conscious traders who want to start small, with minimum investments. One of the xChief’s advantages is the no minimum deposit requirement for its Cent account, which will be a great start for beginners. However, those beginner traders who are looking for extensive educational materials will find the broker’s educational resources unhelpful.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options xChief

As we have found, xChief offers its tradable products based on CFDs, which limits investment opportunities. Besides, the broker offers only 150 instruments, which limits the chance for diversification.

However, there are alternative investment options with xChief. The broker offers copy trading features and PAMM accounts.

- Clients can use the Copy Trading opportunity, mirroring the trades from experienced traders, and gaining profits without putting much effort or time.

- The PAMM accounts enable clients to allocate their funds to more experienced experts, earning profits without being actively engaged in trading.

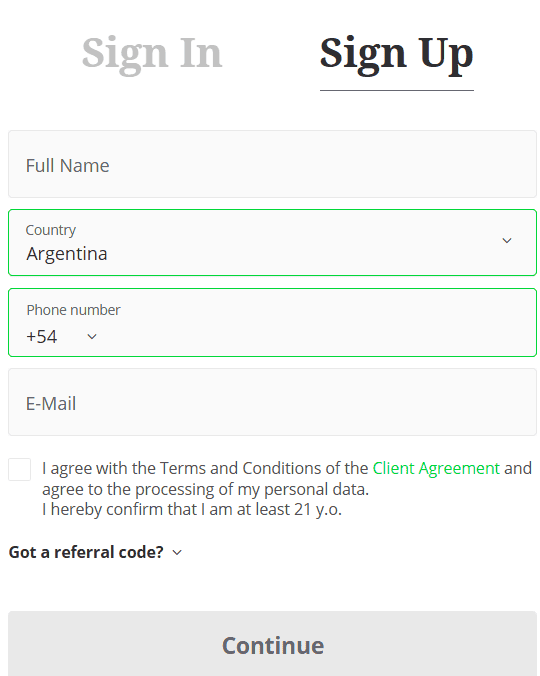

Account Opening

Score – 4.5/5

How to Open an xChief Demo Account?

Opening a demo account with xChief is a good chance for novice clients to practice and gain skills. With xChief, the demo account opening process takes only a few minutes.

Here is how to start with a demo account:

- Go to the broker’s website and choose the demo option

- Fill out the form with the basic personal details

- Select trading parameters, such as leverage, currency, and the balance amount

- Install one of the available platforms, or access via the browser

- Use the account credentials you received through the email address you provided during registration.

- Access the demo account and start practicing.

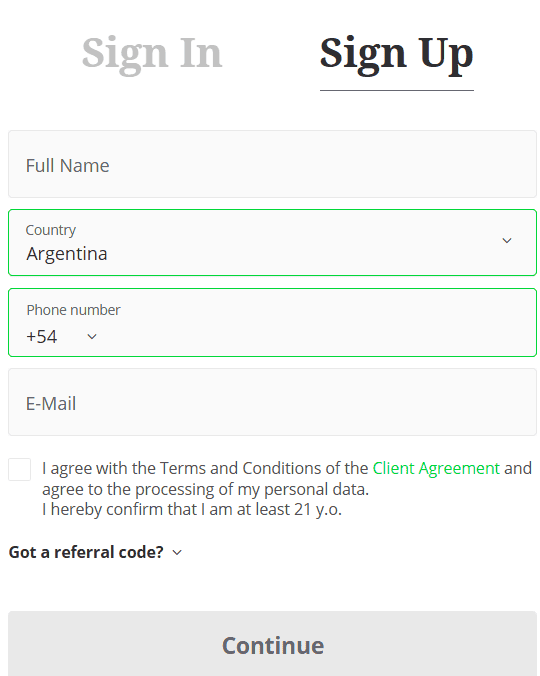

How to Open an xChief Live Account?

xChief ensures a quick and easy account opening process. After deciding on the account type, here are the steps to follow to open a live account:

- Go to the broker’s website and click on the “Sign up” button.

- Fill out the registration form with personal details.

- Verify your identity by providing a valid ID and proof of address.

- Set your account (choose the platform, currency, account type, etc.).

- Download the platform of your choice.

- Fund your account and start trading.

Score – 4.2/5

xChief offers various bonuses and promotional programs to enhance its clients’ experience and give them more opportunities. The broker offers the following:

- Through the No Deposit Bonus policy, the broker credits its clients with a $100 free bonus on sign-up, with no deposit required. Traders receive the No-Deposit Bonus if they open an account through the xChief mobile application.

- The welcome bonus is equal to 100% of the initial deposit, but it cannot surpass $500. The bonus is withdrawable when the trader reaches the required trading turnover.

- xChief also introduces other promotional programs. Traders can find information about them on the broker’s website, under the “Promo” section.

xChief Compared to Other Brokers

After reviewing all the aspects of trading with xChief, we compared the offerings with other good-standing brokers to find how competitive its proposal is.

We first compared xChief’s regulatory status with brokers like Fortrade and FP Markets. Our comparison revealed that although xChief is regulated by a well-respected ASIC, its regulation applies only to wholesale clients. Thus, retail clients can trade under the MISA oversight only. On the other hand, Fortrade and FP Markets hold licenses from top-tier authorities, including the FCA and ASIC.

As to the broker’s fees, the broker offers low and transparent fees. Likewise, FIBO Group and Admirals have low spreads from 0.6 pips and reasonable fixed commissions.

As to the education section, xChief lacks comprehensive materials, while Fortrade and FP Markets allow their clients access to extensive courses, articles, webinars, and other valuable resources. As we found, xChief offers the popular MT4 and MT5 platforms, and the xCHief App, while other brokers include alternative platforms as well.

All in all, we found that xChief is a broker with favorable conditions, and while it might lack in certain aspects, it excels in others.

| Parameter |

xChief |

Fortrade |

OANDA |

FIBO Group |

FP Markets |

Admirals |

Libertex |

| Spread-Based Account |

Average 1.1 pips |

Average 2 pips |

From 0.8 Pips |

From 0.6 pips |

From 1 pip |

From 0.6 pips |

N/A |

| Commission-Based Account |

0 pips+ $3 |

Not Available |

0.1 pips + $4 |

0 pips+ 0.003% |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0 pips+ 0.005% |

| Fees Ranking |

Low/ Average |

Average |

Low |

Low |

Low/ Average |

Low/ Average |

Low/Average |

| Trading Platforms |

MT4, MT5, xChief App |

Fortrader Platform, MT4 |

MT4, MT5, OandaTrade |

MT4, MT5, cTrader |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

Libertex Platform, MT4, MT5, |

| Asset Variety |

150+ instruments |

300+ instruments |

500+ instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

170+ instruments |

| Regulation |

ASIC, MISA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

FCA, CFTC, NFA, MAS, ASIC, IIROC, FFAJ |

FSC BVI, CySEC |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

CySEC, SVG |

| Customer Support |

24/7 support |

24/5 |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Basic |

Excellent |

Good |

Good |

Excellent |

Excellent |

Basic |

| Minimum Deposit |

No deposit requierement |

$100 |

$0 |

$0 |

$100 |

$1 |

$10 |

Full Review of Broker xChief

In summary, xChief is a well-regarded broker that has been operating for a long time. As we have found, the broker offers retail services under its MISA (Comoros) entity, accepting global clients. Under ASIC, which ensures stricter supervision, only wholesale clients from Australia are eligible to register. This makes the broker partially reliable.

xChief’s competitive fee structure, the availability of MT4 and MT5 platforms, and the xChief App allow access to varied trading instruments like forex and stock CFDs, enabling various trading opportunities.

However, there are still certain restrictions while trading with the broker, such as the lack of high-quality educational materials, which makes the broker less suitable for beginners. Besides, the instrument range is limited to 150 products only.

Regardless, we found that the broker offers various promotional bonuses to enhance the trading experience.

Share this article [addtoany url="https://55brokers.com/forexchief-review/" title="xChief"]

Tested the withdrawal today, and it worked flawlessly. Fast and efficient service. Impressed!

xChief is well-suited for beginners, offering a cent account and a low minimum deposit to ease you into trading. Their no-deposit bonus also lets you start without any initial financial commitment.

My time with xChief has been good overall. Placing orders is quick, and the fixed spread usually benefits me. Though I don’t scalp much, their EA works fine when I do. There are some minor issues, but nothing major. Overall, I’m happy with xChief.

XСhief offers a wide range of trading options and decent customer service in Europe. I like that their platform combines forex and cryptocurrency trading with low spreads and commissions. Overall, it’s a solid choice for traders, but not everything about the company is perfect yet.

Forex Chief has been a positive choice for me. Their trading platform is versatile, offering a wide range of instruments. The execution speed and low spreads have boosted efficiency. What stands out is their responsive customer support, adding to the overall positive experience. In short, a reliable and efficient broker for my trading needs.