- What is Finotive Funding?

- Finotive Funding Pros Cons

- Is Finotive Funding Legit?

- Finotive Funding Challenge

- Funded Account

- Account Conditions

- Payout

- Finotive Funding Alternative

What is Finotive Funding Prop Firm?

Finotive Funding is a proprietary trading firm that stands out for offering a unique opportunity for traders to access and manage substantial trading capital. Traders have the opportunity to generate significant earnings by managing funded accounts that can go as high as $200,000, coupled with the advantage of retaining up to 95% of the profits they make. This opportunity is extended across a variety of financial markets, encompassing trading in forex, commodities, stock indices, and even digital currencies like cryptocurrencies.

Finotive Funding, a proprietary trading firm, offers traders the chance to trade with the firm’s funds after passing a test or challenge. This opportunity requires minimal personal investment and allows traders to operate as professionals. However, potential risks associated with trading should be carefully considered. For more detailed info about Prop Trading follow this link

| Finotive Funding Advantages | Finotive Funding Disadvantages |

|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| High Paying Profit Share | No MetaTrader 4 Platform |

| MT5 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Good range of Challenge Programs | |

| Free Trial | |

Is Finotive Funding Legit?

Finotive Funding, headquartered in Hungary, operates as an affiliate of Finotive Markets, a broker specializing in Forex. This proprietary trading firm is structured to comply with Hungarian legal requirements, ensuring adherence to established industry norms and standards. This adherence underscores their commitment to maintaining a high level of operational integrity within the framework of Hungary’s regulatory environment.

- Prop Trading firms like Finotive Funding, unlike regulated Forex Brokers, operate with less regulatory oversight, meaning they’re generally not monitored by financial industry regulators. This difference highlights the importance of understanding the risks involved in engaging with such firms.

Is Finotive Funding Scam?

Our review of Finotive Funding’s official website found no clear evidence of it being a scam. However, given the generally lower regulation of Prop Trading Firms compared to other financial institutions, it’s more challenging to conclusively determine their legitimacy.

Our professional recommendation is to thoroughly educate yourself about Prop Trading and its associated risks. Opting for a company with a solid reputation and a longer operational history can contribute to a more stable trading experience. While Prop Trading involves lower financial risk compared to direct trading with your funds — as you primarily pay subscription fees rather than make large investments — it’s still crucial to approach this with an informed perspective on the potential financial implications. Read about Trading with personal capital

Finotive Funding Challenge Evaluation Rules

The key aspect of our Finotive Funding review focuses on the evaluation process for gaining a Funded Trading Account. This involves specific tests to assess trading skills and risk management, along with an understanding of the registration fees required for participation. For detailed information on these processes and costs, it’s advisable to consult Finotive Funding’s official website.

- At Finotive Funding, the challenge’s main aim is to validate your trading skills. The evaluation is split into two phases, each with profit goals linked to your selected account size. Phase 1 has stricter rules, while Phase 2 offers more flexibility, especially in drawdown limits, to test the consistency of your trading. The firm also provides a single-phase evaluation and instant funding options for different trader needs.

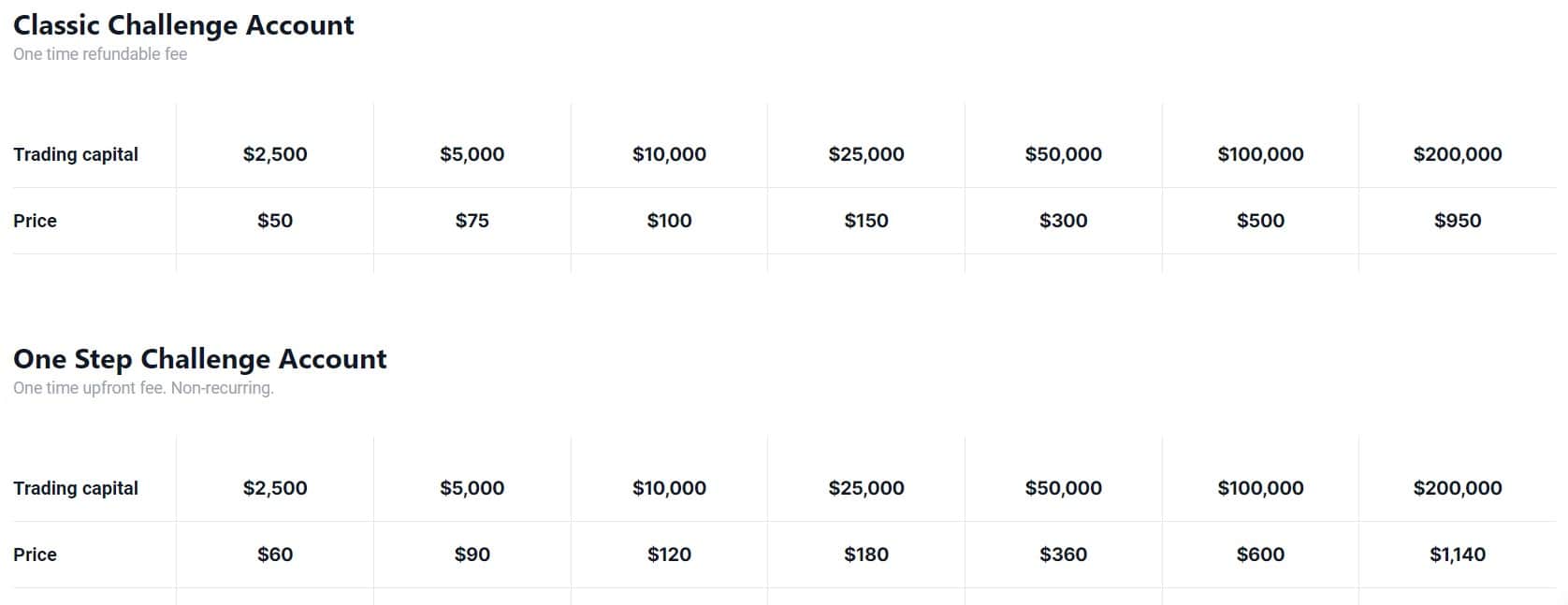

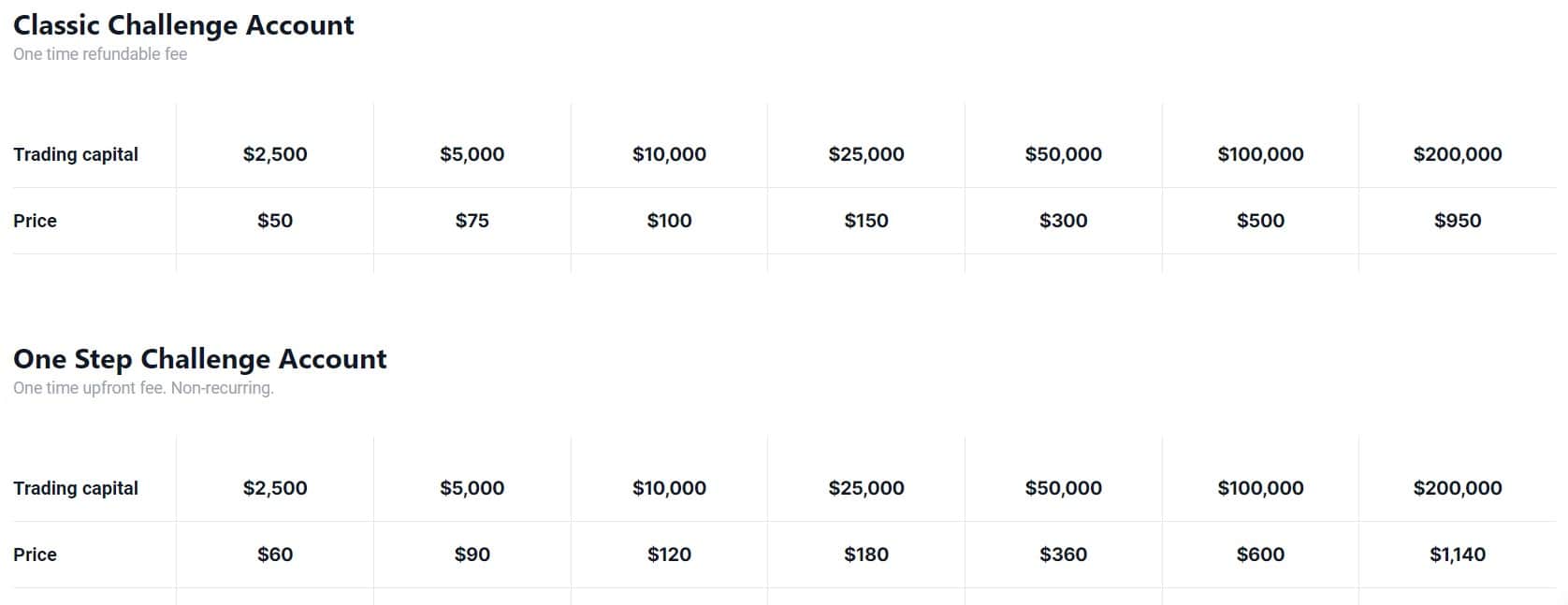

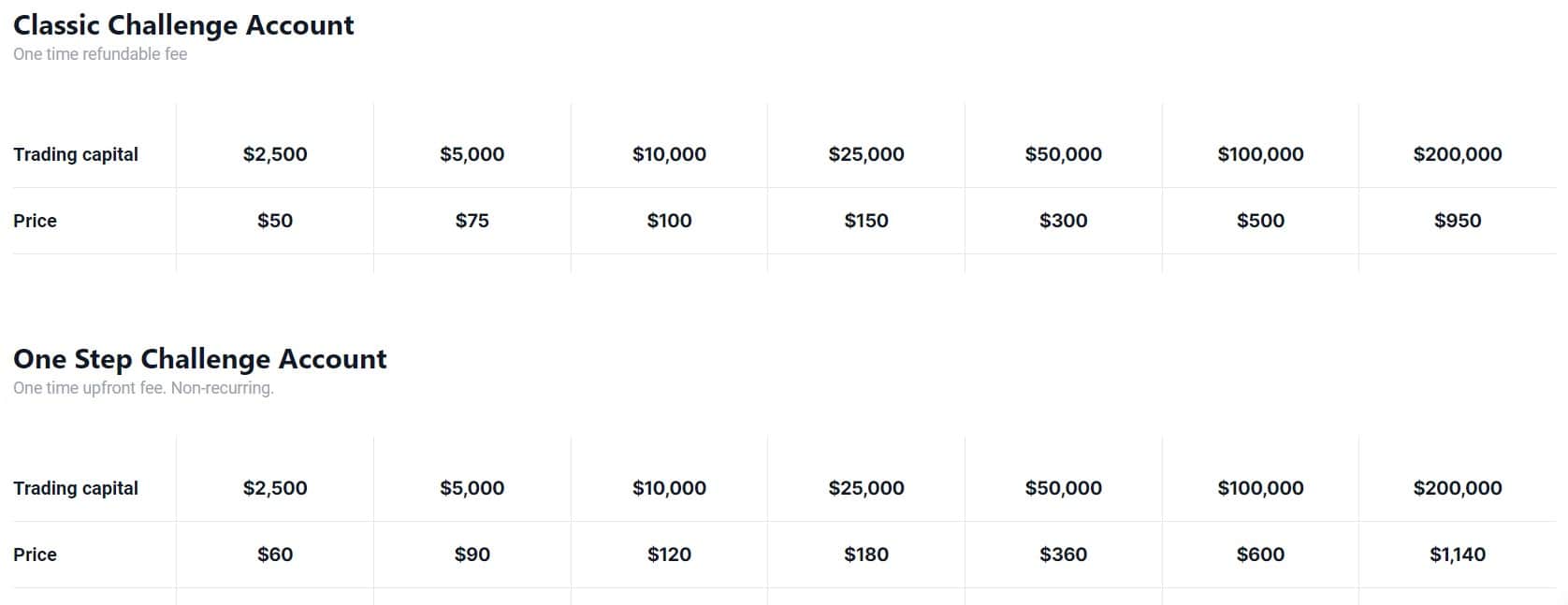

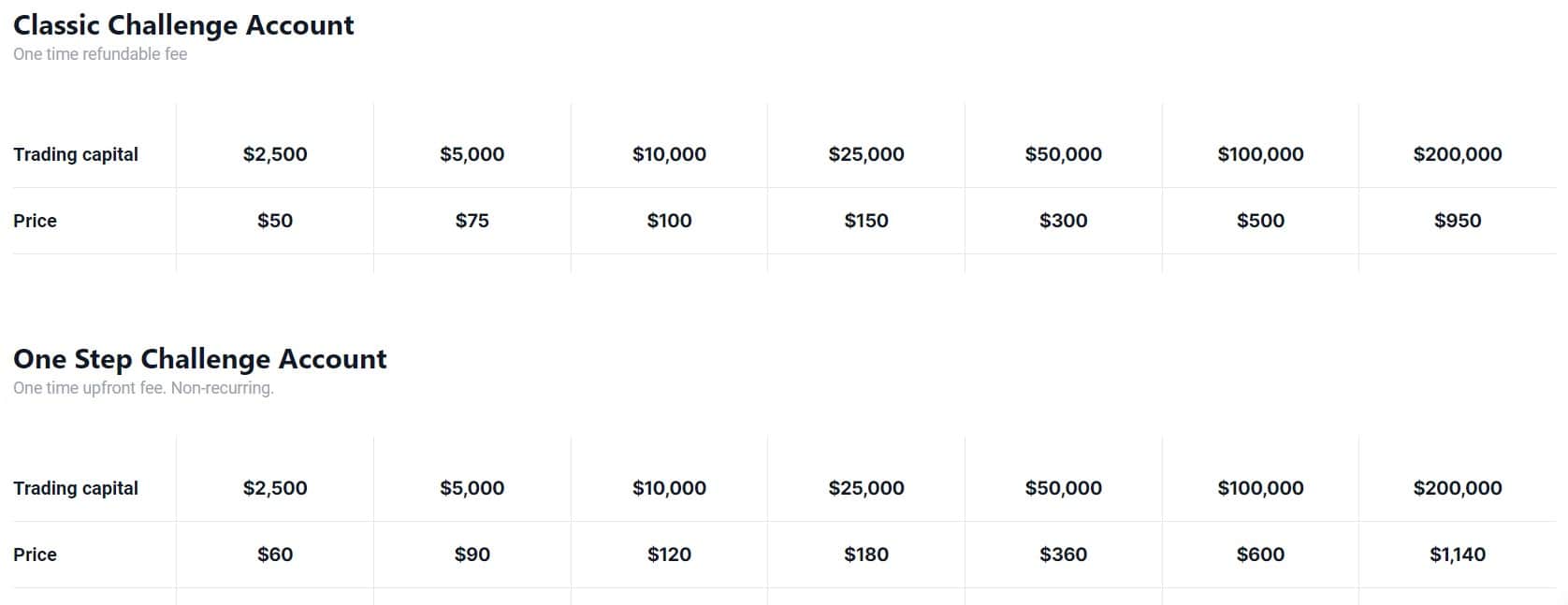

Account Balance and Registration Fee

Before logging in to Finotive Funding, you need to select the program type and account balance you aim to qualify for. The challenge conditions and the registration fee vary based on the selected account size. For detailed fee comparisons based on account sizes, you can check the relevant section on Finotive Funding’s website or in comprehensive reviews of their services.

- Finotive Funding offers five unique trading challenges: Classic, One-Step, Pro, Standard Instant Funding, and Aggressive Instant Funding. These challenges vary primarily in terms of time limits, profit targets, and trading rules. For specific details, you can visit their official website or read reviews.

- Overall, Finotive Funding stands out for its low capital requirements and offers a range of account balances with fees that are competitive and lower than those of its competitors. However, unlike other firms, Finotive Funding fees are non-refundable.

- Finotive Funding offers a range of account balances that depend on the chosen program, spanning from $2,500 to $200,000, and even provides Finotive Funding Scaling option up to $3.2 million.

| Fees | Finotive Funding | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $2,500 | $10,000 | $50,000 |

| Fee | $50 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $950 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

Profit Target

The challenge encompasses several rules that traders must adhere to to demonstrate their successful strategy and performance. One of the critical parameters is the Profit Target, and the specific targets offered by Finotive Funding depend on the program and phase a trader is engaged in. In the Standard Challenge, traders aim for a 7.5% profit target in Phase 1 and 5% in Phase 2, while the One Step Program sets a 10% profit target.

Maximum Loss

In prop trading, traders must adhere to predefined loss thresholds, including Maximum Loss and Maximum Daily Loss levels. Finotive Funding sets Maximum Loss at 8% for Standard Instant Funding and 16% for Aggressive Instant Funding. In the Standard Challenge, both phases have a 10% maximum loss limit, while the One Step Challenge has a 7.5% maximum loss. Daily loss limits are 5% for Standard Instant Funding, 10% for Aggressive Instant Funding, 5% for Standard Challenge, and 4% for One Step Challenge

- During the challenge stage, strict adherence to all established rules is crucial. Deviating from these rules may lead to test cancellation, necessitating a reset with an associated fee to begin the challenge anew.

Minimum Trading Period

Finotive Funding imposes no trading period limitations, meaning there is no minimum trading duration requirement for any of its funding programs.

See the detailed table with Finotive Funding Challenge conditions based on Account Size:

Finotive Classic and One Step Challenges

Free Trial

Our research shows that Finotive Funding provides a 7-day Free Trial account, allowing traders to assess their trading conditions and become familiar with dashboard features before committing to any purchase. This free trial grants access to the 100,000 1-step challenge, offering the same trading conditions as a real account experience.

Finotive Funding Funded Account

Upon successfully passing the test or challenge, traders will have their Funded Account established, a process that generally takes a few business days to activate. It’s essential to emphasize that the account conditions and balance will precisely match the qualifications achieved during the test. If a trader wishes to upgrade their account to a higher grade, they will be required to start the test anew for the desired Account Balance level they intend to trade with.

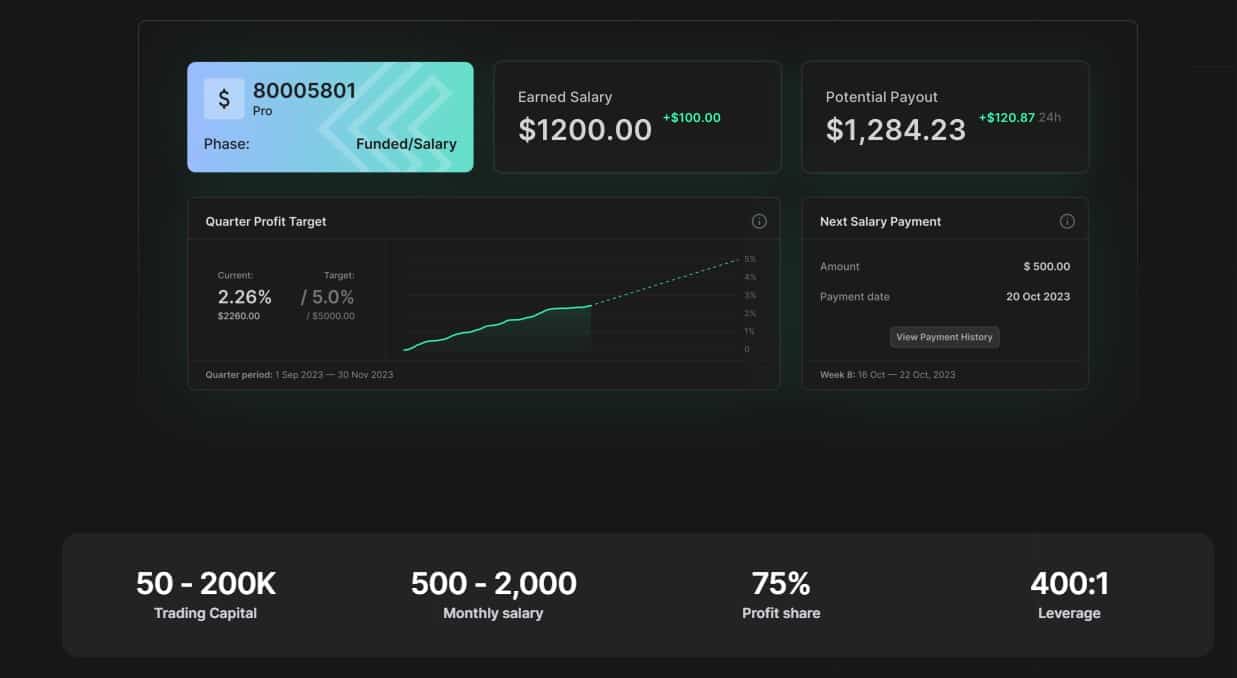

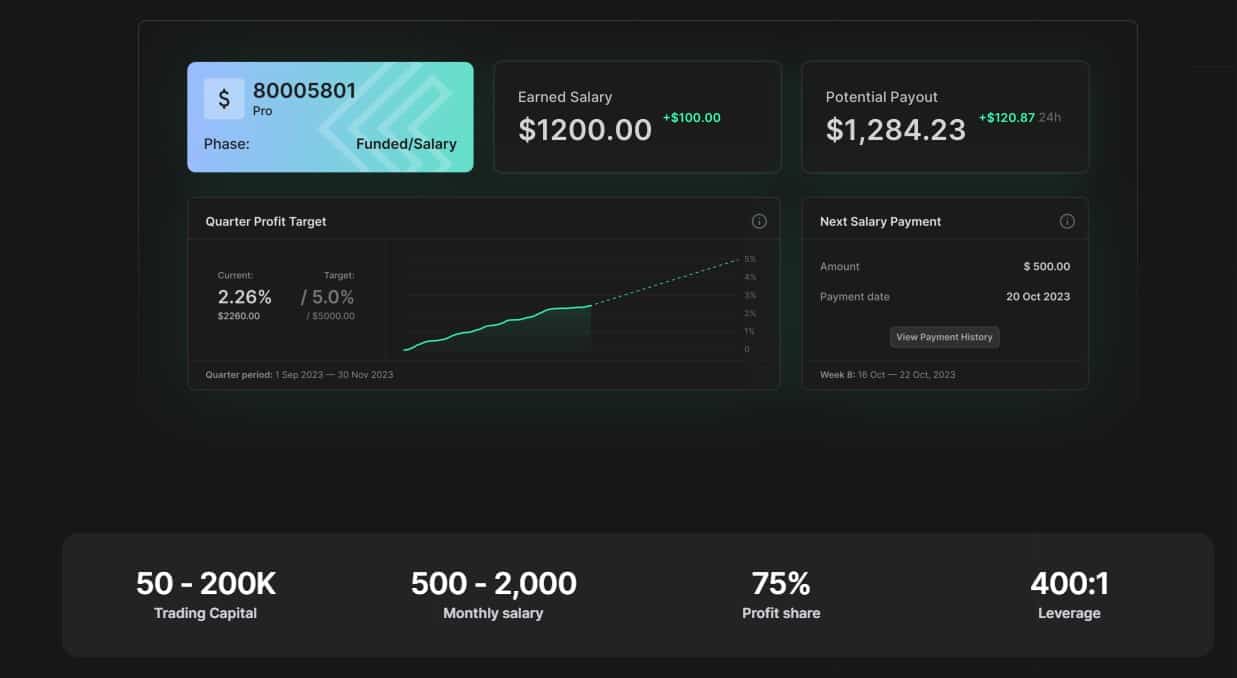

Profit Split

Finotive Funding offers a flexible profit split structure that varies across its programs. Traders can earn profit splits ranging from 60% to 95%, depending on the program and their trading performance. The profit split can increase as traders meet specific profit targets and demonstrate their trading skills. It’s important to review the details of each program to understand the specific profit split percentages applicable to your chosen account type and trading strategy.

Finotive Pro Challenge

Payout and Withdrawals

For payouts from Finotive Funding, the process appears to be well-structured. According to their website, once a trader successfully completes the challenge stages and gets funded, they can start withdrawing their profits. For Finotive Pro account holders, there are specific conditions like a quarterly profit target and consistency rule, which, if met, enable the trader to withdraw their earnings and also receive a salary.

Withdrawal Method

Finotive Funding offers several withdrawal methods for traders. These include the use of credit/debit cards via TrustPayments and cryptocurrencies via xMoney. Additionally, Finotive Funding has partnered with Deel, providing an alternative withdrawal method for traders.

Account Conditions

For Account Conditions themselves, we check carefully whether Broker has various account preferences, also what Platforms, Instruments and Trading Costs are applicable. It is also important to check Leverage levels and Trading conditions offered, since some Brokers may restrict some startegies and do now allow specific practices in Funded accounts, which may result in loss of Account therefore to regain it you will need to pass the test again. See detailed breakdown below:

Trading Instruments

Finotive Funding provides traders with a comprehensive selection of trading instruments, encompassing a wide spectrum that includes forex currency pairs, commodities, indices, and cryptocurrencies. This diverse range of instruments offers traders the opportunity to engage in various financial markets and diversify their trading portfolios to suit their investment preferences and strategies.

Finotive Funding Commission

Finotive Funding does have commission fees associated with its trading accounts. The exact commission rates can vary depending on the specific account type and trading conditions. For instance, with their Finotive Pro accounts, traders benefit from reduced commission rates. These lower commissions are part of the advantages offered to enhance trading effectiveness and cost-efficiency.

Leverage

Finotive Funding provides leverage for trading accounts in both the Challenge and for Funded traders, offering a maximum leverage of up to 1:400 for all trading instruments.

Finotive Funding App Platform

Finotive Funding is an affiliate of Finotive Markets LLC, a brokerage that offers fast execution, tight spreads, and 24/7 crypto trading. They use the popular trading platform, MetaTrader 5, to provide their trading services.

Trading Conditions

Finotive Funding has carefully designed its trading conditions to create a fair and organized trading environment. These conditions offer traders the chance for both profit and progress in their trading endeavors.

- Finotive Funding maintains a flexible trading environment with no constraints on activities like news trading, holding positions over the weekend, or lot sizes.

- Finotive Funding offers an Islamic account option, it’s likely designed to comply with Islamic finance principles, which prohibit certain activities such as charging or paying interest

- At Finotive Funding, while slippage is typically minimal, it is important to note that during news trading, the company enforces a 5-minute restriction on opening and closing trades around news releases to mitigate potential slippage.

Finotive Funding Promotions

Finotive Funding Alternative Brokers

Taking into account all the information we have gathered about Finotive Funding, we can conclude that the company presents an attractive opportunity for Funded Traders. They offer competitive costs, provide a free trial with no time limitations, and offer various programs with lower costs to choose from. This wide range of options opens up opportunities for traders with lower costs and enhances the appeal of Finotive Funding as a trading platform.

It’s advisable to thoroughly evaluate and compare proposals with other Prop Trading Firms. Some renowned firms may offer similar conditions or better suit specific traders based on their instrument preferences and alternative trading platforms, apart from MetaTrader. Nonetheless, it’s essential to acknowledge the distinct advantages offered by Finotive Funding. Below, you’ll find our curated selection of alternatives, accompanied by a table comparing them to Finotive Funding.

Share this article [addtoany url="https://55brokers.com/finotive-funding-review/" title="Finotive Funding"]