- What is FIBO Group?

- FIBO Group Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FIBO Group Compared to Other Brokers

- Full Review of Broker FIBO Group

Overall Rating 4.5

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is FIBO Group?

International Financial Holding FIBO Group (Financial Intermarket Brokerage Online Group) is one of the oldest players in internet trading, with its history dating back to 1998. From its inception, the broker has adhered to the principles of transparent activities, with the protection of interests and strict compliance with laws.

FIBO Group Company was established in the BVI and is still headquartered there, however, the broker enlarged its offering to invest safely via an EU Branch located in Cyprus FIBO Markets Ltd (ex. FIBO Group Holdings Ltd) solely reserved for EU clients with respected European regulatory authorization. As such, international trading operates via the BVI Entity, and trading conditions are different based on entity rules and applicable regulations, so we advise referring to relevant conditions. Moreover, FIBO Group’s world coverage includes high-quality support established through the Vienna, Limassol, Shanghai, Singapore, Munich, Kyiv, and Astana offices.

FIBO Group Pros and Cons

Based on our expert findings, FIBO Group is a reliable broker with a strong establishment and a good reputation. It offers an NDD environment with great conditions for CFD and FX trading, including a low minimum deposit and low spreads. The broker offers a wide range of industry-standard platforms, as well as the option for technical traders to use cTrader’s sophisticated features. We also noted a good range of educational courses and webinars for beginners.

On the negative side, the broker’s market proposal is quite narrow and limited to FX and CFD trading. Also, we find the educational section unsuitable for expert traders.

| Advantages | Disadvantages |

|---|

| Highly regulated and Established broker | International trading is provided by an offshore entity in BVI |

| Good reputation and years of operation | Conditions may vary based on the entity |

| Global coverage | |

| CySEC regulated | |

| Global expands including Asia, MENA, Africa regions | |

| Different account types based either on spreads or commissions | |

| Low minimum deposit | |

FIBO Group Features

FIBO Group is a tightly regulated Forex and CFD broker with good market conditions and a safe trading environment. The broker provides access to multiple asset classes, a good range of account types with a competitive fee structure, and advanced platforms for enhanced trading experience. While trading with FIBO Group it is essential to be aware of different aspects of its proposal:

FIBO Group Features in 10 Points

| 🗺️ Regulation and License | FSC BVI, CySEC |

| 🗺️ Account Types | MT4 Cent, MT4 Fixed, MT4 NDD, MT4 NDD No Commission, cTrader NDD, cTrader Zero Spread, MT5 NDD |

| 🖥 Trading Platforms | MT4, MT5, cTrader, FIBO Forex Drive app |

| 📉 Trading Instruments | Currency pairs, Cryptocurrencies, CFDs, Spot Metals, US Stocks |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0,6 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base Currencies | EUR, USD |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is FIBO Group For?

We researched the broker’s offerings, and different aspects of its proposal, and based on Our findings and Financial Expert Opinion here we list what FIBO Group is Good for:

- Beginning Traders

- Automated Trading

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT4 or MT5 platform

- For the cTrader Platform use

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- Suitable for Technical Analysis

- Tight Spread Trading

- PAMM Trading

FIBO Group Summary

Based on our research, FIBO Group spreads its services within all major markets, Europe, Asia, MENA, and CIS regions while bringing a range of services and trading instruments to choose from. The company also provides a variety of technologies and solutions to use, suitable for almost every trading need. Whether there is a need for seamless execution with no interventions, a choice between strategies built on a fixed spread or variable one, a necessity to use high leverage, competitive trading conditions, or even Social trading capabilities it’s all available in FIBO Group.

55Brokers Professional Insights

FIBO Group is our shortlisted broker due to its high level of technology, consistency of the trading technology provided and a long history of operation with a favorable trading experience. We like a wide range of account types that will suit any trading expectation and a good range of advanced platforms for flexible and profitable trading, either you large or small size trader also holding long or short positions. Also, costs are excellent with low spreads quotes on all instrument selection.

The instrument selection is good, though the tradable products are mostly CFD-based, which might incur some limitations for traders ready to explore more investment opportunities. Besides, conditions depend on the entity you trade with, so our best advice is to open an account with the European branch for better protection.

Overall, FIBO Group is a good choice for traders of different levels, although the education section does not include extensive materials, and those clients who need close guidance and deep education, might meet certain limitations.

Consider Trading with FIBO Group If:

| FIBO Group is an excellent Broker for: | - Forex and CFD traders

- Clients of all levels

- Those who prefer trading on the MT4/MT5 platforms

- Clients who favor access through Web trader

- Algorithmic traders

- Those who look for access to PAMM accounts

- Traders looking for a wide range of account types and diverse fee structures

- Global traders

- Client prioritizing tight regulations and safety

|

Avoid Trading with FIBO Group If:

| FIBO Group might not be the best for: | - Clients looking for multi-regulated brokers

- Traders who need 24/7 support

- Those looking for extensive investment opportunities |

Regulation and Security Measures

Score – 4.3/5

FIBO Group Regulatory Overview

FIBO Group, Ltd. is a registered Financial Services firm and is a company regulated by the Financial Services Commission, British Virgin Islands. In fact, BVI is an offshore zone with fairly low regulatory requirements and standards for financial firms.

Considering the strict European regulations overseeing the brokerage and its operations, we conclude that FIBO Group is a safe choice for investment, even when dealing with its international entity.

How Safe is Trading with FIBO Group?

Security and protection measures vary at FIBO Group since Broker operates via 2 different entities. The European branch is heavily overseen and protected as the broker provides provision of investment services and secure trading along with professional indemnity insurance and is a member of the Investor Compensation Fund (ICF).

- While the International BVI entity Protective measures are different and indeed lower, the customers and partners can be assured that all services, provided by any of the companies within the FIBO holding Group meet the highest international standards and are under the control of national applicable regulators.

Consistency and Clarity

FIBO Group is one of the oldest operating brokers, being in the market since 1998. This fact alone that the broker has been around for several decades, securing its place in the financial markets, speaks volumes about the broker’s credibility and standing. Another good point that further confirms the broker’s consistency and transparency is its top-tier regulation that provides safety and ease of mind to traders.

As we researched FIBO Group, we were really curious about the client’s feedback on FIBO Group’s overall operation. Generally, clients pointed out the tight regulation, a good variety of accounts, customer support, and the availability of enhanced features. From negative reviews, we mostly noticed that traders were displeased with individual bad experiences with withdrawals. We recommend to consider all the reviews and only then conclude if the broker is suitable for their trading tendencies and expectations. At last, another good point of the company is that FIBO Group during its years of operation has won numerous awards for its excellent customer service and achievements.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with FIBO Group?

FIBO Group offers an extensive range of account types, each with good conditions and features that suit certain trading expectations. This variety gives traders an opportunity to choose exactly what they are looking for, whether they are beginners or professionals ready to try new strategies and trade big. The seven account types FIBO Group offers are MT4 Cent, MT4 Fixed, MT4 NDD, MT4 NDD No Commission, cTrader NDD, cTrader Zero Spread, and MT5 NDD. The MT4 Cent account has a $0 minimum deposit requirement. For all the other accounts the minimum deposit is $50.

MT4 Cent Account

This account is especially suitable for beginners who still need to explore the Forex market. The minimum deposit is just 0 cents, which enables clients to start small. The available leverage is up to 1:3000, the account features low floating spreads from 0.6 pips. The account currency is in US Cents.

MT4 Fixed Account

The MT4 Fixed account is for those who prefer stability in trading conditions and prefer Forex and CFD trading. This account offers fixed spreads from 2 pips that remain stable even during market changes. The account currency is EUR or USD, and the leverage depends on the instrument traded and varies up to 1:200. The account is especially suitable for automated trading strategies. Another good point is that a demo account is also available, allowing clients to practice without risks.

MT4 NDD Account

With NDD processing, this account type enables to trade with prices from the largest liquidity providers for world electronic networks. The account offers low floating spreads from 0 pips and a commission of 0.003% on the amount of a transaction. With a maximum leverage of 1:400, a low initial deposit, and access to the MT4 platform, the account is a favorable choice for clients who prefer intraday strategies such as scalping. The account base currencies are EUR, USD, and GLD.

MT4 NDD No Commission Account

With its offerings, this account is similar to the MT4 NDD account. Yet there are also differences among them, and the greatest difference is that as the name prompts this account does not apply any commissions. The spreads start from 0.8 pips, and the base currencies offer greater variety – EUR, USD, GLD, BTC, and ETH.

cTrader NDD Account

As the name has it, the trades are conducted through the broker’s cTrader platform. This is a commission-based account, with spreads from 0 pips, and a commission fee of 0.003% from the amount of a transaction. The account base currencies are USD and EUR.

cTrader Zero Spread Account

This is another account type, proposing trading with a different fee structure. The spreads are from 0 pips, and the applied commission is different from the other mentioned commission-based accounts incurring a commission of 0.012% from the amount of a transaction Min $1. For Forex pairs the multiplier is up to 1:1000, and for Metals up to 1:400. The base currency is USD.

MT5 NDD Account

This is the only account type that enables trades on the MT5 platform. The MT5 account has again a commission-based structure, with spreads starting as low as 0 pips, and a fixed commission of 0,003% from the amount of a transaction. The maximum leverage is up to 1:400, the account base currency is USD.

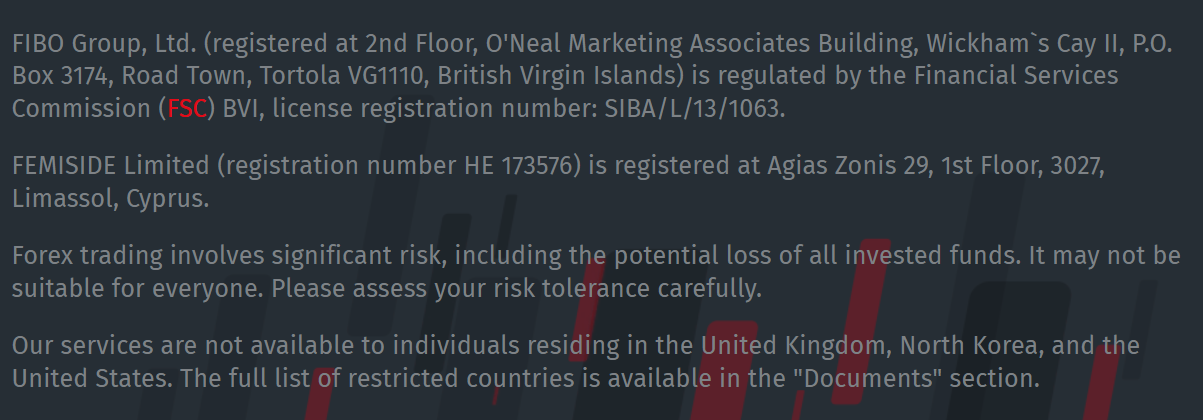

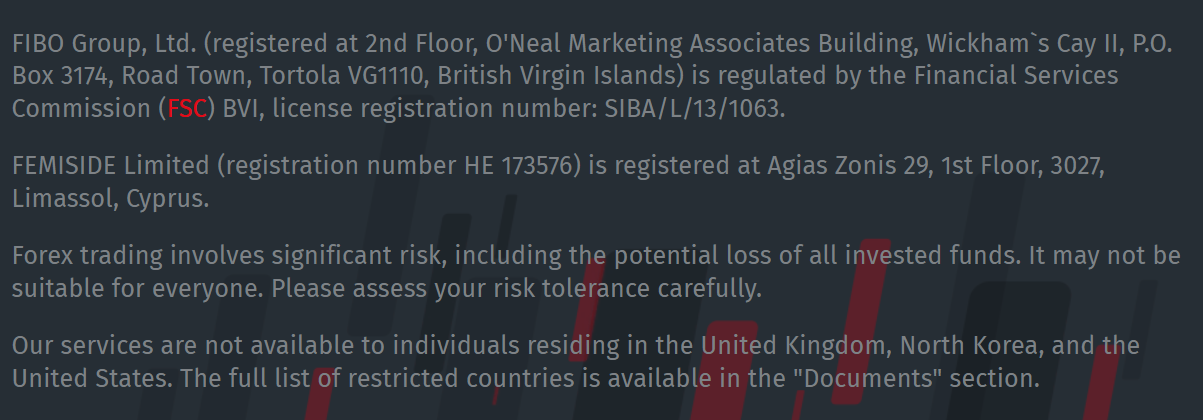

Regions Where FIBO Group is Restricted

The services FIBO Group provides are not available in certain countries due to regulatory restrictions or sanctions in place. Here is the list of countries that are restricted and FIBO Group does not accept residents from these countries as their clients:

- Australia

- Belgium

- Russia

- the United Kingdom

- North Korea

- the USA

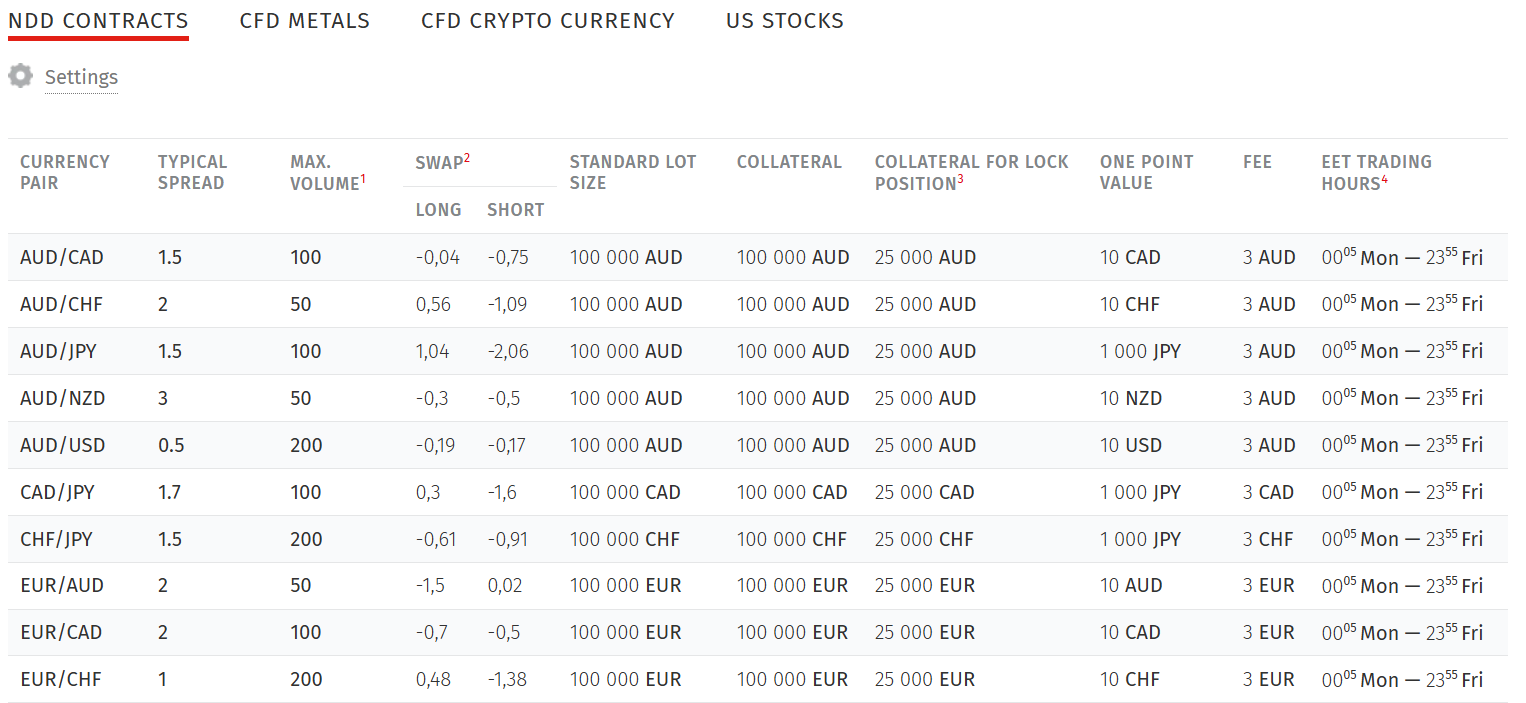

Cost Structure and Fees

Score – 4.6/5

FIBO Group Brokerage Fees

FIBO Group offers 7 account types, and the costs and fees depend mainly on the conditions of these accounts. There are accounts that are only spread-based, integrating all the costs into spreads, with no additional transaction fees. And, there are also commission-based accounts, offering different commission options. This variety will surely meet the trading needs of a large scale of traders, from cost-conscious clients to high-frequency ones.

FIBO Group offers 3 spread-based accounts – MT4 Cent, MT4 Fixed, and MT4 NDD No Commission. These accounts integrate all the fees into spreads, with no commissions added. For the MT4 Cent account spreads start from 0.6 pips, for the MT4 fixed account the spreads are fixed with an average of 2 pips, and for the MT4 NDD No Commission account spreads start from 0.8 pips. The typical Gold spread for the MT4 Cent account is 30 cents.

Commissions with the FIBO Group depend on the chosen account type. Out of the 7 account types the broker offers, 4 are commission-based. The commissions and spreads applied are different for each account:

MT4 NDD account, cTrader NDD account, MT5 NDD account– spreads from 0 pips+ commission of 0.003% from the amount of a transaction

cTrader Zero Spread account – spreads from 0 pips+ commission of 0.012% from the amount of a transaction

- FIBO Group Rollover/Swaps

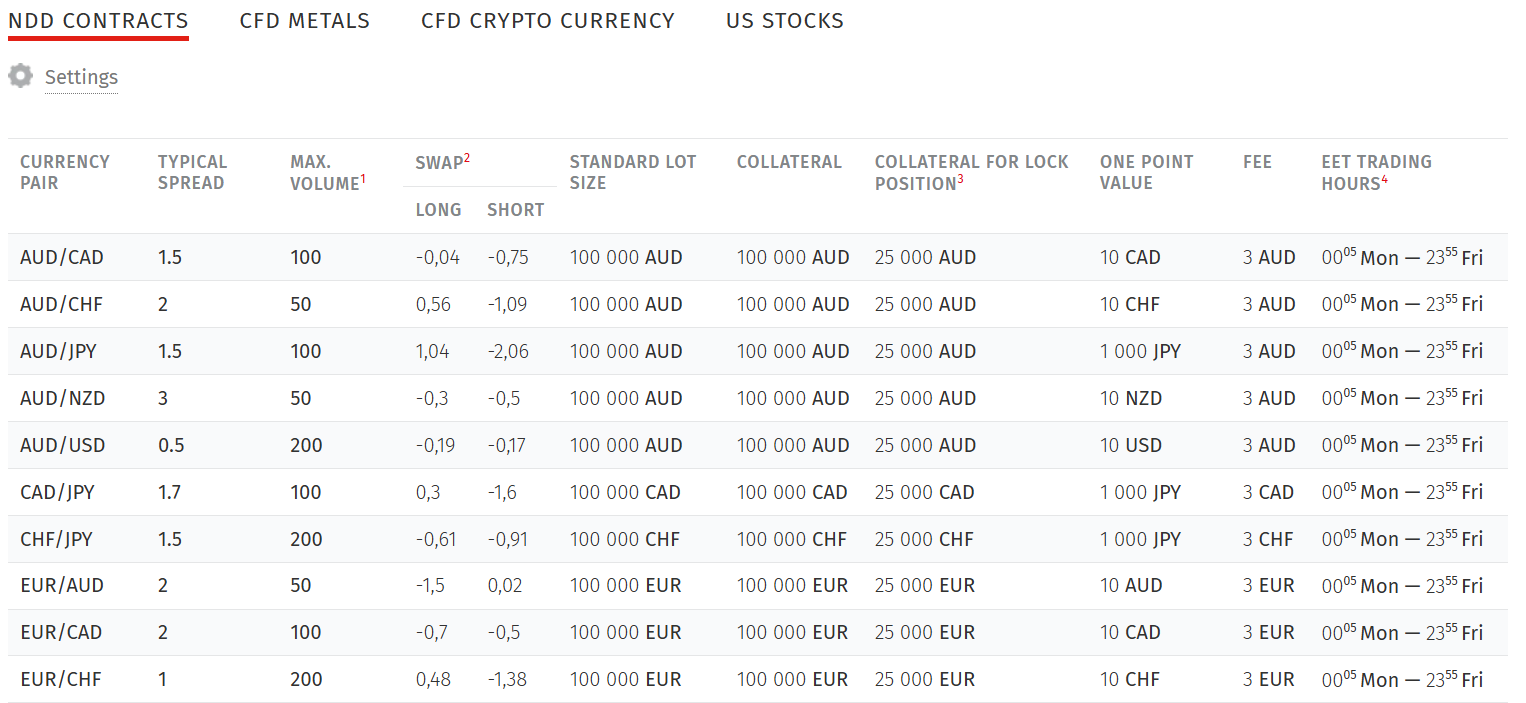

The broker also incurs swap fees, fees held for holding positions overnight. The broker provides this information on its website for each account type and for each instrument separately for both long and short positions. We have reviewed the applied swaps for the MT4 Cent account: the long swaps for the EUR/USD pair are -0,84, and the short swap is 0,28.

How Competitive Are FIBO Group Fees?

What we liked the most about the FIBO Group fees, is the transparency the broker provides. Clients can easily access the broker’s website and learn all the applicable fees for trading, for each account type and for each instrument separately, and in great detail.

Besides this obvious advantage of transparency and clarity, FIBO group also offers a really wide range of accounts that offer both spread and commission-based structures, with different opportunities, that will meet the needs of literally everyone. The spreads for all the accounts are very low, starting from 0.8 pips for the MT4 Cent account, which is lower than the market average.

| Asset/Pair | FIBO Group Spread | Pepperstone Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 0.6 pips | 2.4 pips | 0.9 pips |

| Crude Oil WTI Spread | 0.50 pips | 2.4 pips | 3 cents |

| Gold Spread | 30 cents | 0.15 pips | $0.27 |

| BTC USD Spread | 15000 | 20.22 | 0.10% |

FIBO Group Additional Fees

When considering the broker’s additional fees, we found that there are no commissions for deposits, due to the broker’s efforts. FIBO Group compensates the commissions charged by any payment method. We also found that the broker charges an Inactivity fee for the dormant accounts. If no trading positions are opened within 91 days then there will be a fee of $5 per month.

Trading Platforms and Tools

Score – 4.5/5

We find the FIBO Group platform assortment quite versatile, and equipped with good features and tools. The platforms are based on the account types, each account type enabling access to a certain platform. With FIBO Group clients can conduct their trades on the MT4 and MT5 platforms, cTrader, and Web Trader, which gives a good level of flexibility to clients. Besides, the broker also offers its own app, enabling trading on the go.

Trading Platform Comparison to Other Brokers:

| Platforms | FIBO Group Platforms | Pepperstone Platforms | IFC Markets Platfoms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

FIBO Group Web Platform

The broker’s WebTrader supports both MT4 and MT5 platforms and is a user-friendly web-based terminal, equipped with most of the conditions that are available via desktop access. Through web traders, clients can access financial markets directly from their browsers. The terminal includes real-time quotes, one-click trading, 30 built-in indicators, advanced charts, and graphical tools, that will support traders in technical analysis. In short, the web-based platform is a flexible way of conducting trades through any browser, supported by every device.

FIBO Group Desktop MetaTrader 4 Platform

FIBO Group’s MetaTrader 4 includes a wide range of instruments for successful trading, such as indicators for technical analysis, news feeds, online quotes, and customizable charts, and bars. For those clients who manage multiple accounts, the MetaTrader Multi Terminal is a good fit with its user-friendly interface and advanced features, that support the management of several accounts at the same time. It gives access to the trading history, provides quotes for all instruments, and ensures the smooth execution of trades.

FIBO Group Desktop MetaTrader 5 Platform

The FIBO Group MT5 platform is a better, more sophisticated solution to the former version, meeting the more advanced needs of Forex and CFD traders. The platform offers more features, including additional timeframes, a better offering of technical indicators, an economic calendar, and enhanced charting tools with access to various order types, ensuring flexibility and availability of more complex trading strategies.

The MT5 platform with its innovative features and faster order execution, is excellent for both beginners and professionals. It also provides automated solutions with built-in support for Expert Advisors (EAs) and algorithmic trading.

FIBO Group cTrader Platform

The FIBO Group cTrader platform offers a customizable interface, supports 14 languages, and ensures seamless connectivity from any location. The platform is developed to provide a better trading experience to traders of all levels, with its advanced charting tools, a comprehensive range of indicators, oscillators, and many others. The platform also enables the users to create custom indicators and seamlessly integrate with the cAlgo analytical platform for algorithmic trading.

With innovative functionalities like multiple account management, and quick switching between demo and live accounts, the broker’s cTrader platform can become a good solution for trying out strategies of different levels of complexity and exploring new opportunities.

Main Insights from Testing

All in all, the platform provides an efficient trading opportunity with No Dealing Desk technology. It offers traders unique features and tools, that are not available in any other platform, elevating its clients’ trading experience and enabling them to explore the market further. With its user-friendly interface, support for multiple accounts, and seamless connectivity, the cTrader might become a great tool, enabling beginners and advanced traders to enjoy the platform’s innovative solutions.

FIBO Group MobileTrader App

The FIBO Forex Drive mobile app gives traders great flexibility in conducting their trades from the palm of their hands while enabling them to take advantage of advanced and versatile features. Traders get features like 24/7 account management, training, market updates, and easy deposit and withdrawal options. In addition to the Forex Drive app, FIBO Group also supports mobile trading through the MT4, MT5, and cTrader mobile platforms, without limiting the capabilities of the platforms and enabling access to a good range of tools and features.

Trading Instruments

Score – 4.3/5

What Can You Trade on the FIBO Group Platform?

FIBO Group offers access to quite a good range of instruments. Although the offering might be a bit restricting, as traders can access only Currency pairs, Cryptocurrencies, CFDs, Spot Metals, and US Stocks, yet, combined with great market conditions, competitive fees with low spreads, and fixed commissions, the broker supports traders in exploring the most essential instruments. Here is the full range of the tradable products available with FIBO Group:

- 41 Forex pairs

- Spot Metals such as Gold and Silver

- Cryptocurrencies (Bitcoin, Ethereum, Ethereum Classic, Litecoin, Zcash, Dash, Monero)

- CFD Indices

- CFD Commodities

- US Stocks

Main Insights from Exploring FIBO Group Tradable Assets

All in all, we found the broker’s offering a good one, with great conditions, transparency, and clarity in applicable fees for each instrument. Although the range of instruments is not extensive, traders still have access to the essential assets and instruments and can explore the market.

The main restriction is that FIBO Group’s products are only based on CFDs. While traders can profit from speculating on prices, they still cannot own stocks and shares in the traditional sense of investment.

Leverage Options at FIBO Group

While trading with FIBO Group you are offered to use leverage, or a tool allowing you to use a loan taken from the broker with the purpose of increasing your trading size. Besides, the leverage levels are also determined by the regulatory restrictions, therefore trading with a European entity of FIBO Group you will automatically fall under ESMA regulation:

- European traders are allowed leverage to a maximum of 1:30 for Major Currency pairs and even 1:10 for Commodities.

- FIBO Group’s global office gives access to the highest possible leverage up to 1:3000, which is a fantastically high level you should be careful with.

Leverage offers vast capabilities and the possibility of higher gains if you use tools smartly and avoid taking high risks.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at FIBO Group

FIBO Group includes flexible deposit or withdrawal options, which allow secure and reliable transactions of funds. No transaction fees are applied for deposits, regardless of the funding method used. For bank transfer deposits, the broker compensates up to $30 in bank fees for deposits over $1,000. The payment methods include:

- Bank Wire Transfers

- Card Payments

- as well as Online Payments through Bitpay or Blockchain, Neteller, Skrill, Qiwi, etc.

Yet, make sure to check with the support service which payment method is available according to the entity you trade with, as well as your residence.

Minimum Deposit

The minimum deposit requirement for FIBO’s 6 account types is $50. However, the minimum deposit for its MT4 Cent account is $0.

Withdrawal Options at FIBO Group

FIBO withdrawal options are various including popular bank wire and e-wallets like Skrill. Also, you should note that depending on the conditions and method of payment you use, the fees may be waived. Typically fees are none, but some options range from 35-50$ per transfer.

- For Bank Wires transfers are normally processed within 2-5 days, for credit cards the estimated processing time is a few minutes after the withdrawal request, and for e-wallets depends on the method used. For instance, for Skrill, the processing takes a few minutes, while for Nettler it might take up to 2 working days.

Customer Support and Responsiveness

Score – 4.6/5

Testing FIBO Group Customer Support

Another important factor to consider when choosing the right broker is customer support service. The broker offers multichannel support through international phone calls, email, and live chat. Additionally, it provides a comprehensive client area for account management and access to market analysis.

- The broker also has a FAQ section, where traders can find answers to common trading-related questions.

- In addition, FIBO Group is active socially, providing updated information about its activities and the latest market news through Linkedin, IG, FB, Telegram, and YouTube.

Contacts FIBO Group

All in all, FIBO Group provides high-quality customer support, through various methods of communication. We found the live chat quite helpful, with prompt and quick answers.

- Those who prefer directing their questions through email can use the provided email address: service@fibogroup.com. Traders from Khazakhstan can use the following email address: kz@fibogroup.com

- For phone calls the broker offers +44 (845) 09-50-118

Research and Education

Score – 4.4/5

Research Tools FIBO Group

We found the broker’s research resources quite good, with helpful analytical tools and market analysis capabilities. The several platforms FIBO Group offers for trades already include comprehensive research features, enabling traders to run in-depth technical and fundamental analyses. The additional research tools provided enhance the broker’s offering even further:

- The broker’s Market Analysis section includes valuable insights into the financial markets and assists in making important decisions. It is comprised of a range of analytical tools, such as daily market reviews, opinions from experts, and technical analysis on major instruments.

- The Forecasts section includes insights into market trends and the possible changes the market might take, concentrating on financial instruments such as Forex pairs, commodities, indices, and cryptocurrencies.

Education

While researching the broker’s education section, we found several points we would like to consider. First, the broker provides several resources on its website, that might be useful for traders and can assist them in understanding the market better.

- The Glossary section provided by FIBO Group is quite extensive, containing a good range of financial terms that are essential to be acquainted with, when you are involved in Forex trading. This section can especially be useful for beginners, who constantly come across foreign terms and are not sure how to interpret them.

- The broker also provides Video courses, that will teach traders everything about the market, and help them understand how to navigate the platforms and conduct profitable trades. The courses are free and available for everyone.

- The broker has also founded an International trading academy that has been around for a long time, providing vocational training and trading experience, daily analysis by financial market experts, assistance in developing individual trading strategies, and many more services.

Is FIBO Group a Good Broker for Beginners?

The answer is positive and is based on our extensive research on all the aspects of trading with the broker. With great platforms, a competitive fee structure, and a wide range of account types, suitable for every trading need, FIBO Group has its own place in the market and provides both safety and good market conditions from beginners to professionals. The availability of a Demo account and a Cent account with a $0 initial deposit option further solidifies the fact that FIBO Group is a good fit for novice traders. Besides, the research and education sections are also adequate and will provide good knowledge of the market. At last, supportive customer support is another advantage traders will surely appreciate.

Portfolio and Investment Opportunities

Score – 4.1/5

Investment Options FIBO Group

In terms of investment, FIBO Group is not the broker that offers a great diversity of instruments and availability of real shares trading, as the offering is mainly based on CFDs. However, the broker has come up with other solutions, that pretty much cover the lack of traditional investment, suggesting advanced options:

- FIBO Group offers a Copy trading opportunity through its cTrader platform. This feature is especially advantageous for beginners looking to learn from experienced traders and for professionals who wish to share their strategies and build a follower base.

- In addition, FIBO Group provides tools for Money Managers and Professional Traders, enabling them to manage multiple accounts efficiently through advanced platforms like PAMM. It works the following way: a trader signs up as a Managed Account (PAMM) manager and opens one or multiple Managed Accounts. By the end of each investment period, both the profits and losses are calculated on the account and divided among the investors and the manager.

Account Opening

Score – 4.6/5

How to Open a Demo Account?

Opening a Demo account is quick and easy with FIBO Group, with simple consecutive steps that will take only a few minutes:

- Go to the broker’s website and choose the ‘Open Demo Account’ option

- Supply your email address, and you will get an email to verify your email address

- After verification, you will be taken to the Client’s Area

- Supply personal information (name, country, phone number, etc.)

- Choose again the Demo account option, then choose an account type, platform, leverage, and currency

- Confirm the information and get account credentials via email

- Start trading

How to Open a FIBO Group Live Account?

Opening a FIBO Group live account entails the same steps, as for the Demo account opening. Only, as in the case of most brokers, it takes longer and requires more detailed personal information and documentation for identity verification. Here are the steps to open a live account with FIBO Group:

- Go to the broker’s website and choose the ‘Open Live Account’ option

- Supply your email address, and you will get an email of verification

- Once the email is verified, you will be taken to the Client’s Area

- Then, you will be required to fill out a registration form (name, country, phone, etc)

- You will also need to provide a valid ID and documents to confirm your address of residence

- Then choose conditions, platform, account type, multiplier, currency, etc.)

- Click on the open account

- You will get a verification email and will be provided with account credentials

- Once this is done, you can fund your account and start trading

Score – 4.2/5

Another advantage of FIBO Group is that the broker offers a few additional tools and features, that enhance the experience. Some features we found are the following:

- FIBO Group Cashback program gives the clients an opportunity to receive additional income. Traders get cashback based on the monthly trading volume on the account; the higher the trading volume, the more cashback they receive. It is up to traders to use the credited cashback for trading purposes or withdraw it.

- The Economic Calendar keeps traders informed about essential economic events that will probably impact the market. It provides real-time updates, with detailed event descriptions and the approximate expected date. This is a great tool to keep traders updated and ready for major market changes.

FIBO Group Compared to Other Brokers

After reviewing FIBO Group from different aspects, we have also compared the broker to other brokers in the market that are considered safe and well-regarded. We first compared FIBO Group to Fortrade in regard to regulation and security. Both of the brokers hold licenses from respected authorities, yet, while FIBO Group is regulated by CySEC, Fortrade holds licenses from FCA and ASIC as well, which further solidifies the broker’s reliability and adherence to strong rules and guidelines.

We also compared FIBO Group to its peers in the market to see how competitive the broker’s fees are. In fact, the broker offers a very large range of accounts, and each comes with very low prices, which we haven’t detected in any other broker, including Eightcap, Fortrade, and even Eightcap.

FIBO Group also offers a good selection of platforms, equipped with advanced features and tools we appreciate. The offering is better than Eightcap’s, which enables access to the popular MT4/MT5 platforms. Yet, FP Markets still includes a better selection of platforms, also offering a proprietary platform.

To see which broker is more favorable for beginner traders, we reviewed aspects like education, customer support, and minimum deposit requirements to find that FIBO Group is good in all of the mentioned aspects, with quite good education available, a supportive team, and a Cent account with a $0 initial deposit requirement. FP Markets and Admiral Markets still offer 24/7 support and better educational resources, with Admiral Markets only a $1 initial funding requirement.

| Parameter |

FIBO Group |

Fortrade |

OANDA |

Exness |

FP Markets |

Admiral Markets |

Eightcap |

| Spread Based Account |

Average 0.6 pips |

Average 2 pips |

From 0.8 Pips |

From 0.2 pips |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission Based Account |

0 pips+ 0.003% |

Not Available |

0.1 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Low |

Average |

Low |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader |

Fortrader Platform, MT4 |

MT4, MT5, OandaTrade |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

200+ instruments |

300+ instruments |

500+ instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

FSC BVI, CySEC |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

FCA, CFTC, NFA, MAS, ASIC, IIROC, FFAJ |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/5 |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Good |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$0 |

$100 |

$0 |

$10 |

$100 |

$1 |

$100 |

Full Review of Broker FIBO Group

In conclusion, FIBO Group is a trustworthy broker with a rich history going back to 1998. The broker offers stability, transparency, and adherence to strict financial regulations. FIBO Group provides quality and versatile service with a wide range of platforms, including MT4, MT5, cTrader, and a good selection of platform-based account types, also enabling social trading and PAMM accounts, which fit the needs of both beginners and professional traders. What we liked about FIBO Group is its competitive fee structure with different solutions that give more choices to clients. The offered spreads are tight, and commissions are considerably on the lower side.

However, while FIBO Group does have a good selection of instruments, the reliance on CFD-based products may result in fewer options for those who look for traditional investments, such as stocks or bonds. Meanwhile, while the broker offers good support and tools, some would have liked to see a more detailed education section to help the less experienced traders. Considering these minor cons, FIBO Group still remains a favorable choice for traders in search of competitive conditions, advanced platforms, and the security of a well-regulated broker with a wide global reach.

Share this article [addtoany url="https://55brokers.com/fibo-group-review/" title="FIBO Group"]

Really quite comfy to trade with EA. Fibo does not restrict that and even promotes some of the accounts as most suitable for experts. You can set up and test your EA on a demo and if it works fine go live on a cent account with some small deposit. I did not have to get any special permission, everything worked as intended.

Fibo Groups is a 100% Scam, Please be aware ( with Proof)

Hello everyone, I want to share the terrible experience with Fibo Groups that initially one of my friends he suggested me this broker, and even though I saw so many negative reviews on various FX broker review websites I opened an account with $100 to check the broker when I opened they connect with an account manager call “Kairat from Kazakhistan”, he helped me for verifying the account. After that I started the trading and I gained some profit, then slowly I deposit capital to $1000 and after sometimes $6000, then I tried to withdraw $1000 to Skrill and $5000 to USDT wallet and it was Successful, everything went smooth and no issues with the spread, slippage, and execution speed. And then I deposited $25,302.5 and made $45,453.28 and huge commissions that $19,129.90 which is almost 45% of the profit and the account balance was $27,659.88. Then suddenly noticed that they increased slippage is more than 15 pips which usually 1-3pips, spread Is more than 5pips which usually 1-2 pips. The execution speed was 10,000ms which is usually an average of 100ms, and the account started to go negative side, and I stopped trading and I understood that they try to blow my account using their plugins.

After that I tried to withdraw $25,000 on 17.06.2022, usually, they approve around 24 hours, after 24 hours I asked the account manager he said they’ll process it soon, but it didn’t happen, then after another day I asked them about the status of the withdrawal account manager said it’s on account checking department, but they didn’t do any checking like this before and after 5 days they said they can’t give the profit of 01.06.2022 – 17.01.2022 and I asked the reason to the account manager he said he’s line manager didn’t give any reasons to him instead I need to make the reason request through the portal, I asked them they simply just said below statement without giving the reason.

{ thank you for reaching out.

We kindly inform you that a checkup revealed the abuse of a vulnerability in

the trading software (Meta Trader 5, trading platform) registered on the

mentioned account from 01.06.22. According to the clause 4.9 of the

Customer Agreement, the positions have been deleted and the total

balance of the account has been recalculated.

Please, be aware that according to clause 4.9 of the Customer Agreement

available on the official web-site of FIBO Group

(https://www.fibogroup.com/u/document_file/1624/customer_agreement.pdf)

the Company shall reserve the right to cancel (annul) any Transaction due

to wrong quotation found by the Company provided that this wrong

quotation appeared as a result of malfunction of the Client Terminal.

We look forward to your understanding and further cooperation.

Should any question arise please do not hesitate to contact us!

Best regards,

Customer Service}

If there is no price quotation when I placed the Trades why they placed the Trades? So many scam brokers used to tell this reason to profitable traders.

I have attached all screenshots here, please prefer all details.

I urged to everyone please avoid this broker if you’re trying to make a profit from this broker you’ll never make the money. Even though your family or colleague says it’s a good broker, they’ll wait for their timing, I promise you they’re real market makers. I asked them again please release my money they said that its the company’s final Decision and had no explanation for what went wrong. Please contact me for more details about this broker

My lessons

● Don’t ever choose Fibo Groups

● They’ll add an Account manager and he’ll ask every time he called when you deposit your $50k ● don’t go with an offshore broker, they can do whatever you want.

● don’t maintain a huge balance with this kind of broker

● if you’re a profitable trader then don’t go with this broker.

Please avoid this broker! I would say it’s 100% scam.

Thank you!

Hi team is it allowed to get a standard account type if yes, how much I must invest on Standard account. What is the maximum high execution speed also I’m looking for leverage of 1,888 or more.