- What is Evest?

- Evest Pros and Cons

- Regulation and Security Measures

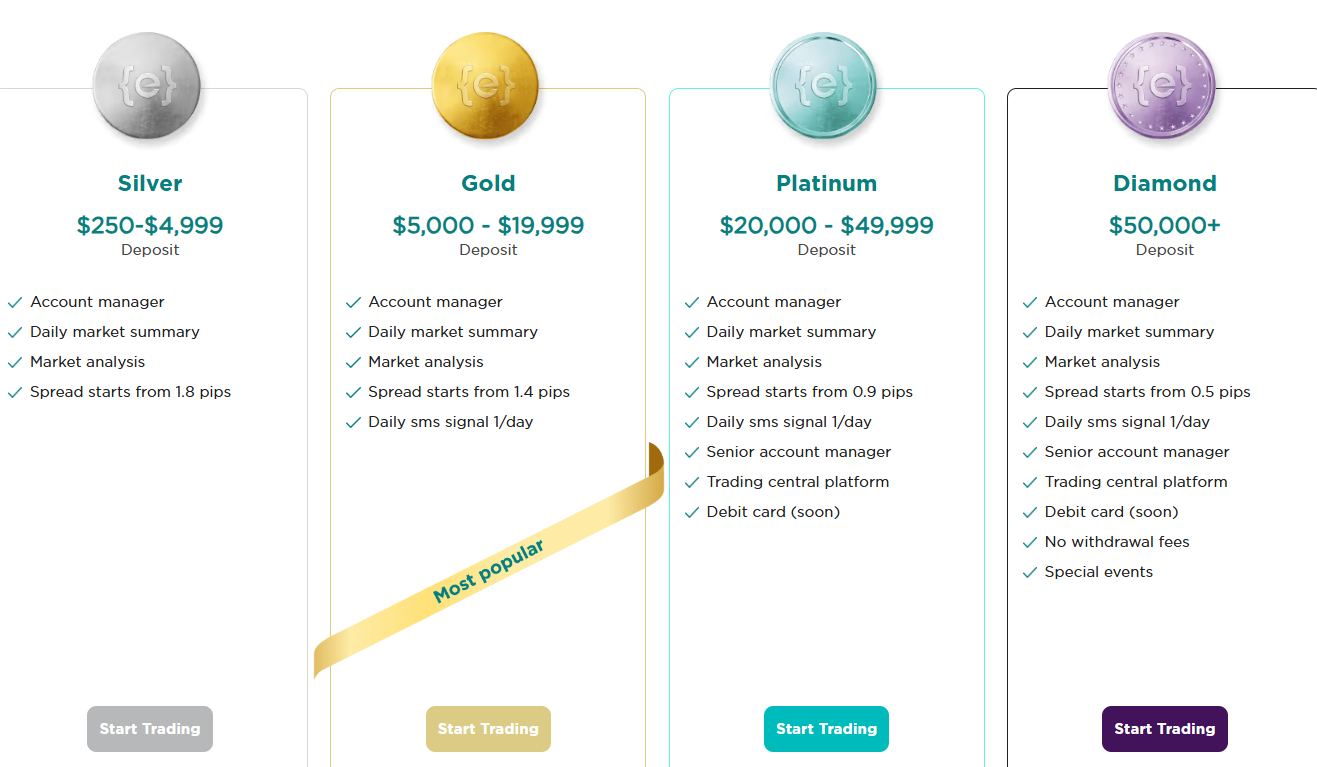

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Evest Compared to Other Brokers

- Full Review of Broker Evest

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

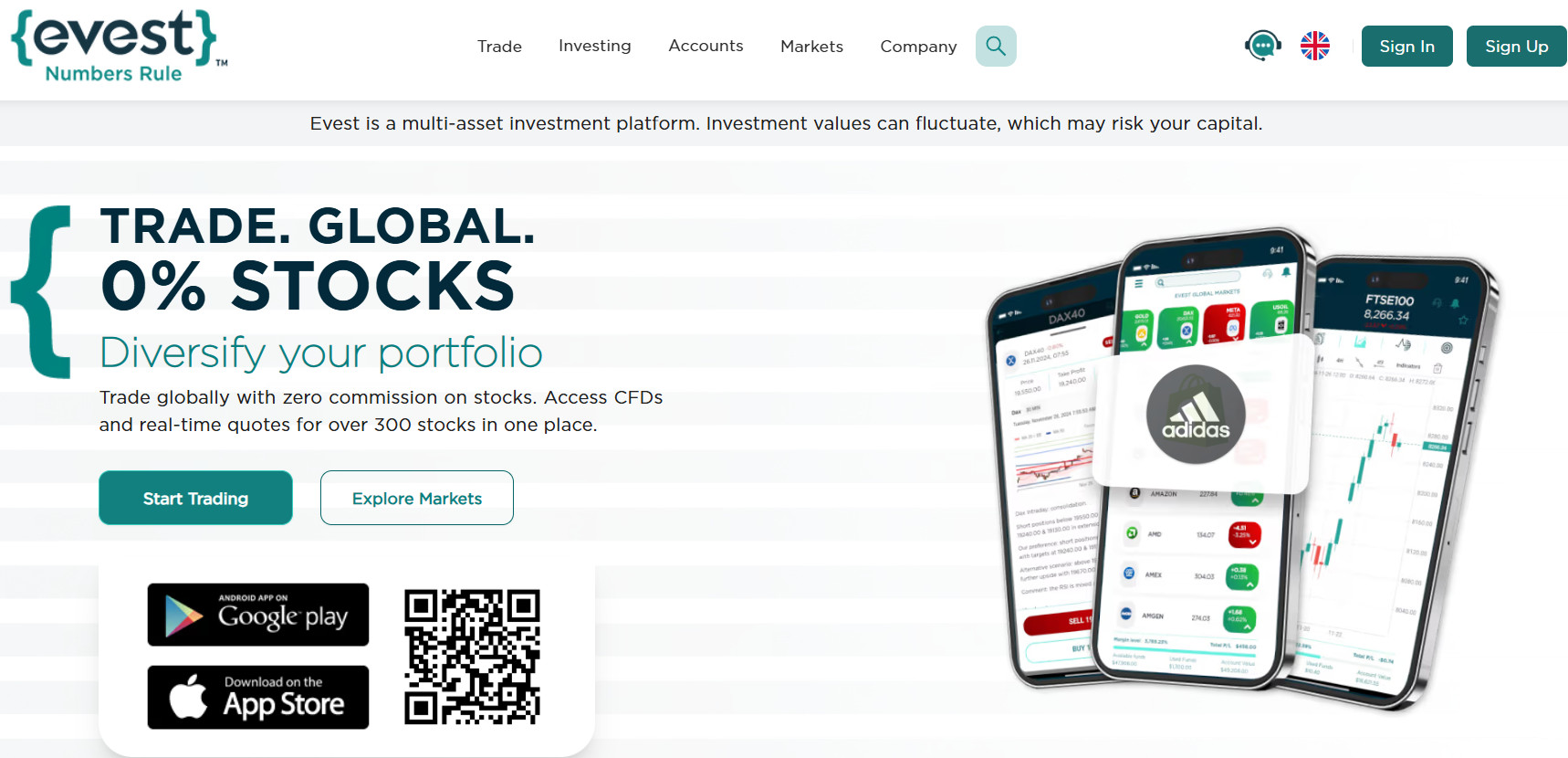

What is Evest?

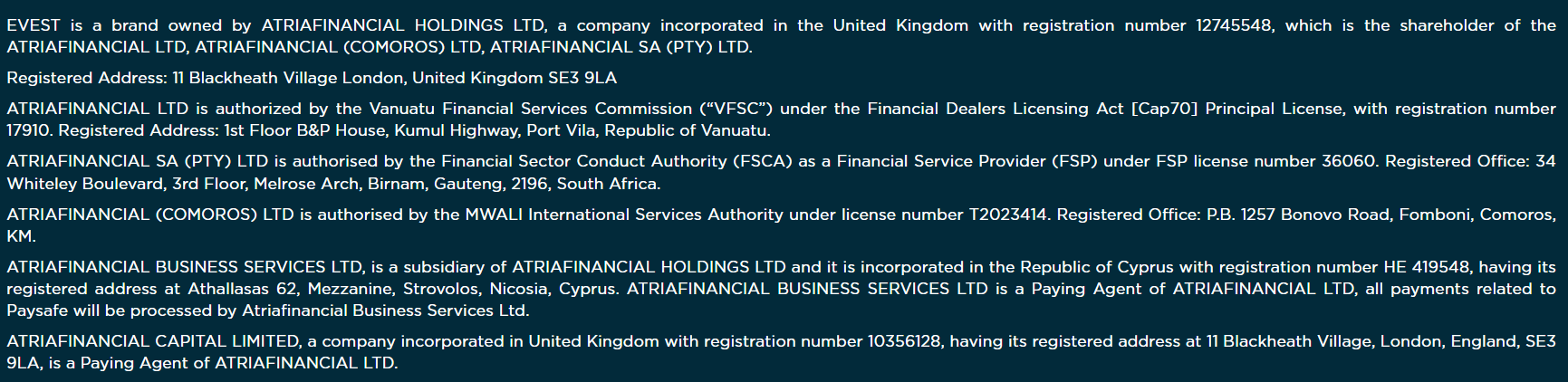

Evest is a global CFD and Forex broker that operates under the brand name ATRIAFINANCIAL LTD, offering access to a wide range of financial assets. The broker offers over 400 tradable products across stocks, currencies, cryptocurrencies, commodities, indices, and futures indices. Trades are conducted on the broker’s proprietary web-based platform and mobile app.

The broker has an association with multiple entities operating under the brand name ATRIAFINANCIAL, including subsidiaries in the UK and Cyprus, serving as payment agents. The broker holds a serious license from the FSCA in South Africa, whereas previously it operated as an offshore broker registered in Vanuatu with no stringent oversight.

The broker offers comprehensive features and trading conditions, including copy trading in its offering as an alternative option for investments. The education section is also good, with webinars, Trading Academy, and Trading Central available.

Evest Pros and Cons

We have noticed that Evest offers customer-oriented services, providing a safe and competitive trading environment. The broker offers several account types with different conditions. The minimum deposit requirement is $250, which is considered an average in the market.

Another advantage of Evest is its extensive education section that includes a Trading academy, webinars, and more. The multilingual customer support via multiple channels ensures quick and helpful assistance.

One drawback of trading with Evest is the lack of a popular platform that traders favor. Clients can conduct trades on the broker’s proprietary web platform or through the mobile application. Additionally, regarding regulation, Evest does not hold a top-tier license from respected authorities such as the FCA or ASIC.

| Advantages | Disadvantages |

|---|

| Regulated in South Africa | Lack of top-tier license |

| Competitive trading conditions | Conditions may vary according to regulation and entity |

| Good range of instruments | The MT4 or MT5 platforms are not included |

| Advanced proprietary platforms | |

| Fast account opening and free Demo account | |

| Comprehensive educational resources | |

| Forex and CFDs trading | |

| Competitive trading costs and spreads | |

| Dedicated customer support | |

Evest Features

Evest stands out for its favorable proposal, offering a range of trading instruments, competitive spreads, and its advanced platforms for web and mobile traders. We have carefully considered the different aspects of trading with Evest and came up with a list of the main features:

Evest Features in 10 Points

| 🗺️ Regulation | FSCA, VFSC, MISA |

| 🗺️ Account Types | Silver, Gold, Platinum, Diamond |

| 🖥 Trading Platforms | Proprietary web and mobile platforms |

| 📉 Trading Instruments | Forex, commodities, stocks, cryptocurrencies, indices, and futures indices |

| 💳 Minimum deposit | $250 |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Various currencies available |

| 📚 Trading Education | Trading Academy |

| ☎ Customer Support | Monday to Friday 08:00 – 00:00

Sunday 09:00 - 18:00 |

Who is Evest For?

Evest is a suitable choice for traders prioritizing a secure and user-friendly environment. Based on our findings and Financial Expert Opinions, Evest is especially a good fit for the following:

- Traders from the South African region

- CFD and currency trading

- Cryptocurrency traders

- International traders

- Professional trading

- Beginner and intermediate traders

- Muslim Trading

- Copy traders

- Competitive fees and spreads

- Good trading tools and learning materials

- A helpful customer support team

Evest Summary

In conclusion, we revealed that Evest provides competitive trading conditions backed by a serious license from the FSCA. Although the broker started off as an offshore broker, at present it follows strict guidelines and regulatory laws. With a strong client focus and a commitment to continuous improvement, Evest ensures a growing and safe trading environment, favorable conditions, and competitive pricing.

Although Evest does not offer any of the market’s popular platforms, such as MT4/MT5 or cTrader, its proprietary platform allows sufficient flexibility and functionality. The broker also stands out for its comprehensive learning materials, which are well-suited for traders of all experience levels.

55Brokers Professional Insights

At present, Evest is considered a well-regulated broker with oversight from the South African FSCA. When Evest was first established, it was operating solely as an offshore broker. For a long time, it was on our list of unregulated brokers and was not considered a favorable choice. However, its development and growth in terms of regulation have transformed the broker’s status into a regulated and trustworthy choice.

As we have found, the broker offers reasonable trading costs expressed in spreads. Its four account types are tailored to please different clients. Trades are conducted on the broker’s proprietary platforms, and no other platform options are available. However, the advanced web platform and mobile app include diverse charting tools, technical indicators, and other unique features.

The broker provides access to over 400 tradable instruments across various financial markets. The broker also provides management tools, including guaranteed stop-loss orders and negative balance protection. Another advantage is Evest’s impressive educational resources, including Trading Academy, webinars, and more.

Consider Trading with Evest If:

| Evest is an excellent Broker for: | - Beginner traders

- Professional clients

- Traders who prioritize extensive educational resources

- A good range of tradable products

- CFD and currency traders

- Cryptocurrency traders

- Clients who prefer no commission structure

- Copy traders

- Clients from the South African region |

Avoid Trading with Evest If:

| Evest is not the best for: | - Clients looking for top-tier regulation

- The MT4/MT5 platform enthusiasts

- Traditional investors

- Clients looking for 24/7 customer support |

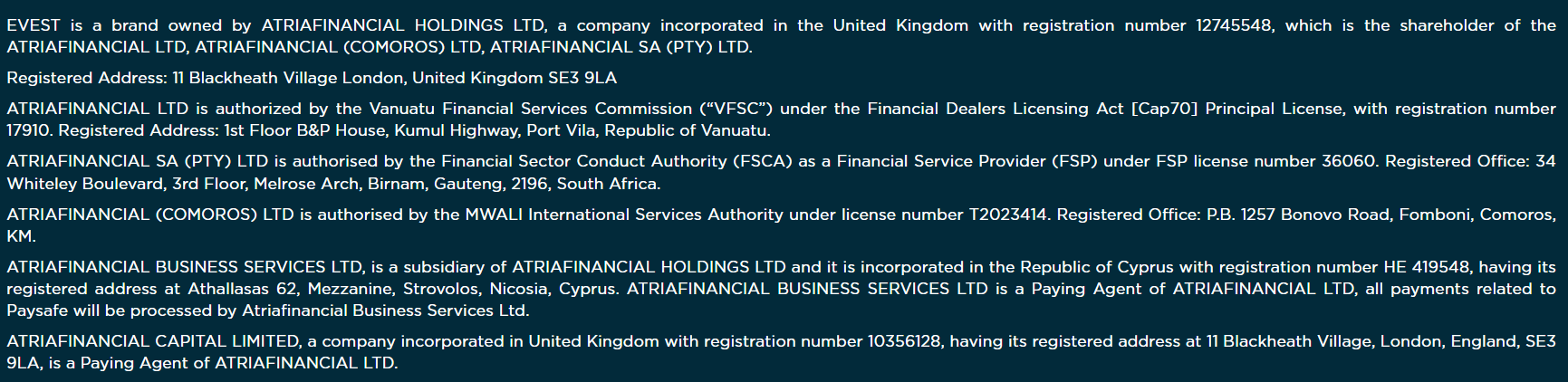

Regulation and Security Measures

Score – 4.3/5

Evest Regulatory Overview

Evest is a regulated broker that holds a serious license from a respected regulatory authority. The broker’s compliance with strict laws ensures transparency in practices.

- The broker holds a license from the South African FSCA, ensuring that its services are safe and reliable for traders from the South African region.

- However, the broker also holds an offshore license from the Financial Services Commission of Mauritius (FSC). The regulation does not provide strict oversight and stands out for its lax practices. So, we strongly recommend recognizing the differences when trading in different jurisdictions.

- The broker also has a registered entity in the MWALI International Services Authority, which is also an offshore zone and represents the same lax approaches as any other offshore zone.

How Safe is Trading with Evest?

We have also researched how Evest protects its clients and what measures it employs. As we have found, the broker is regulated by the FSCA, a respected authority in the market. The latter, as an integral part of its oversight, assures the protection of traders’ investments.

- Thus, trading with Evest under its FSCA regulation, clients are protected via negative balance protection.

- Clients are also protected by account segregation, as following strict rules, Evest is obliged to keep its clients’ accounts segregated from the company’s accounts.

- However, the broker is not a member of any compensation fund, which means that in the event of insolvency, there is no payout mechanism to protect its clients.

Consistency and Clarity

An essential part of our review is researching the broker in terms of consistency and clarity. As we found, not in the farthest past, Evest was considered an offshore broker, operating solely under offshore oversight. It also received multiple negative reviews from clients and warnings from respected financial authorities.

However, the broker has strengthened its regulatory status and has obtained a license from the FSCA. It has added a substantial layer of protection to Evest, obliging it to follow strict laws and guidelines. Our comparison of the current customer feedback allows us to see a positive change, as many clients express their satisfaction with the broker. From our side, we advise considering the broker’s past, comparing it to the present compliance with laws, and only then deciding if it is a reasonable choice to open an account with Evest.

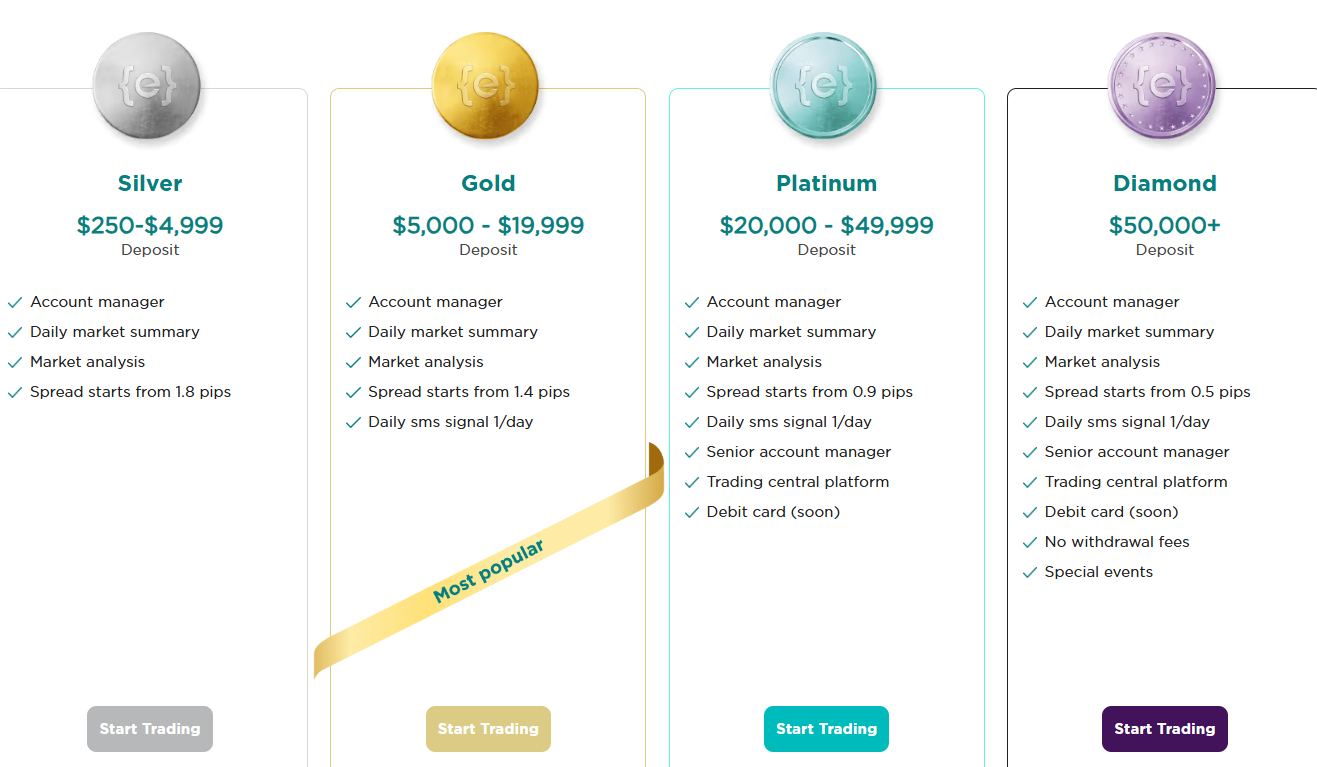

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Evest?

Evest provides four distinct account types to cater to various trading styles and needs. Each account stands out for its specifically tailored conditions to meet the expectations of beginners to professionals.

Evest additionally offers swap-free accounts for its Muslim clients. Novice traders can also benefit from a demo account by practicing trading with virtual funds before engaging in real-time trading.

- The broker provides four primary account types: Silver, Gold, Platinum, and Diamond. Each of these Evest account types comes with its unique features and specifications. The Silver account, for instance, requires a minimum deposit of $250, and it offers a daily market summary and analysis. Gold accounts, on the other hand, necessitate a minimum deposit starting at $5,000.

- Meanwhile, Platinum and Diamond accounts have more substantial investment requirements, but they offer enhanced trading privileges, including lower fees, access to a Senior account manager, the Trading Central platform, exemption from withdrawal fees, and a range of other benefits.

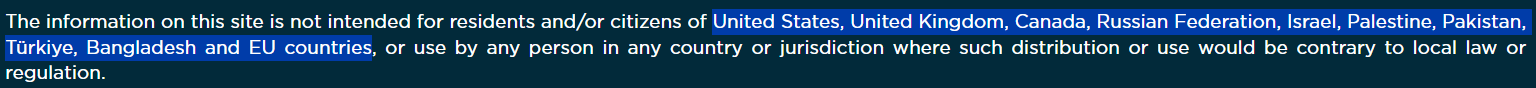

Regions Where Evest is Restricted

Evest services are unavailable in certain regions due to regulatory and compliance reasons. The broker does not accept clients from a list of countries, including:

- The United States

- The United Kingdom

- Canada

- Russian Federation

- Israel

- Palestine

- Pakistan

- Turkey

- Bangladesh

- EU countries

Cost Structure and Fees

Score – 4.3/5

Evest Brokerage Fees

Evest offers a spread-based structure for its CFD-based products for all account types. We found the broker’s spreads competitive with no hidden fees. Commissions are applied only for real stock trading, available through Gold, Platinum, and Diamond accounts.

All in all, the Evest’s spread-based structure is favorable, offering low spreads, especially for more advanced accounts.

Evest offers a spread-based structure for CFD trading. All accounts offer a commission-free structure. The average spread for the EUR/USD pair for the Silver account is on the higher side, 2 pips on average. For the Gold account, spreads are slightly lower (1.4 pips). The Platinum account offers favorable spreads of 0.9 pips, and the Diamond account 0.5 pips, respectively.

Evest does not apply commissions for the CFD-based products for any of its account types. Commissions are applied for real stock trading only, available through Gold, Platinum, and Diamond accounts. The Silver account does not support real stock trading.

Evest also applies swap fees for the positions held overnight. The long swap for the EUR/USD is -5.8, while the short swap is -3.7.

How Competitive Are Evest Fees?

Based on our testing, Evest provides transparent and clear trading fees. Each account comes with its average spreads, offering competitive pricing based on instruments. There are no commissions applied, which results in favorable costs.

However, there are commissions for real stock trading. Clients should contact the support team and check all the applicable fees and conditions for traditional investments.

Besides, we found that the broker has only a few additional fees and no hidden costs. From a safety perspective, we advise clients to be careful, as trading and pricing conditions may vary depending on the broker’s entity.

| Asset/ Pair | Evest Spreads | AAAFx Spreads | CMC Markets Spread |

|---|

| EUR USD Spread | 2 pips | 0.3 pips | 0.5 pips |

| Crude Oil WTI Spread | 1.1 | 30 pips | 2.5 |

| Gold Spread | 3.7 | 23 pips | 0.2 |

Evest Additional Fees

When trading with Evest, clients should consider the additional fees added to the overall costs. Here are the extra fees to consider:

- Evest applies a $5 fee for withdrawal processing. All withdrawals should be above $25.

- The broker also applies a 2% conversion fee.

- At last, after two months of inactivity, the broker applies a $75 fee. After three months of dormancy, clients will pay a $50 inactivity fee.

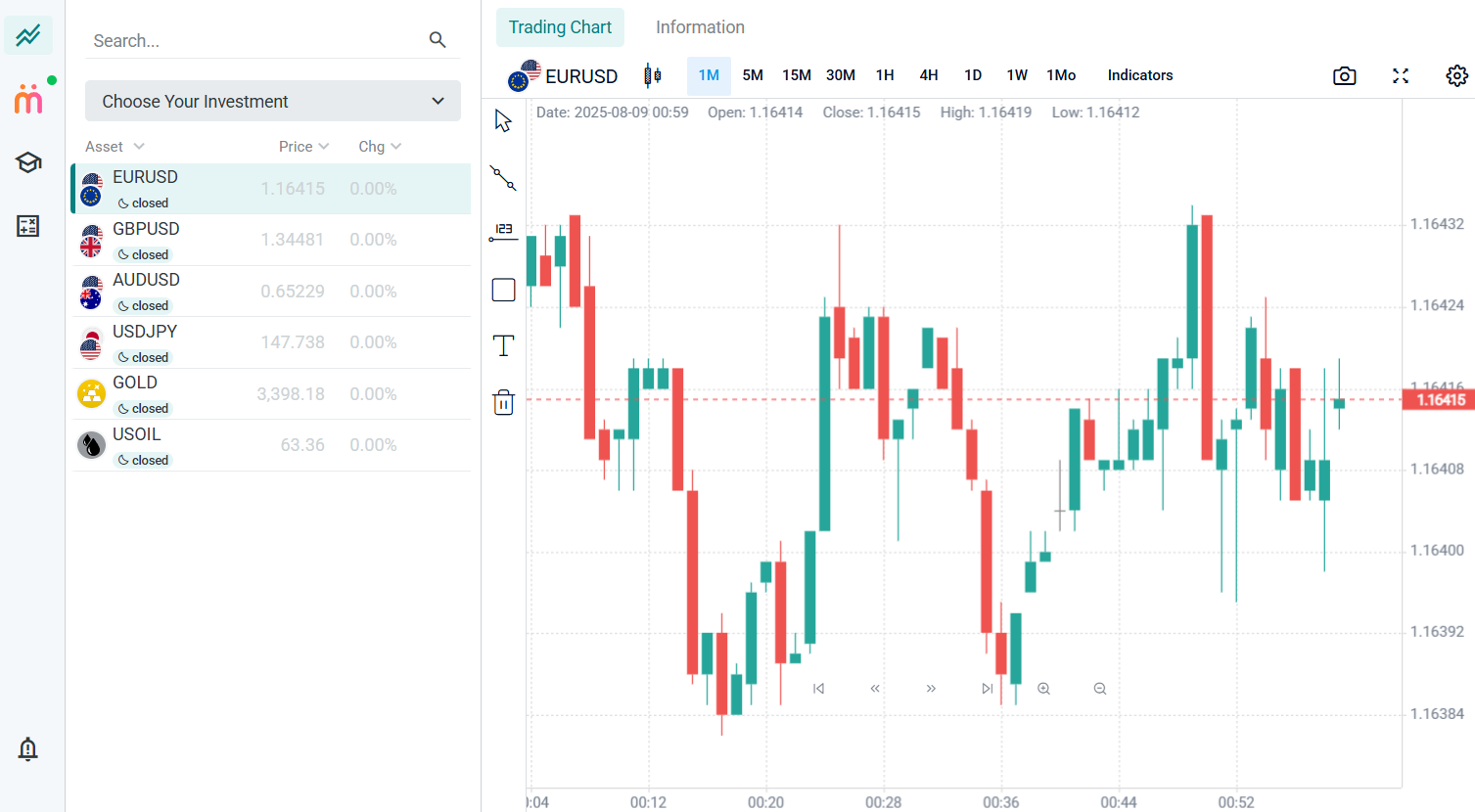

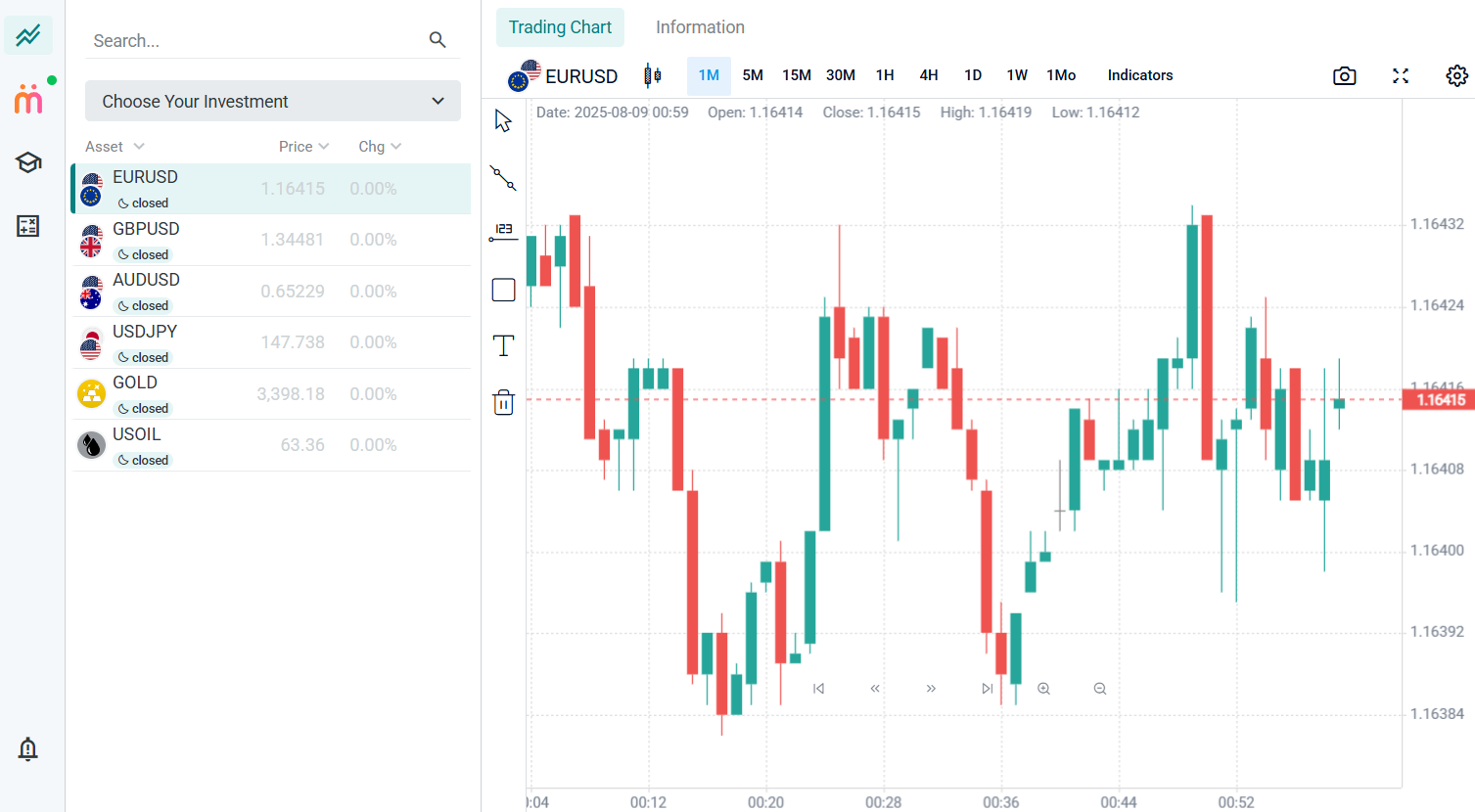

Score – 4.2/5

Evest provides a suite of proprietary trading platforms and tools developed to meet the needs of clients of different experience levels. The advanced Web Platform stands out with its simple interface, cutting-edge charting, technical indicators, and customization capabilities. The broker also offers a mobile app for clients who prefer to trade on the go.

| Platforms | Evest Platforms | AAAFx Platforms | CMC Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | Yes | No | Yes |

| Mobile Platform | Yes | Yes | Yes |

Evest Web Platform

The Web Platform is a proprietary trading platform designed to deliver a powerful yet intuitive trading experience. The broker’s WebPlatform is a browser-based solution that requires no downloads or installations. It features advanced charting tools, real-time market data, and a user-friendly interface. The interface is simple and easy to use, without unnecessary complications, ensuring smooth navigation.

The platform supports one-click trading, customizable structures, and multiple asset classes, allowing users to conduct trades efficiently.

Evest Desktop MetaTrader 4/5 Platform

Based on our findings, Evest does not offer the popular MT4 platform. At some point in its operations, the broker included the MT5 platform in the proposal. However, Evest does not support MT5 accounts for now. All trades are conducted on the broker’s proprietary web platform or through the mobile app. Many MT4/MT5 enthusiast traders may see this as a disadvantage. Yet our testing revealed that the broker’s offering is favorable and suitable for different needs and strategies.

Evest MobileTrader App

Evest offers its mobile app, which carries full functionality to traders who prefer to trade on the go. The app is available for iOS and Android. The platform offers a multilingual interface, full financial control, security measures, and user verification.

The app’s simple structure makes trading convenient for both beginners and skilled traders. Clients can access real-time quotes across multiple asset classes and interactive charts with technical indicators.

Main Insights from Testing

Testing the broker’s web platform and mobile app, we had a smooth and intuitive trading experience, marked by efficient performance and fast execution. The interface is simple and user-friendly, equipped with customizable charts and innovative trading tools. Although the broker does not offer the most demanded MT4/MT5 platforms, its proprietary platforms are favorable for most clients and strategies.

AI Trading

We found no built-in AI or AI bots available with Evest. It means that clients looking for innovative AI solutions will not consider the broker’s offering a good fit for their trading expectations.

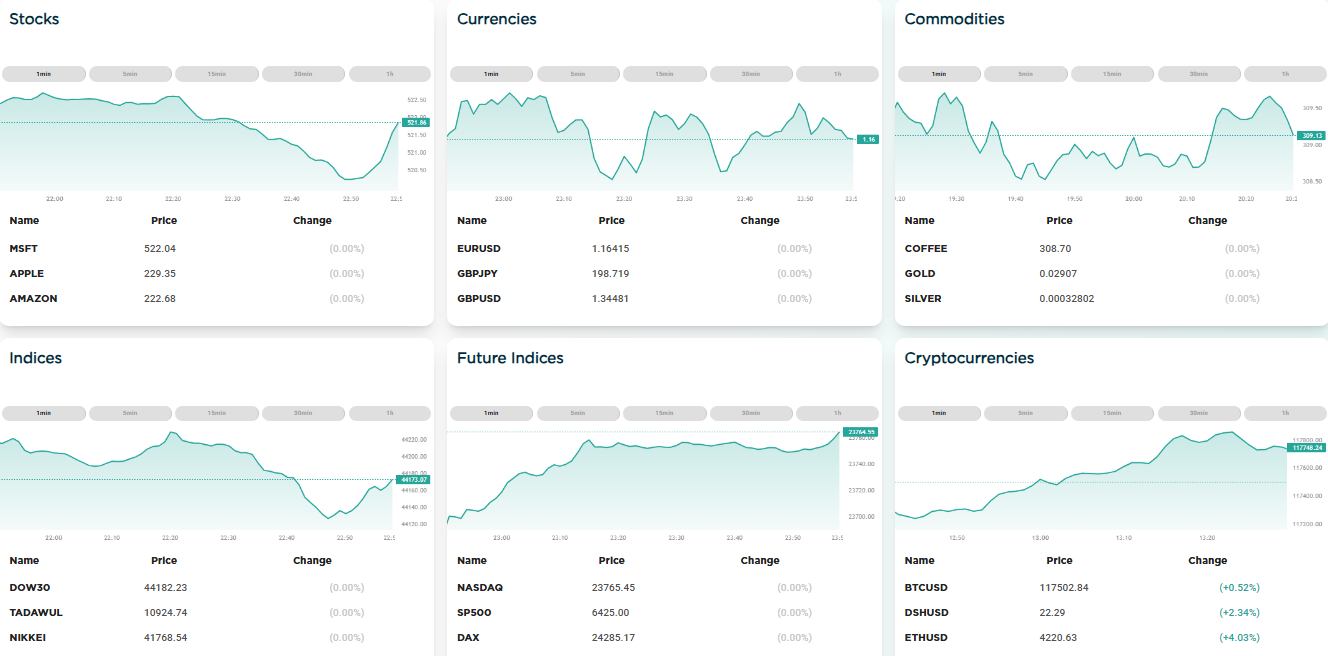

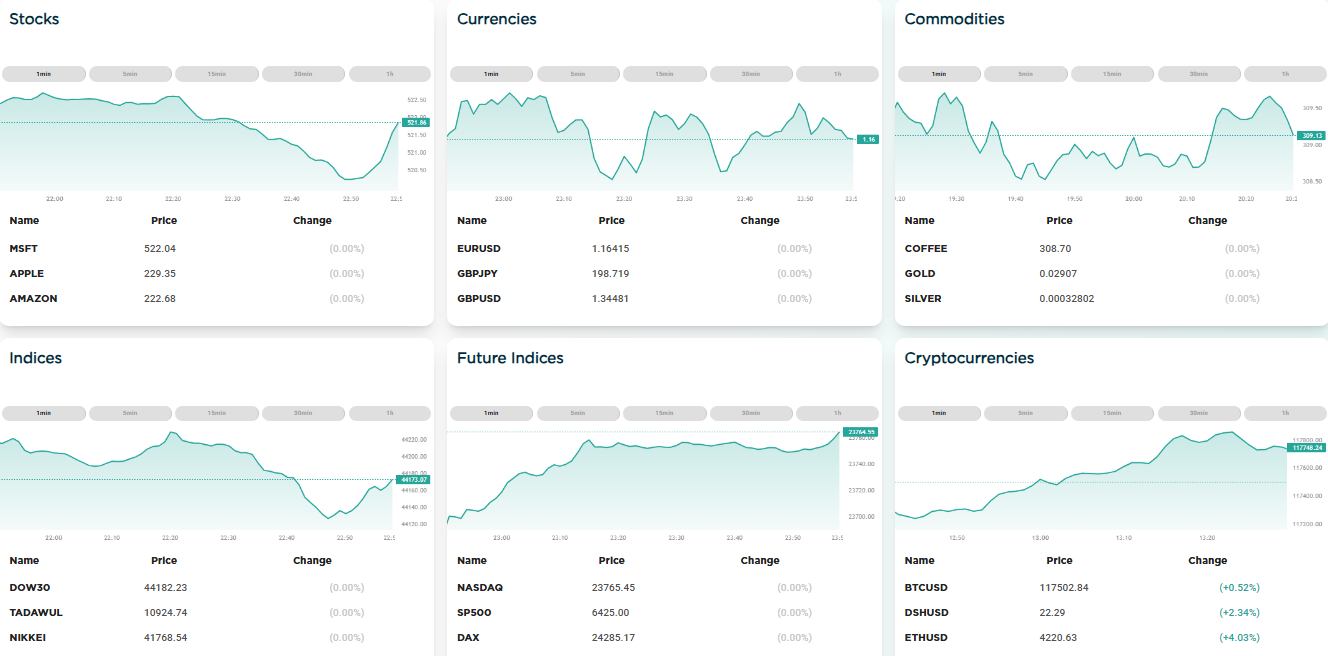

Trading Instruments

Score – 4.3/5

What Can You Trade on the Evest Platform?

By opening an account with Evest, clients can trade DFD products across various financial assets. The broker offers more than 400 tradable products, ensuring diversity and exposure to the global market. The broker also offers real stock trading for its Gold, Platinum, and Diamond accounts, thus making the offering favorable for traditional investors.

Below are listed the main trading instruments to trade with Evest:

- Currency pairs

- Cryptocurrencies

- Metals

- Indices

- Future Indices

- Commodities

- Shares

Main Insights from Exploring Evest Tradable Assets

Our research of Evest’s products revealed over 400 instruments across a good variety of financial assets. Forex traders can access an impressive number of major, minor, and exotic currency pairs. Besides, the broker offers commodities, including gold, silver, agricultural products, and more.

The broker also offers investment baskets, a collection of assets grouped by strategy and trading preferences. The broker also offers cryptocurrency trading, offering a good range of stablecoins and altcoins, including Bitcoin, Litecoin, and Ethereum.

All in all, trading instruments offered by Evest come with favorable conditions and allow traders sufficient diversity. However, check the availability of products based on the entity, as conditions and instrument availability might vary across entities.

Leverage Options at Evest

Leverage is a useful tool in trading, allowing traders to enter the market with a small investment and earn substantial profits. However, it is crucial to understand how leverage works, as it can also lead to financial loss.

Evest leverage is offered according to the FSCA, VFSC, and MISA regulations:

- Trades from South Africa are eligible to use leverage up to 1:30 for major currency pairs.

- Global traders registered with the VFSC and MISA entities may use higher leverage up to 1:400.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Evest

Evest includes various funding methods, which might be available depending on the entity. Traders can fund their accounts via credit/debit cards, wire transfers, Skrill, Neteller, and more. There is no deposit fee for the funding methods; however, there is a $2 conversion fee.

Minimum Deposit

The minimum deposit to open an Evest account is $250. Every account has its requirements. For the Diamond account, for instance, the minimum deposit is $50,000.

Withdrawal Options at Evest

To make withdrawals with Evest, traders can use multiple methods. Traders should use the same method used to make a deposit.

- Note that the minimum withdrawal shouldn’t be lower than $25.

- Usually, withdrawal requests take up to 5 working days to process. The time of withdrawal mostly depends on the method used.

Customer Support and Responsiveness

Score – 4.4/5

Testing Evest Customer Support

Clients can contact the broker’s support team by opening a support ticket. Live Chat and tickets are available 24/5. Traders can also use the inquiry form and the available phone number.

- The broker also includes a Help Center, where traders can find detailed answers to trading-related questions.

Contacts Evest

We found that Evest delivers reliable customer help. We found the answers and solutions provided by the helping agents satisfactory.

- The live chat provides prompt and detailed answers 24/5.

- The broker also includes an inquiry form that traders can use to direct their questions, worries, and concerns.

- Evest is also present on social media, providing updated information on the market, including LinkedIn, Facebook, Instagram, YouTube, X, and Telegram.

Research and Education

Score – 4.5/5

Research Tools Evest

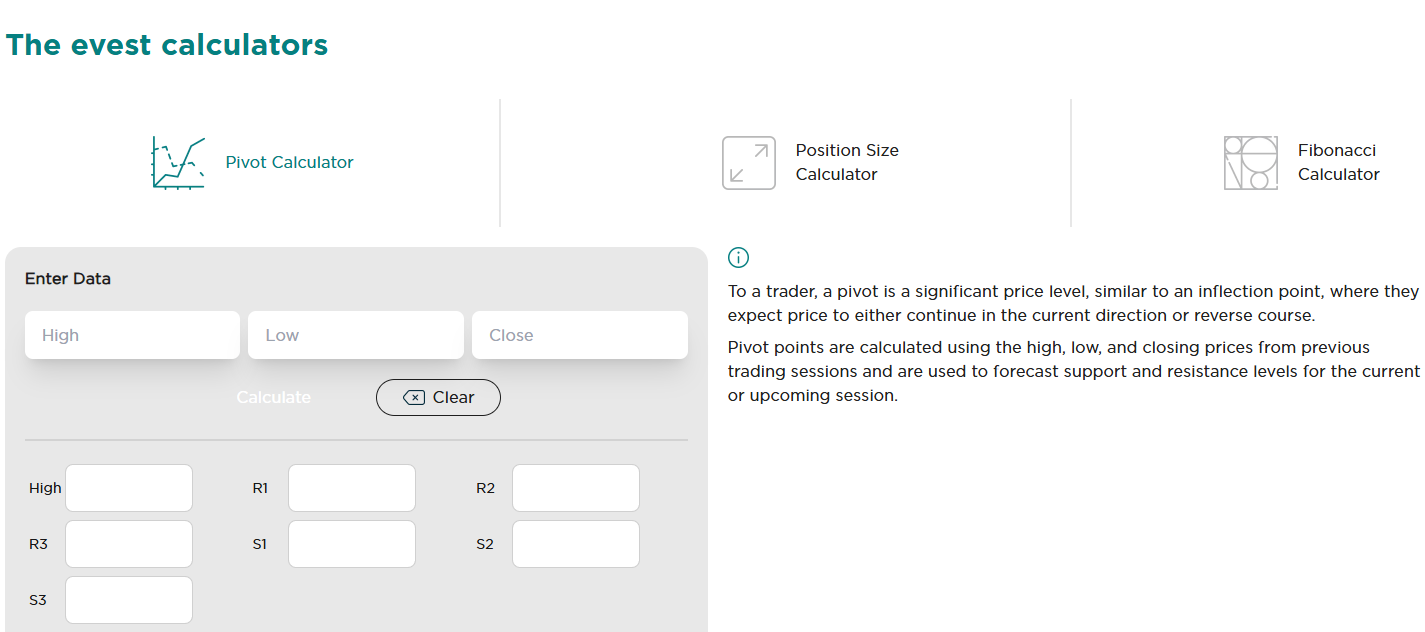

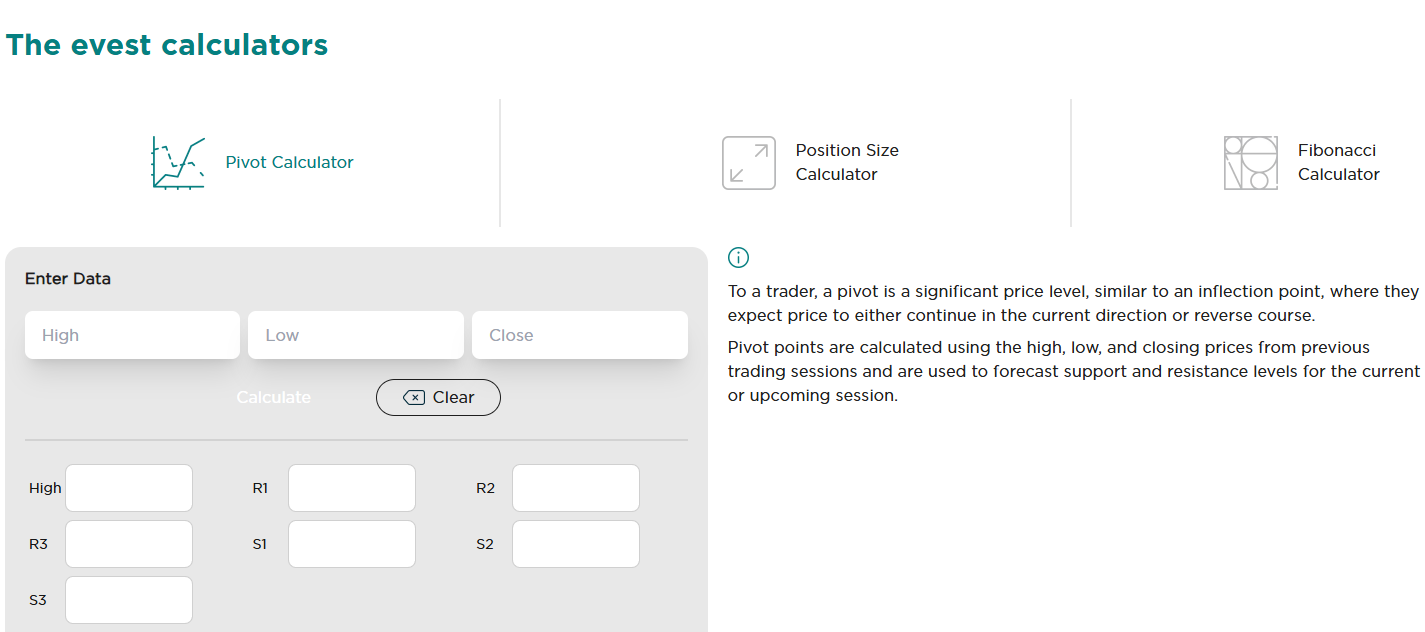

Evest’s platforms offer a range of research tools designed to enhance the trading experience. The offering includes multiple chart types and timeframes, one-click trading, and customizable features.

In addition to already useful research tools, clients can use:

- Tip Ranks help clients access market insights, providing price targets, performance rankings, and analyst ratings. Based on the provided information, clients can make informed decisions.

- Evest Analytics analyzes corporations by separating them into subgroups based on different criteria, such as geographic position, market capitalization, and industry.

- A calculator is also a useful tool, allowing clients to evaluate and examine their trades more profoundly.

Education

The broker offers its Trading Academy, which serves as an invaluable educational experience.

- The Academy allows its traders to access well-structured courses, video lessons, and advanced e-books to expand their clients’ knowledge of trading and provide them with the necessary information to make the best out of trading.

- Clients can also take part in webinars and seminars to gain insights from industry professionals and immerse themselves in interactive learning sessions.

Is Evest a Good Broker for Beginners?

We have also considered whether Evest is a good option for beginners. All in all, the broker’s proprietary platform is easy to navigate, without creating complexities for inexperienced traders. For beginners, the Silver account will be the most suitable choice. However, the initial deposit requirement is a little higher, starting from $250. Yet, due to the favorable conditions, the broker can attract traders of any level of experience.

- The novice clients can also open a demo account and practice in a safe environment, which is another advantage.

Portfolio and Investment Opportunities

Score – 4.3 /5

Investment Options Evest

Evest provides its clients with a range of opportunities to diversify their portfolios. Aside from the available 400 instruments on CFDs, Evest also allows real stock trading, which attracts long-term and traditional traders. The platform also features investment baskets grouped by theme or sectors.

- As an alternative option for investors, traders can engage in copy trading. Through Copy Trading, clients are able to copy the successful trades of experts and gain profits.

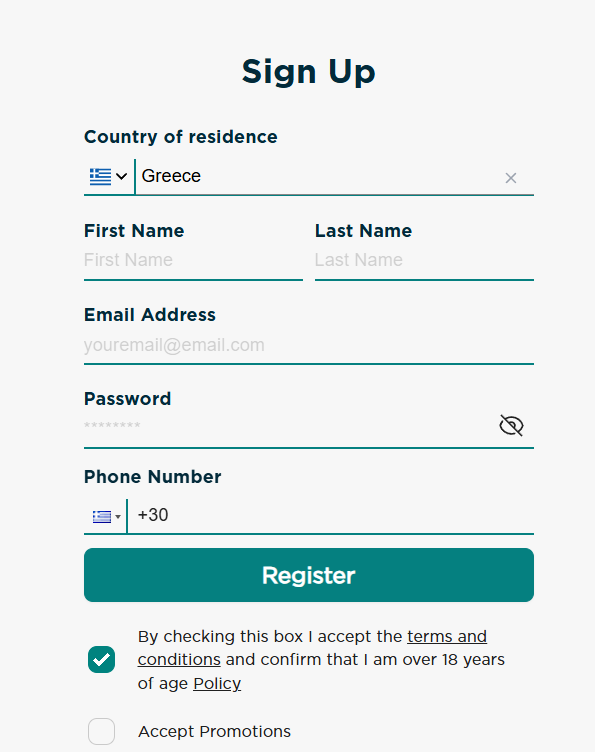

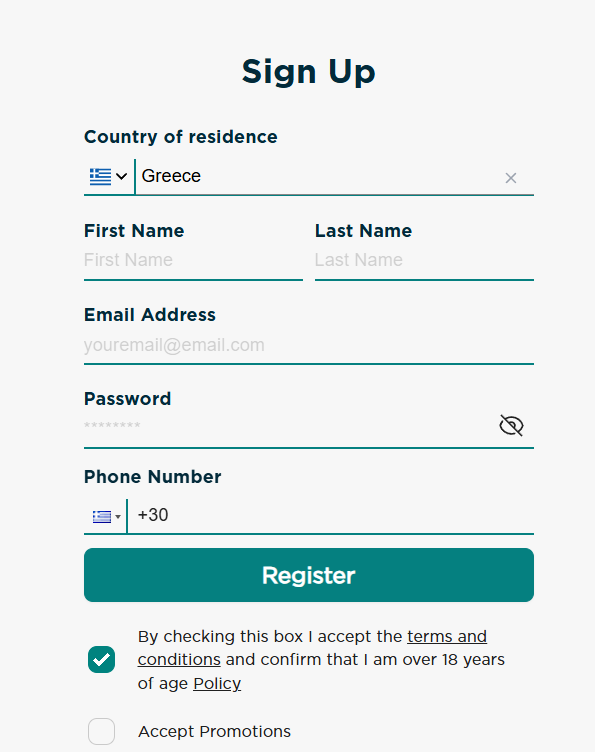

Account Opening

Score – 4.5/5

How to Open an Evest Demo Account?

A demo account’s availability is essential for many beginner traders, who need to practice and acquire skills. With Evest, opening a demo account is a quick and smooth process.

Here are the steps to follow:

- Go to the broker’s official website and click on the “Open a Demo Account”.

- Fill out the registration form by providing your name, email, phone number, and password.

- Get the confirmation email and verify your account.

- Access the web platform by using the credentials received by email.

- Receive the virtual funds of up to $25,000 and start practicing.

How to Open an Evest Live Account?

Opening an Evest live account is a simple process. Traders should first determine the entity they want to register with, then choose one of the available account types. After deciding on the account type, Evest clients need to proceed with the following steps:

- Go to the broker’s official website and click on the “Start trading” button.

- Complete the registration form by providing personal data.

- Receive the confirmation link by email and verify your account.

- Upload proof of identity.

- Fill out a questionnaire.

- Choose the account type.

- Fund your account and start trading.

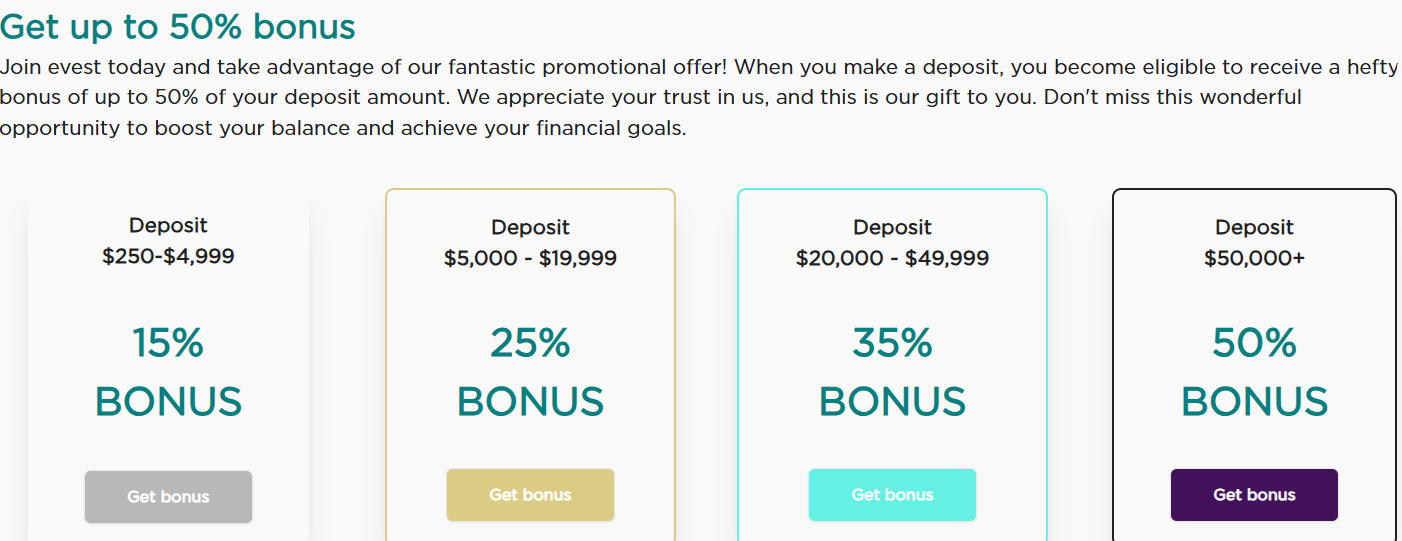

Score – 4.2/5

On the Evest website, traders can find various advanced tools and features to enhance their trading outcomes for both beginners and experienced traders.

- Trading Central provides cutting-edge tools to elevate the trading experience with real-time insights and expert analysis. Traders will receive daily analysis and predict essential market events with actionable macroeconomic data.

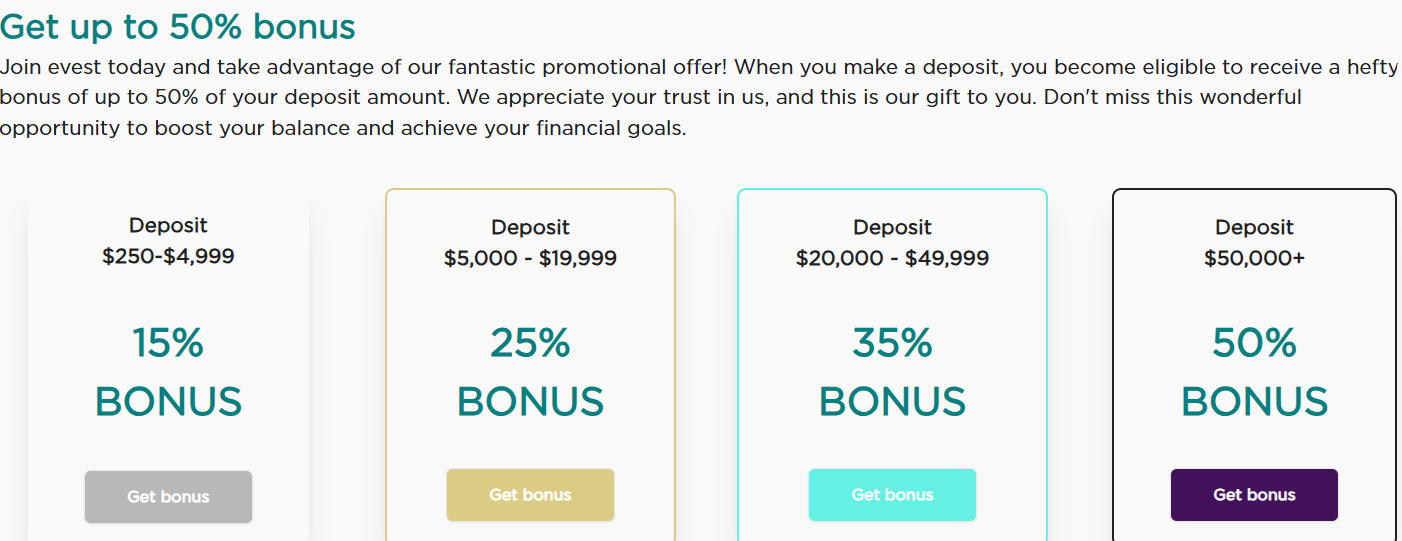

- Evest offers deposit bonuses up to 50%, depending on the deposit amount. The bonus percentage depends on the funding amount.

Evest Compared to Other Brokers

Comparing Evest to its competitors allows us to see how the broker stands out in the market. As we found, Evest holds a license from the FSCA in South Africa. However, our comparison revealed more tightly regulated brokers, including Pepperstone and Fortrade, which hold top-tier licenses.

Regarding trading fees, Evest offers average spreads with no commissions on CFD-based products. On the other hand, Forex.com and TriuphFX charge lower spreads.

While most brokers offer one of the popular MT4 or MT5 platforms, Evest allows trading through its proprietary web and mobile platforms. With Evest, clients can diversify their trading not only by investing in CFD products but also by engaging in real stock trading, which not all brokers support.

Evest also has strong educational resources, which is a critical advantage over competitors with more restricted knowledge materials. Overall, Evest is suitable for traders who prioritize a trustworthy environment and favorable conditions.

| Parameter |

Evest |

Pepperstone |

FXTB |

TriumphFX |

TMGM |

Forex.com |

Fortrade |

| Spread-Based Account |

Average 2 pips |

From 1 pip |

Average 3 pip |

Average 0.6 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission-Based Account |

Commissions only for real stock trading |

0.0 pips + $3.5 |

No commission |

Not available |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Low/Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

Proprietary WebTrader, Mobile app |

MT4, MT5, cTrader, TradingView |

MT4, Web Trader |

MT4 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

400+ instruments |

Over 1,200 instruments |

300+ instruments |

64+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

FSCA, VFSC, MISA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

CySEC |

CySEC, FSC, FSA |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent education and research |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

€250 |

$0 |

$250 |

$100 |

$100 |

$100 |

$100 |

Full Review of Broker Evest

Considering the information we have compiled about Evest, there were notable concerns regarding the broker’s trustworthiness and credibility in the past. Despite the enticing features and services it provided, the fact that it was registered in an offshore jurisdiction (Vanuatu) raised considerable doubts. However, the broker’s present regulation by the respected FSCA in the South African region has strengthened its presence and ensures safe practices.

As our research reveals, Evest has many attractive aspects that traders can appreciate. The broker offers several account types with different conditions, a simple and easy-to-use platform, and average spreads with no commissions. Clients can diversify their portfolios through the 400 tradable instruments across Forex, commodities, stocks, cryptocurrencies, indices, and futures indices. It also allows real stock trading with attractive opportunities. In addition, clients can hold Investment baskets, another advantage the broker offers.

One of the most attractive aspects of trading with Evest is access to comprehensive research and educational tools, as the broker includes a Trading Academy and Trading Central.

Based on all of the above, Evest can become a favorable choice for various clients, especially for those looking for competitive prices, a user-friendly platform, and exposure to the global market.

Share this article [addtoany url="https://55brokers.com/evest-review/" title="Evest"]