- What is Elite Trader Funding?

- Elite Trader Funding Pros Cons

- Is Elite Trader Funding Legit?

- Elite Trader Funding Challenge

- Funded Account

- Account Conditions

- Payout

- Elite Trader Funding Alternative

What is Elite Trader Funding Prop Firm?

Elite Trader Funding, headquartered in the United States, operates as a proprietary trading firm presenting traders with the chance to engage in the Trading Market by offering them access to a Funded Account. This opportunity allows traders to utilize the firm’s capital, enabling them to participate in financial markets without the necessity of investing their funds.

Elite Trader Funding offers a unique opportunity to engage in real trading with minimal initial capital. Traders can become funded professionals by passing a qualifying test or challenge and trading with company funds. Learn more about proprietary trading here, but be sure to consider the associated risks detailed below.

| Elite Trader Funding Advantages | Elite Trader Funding Disadvantages |

|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Only Futures Trading |

| 100% Profit Share | No MetaTrader Platforms |

| A variety of trading platforms | No refund |

| Good range of Challenge Programs | |

| Free Trial | |

Is Elite Trader Funding Legit?

Based on a range of reviews and assessments, Elite Trader Funding is considered a credible proprietary trading firm. Operating within the US and following the country’s financial regulations, the firm provides traders the chance to engage in market trading using its capital.

- Prop Trading firms like Elite Trader Funding operate differently from regulated Forex Brokers. They are typically less regulated and not overseen by standard industry regulators, leading to a different risk profile. Traders should be aware of this lower level of regulatory protection and understand the risks involved in using the company-provided funds for trading.

Is Elite Trader Funding Scam?

A review of Elite Trader Funding’s official website reveals no clear evidence of the company being a scam. However, it’s important to note that Prop Trading Firms generally operate with less regulation from financial authorities compared to traditional financial institutions.

As our professional advise, it is best to learn well about Prop Trading, understand risks and choose Company with a good reputation also one operate for many years so the proposal is more stable. Yet, since you do not invest much money to trading but just pay subscription fees the potential losses still considered lower if compared to engaging into Real Trading with your own funds.

Elite Trader Funding Challenge Evaluation Rules

In our Elite Trader Funding Review, the crucial aspect to explore is how the evaluation challenge is structured and the requirements for joining the trading challenge. This includes understanding the tests needed to obtain a Funded Trading Account and become a Proprietary Trader, as well as the typical costs associated with the registration fee.

- The primary objective of the Challenge or Test is to demonstrate your trading proficiency, and Elite Trader Funding provides a range of five distinct evaluation programs tailored to various needs, each associated with specific account types and balances. These evaluations come in three variants: a one-step evaluation, a two-step evaluation, and an instant funding option.

Account Balance and Registration Fee

Before accessing Elite Trader Funding, select your desired Model and Account Balance to qualify. This choice affects challenge conditions and registration fees, with the latter reimbursed upon becoming a Funded Trader. Check our Registration Fee comparison table for details.

- Elite Trader Funding offers a diverse selection of five distinct evaluation programs — 1 Step, EOD Drawdown Fast Track, Static, and Diamond Hand, each meticulously designed to cater to varying requirements. These programs are directly linked to specific account types and associated balance levels.

- In summary, the fee structure and account balance requirements offered by Elite Trader Funding are highly appealing. We have observed that their account sizes and fees start at a level lower than those of their competitors, which is a notable advantage.

- Elite Trader provides a wide range of starting balance options, encompassing amounts ranging from as low as $10,000 to as high as $300,000, catering to a broad spectrum of traders.

| Fees | Elite Trader Funding | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $10,000 | $10,000 | $50,000 |

| Fee | $80 | €155 | $289 |

| Maximum Account Size | $300,000 | $200,000 | $400,000 |

| Fee | $655 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

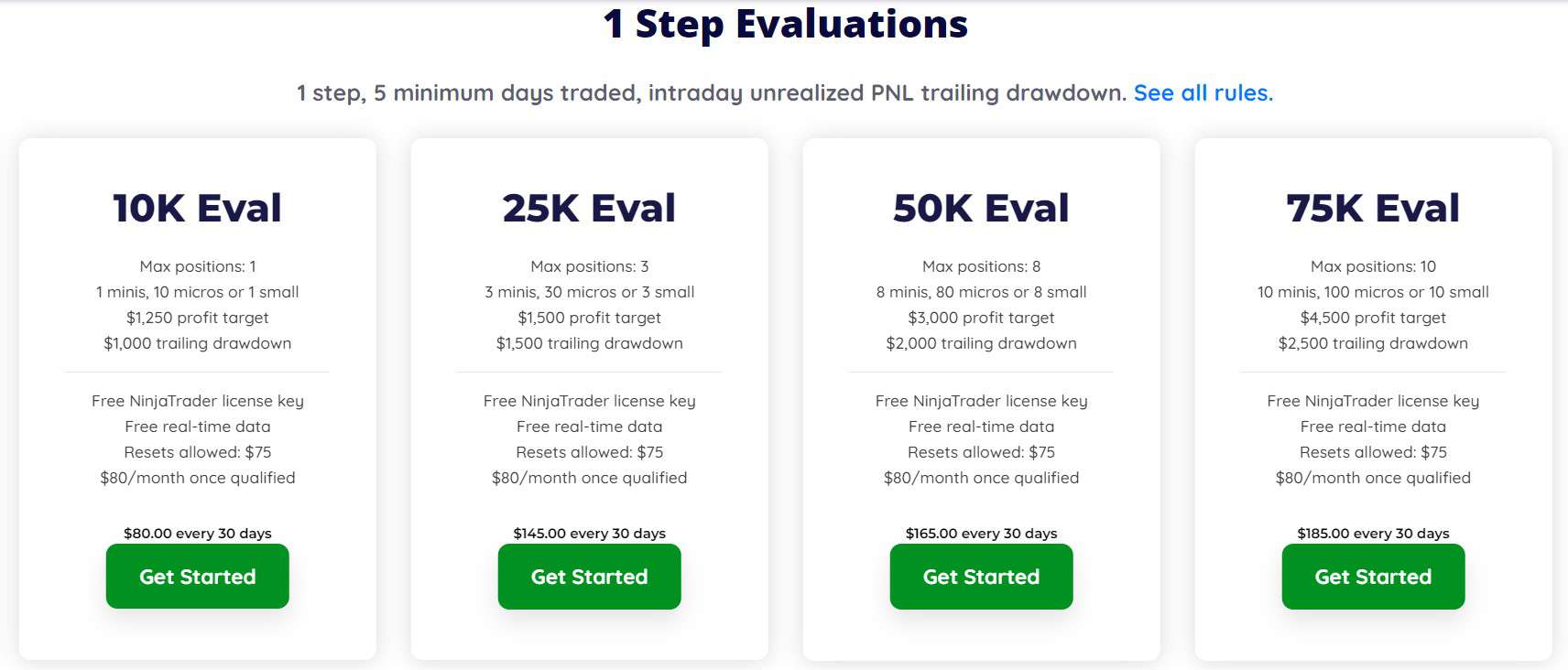

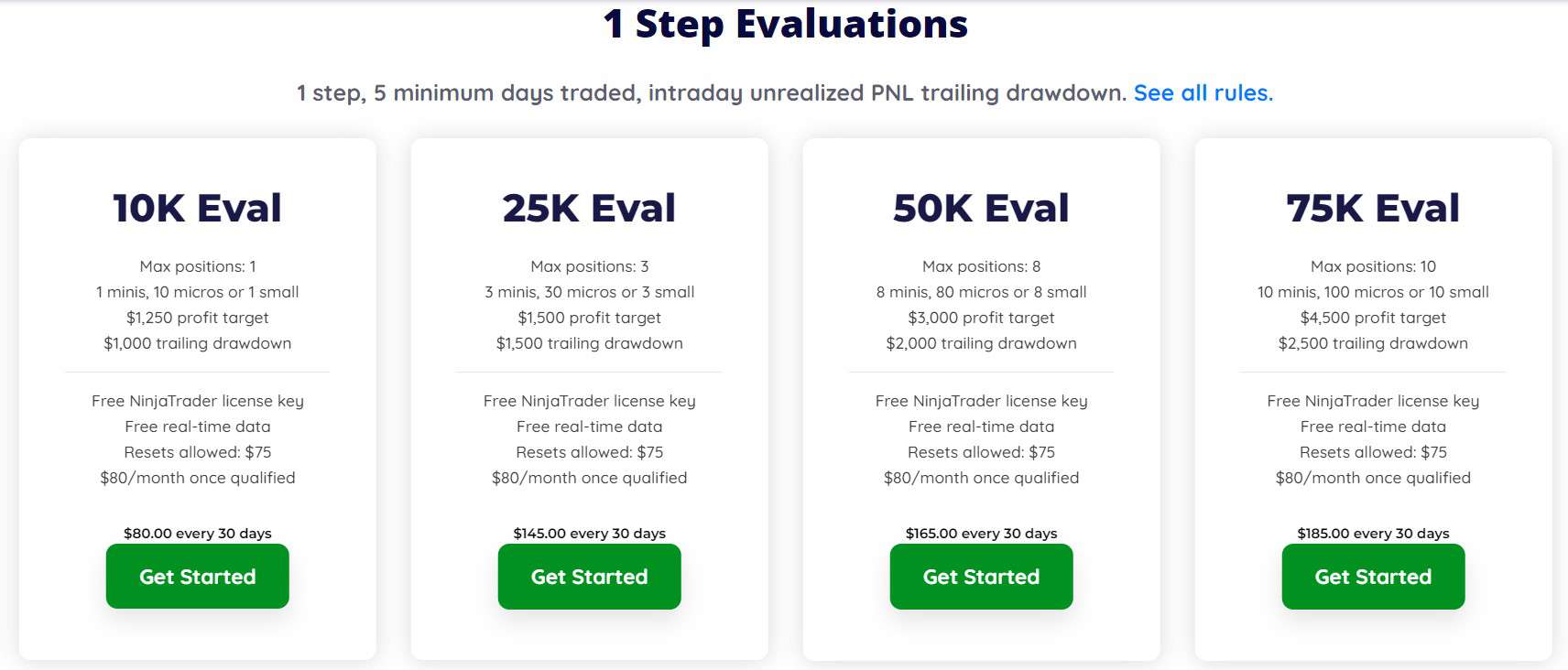

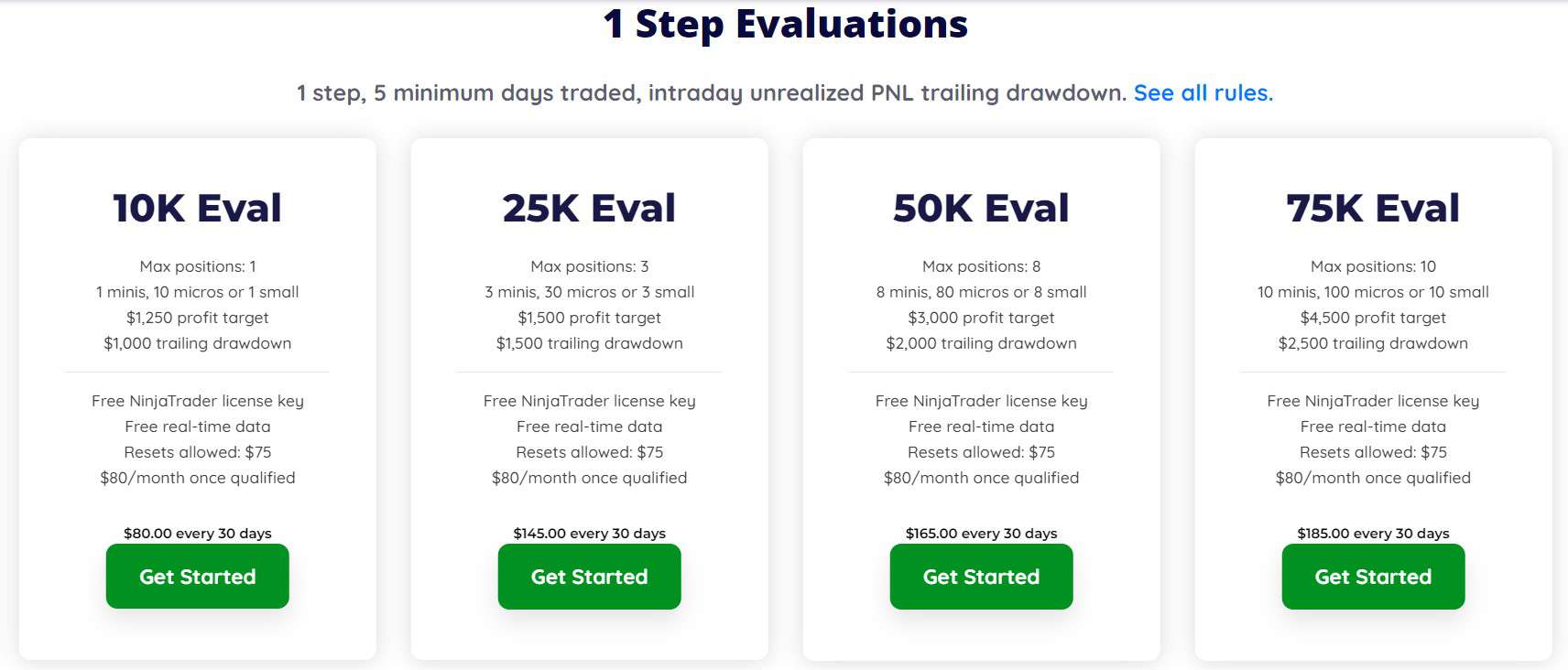

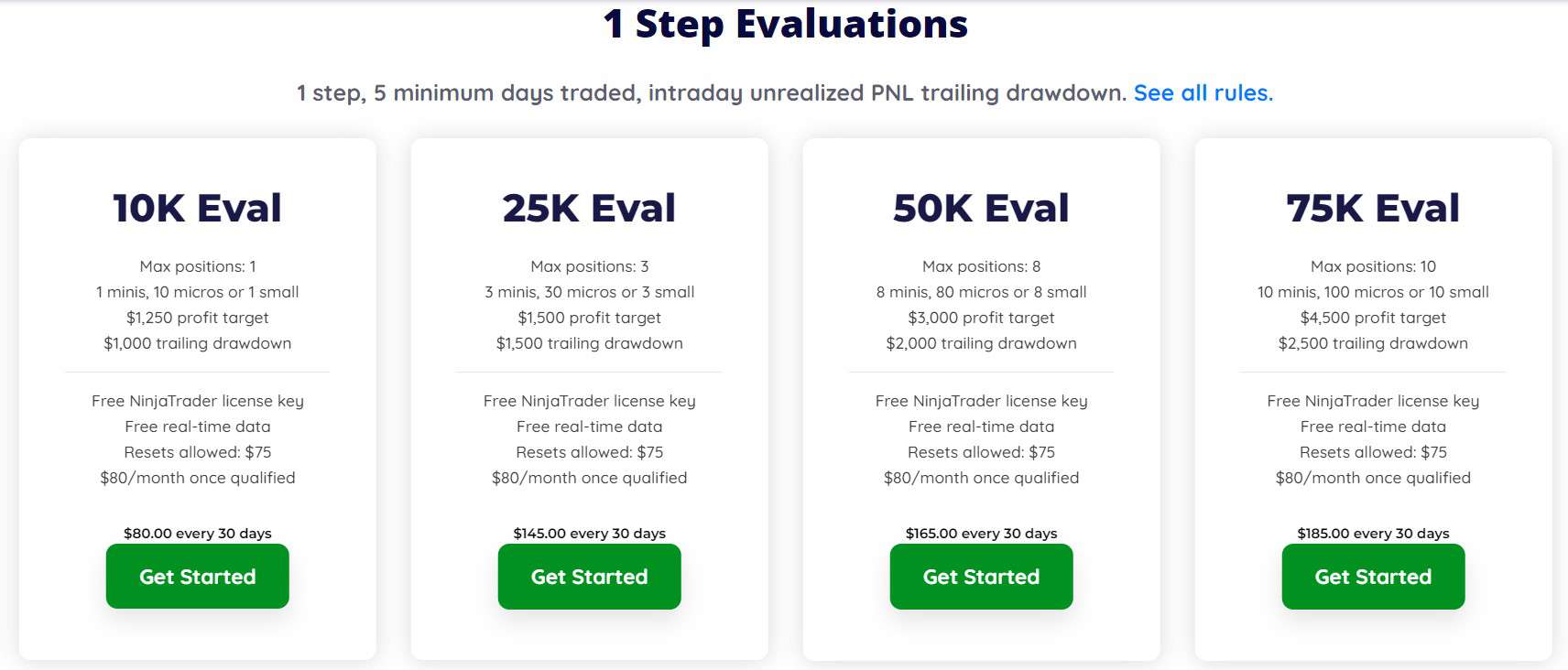

The profit targets at Elite Trader Funding vary depending on the account size and evaluation type. For example, in the 1 Step Evaluations, a $10K account has a $1,250 target, while a $300K account has a $20,000 target. Similarly, in the Static Drawdown Evaluations, the profit target for a $100K account is $2,000, and for a $150K account, it’s $4,000. Fast Track Evaluations have targets like $2,000 for a $25K account and up to $15,000 for a $250K account

Maximum Loss

Elite Trader Funding imposes a daily loss limit of 3% and a maximum drawdown of 10% of the account balance. Exceeding these limits leads to account termination. Specific programs, like the $25,000 account 1-Step Evaluation, offer tailored profit-to-drawdown ratios. The firm also enforces a 40% rule for Elite Sim-funded accounts to encourage consistent trading

- To clarify well All set rules have to be in line at the stage of challenge, otherwise your test will be canceled and you will either have to reset it, meaning pay another reset fee to participate to challenge from the beginning.

Minimum Trading Period

Another crucial rule commonly employed in Proprietary Trading assessments is the requirement to achieve profitability within a specified minimum timeframe. In the case of Elite Trader Funding, the minimum number of trading days is consistently set at 5 for all account sizes.

See the detailed table with Elite Trader Funding Challenge conditions based on Account Size:

Elite Trader Funding 1 Step Evaluation

Free Trial

Elite Trader Funding offers a free 14-day trial period. During this trial, new users can access the services and trading platforms without any initial fee. After the trial period, a subscription fee is charged, which varies depending on the account and trading conditions selected.

Elite Trader Funding Funded Account

Upon successfully passing the test or challenge, the trader will have their Funded Account established, a process that may typically take a few business days to activate. It’s crucial to emphasize that the account conditions and balance will precisely match the qualifications achieved in the initial test. Should you wish to transition to a higher-grade account, it’s important to be aware that you will be required to undergo a new test starting from scratch for the specific Account Balance you desire to trade with.

Profit Split

The challenge itself entails adherence to several rules, serving as a means to validate your successful trading strategy and performance. One of the paramount parameters in this regard is the Profit Target, which varies according to the specific Challenge you choose. It’s noteworthy that Elite Trader Funding permits traders to retain 100% of their initial profit and 90% of subsequent profits.

Payout and Withdrawals

For payouts, traders must have traded a minimum of 15 days for the first cycle and a minimum of 10 days for subsequent cycles. Elite Trader Funding Payout requests undergo a verification process taking less than 24 hours.

Withdrawal Method

Elite Trader Funding processes payouts on Fridays weekly, with clients eligible to request a payout monthly. Payments are made via Deel, with ACH and PayPal as supported methods.

Account Conditions

When reviewing Account Conditions, we closely examine broker preferences, platforms, instruments, trading costs, leverage levels, and trading restrictions. Violating these restrictions may result in the loss of your account, requiring you to retake the test. See the breakdown below:

Trading Instruments

Elite Trader Funding offers a range of trading instruments including futures on various asset classes such as currencies, cryptocurrencies, stocks, agricultural commodities, metals, and energies. These instruments provide traders with a diverse set of opportunities to trade in different market

Elite Trader Funding Commission

Elite Trader Funding’s commission fees depend on the selected tradable instrument. For example, the minimum commission for trading currency futures like E-Micro GBP/USD starts at $0.50 per side. The maximum commission can be $2.81 per side for trading agriculture futures such as Soybean, Wheat, Rough Rice, etc. Therefore, for a round trip, the commissions for different financial instruments range between $1.00 and $5.62

Leverage

The stated account balances represent the ultimate buying power, and thus, leverage is not offered. Instead, there are restrictions on the number of contracts you can trade based on your account size.

Elite Trader Funding App Platform

Elite Trader Funding offers trading on platforms like NinjaTrader, Rithmic, TradingView, and Tradovate, without supporting MT4 and MT5. These platforms cater to various futures contracts in markets such as currencies, cryptocurrencies, stocks, commodities, energy, and metals. The focus is on providing traders with diverse trading opportunities across different asset classes

Trading Conditions

- Elite Trader Funding permits a range of popular trading conditions, including News Trading, Swing Trading, EA Trading, and Weekend Holding. Additionally, traders can utilize Copy Trading from other Elite Trader Funding accounts, providing an added advantage for diverse strategy traders. However, it’s important to be aware of certain restrictions, such as the prohibition of High-Frequency Trading, Latency Trading, and Arbitrage strategies.

Elite Trader Funding Promotions

Elite Trader Funding Alternative Brokers

It’s advisable to thoroughly evaluate and compare the offerings of Elite Trader Funding with those of other Proprietary Trading Firms. Some well-known firms may provide similar conditions or better suit the needs of specific traders, especially when it comes to instrument choices and platforms other than MetaTrader. However, Elite Trader Funding also offers distinct advantages, which we’ve outlined below along with a table comparing Elite Trader Funding to other companies:

Share this article [addtoany url="https://55brokers.com/elite-trader-funding-review/" title="Elite Trader Funding"]

Please 🥺 lake