ECB Surprises Markets, Changes Guidance to Hawkish

-

Updated:

The euro has rallied strongly over the previous days as traders bought the shared currency following last week’s European Central Bank (ECB) monetary policy decision and press conference.

At its Thursday meeting, the ECB sounded unexpectedly hawkish, saying it might recalibrate monetary policy at its next meeting in March.

According to the report, the Governing Council agreed that it’s sensible not to exclude a rate hike this year and that an end of bond-buying under the APP in the third quarter is possible.

Additionally, both Bloomberg and Reuters reported that ECB policymakers “see policy change at March meeting if inflation doesn’t ease,” adding that a “sizable minority” of ECB policymakers wanted to change policy at Thursday’s meeting, and also noted that ECB policymakers see a faster tapering of APP purchases as the “first port of call to fight high inflation.”

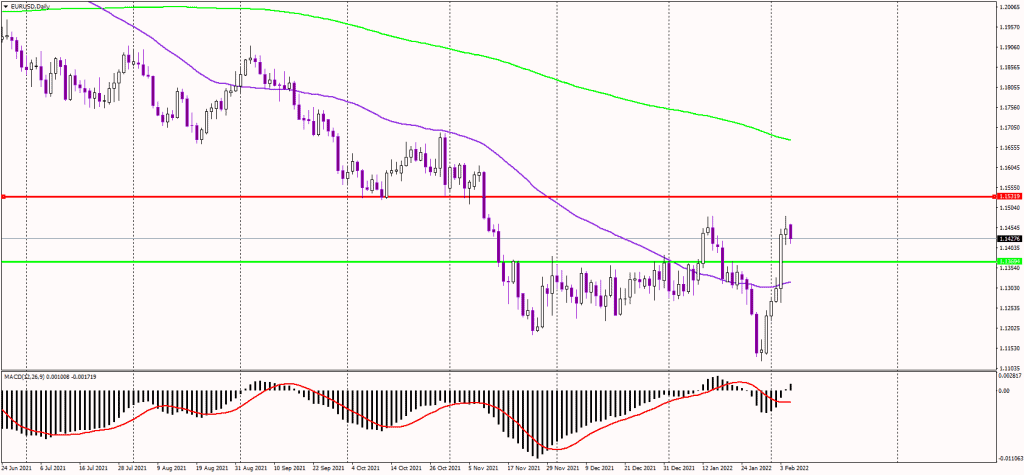

The euro strengthened massively following the ECB decision, sending the EURUSD pair to one-month highs near 1.1480. At the same time, yields in the eurozone soared, while the rate market now expects the ECB to hike rates two times by September 2022.

The German 2-year yield had a nine-sigma event, causing it to spike steeply to multi year highs, reaching 0.2% for the first time since 2015. It looks like monetary policy in the euro zone could start to tighten gradually.

The next resistance for the euro now stands at previous lows at 1.1520. If the shared currency rises above that level, the medium-term outlook could change to bullish, targeting the 200-day moving average (green line) near 1.1670.

Alternatively, support could be found at previous highs of 1.1380 and corrections to this level are expected to be bought.