- What is DeltaStock?

- DeltaStock Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- DeltaStock Compared to Other Brokers

- Full Review of Broker DeltaStock

Overall Rating 4.3

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is DeltaStock?

DeltaStock is a Bulgaria-based Forex broker that provides a range of financial instruments, including Forex, shares, commodities, indices, crypto CFDs, and more.

Based on our research, the firm is regulated and authorized by the Financial Supervision Commission (FSC) in Bulgaria. The regulatory body plays a crucial role in ensuring the stability and integrity of the financial sector by enforcing regulatory standards and protecting the interests of investors.

Overall, the broker provides competitive trading conditions and a diverse range of instruments through the advanced trading platform.

DeltaStock Pros and Cons

Per our findings, the broker has both advantages and disadvantages that are important to consider. On the positive side, it offers a diverse range of financial instruments, a low minimum deposit requirement, and access to the advanced MT5 platform via web, desktop, and mobile. The firm also provides comprehensive educational materials and resources.

For the cons, there is no 24/7 customer support available. Additionally, the brokerage operates under a single regulatory body, which may be a drawback for traders seeking accounts with multiple regulatory authorities.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| Good trading conditions | No additional license |

| Competitive pricing | |

| Trading instruments | |

| MT5 trading platform | |

| Education | |

| Low minimum deposit | |

| Professional trading | |

DeltaStock Features

According to our analysis, DeltaStock provides a trustworthy trading environment with competitive fees, making it an attractive option for traders of all levels. The broker allows access to the well-known MetaTrader 5 platform, which enables users to trade various instruments. Below is a quick assessment of the broker’s services to see how they meet your trading expectations:

DeltaStock Features in 10 Points

| 🗺️ Regulation | FSC |

| 🗺️ Account Types | DeltaTrading Account, MetaTrader 5 Account, DeltaStock Pro account |

| 🖥 Trading Platforms | MT5, Delta Trading |

| 📉 Trading Instruments | Forex, Precious Metals, Shares, Indices, Futures, Commodities, ETPs, ETFs, Crypto CFDs |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is DeltaStock For?

DeltaStock can be a favorable choice for different traders with varying trading needs and strategies. Below, you can see what the broker is most beneficial for:

- European traders

- Currency trading

- Professional trading

- Currency trading

- Competitive prices

- Beginners

- Advanced traders

- NDD/STP execution

- Good learning materials

- EA/Auto trading

DeltaStock Summary

DeltaStock is a reliable and regulated brokerage firm that presents a diverse range of financial instruments and trading platforms to cater to the needs of a broad range of traders. With competitive pricing, convenient deposit and withdrawal processes, and a commitment to trader education, the broker aims to provide a comprehensive experience.

Overall, the broker offers a competitive trading environment that caters to traders of various skill levels. However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific requirements.

55Brokers Professional Insights

DeltaStock is a suitable broker for European traders, those looking for spread based accounts, prefere trading on MetaTrader 5, or a professional Forex Traders. There are several account typesoffered, so are tailored to meet specific trading needs, enabling traders to conduct their trades via the Delta Trading platform or the popular and advanced MT5 platform, while offering quite good range of financial assets, including Forex, precious metals, shares, indices, futures, commodities, ETPs, ETFs, and crypto CFDs. Clients interested in investments can also engage in government and corporate bond investments, diversifying their trading opportunities.

Another good point for beginners in trading is the education section, you will be covered with trading basics, video gallery, glossary, and a good range of research tools is undeniably beneficial. The broker also offers a demo account to gain skills or for more experienced traders to polish their trading knowledge and practice more advanced strategies. Customer support is also on a good level so clients can count on that too. However, the broker holds a license from only the Bulgarian FSC, and this sole regulation might be unsatisfactory for traders prioritizing top-tier oversight, yet overall the proposal is quite balanced.

Consider Trading with DeltaStock If:

| DeltaStock is an excellent Broker for: | - Beginner traders

- Cost-conscious-clients

- Professional traders

- Traders who are looking to diversify their trading

- Currency traders

- CFD trading

- Auto traders

- Mobile traders

- Beginner traders looking for good education

|

Avoid Trading with DeltaStock If:

| DeltaStock is not the best for: | - Clients looking for copy trading opportunities

-Traders looking for PAMM or MAM account

- MT4 enthusiasts

- Clients looking for 24/7 support |

Regulation and Security Measures

Score – 4.2/5

DeltaStock Regulatory Overview

DeltaStock is a regulated brokerage company authorized by the European FSC (Bulgaria). The regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry. Thus, DeltaStock is a legitimate and regulated financial trading provider that follows the necessary regulations for offering Forex trading services. The broker’s commitment to compliance with industry standards is evident through its regulation under a respected European authority.

- DeltaStock also follows the laws and guidelines imposed by the MiFID II, ensuring the safety and reliability of its services and practices.

How Safe is Trading with DeltaStock?

According to our findings, DeltaStock adheres to regulatory standards that aim to safeguard client interests. Additionally, the broker employs encryption and security protocols to protect clients’ personal and financial information.

Moreover, the firm offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance. However, we suggest conducting thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

Consistency and Clarity

Founded in 1998. DeltaStock has been in the market for over 25 years. The broker adheres to European rules and laws, ensuring safe and reliable practices. Our research reveals that the broker has been delivering consistent and transparent services, gradually enhancing its offering and adding new opportunities. However, we have noticed that the broker has stopped supporting access to the MT4 platform, while in the past, clients could conduct trades through the MT4 as well. Other than that, the broker’s proposal has expanded over the years.

Clients from over 100 countries have access to the broker’s services and share mixed experiences, from impressed feedback to concerns. Positive reviews highlight fast withdrawals, quick trade execution, and dedicated customer support. However, not all clients are satisfied with withdrawal processing. Others report platform issues, such as freezing or customization problems. All in all, many traders still think that DeltaStock is a trustworthy broker, ensuring a positive experience.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with DeltaStock?

Per our research, the brokerage provides different account options to meet the diverse requirements of traders. These account types include DeltaTrading Account, MetaTrader 5 Account, and DeltaStock Pro Account.

- The DeltaTrading account enables trades on the Delta Trading platform with access to over 900 tradable products. The minimum deposit requirement is $100, enabling any trader to access the market with ease and low investments. The leverage is up to 1:200, based on the instrument traded.

- The MetaTrader account is a good choice for traders who prefer the MT5 platform, with access to automated trading capabilities. The account offers a good range of tradable products across Forex, Precious Metals, Shares, Indices, Futures, Commodities, ETPs, ETFs, and Crypto CFDs. This minimum deposit is $100, enabling both beginner and professional clients to enjoy efficient trading.

- The DeltaStock Pro account is tailored for professional traders, enabling them access to higher leverage ratios and unique trading benefits. Traders also get premium access to the broker’s special events and take advantage of the bonus programs.

Regions Where DeltaStock is Restricted

DeltaStock offers its services to residents of over 100 countries worldwide. However, the broker does not accept certain jurisdictions that contradict the broker’s regulations. Besides, DeltaStock does not accept clients from regions included in the list of sanctioned countries.

- United States

- Japan

- Canada

- Iraq

- Iran

- Sudan

- North Korea

- Cuba

- Lebonon

Cost Structure and Fees

Score – 4.3/5

DeltaStock Brokerage Fees

After examining the broker’s fee offering, we found that DeltaStock provides competitive pricing for its trading services. The fees depend on the selected account type and encompass spread-related charges, swap rates, and other transaction costs. The spreads are both fixed and variable, offering different fee structures. The broker also offers short and long swap fees that are different for each instrument.

Based on our test trade, the broker provides competitive spreads, both fixed and variable, with an average fixed spread of 2 pips for the EUR/USD currency pair in the Forex market. The variable spread for the EUR/USD pair is 0.8 pips. For gold, the broker offers a fixed spread of $4.60 and a variable spread starting from $0.40.

However, spreads can vary based on market conditions, volatility, and liquidity, so traders should consult the broker’s website or contact customer support for detailed information and updates on charges.

Based on our research, the broker does not offer any commissions, and all the costs are included in spreads. However, traders should consult the support team to check if there are any transaction fees applied based on instrument, account type, or other stipulations.

DeltaStock publicly displays all the short and long swaps for each instrument. The long swap fee for the EUR/USD pair is -1.06, and the short swap fee is 0.43. Swaps depend on market conditions and changes; thus, it is essential to check them before placing a trade.

How Competitive Are DeltaStock Fees?

DeltaStock offers competitive fees that fully align with the market average. The broker’s charges are spread-based, with all the trading costs integrated into spreads. Spreads are either fixed or variable for each instrument, enabling traders to choose the most favorable option for them. For the EUR/USD pair, the fixed spread offered is 2 pips, which is an average offering, especially since all the trading costs are included. For the most part, there are no mentioned commissions, but we recommend traders check with the support team before starting trading, as there may always be changes in regard to the applied charges.

DeltaStock also has swap fees for the positions held overnight. The swaps are either long or short. They depend on the instrument traded and market conditions.

| Asset/ Pair | DeltaStock Spread | Eurotrader Spread | XTrend Spread |

|---|

| EUR USD Spread | 2 pips | 1 pips | 0.2 pips |

| Crude Oil WTI Spread | 1 | 0.024 | 0.024 |

| Gold Spread | $4.60 | 0.07 | 0.07 |

DeltaStock Additional Fees

As we have found, the broker does not have transaction fees for deposits. For wire transfer withdrawals, there are no fees for the banks within the EEC. For the banks outside of the EEC, there is a charge of 1 EUR. For ePayment, there is a 1.50% charge of the payment amount.

- The broker also applies an annual inactivity fee, applied during the calendar year at the company’s discretion. Traders should check the details with the support team.

Score – 4.3/5

DeltaStock offers different trading platforms to cater to the preferences and needs of its users. Traders can use the widely popular MetaTrader 5 platform, known for its advanced charting tools, technical analysis capabilities, and algorithmic trading support. Besides, clients have access to the broker’s Delta Trading platform. Both options are available via web, desktop, and mobile.

| Platforms | DeltaStock Platforms | Eurotrader Platforms | XTrend Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

DeltaStock Web Platform

DeltaStock offers web trading via its Delta Trading platform and the MT5 web platform. This offers good flexibility, eliminating the need for downloads and installations. Traders can reach their accounts through the browser with just internet access. The web platform enables the same efficiency, with various indicators, charting capabilities, various order types, and a good selection of trading resources, including an economic calendar, real-time quotes, market news, and more.

DeltaStock Desktop MetaTrader 4 Platform

As we have found, DeltaStock used to offer the popular MT4 platform. However, at present, the broker does not enable its services through the MT4 platform. Thus, trades are conducted either on the MT5 or Delta Trading platforms. Although both platforms offer advanced and innovative features, for some traders, the lack of the MT4 platform can still be considered a disadvantage.

DeltaStock Desktop MetaTrader 5 Platform

We found that the broker’s MT5 platform provides a comprehensive set of trading tools to assist traders in making informed decisions and enhancing their trading experience. These tools may include advanced charting features, technical analysis indicators, and risk management tools integrated into the MT5 platform. There are over 80 technical indicators, over 21 timeframes, Expert Advisors, and one-click trading. Besides, traders can choose between two trading models, hedging or netting. Also, traders have access to a forum chat, where they can communicate with fellow traders and share experiences.

DeltaStock Delta Trading Platform

The Delta Trading platform is a good choice for both novice and professional traders, offering an easy-to-use interface combined with advanced features and tools. Clients can access over 900 tradable products across a wide range of financial assets, diversifying their trades. The Delta Trading Platform allows clients to develop trading strategies with semi-automated capabilities. Traders have access to trading statistics, history, good charting tools, different order types, real-time updates, and more.

The platform is available through web, desktop, and mobile platforms, enabling traders access to their accounts. Additionally, traders might benefit from market analysis resources, economic calendars, and other relevant tools to stay updated on market trends and events.

DeltaStock MobileTrader App

DeltaStock offers mobile trading through its Delta Trading and MT5 platforms, enabling flexibility and ease of access. The mobile versions of both platforms ensure full trading functionalities, instant quotes, real-time charts, essential indicators, analysis tools, and access to trading history. Traders who prefer mobile trading will appreciate the mobility and functionality the apps allow, ensuring instant access to accounts combined with efficient capabilities and versatility.

Main Insights from Testing

Based on the testing of the broker’s trading platforms, we can say that DeltaStock offers well-equipped and advanced platforms available for web, desktop, and mobile versions. All the platforms are equipped with great tools and features. The MT5 platform ensures an innovative and advanced experience, while the broker’s Delta Trading platform is another attractive choice for novice and professional clients. We also found that the broker previously offered the popular MT4 platform. However, the platform is unavailable now.

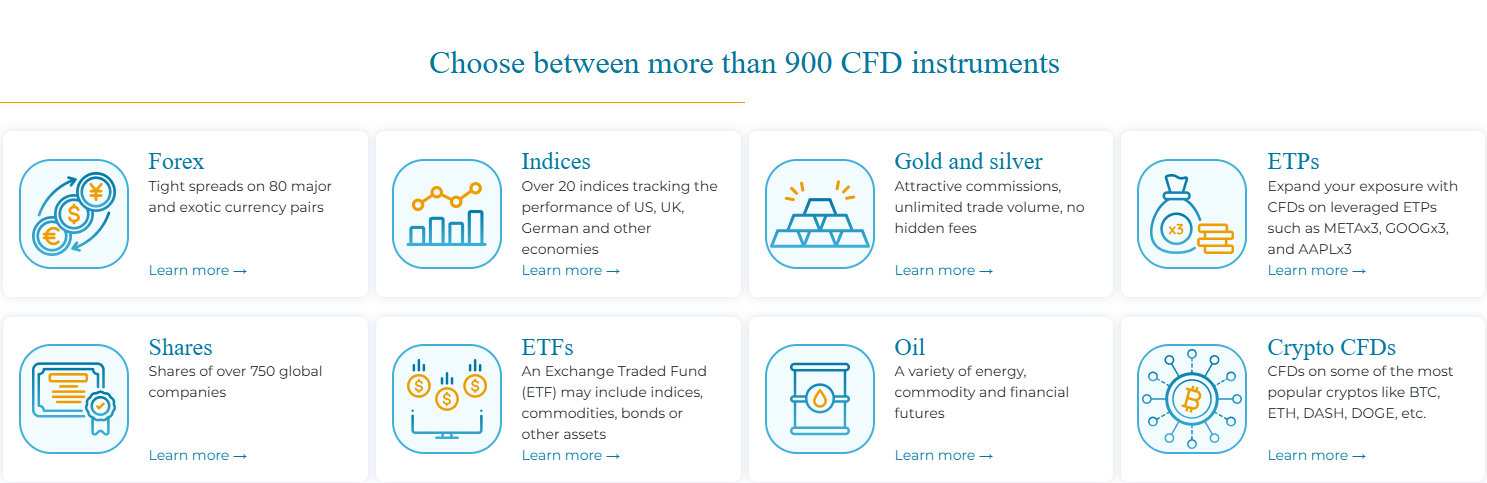

Trading Instruments

Score – 4.4/5

What Can You Trade on the DeltaStock Platform?

DeltaStock provides access to over 900 instruments in diverse asset classes, such as Forex, Precious Metals, Shares, Indices, Futures, Commodities, ETPs, ETFs, and Crypto CFDs. The firm enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

- TDeltaStock also offers access to government and corporate bonds, enabling institutional and corporate clients to expand their portfolios.

Main Insights from Exploring DeltaStock Tradable Assets

Our research revealed that DeltaStock offers a rather impressive number of tradable products across various asset classes. Traders can access more than 80 currency pairs (minor, major, and exotic) with tight spreads and competitive conditions. Traders can also trade popular commodities, such as gold, silver, and oil.

DeltaStock provides access to more than 20 global indices, including the US, UK, and German economies. Besides, clients can access CFD shares of over 750 global companies, profiting from the price fluctuations. The broker also offers ETFs and ETPs, further diversifying the trading experience of its clients. At last, clients can engage in cryptocurrency trading, accessing popular cryptos, such as Bitcoin, Ethereum, Litecoin, and more.

Leverage Options at DeltaStock

Leverage is a useful tool that enables traders to enter the market with limited capital. However, its use can lead to substantial profits or losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences.

DeltaStock leverage is offered according to the FSC regulation:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs. However, the website states the availability of higher leverage of up to 1:200. Thus, understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at DeltaStock

Per our research, the broker provides multiple funding methods to facilitate deposits and withdrawals for traders, including bank wire transfers, credit/debit card payments, and electronic payment processors. These methods offer flexibility to clients, allowing them to choose the option that best suits their preferences and requirements.

- The broker does not apply transaction charges for deposits, regardless of the funding method used.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $100 as an initial deposit amount. This initial low deposit requirement enables any trader to engage in trading with ease, without substantial investments.

Withdrawal Options at DeltaStock

Based on our analysis, the withdrawal process is both convenient and quick. There are certain withdrawal charges, depending on the method used. For bank wires, the withdrawal process takes about 2 business days, while for credit/debit cards, the processing period is up to 5 working days. There are also certain withdrawal charges, based on the method used and other circumstances.

Customer Support and Responsiveness

Score – 4.6/5

Testing DeltaStock Customer Support

The platform offers 24/5 customer support via live chat, email, and phone lines. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker also offers an FAQ section, where traders can find general answers to questions on navigating platforms, account opening, trading margins, and other trading-related topics.

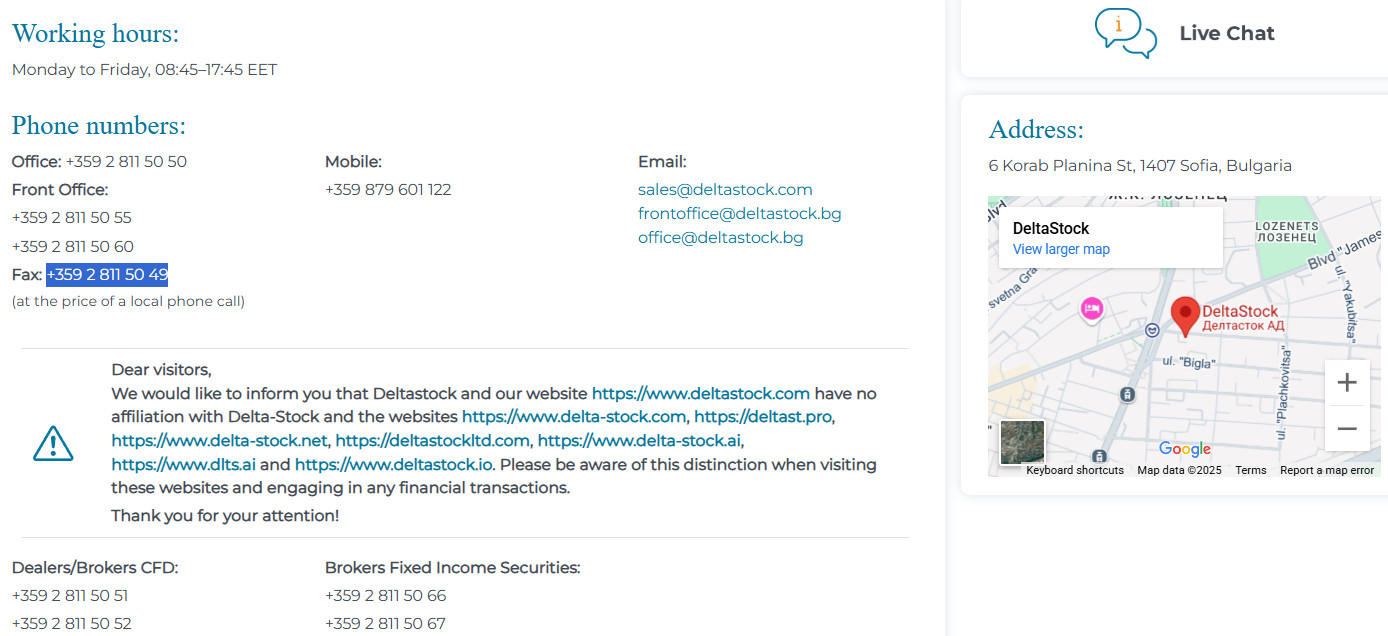

Contacts DeltaStock

DeltaStock provides its customers with dedicated support, offering quick solutions and prompt answers. Clients can contact the broker’s team through the following options:

- Traders can engage in a live conversation with the broker’s representative. The live chat is the quickest and most accessible form to communicate with the support team.

- The broker also provides email addresses to send questions and inquiries of different characters, from general questions to complaints and offers: sales@deltastock.com, frontoffice@deltastock.bg, and office@deltastock.bg.

- Clients can speak to the customer agents directly, by using one of the provided phone numbers: 359 2 811 50 50 (office), +359 2 811 50 55, and +359 2 811 50 60 (front office), +359 2 811 50 49 (fax).

- At last, for those who prefer contact through social media, the broker is active on the following platforms: Facebook, X, LinkedIn, Telegram, and YouTube.

Research and Education

Score – 4.5/5

Research Tools DeltaStock

DeltaStock’s research includes quite impressive research tools and features on its platforms. Both the broker’s proprietary platform and MT5 offer advanced capabilities for in-depth research. However, traders can also benefit from additional research tools, including Economic Calendar, news updates, daily analysis, trading positions calculators, currency converter, CFD quotes, and more. The mentioned resources are available for all the broker’s platforms, enabling them efficient capabilities to research the market to the fullest.

Education

DeltaStock provides impressive educational resources to enhance the knowledge and skills of its clients. These resources include learning courses, video tutorials, articles, and other educational materials covering various aspects of trading, market analysis, and risk management.

- The Trading Basics section includes all the essential resources for traders to learn and trade with ease and substantial knowledge.

- The Advanced Trading section includes more complicated topics, including chart analysis, different trading styles, and more.

- The trading glossary includes essential trading terms, simplifying them into more comprehensible language for clients to have a better understanding and trade with ease.

- The Video Gallery section provides traders with educational videos on various topics, including a Delta Trading platform video guide to navigate the platform with ease.

Is DeltaStock a Good Broker for Beginners?

Based on our research, DeltaStock is a good solution for traders new to trading. DeltaStock’s proposal is a favorable option for traders looking for small initial deposits, competitive costs, and overall beneficial conditions. The availability of a demo account is another advantage, enabling novice traders to get the necessary knowledge and skills before diving into live trading. Besides, beginners can enjoy free access to basic educational resources, video courses, a Forex glossary, and research tools, including market news, calculators, and an economic calendar. Thus, DeltaStock makes a pretty good option for beginner traders.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options DeltaStock

DeltaSock offers an impressive range of financial assets, including Forex, Precious Metals, Shares, Indices, Futures, Commodities, ETPs, ETFs, and Crypto CFDs. There are over 900 available tradable products that traders can access through the broker’s Delta Trading proprietary platform. This range of instruments enables traders to diversify their trading and explore the market further.

- Recently, DeltaStock has expanded its offerings, enabling professional and institutional clients access to Bulgarian and global bonds. This way, traders can engage in long-term investments and widen their opportunities in the market.

- However, we have checked whether DeltaStock offers alternative options for investment, such as copy trading, or features like MAM and PAMM accounts, and found that none of the mentioned opportunities are available.

Account Opening

Score – 4.5/5

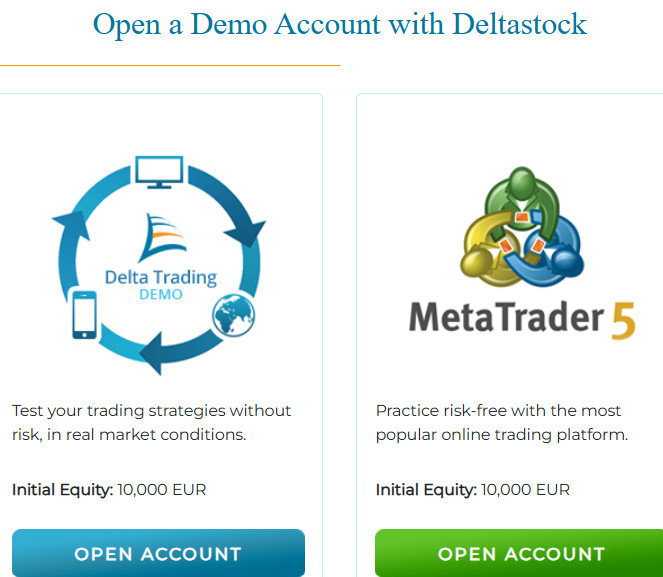

How to Open a DeltaStock Demo Account?

The DeltaStock demo account enables clients access to the market in a reliable and risk-free environment, providing up to $10,000 virtual funds to use while enhancing their skills and knowledge. Note that due to regulatory reasons, the demo account is not available for traders from Spain.

Opening a demo account with DeltaStock is easy, with a few steps to follow:

- Visit the broker’s website and choose the ‘Open Demo account’ option.

- Choose between the platforms – Delta Trading Demo or MT5 Demo.

- Provide the required information to fill out the registration form (name, phone number, email, country).

- Agree with the terms and conditions and submit the form.

- Receive account credentials to the provided email, and enter the account.

- Download the chosen platform if you are going to trade through the desktop platform.

- Start practicing.

How to Open a DeltaStock Live Account?

Opening a live account with DeltaStock is quite an easy process, as you can log in and register with DeltaStock within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page

- Enter the required personal data (name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow up with the money deposit

Score – 3.5/5

DeltaStock is an attractive trading solution with comprehensive trading features and tools. Thanks to a good selection of advanced tools included in the broker’s platforms, clients are able to conduct in-depth research and analysis and make informed decisions.

Great accommodations are the broker’s additional research resources, such as different calculators, economic calendars, news, quotes, market stats, and other capabilities we have already mentioned in this review’s research and education sections.

- Although the broker does not provide additional bonus programs or other appealing offerings, its available tools are already enough for a profitable trading experience.

DeltaStock Compared to Other Brokers

As a final step in our review of DeltaStock, we have compared the broker to other brokers with similar proposals to see how DeltaStock aligns with the market average expectations.

We first reviewed DeltaStock’s regulation and found that it is licensed by the Bulgarian FSC. This makes the broker compliant with the MiFID II and ESMA rules, ensuring reliability and transparency of practices. However, other brokers, such as Fusion Markets and CMC Markets, hold top-tier licenses from ASIC, FCA, and other good-standing financial authorities, adding an extra layer of protection for their clients.

Further, we compared the broker’s trading costs to see how competitive they are. DeltaStock offers average spreads of 2 pips for the EUR/USD pair. Brokers like CityIndex, Fusion Markets, MarketsVox, and CMC Markets offer much lower spreads.

With DeltaStock, trades are conducted either on the broker’s Delta Trading platform or the MT5 platform. However, Fusion Markets stands out for a wider selection of platforms (MT4, MT5, cTrader, TradingView, DupliTrade, and Fusion+). With DeltaStock, traders have access to over 900 tradable products, yet Saxo Bank has a more impressive offering that exceeds 71,000 instruments across diverse financial assets.

Also, DeltaStock includes a rather impressive educational section, including tutorials for beginner and advanced traders, video courses, a trading glossary, and various research tools. Saxo Bank and City Index also provide excellent educational resources, supporting novice traders.

| Parameter |

DeltaStock |

Fusion Markets |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

X Open Hub |

| Spread-Based Account |

Average 2 pips |

Average 0.92 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission-Based Account |

No commissions mentioned |

0.0 pips + $2.25 per side |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Delta Trading, MT5 |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

900+ instruments |

250+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FSC |

ASIC, VFSC, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$0 |

$0 |

$100 |

$0 |

$0 |

Full Review of Broker DeltaStock

Based on our financial expert’s opinion and thorough research of DeltaStock, we have drawn the following conclusions about the broker.

DeltaStock is a tightly regulated broker by the Bulgarian FSC, complying with the MiFID II rules and guidelines. This puts the broker in a safe category, protecting clients and their investments.

The broker offers a good range of trading instruments, over 900, from its DeltaStock platform across Forex, Precious Metals, Shares, Indices, Futures, Commodities, ETPs, ETFs, and Crypto CFDs. The costs are average when compared to other brokers or a bit higher for some instruments. There are no publicly announced commissions, and all costs are integrated into spreads. However, we recommend traders check all the spreads and possible commissions before investing with the broker.

Also, DeltaStock has expanded its investment opportunities, offering Bulgarian and global bonds for professional and institutional clients.

As we have found, a broker is a good option for beginner traders. With its $100 initial deposit requirement, demo account availability, and impressive educational section equipped with various handy materials and research tools, DeltaStock can become a favorable first choice for novice traders.

Share this article [addtoany url="https://55brokers.com/deltastock-review/" title="DeltaStock"]