- CLM Pros and Cons

- Is CLM safe or a scam?

- Trading Platform

- Fees

- Spread

- Leverage

- Funding methods

- Conclusion

What is Core Liquidity Markets CLM?

Core Liquidity Market or CLM is a brokerage firm established in Australia, as well as the one operating entity through offshore Saint Vincent and the Grenadines with a purpose of global reach. The company operates since 2013 and ever since gained a quite good reputation among industry along with numerous traders they serve all around the world.

- There are some finds based on our expert research and financial trading opinion, be sure to read the Core Liquidity Updates

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC |

| 📉 Instruments | Equities, Commodities, FX, Indices, Cryptocurrencies and Gold |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 1.3pips |

| 💳 Minimum deposit | 100 $ |

| 🎮 Demo Account | Available |

| 💰 Base currencies | AUD, USD |

| 📚 Education | Education materials, research included |

| ☎ Customer Support | 24/5 |

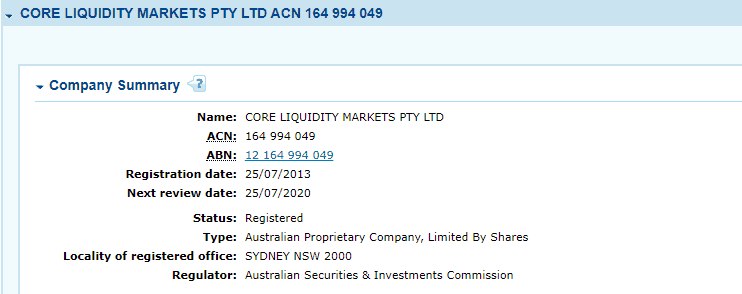

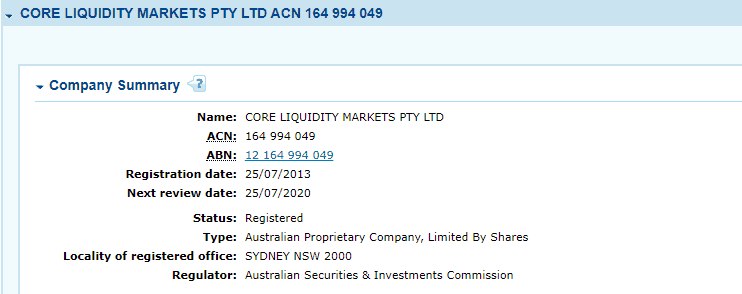

Is Core Liquidity Markets CLM safe or a scam?

Now going to the most important part of Core Liquidity Markets CLM review, a license under which the company establishes its trading business and provides services.

As we reviled, Core Liquidity Markets operates through two locations, while one entity is located in Australia therefore licensed by ASIC. And second entity is based in offshore Saint Vincent and the Grenadines, which is only registering financial firms and does not provide strict regulation.

Even though, together with serious and respected guidelines of operation obtained from ASIC, we consider Core Liquidity Markets as a safe broker to trade with.

There are numerous established standards firms should follow before it receives its ASIC license while further constantly overseen in terms of its reliability. Also, ASIC being one of the most customer-oriented regulatory body covers traders’ needs and supports in numerous ways, including money safety, education materials and support at every stage.

Therefore, trading with Australian regulated broker you may trade assured of protected environment and unparalleled conditions to trade.

Leverage

Also, while trading with Liquidity Markets or CLM you will use a high leverage ratio, as ASIC still allows those levels even for retail traders. Thus, some Forex instruments are offered with 1:500 ratio, while each instrument features its own level defined by the company and regulatory restriction.

However, make sure to learn how to use leverage smartly as unrealized use may increase your risks dramatically.

Instruments

Core Liquidity Markets CLM trading proposal gives a healthy way for traders whatever strategy you perform, or level you are. CLM also diversified its portfolio by various access and a market range with Equities, Commodities, FX, Indices, Cryptocurrencies and Gold.

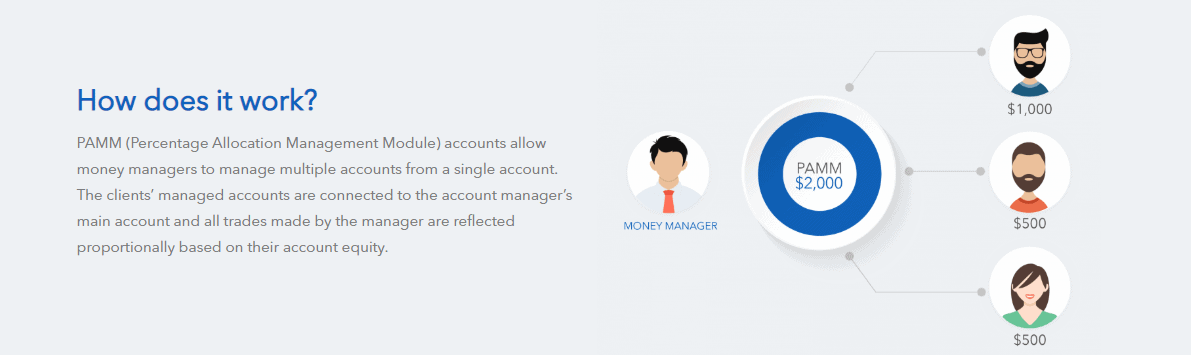

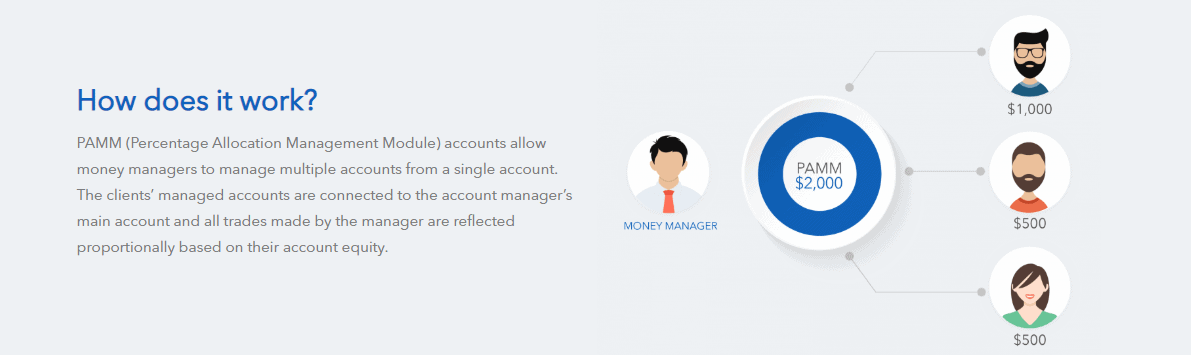

In addition, there is a developed Money managers program including MAM and PAMM accounts that brings access to a wide selection of services through tailored trading conditions.

Account types

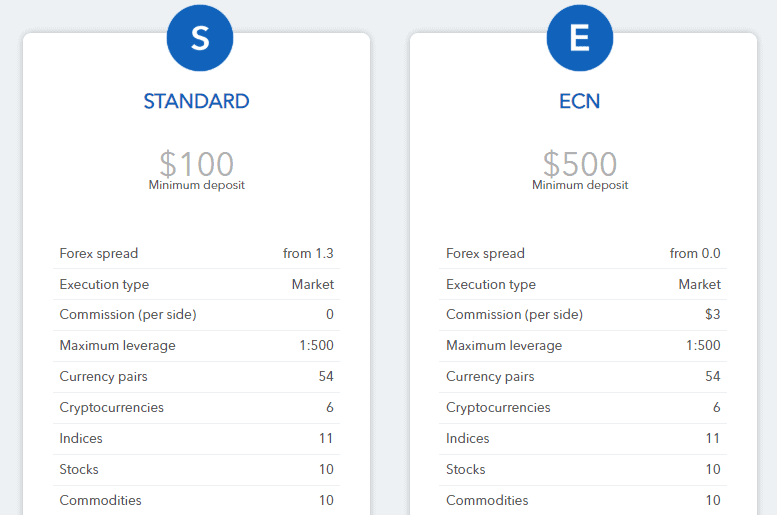

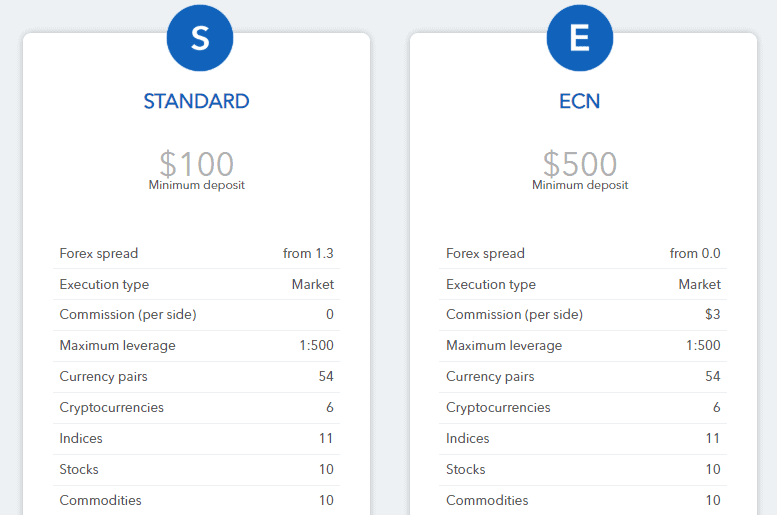

Core Liquidity Markets offers two account types with a great opportunity to engage into trading with relatively small first deposits for both accounts Standard or ECN. Also, these two allow you to choose the most suitable option according to your trading style either with all costs included into a spread or with a raw spread plus commission charge per trade.

Fees

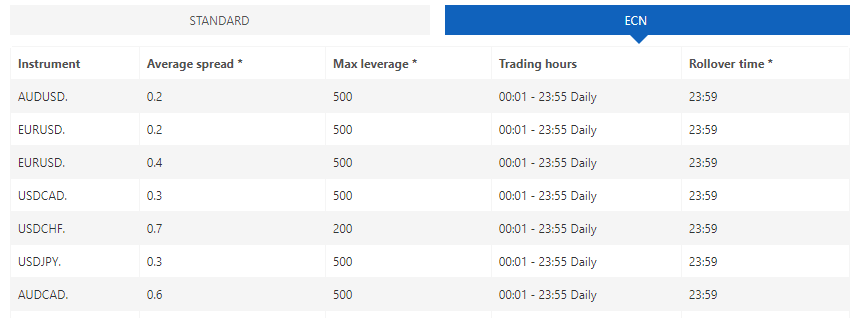

As we already mention, Standard account features spread only basis where spreads starting from 1.3pips, and ECN account spreads are starting from 0pips but adding a commission of $3 per side.

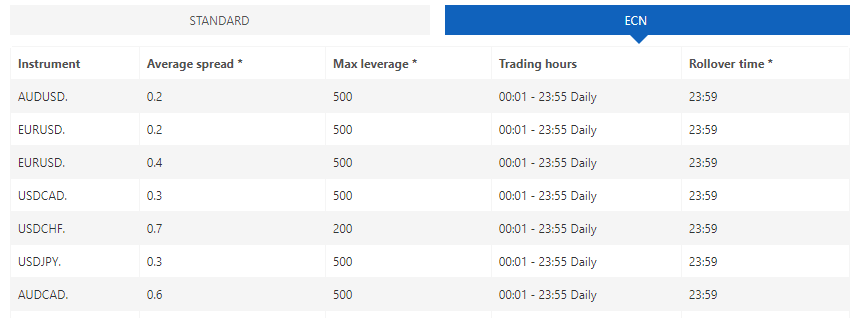

For instance see some CLM spreads below, as well you may check BDSwiss to know better pricing of the company.

Besides while holding a position longer than a day you may either benefit from the interest rate or be charged an extra fee in case you going long. This interest rate is also known as rollover or overnight fee is different for every instrument and calculated based on a base rate.

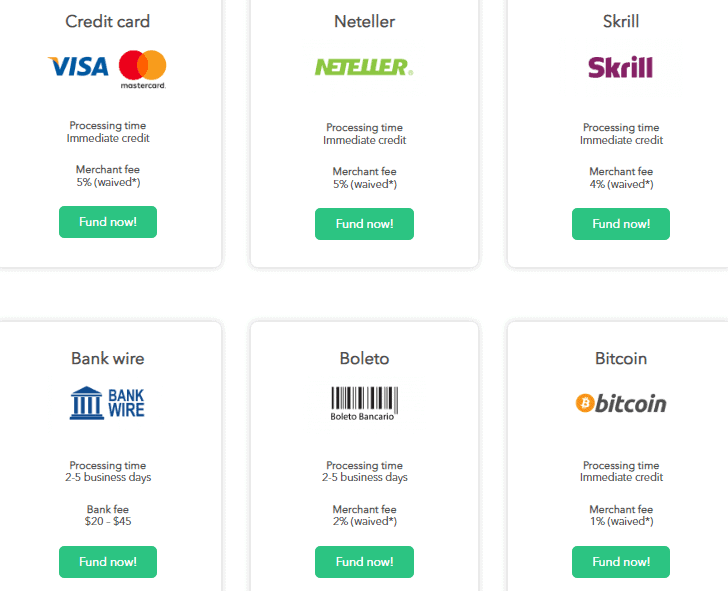

What Payment Methods Core Liquidity Markets CLM uses?

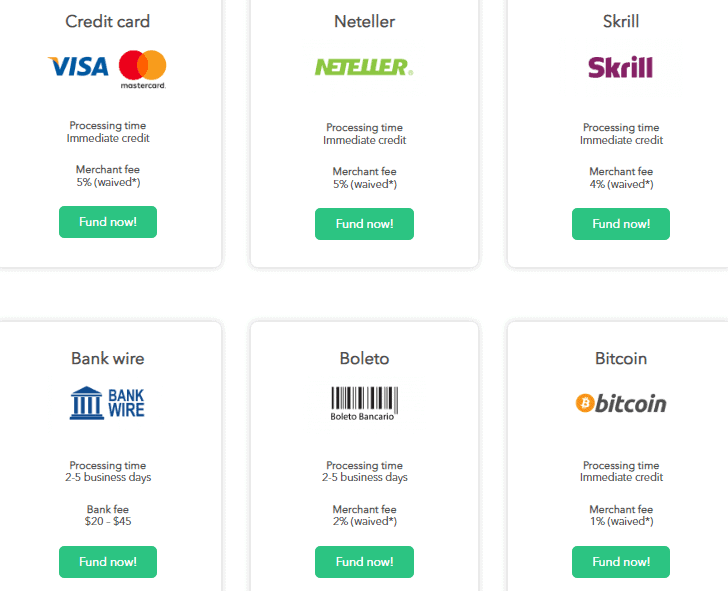

Depositing funds to your Core Liquidity Markets account is eventually smooth process, as the broker supports various methods including Bitcoin payments, Credit, Debit card, Bank Wire Transfer or Skrill, Neteller, Boleto.

Minimum deposit

The minimum deposit for Core Liquidity markets is 1,000$ for Standard Account and is $50,000 for Platinum one. Even though the deposit requirement is quite high and reachable mainly for professional or high-volume traders, CLM target stands mainly on those customers.

Core Liquidity Markets minimum deposit vs other brokers

|

CLM |

Most Other Brokers |

| Minimum Deposit |

$250 |

$500 |

Withdrawal fee

Most of the payment methods Core Liquidity Markets CLM waived fees that were typically charged by the payment provider, so you benefit from free a charge deposits as well. Nevertheless, depending on the country or anther there are some small charges may be applicable, respectively withdrawals will be charged a minimum of 5$ assessed to all withdrawals.

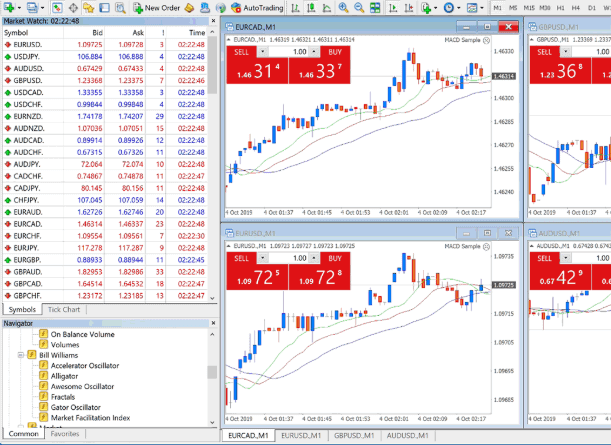

Trading Platforms

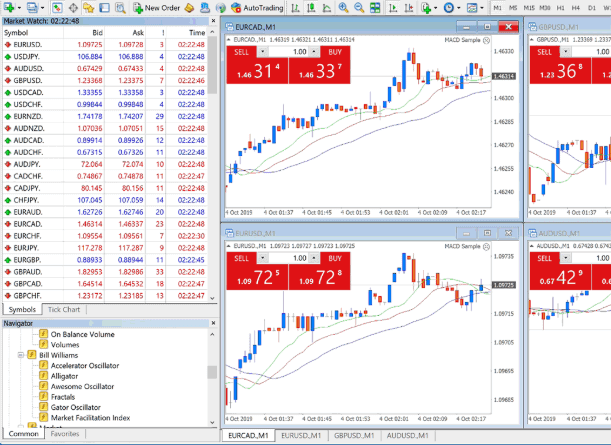

Obviously, Core Liquidity Markets made choice to a mainstay on the most complete charting platform and the one most known to traders worldwide. And this platform is MetaTrader4, software suitable for beginners and professionals, most favorite among manual or automated strategy traders, developers and so on.

In addition to its powerful trading capabilities, MT4 also brings access to over 100 trading instruments available from a single account and interface. Also, brokers servers located in LD4, therefore delivering light-stream speeds for your executions and connecting quotes from numerous liquidity providers for best outcomes.

Conclusion

Concluding Core Liquidity Markets CLM Review we see a company that operates trading conditions suitable for beginning traders, professionals or Money Managers. The trading costs are also set a good level, so you may access vast trading instruments. Also being an ASIC regulated firm brings stability to your account under which the protection applies. Here you can find TopFX broker which provides liquidity solutions.

Core Liquidity Markets CLM Updates

Based on our finds Core Liquidity Markets CLM, for now, operates solely through its SVG offshore entity and does not serve trading services via its ASIC Australia-regulated branch, we recommend doing your own research about CLM and do not recommend trading with offshore brokers due to lack of regulation and law regulatory requirements.

- With our experience in Trading with over 10 year of expertise money safety stands first, it is much better to choose a reliable broker with top-tier regulations and good conditions like HFM, FXTM or XM.

Share this article [addtoany url="https://55brokers.com/core-liquidity-markets-clm-review/" title="Core Liquidity Markets CLM"]

REALLY BAD COMPANY!! AVOID AT ALL COSTS or else you’ll get charged near 10% of fees to Withdraw your money… You have fees to withdraw and they have TERRIBLE support!!!

I looking for market execution type, high execution speed 0,5 second, account type std

Hi I’m interested